UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended September 28, 2013 |

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-9929

INSTEEL INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

North Carolina |

56-0674867 | |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

Identification No.) |

1373 Boggs Drive, Mount Airy, North Carolina 27030

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (336) 786-2141

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class Name of Each Exchange on Which Registered Common Stock (No Par Value) (Preferred Share Purchase The NASDAQ Stock Market LLC Rights are attached to and trade with the Common Stock) (NASDAQ Global Select Market)

Securities registered pursuant to Section 12(g) of the Act:

Preferred Share Purchase Rights (attached to and trade with the Common Stock)

Title of Class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to the Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer [ ] |

Accelerated filer [X] |

|

Non-accelerated filer [ ] (Do not check if a smaller reporting company) |

Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

As of March 30, 2013 (the last business day of the registrant’s most recently completed second quarter), the aggregate market value of the common stock held by non-affiliates of the registrant was $272,849,494 based upon the closing sale price as reported on the NASDAQ Global Select Market. As of October 28, 2013, there were 18,184,912 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the registrant’s proxy statement to be delivered to shareholders in connection with the 2014 Annual Meeting of Shareholders are incorporated by reference as set forth in Part III hereof.

|

TABLE OF CONTENTS | ||

|

|

Cautionary Note Regarding Forward-Looking Statements |

3 |

|

PART I | ||

|

Item 1. |

Business |

4 |

|

Item 1A. |

Risk Factors |

7 |

|

Item 1B. |

Unresolved Staff Comments |

10 |

|

Item 2. |

Properties |

10 |

|

Item 3. |

Legal Proceedings |

10 |

|

Item 4. |

Mine Safety Disclosures |

10 |

|

PART II | ||

|

Item 5. |

Market for the Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities |

10 |

|

Item 6. |

Selected Financial Data |

12 |

|

Item 7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

12 |

|

Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

20 |

|

Item 8. |

Financial Statements and Supplementary Data |

21 |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

51 |

|

Item 9A. |

Controls and Procedures |

51 |

|

Item 9B. |

Other Information |

53 |

|

PART III | ||

|

Item 10. |

Directors, Executive Officers and Corporate Governance |

53 |

|

Item 11. |

Executive Compensation |

53 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

53 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

53 |

|

Item 14. |

Principal Accounting Fees and Services |

54 |

|

PART IV | ||

|

Item 15. |

Exhibits, Financial Statement Schedules |

54 |

|

SIGNATURES |

55 | |

|

EXHIBIT INDEX |

56 | |

Cautionary Note Regarding Forward-Looking Statements

This report contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, particularly in the “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this report. When used in this report, the words “believes,” “anticipates,” “expects,” “estimates,” “intends,” “may,” “should” and similar expressions are intended to identify forward-looking statements. Although we believe that our plans, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable, they are subject to a number of risks and uncertainties, and we can provide no assurances that such plans, intentions or expectations will be achieved. Many of these risks are discussed herein under the caption “Risk Factors” and are updated from time to time in our filings with the U.S. Securities and Exchange Commission (“SEC”). You should read these risk factors carefully.

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. All forward-looking statements speak only to the respective dates on which such statements are made and we do not undertake and specifically decline any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

It is not possible to anticipate and list all risks and uncertainties that may affect our future operations or financial performance; however, they would include, but are not limited to, the following:

|

● |

general economic and competitive conditions in the markets in which we operate; |

|

● |

credit market conditions and the relative availability of financing for us, our customers and the construction industry as a whole; |

|

● |

the continuation of reduced spending for nonresidential and residential construction and the impact on demand for our products; |

|

● |

changes in the amount and duration of transportation funding provided by federal, state and local governments and the impact on spending for infrastructure construction and demand for our products; |

|

● |

the cyclical nature of the steel and building material industries; |

|

● |

fluctuations in the cost and availability of our primary raw material, hot-rolled steel wire rod, from domestic and foreign suppliers; |

|

● |

competitive pricing pressures and our ability to raise selling prices in order to recover increases in wire rod costs; |

|

● |

changes in United States (“U.S.”) or foreign trade policy affecting imports or exports of steel wire rod or our products; |

|

● |

unanticipated changes in customer demand, order patterns and inventory levels; |

|

● |

the impact of weak demand and reduced capacity utilization levels on our unit manufacturing costs; |

|

● |

our ability to further develop the market for engineered structural mesh (“ESM”) and expand our shipments of ESM; |

|

● |

legal, environmental, economic or regulatory developments that significantly impact our operating costs; |

|

● |

unanticipated plant outages, equipment failures or labor difficulties; |

|

● |

continued escalation in certain of our operating costs; and |

|

● |

the risks and uncertainties discussed herein under the caption “Risk Factors.” |

PART I

Item 1. Business

General

Insteel Industries, Inc. (“we,” “us,” “our,” “the Company” or “Insteel”) is the nation’s largest manufacturer of steel wire reinforcing products for concrete construction applications. We manufacture and market prestressed concrete strand (“PC strand”) and welded wire reinforcement (“WWR”), including ESM, concrete pipe reinforcement (“CPR”) and standard welded wire reinforcement (“SWWR”). Our products are sold primarily to manufacturers of concrete products that are used in nonresidential construction. For fiscal 2013, we estimate that approximately 90% of our sales were related to nonresidential construction and 10% were related to residential construction.

Insteel is the parent holding company for two wholly-owned subsidiaries, Insteel Wire Products Company (“IWP”), an operating subsidiary, and Intercontinental Metals Corporation, an inactive subsidiary. We were incorporated in 1958 in the State of North Carolina.

Our business strategy is focused on: (1) achieving leadership positions in our markets; (2) operating as the lowest cost producer; and (3) pursuing growth opportunities in our core businesses that further our penetration of the markets we currently serve or expand our geographic footprint. Headquartered in Mount Airy, North Carolina, we operate nine manufacturing facilities that are located in the U.S. in close proximity to our customers. Our growth initiatives are focused on organic opportunities as well as acquisitions in existing or related markets that leverage our infrastructure and core competencies in the manufacture and marketing of concrete reinforcing products.

On November 19, 2010, we, through our wholly-owned subsidiary, IWP, purchased certain assets of Ivy Steel and Wire, Inc. (“Ivy”) for approximately $50.3 million, after giving effect to post-closing adjustments (the “Ivy Acquisition”). Ivy was one of the nation’s largest producers of WWR and wire products for concrete construction applications (see Note 4 to the consolidated financial statements). Among other assets, we acquired Ivy’s production facilities located in Arizona, Florida, Missouri and Pennsylvania; production equipment located at a leased facility in Texas; and certain related inventories. We also entered into a short-term sublease with Ivy for the Texas facility. Subsequent to the acquisition, we elected to consolidate certain of our WWR operations in order to reduce our operating costs, which involved the closure of facilities in Wilmington, Delaware and Houston, Texas. These actions were taken in response to the close proximity of Ivy’s facilities in Hazleton, Pennsylvania and Houston, Texas to our existing facilities in Wilmington, Delaware and Dayton, Texas.

Internet Access to Company Information

Additional information about us and our filings with the SEC, including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments thereto, are available at no cost on our web site at http://investor.insteel.com/sec.cfm and the SEC’s web site at www.sec.gov as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information available on our web site and the SEC’s web site is not part of this report and shall not be deemed incorporated into any of our SEC filings.

Products

Our concrete reinforcing products consist of PC strand and WWR.

PC strand is a high strength seven-wire strand that is used to impart compression forces into precast concrete elements and structures, which may be either pretensioned or posttensioned, providing reinforcement for bridges, parking decks, buildings and other concrete structures. Pretensioned or “prestressed” concrete elements or structures are primarily used in nonresidential construction while posttensioned concrete elements or structures are used in both nonresidential and residential construction. For 2013, 2012 and 2011, PC strand sales represented 37%, 37% and 38%, respectively, of our consolidated net sales.

WWR is produced as either a standard or a specially engineered reinforcing product for use in nonresidential and residential construction. We produce a full range of WWR products, including ESM, CPR and SWWR. ESM is an engineered made-to-order product that is used as the primary reinforcement for concrete elements or structures, frequently serving as a replacement for hot-rolled rebar due to the cost advantages that it offers. CPR is an engineered made-to-order product that is used as the primary reinforcement in concrete pipe, box culverts and precast manholes for drainage and sewage systems, water treatment facilities and other related applications. SWWR is a secondary reinforcing product that is produced in standard styles for crack control applications in residential and light nonresidential construction, including driveways, sidewalks and various slab-on-grade applications. For 2013, 2012 and 2011, WWR sales represented 63%, 63% and 62%, respectively, of our consolidated net sales.

Marketing and Distribution

We market our products through sales representatives who are our employees. Our outside sales representatives sell multiple product lines in their respective territories, thereby reducing duplication of personnel and travel expenses as compared to the product line sales strategy previously utilized by the Company. Our sales representatives are trained in the technical applications of our products. We sell our products nationwide as well as into Canada, Mexico, and Central and South America, delivering our products primarily by truck, using common or contract carriers. The delivery method selected is dependent upon backhaul opportunities, comparative costs and customer service requirements.

Customers

We sell our products to a broad range of customers that includes manufacturers of concrete products, and to a lesser extent, distributors, rebar fabricators and contractors. In fiscal 2013, we estimate that approximately 70% of our net sales were to manufacturers of concrete products and 30% were to distributors, rebar fabricators and contractors. In many cases we are unable to identify the specific end use for our products as a high percentage of our customers sell into both the nonresidential and residential construction sectors. There were no customers that represented 10% or more of our net sales in fiscal years 2013, 2012 and 2011.

Backlog

Backlog is minimal for our business because of the relatively short lead times that are required by our customers. We believe that the majority of our firm orders existing on September 28, 2013 will be shipped prior to the end of the first quarter of fiscal 2014.

Product Warranties

Our products are used in applications which are subject to inherent risks including performance deficiencies, personal injury, property damage, environmental contamination or loss of production. We warrant our products to meet certain specifications and actual or claimed deficiencies from these specifications may give rise to claims, although we do not maintain a reserve for warranties as the historical claims have been immaterial. We maintain product liability insurance coverage to minimize our exposure to such risks.

Seasonality and Cyclicality

Demand in our markets is both seasonal and cyclical, driven by the level of construction activity, but can also be impacted by fluctuations in the inventory positions of our customers. From a seasonal standpoint, the highest level of shipments within the year typically occurs when weather conditions are the most conducive to construction activity. As a result, shipments and profitability are usually higher in the third and fourth quarters of the fiscal year and lower in the first and second quarters. From a cyclical standpoint, the level of construction activity tends to be correlated with general economic conditions although there can be significant differences between the relative performance of the nonresidential and residential construction sectors for extended periods.

Raw Materials

The primary raw material used to manufacture our products is hot-rolled carbon steel wire rod, which we purchase from both domestic and foreign suppliers. Wire rod can generally be characterized as a commodity product. We purchase several different grades and sizes of wire rod with varying specifications based on the diameter, chemistry, mechanical properties and metallurgical characteristics that are required for our end products. High carbon grades of wire rod are required for the production of PC strand while low carbon grades are used to manufacture WWR.

Pricing for wire rod tends to fluctuate based on both domestic and global market conditions. In most economic environments, domestic demand for wire rod exceeds domestic production capacity and imports of wire rod are necessary to satisfy the supply requirements of the U.S. market. Trade actions initiated by domestic wire rod producers can significantly impact the pricing and availability of imported wire rod, which during fiscal years 2013 and 2012 represented approximately 25% and 17%, respectively, of our total wire rod purchases. We believe that the substantial volume of our wire rod requirements, our strong financial condition and our desirable mix of sizes and grades represents a competitive advantage by making us a more attractive customer to our suppliers relative to our competitors.

Our ability to source wire rod from overseas suppliers is limited by domestic content requirements generally referred to as “Buy America” or “Buy American” laws that exist at both the federal and state levels. These laws generally require a domestic “melt and cast” standard for purposes of compliance. Certain segments of the PC strand market and the majority of our CPR and ESM products are certified to customers to be in compliance with the domestic content regulations.

Selling prices for our products tend to be correlated with changes in wire rod prices. However, the timing of the relative price changes varies depending upon market conditions and competitive factors. The relative supply and demand conditions in our markets determine whether our margins expand or contract during periods of rising or falling wire rod prices.

Competition

We believe that we are the largest domestic producer of PC strand and WWR. The markets in which our business is conducted are highly competitive. Some of our competitors, such as Nucor Corporation, Keystone Steel & Wire Co., Oklahoma Steel and Wire, and Gerdau Long Products North America, are vertically integrated companies that produce both wire rod and concrete reinforcing products and offer multiple product lines over broad geographic areas. Other competitors are smaller independent companies that offer limited competition in certain markets. Market participants compete on the basis of price, quality and service. Our primary competitors for WWR products are Nucor Corporation, Gerdau Ameristeel Corporation, Engineered Wire Products, Inc., Davis Wire Corporation, Oklahoma Steel & Wire Co., Inc., Concrete Reinforcements Inc. and Wire Mesh Corporation. Our primary competitors for PC strand are American Spring Wire Corporation, Sumiden Wire Products Corporation, Strand-Tech Martin, Inc. and Wire Mesh Corporation. Import competition is also a significant factor in certain segments of the PC strand market.

In response to irrationally-priced import competition from offshore PC strand suppliers, we have pursued trade cases when necessary as a means of ensuring that foreign producers were complying with the applicable trade laws and regulations. In 2003, we, together with a coalition of domestic producers of PC strand, obtained a favorable determination from the U.S. Department of Commerce (the “DOC”) in response to the petitions we had filed alleging that imports of PC strand from Brazil, India, Korea, Mexico and Thailand were being “dumped” or sold in the U.S. at a price that was lower than fair value and had injured the domestic PC strand industry. The DOC imposed anti-dumping duties ranging from 12% up to 119%, which had the effect of limiting the participation of these countries in the domestic market. In 2010, we, together with a coalition of domestic producers of PC strand, obtained favorable determinations from the DOC in response to the petitions we had filed alleging that imports of PC strand from China were being “dumped” or sold in the U.S. at a price that was lower than fair value and that subsidies were being provided to Chinese PC strand producers by the Chinese government, both of which had injured the domestic PC strand industry. The DOC imposed final countervailing duty margins ranging from 9% to 46% and anti-dumping margins ranging from 43% to 194%, which had the effect of limiting the continued participation of Chinese producers in the domestic market.

Quality and service expectations of customers have risen substantially over the years and are key factors that impact their selection of suppliers. Technology has become a critical competitive factor from the standpoint of manufacturing costs, quality and customer service capabilities. In view of our sophisticated information systems, technologically advanced manufacturing facilities, low cost production capabilities, strong market positions, and broad product offering and geographic reach, we believe that we are well-positioned to compete favorably with other producers of our concrete reinforcing products.

Employees

As of September 28, 2013, we employed 687 people. We have not experienced any work stoppages and believe that our relationship with our employees is good. However, should we experience a disruption of production, we have contingency plans in place that we believe would enable us to continue serving our customers, although there can be no assurances that a work slowdown or stoppage would not adversely impact our operating costs and overall financial results.

Financial Information

For information with respect to revenue, operating profitability and identifiable assets attributable to our business and geographic areas, see the items referenced in Item 6, Selected Financial Data; Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations; and Note 13 to the consolidated financial statements.

Environmental Matters

We believe that we are in compliance in all material respects with applicable environmental laws and regulations. We have experienced no material difficulties in complying with legislative or regulatory standards and believe that these standards have not materially impacted our financial position or results of operations. Although our future compliance with additional environmental requirements could necessitate capital outlays, we do not believe that these expenditures would ultimately have a material adverse effect on our financial position or results of operations. We do not expect to incur material capital expenditures for environmental control facilities during fiscal years 2014 and 2015.

Executive Officers of the Company

Our executive officers are as follows:

|

Name |

Age |

Position | ||

|

H.O. Woltz III |

57 |

President, Chief Executive Officer and Chairman of the Board | ||

|

Michael C. Gazmarian |

54 |

Vice President, Chief Financial Officer and Treasurer | ||

|

James F. Petelle |

63 |

Vice President - Administration and Secretary | ||

|

Richard T. Wagner |

54 |

Vice President and General Manager of IWP |

H. O. Woltz III, 57, was elected Chief Executive Officer in 1991 and has been employed by us and our subsidiaries in various capacities since 1978. He was named President and Chief Operating Officer in 1989. He served as our Vice President from 1988 to 1989 and as President of Rappahannock Wire Company, formerly a subsidiary of our Company, from 1981 to 1989. Mr. Woltz has been a Director since 1986 and also serves as President of Insteel Wire Products Company. Mr. Woltz served as President of Florida Wire and Cable, Inc. until its merger with Insteel Wire Products Company in 2002. Mr. Woltz serves on the Executive Committee of our Board of Directors and was elected Chairman of the Board in 2009.

Michael C. Gazmarian, 54, was elected Vice President, Chief Financial Officer and Treasurer in February 2007. He had previously served as Chief Financial Officer and Treasurer since 1994, the year he joined us. Before joining us, Mr. Gazmarian had been employed by Guardian Industries Corp., a privately-held manufacturer of glass, automotive and building products, since 1986, serving in various financial capacities.

James F. Petelle, 63, joined us in October 2006. He was elected Vice President and Assistant Secretary on November 14, 2006 and Vice President - Administration and Secretary on January 12, 2007. He was previously employed by Andrew Corporation, a publicly-held manufacturer of telecommunications infrastructure equipment, having served as Secretary from 1990 to May 2006, and Vice President - Law from 2000 to October 2006.

Richard T. Wagner, 54, joined us in 1992 and has served as Vice President and General Manager of the Concrete Reinforcing Products Business Unit of the Company’s subsidiary, Insteel Wire Products Company, since 1998. In February 2007, Mr. Wagner was appointed Vice President of the parent company, Insteel Industries, Inc. Prior to 1992, Mr. Wagner served in various positions with Florida Wire and Cable, Inc., a manufacturer of PC strand and galvanized strand products, since 1977.

The executive officers listed above were elected by our Board of Directors at its annual meeting held February 12, 2013 for a term that will expire at the next annual meeting of the Board of Directors or until their successors are elected and qualify. The next meeting at which officers will be elected is expected to be February 12, 2014.

Item 1A. Risk Factors

You should carefully consider all of the information set forth in this annual report on Form 10-K, including the following risk factors, before investing in any of our securities. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that are currently unknown to us or that we currently consider to be immaterial may also impair our business or adversely affect our financial condition and results of operations. We may amend or supplement these risk factors from time to time by other future reports and statements that we file with the SEC.

Our business is cyclical and can be negatively impacted by prolonged economic downturns or reduced availability of financing in the credit markets that reduce the level of construction activity and demand for our products.

Demand for our concrete reinforcing products is cyclical in nature and sensitive to changes in the economy and in the availability of financing in the credit markets. Our products are sold primarily to manufacturers of concrete products for the construction industry and used for a broad range of nonresidential and residential construction applications. Demand in these markets is driven by the level of construction activity, which tends to be correlated with conditions in the general economy as well as other factors beyond our control. The tightening in the credit markets that has persisted since fiscal 2009 could continue to unfavorably impact demand for our products by reducing the availability of financing to our customers and the construction industry as a whole. Future prolonged periods of economic weakness or reduced availability of financing could have a material adverse impact on our business, results of operations, financial condition and cash flows.

Our business can be negatively impacted by reductions in the amount and duration of government funding for infrastructure projects that reduce the level of construction activity and demand for our products.

Certain of our products are used in the construction of highways, bridges and other infrastructure projects that are funded by federal, state and local governments. Reductions in the amount of funding for such projects or the period for which it is provided could have a material adverse impact on our business, results of operations, financial condition and cash flows.

In particular, the recent U.S. government partial shutdown presents a significant risk. If the U.S. government budget process results in a prolonged shutdown, we may experience delayed orders, delayed payments, and declines in revenues, profitability, and cash flows. Additionally, we may experience related supply chain delays, disruptions, or other problems associated with financial constraints faced by our suppliers. These conditions could have a material adverse impact on our business, results of operations, financial condition, and cash flows.

Our operations are subject to seasonal fluctuations that may impact our cash flow.

Our shipments are generally lower in the first and second quarters primarily due to the reduced level of construction activity resulting from winter weather conditions together with customer plant shutdowns associated with holidays. As a result, our cash flow from operations may vary from quarter to quarter due to these seasonal factors.

Demand for our products is highly variable and difficult to forecast due to our minimal backlog and the unanticipated changes that can occur in customer order patterns or inventory levels.

Demand for our products is highly variable. The short lead times for customer orders and minimal backlog that characterize our business make it difficult to forecast the future level of demand for our products. In some cases, unanticipated downturns in demand can be exacerbated by inventory reduction measures pursued by our customers. The combination of these factors may cause significant fluctuations in our sales, profitability and cash flows.

Our customers may be adversely affected by the continued negative macroeconomic conditions and tightening in the credit markets.

Current negative macroeconomic conditions and the tightening in the credit markets could limit the ability of our customers to fund their financing requirements, thereby reducing their purchasing volume with us. Further, the reduction in the availability of credit may increase the risk of customers defaulting on their payment obligations to us. The continuation or occurrence of these events could materially and adversely impact our business, financial condition and results of operations.

Our financial results can be negatively impacted by the volatility in the cost and availability of our primary raw material, hot-rolled carbon steel wire rod.

The primary raw material used to manufacture our products is hot-rolled carbon steel wire rod, which we purchase from both domestic and foreign suppliers. We do not use derivative commodity instruments to hedge our exposure to changes in the price of wire rod as such instruments are currently unavailable in the financial markets. Beginning in fiscal 2004, a tightening of supply in the rod market together with fluctuations in the raw material costs of rod producers resulted in increased price volatility which has continued through fiscal 2013. In response to the increased pricing volatility, wire rod producers have resorted to increasing the frequency of price adjustments, typically on a monthly basis as well as unilaterally changing the terms of prior commitments.

Although changes in our wire rod costs and selling prices tend to be correlated, depending upon market conditions, there may be periods during which we are unable to fully recover increased rod costs through higher selling prices, which would reduce gross profit and cash flow from operations. Additionally, should raw material costs decline, our financial results may be negatively impacted if the selling prices for our products decrease to an even greater degree and to the extent that we are consuming higher cost material from inventory.

Our financial results can also be significantly impacted if raw material supplies are inadequate to satisfy our purchasing requirements. In addition, trade actions by domestic wire rod producers against offshore suppliers can have a substantial impact on the availability and cost of imported wire rod. The imposition of anti-dumping or countervailing duty margins by the DOC against exporting countries can have the effect of reducing or eliminating their activity in the domestic market, which is of increasing significance in view of the reductions in domestic wire rod production capacity that have occurred in recent years. If we were unable to obtain adequate and timely delivery of our raw material requirements, we may be unable to manufacture sufficient quantities of our products or operate our manufacturing facilities in an efficient manner, which could result in lost sales and higher operating costs.

Foreign competition could adversely impact our financial results.

Our PC strand business is subject to offshore import competition on an ongoing basis in that in most market environments, domestic production capacity is insufficient to satisfy domestic demand. If we are unable to purchase raw materials and achieve manufacturing costs that are competitive with those of foreign producers, or if the margin and return requirements of foreign producers are substantially lower, our market share and profit margins could be negatively impacted. In response to irrationally-priced import competition from offshore PC strand suppliers, we have pursued trade cases when necessary as a means of ensuring that foreign producers were complying with the applicable trade laws and regulations. These trade cases have resulted in the imposition of duties which have had the effect of limiting the continued participation of certain countries in the domestic market. Trade law enforcement is critical to our ability to maintain our competitive position against foreign PC strand producers that engage in unlawful trade practices.

Our manufacturing facilities are subject to unexpected equipment failures, operational interruptions and casualty losses.

Our manufacturing facilities are subject to risks that may limit our ability to manufacture products, including unexpected equipment failures and catastrophic losses due to other unanticipated events such as fires, explosions, accidents, adverse weather conditions and transportation interruptions. Any such equipment failures or events can subject us to material plant shutdowns, periods of reduced production or unexpected downtime. Furthermore, the resolution of certain operational interruptions may require significant capital expenditures. Although our insurance coverage could offset the losses or expenditures relating to some of these events, our results of operations and cash flows could be negatively impacted to the extent that such claims were not covered or only partially covered by our insurance.

Our financial results could be adversely impacted by the continued escalation in certain of our operating costs.

Our employee benefit costs, particularly our medical and workers’ compensation costs, have increased substantially in recent years and are expected to continue to rise. In March 2010, Congress passed and the President signed The Patient Protection and Affordable Care Act, which will have a significant impact on employers, health care providers, insurers and others associated with the health care industry and is expected to increase our employee health care costs. This legislation requires certain large employers to offer health care benefits to full-time employees or face potential annual penalties. To avoid these penalties, employers must offer health benefits providing a minimum level of coverage and must limit the amount that employees are charged for the coverage. Although this new requirement has been delayed generally from January 2014 to January 2015, any significant increases in the costs attributable to our self-insured health plans could adversely impact our business, financial condition and results of operations.

In addition, higher prices for natural gas, electricity, fuel and consumables increase our manufacturing and distribution costs. Most of our sales are made under terms whereby we incur the fuel costs and surcharges associated with the delivery of products to our customers. Although we have implemented numerous measures to offset the impact of the ongoing escalation in these costs, there can be no assurance that such actions will be effective. If we are unable to pass these additional costs through by raising selling prices, our financial results could be adversely impacted.

Our capital resources may not be adequate to provide for our capital investment and maintenance expenditures if we were to experience a substantial downturn in our financial performance.

Our operations are capital intensive and require substantial recurring expenditures for the routine maintenance of our equipment and facilities. Although we expect to finance our business requirements through internally generated funds or from borrowings under our $100.0 million revolving credit facility, we cannot provide any assurances these resources will be sufficient to support our business. A material adverse change in our operations or financial condition could limit our ability to borrow funds under our credit facility, which could further adversely impact our liquidity and financial condition. Any significant future acquisitions could require additional financing from external sources that may not be available on favorable terms, which could adversely impact our operations, growth plans, financial condition and results of operations.

Environmental compliance and remediation could result in substantially increased capital investments and operating costs.

Our business is subject to numerous federal, state and local laws and regulations pertaining to the protection of the environment that could require substantial increases in capital investments and operating costs. These laws and regulations, which are constantly evolving, are becoming increasingly stringent and the ultimate impact of compliance is not always clearly known or determinable because regulations under some of these laws have not yet been promulgated or are undergoing revision.

Our stock price can be volatile, often in connection with matters beyond our control.

Equity markets in the U.S. have been increasingly volatile in recent years. During fiscal 2013, our common stock traded as high as $19.37 and as low as $10.53. There are numerous factors that could cause the price of our common stock to fluctuate significantly, including: variations in our quarterly and annual operating results; changes in our business outlook; changes in market valuations of companies in our industry; changes in the expectations for nonresidential and residential construction; and announcements by us, our competitors or industry participants that may be perceived to impact us or our operations.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Insteel’s corporate headquarters and IWP’s sales and administrative offices are located in Mount Airy, North Carolina. At September 28, 2013, we operated nine manufacturing facilities located in Dayton, Texas; Gallatin, Tennessee; Hazleton, Pennsylvania; Hickman, Kentucky; Jacksonville, Florida; Kingman, Arizona; Mount Airy, North Carolina; Sanderson, Florida; and St. Joseph, Missouri.

We own all of our real estate. We believe that our properties are in good operating condition and that our machinery and equipment have been well maintained. We also believe that our manufacturing facilities are suitable for their intended purposes and have capacities adequate to satisfy the current and projected needs for our existing products.

Item 3. Legal Proceedings.

We are, from time to time, involved in various lawsuits, claims, investigations and proceedings, including commercial, environmental and employment matters, which arise in the ordinary course of business. We do not anticipate that the ultimate cost to resolve these other matters will have a material adverse effect on our financial position, results of operations or cash flows.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities.

Our common stock is listed on the NASDAQ Global Select Market under the symbol “IIIN” and has been trading on NASDAQ since September 28, 2004. As of October 23, 2013, there were 738 shareholders of record. The following table summarizes the high and low sales prices as reported on the NASDAQ Global Select Market and the cash dividend per share declared in fiscal 2013 and fiscal 2012:

|

Fiscal 2013 |

Fiscal 2012 |

|||||||||||||||||||||||

|

High |

Low |

Cash Dividends |

High |

Low |

Cash Dividends |

|||||||||||||||||||

|

First Quarter |

$ | 12.67 | $ | 10.53 | $ | 0.28 | $ | 11.25 | $ | 9.27 | $ | 0.03 | ||||||||||||

|

Second Quarter |

17.22 | 11.79 | 0.03 | 13.74 | 10.47 | 0.03 | ||||||||||||||||||

|

Third Quarter |

19.37 | 14.01 | 0.03 | 12.38 | 8.93 | 0.03 | ||||||||||||||||||

|

Fourth Quarter |

18.21 | 15.18 | 0.03 | 12.24 | 9.46 | 0.03 | ||||||||||||||||||

We currently pay a quarterly cash dividend of $0.03 per share. While we intend to pay regular quarterly cash dividends for the foreseeable future, the declaration and payment of future dividends, if any, are discretionary and will be subject to determination by the Board of Directors each quarter after taking into account various factors, including general business conditions and our financial condition, operating results, cash requirements and expansion plans. See Note 7 of the consolidated financial statements for additional discussion with respect to restrictions on our ability to make dividend payments under the terms of our revolving credit facility.

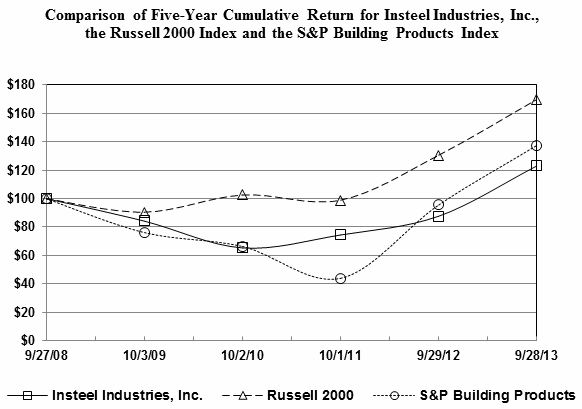

Stock Performance Graph

The line graph below compares the cumulative total shareholder return on our common stock with the cumulative total return of the Russell 2000 Index and the S&P Building Products Index for the five years ended September 28, 2013. The graph and table assume that $100 was invested on September 27, 2008 in each of our common stock, the Russell 2000 Index and the S&P Building Products Index, and that all dividends were reinvested. Cumulative total shareholder returns for our common stock, the Russell 2000 Index and the S&P Building Products Index are based on our fiscal year.

Fiscal Year Ended 9/27/08 10/3/09 10/2/10 10/1/11 9/29/12 9/28/13 Insteel Industries, Inc. Russell 2000 S&P Building Products

$

100.00

$

84.19

$

65.33

$

74.41

$

87.61

$

122.93

100.00

90.45

102.53

98.91

130.47

169.68

100.00

76.14

66.36

43.94

95.46

137.33

Issuer Purchases of Equity Securities

On November 18, 2008, our Board of Directors approved a share repurchase authorization to buy back up to $25.0 million of our outstanding common stock. Repurchases may be made from time to time in the open market or in privately negotiated transactions subject to market conditions, applicable legal requirements and other factors. We are not obligated to acquire any particular amount of common stock and may commence or suspend the program at any time at our discretion without prior notice. The share repurchase authorization continues in effect until terminated by the Board of Directors. As of September 28, 2013, there was $24.8 million remaining available for future share repurchases under this authorization. We did not repurchase any shares of our common stock during 2013 and 2012.

Rights Agreement

On April 21, 2009, the Board of Directors adopted Amendment No. 1 to Rights Agreement, effective April 25, 2009, amending the Rights Agreement dated as of April 27, 1999 between us and American Stock Transfer & Trust Company, LLC, successor to First Union National Bank. Amendment No. 1 and the Rights Agreement are hereinafter collectively referred to as the “Rights Agreement.” In connection with adopting the Rights Agreement, on April 26, 1999, the Board of Directors declared a dividend distribution of one right per share of our outstanding common stock as of May 17, 1999. The Rights Agreement also provides that one right will attach to each share of our common stock issued after May 17, 1999. Each right entitles the registered holder to purchase from us on certain dates described in the Rights Agreement one two-hundredths of a share (a “Unit”) of our Series A Junior Participating Preferred Stock at a purchase price of $46 per Unit, subject to adjustment as described in the Rights Agreement. For more information regarding our Rights Agreement, see Note 17 to the consolidated financial statements.

Item 6. Selected Financial Data.

Financial Highlights

(In thousands, except per share amounts)

|

Year Ended |

||||||||||||||||||||

|

(52 weeks) |

(52 weeks) |

(52 weeks) |

(52 weeks) |

(53 weeks) |

||||||||||||||||

|

September 28, |

September 29, |

October 1, |

October 2, |

October 3, |

||||||||||||||||

|

2013 |

2012 |

2011 |

2010 |

2009 |

||||||||||||||||

|

Net sales |

$ | 363,896 | $ | 363,303 | $ | 336,909 | $ | 211,586 | $ | 230,236 | ||||||||||

|

Earnings (loss) from continuing operations |

11,735 | 1,809 | (387 | ) | 458 | (20,940 | ) | |||||||||||||

|

Net earnings (loss) |

11,735 | 1,809 | (387 | ) | 473 | (22,086 | ) | |||||||||||||

|

Earnings (loss) per share from continuing operations (basic) |

0.65 | 0.10 | (0.02 | ) | 0.03 | (1.20 | ) | |||||||||||||

|

Earnings (loss) per share from continuing operations (diluted) |

0.64 | 0.10 | (0.02 | ) | 0.03 | (1.20 | ) | |||||||||||||

|

Net earnings (loss) per share (basic) |

0.65 | 0.10 | (0.02 | ) | 0.03 | (1.27 | ) | |||||||||||||

|

Net earnings (loss) per share (diluted) |

0.64 | 0.10 | (0.02 | ) | 0.03 | (1.27 | ) | |||||||||||||

|

Cash dividends declared |

0.37 | 0.12 | 0.12 | 0.12 | 0.12 | |||||||||||||||

|

Total assets |

212,649 | 208,552 | 216,530 | 182,505 | 182,117 | |||||||||||||||

|

Total debt |

- | 11,475 | 14,156 | - | - | |||||||||||||||

|

Shareholders’ equity |

161,056 | 149,500 | 148,474 | 147,876 | 147,070 | |||||||||||||||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The matters discussed in this section include forward-looking statements that are subject to numerous risks. You should carefully read the “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in this Form 10-K.

Overview

Our operations are entirely focused on the manufacture and marketing of concrete reinforcing products for the concrete construction industry. Our business strategy is focused on: (1) achieving leadership positions in our markets; (2) operating as the lowest cost producer; and (3) pursuing growth opportunities within our core businesses that further our penetration of the markets we currently serve or expand our geographic footprint.

On November 19, 2010, we, through our wholly-owned subsidiary, IWP, purchased certain assets of Ivy for approximately $50.3 million, after giving effect to post-closing adjustments. Ivy was one of the nation’s largest producers of WWR and wire products for concrete construction applications (see Note 4 to the consolidated financial statements). Among other assets, we acquired Ivy’s production facilities located in Arizona, Florida, Missouri and Pennsylvania; production equipment located at a leased facility in Texas; and certain related inventories. We also entered into a short-term sublease with Ivy for the Texas facility. Subsequent to the acquisition, we elected to consolidate certain of our WWR operations in order to reduce our operating costs, which involved the closure of facilities in Wilmington, Delaware and Houston, Texas. These actions were taken in response to the close proximity of Ivy’s facilities in Hazleton, Pennsylvania and Houston, Texas to our existing facilities in Wilmington, Delaware and Dayton, Texas.

Critical Accounting Policies

Our financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). Our discussion and analysis of our financial condition and results of operations are based on these financial statements. The preparation of our financial statements requires the application of these accounting principles in addition to certain estimates and judgments based on current available information, actuarial estimates, historical results and other assumptions believed to be reasonable. Actual results could differ from these estimates.

Following is a discussion of our most critical accounting policies, which are those that are both important to the depiction of our financial condition and results of operations and that require judgments, assumptions and estimates.

Revenue recognition. We recognize revenue from product sales when products are shipped and risk of loss and title has passed to the customer. Sales taxes collected from customers are recorded on a net basis and as such, are excluded from revenue.

Concentration of credit risk. Financial instruments that subject us to concentrations of credit risk consist principally of cash and cash equivalents and trade accounts receivable. Our cash is concentrated primarily at one financial institution, which at times exceeds federally insured limits. We are exposed to credit risk in the event of default by institutions in which our cash and cash equivalents are held and by customers to the extent of the amounts recorded on the balance sheet. We invest excess cash primarily in money market funds, which are highly liquid securities that bear minimal risk.

Most of our accounts receivable are due from customers that are located in the U.S. and we generally require no collateral depending upon the creditworthiness of the account. We provide an allowance for doubtful accounts based upon our assessment of the credit risk of specific customers, historical trends and other information. There is no disproportionate concentration of credit risk.

Allowance for doubtful accounts. We maintain allowances for doubtful accounts for estimated losses resulting from the potential inability of our customers to make required payments on outstanding balances owed to us. Significant management judgments and estimates are used in establishing the allowances. These judgments and estimates consider such factors as customers' financial position, cash flows and payment history as well as current and expected business conditions. It is reasonably likely that actual collections will differ from our estimates, which may result in increases or decreases in the allowances. Adjustments to the allowances may also be required if there are significant changes in the financial condition of our customers.

Inventory valuation. We periodically evaluate the carrying value of our inventory. This evaluation includes assessing the adequacy of allowances to cover losses in the normal course of operations, providing for excess and obsolete inventory, and ensuring that inventory is valued at the lower of cost or estimated net realizable value. Our evaluation considers such factors as the cost of inventory, future demand, our historical experience and market conditions. In assessing the realization of inventory values, we are required to make judgments and estimates regarding future market conditions. Because of the subjective nature of these judgments and estimates, it is reasonably likely that actual outcomes will differ from our estimates. Adjustments to these reserves may be required if actual market conditions for our products are substantially different than the assumptions underlying our estimates.

Long-lived assets. We review long-lived assets, which consist principally of property, plant and equipment, for impairment whenever events or changes in circumstances indicate that the carrying value of the asset may not be fully recoverable. Recoverability of long-lived assets to be held and used is measured based on the future net undiscounted cash flows expected to be generated by the related asset or asset group. If it is determined that an impairment loss has been incurred, the impairment loss is recognized in the period in which it is incurred and is calculated based on the difference between the carrying value and the present value of estimated future net cash flows or comparable market values. Assets to be disposed of by sale are recorded at the lower of the carrying value or fair value less cost to sell when we have committed to a disposal plan, and are reported separately as assets held for sale on our consolidated balance sheet. Unforeseen events and changes in circumstances and market conditions could negatively affect the value of assets and result in an impairment charge.

Self-insurance. We are self-insured for certain losses relating to medical and workers’ compensation claims. Self-insurance claims filed and claims incurred but not reported are accrued based upon management’s estimates of the discounted ultimate cost for uninsured claims incurred using actuarial assumptions followed by the insurance industry and historical experience. These estimates are subject to a high degree of variability based upon future inflation rates, litigation trends, changes in benefit levels and claim settlement patterns. Because of uncertainties related to these factors as well as the possibility of changes in the underlying facts and circumstances, future adjustments to these reserves may be required.

Litigation. From time to time, we may be involved in claims, lawsuits and other proceedings. The eventual outcome of such matters and the potential losses that we may ultimately incur are subject to a high degree of uncertainty. We record expenses for litigation when it is probable that a liability has been incurred and the amount of the loss can be reasonably estimated. We estimate the probability of such losses based on the advice of legal counsel, the outcome of similar litigation, the status of the lawsuits and other factors. Due to the numerous factors that enter into these judgments and assumptions, it is reasonably likely that actual outcomes will differ from our estimates. We monitor our potential exposure to these contingencies on a regular basis and may adjust our estimates as additional information becomes available or as there are significant developments.

Stock-based compensation. We account for stock-based compensation arrangements, including stock option grants, restricted stock awards and restricted stock units, in accordance with the provisions of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, Compensation — Stock Compensation. Under these provisions, compensation cost is recognized based on the fair value of equity awards on the date of grant. The compensation cost is then amortized on a straight-line basis over the vesting period. We use the Monte Carlo valuation model to determine the fair value of stock options at the date of grant, which requires us to make assumptions such as expected term, volatility and forfeiture rates to determine the stock options’ fair value. These assumptions are based on historical information and judgment regarding market factors and trends. If actual results differ from our assumptions and judgments used in estimating these factors, future adjustments to these estimates may be required.

Assumptions for employee benefit plans. We account for our defined employee benefit plans, the Insteel Wire Products Company Retirement Income Plan for Hourly Employees, Wilmington, Delaware (the “Delaware Plan”) and the supplemental employee retirement plans (each, a “SERP”) in accordance with FASB ASC Topic 715, Compensation – Retirement Benefits. Under the provisions of ASC Topic 715, we recognize net periodic pension costs and value pension assets or liabilities based on certain actuarial assumptions, principally the assumed discount rate and the assumed long-term rate of return on plan assets.

The discount rates we utilize for determining net periodic pension costs and the related benefit obligations for our plans are based, in part, on current interest rates earned on long-term bonds that receive one of the two highest ratings assigned by recognized rating agencies. Our discount rate assumptions are adjusted as of each valuation date to reflect current interest rates on such long-term bonds. The discount rates are used to determine the actuarial present value of the benefit obligations as of the valuation date as well as the interest component of the net periodic pension cost for the following year. The discount rate for the Delaware Plan and SERPs was 4.75%, 4% and 4.75% for 2013, 2012 and 2011, respectively.

The assumed long-term rate of return on plan assets for the Delaware Plan represents the estimated average rate of return expected to be earned on the funds invested or to be invested in the plan’s assets to fund the benefit payments inherent in the projected benefit obligations. Unlike the discount rate, which is adjusted each year based on changes in current long-term interest rates, the assumed long-term rate of return on plan assets will not necessarily change based upon the actual short-term performance of the plan assets in any given year. The amount of net periodic pension cost that is recorded each year is based on the assumed long-term rate of return on plan assets for the plan and the actual fair value of the plan assets as of the beginning of the year. We regularly review our actual asset allocation and, when appropriate, rebalance the investments in the plan to more accurately reflect the targeted allocation.

For 2013, 2012 and 2011, the assumed long-term rate of return utilized for plan assets of the Delaware Plan was 8%. We currently expect to use the same assumed rate for the long-term return on plan assets in 2014. In determining the appropriateness of this assumption, we considered the historical rate of return of the plan assets, the current and projected asset mix, our investment objectives and information provided by our third-party investment advisors.

The projected benefit obligations and net periodic pension cost for the SERPs are based in part on expected increases in future compensation levels. Our assumption for the expected increase in future compensation levels is based upon our average historical experience and management’s intentions regarding future compensation increases, which generally approximates average long-term inflation rates.

Assumed discount rates and rates of return on plan assets are reevaluated annually. Changes in these assumptions can result in the recognition of materially different pension costs over different periods and materially different asset and liability amounts in our consolidated financial statements. A reduction in the assumed discount rate generally results in an actuarial loss, as the actuarially-determined present value of estimated future benefit payments will increase. Conversely, an increase in the assumed discount rate generally results in an actuarial gain. In addition, an actual return on plan assets for a given year that is greater than the assumed return on plan assets results in an actuarial gain, while an actual return on plan assets that is less than the assumed return results in an actuarial loss. Other actual outcomes that differ from previous assumptions, such as individuals living longer or shorter lives than assumed in the mortality tables that are also used to determine the actuarially-determined present value of estimated future benefit payments, changes in such mortality tables themselves or plan amendments will also result in actuarial losses or gains. Under GAAP, actuarial gains and losses are deferred and amortized into income over future periods based upon the expected average remaining service life of the active plan participants (for plans for which benefits are still being earned by active employees) or the average remaining life expectancy of the inactive participants (for plans for which benefits are not still being earned by active employees). However, any actuarial gains generated in future periods reduce the negative amortization effect of any cumulative unamortized actuarial losses, while any actuarial losses generated in future periods reduce the favorable amortization effect of any cumulative unamortized actuarial gains.

The amounts recognized as net periodic pension cost and as pension assets or liabilities are based upon the actuarial assumptions discussed above. We believe that all of the actuarial assumptions used for determining the net periodic pension costs and pension assets or liabilities related to the Delaware Plan are reasonable and appropriate. The funding requirements for the Delaware Plan are based upon applicable regulations, and will generally differ from the amount of pension cost recognized under ASC Topic 715 for financial reporting purposes. During 2013, 2012 and 2011, we made contributions totaling $307,000, $206,000 and $478,000, respectively, to the Delaware Plan.

We currently expect net periodic pension costs for 2014 to be $12,000 for the Delaware Plan and $588,000 for the SERPs. Cash contributions to the plans during 2014 are expected to be $247,000 for the Delaware Plan and $290,000 for the SERPs.

A 0.25% decrease in the assumed discount rate for the Delaware Plan would have increased our projected and accumulated benefit obligations as of September 28, 2013 by approximately $80,000 and have no impact on the expected net periodic pension cost for 2014. A 0.25% decrease in the assumed discount rate for our SERPs would have increased our projected and accumulated benefit obligations as of September 28, 2013 by approximately $224,000 and $172,000, respectively, and the net periodic pension cost for 2014 by approximately $19,000.

A 0.25% decrease in the assumed long-term rate of return on plan assets for the Delaware Plan would have increased the expected net periodic pension cost for 2014 by approximately $5,000.

Recent Accounting Pronouncements.

Current Adoptions

In June 2011, the FASB issued Accounting Standards Update (“ASU”) No. 2011-05 “Comprehensive Income – Presentation of Comprehensive Income.” ASU No. 2011-05 changes the presentation of comprehensive income in the financial statements for all periods reported and eliminates the option under the previous guidance that allowed for the presentation of other comprehensive income as part of the statement of shareholders’ equity. The update allows two options for the presentation of comprehensive income: (1) a single statement of comprehensive income, which includes all components of net income and other comprehensive income; or (2) a statement of income followed immediately by a statement of comprehensive income, which includes summarized net income and all components of other comprehensive income. The amendments in this update are effective retrospectively for annual reporting periods, and interim periods within those years, beginning after December 15, 2011. We adopted ASU No. 2011-05 in the first quarter of fiscal 2013 and chose to present a single statement of comprehensive income for our interim reporting periods and separate statements of income and comprehensive income for our annual reporting periods. The adoption of ASU 2011-05 did not impact our consolidated financial statements except for the change in presentation.

Future Adoptions

In February 2013, the FASB issued ASU No. 2013-02 “Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income.” ASU No. 2013-02 requires an entity to disaggregate the total change of each component of other comprehensive income either on the face of the income statement or as a separate disclosure in the notes. This update is effective for us beginning in the first quarter of fiscal 2014. We do not expect the adoption of this update will have a material effect on our consolidated financial statements.

Results of Operations

Statements of Operations – Selected Data

(Dollars in thousands)

Year Ended September 28, 2013 Change September 29, 2012 Change October 1, 2011 Net sales Gross profit Percentage of net sales Selling, general and administrative expense Percentage of net sales Other expense (income), net N/M Restructuring charges, net Gain on early extinguishment of debt N/M Acquisition costs Bargain purchase gain Interest expense Interest income Effective income tax rate N/M Net earnings (loss) N/M N/M "N/M" = not meaningful

$

363,896

0.2%

$

363,303

7.8%

$

336,909

39,233

74.7%

22,458

(29.3%

)

31,743

10.8%

6.2%

9.4%

$

20,682

9.4%

$

18,911

(3.6%

)

$

19,608

5.7%

5.2%

5.8%

$

333

$

(188

)

(15.3%

)

$

(222

)

-

(100.0%

)

832

(90.0%

)

8,318

-

(100.0%

)

(425

)

-

-

-

-

(100.0%

)

3,518

-

-

-

(100.0%

)

(500

)

235

(62.3%

)

623

(35.0%

)

958

(14

)

(33.3%

)

(21

)

(44.7%

)

(38

)

34.8%

33.6%

$

11,735

$

1,809

$

(387

)

2013 Compared with 2012

Net Sales

Net sales for 2013 were relatively flat at $363.9 million compared with $363.3 million in 2012. Shipments for the year increased 4.6% while average selling prices decreased 4.3% from the prior year levels. The increase in shipments was primarily due to modest improvement in market conditions and demand for our products relative to the prior year. The decrease in average selling prices was driven by competitive pricing pressures. Sales for both years reflect severely depressed volumes due to the continuation of recessionary conditions in our construction end-markets.

Gross Profit

Gross profit increased 74.7% to $39.2 million, or 10.8% of net sales, in 2013 from $22.5 million, or 6.2% of net sales, in 2012. The year-over-year increase was primarily due to wider spreads between average selling prices and raw material costs relative to the prior year together with higher shipments. Gross profit for both years was unfavorably impacted by depressed shipment volumes and elevated unit conversion costs largely driven by reduced operating schedules.

Selling, General and Administrative Expense

Selling, general and administrative expense (“SG&A expense”) increased 9.4% to $20.7 million, or 5.7% of net sales, in 2013 from $18.9 million, or 5.2% of net sales, in 2012 primarily due to higher compensation expense ($1.5 million), a reduction in the gain on the settlement of life insurance policies ($460,000) and the relative year-over-year change in the cash surrender value of life insurance policies ($155,000). The increase in compensation expense was primarily driven by higher incentive plan expense due to our improved financial results in the current year. The cash surrender value of life insurance policies increased $555,000 in the current year compared with $710,000 in the prior year due to the related changes in the value of the underlying investments. These increases in SG&A expense were partially offset by lower bad debt expense ($551,000).

Gain on Early Extinguishment of Debt

A gain on the early extinguishment of debt of $425,000 was recorded in 2012 for the discount on our prepayment of the remaining balance outstanding on the subordinated note that was issued in connection with the Ivy Acquisition.

Restructuring Charges, Net

Net restructuring charges of $832,000 were recorded in 2012 that included $744,000 for equipment relocation costs and $139,000 for facility closure costs less $11,000 of net proceeds from the sale of decommissioned equipment and a $40,000 adjustment related to the remaining employee separation costs associated with plant closures and other staffing reductions.

Other Expense (Income)

Other expense for 2013 was $333,000 compared to $188,000 of other income in 2012. The other expense for the current year was primarily due to the net loss on the disposal of equipment.

Interest Expense

Interest expense decreased 62.3% to $235,000 in 2013 from $623,000 in 2012 primarily due to the reduction in average debt outstanding during 2013 and the lower interest rate on borrowings on the revolving credit facility relative to the secured subordinated promissory note associated with the Ivy Acquisition that was outstanding in the prior year prior to its prepayment in December 2011.

Income Taxes

Our effective income tax rate was 34.8% in 2013 compared with 33.6% in 2012 due to changes in permanent book versus tax differences.

Net Earnings

Net earnings were $11.7 million ($0.64 per diluted share) in 2013 compared to $1.8 million ($0.10 per share) in 2012 with the year-over-year change primarily due to the increase in gross profit partially offset by higher SG&A expense.

2012 Compared with 2011

Net Sales

Net sales increased 7.8% to $363.3 million in 2012 from $336.9 million in 2011. Shipments for 2012 increased 5.1% from 2011 and average selling prices increased 2.6%. The increase in shipments was primarily due to the full year contribution of the Ivy facilities in 2012. The increase in average selling prices was driven by price increases that were implemented to recover higher raw material costs. Sales for both years reflect severely depressed volumes due to the continuation of recessionary conditions in our construction end-markets.

Gross Profit

Gross profit decreased 29.3% to $22.5 million, or 6.2% of net sales, in 2012 from $31.7 million, or 9.4% of net sales, in 2011. The year-over-year decline was primarily due to the narrowing of spreads between selling prices and raw material costs resulting from competitive pricing pressures. Gross profit for both years was unfavorably impacted by depressed shipment volumes and elevated unit conversion costs largely driven by reduced operating schedules.

Selling, General and Administrative Expense

SG&A expense decreased 3.6% to $18.9 million, or 5.2% of net sales, in 2012 from $19.6 million, or 5.8% of net sales, in 2011 primarily due to the relative year-over-year changes in the cash surrender value of life insurance policies ($975,000), an increase in the gain on the settlement of life insurance policies ($148,000) and a reduction in consulting and professional services expense ($276,000). The cash surrender value of life insurance policies increased $710,000 in 2012 compared with a decrease of $265,000 in 2011 due to the related changes in the value of the underlying investments. These reductions in SG&A expense were partially offset by higher employee benefit ($278,000) and bad debt expense ($142,000). The increase in employee benefit expense was primarily related to an increase in supplemental retirement plan expense.

Gain on Early Extinguishment of Debt

A gain on the early extinguishment of debt of $425,000 was recorded in 2012 for the discount on our prepayment of the remaining balance outstanding on the subordinated note that was issued in connection with the Ivy Acquisition.

Restructuring Charges, Net

Net restructuring charges decreased 90.0% to $832,000 in 2012 from $8.3 million in 2011 primarily due to reduced restructuring activities associated with the Ivy Acquisition during 2012. Net restructuring charges for 2012 included $744,000 for equipment relocation costs and $139,000 for facility closure costs less $11,000 of net proceeds from the sale of decommissioned equipment and a $40,000 adjustment related to the remaining employee separation costs associated with plant closures and other staffing reductions. Net restructuring charges of $8.3 million in 2011 included $3.8 million for impairment charges related to plant closures and the decommissioning of equipment, $2.3 million for employee separation costs associated with plant closures and other staffing reductions, $1.2 million for equipment relocation costs, $533,000 for the future lease obligations associated with the closed Houston, Texas facility and $464,000 for facility closure costs. The plant closure costs were incurred in connection with the consolidation of our Texas and Northeast operations, which involved the closure of facilities in Houston, Texas and Wilmington, Delaware, and the absorption of the business by other Insteel facilities. The plant closure costs are net of a $1.6 million gain on the sale of the Wilmington, Delaware facility. The employee separation costs were related to the staffing reductions that were implemented across our sales, administration and manufacturing support functions to address the redundancies resulting from the Ivy Acquisition and in connection with the plant closures.

Acquisition Costs

Acquisition costs of $3.5 million were incurred in 2011 for the advisory, accounting, legal and other professional fees directly related to the Ivy Acquisition. The accounting requirements for business combinations require the expensing of acquisition costs in the period in which they are incurred. We did not incur any additional acquisition costs related to the Ivy Acquisition in 2012.

Bargain Purchase Gain

A bargain purchase gain of $500,000 was recorded in 2011 based on the excess of the fair value of the net assets acquired in the Ivy Acquisition over the purchase price.

Interest Expense

Interest expense decreased 35.0% to $623,000 in 2012 from $958,000 in 2011 primarily due to the lower interest rate on borrowings on the revolving credit facility in 2012 relative to the secured subordinated promissory note associated with the Ivy Acquisition that was outstanding in the prior year and prepaid in December 2011.

Income Taxes

Our effective income tax rate was 33.6% in 2012 due to changes in permanent book versus tax differences largely related to non-taxable life insurance proceeds, which were partially offset by non-deductible stock-based compensation expense. The effective income tax rate in 2011 was distorted by the impact of changes in permanent book versus tax differences largely related to non-deductible stock-based compensation expense and the establishment of a valuation allowance against certain state net operating losses and tax credits that we do not expect to realize.

Net Earnings (Loss)

Net earnings were $1.8 million ($0.10 per share) in 2012 compared with a net loss of $387,000 ($0.02 per share) in 2011 with the year-over-year change primarily due to reductions in the restructuring charges and acquisition costs incurred in connection with the Ivy Acquisition and the gain from the early extinguishment of debt partially offset by the decrease in gross profit in 2012.

Liquidity and Capital Resources

Selected Financial Data

(Dollars in thousands)

Year Ended September 28, 2013 September 29, 2012 October 1, 2011 Net cash provided by (used for) operating activities Net cash used for investing activities Net cash used for financing activities Cash and cash equivalents Working capital Total debt Percentage of total capital Shareholders' equity Percentage of total capital Total capital (total debt + shareholders' equity)

$

36,828

$

13,144

$

(2,907

)

(6,294

)

(8,191

)

(41,389

)

(15,104

)

(4,953

)

(1,629

)

15,440

10

10

83,791

79,065

75,789

-

11,475

14,156

-

7

%

9

%

$

161,056

$

149,500

$

148,474

100

%

93

%

91

%

$

161,056

$

160,975

$

162,630

Operating Activities