Pay vs Performance Disclosure

|

3 Months Ended |

12 Months Ended |

33 Months Ended |

Apr. 14, 2020 |

Dec. 31, 2022

USD ($)

|

Dec. 31, 2021

USD ($)

|

Dec. 31, 2020

USD ($)

|

Dec. 31, 2022 |

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Pay vs Performance [Table Text Block] |

|

Pay Versus Performance Set forth below is information about the

relationship between “compensation actually paid” to our NEOs and certain financial performance measures. For further information

concerning our pay-for-performance philosophy and how we align executive compensation with our performance, refer to “Executive

Compensation – Compensation Discussion and Analysis” beginning on page 28. | | | | | | | | | | | | | | | Value of Initial Fixed $100

Investment Based on: | | | | | | Year | | Summary

Compensation

Table Total

for First

CEO (1)

($) | | Compensation

Actually Paid

to First

CEO (1)(2)

($) | | Summary

Compensation

Table Total

for Second

CEO (1)

($) | | Compensation

Actually Paid

to Second

CEO (1)(2)

($) | | Average

Summary

Compensation

Table Total

for Non-CEO

NEOs (3)

($) | | Average

Compensation

Actually Paid

to Non-CEO

NEOs (3)

($) | | Altria Total

Shareholder

Return

($) | | Peer Group

Total

Shareholder

Return (4)

($) | | Net

Income (5)

($ in millions) | | Adjusted

Diluted

EPS (6)

($) | | 2022 | | | – | | | | – | | | | 16,199,700 | | | | 18,053,441 | | | | 5,304,553 | | | | 5,884,220 | | | | 116.24 | | | | 133.76 | | | | 5,764 | | | | 4.84 | | | 2021 | | | – | | | | – | | | | 12,626,972 | | | | 14,938,175 | | | | 3,917,487 | | | | 4,933,885 | | | | 111.37 | | | | 122.64 | | | | 2,475 | | | | 4.61 | | | 2020 | | | 17,835,316 | | | | 883,271 | | | | 12,238,397 | | | | 8,561,449 | | | | 4,992,680 | | | | 3,046,417 | | | | 89.62 | | | | 105.56 | | | | 4,467 | | | | 4.36 | |

| (1) | The First CEO is Howard A. Willard III who retired as Chairman and CEO effective April 14, 2020. The Second CEO is William F. Gifford, Jr. who was elected CEO effective April 16, 2020. | | (2) | The dollar amounts represent the amount of compensation actually paid to each NEO, as computed in accordance with applicable SEC rules. The dollar amounts do not reflect the actual amount of compensation earned by or paid to each NEO during the applicable year. The following adjustments were made to the amounts shown in the “Total” column of the Summary Compensation Table (“SCT”) to calculate the compensation actually paid amounts: |

| | | | Deductions from SCT Total | | Additions to SCT Total (a) | | | Year | | Grant Date Fair

Value of Equity

Awards (b)

($) | | Change in

Pension

Value (c)

($) | | 12/31 Fair Value

for Outstanding

Awards

Granted This

Year (d)

($) | | Change in

Fair Value for

Outstanding

Awards

Granted in

Prior Years (e)

($) | | Change in

Fair Value

for Vested

Awards (f)

($) | | Prior-Year

Fair Value

for Forfeited

Awards

Granted in any

Prior Year (g)

($) | | Dividend

Equivalents

Paid (h)

($) | | Pension

Service

Costs (i)

($) | | | First CEO Adjustments | | | | | | | | | | | | | | | | | | | | | | | | | | | 2022 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2021 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2020 | | | 6,269,997 | | | | 1,046,316 | | | | — | | | | — | | | | (203,296) | | | | (9,853,475) | | | | 343,661 | | | | 77,378 | | | | Second CEO Adjustments | | | | | | | | | | | | | | | | | | | | | | | | | | | 2022 | | | 6,500,044 | | | | — | | | | 5,808,532 | | | | (720,892) | | | | 127,685 | | | | — | | | | 1,011,334 | | | | 2,127,126 | | | | 2021 | | | 6,000,059 | | | | 2,487,905 | | | | 6,312,998 | | | | 1,652,234 | | | | 61,320 | | | | — | | | | 775,597 | | | | 1,997,018 | | | | 2020 | | | 5,707,085 | | | | 3,162,720 | | | | 5,180,587 | | | | (1,434,026) | | | | (203,296) | | | | — | | | | 524,929 | | | | 1,124,663 | | | | Average Non-CEO NEOs Adjustments | | | | | | | | | | | | | | | | | | | | | | | 2022 | | | 1,921,542 | | | | — | | | | 1,717,117 | | | | (212,267) | | | | 56,245 | | | | — | | | | 335,235 | | | | 604,879 | | | | 2021 | | | 1,806,406 | | | | 441,174 | | | | 1,900,621 | | | | 502,384 | | | | 22,142 | | | | — | | | | 274,281 | | | | 564,549 | | | | 2020 | | | 1,985,373 | | | | 1,622,524 | | | | 1,788,516 | | | | (553,066) | | | | (76,170) | | | | — | | | | 184,480 | | | | 317,873 | |

| |

(a) |

Fair

values shown apply updated assumptions from the grant date assumptions described in the “Stock Plans” note to our consolidated

financial statements for each applicable year’s Annual Report on Form 10-K. Fair values for PSUs take into account the probable

outcome of the performance conditions as of each year’s last day or, if earlier, the vesting date. Fair values for RSUs use the

price of Altria common stock as of the last day of each year or, if earlier, the vesting date. |

| |

(b) |

Each amount

shown is the aggregate grant date fair value of stock awards determined pursuant to FASB Codification Topic 718. |

| |

(c) |

The amounts

show the change in the present value of each NEO’s pension benefits for each year from December 31 of the prior year to December

31 of the applicable year. |

| |

(d) |

Reflects the

fair value as of December 31 for outstanding and unvested grants awarded during that same year. |

| |

(e) |

For awards granted in a prior year, reflects

the change in fair value between the year-end and the previous year-end for outstanding and unvested awards. |

| |

(f) |

For awards

that vested, reflects the change in fair value between the end of the previous year and the vest date. |

| |

(g) |

Reflects the fair

value as of the end of the prior year for awards forfeited during the year. |

| |

(h) |

Reflects the sum of

all dividend equivalents on unvested RSUs that were paid during the year. |

| |

(i) |

Reflects the actuarial present value of benefits

attributed by the pension benefit formula to services rendered by each NEO during that period. |

| (3) | The non-CEO NEOs included in both the 2021 and 2022 average compensation are Salvatore Mancuso, Murray R. Garnick, Jody L. Begley and Heather A. Newman. The non-CEO NEOs included in 2020 average compensation are Salvatore Mancuso, Murray R. Garnick, Jody L. Begley and Charles N. Whitaker. | | (4) | The peer group is the S&P 500 Food, Beverage & Tobacco Index, which is the same peer group used in the performance graph in Part II, Item 5 of our 2022 Form 10-K. | | (5) | Net income represents net earnings attributable to Altria as disclosed in the applicable year’s Annual Report on Form 10-K. | | (6) | Adjusted diluted EPS is a non-GAAP financial measure. See Exhibit A to this Proxy Statement for information regarding non-GAAP financial measures and reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures. |

|

|

|

|

| Company Selected Measure Name |

|

Adjusted Diluted EPS

|

|

|

|

| Named Executive Officers, Footnote [Text Block] |

|

(3)The non-CEO NEOs included in both the 2021 and 2022 average compensation are Salvatore Mancuso, Murray R. Garnick, Jody L. Begley and Heather A. Newman. The non-CEO NEOs included in 2020 average compensation are Salvatore Mancuso, Murray R. Garnick, Jody L. Begley and Charles N. Whitaker.

|

|

|

|

| Peer Group Issuers, Footnote [Text Block] |

|

The peer group is the S&P 500 Food, Beverage & Tobacco Index, which is the same peer group used in the performance graph in Part II, Item 5 of our 2022 Form 10-K.

|

|

|

|

| Adjustment To PEO Compensation, Footnote [Text Block] |

|

The dollar amounts represent the amount of compensation actually paid to each NEO, as computed in accordance with applicable SEC rules. The dollar amounts do not reflect the actual amount of compensation earned by or paid to each NEO during the applicable year. The following adjustments were made to the amounts shown in the “Total” column of the Summary Compensation Table (“SCT”) to calculate the compensation actually paid amounts: | | | | Deductions from SCT Total | | Additions to SCT Total (a) | | | Year | | Grant Date Fair

Value of Equity

Awards (b)

($) | | Change in

Pension

Value (c)

($) | | 12/31 Fair Value

for Outstanding

Awards

Granted This

Year (d)

($) | | Change in

Fair Value for

Outstanding

Awards

Granted in

Prior Years (e)

($) | | Change in

Fair Value

for Vested

Awards (f)

($) | | Prior-Year

Fair Value

for Forfeited

Awards

Granted in any

Prior Year (g)

($) | | Dividend

Equivalents

Paid (h)

($) | | Pension

Service

Costs (i)

($) | | | First CEO Adjustments | | | | | | | | | | | | | | | | | | | | | | | | | | | 2022 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2021 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2020 | | | 6,269,997 | | | | 1,046,316 | | | | — | | | | — | | | | (203,296) | | | | (9,853,475) | | | | 343,661 | | | | 77,378 | | | | Second CEO Adjustments | | | | | | | | | | | | | | | | | | | | | | | | | | | 2022 | | | 6,500,044 | | | | — | | | | 5,808,532 | | | | (720,892) | | | | 127,685 | | | | — | | | | 1,011,334 | | | | 2,127,126 | | | | 2021 | | | 6,000,059 | | | | 2,487,905 | | | | 6,312,998 | | | | 1,652,234 | | | | 61,320 | | | | — | | | | 775,597 | | | | 1,997,018 | | | | 2020 | | | 5,707,085 | | | | 3,162,720 | | | | 5,180,587 | | | | (1,434,026) | | | | (203,296) | | | | — | | | | 524,929 | | | | 1,124,663 | | | | Average Non-CEO NEOs Adjustments | | | | | | | | | | | | | | | | | | | | | | | 2022 | | | 1,921,542 | | | | — | | | | 1,717,117 | | | | (212,267) | | | | 56,245 | | | | — | | | | 335,235 | | | | 604,879 | | | | 2021 | | | 1,806,406 | | | | 441,174 | | | | 1,900,621 | | | | 502,384 | | | | 22,142 | | | | — | | | | 274,281 | | | | 564,549 | | | | 2020 | | | 1,985,373 | | | | 1,622,524 | | | | 1,788,516 | | | | (553,066) | | | | (76,170) | | | | — | | | | 184,480 | | | | 317,873 | |

| |

(a) |

Fair

values shown apply updated assumptions from the grant date assumptions described in the “Stock Plans” note to our consolidated

financial statements for each applicable year’s Annual Report on Form 10-K. Fair values for PSUs take into account the probable

outcome of the performance conditions as of each year’s last day or, if earlier, the vesting date. Fair values for RSUs use the

price of Altria common stock as of the last day of each year or, if earlier, the vesting date. |

| |

(b) |

Each amount

shown is the aggregate grant date fair value of stock awards determined pursuant to FASB Codification Topic 718. |

| |

(c) |

The amounts

show the change in the present value of each NEO’s pension benefits for each year from December 31 of the prior year to December

31 of the applicable year. |

| |

(d) |

Reflects the

fair value as of December 31 for outstanding and unvested grants awarded during that same year. |

| |

(e) |

For awards granted in a prior year, reflects

the change in fair value between the year-end and the previous year-end for outstanding and unvested awards. |

| |

(f) |

For awards

that vested, reflects the change in fair value between the end of the previous year and the vest date. |

| |

(g) |

Reflects the fair

value as of the end of the prior year for awards forfeited during the year. |

| |

(h) |

Reflects the sum of

all dividend equivalents on unvested RSUs that were paid during the year. |

| |

(i) |

Reflects the actuarial present value of benefits

attributed by the pension benefit formula to services rendered by each NEO during that period. |

| (3) | The non-CEO NEOs included in both the 2021 and 2022 average compensation are Salvatore Mancuso, Murray R. Garnick, Jody L. Begley and Heather A. Newman. The non-CEO NEOs included in 2020 average compensation are Salvatore Mancuso, Murray R. Garnick, Jody L. Begley and Charles N. Whitaker. | | (4) | The peer group is the S&P 500 Food, Beverage & Tobacco Index, which is the same peer group used in the performance graph in Part II, Item 5 of our 2022 Form 10-K. | | (5) | Net income represents net earnings attributable to Altria as disclosed in the applicable year’s Annual Report on Form 10-K. | | (6) | Adjusted diluted EPS is a non-GAAP financial measure. See Exhibit A to this Proxy Statement for information regarding non-GAAP financial measures and reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures. |

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

|

$ 5,304,553

|

$ 3,917,487

|

$ 4,992,680

|

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

|

$ 5,884,220

|

4,933,885

|

3,046,417

|

|

| Adjustment to Non-PEO NEO Compensation Footnote [Text Block] |

|

The dollar amounts represent the amount of compensation actually paid to each NEO, as computed in accordance with applicable SEC rules. The dollar amounts do not reflect the actual amount of compensation earned by or paid to each NEO during the applicable year. The following adjustments were made to the amounts shown in the “Total” column of the Summary Compensation Table (“SCT”) to calculate the compensation actually paid amounts: | | | | Deductions from SCT Total | | Additions to SCT Total (a) | | | Year | | Grant Date Fair

Value of Equity

Awards (b)

($) | | Change in

Pension

Value (c)

($) | | 12/31 Fair Value

for Outstanding

Awards

Granted This

Year (d)

($) | | Change in

Fair Value for

Outstanding

Awards

Granted in

Prior Years (e)

($) | | Change in

Fair Value

for Vested

Awards (f)

($) | | Prior-Year

Fair Value

for Forfeited

Awards

Granted in any

Prior Year (g)

($) | | Dividend

Equivalents

Paid (h)

($) | | Pension

Service

Costs (i)

($) | | | First CEO Adjustments | | | | | | | | | | | | | | | | | | | | | | | | | | | 2022 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2021 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2020 | | | 6,269,997 | | | | 1,046,316 | | | | — | | | | — | | | | (203,296) | | | | (9,853,475) | | | | 343,661 | | | | 77,378 | | | | Second CEO Adjustments | | | | | | | | | | | | | | | | | | | | | | | | | | | 2022 | | | 6,500,044 | | | | — | | | | 5,808,532 | | | | (720,892) | | | | 127,685 | | | | — | | | | 1,011,334 | | | | 2,127,126 | | | | 2021 | | | 6,000,059 | | | | 2,487,905 | | | | 6,312,998 | | | | 1,652,234 | | | | 61,320 | | | | — | | | | 775,597 | | | | 1,997,018 | | | | 2020 | | | 5,707,085 | | | | 3,162,720 | | | | 5,180,587 | | | | (1,434,026) | | | | (203,296) | | | | — | | | | 524,929 | | | | 1,124,663 | | | | Average Non-CEO NEOs Adjustments | | | | | | | | | | | | | | | | | | | | | | | 2022 | | | 1,921,542 | | | | — | | | | 1,717,117 | | | | (212,267) | | | | 56,245 | | | | — | | | | 335,235 | | | | 604,879 | | | | 2021 | | | 1,806,406 | | | | 441,174 | | | | 1,900,621 | | | | 502,384 | | | | 22,142 | | | | — | | | | 274,281 | | | | 564,549 | | | | 2020 | | | 1,985,373 | | | | 1,622,524 | | | | 1,788,516 | | | | (553,066) | | | | (76,170) | | | | — | | | | 184,480 | | | | 317,873 | |

| |

(a) |

Fair

values shown apply updated assumptions from the grant date assumptions described in the “Stock Plans” note to our consolidated

financial statements for each applicable year’s Annual Report on Form 10-K. Fair values for PSUs take into account the probable

outcome of the performance conditions as of each year’s last day or, if earlier, the vesting date. Fair values for RSUs use the

price of Altria common stock as of the last day of each year or, if earlier, the vesting date. |

| |

(b) |

Each amount

shown is the aggregate grant date fair value of stock awards determined pursuant to FASB Codification Topic 718. |

| |

(c) |

The amounts

show the change in the present value of each NEO’s pension benefits for each year from December 31 of the prior year to December

31 of the applicable year. |

| |

(d) |

Reflects the

fair value as of December 31 for outstanding and unvested grants awarded during that same year. |

| |

(e) |

For awards granted in a prior year, reflects

the change in fair value between the year-end and the previous year-end for outstanding and unvested awards. |

| |

(f) |

For awards

that vested, reflects the change in fair value between the end of the previous year and the vest date. |

| |

(g) |

Reflects the fair

value as of the end of the prior year for awards forfeited during the year. |

| |

(h) |

Reflects the sum of

all dividend equivalents on unvested RSUs that were paid during the year. |

| |

(i) |

Reflects the actuarial present value of benefits

attributed by the pension benefit formula to services rendered by each NEO during that period. |

| (3) | The non-CEO NEOs included in both the 2021 and 2022 average compensation are Salvatore Mancuso, Murray R. Garnick, Jody L. Begley and Heather A. Newman. The non-CEO NEOs included in 2020 average compensation are Salvatore Mancuso, Murray R. Garnick, Jody L. Begley and Charles N. Whitaker. | | (4) | The peer group is the S&P 500 Food, Beverage & Tobacco Index, which is the same peer group used in the performance graph in Part II, Item 5 of our 2022 Form 10-K. | | (5) | Net income represents net earnings attributable to Altria as disclosed in the applicable year’s Annual Report on Form 10-K. | | (6) | Adjusted diluted EPS is a non-GAAP financial measure. See Exhibit A to this Proxy Statement for information regarding non-GAAP financial measures and reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures. |

|

|

|

|

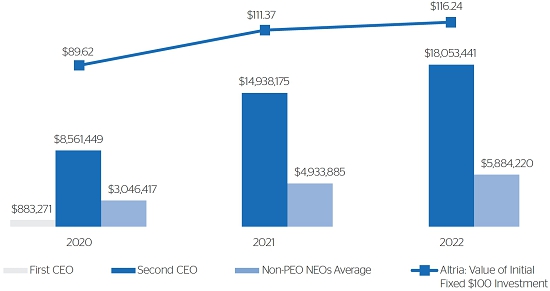

| Compensation Actually Paid vs. Total Shareholder Return [Text Block] |

|

| Compensation

Actually Paid v. Cumulative TSR |

|

|

|

|

|

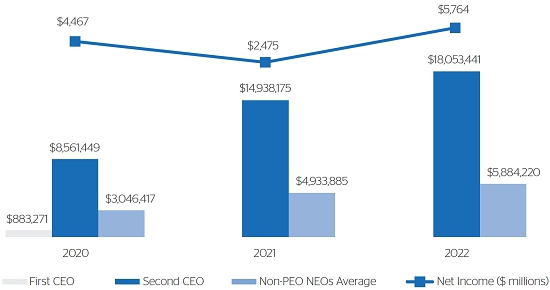

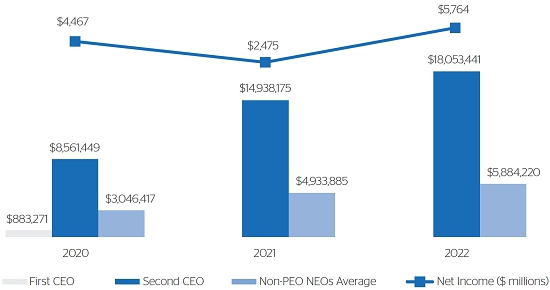

| Compensation Actually Paid vs. Net Income [Text Block] |

|

| Compensation

Actually Paid v. Net Income |

|

|

|

|

|

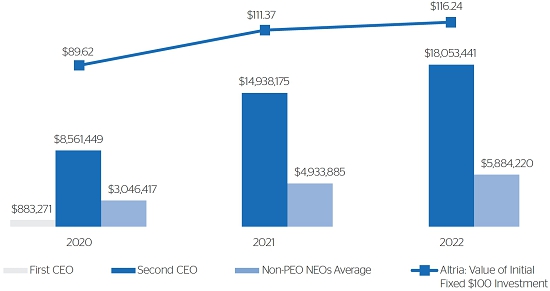

| Compensation Actually Paid vs. Company Selected Measure [Text Block] |

|

| Compensation

Actually Paid v. Adjusted Diluted EPS (1) |

|

| (1) |

Adjusted diluted EPS

is a non-GAAP financial measure. See Exhibit A to this Proxy Statement for information regarding non-GAAP financial measures and reconciliations

of these non-GAAP financial measures to the most directly comparable GAAP financial measures. |

|

|

|

|

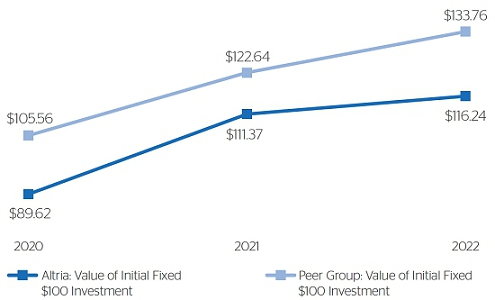

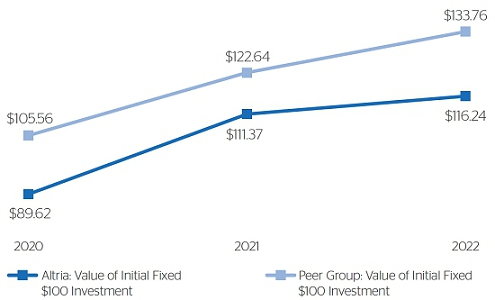

| Total Shareholder Return Vs Peer Group [Text Block] |

|

| Altria

Cumulative TSR v. Peer Group Cumulative TSR |

|

|

|

|

|

| Tabular List [Table Text Block] |

|

The following table lists the most

important performance measures that Altria used to link company performance to compensation actually paid to the NEOs for the most recently

completed fiscal year. The first five items listed are financial performance measures. Strategic initiatives are non-financial performance

measures that are defined by the Committee with respect to awards under the cash-based Annual Incentive Award and LTIP programs. | Most Important Performance Measures | | Adjusted Diluted EPS (1) | | Adjusted Discretionary Cash Flow (1) | | Total Adjusted OCI (1) | | Cash Conversion (1) | | Relative TSR | | Strategic Initiatives |

| (1) |

Adjusted diluted EPS,

adjusted discretionary cash flow, total adjusted OCI and cash conversion are non-GAAP financial measures. See Exhibit A to this Proxy

Statement for information regarding non-GAAP financial measures. |

|

|

|

|

| Total Shareholder Return Amount |

|

$ 116.24

|

111.37

|

89.62

|

|

| Peer Group Total Shareholder Return Amount |

|

133.76

|

122.64

|

105.56

|

|

| Net Income (Loss) |

|

$ 5,764,000,000

|

$ 2,475,000,000

|

$ 4,467,000,000

|

|

| Company Selected Measure Amount |

|

4.84

|

4.61

|

4.36

|

|

| PEO Name |

Howard A. Willard III

|

|

|

|

William F. Gifford, Jr.

|

| Measure [Axis]: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Measure Name |

|

Adjusted Diluted EPS

|

|

|

|

| Measure [Axis]: 2 |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Measure Name |

|

Adjusted Discretionary Cash Flow

|

|

|

|

| Measure [Axis]: 3 |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Measure Name |

|

Total Adjusted OCI

|

|

|

|

| Measure [Axis]: 4 |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Measure Name |

|

Cash Conversion

|

|

|

|

| Measure [Axis]: 5 |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Measure Name |

|

Relative TSR

|

|

|

|

| Measure [Axis]: 6 |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Measure Name |

|

Strategic Initiatives

|

|

|

|

| Howard A. Willard III [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| PEO Total Compensation Amount |

|

$ 0

|

$ 0

|

$ 17,835,316

|

|

| PEO Actually Paid Compensation Amount |

|

0

|

0

|

883,271

|

|

| Howard A. Willard III [Member] | Grant Date Fair Value of Equity Awards [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

0

|

0

|

6,269,997

|

|

| Howard A. Willard III [Member] | Change in Pension Value [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

0

|

0

|

1,046,316

|

|

| Howard A. Willard III [Member] | 12 / 31 Fair Value for Outstanding Awards Granted This Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

0

|

0

|

0

|

|

| Howard A. Willard III [Member] | Change in Fair Value for Outstanding Awards Granted in Prior Years [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

0

|

0

|

0

|

|

| Howard A. Willard III [Member] | Change in Fair Value for Vested Awards [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

0

|

0

|

(203,296)

|

|

| Howard A. Willard III [Member] | Prior-Year Fair Value for Forfeited Awards Granted in any Prior Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

0

|

0

|

(9,853,475)

|

|

| Howard A. Willard III [Member] | Dividend Equivalents Paid [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

0

|

0

|

343,661

|

|

| Howard A. Willard III [Member] | Pension Service Costs [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

0

|

0

|

77,378

|

|

| William F. Gifford, Jr. [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| PEO Total Compensation Amount |

|

16,199,700

|

12,626,972

|

12,238,397

|

|

| PEO Actually Paid Compensation Amount |

|

18,053,441

|

14,938,175

|

8,561,449

|

|

| William F. Gifford, Jr. [Member] | Grant Date Fair Value of Equity Awards [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

6,500,044

|

6,000,059

|

5,707,085

|

|

| William F. Gifford, Jr. [Member] | Change in Pension Value [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

0

|

2,487,905

|

3,162,720

|

|

| William F. Gifford, Jr. [Member] | 12 / 31 Fair Value for Outstanding Awards Granted This Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

5,808,532

|

6,312,998

|

5,180,587

|

|

| William F. Gifford, Jr. [Member] | Change in Fair Value for Outstanding Awards Granted in Prior Years [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

(720,892)

|

1,652,234

|

(1,434,026)

|

|

| William F. Gifford, Jr. [Member] | Change in Fair Value for Vested Awards [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

127,685

|

61,320

|

(203,296)

|

|

| William F. Gifford, Jr. [Member] | Prior-Year Fair Value for Forfeited Awards Granted in any Prior Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

0

|

0

|

0

|

|

| William F. Gifford, Jr. [Member] | Dividend Equivalents Paid [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

1,011,334

|

775,597

|

524,929

|

|

| William F. Gifford, Jr. [Member] | Pension Service Costs [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

2,127,126

|

1,997,018

|

1,124,663

|

|

| Non-PEO NEO [Member] | Grant Date Fair Value of Equity Awards [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

1,921,542

|

1,806,406

|

1,985,373

|

|

| Non-PEO NEO [Member] | Change in Pension Value [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

0

|

441,174

|

1,622,524

|

|

| Non-PEO NEO [Member] | 12 / 31 Fair Value for Outstanding Awards Granted This Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

1,717,117

|

1,900,621

|

1,788,516

|

|

| Non-PEO NEO [Member] | Change in Fair Value for Outstanding Awards Granted in Prior Years [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

(212,267)

|

502,384

|

(553,066)

|

|

| Non-PEO NEO [Member] | Change in Fair Value for Vested Awards [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

56,245

|

22,142

|

(76,170)

|

|

| Non-PEO NEO [Member] | Prior-Year Fair Value for Forfeited Awards Granted in any Prior Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

0

|

0

|

0

|

|

| Non-PEO NEO [Member] | Dividend Equivalents Paid [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

335,235

|

274,281

|

184,480

|

|

| Non-PEO NEO [Member] | Pension Service Costs [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

| Adjustment to Compensation Amount |

|

$ 604,879

|

$ 564,549

|

$ 317,873

|

|