Exhibit 99.1

|

|

DELIVERING SUPERIOR SHAREHOLDER VALUE UBS Natural Gas, Electric Power and Coal Conference February 29, 2012 |

|

|

FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements based on current expectations. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume” and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: our ability to achieve timely and adequate rate recovery of our costs, including returns on debt and equity capital; our ability to manage capital expenditures and other costs while maintaining reliability and customer service levels; variations in demand for electricity, including those due to weather, the general economy, customer and sales growth (or decline), and the effects of energy conservation measures and distributed generation; power plant and transmission system performance and outages; volatile fuel and purchased power costs; fuel and water supply availability; regulatory and judicial decisions, developments and proceedings; new legislation or regulation including those relating to environmental requirements and nuclear plant operations; our ability to meet renewable energy and energy efficiency mandates and recover related costs; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; competition in retail and wholesale power markets; the duration and severity of the economic decline in Arizona and current real estate market conditions; the cost of debt and equity capital and the ability to access capital markets when required; changes to our credit ratings; the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements; generation, transmission and distribution facility and system conditions and operating costs; the ability to meet the anticipated future need for additional baseload generation and associated transmission facilities in our region; the willingness or ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or extend the rights for continued power plant operations; technological developments affecting the electric industry; and restrictions on dividends or other provisions in our credit agreements and Arizona Corporation Commission orders. These and other factors are discussed in Risk Factors described in Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2011, which you should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law. 2 |

|

|

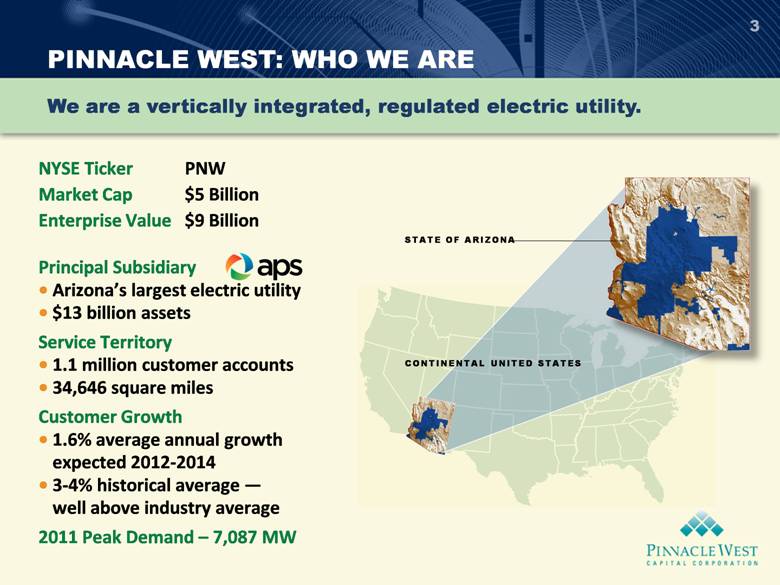

3 NYSE Ticker PNW Market Cap $5 Billion Enterprise Value $9 Billion Principal Subsidiary • Arizona’s largest electric utility • $13 billion assets Service Territory • 1.1 million customer accounts • 34,646 square miles Customer Growth • 1.6% average annual growth expected 2012-2014 • 3-4% historical average — well above industry average 2011 Peak Demand – 7,087 MW CONTINENTAL UNITED STATES STATE OF ARIZONA PINNACLE WEST: WHO WE ARE We are a vertically integrated, regulated electric utility. |

|

|

PINNACLE WEST: OUR VALUE PROPOSITION 4 Our commitment to investors: Deliver superior shareholder returns through… |

|

|

PINNACLE WEST: OUR VALUE PROPOSITION 5 |

|

|

POSITIVE LONG-TERM DEMOGRAPHICS 6 CAPITALIZING ON INTRINSIC GROWTH Superior Growth APS’s customer growth generally outpaces U.S. and Arizona population growth. Annual Growth 1990 1995 2000 2005 2010 2016 Projected APS Customer Growth Arizona Population Growth US Population Growth 2.8%* Millions APS Customer Growth *Compound Annual Growth Rate |

|

|

7 We expect our rate base will grow at a 6% average rate. APS RATE BASE GROWTH STRONG CAPITALIZING ON INTRINSIC GROWTH $ Billions Projected APS Capital Expenditures $ Millions Projected APS Rate Base Other Distribution Transmission Renewables Environmental Traditional Generation 6% Compound Annual Growth Rate |

|

|

PINNACLE WEST: OUR VALUE PROPOSITION 8 |

|

|

OPERATIONAL HIGHLIGHTS 9 Customer Satisfaction Ranked 4th highest nationally among 55 large investor-owned electric utilities in 2011 J.D. Power residential customer survey Strong Nuclear and Coal Baseload Resources 2011 capacity factors above or at industry averages Palo Verde 20-year license extension approved by U.S. Nuclear Regulatory Commission Average Annual Outage Time Per Customer Top quartile in industry over past several years Safety 2011 lowest number of recordable injuries in company history Internationally Recognized Environmental, Sustainability and Governance Leader Dow Jones North America Sustainability Index (7 consecutive years) 15th best in Corporate Responsibility Magazine’s “100 Best Corporate Citizens” We focus on maintaining top-tier performance companywide. MAINTAINING OPERATIONAL EXCELLENCE |

|

|

PINNACLE WEST: OUR VALUE PROPOSITION 10 |

|

|

RENEWABLE ENERGY RISES WITH THE SUN 11 We are helping Arizona become the “Solar Capital of the World.” Germany and Japan are among countries with highest installed solar capacity, yet have solar conditions far inferior to Arizona MAKING COMPELLING CAPITAL INVESTMENTS Arizona |

|

|

APS AZ SUN PROGRAM PROVIDES EARNINGS GROWTH POTENTIAL 200 MW utility-scale photovoltaic solar plants owned by APS Up to $975 million capital investment In service 2011 through 2015 Constructive rate recovery through RES until included in base rates Commitments to date: 83 MW $375 million capital investment 50 MW in commercial operation to date Planning and procurement under way for additional projects 12 MAKING COMPELLING CAPITAL INVESTMENTS Owning solar resources makes sense for our customers and environment and provides returns to our shareholders. |

|

|

13 MAKING COMPELLING CAPITAL INVESTMENTS FOUR CORNERS POWER PLANT TRANSACTIONS Our proposal represents a balanced solution to new environmental regulations. Acquire Southern California Edison’s 739 MW interest in Units 4 & 5 and shut down 560 MW Units 1 – 3 Purchase price: $294 million Acquisition target date: late 2012 Estimated environmental compliance investment: $300 million Finance with mix of debt and equity Arizona, California and other regulatory approvals required Economic, environmental and social benefits |

|

|

TRANSMISSION INVESTMENT ESSENTIAL 14 • 10-Year Transmission Plan (115-kV and above) • $550 million of new transmission investment • 269 miles of new lines • Projects to deliver renewable energy approved by ACC • Transmission investment diversifies regulatory risk • Constructive regulatory treatment • FERC formula rates and retail adjustor Strategic transmission is necessary to maintain reliability and deliver diversified resources to our customers. 100 MW 970 MW 1032 MW 350 MW 4300 MW 1005 MW Legend NORTH SAGUARO N . GILA PALO VERDE - HASSAYAMPA YUCCA GILA BEND REDHAWK KYRENE WESTWING BAGDAD 2016 PINNACLE PEAK CHOLLA NAVAJO . 2015 CORONADO YOUNGS CANYON 2012 SUNDANCE 2014 FOUR CORNERS DESERT BASIN Line Relocation 2014 Planned lines Existing lines Solar potential area Wind potential area 2013 DELANEY 2013 MAZATZAL 2015 MORGAN 2015 MAKING COMPELLING CAPITAL INVESTMENTS |

|

|

PINNACLE WEST: OUR VALUE PROPOSITION 15 |

|

|

2012 PROPOSED RETAIL RATE CASE SETTLEMENT KEY BENEFITS FROM INVESTOR PERSPECTIVE 16 Provides financial support APS needs to achieve Arizona’s energy goals Encourages progress toward sustainable energy future Supports renewable energy and energy efficiency Continues constructive regulatory framework established in 2009 regulatory settlement Demonstrates collaboration and cooperation among APS and numerous stakeholders Allows decision approximately one year after filing Provides no initial base rate change for customers and promotes rate gradualism IMPROVING OUR REGULATORY ENVIRONMENT The proposed settlement contains a number of benefits for customers and shareholders. |

|

|

2012 PROPOSED RETAIL RATE CASE SETTLEMENT KEY FINANCIAL PROPOSALS – BASE RATES & TIMING 17 The provisions of the settlement are targeted to become effective July 1, 2012, as originally requested by APS. IMPROVING OUR REGULATORY ENVIRONMENT Annual Revenue Change Annualized Base Rate Revenue Changes ($ millions) Non-fuel base rate increase $ 116.3 Fuel-related base rate decrease (153.1) Revenues related to AZ Sun and other solar projects to be transferred from Renewable Energy Surcharge to base rates 36.8 Net base rate change $ -0- Procedural Schedule Key Dates Settlement agreement filed January 6, 2012 Hearing conducted January 26 – February 3, 2012 Post- hearing briefs due February 29 and March 14 Decision requested to become effective July 1, 2012 |

|

|

2012 PROPOSED RETAIL RATE CASE SETTLEMENT KEY PROPOSALS – OTHER THAN BASE RATES 18 Post test-year plant additions – 15 months’ additions included in rate base Constructive new or modified adjustment mechanisms Lost fixed Cost Recovery (LFCR) rate mechanism to address ratemaking effects of energy efficiency and distributed renewable energy Power Supply Adjustor (PSA) – 100% pass-through Transmission Cost Adjustor (TCA) – streamlined for future rate changes Environmental Improvement Surcharge (EIS) – recovery of certain carrying costs for government-mandated environmental capital expenditures Four Corners transaction – procedure to allow APS to request related rate adjustments, if transaction consummated Property tax expense deferrals for future tax rate changes Current PSA credit on customer bills to continue until February 1, 2013, rather than reset when base rate changes become effective July 1, 2012 Next general rate case may be filed on or after May 31, 2015 for rates to become effective on or after July 1, 2016 (4-year stay-out) IMPROVING OUR REGULATORY ENVIRONMENT Other key proposals provide customers rate stability while continuing constructive regulatory treatment and limiting regulatory lag. |

|

|

PINNACLE WEST: OUR VALUE PROPOSITION 19 |

|

|

20 Improving our earned return on equity is one of our top priorities. Earned ROEs Key Initiatives • Supportive electric utility rates • Regulatory framework improvements • Cost management initiatives • Efficiency and effectiveness throughout organization STRENGTHENING OUR FINANCIAL PROFILE ROE IMPROVEMENT: A MULTI-PRONGED APPROACH * On-going earnings APS PNW* |

|

|

TOP-TIER DIVIDEND YIELD 21 Dividend Yield Dividend Payout Industry Averages PNW Yield as of December 31, 2011 Payout 12 Months Ended September 30, 2011 Pinnacle West’s annual dividend is $2.10 per share — providing a top-tier yield with a near-average payout. STRENGTHENING OUR FINANCIAL PROFILE |

|

|

SUPERIOR SHAREHOLDER RETURNS 22 Our total return to shareholders has outperformed our industry and the broad market over the past five years. STRENGTHENING OUR FINANCIAL PROFILE Pinnacle West S&P 500 S&P 1500 Electric Utilities 1 Year 2 Years 3 Years 5 Years Periods Ended December 31, 2011 |

|

|

PINNACLE WEST: OUR VALUE PROPOSITION 23 Our commitment to investors Delivering Superior Shareholder Returns |

|

|

APPENDIX STRENGTHENING OUR FINANCIAL PROFILE |

|

|

A RESPECTED, VETERAN LEADERSHIP TEAM 25 Our top executives have more than 130 combined years of creating shareholder value in the energy industry. Jim Hatfield SVP & CFO Mark Schiavoni SVP Fossil Generation Dave Falck EVP, General Counsel & Secretary Randy Edington EVP & Chief Nuclear Officer Don Brandt Chairman & CEO Don Robinson APS President & COO |

|

|

2012 ON-GOING EARNINGS KEY DRIVERS 26 Retail customer growth about 1% Weather-normalized retail electricity sales volume growth slightly negative taking into account effects of Company’s energy efficiency initiatives Weather 2009 regulatory settlement provisions, until 2012 retail rate decision goes into effect Pension and OPEB deferrals Line extensions as revenues Palo Verde depreciation reduction due to license extension 2012 retail rate settlement proposed to become effective July 1, 2012 Retail base rate changes Adjustment mechanism modifications Potential property tax deferrals Transmission rate increases AZ Sun Program Company-wide operating and capital cost management Interest rates IMPROVING OUR REGULATORY ENVIRONMENT Key drivers that may affect 2012 on-going earnings. |

|

|

AMPLE FINANCING ACCESS 27 Investment-grade credit ratings, capitalization and liquidity should provide adequate access to bank and capital markets. STRENGTHENING OUR FINANCIAL PROFILE Capitalization & Liquidity $ Billions Consolidated Capitalization APS ACC Capitalization Consolidated Liquidity December 31, 2011 52.9% 55.4% 2011 $1B APS revolver refinancing* 2011 $200M PNW revolver financing* 2011 $175M PNW senior notes refinancing* 2011 $400M APS senior notes refinancing* 2012 $375M APS senior notes refinancing* 2012 APS potential new debt issuance 2011 - 2012 Major Financing Activities * Completed 0 1 2 3 4 5 6 7 8 47.1% 44.6% 52.9% 55.4% $1.2 |

|

|

CREDIT RATINGS 28 We have investment-grade credit ratings. STRENGTHENING OUR FINANCIAL PROFILE We are disclosing these ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds. APS Parent Corporate Credit Ratings Moody’s Baa2 Baa3 S&P BBB BBB Fitch BBB- BBB- Senior Unsecured Moody’s Baa2 - S&P BBB - Fitch BBB - Outlook Moody’s Stable Stable S&P Positive Positive Fitch Stable Stable |

|

|

S&P CREDIT METRICS 29 APS FFO / Debt FFO / Interest Debt / Capitalization Pinnacle West FFO / Debt FFO / Interest Debt / Capitalization Our key credit metrics have been improving. STRENGTHENING OUR FINANCIAL PROFILE 2007 2008 2009 2010 2011* 17.2% 22.1% 22.8% 22.3% 19.4% 4.1x 5.1x 4.8x 4.6x 4.3X 55.2% 57.4% 56.8% 53.0% 54.4% 15.7% 18.0% 18.4% 22.5% 18.4% 3.7x 4.3x 4.0x 4.6x 4.1X 57.0% 59.4% 59.8% 55.1% 56.0% |

|

|

30 Our goal is to keep O&M growth in line with retail sales growth. $ Millions Excludes RES and demand-side management costs. 2011 also excludes $28 million pretax related to settlement of prior-period Four Corners transmission rights-of-way. STRENGTHENING OUR FINANCIAL PROFILE APS OPERATIONS & MAINTENANCE EXPENSE TRENDS 800 600 400 200 0 2006 2007 2008 2009 2010 2011 |

|

|

ENVIRONMENTAL, SUSTAINABILITY AND GOVERNANCE LEADERSHIP 31 Social Responsibility Reporting Highest Overall Score of U.S. Utilities U.S. DOE/EPA Sustained Excellence since 2008 Partner of the Year since 2005 Top 10 Utility Solar Ranking MAINTAINING OPERATIONAL EXCELLENCE We are recognized internationally for our achievements. Ranked 15th Overall Highest for Any Utility Ranked on Dow Jones Sustainability Index since 2005 Rated 4th Highest Intelligent Utility Best Practices in Customer Service |

|

|

CUSTOMER SATISFACTION: A KEY PRIORITY 32 Our employees provide top-tier customer service. MAINTAINING OPERATIONAL EXCELLENCE Lowering Outage Time Per Customer Average Outage Minutes/Year Outstanding Residential Customer Satisfaction Rating Rating 2011 J.D. Power Residential Customer Survey APS Industry Average 120 100 80 60 40 20 0 2007 2008 2009 2010 2011 700 675 650 625 600 575 550 525 500 APS Industry Average APS Industry Top Quartile |

|

|

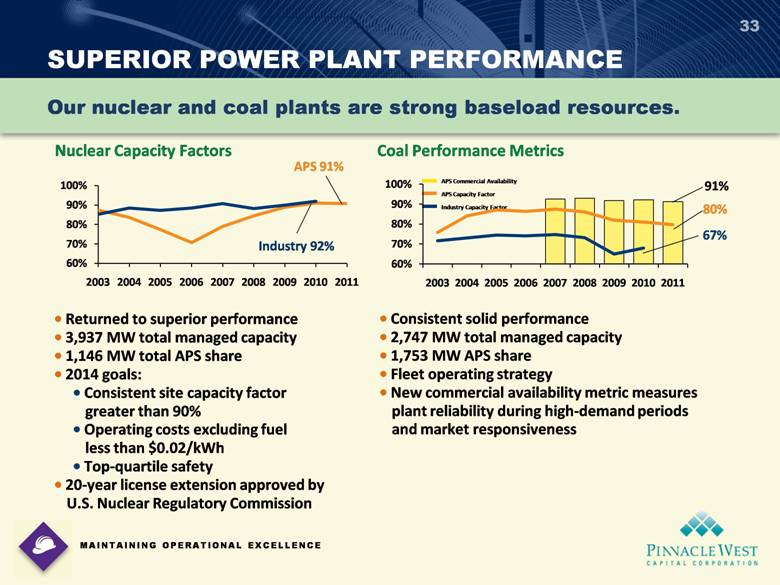

Coal Performance Metrics Nuclear Capacity Factors SUPERIOR POWER PLANT PERFORMANCE 33 Our nuclear and coal plants are strong baseload resources. MAINTAINING OPERATIONAL EXCELLENCE APS Commercial Availability APS Capacity Factor Industry Capacity Factor Industry 92% APS 91% 67% 80% 91% • Returned to superior performance • 3,937 MW total managed capacity • 1,146 MW total APS share • 2014 goals: • Consistent site capacity factor greater than 90% • Operating costs excluding fuel less than $0.02/kWh • Top-quartile safety • 20-year license extension approved by U.S. Nuclear Regulatory Commission • Consistent solid performance • 2,747 MW total managed capacity • 1,753 MW APS share • Fleet operating strategy • New commercial availability metric measures plant reliability during high-demand periods and market responsiveness 100% 90% 80% 70% 60% 2003 2004 2005 2006 2007 2008 2009 2010 2011 100% 90% 80% 70% 60% 2003 2004 2005 2006 2007 2008 2009 2010 2011 91% 80% 67% Industry 92% |

|

|

2011 RETAIL CUSTOMER, SALES AND REVENUE MIXES 34 Residential Commercial Industrial Other Customers Year-End 1.1 Million Retail Sales 28,210 GWh Operating Revenues $3.0 Billion 8% 45% 47% 50% 43% 11% 89% Our business mix is attractive due to favorable climate and other conditions in our market area. MAINTAINING OPERATIONAL EXCELLENCE |

|

|

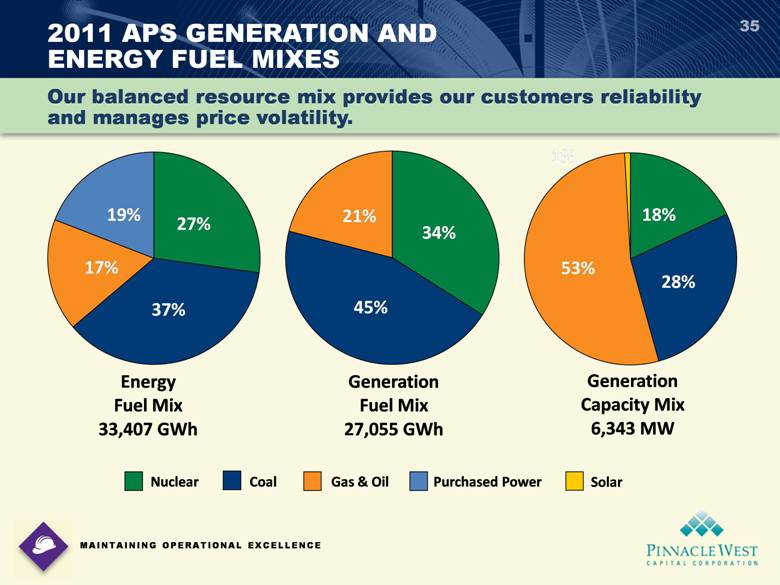

35 2011 APS GENERATION AND ENERGY FUEL MIXES Energy Fuel Mix 33,407 GWh Generation Fuel Mix 27,055 GWh Generation Capacity Mix 6,343 MW Nuclear Coal Gas & Oil Purchased Power Our balanced resource mix provides our customers reliability and manages price volatility. MAINTAINING OPERATIONAL EXCELLENCE 46% 32% 22% 36% 26% 17% 21% 54% 28% 18% Solar |

|

|

ARIZONA CORPORATION COMMISSIONERS 36 IMPROVING OUR REGULATORY ENVIRONMENT Sandra Kennedy (Dem) Paul Newman (Dem) Bob Stump (Rep) Brenda Burns (Rep) Gary Pierce (Rep)* Chairman Terms Through January 2013 The new composition provides opportunities for additional relationships and process efficiencies. Terms Through January 2015 * Term limited |

|

|

2012 PROPOSED RETAIL RATE CASE SETTLEMENT KEY FINANCIAL ASSUMPTIONS 37 IMPROVING OUR REGULATORY ENVIRONMENT Rate base $5.7 billion Allowed return on equity 10% Capital structure Long-term debt 46.1% Common equity 53.9% Base fuel rate (¢/kWh) 3.21¢ Projected fuel-price year for base fuel rate 2012 Test year ended December 31, 2010 adjusted for post-test year plant additions Updated rate base, cost of capital and fuel prices underpin the proposed settlement amounts. |

|

|

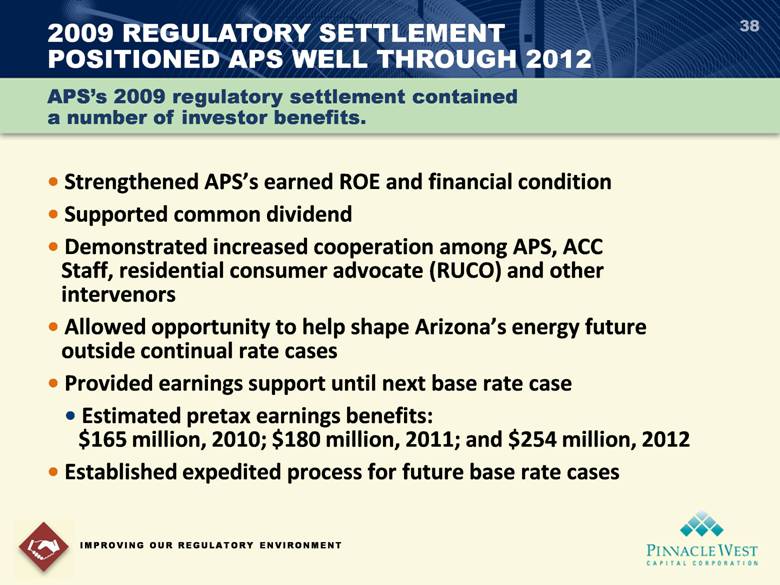

• Strengthened APS’s earned ROE and financial condition • Supported common dividend • Demonstrated increased cooperation among APS, ACC Staff, residential consumer advocate (RUCO) and other intervenors • Allowed opportunity to help shape Arizona’s energy future outside continual rate cases • Provided earnings support until next base rate case • Estimated pretax earnings benefits: $165 million, 2010; $180 million, 2011; and $254 million, 2012 • Established expedited process for future base rate cases 38 2009 REGULATORY SETTLEMENT POSITIONED APS WELL THROUGH 2012 IMPROVING OUR REGULATORY ENVIRONMENT APS’s 2009 regulatory settlement contained a number of investor benefits. |

|

|

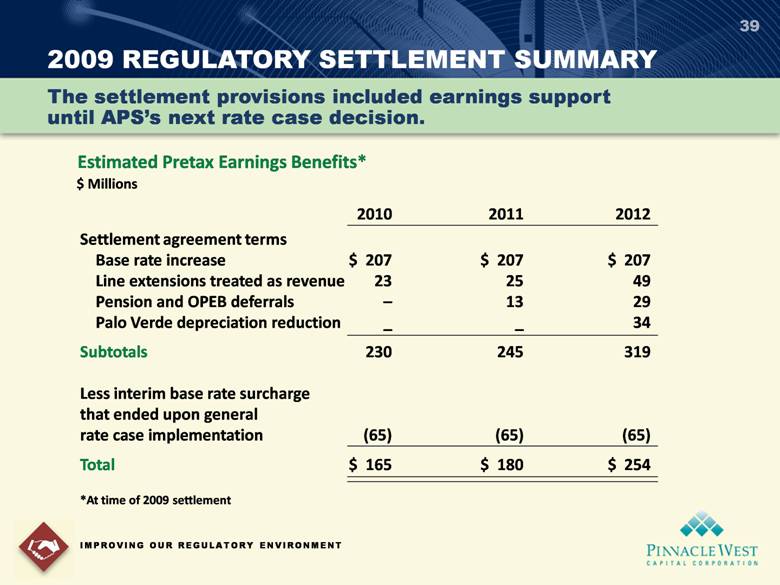

2009 REGULATORY SETTLEMENT SUMMARY 39 IMPROVING OUR REGULATORY ENVIRONMENT The settlement provisions included earnings support until APS’s next rate case decision. Estimated Pretax Earnings Benefits* $ Millions 2010 2011 2012 Settlement agreement terms Base rate increase $ 207 $ 207 $ 207 Line extensions treated as revenue 23 25 49 Pension and OPEB deferrals – 13 29 Palo Verde depreciation reduction — — 34 Subtotals 230 245 319 Less interim base rate surcharge that ended upon general rate case implementation (65) (65) (65) Total $ 165 $ 180 $ 254 *At time of 2009 settlement |

|

|

OUR REGULATORY MIX 40 Most Recent Rate Decisions $6.8 Billion Total Approved Rate Base ACC FERC Rates Effective Date 1/1/2010 6/1/2011 Test Year Ended 12/31/2007* 12/31/2010 Rate Base $5.6 B $1.2 B Equity Layer 54% 54% Allowed ROE 11.00% 10.75% IMPROVING OUR REGULATORY ENVIRONMENT The bulk of APS’s revenues comes from a regulated retail rate base and a meaningful transmission business. * Adjusted to include post test-year plant in service through June 30, 2009 Transmission 18% Generation & Distribution 82% |

|

|

41 • FERC Formula Rates adopted in 2008 • Adjusted annually with 10.75% allowed ROE • Based on FERC Form 1 and certain projections • Retail portion flows through ACC Transmission Cost Adjustor (TCA) • Recent transmission revenue changes CONSTRUCTIVE TRANSMISSION RATE REGULATION Annual Revenue Rate Effective Dates Annual Revenue Rate Effective Dates Annual Revenue Rate Effective Dates Retail Portion (TCA) $ 38 M 7/1/2011 $(10) M 8/1/2010 $ 21 M 8/1/2009 Wholesale Portion $ 6 M 6/1/2011 $ (2) M 6/1/2010 $ 2 M 6/1/2009 Total Increase (Decrease) $ 44 M $(12) M $ 23 M Equity Ratio 54% 51% 55% Rate Base $1.2 B $1.1 B $1.1 B Test Year 2010 2009 2008 IMPROVING OUR REGULATORY ENVIRONMENT We have achieved transmission rate treatment with annual adjustments. |

|

|

42 SIGNIFICANT REGULATORY PROGRESS SINCE 2005 IMPROVING OUR REGULATORY ENVIRONMENT We have achieved a more supportive regulatory structure and improvements in cost recovery timing. Mechanism Adopted/ Last Adjusted Description Power Supply Adjustor (“PSA”) April 2005 / February 2012 Recovers 90% of variance between actual fuel and purchased power costs and base fuel rate Includes forward-looking, historical and transition components Renewable Energy Surcharge (“RES”) May 2008 / January 2012 Recovers costs related to renewable initiatives Collects projected dollars to meet RES targets Provides incentives to customers to install distributed renewable energy Demand-Side Management Adjustment Clause (“DSMAC”) April 2005 / March 2012* Recovers costs related to energy efficiency and DSM programs above $10 million in base rates Provides performance incentive to APS for net benefits achieved Provides rebates and other incentives to participating customers Environmental Improvement Surcharge (“EIS”) July 2007 / July 2007 Recovers retroactively costs related to environmental upgrades not fully recovered through base rates Allows for cost recovery of ACC-approved projects Retail Line Extension Fees February 2008 /January 2010 “Pay as you go” mechanism collects dollars spent for new distribution construction at beginning of project Better protects existing customers by allocating cost of expansion to developers Transmission Cost Adjustor (“TCA”) April 2005 / July 2011 Recovers FERC-approved transmission costs related to retail customers Resets annually as result of FERC Formula Rate process (see below) FERC Formula Rates 2008 / June 2011 Recovers transmission costs based on historical costs per FERC Form 1 and certain projected data Resets annually * Target |

|

|

A WELL-BALANCED GENERATION PORTFOLIO 43 Fuel / Plant Location Units Dispatch Commercial Ops. Date Ownership Interest1 Net Capacity (MW) Nuclear Palo Verde Wintersburg, AZ 1-3 Base 1986 - 1989 29.1% 1,146 Total Nuclear 1,146 Coal Cholla Joseph City, AZ 1-3 Base 1962 - 1980 100 647 Four Corners Farmington, NM 1-3 Base 1963 - 1964 100 560 Four Corners Farmington, NM 4,5 Base 1969 - 1970 15 231 Navajo Page, AZ 1-3 Base 1974 - 1976 14 315 Total Coal 1,753 Gas/Oil - Combined Cycle Redhawk Arlington, AZ 1,2 Intermediate 2002 100 984 West Phoenix Phoenix, AZ 1-5 Intermediate 1976 - 2003 100 887 Total Gas/Oil - Combined Cycle 1,871 Gas/Oil - Steam Turbines Ocotillo Tempe, AZ 1,2 Peaking 1960 100 220 Saguaro Red Rock, AZ 1,2 Peaking 1954 - 1955 100 210 Total Gas/Oil - Steam Turbines 430 Gas/Oil – Combustion Turbines Sundance Casa Grande, AZ 10 Peaking 2002 100 420 Yucca Yuma, AZ 6 Peaking 1971 - 2008 100 243 Saguaro Red Rock, AZ 1-3 Peaking 1972 - 2002 100 189 West Phoenix Phoenix, AZ 1,2 Peaking 1972 - 1973 100 110 Ocotillo Tempe, AZ 1,2 Peaking 1972 - 1973 100 110 Douglas Douglas, AZ 1 Peaking 1972 100 16 Total Gas/Oil - Combustion Turbines 1,088 Solar Total Solar Total Generation Capacity 6,343 As of February 24, 2012 1Includes leased generating plants. 5 Paloma Cotton Center Hyder Various Gila Bend, AZ Gila Bend, AZ Hyder, AZ Multiple Arizona Facilities - - - - As Available As Available As Available As Available 2011 2011 2011 - 2012 1996 - 2006 100 100 100 100 16 17 17 55 MAKING COMPELLING CAPITAL INVESTMENTS |

|

|

44 MAKING COMPELLING CAPITAL INVESTMENTS RESOURCE PLANNING FOR RELIABILITY AND SUSTAINABILITY Additional Resources by 2025 • 2012 Four Corners transactions • Renewables (primarily solar and wind) • Energy efficiency • Natural gas Through a balanced resource mix including renewable resources and energy efficiency programs, we will meet future load growth. MW Projected 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 3% Four Corners Transactions, Net 4% Other Future Purchases 22% Future Renewable Resources 22% Future Energy Efficiency 50% Future Natural Gas Generation Load Requirement Including 15% Reserves Existing contracts Resource Planning Requirement Four Corners 4-5 Existing Owned Resources Assumes retirement of Four corners 1-3 2011 2013 2015 2017 2019 2021 2023 2025 |

|

|

45 FOUR CORNERS POWER PLANT FACTS & FIGURES MAKING COMPELLING CAPITAL INVESTMENTS Common Unit 1 Unit 2 Unit 3 Unit 4 Unit 5 Commercial Operation Date 1963 1963 1964 1969 1970 Original Cost ($M) $37 $369 $166 Net Book Value at 12/31/10 ($M) $20 $125 $63 Current Depreciation Ends 2031 Mid-2016 Mid-2016 Mid-2016 2031 2031 Current Expiration Dates Site Lease July 6, 2016 BHP Coal Agreement July 6, 2016 Certain Related Rights-of-Way July 6, 2016 Total Employees (549) 48 Common (75% Native Americans) + 75 Matrix 193 233 Capacity (MW) 170 170 220 770 770 Ownership Percentages Arizona Public Service 100% 100% 100% 15% 15% Southern California Edison - - - 48% 48% Public Service Company of New Mexico - - - 13% 13% Salt River Project - - - 10% 10% El Paso Electric - - - 7% 7% Tucson Electric Power - - - 7% 7% Heat Rate (Btu/kWh) 10,816 11,051 10,614 9,443 10,035 |

|

|

46 Renewable Energy (RES) Minimum Requirements Portion of retail sales to be supplied by renewable resources 5% by 2015 15% by 2025 Distributed energy component 30% of total requirement by 2012 APS committed to approximately double 2015 requirement Pursuant to 2009 regulatory settlement Energy Efficiency Requirements Increasing annually 2011-2020 Cumulative energy savings as percent of retail sales 3% by 2012 9.5% by 2015 22% by 2020 ARIZONA’S RENEWABLE RESOURCE AND ENERGY EFFICIENCY STANDARDS We are committed to aggressive renewable and energy efficiency standards. MAKING COMPELLING CAPITAL INVESTMENTS |

|

|

AZ SUN PROGRAM SUMMARY PHASE I 47 MAKING COMPELLING CAPITAL INVESTMENTS Name Location Capacity Developer Actual or Target COD* Paloma Gila Bend, AZ 17 MW First Solar Sept. 2011 Cotton Center Gila Bend, AZ 17 MW Solon Oct. 2011 Hyder Phase 1 Hyder, AZ 11 MW SunEdison Oct. 2011 Hyder Phase 2 Hyder, AZ 5 MW SunEdison Feb. 2012 Chino Valley Chino Valley, AZ 19 MW SunEdison 4Q 2012 Luke Air Force Base Glendale, AZ 14 MW SunPower 2013 Total Announced To Date 83 MW To Be Announced 17 MW Phase I Total 100 MW As of December 31, 2011 * In Service or Commercial Operation Date APS is investing up to $500 million in Phase I to own 100 MW of solar generation. |

|

|

RENEWABLE PURCHASE POWER CONTRACTS 48 MAKING COMPELLING CAPITAL INVESTMENTS Fuel / Contract Location Owner/ Developer Status 1 PPA Signed Commercial Operation Date Term (years) Capacity Net (MW) Solar Solana Gila Bend, AZ Abengoa UC Feb-2008 2013 30 250 Ajo Ajo, AZ Duke Energy Gen Sacs IO Jan-2010 2011 25 5 Prescott Prescott, AZ SunEdison UC Feb-2010 2011 30 10 Solar 1 Tonopah, AZ Not Disclosed UD Jan-2011 2012 30 15 Total Solar 310 Wind Aragonne Mesa Santa Rosa, NM Indigent Asset Mgmt IO Dec-2005 Dec-2006 20 90 High Lonesome Mountainair, NM Foresight / EME IO Feb-2008 Jul-2009 30 100 Perrin Ranch Wind Williams, AZ NextEra Energy UC Jul-2010 Dec -2011 25 99 Total Wind 289 Geothermal CE Turbo Imperial County, CA California Energy IO Jan-2006 Jan-2006 23 10 Total Geothermal 10 Biomass Snowflake Snowflake, AZ Ajani IO Sep-2005 Jun-2008 15 14 Total Biomass 14 Biogas Glendale Energy Glendale, AZ Glendale Energy LLC IO Jul-2008 Jan-2010 20 3 Landfill 1 Surprise, AZ Not Disclosed UD Dec-2010 2012 20 3 Total Biogas 6 Total Renewable Contracted Capacity 629 Solar 2 Solar 3 Tonopah, AZ Not Disclosed Jan-2012 2013 30 15 Maricopa County, AZ Not Disclosed Jan-2012 2013 30 15 UD UD As of February 24, 2012 1 UD = Under Development; UC= Under Construction; IO = In Operation |

|

|

SOLANA: A “SUNNY PLACE” 49 • 250-MW 30-year PPA for all output (~900 GWh/year) • Concentrating solar trough facility 70 miles southwest of Phoenix • Expected to be first major stored-energy plant in U.S. on targeted 2013 commercial operation date • Near existing transmission lines • Thermal storage capability with summer on-peak capacity factor +90% • To be built, owned and operated by Abengoa Solar • DOE loan guarantee financing finalized MAKING COMPELLING CAPITAL INVESTMENTS Solana will provide about one-third of APS’s renewable energy target of 10% by 2015. |

|

|

50 APS ENERGY EFFICIENCY INITIATIVES INCREASING • Program costs currently recovered through retail rate adjustor • Under 2009 retail regulatory settlement, APS to achieve additional retail sales savings of 4.0% in 2010-2012 • Arizona energy efficiency rules require cumulative savings of 22% of retail sales by 2020 Cumulative Annual Energy Savings Associated with EE/DSM Programs APS plans to double customers’ energy efficiency savings from 2010 through 2012. GWh MAKING COMPELLING CAPITAL INVESTMENTS 2,250 2,000 1,750 1,500 1,250 1,000 750 500 250 0 2005 2006 2007 2008 2009 2010 2011 2012 MAKING COMPELLING CAPITAL INVESTMENTS |