Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material under §240.14a-12 | |||

FNB UNITED CORP. | ||||

| (Name of registrant as specified in its charter) | ||||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) | Total fee paid: | |||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| (3) | Filing Party:

| |||

|

| ||||

| (4) | Date Filed:

| |||

|

| ||||

Table of Contents

FNB UNITED CORP.

150 South Fayetteville Street

Asheboro, North Carolina 27203

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on June 21, 2012

Notice is hereby given that the Annual Meeting of Shareholders of FNB United Corp., or FNB, will be held on June 21, 2012 at 3:00 p.m., Eastern Time at the Pinewood Country Club, 247 Pinewood Road, Asheboro, North Carolina 27205. The following proposals and other business will be considered and conducted at the meeting:

| 1. | To elect the following directors to the following classes and terms: |

Class I Directors with two-year terms expiring at the FNB Annual Meeting in 2014:

Scott B. Kauffman

J. Chandler Martin

Brian E. Simpson

Class II Directors with three-year terms expiring at the FNB Annual Meeting in 2015:

Austin A. Adams

R. Reynolds Neely, Jr.

Louis A. “Jerry” Schmitt

Boyd C. Wilson, Jr.

Class III Directors with one-year terms expiring at the FNB Annual Meeting in 2013:

John J. Bresnan

Robert L. Reid

Jerry R. Licari

| 2. | To ratify the appointment of Dixon Hughes Goodman LLP as FNB’s independent registered public accounting firm for 2012. |

| 3. | To approve a non-binding, advisory proposal on the compensation of FNB’s executive officers; |

| 4. | To approve the 2012 Incentive Plan; and |

| 5. | To transact such other business as may properly come before the meeting or any adjournment of the meeting. |

Only shareholders of record at the close of business on May 3, 2012 are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

By Order of the Board of Directors

Beth S. DeSimone, Secretary

April 30, 2012

Table of Contents

IMPORTANT

YOUR VOTE IS IMPORTANT. IN ORDER TO ASSURE YOUR REPRESENTATION AT THE ANNUAL MEETING, PLEASE MARK, SIGN, DATE AND RETURN THE ENCLOSED PROXY AS SOON AS POSSIBLE IN THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED FOR MAILING IN THE UNITED STATES.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE ELECTION AS DIRECTORS OF THE NOMINEES NAMED IN THIS PROXY STATEMENT, FOR THE RATIFICATION OF THE SELECTION OF DIXON HUGHES GOODMAN LLP AS AN INDEPENDENT REGISTERED ACCOUNTING FIRM FOR FISCAL YEAR 2012, FOR THE NON-BINDING ADVISORY PROPOSAL ON THE COMPENSATION OF FNB’S EXECUTIVE OFFICERS, AND FOR THE APPROVAL OF THE 2012 INCENTIVE PLAN.

Table of Contents

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE 2012 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 21, 2012

FNB’s Proxy Statement for the 2012 Annual Meeting of Shareholders, and FNB’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, are available at http:/www.myyesbank.com.

IMPORTANT NOTICE REGARDING DELIVERY OF SECURITY HOLDER DOCUMENTS

The Securities and Exchange Commission (“SEC”) has adopted rules that permit companies and intermediaries such as brokers to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more shareholders sharing the same address by delivering a single proxy statement addressed to those shareholders. This process is commonly referred to as “householding.”

FNB has implemented “householding” in an effort to reduce the number of duplicate mailings to the same address. Under the householding process, only one proxy statement will be delivered to multiple shareholders sharing an address, unless FNB has received contrary instructions from one or more of the shareholders. This process benefits both shareholders and FNB, because it eliminates unnecessary mailings delivered to your home and helps to reduce FNB’s expenses. “Householding” is not being used, however, if FNB has received specific instructions from one or more of the shareholders sharing an address indicating that they desire to receive multiple copies of the proxy statement. If your household has received only one annual report and one proxy statement, FNB will deliver promptly a separate copy of the annual report and the proxy statement to any shareholder who contacts FNB Investor Relations department at: FNB United Corp., Attention: Investor Relations, P O Box 1328, Asheboro, North Carolina 27204 or from FNB’s Investor Relations page on its corporate web site at www.MyYesBank.com. Please note, however, that if you also hold shares of FNB in “street name” (e.g., in a brokerage account or retirement plan account) you may continue to receive duplicate mailings.

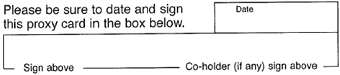

Each proxy card should be signed, dated and returned in the enclosed self-addressed envelope. If your household has received multiple copies of FNB’s annual report and proxy statement, you can request the delivery of single copies in the future by contacting FNB, as instructed above, or your broker, if you hold the shares in “street name.”

Table of Contents

| Page | ||||

| 1 | ||||

| 3 | ||||

| 6 | ||||

| 18 | ||||

| 25 | ||||

| 26 | ||||

| 36 | ||||

| 41 | ||||

| 44 | ||||

| 45 | ||||

| 45 | ||||

| A-1 | ||||

Table of Contents

PROXY STATEMENT FOR

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD JUNE 21, 2012

INTRODUCTION

This Proxy Statement is being furnished to shareholders of FNB United Corp. (“FNB”) in connection with the solicitation of proxies by the FNB Board of Directors (“FNB Board”) for use at the Annual Meeting of Shareholders, and any adjournments thereof, to be held at the time and place set forth in the accompanying notice (“Annual Meeting”). This Proxy Statement is being mailed to shareholders on or about May 15, 2012. At the Annual Meeting, shareholders of FNB will be asked to elect three Class I Directors to serve a two-year term, four Class II directors of FNB to serve a three-year term, and three Class III directors to serve a one year term. In addition, shareholders will be asked to approve the ratification of the selection of Dixon Hughes Goodman LLP as FNB’s independent registered public accounting firm for the fiscal year 2012, to approve a non-binding, advisory proposal on the compensation of FNB’s executive officers and to approve the 2012 Incentive Plan.

All shareholders are urged to read this Proxy Statement carefully and in its entirety.

Date, Time and Place of the FNB Annual Meeting

The Annual Meeting will be held on June 21, 2012, at 3:00 p.m., Eastern Time, at the Pinewood Country Club, 247 Pinewood Road, Asheboro, North Carolina 27205.

Record Date; Voting Rights

The securities that can be voted at the Annual Meeting consist of shares of common stock of FNB, no par value per share (“Common Stock”), with each share entitling its owner to one vote on all matters. Only holders of the Common Stock at the close of business on May 3, 2012 (“Record Date”) will be entitled to notice of and to vote at the Annual Meeting.

A quorum is required for the transaction of business at the Annual Meeting. A “quorum” is the presence at the meeting, in person or represented by proxy, of the holders of the majority of the outstanding shares of Common Stock. Abstentions and broker nonvotes will be counted as present and entitled to vote for purposes of determining a quorum.

The director nominees will be elected by a plurality of the votes cast at the Annual Meeting. “Plurality” means that the nominees receiving the largest number of votes cast are elected as directors up to the maximum number of directors to be chosen at the meeting. Abstentions and broker nonvotes will not affect the election results if a quorum is present. Each of the ratification of the selection of Dixon Hughes Goodman LLP as FNB’s independent registered public accounting firm for fiscal year 2012, the non-binding advisory proposal on the compensation of FNB’s executive officers and the approval of the 2012 Incentive Plan will be approved if the number of votes cast in favor of each proposal exceeds the number of votes cast against the proposal. Abstentions and broker nonvotes, as well as the failure to return a signed proxy card assuming a quorum is present, will not be counted as a vote for or against the ratification and non-binding proposal and will not affect voting on either proposal.

Voting of Proxies

If the appropriate enclosed form of proxy is properly executed and returned to FNB in time to be voted at the Annual Meeting, the shares represented thereby will be voted in accordance with the instructions marked on the proxy. Executed but unmarked proxies will be voted “FOR” the director nominees proposed by the FNB Board, who are presented in this Proxy Statement, “FOR” the ratification of the selection of Dixon Hughes Goodman LLP as FNB’s independent registered public accounting firm for fiscal year 2012, “FOR” the

1

Table of Contents

non-binding advisory proposal on the compensation of FNB’s executive officers and “FOR” the approval of the 2012 Incentive Plan. Only shares affirmatively voted for the approval of the proposals to be considered at the Annual Meeting or properly executed proxies that do not contain voting instructions will be counted as favorable votes for the proposals. Under Nasdaq rules, your broker or bank does not have discretionary authority to vote your shares of Common Stock on any of the proposals other than the ratification of the independent registered public accounting firm proposal. To avoid a broker nonvote, you must provide voting instructions to your broker, bank or other nominee by following the instructions provided to you.

How to Vote

If you own shares of FNB Common Stock in your own name, you are an “owner of record.” This means that you may use the enclosed proxy card(s) to tell the persons named as proxies how to vote your shares of FNB Common Stock. An owner of record has four voting options:

Internet. You can vote over the Internet by accessing the website shown on your proxy card and following the instructions on the website. Internet voting is available 24 hours a day. Have your proxy card in hand when you access the web site and follow the instructions to vote.

Telephone. You can vote by telephone by calling the toll-free number shown on your proxy card. Telephone voting is available 24 hours a day.

Mail. You can vote by mail by completing, signing, dating and mailing your proxy card(s) in the postage-paid envelope included with this document.

In Person. You may attend the Annual Meeting and cast your vote in person. The FNB Board recommends that you vote by proxy even if you plan to attend the Annual Meeting.

If you hold your shares of FNB common stock in “street name” through a broker, bank or other nominee, you must provide the record holder of your shares with instructions on how to vote the shares. Please follow the voting instructions provided by the broker or bank. You may not vote shares held in street name by returning a proxy card directly to FNB or by voting in person at the Annual Meeting unless you provide a “legal proxy,” which you must obtain from your broker, bank or other nominee. Further, brokers, banks or other nominees who hold shares of FNB Common Stock on behalf of their customers may not give a proxy to FNB to vote those shares with respect to any of the proposals, other than the proposal to ratify the appointment of FNB’s independent registered public accounting firm, without specific instructions from their customers, as under Nasdaq rules, brokers, banks and other nominees do not have discretionary voting power on these matters.

Directing the voting of your FNB shares will not affect your right to vote in person if you decide to attend the Annual Meeting.

Revoking Your Proxy

You may revoke your proxy at any time after you give it, and before it is voted, in one of the following ways:

| • | by notifying FNB’s Secretary that you are revoking your proxy by written notice that bears a date later than the date of the proxy and that FNB receives prior to the Annual Meeting; |

| • | by signing another FNB proxy card bearing a later date and mailing it so that FNB receives it prior to the Annual Meeting; |

| • | by voting again using the telephone or Internet voting procedures; or |

| • | by attending the Annual Meeting and voting in person, although attendance at the Annual Meeting alone will not, by itself, revoke a proxy. |

2

Table of Contents

If your broker, bank or other nominee holds your shares in street name, you will need to contact your broker, bank or other nominee to revoke your voting instructions.

Except for procedural matters incident to the conduct of the Annual Meeting, FNB does not know of any matters other than those described in the Notice of Annual Meeting that are to come before the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons named in the accompanying proxy will vote the shares represented by the proxies in their discretion on such matters as recommended by a majority of the FNB Board.

Proxy Solicitations

FNB will pay the costs of the Annual Meeting and the solicitation of proxies. Solicitation of proxies may be made in person or by mail or telephone by directors, officers and regular employees of FNB or CommunityOne without receiving additional compensation. FNB may also request banking institutions, brokerage firms, custodians, nominees and fiduciaries to forward solicitation material to the beneficial owners of FNB Common Stock held of record by such person, and FNB will reimburse such forwarding expenses.

BENEFICIAL OWNERS OF FNB COMMON STOCK

Under Section 13(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), a beneficial owner of a security is any person who directly or indirectly has or shares voting power or investment power over such security. Such beneficial owner under this definition need not enjoy the economic benefit of such securities. The following are the only shareholders known to FNB to be deemed to be a beneficial owner of 5% or more of FNB common stock as of May 3, 2012.

| Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class |

||||||

| Carlyle Financial Services Harbor, L.P. (1) Cayman Islands c/o The Carlyle Group 1001 Pennsylvania Avenue, N.W. Suite 220 South Washington, DC 20004-2505 |

4,930,313 | 23.4 | % | |||||

| Oak Hill Capital Partners III, L.P. (2) Cayman Islands Oak Hill Capital Management Partners III, L.P. c/o Oak Hill Capital Management, LLC 65 East 55th Street, 32nd Floor New York, NY 10022 |

4,930,314 | 23.4 | % | |||||

| The U.S. Department of the Treasury (3) 1500 Pennsylvania Avenue, NW Washington, DC 20220 |

1,107,626 | 5.2 | % | |||||

| (1) | Based on information reported on Schedule 13D filed with the SEC on October 31, 2011, DBD Cayman Holdings, Ltd. is the sole shareholder of DBD Cayman, Ltd., which is the general partner of TCG Holdings Cayman II L.P., which is the general partner of TC Group Cayman Investment Holdings, L.P., which is the sole shareholder of Carlyle Financial Services, Ltd., which is the general partner of TCG Financial Services, L.P., which is the general partner of Carlyle Financial Services Harbor, L.P. The shares of Common Stock are held directly by Carlyle Financial Services Harbor, L.P. William E. Conway,Jr., Daniel A. D’Aniello and David M. Rubenstein are the ordinary members as well as the directors of DBD Cayman Holding, Ltd., |

3

Table of Contents

| and in such capacities, may be deemed to share the beneficial ownership of the shares of Common Stock owned by DBD Cayman, Ltd., William E. Conway., Jr., Daniel A. D’Aniello, David M. Rubenstein and Glenn Youngkin are the directors of Carlyle Financial Services, Ltd. and, in such capacity, may be deemed to share beneficial ownership of the shares of Common Stock beneficially owned by Carlyle Financial Services, Ltd. |

| (2) | Based on information reported on Schedule 13D filed with the SEC on October 31, 2011, the general partner of Oak Hill Capital Partners III, L.P. and Oak Hill Capital Management Partners III, L.P. (together the “Oak Hill Funds”) is OHCP GenPar III, L.P., a Cayman Islands limited partnership. The general partner of OHCP GenPar III, L.P. is OHCP MGP Partners III, L.P., a Cayman Islands limited partnership. The general partner of OHCP MGP Partners III, L.P. is OHCP MGP III, Ltd., a Cayman Islands company. J. Taylor Crandall, Steven Gruber and Denis Nayden are the directors of OHCP MGP III, Ltd. J. Taylor Crandall, Steven Gruber, Denis Nayden, John Fant, Kevin Levy, Ray Pinson, Shawn Hessing and John Monsky are the executive officers of OHCP MGP III, Ltd. Each of Messrs. Crandall, Gruber, Nayden, Fant, Levy, Pinson, Hessing and Monsky expressly disclaims beneficial ownership of the shares of common stock referred to herein. |

| (3) | Includes 1,085,554 shares of Common Stock issued on October 21, 2011, and 22,072 shares of Common Stock issuable upon exercise of the warrant. |

FNB is not aware of any other person who beneficially owns more than 5% of any class of securities of FNB other than those listed above.

The following table sets forth, as of April 16, 2012, the amount and percentage of our Common Stock beneficially owned by each director, each nominee for director and each of the Named Executive Officers (as defined below) of FNB, as well as the directors and executive officers of FNB as a group. Unless otherwise indicated, all persons listed below have sole voting and investment power of all shares of Common Stock. The business address of each of FNB’s directors and officers is 150 S. Fayetteville Street, Asheboro, NC 27203.

| Name |

Shares of Common Stock Beneficially Owned |

Percent Owned | ||||||

| Austin A. Adams |

9,375 | * | ||||||

| John J. Bresnan (1) |

4,930,313 | 23.4 | ||||||

| Scott B. Kauffman (2) |

4,930,314 | 23.4 | ||||||

| David C. Lavoie |

6,250 | * | ||||||

| Jerry R. Licari |

9,375 | * | ||||||

| J. Chandler Martin |

9,375 | * | ||||||

| Angus M. McBryde, III |

9,376 | * | ||||||

| Herschel Ray McKenney, Jr. (3) |

10,336 | * | ||||||

| Gregory P. Murphy |

18,750 | * | ||||||

| R. Reynolds Neely, Jr. (4) |

829 | * | ||||||

| Robert L. Reid |

24,172 | * | ||||||

| Louis A. “Jerry” Schmitt |

9,375 | * | ||||||

| Brian E. Simpson |

24,173 | * | ||||||

| Boyd Cecil Wilson, Jr. (5) |

7,227 | * | ||||||

| David L. Nielsen |

23,348 | * | ||||||

| All directors and officers as a group (15 persons) |

10,022,678 | 46.8 | ||||||

| (1) | Includes shares held by Carlyle Financial Services Harbor L.P. Mr. Bresnan is a Managing Director of the The Carlyle Group and maybe considered to have beneficial ownership of the shares held by Carlyle Financial Services Harbor L.P. Mr. Bresnan disclaims beneficial ownership of all such shares except to the extent of his pecuniary interest therein. |

| (2) | Includes shares held by Oak Hill Capital Partners III, L.P. Mr. Kauffman is a principal of Oak Hill Capital Management, LLC, the adviser of the Oak Hill Funds, and disclaims beneficial ownership of the shares of Common Stock owned by the Oak Hill Funds. |

4

Table of Contents

| (3) | Includes 10,209 shares held by other family members, as trustee or through a corporation. |

| (4) | Includes 309 shares held by his spouse, other family members, as trustee or through a corporation. |

| (5) | Includes 386 shares jointly held by his spouse, other family members, as trustee or through a corporation. |

| * | Less than 1% of the outstanding Common Stock. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires FNB’s directors and executive officers, and persons who own more than 10% of FNB’s stock, to report to the SEC certain of their transactions with respect to FNB’s Common Stock. The SEC reporting rules require that changes in beneficial ownership generally be reported on Form 4 within two business days after the date on which the change occurs. A Form 3 to report stock holdings in FNB must be filed within ten days of when a director, executive officer or person who owns more than 10% of FNB’s stock becomes subject to Section 16(a) of the Exchange Act.

Officers, directors and greater than ten percent shareholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file. To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, during the fiscal year ended December 31, 2011, all Section 16(a) filing requirements applicable to our officers, directors and greater than ten percent beneficial owners were filed in a timely manner.

5

Table of Contents

PROPOSALS TO BE CONSIDERED AT THE ANNUAL MEETING

Proposal 1: Election of Directors

The Bylaws of FNB provide that the number of directors shall not be less than nine nor more than 25, with the exact number of directors within such maximum and minimum limits to be fixed and determined from time to time by resolution adopted by a majority of the full board of directors or by resolution of the shareholders at any annual or special meeting thereof. The FNB Board has set the total number of directors at eleven, all of whom either will be elected at the FNB Annual Meeting or were previously elected and will remain in office after that meeting.

The FNB Board is divided into three classes: Class I, Class II and Class III. In connection with the transactions consummated on October 21, 2011, including the private placement of our common stock to certain investors, all of FNB’s current directors except for Mr. McKenney and Mr. Neely were appointed to the FNB Board and assigned to classes, as set forth below. In accordance with North Carolina law, the directors appointed in connection with the Recapitalization are nominated for election at this annual meeting to serve in the classes to which they were previously appointed. It is intended that the person named in the accompanying form of proxy will vote for the ten nominees listed below for directors of FNB unless authority so to vote is withheld. Each nominee is at present a member of the FNB Board. Each director will serve for the terms set forth below, or until their successors shall be elected and shall qualify. Directors are elected by a plurality of the votes cast. “Plurality” means that the nominees receiving the largest number of votes cast are elected as directors up to the maximum number of directors to be chosen at the meeting. Abstentions and broker nonvotes will not affect the election results if a quorum is present.

Messrs. Bresnan and Kauffman were initially appointed to the FNB Board in connection with the Recapitalization and pursuant to the terms of the investment agreements entered into by and between the FNB and affiliates of The Carlyle Group and Oak Hill Capital Partners, respectively. For further information regarding the Recapitalization, please see Section 1 of our Annual Report on Form 10-K for the fiscal year ended December 31, 2011, filed with the SEC on March 30, 2012.

The following information is furnished with respect to the nominees for election as directors of FNB and for Mr. McKenney, whose term expires with the Class III directors whose terms expire at the annual meeting occurring in 2013.

In the event that any nominee should not be available to serve for any reason (which is not anticipated), it is intended that the person acting under the proxy will vote for the election, in his or her stead, of such substitute nominee as may be designated by the Compensation and Nominating Committee and approved by the FNB Board.

Recommendation of the FNB Board

The FNB Board recommends a vote “FOR” the nominees named below:

Nominees for Class I Directors with Terms Expiring at the Annual Meeting in 2014

Scott B. Kauffman, 37, became a director of FNB and its subsidiary banks on October 21, 2011 and serves on the Strategic Planning and the Compensation and Nominating Committee. Mr. Kauffman is a Principal at Oak Hill Capital Management, where since 2009, he has focused on the firm’s financial services investments. He is responsible for originating, structuring and managing the investments in the Business and Financial Services Group. Prior to joining Oak Hill, Kauffman was a Managing Director at Goldman, Sachs & Co. in the Financial Institutions Group, where for 13 years, he was actively engaged in maintaining and building client relationships, providing strategic advice and transaction execution and expertise to Boards of Directors and Executive and

6

Table of Contents

Senior Management of financial institutions. Mr. Kauffman was the Co-Chief Operating Officer for the America’s Financial Institutions Bank Group and a member of the Merger Leadership Group. Mr. Kauffman holds his Chartered Financial Analyst designation and is a Member of The Association for Investment Management and Research and a Member of Investment Analyst Society of Chicago. Mr. Kauffman’s expertise in the financial services investment and transactional area allow him to bring relevant insight and strategic outlook onto our operations and business plans.

J. Chandler Martin, 61, has been a director since October 21, 2011. Mr. Martin serves as Chair of the Risk Management Committee and also is a member on the Audit Committee. Mr. Martin retired in 2008 as Treasurer at Bank of America where he was responsible for funding, liquidity and interest rate risk management. Previously, he was the Enterprise Market and Operational Risk Executive and the risk management executive for Global Corporate and Investment Banking. Mr. Martin returned to Bank of America for 9 months beginning in October of 2008 to assist the organization in the integration process for Enterprise Risk Management following the Company’s acquisition of Merrill Lynch. During that time he served as the Enterprise Credit and Market Risk Executive. In 2008, Mr. Martin served as a Policy Group Member of The Counterparty Risk Management Policy Group III and co-chaired the Risk Monitoring and Risk Management Working Group. Mr. Martin’s expertise in the risk management area, both the credit and funding sides, offers valuable experience to the Board and the Risk Management Committee as we continue to work through problem assets and deploy excess liquidity.

Brian E. Simpson, 49, has been a director and Chief Executive Officer since October 21, 2011. He serves as Chair of the Strategic Planning Committee. Mr. Simpson was appointed Chief Executive Officer of FNB and its subsidiary banks upon consummation of the Recapitalization and had been advising the Company since October 2010. Until 2002, Mr. Simpson was a senior executive and Operating Committee member at Wachovia Corp. (First Union) with responsibility for all aspects of the company’s mortgage and home equity finance, structured finance, commercial real estate and leasing businesses. Mr. Simpson led the company’s Asset/Liability Committee and was a staff liaison to the Board’s Credit/Market Risk Committee. Mr. Simpson was also a member of the Credit Committee, the Market Risk Committee and the Capital Markets Commitment Committee, and the company’s senior regulatory contact team. Mr. Simpson was the co-founder and President of Casa Fiora, LLC, a domestic manufacturer of custom draperies and other home furnishings distributed nationally through better furniture retailers and professional design. Mr. Simpson is a past Chairman of the City of Charlotte’s Housing Trust Fund Advisory Board, and serves on the boards of several other community organizations. As the Chief Executive Officer, Mr. Simpson provides insight to the Board on our day to day operations, issues and financial results.

Nominees for Class II Directors with Terms Expiring at the Annual Meeting in 2015

Austin A. Adams, 68, has served as a director of FNB and its subsidiary banks since October 21, 2011. He is Chairman of the Board and lead independent director. He also is a member of the Strategic Planning Committee and the Compensation and Nominating Committee. Mr. Adams retired in 2006 as Chief Information Officer and Executive Committee member at JPMorgan Chase. He was responsible for technology and operations, managing nearly 28,000 employees and a multi-billion dollar budget. Mr. Adams previously served as CIO and Executive Committee member at Bank One and First Union. Mr. Adams currently serves on the board of directors of two public companies, Dun & Bradstreet and Spectra Energy. As an expert in integration planning and execution and in bank operations, Mr. Adams provides the Board with a strategic outlook and management experience into operations.

R. Reynolds Neely, Jr., 58, has served as a director since of FNB United and CommunityOne Bank since 1980. Mr. Neely serves on the Audit Committee and Enforcement and Compliance Committee. Mr. Neely is the Director of the Community Development Division of the City of Asheboro, North Carolina where he has worked for over 33 years. Mr. Neely’s long-standing service to the company and his knowledge of the community provide insights to the Board on the local market in which we serve.

7

Table of Contents

Louis A. “Jerry” Schmitt, 72, has served as a director of FNB and its subsidiary banks since October 21, 2011. He is the Chair of the Compensation and Nominating Committee and also serves as a member of the Risk Management Committee. He is also a member of the Director’s Committee of Bank of Granite. Prior to his retirement, Mr. Schmitt was Executive Vice President and Co-Head of Capital Markets for First Union with responsibility for overall management of trading, sales and underwriting related to all fixed income activities. Mr. Schmitt also chaired the Asset/Liability Management Committee and served on the Executive Committee of First Union and was a staff liaison to the Credit/Market Risk Committee of the Board. Schmitt’s financial and managerial experience provides the Board and the Compensation and Nominating Committee with experience on motivating professionals with compensation plans and policies.

Boyd C. Wilson, Jr., 59 has served as a Director of Bank of Granite Corporation and Bank of Granite since 1996 and as a director of FNB and CommunityOne Bank since October 21, 2011. Mr. Wilson is a member of both the Risk Management and the Audit Committee. He also is the Chair of the Director’s Committee of Bank of Granite. Mr. Wilson is Executive Vice President of Broyhill Investments, Inc., an investment company located in Lenoir, North Carolina, where he has served in such capacity since 2005 and has served as a Director since 2007. Mr. Wilson also serves as Vice President and Chief Financial Officer of BMC Fund, Inc., a regulated investment company located in Lenoir, North Carolina, where he has served in such capacity since 2006. From 2002 to 2005, Mr. Wilson served as Vice President of Finance and Administration of Kincaid Furniture Company, Incorporated, a furniture manufacturer located in Hudson, North Carolina. Mr. Wilson is a Certified Public Accountant and a Chartered Global Management Accountant. Mr. Wilson’s accounting and financial experience provides value to the Audit Committee and his experience with Granite provide insights to the Board on the local market in which we serve.

Nominees for Class III Directors with Terms Expiring at the Annual Meeting in 2013

John J. Bresnan, 63, has been a director of FNB and its subsidiary banks since October 21, 2011. He serves on both the Strategic Planning Committee and the Compensation and Nominating Committee. He is a Managing Director with The Carlyle Group and serves as the Chief Risk Officer to Carlyle’s Investment Grade Opportunity group as well as Senior Advisor to Carlyle’s Global Financial Services group. He is based in Charlotte. Prior to joining Carlyle, Mr. Bresnan worked at Wachovia Corporation from 1995 to 2009, where he was Managing Director, Head of Global Markets Capital Management. Mr. Bresnan also spent twenty-five years on Wall Street, including 13 years with Lehman Brothers, where he was the Managing Director responsible for Credit. Mr. Bresnan’s expertise in the financial services investment and transactional area allow him to bring relevant insight and strategic outlook into our operations and business plans.

Jerry R. Licari, 65, has been a director of FNB and its subsidiary banks since October 21, 2011. He is Chair of the Audit Committee and serves on the Enforcement and Compliance Committee. He also serves on the Director’s Committee of Bank of Granite. He is currently President, CFO, and COO of Uncle Maddio’s of Charlotte, LLC (UMC). Prior to that, Mr. Licari was a lead and audit engagement partner for KPMG LLP and served major U.S. banks and insurance companies from 1977 to 2004. Mr. Licari also served as an SEC Reviewing partner (concurring partner) for insurance and bank clients filing with the SEC from 1981-2000, and held numerous leadership positions including the Director of the Global Center for Industry Solutions from 2004-2006, U.S. Banking Partner in Charge from 2002-2004 and U.S. Partner in Charge of the Financial Risk Management Practice from 2000-2001. Mr. Licari’s deep audit experience in the financial services industry brings valuable experience to the Board with respect to accounting and strategic aspects of FNB’s business, and to the Audit Committee on which he serves as “audit committee financial expert.”

Robert L. Reid, 56, has been a director of FNB and its subsidiary banks since October 21, 2011 and serves on the Strategic Planning Committee and the Enforcement Compliance Committee. He also is a member of the Directors’ Committee of Bank of Granite. Mr. Reid was appointed President of FNB and its subsidiary banks upon consummation of the Recapitalization and had been advising the Company since October 2010. Prior to that, Mr. Reid spent 30 years with Wachovia Corporation and its predecessor, with extensive leadership roles in

8

Table of Contents

community banking, retail banking, corporate banking, commercial banking, business banking, real estate finance, capital management, and wealth management. At the time of his retirement in June 2009, Mr. Reid was Executive Vice President/Managing Director: Real Estate Division for Wachovia Corporation. From 2003 to 2008, Mr. Reid was President of the Retirement and Investment Products Group at Wachovia. From December 2000 to April 2003 and from May 1996 to December 1997, Mr. Reid served as the CEO of First Union – Pennsylvania/Delaware, providing direct management and leadership for First Union’s community and branch banking business in Pennsylvania and Delaware. From December 1997 to December 2000, Reid served as the CEO of First Union – Atlantic, overseeing First Union’s community and branch banking business in New Jersey, New York, and Connecticut. Mr. Reid’s extensive branch and community banking experience and his role as President of the Bank provides the Board with unique insight into bank operations and customers.

Class III Director with Continuing Term Expiring at the Annual Meeting in 2013

H. Ray McKenney, Jr., 57, has served as a Director of FNB United and CommunityOne Bank since 2006. He is Chair of the Enforcement Compliance Committee and serves on the Risk Management Committee. Mr. McKenney is President of MBM Auto Management, a multi-franchise automobile and power sports management company he founded in 1981. Mr. McKenney currently serves on the Board of Trustees of Gaston Christian Schools. He also serves on the Board of Directors for Carolina Chevrolet and Carolina Cadillac Dealers Association. Mr. McKenney was a founding Director of First Gaston Bank of North Carolina and served on the Board from 1995 to 2006, with a term as Chairman of the Board. He also served on the Board of its parent holding company, Integrity Financial Corporation, during the same time period. Mr. McKenney’s experience as a board member of FNB and its predecessor companies and his expertise as a business owner provides the Board with needed experience on the Risk Management Committee and perspective on the local markets in which we serve.

Proposal 2: Ratification of Independent Registered Public Accounting Firm Appointment

The Audit Committee of the FNB Board has appointed the firm of Dixon Hughes Goodman LLP as the independent registered public accounting firm for FNB for the 2012 fiscal year, and to audit and report on FNB’s financial statements for the fiscal year ending December 31, 2012. Action by shareholders is not required by law in the appointment of independent auditors. However, the FNB Board considers this selection to be an important issue and therefore is submitting the selection of Dixon Hughes Goodman LLP for ratification by the shareholders.

The Audit Committee is directly responsible for the appointment, compensation and oversight of the audit work and the independent auditors. In the event the appointment is not ratified by a majority of the votes cast, in person or by proxy, it is anticipated that no change in independent auditors would be made for the current year because of the difficulty and expense of making any changes during the year, but that vote would be considered in connection with the independent auditors’ appointment for 2013. Conversely, even if the appointment of Dixon Hughes Goodman LLP is ratified by the shareholders, the Audit Committee may, in its discretion, appoint a new independent registered public accounting firm at any time if it determines that such a change would be in the best interests of FNB.

Dixon Hughes Goodman LLP was FNB’s independent auditor for the year ended December 31, 2011, and has served in that capacity since 2004. Dixon Hughes Goodman LLP has no direct or indirect financial interest in FNB or in any of its subsidiaries, nor has it had any connection with FNB or any of its subsidiaries in the capacity of promoter, underwriter, voting trustee, director, officer or employee. Representatives of Dixon Hughes Goodman LLP will be present at the Annual Meeting and will be afforded an opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions, including those relating to the 2011 audit of FNB’s financial statements.

9

Table of Contents

Fees Paid to Independent Registered Public Accounting Firm

Fees for professional services provided by Dixon Hughes Goodman LLP in each of the last two fiscal years, in each of the following categories are:

| 2011 | 2010 | |||||||

| Audit Fees |

$ | 692,592 | $ | 391,455 | ||||

| Audit-Related Fees |

$ | 56,200 | $ | 25,000 | ||||

| Tax Fees |

$ | 65,790 | $ | 51,575 | ||||

| All Other Fees |

$ | 0 | $ | 0 | ||||

|

|

|

|

|

|||||

| Total |

$ | 814,582 | $ | 468,030 | ||||

Audit Fees. This category consists of fees billed and expected to be billed for professional services rendered for the audit of our annual financial statements, the audit of internal control over financial reporting as of December 31, 2011, as required by the Sarbanes-Oxley Act of 2002, the reviews of FNB’s quarterly reports on Form 10-Q, accounting consultations and SEC registration statements.

Audit-Related Fees. This category consists of fees billed for services that are reasonably related to the performance of the audit or review of our financial statements and are not otherwise reported under “Audit Fees.” During 2011 and 2010, these fees consisted of the audit of our benefit plans, routine accounting consultations and accounting consultations related to merger transactions.

Tax Fees. This category consists of fees billed for professional services for tax compliance, tax advice and, during 2011 and 2010, tax consultations related to merger specific issues.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee is required to pre-approve all audit and non-audit services performed by the independent auditors to assure that the provision of such services does not impair the registered public accounting firm’s independence. In addition, any proposed services exceeding pre-approved cost levels will require specific pre-approval by the Audit Committee. The Audit Committee may delegate pre-approval authority to one or more of its members. The member or members to whom such authority is delegated will report any pre-approval decisions to the Audit Committee at its next scheduled meeting. The Audit Committee does not delegate its responsibilities to pre-approve services performed by the independent auditors to management.

During fiscal year 2010 and 2011, the Audit Committee pre-approved all services provided by the independent auditors. None of the hours expended on the principal accountant’s engagement to audit FNB’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

Recommendation of the FNB Board

The FNB Board unanimously recommends a vote “FOR” ratification of the appointment of the Dixon Hughes Goodman LLP as our independent registered public accounting firm for 2012. Proxies, unless indicated to the contrary, will be voted “FOR” ratification.

10

Table of Contents

Proposal 3: Non-Binding Approval of Executive Compensation

Background of the Proposal

On February 13, 2009, FNB issued to the U.S. Treasury (the “Treasury”), as a participant in the Treasury’s Capital Purchase Program (“CPP”) of the Troubled Asset Relief Program (“TARP”), 51,500 shares of its Fixed Rate Cumulative Perpetual Preferred Stock, Series A, having a liquidation value per share of $1,000 (“Preferred Stock”), for a total price of $51.5 million. As part of its purchase of the Preferred Stock, the Treasury received a warrant to purchase 22,072 shares of FNB’s common stock at an initial per share exercise price of $3.50, subject to adjustment pursuant to customary anti-dilution provisions (the “Warrant”).

Under the federal laws applicable to this program, those financial institutions that have sold preferred stock and issued warrants to the Treasury under the CPP are required to permit a separate and non-binding shareholder vote to approve the compensation of such financial institution’s executive officers. The Treasury and the SEC issued guidance that requires participants in the CPP to submit to shareholders annually for their approval the executive compensation arrangements as described in the Compensation Discussion and Analysis and the tabular disclosure regarding named executive officer compensation (together with the accompanying narrative disclosure) in their proxy statements. The Dodd Frank Wall Street Reform and Consumer Protection Act also requires shareholders to vote to approve, on a nonbinding basis, the compensation of our Named Executive Officers, as disclosed in this proxy statement in accordance with the SEC rules.

As part of the Recapitalization, FNB entered into a TARP Exchange Agreement with the Treasury, pursuant to which the Treasury agreed to exchange the Preferred Stock held by the Treasury, for a number of shares of common stock of FNB having a value (valued at $16.00 per share reflecting the one-for-one hundred reverse stock split (“Reverse Stock Split”) of our common stock effected on October 31, 2011) equal to the sum of 25% of the aggregate liquidation value of the Preferred Stock, plus 100% of the amount of accrued and unpaid dividends on the preferred stock as of the closing date of the recapitalization. FNB also agreed to amend and restate the terms of the Warrant, extended the term of the Warrant and adjusted the exercise price to $16.00 per share, reflecting the terms of the Reverse Stock Split. The TARP Exchange Agreement requires FNB to continue to meet the compensation standards described in this Proxy Statement for as long as the Treasury owns FNB common stock.

Executive Compensation

FNB believes that its compensation policies and procedures, which are reviewed and recommended for full FNB Board approval by the Compensation and Nominating Committee, are fair based on the level of responsibility and accountability of each employee, and do not provide excessive benefits or encourage excessive risk taking. FNB believes that the compensation policies and procedures also comply with the standards for executive compensation and corporate governance imposed by federal law for those companies, such as FNB, that participate in the CPP. These standards are discussed in detail in the “Compensation Discussion and Analysis” section of this proxy statement.

With the consummation of the Recapitalization, the Compensation and Nominating Committee has been reviewing all of FNB’s compensation plans, including its executive compensation plans. These reviews are ongoing. On October 21, 2011, the Board of Directors approved the employment agreements of the chief executive officer, chief financial officer and the three other most highly-compensated executive officers of FNB (collectively, the “Named Executive Officers”) and the compensation provided thereunder for 2011. For purposes of this Proxy Statement, the Named Executive Officers also include the former Interim Chief Executive Officer and President, who retired on October 21, 2011, and the former Chief Financial Officer, who retired on December 31, 2011.

As required by the requirements of federal law applicable to the CPP, and the guidance provided by the SEC, the FNB Board has authorized a shareholder vote on FNB’s executive compensation plans, programs and arrangements as reflected in the Compensation Discussion and Analysis, the disclosures regarding named

11

Table of Contents

executive officer compensation provided in the various tables included in this Proxy Statement, the accompanying narrative disclosures and the other compensation information provided in this Proxy Statement. Accordingly, FNB is presenting the following non-binding proposal, commonly known as a “Say on Pay” proposal, for shareholder approval:

RESOLVED, that the shareholders approve the compensation of FNB’s current Named Executive Officers as reflected in the Summary Compensation Table of FNB’s Proxy Statement for the 2012 Annual Meeting of Shareholders, including the discussion under the “Compensation Discussion and Analysis” and “Executive Compensation” and related disclosures contained in this Proxy Statement.

Vote Required; Effect

Approval of FNB’s executive compensation policies and procedures requires that the number of votes cast in favor of the proposal exceed the number of votes cast against it. Abstentions and broker non-votes will not be counted as votes cast and therefore will not affect the determination as to whether FNB’s executive compensation policies and procedures are approved. Because this shareholder vote is advisory, it will not be binding upon the FNB Board. However, the Compensation and Nominating Committee will take into account the outcome of the vote when considering future executive compensation arrangements.

Recommendation of the FNB Board of Directors

The FNB Board unanimously recommends a vote “FOR” approval of the compensation of FNB’s executives.

Proposal 4: Approval of the 2012 Incentive Plan

We are asking the shareholders to approve the FNB United Corp. 2012 Incentive Plan (the “Plan”), the material terms of which are more fully described below. The FNB Board approved the Plan on April 26, 2012, subject to the shareholder approval solicited by this Proxy Statement. The purpose of the Plan is to assist us in attracting, retaining and providing incentives to executive officers, directors, employees and consultants. The use of stock options has long been a vital component of FNB’s overall compensation philosophy, which is premised on the principle that any long-term incentive compensation should be closely aligned with shareholders’ interests. Stock options and incentive awards align employees’ interests directly with those of other shareholders because an increase in our stock price after the date of award is necessary for employees to realize any value, thus rewarding executives and employees only upon improved stock price performance. Management believes that stock options and other incentive awards, the core of the FNB’s long-term employee incentive and retention program, will be effective in enabling FNB to attract and retain the talent critical for sustainable growth. Therefore, FNB considers approval of the Plan vital to FNB’s future success.

The Plan provides for the grant of stock options and other stock-based awards, as well as cash-based performance awards. If the shareholders approve the Plan, no new awards will be granted under FNB’s 2003 Stock Incentive Plan, as amended (the “Prior Plan”).

No awards have been granted under the Plan prior to the shareholder vote to approve the Plan.

Description of the Plan

The Plan permits the grant of Options, Restricted Stock, Restricted Stock Units (“RSUs”), Performance Awards, and Other Stock-Based Awards (each, an “Award”). The following summary of the material features of the Plan is entirely qualified by reference to the full text of the Plan, a copy of which is attached hereto as Appendix A. Unless otherwise specified, capitalized terms used in this summary have the meanings assigned to them in the Plan.

12

Table of Contents

Eligibility

All employees and non-employee directors, and consultants and independent contractors of FNB or its affiliates are eligible to receive grants of Awards under the Plan. It is currently expected that approximately 100 employees will participate in the Plan, along with 7 non-employee directors who serve on the FNB Board. Information cannot be provided with respect to the number of awards to be received by any individual employee or group of employees pursuant to the Plan, since the grant of such awards is within the discretion of the Committee (as defined below).

No stock-based Awards will be granted under the Prior Plan or any other stock incentive plan between the Record Date and the date of the shareholders’ meeting.

Administration

The Plan will be administered by the Compensation and Nominating Committee, unless the FNB Board appoints another committee or person(s) for such purpose. The Committee may also designate a subcommittee or person to administer specific Awards, and the FNB Board also has the power to designate a committee, subcommittee or person to administer the Plan or specific Awards (such administrator, whether the Compensation and Nominating Committee or any other approved committee or subcommittee, the “Committee”). With respect to Awards granted to non-employee directors, the FNB Board serves as the “committee,” unless the FNB Board appoints another committee or person(s) for such purpose.

The Committee has all the powers vested in it by the terms of the Plan, including the authority to determine: eligibility; the terms of Awards, including transferability; the exercise prices; whether a stock option shall be an incentive stock option or a nonqualified stock option, any Performance Goals applicable to Awards, provisions related to vesting, the period during which Awards may be exercised and the period during which Awards shall be subject to restrictions, and otherwise administer the Plan. Subject to the provisions of the Plan, the Committee has authority to interpret the Plan and agreements under the Plan and to make all other determinations relating to the administration of the Plan.

Stock Subject to the Plan

The maximum number of shares of Common Stock that may be issued under the Plan is 600,000 shares. If an Option expires or terminates for any reason without having been fully exercised, if any shares of Restricted Stock are forfeited, or if any Award terminates, expires or is settled without all or a portion of the shares of Common Stock covered by the Award being issued, such shares are available for the grant of additional Awards. However, any shares that are withheld (or delivered) to pay withholding taxes or to pay the exercise price of an Option are not available for the grant of additional Awards.

The maximum number of shares of Common Stock with respect to which an employee may be granted Awards under the Plan during any calendar year period is 50,000 shares.

Options

The Plan authorizes the grant of Nonqualified Stock Options and Incentive Stock Options. Incentive Stock Options are stock options that satisfy the requirements of Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”). Nonqualified Stock Options are stock options that do not satisfy the requirements of Section 422 of the Code. The exercise of an Option permits the participant to purchase shares of Common Stock from FNB at a specified exercise price per share. Options granted under the Plan are exercisable upon such terms and conditions as the Committee shall determine. The exercise price per share and manner of payment for shares purchased pursuant to Options are determined by the Committee, subject to the terms of the Plan. The per share exercise price of Options granted under the Plan may not be less than 100% of the fair market value per share on the date of grant. Additionally, no incentive stock option may be granted under the Plan to any person who, at the time of the grant, owns (or is deemed to own) stock possessing more than 10% of the total combined voting

13

Table of Contents

power of FNB or any parent corporation or subsidiary corporation, as defined in Sections 424(e) and (f) of the Code, respectively, of FNB, unless the option’s exercise price is at least 110% of the Fair Market Value of the stock subject to the option on the date of grant, and the term of the option does not exceed five years from the date of grant. The Plan provides that the term during which Options may be exercised is determined by the Committee, except that no Option may be exercised more than ten years after its date of grant (except in the case of ten-percent holders).

Restricted Stock Awards

The Plan authorizes the Committee to grant Restricted Stock Awards. Shares of Common Stock covered by a Restricted Stock Award are restricted against transfer and subject to forfeiture and such other terms and conditions as the Committee determines. Such terms and conditions may provide, in the discretion of the Committee, for the vesting of awards of Restricted Stock to be contingent upon the achievement of one or more Performance Goals as described below.

Restricted Stock Units

RSU Awards granted under the Plan are contingent awards of Common Stock or the cash equivalent thereof. Pursuant to such Awards, shares of Common Stock are issued, or the cash value of the shares is paid, subject to such terms and conditions as the Committee deems appropriate. Unlike in the case of awards of Restricted Stock, shares of Common Stock are not issued immediately upon the award of RSUs, but instead shares of Common Stock are issued or the cash value of the shares is paid upon the satisfaction of such terms and conditions as the Committee may specify, including the achievement of one or more Performance Goals.

Performance Awards

The Plan authorizes the grant of Performance Awards. Performance Awards provide for payments in cash, shares of Common Stock or a combination thereof contingent upon the attainment of one or more Performance Goals (described below) established by the Committee. For purposes of the limit on the number of shares of Common Stock with respect to which an employee may be granted Awards during any calendar year, a Performance Award is deemed to cover the number of shares of Common Stock equal to the maximum number of shares that may be issued upon payment of the Award. The maximum cash amount that may be paid to any participant pursuant to all Performance Awards granted to such participant during a calendar year may not exceed $2.0 million.

Other Stock-Based Awards

The Plan authorizes the grant of Other Stock-Based Awards (including the issuance or offer for sale of unrestricted shares of Common Stock) covering such number of shares and having such terms and conditions as the Committee may determine, including terms that condition the payment or vesting of Other Stock-Based Awards upon the achievement of one or more Performance Goals.

Dividends and Dividend Equivalents

The terms of an Award (other than an Option) may, at the Committee’s discretion, provide a Participant with the right to receive dividend payments or dividend equivalent payments with respect to Shares covered by the Award. The payments may be either made currently or credited to an account established for the Participant, and may be settled in cash or shares, as determined by the Committee. Payment of dividends and dividend equivalents may be contingent upon the achievement of one or more Performance Goals.

Performance Goals

As described above, the terms and conditions of an Award may provide for the payment of cash or the issuance of Shares to be contingent upon the achievement of one or more specified Performance Goals established by the Committee. For this purpose, “Performance Goals” means performance goals established by

14

Table of Contents

the Committee which may be based on satisfactory internal or external audits, achievement of balance sheet or income statement objectives, cash flow, customer satisfaction metrics, and achievement of customer satisfaction goals, dividend payments, earnings (including before or after taxes, interest, depreciation, and amortization), earnings growth, earnings per share, economic value added, expenses (including sales, general and administrative expenses), improvement of financial ratings, internal rate of return, market share, geographic expansion, net asset value, net income, net operating gross margin, net operating profit after taxes, net sales growth, operating income, operating margin, comparisons to the performance of other companies, pro forma income, regulatory compliance, return measures (including return on assets, designated assets, capital, capital employed, equity, or stockholder equity, and return versus FNB’s cost of capital), revenues, sales, stock price (including growth measures and total stockholder return), comparison to stock market indices, implementation or completion of one or more projects or transactions (including mergers, acquisitions, dispositions, and restructurings), working capital, or any other objective goals that the Committee establishes. Performance Goals may be absolute in their terms or measured against or in relationship to other companies comparably, similarly or otherwise situated. Performance Goals may be particular to an Eligible Person or the department, branch, Affiliate, or division in which the Eligible Person works, or may be based on the performance of FNB, one or more Affiliates, or FNB and one or more affiliates, and may cover such period as the Committee may specify.

Capital Adjustments

If the outstanding Common Stock of FNB changes as a result of a stock dividend, stock split, reverse stock split, spin-off, split-up, recapitalization, reclassification, combination or exchange of shares, merger, consolidation or liquidation, or the like, the Committee shall substitute or adjust: (a) the number and class of securities subject to outstanding Awards, (b) the consideration to be received upon exercise or payment of an Award, (c) the exercise price of Options, (d) the aggregate number and class of securities for which Awards may be granted under the Plan, and/or (e) the maximum number of securities with respect to which an employee may be granted Awards during any calendar year. In the event of a merger or consolidation to which FNB is a party or any sale, disposition or exchange of at least 50% all of FNB’s Common Stock or all or substantially all of FNB’s assets for cash, securities or other property, or any other similar transaction or event (each, a “Transaction”), the Committee may cause any Award granted under the Plan to be cancelled in consideration of a payment in such form as the Committee may specify equal to the fair value of the cancelled Award, as determined by the Committee in its discretion. The fair value of an Option, however, is deemed to be equal to the difference between the exercise price of the Option and the fair market value of the shares covered by the Option. The Committee is not required to take the same action with respect to all participants in the event of an adjustment.

Withholding

FNB is generally required to withhold tax on the amount of income recognized by a participant with respect to an Award. Withholding requirements may be satisfied, as provided in the agreement evidencing the Award, by (a) tender of a cash payment to FNB, (b) withholding of shares of Common Stock otherwise issuable, or (c) delivery to FNB by the participant of unencumbered shares of Common Stock.

Termination and Amendment; Term of Plan

The FNB Board may amend or terminate the Plan at any time. However, after the Plan has been approved by the FNB shareholders, the FNB Board may not amend or terminate the Plan without the approval of (a) FNB’s shareholders if such shareholder approval of the amendment is required by applicable law, rules or regulations, and (b) each affected participant if such amendment or termination would adversely affect such participant’s rights or obligations under any Awards granted prior to the date of the amendment or termination.

Unless sooner terminated by the FNB Board, the Plan will terminate on April 26, 2022. Once the Plan is terminated, no further Awards may be granted or awarded under the Plan. Termination of the Plan will not affect the validity of any Awards outstanding on the date of termination.

15

Table of Contents

Summary of Certain Federal Income Tax Consequences

The following discussion briefly summarizes certain United States federal income tax aspects of Options, Restricted Stock, RSUs, and Performance Awards granted pursuant to the Plan. State, local and foreign tax consequences may differ.

| • | Incentive Stock Options. A participant who is granted an Incentive Stock Option will not recognize income on the grant or exercise of the Option. However, the difference between the exercise price and the fair market value of the stock on the date of exercise is an adjustment item for purposes of the alternative minimum tax. If a participant does not exercise an Incentive Stock Option within certain specified periods after termination of employment, the participant will recognize ordinary income on the exercise of the Incentive Stock Option in the same manner as on the exercise of a Nonstatutory Stock Option, as described below. |

| • | Nonstatutory Stock Options, RSUs, Performance Awards and Other Stock-Based Awards. A participant generally is not required to recognize income on the grant of a Nonstatutory Stock Option, RSU, Performance Award or Other Stock-Based Award. Instead, ordinary income generally is required to be recognized on the date the Nonstatutory Stock Option is exercised, or in the case of an RSU, Performance Award, or Other Stock Based Award on the date of payment of such Award in cash and/or shares of Common Stock. In general, the amount of ordinary income required to be recognized is: (a) in the case of a Nonstatutory Stock Option, an amount equal to the excess, if any, of the fair market value of the shares of Common Stock on the date of exercise over the exercise price; and (b) in the case of an RSU, Performance Award, or Other Stock-Based Award, the amount of cash and/or the fair market value of any shares of Common Stock received. |

| • | Restricted Stock. A participant who is granted Restricted Stock under the Plan is not required to recognize income with respect to the shares until the shares vest, unless the participant makes a special tax election to recognize income upon award of the shares. In either case, the amount of income the participant recognizes equals the fair market value of the shares of Common Stock at the time income is recognized. |

| • | Gain or Loss on Sale or Exchange of Shares. In general, gain or loss from the sale or exchange of shares of Common Stock granted or awarded under the Plan will be treated as capital gain or loss, provided that the shares are held as capital assets at the time of the sale or exchange. However, if certain holding period requirements are not satisfied at the time of a sale or exchange of shares of Common Stock acquired upon exercise of an Incentive Stock Option (a “disqualifying disposition”), a participant generally will be required to recognize ordinary income upon such disposition. |

| • | Deductibility by Company. FNB generally is not allowed a deduction in connection with the grant or exercise of an Incentive Stock Option. However, if a participant is required to recognize ordinary income as a result of a disqualifying disposition, FNB generally will be entitled to a deduction equal to the amount of ordinary income so recognized. In general, in the case of a Nonstatutory Stock Option (including an Incentive Stock Option that is treated as a Nonstatutory Stock Option, as described above), a Performance Award, a Restricted Stock Award, an RSU, or an Other Stock-Based Award, FNB will be allowed a deduction in an amount equal to the amount of ordinary income recognized by the participant. |

| • | Performance-Based Compensation. Subject to certain exceptions, Section 162(m) of the Code disallows federal income tax deductions for compensation paid by a publicly-held corporation to certain executives to the extent the amount paid to an executive exceeds $1 million for the taxable year. The Plan has been designed to allow the grant of Awards that qualify under an exception to the deduction limit of Section 162(m) for “performance-based compensation.” |

16

Table of Contents

| • | Pursuant to the TARP Exchange Agreement with the U.S. Treasury described elsewhere in this Proxy Statement, for as long as the U.S. Treasury owns FNB Common Stock, the tax deduction for compensation paid to the Chief Executive Officer, Chief Financial Officer or any of the three most highly-compensated executive officers is limited to $500,000 annually and the exception for performance-based compensation does not apply. |

| • | Parachute Payments. Where payments to certain persons that are contingent on a change in control exceed limits specified in the Code, the person generally is liable for a 20 percent excise tax on, and the corporation or other entity making the payment generally is not entitled to any deduction for, a specified portion of such payments. Under the Plan, the Committee has plenary authority and discretion to determine the vesting schedule of Awards. Any Award under which vesting is accelerated by a change in control of FNB would be relevant in determining whether the excise tax and deduction disallowance rules would be triggered. |

| • | Tax Rules Affecting Nonqualified Deferred Compensation Plans. Section 409A of the Code imposes tax rules that apply to “nonqualified deferred compensation plans.” Failure to comply with, or to qualify for an exemption from, the new rules with respect to an Award could result in significant adverse tax results to the Award recipient, including immediate taxation upon vesting, and an additional income tax of 20 percent of the amount of income so recognized. The Plan is intended to allow the granting of Awards that comply with, or qualify for an exemption from, Section 409A of the Code. |

Vote Required; Effect

Approval of the 2012 Stock Incentive Plan would require that the number of votes cast in favor of the proposal exceed the number of votes cast against it. In tabulating the vote, abstentions will have the same effect as votes against the proposal and shares that are the subject of a broker nonvote will be deemed absent and will have no effect on the outcome of the vote.

Recommendation of the FNB Board

The FNB Board unanimously recommends a vote “FOR” the approval of the 2012 Stock Incentive Plan. Proxies, unless indicated to the contrary, will be voted “FOR” approval of the Plan.

Other Matters

There is no business other than as set forth, so far as now known, to be presented for action by the shareholders at the meeting. It is intended that the proxies will be exercised by the persons named therein upon matters that may properly come before the meeting or any adjournment thereof, in accordance with the recommendations of management.

17

Table of Contents

Director Independence

The FNB Board determines annually that a majority of directors serving on the FNB Board are independent as defined in the NASDAQ listing standards. In 2011, the FNB Board considered all direct and indirect transactions described in “Transactions with Related Parties” and “Compensation Committee Interlocks and Insider Participation” in determining whether the director is independent. There were no related party transactions other than those described in this Proxy Statement. The Compensation and Nominating Committee has the delegated responsibility to evaluate each director’s qualifications for independence for the FNB Board and for the committees of the FNB Board. Following review of the objective measures, the Compensation and Nominating Committee and FNB Board also consider on a subjective basis each director’s personal and/or business relationships, regardless of dollar amount.

On April 26, 2012, the FNB Board determined the following nine directors are independent under the NASDAQ listing rules: Mr. Adams, Mr. Bresnan, Mr. Kauffman, Mr. Licari, Mr. Martin, Mr. McKenney, Mr. Neely, Mr. Schmitt, and Mr. Wilson. As discussed below, all members of the Compensation and Nominating Committee are independent under this NASDAQ rule. In addition, the FNB Board determined that each of the members of the Audit Committee is independent under applicable SEC and NASDAQ rules.

The Board and Meetings

The directors of FNB also serve on the board of directors of CommunityOne Bank, N.A., Bank of Granite and Bank of Granite Corp, except that R. Reynolds Neely, Jr. and H. Ray McKenney, Jr. do not serve on Bank of Granite or Bank of Granite Corporation Boards or any committees thereunder. The FNB Board of directors holds regular monthly meetings to conduct the normal business of FNB and meets on other occasions when required for special circumstances. The CommunityOne, Bank of Granite and Bank of Granite Corp. boards of directors each also holds regular monthly meetings and may meet on other occasions as circumstances warrant.

Effective upon consummation of the Recapitalization of FNB United on October 21, 2011, the FNB Board membership was reconstituted and the Board committees were reduced from eight to four standing committees. Among these committees are the Audit Committee, Compensation and Nominating Committee, Risk Management Committee, and the Strategic Planning Committee, whose members and principal functions are described below under “Board Role in Oversight of Risk.” In addition, FNB and CommunityOne Bank each has an Enforcement Compliance Committee and Bank of Granite has a Director’s Committee. These committees assist the respective Boards in overseeing the respective bank’s compliance with a consent order agreed to between the bank and the OCC, in the case of CommunityOne Bank, and the FDIC, in the case of Bank of Granite, and with FNB’s compliance with a Written Agreement it has with the Federal Reserve Bank of Richmond. During the fiscal year ended December 31, 2011, the FNB Board held a total of 32 meetings. Each director attended 75% or more of the total number of meetings of the FNB Board and of the committees on which that director served. Directors are encouraged to attend the annual meeting of shareholders. Eleven of FNB’s directors attended FNB’s last annual meeting of shareholders. The members of the FNB Board who are independent within the meaning of the NASDAQ listing standards meet regularly in executive session without management present. Although executive sessions are generally held in conjunction with a regularly scheduled board of directors meeting, other sessions may be called by two or more independent directors in their own discretion or at the request of the FNB Board.

Board Structure

The FNB Board has a separate chairman, a non-executive position, and a Chief Executive Officer. The FNB Board believes that, as part of our efforts to embrace and adopt good corporate governance practices, different individuals should hold the positions of Chairman of the Board and Chief Executive Officer to aid in the Board’s oversight of management. We believe that by having a separate Chairman and CEO, we are better able to protect shareholder interests by providing independent oversight of the officers.

18

Table of Contents

The duties of the non-executive Chairman of the Board include:

| • | presiding over all meetings of the FNB Board; |

| • | preparing the agenda for FNB Board meetings with the Secretary and in consultation with the CEO and other members of the FNB Board; |

| • | assigning tasks to the appropriate committees of the FNB Board; |

| • | ensuring the information flows openly between senior management and the FNB Board; and |

| • | presiding over all meetings of shareholders. |

The Chair of the FNB Board, Austin A. Adams, also is designated by the FNB Board as the “lead independent director.” We believe that the FNB Board, the Board Committees as presently constituted and the leadership structure of the FNB Board enables the FNB Board to fulfill its role in overseeing and monitoring the management and operations of FNB and protecting the interests of FNB and its shareholders.

Board Role in Oversight of Risk

FNB historically has maintained risk management as an enterprise-wide initiative and the responsibility of every employee. With the consummation of the Recapitalization on October 21, 2011, and the reconstitution of the Board and management of FNB and its bank subsidiaries, risk management has taken on renewed emphasis and importance. The FNB Board has adopted a business plan under which management’s goals have been prioritized in the following order: 1st – sound risk management; 2nd –profitability; and 3rd –growth. The FNB Board and management believe that these three goals are not necessarily in conflict, but rather support each other so long as the profitability and earnings growth expectations are consistent with a risk-controlled business strategy. Successful execution of FNB’s strategy will attain its maximum benefits over a longer term time frame. Executive management is ultimately accountable to the FNB Board and FNB shareholders for risk management. The FNB Board oversees management’s risk controlled strategies, as well as planning and responding to risks arising from changing business conditions or the initiation of new activities or products. The FNB Board also is responsible for overseeing compliance with laws and regulations, responding to recommendations from auditors and supervisory authorities, and overseeing management’s compliance with internal policies and controls addressing the operations and risks of significant activities.