DEF 14A0000764622false00007646222023-01-012023-12-31iso4217:USD00007646222022-01-012022-12-3100007646222021-01-012021-12-3100007646222020-01-012020-12-310000764622pnw:ReportedValueOfEquityAwardsMemberecd:PeoMember2023-01-012023-12-310000764622pnw:EquityAwardAdjustmentsMemberecd:PeoMember2023-01-012023-12-310000764622pnw:ReportedChangeInTheActuarialPresentValueOfPensionBenefitsMemberecd:PeoMember2023-01-012023-12-310000764622pnw:PensionBenefitAdjustmentsMemberecd:PeoMember2023-01-012023-12-310000764622pnw:ReportedValueOfEquityAwardsMemberecd:PeoMember2022-01-012022-12-310000764622pnw:EquityAwardAdjustmentsMemberecd:PeoMember2022-01-012022-12-310000764622pnw:ReportedChangeInTheActuarialPresentValueOfPensionBenefitsMemberecd:PeoMember2022-01-012022-12-310000764622pnw:PensionBenefitAdjustmentsMemberecd:PeoMember2022-01-012022-12-310000764622pnw:ReportedValueOfEquityAwardsMemberecd:PeoMember2021-01-012021-12-310000764622pnw:EquityAwardAdjustmentsMemberecd:PeoMember2021-01-012021-12-310000764622pnw:ReportedChangeInTheActuarialPresentValueOfPensionBenefitsMemberecd:PeoMember2021-01-012021-12-310000764622pnw:PensionBenefitAdjustmentsMemberecd:PeoMember2021-01-012021-12-310000764622pnw:ReportedValueOfEquityAwardsMemberecd:PeoMember2020-01-012020-12-310000764622pnw:EquityAwardAdjustmentsMemberecd:PeoMember2020-01-012020-12-310000764622pnw:ReportedChangeInTheActuarialPresentValueOfPensionBenefitsMemberecd:PeoMember2020-01-012020-12-310000764622pnw:PensionBenefitAdjustmentsMemberecd:PeoMember2020-01-012020-12-310000764622pnw:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2023-01-012023-12-310000764622pnw:YearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:PeoMember2023-01-012023-12-310000764622pnw:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedInTheSameCoveredFiscalYearMemberecd:PeoMember2023-01-012023-12-310000764622pnw:ChangeInFairValueAsPOfTheVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInheCoveredFiscalYearMemberecd:PeoMember2023-01-012023-12-310000764622pnw:FairValueAtTheEndOfThPriorFiscalYearOfEquityAwardsThatFailedToMeetVestingConditionsInTheCoveredFiscalYearMemberecd:PeoMember2023-01-012023-12-310000764622pnw:ValueOfDividendsOrOtherEarningsPaidOnStockAwardsInTheCoveredFiscalYearNotOtherwiseReflectedInFairValueOrTotalCompensationMemberecd:PeoMember2023-01-012023-12-310000764622pnw:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2022-01-012022-12-310000764622pnw:YearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:PeoMember2022-01-012022-12-310000764622pnw:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedInTheSameCoveredFiscalYearMemberecd:PeoMember2022-01-012022-12-310000764622pnw:ChangeInFairValueAsPOfTheVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInheCoveredFiscalYearMemberecd:PeoMember2022-01-012022-12-310000764622pnw:FairValueAtTheEndOfThPriorFiscalYearOfEquityAwardsThatFailedToMeetVestingConditionsInTheCoveredFiscalYearMemberecd:PeoMember2022-01-012022-12-310000764622pnw:ValueOfDividendsOrOtherEarningsPaidOnStockAwardsInTheCoveredFiscalYearNotOtherwiseReflectedInFairValueOrTotalCompensationMemberecd:PeoMember2022-01-012022-12-310000764622pnw:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2021-01-012021-12-310000764622pnw:YearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:PeoMember2021-01-012021-12-310000764622pnw:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedInTheSameCoveredFiscalYearMemberecd:PeoMember2021-01-012021-12-310000764622pnw:ChangeInFairValueAsPOfTheVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInheCoveredFiscalYearMemberecd:PeoMember2021-01-012021-12-310000764622pnw:FairValueAtTheEndOfThPriorFiscalYearOfEquityAwardsThatFailedToMeetVestingConditionsInTheCoveredFiscalYearMemberecd:PeoMember2021-01-012021-12-310000764622pnw:ValueOfDividendsOrOtherEarningsPaidOnStockAwardsInTheCoveredFiscalYearNotOtherwiseReflectedInFairValueOrTotalCompensationMemberecd:PeoMember2021-01-012021-12-310000764622pnw:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2020-01-012020-12-310000764622pnw:YearOverYearChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:PeoMember2020-01-012020-12-310000764622pnw:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedInTheSameCoveredFiscalYearMemberecd:PeoMember2020-01-012020-12-310000764622pnw:ChangeInFairValueAsPOfTheVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInheCoveredFiscalYearMemberecd:PeoMember2020-01-012020-12-310000764622pnw:FairValueAtTheEndOfThPriorFiscalYearOfEquityAwardsThatFailedToMeetVestingConditionsInTheCoveredFiscalYearMemberecd:PeoMember2020-01-012020-12-310000764622pnw:ValueOfDividendsOrOtherEarningsPaidOnStockAwardsInTheCoveredFiscalYearNotOtherwiseReflectedInFairValueOrTotalCompensationMemberecd:PeoMember2020-01-012020-12-310000764622pnw:ServiceCostPensionBenefitAdjustmentMemberecd:PeoMember2023-01-012023-12-310000764622ecd:PeoMemberpnw:PriorServiceCostPensionBenefitAdjustmentMember2023-01-012023-12-310000764622pnw:PensionBenefitAwardAdjustmentsMemberecd:PeoMember2023-01-012023-12-310000764622pnw:ServiceCostPensionBenefitAdjustmentMemberecd:PeoMember2022-01-012022-12-310000764622ecd:PeoMemberpnw:PriorServiceCostPensionBenefitAdjustmentMember2022-01-012022-12-310000764622pnw:PensionBenefitAwardAdjustmentsMemberecd:PeoMember2022-01-012022-12-310000764622pnw:ServiceCostPensionBenefitAdjustmentMemberecd:PeoMember2021-01-012021-12-310000764622ecd:PeoMemberpnw:PriorServiceCostPensionBenefitAdjustmentMember2021-01-012021-12-310000764622pnw:PensionBenefitAwardAdjustmentsMemberecd:PeoMember2021-01-012021-12-310000764622pnw:ServiceCostPensionBenefitAdjustmentMemberecd:PeoMember2020-01-012020-12-310000764622ecd:PeoMemberpnw:PriorServiceCostPensionBenefitAdjustmentMember2020-01-012020-12-310000764622pnw:PensionBenefitAwardAdjustmentsMemberecd:PeoMember2020-01-012020-12-310000764622pnw:AverageReportedValueOfEquityAwardsMemberecd:NonPeoNeoMember2023-01-012023-12-310000764622pnw:AverageEquityAwardAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310000764622pnw:AverageReportedChangeInTheActuarialPresentValueOfPensionBenefitsMemberecd:NonPeoNeoMember2023-01-012023-12-310000764622pnw:AveragePensionBenefitAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310000764622pnw:AverageReportedValueOfEquityAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000764622pnw:AverageEquityAwardAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000764622pnw:AverageReportedChangeInTheActuarialPresentValueOfPensionBenefitsMemberecd:NonPeoNeoMember2022-01-012022-12-310000764622pnw:AveragePensionBenefitAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000764622pnw:AverageReportedValueOfEquityAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000764622pnw:AverageEquityAwardAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000764622pnw:AverageReportedChangeInTheActuarialPresentValueOfPensionBenefitsMemberecd:NonPeoNeoMember2021-01-012021-12-310000764622pnw:AveragePensionBenefitAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000764622pnw:AverageReportedValueOfEquityAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000764622pnw:AverageEquityAwardAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000764622pnw:AverageReportedChangeInTheActuarialPresentValueOfPensionBenefitsMemberecd:NonPeoNeoMember2020-01-012020-12-310000764622pnw:AveragePensionBenefitAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000764622pnw:AverageYearEndFairValueOfEquityAwardsGrantedDuringTheCoveredFiscalYearThatAreOutstandingAndUnvestedAsOfTheEndOfTheCoveredFiscalYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000764622pnw:YearOverYearAverageChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:NonPeoNeoMember2023-01-012023-12-310000764622pnw:AverageFairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedInTheSameCoveredFiscalYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000764622pnw:YearOverYearAverageChangeInFairValueAsOfTheVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheCoveredFiscalYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000764622pnw:AverageFairValueAtTheEndOfThPriorFiscalYearOfEquityAwardsThatFailedToMeetVestingConditionsInTheCoveredFiscalYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000764622pnw:AverageValueOfDividendsOrOtherEarningsPaidOnStockAwardsInTheCoveredFiscalYearNotOtherwiseReflectedInFairValueOrTotalCompensationMemberecd:NonPeoNeoMember2023-01-012023-12-310000764622pnw:AverageYearEndFairValueOfEquityAwardsGrantedDuringTheCoveredFiscalYearThatAreOutstandingAndUnvestedAsOfTheEndOfTheCoveredFiscalYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000764622pnw:YearOverYearAverageChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000764622pnw:AverageFairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedInTheSameCoveredFiscalYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000764622pnw:YearOverYearAverageChangeInFairValueAsOfTheVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheCoveredFiscalYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000764622pnw:AverageFairValueAtTheEndOfThPriorFiscalYearOfEquityAwardsThatFailedToMeetVestingConditionsInTheCoveredFiscalYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000764622pnw:AverageValueOfDividendsOrOtherEarningsPaidOnStockAwardsInTheCoveredFiscalYearNotOtherwiseReflectedInFairValueOrTotalCompensationMemberecd:NonPeoNeoMember2022-01-012022-12-310000764622pnw:AverageYearEndFairValueOfEquityAwardsGrantedDuringTheCoveredFiscalYearThatAreOutstandingAndUnvestedAsOfTheEndOfTheCoveredFiscalYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000764622pnw:YearOverYearAverageChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000764622pnw:AverageFairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedInTheSameCoveredFiscalYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000764622pnw:YearOverYearAverageChangeInFairValueAsOfTheVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheCoveredFiscalYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000764622pnw:AverageFairValueAtTheEndOfThPriorFiscalYearOfEquityAwardsThatFailedToMeetVestingConditionsInTheCoveredFiscalYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000764622pnw:AverageValueOfDividendsOrOtherEarningsPaidOnStockAwardsInTheCoveredFiscalYearNotOtherwiseReflectedInFairValueOrTotalCompensationMemberecd:NonPeoNeoMember2021-01-012021-12-310000764622pnw:AverageYearEndFairValueOfEquityAwardsGrantedDuringTheCoveredFiscalYearThatAreOutstandingAndUnvestedAsOfTheEndOfTheCoveredFiscalYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000764622pnw:YearOverYearAverageChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000764622pnw:AverageFairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedInTheSameCoveredFiscalYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000764622pnw:YearOverYearAverageChangeInFairValueAsOfTheVestingDateOfEquityAwardsGrantedInPriorYearsThatVestedInTheCoveredFiscalYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000764622pnw:AverageFairValueAtTheEndOfThPriorFiscalYearOfEquityAwardsThatFailedToMeetVestingConditionsInTheCoveredFiscalYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000764622pnw:AverageValueOfDividendsOrOtherEarningsPaidOnStockAwardsInTheCoveredFiscalYearNotOtherwiseReflectedInFairValueOrTotalCompensationMemberecd:NonPeoNeoMember2020-01-012020-12-310000764622pnw:AverageServiceCostPensionBenefitAdjustmentMemberecd:PeoMember2023-01-012023-12-310000764622ecd:PeoMemberpnw:AveragePriorServiceCostPensionBenefitAdjustmentMember2023-01-012023-12-310000764622pnw:AveragePensionBenefitAwardAdjustmentsMemberecd:PeoMember2023-01-012023-12-310000764622pnw:AverageServiceCostPensionBenefitAdjustmentMemberecd:PeoMember2022-01-012022-12-310000764622ecd:PeoMemberpnw:AveragePriorServiceCostPensionBenefitAdjustmentMember2022-01-012022-12-310000764622pnw:AveragePensionBenefitAwardAdjustmentsMemberecd:PeoMember2022-01-012022-12-310000764622pnw:AverageServiceCostPensionBenefitAdjustmentMemberecd:PeoMember2021-01-012021-12-310000764622ecd:PeoMemberpnw:AveragePriorServiceCostPensionBenefitAdjustmentMember2021-01-012021-12-310000764622pnw:AveragePensionBenefitAwardAdjustmentsMemberecd:PeoMember2021-01-012021-12-310000764622pnw:AverageServiceCostPensionBenefitAdjustmentMemberecd:PeoMember2020-01-012020-12-310000764622ecd:PeoMemberpnw:AveragePriorServiceCostPensionBenefitAdjustmentMember2020-01-012020-12-310000764622pnw:AveragePensionBenefitAwardAdjustmentsMemberecd:PeoMember2020-01-012020-12-31000076462212023-01-012023-12-31000076462222023-01-012023-12-31000076462232023-01-012023-12-31000076462242023-01-012023-12-31000076462252023-01-012023-12-31000076462262023-01-012023-12-31000076462272023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| | | | | | | | | | | |

| Filed by the Registrant | | Filed by a Party other than the Registrant |

| | | | | |

| Check the appropriate box: |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

PINNACLE WEST CAPITAL CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

| No fee required. |

| Fee paid previously with preliminary materials. |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

A Message from Our Chairman, President and CEO

Jeffrey B. Guldner

Chairman of the Board, President

and Chief Executive Officer

| | |

|

To our Shareholders: On behalf of our Board of Directors, management, and employees, I invite you to participate in our 2024 Annual Meeting of Shareholders. The meeting will be held at 1:30 p.m. (EDT), Wednesday, May 22, 2024. Details regarding how to attend the meeting and the business to be conducted are in the accompanying Notice of Annual Meeting and Proxy Statement. |

|

2023 Highlights

Your Company had many success stories in 2023 and I am proud of our accomplishments. My letter in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 will provide you the details of some of our accomplishments, but a few that I would like to specifically mention here are:

•our outstanding operational performance, including the fact that Palo Verde Generating Station attained its 32nd consecutive year as the nation’s largest power producer, all of it carbon-free;

•the significant increase in customer satisfaction, including the improvement in our J.D. Power rankings in which APS ranked in the second quartile of large investor-owned utilities for both business and residential customers in 2023;

•the strengthening of our financials, including minimizing shareholder impact from the 2019 rate case decision by deferring any equity issuance, managing costs and capital allocation, and sustaining dividend growth; and

•the outstanding performance by our employees. In the Summer of 2023, Arizona had a record 22 days of temperatures 115 degrees or higher and 55 days above 110 degrees. On July 15, 2023, customers shattered the all-time Company record with a peak demand of 8,162 MWs and exceeded the 2020 record of 7,660 MWs on 18 different days in July and August of 2023. All the while, our employees kept the power flowing and the lights on – consistently delivering on our promise of safely providing reliable service.

You should be proud of what your Company accomplished in 2023.

Rate Case Outcome

In 2022 and 2023, we progressed through a new rate case which overall culminated in a constructive outcome. You can read more about the rate case outcome in the Proxy Statement on page 5. The resulting outcome of this rate case will have multiple constructive impacts for the Company, including allowing us to continue to invest in the growth of the state, deliver affordable and reliable power to our customers, and improve shareholder value. However, we are still mindful that we continue to face challenges from lagging historical costs due to rising interest rates and inflationary pressures. We look forward to working with the Arizona Corporation Commission on addressing these lagging costs in the near future. The APS Promise and the 10-Year Strategic Plan

The APS Promise sets forth our purpose, our vision and our mission:

•Purpose: As Arizona stewards, we do what is right for the people and prosperity of our state.

•Vision: Create a sustainable energy future for Arizona.

•Mission: Serve our customers with clean, reliable, and affordable energy.

You can read more about the APS Promise on the inside back cover of this Proxy Statement.

Our 10-Year Strategic Plan outlines how we will deliver on the APS Promise. You can read more about the Plan on page 64 of this Proxy Statement. In 2023, we continued our focus on categorizing our strategy and business planning ambitions into two different time horizons: •Today-forward, where we focus on near-term execution to maximize the potential of our current business with metrics that focus on today and now. In our today-forward planning, we look at numerous factors, including our corporate and business unit plans, our tiered metrics, the Company’s position on key issues and topics, and our strategic initiatives.

•Future-back, where we look at how we change the business over the next decade in order to execute on our Vision and Mission. In our future-back planning, we focus on our long-term strategies and risks, we engage in future state scenario planning, and we scan the external environment for opportunities and risks related to our business model.

Your leadership team recognizes that Arizona is in the midst of a transformation. Our state’s population continues to grow, especially in Maricopa County, and Phoenix is booming as a vibrant commercial hub in the Southwest region, attracting an influx of new residents and businesses, with large industrial customers and data centers continuing to express interest in the Valley. At the same time, our customers’ needs and preferences are evolving, including increased demand for innovative demand-side programs and options to purchase clean energy directly. We continue to review, refine, and implement our strategic plan to meet the opportunities and challenges presented by the growth in our state and our customers’ choices, expectations, and satisfaction. We believe this strategic approach and focus will drive shareholder value.

| | | | | | | | |

ii | | | 2024 Proxy Statement |

| |

Board of Directors

I want to thank the Board of Directors for their outstanding support in 2023. Our Board of Directors plays a vital role in establishing our corporate strategy. I can assure you that our Board is extremely thoughtful and engaged in our Company, our strategy, and our performance.

As we noted last year, Kathy Munro will be retiring from the Board at the Annual Meeting. I want to personally thank her for the guidance, knowledge, and expertise that she has brought to the Board and to the leadership team over the years. We are a stronger Company thanks to her service as a director.

Finally, your vote is important to us. Whether or not you plan to participate in the Annual Meeting, we encourage you to vote promptly. You may vote on the internet; by telephone; or by completing, signing, dating, and returning a Proxy Card or Voting Instruction Form.

Thank you for your investment and continued support of Pinnacle West.

Sincerely,

Jeffrey B. Guldner

Chairman of the Board, President

and Chief Executive Officer

| | | | | |

| 2024 Proxy Statement | iii |

|

A Message from Our Independent Directors

Dear Fellow Shareholders,

As Independent Directors, we are committed to sound governance principles, and are focused on ensuring long term value for our shareholders as Pinnacle West makes progress toward our clean energy goals, while improving customer satisfaction, ensuring reliability and affordability. Below we highlight a few areas of focus for 2023.

Oversight of Strategy

The energy industry is rapidly changing, largely in part due to the development of new technologies, as well as an emphasis on clean energy by customers, investors, and other stakeholders. The energy landscape in Arizona is experiencing unprecedented load growth and increases in demand for energy. At our Board meetings and during our Strategic Retreat, we engaged with the management team in robust discussions about overall strategy, business priorities, long-term risks, and growth opportunities. The Today-Forward and Future-Back strategic framework allows the Board to actively monitor the changing landscape, while focusing on shareholder returns, customer experience and satisfaction, system reliability, resiliency, and affordability.

Risk and Risk Management

Risk, and risk management, are issues that the Board reviews on a regular basis. As you will note on page 39 of the Proxy Statement, the Board engages in detailed risk review discussions with the management team, as well as the employee subject matter experts when appropriate. In 2023, we also engaged in a thorough and comprehensive review of the risks identified in this Proxy Statement and other risks identified by the Company as its top risks. We understand that a critical role of the Board is risk oversight; be assured it is a priority for the Board and one that we actively address. Improved Regulatory Outcome

In the last two years, one of the Company's strategic initiatives was to achieve more productive outcomes from the Arizona Corporation Commission by enhancing our engagement with commissioners and other stakeholders. This strategy was a thoughtful undertaking by the management team, fully supported by the Board. Management’s engagement strategy has resulted in a number of favorable decisions for APS in the last year and you can read more about these outcomes in Jeff's letter in the Annual Report. We will maintain our focus on this engagement strategy and support management's efforts to improve outcomes with the Arizona Corporation Commission so that we can invest in the infrastructure needed to support Arizona's growth while delivering reliable and affordable power and improving shareholder value.

| | | | | | | | |

iv | | | 2024 Proxy Statement |

| |

Shareholder Outreach

What our investors think is very important to us. We support management’s efforts to engage with a broad set of stakeholders throughout the year, and the independent directors stand ready to engage with our investors as well. We appreciate your perspectives and we review your comments and feedback and incorporate them into our decision making.

Board Composition

Board composition is one of our most important responsibilities, and it is clear that our succession planning approach to Board membership is working successfully and as planned. In 2023, Dale Klein, former Chair of the Nuclear Regulatory Commission, retired from the Board. We retained the nuclear expertise with the addition of Kristine Svinicki, also a former Chair of the Nuclear Regulatory Commission. This is indicative of our approach to Board membership, showing that we are looking at, and planning for, the current and future areas of expertise that will be needed to best serve the Company and its shareholders.

We believe in the business value of having diverse perspectives in the boardroom. We are deliberate in ensuring we have the right mix of perspectives, skills, and expertise to address the Company’s current and future needs.

Sadly, we will be saying goodbye to Kathy Munro at the 2024 Annual Meeting of Shareholders. Kathy has been a leader, mentor, and phenomenal asset to Pinnacle West and its shareholders. We will miss her guidance and expertise. Paula Sims, a proven leader with utility experience, has taken on the role of Lead Director and Chairman of the Corporate Governance and Public Responsibility Committee. We made a few other important changes to our Board leadership structure in 2023. Bill Spence took over the role of Chairman of the Nuclear and Operating Committee, and Jim Trevathan is now Chairman of the Finance Committee. Both individuals bring experience, expertise, and new perspectives to their committees.

Thank you for the trust you place in us. The Board is engaged and committed to our common goal of creating enduring, long-term value for customers, employees, and shareholders alike.

Sincerely,

| | | | | | | | |

| | |

| Glynis A. Bryan | Gonzalo A. de la Melena, Jr. | Richard P. Fox |

| | |

| | |

| Kathryn L. Munro | Bruce J. Nordstrom | Paula J. Sims |

| | |

| | |

| William H. Spence | Kristine L. Svinicki | James E. Trevathan, Jr. |

| | | | | | | | |

vi | | | 2024 Proxy Statement |

| |

This Proxy Statement contains forward-looking statements based on current expectations, including statements regarding our financial outlook and goals, operating performance and events or developments that we expect or anticipate will occur in the future. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume,” “project,” “anticipate,” “goal,” “seek,” “strategy,” “likely,” “should,” “will,” “could,” and similar words. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Management believes that these forward-looking statements are reasonable as and when made. Because actual results may differ materially from expectations, we caution readers not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by the Company. These and other factors are discussed in our Annual Report on Form 10-K for the year ended December 31, 2023 along with our other public filings with the Securities and Exchange Commission, which readers should review carefully. The Company does not assume any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

| | | | | |

| 2024 Proxy Statement | vii |

|

| | | | | | | | | | | |

| | | |

| INDEX OF FREQUENTLY REQUESTED INFORMATION | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | | |

viii | | | 2024 Proxy Statement |

| |

Notice of the 2024 Annual Meeting of Shareholders

| | | | | | | | | | | |

| VOTING ITEMS | | |

| 1.To elect nine Directors to serve until the 2025 Annual Meeting of Shareholders | | |

|  FOR each Director nominee FOR each Director nominee | | |

| 2.To hold an advisory vote to approve executive compensation | | |

|  FOR FOR | | |

| 3.To ratify the appointment of our independent registered public accounting firm for the year ending December 31, 2024 | | |

|  FOR FOR | | |

| | | |

| | | |

Your vote is important. Whether you plan to participate in the Annual Meeting or not, please promptly vote by telephone, via the internet, by Proxy Card, or by Voting Instruction Form. By order of the Board of Directors, Diane Wood Corporate Secretary April 4, 2024 The Proxy Statement and form of proxy are first being made available to shareholders on or about April 4, 2024. | |

| | | | | | | | | | | |

| | |

| May 22, 2024 1:30 p.m. Eastern Daylight Time EXECUTIVE OFFICES ADDRESS: PINNACLE WEST CAPITAL CORPORATION Post Office Box 53999 Phoenix, Arizona 85072-3999 | |

| | | |

| | | |

| | DATE AND TIME Wednesday, May 22, 2024 at 1:30 p.m. Eastern Daylight Time | |

| | | |

| | LOCATION Online at www.virtualshareholdermeeting.com/PNW | |

| | | |

| | WHO CAN VOTE All shareholders of record at the close of business on March 14, 2024, are entitled to notice of and to vote at the Annual Meeting | |

| | | |

| ADVANCE VOTING METHODS | |

| | INTERNET www.proxyvote.com | |

| | | |

| | TELEPHONE 1-800-690-6903 | |

| | | |

| | MAIL Mark, sign, date, and mail your Proxy Card or Voting Instruction Form (a postage-paid envelope is provided for mailing in the United States) | |

| | | |

Proposals to be Voted Upon

| | | | | | | | |

| Proposal | Board

Recommendation | Page Reference |

| | |

1.Election of Directors The Board of Directors and the Corporate Governance and Public Responsibility Committee believe that the nine nominees possess the skills and experience necessary to serve on the Board and have concluded that each nominee is qualified to serve as Director. |  FOR FOR | |

| | |

| | |

2.Advisory Vote on Executive Compensation The Company has designed its executive compensation program to align executives’ interests with those of our shareholders, make executives accountable for business and individual performance by putting pay at risk, and attract, retain, and reward the executive talent required to achieve our corporate objectives and to increase long-term shareholder value. We believe that our compensation policies and practices promote a pay-at-risk philosophy and, as such, are aligned with the interests of our shareholders. |  FOR FOR | |

| | |

| | |

3.Ratification of the Appointment of Deloitte & Touche LLP (“D&T”) as the Independent Registered Public Accounting Firm for the Company The Audit Committee has discussed the qualifications and performance of D&T and believes that the continued retention of D&T to serve as the Company’s independent registered public accounting firm is in the best interest of the Company and its shareholders. |  FOR FOR | |

| | |

Proxy Statement Summary

The Value We Create

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | The APS Promise | | | | | Our Strategy | | |

| Our Purpose As Arizona stewards, we do what is right for the people and prosperity of our state. Our Vision Create a sustainable energy future for Arizona. Our Mission Serve our customers with clean, reliable, and affordable energy. | | | | How we will execute our Mission to achieve our Vision. | | |

| | | | | | | |

| | | | | | | |

| | | | Long-term issues and priority areas of focus for our business over the next ten years: •focus on customer experience and community stewardship; •support an evolving workforce; •decarbonize and manage generation resources; •achieve a constructive regulatory environment; and •ensure long-term financial health. | | |

| | | | | |

| | Our Principles | | | | | |

| The culture and behaviors that will enable us to fulfill our Purpose, Vision, and Mission: Design for Tomorrow See the Way Forward Innovate with Courage Value Learning Empower Each Other Embrace Diverse Perspectives Challenge Respectfully Unite as One Team Succeed Together Create Clarity Anchor in Safety Deliver for the Community | | | | | | | |

| | | Strategies and Goals Actions and targets that guide resources and efforts to address our long-term issues: Business Plan — defines how each business unit executes our strategy. Performance Ambitions — defines the enterprise-wide priorities across both “run” and “change” the business activities over a five-year period. Tiered Metrics — provides a clear look at what the Company is trying to accomplish by measuring what matters. Performance Management — recognizes and rewards the individual contributions to priority work. | | |

| | | | | | | | | |

The Value We Create for Our Stakeholders

| | | | | |

| |

| Financial |

| Creating long-term value for our shareholders is dependent upon having the right strategy to drive our operational performance. We recognize the links between strong customer satisfaction, a constructive regulatory environment, and financial health and stability. To support future value creation for our shareholders, we are committed to enhancing our customer focus and improving our regulatory relationships. In addition, our strong customer growth and clean energy investments contribute to our potential to continue to build shareholder value. |

| |

| |

| |

| Customers |

| Customers are at the core of what we do every day at APS and we are committed to providing options that make it easier for them to do business with us. Recognizing that creating customer value is inextricably linked to increasing shareholder value, our focus remains on our customers and our goal of achieving an industry-leading customer experience. |

| |

| |

| |

| Employees |

| Our more than 6,000 dedicated employees strengthen our Company with their skills, experience, and diverse perspectives. We recognize that the next generation of employees has its own unique career expectations, and we are taking steps to support changing needs and priorities. We also continue to develop new strategies to attract and retain our highly-skilled employees and ensure they remain engaged during this time of change. |

| |

| |

| |

| Environment |

| APS demonstrates commitment to its role as a leader in environmental and sustainability stewardship by establishing sound environmental policies, managing environmental risks, implementing environmental management systems and driving the adoption of sustainable practices. Anchored by our Clean Energy Commitment to provide 100% clean, carbon-free electricity by 2050, our sustainability initiatives also include ensuring adequate water security, waste management, and biodiversity. |

| |

| |

| |

| Communities |

| In addition to powering Arizona, we empower communities across Arizona through programs and partnerships dedicated to improving the lives of Arizonans. We not only invest in the communities where we do business, we also focus on building meaningful relationships, which help us manage our social, economic, and environmental impact. |

| |

| |

Financial Highlights

Shareholder Value

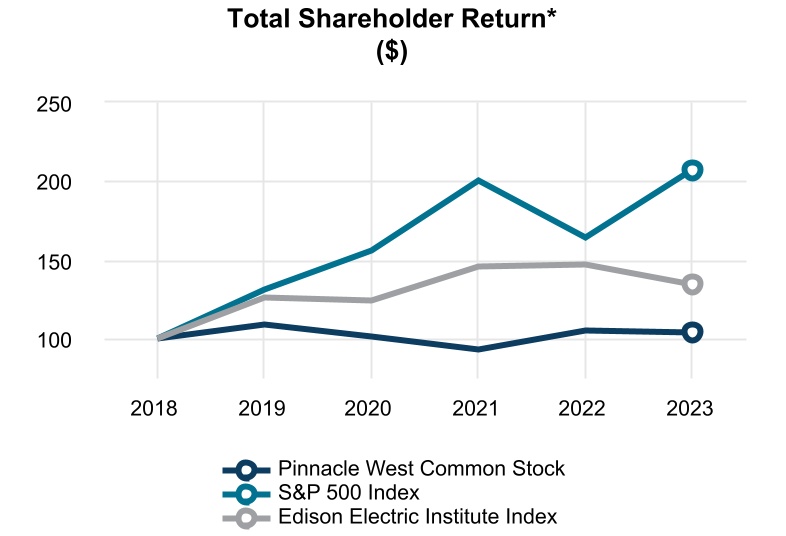

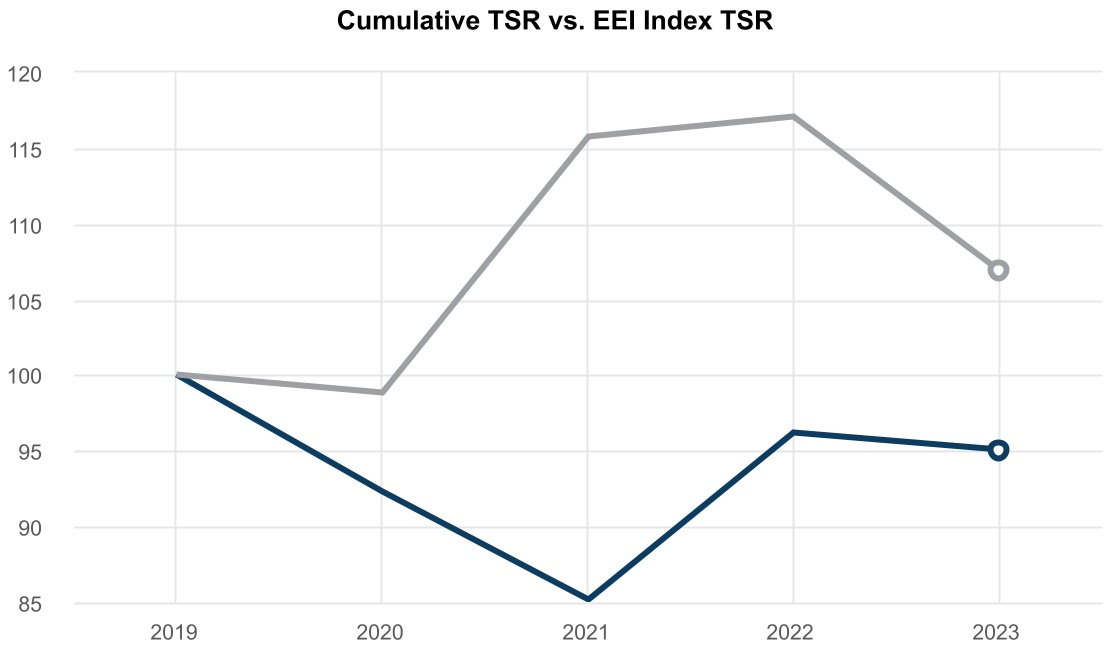

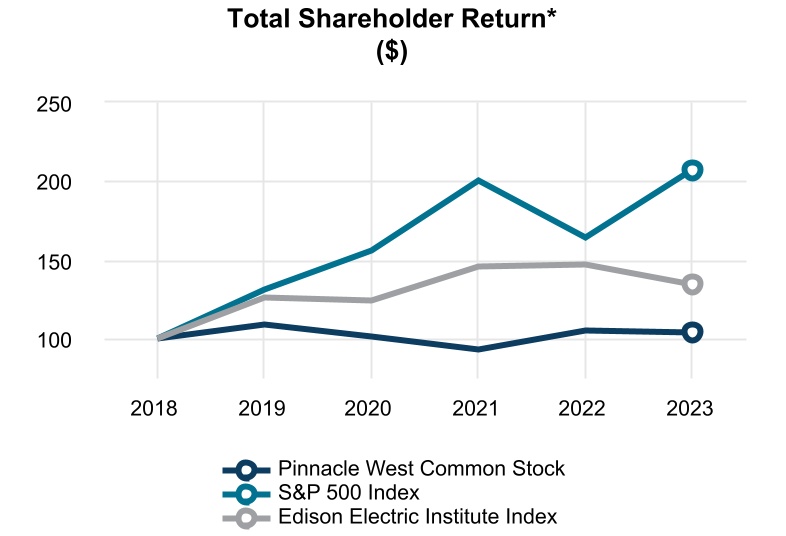

Our management team is committed to increasing shareholder value as one of our top priorities. In 2023, we continued to face significant financial challenges, resulting from an unfavorable rate case decision implemented in December 2021. That decision by the Arizona Corporation Commission (“ACC”) led the Company to reset its financial outlook. In response to the decision, we committed to minimizing shareholder impact by deferring equity issuances, managing costs and capital allocation, and sustaining dividend growth. We also appealed portions of the rate case decision. We received a constructive appellate court decision that reversed a disallowance of recovery for required investments in pollution control equipment at our Four Corners Power Plant (“Four Corners”) and began recovering those costs in July 2023. The results of the appeal, combined with favorable weather, resulted in our total shareholder return (“TSR”) outperforming the Edison Electric Institute Index (“EEI Index”) in 2023. Our 2023 TSR was -1.15% compared to the EEI Index performance of -8.70%. The Company believes that the negative TSRs were attributable, in part, to the fact that utilities were the worst performing sector in 2023, largely due to negative sentiment associated with rising interest rates and inflationary pressures. This is different than the chart below which depicts the TSR of $100 invested as of December 31, 2018 through December 31, 2023, with dividends reinvested. Both the EEI Index and S&P 500 outperformed our TSR from 2018-2023, although our annual TSR has improved since 2022.

* Value of $100 invested as of December 31, 2018, with dividends reinvested.

In 2022 and 2023, we progressed through a new rate case which culminated in a constructive outcome and $253.4 million dollar net revenue increase effective March 2024. We believe this increase will meet customer needs by ensuring grid reliability and resiliency and has improved our return on equity to 9.55% with a 0.25% fair value increment enabling us to strengthen the electric grid and support Arizona’s growing demand for energy. We believe this balanced rate case outcome will have multiple constructive impacts for the Company, including allowing us to continue to invest in the growth of Arizona, deliver affordable and reliable power to our customers, and improve shareholder value. However, even with this net revenue increase, we continue to face challenges from lagging historical costs due to rising interest rates and inflationary pressures. We look forward to working with the ACC on addressing these lagging costs in the near future. We are committed to continuing to cultivate robust communication and collaboration with the ACC and other stakeholders to find constructive solutions that support our customers while maintaining the financial health of our Company. We believe we have the right strategy and team in place to meet our near-term goals and deliver long-term shareholder value.

2023 Financial and Operating Highlights

•PNW increased its dividend for the 12th consecutive year.

•As a direct outcome of favorable weather and the constructive outcome of the general rate case appeal, PNW ended 2023 with earnings above budgeted expectations.

•Provided reliable, affordable, and clean energy to serve our customers during a record-breaking summer that exceeded previous all-time peak load 18 times, setting a new all-time peak customer demand of 8,162 MWs on July 15, 2023.

•Our supply chain organization mitigated rising costs through securing long-term pricing with strategic suppliers.

•Maintained grid reliability and minimized customer costs by utilizing existing real-time markets and continuing to evaluate additional market steps, including day ahead market participation and a regional resource adequacy construct.

•Demonstrated resilience and reliability by ending the year significantly better than industry top quartile performance, despite experiencing the hottest July on record of any U.S. city.

•Non-nuclear generation units performed exceptionally well during the crucial summer run, with a summertime equivalent availability factor of 93.4% and start up reliability of 99.7%.

•Added 351 MWs of clean energy to the APS owned generation fleet with 150 MWs of solar and 201 MWs of batteries placed in service in 2023.

Customer Highlights

Recognizing that creating customer value is inextricably linked to increasing shareholder value, our focus remains on our customers and our goal of achieving an industry-leading customer experience. Since 2020, our multi-year objective has included incrementally improving our J.D. Power (“JDP”) residential and business customer satisfaction ratings from the fourth to the first quartile of our peer set. Our JDP Residential rankings for overall customer satisfaction have improved annually, finishing 2023 ranked in the second quartile among large investor-owned utilities. In fact, residential customers ranked APS second in the peer set for both “Perfect Power” (no brief or lengthy outages) and “Phone Customer Care”. Business customer satisfaction finished the year ranked in the second quartile of utilities nationally.

Customer Care Center

Our residential customers can contact us anytime - day or night - through our 24/7 Customer Care Center. In 2023, our call center performed at industry leading service levels with associates answering 77% of more than 1.6 million calls in 30 seconds or less. We also experienced growth in online transactions and engagements through both English and Spanish digital customer platforms, including website, mobile app, text, and email alerts and notifications. Through our website and mobile app, customers completed nearly 60 million transactions and engagements in 2023. Digital Customer Care ended the year squarely in the second quartile for JDP satisfaction.

Customer Advisory Board

Formed in 2020 and made up of a cross-section of residential customers, this group met five times in 2023 to inform the Company of customer needs, wants, and perspectives on a variety of topics, including several APS programs, clean energy, and outage experience. The Customer Advisory Board’s input helped shape communications to customers as well as related program development and execution.

| | | | | |

| |

| Customer Experience Strategy Council |

| In 2021, we initiated an organization-wide customer experience strategy council designed to further drive a customer-centric culture, deliver more frictionless customer experiences, and improve JDP satisfaction performance. Through this and other ongoing initiatives, we continued to improve our customers’ experiences in 2023 by: •improving the ease-of-use of our automated phone system and advancing phone advisor soft skill development through updated training curriculum; •adding 1,100+ in-person payment locations, as well as introducing new customer payment channels, including Google and Apple Pay; •implementing numerous aps.com enhancements, including improving page-loading speeds, adding user-friendly dashboards, and making content more simple, relevant, and useful; •enhancing customer touchpoints throughout the outage journey and continuing to improve the functionality of our online outage center; •continuing to communicate with customers in their preferred channels about topics that matter most to them, including reliability, energy-efficiency, financial assistance, the environment, and programs that enable them to design their own personalized energy experience; and •continuing to focus on employee learning, training, tools, and resources to ensure all employees understood their role in our customers’ experiences. |

| |

| | | | | |

| |

| Limited Income Offerings |

| We have assistance programs and direct customers to state and local assistance programs that provide discounts to qualified limited-income customers, as well as other non-income based assistance programs for customers struggling to pay their bills, including flexible payment arrangements and emergency utility bill assistance and, to ensure our most vulnerable customers are connected to these programs, we train and partner with more than 100 community action agencies. These programs include: •Crisis Bill Assistance. Qualified customers experiencing an unplanned major expense or an unexpected reduction in income can receive up to $1,000 a year to cover current or past due APS bills through the Crisis Bill Assistance program. This assistance provides approximately $2.5 million in annual funding. •Energy Support. Our Energy Support program gives qualified, limited-income customers a 25% discount or a 35% discount (if someone in the home has a life-threatening illness or uses critical medical equipment that requires electricity) on their bill each month. In 2023, more than 76,800 customers were enrolled in the program, providing approximately $36.9 million in discounts. •Customer Support Fund. Call Center advisors were able to provide $100 in utility bill assistance for customers struggling to pay their bill and experiencing a hardship. In total, this fund helped approximately 16,000 customers in 2023. •Project Share. This program encourages our customers and employees to make tax-deductible contributions through their monthly electric bills and employee paychecks, respectively. In addition, we match employee contributions dollar-for-dollar. All contributions are then administered by the Salvation Army to help customers who find themselves in a financial crisis pay their utility bills. •Safety Net and Guest Role. These programs allow customers to designate a friend or relative to receive a copy of their monthly APS bill and to serve as a reminder when payment is due and/or be notified if the account becomes past due. Also, individuals designated as “Guest Roles” can access account information with options to make payments and compare service plans. •Payment Arrangements. APS is committed to working with customers who continue to make good faith efforts to get current on their bills through partial or full payments, revised payment arrangements, and/or customer assistance. To help customers continue to pay down their outstanding balances and avoid disconnection, APS modified 339,000 payment arrangements in 2023. •State and Local Assistance. There were several additional assistance programs through Arizona in 2023 for qualified customers, including the Low-Income Housing Energy Assistance Program that works with Community Action Programs and other local providers to lower energy costs for customers struggling to pay their energy bills, as well as Emergency Rental Assistance Program, Housing Assistance Fund, and more. In 2023, 41,700 customers received $28.2 million in bill assistance from these sources. |

| |

Employee Highlights

Our more than 6,000 dedicated employees strengthen our Company with their skills, experience, and diverse perspectives. Human capital measures and objectives that our Company focuses on to manage our business include employee safety, inclusion and belonging, succession planning, hiring and retention of talent, compensation and benefits, and employee engagement.

| | | | | |

| |

| Focused on Our People |

| Our Company seeks to attract, retain, and create a productive work environment for all employees. We believe the strength, talent, and commitment of our employees are significant contributors to our Company’s success. Talent Strategy •Internship programs: 57 summer internships were completed in 2023, 67% of interns were diverse, based on race, ethnicity, or gender •Apprentice programs: 130(1) apprentices in the programs, 36 of whom were hired into the programs in 2023 •Incoming engineer programs: Legacy Engineer Program (Palo Verde Generating Station (“PVGS”)); Rotational Engineer Program (Transmission and Distribution) •Enhanced recruitment marketing: Improved marketing collateral and increased job advertising (externally and internally) to attract top talent and create greater awareness of career opportunities available to employees •Strong commitment to our communities: Filled 121 Customer Care Center Associate I in 2023 roles utilizing community organizations and partnerships as talent sources. All hires were Arizona residents. Continued to support talent programs that support Arizona and aim to increase our diversity, such as the U.S. Department of Defense SkillBridge veteran hiring program, ElevateEdAZ Job Shadow Program for high school students, and the Arizona Latino Student Mentorship Program |

| |

| Retention •Robust employee engagement, including 11 Employee Network Groups (“ENG”) (see page 12 of this Proxy Statement to learn more about the variety of ENGs available) •Average employee tenure of 11.64 years due to strong talent strategy and an engaged workforce •Total turnover for 2023 was 8.2%, about one-third of which were related to retirements •Annual employee experience and focused quarterly pulse surveys allow us to gather employee feedback, identify opportunities for improvement, and take meaningful action in response to survey results •Actions taken in response to the surveys focus on improvements in targeted areas. Examples include improving communication between employees and leadership, improving internal processes, and employee recognition |

| |

| Development and Succession Planning •Graduated 152 employees from our leadership academies in 2023 •Conducted annual and ongoing succession planning conversations to support successor talent identification, development, and transition •Supported our modern learning culture by continuing to offer on-demand learning to our leaders and program participants who collectively completed over 9,500 development modules |

| |

(1)As of June 30, 2023.

| | | | | | | | | | | |

| | | |

| Inclusion and Belonging |

| At APS, we believe that belonging matters. When we feel seen, heard, and valued, we can more effectively unite behind our APS Promise. You can find more information on the APS Promise on the inside back cover of this Proxy Statement. We create this sense of belonging through our commitment to inclusion. Inclusion at APS involves taking deliberate action to embrace the unique perspectives of each employee. True inclusion brings greater appreciation for our diversity. This allows us to equitably leverage our powerful workforce so we can succeed together to bring our APS Promise to life. |

| | | |

| | | |

| Employee diversity:(1) | | •We are a few years into the Inclusion and Belonging Strategy that we launched in 2021. Key activities include: •bringing inclusive leadership education to officers, senior leaders, business unit leadership teams, and other stakeholders, covering topics such as cultural competence and unconscious bias; •developing and launching self-paced modules for all employees, explaining how cultural competence drives inclusion of diverse groups; •conducting cultural competence assessments with our inclusion council groups and other key stakeholders; and •holding listening sessions with employees to learn about what matters most to them. |

| •35% are ethnically or racially diverse •26% are female •14% are veterans |

| | |

| New hires in 2023: | |

| •42% were ethnically or racially diverse •35% were female •8% were veterans | |

| | |

| 39% of all officers are female(1) 18% of all officers are ethnically or racially diverse(1) | |

| | |

(1)As of December 31, 2023.

| | | | | | | | |

10 | | | 2024 Proxy Statement |

| |

Our Key Areas of Focus

| | | | | | | | | | | | | | | | | | | | | | | |

Alignment and

Accountability | | Workforce

Evolution | | Leveraging

Connections |

| | | | | | | |

| | | | | | | |

| Inclusion Education and Dialogue — Create experiential learning to ensure alignment around relevant concepts across the organization | | | Talent Acquisition — Analyze and evolve current recruiting and selection processes to improve external diverse hiring | | | ENG — Evolve our ENGs to increasingly serve as business resources over time |

| | | | | | | |

| Governance and Influence — Build governance structure to ensure alignment and accountability | | | Talent Development, Performance, and Succession — Assess existing talent processes to ensure equity and improve diverse representation among leadership | | | Employee Communication and Events — Visibly demonstrate our commitment to diversity, expose employees to different cultures and perspectives, and recognize key occasions |

| | | | | | | |

| Analytics — Extract data-driven insights to shape our approach and monitor progress through meaningful measures | | | Workforce Development — Explore our current activities and create clarity and ownership for developing talent pipelines to create a diverse workforce for the future | | | Internal Partnerships — Partner with key internal stakeholder groups to ensure an integrated and aligned approach |

| | | | | | | |

| Policies and Practices — Assess and revise internal policies and practices to ensure equity | | | | | | External Partnerships and Recognition — Partner with external organizations to benchmark, innovate, and be recognized for our inclusion efforts |

| | | | | | | |

| | | | | |

| 2024 Proxy Statement | 11 |

|

Employee Network Groups

To encourage employees to challenge themselves, develop additional skills, and advance within their chosen fields, the Company supports 11 employee networks that enable employees to connect with one another and promote career development:

| | | | | | | | |

| | |

| | The African American Network for Diversity and Inclusion’s mission is to create a collaborative and highly-engaged network of African-American employees that promote the interests of AANDI, its strategic initiatives, and the values of APS. |

| | The Lesbian, Gay, Bisexual & Transgender Alliance’s mission is to empower inclusion through community, support, and education. |

| | The Veteran Engagement, Transition & Retention Network’s mission is to develop opportunities benefiting our honored Arizona veterans. We strive to promote their service to our country, leadership skills, and the achievements of veterans in the organization. |

| | Women in Search of Excellence’s mission is to build a community at APS to further develop women as they achieve their personal and professional excellence. |

| | Palo Verde Young Generation in Nuclear’s mission is to unite young professionals for the purpose of strengthening its community by focusing on the success of nuclear technology. |

| | Palo Verde Women in Nuclear’s mission is to promote an environment in which all employees are able to succeed while working to encourage public awareness about nuclear energy. |

| | The Native American Network Organization’s mission is to attract and develop Native American talent by providing professional development opportunities, assisting in recruiting and retention, and encouraging community development. |

| | NextGen’s mission is to unite professionals new to the utility industry by providing professional development opportunities, enhance recruitment and retention, and organize community outreach programs. |

| | The Hispanic Organization for Leadership and Advancement promotes a culture of inclusiveness and community stewardship across APS, as well as develops high-performing leaders in pursuit of operational excellence and continuous self-improvement. |

| | Links’ mission is to connect experienced employees with opportunities for development, networking, and engagement. |

| | AsPIRE is dedicated to promoting awareness and understanding of the Asian American and Pacific Islander (“AAPI”) community and culture; advocating for diversity and inclusion in the workplace; and providing support and resources for AAPI employees to thrive and succeed in their careers. |

| | | | | | | | |

12 | | | 2024 Proxy Statement |

| |

Environmental Highlights

Through our Clean Energy Commitment, we are dedicated to providing clean, reliable, and affordable electricity in order to achieve a sustainable future for our Company and our customers.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| Recognition |

| •Pinnacle West maintained its “AA” rating from MSCI (as of February 10, 2024). •On the list of Top 100 Green Utilities from Energy Intelligence for the fifth year in a row. |

|

|

| Energy Innovation |

| APS is in the midst of one of the greatest periods of change in our Company’s nearly 140 year history. •Over 1,400 MW of utility scale renewable capacity today •Plan to add more than 2,500 MW of additional clean energy technologies, including solar and storage, by 2027 | | Our 11 grid-scale solar plants are powered by more than 1.6 million solar panels |

|

| | | | | |

| 2024 Proxy Statement | 13 |

|

APS Clean Energy Commitment

| | | | | | | | | | | | | | | | | |

Our Commitment: 100% Clean Energy by 2050 We have set a bold, three-part goal to provide a clean energy future for our customers: •a 2050 goal to provide 100% clean, carbon-free electricity; •a 2031 commitment to exit from coal-fired generation; and •a 2030 target to achieve a resource mix that is 65% clean energy, with 45% of the generation portfolio coming from renewable energy. A Clean Economic Future •Our clean energy plan will be guided by sound science and focused on achieving environmental and economic gains — all while maintaining affordable, reliable service for our customers. •Collaboration with customers, regulators and other stakeholders is key to our plan’s ultimate success. We look forward to working alongside those who believe in this vision to move forward together to keep Arizona clean, beautiful and thriving. Pathways to 100% Clean | | Clean Energy Pathway |

| | | | |

| Policy Decisions | | Electrification | |

| Support policy decisions that leverage market-based technology and innovation to attract investment in Arizona | | Electrification will drive a cleaner environment and more energy-efficient operations throughout the economy | |

| | | | |

| | | | |

| Existing Power Sources | | Modernization of the Electric Grid | |

| Near-term use of natural gas until technological advances are available to maintain reliable service affordably | | Continue to advance infrastructure that is responsive and resilient while providing customers more choice and control | |

| | | | |

| | | | |

| Evolving Market-Based Solutions | | Energy Storage Solutions | |

| Participation in the Energy Imbalance Market (“EIM”) provides access to clean energy resources while saving customers money | | Storage creates opportunities to take advantage of midday solar generation and better respond to peak demand | |

| | | | | |

| | | | | | | | |

14 | | | 2024 Proxy Statement |

| |

| | | | | |

| |

Path Forward | Steady progress on our commitment: •In 2023, deployed more than 83,800 residential thermostats with a demonstrated capability of shedding more than 135 MW of energy. •In 2024, the Company expects to add 215 MW of utility-scale solar energy, 216 MW of wind energy, and more than 450 MW of energy storage. •By 2027, APS will seek to add more than 6,000 MW of solar and wind power, coupled with battery storage, which would provide the greatest long-term value and affordability to customers. •You can learn more about our Clean Energy Commitment at www.aps.com/cleanenergy. |

| |

Community Highlights

Our multifaceted approach to community engagement is grounded in our commitment to community development. We not only invest in the communities where we do business but also focus on building meaningful relationships, which help us manage our social, economic and environmental impact.

We use a variety of communication channels to develop dialogue in our communities, such as open houses, community summits, business forums and other special events. These enable us to gather feedback from participants, inform them about issues that affect their communities and APS, and identify issues and opportunities for action. We also develop strategic partnerships in areas such as diversity, inclusion and workforce development to advance social and economic goals.

| | | | | |

| |

| |

| Coal Communities Transition |

| The transition away from coal-fired power plants toward a clean energy future will pose unique economic challenges for the communities around these plants. We worked collaboratively with community leaders and stakeholders to propose a comprehensive Coal Communities Transition Plan. The proposed framework provides substantial financial and economic development support to build new economic opportunities and addresses a transition strategy for plant employees. We are committed to continuing our long-running partnership with the Navajo Nation in other areas as well, including expanding electrification and developing renewable projects on or near the Navajo nation. The ACC approved a portion of the plan in the 2019 rate case decision. No additional Coal Community Transition funding was approved in the 2022 rate case. As a result, funding to the Navajo Nation has already been provided in the amount of $11.51 million, and additional funding will be provided in the amount of $22.75 million from Pinnacle West and $5.83 million, which is the remaining portion of funding that was approved by the ACC in the 2019 rate case. |

| |

| |

| |

| Community Engagement |

| At APS, we initiate and maintain relationships with stakeholders to understand our communities’ needs and identify opportunities to build healthy and sustainable communities. Our External Affairs team collaborates with representatives from a wide range of community and government entities, including: state, county, municipal and tribal governments; military bases; school districts; nonprofits; business organizations; and public interest groups to maximize existing resources to address important community issues and opportunities. In 2023, we hosted seven APS Energy Update meetings across our service area, with APS President Ted Geisler as the featured speaker. These meetings provided an opportunity to inform and educate stakeholders about our Company and have a direct exchange of ideas, perspectives, and gather feedback and concerns. In total, over 245 community leaders participated in these meetings, representing over 120 organizations in the nonprofit, government and private sectors. |

| |

| |

| |

| | | | | |

| 2024 Proxy Statement | 15 |

|

| | | | | |

| |

| |

| Philanthropy and Volunteerism |

| We are actively involved in the communities we serve. We partner with nonprofit organizations and community groups across the state to build a stronger, healthier Arizona. Our efforts include financial support, board service, and volunteer assistance. We donated more than $10.2 million to worthwhile causes in 2023. This includes our Corporate Giving program, which funds organizations that contribute to the growth and prosperity of Arizona, with a focus on arts and culture, education and employment, small business and entrepreneurship, environment, human services, and community development. Giving back to our communities is an integral part of the APS culture, and our employees donate their time and talents to a wide range of charitable organizations and civic initiatives. In 2023, our employees volunteered an estimated 79,286 hours, both in-person and virtually, to causes important to them. Our employees sit on the boards of nearly 300 Arizona community and nonprofit organizations and industry groups. Employee engagement of this kind not only assists those organizations, but also produces valuable human capital development, as volunteerism increases loyalty, performance, and job satisfaction while providing employees with professional development opportunities. Other accomplishments for 2023 include: •employees pledged $2.1 million to the 2023 Community Service Fund campaign (United Way) with the Company matching 25%, for a total of $2.6 million; •for the sixth consecutive year, we supported Arizona teachers through our Supply My Class program, in which 500 Arizona K-12 teachers from 251 Title I schools received $500 each to purchase much-needed classroom supplies, all hand-delivered by an APS employee or officer for the first time since the program’s inception; •through our partnership with Earn to Learn, 238 new scholarships were awarded to low-to moderate-income, post-secondary students in the Phoenix and rural areas through a matched savings program; •in partnership with key nonprofit partners, we expanded our heat relief strategy aimed at expanding assistance to vulnerable individuals during Arizona’s hot summer months. In partnership with the Foundation for Senior Living, we provided 44 vulnerable, limited-income households served by APS with emergency air conditioning repair or replacement through the Healthy Homes Air Conditioning Program, an increase of 25% over last year and, through our partnership with Solari/211 and Lyft, we were able to provide residents with more than 600 rides to cooling sites; •through strategic APS grants, in partnership with St. Vincent de Paul, Phoenix Industrial Development Authority, and others, over 400 individuals received rent and utility assistance, 269 individuals from downtown Phoenix homeless encampments received emergency shelter, and another 500 individuals transitioned into supportive and affordable permanent housing; •we distributed nearly $55,000 through the Utilities Grant Program to maximize support of communities impacted by coal plant transitions; and •we continued our Community Tree Program aimed at increasing shade tree canopy cover in vulnerable communities, provided grants to 13 nonprofits, cities/towns and school districts, planting 386 desert-adapted shade trees. |

| |

| | | | | | | | |

16 | | | 2024 Proxy Statement |

| |

Governance Highlights

Our strong corporate governance practices demonstrate the Board’s commitment to enabling an effective structure to support the successful execution of our strategic priorities.

| | | | | | | | |

| | |

Board Independence •Independent Lead Director role with clearly defined and robust responsibilities •Eight of our nine Director nominees are independent and the members of all of the Board committees are independent | Board Oversight •Robust management succession planning •Focused Board oversight of strategy and risk •Thorough CEO performance oversight process Board Performance •Annual Board, committee, and individual Director evaluations and discussions with the Lead Director •Director skills and experience necessary to provide oversight of our strategy and operations •Robust Board refreshment, with Director retirement policy | Shareholder Rights •A group of 15% of our shareholders can call a special meeting (“Shareholder Special Meeting Rights”) •Annual elections of all Directors with cumulative voting •No poison pill plan or similar anti-takeover provision in place •No supermajority provisions in our Articles of Incorporation or Bylaws •Proxy access rights allow up to 20 shareholders owning 3% of our outstanding stock for at least 3 years to nominate up to 25% of the Board |

Compensation Governance

•Shareholder feedback informs compensation program design

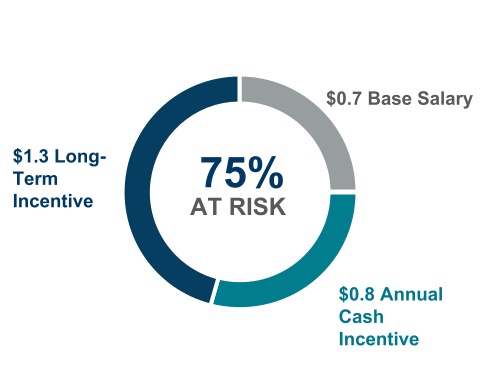

•Substantial proportion of target compensation is at risk (85% for the CEO for 2023 and 73% for other NEOs for 2023)

•Performance shares are tied to relative performance, ensuring long-term financial health and furthering our Clean Energy Commitment

•No excise tax gross-up provisions in new or materially amended Change of Control Agreements with our NEOs

•Anti-hedging policy for all Directors, officers, and employees, and anti-pledging policy for all Directors and officers

•Stock ownership guidelines for all NEOs and Directors

•Clawback policy for our current and former executive officers that is compliant with the rules of the New York Stock Exchange (“NYSE”), covering short- and long-term incentive awards

Average shareholder support for our executive compensation program over the past five years has exceeded 94%. In 2023, shareholder support was 94.8%.

| | | | | |

| 2024 Proxy Statement | 17 |

|

Board Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| 10 | 9 | 4 | 2 | 9.1 YEARS(1) | |

| Directors | Independent | Women | Diverse Ethnicity | Average Tenure of Independent Directors | |

| 5 | 1 | 3 | |

| 0-5 years | 6-10 years | Over 10 years | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Occupation | Age(2) | Director

Since | Independent | Committees |

| Glynis A. Bryan | Chief Financial Officer, Insight Enterprises, Inc. | 65 | 2020 | | | | | |

| Gonzalo A. de la Melena, Jr. | Founder and Chief Executive Officer, Emerging Airport Adventures, LLC | 55 | 2022 | | | | | |

| Richard P. Fox | Independent Consultant and former Managing Partner, Ernst & Young | 76 | 2014 | | | | | |

| Jeffrey B. Guldner | Chairman of the Board, President and Chief Executive Officer of PNW and Chairman of the Board and Chief Executive Officer of APS | 58 | 2019 | | | | | |

| Kathryn L. Munro | Principal, BridgeWest, LLC | 75 | 2000 | | | | | |

| Bruce J. Nordstrom | Of Counsel and CPA, Nordstrom & Associates, P.C. | 74 | 2000 | | | | | |

| Paula J. Sims | Lead Director

Retired Professor of Practice, University of North Carolina Kenan-Flager Business School, and Former Senior Vice President of Corporate Development and Improvement, Duke/Progress Merger | 62 | 2016 | | | | | |

| William H. Spence | Former Chairman and Chief Executive Officer, PPL Corporation | 67 | 2021 | | | | | |

| Kristine L. Svinicki | Former Nuclear Regulatory Commission (“NRC”) Chairman | 57 | 2023 | | | | | |

| James E. Trevathan, Jr. | Former Executive Vice President and Chief Operating Officer, Waste Management, Inc. | 70 | 2018 | | | | | |

| | | | | | | | | |

| Committees |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Audit | | Corporate Governance and Public Responsibility | | Finance | | Human Resources | | Nuclear and Operating | | Financial Expert | | Chair |

(1)Tenure as of March 14, 2024.

(2)Directors’ ages are as of February 21, 2024.

| | | | | | | | |

18 | | | 2024 Proxy Statement |

| |

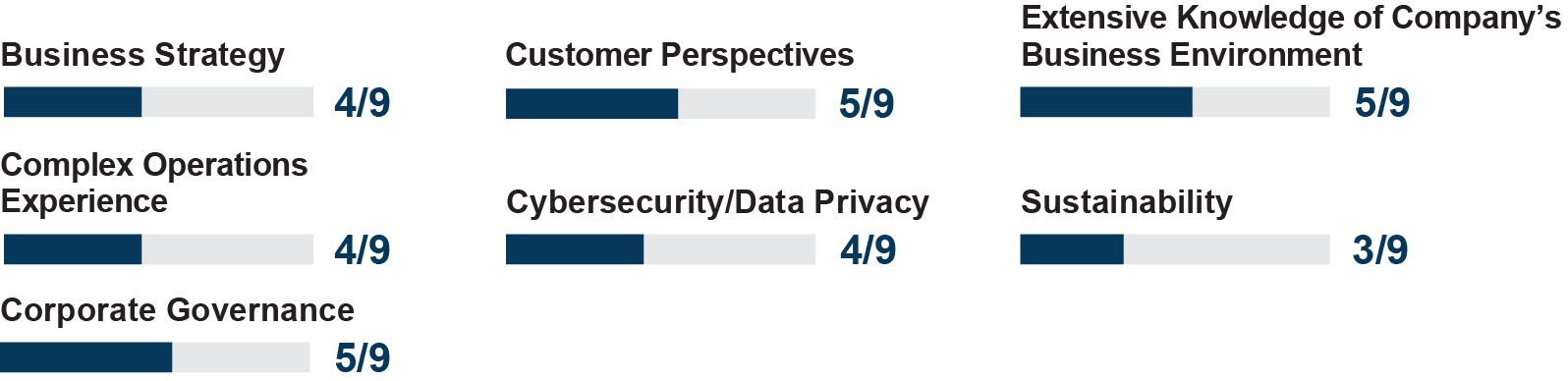

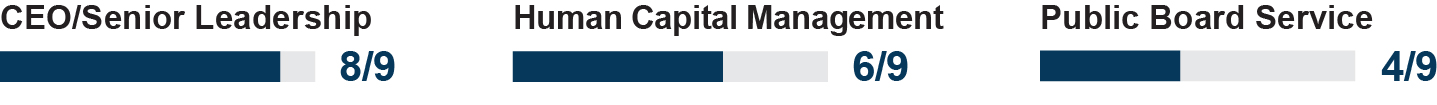

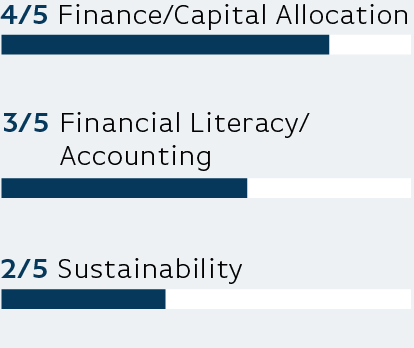

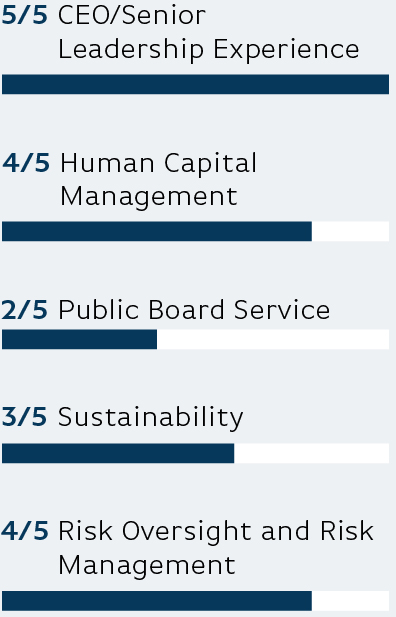

Directors’ Key Skills and Experience

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| DIVERSITY | | | | | | | | | | |

| Gender or Ethnicity | | | | | | | | | | |

| FINANCE AND ACCOUNTING | | | | | | | | | | |

| Audit Expertise | | | | | | | | | | |

| Finance/Capital Allocation | | | | | | | | | | |

| Financial Literacy and Accounting | | | | | | | | | | |

| BUSINESS OPERATIONS AND STRATEGY | | | | | | | | | | |

| Business Strategy | | | | | | | | | | |

| Complex Operations Experience | | | | | | | | | | |

| Corporate Governance | | | | | | | | | | |

| Customer Perspectives | | | | | | | | | | |

| Extensive Knowledge of Company’s Business Environment | | | | | | | | | | |

| Cybersecurity/Data Privacy | | | | | | | | | | |

| Sustainability | | | | | | | | | | |

| LEADERSHIP EXPERIENCE IN A LARGE ORGANIZATION | | | | | | | | | | |

| CEO/Senior Leadership | | | | | | | | | | |

| Public Board Service | | | | | | | | | | |

| Human Capital Management | | | | | | | | | | |

| THE COMPANY’S INDUSTRY | | | | | | | | | | |

| Nuclear Experience | | | | | | | | | | |

| Utility Industry Experience | | | | | | | | | | |

| PUBLIC POLICY AND REGULATORY COMPLIANCE | | | | | | | | | | |

| Government/Public Policy/Regulatory | | | | | | | | | | |

| RISK OVERSIGHT AND RISK MANAGEMENT | | | | | | | | | | |

| Risk Oversight and Risk Management | | | | | | | | | | |

■Board Leadership

| | | | | |

| 2024 Proxy Statement | 19 |

|

Compensation Highlights

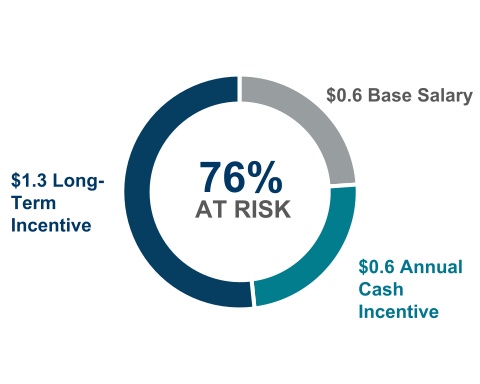

Our compensation program is designed to be transparent and has a clear emphasis on putting pay at risk. Our executive compensation philosophy centers on the core objectives of maintaining alignment with shareholder interests and retaining key management.

The Company believes that a significant portion of each NEO’s total compensation opportunity should reflect both upside potential and downside risk. As shown below, we place a strong emphasis on performance-based, shareholder-aligned incentive compensation.

For 2023, the Company’s core executive compensation program for our NEOs consisted of the following key components(1):

| | | | | | | | | | | | | | |

| Pay Element | Measurement Period | Performance Link | Description |

| Cash | Salary is based on experience, performance, and responsibilities and is benchmarked to a peer group and market survey data to align with competitive levels. |

| Cash | 1 year | Earnings CEO: 50.0% Other NEOs: 50.0% | Universal measure of business financial performance; encourages achievement of bottom-line earnings growth goals. |

Business Unit Performance 50.0% | Pre-established operational business unit performance goals that include safety, customer experience, and operational quality and efficiency metrics. |

| Performance Shares 70% | 3 years | Relative TSR 40% | Links pay to key measures generating shareholder value relative to others in the industry. |

EPS Performance 40% | Links pay to key measures generating shareholder value and financial targets. |

Clean Megawatts Installed 20% | Links pay to our Clean Energy Commitment. |

Restricted Stock Units 30% | Vest ratably over 4 years | Stock Price | Encourages retention; value dependent upon share price appreciation and four-year vesting to encourage retention. |

| We provide benefits, including pension and deferred compensation programs, change of control agreements, and limited perquisites that are designed to attract and retain our executive talent. |

(1)For additional details on our executive compensation program for our NEOs, see page 61 of this Proxy Statement. | | | | | | | | |

20 | | | 2024 Proxy Statement |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CEO AND OTHER NEOs’ TOTAL COMPENSATION |

| | | | | | | | | | |

| | 15.1% Base Salary | 17.4% Target Annual Incentive | 67.5% Long-Term Incentive | |

| CEO | | | | | |

| | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | 85% At-Risk Performance-Based Pay | |

| | | | | | | | | | |

| | 26.9% Base Salary | 20.5% Target Annual Incentive | 52.6% Long-Term Incentive | | |

| Other NEOS | | | | |

| |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | 73% At-Risk Performance-Based Pay | |

| | | | | | | | | | |

| | | | | |

| 2024 Proxy Statement | 21 |

|

Information About Our Board and Corporate Governance

Director Nomination Process

Director Qualifications

The Bylaws and the Corporate Governance Guidelines contain Board membership criteria. Under the Bylaws, a Director must be a shareholder of the Company. The Corporate Governance and Public Responsibility Committee is responsible for identifying and recommending to the Board individuals qualified to become Directors. The Board believes its members should collectively have knowledge, skills, and experience in the areas discussed below.

Skills and Experience Possessed by Our Director Nominees

Finance and Accounting

As a publicly traded company subject to the rules of the Securities and Exchange Commission (“SEC”) and the New York Stock Exchange (“NYSE”), and because we operate in a complex and highly regulated financial environment, we require strong financial, accounting and capital allocation skills and experience.

Business Operations and Strategy

As a large organization with complex operations, our Board must have a comprehensive combination of skills and experience in business operations and strategy in order to guide the development of our near- and long-term operational and strategic goals, and make sure they are sustainable, which requires knowledge about the Company, our business environment, and our customers’ perspectives.

| | | | | | | | |

22 | | | 2024 Proxy Statement |

| |

Leadership Experience in a Large Organization

Leadership experience in a large organization, at both the management and director level, provides Directors with the ability to effectively oversee management in setting, implementing, and evaluating the Company’s strategic objectives for long-term financial and operational sustainability, as well as providing invaluable experience in developing, implementing, and maintaining policies and practices for managing an effective workforce.

The Company’s Industry

Having an understanding of both the utility industry and the nuclear industry is important to understanding the challenges we face as we develop and implement our business strategy.

Public Policy and Regulatory Compliance

Operating in the heavily regulated utility industry, we are directly affected by public policy and the actions of various federal, state, and local governmental agencies.

Risk Oversight and Risk Management

Operations in our industry require the development of policies and procedures that allow for the oversight and effective management of risk.

| | | | | |

| 2024 Proxy Statement | 23 |

|

Personal Qualities of our Directors

The Board believes that diversity, utilizing a broad meaning that specifically includes race, gender, background, ethnicity, accomplishments, and other traits, is an important consideration in selecting candidates. We require our outside director search firm to make diversity a focal point of any of our searches, with an emphasis on women and ethnically diverse candidates. Although diversity is a consideration, the Board also believes it is necessary to select the best candidate overall to serve as a director. Additionally, each Director should possess the following core characteristics:

| | | | | |

| |

| High Standards | We look for individuals who set high standards and expectations for themselves and others and who demonstrate a commitment to accomplishing those standards and expectations. |

| |

| |

| Informed Judgment | Directors should be thoughtful in their deliberations. We look for individuals who demonstrate intelligence, wisdom, and thoughtfulness in decision-making. Their decision-making process should include a willingness to thoroughly discuss issues, ask questions, express reservations, and voice dissent. |

| |

| |

| Integrity and Accountability | Directors should act with integrity. We look for individuals who have integrity and strength of character in their personal and professional dealings. Our Directors should be prepared to be, and are, held accountable for their decisions. |

| |

| |