Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2012 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number 1-08895 |

||

HCP, Inc.

(Exact name of registrant as specified in its charter)

| Maryland | 33-0091377 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

3760 Kilroy Airport Way, Suite 300 Long Beach, California |

90806 (Zip Code) |

|

| (Address of principal executive offices) | ||

Registrant's telephone number, including area code (562) 733-5100 |

||

Securities registered pursuant to Section 12(b) of the Act: |

||

| Title of each class | Name of each exchange on which registered |

|

|---|---|---|

Common Stock |

New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant; (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act.) Yes o No ý

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter: $18.8 billion.

As of February 4, 2013 there were 453,379,156 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for the registrant's 2013 Annual Meeting of Stockholders have been incorporated by reference into Part III of this Report.

2

All references in this report to "HCP," the "Company," "we," "us" or "our" mean HCP, Inc. together with its consolidated subsidiaries. Unless the context suggests otherwise, references to "HCP, Inc." mean the parent company without its subsidiaries.

Business Overview

HCP, an S&P 500 company, invests primarily in real estate serving the healthcare industry in the United States. We are a Maryland corporation organized in 1985 to qualify as a self-administered real estate investment trust ("REIT"). We are headquartered in Long Beach, California, with offices in Nashville, Tennessee and San Francisco, California. We acquire, develop, lease, manage and dispose of healthcare real estate, and provide financing to healthcare providers. Our portfolio is comprised of investments in the following five healthcare segments: (i) senior housing, (ii) post-acute/skilled nursing, (iii) life science, (iv) medical office and (v) hospital. We make investments within our healthcare segments using the following five investment products: (i) properties under lease, (ii) debt investments, (iii) developments and redevelopments, (iv) investment management and (v) investments in senior housing operations utilizing the structure permitted by the Housing and Economic Recovery Act of 2008, which is commonly referred to as "RIDEA."

The delivery of healthcare services requires real estate and, as a result, tenants and operators depend on real estate, in part, to maintain and grow their businesses. We believe that the healthcare real estate market provides investment opportunities due to the following:

- •

- Compelling demographics driving the demand for healthcare services;

- •

- Specialized nature of healthcare real estate investing; and

- •

- Ongoing consolidation of a fragmented healthcare real estate sector.

Our website address is www.hcpi.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the "Exchange Act") are available on our website, free of charge, as soon as reasonably practicable after we electronically file such materials with, or furnish them to, the United States ("U.S.") Securities and Exchange Commission ("SEC").

Healthcare Industry

Healthcare is the single largest industry in the U.S. based on Gross Domestic Product ("GDP"). According to the National Health Expenditures report by the Centers for Medicare and Medicaid Services ("CMS"): (i) national health expenditures are projected to grow 3.8% in 2013 and 7.4% in 2014; (ii) the average compounded annual growth rate for national health expenditures, over the projection period of 2015 through 2021, is anticipated to be 6.2%; and (iii) the healthcare industry is projected to represent 17.8% of U.S. GDP in 2013.

Senior citizens are the largest consumers of healthcare services. According to CMS, on a per capita basis, the 75-year and older segment of the population spends 76% more on healthcare than the 65 to 74-year-old segment and over 200% more than the population average.

3

U.S. Population Over 65 Years Old

Source: U.S. Census Bureau, the Statistical Abstract of the United States.

Business Strategy

Our primary goal is to increase shareholder value through profitable growth, which allows us to maintain or increase dividends per share to our shareholders. Our investment strategy to achieve this goal is based on three principles: (i) opportunistic investing, (ii) portfolio diversification and (iii) conservative financing.

Opportunistic Investing

We make investment decisions that are expected to drive profitable growth and create shareholder value. We attempt to position ourselves to create and take advantage of situations to meet our goals and investment criteria.

Portfolio Diversification

We believe in maintaining a portfolio of healthcare investments diversified by segment, geography, operator, tenant and investment product. We monitor, but do not limit, our investments based on the percentage of our total assets that may be invested in any one property type, investment product, geographic location, the number of properties which we may lease to a single operator or tenant, or loans we may make to a single borrower. With investments in multiple segments and investment products, we can focus on opportunities with the most attractive risk/reward profile for the portfolio as a whole. We may structure transactions as master leases, require operator or tenant insurance and indemnifications, obtain credit enhancements in the form of guarantees, letters of credit or security deposits, and take other measures to mitigate risk.

Conservative Financing

We believe a conservative balance sheet is important to our ability to execute our opportunistic investing approach. We strive to maintain a conservative balance sheet by actively managing our debt-to-equity levels and maintaining multiple sources of liquidity, such as our revolving line of credit facility, access to capital markets and secured debt lenders, relationships with current and prospective institutional joint venture partners, and our ability to divest of assets. Our debt obligations are primarily fixed rate with staggered maturities, which reduces the impact of rising interest rates on our operations.

We finance our investments based on our evaluation of available sources of funding. For short-term purposes, we may utilize our revolving line of credit facility or arrange for other short-term borrowings from banks or other sources. We arrange for longer-term financing through offerings of

4

equity and debt securities, placement of mortgage debt and capital from other institutional lenders and equity investors.

We specifically incorporate by reference into this section the information set forth in Item 7, "2012 Transaction Overview," included elsewhere in this report.

Competition

Investing in real estate serving the healthcare industry is highly competitive. We face competition from other REITs, investment companies, pension funds, private equity and hedge fund investors, sovereign funds, healthcare operators, lenders, developers and other institutional investors, some of whom may have greater resources and lower costs of capital than we do. Increased competition makes it more challenging for us to identify and successfully capitalize on opportunities that meet our objectives. Our ability to compete may also be impacted by national and local economic trends, availability of investment alternatives, availability and cost of capital, construction and renovation costs, existing laws and regulations, new legislation and population trends.

Income from our facilities is dependent on the ability of our operators and tenants to compete with other companies on a number of different levels, including: the quality of care provided, reputation, the physical appearance of a facility, price and range of services offered, alternatives for healthcare delivery, the supply of competing properties, physicians, staff, referral sources, location, the size and demographics of the population in surrounding areas, and the financial condition of our tenants and operators. Private, federal and state payment programs as well as the effect of laws and regulations may also have a significant influence on the profitability of our tenants and operators. For a discussion of the risks associated with competitive conditions affecting our business, see "Risk Factors" in Item 1A.

Healthcare Segments

Senior housing. At December 31, 2012, we had interests in 441 senior housing facilities, 21 of which are in a RIDEA structure. Excluding RIDEA properties, all of our senior housing facilities are leased to single tenants under triple-net lease structures. Senior housing facilities include assisted living facilities ("ALFs"), independent living facilities ("ILFs") and continuing care retirement communities ("CCRCs"), which cater to different segments of the elderly population based upon their personal needs. Services provided by our operators or tenants in these facilities are primarily paid for by the residents directly or through private insurance and are less reliant on government reimbursement programs such as Medicaid and Medicare. Our senior housing property types are further described below:

- •

- Assisted Living Facilities. ALFs are licensed care

facilities that provide personal care services, support and housing for those who need help with activities of daily living ("ADL"), such as bathing, eating and dressing, yet require

limited medical care. The programs and services may include transportation, social activities, exercise and fitness programs, beauty or barber shop access, hobby and craft activities, community

excursions, meals in a dining room setting and other activities sought by residents. These facilities are often in apartment-like buildings with private residences ranging from single

rooms to large apartments. Certain ALFs may offer higher levels of personal assistance for residents requiring memory care as a result of Alzheimer's disease or other forms of dementia. Levels of

personal assistance are based in part on local regulations. At December 31, 2012, we had interests in 363 ALFs.

- •

- Independent Living Facilities. ILFs are designed to meet the needs of seniors who choose to live in an environment surrounded by their peers with services such as housekeeping, meals and activities. These residents generally do not need assistance with ADL. However, in some of our

5

- •

- Continuing Care Retirement Communities. CCRCs provide housing and health-related services under long-term contracts. This alternative is appealing to residents as it eliminates the need for relocating when health and medical needs change, thus allowing residents to "age in place." Some CCRCs require a substantial entry or buy-in fee and most also charge monthly maintenance fees in exchange for a living unit, meals and some health services. CCRCs typically require the individual to be in relatively good health and independent upon entry. At December 31, 2012, we had interests in 14 CCRCs.

facilities, residents have the option to contract for these services. At December 31, 2012, we had interests in 64 ILFs.

During the fourth quarter of 2012, we acquired 129 senior housing communities for $1.7 billion, from a joint venture between Emeritus Corporation and Blackstone Real Estate Partners VI, an affiliate of Blackstone (the "Blackstone JV"). Located in 29 states, the portfolio encompasses 10,077 units representing a diversified care mix of 61% assisted living, 25% independent living, 13% memory care and 1% skilled nursing. Emeritus continues to operate the communities pursuant to a new triple-net, master lease for the 129 properties guaranteed by Emeritus. For a more detailed description of the acquisition see Note 4 to the Consolidated Financial Statements.

Our senior housing segment accounted for approximately 33%, 30% and 30% of total revenues for the years ended December 31, 2012, 2011 and 2010, respectively. The following table provides information about our senior housing operator concentration for the year ended December 31, 2012:

Operators

|

Percentage of Segment Revenues |

Percentage of Total Revenues |

|||||

|---|---|---|---|---|---|---|---|

HCR ManorCare, Inc. ("HCR ManorCare")(1) |

11 | 30 | |||||

Emeritus Corporation ("Emeritus")(2) |

23 | 8 | |||||

Sunrise Senior Living Inc. ("Sunrise")(3) |

15 | 5 | |||||

Brookdale Senior Living, Inc. ("Brookdale")(4) |

14 | 5 | |||||

- (1)

- Percentage

of total revenues includes revenues earned from both our senior housing and post-acute/skilled nursing facilities leased to HCR

ManorCare.

- (2)

- Percentage

of total revenues from Emeritus includes partial results for Blackstone JV acquisition. Assuming that full-year results were included

for this acquisition in our 2012 revenues, the percentage of segment revenues and total revenues would be 36% and 12%, respectively.

- (3)

- Certain

of our properties are leased to tenants who have entered into management contracts with Sunrise to operate the respective property on their behalf.

To determine our concentration of revenues generated from properties operated by Sunrise, we aggregate revenue from these tenants with revenue generated from the two properties that are leased

directly to Sunrise.

- (4)

- Brookdale percentages do not include $143 million of senior housing revenues, related to 21 senior housing facilities that Brookdale operates on our behalf under a RIDEA structure. Assuming that these revenues were attributable to Brookdale, the percentage of combined segment and total revenues associated Brookdale would be 36% and 12% respectively.

Post-acute/skilled nursing. At December 31, 2012, we had interests in 312 post-acute/skilled nursing facilities ("SNFs"). SNFs offer restorative, rehabilitative and custodial nursing care for people not requiring the more extensive and sophisticated treatment available at hospitals. Ancillary revenues and revenues from sub-acute care services are derived from providing services to residents beyond room and board and include occupational, physical, speech, respiratory and intravenous therapy, wound care, oncology treatment, brain injury care and orthopedic therapy as well as sales of pharmaceutical products and other services. Certain SNFs provide some of the foregoing services on an out-patient basis. Post-acute/skilled nursing services provided by our operators and tenants in these facilities are primarily paid for either by private sources or through the Medicare and Medicaid programs. All of our SNFs are leased to single tenants under triple-net lease structures.

6

Our post-acute/skilled nursing segment accounted for approximately 29%, 29% and 13% of total revenues for the years ended December 31, 2012, 2011 and 2010, respectively. The following table provides information about our post-acute/skilled nursing operator/tenant concentration for the year ended December 31, 2012:

Operators/Tenants and Borrowers

|

Percentage of Segment Revenues |

Percentage of Total Revenues |

|||||

|---|---|---|---|---|---|---|---|

HCR ManorCare(1) |

90 | 30 | |||||

- (1)

- Percentage of total revenues includes revenues earned from both senior housing and post-acute/skilled nursing facilities leased to HCR ManorCare.

Life science. At December 31, 2012, we had interests in 113 life science properties, including four facilities owned by our Investment Management Platform. These properties contain laboratory and office space primarily for biotechnology, medical device and pharmaceutical companies, scientific research institutions, government agencies and other organizations involved in the life science industry. While these properties contain similar characteristics to commercial office buildings, they generally contain more advanced electrical, mechanical, and heating, ventilating, and air conditioning ("HVAC") systems. The facilities generally have specialty equipment including emergency generators, fume hoods, lab bench tops and related amenities. In many instances, life science tenants make significant investments to improve their leased space, in addition to landlord improvements, to accommodate biology, chemistry or medical device research initiatives. Life science properties are primarily configured in business park or campus settings and include multiple buildings. The business park and campus settings allow us the opportunity to provide flexible, contiguous/adjacent expansion to accommodate the growth of existing tenants. Our properties are located in well-established geographical markets known for scientific research, including San Francisco, San Diego and Salt Lake City. At December 31, 2012, 96% of our life science leases (based on leased square feet) were under triple-net structures.

Our life science segment accounted for approximately 15%, 17% and 22% of total revenues for the years ended December 31, 2012, 2011 and 2010, respectively. The following table provides information about our life science tenant concentration for the year ended December 31, 2012:

Tenants

|

Percentage of Segment Revenues |

Percentage of Total Revenues |

|||||

|---|---|---|---|---|---|---|---|

Genentech, Inc. |

19 | 3 | |||||

Amgen, Inc. |

18 | 3 | |||||

Medical office. At December 31, 2012, we had interests in 273 medical office buildings ("MOBs"), including 66 facilities owned by our Investment Management Platform. These facilities typically contain physicians' offices and examination rooms, and may also include pharmacies, hospital ancillary service space and outpatient services such as diagnostic centers, rehabilitation clinics and day-surgery operating rooms. While these facilities are similar to commercial office buildings, they require additional plumbing, electrical and mechanical systems to accommodate multiple exam rooms that may require sinks in every room, and special equipment such as x-ray machines. In addition, MOBs are often built to accommodate higher structural loads for certain equipment and may contain "vaults" or other specialized construction. Our MOBs are typically multi-tenant properties leased to healthcare providers (hospitals and physician practices), with approximately 77% of our MOBs, based on square feet, located on hospital campuses and 94% are affiliated with hospital systems. At December 31, 2012, 47% of our medical office leases (based on leased square feet) were under triple-net structures.

7

Our medical office segment accounted for approximately 18%, 19% and 25% of total revenues for the years ended December 31, 2012, 2011 and 2010, respectively. During the year ended December 31, 2012, HCA, Inc. ("HCA"), as our tenant, contributed 14% of our medical office segment revenues.

Our Investment Management Platform represents the following unconsolidated joint ventures: (i) HCP Ventures III, LLC, and HCP Ventures IV, LLC, which consists of MOB portfolios, and (ii) the HCP Life Science ventures. For a more detailed description of these unconsolidated joint ventures, see Note 8 to the Consolidated Financial Statements.

Hospital. At December 31, 2012, we had interests in 21 hospitals, including four facilities owned by our Investment Management Platform. Services provided by our operators and tenants in these facilities are paid for by private sources, third-party payors (e.g., insurance and Health Maintenance Organizations or "HMOs"), or through the Medicare and Medicaid programs. Our hospital property types include acute care, long-term acute care, specialty and rehabilitation hospitals. Our hospitals are generally leased to single tenants or operators under triple-net lease structures.

Our hospital segment accounted for approximately 5%, 5% and 10% of total revenues for the years ended December 31, 2012, 2011 and 2010, respectively. The following table provides information about our hospital operator/tenant concentration for the year ended December 31, 2012:

Operators/Tenants and Borrowers

|

Percentage of Segment Revenues |

Percentage of Total Revenues |

|||||

|---|---|---|---|---|---|---|---|

HCA(1) |

29 | 4 | |||||

Tenet Healthcare Corporation |

27 | 1 | |||||

- (1)

- Percentage of total revenues from HCA includes revenues earned from both our medical office and hospital segments.

Investment Products

Properties under lease. We primarily generate revenue by leasing properties under long-term leases. Most of our rents and other earned income from leases are received under triple-net leases or leases that provide for a substantial recovery of operating expenses. However, some of our MOBs and life science facility rents are structured under gross or modified gross leases. Accordingly, for such gross or modified gross leases, we incur certain property operating expenses, such as real estate taxes, repairs and maintenance, property management fees, utilities and insurance.

Our ability to grow income from properties under lease depends, in part, on our ability to (i) increase rental income and other earned income from leases by increasing rental rates and occupancy levels, (ii) maximize tenant recoveries and (iii) control non-recoverable operating expenses. Most of our leases include contractual annual base rent escalation clauses that are either predetermined fixed increases and/or are a function of an inflation index.

Debt investments. Our mezzanine loans are generally secured by a pledge of ownership interests of an entity or entities, which directly or indirectly own properties, and are subordinate to more senior debt, including mortgages and more senior mezzanine loans. Borrowers of our interests in mortgage and construction loans are typically healthcare providers and healthcare real estate generally secures these loans.

Developments and redevelopments. We generally commit to development projects that are at least 50% pre-leased or when we believe that market conditions will support speculative construction. We work closely with our local real estate service providers, including brokerage, property management, project management and construction management companies to assist us in evaluating development proposals and completing developments. Our development and redevelopment investments are primarily in our life science and medical office segments. Redevelopments are properties that require

8

significant capital expenditures (generally more than 25% of acquisition cost or existing basis) to update, achieve stabilization or to change the primary use of the properties.

Investment management. We co-invest in real estate properties with institutional investors through joint ventures structured as partnerships or limited liability companies. We target institutional investors with long-term investment horizons who seek to benefit from our expertise in healthcare real estate. Predominantly, we retain noncontrolling interests in the joint ventures ranging from 20% to 30% and serve as the managing member. These ventures generally allow us to earn acquisition and asset management fees, and have the potential for promoted interests or incentive distributions based on performance of the joint venture.

Operating properties ("RIDEA"). We may enter into contracts with healthcare operators to manage communities that are placed in a structure permitted by the Housing and Economic Recovery Act of 2008 (commonly referred to as "RIDEA"). Under the provisions of RIDEA, a REIT may lease "qualified healthcare properties" on an arm's length basis to a taxable REIT subsidiary ("TRS") if the property is operated on behalf of such subsidiary by a person who qualifies as an "eligible independent contractor." We view RIDEA as a structure primarily to be used on properties that present attractive valuation entry points and to drive growth by: (i) transitioning the asset to a new operator that can bring scale, operating efficiencies, and/or ancillary services; or (ii) investing capital to reposition the asset.

Portfolio Summary

At December 31, 2012, we managed $21.3 billion of investments in our Owned Portfolio and Investment Management Platform. At December 31, 2012, we also owned $540 million of assets under development, including redevelopment, and land held for future development.

Owned Portfolio

As of December 31, 2012, our leases and operating properties and debt investments in our Owned Portfolio consisted of the following (square feet and dollars in thousands):

| |

|

|

|

|

|

Year Ended December 31, 2012 |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

Investment(3) | |

|

|

|||||||||||||||

| |

Number of Properties(1) |

|

Total Investment |

|

Interest Income(5) |

||||||||||||||||

Segment

|

Capacity(2) | Properties(1) | Debt | NOI(4) | |||||||||||||||||

Senior housing |

441 | 45,669 Units | $ | 7,543,163 | $ | 123,642 | $ | 7,666,805 | $ | 531,419 | $ | 3,503 | |||||||||

Post-acute/skilled |

312 | 41,538 Beds | 5,669,469 | 328,905 | 5,998,374 | 538,856 | 19,993 | ||||||||||||||

Life science |

109 | 7,002 Sq. ft. | 3,362,298 | — | 3,362,298 | 236,491 | — | ||||||||||||||

Medical office |

207 | 14,274 Sq. ft. | 2,613,254 | — | 2,613,254 | 202,547 | — | ||||||||||||||

Hospital |

17 | 2,410 Beds | 650,937 | 46,292 | (6) | 697,229 | 80,980 | 1,040 | |||||||||||||

Total |

1,086 | $ | 19,839,121 | $ | 498,839 | $ | 20,337,960 | $ | 1,590,293 | $ | 24,536 | ||||||||||

- (1)

- Represents

1,065 properties under lease with an investment value of $19.1 billion and 21 operating properties under a RIDEA structure with an

investment value of $759 million.

- (2)

- Senior

housing facilities are measured in units (e.g., studio, one or two bedroom units). Life science facilities and medical office buildings are

measured in square feet. SNFs and hospitals are measured in licensed bed count.

- (3)

- Property

investments represent: (i) the carrying amount of real estate and intangibles, after adding back accumulated depreciation and amortization;

and (ii) the carrying amount of direct financing leases. Debt investment represents the carrying amount of mezzanine, mortgage and other secured loan investments.

- (4)

- Net Operating Income from Continuing Operations ("NOI") is a non-GAAP supplemental financial measure used to evaluate the operating performance of real estate properties. For the reconciliation of NOI to net income for 2012, refer to Note 14 in our Consolidated Financial Statements.

9

- (5)

- Interest

income represents interest earned from our debt investments.

- (6)

- Includes a senior secured loan to Delphis Operations, L.P. ("Delphis") that was placed on non-accrual status effective January 1, 2011 with a carrying value of $31 million at December 31, 2012. For a more detailed description of the senior secured loan to Delphis, see Note 7 to the Consolidated Financial Statements.

See Note 14 to the Consolidated Financial Statements for additional information on our business segments.

Developments and Redevelopments

At December 31, 2012, in addition to our investments in properties under lease and debt investments, we have an aggregate investment of $540 million in assets under development, including redevelopment, and land held for future development, primarily in our life science and medical office segments.

Investment Management Platform

As of December 31, 2012, our Investment Management Platform consisted of the following properties under lease (square feet and dollars in thousands):

Segment

|

Number of Properties |

Capacity(1) | HCP's Ownership Interest |

Joint Venture Investment(2) |

Total Revenues |

Total Operating Expenses |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Medical office(3) |

66 | 3,389 Sq. ft. | 20 - 30% | $ | 729,831 | $ | 72,421 | $ | 30,870 | ||||||||

Life science |

4 | 278 Sq. ft. | 50 - 63% | 144,489 | 10,881 | 1,513 | |||||||||||

Hospital |

4 | 149 Beds | 20% | 81,383 | 4,001 | 963 | |||||||||||

Total |

74 | $ | 955,703 | $ | 87,303 | $ | 33,346 | ||||||||||

- (1)

- Life

science facilities and medical office buildings are measured in square feet.

- (2)

- Represents

the joint ventures' carrying amount of real estate and intangibles, after adding back accumulated depreciation and amortization.

- (3)

- During 2010, one MOB was placed into redevelopment; its statistics are not included in the medical office information.

Employees of HCP

At December 31, 2012, we had 149 full-time employees, none of whom are subject to a collective bargaining agreement.

Government Regulation, Licensing and Enforcement

Overview

Our tenants and operators are typically subject to extensive and complex federal, state and local healthcare laws and regulations relating to fraud and abuse practices, government reimbursement, licensure and certificate of need and similar laws governing the operation of healthcare facilities, and we expect that the healthcare industry, in general, will continue to face increased regulation and pressure in the areas of fraud, waste and abuse, cost control, healthcare management and provision of services, among others. These regulations are wide-ranging and can subject our tenants and operators to civil, criminal and administrative sanctions. Affected tenants and operators may find it increasingly difficult to comply with this complex and evolving regulatory environment because of a relative lack of guidance in many areas as certain of our healthcare properties are subject to oversight from several government agencies and the laws may vary from one jurisdiction to another. Changes in laws and regulations and reimbursement enforcement activity and regulatory non-compliance by our tenants and

10

operators can all have a significant effect on their operations and financial condition, which in turn may adversely impact us, as detailed below and set forth under "Risk Factors" in Item 1A.

Based on information primarily provided by our tenants and operators, excluding our medical office segment, at December 31, 2012 we estimate that approximately 18% and 14% of the annualized base rental payments received from our tenants and operators were dependent on Medicare and Medicaid reimbursement, respectively.

The following is a discussion of certain laws and regulations generally applicable to our operators, and in certain cases, to us.

Fraud and Abuse Enforcement

There are various extremely complex federal and state laws and regulations governing healthcare providers' relationships and arrangements and prohibiting fraudulent and abusive practices by such providers. These laws include (i) federal and state false claims acts, which, among other things, prohibit providers from filing false claims or making false statements to receive payment from Medicare, Medicaid or other federal or state healthcare programs, (ii) federal and state anti-kickback and fee-splitting statutes, including the Medicare and Medicaid anti-kickback statute, which prohibit the payment or receipt of remuneration to induce referrals or recommendations of healthcare items or services, (iii) federal and state physician self-referral laws (commonly referred to as the "Stark Law"), which generally prohibit referrals by physicians to entities with which the physician or an immediate family member has a financial relationship, (iv) the federal Civil Monetary Penalties Law, which prohibits, among other things, the knowing presentation of a false or fraudulent claim for certain healthcare services and (v) federal and state privacy laws, including the privacy and security rules contained in the Health Insurance Portability and Accountability Act of 1996, which provide for the privacy and security of personal health information. Violations of healthcare fraud and abuse laws carry civil, criminal and administrative sanctions, including punitive sanctions, monetary penalties, imprisonment, denial of Medicare and Medicaid reimbursement and potential exclusion from Medicare, Medicaid or other federal or state healthcare programs. These laws are enforced by a variety of federal, state and local agencies and can also be enforced by private litigants through, among other things, federal and state false claims acts, which allow private litigants to bring qui tam or "whistleblower" actions. Many of our operators and tenants are subject to these laws, and some of them may in the future become the subject of governmental enforcement actions if they fail to comply with applicable laws.

Reimbursement

Sources of revenue for many of our tenants and operators include, among other sources, governmental healthcare programs, such as the federal Medicare program and state Medicaid programs, and non-governmental payors, such as insurance carriers and HMOs. As federal and state governments focus on healthcare reform initiatives, and as the federal government and many states face significant budget deficits, efforts to reduce costs by these payors will likely continue, which may result in reduced or slower growth in reimbursement for certain services provided by some of our tenants and operators.

Healthcare Licensure and Certificate of Need

Certain healthcare facilities in our portfolio are subject to extensive federal, state and local licensure, certification and inspection laws and regulations. In addition, various licenses and permits are required to dispense narcotics, operate pharmacies, handle radioactive materials and operate equipment. Many states require certain healthcare providers to obtain a certificate of need, which requires prior approval for the construction, expansion and closure of certain healthcare facilities. The

11

approval process related to state certificate of need laws may impact some of our tenants' and operators' abilities to expand or change their businesses.

Life Science Facilities

While certain of our life science tenants include some well-established companies, other such tenants are less established and, in some cases, may not yet have a product approved by the Food and Drug Administration or other regulatory authorities for commercial sale. Creating a new pharmaceutical product or medical device requires substantial investments of time and money, in part, because of the extensive regulation of the healthcare industry; it also entails considerable risk of failure in demonstrating that the product is safe and effective and in gaining regulatory approval and market acceptance.

Senior Housing Entrance Fee Communities

Certain of the senior housing facilities mortgaged to or owned by us are operated as entrance fee communities. Generally, an entrance fee is an upfront fee or consideration paid by a resident, a portion of which may be refundable, in exchange for some form of long-term benefit. Some of the entrance fee communities are subject to significant state regulatory oversight, including, for example, oversight of each facility's financial condition, establishment and monitoring of reserve requirements and other financial restrictions, the right of residents to cancel their contracts within a specified period of time, lien rights in favor of the residents, restrictions on change of ownership and similar matters.

Americans with Disabilities Act (the "ADA")

Our properties must comply with the ADA and any similar state or local laws to the extent that such properties are "public accommodations" as defined in those statutes. The ADA may require removal of barriers to access by persons with disabilities in certain public areas of our properties where such removal is readily achievable. To date, we have not received any notices of noncompliance with the ADA that have caused us to incur substantial capital expenditures to address ADA concerns. Should barriers to access by persons with disabilities be discovered at any of our properties, we may be directly or indirectly responsible for additional costs that may be required to make facilities ADA-compliant. Noncompliance with the ADA could result in the imposition of fines or an award of damages to private litigants. The obligation to make readily achievable accommodations pursuant to the ADA is an ongoing one, and we continue to assess our properties and make modifications as appropriate in this respect.

Environmental Matters

A wide variety of federal, state and local environmental and occupational health and safety laws and regulations affect healthcare facility operations. These complex federal and state statutes, and their enforcement, involve a myriad of regulations, many of which involve strict liability on the part of the potential offender. Some of these federal and state statutes may directly impact us. Under various federal, state and local environmental laws, ordinances and regulations, an owner of real property or a secured lender, such as us, may be liable for the costs of removal or remediation of hazardous or toxic substances at, under or disposed of in connection with such property, as well as other potential costs relating to hazardous or toxic substances (including government fines and damages for injuries to persons and adjacent property). The cost of any required remediation, removal, fines or personal or property damages and the owner's or secured lender's liability therefore could exceed or impair the value of the property, and/or the assets of the owner or secured lender. In addition, the presence of such substances, or the failure to properly dispose of or remediate such substances, may adversely affect the owner's ability to sell or rent such property or to borrow using such property as collateral which, in turn, could reduce our revenues. For a description of the risks associated with environmental matters, see "Risk Factors" in Item 1A of this report.

12

The section below discusses the most significant risk factors that may materially adversely affect our business, results of operations and financial condition.

As set forth below, we believe that the risks facing our company generally fall into the following categories:

- •

- Risks related to our business; and

- •

- Risks related to tax matters, including REIT-related risks.

Risks Related to Our Business

Volatility or disruption in the financial markets may impair our ability to raise capital, obtain new financing or refinance existing obligations and fund real estate and development activities.

The global financial markets recently have experienced pervasive and fundamental disruptions. While these conditions have stabilized since the first quarter of 2009 and the capital markets generally have shown signs of improvement, the sustainability of an economic recovery is uncertain and additional levels of market disruption and volatility could materially adversely impact our ability to raise capital, obtain new financing or refinance our existing obligations as they mature and fund real estate and development activities.

Market volatility could also lead to significant uncertainty in the valuation of our investments and those of our joint ventures, that may result in a substantial decrease in the value of our properties and those of our joint ventures. As a result, we may not be able to recover the carrying amount of such investments and the associated goodwill, if any, which may require us to recognize impairment charges in earnings.

We rely on external sources of capital to fund future capital needs and limitations on our access to such capital could have a materially adverse effect on our ability to meet commitments as they become due or make future investments necessary to grow our business.

We may not be able to fund all future capital needs from cash retained from operations. If we are unable to obtain enough internal capital, we may need to rely on external sources of capital (including debt and equity financing) to fulfill our capital requirements. If we cannot access these external sources of capital, we may not be able to make the investments needed to grow our business and to meet our obligations and commitments as they mature. Our access to capital depends upon a number of factors, some of which we have little or no control over, including but not limited to:

- •

- general availability of credit and market conditions, including rising interest rates and increased borrowing cost;

- •

- the market price of the shares of our equity securities and the credit ratings of our debt and preferred securities;

- •

- the market's perception of our growth potential and our current and potential future earnings and cash distributions;

- •

- our degree of financial leverage and operational flexibility;

- •

- the financial integrity of our lenders, which might impair their ability to meet their commitments to us or their

willingness to make additional loans to us, and our inability to replace the financing commitment of any such lender on favorable terms, or at all;

- •

- the stability in the market value of our properties;

13

- •

- the financial performance and general market perception of our operators, tenants and borrowers;

- •

- changes in the credit ratings on U.S. government debt securities or default or delay in payment by the United States of

its obligations; and

- •

- issues facing the healthcare industry, including, but not limited to, healthcare reform and changes in government reimbursement policies.

If our access to capital is limited by these factors or other factors, it could have a material adverse impact on our ability to fund operations, refinance our debt obligations, fund dividend payments, acquire properties and development activities.

Adverse changes in our credit ratings could impair our ability to obtain additional debt and equity financing on favorable terms, if at all, and negatively impact the market price of our securities, including our common stock.

The credit ratings of our senior unsecured debt are based on our operating performance, liquidity and leverage ratios, overall financial position and other factors employed by the credit rating agencies in their rating analyses of us. Our credit ratings can affect the amount and type of capital we can access, as well as the terms of any financings we may obtain. There can be no assurance that we will be able to maintain our current credit ratings and in the event that our current credit ratings deteriorate, we would likely incur higher borrowing costs and it may be more difficult or expensive to obtain additional financing or refinance existing obligations and commitments. Also, a downgrade in our credit ratings would trigger additional costs or other potentially negative consequences under our current and future credit facilities and debt instruments.

Our level of indebtedness may increase and materially adversely affect our future operations.

Our outstanding indebtedness as of December 31, 2012 was approximately $8.7 billion. We may incur additional indebtedness in the future, including in connection with the development or acquisition of assets, which may be substantial. Any significant additional indebtedness could negatively affect the credit ratings of our debt and require us to dedicate a substantial portion of our cash flow to interest and principal payments due on our indebtedness. Greater demands on our cash resources may reduce funds available to us to pay dividends, conduct development activities, make capital expenditures and acquisitions, or carry out other aspects of our business strategy. Increased indebtedness can also limit our ability to adjust rapidly to changing market conditions, make us more vulnerable to general adverse economic and industry conditions and create competitive disadvantages for us compared to other companies with relatively lower debt levels. Increased future debt service obligations may limit our operational flexibility, including our ability to finance or refinance our properties, contribute properties to joint ventures or sell properties as needed.

Covenants related to our indebtedness limit our operational flexibility and breaches of these covenants could materially adversely affect our business, results of operations and financial condition.

Our unsecured credit facilities, unsecured debt securities and secured debt and other indebtedness that we may incur in the future, require or will require us to comply with a number of customary financial and other covenants, such as maintaining certain levels of debt service coverage and leverage ratio, tangible net worth requirements and maintaining REIT status. Our continued ability to incur additional debt and to conduct business in general is subject to compliance with these financial and other covenants, which limit our operational flexibility. For example, mortgages on our properties contain customary covenants such as those that limit or restrict our ability, without the consent of the lender, to further encumber or sell the applicable properties, or to replace the applicable tenant or operator. Breaches of certain covenants may result in defaults under the mortgages on our properties

14

and cross-defaults under certain of our other indebtedness, even if we satisfy our payment obligations to the respective obligee. Additionally, defaults under the leases or operating agreements related to mortgaged properties, including defaults associated with the bankruptcy of the applicable tenant or operator, may result in a default under the underlying mortgage and cross-defaults under certain of our other indebtedness. Covenants that limit our operational flexibility as well as defaults under our debt instruments could materially adversely affect our business, results of operations and financial condition.

An increase in interest rates could increase interest cost on new debt, and could materially adversely impact our ability to refinance existing debt, sell assets and limit our acquisition, investment and development activities.

If interest rates increase, so could our interest costs for any new debt. This increased cost could make the financing of any acquisition and development activity more costly. Rising interest rates could limit our ability to refinance existing debt when it matures, or cause us to pay higher interest rates upon refinancing and increase interest expense on refinanced indebtedness. In addition, an increase in interest rates could decrease the amount third parties are willing to pay for our assets, thereby limiting our ability to reposition our portfolio promptly in response to changes in economic or other conditions.

We depend on a limited number of operators and tenants that account for a large percentage of our revenues.

During the year ended December 31, 2012, approximately 48% of our revenues were generated by our leasing or financial arrangements with the following four companies: HCR ManorCare (30%); Emeritus (8%); Sunrise (5%); and Brookdale (5%). The failure, inability or unwillingness of these operators or tenants to meet their obligations to us could materially reduce our cash flow as well as our results of operations, which could in turn reduce the amount of dividends we pay, cause our stock price to decline and have other material adverse effects on our business, results of operations and financial condition.

In addition, any failure by these operators or tenants to effectively conduct their operations or to maintain and improve our properties could adversely affect their business reputation and their ability to attract and retain patients and residents in our properties, which could have a material adverse effect on our business, results of operations and financial condition. These operators and tenants generally have also agreed to indemnify, defend and hold us harmless from and against various claims, litigation and liabilities arising in connection with their respective businesses, and we cannot provide any assurance that they will have sufficient assets, income, access to financing and insurance coverage to enable it to satisfy its indemnification obligations.

Economic and other conditions that negatively affect geographic areas to which a greater percentage of our revenue is attributed could materially adversely affect our business, results of operations and financial condition.

For the year ended December 31, 2012, approximately 44% of our revenue was derived from properties located in California (22%), Texas (12%) and Florida (10%). As a result, we are subject to increased exposure to adverse conditions affecting these regions, including downturns in the local economies or changes in local real estate conditions, increased competition or decreased demand, and changes in state-specific legislation, which could adversely affect our business and results of operations.

The bankruptcy, insolvency or financial deterioration of one or more of our major operators or tenants may materially adversely affect our business, results of operations and financial condition.

We lease our properties directly to operators in most cases, and in certain other cases, we lease to third-party tenants who enter into long-term management agreements with operators to manage the

15

properties. Although our leases, financing arrangements and other agreements with our tenants and operators generally provide us the right under specified circumstances to terminate a lease, evict an operator or tenant, or demand immediate repayment of certain obligations to us, the bankruptcy and insolvency laws afford certain rights to a party that has filed for bankruptcy or reorganization that may render certain of these remedies unenforceable, or at the least, delay our ability to pursue such remedies. For example, we cannot evict a tenant or operator solely because of its bankruptcy filing. A debtor has the right to assume, or to assume and assign to a third party, or to reject its unexpired contracts in a bankruptcy proceeding. If a debtor were to reject its leases with us, our claim against the debtor for unpaid and future rents would be limited by the statutory cap set forth in the U.S. Bankruptcy Code, which may be substantially less than the remaining rent actually owed under the lease. In addition, the inability of our tenants or operators to make payments or comply with certain other lease obligations may affect our compliance with certain covenants contained in our debt securities, credit facilities and the mortgages on the properties leased or managed by such tenants and operators. In addition, under certain conditions, defaults under the underlying mortgages may result in cross-default under our other indebtedness. Although we believe that we would be able to secure amendments under the applicable agreements in those circumstances, the bankruptcy of an applicable operator or tenant may potentially result in less favorable borrowing terms than currently available, delays in the availability of funding or other material adverse consequences. In addition, many of our facilities are leased to healthcare providers who provide long-term custodial care to the elderly; evicting such operators for failure to pay rent while the facility is occupied may be a difficult and slow process and may not be successful.

Our operators and tenants may not procure the necessary insurance to adequately insure against losses.

Our leases generally require our tenants and operators to secure and maintain comprehensive liability and property insurance that covers us, as well as the tenants and operators. Some types of losses may not be adequately insured by our tenants and operators. Should an uninsured loss or a loss in excess of insured limits occur, we could incur liability or lose all or a portion of the capital we have invested in a property, as well as the anticipated future revenues from the property. In such an event, we might nevertheless remain obligated for any mortgage debt or other financial obligations related to the property. We continually review the insurance maintained by our tenants and operators and believe the coverage provided to be customary for similarly situated companies in our industry. However, we cannot assure you that material uninsured losses, or losses in excess of insurance proceeds, will not occur in the future.

Our operators and tenants are faced with litigation and may experience rising liability and insurance costs.

In some states, advocacy groups have been created to monitor the quality of care at healthcare facilities and these groups have brought litigation against the operators and tenants of such facilities. Also, in several instances, private litigation by patients has succeeded in winning large damage awards for alleged abuses. The effect of this litigation and other potential litigation may materially increase the costs incurred by our operators and tenants for monitoring and reporting quality of care compliance. In addition, their cost of liability and medical malpractice insurance can be significant and may increase so long as the present healthcare litigation environment continues. Cost increases could cause our operators to be unable to make their lease or mortgage payments or fail to purchase the appropriate liability and malpractice insurance, potentially decreasing our revenues and increasing our collection and litigation costs. In addition, as a result of our ownership of healthcare facilities, we may be named as a defendant in lawsuits allegedly arising from the actions of our operators or tenants, for which claims such operators and tenants have agreed to indemnify, defend and hold us harmless from and against, but which may require unanticipated expenditures on our part.

16

Operators and tenants that fail to comply with the requirements of, or changes to, governmental reimbursement programs such as Medicare or Medicaid, may cease to operate or be unable to meet their financial and other contractual obligations to us.

Certain of our operators and tenants are affected by an extremely complex set of federal, state and local laws and regulations that are subject to frequent and substantial changes (sometimes applied retroactively) resulting from legislation, adoption of rules and regulations, and administrative and judicial interpretations of existing law. See "Item 1—Business—Government Regulation, Licensing and Enforcement" above. For example, to the extent that any of our operators or tenants receive a significant portion of their revenues from governmental payors, primarily Medicare and Medicaid, such revenues may be subject to:

- •

- statutory and regulatory changes;

- •

- retroactive rate adjustments;

- •

- recovery of program overpayments or set-offs;

- •

- administrative rulings;

- •

- policy interpretations;

- •

- payment or other delays by fiscal intermediaries or carriers;

- •

- government funding restrictions (at a program level or with respect to specific facilities); and

- •

- interruption or delays in payments due to any ongoing governmental investigations and audits at such property.

In recent years, governmental payors have frozen or reduced payments to healthcare providers due to budgetary pressures. Healthcare reimbursement will likely continue to be of significant importance to federal and state authorities. We cannot make any assessment as to the ultimate timing or the effect that any future legislative reforms may have on our operators' and tenants' costs of doing business and on the amount of reimbursement by government and other third-party payors. The failure of any of our operators or tenants to comply with these laws, requirements and regulations could materially adversely affect their ability to meet their financial and contractual obligations to us.

Legislation to address the federal government's projected operating deficit could have a material adverse effect on our operators' liquidity, financial condition or results of operations.

Congress may consider legislation to address the fiscal condition of the United States that may include entitlement reform, tax reform, reductions in domestic discretionary spending, budget sequestration of certain non-defense discretionary federal programs, and an increase in the national debt limit that could have a material adverse effect on our operators' liquidity, financial condition or results of operations. In particular, Congress may consider legislation affecting the funding of entitlement programs such as Medicare, Medicaid and Medicare Advantage Plans that may result in reductions in funding and reimbursements to providers; tax reform that may impact corporate and individual tax rates and retirement plans; and an increase in the federal debt limit that may have an impact on credit markets. Additionally, the Administration may implement proposals under current law or legislation that may be approved by Congress that could modify the delivery of services and benefits under Medicare, Medicaid or Medicare Advantage Plans. Such changes could have a material adverse effect on our operators' liquidity, financial condition or results of operations, which could adversely affect their ability to satisfy their obligations to us and could have a material adverse effect on us.

17

Operators and tenants that fail to comply with federal, state and local licensure, certification and inspection laws and regulations may cease to operate or be unable to meet their financial and other contractual obligations to us.

Certain of our operators and tenants are subject to extensive federal, state, local and industry-related licensure, certification and inspection laws, regulations and standards. Our operators' or tenants' failure to comply with any of these laws, regulations or standards could result in loss of accreditation, denial of reimbursement, imposition of fines, suspension or decertification from federal and state healthcare programs, loss of license or closure of the facility. For example, certain of our properties may require a license, registration and/or certificate of need to operate. Failure of any operator or tenant to obtain a license, registration or certificate of need, or loss of a required license, registration or certificate of need, would prevent a facility from operating in the manner intended by such operator or tenant. Additionally, failure of our operators and tenants to generally comply with applicable laws and regulations may have an adverse effect on facilities owned by or mortgaged to us, and therefore may materially adversely impact us. See "Item 1—Business—Government Regulation, Licensing and Enforcement—Healthcare Licensure and Certificate of Need" above.

Increased competition, as well as an inability to grow revenues as originally forecast, have resulted and may further result in lower net revenues for some of our operators and tenants and may affect their ability to meet their financial and other contractual obligations to us.

The healthcare industry is highly competitive and can become more competitive in the future. The occupancy levels at, and rental income from, our facilities is dependent on our ability and the ability of our operators and tenants to maintain and increase such levels and income and to compete with entities that have substantial capital resources. These entities compete with other operators and tenants on a number of different levels, including the quality of care provided, reputation, the physical appearance of a facility, price, the range of services offered, family preference, alternatives for healthcare delivery, the supply of competing properties, physicians, staff, referral sources, location and the size and demographics of the population in the surrounding area. Private, federal and state payment programs and the effect of laws and regulations may also have a significant influence on the profitability of the properties and their tenants. Our operators and tenants also compete with numerous other companies providing similar healthcare services or alternatives such as home health agencies, life care at home, community-based service programs, retirement communities and convalescent centers. Such competition, which has intensified due to overbuilding in some segments in which we invest, has caused the occupancy rate of newly constructed buildings to slow and the monthly rate that many newly built and previously existing facilities were able to obtain for their services to decrease. We cannot be certain that the operators and tenants of all of our facilities will be able to achieve occupancy and rate levels that will enable them to meet all of their obligations to us. Further, many competing companies may have resources and attributes that are superior to those of our operators and tenants. Thus, our operators and tenants may encounter increased competition in the future that could limit their ability to maintain or attract residents or expand their businesses which could materially adversely affect their ability to meet their financial and other contractual obligations to us, potentially decreasing our revenues, impairing our assets, and increasing our collection and dispute costs.

Our tenants in the life science industry face high levels of regulation, expense and uncertainty.

Life science tenants, particularly those involved in developing and marketing pharmaceutical products, are subject to certain unique risks, as follows:

- •

- some of our tenants require significant outlays of funds for the research, development and clinical testing of their products and technologies. If private investors, the government or other sources of funding are unavailable to support such activities, a tenant's business may be adversely affected or fail;

18

- •

- the research, development, clinical testing, manufacture and marketing of some of our tenants' products require federal,

state and foreign regulatory approvals which may be costly or difficult to obtain;

- •

- even after a life science tenant gains regulatory approval and market acceptance, the product may still present

significant regulatory and liability risks, including, among others, the possible later discovery of safety concerns, competition from new products, and ultimately the expiration of patent protection

for the product;

- •

- our tenants with marketable products may be adversely affected by healthcare reform and the reimbursement policies of

government or private healthcare payors; and

- •

- our tenants may be unable to adequately protect their intellectual property under patent, copyright or trade secret laws.

We cannot assure you that our life science tenants will be successful in their businesses. If our tenants' businesses are adversely affected, they may have difficulty making payments to us, which could materially adversely affect our business, results of operations and financial condition.

We may be unable to successfully foreclose on the collateral securing our real estate-related loans, and even if we are successful in our foreclosure efforts, we may be unable to successfully operate, occupy or reposition the underlying real estate, which may adversely affect our ability to recover our investments.

If an operator or tenant defaults under one of our mortgages or mezzanine loans, we may have to foreclose on the loan or protect our interest by acquiring title to the collateral and thereafter making substantial improvements or repairs in order to maximize the property's investment potential. In some cases, as noted above, the collateral consists of the equity interests in an entity that directly or indirectly owns the applicable real property or interests in operating facilities and, accordingly, we may not have full recourse to assets of that entity. Operators, tenants or borrowers may contest enforcement of foreclosure or other remedies, seek bankruptcy protection against our exercise of enforcement or other remedies and/or bring claims for lender liability in response to actions to enforce mortgage obligations. Foreclosure-related costs, high loan-to-value ratios or declines in the value of the facility may prevent us from realizing an amount equal to our mortgage or mezzanine loan upon foreclosure, and we may be required to record valuation allowance for such losses. Even if we are able to successfully foreclose on the collateral securing our real estate-related loans, we may inherit properties for which we may be unable to expeditiously seek tenants or operators, if at all, which would adversely affect our ability to fully recover our investment.

Required regulatory approvals can delay or prohibit transfers of our healthcare facilities.

Transfers of healthcare facilities to successor tenants or operators may be subject to regulatory approvals or ratifications, including, but not limited to, change of ownership approvals under certificate of need laws and Medicare and Medicaid provider arrangements that are not required for transfers of other types of commercial operations and other types of real estate. The replacement of any tenant or operator could be delayed by the regulatory approval process of any federal, state or local government agency necessary for the transfer of the facility or the replacement of the operator licensed to manage the facility. If we are unable to find a suitable replacement tenant or operator upon favorable terms, or at all, we may take possession of a facility, which might expose us to successor liability or require us to indemnify subsequent operators to whom we might transfer the operating rights and licenses, all of which may materially adversely affect our business, results of operations, and financial condition.

19

Competition may make it difficult to identify and purchase, or develop, suitable healthcare facilities, to grow our investment portfolio.

We face significant competition from other REITs, investment companies, private equity and hedge fund investors, sovereign funds, healthcare operators, lenders, developers and other institutional investors, some of whom may have greater resources and lower costs of capital than we do. Increased competition makes it more challenging for us to identify and successfully capitalize on opportunities that meet our business goals and could improve the bargaining power of property owners seeking to sell, thereby impeding our investment, acquisition and development activities. If we cannot capitalize on our development pipeline, identify and purchase a sufficient quantity of healthcare facilities at favorable prices or if we are unable to finance acquisitions on commercially favorable terms, our business, results of operations and financial condition may be materially adversely affected.

We may be required to incur substantial renovation costs to make certain of our healthcare properties suitable for other operators and tenants.

Healthcare facilities are typically highly customized and may not be easily adapted to non-healthcare-related uses. The improvements generally required to conform a property to healthcare use, such as upgrading electrical, gas and plumbing infrastructure, are costly and at times tenant-specific. A new or replacement operator or tenant may require different features in a property, depending on that operator's or tenant's particular operations. If a current operator or tenant is unable to pay rent and vacates a property, we may incur substantial expenditures to modify a property before we are able to secure another operator or tenant. Also, if the property needs to be renovated to accommodate multiple operators or tenants, we may incur substantial expenditures before we are able to re-lease the space. These expenditures or renovations may materially adversely affect our business, results of operations and financial condition.

20

We face additional risks associated with property development that can render a project less profitable or not profitable at all and, under certain circumstances, prevent completion of development activities once undertaken.

Large-scale, ground-up development of healthcare properties presents additional risks for us, including risks that:

- •

- a development opportunity may be abandoned after expending significant resources resulting in the loss of deposits or

failure to recover expenses already incurred;

- •

- the development and construction costs of a project may exceed original estimates due to increased interest rates and

higher materials, transportation, labor, leasing or other costs, which could make the completion of the development project less profitable;

- •

- construction and/or permanent financing may not be available on favorable terms or at all;

- •

- the project may not be completed on schedule, which can result in increases in construction costs and debt service

expenses as a result of a variety of factors that are beyond our control, including natural disasters, labor conditions, material shortages, regulatory hurdles, civil unrest and acts of war; and

- •

- occupancy rates and rents at a newly completed property may not meet expected levels and could be insufficient to make the property profitable.

These risks could result in substantial unanticipated delays or expenses and, under certain circumstances, could prevent completion of development activities once undertaken, any of which could have a material adverse effect on our business, results of operations and financial condition.

Our use of joint ventures may limit our flexibility with jointly owned investments.

We have and may continue in the future to develop and/or acquire properties in joint ventures with other persons or entities when circumstances warrant the use of these structures. Our participation in joint ventures is subject to risks that may not be present with other methods of ownership, including:

- •

- we could experience an impasse on certain decisions because we do not have sole decision-making authority, which could

require us to expend additional resources on resolving such impasses or potential disputes, including litigation or arbitration;

- •

- our joint venture partners could have investment goals that are not consistent with our investment objectives, including

the timing, terms and strategies for any investments;

- •

- our ability to transfer our interest in a joint venture to a third party may be restricted;

- •

- our joint venture partners might become bankrupt, fail to fund their share of required capital contributions or fail to

fulfill their obligations as a joint venture partner, which may require us to infuse our own capital into the venture on behalf of the partner despite other competing uses for such capital; and

- •

- our joint venture partners may have competing interests in our markets that could create conflict of interest issues.

From time to time, we acquire other companies and if we are unable to successfully integrate these operations, our business, results of operations and financial condition may be materially adversely affected.

Acquisitions require the integration of companies that have previously operated independently. Successful integration of the operations of these companies depends primarily on our ability to consolidate operations, systems, procedures, properties and personnel and to eliminate redundancies and costs. We may encounter difficulties in these integrations. Potential difficulties associated with

21

acquisitions include the loss of key employees, the disruption of our ongoing business or that of the acquired entity, possible inconsistencies in standards, controls, procedures and policies and the assumption of unexpected liabilities, including:

- •

- liabilities relating to the clean-up or remediation of undisclosed environmental conditions;

- •

- unasserted claims of vendors or other persons dealing with the seller;

- •

- liabilities, claims and litigation, whether or not incurred in the ordinary course of business, relating to periods prior

to our acquisition;

- •

- claims for indemnification by general partners, directors, officers and others indemnified by the seller; and

- •

- liabilities for taxes relating to periods prior to our acquisition.

In addition, the acquired companies and their properties may fail to perform as expected, including in respect of estimated cost savings. Inaccurate assumptions regarding future rental or occupancy rates could result in overly optimistic estimates of future revenues. Similarly, we may underestimate future operating expenses or the costs necessary to bring properties up to standards established for their intended use. If we have difficulties with any of these areas, or if we later discover additional liabilities or experience unforeseen costs relating to our acquired companies, we might not achieve the economic benefits we expect from our acquisitions, and this may materially adversely affect our business, results of operations and financial condition.

From time to time we have made, and in the future we may seek to make, one or more material acquisitions, which may involve the expenditure of significant funds.

We regularly review potential transactions in order to maximize shareholder value and believe that currently there are available a number of acquisition opportunities that would be complementary to our business, given the recent industry consolidation trend. In connection with our review of such transactions, we regularly engage in discussions with potential acquisition candidates, some of which are material. Any future acquisitions could require the issuance of securities, the incurrence of debt, assumption of contingent liabilities or incurrence of significant expenditures, any of which could materially adversely impact our business, financial condition or results of operations. In addition, the financing required for such acquisitions may not be available on commercially favorable terms or at all.

Loss of our key personnel could temporarily disrupt our operations and adversely affect us.

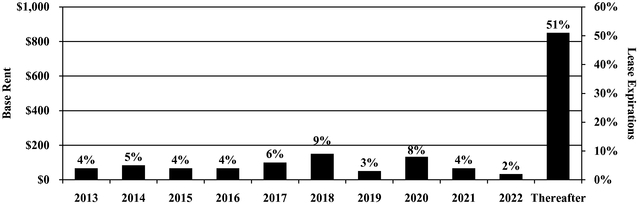

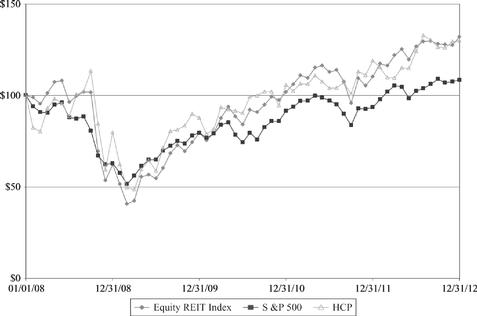

We are dependent on the efforts of our executive officers, and competition for these individuals is intense. Although our chief executive officer, chief financial officer, chief investment officer and general counsel have employment agreements with us, we cannot assure you that they will remain employed with us. The loss or limited availability of the services of any of our executive officers, or our inability to recruit and retain qualified personnel in the future, could, at least temporarily, have a material adverse effect on our business, results of operations and financial condition and be negatively perceived in the capital markets.