UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR | |

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended | |

| OR | |

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR | |

| | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 193 |

| Date of event requiring this shell company report …………………………………………… | |

| For the transition period from ……………………………… to ……………………………… |

Commission file number

Caledonia Mining Corporation Plc

(Exact name of Registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

Caledonia Mining Corporation Plc

(Address of principal executive offices)

(Name, telephone, email and/or facsimile number and address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| | | |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or stock as of the closing of the period covered by the annual report:

Indicate by check mark if the registration is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐Yes ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, and/or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ☐ | |

| Non-accelerated filer ☐ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP | ☐ | | ☒ | Other | ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F ("Annual Report") and the exhibits attached hereto contain "forward-looking information" and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation that involve risks and uncertainties relating, but not limited to, the Company’s current expectations, intentions, plans, and beliefs. Forward-looking information can often be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “target”, “intend”, “estimate”, “could”, “should”, “may” and “will” or the negative of these terms or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Examples of forward-looking information in this Annual Report include: our mineral reserve and mineral resource calculations with underlying assumptions, production guidance, estimates of future/targeted production rates, planned mill capacity increases, estimates of future metallurgical recovery rates and the ability to maintain high metallurgical recovery rates, Caledonia Mining Corporation Plc and subsidiaries (“Caledonia” or “Company” or “Group”) plans and timing regarding further exploration, drilling and development, the prospective nature of exploration and development targets, the ability to upgrade and convert mineral reserves and mineral resources, capital costs, our intentions with respect to financial position and third party financing and future dividend payments. This forward-looking information is based, in part, on assumptions and factors that may change or prove to be incorrect, thus causing actual results, performance or achievements to be materially different from those expressed or implied by forward-looking information. Such factors and assumptions include, but are not limited to: failure to establish estimated mineral reserves and mineral resources, the grade and recovery of ore which is mined varying from estimates, success of future exploration and drilling programs, reliability of drilling, sampling and assay data, assumptions regarding the representativeness of mineralization being inaccurate, success of planned metallurgical test-work, capital and operating costs varying significantly from estimates, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, changes in government regulations, legislation and rates of taxation, inflation, changes in exchange rates and the availability of foreign exchange, fluctuations in commodity prices, delays in the development of projects and other factors.

Shareholders, potential shareholders and other prospective investors should be aware that these statements are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the forward-looking statements. Such factors include, but are not limited to: risks relating to estimates of mineral reserves and mineral resources proving to be inaccurate, fluctuations in gold price, risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected geological or structural formations, pressures, power outages, explosions, landslides, cave-ins and flooding), risks relating to the credit worthiness or financial condition of suppliers, refiners and other parties with whom the Company does business; inadequate insurance, or inability to obtain insurance, to cover these risks and hazards, employee relations; relationships with and claims by local communities and indigenous populations; political risk; risks related to natural disasters, terrorism, civil unrest, public health concerns (including health epidemics or outbreaks of communicable diseases such as the coronavirus); availability and increasing costs associated with mining inputs and labor; the speculative nature of mineral exploration and development, including the risks of obtaining or maintaining necessary licenses and permits, diminishing quantities or grades of mineral reserves and mineral resources as mining occurs; global financial condition, the actual results of current exploration activities, changes to conclusions of economic evaluations, and changes in project parameters to deal with un-anticipated economic or other factors, risks of increased capital and operating costs, environmental, safety or regulatory risks, expropriation, the Company’s title to properties including ownership thereof, increased competition in the mining industry for properties, equipment, qualified personnel and their costs, risks relating to the uncertainty of timing of events including targeted production rate increase and currency fluctuations. Shareholders, potential shareholders and other prospective investors are cautioned not to place undue reliance on forward-looking information. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and various future events will not occur. Caledonia reviews forward-looking information for the purposes of preparing each annual report, however Caledonia undertakes no obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

STATUS AS AN EMERGING GROWTH COMPANY

We are an “emerging growth company” as defined in Section 3(a) of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”) by the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. We will continue to qualify as an "emerging growth company" until the earliest to occur of: (a) the last day of the fiscal year during which we had total annual gross revenues of US$1,235,000,000 (as such amount is indexed for inflation every 5 years by the United States Securities and Exchange Commission (“SEC”) or more; (b) the last day of our fiscal year following the fifth anniversary of the date of the first sale of equity securities pursuant to an effective registration statement under the United States Securities Act of 1933, as amended (the “Securities Act”); (c) the date on which we have, during the previous 3-year period, issued more than US$1,000,000,000 in non-convertible debt; or (d) the date on which we are deemed to be a "large accelerated filer", as defined in Exchange Act Rule 12b-2. We expect to continue to be an emerging growth company for the immediate future. During 2020 Caledonia completed the first sale of equity securities under the Securities Act and may no longer qualify as an emerging growth company in 2026. Refer to note 25 in the Consolidated Financial Statements for detail on the sales of equity securities.

Generally, a registrant that registers any class of its securities under Section 12 of the Exchange Act is required to include in the second and all subsequent annual reports filed by it under the Exchange Act a management report on internal control over financial reporting and, subject to an exemption available to registrants that are neither an "accelerated filer" or a "larger accelerated filer" (as those terms are defined in Exchange Act Rule 12b-2), an auditor attestation report on management's assessment of internal control over financial reporting. However, for so long as we continue to qualify as an emerging growth company, we will be exempt from the requirement to include an auditor attestation report on management’s assessment of internal controls over financial reporting in its annual reports filed under the Exchange Act, even if we were to qualify as an "accelerated filer" or a "larger accelerated filer". In addition, Section 103(a)(3) of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) has been amended by the JOBS Act to provide that, among other things, auditors of an emerging growth company are exempt from any rules of the Public Company Accounting Oversight Board requiring a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the company.

SPECIAL NOTE REGARDING LINKS TO EXTERNAL WEBSITES

Links to external, or third-party websites, are provided solely for convenience. We take no responsibility whatsoever for any third-party information contained in such third-party websites, and we specifically disclaim adoption or incorporation by reference of such information into this report.

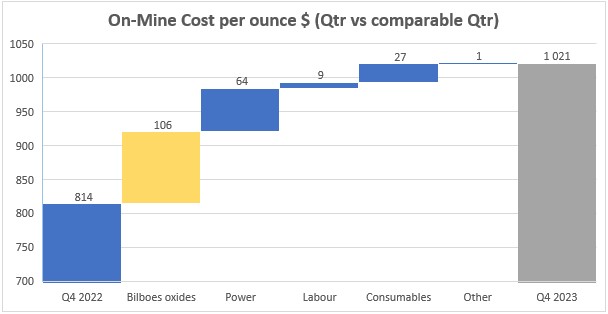

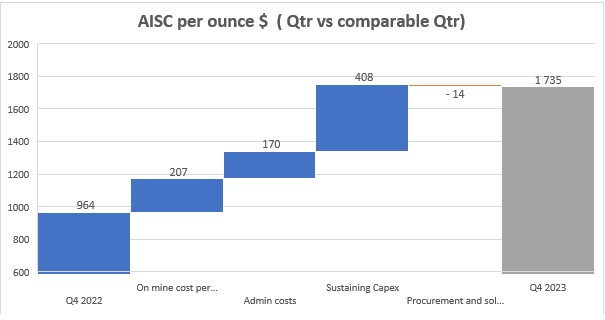

NON-IFRS FINANCIAL INFORMATION

This Annual Report contains financial statements of the Company prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). In addition, this Annual Report also contains non-IFRS financial measures (“Non-IFRS Measures”) including “on-mine cost per ounce”, “all-in sustaining cost per ounce”, “all-in cost per ounce”, “average realized gold price” and “adjusted earnings per share” as we believe these are useful metrics for measuring our performance. However, these Non-IFRS Measures do not have any standardized meaning prescribed by IFRS and are not necessarily comparable to similar measures presented by other publicly traded entities. These measures should be considered as supplemental in nature and not as a substitute for related financial information prepared in accordance with IFRS.

CURRENCY

Unless otherwise indicated, all references to “$”, “US dollars”. “USD”, or "US$" are to United States of America dollars.

FOREIGN PRIVATE ISSUER FILINGS

We are considered a “foreign private issuer” pursuant to Rule 405 promulgated under the Securities Act. In our capacity as a foreign private issuer, we are exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act and the rules under the Exchange Act with respect to their purchases and sales of our shares. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as United States companies whose securities are registered under the Exchange Act. In addition, we are not required to comply with Regulation FD, which restricts the selective disclosure of material information.

For as long as we are a “foreign private issuer” we intend to file our annual financial statements on Form 20-F and furnish our quarterly financial statements on Form 6-K to the SEC for so long as we are subject to the reporting requirements of Section 13(g) or 15(d) of the Exchange Act. However, the information we file or furnish may not be the same as the information that is required in annual and quarterly reports on Form 10-K or Form 10-Q for U.S. domestic issuers. Accordingly, there may be less information publicly available concerning us than there is for a company that files as a domestic issuer.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We are required to determine our status as a foreign private issuer on an annual basis at the end of our second fiscal quarter. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by United States residents and any of the following three circumstances applies: (1) the majority of our executive officers or directors are United States citizens or residents; (2) more than 50% of our assets are located in the United States; or (3) our business is administered principally in the United States. If we lose our “foreign private issuer status” we would be required to comply with Exchange Act reporting and other requirements applicable to U.S. domestic issuers, which are more detailed and extensive than the requirement for “foreign private issuers”.

| ITEM 1 - IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

| Not applicable. |

| Not applicable. |

| Not applicable. |

| Not applicable. |

An investment in our shares involves a high degree of risk and should be considered speculative. You should carefully consider the following risks set out below and other information before investing in our shares. If any event arising from these risks occurs, our business, prospects, financial condition, results of operations or cash flows could be adversely affected, the trading price of our shares could decline and all or part of any investment may be lost.

Our operations are highly speculative due to the high-risk nature of our business, which include the acquisition, financing, exploration, development of mineral infrastructure and operation of mines. The risks and uncertainties set out below are not the only ones we face. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also impair our operations. If any of the risks actually occur, our business, financial condition and operating results could be adversely affected. As a result, the trading price of our shares could decline and investors could lose part or all of their investment. Our business is subject to significant risks and past performance is no guarantee of future performance.

Our shares may not continue to be listed on the NYSE American LLC (“NYSE American”)

Failure to meet the applicable maintenance requirements of the NYSE American could result in our shares being delisted from the NYSE American. If we are delisted from the NYSE American, our shares may be eligible for trading on an over-the-counter market in the United States. In the event that we are not able to obtain a listing on another U.S. stock exchange or quotation service for our shares, it may be extremely difficult or impossible for shareholders to sell their shares in the United States. Moreover, if we are delisted from the NYSE American, but obtain a substitute listing for our shares in the United States, it may be on a market with less liquidity, and therefore potentially more price volatility, than the NYSE American. Shareholders may not be able to sell their shares on any such substitute U.S. market in the quantities, at the times, or at the prices that could potentially be available on a more liquid trading market. As a result of these factors, if our shares are delisted from the NYSE American, the price of our shares is likely to decline. In addition, a decline in the price of our shares will impair our ability to obtain financing in the future.

Future sales of our shares into the public market by holders of our options may lower the market price, which may result in losses to our shareholders.

As of April 26, 2024, we had 19,194,860 shares issued and outstanding. In addition, as of April 28, 2024, 20,000 shares were issuable upon exercise of outstanding stock options, all of which may be exercised in the future resulting in dilution to our shareholders. Awards under the incentive plan made to executives and certain other senior members of management on January 24, 2022, April 7, 2023 and April 8, 2024, consisting of a target of 113,693,80,7732 and 125,433 Equity-settled Performance Units (“EPUs”) respectively, are only to be settled in shares. The EPUs that vest will be subject to a performance multiplier and a maximum amount of 150% of target EPUs could vest. Accordingly, providing for such a maximum amount, Caledonia could grant options on a further 1,419,638 shares as at the date of this Annual Report on the assumption that all other outstanding awards (other than the options mentioned above) are settled in cash at the request of the holders. As of April 28, 2024, our senior officers and directors beneficially owned or had an interest in, as a group, 2,861,550 shares (14.91% of our issued share capital). Sales of substantial amounts of our shares into the public market, by our officers or directors or pursuant to the exercise of options, or even the perception by the market that such sales may occur, may lower the market price of our shares.

The price of gold is subject to volatility and may have a significant effect on our future activities and profitability.

The economic viability of our revenues, operations and exploration and development projects is, and is expected to be, heavily dependent on the price of gold, which is particularly subject to fluctuation and has fluctuated significantly in recent years. The price of gold is affected by numerous factors beyond our control including, but not limited to: international economic and political conditions; expectations of inflation; international currency exchange rates; interest rates; global or regional consumption patterns; speculative activities; levels of supply and demand; increased production due to new mine developments and improved mining and production methods; availability and costs of metal substitutes; and inventory carrying costs. The effect of these factors on the price of gold, and therefore the economic viability of our operations, cannot be accurately predicted. As required by Zimbabwean legislation, Blanket Mine (1983) (Private) Limited (“Blanket”), the company which owns the Blanket mine (“Blanket Mine”), Caledonia Holdings Zimbabwe (Private) Limited (“CHZ”), as agent, and Bilboes Holdings (Private) Limited (“Bilboes Holdings”) deliver their production to Fidelity Printers and Refiners Limited (“Fidelity”), which refines the gold to a purity of 99.5%. 75% of the gold delivered to Fidelity is refined on a toll-treatment basis. For the 75% portion Caledonia retains ownership of the gold that is then exported by Caledonia to a refiner of its choice outside Zimbabwe which undertakes further processing and sells the resulting gold on the international market.

75% of the portion of unrefined metals produced by Blanket and exported by Caledonia to Al Etihad Gold Refinery DMCC (“AEG”),from April of 2023 on the toll refinement basis, is transported by Ferrari Logistics Southern Africa (Proprietary) Limited to AEG in Dubai, UAE and further refined and sold by AEG at a cost of $7 per ounce. Gold transported throughout this process is fully insured. The sales to AEG are priced at the London Bullion Market Association (“LBMA”) post-delivery price less refining fee and the quantities are determined on the lodgment date. Settlement occurs within 2 days from AEG.

25% of Blanket's gold is sold to Fidelity at a price which reflects the prevailing LBMA price and the official Zimbabwe Gold (“ZiG”) or Zimbabwean real-time gross settlement, bond notes or bond coins (“RTGS$”)/USD exchange rate on the date of sale. Fidelity charges a 1.24% toll refining fee from the gross export proceeds. Fidelity collects a 5% royalty of which 50% is remitted to the Government of Zimbabwe in physical gold. The royalty is deducted from USD and RTG$ revenues proportionately. Settlement occurs within 14 days of delivery from Fidelity.

To hedge against negative gold prices, Caledonia hedges by way of purchasing out of the money put options. During 2023 and to the date of this Annual Report, the following hedges were purchased:

| Purchase date |

Ounces hedged |

Strike price |

Period of hedge |

| December 22, 2022 |

16,672 oz |

$1,750 |

December 2022 - May 2023 |

| May 22, 2023 |

28,000 oz |

$1,900 |

June - December 2023 |

| December 19, 2023 |

12,000 oz |

$1,950 |

January - March 2024 |

| March 7, 2024 |

12,000 oz |

$2,050 |

April to June 2024 |

| April 1, 2024 |

12,000oz |

$2,100 |

July – September 2024 |

Hedged ounces entered approximates the cash flow effect of Caledonia’s attributable share of the production.

Our Business Operations and/or Activities could be impacted by the spread of contagious diseases, such as the Coronavirus.

Our business could be significantly adversely affected by the effects of a widespread global outbreak of contagious diseases, including the recent outbreak of respiratory illness caused by a novel coronavirus (“COVID-19”). We cannot accurately predict the impact that contagious diseases, such as COVID-19, will have on third parties’, including our employees’ ability to fulfil their obligations to the Company, including due to uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries (including those countries we rely on to conduct our business operations), resulting in an economic downturn that could negatively impact our operating results.

Currently there are no concerns over the valuation of our assets as disclosed in the Consolidated Financial Statements and the Company does not foresee any changes in the cost of capital, cash requirements or any covenant defaults in our credit agreements. At the date of the authorisation of this document management is of the opinion that the effects of COVID-19 have been considered in making significant judgements and estimates, valuations and evaluating our going concern principle. However, it must be recognised that the duration and effects of pandemics are uncertain and can affect our forecasting accuracy. As of the date of this Annual Report, the severity of the effects of COVID-19 appear to be diminishing in the jurisdictions where the Company operates.

We cannot guarantee that there will not be an increase in input costs affecting our results of operations and financial performance.

Mining companies could experience higher costs of steel, reagents, labor, electricity, government levies, fees, royalties and other direct and indirect taxes. Our investment in a solar plant and efficiencies at existing operations should assist in curbing cost increases. However, there can be no assurance that we will be able to control such input costs and any increase in input costs above our expectations may have a negative result on our results of operations and financial performance.

Our operations may be subject to increased costs or even suspended or terminated as a result of any loss of required infrastructure in our operations.

Infrastructure, including water and electricity supplies, that is currently available and used by us may, as a result of adverse climatic conditions, natural disaster, incorrect or inadequate maintenance, sabotage or for other reasons, be destroyed or made unavailable or available in a reduced capacity. Were this to occur, operations at our properties may become more costly or have to be curtailed or even terminated, potentially having serious adverse consequences to our financial condition and viability that could, in turn, have a material adverse effect on our business, results of operations or financial performance.

Our operations may be subject to inadequate water supply.

Blanket uses water in the metallurgical process, some of which is pumped from the deeper levels of the mine but most of which is obtained from the “Blanket dam” (which, despite its name, is neither owned nor managed by Blanket Mine) which also supplies water to the nearby town of Gwanda. Blanket Mine is situated in a semi-arid region and rainfall typically only occurs in the period November to February. Management believes that there is enough water in the Blanket Mine dam to maintain normal operations until the next rainy season. During dry periods as a precautionary measure, Blanket intends to resuscitate existing boreholes and determine their yield; conduct hydrological surveys to identify potential new boreholes; recycle water from the lower levels of unused workings and construct a pond to store water that is pumped from current workings. If, however, there is inadequate water supply, operations at Blanket Mine may become more costly or have to be curtailed, suspended or even terminated which may have serious adverse consequences to the viability of gold production from Blanket Mine that could, in turn, have a material adverse effect on our business, results of operations or financial performance.

Our operations may be subject to inadequate electricity supply.

Zimbabwe’s electricity generation is mainly from the Kariba hydro station on the Zambezi river, the Hwange coal-fired station and several other much smaller coal-fired power stations. Even if Zimbabwe’s installed generating capacity is fully operational, it cannot generate enough electricity to meet its requirements and therefore Zimbabwe imports electricity from Mozambique and South Africa. Blanket Mine has a supply agreement with the Zimbabwe Electricity Supply Authority (“ZESA”) in terms of which it pays a premium rate in return for uninterrupted power.

The generating capacity at the Kariba hydro generating station fluctuates at times when the water levels are low. In addition, the export of electricity from South Africa to Zimbabwe is also interrupted due to a lack of generating capacity in South Africa and therefore interruptions to the Blanket supply do occur. The combined effect of these are severe electricity shortages that lead to “load-shedding” or low voltage occurrences.

Power surges as experienced at Blanket, if not controlled, can cause severe damage to Blanket’s electrical equipment. Blanket’s use of diesel for generating electricity decreased from approximately 3,827 kilo liters for the year in 2022 to 1,488 kilo liters in 2023.

Blanket has addressed the issue of interrupted power supply by installing stand-by generators. These generators can supply the whole mine with electricity but is a costly and environmentally unfriendly electricity source that is reliant on fuel imports that may from time to time be in shortage in Zimbabwe.

To mitigate against the current electricity situation, Caledonia has constructed a 12.2MWac solar plant at a cost of approximately $14.2 million (including construction costs and other project planning, structuring, funding and administration costs) supplying the Blanket operations. The solar plant was fully commissioned early February 2023 and provides approximately 24% of Blanket Mine’s average daily electricity demand. The plant has been providing power to Blanket from its initial connection to the Blanket grid in November 2022. The solar plant was classified as held for sale on September 28, 2023. Refer to note 24 of the Consolidated Financial Statements. The primary amount of electricity produced by the solar plant, after sale, will be sold to Blanket.

In April 2023 Blanket entered into a power supply agreement with the Intensive Energy Users Group (“IEUG”) and the Zimbabwean power utility to allow the IEUG to obtain power outside of Zimbabwe and strengthen the Zimbabwean power grid. As a result of this arrangement, Blanket has paid a lower tariff for IEUG supplied energy from April 2023, but it has not improved the power quality received at Blanket due to the continued difficulty with the Zimbabwe grid.

If an electricity shortage or outage persists, operations at the mines may become more costly or have to be curtailed, suspended or even terminated which may have serious adverse consequences to the viability of production from the mines that could, in turn, have a material adverse effect on our business, results of operations or financial performance.

We do business in countries and jurisdictions outside of the United States where different economic, cultural, regulatory, monetary and political environments could adversely impact our business, results of operations and financial condition.

The jurisdictions in which we operate are unpredictable. Assets and investments in these foreign jurisdictions are subject to risks that are usually associated with operating in a foreign country and any of these could result in a material adverse effect on our business, results of operations or financial performance. These risks include, but are not limited to, access to assets, labor disputes and unrest; arbitrary revocation of government orders, approvals, licenses and permits; corruption; uncertain political and economic environments; bribery; war; civil disturbances and terrorist actions; sudden and arbitrary changes to laws and regulations; delays in obtaining government permits; limitations on foreign ownership; more onerous foreign exchange controls; currency devaluations; import and export regulations; inadequate, damaged or poorly maintained infrastructure; and endemic illnesses. There can be no guarantee that governments in these jurisdictions will not unilaterally expropriate the property of companies that are involved in mining.

Caledonia’s mining operations are conducted in Zimbabwe and, as such, these operations are exposed to various levels of political, economic and other risks and uncertainties in addition to those set out above. These risks and uncertainties include, but are not limited to, expropriation and nationalization, or mandatory levels of Zimbabwean ownership beyond currently mandated levels; renegotiation, nullification or partisan terms of existing concessions, licenses, permits and contracts; illegal mining; changes in monetary and taxation policies; restrictions on foreign exchange and repatriation; and changing political conditions, currency controls and governmental regulations that favor or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction.

The current monetary situation in Zimbabwe can be summarized as follows:

| ● |

Blanket produces ore gold that it is obliged to deliver to Fidelity, a subsidiary of the Reserve Bank of Zimbabwe (“RBZ”), which refines the gold to a purity of 99.5% on a toll-treatment basis. With effect from April 2023, 25% of the resultant gold is sold to Fidelity and the remaining 75% is exported by Caledonia to a refiner of its choice outside Zimbabwe which undertakes further processing and sells the resulting gold on the international market. During 2023 all gold exports were sent to AEG in Dubai. The sale proceeds for the gold exported and sold via the offshore refiner is paid to Blanket’s commercial bankers in Zimbabwe within 48 hours of delivery. Management believes this new sales mechanism reduces the risk associated with selling and receiving payment from a single refining source in Zimbabwe. It also creates the opportunity to use more competitive offshore refiners and it may allow for the Company to raise debt funding secured against offshore gold sales. 25% of Blanket's gold is sold to Fidelity at a price which reflects the prevailing LBMA price and the official RTGS$/USD exchange rate on the date of sale. Payment is made by Fidelity to Blanket in RTGS$ or ZiG from April 5, 2024 within 14 days of the sale. Fidelity charges a refining fee of 1.24% of the USD export proceeds; Fidelity collects half of the 5% royalty which is payable to the Government of Zimbabwe in physical gold which is deducted from the amount exported and the balance is paid in USD and RTGS$ or ZiG proportionately to the 75:25 revenue split between USD and RTGS$ or ZiG. |

|

| ● |

The interbank RTGS$ or ZiG/USD exchange rates at each quarter end and at the latest practicable date prior to the publication of this Annual Report are set out below. |

| Interbank Exchange Rates |

(RTGS$:US$1) |

(ZiG:US$1) |

||

| February 20, 2019 |

2.50 |

|||

| March 31, 2019 |

3.00 |

|||

| June 30, 2019 |

6.54 |

|||

| September 30, 2019 |

15.09 |

|||

| December 31, 2019 |

16.77 |

|||

| March 31, 2020 |

25.00 |

|||

| June 30, 2020 |

57.36 |

|||

| September 30, 2020 |

81.44 |

|||

| December 31, 2020 |

81.79 |

|||

| March 31, 2021 |

84.40 |

|||

| June 30, 2021 |

85.42 |

|||

| September 30, 2021 |

87.67 |

|||

| December 31, 2021 |

108.66 |

|||

| March 31, 2022 |

142.42 |

|||

| June 30, 2022 |

370.96 |

|||

| September 30, 2022 |

621.89 |

|||

| December 31, 2022 |

684.33 |

|||

| March 31, 2023 |

929.86 |

|||

| June 30, 2023 |

5,739.80 |

|||

| September 30, 2023 |

5,466.75 |

|||

| December 31, 2023 |

6,104.72 |

|||

| March 31, 2024 |

22,055.47 |

|||

| April 8 , 2024 |

13.56 |

|||

| May 10, 2024 | 13.52 |

| ● |

Devaluation of the RTGS$ means that net monetary assets held in RTGS$ will devalue in USD terms. In the ordinary course of its business, Caledonia has net RTGS$-denominated assets comprising RTGS$-denominated cash and receivables (primarily for the 25% of gold sold to Fidelity and VAT receivables) and RTGS$ liabilities (mainly comprising taxes payable). During the first quarter of 2024, due to the increase in the rate of RTGS$ devaluation, management engaged more aggressively in RTGS$-denominated procurement to reduce its RTGS$-denominated cash. In the first quarter of 2024 to the date of this Annual Report, Blanket made prepayments of approximately $2 million in respect of consumables and supplies denominated in RTGS$. |

|

| ● |

RTGS$ cash balances at December 31, 2023 amounted to a USD equivalent of $539,115 and $360,541 at March 8, 2024. |

|

| ● |

On April 5, 2024 the Reserve Bank of Zimbabwe issued a Monetary Statement policy that introduced a structured currency (which is generally defined as a currency that is pegged to a specific exchange rate or currency basket and backed by a bundle of foreign exchange assets (including gold).). The structured currency called the ZiG replaced the RTGS$ from the said date. Banks were instructed to convert the RTGS$ balances into the new currency to foster simplicity, certainty, and predictability in monetary and financial affairs. The new currency will co-circulate with other foreign currencies in the economy. The retention threshold remained unchanged. |

Investors should recognize that Caledonia’s ability to implement its investment and operational strategies, Caledonia’s ability to sustain its operations outside Zimbabwe and pay future dividends depends, inter alia, on the ability to continue to externalize cash from Zimbabwe and receive payments for the sale of its gold proceeds.

On June 27, 2023 the U.S. Department of State together with other U.S. government agencies issued an advisory in light of reports related to the role of illicit actors in the gold trade to (i) highlight the opportunities and specific risks raised by the gold trade across sub-Saharan Africa and (ii) encourage industry participants to adopt and apply strengthened due diligence practices to ensure that such malign actors are unable to exploit and benefit from the sector, which remains essential to the livelihoods of millions of people across sub-Saharan Africa. Caledonia acknowledges and concurs with the U.S. Department of State’s warning that without adequate due diligence and appropriate mitigating measures, an industry participant may inadvertently contribute to one or more of these risks, including conflict and terror financing, money laundering activities, sanctions evasion, human rights and labor rights abuses and environmental degradation. Caledonia has robust policies in place to counter such risks including, amongst other things: a Code of Business Conduct, Ethics and Anti-Bribery Policy, a Human Rights Policy and Customer AML/KYC Policy, and it encourages whistleblowing and grievance reporting in order to monitor compliance. Caledonia performs enhanced due diligence on significant suppliers and other counterparties (including, but not limited to, sanctions and political exposure checks), has established new and robust routes to market for its gold production (none of which, for the avoidance of doubt, is artisanal) and has scrutinized the new refineries to which it now sells its gold. The Company reports its environmental, social and governance (“ESG”) performance annually, disclosing key environmental data, supports artisanal miners in the form of tributing of gold claims (as well as the local community generally) and has adopted best practice in the construction of its new tailings storage facility (“TSF”) at Blanket. For more information in all of these areas, please refer to Caledonia’s ESG reports.

Our operations are subject to various government approvals, permits, licenses and legal regulation for which no assurance can be provided that such approvals, permits or licenses will be obtained or if obtained will not be revoked or suspended.

Government approvals, permits and licenses are required in connection with a number of our activities and additional approvals, permits and licenses may be required in the future. The duration and success of our efforts to obtain approvals, permits and licenses are contingent upon many variables outside of our control. Obtaining governmental approvals, permits and licenses can increase costs and cause delays depending on the nature of the activity and the interpretation of applicable requirements implemented by the relevant authority. While we and our affiliates currently hold the necessary licenses to conduct operations there can be no assurance that all necessary approvals, permits and licenses will be maintained or obtained or that the costs involved will not exceed our estimates or that we will be able to maintain such permits or licenses. To the extent such approvals, permits and licenses are not obtained or maintained, we may be prohibited from proceeding with planned drilling, exploration, development or operation of properties which could have a material adverse effect on our business, results of operations and financial performance.

In addition, failure to comply with applicable laws, regulations and requirements in the countries in which we operate may result in enforcement action, including orders calling for the curtailment or termination of operations on our property, or calling for corrective or remedial measures requiring considerable capital investment. Although we believe that our activities are currently carried out in all material respects in accordance with applicable rules and regulations, no assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner that could limit or curtail production or development of our properties or otherwise have a material adverse effect on our business, results of operations and financial performance.

We face risks related to mining, exploration and mine construction on potential properties.

Our level of profitability, if any, in future years will depend on whether our mines produce at forecasted rates and whether any exploration and development stage properties can be brought into production. The mining, exploration and development of mineral deposits involves significant risks. It is impossible to ensure that any current and future exploration programs will establish mineral reserves or mineral resources. Whether a mineral ore body will be commercially viable depends on several factors, and the exact effect of these factors cannot be accurately predicted. The exploration, development and production activities are subject to political, economic and other risks, including:

| ● |

cancellation or renegotiation of contracts; |

|

| ● |

changes in local and foreign laws and regulations; |

|

| ● |

changes in tax laws; |

|

| ● |

delays or refusal in granting prospecting permissions, mining authorizations and work permits for foreign management staff; |

|

| ● |

environmental controls and permitting; |

|

| ● |

expropriation or nationalization of property or assets; |

|

| ● |

foreign exchange controls and the availability of foreign exchange; |

|

| ● |

government mandated social expenditures; |

|

| ● |

import and export regulation, including restrictions on the sale of production in foreign currencies; |

|

| ● |

inflation of costs that is not compensated for by a currency devaluation; |

|

| ● |

requirement that a foreign subsidiary or operating unit has a domestic joint venture partner, which, possibly, the foreign company must subsidize; |

|

| ● |

restrictions on the ability of local operating companies to hold foreign currencies in offshore and/or local bank accounts; |

|

| ● |

restrictions on the ability of a foreign company to have management control of exploration and/or development and/or mining operations; |

| ● |

restrictions on the remittance of dividend and interest payments offshore; |

|

| ● |

retroactive tax or royalty claims; |

|

| ● |

risks of loss due to civil strife, acts of war, guerrilla activities, insurrection and terrorism; |

|

| ● |

royalties and tax increases or claims by governmental entities; |

|

| ● |

unreliable local infrastructure and services such as power, water, communications and transport links; |

|

| ● |

demands or actions by native or indigenous groups; |

|

| ● |

other risks arising out of foreign sovereignty over the areas in which operations are conducted; and |

|

| ● |

lack of investment funding. |

Such risks could potentially arise in any country in which we operate.

As a result of the foregoing, our exploration, development and production activities in Zimbabwe may be substantially affected by factors beyond our control, any of which could materially adversely affect our financial position or results from operations. Furthermore, in the event of a dispute arising from such activities, we may be subject to exclusive jurisdiction of courts outside North America or may not be successful in subjecting persons to the jurisdiction of the courts in North America, which could adversely affect the outcome of a dispute.

We will need to identify new mineral reserves to replace mineral reserves that have been depleted by mining activities and to commence new projects. No assurance can be given that exploration activities by us will be successful in identifying sufficient mineral reserves of an adequate grade and suitable metallurgical characteristics suitable for further development or production.

Refer to section 4.B – “Business Overview” for more information on our mining properties and projects.

Further development and commercial production at Blanket Mine, Bilboes and acquired exploration and evaluation assets cannot be assured.

We are engaged in further development activities at Blanket Mine, exploration and evaluation activities at Blanket’s satellite properties, the Bilboes gold project in Zimbabwe (“Bilboes” or the “Bilboes Project”) (oxides and sulphides) and the Maligreen project (“Maligreen”). Mining activities commenced at the Bilboes oxide mine in December 2022 and due to operating losses mining activities were placed on care and maintenance at the end of September 2023.

The estimates for future production, at Blanket Mine and the Bilboes Project, are based on mining plans and are subject to change. Production estimates are subject to risk and no assurance can be given that future production estimates will be achieved. Actual production may vary from estimated production for a variety of reasons including un-anticipated variations in grades, mined tonnages and geological conditions, accident and equipment breakdown, changes in metal prices and the cost and supply of inputs and changes to government regulations. Construction and development of projects are subject to numerous risks including, but not limited to: obtaining equipment, permits and services; changes in regulations; currency rate changes; labor shortages; fluctuations in metal prices; and the loss of community support.

Substantial expenditures are required to establish reserves through drilling, to develop metallurgical processes to extract gold from ore and to develop the mining, processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be capable of economic extraction by metallurgical process, or discovered in sufficient quantities or grades, or the estimated operating costs of the mining venture are sufficient, to justify development of the deposit, or that the funds required for development can be obtained on a timely and economically acceptable basis.

The marketability of any minerals acquired or discovered may be affected by numerous factors which are beyond our control and which cannot be predicted, such as metal price and market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection. Depending on the price of minerals produced, the Company may determine that it is not commercially feasible to commence or continue commercial production.

Refer to capital investments under Item 4.A – “History and Development of the Company”, for detail on development activities at Blanket and the Bilboes Project and exploration and evaluation assets.

We face credit risk exposure from counterparties to certain contractual obligations and there is no assurance that any such counterparty may not default in such obligation causing us to incur a financial loss.

Credit risk is the risk that a party with a contractual obligation with us will default causing a loss. New regulations introduced by the Zimbabwean Ministry of Finance in January 2014 required that all gold produced in Zimbabwe must be sold to Fidelity, a company which is controlled by the Zimbabwean authorities. Accordingly, all of our production from Blanket Mine and the Bilboes oxide mine was sold to Fidelity until April 26, 2023 when production began to be sold to both Fidelity and AEG (see above). This mechanism means that the Company is no longer fully exposed to credit risk from Fidelity in respect of the US dollar component of its sales. This arrangement introduces a credit risk, beyond our control, that receivables and contractual performance due from Fidelity will not be paid or performed in a timely manner, or at all. If Fidelity, the Zimbabwean government or AEG were unable or unwilling to conduct business with us, or satisfy obligations to us, we could experience a material adverse effect upon our operations and financial performance. All payments due from Fidelity or AEG at year end have been received in full and on time.

The mining industry is highly competitive and there is no guarantee we will always be able to compete effectively.

The mining industry is a highly diverse and competitive international business. The selection of geographic areas of interest are only limited by the degree of risk a company is willing to accept by the acquisition of properties in emerging or developed markets and/or prospecting in explored or virgin territory. Mining, by its nature, is a competitive business with the search for fresh ground with good exploration potential and the raising of the requisite capital to move projects forward to production. There is aggressive competition within the mining industry for the discovery and acquisition of properties considered to have commercial potential. We will compete with other interests, many of which have greater financial resources than we will have, for the opportunity to participate in promising projects. Such competition may have better access to potential resources, more developed infrastructure, more available capital, have better access to necessary financing, and more knowledgeable and available employees than us. We may encounter competition in acquiring mineral properties, hiring mining professionals, obtaining mining resources, such as manpower, drill rigs, and other mining equipment. Such competitors could outbid us for potential projects or produce gold at lower costs. Increased competition could also affect our ability to attract necessary capital funding or acquire suitable properties or prospects for gold exploration or production in the future. Significant capital investment is required to achieve commercial production from successful exploration and development efforts. Globally, the mining industry is prone to cyclical variations in the price of the commodities produced by it, as dictated by supply and demand factors, speculative factors and industry-controlled marketing cartels. Nature provides the ultimate uncertainty with geological and occasionally climatic surprises. Commensurate with the acceptance of this risk profile is the potential for high rewards. If we are unable to successfully compete for properties, capital, customers or employees it could have a materially adverse effect on our results of operations.

We were required to facilitate the economic participation of certain indigenous groups in our business and there can be no assurance that such required participation was at fair market value or that the terms of the agreements can be amended.

The government of Zimbabwe introduced legislation in 2012 requiring companies to facilitate participation in their shareholdings and business enterprises by the indigenous population (typically referred to as indigenization). It is not assured that such interests were paid for at full fair value. As reported, Blanket Mine complied with the requirements of the Indigenization and Economic Empowerment Act in Zimbabwe whereby indigenous shareholders legally owned 51% of Blanket Mine since September 2012 (until 2020 – see below).

Pronouncements from the Zimbabwe Government following the appointment of the new President in late 2017 announced a relaxation in the indigenization policy which, amongst other things, included the removal of an indigenization requirement for gold mining companies. These pronouncements were passed into law in March 2018.

We currently do not depend on our ability to successfully access the capital and financial markets. However, should our financial position change any inability to access the capital or financial markets may limit our ability to execute our business plan or pursue investments that we may rely on for future growth.

Depending on our ability to generate income from our operations, we may require further financing for current and future exploration and development. Should our projections for fiscal years 2024 through to 2026 prove incorrect, to finance our working capital needs, we may have to raise funds through the issuance of additional equity or debt securities. Depending on the type and the terms of any financing we pursue, shareholders’ rights and the value of their investment in our shares could be reduced. Any additional equity financing will dilute shareholdings, and new or additional debt financing, if available, may involve restrictions on financing and operating activities. In addition, if we issue secured debt securities, the holders of the debt would have a claim to our assets that would be prior to the rights of shareholders until the debt is paid. Interest on these debt securities would increase costs and negatively impact operating results.

If we are unable to obtain additional financing, as needed, at competitive rates, our ability to implement our business plan and strategy may be affected, and we may be required to reduce the scope of our operations and scale back our exploration and development programs as the case may be. There is, however, no guarantee that we will be able to secure any additional funding or be able to secure funding which will provide us with sufficient funds to meet our objectives, which may adversely affect our business and financial position.

Our share price has been and is likely to continue to be volatile and an investment in our shares could suffer a decline in value.

Market prices for mining company securities, by their nature, are volatile. Factors, such as rapidly changing commodity prices, political unrest globally and in countries where we operate, speculative interest in mining stocks etc. are but a few factors affecting the volatility of the share price. Our shares are listed in the U.S. on the NYSE American, depositary interests representing our shares are admitted to trading on AIM of the London Stock Exchange (“AIM”), and depositary receipts representing our shares were listed on the VFEX in December 2021 raising gross proceeds of approximately $7.8m (the use of the term “share” in this Annual Report also, where the context requires, extends to a depositary interest or depositary receipt representing a share). The Company voluntarily delisted its shares from the Toronto Stock Exchange (“TSX”) on June 19, 2020. After the delisting the Company remains a Canadian reporting issuer and has to comply with Canadian securities laws unless and until it can demonstrate that less than 2% of its beneficial shareholders are Canadian residents. During 2023 gross proceeds of $10.8m and $5.9m were raised by issuing depository interests on AIM and depository receipts on the VFEX respectively.

The market price of our shares may be highly volatile and subject to wide fluctuations. In addition, the trading volume of our shares may fluctuate and cause significant price variations to occur. If the market price of our shares declines significantly, you may be unable to resell your shares at or above the purchase price, if at all. We cannot assure you that the market price of our shares will not fluctuate or significantly decline in the future.

Factors affecting our share price include but are not limited to:

| ● |

actual or expected fluctuations in our operating results; |

|

| ● |

actual or expected changes in our growth rates or our competitors’ growth rates; |

|

| ● |

changes in the market price of gold; |

|

| ● |

changes in the demand for gold; |

|

| ● |

high extraction costs; |

|

| ● |

accidents; |

|

| ● |

changes in market valuations of similar companies; |

| ● |

additions to or departures of our key personnel; |

|

| ● |

actual or anticipated fluctuations in our quarterly operating results or those of our competitors; |

|

| ● |

publication of research reports by securities analysts about us or our competitors in the industry; |

|

| ● |

our failure or the failure of our competitors to meet analysts’ projections or guidance that we or our competitors may give to the market; |

|

| ● |

fluctuations of exchange rates between the US$, GBP, CAD, RTGS$, ZiG and ZAR; |

|

| ● |

changes or proposed changes in laws and regulations affecting the gold mining industry; |

|

| ● |

changes in trading volume of our shares on the NYSE American, AIM or VFEX; |

|

| ● |

sales or perceived potential sales of our shares by us, our directors, senior management or our shareholders in the future; |

|

| ● |

short selling or other market manipulation activities; |

|

| ● |

announcement or expectation of additional financing efforts; |

|

| ● |

terrorist acts, acts of war or periods of widespread civil unrest; |

|

| ● |

natural disasters and other calamities; |

|

| ● |

litigation involving us, including: shareholder litigation, investigations or audits by regulators into our operations; or proceedings initiated by our competitors or clients; |

|

| ● |

strategic decisions by us or our competitors, such as acquisitions, divestitures, spin-offs, joint ventures, strategic investments or changes in business strategy; |

|

| ● |

the passage of legislation or other regulatory developments affecting us or our industry; |

|

| ● |

fluctuations in the valuation of companies perceived by investors to be comparable to us; and |

|

| ● |

conditions in the U.S., United Kingdom and Zimbabwe financial markets or changes in general economic conditions. |

The Company conducted equity raises by way of placings in the first two quarters of 2023 which targeted institutional investors in the UK, Europe, South Africa and Zimbabwe. The equity raises were over-subscribed: depositary interests in respect of 781,749 shares were issued to institutional investors in the UK, Europe and South Africa on March 30, 2023 and Zimbabwe depositary receipts in respect of 425,765 shares were issued to investors in Zimbabwe on April 14, 2023. The placing price was $13.74 and the placings raised $16.6 million before expenses. Mark Learmonth, Chief Executive Officer, and Toziyana Resources Limited, a company affiliated with Victor Gapare, an executive Director of the Company, subscribed for 3,587 shares and 11,000 shares respectively in the equity raise before the start of the Quarter. The proceeds of the equity raises were or are expected to be used for the Bilboes pre-feasibility study (refer to Exhibit 15.6), a shared services centre in Zimbabwe, the establishment of an international procurement arm to supply future operations, and exploration drilling at Motapa.

We are dependent on key management employees.

Our success depends (i) on the continued contributions of our directors, executive officers, management and consultants; and (ii) on our ability to attract new personnel whenever we seek to implement our business strategy. The loss of the services of any of these persons could have a materially adverse effect on our business, prospects, results of operations and financial performance. The limited availability of mining and other technical skills and experience in Zimbabwe and the difficulty of attracting appropriately skilled employees to Zimbabwe creates a risk that appropriate skills may not be available if, for whatever reason, the current skills base at the mines are depleted. There is no assurance that we will always be able to locate and hire all the personnel that we may require. Where appropriate, we engage with consulting and service companies to undertake some of the work functions. The Caledonia and Blanket management teams have been augmented so that it could provide appropriate support to Blanket if this is required.

Our mineral rights may be subject to defects in title.

We are not currently aware of any significant competing ownership claims or encumbrances respecting title to our properties. However, the ownership and validity or title of unpatented mining claims and concessions are often uncertain and may be contested. We also may not have, or may not be able to obtain, all necessary surface rights to develop a property. Although we have taken reasonable measures to ensure proper title to our properties, there is no guarantee of title to our properties or that competing ownership claims or encumbrances respecting our properties will not be made in the future. Title insurance is generally not available for mineral properties and our ability to ensure that we have obtained secure claims to individual mineral properties or mining concessions may be severely constrained. Our mineral properties may be subject to prior unregistered agreements, transfers or claims, and title may be affected by, among other things, undetected defects. We may incur significant costs related to defending the title to our properties. A successful claim contesting our title to a property may cause us to compensate other persons or perhaps reduce our interest in the affected property or lose our rights to explore and, if warranted, develop that property. This could result in us not being compensated for our prior expenditures relating to the property. Also, in any such case, the investigation and resolution of title issues would divert our management’s time from ongoing exploration and, if warranted, development programs. Any impairment or defect in title could have a negative impact on us.

We are subject to operational hazards and risks that could have a material adverse effect on our business, results of operations and financial performance.

We are subject to risks typical in the mining business. These include, but are not limited to, operational issues such as unexpected geological conditions or earthquakes causing unanticipated increases in the costs of extraction or leading to falls of ground and rock bursts, particularly as mining moves into deeper levels. Major cave-ins, flooding or fires could also occur under extreme conditions. Although equipment is monitored and maintained and all staff receive safety training, accidents caused by equipment failure or human error could occur. Such occurrences could result in damage to, or destruction of, mineral properties or production facilities, personal injury or death, environmental damage, delays in mining, monetary losses and possible legal liability. As a result, we may incur significant liabilities and costs that could have a material adverse effect upon our business, results of operations and financial performance.

Lawsuits may be filed against us and an adverse ruling in any such lawsuit could have a material adverse effect on our business, results of operations and financial performance.

We may become party to legal claims arising in the ordinary course of business. There can be no assurance that unforeseen circumstances resulting in legal claims will not result in significant costs or losses. The outcome of outstanding, pending or future proceedings cannot be predicted with certainty and may be determined adversely to us and as a result, could have a material adverse effect on our assets, liabilities, business, financial condition and results of operations. Even if we prevail in any such legal proceedings, the proceedings could be costly and time-consuming and may divert the attention of management and key personnel from our business operations, which could adversely affect our financial condition. In the event of a dispute arising in respect of our foreign operations, we may be subject to the exclusive jurisdiction of foreign courts or may not be successful in subjecting foreign persons to the jurisdiction of courts in the United States of America, South Africa, Zimbabwe, Canada, the United Kingdom, Jersey Channel Islands or international arbitration. The legal and political environments in which we operate may make it more likely that laws will not be enforced and that judgments will not be upheld. If we are unsuccessful in enforcing our rights under the agreements to which we are party to or judgments that have been granted, or if laws are not appropriately enforced, it could have a material adverse effect on our business, results of operations and financial performance.

We face risks related to illegal mining and no assurance can be provided that such illegal mining will not have an adverse effect on our business, results of operations and financial performance.

Illegal mining activities on properties controlled by the business have been identified. This gives rise to increased security costs and an increased risk of theft and damage to equipment. The business has received adequate support and assistance from the Zimbabwean police in investigating such cases but there can be no guarantee that the support from the Zimbabwean police will continue and whether their support will stop illegal mining activities.

Most of our employees are members of the Associated Mine Workers Union of Zimbabwe and any work stoppage or industrial action implemented by the union may affect our business, results of operations and financial performance.

Most of the employees are members of either the Associated Mine Workers Union of Zimbabwe or Zimbabwe Diamond and Allied Minerals Workers Union. Pay rates for all wage-earning staff are negotiated on a Zimbabwe industry-wide basis between the union and representatives of the mine owners. Any industrial action called by the union may affect our operations even though our operations may not be at the root cause of the action. Strikes, lockouts or other work stoppages could have a material adverse effect on our business, results of operations and financial performance. In addition, any work stoppage or labor disruption at key customers or service providers could impede our ability to supply products, to receive critical equipment and supplies for our operations or to collect payment from customers encountering labor disruptions. Work stoppages or other labor disruptions could increase our costs or impede our ability to operate.

There can be no assurance that changes to any environmental, health and safety laws to which we are currently subject would not adversely affect our exploration and development programs.

Our exploration, development and operations are subject to environment, health and safety (“EH&S”) laws and regulations in the countries in which the relevant activity is being conducted.

In 2018, a training facility (called the Nyanzvi initiative) was established at Blanket using dedicated facilities and specially trained facilitators. The entire Blanket workforce participated in the program which resulted in the general improvement in safety in the first two quarters of 2020. The Nyanzvi program was suspended from late March 2020 due to the need to observe social distancing because of COVID-19 which contributed to the increase in reportable events. The Nyanzvi initiative was resumed in the last quarter of 2021 as COVID-19 restrictions were relaxed; management believes this will help to increase general safety awareness.

During 2023 102 employees trained on Nyanzvi 2. Co-creation training of the engineering leadership, which comprise 17 section engineers, manager, foremen and charge hands. An engineering pilot team of 11 employees was trained. Team rankings for the best performers for all departments continued in the fourth quarter of 2024.

Safety training is an ongoing exercise and it will remain an area of focus for the Company. There is no assurance, however, that future changes in EH&S, if any, will not adversely affect our exploration and development programs or our operations. There are no assurances that regulatory and environmental approvals required under EH&S will be obtained on a timely basis or if at all. A breach of EH&S may result in the temporary suspension of operations, the imposition of fines, other penalties (including administrative penalties and regulatory prosecution), and government orders, which could potentially have a material adverse effect on operations.

Due to the nature of our business, our operations face extensive EH&S risks.

Gold mining is exposed to numerous risks and events, the occurrence of which may result in the death of, or personal injury to, employees. EH&S legislation applicable to us could suspend part or all of our operations. EH&S incidents could therefore lead to increased unit production costs or lower production which could negatively affect our business, operating and/or financial results.

Regrettably, a fatality occurred on February 16, 2023. The fatality occurred as a result of a secondary blasting accident. The directors and management of Caledonia and Blanket express their sincere condolences to the family and colleagues of the deceased. Management has provided the necessary assistance to the Ministry of Mines Inspectorate Department in its enquiries into the incident. Caledonia takes the safety of its employees very seriously and, accordingly, measures have been taken to reinforce adherence to prescribed safety procedures.

In August, 2023 Caledonia reported that an employee of a company contracted to Blanket died of injuries sustained in an accident at Blanket.

We are exposed to the risk of onerous environmental legislation which could potentially result in significant cost and liabilities

The environment, including water streams, land, habitat and environments near the mining sites can be impacted by our mining and other operational activities. With an increasing global focus and public sensitivity to environmental sustainability and environmental regulation becoming more stringent, we could be subject to further environmental related responsibilities and associated liability. Environmental legislation and permitting requirements are likely to evolve in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, an increase in capital expenditure and a heightened degree of responsibility for companies and their directors and employees.

Closure of mining operations, without sufficient financial provision for the funding of rehabilitation liabilities may result in our directors becoming subject to prosecution, litigation and potentially significant liabilities.

Future expenditure on rehabilitation might not be complete or accurately provided for due to higher than expected cost increases, changes in legislation, unidentified factors or other factors out of our control. Annual in-house reviews and rehabilitation costs and footprint estimation are done to control this risk. Every third year external experts review our footprint and cost estimations. At December 31, 2023 our total consolidated rehabilitation provision amounted to $11.0m as stated in note 29 of the Consolidated Financial Statements.

We may enter into acquisitions or other material transactions at any time.

We continually seek to replace and expand our reserves through the exploration of our existing properties and may expand through acquisitions of interests in new properties or interests in properties such as the Bilboes Project, Maligreen and Motapa. Acquisitions involve a number of risks, including: the possibility that we, as a successor owner, may be legally and financially responsible for liabilities of prior owners; the possibility that we may pay more than the acquired company or assets are worth; the additional expenses associated with completing an acquisition and amortizing any acquired intangible assets; the difficulty of integrating the operations and personnel of an acquired business; the challenge of implementing uniform standards, controls, procedures and policies throughout an acquired business; the inability to integrate, train, retain and motivate key personnel of an acquired business; and the potential disruption of our ongoing business and the distraction of management from its day-to-day operations. These risks and difficulties, if they materialize, could disrupt our ongoing business, distract management, result in the loss of key personnel, increase expenses and may have a material adverse effect on our business, results of operations and financial performance.

As a foreign private issuer, we are permitted to file less information with the SEC than a company that is not a foreign private issuer or that files as a domestic issuer.

As a foreign private issuer, we are exempt from certain rules under the Exchange Act that impose disclosure requirements as well as procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as a company that files as a domestic issuer whose securities are registered under the Exchange Act, nor are we generally required to comply with the SEC’s Regulation FD, which restricts the selective disclosure of material non-public information. For as long as we are a “foreign private issuer” we intend to file our annual financial statements on Form 20-F and furnish our quarterly financial statements on Form 6-K to the SEC for so long as we are subject to the reporting requirements of Section 13(g) or 15(d) of the Exchange Act. However, the information we file or furnish is not the same as the information that is required in annual and quarterly reports on Form 10-K or Form 10-Q for U.S. domestic issuers. Accordingly, there may be less information publicly available concerning us than there is for a company that files as a domestic issuer.

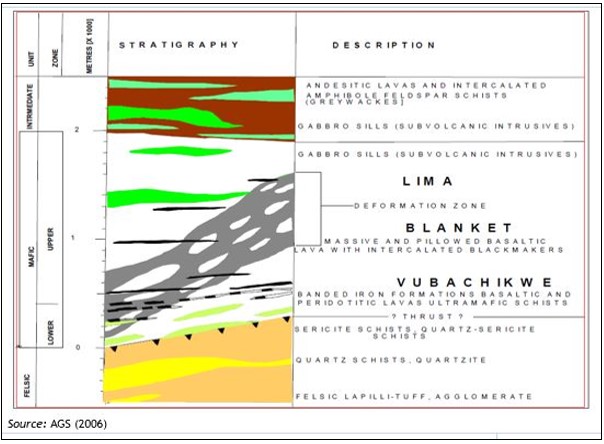

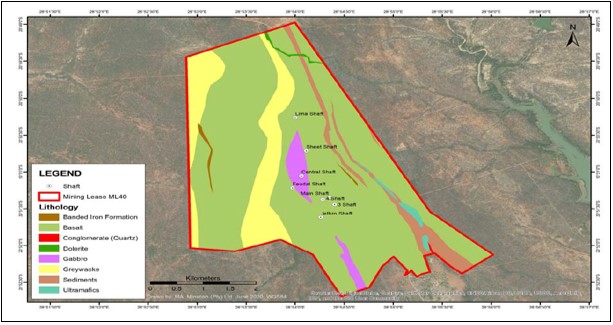

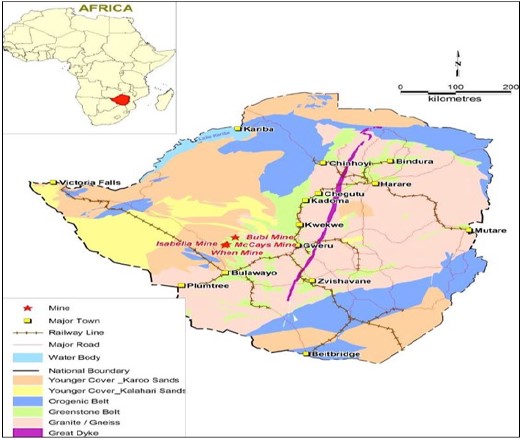

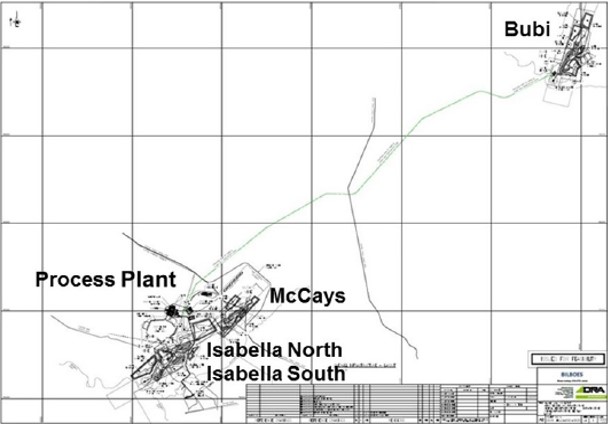

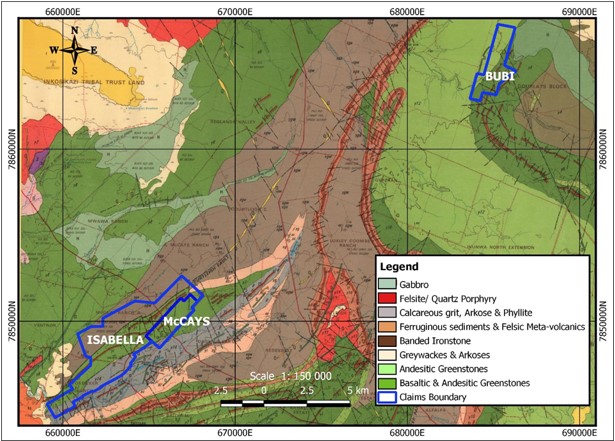

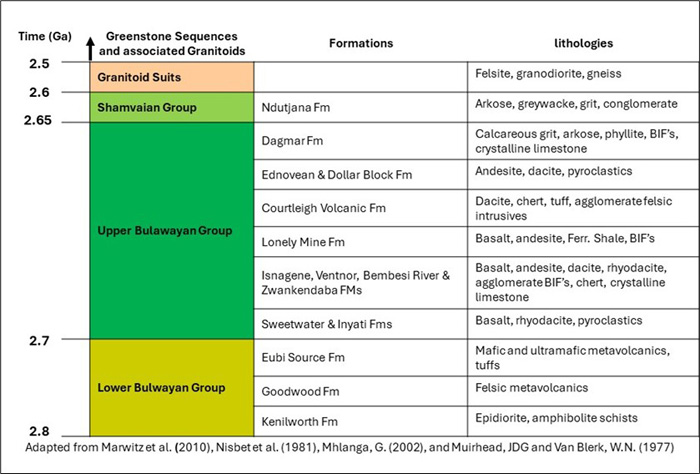

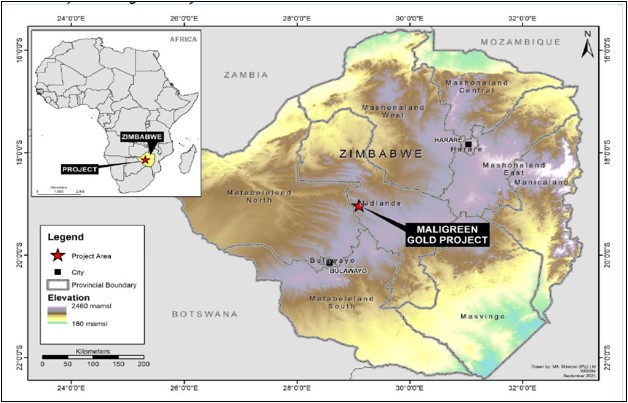

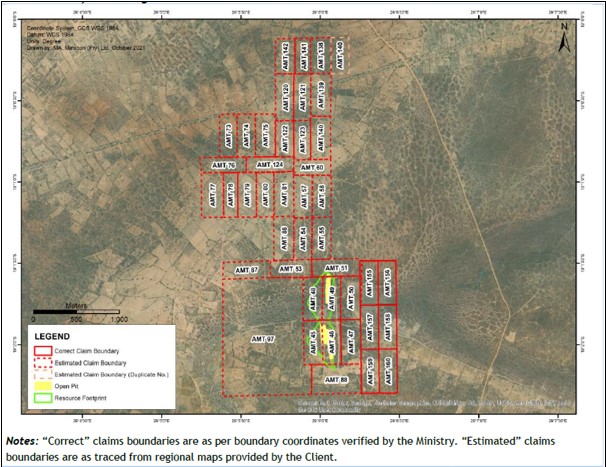

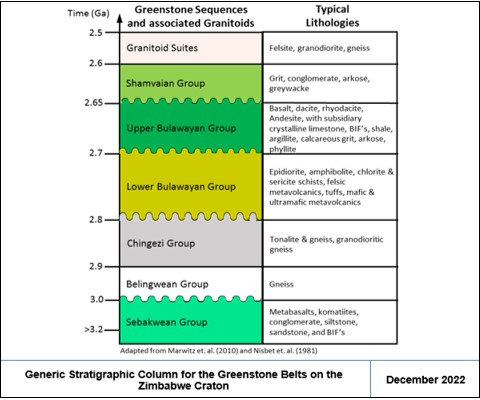

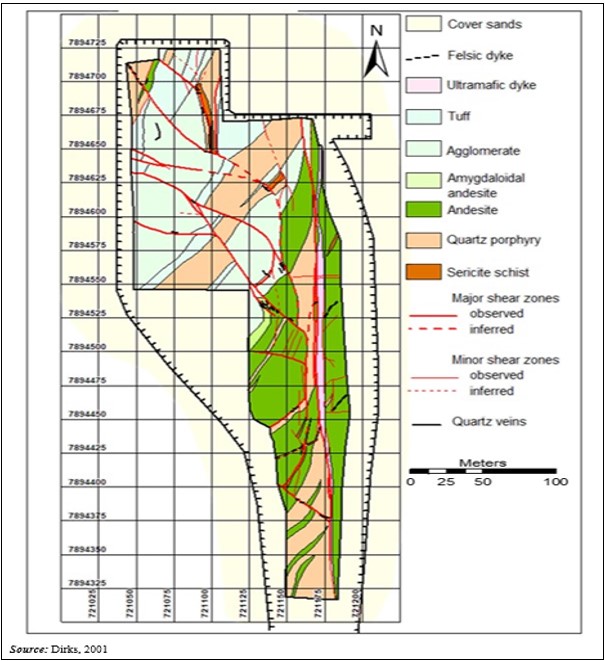

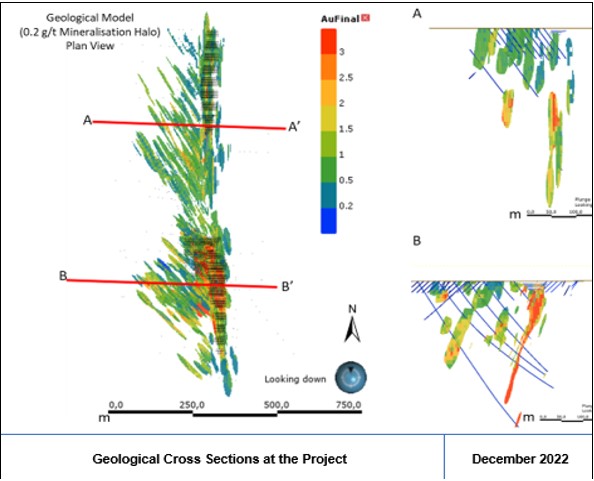

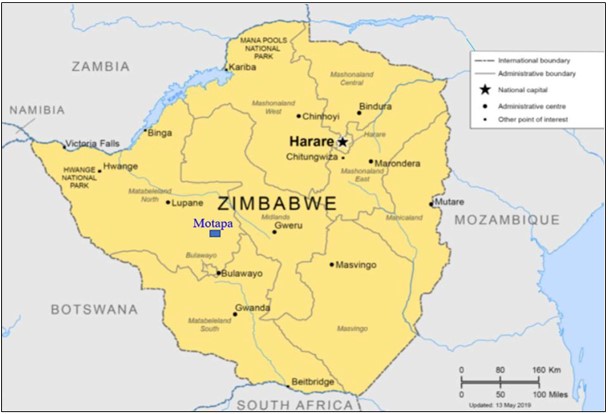

We may lose our foreign private issuer status, which would then require us to comply with the Exchange Act’s domestic reporting regime and cause us to incur additional legal, accounting and other expenses.