udt_10k-123110.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

FORM 10-K

(Mark One):

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2010

|

|

OR

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission File Number 001-09327

UNIVERSAL DETECTION TECHNOLOGY

(Exact name of registrant as specified in its charter)

|

California

|

|

95-2746949

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

340 North Camden Drive, Beverly Hills, CA

|

|

90210

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (310) 248-3655

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, no par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. The aggregate market value of the common stock held by non-affiliates as of June 30, 2010 was $2,448,864. As of April 15, 2011, there were 3,587,599,829 shares of the registrant’s common stock outstanding.

FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, which we refer to in this annual report as the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, which we refer to in this annual report as the Exchange Act. Forward-looking statements are not statements of historical fact but rather reflect our current expectations, estimates and predictions about future results and events. These statements may use words such as "anticipate," "believe," "estimate," "expect," "intend," "predict," "project" and similar expressions as they relate to us or our management. When we make forward-looking statements, we are basing them on our management's beliefs and assumptions, using information currently available to us. These forward-looking statements are subject to risks, uncertainties and assumptions, including but not limited to, risks, uncertainties and assumptions discussed in this annual report. Factors that can cause or contribute to these differences include those described under the headings "Risk Factors" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations."

If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we projected. Any forward-looking statement you read in this annual report reflects our current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, growth strategy and liquidity. All subsequent written and oral forward-looking statements attributable to us or individuals acting on our behalf are expressly qualified in their entirety by this paragraph. You should specifically consider the factors identified in this annual report which would cause actual results to differ before making an investment decision. We are under no duty to update any of the forward-looking statements after the date of this annual report or to conform these statements to actual results.

ITEM 1. DESCRIPTION OF BUSINESS

Universal Detection Technology (the "Company," “UDT” or "We") is engaged in the marketing and resale of detection devices for chemical, biological, radiological, nuclear, and explosive (CBRNE) threats. Through agreements with various third parties we supply bioterrorism detection kits capable of detecting anthrax, ricin, botulinum, plague, and SEBs, mold detection kits, chemical detection equipment, radiation detection systems, and counter-terrorism training references.

We have entered into supply and distribution agreements with four parties enabling us to supply a host of products and services for detection of hazardous materials and training references. By combining our in-house experience and knowledge and outside expertise offered by various consultants and third parties, we have added threat evaluation and consulting services, and training courses to our services. We sell and market security and counter-terrorism products including bioterrorism detection kits, chemical detectors, radiation detection systems, and training references. Some of the products and services we offer have not been sold to date and there is no guarantee that any of them will be demanded and sold in the market in the future. We plan to continue expanding our product base and intend to sell products to more users inside and outside the U.S. Our strategy is to generate sales by enhancing our web presence and marketing the Company as a supplier of complete CBRNE detection equipment. We plan to attend various industry trade shows and to offer products in certain training scenarios so that first responders can become more familiar with our products. Our target customer markets primarily consist of first responders with some emphasis on the bioterror and military defense market. Our geographical customer focus is on the U.S., Europe, and Asia. There is no guarantee that we will succeed in implementing this strategy or if implemented, that this strategy will be successful.

In 2010 we realized revenues of $5,368 from sales. We have incurred losses for the fiscal years ended December 31, 2010 and 2009 in the approximate amounts of $2.2 and$4.6 million, respectively, and have an accumulated deficit of $45.4 million as of December 31, 2010. At December 31, 2010, we were in default on certain debt obligations totaling approximately $428,240, in addition to accumulated interest of approximately $652,920. We require approximately $1.2million in the next 12 months to repay debt obligations. We do not anticipate that our cash on hand is adequate to meet our operating expenses over the next 12 months. In addition, we do not have adequate capital to repay all of our debt currently due and becoming due in the next 12 months. We principally expect to raise funds through the sale of equity or debt securities. During the past 12 months, management spent the substantial majority of its time on sales and marketing of Company’s products and services. These activities diverted management from capital raising activities. We will actively continue to pursue additional equity or debt financing in the coming months, but cannot provide any assurances that it will be successful or on terms that are acceptable to us. If we are unable to pay our debts as they become due and are unable to obtain financing on terms acceptable to us, or at all, we will not be able to accomplish any or all of our initiatives and will be forced to consider other alternatives including suspending our business operations.

INDUSTRY BACKGROUND

The tragic events of September 11, 2001 redefined a new age of public safety and security, not only for the United States, but also for the entire world. In the wake of the tragedy, the world was shocked to learn of another nontraditional, deadly asymmetric weapon was being deployed: lethal bioagents. A week after 9/11, envelopes containing anthrax, delivered by the U.S. Postal Service, were sent to five news media outlets, and on October 9th, two U.S. Senate offices.

By November 2001, 22 people in four states and the District of Columbia contracted anthrax, many of them through the tainting of letters via the postal sorting machines. In all, the bioterrorism attacks claimed six lives.

The Commission on the Prevention of Weapons of Mass Destruction Proliferation and Terrorism, led by an independent U.S. congressional committee, asserts that a large scale biological attack, expected to hit somewhere in the world by the end of 2013, has yet to be seen.

Along with the grave predictions in the December 2008 report, World at Risk, the Commission listed recommendations on how the government can reduce the risk of a biological attack. In January 2010, the commission issued a report card following up on those recommendations. For its efforts to “enhance the nation’s capabilities for rapid response to prevent biological attacks from inflicting mass casualties,” the government received an “F” letter grade.

The United States Department of Homeland Security was formed to consolidate the federal government's efforts to secure the U.S. homeland, with the primary goal being an America that is stronger, safer, and more secure. The private sector also has responded to the need for preparedness against bioterrorism by developing numerous anti-terror products and services. As a result a market for anti-terror products and counter-attack products in the bioagent, nuclear, physical and radiological spheres has developed and continues to expand.

OUR SOLUTIONS

Universal Detection Technology is a supplier of equipment and services used for detection of:

|

|

·

|

Radiological and Nuclear threats

|

The chemical detection kits offered by Universal Detection Technology serve to equip first responders and military personnel with tools that rapidly identify the presence of a chemical agent threat, such as extreme levels of acidity or basicity, chlorine/fluoride, hydrogen sulfide and sulfur dioxide. Designed for use in the field for first responders or military personnel, the "Chameleon" detection system offers hands-free detection for harmful chemical agents and eliminates the need for a liquid sample. Users wear a portable chemical detection kit on their forearm. Each armband has a cassette holder containing up to ten (10) small cassettes, each of which can detect a unique chemical agent and identify its presence through a clear color-changing indicator. The Chameleon armband is fully functioning in extreme temperatures (-30 C to 50 C or -22 F to 122 F), and can operate while fully immersed in water. The Chameleon armband is a hand-held chemical detection device which we market and sell to first responders. We purchase and distribute the Chameleon device from Morphix Technologies under an open-ended supply and distribution agreement. To date, we have sold a nominal number of such units resulting in insignificant revenue amounts. We have no exclusive rights under the distribution agreement and the agreement may be terminated upon 30 days prior notice by either party, or immediately upon a breach of the agreement. Under the terms of the Agreement, we are permitted to sell these products within the United States only.

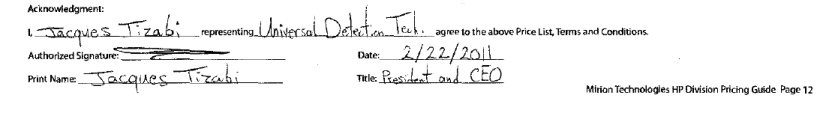

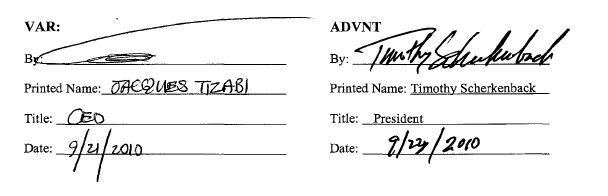

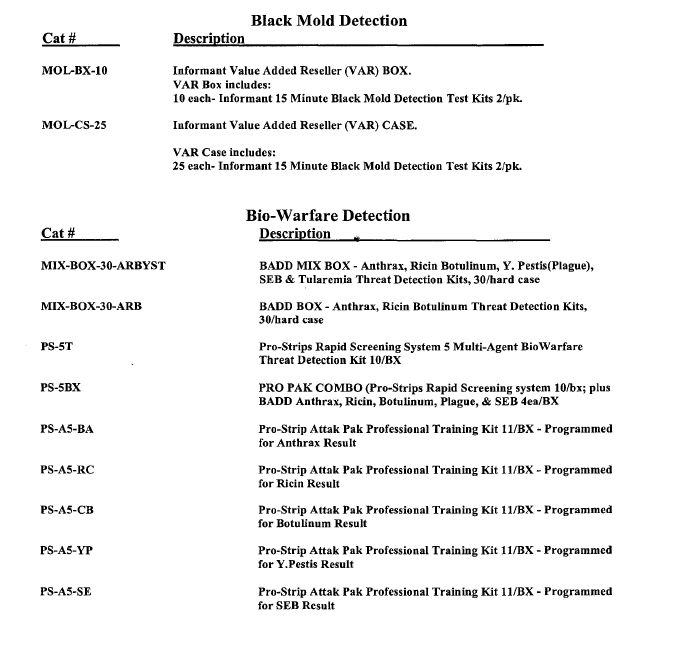

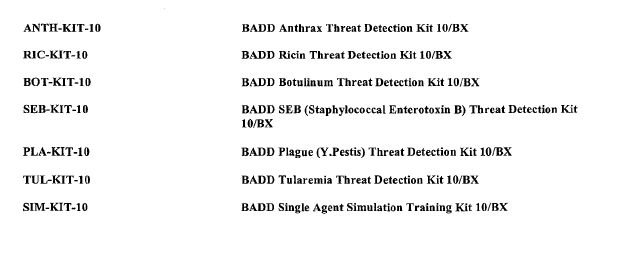

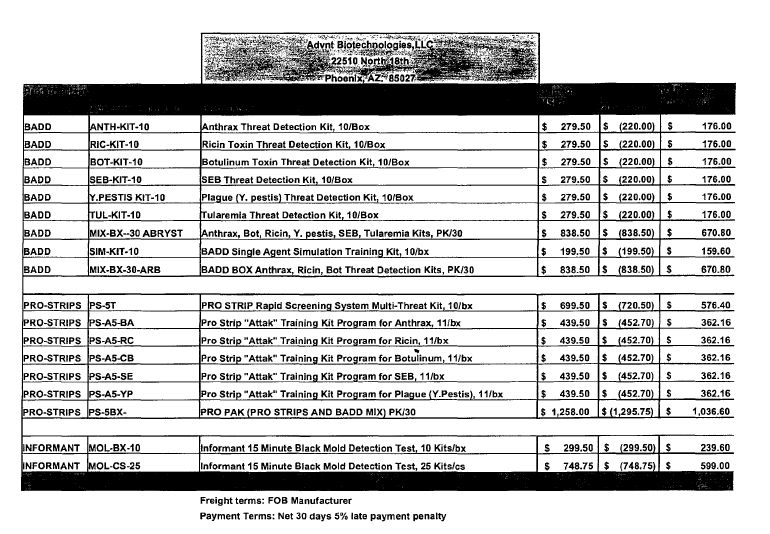

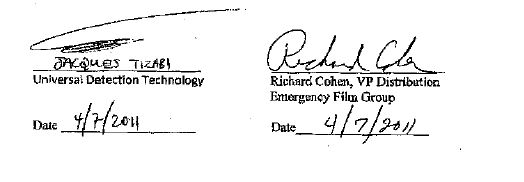

The Company’s biological detection equipment gives first responders the ability to immediately identify the presence of deadly agents in a sample. These biological detection kits are handheld assays capable of detecting anthrax, ricin toxin, botulinum, plague, SEBs, and tularemia. The Company is in the process of adding more biological agents to the list of the threats that these handheld kits can identify. The detection kits are sold as TS-10-5, TS-10-T-5, ANT-12, RIC-12, BOT-12, PLA-12, SEB-12, TUL-12. We purchase and distribute these kits from Advnt Biotechnologies, LLC under a one year VAR and distribution agreement. During 2010, we have sold approximately 80 of such units. A majority of our revenues in 2010 were derived from the sales of these units. We have no exclusive rights under the distribution agreement. The agreement may be terminated by either party upon 60 days prior notice by either party or immediately upon a breach of the agreement. Under the terms of the agreement, we are permitted to sell these products throughout the world with no geographic restrictions.

In February 2011, The Company entered into a reseller agreement with Mirion Technologies Inc. Through the agreement, the Company offers nuclear detection and monitoring devices created and made by Mirion that include electronic dosimetry and teledosimetry devices. We have no exclusive rights under the distribution agreement. Under the terms of the original agreement, we are permitted to sell these products in the United States only. However, we have amended the agreement via various items of correspondence with Mirion such that we can sell these products in other parts of the world, including Japan. In addition to electronic dosimetry and teledosimetry, other best-in-breed solutions include contamination and clearance applications, personnel and vehicle/cargo gateway monitors and portable survey meters. The Company, under its agreement with Mirion, also provides innovative passive dosimetry systems for measurement of cumulative radiation exposures. Radiation detection product lines include:

|

|

·

|

Active Dosimetry, Teledosimetry and Portable Instruments

|

|

|

·

|

Contamination and Clearance

|

|

|

·

|

Passive Dosimetry Systems

|

UDT’s Mold detection kit utilizes a highly accurate testing technology called immunochromatographic assay, also known as a rapid test or Hand-Held Assay (HHA). These devices have been used for over 30 years in the medical field for detecting disease, fertility, drugs of abuse and respiratory disorders. Designed to rapidly detect the presence of specific substances in field-collected samples, HHA’s have proven to be an indispensable tool for saving countless lives while reducing the time it takes to acquire results. Unlike the ATP test which detects any and all living cells, regardless of what those cells are, UDT’s kits detect only specific species of Aspergillus, Penicillium and Stachybotrys such as Stachybotrys chlorohalonata, Stachybotrys microspora, Stachybotrys echinata and Stachybotrys chartarum, in addition to certain Aspergillus and Penicillium sub-species. Each kit is individually packaged and includes everything necessary to run the test. No additional collection kits, readers or electronics are required. The Mold detection kit is sold as the MDK-2. We purchase and distribute MDK-2 from Advnt Biotechnologies LLC under the agreement described above. During 2010, we did not sell any MDK-2 units.

Universal Detection Technology has also situated itself to provide various counter-terrorism services. Such services include training courses for first responders, event security, threat evaluation & consulting, and DVDs aimed at providing information and training regarding combating terrorism and managing emergency situations. Through a reseller agreement with Detrick Lawrence Corporation and its division, the Emergency Film Group, we market and sell a series of DVD’s related to combating terrorism and handling emergency situations and first response. To date, we have sold only a nominal amount of these services and products and the resulting revenue for 2010 was insignificant.

MARKETING AND SALES

Our sales and marketing plan includes strategic partnership agreements and retention of our in-house staff and outside consultants. The Company has retained the services of consultants to market its products in the United States and internationally. In the United States, we plan to continue presenting our technologies at industry events and trade shows. We also retain domestic distributors and consultants to arrange meetings with and presentations to building owners and operators, government officials in charge of decisions for safety and security of government and private venues and buildings, homeland security officials, and security companies. In 2010 we continued to aggressively use the internet to market and promote Universal Detection Technology and its products and services to the public. This strategy includes creation of an interactive and informational presence through our website and use of various third parties to bring traffic to our website. We have hired an outside consultant to help expedite the changes and enhancements to our website. We have been successful in generating traffic to the Universal Detection website. We intend to do more internet marketing and search engine optimization activities in 2011.

We also plan to develop brand recognition for our Company and for our product through attendance at national and international defense related exhibitions, use of print and video promotional materials, and by granting interviews to national and international news media.

In October 2010, we registered as supplier in Raytheon Corporation's supplier network database. That registration allows us to post, in that database, a selection of the products we are authorized to resell. To date, we have generated no purchase orders from this data base registration and we can make no assurance that any sales will be generated through this database listing.

In September of 2010, we sold approximately $2,000 of biological weapons detection kits and training test kits to Boeing Corporation under a stand-alone purchase order. The order was for 10 training test kits and 20 five-agent biological weapons detection kits. To date, Boeing has not ordered any other product form us and we can make no assurances that Boeing will ever order additional product from us in the future.

We currently sell and plan to sell our products through a combination of unsolicited telephone orders, electronically generated sales via our website and in follow up to customer meetings or tradeshows.

MANUFACTURING

Currently, we do not have any manufacturing capabilities. In the past we have used original equipment manufacturers to manufacture our products. In addition to our own brands we also market third party brands that are related to our field of business. We are not obligated to continue to work with any of our current suppliers. As such, we may choose to work with other suppliers in the future. Should any of our supply and distribution agreements be terminated, we believe we can source adequate replacement supply parties and products without causing any material disruption to our business.

EMPLOYEES

As of December 31, 2010, we had a total of three employees. We also employ outside consultants from time to time to provide various services. None of our employees are represented by a labor union. We consider our employee relations to be good.

COMPETITION

We face intense competition from a number of companies that offer products in our targeted application areas. Our competitors may offer or be developing products superior to ours. Our competitors may be significantly better financed than us. There are various technological approaches available to our competitors and us that may be applicable to the detection of pathogens in the air or on surfaces, and the feasibility and effectiveness of these techniques has yet to be fully evaluated or demonstrated. Several companies provide or are in the process of developing instruments for detection of bioterrorism agents. Such technologies include a diverse range of products from PCR and DNA analyzers to handheld immunoassay technologies. For example, Northrup Grumman supplies a system called the BDS, which is a large machine that collects air samples from areas that are being monitored and after performing DNA amplification tests for the DNA of the anthrax bacteria. The bio-detection kits we sell, on the other hand, are small handheld assays that work based on sandwich immunoassay technology.

We also expect to encounter intense competition from a number of new development-stage companies that continue to enter the bioterrorism detection device market. Our competitors may succeed in developing or marketing technologies and products that are more effective or commercially attractive than our potential products or that render our technologies and potential products obsolete. As these companies develop their technologies, they may develop proprietary positions that prevent us from successfully commercializing

our products.

INTELLECTUAL PROPERTY

The Company does not own any intellectual property rights with respect to the products it markets and sells. As such, the Company may be at a competitive disadvantage with respect to protecting its ability to continue to market and sell any particular device, even if such device is in high demand. In contrast, many of the Company's competitors develop proprietary technologies and devices which compete with the products marketed by and sold by the Company. As such, such competitors can control the marketing, sales and further development of their product offerings in a manner that the Company cannot. Because the Company is a re-seller of products developed by other parties, it cannot control its product offerings as well as its competitors may be able to.

GENERAL

The Company was formed on December 24, 1971 in the State of California under the name Pollution Research and Control Corporation. It has operated continuously since that date. In August, 2003 the Company changed its name to Universal Detection Technology.

ITEM 1A. RISK FACTORS

YOU SHOULD READ THE FOLLOWING DISCUSSION AND ANALYSIS TOGETHER WITH OUR CONSOLIDATED FINANCIAL STATEMENTS AND RELATED NOTES INCLUDED ELSEWHERE IN THIS ANNUAL REPORT. SOME OF THE INFORMATION CONTAINED IN THIS DISCUSSION AND ANALYSIS OR SET FORTH ELSEWHERE IN THIS ANNUAL REPORT, INCLUDING INFORMATION WITH RESPECT TO OUR PLANS AND STRATEGIES FOR OUR BUSINESS, INCLUDES FORWARD-LOOKING STATEMENTS THAT INVOLVE RISKS AND UNCERTAINTIES. YOU SHOULD REVIEW THE "RISK FACTORS" SECTION OF THIS REPORT FOR A DISCUSSION OF IMPORTANT FACTORS THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THE RESULTS DESCRIBED IN OR IMPLIED BY THE FORWARD-LOOKING STATEMENTS CONTAINED IN THIS REPORT. IF ANY OF THE FOLLOWING RISKS ACTUALLY OCCUR, OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS COULD SUFFER.

OUR INDEPENDENT AUDITORS' REPORT EXPRESSES DOUBT ABOUT OUR ABILITY TO CONTINUE AS A GOING CONCERN.

Our independent auditors' report, dated April 15, 2011 includes an explanatory paragraph expressing substantial doubt as to our ability to continue as a going concern, due to our working capital deficit at December 31, 2010. We have experienced operating losses since the date of the auditors' report. Our auditor's opinion may impede our ability to raise additional capital on terms acceptable to us. If we are unable to obtain financing on terms acceptable to us, or at all, we will not be able to accomplish any or all of our initiatives and will be forced to consider steps that would protect our assets against our creditors. If we are unable to continue as a going concern, your entire investment in us could be lost.

WE ARE IN DEFAULT OF A SUBSTANTIAL PORTION OF OUR DEBT AND DO NOT HAVE ADEQUATE CASH TO FUND OUR WORKING CAPITAL NEEDS. OUR FAILURE TIMELY TO PAY OUR INDEBTEDNESS MAY REQUIRE US TO CONSIDER STEPS THAT WOULD PROTECT OUR ASSETS AGAINST OUR CREDITORS.

If we cannot raise additional capital, we will not be able to repay our debt or pursue our business strategies as scheduled, or at all, and we may cease operations. We have been unable to pay all of our creditors and certain other obligations in accordance with their terms, and as a result, at December 31, 2010 we are in default on a portion of our debt totaling approximately $428,240 excluding accumulated interest of approximately $652,920. In the aggregate, as of December 31, 2010, we have approximately $1.9 million in debt obligations, including interest, owing within the next 12 months. We cannot assure you that any of these note-holders will agree to extend payment of these debt obligations or ultimately agree to revise the terms of this debt to allow us to make scheduled payments over an extended period of time.

We have nominal cash on hand and short-term investments and we do not expect to generate material cash from operations within the next 12 months. We have attempted to raise additional capital through debt or equity financings and to date have had limited success. The downtrend in the financial markets has made it extremely difficult for us to raise additional capital. If we are unable to raise capital successfully, or reduce our debt through other means, we may be unable to continue operations.

THE COMPANY DOES NOT OWN ANY PROPRIETARY OR INTELLECTUAL PROPERTY RIGHTS IN THE PRODUCTS IT MARKETS AND SELLS

The Company does not own any intellectual property rights with respect to the products it markets and sells. The Company is a "reseller" of products available to it under supply and distribution agreements. As such, the Company may be at a competitive disadvantage with respect to protecting its ability to continue to market and sell any particular device, even if such device is in high demand. The Company cannot assure the availability of the products it sells or any improvements on such products. In addition, should such products become the subject of infringement claims by third parties, the Company may be unable to continue selling such products while such claims are unresolved. The Company would be forced to rely on the efforts of the owners of the products and underlying technologies to defend such suits should they arise. Such legal challenges, should they arise, would be detrimental to our operations. The Company believes it could source other suppliers of products should any of its suppliers become unable to sell product for any reason, however there can be no assurance that such replacement suppliers can be found timely or upon terms acceptable to the Company, if at all.

WE HAVE NO ABILITY TO FINANCE SIGNFICANT ORDERS OF OUR PRODUCTS OR TO PREPAY FOR ORDERS THAT MAY REQUIRE SUCH PAYMENT; WE MAY BE UNABLE TO TIMELY FULFILL ORDERS, IF AT ALL

The Company is a "reseller" of products available to it under supply and distribution agreements.When we obtain products for resale to our customers, we must be able to finance the purchase of such products. When the quantities and/or unit prices are low or nominal, we can finance that acquisition through existing cash, or require pre-payment from our customers, or request that the supply invoices be payable at a point in the future subsequent to the collection of the purchase price from our customers. The products we offer vary in price from several hundred dollars per unit to several thousand dollars per unit. From time to time, our management has made loans to the Company the proceeds of which are used for general operations including the acquisition of limited amount of product for demonstration and resale. Currently, we believe that none of our accounts receivable would be attractive to commercial finance lenders or factors as a means to finance product acquisition. Should we be successful in generating significant purchase requests for the products we market and sell, we may be unable to process those orders due to a lack of financing opportunities and a lack of cash on hand. While we may attempt to structure such orders, should they arise, in a way that provides for payment in advance from customers, or payment of invoices after customer collection, or upon a factoring or other finance arrangement, there can be no assurance that we can structure the financing terms in a manner that supports product acquisition in large quantities, if at all. In addition, we have no control over how quickly our suppliers will make product available to us. Even assuming we can finance orders of all sizes, we must rely upon our suppliers to provide product and ship product in a timely manner. However, we cannot control the timing and shipment of the products that we resell. If we are able to generate purchase orders, we may be unable to fulfill them timely and upon financing terms acceptable to us or our suppliers and customers, which would be detrimental to our operations.

THE SECRETARY OF STATE OF CALIFORNIA HAS ASSIGNED A "SUSPENDED" STATUS TO OUR CORPORATE ENTITY WHICH MAKES US VULNERABLE TO CHALLENGE AND UNABLE TO TAKE ACTIONS THAT CORPORATIONS IN GOOD STANDING MAY TAKE

Due to a failure to timely file certain state and franchise tax returns in the State of California, the Secretary of State of California has suspended our corporate status. We have since made all filings required by the Franchise Tax Board in the State of California, together with all fees, taxes and penalties due. We fully expect the status of the corporation to be restored to "active" and for the Company to be in good standing in the State of California. Until restored we have limited abilities to function as a corporation under the laws of the State of California and we are vulnerable to suit and challenge of our activities since our suspended status became effective. We if are unable to promptly restore our good standing, our operations will be adversely affected, which would be detrimental to our shareholders.

WE HAVE A HISTORY OF LOSSES AND WE DO NOT ANTICIPATE THAT WE WILL BE PROFITABLE IN FISCAL 2011.

We do not anticipate generating significant sales. We have not been profitable in the past years and had an accumulated deficit of approximately $45.4million at December 31, 2010. We have had little revenues from sales of our products since the beginning of fiscal 2002, the commencement of our entry in the counter terrorism market. During the fiscal years ended December 31, 2010 and 2009, we had losses of $2.2 and$4.6 million, respectively. During fiscal 2010, we had gross revenues of $5,368. Achieving profitability depends upon numerous factors, including our ability to develop, market, and sell commercially accepted products timely and cost-efficiently. We do not anticipate that we will be profitable in fiscal 2011.

IF WE OBTAIN FINANCING, EXISTING SHAREHOLDER INTERESTS MAY BE DILUTED.

If we raise additional funds by issuing equity or convertible debt securities, the percentage ownership of our shareholders will be diluted. In addition, any convertible securities issued may not contain a minimum conversion price, which may make it more difficult for us to raise financing and may cause the market price of our common stock to decline because of the indeterminable overhang that is created by the discount to market conversion feature. In addition, any new securities could have rights, preferences and privileges senior to those of our common stock. Furthermore, we cannot assure you that additional financing will be available when and to the extent we require or that, if available, it will be on acceptable terms.

MANAGEMENT HAS LLIMITED EXPERIENCE IN SALES AND DISTRIBUTION. WE MAY NOT BE ABLE TO MARKET AND DISTRIBUTE PRODUCTS EFFECTIVELY, WHICH COULD HARM OUR FUTURE PROSPECTS.

If we are unable to establish a successful sales, marketing, and distribution operation, we will not be able to generate sufficient revenue in order to maintain operations. We have limited experience in marketing or distributing new products. We have limited experience in developing, training, or managing a sales force. If we choose to establish a direct sales force, we will incur substantial additional expense. We may not be able to build a sales force on a cost effective basis or at all. Any direct or internet marketing and sales efforts may prove to be unsuccessful. In addition, our marketing and sales efforts may be unable to compete with the extensive and well-funded marketing and sales operations of some of our competitors. We also may be unable to engage qualified distributors. Even if engaged, they may fail to satisfy financial or contractual obligations to us, or adequately market our products.

OUR PRODUCTS MAY NOT BE COMMERCIALLY ACCEPTED WHICH WILL ADVERSELY AFFECT OUR REVENUES AND PROFITABILITY.

Our ability to enter into the bioterrorism detection device market, establish brand recognition and compete effectively depends upon many factors, including broad commercial acceptance of our products. If our products are not commercially accepted, we will not recognize meaningful revenue and may not continue to operate. The success of our products will depend in large part on the breadth of information these products capture and the timeliness of delivery of that information. The commercial success of our products also depends upon the quality and acceptance of other competing products, general economic and political conditions and other factors, all of which can change and cannot be predicted with certainty. We cannot assure you that our new products will achieve market acceptance or will generate significant revenue.

EXISTING AND DEVELOPING TECHNOLOGIES MAY ADVERSELY AFFECT THE DEMAND FOR OUR PRODUCTS.

Our industry is subject to rapid and substantial technological change. Developments by others may render our technologies and planned products noncompetitive or obsolete, or we may be unable to keep pace with technological developments or other market factors. Competition from other companies, universities, governmental research organizations and others diversifying into our field is intense and is expected to increase.

SHARES ISSUED UPON THE EXERCISE OF OUR OUTSTANDING OPTIONS AND WARRANTS, OR UPON THE CONVERSION OF PROMISSORY NOTES, MAY DILUTE YOUR STOCK HOLDINGS AND ADVERSELY AFFECT OUR STOCK PRICE.

If exercised, our outstanding options and warrants will cause immediate and substantial dilution to our stockholders. We have issued options and warrants to acquire our common stock to our employees, consultants, and investors at various prices, some of which are or may in the future be below the market price of our stock. As of December 31, 2010, we had outstanding options and warrants to purchase a total of 539,750shares of common stock. Of these options and warrants, all have exercise prices at or above the recent market price of $0.001 per share (as of April 8, 2011) and none have exercise prices at or below this price. In addition, because of our financial condition and substantial indebtedness and our need to raise capital, from time to time we have converted outstanding debt obligations into common stock. During 2010, we converted debt at conversion prices ranging from $.006 to $.0038 per share. Our conversion of outstanding debt obligations to common stock, as well as the exercise of outstanding options and warrants to purchase common stock, which the Board of Directors may authorize and undertake from time to time, may dilute the stockholdings of current shareholders.

THE LOSS OF OUR PRESIDENT AND CHIEF EXECUTIVE OFFICER WOULD DISRUPT OUR BUSINESS.

Our success depends in substantial part upon the services of Jacques Tizabi, our President, Chief Executive Officer and Chairman of the Board of Directors. The loss of or the failure to retain the services of Mr. Tizabi would adversely affect the development of our business and our ability to realize profitable operations. We do not maintain key-man life insurance on Mr. Tizabi and have no present plans to obtain this insurance.

WE MAY BE SUED BY THIRD PARTIES WHO CLAIM THE PRODUCTS WE SELL INFRINGE ON THEIR INTELLECTUAL PROPERTY RIGHTS. DEFENDING AN INFRINGEMENT LAWSUIT IS COSTLY AND WE MAY NOT HAVE ADEQUATE RESOURCES TO DEFEND OURSELVES.

We may be exposed to future litigation by third parties based on claims that the products we sell infringe on the intellectual property rights of others or that we have misappropriated the trade secrets of others. This may be true even if we do not own the technologies embedded in the products we sell. This risk is compounded by the fact that the validity and breadth of claims covered in technology patents in general and the breadth and scope of trade secret protection involves complex legal and factual questions for which important legal principles are unresolved. Any litigation or claims against us, whether or not valid, could result in substantial costs, could place a significant strain on our financial and managerial resources, and could harm our reputation.

WE HAVE NOT PAID ANY CASH DIVIDENDS AND NO CASH DIVIDENDS WILL BE PAID IN THE FORESEEABLE FUTURE.

We do not anticipate paying cash dividends on our common stock in the foreseeable future, and we cannot assure an investor that funds will be legally available to pay a dividend or that even if the funds are legally available, that a dividend will be paid.

THE APPLICATION OF THE “PENNY STOCK” RULES COULD ADVERSELY AFFECT THE MARKET PRICE OF OUR COMMON STOCK AND INCREASE YOUR TRANSACTION COSTS TO SELL THOSE STOCK.

As long as the trading price of our common stock is below $5 per share, the open-market trading of our common stock will be subject to the “penny stock” rules. The “penny stock” rules impose additional sales practice requirements on broker-dealers who sell securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 together with their spouse). For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of securities and have received the purchaser’s written consent to the transaction before the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the broker-dealer must deliver, before the transaction, a disclosure schedule prescribed by the SEC relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information on the limited market in penny stocks. These additional burdens imposed on broker-dealers may restrict the ability or decrease the willingness of broker-dealers to sell our common stock, and may result in decreased liquidity for our common stock and increased transaction costs for sales and purchases of our common stock as compared to other securities.

OUR STOCK PRICE IS VOLATILE.

The trading price of our common stock fluctuates widely and in the future may be subject to similar fluctuations in response to quarter-to-quarter variations in our operating results, announcements of technological innovations or new products by us or our competitors, general conditions in the terrorism detection device industry in which we compete and other events or factors. In addition, in recent years, broad stock market indices, in general, and the securities of technology companies, in particular, have experienced substantial price fluctuations. These broad market fluctuations also may adversely affect the future trading price of our common stock.

OUR STOCK HISTORICALLY FLUCTUATES WIDELY IN TRADING VOLUME AND PRICE. THEREFORE, SHAREHOLDERS MAY NOT BE ABLE TO SELL THEIR SHARES FREELY OR AT PRICES AND AT TIMES THAT THEY DESIRE TO SELL SHARES.

The volume of trading in our common stock historically has fluctuated and a limited market presently exists for the shares. We have no analyst coverage of our securities. The lack of analyst reports about our stock may make it difficult for potential investors to make decisions about whether to purchase our stock and may make it less likely that investors will purchase our stock. Our stock trades in a wide fluctuation of volume that we cannot predict or control. We cannot assure you that our trading volume will increase, or that our historically light trading volume or any trading volume whatsoever will be sustained in the future. Therefore, we cannot assure you that our shareholders will be able to sell their shares of our common stock at the time or at the price that they desire, or at all.

POTENTIAL ANTI-TAKEOVER TACTICS AND RIGHTS AND PREFERENCES GRANTED THROUGH THE ISSUANCE OF PREFERRED STOCK RIGHTS MAY BE DETRIMENTAL TO COMMON SHAREHOLDERS.

We are authorized to issue up to 20,000,000 shares of preferred stock. The issuance of preferred stock does not require approval by the shareholders of our common stock. Our Board of Directors, in its sole discretion, has the power to issue preferred stock in one or more series and establish the dividend rates and preferences, liquidation preferences, voting rights, redemption and conversion terms and conditions and any other relative rights and preferences with respect to any series of preferred stock. Holders of preferred stock may have the right to receive dividends, certain preferences in liquidation and conversion and other rights, any of which rights and preferences may operate to the detriment of the shareholders of our common stock. Further, the issuance of any preferred stock having rights superior to those of our common stock may result in a decrease in the market price of the common stock and, additionally, could be used by our Board of Directors as an anti-takeover measure or device to prevent a change in our control.

WE ARE SUBJECT TO THE REQUIREMENTS OF SECTION 404 OF THE SARBANES-OXLEY ACT. IF WE ARE UNABLE TO TIMELY COMPLY WITH SECTION 404, OUR PROFITABILITY, STOCK PRICE AND RESULTS OF OPERATIONS AND FINANCIAL CONDITION COULD BE MATERIALLY ADVERSELY AFFECTED.

DISCLOSURE CONTROLS AND PROCEDURES

Under the supervision and with the participation of our Management, including our Chief Executive Officer ("CEO"), who is also our acting Chief Financial Officer ("CFO"), we evaluated the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act as of a date (the "Evaluation Date") as of the end of the reporting period covered by the Company's Annual Report on Form 10-K, December 31, 2010. The term disclosure controls and procedures means controls and other procedures of an issuer that are designed to ensure that information required to be disclosed by the issuer in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer's management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

Our management performed such an evaluation and based on such evaluation, our Chief Executive Officer and Acting Chief Financial Officer concluded that, as of the end of such period, our disclosure controls and procedures are not effective in recording, processing, summarizing and reporting, on a timely basis, information required to be disclosed by us in the reports that we file or submit under the Exchange Act and are not effective in ensuring that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to our management, including our Chief Executive Officer and Acting Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

INTERNAL CONTROL OVER FINANCIAL REPORTING

Our Management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) or 15d-15(f) promulgated under the Exchange Act as a process designed by, or under the supervision of, the Company's principal executive and principal financial officers and effected by the Company's board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America and includes those policies and procedures that:

* Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company;

* Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and

* Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements.

As of December 31, 2010 Management assessed the effectiveness of our internal control over financial reporting based on the criteria for effective internal control over financial reporting established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission and SEC guidance on conducting such assessments. Based on that evaluation, they concluded that, as of the end of the period covered by this report, such internal controls over financial reporting were not effective to control deficiencies that constituted material weaknesses. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the registrant's annual or interim financial statements will not be prevented or detected on a timely basis.

Our failure to maintain adequate disclosure controls and procedures and internal control over financial reporting may mean that prospective investors and partners will lack confidence in our financial statements, which could cause us to lose financing opportunities or business opportunities, each of which could have a material adverse effect on our business and on our stock price and trading. While our management is working to remedy the material weaknesses there can be no assurance that such actions will be successfully implemented or that we will be able to fully overcome such material weaknesses.

OUR ISSUANCE OF ADDITIONAL COMMON STOCK, OR OPTIONS TO PURCHASE OUR STOCK, WOULD DILUTE YOUR PROPORTIONATE OWNERSHIP AND VOTING RIGHTS.

We are entitled under our articles of incorporation to issue up to 20,020,000,000 shares of capital stock which includes 20,000,000,000 shares of common stock, 20,000,000 shares of Preferred Stock. Our Preferred Stock may be designated in a senior position to our common stock. After taking into consideration our outstanding common stock at April 15, 2011 of 3,587,599,829 shares, we will be entitled to issue up to 16,412,400,171 additional shares of common stock and 20,000,000 of Preferred Stock. Our board of directors may generally issue stock, or options or warrants to purchase those shares, without further approval by our stockholders based upon such factors as our board of directors may deem relevant at that time. It is likely that we will be required to issue a large amount of additional securities to raise capital to further our development or convert outstanding indebtedness to equity. It is also likely that we will be required to issue a large amount of additional securities to directors, officers, employees and consultants as compensatory grants in connection with their services, both in the form of stand-alone grants or under our stock plans. We cannot give you any assurance that we will not issue additional common stock, or options or warrants to purchase those shares, under circumstances we may deem appropriate at the time.

Item 1B. UNRESOLVED STAFF COMMENTS

Not applicable for Smaller Reporting Companies.

ITEM 2. DESCRIPTION OF PROPERTY

We currently do not own any real property. As of June 2009, we moved our corporate headquarters to 340 N. Camden Drive, Suite 302, Beverly Hills, CA 90210, USA. Our offices are still at this address. Our lease for this premises expires on June 1, 2012. The base monthly rent is $6,896. We believe this operating space is adequate for the Company's needs for the foreseeable future.

ITEM 3. LEGAL PROCEEDINGS

On May 15, 2002, Walt Disney World Co. commenced action in the Los Angeles Superior Court against the Company and a former wholly-owned subsidiary (WALT DISNEY WORLD CO. V. POLLUTION RESEARCH AND CONTROL CORP. AND DASIBI ENVIRONMENTAL CORP. (Case No. BC 274013 Los Angeles Superior Court) for amounts due in connection with unpaid rent. A judgment was entered for $411,500. No amounts have been paid in connection with the judgment. As of December 31, 2010, $411,500 has been accrued.

On or about April 16, 2004, Plaintiffs A. Sean Rose, Claire F. Rose, and Mark Rose commenced an action in the Los Angeles Superior Court against the Company (A. SEAN ROSE, CLAIRE F. ROSE AND MARK ROSE V. UNIVERSAL DETECTION TECHNOLOGY, FKA POLLUTION RESEARCH AND CONTROL CORPORATION) for amounts allegedly due pursuant to four unpaid promissory notes. On August 2, 2004, the parties executed a Confidential Settlement Agreement and Mutual Releases (the “Agreement”). On December 30, 2005, Plaintiffs commenced an action against the Company, alleging the Company breached the Agreement and sought approximately $205,000 in damages. A judgment was entered on April 11, 2006 for $209,277.58. The Company has previously accrued for this settlement. As of December 31, 2010, we have accrued $559,303 for this settlement including principal and interest.

On June 2, 2006, Plaintiff Trilogy Capital Partners instituted an action in the Los Angeles Superior Court (TRILOGY CAPITAL PARTNERS V. UNIVERSAL DETECTION TECHNOLOGY, ET. AL., Case No. SC089929) against the Company. Plaintiff's Complaint alleged damages against UDT for breach of an engagement letter in the amount of $93,448.54. Also, Plaintiff alleged that UDT had failed to issue warrants to it pursuant to a written agreement. After completing the initial stages of litigation and conducting extensive mediation, Plaintiff and UDT reached a settlement wherein commencing December 15, 2006, UDT would make monthly payments to Plaintiff of $2,000 until a debt of $90,000 plus accrued interest at six percent per annum was fully paid. In exchange, Plaintiff would release all of its claims against UDT. UDT has not been current on all of its agreed payments to Plaintiff. As of December 31 2010, $28,098 was due under the agreement.

On November 15, 2006, Plaintiff NBGI, Inc. instituted an action in the Los Angeles Superior Court (NBGI, Inc. v. Universal Detection Technology, et. al., Case No. BC361979) against UDT. NBGI, Inc.'s Complaint alleged breach of contract, and requested damages in the amount of $111,014.34 plus interest at the legal rate and for costs of suit. A Motion for Summary Judgment was set for September 11, 2007. The Summary Judgment was granted in NBGI’s favor and judgment has been entered. No payments have been made on this judgment and no actions to enforce the judgment have been taken against UDT.

On November 1, 2010 the accounting firm of A.J. Robbins, P.C. filed a lawsuit in the District Court, City and County of Denver, Colorado, seeking recovery of fees allegedly owed for accounting services performed during 2004 to 2008. The claims have been asserted against UDT and our CEO, Jacques Tizabi, as a result of a personal guarantee. UDT and our CEO dispute that the fees are owed and intends to oppose the suit.On December 15, 2010, Defendants filed an Answer which asserts several defenses. The parties have exchanged initial disclosures, and the matter has been set for trial commencing on December 5, 2011. Formal discovery has not yet commenced.

ITEM 4. REMOVED AND RESERVED

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is traded on the OTC Bulletin Board under the symbol “UNDT.” The following table sets forth the high and low bid information of our common stock on the OTC Bulletin Board for each quarter during the last two fiscal years, as reported by the OTC Bulletin Board. This information reflects inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

| |

|

|

|

|

|

|

Year

|

|

Period

|

|

High Bid

|

|

|

Low Bid

|

|

| |

|

|

|

|

|

|

|

|

|

2009

|

|

First Quarter

|

|

|

0.01 |

|

|

|

0.0033 |

|

| |

|

Second Quarter

|

|

|

0.01 |

|

|

|

0.0024 |

|

| |

|

Third Quarter

|

|

|

0.015 |

|

|

|

0.0021 |

|

| |

|

Fourth Quarter

|

|

|

0.0098 |

|

|

|

0.0023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

2010

|

|

First Quarter

|

|

|

0.0035 |

|

|

|

0.0022 |

|

| |

|

Second Quarter

|

|

|

0.0048 |

|

|

|

0.0017 |

|

| |

|

Third Quarter

|

|

|

0.0038 |

|

|

|

0.0005 |

|

| |

|

Fourth Quarter

|

|

|

0.0011 |

|

|

|

0.0003 |

|

HOLDERS OF RECORD

As of April 15, 2011, we had 1,321 shareholders of record of our common stock. Our Transfer Agent is OTR located at 1001 SW Fifth Avenue, Suite 1550, Portland, OR 97204-1143. OTR's phone number is (503) 225-0375.

DIVIDEND POLICY

We do not currently pay any dividends on our common stock, and we currently intend to retain any future earnings for use in our business. Any future determination as to the payment of dividends on our common stock will be at the discretion of our Board of Directors and will depend on our earnings, operating and financial condition, capital requirements and other factors deemed relevant by our Board of Directors including the General Corporation Law of the State of California, which provides that dividends are only payable out of retained earnings or if certain minimum ratios of assets to liabilities are satisfied. The declaration of dividends on our common stock also may be restricted by the provisions of credit agreements that we may enter into from time to time.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

Set forth in the table below is information regarding awards made through equity compensation plans through December 31, 2010.

|

Plan Category

|

Number of

securities to be

issued upon

exercises of

outstanding options, warrants, and rights

(a)

|

Weighted-average exercise

price of outstanding options, warrants, and rights

(b)

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

(c)

|

|

Equity compensation plans approved by security holders

|

N/A

|

N/A

|

N/A

|

| |

|

|

|

|

Equity compensation plans not approved by security holders (1)

|

|

|

|

|

2006 Stock Compensation Plan

|

37,500 (2)

|

N/A

|

0

|

|

2006 Consultant Stock Plan

|

125,000 (2)

|

N/A

|

0

|

|

2006-II Consultant Stock Plan

|

187,500 (2)

|

N/A

|

0

|

|

2007 Consultant Stock Plan

|

375,000

|

N/A

|

0

|

|

2007 Equity Incentive Plan II&III

|

295,000 (2)(3)

|

N/A

|

0

|

|

2007 Equity Incentive Plan IV

|

450,000

|

N/A

|

31

|

|

2007 Equity Incentive Plan V & VI

|

1,350,000(4)

|

N/A

|

16,109

|

|

2008 Equity Incentive Plan

|

1,500,000

|

N/A

|

45

|

|

2008 Equity Incentive Plan II

|

1,650,000

|

N/A

|

15,730

|

|

2008 Equity Incentive Plan III

|

2,500,000

|

N/A

|

0

|

|

2008 Equity Incentive Plan IV

|

3,800,000

|

N/A

|

0

|

|

2009 Equity Incentive Plan

|

10,000,000

|

N/A

|

0

|

|

2009 Equity Incentive Plan II

|

60,000,000

|

N/A

|

394,588

|

|

2009 Equity Incentive Plan III

|

200,000,000

|

N/A

|

0

|

|

|

(1)

|

The Company has individual compensation arrangements with Messrs. Amir Ettehadieh and Nima Montazeri. Under these arrangements Messrs. Ettehadieh and Montazeri help the company with matters related to research, business development, and administration. For their services, Messrs. Ettehadieh and Montazeri receive the equivalent of $7,000 worth of common shares of the Company per month, which shares are issued under the then-current equity incentive plan, including those plans listed above.

|

|

|

(2)

|

Represents total number of shares of common stock originally authorized for stock grants. Stock option grants were not authorized.

|

|

|

(3)

|

Consists of the second and third plans.

|

|

|

(4)

|

Consists of the fifth and sixth plans.

|

On February 13, 2006, our Board of Directors adopted the 2006 Stock Compensation Plan (the "Plan"). The Plan authorizes common stock grants to our non-executive employees, professional advisors and consultants. We reserved 7,500,000 shares of our common stock for awards to be made under the Plan. The Plan is to be administered by our Board of Directors, or by any committee to which such duties are delegated by the Board.

On June 29, 2006, our Board of Directors adopted the 2006 Consultant Stock Plan (the "2006 Plan"). The 2006 Plan authorizes common stock grants to our employees, officers, directors, consultants, independent contractors, advisors, or other service providers, provided that such services are not in connection with the offer and sale of securities in a capital-raising transaction. We reserved 25,000,000 shares of our common stock for awards to be made under the 2006 Plan. The 2006 Plan is to be administered by a committee of one or more members of our Board of Directors.

On November 22, 2006, our Board of Directors adopted the 2006-II Consultant Stock Plan (the "2006-II Plan"). The 2006-II Plan authorizes common stock grants to our employees, officers, directors, consultants, independent contractors, advisors, or other service providers, provided that such services are not in connection with the offer and sale of securities in a capital-raising transaction. We reserved 37,500,000 shares of our common stock for awards to be made under the 2006-II Plan. The 2006-II Plan is to be administered by a committee of two or more members of our Board of Directors.

On April 17, 2007, the Board of Directors adopted the 2007 Consultant Stock Plan (the “2007 Plan”). The 2007 Plan grants to our employees, officers, directors, consultants, independent contractors, advisors, or other service providers, provided that such services are not in connection with the offer and sale of securities in a capital-raising transaction. We reserved 375,000 shares of our common stock for awards to be made under the 2007 Plan. The 2007 Plan is to be administered by a committee of two or more members of our Board of Directors.

On June 5, 2007, the Board of Directors adopted the 2007 Equity Incentive Plan (the “2007-II Plan”). The 2007-II Plan grants to our employees, officers, directors, consultants, independent contractors, advisors, or other service providers, provided that such services are not in connection with the offer and sale of securities in a capital-raising transaction. The Company reserved 150,000 shares of its common stock for awards to be made under the 2007-II Plan. The 2007-II Plan is to be administered by a committee of two or members of the Board of Directors.

On June 27, 2007, the Board of Directors adopted the 2007 Equity Incentive Plan (the “2007-III Plan”). The 2007-III Plan grants to our employees, officers, directors, consultants, independent contractors, advisors, or other service providers, provided that such services are not in connection with the offer and sale of securities in a capital-raising transaction. The Company reserved 145,000 shares of its common stock for awards to be made under the 2007-III Plan. The 2007-III Plan is to be administered by a committee of two or members of the Board of Directors.

On July 13, 2007, the Board of Directors adopted the 2007-2 Equity Incentive Plan (the “2007-IV Plan”). The 2007-IV Plan grants to our employees, officers, directors, consultants, independent contractors, advisors, or other service providers, provided that such services are not in connection with the offer and sale of securities in a capital-raising transaction. The Company reserved 450,000 shares of our common stock for awards to be made under the 2007-IV Plan. The 2007-IV Plan is to be administered by a committee of two or more members of the Board of Directors.

On October 10, 2007, the Board of Directors adopted the 2007-3 Equity Incentive Plan (the “2007-V Plan”). The 2007-V Plan grants to our employees, officers, directors, consultants, independent contractors, advisors, or other service providers, provided that such services are not in connection with the offer and sale of securities in a capital-raising transaction. The Company reserved 600,000 shares of common stock for awards to be made under the 2007-V Plan. The 2007-V Plan is to be administered by a committee of two or more members of our Board of Directors.

On November 1, 2007, the Board of Directors adopted the 2007-4 Equity Incentive Plan (the “2007-VI Plan”). The 2007-VI Plan grants to our employees, officers, directors, consultants, independent contractors, advisors, or other service providers, provided that such services are not in connection with the offer and sale of securities in a capital-raising transaction. The Company reserved 750,000 shares of common stock for awards to be made under the 2007-VI Plan. The 2007-VI Plan is to be administered by a committee of two or more members of our Board of Directors.

On February 11, 2008, the Board of Directors adopted the 2008 Equity Incentive Plan (the “2008 Plan”). The 2008 Plan grants to our employees, officers, directors, consultants, independent contractors, advisors, or other service providers, provided that such services are not in connection with the offer and sale of securities in a capital-raising transaction. The Company reserved 1,500,000 shares of common stock for awards to be made under the 2008 Plan. The 2008 Plan is to be administered by a committee of two or more members of our Board of Directors.

On April 29, 2008, the Board of Directors adopted the 2008 Equity Incentive Plan II (the “2008-II Plan”). The 2008-II Plan grants to our employees, officers, directors, consultants, independent contractors, advisors, or other service providers, provided that such services are not in connection with the offer and sale of securities in a capital-raising transaction. The Company reserved 1,650,000 shares of common stock for awards to be made under the 2008-III Plan. The 2008-II Plan is to be administered by a committee of two or more members of our Board of Directors.

On July 1, 2008, the Board of Directors adopted the 2008 Equity Incentive Plan III (the “2008-III Plan”). The 2008-III Plan grants to our employees, officers, directors, consultants, independent contractors, advisors, or other service providers, provided that such services are not in connection with the offer and sale of securities in a capital-raising transaction. The Company reserved 2,500,000 shares of common stock for awards to be made under the 2008-III Plan. The 2008-III Plan is to be administered by a committee of two or more members of our Board of Directors.

On September 2, 2008, the Board of Directors adopted the 2008 Equity Incentive Plan IV (the “2008-IV Plan”). The 2008-IV Plan grants to our employees, officers, directors, consultants, independent contractors, advisors, or other service providers, provided that such services are not in connection with the offer and sale of securities in a capital-raising transaction. The Company reserved 3,800,000 shares of common stock for awards to be made under the 2008-IV Plan. The 2008-IV Plan is to be administered by a committee of two or more members of our Board of Directors.

On February 22, 2009, the Board of Directors adopted the 2009 Equity Incentive Plan (the “2009 Plan”). The 2009 Plan grants to our employees, officers, directors, consultants, independent contractors, advisors, or other service providers, provided that such services are not in connection with the offer and sale of securities in a capital-raising transaction. The Company reserved 10,000,000 shares of common stock for awards to be made under the 2009 Plan. The 2009 Plan is to be administered by a committee of two or more members of our Board of Directors.

On May 14, 2009, the Board of Directors adopted the 2009 Equity Incentive Plan II (the “2009-II Plan”). The 2009-II Plan grants to our employees, officers, directors, consultants, independent contractors, advisors, or other service providers, provided that such services are not in connection with the offer and sale of securities in a capital-raising transaction. The Company reserved 60,000,000 shares of common stock for awards to be made under the 2009-II Plan. The 2009-II Plan is to be administered by a committee of two or more members of our Board of Directors.

On November 5, 2009, the Board of Directors adopted the 2009 Equity Incentive Plan III (the “2009-III Plan”). The 2009-III Plan grants to our employees, officers, directors, consultants, independent contractors, advisors, or other service providers, provided that such services are not in connection with the offer and sale of securities in a capital-raising transaction. The Company reserved 200,000,000 shares of common stock for awards to be made under the 2009-III Plan. The 2009-III Plan is to be administered by a committee of two or more members of our Board of Directors.

With respect to each of the above Plans, and subject to the provisions of each Plan, the Board and/or committee shall have authority to (a) grant, in its discretion, stock awards; (b) determine in good faith the fair market value of the stock covered by any grant; (c) determine which eligible persons shall receive grants and the number of shares, restrictions, terms and conditions to be included in such grants; (d) construe and interpret the Plans; (e) promulgate, amend and rescind rules and regulations relating to its administration, and correct defects, omissions and inconsistencies in the Plans or any grants; (f) consistent with the Plans and with the consent of the participant, amend any outstanding grant; and (g) make all other determinations necessary or advisable for the Plans’ administration. The interpretation and construction by the Board of any provisions of the Plans shall be conclusive and final.

SALES OF UNREGISTERED SECURITIES

During fiscal 2010, we issued the following securities which were not registered under the Securities Act. We did not employ any form of general solicitation or advertising in connection with the issuance of the securities described below. In addition, we believe the purchasers and recipients of the securities are “Accredited Investors” for the purpose of Rule 501 of the Securities Act. For these reasons, among others, the offer and sale of the following securities were made in reliance on the exemption from registration provided by Section 4(2) of the Securities Act or Regulation D promulgated by the SEC under the Securities Act:

|

|

·

|

During 2010, we issued 996,977,751 shares of common stock to various note holders to convert outstanding debt obligations valued at approximately $1,289,370 as follows:

|

On January 27, 2010, we issued 50,053,381 shares of common stock to convert outstanding debt obligations valued at $150,160.

On March 24, 2010, we issued 24,380,000 shares of common stock to convert outstanding debt obligations valued at $56,074.

On March 24, 2010, we issued 28,750,000 shares of common stock to convert outstanding debt obligations valued at $66,125.

On March 22, 2010, we issued 48,887,490 shares of common stock to convert outstanding debt obligations valued at $112,441.

On April 09, 2010, we issued 44,075,000 shares of common stock to convert outstanding debt obligations valued at $167,485.

On April 09, 2010, we issued 18,671,500 shares of common stock to convert outstanding debt obligations valued at $70,952.

On May 19, 2010, we issued 30,510,000 shares of common stock to convert outstanding debt obligations valued at $67,122.

On May 19, 2010, we issued 25,000,000 shares of common stock to convert outstanding debt obligations valued at $55,000.

On May 19, 2010, we issued 3,155,620 shares of common stock to convert outstanding debt obligations valued at $6,942.

On May 19, 2010, we issued 3,360,000 shares of common stock to convert outstanding debt obligations valued at $7,392.

On May 19, 2010, we issued 734,770 shares of common stock to convert outstanding debt obligations valued at $1,616.

On August 25, 2010, we issued 67,260,000 shares of common stock to convert outstanding debt obligations valued at $53,808.

On September 13, 2010, we issued 75,000,000 shares of common stock to convert outstanding debt obligations valued at $75,000.

On October 19, 2010, we issued 32,372,093 shares of common stock to convert outstanding debt obligations valued at $29,135.

On October 19, 2010, we issued 38,025,000 shares of common stock to convert outstanding debt obligations valued at $34,223.

On November 01, 2010, we issued 81,000,000 shares of common stock to convert outstanding debt obligations valued at $64,800.

On November 10, 2010, we issued 80,505,000 shares of common stock to convert outstanding debt obligations valued at $48,303.

On November 15, 2010, we issued 79,560,000 shares of common stock to convert outstanding debt obligations valued at $55,692.

On November.15, 2010, we issued 76,931,050 shares of common stock to convert outstanding debt obligations valued at $53,852.

On November 30, 2010, we issued 89,354,486 shares of common stock to convert outstanding debt obligations valued at $53,613.

On December 20, 2010, we issued 99,392,361 shares of common stock to convert outstanding debt obligations valued at $59,635.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable for Smaller Reporting Companies.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our consolidated financial statements provided in this annual report on Form 10-K. Certain statements contained herein may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially, as discussed more fully herein.

The forward-looking information set forth in this annual report is as of the date of this filing, and we undertake no duty to update this information. More information about potential factors that could affect our business and financial results is included in the section of this annual report entitled "Risk Factors."

OVERVIEW

Universal Detection Technology (the "Company," “UDT” or "We") is engaged in the marketing and resale of detection devices for chemical, biological, radiological, nuclear, and explosive (CBRNE) threats. Through agreements with various third parties we supply bioterrorism detection kits capable of detecting anthrax, ricin, botulinum, plague, and SEBs, mold detection kits, chemical detection equipment, radiation detection systems, and counter-terrorism training references.

We have entered into supply and distribution agreements with four parties enabling us to supply a host of products and services for detection of hazardous materials. By combining our in-house experience and knowledge and outside expertise offered by various consultants and third parties, we have added threat evaluation and consulting services, and training courses to our services. We sell and market security and counter-terrorism products including bioterrorism detection kits, chemical detectors, radiation detection systems, and training references. Some of the products and services we offer have not been sold to date and there is no guarantee that any of them will be demanded and sold in the market in the future. We plan to continue expanding our product base and intend to sell products to more users inside and outside the U.S. Our strategy is to generate sales by enhancing our web presence and marketing the Company as a supplier of complete CBRNE detection equipment. We plan to attend various industry trade shows and to offer products in certain training scenarios so that first responders can become more familiar with our products. Our target customer markets primarily consist of first responders with some emphasis on the bioterror and military defense market. Our geographical customer focus is on the U.S., Europe, and Asia. There is no guarantee that we will succeed in implementing this strategy or if implemented, that this strategy will be successful.

Universal Detection Technology has also situated itself to provide various counter-terrorism services. Such services include training courses for first responders, event security, threat evaluation & consulting, and DVDs aimed at providing information and training regarding combating terrorism and managing emergency situations. To date, we have sold only a nominal amount of these services and products and the resulting revenue for 2010 was insignificant.

Our business operations are more fully described under "Description Business" in Item 1 of Part I of this Report.

Results of Operations

The following discussion is included to describe our consolidated financial position and results of operations. The audited consolidated financial statements and notes thereto contain detailed information that should be referred to in conjunction with this discussion.

Revenue – Total revenue for the year ended December 31, 2010 was $5,368 as compared to $19,467 the prior fiscal year, a decrease of $14,099. The decrease is primarily due to a reduced number of detection unit sales.

Operating Expenses –Total operating expenses for the year ended December 31, 2010 were $1,289,287. Total operating expenses for the year ended December 31, 2009 was $2,485,754 representing a decrease of $1,196,467(48%). The decrease is primarily attributable to a decrease in marketing expense current year and the impairment of patent prior year.

Other income(expense). Other income (expense) amounted to ($907,740) for the year ended December 31, 2010 as compared to ($2,148,913)for the year ended December 31, 2009 The change is principally related to the loss recognized on the settlement of shares issued for debt.

Net loss. Net loss for the year ended December 31, 2010 was $2,196,195, as compared to a net loss of $4,626,644 for the same period in the prior fiscal year, representing a decreased loss of $2,430,449. The primary reason for this is a decrease in loss recognized on settlement of shares issued for debt and a decrease in marketing expense.

PLAN OF OPERATION