Table of Contents

As filed with the Securities and Exchange Commission on May 23, 2012

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

COMMUNITY HEALTH SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 8062 | 13-3893191 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

CHS/COMMUNITY HEALTH SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 8062 | 76-0137985 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

4000 Meridian Boulevard

Franklin, Tennessee 37067

(615) 465-7000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Rachel A. Seifert

Executive Vice President, Secretary and General Counsel

4000 Meridian Boulevard

Franklin, Tennessee 37067

(615) 465-7000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

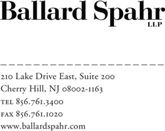

Joshua N. Korff

Michael Kim

Kirkland & Ellis LLP

601 Lexington Avenue

New York, NY 10022

(212) 446-4800

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. þ

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. þ

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer þ | Accelerated filer ¨ | |||

| Non-accelerated filer ¨ | (Do not check if a smaller reporting company) | Smaller reporting company ¨ | ||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price per Unit |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee | ||||

| Debt Securities of Community Health Systems, Inc.(3) |

(1)(2) | (1)(2) | (1)(2) | (1)(2) | ||||

| Guarantees of Debt Securities of Community Health Systems, Inc. by certain subsidiaries of Community Health Systems, Inc.(3)(4) |

(1)(2) | (1)(2) | (1)(2) | (1)(2) | ||||

| Preferred Stock, par value $0.01 per share of Community Health Systems, Inc.(3) |

(1)(2) | (1)(2) | (1)(2) | (1)(2) | ||||

| Depositary Shares of Community Health Systems, Inc.(3)(5) |

(1)(2) | (1)(2) | (1)(2) | (1)(2) | ||||

| Common Stock, par value $0.01 per share of Community Health Systems, Inc.(3) |

(1)(2) | (1)(2) | (1)(2) | (1)(2) | ||||

| Securities Warrants of Community Health Systems, Inc.(3) |

(1)(2) | (1)(2) | (1)(2) | (1)(2) | ||||

| Debt Securities of CHS/Community Health Systems, Inc.(3) |

(1)(2) | (1)(2) | (1)(2) | (1)(2) | ||||

| Guarantees of Debt Securities of CHS/Community Health Systems, Inc. by Community Health Systems, Inc. and certain subsidiaries of Community Health Systems, Inc.(3)(4) |

(1)(2) | (1)(2) | (1)(2) | (1)(2) | ||||

|

| ||||||||

|

| ||||||||

| (1) | We will determine the proposed maximum offering price per unit from time to time in connection with issuances of securities registered under this registration statement. |

| (2) | An unspecified aggregate initial offering price or number of the securities of each identified class is being registered as may from time to time be issued at unspecified prices. In accordance with Rules 456(b) and 457(r), the Registrant is deferring payment of all the registration fee. |

| (3) | An indeterminate aggregate initial offering price or number of the securities of each identified class is being registered as may from time to time be offered at indeterminate prices. Separate consideration may or may not be received for securities that are issuable on exercise, conversion or exchange of other securities or that are issued in units or represented by depositary shares. Includes an indeterminate amount of our securities as may be issued upon conversion of or exchange for, as the case may be, any other securities registered under this registration statement. |

| (4) | No additional consideration will be received for the guarantees and, pursuant to Rule 457(n), no additional fee is required. |

| (5) | Each depositary share registered hereunder will be issued under a deposit agreement and will represent an interest in a fractional share or multiple shares of preferred stock and will be evidenced by a depositary receipt. |

Table of Contents

TABLE OF ADDITIONAL REGISTRANTS

| Exact Name of |

Jurisdiction of Incorporation or Formation |

Principal |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

||||||||||

| Abilene Hospital, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 |

8062 | 46-0496920 | ||||||||||

| Abilene Merger, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 46-0496918 | ||||||||||

| Affinity Health Systems, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-3391769 | ||||||||||

| Affinity Hospital, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-3391873 | ||||||||||

| Anna Hospital Corporation |

IL | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 36-4431843 | ||||||||||

| Berwick Hospital Company, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 23-2975836 | ||||||||||

| Big Bend Hospital Corporation |

TX | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 75-2717545 | ||||||||||

| Big Spring Hospital Corporation |

TX | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 75-2574581 | ||||||||||

| Birmingham Holdings II, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 26-2784086 | ||||||||||

| Birmingham Holdings, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-3320362 | ||||||||||

| Bluefield Holdings, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 27-2372042 | ||||||||||

| Bluefield Hospital Company, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 27-2372291 | ||||||||||

| Blue Island Hospital Company, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 45-4082512 | ||||||||||

| Blue Island Illinois Holdings, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 61-1667279 | ||||||||||

| Bluffton Health System, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1792272 | ||||||||||

| Brownsville Hospital Corporation |

TN | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 42-1557534 | ||||||||||

| Brownwood Hospital, L.P. |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762521 | ||||||||||

| Brownwood Medical Center, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762523 | ||||||||||

| Bullhead City Hospital Corporation |

AZ | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 86-0982071 | ||||||||||

| Bullhead City Hospital Investment Corporation | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-1577204 | ||||||||||

| Carlsbad Medical Center, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762526 | ||||||||||

| Centre Hospital Corporation |

AL | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-4370931 | ||||||||||

| CHHS Holdings, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-2189938 | ||||||||||

| CHS Kentucky Holdings, LLC |

DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 26-1639057 | ||||||||||

Table of Contents

| Exact Name of |

Jurisdiction of Incorporation or Formation |

Principal |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

||||||||||

| CHS Pennsylvania Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 26-1639170 | ||||||||||

| CHS Virginia Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 26-1639119 | ||||||||||

| CHS Washington Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 26-3272205 | ||||||||||

| Clarksville Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-3320418 | ||||||||||

| Cleveland Hospital Corporation | TN | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1587878 | ||||||||||

| Cleveland Tennessee Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1281627 | ||||||||||

| Clinton Hospital Corporation | PA | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 90-0003715 | ||||||||||

| Coatesville Hospital Corporation | PA | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 23-3069798 | ||||||||||

| College Station Hospital, L.P. | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762360 | ||||||||||

| College Station Medical Center, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762359 | ||||||||||

| College Station Merger, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1771861 | ||||||||||

| Community GP Corp. | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1648466 | ||||||||||

| Community Health Investment Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 76-0152801 | ||||||||||

| Community LP Corp. | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1648206 | ||||||||||

| CP Hospital GP, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-3904557 | ||||||||||

| CPLP, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-3904614 | ||||||||||

| Crestwood Hospital, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1769644 | ||||||||||

| Crestwood Hospital, LP, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762369 | ||||||||||

| CSMC, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762362 | ||||||||||

| CSRA Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-5111915 | ||||||||||

| Deaconess Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 47-0890490 | ||||||||||

| Deaconess Hospital Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-2401268 | ||||||||||

| Deming Hospital Corporation | NM | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 85-0438008 | ||||||||||

| Desert Hospital Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-8111921 | ||||||||||

| Detar Hospital, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1754943 | ||||||||||

Table of Contents

| Exact Name of |

Jurisdiction of Incorporation or Formation |

Principal |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

||||||||||

| DHFW Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 26-2817294 | ||||||||||

| DHSC, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-2871473 | ||||||||||

| Dukes Health System, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 52-2379885 | ||||||||||

| Dyersburg Hospital Corporation | TN | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 42-1557536 | ||||||||||

| Emporia Hospital Corporation | VA | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 54-1924866 | ||||||||||

| Evanston Hospital Corporation | WY | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 83-0327475 | ||||||||||

| Fallbrook Hospital Corporation | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 91-1918215 | ||||||||||

| Foley Hospital Corporation | AL | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1811413 | ||||||||||

| Forrest City Arkansas Hospital Company, LLC | AR | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-4217095 | ||||||||||

| Forrest City Hospital Corporation | AR | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-4216978 | ||||||||||

| Fort Payne Hospital Corporation | AL | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-4370870 | ||||||||||

| Frankfort Health Partner, Inc. | IN | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 35-2009540 | ||||||||||

| Franklin Hospital Corporation | VA | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 52-2200240 | ||||||||||

| Gadsden Regional Medical Center, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 63-1102774 | ||||||||||

| Galesburg Hospital Corporation | IL | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 37-1485782 | ||||||||||

| Granbury Hospital Corporation | TX | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 75-2682017 | ||||||||||

| Granite City Hospital Corporation | IL | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 36-4460625 | ||||||||||

| Granite City Illinois Hospital Company, LLC | IL | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 36-4460628 | ||||||||||

| Greenville Hospital Corporation | AL | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 63-1134649 | ||||||||||

| GRMC Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-8112090 | ||||||||||

| Hallmark Healthcare Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 63-0817574 | ||||||||||

| Hobbs Medco, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1769641 | ||||||||||

| Hospital of Barstow, Inc. | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 76-0385534 | ||||||||||

| Hospital of Fulton, Inc. | KY | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 61-1218106 | ||||||||||

Table of Contents

| Exact Name of |

Jurisdiction of Incorporation or Formation |

Principal |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

||||||||||

| Hospital of Louisa, Inc. | KY | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 61-1238190 | ||||||||||

| Hospital of Morristown, Inc. | TN | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1528689 | ||||||||||

| Jackson Hospital Corporation (KY) | KY | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 61-1285331 | ||||||||||

| Jackson Hospital Corporation (TN) | TN | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 42-1557525 | ||||||||||

| Jourdanton Hospital Corporation | TX | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 74-3011840 | ||||||||||

| Kay County Hospital Corporation | OK | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-4052833 | ||||||||||

| Kay County Oklahoma Hospital Company, LLC | OK | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-4052936 | ||||||||||

| Kirksville Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 36-4373298 | ||||||||||

| Lakeway Hospital Corporation | TN | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1564360 | ||||||||||

| Lancaster Hospital Corporation | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 57-1010381 | ||||||||||

| Las Cruces Medical Center, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 75-2905434 | ||||||||||

| Lea Regional Hospital, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1760149 | ||||||||||

| Lexington Hospital Corporation | TN | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 42-1557533 | ||||||||||

| Longview Clinic Operations Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 75-1470252 | ||||||||||

| Longview Medical Center, L.P. | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762420 | ||||||||||

| Longview Merger, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1769639 | ||||||||||

| LRH, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762421 | ||||||||||

| Lutheran Health Network of Indiana, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762363 | ||||||||||

| Marion Hospital Corporation | IL | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 37-1359605 | ||||||||||

| Martin Hospital Corporation | TN | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 42-1557527 | ||||||||||

| Massillon Community Health System LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 55-0799029 | ||||||||||

| Massillon Health System LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 34-1840860 | ||||||||||

| Massillon Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 27-0201156 | ||||||||||

| McKenzie Tennessee Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 42-1557531 | ||||||||||

| McNairy Hospital Corporation | TN | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 42-1557530 | ||||||||||

Table of Contents

| Exact Name of |

Jurisdiction of Incorporation or Formation |

Principal |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

||||||||||

| MCSA, L.L.C. | AR | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 71-0785071 | ||||||||||

| Medical Center of Brownwood, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762425 | ||||||||||

| Merger Legacy Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 27-1344746 | ||||||||||

| MMC of Nevada, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 42-1543617 | ||||||||||

| Moberly Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 43-1651906 | ||||||||||

| MWMC Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-8007512 | ||||||||||

| Nanticoke Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 27-4577346 | ||||||||||

| National Healthcare of Leesville, Inc. | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 95-4066162 | ||||||||||

| National Healthcare of Mt. Vernon, Inc. | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 58-1622971 | ||||||||||

| National Healthcare of Newport, Inc. | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 71-0616802 | ||||||||||

| Navarro Hospital, L.P. | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762428 | ||||||||||

| Navarro Regional, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762429 | ||||||||||

| NC-DSH, LLC | NV | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 88-0305790 | ||||||||||

| Northampton Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 52-2325498 | ||||||||||

| Northwest Hospital, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762430 | ||||||||||

| NOV Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-8112009 | ||||||||||

| NRH, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762431 | ||||||||||

| Oak Hill Hospital Corporation | WV | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 27-0003893 | ||||||||||

| Oro Valley Hospital, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 52-2379881 | ||||||||||

| Palmer-Wasilla Health System, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762371 | ||||||||||

| Payson Hospital Corporation | AZ | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 86-0874009 | ||||||||||

| Peckville Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 45-2672049 | ||||||||||

| Pennsylvania Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 06-1694707 | ||||||||||

| Phillips Hospital Corporation | AR | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 75-2976342 | ||||||||||

| Phoenixville Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-1055060 | ||||||||||

Table of Contents

| Exact Name of |

Jurisdiction of Incorporation or Formation |

Principal |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

||||||||||

| Pottstown Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 06-1694708 | ||||||||||

| QHG Georgia Holdings II, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 27-1344786 | ||||||||||

| QHG Georgia Holdings, Inc. | GA | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 58-2386459 | ||||||||||

| QHG Georgia, LP | GA | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 58-2387537 | ||||||||||

| QHG of Bluffton Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1792274 | ||||||||||

| QHG of Clinton County, Inc. | IN | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 35-2006952 | ||||||||||

| QHG of Enterprise, Inc. | AL | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 63-1159023 | ||||||||||

| QHG of Forrest County, Inc. | MS | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1704095 | ||||||||||

| QHG of Fort Wayne Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 35-1946949 | ||||||||||

| QHG of Hattiesburg, Inc. | MS | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1704097 | ||||||||||

| QHG of Massillon, Inc. | OH | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 31-1472380 | ||||||||||

| QHG of South Carolina, Inc. | SC | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1587267 | ||||||||||

| QHG of Spartanburg, Inc. | SC | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 57-1040117 | ||||||||||

| QHG of Springdale, Inc. | AR | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1755664 | ||||||||||

| QHG of Warsaw Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1764509 | ||||||||||

| Quorum Health Resources, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1742954 | ||||||||||

| Red Bud Hospital Corporation | IL | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 36-4444121 | ||||||||||

| Red Bud Illinois Hospital Company, LLC | IL | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 36-4443919 | ||||||||||

| Regional Hospital of Longview, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762464 | ||||||||||

| River Region Medical Corporation | MS | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1576702 | ||||||||||

| Roswell Hospital Corporation | NM | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 74-2870118 | ||||||||||

| Ruston Hospital Corporation | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-8066937 | ||||||||||

| Ruston Louisiana Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-8066999 | ||||||||||

| SACMC, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762472 | ||||||||||

| Salem Hospital Corporation | NJ | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 22-3838322 | ||||||||||

Table of Contents

| Exact Name of |

Jurisdiction of Incorporation or Formation |

Principal |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

||||||||||

| San Angelo Community Medical Center, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762473 | ||||||||||

| San Angelo Medical, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1769697 | ||||||||||

| San Miguel Hospital Corporation | NM | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 74-2930034 | ||||||||||

| Scranton Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 27-4577223 | ||||||||||

| Scranton Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 27-4564798 | ||||||||||

| Scranton Quincy Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 45-2671991 | ||||||||||

| Scranton Quincy Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 45-2672023 | ||||||||||

| Shelbyville Hospital Corporation | TN | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-2909388 | ||||||||||

| Siloam Springs Arkansas Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 26-3635210 | ||||||||||

| Siloam Springs Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 26-3635188 | ||||||||||

| Southern Texas Medical Center, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1769737 | ||||||||||

| Spokane Valley Washington Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 26-1315140 | ||||||||||

| Spokane Washington Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 26-1315081 | ||||||||||

| Tennyson Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-3943816 | ||||||||||

| Tomball Texas Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 45-2784214 | ||||||||||

| Tomball Texas Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 45-2856063 | ||||||||||

| Tooele Hospital Corporation | UT | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 87-0619248 | ||||||||||

| Triad Healthcare Corporation | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 75-2816101 | ||||||||||

| Triad Holdings III, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 75-2821745 | ||||||||||

| Triad Holdings IV, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1766957 | ||||||||||

| Triad Holdings V, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 51-0327978 | ||||||||||

| Triad Nevada Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 26-1639289 | ||||||||||

| Triad of Alabama, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762412 | ||||||||||

| Triad of Oregon, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1761990 | ||||||||||

| Triad-ARMC, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 46-0496926 | ||||||||||

Table of Contents

| Exact Name of |

Jurisdiction of Incorporation or Formation |

Principal |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

||||||||||

| Triad-El Dorado, Inc. | AR | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1628508 | ||||||||||

| Triad-Navarro Regional Hospital Subsidiary, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1681610 | ||||||||||

| Tunkhannock Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 27-4566015 | ||||||||||

| VHC Medical, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1769671 | ||||||||||

| Vicksburg Healthcare, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1752111 | ||||||||||

| Victoria Hospital, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1760818 | ||||||||||

| Victoria of Texas, L.P. | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1754940 | ||||||||||

| Virginia Hospital Company, LLC | VA | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 02-0691406 | ||||||||||

| Warren Ohio Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 27-3190619 | ||||||||||

| Warren Ohio Rehab Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 27-3190578 | ||||||||||

| Watsonville Hospital Corporation | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 91-1894113 | ||||||||||

| Waukegan Hospital Corporation | IL | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-3978400 | ||||||||||

| Waukegan Illinois Hospital Company, LLC | IL | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-3978521 | ||||||||||

| Weatherford Hospital Corporation | TX | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-5694260 | ||||||||||

| Weatherford Texas Hospital Company, LLC | TX | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-5694301 | ||||||||||

| Webb Hospital Corporation | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-0167530 | ||||||||||

| Webb Hospital Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 20-0167590 | ||||||||||

| Wesley Health System, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 52-2050792 | ||||||||||

| West Grove Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 25-1892279 | ||||||||||

| WHMC, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762551 | ||||||||||

| Wilkes-Barre Behavioral Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 26-3632720 | ||||||||||

| Wilkes-Barre Holdings, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 26-3632542 | ||||||||||

| Wilkes-Barre Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 26-3632648 | ||||||||||

| Williamston Hospital Corporation | NC | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1749107 | ||||||||||

| Women & Children’s Hospital, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762556 | ||||||||||

Table of Contents

| Exact Name of |

Jurisdiction of Incorporation or Formation |

Principal |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

||||||||||

| Woodland Heights Medical Center, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762558 | ||||||||||

| Woodward Health System, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 62-1762418 | ||||||||||

| Youngstown Ohio Hospital Company, LLC | DE | 4000 Meridian Boulevard Franklin, Tennessee 37067 | 8062 | 27-3074094 | ||||||||||

| * | The address, including zip code, and telephone number, including area code, of each of the additional Registrants’ principal executive offices is c/o Community Health Systems, Inc., 4000 Meridian Boulevard Franklin, Tennessee 37067, (615) 465-7000. |

| † | The name, address, including zip code, and telephone number, including area code, of the agent for service for each of the additional Registrants is Rachel A. Seifert, Community Health Systems, Inc., Executive Vice President, Secretary and General Counsel, 4000 Meridian Boulevard, Franklin, Tennessee 37067, (615) 465-7000. |

Table of Contents

PROSPECTUS

Community Health Systems, Inc.

Debt Securities

Preferred Stock

Securities Warrants

Common Stock

Depositary Shares

Guarantees of Debt Securities

CHS/Community Health Systems, Inc.

Debt Securities

Guarantees of Debt Securities

Community Health Systems, Inc. and CHS/Community Health Systems, Inc. may offer and sell, from time to time, in one or more offerings, any combination of the securities we describe in this prospectus. This prospectus also covers guarantees, if any, of our obligations under any debt securities, which may be given by one or more of our subsidiaries.

We will provide the specific terms of these securities in supplements to this prospectus. This prospectus may not be used to sell securities unless accompanied by a prospectus supplement. We urge you to read carefully this prospectus, any accompanying prospectus supplement, and any documents we incorporate by reference into this prospectus or any prospects supplement before you make your investment decision.

Our common stock is quoted on the New York Stock Exchange under the symbol “CYH.” If we decide to list or seek a quotation for any other securities, the prospectus supplement relating to those securities will disclose the exchange or market on which those securities will be listed or quoted.

Investing in our securities involves certain risks. See “Risk Factors” beginning on page 2 of this prospectus, in the applicable prospectus supplement and in our most recent annual report on Form 10-K, along with the disclosure related to the risk factors contained in our subsequent quarterly reports on Form 10-Q, as updated by our subsequent filings with the Securities and Exchange Commission, which are incorporated by reference herein.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 23, 2012.

Table of Contents

| ii | ||||

| iii | ||||

| v | ||||

| vi | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| DESCRIPTION OF THE DEBT SECURITIES AND GUARANTEES OF DEBT SECURITIES |

9 | |||

| 12 | ||||

| 15 | ||||

| 16 | ||||

| 18 | ||||

| 18 |

i

Table of Contents

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) utilizing a “shelf” registration process. Under this shelf process, we may sell any combination of the securities described in this prospectus, at any time and from time to time over the next three years, in one or more offerings.

This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement together with additional information described under the headings “Where You Can Find Additional Information” and “Incorporation of Certain Documents by Reference.” You should rely only on the information contained or incorporated by reference in this prospectus and any prospectus supplement. We have not authorized any person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front thereof.

We have filed or incorporated by reference exhibits to the registration statement of which this prospectus forms a part. You should read the exhibits carefully for provisions that may be important to you.

ii

Table of Contents

This prospectus, any prospectus supplement and any documents we incorporate by reference may include “forward-looking statements” within the meaning of the federal securities laws, which involve risks, assumptions and uncertainties. Statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” “thinks” and similar expressions are forward-looking statements. These statements involve known and unknown risks, assumptions, uncertainties and other factors that may cause our actual results and performance to be materially different from any future results or performance expressed or implied by these forward-looking statements. These factors include, but are not limited to, the following:

| • | general economic and business conditions, both nationally and in the regions in which we operate; |

| • | implementation and effect of adopted and potential federal and state healthcare legislation; |

| • | risks associated with our substantial indebtedness, leverage and debt service obligations; |

| • | demographic changes; |

| • | changes in, or the failure to comply with, governmental regulations; |

| • | potential adverse impact of known and unknown government investigations, audits, and Federal and State False Claims Act litigation and other legal proceedings; |

| • | our ability, where appropriate, to enter into and maintain managed care provider arrangements and the terms of these arrangements; |

| • | changes in, or the failure to comply with, managed care provider contracts could result in disputes and changes in reimbursement that could be applied retroactively; |

| • | changes in inpatient or outpatient Medicare and Medicaid payment levels; |

| • | increases in the amount and risk of collectability of patient accounts receivable; |

| • | increases in wages as a result of inflation or competition for highly technical positions and rising supply costs due to market pressure from pharmaceutical companies and new product releases; |

| • | liabilities and other claims asserted against us, including self-insured malpractice claims; |

| • | competition; |

| • | our ability to attract and retain, at reasonable employment costs, qualified personnel, key management, physicians, nurses and other healthcare workers; |

| • | trends toward treatment of patients in less acute or specialty healthcare settings, including ambulatory surgery centers or specialty hospitals; |

| • | changes in medical or other technology; |

| • | changes in U.S. generally accepted accounting principles; |

| • | the availability and terms of capital to fund additional acquisitions or replacement facilities; |

| • | our ability to successfully acquire additional hospitals or complete divestitures; |

| • | our ability to successfully integrate any acquired hospitals or to recognize expected synergies from such acquisitions; |

| • | our ability to obtain adequate levels of general and professional liability insurance; |

| • | timeliness of reimbursement payments received under government programs; and |

| • | the other risk factors set forth in our public filings with the SEC. |

iii

Table of Contents

Some of the other important factors that could cause actual results to differ materially from our expectations are disclosed elsewhere in, or incorporated by reference into, this prospectus and any accompanying prospectus supplement, including, without limitation, our Annual Reports on Form 10-K under “Risk Factors” and in conjunction with the forward-looking statements included in this prospectus. Although we believe that these statements are based upon reasonable assumptions, we can give no assurance that our goals will be achieved. Given these uncertainties, prospective investors are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements are made as of the date of this prospectus or the date of any accompanying prospectus supplement or the other documents incorporated by reference herein or therein. All subsequent written and oral forward-looking statements attributable to us, or to persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements. We do not undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

iv

Table of Contents

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We are a reporting company under the Securities Exchange Act of 1934 and file annual, quarterly and current reports, proxy statements and other information with the SEC. The public may read and copy any materials filed with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains an Internet web site that contains reports, proxy and information statements, and other information regarding issuers, including us, that file electronically with the SEC. The public can obtain any documents that we file electronically with the SEC at the SEC’s Internet web site, http://www.sec.gov, or through the New York Stock Exchange, 20 Broad Street, New York, New York 10005, on which our common stock is listed.

Our Internet address is www.chs.net and the investor relations section of our website is located at www.chs.net/investor/index.html. We make available free of charge, through the investor relations section of our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and, if applicable, amendments to those reports, as soon as reasonably practical after they are filed with the SEC. Except as set forth under “Incorporation of Certain Documents by Reference,” information on our Internet website is not incorporated into this prospectus by reference and should not be considered a part of this prospectus or the registration statement of which it is a part . In addition, you may request copies of these filings at no cost through our Investor Relations Department at: Community Health Services, Inc., 4000 Meridian Boulevard, Franklin, TN 37067, Attn: Investor Relations Department; Telephone: (615) 465-7000.

We have filed with the SEC a registration statement on Form S-3 relating to the securities covered by this prospectus. This prospectus is a part of the registration statement and does not contain all the information in the registration statement. Whenever a reference is made in this prospectus or any prospectus supplement to a contract or other document of ours, the reference is only a summary. For a copy of the contract or other document, you should refer to the exhibits that are a part of the registration statement or incorporated by reference into the registration statement by the filing of a Form 8-K or otherwise. You may review a copy of the registration statement and the documents we incorporate by reference at the SEC’s Public Reference Room in Washington, D.C., as well as through the SEC’s Internet web site as listed above, or by contacting our Investor Relations Department, as described above.

v

Table of Contents

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus information contained in documents that we file with it. This means that we can disclose important information to you by referring you to those documents. The information incorporated by reference into this prospectus is an important part of this prospectus, and information we file later with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below and any future filings we will make with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934 prior to the termination or completion of the offering made by this prospectus (other than, in each case, documents or information deemed to have been furnished and not filed in accordance with SEC rules, including current reports on Form 8-K furnished under Item 2.02 and Item 7.01 (including any financial statements or exhibits relating thereto furnished pursuant to Item 9.01)):

| • | our Annual Report on Form 10-K for the fiscal year ended December 31, 2011 (including portions of our Proxy Statement for our 2012 Annual Meeting of Stockholders filed on April 5, 2012 (the “Proxy Statement”) with the SEC to the extent specifically incorporated by reference in such Form 10-K) filed on February 23, 2012; |

| • | our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2012 filed on April 27, 2012; |

| • | our Current Reports on Form 8-K filed on February 6, 2012, March 1, 2012, March 8, 2012, March 9, 2012, March 23, 2012, April 25, 2012, May 17, 2012 and May 24, 2012; and |

| • | the description of our common stock on our Registration Statement on Form 8-A filed on June 5, 2000. |

You may request a copy of these filings at no cost, by writing or telephoning us as follows:

Community Health Systems, Inc.

4000 Meridian Boulevard, Franklin, TN 37067

Attn: Investor Relations Department

(615) 465-7000

You may also obtain a copy of these filings from our Internet web site at http://www.chs.net. Please note, however, that the information on our Internet web site is not incorporated by reference into this prospectus and should not be considered a part of this prospectus.

vi

Table of Contents

The following summary highlights information contained elsewhere in this prospectus. It does not contain all the information that may be important to you in making an investment decision. You should read this entire prospectus carefully, including the documents incorporated by reference herein, which are described under “Incorporation of Certain Documents by Reference” and “Where You Can Find Additional Information.” You should also carefully consider, among other things, the matters discussed in the section titled “Risk Factors.”

In this prospectus “we,” “us,” “our” and the “Company” refer to Community Health Systems, Inc., a Delaware corporation, and its consolidated subsidiaries, including CHS/Community Health Systems, Inc., unless the context otherwise requires. “CHS” refers to CHS/Community Health Systems, Inc., a Delaware corporation and a wholly owned subsidiary of Community Health Systems, Inc., and none of its subsidiaries.

Our Company

We are one of the largest publicly-traded operators of hospitals in the United States in terms of number of facilities and net operating revenues. We provide healthcare services through the hospitals that we own and operate in non-urban and selected urban markets. We generate revenues by providing a broad range of general and specialized hospital healthcare services to patients in the communities in which we are located. As of March 31, 2012, we owned or leased 134 hospitals comprised of 130 general acute care hospitals and four stand-alone rehabilitation or psychiatric hospitals. In addition, we own and operate home care agencies, located primarily in markets where we also operate a hospital, and through our wholly-owned subsidiary, Quorum Health Resources, LLC, or QHR, we provide management and consulting services to non-affiliated general acute care hospitals located throughout the United States. For the hospitals and home care agencies that we own and operate, we are paid for our services by governmental agencies, private insurers and directly by the patients we serve. For our management and consulting services, we are paid by the non-affiliated hospitals utilizing our services.

Historically, we have grown by acquiring hospitals and by improving the operations of our facilities. We generally target hospitals in growing, non-urban and selected urban healthcare markets for acquisition because of their favorable demographic and economic trends and competitive conditions. Because non-urban service areas have smaller populations, there are generally fewer hospitals and other healthcare service providers in these communities and generally a lower level of managed care presence in these markets. We believe that smaller populations support less direct competition for hospital-based services and these markets generally view the local hospital as an integral part of the community. Patients needing the most complex care are more often served by the larger, more specialized urban hospitals. We believe opportunities exist for skilled, disciplined operators in selected urban markets to create networks between urban hospitals and non-urban hospitals in order to expand the breadth of services offered in the non-urban hospitals while improving physician alignment in those markets and making it more attractive to managed care.

Our Corporate Information

Community Health Systems, Inc. was incorporated in the State of Delaware on June 6, 1996. CHS/Community Health Systems, Inc. was incorporated in the State of Delaware on March 25, 1985. Our principal executive offices are located at 4000 Meridian Boulevard, Franklin, Tennessee 37067, and our telephone number is (615) 465-7000. Our website is www.chs.net. Information on our website shall not be deemed part of this prospectus.

1

Table of Contents

Our business is subject to uncertainties and risks. You should consider carefully all of the information set forth in any accompanying prospectus supplement and the documents incorporated by reference herein and therein, unless expressly provided otherwise, including the risk factors incorporated by reference from our most recent annual report on Form 10-K, as updated by our quarterly reports on Form 10-Q and other filings we make with the SEC. The risks described in any document incorporated by reference herein are not the only ones we face, but are considered by us to be the most material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods.

2

Table of Contents

Unless indicated otherwise in any applicable prospectus supplement, we expect to use the net proceeds from the sale of our securities for our operations and for other general corporate purposes, including repayment or refinancing of borrowings, working capital, capital expenditures, investments, acquisitions and the repurchase of our outstanding securities. Additional information on the use of net proceeds from the sale of securities that we may offer from time to time by this prospectus may be set forth in the applicable prospectus supplement relating to a particular offering.

3

Table of Contents

COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES

The following table sets forth our ratio of earnings to fixed charges for each of the periods shown on a consolidated basis. For purposes of determining the ratio of earnings to fixed charges, earnings are defined as earnings (loss) from continuing operations before income taxes, plus fixed charges. Fixed charges consist of interest expense on all indebtedness, amortization of debt discount, amortization of deferred financing costs and an interest factor attributable to operating leases.

| Fiscal Years Ended December 31, | Three Months Ended March 31, 2012 |

|||||||||||||||||||||||

| 2007 | 2008 | 2009 | 2010 | 2011 | ||||||||||||||||||||

| Earnings |

||||||||||||||||||||||||

| Income from continuing operations before provision for income taxes |

$ | 111,858 | $ | 366,287 | $ | 447,662 | $ | 518,894 | $ | 473,547 | $ | 145,537 | ||||||||||||

| Income from equity investees |

(25,136 | ) | (42,073 | ) | (36,531 | ) | (45,443 | ) | (49,491 | ) | (12,013 | ) | ||||||||||||

| Distributed income from equity investees |

19,902 | 32,897 | 33,705 | 33,882 | 39,995 | 2,941 | ||||||||||||||||||

| Interest and amortization of deferred finance costs |

356,488 | 643,397 | 643,608 | 647,593 | 644,410 | 152,175 | ||||||||||||||||||

| Amortization of capitalized interest |

881 | 1,468 | 2,021 | 2,421 | 2,882 | 3,285 | ||||||||||||||||||

| Implicit rental interest expense |

36,696 | 55,440 | 59,384 | 62,116 | 63,695 | 16,806 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Earnings |

$ | 500,689 | $ | 1,057,416 | $ | 1,149,849 | $ | 1,219,463 | $ | 1,175,038 | $ | 308,731 | ||||||||||||

| Fixed Charges |

||||||||||||||||||||||||

| Interest and amortization of deferred finance costs |

$ | 356,488 | $ | 643,397 | $ | 643,608 | $ | 647,593 | $ | 644,410 | $ | 152,175 | ||||||||||||

| Capitalized interest |

19,009 | 22,087 | 16,649 | 11,316 | 20,998 | 7,199 | ||||||||||||||||||

| Implicit rental interest expense |

36,696 | 55,440 | 59,384 | 62,116 | 63,695 | 16,806 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Fixed Charges |

$ | 412,193 | $ | 720,924 | $ | 719,641 | $ | 721,025 | $ | 729,103 | $ | 176,180 | ||||||||||||

| Ratio of earnings to fixed charges |

1.21x | 1.47x | 1.60x | 1.69x | 1.61x | 1.75X | ||||||||||||||||||

4

Table of Contents

DESCRIPTION OF THE SECURITIES WE MAY ISSUE

Overview

This prospectus describes the securities we may issue from time to time. The remainder of this section provides some background information about the manner in which the securities may be held. The three sections following this section of the prospectus describe the terms of the basic categories of securities that we may issue pursuant to this prospectus:

| • | our debt securities, which: |

| • | may be senior or subordinated; |

| • | may be secured or unsecured; |

| • | may be convertible or exchangeable into our common stock or other securities; |

| • | may be guaranteed by CHS and one or more of our other subsidiaries; or |

| • | may be issued by CHS rather than us and guaranteed by us and/or one or more of our other subsidiaries; |

| • | warrants to purchase our debt securities, preferred stock, depositary shares or common stock; and |

| • | our common stock, preferred stock and depositary shares representing fractional shares of our preferred stock. |

Under SEC rules, we are required to present in our financial statements supplemental condensed consolidating financial information concerning us, CHS, our subsidiary guarantors, our subsidiary non-guarantors and eliminations. See the last three paragraphs of “Description of the Debt Securities and Guarantees of Debt Securities.”

Prospectus Supplements

This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of any securities that we offer, as well as the other specific terms related to that offering. The prospectus supplement may also add to or change information contained in this prospectus. If so, the prospectus supplement should be read as superseding this prospectus. You should read both this prospectus and any applicable prospectus supplement together with the exhibits filed with our registration statement, of which this prospectus is a part, and the additional information described under the headings “Where You Can Find Additional Information” and “Incorporation of Certain Documents by Reference.”

Legal Ownership of Securities

Holders of Securities

Book-Entry Holders. We will issue debt securities under this prospectus in book-entry form only, unless we specify otherwise in the applicable prospectus supplement. We may, but are not obligated to, issue shares of common stock, shares of preferred stock and securities warrants under this prospectus in book-entry form. If securities are issued in book-entry form, this means the securities will be represented by one or more global securities registered in the name of a financial institution that holds them as depositary on behalf of other financial institutions that participate in the depositary’s book-entry system. These participating institutions, in turn, hold beneficial interests in the securities on behalf of themselves or their customers.

We will only recognize the person in whose name a security is registered as the holder of that security. Consequently, for securities issued in global form, we will recognize only the depositary as the holder of the

5

Table of Contents

securities, and all payments on the securities will be made to the depositary. The depositary passes along the payments it receives to its participants, which in turn pass the payments along to their customers, who are the beneficial owners. The depositary and its participants do so under agreements they have made with one another or with their customers. They are not obligated to do so under the terms of the securities.

As a result, investors of securities in book-entry form will not own these securities directly. Instead, they will own beneficial interests in a global security, through a bank, broker or other financial institution that participates in the depositary’s book-entry system or holds an interest through a participant. As long as the securities are issued in global form, investors will be indirect holders, and not holders, of the securities. For more information about securities issued in global form, see “— Global Securities” below.

Street Name Holders. Alternatively, we may initially issue securities under this prospectus in non-global form. We may also terminate a global security at any time after it is issued. In these cases, investors may choose to hold their securities in their own names or in “street name.” Securities held by an investor in street name would be registered in the name of a bank, broker or other financial institution that the investor chooses. In that event, the investor would hold only a beneficial interest in those securities through an account that the investor maintains at that institution.

For securities held in street name, we will recognize only the intermediary banks, brokers and other financial institutions in whose names the securities are registered as the holders of those securities and all payments on those securities will be made to them. These institutions pass along the payments they receive to their customers who are the beneficial owners, but only because they agree to do so in their customer agreements or because they are legally required to do so. Investors who hold securities in street name will be indirect holders, not holders, of those securities.

Legal Holders. We, and any third parties employed by us or acting on your behalf, including trustees, depositories and transfer agents, generally are obligated only to the legal holders of the securities. In a number of respects, we do not have direct obligations to investors who hold beneficial interests in global securities, in street name or by any other indirect means. This will be the case whether an investor chooses to be an indirect holder of a security or has no choice because we are issuing the securities only in global form.

For example, once we make a payment or give a notice to the legal holder, we have no further responsibility for the payment or notice even if that legal holder is required, under agreements with depositary participants or customers or by law, to pass it along to the indirect holders but does not do so. Similarly, if we want to obtain the approval of the holders to amend an indenture, to relieve ourselves of the consequences of a default or of our obligation to comply with a particular provision of the indenture or for any other purpose, we would seek the approval only from the legal holders, and not the indirect holders, of the securities. Whether and how the legal holders contact the indirect holders is determined by the legal holders.

When we refer to you, we mean those who invest in the securities being offered by this prospectus, whether they are the legal holders or only indirect holders of those securities. When we refer to your securities, we mean the securities in which you hold a direct or indirect interest.

Special Considerations for Indirect Holders. If you hold securities through a bank, broker or other financial institution, either in book-entry form or in street name, you should check with your own institution to find out:

| • | how it handles securities payments and notices; |

| • | whether it imposes fees or charges; |

| • | how it would handle a request for the holders’ consent, if ever required; |

| • | whether and how you can instruct it to send you securities registered in your own name so you can be a legal holder, if that is permitted in the future; |

6

Table of Contents

| • | how it would exercise rights under the securities if there were a default or other event triggering the need for holders to act to protect their interests; and |

| • | if the securities are in book-entry form, how the depositary’s rules and procedures will affect these matters. |

Global Securities

What is a Global Security? A global security represents one or any other number of individual securities. Generally, all securities represented by the same global securities will have the same terms. We may, however, issue a global security that represents multiple securities that have different terms and are issued at different times. We call this kind of global security a master global security.

A global security may not be transferred to or registered in the name of anyone other than the depositary or its nominee, unless special termination situations arise or as otherwise described in the applicable prospectus supplement. We describe those situations under “— Special Situations When a Global Security Will Be Terminated” below. As a result of these arrangements, the depositary, or its nominee, will be the sole registered owner and holder of all securities represented by a global security, and investors will be permitted to own only beneficial interests in a global security. Beneficial interests must be held by means of an account with a broker, bank or other financial institution that in turn has an account with the depositary or with another institution that does. Thus, an investor whose security is represented by a global security will not be a holder of the security, but only an indirect holder of a beneficial interest in the global security.

Special Considerations for Global Securities. As an indirect holder, an investor’s rights relating to a global security will be governed by the account rules of the investor’s financial institution and of the depositary, as well as general laws relating to securities transfers. We do not recognize this type of investor as a holder of securities and instead will deal only with the depositary that holds the global security.

If securities are issued only in the form of a global security, an investor should be aware of the following:

| • | an investor cannot cause the securities to be registered in the name of the investor, and cannot obtain physical certificates for the investor’s interest in the securities, except in the special situations we describe below; |

| • | an investor will be an indirect holder and must look to the investor’s own broker, bank or other financial institution for payments on the securities and protection of the investor’s legal rights relating to the securities, as we describe under “— Legal Ownership of Securities — Holders of Securities” above; |

| • | an investor may not be able to sell interests in the securities to some insurance companies and to other institutions that are required by law to own their securities in non-book-entry form; |

| • | an investor may not be able to pledge the investor’s interest in a global security in circumstances where certificates representing the securities must be delivered to the lender or other beneficiary of the pledge in order for the pledge to be effective; |

| • | the depositary’s policies, which may change from time to time, will govern payments, transfers, exchanges and other matters relating to an investor’s interest in a global security. Neither we nor any third parties employed by us or acting on your behalf, including trustees and transfer agents, have any responsibility for any aspect of the depositary’s actions or for its records of ownership interests in a global security. Neither we, the trustee, the transfer agent nor any other third parties supervise the depositary in any way; |

| • | The Depository Trust Company (“DTC”) requires that those who purchase and sell interests in a global security within its book-entry system use immediately available funds and your broker, bank or other financial institution may require you to do so as well; and |

7

Table of Contents

| • | brokers, banks and other financial institutions that participate in the depositary’s book-entry system, and through which an investor holds its interest in a global security, may also have their own policies affecting payments, notices and other matters relating to the security. There may be more than one financial intermediary in the chain of ownership for an investor. We do not monitor and are not responsible for the actions of any of those intermediaries. |

Special Situations When a Global Security Will Be Terminated. In some situations described below, a global security will be terminated and interests in it will be exchanged for certificates in non-global form representing the securities it represented. After that exchange, the choice of whether to hold the securities directly or in street name will be up to the investor. Investors must consult their own banks or brokers to find out how to have their interests in a global security transferred on termination to their own names so that they will be holders. We have described the rights of holders and street name investors under “— Legal Ownership of Securities — Holders of Securities” above.

The special situations for termination of a global security are as follows:

| • | if the depositary notifies us that it is unwilling, unable or no longer qualified to continue as depositary for that global security, and we do not appoint another institution to act as depositary within a specified time period; or |

| • | if we elect to terminate that global security. |

A prospectus supplement may also list additional situations for terminating a global security that would apply to that particular series of securities covered by that prospectus supplement. If a global security is terminated, the depositary has the sole responsibility for determining the institutions in whose names the securities represented by the global security will be registered and, therefore, who will be the holders of those securities.

8

Table of Contents

DESCRIPTION OF THE DEBT SECURITIES AND

GUARANTEES OF DEBT SECURITIES

We may issue debt securities from time to time in one or more distinct series. The debt securities will either be senior debt securities or subordinated debt securities. Senior debt securities will be issued under a senior indenture and subordinated debt securities will be issued under a subordinated indenture. Unless otherwise specified in the applicable prospectus supplement the trustee under the indentures will be Regions Bank. We will include in a supplement to this prospectus the specific terms of each series of debt securities being offered, including the terms, if any, on which a series of debt securities may be convertible into or exchangeable for common stock, preferred stock or other debt securities. The statements and descriptions in this prospectus or in any prospectus supplement regarding provisions of the debt securities, their indentures and their guarantees, if any, are summaries of these provisions, do not purport to be complete and are subject to, and are qualified in their entirety by reference to, all of the provisions of the debt securities, their indentures (including any amendments or supplements we may enter into from time to time which are permitted under each indenture) and their guarantees, if any.

The applicable prospectus supplement will specify whether such debt securities will be issued by the Company or CHS, and whether the debt securities will be guaranteed by the Company or CHS or one or more of our other subsidiaries. Unless otherwise specified in the prospectus supplement, the debt securities will be direct unsecured obligations of the issuer. The senior debt securities will rank equally with any of our other senior and unsubordinated debt. The subordinated debt securities will be subordinate and junior in right of payment to any senior indebtedness. There may be subordinated debt securities that are senior or junior to other series of subordinated debt securities.

The applicable prospectus supplement will set forth the terms of each series of debt securities, including, if applicable:

| • | the title of the debt securities and whether the debt securities will be senior debt securities or subordinated debt securities; |

| • | any limit upon the aggregate principal amount of the debt securities; |

| • | whether the debt securities will be issued as registered securities, bearer securities or both, and any restrictions on the exchange of one form of debt securities for another and on the offer, sale and delivery of the debt securities in either form; |

| • | the date or dates on which the principal amount of the debt securities will mature; |

| • | if the debt securities bear interest, the rate or rates at which the debt securities bear interest and the date or dates from which interest will accrue; |

| • | if the debt securities bear interest, the dates on which interest will be payable and the regular record dates for interest payments; |

| • | the place or places where the payment of principal, any premium and interest will be made, where the debt securities may be surrendered for transfer or exchange and where notices or demands to or upon us may be served; |

| • | any optional redemption provisions, which would allow us to redeem the debt securities in whole or in part; |

| • | any sinking fund or other provisions that would obligate us to redeem, repay or purchase the debt securities; |

| • | if the currency in which the debt securities will be issuable is United States dollars, the denominations in which any registered securities will be issuable, if other than denominations of $1,000 and any |

9

Table of Contents

| integral multiple thereof, and the denominations in which any bearer securities will be issuable, if other than the denomination of $5,000; |

| • | if other than the entire principal amount, the portion of the principal amount of debt securities which will be payable upon a declaration of acceleration of the maturity of the debt securities; |

| • | the events of default and covenants relevant to the debt securities, including, the inapplicability of any event of default or covenant set forth in the indenture relating to the debt securities, or the applicability of any other events of defaults or covenants in addition to the events of default or covenants set forth in the indenture relating to the debt securities; |

| • | if a person other than Regions Bank is to act as trustee for the debt securities, the name and location of the corporate trust office of that trustee; |

| • | if other than United States dollars, the currency in which the debt securities will be paid or denominated; |

| • | if the debt securities are to be payable, at our election or the election of a holder of the debt securities, in a currency other than that in which the debt securities are denominated or stated to be payable, the terms and conditions upon which that election may be made, and the time and manner of determining the exchange rate between the currency in which the debt securities are denominated or stated to be payable and the currency in which the debt securities are to be so payable; |

| • | the designation of the original currency determination agent, if any; |

| • | if the debt securities are issuable as indexed securities, the manner in which the amount of payments of principal, any premium and interest will be determined; |

| • | if the debt securities do not bear interest, the dates on which we will furnish to the trustee the names and addresses of the holders of the debt securities; |

| • | provisions for the satisfaction and discharge or defeasance or covenant defeasance of the indenture with respect to the debt securities issued under that indenture; |

| • | the date as of which any bearer securities and any global security will be dated if other than the date of original issuance of the first debt security of a particular series to be issued; |

| • | whether the debt securities will be issued in whole or in part in the form of a global security or securities and, in that case, any depositary and global exchange agent for the global security or securities, whether the global form shall be permanent or temporary and, if applicable, the exchange date; |

| • | if debt securities are to be issuable initially in the form of a temporary global security, the circumstances under which the temporary global security can be exchanged for definitive debt securities and whether the definitive debt securities will be registered securities, bearer securities or will be in global form and provisions relating to the payment of interest in respect of any portion of a global security payable in respect of an interest payment date prior to the exchange date; |

| • | the extent and manner to which payment on or in respect of debt securities will be subordinated to the prior payment of our other liabilities and obligations; |

| • | whether payment of any amount due under the debt securities will be guaranteed by one or more guarantors, including one or more of our subsidiaries; |

| • | whether the debt securities may be converted or exchanged into or for common stock, preferred stock or other securities or property and the terms of any conversion provisions; |

| • | whether the debt securities will be secured or unsecured; |

| • | the forms of the debt securities; and |

10

Table of Contents

| • | any other terms of the debt securities, which terms shall not be inconsistent with the requirements of the Trust Indenture Act of 1939, as amended. |

This prospectus is part of a registration statement that does not limit the aggregate principal amount of debt securities that we may issue and provides that we may issue debt securities from time to time in one or more series under one or more indentures, in each case with the same or various maturities, at par or at a discount. Unless indicated in a prospectus supplement, we may issue additional debt securities of a particular series without the consent of the holders of the debt securities of such series outstanding at the time of the issuance. Any such additional debt securities, together with all other outstanding debt securities of that series, will constitute a single series of debt securities under the applicable indenture.