FNB

United Corp. Fourth Quarter 2011

April 6, 2012

Exhibit 99.1 |

2

Presenters

Brian Simpson

Chief Executive Officer

David Nielsen

Executive Vice President and

Chief Financial Officer

David Lavoie

Executive Vice President and

Chief Risk Officer |

3

Forward Looking Statements & Other Information

Forward Looking Statements

This presentation contains certain forward-looking statements within the safe

harbor rules of the federal securities laws. These

statements

generally

relate

to

FNB’s

financial

condition,

results

of

operations,

plans,

objectives,

future

performance

or

business.

They

usually

can

be

identified

by

the

use

of

forward-looking

terminology,

such

as

“believes,”

“expects,”

or

“are

expected to,”

“plans,”

“projects,”

“goals,”

“estimates,”

“may,”

“should,”

“could,”

“would,”

“intends to,”

“outlook”

or “anticipates,”

or variations of these and similar words, or by discussions of strategies that

involve risks and uncertainties. Forward looking statements

are

subject

to

risks

and

uncertainties,

including

but

not

limited

to,

those

described

in

FNB’s

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2011

under

the

section

entitled

“Item

1A,

Risk

Factors,”

and

in

our

quarterly

reports on Form 10-Q. You are cautioned not to place undue reliance on

these forward-looking statements, which are subject to numerous

assumptions, risks and uncertainties, and which change over time. These forward-looking statements

speak only as of the date of this presentation. Actual results may differ

materially from those expressed in or implied by any forward looking

statements contained in this presentation. We assume no duty to revise or update any forward-looking

statements, except as required by applicable law.

Non-GAAP Financial Measures

In

addition

to

the

results

of

operations

presented

in

accordance

with

Generally

Accepted

Accounting

Principles

(GAAP),

FNB

management uses and this presentation contains or references, certain non-GAAP

financial measures, such as net interest income on a fully taxable

equivalent basis and tangible shareholders equity. FNB believes these non-GAAP financial

measures provide information useful to investors in understanding our underlying

operational performance and our business and performance trends as they

facilitate comparisons with the performance of others in the financial services industry.

Although

FNB

believes

that

these

non-GAAP

financial

measures

enhance

investors’

understanding

of

FNB’s

business

and

performance, these non-GAAP financial measures should not be considered an

alternative to GAAP. The non-GAAP financial measures contained within

this presentation should be read in conjunction with the audited financial statements and

analysis as presented in FNB’s Annual Report on Form 10-K as well as the

unaudited financial statements and analyses as presented in FNB’s

Quarterly Reports on Forms 10-Q. A reconciliation of these non-GAAP measures to the most directly

comparable GAAP measure is included as an appendix to this presentation. |

4

Key Accomplishments

Recapitalization:

Issued $310 million of common equity

Exchanged $51.5 million of TARP at 75% discount

Settled $12.5 million of Bank preferred and $2.5 million of

Bank subordinated debt at a 65% and 75% discount, respectively

Acquired Bank of Granite Corporation via issuance of 3.375 shares of

FNB common stock for each Granite share

Appointed new management team and Board with extensive

financial services experience

1-for-100 Reverse Stock Split

Completed joint recapitalization and

Merger of FNB and Bank of Granite

on October 21, 2011

Began executing our plans and

strategies

Reduced problem assets by 45%

Launched “Back to Business”

strategies:

New governance model balancing risk taking and risk

management

4 lines of business: Commercial, Consumer, Mortgage &

Wealth Management

Established Merger Project Office to execute flawless integration of

CommunityOne and Granite |

5

Operating Highlights

2011 net loss from continuing

operations increased $1.1 million

(1%)

2011 net loss to common

shareholders decreased $42.4 million

(31%)

Gain on retirement of preferred

stock, net of accretion and

dividends of $44.6

4Q 2011 net loss from continuing

operations increased $16.7 million

(121%)

4Q 2011 net loss to common

shareholders decreased $32.1 million

(214%)

Gain on retirement of preferred

stock, net of accretion and

dividends of $47.8 million in 4Q

2011

Annual Performance Summary

Dollars in thousands except per share data

2009

2010

2011

Net loss from continuing operations

(102,561)

$

(130,421)

$

(131,518)

$

Net loss to common shareholders

(104,567)

(135,121)

(92,722)

Net loss to common shareholders per share

(915.89)

(1,182.79)

(22.09)

Quarterly Performance Summary

1

Dollars in thousands except per share data

4Q 2010

3Q 2011

4Q 2011

Net loss from continuing operations

(47,207)

$

(13,890)

$

(30,628)

$

Net (loss)/income to common shareholders

(49,307)

(15,023)

17,090

Net (loss)/income to common shareholders per share

(431.62)

(131.41)

1.05

1

Quarterly data unaudited

December 31, |

6

Annual Operating Results

Net interest income declined $12.1

million (23%) to $39.6 million

Average yield on earning assets

declined 81 bps (18%)

Average earning assets declined

$123 million (7%)

Provision expense declined $65.3

million on improved asset quality

Non-interest expense increased

$49.3 million (65%)

$36.9 million increase in OREO

expenses from asset resolution

efforts

Includes $4.0 million Granite

expenses for 71 days

Net interest margin declined 52 bps

from 2.81% to 2.29%

Impact of NPLs and holding

additional cash positions

Improved funding mix and decline

in cost of acquired deposits

71 days of higher yield on

purchased Granite loans

Annual Results

1

Results of Operations

Dollars in thousands, except per share data

2009

2010

2011

Net interest income

60,535

$

51,650

$

39,555

$

Provision expense

(61,509)

(132,755)

(67,362)

Noninterest income

13,442

27,622

21,970

Noninterest expense

(111,615)

(75,679)

(125,040)

Net loss from continuing operations

(102,561)

(130,421)

(131,518)

Discontinued operations, net of taxes

865

(1,406)

(5,796)

Preferred stock gain and dividends, net

(2,871)

(3,294)

44,592

Net loss to common shareholders

(104,567)

$

(135,121)

$

(92,722)

$

(923.47)

$

(1,170.48)

$

(20.71)

$

Net loss to common shareholders per share

(915.89)

$

(1,182.79)

$

(22.09)

$

Weighted average basic and diluted shares outstanding

114,170

114,240

4,196,926

Average Balances, Yields and Net Interest Margin

Dollars in thousands, except per share data

2009

2010

2011

Average loans

1,591,560

$

1,497,690

$

1,137,817

$

Average yield

5.21%

4.58%

4.65%

Average earning assets

2,001,328

1,870,389

1,747,402

Average yield

5.17%

4.45%

3.64%

Average interest bearing liabilities

1,821,804

1,793,310

1,744,943

Average rate

2.25%

1.71%

1.35%

Net interest margin

3.12%

2.81%

2.29%

Net interest rate spread

2.92%

2.74%

2.29%

1

Condensed, derived from audited financial statements

Net loss to common shareholders from

continuing operations per share |

7

Quarterly Operating Results

Net interest income increased $5.7

million (73%) to $13.4 million

Average yield on earning assets

declined 25 bps (7%)

Average earning assets increased

$507 million (33%)

Provision expense declined $0.8

million on improved asset quality

Non-interest expense increased

$19.5 million (84%)

$15.3 million increase in OREO

expenses from asset resolution

efforts

Includes $4.0 million Granite

expenses for 71 days

Net interest margin improved 59 bps

from 2.04% to 2.63%

Impact of reduced NPLs

Improved funding mix and decline

in cost of acquired deposits

71 days of higher yield on

purchased Granite loans

Offset by excess cash positions

Quarterly Results

1

Results of Operations

Dollars in thousands, except per share data

4Q 2010

3Q 2011

4Q 2011

Net interest income

10,867

$

7,739

$

13,417

$

Provision expense

(40,329)

(7,181)

(6,418)

Noninterest income

12,804

10,080

4,908

Noninterest expense

(27,058)

(23,200)

(42,646)

Net loss from continuing operations

(47,207)

(13,890)

(30,628)

Discontinued operations, net of taxes

(1,272)

(40)

(74)

Preferred stock gain and dividends, net

(828)

(1,093)

47,792

Net income (loss) to common shareholders

(49,307)

$

(15,023)

$

17,090

$

(420.47)

$

(131.06)

$

1.05

$

Net income (loss) to common shareholders per share

(431.61)

$

(131.41)

$

1.05

$

Weighted average basic and diluted shares outstanding

114,238

114,320

16,311,834

Average Balances, Yields and Net Interest Margin

Dollars in thousands

4Q 2010

3Q 2011

4Q 2011

Average loans

1,429,311

$

992,096

$

1,154,424

Average yield

4.18%

4.41%

5.59%

Average earning assets

1,852,342

1,521,652

2,028,332

Average yield

3.89%

3.50%

3.75%

Average interest bearing liabilities

1,790,873

1,627,217

1,910,164

Average rate

1.55%

1.37%

1.18%

Net interest margin

2.39%

2.04%

2.63%

Net interest rate spread

2.34%

2.13%

2.56%

1

Quarterly data unaudited

Net income (loss) to common shareholders from

continuing operations per share |

8

Noninterest Expense

Noninterest expense increased $19.5

million (84%) from 3Q 2011

OREO expense increased $15.3

million (326%)

Personnel expense increased $2.1

million (32%)

Professional fees increased by

$1.8 million (133%)

Recurring non-credit noninterest

expense increased by $6.6 million

(47%)

Results include $4.0 million for 71

days of Granite activities

Quarterly Results

1

Noninterest Expense

Dollars in thousands

4Q 2010

3Q 2011

4Q 2011

Personnel expense

6,392

$

6,453

$

8,547

$

Net occupancy expense

1,167

1,180

1,450

Furniture, equipment and data processing expense

1,638

1,561

1,868

Professional fees

1,000

1,339

3,117

Stationery, printing and supplies

137

100

154

Advertising and marketing

369

170

139

Other real estate owned expense

8,101

4,685

19,966

Credit/debit card expense

390

434

421

FDIC insurance

2,926

1,461

1,807

Goodwill impairment

-

-

-

Loan collection expense

286

1,220

1,161

Merger-related expense

-

2,207

(971)

Mortgage servicing rights impairment

2,995

-

-

Prepayment penalty on borrowings

-

1,028

577

Loss on sale of loans held for sale

-

-

1,241

Core deposit intangible amortization

199

199

301

Other expense

1,458

1,163

2,868

Total noninterest expense

27,058

$

23,200

$

42,646

$

Other information:

Other real estate owned expense

8,101

4,685

19,966

Loan collection expense

286

1,220

1,161

Merger-related expense

-

2,207

(971)

Mortgage servicing rights impairment

2,995

-

-

Prepayment penalty on borrowings

-

1,028

577

Loss on sale of loans held for sale

-

-

1,241

Recurring non-credit noninterest expense

2

15,676

$

14,060

$

20,672

$

FTE Employees

502

462

609

1

Quarterly data unaudited

2

Non-GAAP measure. Reconciliation included in

Table |

9

Balance Sheet

Total assets increased $506.7 million

(27%)

Purchased Granite October 21,

2011

Cash and interest bearing bank

balances increased $392.8 million

(245%)

Net loans decreased $27.6 million

(2%)

OREO increased $48.0 million

(77%)

Intangible assets increased $7.9

million (190%)

Deposits increased $432.7 million

(26%)

Purchased Granite October 21,

2011

Other borrowings decreased $94.4

million (43%)

Net reduction of $86 million of

FHLB advances in 4Q 2011

Tangible Shareholders' Equity Rollforward

1

Tangible shareholders' equity, December 31, 2010

(33,010)

$

Total comprehensive loss

(137,592)

Private placement of common stock, net

289,571

Issuance and retirement of preferrred stock, net

1,875

Issuance of common stock for Granite purchase

4,924

Decrease/(increase) in intangible assets, net

(7,909)

Dividends, stock compensation expense and Series A preferred conversion, net

(926)

Tangible shareholders' equity, December 31, 2011

116,933

$

1

Non-GAAP measure. See Appendix for reconciliation to GAAP presentation

Balance Sheet

Dollars in thousands

2009

2010

2011

Cash and interest bearing bank balances

27,698

$

160,594

$

553,416

$

Investment securities

326,189

305,331

431,306

Loans, net

1,518,127

1,210,288

1,182,704

Other real estate owned

35,170

62,058

110,009

Intangible assets

4,968

4,173

12,082

Other assets

133,925

120,836

119,346

Assets from discontinued operations

55,219

39,089

245

Total assets

2,101,296

$

1,902,369

$

2,409,108

$

Deposits

1,722,128

$

1,696,390

$

2,129,111

$

Borrowings

261,459

218,315

123,910

17,790

14,600

25,980

Liabilities from discontinued operations

1,560

1,901

1,092

Equity

98,359

(28,837)

129,015

Total liabilities and equity

2,101,296

$

1,902,369

$

2,409,108

$

Other liabilities

December 31, |

10

Deposits

Deposits increased $432.7 million

(26%)

Purchased Granite October 21,

2011

Managed attrition of higher rate

single service CD customers and

non-relationship public funds CD

customers

Improved deposit mix profile via

management actions and the Granite

acquisition

Indeterminate term core now

represents 51% of deposits, up

from 43% at year end 2010

Increased core deposits from 68% in

2010 to 76% of the total in 2011

Deposits

Dollars in thousands

2009

2010

2011

Noninterest-bearing demand

152,522

$

148,933

$

234,673

$

Interest-bearing demand

226,696

230,084

349,802

Savings

40,723

43,724

68,236

Money market

326,958

312,007

431,790

Brokered

112,340

140,151

112,066

Time deposits < $100,000

381,384

416,098

538,306

Time deposits > $100,000

481,505

405,393

394,238

Total deposits

1,722,128

$

1,696,390

$

2,129,111

$

December 31,

Deposit Product Mix

Dollars in thousands

2009

2010

2011

Noninterest-bearing demand

9%

9%

11%

Interest-bearing demand

13%

14%

16%

Savings

2%

3%

3%

Money market

19%

18%

20%

Time deposits < $100,000

22%

25%

25%

Core

66%

68%

76%

Brokered

7%

8%

5%

Time deposits > $100,000

28%

24%

19%

Total deposits

100%

100%

100%

Memo: Total time deposits

50%

48%

44%

December 31, |

11

Capital and Liquidity

Capital ratios in excess of

Well Capitalized levels at

both banks

Both banks designated as

adequately capitalized by

their regulators at December

31, 2011 because they

remain subject to regulatory

orders

CommunityOne Bank and

Bank of Granite leverage

ratios are currently below

the levels required in

their respective

regulatory orders

The loans to deposits ratio at

December 31, 2011 was 57%

Capital and Liquidity Ratios

Well

Regulatory

2009

2010

2011

Capitalized

Orders

FNB United Corp

Leverage

5.68%

-1.86%

6.70%

5.00%

N/A

Tier 1 risk based capital

6.86%

-2.56%

11.71%

6.00%

N/A

Total risk based capital

10.29%

-2.56%

13.81%

10.00%

N/A

Tangible common equity/Tangible assets

1.97%

-4.92%

4.88%

N/A

N/A

Loans to deposits

90.76%

76.87%

57.19%

N/A

N/A

CommunityOne Bank

Leverage

6.60%

0.86%

7.39%

5.00%

9.00%

Tier 1 risk based capital

7.96%

1.18%

13.23%

6.00%

N/A

Total risk based capital

10.08%

2.36%

14.52%

10.00%

12.00%

Bank of Granite

Leverage

N/A

N/A

7.19%

5.00%

8.00%

Tier 1 risk based capital

N/A

N/A

12.04%

6.00%

N/A

Total risk based capital

N/A

N/A

12.04%

10.00%

12.00%

December 31, |

12

Transaction Overview -

Bank of Granite

(dollars in thousands)

2011

(as initially

recorded by

Bank of Granite

Measurement

Period

Fair Value

Adjustments

October 21,

2011

(as recorded by

the Company)

Assets acquired:

Cash and cash equivalents

99,126

$

-

$

99,126

$

Investment securities

186,746

(385)

186,361

Loans, net

410,123

(16,470)

393,653

Premises and equipment, net

9,135

643

9,778

Other real estate owned

21,674

(3,238)

18,436

Bank-owned life insurance

4,432

-

4,432

Core deposit intangible

-

4,900

4,900

Other assets

8,052

(286)

7,766

Total assets acquired

739,288

$

(14,836)

$

724,452

$

Liabilities assumed:

Deposits

716,863

$

2,580

$

719,443

$

Other

3,668

322

3,990

Total liabilities assumed

720,531

$

2,902

$

723,433

$

Equity:

Total shareholders’ equity

18,757

$

(18,757)

$

-

$

Total liabilities assumed

and shareholders' equity 739,288

$

(15,855)

$

723,433

$

Contributed capital

4,924

$

Total liabilities assumed and contributed capital

728,357

$

Goodwill (excess of liabilities assumed and contributed capital over assets

acquired) 3,905

$

Total estimated fair value

adjustments of $17.7 million

to assets and liabilities

before goodwill

Estimated fair value of

purchase consideration of

$4.9 million

Recorded estimated fair

value adjustment of $16.5

million on net loans

$34.6 million gross loan

estimated fair value

adjustment, net of $18.1

million allowance |

13

12%

7%

8%

25%

21%

8%

25%

30%

37%

34%

38%

44%

0%

20%

40%

60%

80%

100%

120%

2009

2010

2011

Loans held for sale

Commercial and agricultural

Real estate-construction

1-4 family residential

CRE, OO and NOO

Consumer

Loan Portfolio

Significant changes in mix driven by

problem loan resolution

Real estate construction loans fell

from $277 million to $93 million

Residential mortgage loans are

growing

Nonperforming loans reduced

through charge offs, restructure,

foreclosure and asset sales, including

an active note sale program

Process includes early identification

of problems, appropriate recognition

of risk, increased workout staffing,

and actionable correction plans

Particular attention currently on the

acquired portfolio –

calling program,

internal & external loan reviews

Loan Portfolio Composition

Loan Portfolio

Dollars in thousands

2009

2010

2011

Loans held for sale

4,567

$

-

$

4,529

$

Loans held for investment:

Commercial and agricultural

194,134

93,747

95,203

Real estate-construction

394,427

276,976

93,044

Real estate-mortgage:

1-4 family residential

398,134

388,859

449,797

Commercial

529,822

494,861

535,957

Consumer

46,504

49,532

43,534

Total loans held for investment

1,563,021

1,303,975

1,217,535

Total loans

1,567,588

$

1,303,975

$

1,222,064

$

December 31, |

14

Allowance For Loan Losses

Nonperforming originated loans fell by

68% in a single year

Originated performing and

nonperforming loans are accounted for

under ASC 310-20

ALL established via provision, losses

recognized via charge-offs

ALL of $39.4 million

Acquired performing loans are

accounted for under ASC 310-20

Subject to ALL as FV mark is

accreted

Recorded at FV at acquisition date,

$3.7 million mark

Purchased loans, both performing and

impaired, are accounted for under ASC

310-30 (SOP-03-3)

Excluded from ALL; Deficit of

expected cash flows below carrying

value recorded as net charge-offs

Recorded at FV at acquisition date,

$31.9 million non-accretable

difference

Loan Portfolio By ALL Methodology

$1,393

$974

$742

$174

$330

$106

$65

$39

$269

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

2009

2010

2011

Originated

Originated nonperforming

Acquired impaired (PCI)

Acquired performing

Acquired performing (PCI) |

15

Asset Quality

Lending process strengthened through

dual-signature approval system, new

credit policies, and creation of an

internal loan review function

ALL declined by 58% in 2011 due to

improvement in portfolio quality

achieved through problem loan

resolution

Acquired portfolio has been marked

to FMV and carried as performing

loans

Real estate construction loans

reduced to 8% of total loans, but

continue to represent 32% of

nonperforming loans

Asset Quality

Dollars in thousands

2009

2010

2011

Allowance for Loan Loss (ALL)

49,229

$

93,687

$

39,360

$

Non-accretable difference on purchased loans

-

-

31,938

Nonperforming loans/Total loans held for investment

11.2%

25.3%

8.7%

Nonperforming Assets/Total loans plus OREO

13.1%

28.7%

16.3%

Net charge-offs/Average loans

3.0%

5.9%

10.7%

ALL/Total loans

3.1%

7.2%

3.2%

ALL+Non-accretable difference/Total loans

3.1%

7.2%

5.9%

December 31,

Nonperforming Loans

NPL

% NPL

% of NPLs

Commercial and agricultural

4,941

$

5.2%

5%

Real estate - construction

34,051

36.6%

32%

Real estate - mortgage:

1-4 family residential

26,857

6.0%

25%

Commercial

39,874

7.4%

38%

Consumer

250

0.6%

0%

Total

105,973

$

8.7%

100%

December 31, 2011 |

16

Non-Performing Assets

Nonperforming loans previously

concentrated in Real Estate

Construction and Commercial RE

mortgages were largely resolved

during 2011

OREO, the final stage of resolution for

many problem loans, has become a

significant part of nonperforming

assets

OREO staffing and processes have

been strengthened

OREO offered for sale through

workout staff, real estate brokers and

through our OREO sale data site

An OREO financing program has been

recently introduced

OREO assets are carried at market

value based on current appraised

value

As of December 31, 2011, almost 20%

of OREO was under contract for sale

and carried at the projected net sales

proceeds

Nonperforming Loans and OREO

Dollars in thousands

2009

2010

2011

Commercial and agricultural

4,816

$

13,322

$

4,941

$

Real estate - construction

103,478

144,817

34,051

Real estate - mortgage:

1-4 family residential

27,907

39,161

26,857

Commercial

38,175

132,246

39,874

Consumer

38

340

250

Total

174,414

$

329,886

$

105,973

$

OREO, other foreclosed assets and disc ops assets

35,238

62,364

110,386

Total nonperforming assets

209,652

$

392,250

$

216,359

$

December 31,

Nonperforming Loans

2009

2010

2011

Commercial and agricultural

3%

4%

5%

Real estate - construction

59%

44%

32%

Real estate - mortgage:

1-4 family residential

16%

12%

25%

Commercial

22%

40%

38%

Consumer

0%

0%

0%

Total

100%

100%

100%

December 31, |

17

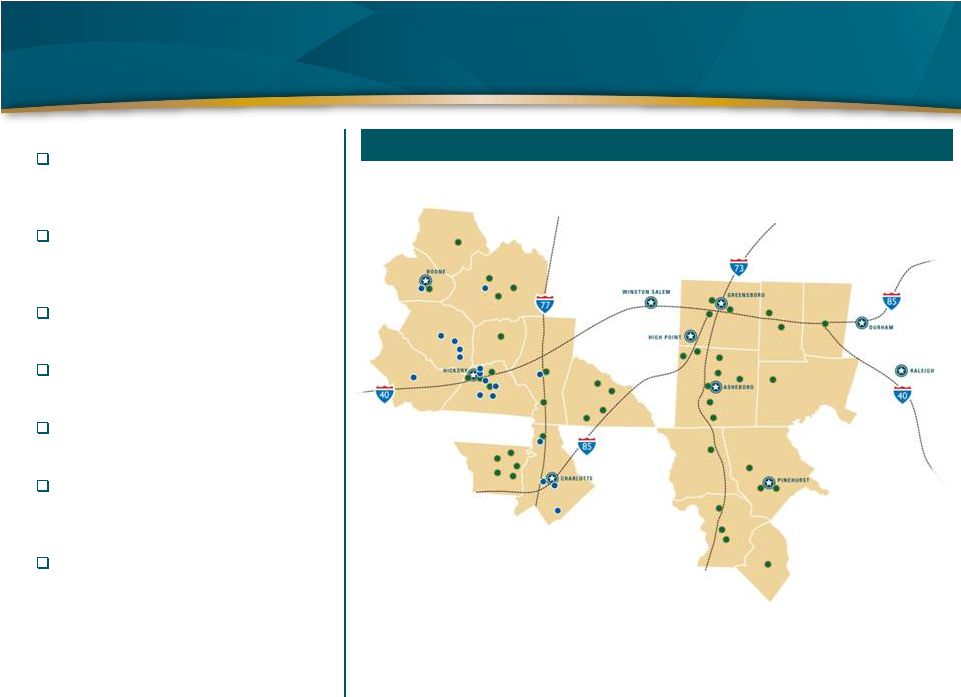

FNB United Profile

2nd largest Community Bank

headquartered in North Carolina

Merger of two 100+ year old

community banks

Assets of $2.4 billion

Deposits of $2.1 billion

110,000+ customers

63 branches in central and western

North Carolina

Market capitalization at March

30,2011 was $400 million

CommunityOne and Bank of Granite Branches |

18

2012 Key Priorities and Strategies

Complete the credit clean up

Individualized workout strategies

Active liquidation efforts

Early action to stem down-migration

Strong loan review function

Get the banks “Back to Business”

4 Lines of Business based on customer segments: Mortgage, Commercial, Consumer and

Wealth Leadership, sales and credit officer changes completed

Enhanced sales and credit training underway

Established clear calling, production and revenue goals, with company-wide

referral tracking Integrate Bank of Granite flawlessly

Established Merger Project Office with clearly articulated guiding principals

Robust planning processes: target environment design, detailed task plans, readiness

assessments, testing and mock conversions

Key product, vendor and network decisions complete |

Appendix |

20

Non-GAAP Measures

Reconciliation of Non-GAAP Measures

Dollars in thousands

2010

2011

Total shareholders' equity

(28,837)

$

129,015

$

Less:

Goodwill

-

(3,905)

Core deposit and other intangibles

(4,173)

(8,177)

Tangible shareholders' equity

(33,010)

$

116,933

$

Reconciles non-GAAP measures to

the most directly comparable GAAP

measure |