Exhibit 99.1

|

FOR IMMEDIATE RELEASE |

February 21, 2014 | |

|

Media Contact: |

Alan Bunnell, (602) 250-3376 |

|

|

Analyst Contact: |

Paul Mountain, (602) 250-4952 |

|

|

Website: |

pinnaclewest.com |

|

PINNACLE WEST REPORTS 2013 FOURTH-QUARTER

AND FULL-YEAR RESULTS

· Fourth-quarter results impacted by lower retail energy sales and milder-than-normal weather

· Full-year results benefit from superior operational performance and cost management

· 2013 results in top half of earnings guidance range

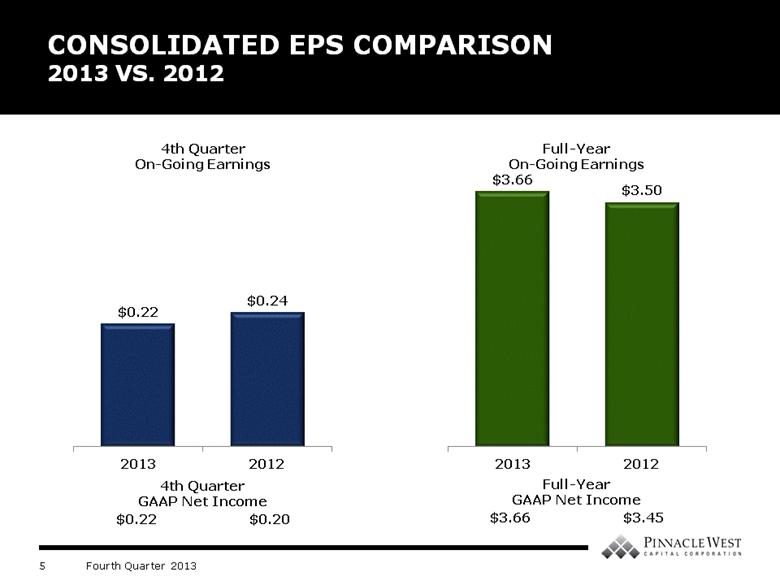

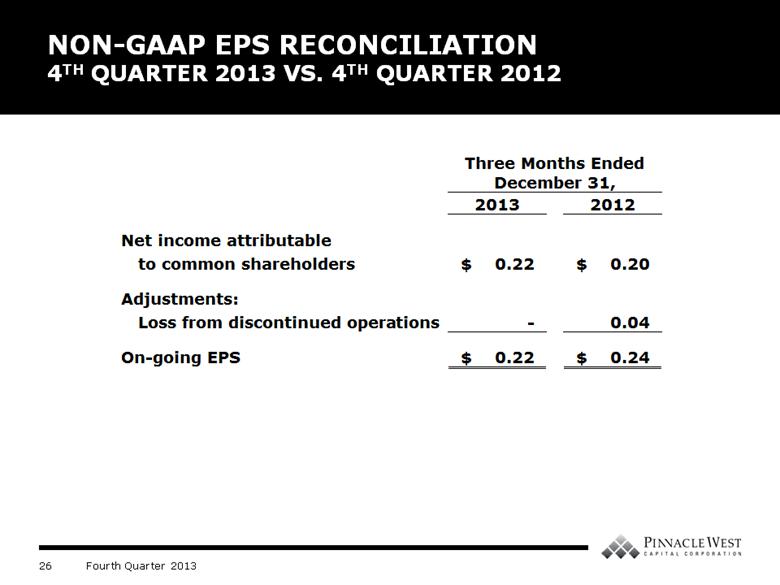

PHOENIX - Pinnacle West Capital Corporation (NYSE: PNW) today reported consolidated on-going earnings of $24.3 million, or $0.22 per diluted share of common stock, for the quarter ended December 31, 2013. This result compares with on-going earnings of $26.9 million, or $0.24 per share, in the same 2012 period. The Company’s net income attributable to common shareholders for the 2013 fourth quarter was $24.3 million, or $0.22 per diluted share, compared with net income of $22.6 million, or $0.20 per share, for the same quarter a year ago.

For full-year 2013, Pinnacle West reported consolidated on-going earnings of $406.1 million, or $3.66 per diluted share, compared to $387.4 million, or $3.50 per share, a year ago. The Company’s consolidated net income attributable to common shareholders for 2013 also was $3.66 per diluted share, compared with $3.45 per share in 2012.

“By managing our costs and focusing on operational excellence, our employees delivered solid full-year financial results for shareholders while also maintaining superior service for our 1.2 million customers,” said Pinnacle West Chairman, President and Chief Executive Officer Don Brandt. “We provided our customers with top-tier service reliability, maintained superior power plant performance, and once again ranked among the top 10 percent in the electric utility industry for overall customer satisfaction.”

Brandt cited additional examples of the Company’s recent achievements:

· About 400 megawatts (MW) of solar capacity was added to APS’s system in 2013, the most the company has tallied in a single year, thus growing total solar resources to 755 MW.

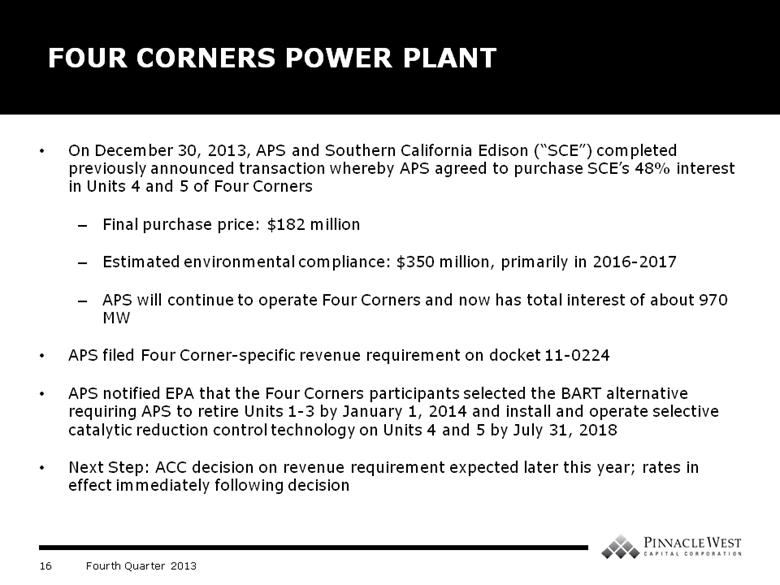

· The purchase of Southern California Edison’s ownership in Units 4 and 5 of the Four Corners Power Plant was completed, and the plant’s older, less efficient Units 1, 2 and 3 were retired.

· Palo Verde Nuclear Generating Station achieved its 22nd consecutive year as the nation’s largest power producer. And, for the ninth time, Palo Verde became the only U.S. generating facility to ever produce more than 30 million megawatt-hours in a year.

· The Company experienced its safest year ever as the number of recordable employee injuries decreased for the sixth straight year, besting 2012’s prior record by 26 percent.

· Pinnacle West’s total return to shareholders was 8.0 percent, and total shareholder value increased $466 million in 2013.

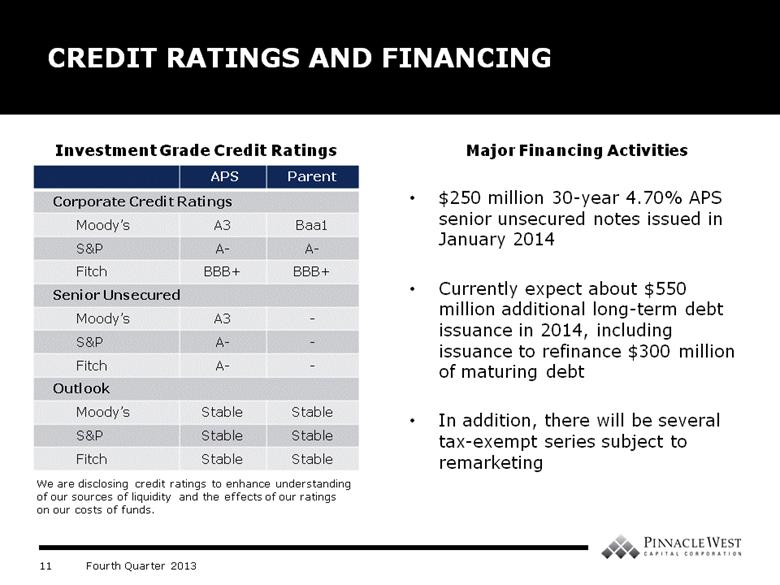

· And, for the third time in as many years, Standard & Poor’s Corporation (S&P) upgraded credit ratings for Pinnacle West and APS, up from BBB+ to A-, the companies’ highest credit ratings since 1984. Additionally, Moody’s upgraded APS’s senior unsecured and corporate credit ratings to A3 and Pinnacle West’s corporate credit rating to Baa1.

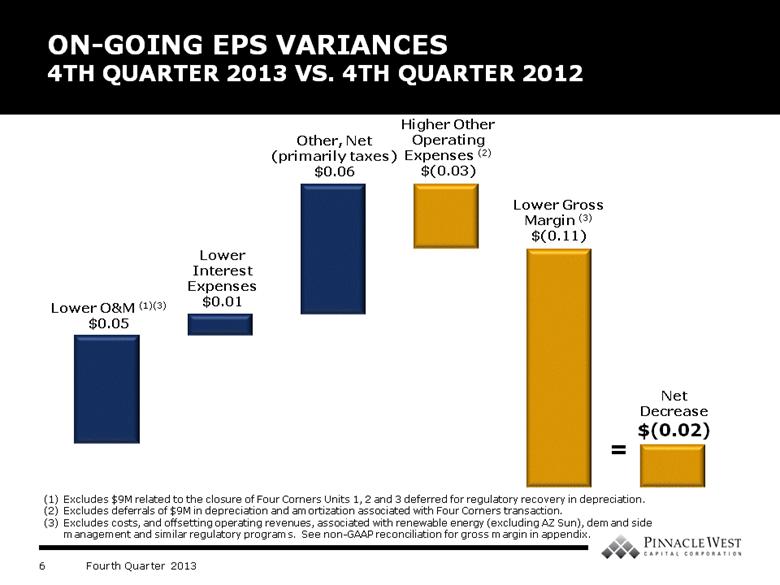

The fourth-quarter on-going results comparison was adversely impacted by the following major items:

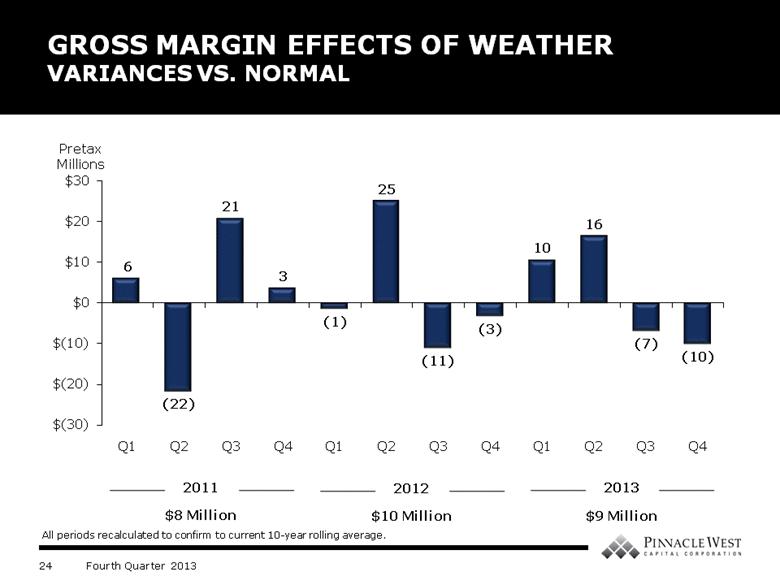

· Weather variations decreased the quarterly results by $0.05 per share compared to the 2012 fourth quarter. The decline was driven primarily by one of the coolest Octobers on record in the Phoenix-metro area, thereby reducing the number of residential cooling degree-days (a proxy for the effects of weather) by 84 percent compared to normal for the month of October.

· Lower transmission revenue reduced earnings by $0.04 per share due to the timing of the FERC formula rate true-up.

· A decrease in retail electricity sales — excluding the effects of weather variations, but including effects of customer conservation, energy efficiency programs and distributed renewable generation — affected earnings by $0.03 per share. Weather-normalized retail sales decreased 1.9 percent in the current-year fourth quarter compared with the corresponding 2012 period. The sales decrease was primarily related to changes in customer usage, partially offset by customer growth of 1.3 percent.

These factors were offset in part by the following positive factors:

· Tax-related items positively impacted earnings by $0.04 per share.

· Lower operating expenses impacted earnings by $0.02 per share compared with the prior-year quarter. The decrease largely was the result of lower employee benefit costs, partially offset by higher depreciation and amortization resulting from increased plant in service, as well as increased property taxes.

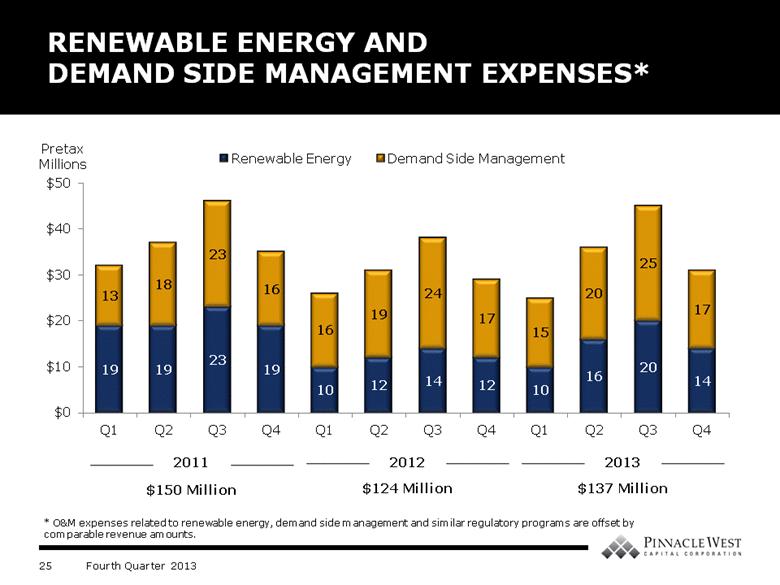

The operating expense variance excludes costs associated with renewable energy, energy efficiency and similar regulatory programs, which are largely offset by comparable amounts of operating revenues.

· The Company’s 2012 regulatory settlement, which included a retail non-fuel base rate increase, improved earnings by $0.02 per share, largely due to adjustment of the Lost Fixed Cost Recovery (LFCR) mechanism. The regulatory settlement became effective July 1, 2012.

· The net effect of other items increased earnings $0.02 per share.

APS, the Company’s principal subsidiary, recorded 2013 fourth-quarter net income attributable to common shareholder of $30.0 million versus net income of $26.8 million for the comparable 2012 quarter. For 2013 as a whole, APS net income attributable to common shareholder was $425.0 million compared with $395.5 million for 2012.

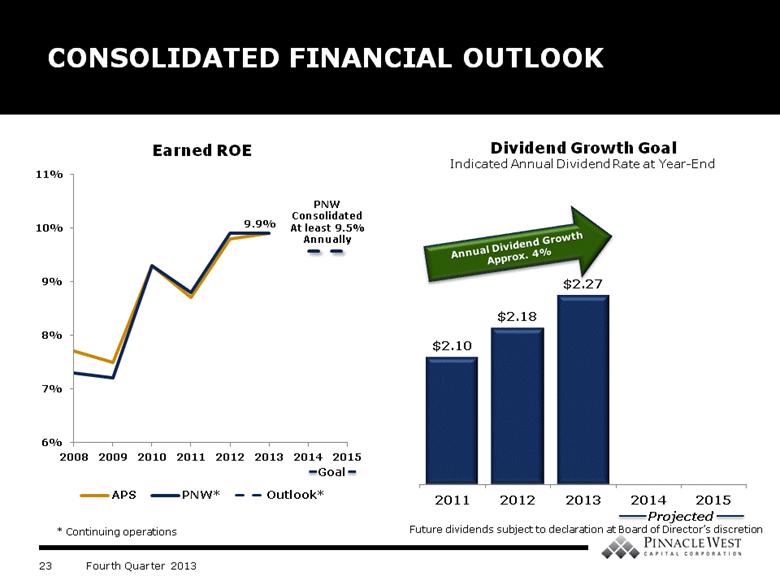

Financial Outlook

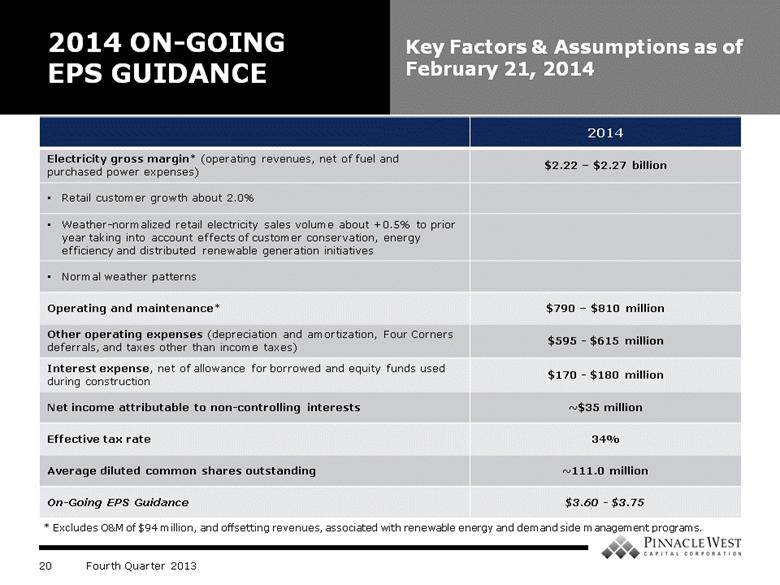

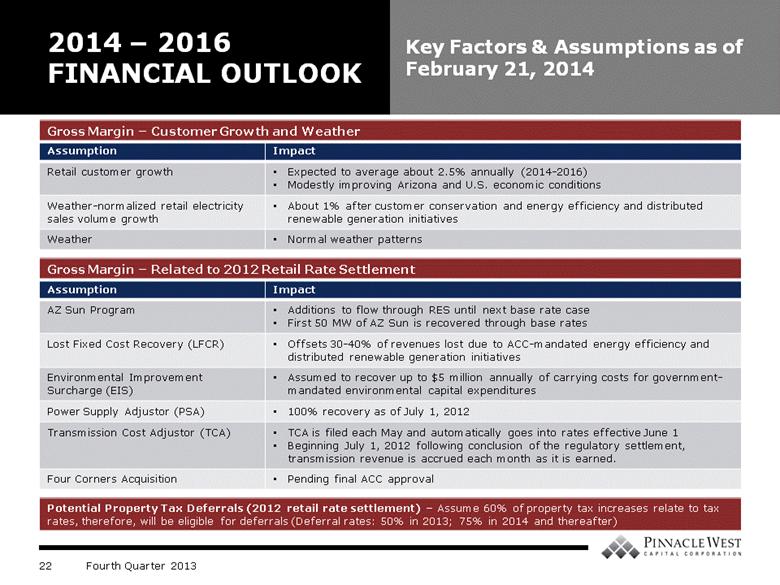

For 2014, the Company continues to expect its on-going consolidated earnings will be in the range of $3.60 to $3.75 per diluted share. Longer-term, the Company’s goal is to achieve a consolidated earned return on average common equity of at least 9.5 percent annually through 2015.

Key factors and assumptions underlying the 2014 outlook can be found in the fourth-quarter 2013 earnings presentation slides on the Company’s website at pinnaclewest.com/investors.

Conference Call and Webcast

Pinnacle West invites interested parties to listen to the live webcast of management’s conference call to discuss the Company’s 2013 fourth-quarter and full-year results, as well as recent developments, at 11 a.m. (ET) today, February 21. The webcast can be accessed at pinnaclewest.com/presentations and will be available for replay on the website for 30 days. To access the live conference call by telephone, dial (877) 407-8035 or (201) 689-8035 for international callers. A replay of the call also will be available until 11:59 p.m. (ET), Friday, Feb. 28, 2014, by calling (877) 660-6853 in the U.S. and Canada or (201) 612-7415 internationally and entering conference ID number 13574456.

General Information

Pinnacle West Capital, an energy holding company based in Phoenix, has consolidated assets of about $13.5 billion, nearly 6,400 megawatts of generating capacity and about 6,400 employees in Arizona and New Mexico. Through its principal subsidiary, Arizona Public Service, the Company provides retail electricity service to nearly 1.2 million Arizona homes and businesses. For more information about Pinnacle West, visit the Company’s website at pinnaclewest.com.

Dollar amounts in this news release are after income taxes. Earnings per share amounts are based on average diluted common shares outstanding. For more information on Pinnacle West’s operating statistics and earnings, please visit pinnaclewest.com/investors.

PINNACLE WEST CAPITAL CORPORATION

NON-GAAP FINANCIAL MEASURE RECONCILIATION

NET INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS

(GAAP MEASURE) TO ON-GOING EARNINGS (NON-GAAP FINANCIAL MEASURE)

|

|

|

Three Months Ended |

|

Three Months Ended |

| ||||||||

|

|

|

Dollars in |

|

Diluted |

|

Dollars in |

|

Diluted |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Net Income Attributable to Common Shareholders |

|

$ |

24.3 |

|

$ |

0.22 |

|

$ |

22.6 |

|

$ |

0.20 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

| ||||

|

Loss from Discontinued Operations |

|

— |

|

— |

|

4.3 |

|

0.04 |

| ||||

|

On-going Earnings |

|

$ |

24.3 |

|

$ |

0.22 |

|

$ |

26.9 |

|

$ |

0.24 |

|

|

|

|

Twelve Months Ended |

|

Twelve Months Ended |

| ||||||||

|

|

|

Dollars in |

|

Diluted |

|

Dollars in |

|

Diluted |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Net Income Attributable to Common Shareholders |

|

$ |

406.1 |

|

$ |

3.66 |

|

$ |

381.5 |

|

$ |

3.45 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

| ||||

|

Loss from Discontinued Operations |

|

— |

|

— |

|

5.9 |

|

0.05 |

| ||||

|

On-going Earnings |

|

$ |

406.1 |

|

$ |

3.66 |

|

$ |

387.4 |

|

$ |

3.50 |

|

NON-GAAP FINANCIAL INFORMATION

In this press release, we refer to “on-going earnings.” On-going earnings is a “non-GAAP financial measure,” as defined in accordance with SEC rules. We believe on-going earnings provide investors with a useful indicator of our results that is comparable among periods because it excludes the effects of unusual items that may occur on an irregular basis. Investors should note that these non-GAAP financial measures involve judgments by management, including whether an item is classified as an unusual item. We use on-going earnings, or similar concepts, to measure our performance internally in reports for management.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements based on our current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume” and similar words. Because actual results may differ materially from expectations, we caution readers not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to:

· our ability to manage capital expenditures and operations and maintenance costs while maintaining reliability and customer service levels;

· variations in demand for electricity, including those due to weather, the general economy, customer and sales growth (or decline), and the effects of energy conservation measures and distributed generation;

· power plant and transmission system performance and outages;

· competition in retail and wholesale power markets;

· regulatory and judicial decisions, developments and proceedings;

· new legislation or regulation including those relating to environmental requirements, nuclear plant operations and potential deregulation of retail electric markets;

· fuel and water supply availability;

· our ability to achieve timely and adequate rate recovery of our costs, including returns on debt and equity capital;

· our ability to meet renewable energy and energy efficiency mandates and recover related costs;

· risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty;

· current and future economic conditions in Arizona, particularly in real estate markets;

· the cost of debt and equity capital and the ability to access capital markets when required;

· environmental and other concerns surrounding coal-fired generation;

· volatile fuel and purchased power costs;

· the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements;

· the liquidity of wholesale power markets and the use of derivative contracts in our business;

· potential shortfalls in insurance coverage;

· new accounting requirements or new interpretations of existing requirements;

· generation, transmission and distribution facility and system conditions and operating costs;

· the ability to meet the anticipated future need for additional baseload generation and associated transmission facilities in our region;

· the willingness or ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or extend the rights for continued power plant operations;

· technological developments affecting the electric industry; and

· restrictions on dividends or other provisions in our credit agreements and ACC orders.

These and other factors are discussed in Risk Factors described in Part 1, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2013, which readers should review carefully before placing any reliance on our financial statements or disclosures. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law.

# # #

PINNACLE WEST CAPITAL CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

(dollars and shares in thousands, except per share amounts)

|

|

|

THREE MONTHS ENDED |

|

TWELVE MONTHS ENDED |

| ||||||||

|

|

|

DECEMBER 31, |

|

DECEMBER 31, |

| ||||||||

|

|

|

2013 |

|

2012 |

|

2013 |

|

2012 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Operating Revenues |

|

$ |

699,762 |

|

$ |

693,122 |

|

$ |

3,454,628 |

|

$ |

3,301,804 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Operating Expenses |

|

|

|

|

|

|

|

|

| ||||

|

Fuel and purchased power |

|

236,493 |

|

210,864 |

|

1,095,709 |

|

994,790 |

| ||||

|

Operations and maintenance |

|

238,854 |

|

237,141 |

|

924,727 |

|

884,769 |

| ||||

|

Depreciation and amortization |

|

98,298 |

|

103,268 |

|

415,708 |

|

404,336 |

| ||||

|

Taxes other than income taxes |

|

40,076 |

|

39,052 |

|

164,167 |

|

159,323 |

| ||||

|

Other expenses |

|

2,141 |

|

1,508 |

|

7,994 |

|

6,831 |

| ||||

|

Total |

|

615,862 |

|

591,833 |

|

2,608,305 |

|

2,450,049 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Operating Income |

|

83,900 |

|

101,289 |

|

846,323 |

|

851,755 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Other Income (Deductions) |

|

|

|

|

|

|

|

|

| ||||

|

Allowance for equity funds used during construction |

|

6,883 |

|

6,797 |

|

25,581 |

|

22,436 |

| ||||

|

Other income |

|

317 |

|

249 |

|

1,704 |

|

1,606 |

| ||||

|

Other expense |

|

(2,603 |

) |

(7,409 |

) |

(16,024 |

) |

(19,842 |

) | ||||

|

Total |

|

4,597 |

|

(363 |

) |

11,261 |

|

4,200 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Interest Expense |

|

|

|

|

|

|

|

|

| ||||

|

Interest charges |

|

50,516 |

|

52,407 |

|

201,888 |

|

214,616 |

| ||||

|

Allowance for borrowed funds used during construction |

|

(4,000 |

) |

(4,543 |

) |

(14,861 |

) |

(14,971 |

) | ||||

|

Total |

|

46,516 |

|

47,864 |

|

187,027 |

|

199,645 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Income From Continuing Operations Before Income Taxes |

|

41,981 |

|

53,062 |

|

670,557 |

|

656,310 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Income Taxes |

|

9,167 |

|

18,157 |

|

230,591 |

|

237,317 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Income From Continuing Operations |

|

32,814 |

|

34,905 |

|

439,966 |

|

418,993 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Loss From Discontinued Operations |

|

|

|

|

|

|

|

|

| ||||

|

Net of Income Taxes |

|

— |

|

(4,234 |

) |

— |

|

(5,829 |

) | ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Net Income |

|

32,814 |

|

30,671 |

|

439,966 |

|

413,164 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Less: Net income attributable to noncontrolling interests |

|

8,554 |

|

8,040 |

|

33,892 |

|

31,622 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Net Income Attributable To Common Shareholders |

|

$ |

24,260 |

|

$ |

22,631 |

|

$ |

406,074 |

|

$ |

381,542 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Weighted-Average Common Shares Outstanding - Basic |

|

110,130 |

|

109,693 |

|

109,984 |

|

109,510 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Weighted-Average Common Shares Outstanding - Diluted |

|

110,936 |

|

110,776 |

|

110,806 |

|

110,527 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Earnings Per Weighted-Average Common Share Outstanding |

|

|

|

|

|

|

|

|

| ||||

|

Income from continuing operations attributable to common shareholders - basic |

|

$ |

0.22 |

|

$ |

0.24 |

|

$ |

3.69 |

|

$ |

3.54 |

|

|

Net income attributable to common shareholders - basic |

|

$ |

0.22 |

|

$ |

0.21 |

|

$ |

3.69 |

|

$ |

3.48 |

|

|

Income from continuing operations attributable to common shareholders - diluted |

|

$ |

0.22 |

|

$ |

0.24 |

|

$ |

3.66 |

|

$ |

3.50 |

|

|

Net income attributable to common shareholders - diluted |

|

$ |

0.22 |

|

$ |

0.20 |

|

$ |

3.66 |

|

$ |

3.45 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Amounts Attributable To Common Shareholders |

|

|

|

|

|

|

|

|

| ||||

|

Income from continuing operations, net of tax |

|

$ |

24,260 |

|

$ |

26,865 |

|

$ |

406,074 |

|

$ |

387,380 |

|

|

Discontinued operations, net of tax |

|

— |

|

(4,234 |

) |

— |

|

(5,838 |

) | ||||

|

Net income attributable to common shareholders |

|

$ |

24,260 |

|

$ |

22,631 |

|

$ |

406,074 |

|

$ |

381,542 |

|