Exhibit 99.2

| CALEDONIA MINING CORPORATION PLC | November 10, 2022 |

Management’s Discussion and Analysis

This management’s discussion and analysis (“MD&A”) of the consolidated operating results and financial position of Caledonia Mining Corporation Plc (“Caledonia” or the “Company”) is for the quarter ended September 30, 2022 (“Q3 2022” or the “Quarter”). It should be read in conjunction with the Interim Financial Statements of Caledonia for the Quarter (the “Interim Financial Statements”) which are available from the System for Electronic Data Analysis and Retrieval at www.sedar.com or from Caledonia’s website at www.caledoniamining.com. The Interim Financial Statements and related notes have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board. In this MD&A, the terms “Caledonia”, the “Company”, the “Group”, “we”, “our” and “us” refer to the consolidated operations of Caledonia Mining Corporation Plc and its subsidiaries unless otherwise specifically noted or the context requires otherwise.

Note that all currency references in this document are to thousands of US Dollars, unless otherwise stated.

TABLE OF CONTENTS

| 1. | OVERVIEW | |

| 2. | HIGHLIGHTS | |

| 3. | SUMMARY FINANCIAL RESULTS | |

| 4. | OPERATIONS | |

| 4.1 | Safety, Health and Environment | |

| 4.2 | Social Investment and Contribution to the Zimbabwean Economy | |

| 4.3 | Gold Production | |

| 4.4 | Underground | |

| 4.5 | Metallurgical Plant | |

| 4.6 | Production Costs | |

| 4.7 | Capital Projects | |

| 4.8 | Indigenisation | |

| 4.9 | Zimbabwe Commercial Environment | |

| 4.10 | Opportunities and Outlook | |

| 4.11 | COVID-19 | |

| 4.12 | Solar project | |

| 5. | EXPLORATION | |

| 6. | INVESTING | |

| 7. | FINANCING | |

| 8. | LIQUIDITY AND CAPITAL RESOURCES | |

| 9. | OFF-BALANCE SHEET ARRANGEMENTS, CONTRACTUAL COMMITMENTS AND CONTINGENCIES | |

| 10. | NON-IFRS MEASURES | |

| 11. | RELATED PARTY TRANSACTIONS | |

| 12. | CRITICAL ACCOUNTING ESTIMATES | |

| 13. | FINANCIAL INSTRUMENTS | |

| 14. | DIVIDEND POLICY | |

| 15. | MANAGEMENT AND BOARD | |

| 16. | SECURITIES OUTSTANDING | |

| 17. | RISK ANALYSIS | |

| 18. | FORWARD LOOKING STATEMENTS | |

| 19. | CONTROLS | |

| 20. | QUALIFIED PERSON | |

| 1. | OVERVIEW |

Caledonia is an exploration, development and mining corporation focused on Zimbabwe. Caledonia’s primary asset is a 64% ownership in Blanket Mine (“Blanket”), a gold mine in Zimbabwe. Caledonia consolidates Blanket into the Interim Financial Statements; accordingly, operational and financial information set out in this MD&A is on a 100% basis, unless otherwise specified. Caledonia’s shares are listed on the NYSE American LLC ("NYSE American"), depositary interests in Caledonia’s shares are admitted to trading on AIM of the London Stock Exchange plc and depositary receipts in Caledonia’s shares are listed on the Victoria Falls Stock Exchange (“VFEX”) (all under the symbols “CMCL”).

| 2. | HIGHLIGHTS |

| 3 months ended September 30 | 9 months ended September 30 | Comment | |||

| 2021 | 2022 | 2021 | 2022 | ||

| Gold produced (oz) | 18,965 | 21,120 | 48,872 | 59,726 | Record quarterly gold production. Gold production in the Quarter was 11.4% higher than in the third quarter of 2021 (the “comparable quarter”) due to increased tonnes milled and higher grade. |

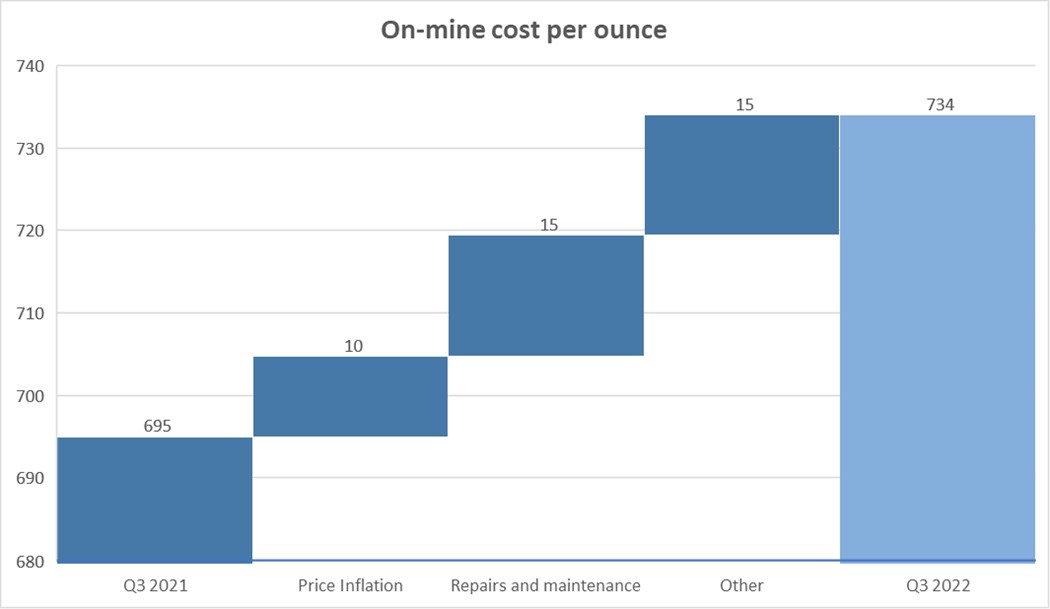

| On-mine cost per ounce ($/oz)1 | 695 | 734 | 743 | 709 | On-mine cost per ounce in the Quarter increased by 5.7% from the comparable quarter due to higher production costs. Inflationary pressures were incurred on key consumables. Unforeseen repairs and maintenance further contributed to the higher on-mine cost per ounce for the Quarter. |

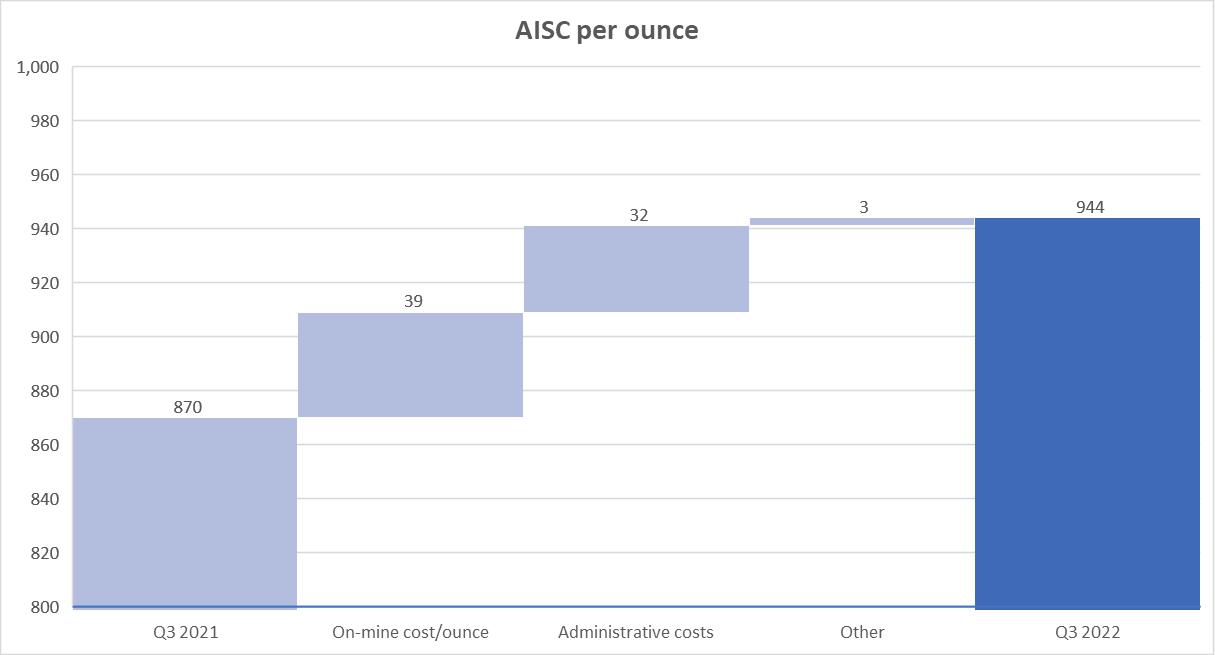

| All-in sustaining cost (“AISC”) | 870 | 944 | 931 | 945 | AISC per ounce in the Quarter increased by 9% compared to the comparable quarter due to higher on-mine cost per ounce and higher administrative costs. |

| Average realised gold price ($/oz)1 | 1,764 | 1,696 | 1,766 | 1,792 | The average realised gold price reflects international spot prices. |

| Gross profit2 | 15,737 | 15,572 | 40,031 | 50,461 | Gross profit for the Quarter decreased due to higher production costs and the lower realised gold price, both of which outweighed the effect of higher production. |

| Net profit attributable to shareholders | 6,939 | 8,614 | 14,183 | 25,932 | Net profit for the Quarter increased due to lower other expenses, higher net foreign exchange gains and fair value gains on derivative financial instruments in the Quarter which offset higher administrative expenses and a higher taxation charge. |

| Basic IFRS earnings per share (“EPS”) (cents) | 57.1 | 66.2 | 115.2 | 197.7 | IFRS EPS reflects the increase in IFRS profit attributable to shareholders. This was partly offset by an increase in the number of shares issued from the comparable quarter. |

| Adjusted EPS1 | 68.9 | 60.7 | 183.2 | 178.8 | Adjusted EPS excludes net foreign exchange gains, deferred tax and fair value movements on derivative financial instruments. |

| Net cash from operating activities | 7,112 | 8,923 | 21,804 | 35,792 | Net cash from operating activities increased due to higher operating profit and reduced working capital movements. This was partly offset by high unrealised foreign exchange gains. |

| Net cash and cash equivalents | 13,010 | 6,167 | 13,010 | 6,167 | Net cash was lower due to continued high levels of capital investment and dividend payments. |

1 Non-IFRS measures such as “On-mine cost per ounce”, “AISC”, “average realised gold price” and “adjusted EPS” are used throughout this document. Refer to section 10 of this MD&A for a discussion of non-IFRS measures.

2 Gross profit is after deducting royalties, production costs and depreciation but before administrative expenses, other income, interest and finance charges and taxation.

Bilboes Gold acquisition and tribute transaction

On July 21, 2022 Caledonia announced that it had signed an agreement to purchase Bilboes Gold Limited (“Bilboes Gold”), the parent company which owns, through its Zimbabwe subsidiary, Bilboes Holdings (Private) Limited (“Bilboes Holdings“), the Bilboes gold project in Zimbabwe (“Bilboes” or the “Project”) for a total consideration of 5,123,044 Caledonia shares representing approximately 28.5% of Caledonia's fully diluted equity, (although this could be subject to customary adjustment up or down to a maximum of 5,497,293 shares) and a 1% net smelter royalty ("NSR") on the Project's revenues.

Bilboes is a large, shear-hosted gold (sulphide and oxide) deposit located approximately 75 km north of Bulawayo, Zimbabwe. Historically, it has been subject to a limited amount of open pit mining.

The Project has NI43-101 compliant measured and indicated mineral resources of 2.56 million ounces of gold at a grade of 2.26 g/t and inferred mineral resources of 576,672 ounces of gold at a grade of 1.89 g/t3. This includes proven and probable mineral reserves of 1.96 million ounces of gold at a grade of 2.29 g/t.

Completion of the transaction is subject to several conditions, including:

| · | that Bilboes Holdings receives confirmation from the Zimbabwe authorities that it will, for the life of the mine, be able to export gold directly and to retain 100% of the sale proceeds in US Dollars with no requirement to convert US Dollar gold revenues into domestic currency; and |

| · | an arrangement with or confirmation from the Zimbabwe authorities and/or an independent power producer regarding the future availability of a sufficiently reliable and affordable electricity supply to the Project. |

Caledonia continues to have constructive engagement with the Zimbabwe authorities regarding the satisfaction of these conditions.

Caledonia has entered into tribute and mining agreements with Bilboes Holdings so that the oxide project can be re-started with the expectation that the oxide project will generate a profit within approximately 6 months of the commencement of activity dependant on procurement during the festive season. This also has the benefit of an element of pre-stripping for the main development.

Record Quarterly Production at Blanket Mine

Production for the Quarter was 21,120 ounces, an 11% increase from the comparable quarter. Production for the Quarter exceeded our expectations and represents a new quarterly production record. Production for the Quarter excludes a surface stockpile of approximately 16,500 tonnes of crushed ore containing approximately 1,750 ounces of recoverable gold.

Blanket remains on track to achieve the higher end of its production guidance of between 73,000 and 80,000 ounces of gold in 20224.

___________________________

3 Refer to the technical report entitled "BILBOES GOLD PROJECT FEASIBILITY STUDY" with effective date 15 December 2021 prepared by DRA Projects (Pty) Ltd filed by the Company on SEDAR (www.sedar.com) on 21 July 2022.

4 Refer to the technical report entitled "Caledonia Mining Corporation Plc NI 43-101 Technical Report on the Blanket Gold Mine, Zimbabwe" dated May 17, 2021 prepared by Minxcon (Pty) Ltd and filed by the Company on SEDAR on May 26, 2021

Changes to the board and management

The following changes to management and the board were announced during the reporting period:

| · | On July 1, 2022, Mr Mark Learmonth, previously Chief Financial Officer, was appointed as Chief Executive Officer to replace Mr Steve Curtis, who retired. Mr Curtis remains a non-executive director of the Company and a consultant to the Group; and |

| · | On July 1, 2022, Mr Chester Goodburn, previous Group Financial Manager, was appointed as Chief Financial Officer. |

Strategy and Outlook: increased focus on growth opportunities

Caledonia’s immediate strategic focus is on Blanket: to increase production to the target of 80,000 ounces of gold per annum, reduce operating costs and increase the flexibility to undertake further development and exploration, thereby safeguarding and enhancing Blanket’s long-term future. Management believes there is excellent exploration potential at Blanket at depth, in the older shallower areas of the mine and in brownfield sites immediately adjacent to the existing Blanket footprint.

Caledonia also intends to complete the acquisition of Bilboes and, thereafter, to prepare a feasibility study to identify the most judicious way to commercialise the Project with regard to the availability of funding on acceptable terms. Caledonia plans to re-start the oxides project at Bilboes during quarter 4 in terms of a tribute agreement with a view to creating a cash-generative operation.

Caledonia completed the verification of the existing geological information at the Maligreen mining claims in the Zimbabwe midlands and estimated the NI 43-101 compliant inferred mineral resource of approximately 862,600 ounces of gold in 14.2 million tonnes at a grade of 1.89g/t. The QAQC and evaluation resulted in improved confidence and the conversion to measured and indicated mineral resources of 442,300 ounces of gold in 8.03 million tonnes at a grade of 1.71g/t. The remaining inferred mineral resources are estimated at 420,300 ounces of gold in 6.17 million tonnes at a grade of 2.12g/t.

Caledonia has purchased Motapa Mining Company UK Limited, the parent company of a Zimbabwe subsidiary which holds a registered mining lease over the Motapa gold exploration property in Southern Zimbabwe (“Motapa” or the “Project”). The Company has made the purchase from Bulawayo Mining Company Limited, a privately owned UK company. The purchase price is undisclosed but is below the regulatory disclosure threshold.

| 3. | SUMMARY FINANCIAL RESULTS |

The table below sets out the consolidated profit or loss for the Quarter, the 9 months to September 30, 2022 and prior period comparable amounts prepared under IFRS.

| Condensed Consolidated Statements of Profit or Loss and Other Comprehensive Income (unaudited) | ||||||||||||||||

| 3 months ended | 9 months ended | |||||||||||||||

| ($’000’s) | September 30 | September 30 | ||||||||||||||

| 2021 | 2022 | 2021 | 2022 | |||||||||||||

| Revenue | 33,496 | 35,840 | 89,193 | 107,904 | ||||||||||||

| Royalty | (1,679 | ) | (1,796 | ) | (4,471 | ) | (5,408 | ) | ||||||||

| Production costs | (13,729 | ) | (15,802 | ) | (38,948 | ) | (44,663 | ) | ||||||||

| Depreciation | (2,351 | ) | (2,670 | ) | (5,743 | ) | (7,372 | ) | ||||||||

| Gross profit | 15,737 | 15,572 | 40,031 | 50,461 | ||||||||||||

| Other income | 12 | 14 | 42 | 17 | ||||||||||||

| Other expenses | (1,254 | ) | (552 | ) | (5,395 | ) | (1,835 | ) | ||||||||

| Administrative expenses | (1,906 | ) | (2,789 | ) | (5,261 | ) | (8,068 | ) | ||||||||

| Net foreign exchange gain | 413 | 1,559 | 341 | 6,640 | ||||||||||||

| Cash-settled share-based expense | (243 | ) | (25 | ) | (426 | ) | (335 | ) | ||||||||

| Equity-settled share-based expense | — | (94 | ) | — | (176 | ) | ||||||||||

| Derivative financial instrument gains/(expenses) | — | 537 | (107 | ) | (1,160 | ) | ||||||||||

| Operating profit | 12,759 | 14,222 | 29,225 | 45,544 | ||||||||||||

| Net finance costs | (13 | ) | (9 | ) | (354 | ) | (300 | ) | ||||||||

| Profit before tax | 12,746 | 14,213 | 28,871 | 45,244 | ||||||||||||

| Tax expense | (4,423 | ) | (4,018 | ) | (11,318 | ) | (14,051 | ) | ||||||||

| Profit for the period | 8,323 | 10,195 | 17,553 | 31,193 | ||||||||||||

| Other comprehensive income | ||||||||||||||||

| Items that are or may be reclassified to profit or loss | ||||||||||||||||

| Exchange differences on translation of foreign operations | (330 | ) | (699 | ) | (149 | ) | (858 | ) | ||||||||

| Total comprehensive income for the period | 7,993 | 9,496 | 17,404 | 30,335 | ||||||||||||

| Profit attributable to: | ||||||||||||||||

| Owners of the Company | 6,939 | 8,614 | 14,183 | 25,932 | ||||||||||||

| Non-controlling interests | 1,384 | 1,581 | 3,370 | 5,261 | ||||||||||||

| Profit for the period | 8,323 | 10,195 | 17,553 | 31,193 | ||||||||||||

| Total comprehensive income attributable to: | ||||||||||||||||

| Owners of the Company | 6,609 | 7,915 | 14,034 | 25,074 | ||||||||||||

| Non-controlling interests | 1,384 | 1,581 | 3,370 | 5,261 | ||||||||||||

| Total comprehensive income for the period | 7,993 | 9,496 | 17,404 | 30,335 | ||||||||||||

| Earnings per share (cents) | ||||||||||||||||

| Basic IFRS | 56.8 | 66.2 | 115.3 | 197.7 | ||||||||||||

| Diluted IFRS | 56.7 | 64.4 | 115.1 | 197.7 | ||||||||||||

| Adjusted earnings per share (cents) | 68.9 | 60.7 | 183.2 | 178.8 | ||||||||||||

| Dividends declared per share (cents) | 13.0 | 14.0 | 36.0 | 42.0 | ||||||||||||

Revenue in the Quarter was 7% higher than the comparable quarter due to an 11% increase in the quantity of gold sold and a 4% reduction in the average gold price obtained from $1,764 per ounce in the comparable quarter to $1,696 per ounce in the Quarter.

The royalty rate payable to the Zimbabwe Government was unchanged at 5% in the Quarter.

Production costs increased by 15.1% in the Quarter compared to the comparable quarter; the on-mine cost per ounce increased by 5.7% from the comparable quarter. Production costs in the Quarter increased predominantly due to inflationary pressures on consumable expenditures that contributed to a $10 per ounce increase in on-mine cost per ounce and unforeseen repairs and maintenance that contributed a further $15 per ounce. Inflationary increases were incurred on key consumables such as explosives, diesel, cyanide, carbon, lime and steel products (rods, steel balls, and drill steels). Unforeseen repairs and maintenance included the replacement end shield for ball mill No. 7 (BM7) and replacement batteries for the underground locomotives. Higher usage of explosives was also realised in the Quarter due to inefficiencies.

The AISC per ounce in the Quarter increased by 8.5% from the comparable quarter due to the higher production cost and higher administrative expenses.

The on-mine cost per ounce and the AISC per ounce increased in the Quarter compared to the comparable quarter as illustrated in the graphs below.

Administrative expenses are detailed in note 8 to the Interim Financial Statements and include the costs of Caledonia’s offices and personnel in Johannesburg, the UK and Jersey which provide the following functions: technical services, finance, procurement, investor relations, corporate development, legal and company secretarial.

Administrative expenses in the Quarter were 46.3% higher than the comparable quarter. The increase was due mainly to higher legal and professional fees (primarily relating to professional fees related to the Bilboes transaction) and increased travel and investor relations costs as activity levels returned to normal following the lifting of international travel restrictions. Further increases were incurred on software and cyber security costs to strengthen the Group’s controls over information and communication technologies in the Group.

The depreciation charge in the Quarter increased because of increased production (fixed assets are depreciated over production ounces) on the Central Shaft assets following its commissioning at the end of March 2021.

Other expenses are detailed in note 7 to the Interim Financial Statements and include community and social responsibility (“CSR”) expenses of $348 and an impairment expense of $467 on the accumulated expenditures incurred on the Connemara North exploration project.

Net foreign exchange movements relate to gains and losses arising on monetary assets and liabilities that are held in currencies other than the US Dollar. Large foreign exchange movements arose due to the significant devaluation of the Zimbabwe currency against the US Dollar which is discussed in section 4.9 of this MD&A. The net foreign exchange movement in the Quarter was higher than in the comparable quarter reflecting the accelerated depreciation of the Zimbabwe currency in the Quarter.

The tax expense comprised of the following:

| Analysis of Consolidated Tax expense/(credit) for the Quarter | ||||||||||||||||

| ($’000’s) | ||||||||||||||||

| Zimbabwe | South Africa | UK | Total | |||||||||||||

| Income tax | 2,004 | 143 | — | 2,147 | ||||||||||||

| Withholding tax | ||||||||||||||||

| Management fee | — | 38 | — | 38 | ||||||||||||

| Deemed dividend | 32 | — | — | 32 | ||||||||||||

| CHZ dividends to GMS | — | — | 390 | 390 | ||||||||||||

| Deferred tax | 1,460 | (49 | ) | — | 1,411 | |||||||||||

| 3,496 | 132 | 390 | 4,018 | |||||||||||||

The overall effective taxation rate in the Quarter was 28% (Q3 2021: 35%); most of the tax charge comprised income tax and deferred tax incurred in Zimbabwe.

The enacted income tax rate in Zimbabwe is 24.72% (2021: 24.72%). Zimbabwean taxable income is calculated in RTGS$ and payments are made in the same proportions of RTGS$ and USD as revenue is received. Deferred tax predominantly comprises the difference between the accounting and tax treatments of capital investment. 100% of capital expenditure is deductible in the year in which it is incurred for tax and depreciation commences when the project enters production. Large devaluations in the RTGS$ against the USD reduce the income tax paid and the deferred tax liability.

South African income tax arises on intercompany profits arising at Caledonia Mining South Africa Proprietary Limited (“CMSA”).

Zimbabwe withholding tax arose on the management fees paid to CMSA and on dividends paid from Zimbabwe to the Company’s subsidiary in the UK Greenstone Management Services Holdings Limited (“GMS”).

IFRS basic EPS for the Quarter increased by 15.9% from 57.1 cents in the comparable quarter to 66.2 cents. Adjusted EPS for the Quarter, which excludes inter alia the effect of foreign net exchange movements and deferred tax, reduced by 11.9% from 68.9 cents in the comparable quarter to 60.7 cents. The lower adjusted EPS (despite the increased EPS on an IFRS basis) was due primarily to the larger reversal of net foreign exchange gains, a lower add-back of deferred taxation and losses incurred on derivative instruments.

A dividend of 14 cents per share was declared and paid in the Quarter. Caledonia’s dividends are discussed further in section 14.

Risks that may affect Caledonia’s future financial condition are discussed in sections 4.9 and 17.

The table below sets out the consolidated statements of cash flows for the Quarter, the comparable quarter, the 9 months to September 30, 2022 and prior 9 month period comparable amounts prepared under IFRS.

| Condensed Consolidated Statements of Cash Flows (unaudited) | ||||||||||||||||

| 3 months ended | 9 months ended | |||||||||||||||

| ($’000’s) | September 30 | September 30 | ||||||||||||||

| 2021 | 2022 | 2021 | 2022 | |||||||||||||

| Cash flows from operating activities | ||||||||||||||||

| Cash generated from operations | 9,338 | 11,717 | 26,875 | 41,901 | ||||||||||||

| Interest paid | (50 | ) | (27 | ) | (297 | ) | (116 | ) | ||||||||

| Tax paid | (2,176 | ) | (2,767 | ) | (4,774 | ) | (5,993 | ) | ||||||||

| Net cash from operating activities | 7,112 | 8,923 | 21,804 | 35,792 | ||||||||||||

| Cash flows used in investing activities | ||||||||||||||||

| Acquisition of property, plant and equipment | (8,564 | ) | (10,840 | ) | (22,332 | ) | (33,585 | ) | ||||||||

| Acquisition of exploration and evaluation assets | (449 | ) | (311 | ) | (1,423 | ) | (947 | ) | ||||||||

| Realisation of gold ETF | — | — | 1,082 | — | ||||||||||||

| Proceeds on disposal of assets held for sale | 500 | — | 500 | — | ||||||||||||

| Proceeds from disposal of subsidiary | — | — | 340 | — | ||||||||||||

| Net cash used in investing activities | (8,513 | ) | (11,151 | ) | (21,833 | ) | (34,532 | ) | ||||||||

| Cash flows from financing activities | ||||||||||||||||

| Dividends paid | (2,108 | ) | (2,709 | ) | (5,614 | ) | (7,197 | ) | ||||||||

| Repayment of gold loan | — | — | — | (3,698 | ) | |||||||||||

| Proceeds from call options | — | 415 | — | 239 | ||||||||||||

| Term loan repayments | (100 | ) | — | (306 | ) | — | ||||||||||

| Payment of lease liabilities | (31 | ) | (36 | ) | (96 | ) | (115 | ) | ||||||||

| Net cash used in financing activities | (2,239 | ) | (2,330 | ) | (6,016 | ) | (10,771 | ) | ||||||||

| Net decrease in cash and cash equivalents | (3,640 | ) | (4,558 | ) | (6,045 | ) | (9,511 | ) | ||||||||

| Effect of exchange rate fluctuations on cash and cash equivalents | (19 | ) | (137 | ) | (37 | ) | (588 | ) | ||||||||

| Net cash and cash equivalents at beginning of the period | 16,669 | 10,862 | 19,092 | 16,265 | ||||||||||||

| Net cash and cash equivalents at end of the period | 13,010 | 6,167 | 13,010 | 6,167 | ||||||||||||

Cash generated from operating activities is detailed in note 21 to the Interim Financial Statements which shows that cash generated by operations before working capital changes in the Quarter was $13.7 million, 47.3% higher than the $9.3 million in the comparable quarter.

The negative cash working capital movement of $2.0 million in the Quarter was predominantly due to increased prepayments and trade and other receivables, offset by decreased inventory levels. Movements in working capital items are discussed below in the review of the Summarised Consolidated Statements of Financial Position.

Tax paid in the Quarter reflects the increased pre-tax profits at Blanket and is after the offset of part of the overdue VAT recoverable.

Investment in property, plant and equipment remains high due to the continued investment in new development associated with the Central Shaft project, which is discussed further in section 4.7 of this MD&A in sustaining capital investment and includes $0.3 million of investment in the solar project as discussed in section 4.12.

The acquisition of exploration and evaluation assets relates to the ongoing work at the Maligreen claims and geological evaluations as discussed further in section 5.

Dividends comprise $1.8m paid to shareholders of the Company and $0.9m to Blanket’s minority shareholders as discussed in section 14.

The effect of exchange rate fluctuations on cash held predominantly reflects gains or losses on cash balances held in currencies other than the US Dollar. The effect on cash balances forms part of an overall foreign exchange gain or loss arising on all affected financial assets and liabilities.

The table below sets out the consolidated statements of Caledonia’s financial position at the end of the Quarter and December 31, 2021 prepared under IFRS.

| Summarised Consolidated Statements of Financial Position (unaudited) | ||||||||||

| ($’000’s) | As at | December 31 | September 30 | |||||||

| 2021 | 2022 | |||||||||

| Total non-current assets | 157,944 | 187,980 | ||||||||

| Inventories | 20,812 | 19,675 | ||||||||

| Prepayments | 6,930 | 3,885 | ||||||||

| Trade and other receivables | 7,938 | 8,815 | ||||||||

| Income tax receivable | 101 | 38 | ||||||||

| Cash and cash equivalents | 17,152 | 8,256 | ||||||||

| Total assets | 210,877 | 228,649 | ||||||||

| Total non-current liabilities | 12,633 | 6,725 | ||||||||

| Lease liabilities – short term portion | 134 | 127 | ||||||||

| Trade and other payables | 9,957 | 12,340 | ||||||||

| Derivative financial liabilities | 3,095 | — | ||||||||

| Income tax payable | 1,562 | 1,867 | ||||||||

| Overdraft | 887 | 2,089 | ||||||||

| Cash-settled share-based payments - short term portion | 2,053 | 827 | ||||||||

| Total liabilities | 30,321 | 23,975 | ||||||||

| Total equity | 180,556 | 204,674 | ||||||||

| Total equity and liabilities | 210,877 | 228,649 | ||||||||

Non-current assets increased due to the investment at Blanket in the Central Shaft and related infrastructure, electrical infrastructure and sustaining investment; investment in the solar project; and the acquisition and investments in exploration and evaluation properties.

Inventory levels at Blanket reduced by $1.8 million and gold work in progress and ore stockpile increased by $0.6 million because mine production exceeded milling capacity for much of 2022 until milling capacity was increased in September 2022.

Prepayments represent deposits and advance payments for goods and services. Prepayments decreased largely due to the reduction in prepayments in respect of the solar project as it nears completion.

Trade and other receivables are detailed in note 17 to the Interim Financial Statements and include $6.2 million (December 31, 2021: $4.5 million) due from Fidelity in respect of gold deliveries prior to the close of business on September 30, 2022 and $0.8 million (December 31, 2021: $3.2 million) due from the Zimbabwe Government in respect of VAT refunds. The increased receivable due from Fidelity Printers and Refiners (Private) Limited (“Fidelity”), a subsidiary of the Reserve Bank of Zimbabwe (“RBZ”), reflects the higher gold production and a larger delivery of gold at the end of the Quarter. The full amount due from Fidelity in respect of gold deliveries was received as it fell due in October 2022. Also included in trade and other receivables is an amount of $0.6 million that relates to the VAT and duties tax to be refunded to Caledonia Mining Services (Private) Limited (“CMS”) on the import of solar equipment. The Bilboes receivable relates to payments made to Bilboes Holdings (Private) Limited to maintain the liquidity of Bilboes Holdings (Private) Limited before the restart of the oxides project in terms of the tribute agreement. It is expected that this amount will be recovered through the operation of the tribute arrangement.

On August 1, 2022 the Group obtained approval from the Ministry of Mines and Mine Development for the tribute arrangement that allows Caledonia to mine the oxide portion of the Bilboes claims as discussed in section 4.10 of this MD&A. This is accounted for as a separate acquisition of a portion of the greater Bilboes transaction. The expected cost to restore the property, plant and equipment that is relevant to the oxide claims is estimated to be $0.9 million. This amount is expected to be paid in quarter 4 of 2022 and it is recognised as the acquisition cost of the oxide project which remained payable at September 30, 2022 (refer to note 12 and 20 to the Interim Financial Statements) and is therefore included in trade and other payables.

Trade and other payables include an amount provided for the settlement amount with Voltalia on the solar plant of $2.1 million as discussed in section 4.12 of this MD&A.

Derivative financial liabilities decreased due to the gold loan that was repaid in full in quarter 2 of 2022 and the significant decrease in the option price of the remaining options, as discussed in section 7 of this MD&A. The decrease in the cash-settled share-based payments value is due to awards that vested in quarter 1 of 2022 and the decrease in the share price.

The distribution of the consolidated cash across the jurisdictions where the Group operates was as follows:

| Geographical location of cash ($’000’s) | ||||||||||||||||

| As at | Dec 31, | Mar 31, | Jun 30, | Sep 30, | ||||||||||||

| 2021 | 2022 | 2022 | 2022 | |||||||||||||

| Zimbabwe | 8,092 | 5,842 | 8,868 | 883 | ||||||||||||

| South Africa | 635 | 1,861 | 878 | 932 | ||||||||||||

| UK/Jersey | 7,538 | 6,727 | 1,116 | 4,352 | ||||||||||||

| Total net cash and cash equivalents | 16,265 | 14,430 | 10,862 | 6,167 | ||||||||||||

Included in the cash and cash equivalents is a restricted cash amount of US$1 million (denominated in RTGS$) held by Blanket Mine which has been earmarked to Stanbic Bank Zimbabwe as a letter of credit in favor of CMSA. The letter of credit was issued by Stanbic Bank Zimbabwe on September 15, 2022 in RTGS$ and has a 90-day conversion tenure. The cash on maturity will be transferred to CMSA’s bank account, denominated in South African Rand. On July 11, 2022 and August 30, 2022, $4 million and $2 million was transferred respectively from CHZ to the GMS. A further $1.5 million was transferred in October 2022.

The short-term portion of the cash-settled share-based payment liability is in respect of awards made to certain employees at Caledonia, CMSA and Blanket in terms of the OEICP. The awards can be settled in cash or, subject to conditions, shares at the option of the recipient.

The following information is provided for each of the eight most recent quarterly periods ending on the dates specified. The figures are extracted from underlying financial statements that have been prepared using accounting policies consistent with IFRS.

| ($’000’s except per share amounts) | Dec 31, | Mar 31, | Jun 30, | Sep 30, | Dec 31, | Mar 31, | Jun 30, | Sep 30, |

| 2020 | 2021 | 2021 | 2021 | 2021 | 2022 | 2022 | 2022 | |

| Revenues | 28,128 | 25,720 | 29,977 | 33,496 | 32,136 | 35,072 | 36,992 | 35,840 |

| Profit attributable to owners of the Company | 2,973 | 4,550 | 2,694 | 6,939 | 4,222 | 5,940 | 11,378 | 8,614 |

| EPS – basic (cents) | 24 | 37.3 | 21.1 | 56.8 | 33.3 | 44.6 | 87.7 | 63.3 |

| EPS – diluted (cents) | 23.9 | 37.2 | 21.1 | 56.7 | 33.3 | 44.6 | 87.7 | 63.3 |

| Net cash and cash equivalents | 19,092 | 13,027 | 16,669 | 35,840 | 16,265 | 14,430 | 10862 | 6,167 |

Fluctuations in profit attributable to owners of the Company on a quarterly basis are due to, inter alia, substantial foreign exchange profits as discussed in the relevant MD&As and financial statements.

| 4. | OPERATIONS |

| 4.1 | Safety, Health and Environment |

The following safety statistics have been recorded for the Quarter and the preceding seven quarters.

| Blanket Mine Safety Statistics | ||||||||||||||||||||||||||||||||

Classification | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | ||||||||||||||||||||||||

| Fatal | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | ||||||||||||||||||||||||

| Lost time injury | 3 | 0 | 1 | 0 | 2 | 0 | 2 | 1 | ||||||||||||||||||||||||

| Restricted work activity | 1 | 4 | 0 | 1 | 1 | 0 | 1 | 1 | ||||||||||||||||||||||||

| First aid | 0 | 0 | 0 | 1 | 0 | 2 | 3 | 0 | ||||||||||||||||||||||||

| Medical aid | 5 | 2 | 5 | 6 | 8 | 6 | 3 | 1 | ||||||||||||||||||||||||

| Occupational illness | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||

| Total | 9 | 6 | 6 | 8 | 11 | 9 | 9 | 3 | ||||||||||||||||||||||||

| Incidents | 14 | 17 | 9 | 26 | 10 | 9 | 10 | 14 | ||||||||||||||||||||||||

| Near misses | 7 | 11 | 3 | 6 | 2 | 4 | 7 | 6 | ||||||||||||||||||||||||

| Disability Injury Frequency Rate | 0.55 | 0.53 | 0.14 | 0.12 | 0.24 | 0.12 | 0.36 | 0.22 | ||||||||||||||||||||||||

| Total Injury Frequency Rate | 1.23 | 0.79 | 0.85 | 0.98 | 1.58 | 1.07 | 1.08 | 0.34 | ||||||||||||||||||||||||

| Man-hours worked (000’s) | 1,460 | 1,509 | 1,418 | 1,629 | 1,643 | 1,686 | 1,672 | 1,788 | ||||||||||||||||||||||||

The Nyanzvi safety training initiative was resumed in the previous quarter as COVID-19 restrictions were relaxed and this has coincided with a reduction in the injury frequency rates.

| 4.2 | Social Investment and Contribution to the Zimbabwean Economy |

Blanket’s investment in community and social projects which are not directly related to the operation of the mine or the welfare of Blanket’s employees, the payments made to the Gwanda Community Share Ownership Trust (“GCSOT”) and payments of taxation and other non-taxation charges to the Zimbabwe Government and its agencies are set out in the table below.

| Payments to the Community and the Zimbabwe Government ($’000’s) | ||||||||||

| Period | Year | CSR Investment | Payments to GCSOT | Payments to Zimbabwe Government (excl. royalties) | Total | |||||

| Year | 2013 | 2,147 | 2,000 | 15,354 | 19,501 | |||||

| Year | 2014 | 35 | - | 12,319 | 12,354 | |||||

| Year | 2015 | 50 | - | 7,376 | 7,426 | |||||

| Year | 2016 | 12 | - | 10,637 | 10,649 | |||||

| Year | 2017 | 5 | - | 11,988 | 11,993 | |||||

| Year | 2018 | 4 | - | 10,140 | 10,144 | |||||

| Year | 2019 | 47 | - | 10,357 | 10,404 | |||||

| Year | 2020 | 1,689 | 184 | 12,526 | 14,399 | |||||

| Year | 2021 | 1,163 | 948 | 16,426 | 18,537 | |||||

| Q1 | 2022 | 152 | - | 4,091 | 4,244 | |||||

| Q2 | 2022 | 94 | 240 | 5,014 | 5,708 | |||||

| Q3 | 2022 | 92 | 600 | 5,780 | 6,472 | |||||

CSR initiatives fall under six pillars of education, health, women empowerment and agriculture, environment, charity and youth empowerment.

Highlights of the community and social development initiatives during the Quarter include the drilling of boreholes at Datata Primary School, Gwakwe Primary School, Gwanda Government Secondary School, Insimbi Primary School, and Sibona Primary School. Two of the boreholes, Sibona and Gwakwe Primary school, were fully equipped with solar powered 1hp pumps, a 5000-litre water storage tank, and security lights. Drilling and equipping of more boreholes are expected in quarter 4 of 2022. At Phakama Isolation Centre the floor cladding in the two wards which was peeling off was repaired.

Work has begun at Sitezi Solar Project which is intended to provide Sitezi Clinic, Sitezi Primary and Secondary Schools, and the Enqameni Youth Reflection Centre with solar power; potable water reticulation will be installed for the four institutions and the school buildings will be renovated.

GCSOT was paid a $600,000 dividend in the Quarter. The dividend represents the full entitlement on GCSOT’s 10% shareholding in Blanket.

| 4.3 | Gold Production |

Tonnes milled, average grades, recoveries and gold produced during the Quarter, the preceding 8 quarters, the years 2019, 2020 and 2021 and October 2022 are shown in the table below.

| Blanket Mine Production Statistics | ||||||||||

| Year | Tonnes Milled (t) | Gold Head (Feed) Grade (g/t Au) | Gold Recovery (%) | Gold Produced (oz) | ||||||

| Year | 2019 | 556,331 | 3.31 | 93.4 | 55,182 | |||||

| Quarter 1 | 2020 | 140,922 | 3.35 | 93.8 | 14,233 | |||||

| Quarter 2 | 2020 | 143,210 | 3.13 | 93.9 | 13,499 | |||||

| Quarter 3 | 2020 | 157,343 | 3.19 | 93.9 | 15,155 | |||||

| Quarter 4 | 2020 | 156,487 | 3.19 | 93.5 | 15,012 | |||||

| Year | 2020 | 597,962 | 3.21 | 93.8 | 57,899 | |||||

| Quarter 1 | 2021 | 148,513 | 2.98 | 93.0 | 13,197 | |||||

| Quarter 2 | 2021 | 165,760 | 3.34 | 93.8 | 16,710 | |||||

| Quarter 3 | 2021 | 179,577 | 3.48 | 94.2 | 18,965 | |||||

| Quarter 4 | 2021 | 171,778 | 3.57 | 94.3 | 18,604 | |||||

| Year | 2021 | 665,628 | 3.36 | 93.9 | 67,476 | |||||

| Q1 | 2022 | 165,976 | 3.69 | 94.1 | 18,515 | |||||

| Q2 | 2022 | 179,118 | 3.71 | 93.9 | 20,091 | |||||

| Q3 | 2022 | 198,495 | 3.53 | 93.6 | 21,120 | |||||

| October | 2022 | 61,151 | 3.35 | 93.6 | 6,770 | |||||

Gold production for the Quarter was 11.4% higher than the comparable quarter due to a 10.5% increase in tonnes milled and a 1.6% increase in the grade. Tonnes milled and grade are discussed in section 4.4 of this MD&A; gold recoveries are discussed in section 4.5 of this MD&A.

An ore stockpile of approximately 16,500 tonnes (Q2 2022: 12,700 tonnes) existed at Quarter end due to the rate of mining and hoisting exceeding the milling capacity for much of 2022. In September 2022, the milling rate surpassed the hoisting rate by 5,800 tonnes after the commissioning of BM10 and re-commissioning of BM7.

| 4.4 | Underground |

Tonnes milled in the Quarter were 10.5% higher than the comparable quarter. The increased production is due to the commissioning of the Central Shaft at the end of March 2021; Central Shaft currently handles most of the development waste, which creates capacity at No. 4 Shaft to hoist ore. Central Shaft is expected to hoist a combination of waste and ore by the end of quarter 4 2022.

| 4.5 | Metallurgical Plant |

Recoveries in the Quarter were 93.6% compared to 94.2% in the comparable quarter.

The capacity constraints in the metallurgical plant that were experienced during the previous quarter were alleviated in the Quarter due to the commissioning of the new ball mill (BM10) and the repair of BM7. The installation and repair increased the metallurgical production capacity to 2,400 tonnes per day. The increased milling capacity enabled Blanket to increase tonnage milled from 1,976 tonnes per day during June, 2022 to 2,351 tonnes per day during September, 2022 and achieve a new production high for the Quarter.

During the Quarter, Blanket was constructing a conveyor and crushing system, located at Central Shaft, to feed ore from the Central shaft to a primary crusher from which the crushed ore will be transported by truck to the metallurgical plant which is located approximately 800 metres away, close to the No. 4 Shaft The project is expected to be commissioned in quarter 4 of 2022.

| 4.6 | Production Costs |

A narrow focus on the direct costs of production (mainly labour, electricity and consumables) does not fully reflect the total cost of gold production. Accordingly, cost per ounce data for the Quarter and the comparable quarter have been prepared in accordance with the Guidance Note issued by the World Gold Council on June 23, 2013 and is set out in the table below on the following bases:

| i. | On-mine cost per ounce5, which shows the on-mine costs of producing an ounce of gold and includes direct labour, electricity, consumables and other costs that are incurred at the mine including insurance, security and on-mine administration; |

| ii. | All-in sustaining cost per ounce5, which shows the on-mine cost per ounce plus royalty paid, additional costs incurred outside the mine (i.e. at offices in Harare, Johannesburg and Jersey), costs associated with maintaining the operating infrastructure and resource base that are required to maintain production at the current levels (sustaining capital investment), the share-based expense (or credit) arising from the LTIP awards less silver by-product revenue; and |

| iii. | All-in cost per ounce5, which shows the all-in sustaining cost per ounce plus the costs associated with activities that are undertaken with a view to increasing production (expansion capital investment). |

| Cost per Ounce of Gold Sold | ||||||||

| (US$/ounce) | ||||||||

3 months ended September 30 | 9 months ended September 30 | |||||||

| 2021 | 2022 | 2021 | 2022 | |||||

| On-mine cost6 | 695 | 734 | 743 | 709 | ||||

| All-in sustaining cost per ounce6 | 870 | 944 | 931 | 945 | ||||

| All-in cost per ounce6 | 1,250 | 1,454 | 1,375 | 1,534 | ||||

A reconciliation of costs per ounce to IFRS production costs is set out in section 10.

On-mine costs

On-mine cost comprises labour, electricity, consumables, and other costs such as security and insurance. Production costs are detailed in note 6 to the Interim Financial Statements. On-mine costs include the procurement margin paid to CMSA on the grounds that this cost represents a fair value that Blanket would pay for consumables if they were sourced from a third party but exclude the cost of work in progress.

On-mine cost per ounce for the Quarter was 5.7% higher than the comparable quarter due to the increased production costs as discussed in section 3 of this MD&A. On-mine cost increases were partly offset by a lower operational electricity charge due to the installation of two autotap changers on the No. 4 shaft incoming electricity supply line which reduced the frequency of power interruptions resulting from power surges and significantly reduced the generator use to support production and hence the power expense incurred during the Quarter.

_______________________________

5 On-mine cost per ounce, all-in sustaining cost per ounce and all-in cost per ounce are non-IFRS measures. Refer to section 10 for a reconciliation of these amounts to IFRS.

On-mine cost per ounce for the Quarter was within the guidance range of between $669 to $736 per ounce.

All-in sustaining cost

All-in sustaining cost excludes the intercompany procurement margin as this reflects the consolidated cost incurred at the Group level. The all-in sustaining cost per ounce was 8.5% higher than in the comparable quarter because of the higher administrative costs as discussed in section 3 of this MD&A as well as higher sustaining capital expenditure. All-in sustaining cost per ounce for the Quarter of $944 per ounce was within the guidance range of between $880 to $970 per ounce.

All-in cost

All-in cost includes investment in expansion projects at Blanket which remained at a high level in the Quarter due to the continued investment, as discussed in section 4.7 of this MD&A. All-in cost does not include pre-feasibility investment in exploration and evaluation projects.

| 4.7 | Capital Projects |

The main capital development project is the infrastructure relating to the Central Shaft which will allow for three new production levels (26, 30 and 34 levels) below the current operations; a fourth level (38 level) is intended to be added in due course via a decline construction. Central Shaft is currently being used to hoist development waste, men and material – thereby freeing up capacity at No. 4 Shaft to hoist ore. Work in the Quarter at Central Shaft included equipping the grizzlies at the ore passes on 26 and 30 levels. Development from Central Shaft has continued northwards and southwards on 30 and 34 levels towards AR South and Eroica. The total development advances achieved in the Quarter was 1,815 meters compared to 1,527 meters in the previous quarter and the budgeted advance of 1,636 meters.

In addition to the Central Shaft, work continued on the following developments:

| • | Eroica Decline 3: this decline will continue down to the 30 and 34 levels (990m and 1,110m below collar, respectively) and will connect to the haulages from Central Shaft. Progress in the Quarter has been good, and the decline has advanced to a depth of 855m; |

| • | Decline 4: this decline has reached 930m where an intermediate haulage has been cut to facilitate early production in 2022. This haulage will cover the high-grade areas of the Blanket No.3 orebody and the Blanket Quartz Reef and will continue south to open the extensive strike of Blanket No.2 orebody. Twin raises have been mined up to 870m and multiple sub-levels are now being mined to expose the orebody where grades are expected to be over 5g/t; |

| • | Decline 5: the decline branches from Decline 4 at 885m and heads towards the high-grade AR Southeast-west limb. This decline has reached its destination at 930m, and run-of-mine development is now in progress; and |

The Caledonia board has approved an approximately $3 million capital programme to address the remaining issues relating to the electricity supply from the grid which includes installing capacitors to improve the power utilization efficiency and installing further autotap transformers to stabilize the power at Central Shaft. The table below shows spending on capital development projects for the nine months to the end of the Quarter:

| Capital development | ($’000’s) | |||

| Central Shaft incl. infrastructure development | 7,300 | |||

| Capital development ends | 4,996 | |||

| Power | 3,877 | |||

| TOTAL | 16,173 | |||

| 4.8 | Indigenisation |

Transactions that implemented the indigenisation of Blanket (which expression in this section and in certain other sections throughout this MD&A refers to the Zimbabwe company that owns Blanket) were completed on September 5, 2012 following which Caledonia owned 49% of Blanket and received a Certificate of Compliance from the Zimbabwe Government which confirms that Blanket is fully compliant with the Indigenisation and Economic Empowerment Act.

Following the appointment of President Mnangagwa in 2017 the requirement for gold mining companies to be indigenised was removed by a change in legislation with effect from March 2018. On November 6, 2018, the Company announced that it had entered into a sale agreement with Fremiro Investments (Private) Limited (“Fremiro”) to purchase Fremiro’s 15% shareholding in Blanket for a gross consideration of $16.7 million which was to be settled through a combination of the cancellation of the loan between the two entities which stood at $11.5 million as at June 30, 2018 and the issue of 727,266 new shares in Caledonia at an issue price of $7.15 per share. This transaction was completed on January 20, 2020 following which Caledonia has a 64% shareholding in Blanket and Fremiro held approximately 6.3% of Caledonia’s enlarged issued share capital.

As a 64% shareholder, Caledonia receives 64% of Blanket’s dividends plus the repayment of vendor facilitation loans which were extended by Blanket to certain of the indigenous shareholders. The outstanding balance of the facilitation loans at September 30, 2022 was $15.03 million (December 31, 2021: $16.71). The facilitation loans (including interest thereon) are repaid by way of dividends from Blanket; 80% of the dividends declared by Blanket which are attributable to the beneficiaries of the facilitation loans are used to repay such loans and the remaining 20% unconditionally accrues to the respective indigenous shareholders. The dividends attributable to GCSOT, which holds 10% of Blanket, were withheld by Blanket to repay the advance dividends which were paid to GCSOT in 2012 and 2013.

The final payment to settle the advance dividend loan to GCSOT was made on September 22, 2021. Dividends to GCSOT after that date are unencumbered.

The facilitation loans are not shown as receivables in Caledonia’s financial statements in terms of IFRS. These loans are effectively equity instruments as their only means of repayment is via dividend distributions from Blanket. Caledonia continues to consolidate Blanket for accounting purposes. Further information on the accounting effects of indigenisation at Blanket is set out in note 5 to the Interim Financial Statements.

| 4.9 | Zimbabwe Commercial Environment |

Monetary Conditions

The situation in Zimbabwe can be summarised as follows:

| · | Although there continues to be a shortage of foreign currency in Zimbabwe, Blanket has had satisfactory access to foreign exchange to date. |

| · | The rate of local currency (known as “ZWL$”, “RTGS Dollars” or “RTGS$”) annual inflation increased from 61% by January 2022 to 280% by September 2022 which is the highest reading since April 2021. A high rate of RTGS$ inflation has little effect on Blanket’s operations because Blanket’s employees are paid in US Dollars. A large portion of Blanket’s other inputs are denominated in US Dollars. |

| · | Since October 2018, bank accounts in Zimbabwe have been bifurcated between Foreign Currency Accounts (“FCA”), which can be used to make international payments, and RTGS$ accounts which can only be used for domestic transactions. |

| · | The interbank exchange rate at each quarter end since the introduction of the interbank rate in February 2019 is set out below. |

| Interbank Exchange Rates (ZWL$:US$1) | ||||

| February 20, 2019 | 2.50 | |||

| March 31, 2019 | 3.00 | |||

| June 30, 2019 | 6.54 | |||

| September 30, 2019 | 15.09 | |||

| December 31, 2019 | 16.77 | |||

| March 31, 2020 | 25.00 | |||

| June 30, 2020 | 57.36 | |||

| September 30, 2020 | 81.44 | |||

| December 31, 2020 | 81.79 | |||

| March 31, 2021 | 84.40 | |||

| June 30, 2021 | 85.42 | |||

| September 30, 2021 | 87.67 | |||

| December 31, 2021 | 108.66 | |||

| March 31, 2022 | 142.42 | |||

| June 30, 2022 | 370.96 | |||

| September 30, 2022 | 621.89 | |||

| October 21, 2022 | 629.87 | |||

| · | The interbank trading mechanism addressed the most pressing difficulty that emerged after the October 2018 policy implementation, being the erosion of the purchasing power of Blanket’s employees due to rapidly increasing retail prices which had an adverse effect on employee morale. In February 2020, the RBZ announced its intention to further liberalise the interbank market with the objective of increasing liquidity and transparency. However, in response to the COVID-19 pandemic, the Minister of Finance subsequently reversed this policy and re-established a fixed exchange rate of ZWL$25:US$1 with effect from March 26, 2020. On June 23, 2020, the RBZ introduced an “auction system” whereby, on a weekly basis, buyers and sellers of local currency and foreign exchange submit tenders which the RBZ uses to determine a revised interbank rate. RTGS$ denominated goods and services are typically priced using a US Dollar reference point to which the informal exchange rate is applied. The official exchange rate does not reflect the local rate of inflation. |

| · | In June 2021 the RBZ announced that companies whose shares are listed on the Victoria Falls Stock Exchange (“VFEX”) will receive 100% of the revenue arising from incremental production in US Dollars. Blanket subsequently received confirmation that the “baseline” level of production for the purposes of calculating incremental production is 148.38 Kg per month (approximately 57,000 ounces per annum). In addition, the payment of the increased US Dollar proceeds for incremental production was backdated to July 1, 2021. As Blanket intends to increase its production from approximately 58,000 ounces of gold in 2020 to 80,000 ounces of gold from 2022 onwards, a listing on the VFEX should mean that Blanket will receive approximately 71.5% of its total revenues in US Dollars and the balance in local currency. Accordingly in December 2021 Caledonia obtained a secondary listing on the VFEX. Blanket has received all amounts due in terms of the policy. |

| · | In addition to the higher proportion of revenues payable in US Dollars (as outlined above), gold producers are also theoretically allowed to directly export incremental production. However, the practical modalities to achieve this have not yet been clarified; management continues to engage with relevant parties to obtain the necessary clarifications. |

| · | Throughout these developments and to the date of issue of the Interim Financial Statements the US Dollar has remained the primary currency in which the Group’s Zimbabwean entities operate and the functional currency of these entities. As at the date of this MD&A, Blanket has not accumulated excess local currency. |

| · | Blanket sells its gold production to Fidelity, which refines and on-sells the gold into the international market. During the first quarter of 2021, responsibility for making payments for gold deliveries from Blanket moved from the RBZ to its gold refining subsidiary Fidelity. This move simplified and improved the mechanism for making payments for gold and the new system is operating well. |

Electricity supply

The poor quality of electricity supply from the Zimbabwe Electricity Supply Authority (“ZESA”) is the most significant production difficulty at Blanket. Blanket experiences interruptions to its power supply from the grid due to an imbalance between electricity demand and supply. The supply from the grid is also subject to frequent surges and dips in voltage which, if not controlled, cause severe damage to Blanket’s electrical equipment. In the absence of equipment to control these surges, Blanket switches from grid power to diesel power if it experiences significant power surges – although this allows activity to continue, supplementary generator use increases the production and capital expenditure at Blanket. The continued deterioration in the ZESA supply means that the power factor regularly falls to 60%, which means that Blanket is effectively paying for 100% of the power but receives only 60% and the power supply is subject to outages.

The following initiatives were implemented or are planned to alleviate the power issues:

| · | In 2019 and early 2020 Blanket increased its diesel generating capacity to 18MW of installed capacity which was sufficient to maintain all operations and capital projects but only on a stand-by basis. |

| · | On the incoming ZESA supply line at the No. 4 shaft, Blanket installed two 10MVA auto tap transformers to protect equipment at No. 4 Shaft and the main metallurgical plant from voltage fluctuations on the incoming grid supply. Following the installation of these transformers, Blanket has used less diesel in the production of gold – consumption in the Quarter was 115,427 litres compared to 733,188 litres in the comparable quarter. |

| · | On the incoming ZESA supply line at the central shaft, two 10MVA autotap transformers are to be installed in quarter 4 of 2022 at a cost of $0.9 million. This installation is expected to reduce the voltage fluctuations and reduce the power cost and diesel usage allocated to capital projects during quarter 4 of 2022 and thereafter reduce operational expenditure when the Central shaft starts to hoist ore. |

| · | Caledonia’s board approved a project to construct a 12 MWac solar plant which should provide approximately 27% of Blanket’s average daily electricity demand at a planned cost of $14.3 million (including construction costs and other project planning, structuring, funding and administration costs). Caledonia is considering increasing the scale of the solar plant to further reduce Blanket’s reliance on the grid and diesel generators. The solar plant is expected to be commissioned in quarter 4 of 2022. This is discussed further in section 4.12. |

| · | Management is in discussion with the Zimbabwean power utility to obtain an improved supply of electricity. This may include an additional supply line that will result in fewer outages and a power supply that has a higher power factor. Blanket may potentially pay a different KWh rate for this supply line. At the date of approval of this MD&A no agreement with the Zimbabwean power utility was concluded. |

Water supply

Blanket uses water in the metallurgical process. Blanket is situated in a semi-arid region and rainfall typically only occurs in the period November to February. The 2021/2022 rainy season has been adequate, and management believes water supply is satisfactory.

Taxation

The main elements of the Zimbabwe tax regime insofar as it affects Blanket and Caledonia are as follows:

| • | A royalty is levied on gold revenues at a rate of 5% if the gold price is above $1,200 per ounce; a royalty rate at 3% applies if the gold price is below $1,200. With effect from January 1, 2020, the royalty is allowable as a deductible expense for the calculation of income tax. On October 9, 2022, the Zimbabwean government announced that 50% of royalty payments will be payable in gold. The announcement was effective October 1, 2022 but no guidance has been received from government on how this will be implemented. Management does not expect a material effect due to this announcement. |

| • | With effect from February 4, 2022 the 5% royalty was payable 60% in US Dollars and 40% in RTGS$. |

| • | Income tax is levied at 24.72% (2021: 24.72%) on taxable income as adjusted for tax deductions. The main adjustments to taxable income for the purposes of calculating tax are the add-back of depreciation and most of the management fees paid by Blanket to CMSA. 100% of all capital expenditure incurred in the year of assessment is allowed as a deductible expense. As noted above, the royalty is deductible for income tax purposes with effect from January 1, 2020. The calculation of taxable income is performed using financial records prepared in RTGS$, which has significantly reduced the deferred tax liability. Large devaluations in the RTGS$ to the USD would reduce the deferred tax liability. |

| • | Withholding tax is levied on certain remittances from Zimbabwe i.e. dividend payments from Zimbabwe to the UK and payments of management fees from Blanket to CMSA. |

| 4.10 | Opportunities and Outlook |

Central Shaft Project to Increase Production and Extend Mine Life

As discussed in section 4.7, following the commissioning of the Central Shaft, production is expected to increase to the targeted rate of approximately 80,000 ounces per annum from 2022 onwards. The Central Shaft will also create the operational flexibility to establish drilling platforms and resume deep-level exploration drilling.

Bilboes Gold

On July 21, 2022 Caledonia announced that it signed an agreement to purchase Bilboes Gold, the parent company of Bilboes Holdings. The total consideration will be settled in 5,123,044 of Caledonia shares, representing approximately 28.5% of Caledonia's fully diluted equity, (although this could be subject to customary adjustment up or down to a maximum of 5,497,293 shares) and a 1% NSR on the Project's revenues. Completion of the transaction is subject to several conditions, including:

| · | that Bilboes Holdings receives confirmation from the Zimbabwe authorities that it will, for the life of the mine, be able to export gold directly and to retain 100% of the sale proceeds in US Dollars with no requirement to convert US Dollar gold revenues into domestic currency; and |

| · | an arrangement with or confirmation from the Zimbabwe authorities and/or an independent power producer regarding the future availability of a sufficiently reliable and affordable electricity supply to the Project. |

Caledonia continues to have constructive engagements with the Zimbabwe authorities regarding the satisfaction of these conditions. Caledonia has received overarching approval for the transaction from the RBZ, but discussions continue regarding several more detailed consents and approvals that are required.

Bilboes is a large, shear-hosted gold deposit located approximately 75 km north of Bulawayo, Zimbabwe. Historically, it has been subject to a limited amount of open pit mining.

The Project has NI 43-101 compliant measured and indicated mineral resources of 2.56 million ounces of gold at a grade of 2.26 g/t and inferred mineral resources of 576,762 ounces of gold at a grade of 1.89 g/t. This includes is a proven and probable mineral reserves of 1.96 million ounces of gold at a grade of 2.29 g/t. The Project has produced approximately 288,000 ounces of gold since 1989.

A feasibility study prepared by the vendors indicates the potential for an open-pit gold mine producing an average of 168,000 ounces per year over a 10-year life of mine.

After completion of the transaction, Caledonia will conduct its own feasibility study to identify the most judicious way to commercialise the Project to optimize shareholder returns. One approach that will be considered is a phased development which would minimise the initial capital investment and reduce the need for third party funding.

Caledonia has entered into a tribute arrangement with Bilboes Holdings so that the oxide project can be re-started with the expectation that Bilboes Holdings will return to profitable operations within 6 months of the commencement of work on the oxide project. This also has the benefit of an element of pre-stripping for the main development of the Project. The tribute agreement will fall away on completion of the transaction, but the oxides project will continue. Capital and operational start-up costs of $3.8 million is required for the oxides project to start generating revenue. On August 1, 2022 the Group obtained approval from the Ministry of Mines and Mine Development for the tribute arrangement. Work on the oxide project will commence as soon as a short-term funding package has been finalised.

Maligreen

Caledonia completed the verification of the existing geological information at the Maligreen mining claims in the Zimbabwe midlands and estimated the NI 43-101 compliant inferred mineral resource of approximately 862,600 ounces of gold in 14.2 million tonnes at a grade of 1.89g/t. The QAQC and evaluation resulted in improved confidence and the conversion to measured and indicated mineral resources of 442,300 ounces of gold in 8.03 million tonnes at a grade of 1.71g/t. The remaining inferred mineral resources are estimated at 420,300 ounces of gold in 6.17 million tonnes at a grade of 2.12g/t.

Motapa

Caledonia has purchased Motapa Mining Company UK Limited, the parent company of a Zimbabwe subsidiary which holds a registered mining lease over the Motapa gold exploration property in Southern Zimbabwe (“Motapa” or the “Project”). The Company has made the purchase from Bulawayo Mining Company Limited, a privately owned UK company. The purchase price is undisclosed but is below the regulatory disclosure threshold.

Production Guidance

Production guidance for 2022 is between 73,000 and 80,000 ounces. The critical factors that influence whether Blanket can achieve this target include:

| · | Blanket’s ability to maintain an adequate supply of consumables and equipment if there is any resurgence in the COVID-19 pandemic and/or disruption to the supply chain arising from unrest in South Africa; |

| · | Blanket continuing to receive payment in full and on-time for all gold sales; |

| · | Blanket and Caledonia continuing to be able to make local and international payments in the normal course of business; and |

| · | Blanket’s ability to manage the erratic supply of electricity from ZESA. |

This is forward looking information as defined by National Instrument 51-102. Refer to section 18 of this MD&A for further information on forward looking statements.

The production guidance above excludes any production arising under the tribute agreement in respect of the oxides project at Bilboes as described in section 4.10.

Cost Guidance

On-mine cost per ounce guidance for 2022 is in the range of $669 to $736 per ounce; guidance for AISC is $880 to $970 per ounce. This is forward looking information as defined by National Instrument 51-102. Refer to section 18 of this MD&A for further information on forward looking statements.

Capital Expenditure

Capital expenditure at Blanket in 2022 is budgeted to be higher than the guidance of $15.2 million which was provided in the technical report entitled “Caledonia Mining Corporation Plc NI 43-101 Technical Report on the Blanket Gold Mine, Zimbabwe” dated May 17, 2021 prepared by Minxcon (Pty) Ltd and filed by the Company on SEDAR (www.sedar.com) on May 26, 2021 and which has an effective date of January 1, 2020. Blanket capital investment was previously indicated as $30.5 million for 2022, and is now expected to be approximately $37.9 million, the increase being due to the following factors:

| · | A cost overrun of approximately $1.4 million on the Central Shaft development that was envisaged in the initial project plan, this overrun being due mainly to the higher than anticipated running cost of the trackless equipment that is used in capital development on 30 and 34 levels. |

| · | Additional development as a result of delays in the Central Shaft (as discussed in section 4.7) at a cost of approximately $4.3 million. |

| · | A cost overrun of approximately $2.6 million on the Blanket Mine development that resulted from capital ends carried over from 2021, unplanned capital ends due to design changes and general inflation on mining and engineering consumables. |

| · | Additional capital costs resulting from the poor quality of Blanket’s electricity supply from ZESA of approximately $2.9 million (as discussed in section 4.9). This excludes any further investment to finalise the solar plant project constructed at Blanket. |

| · | Investments of approximately $0.5million for Blanket Mine grid enhancements for solar and generators to enable meter-reading, safety and communication protocols. |

| · | Investment of approximately $1.9 million to upgrade the workers’ village to accommodate the larger than anticipated workforce and upgrade the water and sewerage system. |

| · | Investment of approximately $3 million to increase the capacity of the metallurgical plant so that it can handle the increased tonnes required to sustain a production level of 80,000 ounces per annum. |

| · | Investment of $2 million for additional compressors and $1.9 million for the conveyors and crushing system at Central Shaft. |

| · | Further investment of $1.3 million to replace two generators that failed in late 2021 due to excessive use as a result of the increased incidence of load-shedding and voluntary curtailment of the use of grid power to protect against power surges. |

| · | Investment of $0.9 million for the design and construction for the first phase of a new tailings storage facility. |

The cash effect on Caledonia of the increased capital expenditure in 2022 at Blanket and the Bilboes oxides project will be mitigated somewhat by income tax relief at 24.72% because the capital expenditure is allowed as a deductible expense.

Strategy

Caledonia’s immediate strategic focus following the commissioning of the Central Shaft at Blanket is to:

| • | increase production to the target rate of 80,000 ounces of gold per annum from 2022; |

| • | re-commence deep level drilling at Blanket with the objective of upgrading inferred mineral resources, thereby extending the life of mine; |

| • | commence exploration at Blanket above 750 meters; and |

| • | commence exploration within the Blanket lease area that are outside the current mining footprint. |

When the acquisition of Bilboes Gold is completed, Caledonia will commence with its own feasibility study to identify the most judicious manner to commercialise the Project having regard to the availability of funding on acceptable terms. Before completion of the transaction, Caledonia intends to commence work on the oxide project at Bilboes in terms of the tribute arrangement as soon as the necessary short-term funding has been secured.

Caledonia will continue geological evaluations and exploration at the Maligreen and the Blanket Mine claims areas with the objective of increasing the confidence level of the existing estimated mineral resource base as discussed in section 5 of this MD&A.

Caledonia will evaluate further investment opportunities in Zimbabwe and elsewhere having regard to its funding and management capacity.

| 4.11 | COVID-19 |

Blanket employs over 2,000 employees the vast majority of whom live with their dependents on the mine village. One case of COVID-19 was recorded at Blanket during 2020; 232 cases of COVID-19 were detected in 2021 of which there were, regrettably, two deaths - of an employee and a dependent. Further cases were detected at the Company’s offices in Harare, Johannesburg and St Helier. Blanket procured sufficient doses of an approved vaccine for all adult employees and their spouses; as at September 30, 2022, 2,066 of Blanket’s employees and 620 of the Blanket employee dependents living on the Blanket site have been vaccinated on site.

COVID-19 had no significant effect on production, costs or capital projects in the Quarter.

| 4.12 | Solar project |

As noted in section 4.9, Blanket suffers from unstable grid power and load shedding which results in frequent and prolonged power outages. In late 2019 Caledonia initiated a tender process to identify parties to make proposals for a solar project to reduce Blanket’s reliance on grid power. After careful consideration, Caledonia’s board approved the construction of a 12MWac solar plant at a revised construction cost of approximately $14.3 million. The plant is expected to provide all of Blanket’s minimum electricity demand during daylight hours; Blanket will continue to rely on the grid and generators to provide additional power during daylight hours and at night. It is estimated that the solar plant will provide approximately 27% of Blanket’s total daily electricity requirement.

In 2020, the Caledonia board approved the project and the company raised $13 million (before commission and expenses) to fund the project through the sale of 597,963 shares at an average price of $21.74 per share.

The plant was mechanically complete at quarter 2 of 2022 but the project experienced delays in commissioning that resulted in the Company giving notice to terminate the EPC contract in September 2022. A new contractor has been appointed to assist in the final stages of commissioning and the performance testing phase. The following components of the project remain outstanding:

| § | Undertake delivery station and interconnection equipment witness testing with Zimbabwe Electricity Transmission & Distribution Company (“ZETDC”) as a requirement for grid connection to the utility. |

| § | The new EPC contractor must complete hot commissioning of the solar plant, energy management system integration with Blanket Mine and commence performance testing to achieve plant take over. |

| § | Conclusion of the ZETDC banking agreement. |

It is expected that the plant will be commissioned during quarter 4 of 2022.

The Company has commenced the evaluation of a further phase for the solar project to provide Blanket’s peak demand during daylight hours. This will require an agreement between the Company and the Zimbabwe authorities regarding the treatment of power that will be generated by a second phase that is surplus to Blanket’s requirements and/or the installation of storage capacity.

| 5. | EXPLORATION |

Caledonia’s exploration activities are focussed on Blanket and Maligreen.

Blanket

Deep exploration drilling for inferred mineral resource conversion commenced in the quarter after two drilling platforms were established. A single drill rig is employed, achieving 2,997 meters of core drilled. The fleet will be expanded to 3 rigs by December 2022. During the Quarter management has produced a desktop study, digitising existing data to give a consolidated view of surface exploration data. This is expected to give consolidated knowledge of the lease area and inform a potential surface exploration strategy. Management plans to provide an updated NI 43-101 technical report, as at December 31,2022, in quarter 1 of 2023. The GG satellite property remains on care and maintenance.

Maligreen

In 2021 Caledonia purchased the mining claims over an area known as Maligreen ("Maligreen"), situated in the Zimbabwe Midlands, for a cash consideration of US$4 million.

Maligreen is a substantial brownfield exploration opportunity with significant historical exploration and evaluation work having been conducted on the property over the last 30 years. The total area of Maligreen is approximately 550 hectares comprising two historic open pit mining operations which produced approximately 20,000 oz of gold mined from oxides between 2000 and 2002 after which the operation was closed.

As at August 31, 2021 the property was estimated to contain a NI 43-101 compliant inferred mineral resource of approximately 940,000 ounces of gold in 15.6 million tonnes at a grade of 1.88g/t6. Further QAQC and evaluation of previous drill results during the Quarter allowed management to increase the confidence levels of the previous estimate. The September 30, 2022 effective NI 43-101 resource statement7 estimated mineral resources of approximately 442,300 ounces of gold contained in 8.03 million tonnes at a grade of 1. 71g/t and total inferred mineral resources of approximately 420,300 ounces of gold contained in 6.17 million tonnes at a grade of 2.12g/t.

Of the mineral resources, approximately 662,900 ounces are shallower than 220m indicating the potential for an open pit mining operation with 434,100 ounces in 7.94 million tonnes at a grade of 1.70g/t of the open pit potential resource in the measured and indicated resource category. The mineral resource has been estimated using a cut-off grade of 0.4g/t for a potential open pit and 1.5g/t for the potential underground mine resource. These favourable grade tonnage dynamics offer a high level of flexibility in the evaluation of a future mining operation.

Management plans further on-the-ground exploration activities in 2023, but further work on Maligreen will be subordinated to work on the Bilboes project.

Motapa

Caledonia considers Motapa to be highly prospective and strategically important to its growth ambitions in Zimbabwe, both in location and scale. Motapa is a large property contigious to the Bilboes Gold project. Caledonia announced that it had entered into a binding sale and purchase agreement in July 2022.

The project was formerly owner and explored by Anglo American Zimbabwe before its exit from the Zimbabwean gold sector in the late 1990’s. The project is approximately 75Km north fo Bulawayo with a mining lease covering 2,200 hectares.

| 6. | INVESTING |

An analysis of investment in the Quarter, the preceding quarter and the years 2021, 2020 and 2019 is set out below.

| ($’000’s) | 2019 | 2020 | 2021 | 2022 | 2022 | 2022 | ||||||||||||||||||

| Year | Year | Year | Q1 | Q2 | Q3 | |||||||||||||||||||

| Total Investment – Property, plant and equipment | 20,423 | 24,778 | 31,269 | 12,365 | 13,258 | 10,759 | ||||||||||||||||||

| Blanket | 20,128 | 24,315 | 29,323 | 6,601 | 6,335 | 11,279 | ||||||||||||||||||

| Solar | - | 372 | 1,581 | 5,744 | 6,706 | (748 | ) | |||||||||||||||||

| Other | 295 | 91 | 365 | 20 | 217 | 228 | ||||||||||||||||||

| Total investment – Exploration and evaluation assets | 172 | 3,058 | 1,582 | 224 | 412 | 311 | ||||||||||||||||||

| Connemara North | - | 300 | 163 | 4 | - | - | ||||||||||||||||||

| Glen Hume | - | 2,661 | 1,176 | - | - | - | ||||||||||||||||||

| Maligreen | - | - | - | 184 | 364 | 362 | ||||||||||||||||||

| Other Satellite properties | 172 | 97 | 243 | 36 | 48 | (51 | ) |

Investment in property, plant and equipment at Blanket is discussed in section 4.7 of this MD&A; investment in solar is as discussed in section 4.12; investment in exploration and evaluation assets is as set out in section 5. All further investment is expected to be funded by internal cash flows and cash resources.

6 Refer to technical report entitled “Caledonia Mining Corporation Plc NI 43-101 Mineral Resource Report on the Maligreen Gold Project, Zimbabwe dated November 5, 2021 prepared by Minxcon (Pty) Ltd and filed on SEDAR (www.sedar.com).

7 See announcement dated November 7, 2022.

| 7. | FINANCING |

Caledonia financed all its operations using funds on hand and funds generated by its operations, and Blanket’s overdraft facilities which were as set out below at September 30, 2022.

| Overdraft facilities | |||||

| Lender | Date drawn | Principal value | Balance drawn at September 30, 2022 | Repayment terms | Security |

| Stanbic Bank Zimbabwe Limited | Sep-21 | RTGS$300 million | Nil | On demand | Unsecured |

| Stanbic Bank Zimbabwe Limited | Dec-21 | US$2 million | Nil | On demand | Unsecured |

| CABS Bank of Zimbabwe | Apr-22 | US$2 million | US$1.7 million | On demand | Unsecured |

On February 17, 2022 the Group entered into a zero cost contract to hedge 20,000 ounces of gold over a period of 5 months from March to July 2022. The hedging contract had a cap of $1,940 and a collar of $1,825, over 4,000 ounces of gold per month expiring at the end of each month over the 5-month period. At the beginning of the Quarter, this hedging arrangement paid $416,000 due to the prevailing gold price that fell below the collar strike price.