Investment Company Act File No. 811-4236

REGISTRATION STATEMENT

| UNDER THE SECURITIES ACT OF 1933 |

☒ |

| Pre-Effective Amendment No. |

☐ |

| Post-Effective Amendment No. 333 |

☒ |

| UNDER THE INVESTMENT COMPANY ACT OF 1940 |

☒ |

| Amendment No. 334 |

☒ |

New York, New York 10172

J.P. Morgan Investment Management Inc.

4 New York Plaza

New York, New York 10004

| Matthew J. Beck, Esq. JPMorgan Chase & Co. 1111 Polaris Parkway Columbus, OH 43240 |

Jon S. Rand, Esq. Dechert LLP 1095 Avenue of the Americas New York, NY 10036 |

| ☐ |

immediately upon filing pursuant to paragraph (b) |

| ☒ |

on July 1, 2022, pursuant to paragraph (b) |

| ☐ |

60 days after filing pursuant to paragraph (a)(1) |

| ☐ |

on (date) pursuant to paragraph (a)(1) |

| ☐ |

75 days after filing pursuant to paragraph (a)(2) |

| ☐ |

on (date) pursuant to paragraph (a)(2) |

| ☐ |

The post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

| | |

| 1 | |

| 7 | |

| 13 | |

| 19 | |

| 25 | |

| 31 | |

| 38 | |

| 44 | |

| 50 | |

| 50 | |

| 51 | |

| 54 | |

| 63 | |

| 63 | |

| 63 | |

| 64 | |

| 67 | |

| 67 |

| 71 | |

| 78 | |

| 81 | |

| 82 | |

| 84 | |

| 85 | |

| 86 | |

| 87 | |

| 90 | |

| 90 | |

| 90 | |

| 91 | |

| 92 | |

| 100 | |

| 116 | |

| 121 | |

| Back cover |

| | |||

| |

Class A |

Class C |

Class I |

| Maximum Sales Charge (Load) Imposed on Purchases as % of the Offering Price |

|

|

|

| Maximum Deferred Sales Charge (Load) as % of Original Cost of the Shares |

1 |

|

|

| | |||

| |

Class A |

Class C |

Class I |

| Management Fees |

|

|

|

| Distribution (Rule 12b-1) Fees |

|

|

|

| Other Expenses |

|

|

|

| Service Fees |

|

|

|

| Remainder of Other Expenses |

|

|

|

| Total Annual Fund Operating Expenses |

|

|

|

| Fee Waivers and/or Expense Reimbursements1 |

- |

- |

- |

| Total Annual Fund Operating Expenses after Fee Waivers and/or Expense Reimburse- ments1 |

|

|

|

| | ||||

| |

1 Year |

3 Years |

5 Years |

10 Years |

| CLASS A SHARES ($) |

|

|

|

|

| CLASS C SHARES ($) |

|

|

|

|

| CLASS I SHARES ($) |

|

|

|

|

| | ||||

| |

1 Year |

3 Years |

5 Years |

10 Years |

| CLASS A SHARES ($) |

|

|

|

|

| CLASS C SHARES ($) |

|

|

|

|

| CLASS I SHARES ($) |

|

|

|

|

| |

| |

|

|

| |

|

|

| |

|

|

|

|

|

| | |||

| |

Past 1 Year |

Past 5 Years |

Past 10 Years |

| CLASS I SHARES |

|

|

|

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions |

|

|

|

| Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

| CLASS A SHARES |

|

|

|

| Return Before Taxes |

- |

|

|

| CLASS C SHARES |

|

|

|

| Return Before Taxes |

- |

|

|

| BLOOMBERG U.S. 1-15 YEAR BLEND (1-17) MUNICIPAL BOND INDEX (Reflects No Deduction for Fees, Expenses, or Taxes) |

|

|

|

| Portfolio Manager |

Managed the Fund Since |

Primary Title with Investment Adviser |

| Kevin M. Ellis |

2020 |

Managing Director |

| Wayne Godlin |

2020 |

Managing Director |

| David Sivinski |

2006 |

Executive Director |

| For Class A and Class C Shares |

|

| To establish an account |

$1,000 |

| To add to an account |

$50 |

| For Class I Shares | |

| To establish an account |

$1,000,000 |

| To add to an account |

No minimum levels |

| | |||

| |

Class A |

Class C |

Class I |

| Maximum Sales Charge (Load) Imposed on Purchases as % of the Offering Price |

|

|

|

| Maximum Deferred Sales Charge (Load) as % of Original Cost of the Shares |

1 |

|

|

| | |||

| |

Class A |

Class C |

Class I |

| Management Fees |

|

|

|

| Distribution (Rule 12b-1) Fees |

|

|

|

| Other Expenses |

|

|

|

| Service Fees |

|

|

|

| Remainder of Other Expenses |

|

|

|

| Acquired Fund Fees and Expenses |

|

|

|

| Total Annual Fund Operating Expenses |

|

|

|

| Fee Waivers and/or Expense Reimbursements1 |

- |

- |

- |

| Total Annual Fund Operating Expenses after Fee Waivers and/or Expense Reimburse- ments1 |

|

|

|

| | ||||

| |

1 Year |

3 Years |

5 Years |

10 Years |

| CLASS A SHARES ($) |

|

|

|

|

| CLASS C SHARES ($) |

|

|

|

|

| CLASS I SHARES ($) |

|

|

|

|

| | ||||

| |

1 Year |

3 Years |

5 Years |

10 Years |

| CLASS A SHARES ($) |

|

|

|

|

| CLASS C SHARES ($) |

|

|

|

|

| CLASS I SHARES ($) |

|

|

|

|

| |

| |

|

|

| |

|

|

| |

|

|

|

|

|

| | |||

| |

Past 1 Year |

Past 5 Years |

Past 10 Years |

| CLASS I SHARES |

|

|

|

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions |

|

|

|

| Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

| CLASS A SHARES |

|

|

|

| Return Before Taxes |

- |

|

|

| CLASS C SHARES |

|

|

|

| Return Before Taxes |

- |

|

|

| BLOOMBERG U.S. 1-5 YEAR BLEND (1-6) MUNICIPAL BOND INDEX (Reflects No Deduction for Fees, Expenses, or Taxes) |

|

|

|

| Portfolio Manager |

Managed the Fund Since |

Primary Title with Investment Adviser |

| James Ahn |

2006 |

Managing Director |

| Kevin M. Ellis |

2006 |

Managing Director |

| For Class A and Class C Shares | |

| To establish an account |

$1,000 |

| To add to an account |

$50 |

| For Class I Shares | |

| To establish an account |

$1,000,000 |

| To add to an account |

No minimum levels |

| | |||

| |

Class A |

Class C |

Class I |

| Maximum Sales Charge (Load) Imposed on Purchases as % of the Offering Price |

|

|

|

| Maximum Deferred Sales Charge (Load) as % of Original Cost of the Shares |

1 |

|

|

| | |||

| |

Class A |

Class C |

Class I |

| Management Fees |

|

|

|

| Distribution (Rule 12b-1) Fees |

|

|

|

| Other Expenses |

|

|

|

| Service Fees |

|

|

|

| Remainder of Other Expenses |

|

|

|

| Total Annual Fund Operating Expenses |

|

|

|

| Fee Waivers and/or Expense Reimbursements1 |

- |

- |

- |

| Total Annual Fund Operating Expenses after Fee Waivers and/or Expense Reimburse- ments1 |

|

|

|

| | ||||

| |

1 Year |

3 Years |

5 Years |

10 Years |

| CLASS A SHARES ($) |

|

|

|

|

| CLASS C SHARES ($) |

|

|

|

|

| CLASS I SHARES ($) |

|

|

|

|

| | ||||

| |

1 Year |

3 Years |

5 Years |

10 Years |

| CLASS A SHARES ($) |

|

|

|

|

| CLASS C SHARES ($) |

|

|

|

|

| CLASS I SHARES ($) |

|

|

|

|

| |

| |

|

|

| |

|

|

| |

|

|

|

|

|

| | |||

| |

Past 1 Year |

Past 5 Years |

Past 10 Years |

| CLASS I SHARES |

|

|

|

| Return Before Taxes |

|

|

|

| Return After Taxes on Distributions |

|

|

|

| Return After Taxes on Distributions and Sale of Fund Shares |

|

|

|

| CLASS A SHARES |

|

|

|

| Return Before Taxes |

- |

|

|

| CLASS C SHARES |

|

|

|

| Return Before Taxes |

|

|

|

| BLOOMBERG US MUNICIPAL INDEX (Reflects No Deduction for Fees, Expenses, or Taxes) |

|

|

|

| Portfolio Manager |

Managed the Fund Since |

Primary Title with Investment Adviser |

| Richard Taormina |

2005 |

Managing Director |

| Michelle Hallam |

2014 |

Executive Director |

| For Class A and Class C Shares | |

| To establish an account |

$1,000 |

| To add to an account |

$50 |

| For Class I Shares | |

| To establish an account |

$1,000,000 |

| To add to an account |

No minimum levels |

| SHAREHOLDER FEES (Fees paid directly from your investment) | ||

| |

Class A |

Class I |

| Maximum Sales Charge (Load) Imposed on Purchases as a % of the Offering Price |

NONE |

NONE |

| Maximum Deferred Sales Charge (Load) as a % of Original Cost of Shares |

NONE |

NONE |

| ANNUAL FUND OPERATING EXPENSES (Expenses that you pay each year as a percentage of the value of your investment) | ||

| |

Class A |

Class I |

| Management Fees |

0.15% |

0.15% |

| Distribution (Rule 12b-1) Fees |

0.25 |

NONE |

| Other Expenses |

0.35 |

0.35 |

| Service Fees |

0.25 |

0.25 |

| Remainder of Other Expenses |

0.10 |

0.10 |

| Acquired Fund Fees and Expenses |

0.01 |

0.01 |

| Total Annual Fund Operating Expenses |

0.76 |

0.51 |

| Fee Waivers and/or Expense Reimburse- ments1 |

-0.31 |

-0.26 |

| Total Annual Fund Operating Expenses after Fee Waivers and/or Expense Reimbursements1 |

0.45 |

0.25 |

| WHETHER OR NOT YOU SELL YOUR SHARES, YOUR COST WOULD BE: | ||||

| |

1 Year |

3 Years |

5 Years |

10 Years |

| CLASS A SHARES ($) |

46 |

212 |

392 |

913 |

| CLASS I SHARES ($) |

26 |

137 |

259 |

615 |

An investment in this Fund or any other fund may not provide a complete investment program. The suitability of an investment in the Fund should be considered based on the investment objective, strategies and risks described in this prospectus, considered in light of all of the other investments in your portfolio, as well as your risk tolerance, financial goals and time horizons. You may want to consult with a financial advisor to determine if this Fund is suitable for you.

Investments in the Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency.

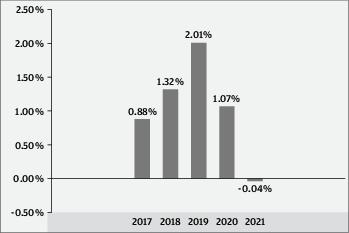

| YEAR-BY-YEAR RETURNS — CLASS I SHARES |

| Best Quarter |

1st quarter, 2019 |

0.68% |

| Worst Quarter |

1st quarter, 2021 |

-0.14% |

| The Fund’s year-to-date total return |

through |

3/31/22 |

was |

-1.11% |

. |

| AVERAGE ANNUAL TOTAL RETURNS (For periods ended December 31, 2021) | |||

| |

Past |

Past |

Life of Fund since |

| |

1 Year |

5 Years |

05/31/2016 |

| CLASS I SHARES |

|

|

|

| Return Before Taxes |

-0.04% |

1.05% |

0.97% |

| Return After Taxes on Distributions |

-0.05 |

1.03 |

0.96 |

| Return After Taxes on Distributions and Sale of Fund Shares |

0.08 |

1.01 |

0.94 |

| CLASS A SHARES |

|

|

|

| Return Before Taxes |

-0.14 |

0.84 |

0.77 |

| BLOOMBERG 1 YEAR MUNICIPAL BOND INDEX (Reflects No Deduction for Fees, Expenses, or Taxes) |

0.31 |

1.44 |

1.25 |

| Portfolio Manager |

Managed the Fund Since |

Primary Title with Investment Adviser |

| Richard Taormina |

2016 |

Managing Director |

| James Ahn |

2016 |

Managing Director |

| For Class A Shares | |

| To establish an account |

$1,000 |

| To add to an account |

$50 |

| For Class I Shares | |

| To establish an account |

$1,000,000 |

| To add to an account |

No minimum levels |

| SHAREHOLDER FEES (Fees paid directly from your investment) | |||

| |

Class A |

Class C |

Class I |

| Maximum Sales Charge (Load) Imposed on Purchases as % of the Offering Price |

3.75% |

NONE |

NONE |

| Maximum Deferred Sales Charge (Load) as % of Original Cost of the Shares |

NONE1 |

1.00% |

NONE |

| ANNUAL FUND OPERATING EXPENSES (Expenses that you pay each year as a percentage of the value of your investment) | |||

| |

Class A |

Class C |

Class I |

| Management Fees |

0.30% |

0.30% |

0.30% |

| Distribution (Rule 12b-1) Fees |

0.25 |

0.75 |

NONE |

| Other Expenses |

0.39 |

0.38 |

0.38 |

| Service Fees |

0.25 |

0.25 |

0.25 |

| Remainder of Other Expenses |

0.14 |

0.13 |

0.13 |

| Total Annual Fund Operating Expenses |

0.94 |

1.43 |

0.68 |

| Fee Waivers and/or Expense Reimbursements1 |

-0.34 |

-0.33 |

-0.18 |

| Total Annual Fund Operating Expenses after Fee Waivers and/or Expense Reimburse- ments1 |

0.60 |

1.10 |

0.50 |

| IF YOU SELL YOUR SHARES, YOUR COST WOULD BE: | ||||

| |

1 Year |

3 Years |

5 Years |

10 Years |

| CLASS A SHARES ($) |

434 |

631 |

844 |

1,456 |

| CLASS C SHARES ($) |

212 |

420 |

750 |

1,551 |

| CLASS I SHARES ($) |

51 |

199 |

361 |

830 |

| IF YOU DO NOT SELL YOUR SHARES, YOUR COST WOULD BE: | ||||

| |

1 Year |

3 Years |

5 Years |

10 Years |

| CLASS A SHARES ($) |

434 |

631 |

844 |

1,456 |

| CLASS C SHARES ($) |

112 |

420 |

750 |

1,551 |

| CLASS I SHARES ($) |

51 |

199 |

361 |

830 |

An investment in this Fund or any other fund may not provide a complete investment program. The suitability of an investment in the Fund should be considered based on the investment objective, strategies and risks described in this prospectus, considered in light of all of the other investments in your portfolio, as well as your risk tolerance, financial goals and time horizons. You may want to consult with a financial advisor to determine if this Fund is suitable for you.

Investments in the Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency.

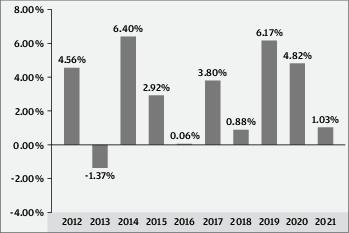

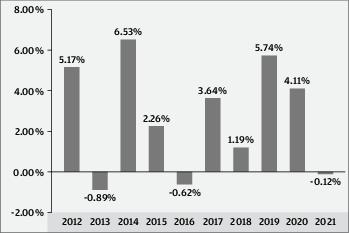

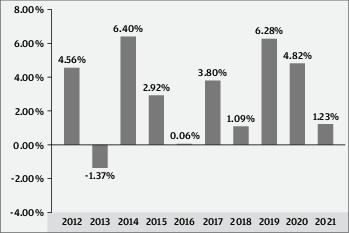

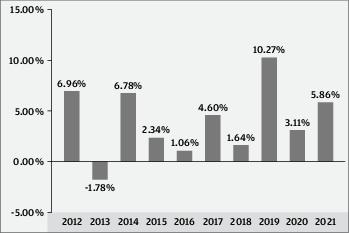

| YEAR-BY-YEAR RETURNS - CLASS I SHARES |

| Best Quarter |

2nd quarter, 2020 |

2.64% |

| Worst Quarter |

4th quarter, 2016 |

-3.39% |

| The Fund’s year-to-date total return |

through |

3/31/22 |

was |

-5.89% |

. |

| AVERAGE ANNUAL TOTAL RETURNS (For periods ended December 31, 2021) | |||

| |

Past 1 Year |

Past 5 Years |

Past 10 Years |

| CLASS I SHARES |

|

|

|

| Return Before Taxes |

-0.12% |

2.89% |

2.67% |

| Return After Taxes on Distributions |

-0.13 |

2.88 |

2.62 |

| Return After Taxes on Distributions and Sale of Fund Shares |

0.54 |

2.74 |

2.63 |

| CLASS A SHARES |

|

|

|

| Return Before Taxes |

-3.97 |

1.99 |

2.17 |

| CLASS C SHARES |

|

|

|

| Return Before Taxes |

-1.73 |

2.27 |

2.16 |

| BLOOMBERG LB CALIFORNIA 1-17 YEAR MUNI INDEX (Reflects No Deduction for Fees, Expenses, or Taxes) |

0.52 |

3.38 |

3.14 |

| Portfolio Manager |

Managed the Fund Since |

Primary Title with Investment Adviser |

| David Sivinski |

2005 |

Executive Director |

| Michelle Hallam |

2004 |

Executive Director |

| For Class A and Class C Shares | |

| To establish an account |

$1,000 |

| To add to an account |

$50 |

| For Class I Shares | |

| To establish an account |

$1,000,000 |

| To add to an account |

No minimum levels |

| SHAREHOLDER FEES (Fees paid directly from your investment) | |||

| |

Class A |

Class C |

Class I |

| Maximum Sales Charge (Load) Imposed on Purchases as a % of the Offering Price |

3.75% |

NONE |

NONE |

| Maximum Deferred Sales Charge (Load) as a % of Original Cost of the Shares |

NONE1 |

1.00% |

NONE |

| ANNUAL FUND OPERATING EXPENSES (Expenses that you pay each year as a percentage of the value of your investment) | |||

| |

Class A |

Class C |

Class I |

| Management Fees |

0.35% |

0.35% |

0.35% |

| Distribution (Rule 12b-1) Fees |

0.25 |

0.75 |

NONE |

| Other Expenses |

0.41 |

0.41 |

0.41 |

| Service Fees |

0.25 |

0.25 |

0.25 |

| Remainder of Other Expenses |

0.16 |

0.16 |

0.16 |

| Total Annual Fund Operating Expenses |

1.01 |

1.51 |

0.76 |

| Fee Waivers and/or Expense Reimbursements1 |

-0.36 |

-0.36 |

-0.21 |

| Total Annual Fund Operating Expenses after Fee Waivers and/or Expense Reimburse- ments1 |

0.65 |

1.15 |

0.55 |

| IF YOU SELL YOUR SHARES, YOUR COST WOULD BE: | ||||

| |

1 Year |

3 Years |

5 Years |

10 Years |

| CLASS A SHARES ($) |

439 |

650 |

878 |

1,533 |

| CLASS C SHARES ($) |

217 |

442 |

790 |

1,636 |

| CLASS I SHARES ($) |

56 |

222 |

402 |

923 |

| IF YOU DO NOT SELL YOUR SHARES, YOUR COST WOULD BE: | ||||

| |

1 Year |

3 Years |

5 Years |

10 Years |

| CLASS A SHARES ($) |

439 |

650 |

878 |

1,533 |

| CLASS C SHARES ($) |

117 |

442 |

790 |

1,636 |

| CLASS I SHARES ($) |

56 |

222 |

402 |

923 |

An investment in this Fund or any other fund may not provide a complete investment program. The suitability of an investment in the Fund should be considered based on the investment objective, strategies and risks described in this prospectus, considered in light of all of the other investments in your portfolio, as well as your risk tolerance, financial goals and time horizons. You may want to consult with a financial advisor to determine if this Fund is suitable for you.

Investments in the Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency.

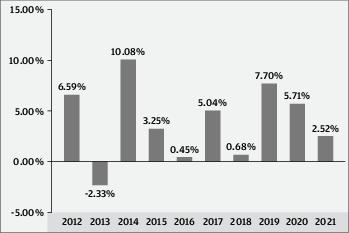

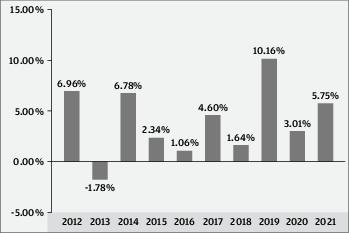

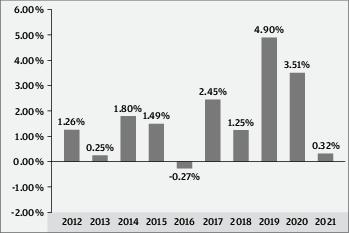

| YEAR-BY-YEAR RETURNS — CLASS I SHARES |

| Best Quarter |

1st quarter, 2019 |

3.81% |

| Worst Quarter |

1st quarter, 2020 |

-6.47% |

| The Fund’s year-to-date total return |

through |

3/31/22 |

was |

-7.16% |

. |

| AVERAGE ANNUAL TOTAL RETURNS (For periods ended December 31, 2021) | |||

| |

Past 1 Year |

Past 5 Years |

Past 10 Years |

| CLASS I SHARES |

|

|

|

| Return Before Taxes |

5.75% |

4.99% |

4.00% |

| Return After Taxes on Distributions |

5.73 |

4.89 |

3.78 |

| Return After Taxes on Distributions and Sale of Fund Shares |

4.63 |

4.47 |

3.56 |

| CLASS A SHARES |

|

|

|

| Return Before Taxes |

1.67 |

4.09 |

3.50 |

| CLASS C SHARES |

|

|

|

| Return Before Taxes |

4.04 |

4.38 |

3.48 |

| BLOOMBERG US MUNICIPAL INDEX (Reflects No Deduction for Fees, Expenses, or Taxes) |

1.52 |

4.17 |

3.72 |

| BLOOMBERG HIGH YIELD MUNICIPAL BOND INDEX (Reflects No Deduction for Fees, Expenses, or Taxes) |

7.77 |

7.53 |

6.72 |

| Portfolio Manager |

Managed the Fund Since |

Primary Title with Investment Adviser |

| Wayne Godlin |

2018 |

Managing Director |

| Richard Taormina |

2007 |

Managing Director |

| Kevin M. Ellis |

2018 |

Managing Director |

| For Class A and Class C Shares | |

| To establish an account |

$1,000 |

| To add to an account |

$50 |

| For Class I Shares | |

| To establish an account |

$1,000,000 |

| To add to an account |

No minimum levels |

| SHAREHOLDER FEES (Fees paid directly from your investment) | |||

| |

Class A |

Class C |

Class I |

| Maximum Sales Charge (Load) Imposed on Purchases as % of the Offering Price |

3.75% |

NONE |

NONE |

| Maximum Deferred Sales Charge (Load) as % of Original Cost of the Shares |

NONE1 |

1.00% |

NONE |

| ANNUAL FUND OPERATING EXPENSES (Expenses that you pay each year as a percentage of the value of your investment) | |||

| |

Class A |

Class C |

Class I |

| Management Fees |

0.30% |

0.30% |

0.30% |

| Distribution (Rule 12b-1) Fees |

0.25 |

0.75 |

NONE |

| Other Expenses |

0.35 |

0.35 |

0.35 |

| Service Fees |

0.25 |

0.25 |

0.25 |

| Remainder of Other Expenses |

0.10 |

0.10 |

0.10 |

| Total Annual Fund Operating Expenses |

0.90 |

1.40 |

0.65 |

| Fee Waivers and/or Expense Reimbursements1 |

-0.25 |

-0.20 |

-0.25 |

| Total Annual Fund Operating Expenses after Fee Waivers and/or Expense Reimburse- ments1 |

0.65 |

1.20 |

0.40 |

| IF YOU SELL YOUR SHARES, YOUR COST WOULD BE: | ||||

| |

1 Year |

3 Years |

5 Years |

10 Years |

| CLASS A SHARES ($) |

439 |

627 |

831 |

1,419 |

| CLASS C SHARES ($) |

222 |

423 |

747 |

1,526 |

| CLASS I SHARES ($) |

41 |

183 |

337 |

787 |

| IF YOU DO NOT SELL YOUR SHARES, YOUR COST WOULD BE: | ||||

| |

1 Year |

3 Years |

5 Years |

10 Years |

| CLASS A SHARES ($) |

439 |

627 |

831 |

1,419 |

| CLASS C SHARES ($) |

122 |

423 |

747 |

1,526 |

| CLASS I SHARES ($) |

41 |

183 |

337 |

787 |

Investments in the Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency.

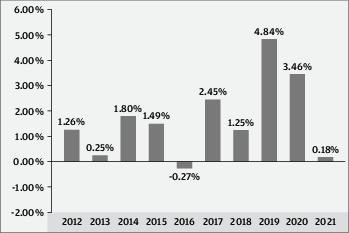

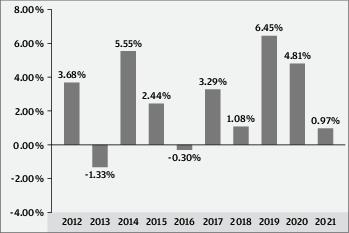

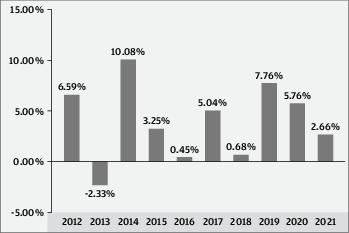

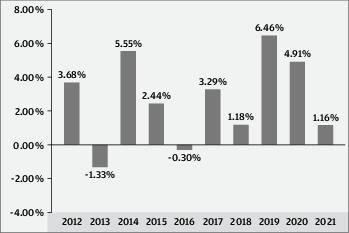

| YEAR-BY-YEAR RETURNS - CLASS I SHARES |

| Best Quarter |

2nd quarter, 2020 |

2.77% |

| Worst Quarter |

4th quarter, 2016 |

-3.11% |

| The Fund’s year-to-date total return |

through |

3/31/22 |

was |

-5.67% |

. |

| AVERAGE ANNUAL TOTAL RETURNS (For periods ended December 31, 2021) | |||

| |

Past 1 Year |

Past 5 Years |

Past 10 Years |

| CLASS I SHARES |

|

|

|

| Return Before Taxes |

0.97% |

3.30% |

2.63% |

| Return After Taxes on Distributions |

0.77 |

3.24 |

2.58 |

| Return After Taxes on Distributions and Sale of Fund Shares |

1.65 |

3.09 |

2.61 |

| CLASS A SHARES |

|

|

|

| Return Before Taxes |

-3.00 |

2.24 |

1.98 |

| CLASS C SHARES |

|

|

|

| Return Before Taxes |

-0.83 |

2.46 |

1.86 |

| BLOOMBERG U.S. 1-15 YEAR BLEND (1-17) MUNICIPAL BOND INDEX (Reflects No Deduction for Fees, Expenses, or Taxes) |

0.86 |

3.57 |

3.05 |

| Portfolio Managers |

Managed the Fund Since |

Primary Title with Investment Adviser |

| Richard Taormina |

2006 |

Managing Director |

| David Sivinski |

2005 |

Executive Director |

| Kevin M. Ellis |

2014 |

Managing Director |

| For Class A and Class C Shares | |

| To establish an account |

$1,000 |

| To add to an account |

$50 |

| For Class I Shares | |

| To establish an account |

$1,000,000 |

| To add to an account |

No minimum levels |

| SHAREHOLDER FEES (Fees paid directly from your investment) | |||

| |

Class A |

Class C |

Class I |

| Maximum Sales Charge (Load) Imposed on Purchases as % of the Offering Price |

3.75% |

NONE |

NONE |

| Maximum Deferred Sales Charge (Load) as % of Original Cost of the Shares |

NONE1 |

1.00% |

NONE |

| ANNUAL FUND OPERATING EXPENSES (Expenses that you pay each year as a percentage of the value of your investment) | |||

| |

Class A |

Class C |

Class I |

| Management Fees |

0.30% |

0.30% |

0.30% |

| Distribution (Rule 12b-1) Fees |

0.25 |

0.75 |

NONE |

| Other Expenses |

0.39 |

0.39 |

0.39 |

| Service Fees |

0.25 |

0.25 |

0.25 |

| Remainder of Other Expenses |

0.14 |

0.14 |

0.14 |

| Total Annual Fund Operating Expenses |

0.94 |

1.44 |

0.69 |

| Fee Waivers and/or Expense Reimbursements1 |

-0.19 |

-0.19 |

-0.19 |

| Total Annual Fund Operating Expenses after Fee Waivers and/or Expense Reimburse- ments1 |

0.75 |

1.25 |

0.50 |

| IF YOU SELL YOUR SHARES, YOUR COST WOULD BE: | ||||

| |

1 Year |

3 Years |

5 Years |

10 Years |

| CLASS A SHARES ($) |

449 |

645 |

858 |

1,470 |

| CLASS C SHARES ($) |

227 |

437 |

769 |

1,572 |

| CLASS I SHARES ($) |

51 |

202 |

365 |

841 |

| IF YOU DO NOT SELL YOUR SHARES, YOUR COST WOULD BE: | ||||

| |

1 Year |

3 Years |

5 Years |

10 Years |

| CLASS A SHARES ($) |

449 |

645 |

858 |

1,470 |

| CLASS C SHARES ($) |

127 |

437 |

769 |

1,572 |

| CLASS I SHARES ($) |

51 |

202 |

365 |

841 |

An investment in this Fund or any other fund may not provide a complete investment program. The suitability of an investment in the Fund should be considered based on the investment objective, strategies and risks described in this prospectus, considered in light of all of the other investments in your portfolio, as well as your risk tolerance, financial goals and time horizons. You may want to consult with a financial advisor to determine if this Fund is suitable for you.

Investments in the Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency.

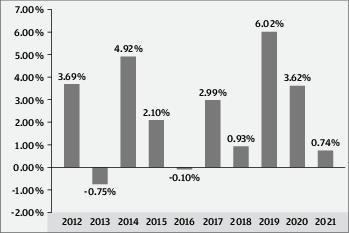

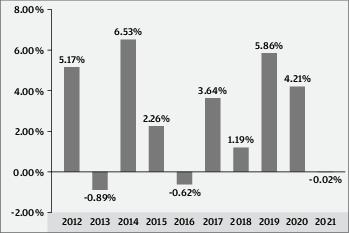

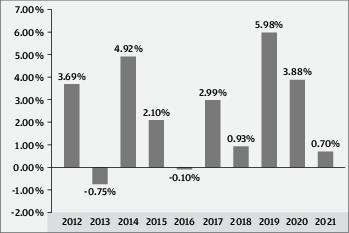

| YEAR-BY-YEAR RETURNS - CLASS I SHARES |

| Best Quarter |

1st quarter, 2019 |

2.46% |

| Worst Quarter |

4th quarter, 2016 |

-2.73% |

| The Fund’s year-to-date total return |

through |

3/31/22 |

was |

-5.27% |

. |

| AVERAGE ANNUAL TOTAL RETURNS (For periods ended December 31, 2021) | |||

| |

Past 1 Year |

Past 5 Years |

Past 10 Years |

| CLASS I SHARES |

|

|

|

| Return Before Taxes |

0.74% |

2.84% |

2.40% |

| Return After Taxes on Distributions |

0.73 |

2.84 |

2.32 |

| Return After Taxes on Distributions and Sale of Fund Shares |

1.19 |

2.76 |

2.47 |

| CLASS A SHARES |

|

|

|

| Return Before Taxes |

-3.23 |

1.78 |

1.76 |

| CLASS C SHARES |

|

|

|

| Return Before Taxes |

-1.01 |

2.08 |

1.65 |

| BLOOMBERG NEW YORK INTERMEDI- ATE (1-17 YEAR) MATURITIES INDEX (Reflects No Deduction for Fees, Expenses, or Taxes) |

1.17 |

3.32 |

2.90 |

| Portfolio Manager |

Managed the Fund Since |

Primary Title with Investment Adviser |

| David Sivinski |

2005 |

Executive Director |

| Kevin M. Ellis |

2005 |

Managing Director |

| For Class A and Class C Shares | |

| To establish an account |

$1,000 |

| To add to an account |

$50 |

| For Class I Shares | |

| To establish an account |

$1,000,000 |

| To add to an account |

No minimum levels |

| FUNDAMENTAL INVESTMENT OBJECTIVES |

| An investment objective is fundamental if it cannot be changed without the consent of a majority of the outstanding shares of the Fund. The investment objectives for the Short-Intermediate Municipal Bond Fund, Sustainable Municipal Income Fund and Tax Free Bond Fund are fundamental. The investment objectives for the remaining Funds are non-fundamental and can be changed without the consent of a majority of the outstanding shares of that Fund. |

An investment in a Fund or any other fund may not provide a complete investment program. The suitability of an investment in a Fund should be considered based on the investment objective, strategies and risks described in this prospectus, considered in light of all of the other investments in your portfolio, as well as your risk tolerance, financial goals and time horizons. You may want to consult with a financial advisor to determine if a Fund is suitable for you.

| |

Sustainable Municipal Income Fund |

Short-Intermediate Municipal Bond Fund |

Tax Free Bond Fund |

Ultra-Short Municipal Fund |

California Tax Free Bond Fund |

High Yield Municipal Fund |

Intermediate Tax Free Bond Fund |

New York Tax Free Bond Fund |

| Alternative Minimum Tax Risk |

• |

• |

• |

• |

• |

• |

• |

• |

| Auction Rate Securities Risk |

○ |

• |

○ |

• |

○ |

• |

○ |

○ |

| California Geographic Concentration Risk |

|

|

|

|

• |

|

|

|

| Credit Risk |

• |

• |

• |

• |

• |

• |

• |

• |

| Debt Securities and Other Callable Securities Risk |

• |

• |

• |

• |

• |

• |

• |

• |

| Derivatives Risk |

○ |

○ |

○ |

○ |

○ |

○ |

○ |

○ |

| Exchange-Traded Fund (ETF) and/or Other Investment Company Risk |

○ |

○ |

○ |

○ |

○ |

• |

○ |

○ |

| Floating and Variable Rate Securities Risk |

○ |

○ |

○ |

• |

○ |

• |

○ |

○ |

| General Market Risk |

• |

• |

• |

• |

• |

• |

• |

• |

| Government Securities Risk |

○ |

○ |

○ |

○ |

• |

• |

• |

• |

| High Yield Securities Risk |

• |

• |

• |

• |

• |

• |

• |

• |

| Industry and Sector Focus Risk |

• |

• |

• |

• |

• |

• |

• |

• |

| Interest Rate Risk |

• |

• |

• |

• |

• |

• |

• |

• |

| Inverse Floating Rate Instrument Risk |

○ |

○ |

○ |

○ |

○ |

• |

○ |

○ |

| Loan Risk |

|

|

|

|

|

○ |

|

|

| Mortgage-Related and Other Asset-Backed Securities Risk |

• |

• |

• |

• |

• |

○ |

• |

• |

| Municipal Housing Authority Obligations Risk |

• |

• |

○ |

• |

○ |

○ |

○ |

○ |

| |

Sustainable Municipal Income Fund |

Short-Intermediate Municipal Bond Fund |

Tax Free Bond Fund |

Ultra-Short Municipal Fund |

California Tax Free Bond Fund |

High Yield Municipal Fund |

Intermediate Tax Free Bond Fund |

New York Tax Free Bond Fund |

| Municipal Obligations Risk |

• |

• |

• |

• |

• |

• |

• |

• |

| New York Geographic Concentration Risk |

|

|

|

|

|

|

|

• |

| Pay-In-Kind and Deferred Payment Securities Risk |

○ |

○ |

○ |

○ |

○ |

○ |

○ |

○ |

| Restricted Securities Risk |

• |

• |

○ |

• |

○ |

• |

○ |

○ |

| Social or Environmental Investing Risk |

• |

|

|

|

|

|

|

|

| Structured Product Risk |

○ |

○ |

○ |

• |

○ |

• |

○ |

○ |

| Taxability Risk |

• |

• |

• |

• |

• |

• |

• |

• |

| Risk Associated with the Fund Holding Cash, Money Market Instruments and Other Short-Term Investments |

|

• |

• |

|

|

|

|

|

| Transactions and Liquidity Risk |

• |

• |

• |

• |

• |

• |

• |

• |

| Ultra-Short Fund Risk |

|

|

|

• |

|

|

|

|

| Cyber Security Risk |

○ |

○ |

○ |

○ |

○ |

○ |

○ |

○ |

| Volcker Rule Risk |

○ |

○ |

○ |

○ |

○ |

○ |

○ |

○ |

| Zero-Coupon Bond Risk |

• |

• |

• |

• |

• |

• |

• |

• |

| WHAT IS A DERIVATIVE? |

| Derivatives are securities or contracts (for example, futures and options) that derive their value from the performance of underlying assets or securities. |

| WHAT IS A CASH EQUIVALENT? |

| Cash equivalents are highly liquid, high-quality instruments with maturities of three months or less on the date they are purchased. They include securities issued by the U.S. government, its agencies and instrumentalities, repurchase agreements, certificates of deposit, bankers’ acceptances, commercial paper, money market mutual funds and bank deposit accounts. |

High Yield Municipal Fund

Intermediate Tax Free Bond Fund

New York Tax Free Bond Fund

Short-Intermediate Municipal Bond Fund

Tax Free Bond Fund

| California Tax Free Bond Fund |

0.28% |

| High Yield Municipal Fund |

0.31 |

| Intermediate Tax Free Bond Fund |

0.24 |

| New York Tax Free Bond Fund |

0.28 |

| Short-Intermediate Municipal Bond Fund |

0.15 |

| Sustainable Municipal Income Fund |

0.23 |

| Tax Free Bond Fund |

0.28 |

| Ultra-Short Municipal Fund |

0.00 |

Shares of the Funds have not been registered for sale outside of the United States. This prospectus is not intended for distribution to prospective investors outside of the United States. The Funds generally do not market or sell shares to investors domiciled outside of the United States, even, with regard to individuals, if they are citizens or lawful permanent residents of the United States.

| |

Class A |

Class C |

Class I |

| Eligibility1,2 |

May be purchased by the general public |

May be purchased by the general public3 |

May be purchased by: •Institutional Investors who meet the minimum investment requirements; •Individuals purchasing directly from the Fund through JPMorgan Distribution Services, Inc. (the “Distributor”) and meeting the investment minimum requirements; •Financial Intermediaries or any other organization, including affiliates of JPMorgan Chase & Co. (JPMorgan Chase), authorized to act in a fiduciary, advisory or custodial capacity for its clients or customers; •Brokerage program of a Financial Intermediary that has entered into a written agreement with the Distributor to offer such shares (“Eligible Brokerage Program”); and •Employees of JPMorgan Chase and its affiliates and officers or trustees of the JPMorgan Funds.4 |

| Minimum Investment1,5,6 |

$1,000 for each Fund or $50, if establishing a monthly $50 Systematic Investment Plan7 |

$1,000 for each Fund or $50, if establishing a monthly $50 Systematic Investment Plan7 |

$1,000,000 – An investor can combine purchases of Class I Shares of other J.P. Morgan Funds in order to meet the minimum. $1,000 for each Fund or $50, if establishing a monthly $50 Systematic Investment Plan for investments through an Eligible Brokerage Program. $1,000 for each Fund or $50 if establishing a monthly $50 Systematic Investment Plan7for investments by employees of JPMorgan Chase and its affiliates and officers or trustees of the J.P. Morgan Funds.4 |

| |

Class A |

Class C |

Class I |

| Minimum Subsequent Investments1 |

$508 |

$508 |

No minimum except $50 for investments by employees of JPMorgan Chase and its affiliates and officers or trustees of the J.P. Morgan Funds and investments through an Eligible Brokerage Program. |

| Systematic Investment Plan |

Yes |

Yes |

No except for investments by employees of JPMorgan Chase and its affiliates and officers or trustees of the J.P. Morgan Funds and investments through an Eligible Brokerage Program. |

| Systematic Redemption Plan |

Yes |

Yes |

No except for investments by employees of JPMorgan Chase and its affiliates and officers or trustees of the JPMorgan Funds. |

| Front-End Sales Charge (refer to Sales Charges and Financial Intermediary Compensation Section for more details) |

Up to 2.25% reduced or waived for large purchases and certain investors, eliminated for purchases of $250,000 or more for Short-Intermediate Municipal Bond Fund and all purchases of the Ultra-Short Municipal Fund. Up to 3.75% reduced or waived for large purchases and certain investors, eliminated for purchases of $250,000 or more for Funds (other than Short- Intermediate Municipal Bond Fund and Ultra-Short Municipal Fund) |

None |

None |

| Contingent Deferred Sales Charge (CDSC) (refer to Sales Charges and Financial Intermediary Compensation Section for more details) |

None for purchases of Ultra- Short Municipal Fund. On purchases of $250,000 or more of Short-Intermediate Municipal Bond Fund. •0.75% on redemptions made within 18 months after purchase. On purchases of $250,000 or more for Funds (other than Ultra-Short Municipal Fund or Short-Intermediate Municipal Bond Fund) •0.75% on redemptions made within 18 months after purchase. Waived under certain circumstances. |

•1.00% on redemptions made within 12 months after purchase. Waived under certain circumstances. |

None |

| Distribution (12b-1) Fee |

0.25% of the average daily net assets. |

0.75% of the average daily net assets. |

None |

| |

Class A |

Class C |

Class I |

| Service Fee |

0.25% of the average daily net assets. |

0.25% of the average daily net assets. |

0.25% of the average daily net assets. |

| Redemption Fee |

None |

None |

None |

| Conversion Feature9 |

None |

Class C Shares will be converted to Class A Shares in the following instances: •If an investor is eligible to purchase Class A Shares, then their Class C Share positions will convert to Class A Shares after 8 years, calculated from the first day of the month of purchase and processed on the tenth business day of the anniversary month. •If Class C Shares held in an account with a third party broker of record are transferred to an account with the Distributor, those Class C Shares will be converted to Class A Shares on the tenth business day of the month following the transfer. |

None |

| Advantages |

If you are eligible to have the sales charge reduced or eliminated or you have a long- term investment horizon, these shares have lower distribution fees over a longer term investment horizon than Class C Shares. |

No front-end sales charge is assessed so you own more shares initially. These shares may make sense for investors who have a shorter investment horizon relative to Class A Shares. |

No front-end sales charge or CDSC is assessed so you own more shares initially. In addition, Class I Shares have lower fees than Class A and Class C Shares. |

| Disadvantages |

A front-end sales charge is generally assessed, diminishing the number of shares owned. If you are eligible to have the sales charge reduced or eliminated, you may be subject to a CDSC. Class A Shares may not make sense for investors who have a shorter investment horizon relative to Class C Shares. |

Shares are subject to CDSC and have higher ongoing distribution fees. This means that over the long term Class C Shares accrue higher fees than Class A Shares. |

Limited availability and higher minimum initial investment than Class A and Class C Shares. |

| Class A Shares Amount of Investment |

Sales Charge as a % of Offering Price |

Sales Charge as a % of your Investment |

Commission as a % of Offering Price2 |

CDSC |

| Less than $50,000 |

0.00 |

0.00 |

0.00 |

0.00 |

| $50,000 to $99,999 |

0.00 |

0.00 |

0.00 |

0.00 |

| $100,000 to $249,999 |

0.00 |

0.00 |

0.00 |

0.00 |

| $250,000 or more |

0.00 |

0.00 |

0.00 |

0.00 |

| Class A Shares Amount of Investment |

Sales Charge as a % of Offering Price |

Sales Charge as a % of your Investment1 |

Commission as a % of Offering Price2 |

CDSC |

| Less than $50,000 |

2.25 |

2.30 |

2.00 |

0.00 |

| $50,000 to $99,999 |

2.00 |

2.04 |

1.50 |

0.00 |

| $100,000 to $249,999 |

1.25 |

1.27 |

1.00 |

0.00 |

| |

|

|

|

|

| Amount of Investment |

Sales Charge as a % of Offering Price |

Sales Charge as a % of your Investment |

Finder’s Fee as a % of your Investment4 |

CDSC as a % of your Redemption3 |

| $250,000 to $3,999,999 |

0.00 |

0.00 |

0.75 |

0-18 months – 0.75% |

| $4,000,000 to $9,999,999 |

0.00 |

0.00 |

0.50 | |

| $10,000,000 or more |

0.00 |

0.00 |

0.25 |

| Class A Shares Amount of Investment |

Sales Charge as a % of Offering Price |

Sales Charge as a % of your Investment1 |

Commission as a % of Offering Price2 |

CDSC |

| Less than $100,000 |

3.75 |

3.90 |

3.25 |

0.00 |

| $100,000 to $249,999 |

3.25 |

3.36 |

2.75 |

0.00 |

| |

|

|

|

|

| Amount of Investment |

Sales Charge as a % of Offering Price |

Sales Charge as a % of your Investment |

Finder’s Fee as a % of your Investment4 |

CDSC as a % of your Redemption3 |

| $250,000 to $3,999,999 |

0.00 |

0.00 |

0.75 |

0-18 months — 0.75% |

| $4,000,000 to $49,999,999 |

0.00 |

0.00 |

0.50 | |

| $50,000,000 or more |

0.00 |

0.00 |

0.25 |

| Class A Shares Amount of Investment |

Sales Charge as a % of Offering Price |

Sales Charge as a % of your Investment |

Finder’s Fee as a % of your Investment |

CDSC as a % of your Redemption1 |

| $0 to $3,999,999 |

0.00 |

0.00 |

0.75 |

0.00 |

| $4,000,000 to $9,999,999 |

0.00 |

0.00 |

0.50 |

0.00 |

| $10,000,000 or more |

0.00 |

0.00 |

0.25 |

0.00 |

| Class A Shares Amount of Investment |

Sales Charge as a % of Offering Price |

Sales Charge as a % of your Investment |

Finder’s Fee as a % of your Investment |

CDSC as a % of your Redemption1 |

| $0 to $3,999,999 |

0.00 |

0.00 |

0.75 |

0.00 |

| $4,000,000 to $49,999,999 |

0.00 |

0.00 |

0.50 |

0.00 |

| $50,000,000 or more |

0.00 |

0.00 |

0.25 |

0.00 |

| Class C Shares Amount of Investment |

Sales Charge as a % of Offering Price |

Sales Charge as a % of your Investment |

Commission as a % of Offering Price |

CDSC as a % of your Redemption |

| All Investments |

0.00 |

0.00 |

1.00 |

0-12 months —1.00% |

Below are the qualifying holdings and account types that may be aggregated in order to exercise your Rights of Accumulation and Letter of Intent privileges to qualify for a reduced front-end sales charge on Class A Shares.

| Class |

Rule 12b-1 Fee |

| Class A |

0.25% |

| Class C |

0.75% |

| Class I |

None |

| Class |

Service Fee |

| Class A |

0.25% |

| Class C |

0.25% |

| Class I |

0.25% |

| HOW TO PURCHASE DIRECTLY WITH THE J.P. MORGAN FUNDS | ||

| |

Opening a New Account |

Purchasing into an Existing Account |

| By Phone or Online 1-800-480-4111 Shareholder Services representatives are available Monday through Friday from 8:00 am to 6:00 pm ET. www.jpmorganfunds.com Note: Certain account types are not available for online account access. Please call for additional information. |

A new account generally may not be opened by phone or online. Employees of JPMorgan Chase & Co. may open a new account online. A new fund position can be added to an existing account by phone or online if you have bank information on file. The minimum initial investment requirement must be met. |

You must already have bank information on file. If we do not have bank information on file, you must submit written instructions. Please call for instructions on how to add bank information to your account. |

| By Mail Regular mailing address: J.P. Morgan Funds Services P.O. Box 219143 Kansas City, MO 64121-9143 Overnight mailing address: J.P. Morgan Funds Services 430 W 7th Street, Suite 219143 Kansas City, MO 64105-1407 |

Mail the completed and signed application with a check to our Regular or Overnight mailing address. Refer to the Additional Information Regarding Purchases section. |

Please mail your check and include your name, the Fund name, and your fund account number. |

| All checks must be made payable to one of the following: •J.P. Morgan Funds; or •The specific Fund in which you are investing. Please include your existing account number, if applicable. All checks must be in U.S. dollars. The J.P. Morgan Funds do not accept credit cards, cash, starter checks, money orders or credit card checks. The Funds and/or the Distributor reserve the right to refuse “third-party” checks and checks drawn on non- U.S. financial institutions even if payment may be effected through a U.S. financial institution. Checks made payable to any individual or company and endorsed to J.P. Morgan Funds or a Fund are considered third-party checks. | ||

| By ACH or Wire1 1-800-480-4111 Wire Instructions: DST Asset Manager Solutions, Inc. 2000 Crown Colony Drive Quincy, MA 02169 Attn: J.P. Morgan Funds Services ABA: 021 000 021 DDA: 323 125 832 FBO: Fund Name Fund: Fund # Account: Your Account # and Your Account Registration |

You may include bank information on your application for your initial purchase to be processed via Automated Clearing House (ACH) rather than sending a check. New accounts cannot be opened by wire purchase. |

Purchase by ACH: To process a purchase via ACH using bank information on file you may call us or process the purchase online. Purchase by Wire: If you choose to pay by wire, please call to notify the Fund of your purchase. You must also initiate the wire with your financial institution. |

| HOW TO PURCHASE DIRECTLY WITH THE J.P. MORGAN FUNDS | ||

| |

Opening a New Account |

Purchasing into an Existing Account |

| Systematic Investment Plan1 |

You may include instructions to set up a Systematic Investment Plan on your application. Bank Information must be included. Refer to Choosing A Share Class for fund minimums. |

If bank information is on file, you may call, go online or mail written instructions to start, edit or delete a Systematic Investment Plan. You cannot have a Systematic Investment Plan and a Systematic Redemption Plan or Systematic Exchange Plan on the same fund account. If bank information is not on file, you will be required to submit a completed form with your bank information and Systematic Investment Plan details. |

| EXCHANGE PRIVILEGES |

| Class A Shares of a Fund may be exchanged for: |

| •Class A Shares of another J.P. Morgan Fund, |

| •Morgan Shares of a J.P. Morgan money market fund (except for JPMorgan Prime Money Market Fund), or |

| •Another share class of the same Fund if you are eligible to purchase that class. |

| Class C Shares of a Fund may be exchanged for: |

| •Class C Shares of another J.P. Morgan Fund (except for JPMorgan Prime Money Market Fund). Your new Class C Shares will be subject to the CDSC of the Fund from which you exchanged, and the current holding period for your exchanged Class C Shares is carried over to your new shares. |

| •Class I, Class L or Class R6 Shares, if available, of the same Fund, provided you meet the eligibility requirements for the class you are exchanging into. In addition, the Class C Shares that you wish to exchange must not currently be subject to any CDSC. |

| Class I Shares of a Fund may be exchanged for: |

| •Class I Shares of another J.P. Morgan Fund, |

| •Morgan Shares of a J.P. Morgan money market fund (except for JPMorgan Prime Money Market Fund), or |

| •Another share class of the same Fund if you are eligible to purchase that class. |

| HOW TO REDEEM | |

| By Phone or Online Note: Certain account types are not available for online account access. |

Call us at 1-800-480-4111 Shareholder Services representatives are available Monday through Friday from 8:00 am to 6:00 pm ET. www.jpmorganfunds.com |

| By Mail |

Regular mailing address: J.P. Morgan Funds Services P.O. Box 219143 Kansas City, MO 64121-9143 Overnight mailing address: J.P. Morgan Funds Services 430 W 7th Street, Suite 219143 Kansas City, MO 64105-1407 |

| Systematic Redemption Plan2, 3 Note:The Funds currently do not charge for this service, but may impose a charge in the future. |

You may include instructions to set up a Systematic Redemption Plan on your application. Payment instructions must be included. You may call, or mail written instructions to start, edit or delete a Systematic Redemption Plan. You may send a written redemption request to your Financial Intermediary, if applicable, or to the Fund at the following address: J.P. Morgan Funds Services P.O. Box 219143 Kansas City, MO 64121-9143 You may redeem over the phone. Please see “Can I redeem by phone?” for more information. If you own Class A or Class C Shares, the applicable CDSC will be deducted from those payments unless such payments are made: 4 •Monthly and constitute no more than 1/12 of 10% of your then-current balance in the Fund each month; or •Quarterly and constitute no more than ¼ of 10% of your then-current balance in the Fund each quarter. It may not be in your best interest to buy additional Class A Shares while participating in a Systematic Redemption Plan. This is because Class A Shares have an upfront sales charge. |

IMPORTANT TAX REPORTING CONSIDERATIONS

| FUND NAME |

FUND CODE |

| JPMorgan Sustainable Municipal Income Fund |

1 |

| JPMorgan Short-Intermediate Municipal Bond Fund |

2 |

| JPMorgan Tax Free Bond Fund |

3 |

| JPMorgan Ultra-Short Municipal Fund |

4 |

| JPMorgan California Tax Free Bond Fund |

5 |

| JPMorgan High Yield Municipal Fund |

6 |

| JPMorgan Intermediate Tax Free Bond Fund |

7 |

| JPMorgan New York Tax Free Bond Fund |

8 |

| INSTRUMENT |

FUND CODE |

RISK TYPE |

| Adjustable Rate Mortgage Loans (ARMs): Loans in a mortgage pool which provide for a fixed initial mortgage interest rate for a specified period of time, after which the rate may be subject to periodic adjustments. |

2, 6 |

Credit Interest Rate Liquidity Market Political Prepayment Valuation |

| Asset-Backed Securities: Securities secured by company receivables, home equity loans, truck and auto loans, leases, and credit card receivables or other securities backed by other types of receivables or other assets. |

1–8 |

Credit Interest Rate Liquidity Market Political Prepayment Valuation |

| Auction Rate Securities: Auction rate municipal securities and auction rate preferred securities issued by closed-end investment companies. |

1–8 |

Credit Interest Rate Liquidity Market |

| Bank Obligations: Bankers’ acceptances, certificates of deposit and time deposits. Bankers’ acceptances are bills of exchange or time drafts drawn on and accepted by a commercial bank. Maturities are generally six months or less. Certificates of deposit are negotiable certificates issued by a bank for a specified period of time and earning a specified return. Time deposits are non-negotiable receipts issued by a bank in exchange for the deposit of funds. |

1–8 |

Credit Currency Interest Rate Liquidity Market Political |

| Borrowings: A Fund may borrow for temporary purposes and/or for investment purposes. Such a practice will result in leveraging of the Fund’s assets and may cause a Fund to liquidate portfolio positions when it would not be advantageous to do so. A Fund must maintain continuous asset coverage of 300% of the amount borrowed, with the exception for borrowings not in excess of 5% of the Fund’s total assets made for temporary administrative purposes. |

1–8 |

Credit Interest Rate Market |

| Call and Put Options: A call option gives the buyer the right to buy, and obligates the seller of the option to sell a security at a specified price at a future date. A put option gives the buyer the right to sell, and obligates the seller of the option to buy a security at a specified price at a future date. A Fund will sell only covered call and secured put options. |

1–8 |

Credit Leverage Liquidity Management Market |

| INSTRUMENT |

FUND CODE |

RISK TYPE |

| Commercial Paper: Secured and unsecured short-term promissory notes issued by corporations and other entities. Maturities generally vary from a few days to nine months. |

1–8 |

Credit Currency Interest Rate Liquidity Market Political Valuation |

| Common Stock Warrants and Rights: Securities, typically issued with preferred stock or bonds, that give the holder the right to buy a proportionate amount of common stock at a specified price. |

3 |

Credit Market |

| Corporate Debt Securities: May include bonds and other debt securities of domestic and foreign issuers, including obligations of industrial, utility, banking and other corporate issuers. |

1–8 |

Credit Currency Interest Rate Liquidity Market Political Prepayment Valuation |

| Credit Default Swaps (CDSs): A swap agreement between two parties pursuant to which one party pays the other a fixed periodic coupon for the specified life of the agreement. The other party makes no payment unless a credit event, relating to a predetermined reference asset, occurs. If such an event occurs, the party will then make a payment to the first party, and the swap will terminate. |

1–3, 5–8 |

Credit Currency Interest Rate Leverage Liquidity Management Market Political Valuation |

| Custodial Receipts: A Fund may acquire securities in the form of custodial receipts that evidence ownership of future interest payments, principal payments or both on certain U.S. Treasury notes or bonds in connection with programs sponsored by banks and brokerage firms. These are not considered to be U.S. government securities. These notes and bonds are held in custody by a bank on behalf of the owners of the receipts. |

1–3, 5–8 |

Credit Liquidity Market |

| Demand Features: Securities that are subject to puts and standby commitments to purchase the securities at a fixed price (usually with accrued interest) within a fixed period of time following demand by a Fund. |

1–8 |

Liquidity Management Market |

| Exchange-Traded Funds (ETFs): Ownership interest in unit investment trusts, depositary receipts, and other pooled investment vehicles that hold a portfolio of securities or stocks designed to track the price performance and dividend yield of a particular broad-based, sector or international index. ETFs include a wide range of investments. |

1–3, 5–8 |

Investment Company Market |

| Foreign Investments: Equity and debt securities (e.g., bonds and commercial paper) of foreign entities and obligations of foreign branches of U.S. banks and foreign banks. Foreign securities may also include American Depositary Receipts (ADRs), Global Depositary Receipts (GDRs), European Depositary Receipts (EDRs) and American Depositary Securities. |

6 |

Foreign Investment Liquidity Market Political Prepayment Valuation |

| INSTRUMENT |

FUND CODE |

RISK TYPE |

| High Yield/High Risk Securities/Junk Bonds: Securities that are generally rated below investment grade by the primary rating agencies or are unrated but deemed by a Fund’s adviser to be of comparable quality. |

1-8 |

Credit Currency High Yield Securities Interest Rate Liquidity Market Political Portfolio Quality Valuation |

| Inflation-Linked Debt Securities: Includes fixed and floating rate debt securities of varying maturities issued by the U.S. government as well as securities issued by other entities such as corporations, foreign governments and foreign issuers. |

4, 6 |

Credit Currency Interest Rate Political |

| Interfund Lending: Involves lending money and borrowing money for temporary purposes through a credit facility. |

1–8 |

Credit Interest Rate Market |

| Inverse Floating Rate Instruments: Leveraged variable debt instruments with interest rates that reset in the opposite direction from the market rate of interest to which the inverse floater is indexed. |

1–8 |

Credit Leverage Market |

| Investment Company Securities: Shares of other investment companies, including money market funds for which the adviser and/or its affiliates serve as investment adviser or administrator. The adviser will waive certain fees when investing in funds for which it serves as investment adviser, to the extent required by law or by contract. |

1–8 |

Investment Company Market |

| Loan Assignments and Participations: Assignments of, or participations in all or a portion of loans to corporations or to governments, including governments in less developed countries. |

1–3, 5–8 |

Credit Currency Extension Foreign Investment Interest Rate Liquidity Market Political Prepayment |

| Master Limited Partnerships: Limited partnerships that are publicly traded on a securities exchange. |

6 |

Market |

| Mortgages (Directly Held): Debt instruments secured by real property. |

6 |

Credit Environmental Extension Interest Rate Liquidity Market Natural Event Political Prepayment Valuation |

| INSTRUMENT |

FUND CODE |

RISK TYPE |

| Mortgage-Backed Securities: Debt obligations secured by real estate loans and pools of loans such as collateralized mortgage obligations (CMOs), commercial mortgage-backed securities (CMBSs) and other asset-backed structures. |

1–8 |

Credit Currency Extension Interest Rate Leverage Liquidity Market Political Prepayment Tax Valuation |

| Mortgage Dollar Rolls1 : A transaction in which the Fund sells securities for delivery in a current month and simultaneously contracts with the same party to repurchase similar but not identical securities on a specified future date. |

2, 6 |

Currency Extension Interest Rate Leverage Liquidity Market Political Prepayment |

| Municipal Securities: Securities issued by a state or political subdivision to obtain funds for various public purposes. Municipal securities include, among others, private activity bonds and industrial development bonds, as well as general obligation notes, tax anticipation notes, bond anticipation notes, revenue anticipation notes, other short-term tax-exempt obligations, municipal leases, obligations of municipal housing authorities and single family revenue bonds. |

1–8 |

Credit Interest Rate Market Natural Event Political Prepayment Tax Valuation |

| New Financial Products: New options and futures contracts and other financial products continue to be developed and the Fund may invest in such options, contracts and products. |

1–8 |

Credit Liquidity Management Market |

| Obligations of Supranational Agencies: Obligations which are chartered to promote economic development and are supported by various governments and governmental agencies. |

2 |

Credit Foreign Investment Liquidity Political Valuation |

| Options and Futures Transactions: A Fund may purchase and sell (a) exchange traded and over- the-counter put and call options on securities, indexes of securities and futures contracts on securities and indexes of securities, and (b) futures contracts on securities and indexes of securities. |

1–8 |

Credit Leverage Liquidity Management Market |

| Preferred Stock: A class of stock that generally pays a dividend at a specified rate and has preference over common stock in the payment of dividends and in liquidation. |

2, 6 |

Market |

| Private Placements, Restricted Securities and Other Unregistered Securities: Securities not registered under the Securities Act of 1933, such as privately placed commercial paper and Rule 144A securities. |

1–8 |

Liquidity Market Valuation |

| INSTRUMENT |

FUND CODE |

RISK TYPE |

| Real Estate Investment Trusts (REITs): Pooled investment vehicles which invest primarily in income producing real estate or real estate related loans or interest. |

6 |

Credit Interest Rate Liquidity Management Market Political Prepayment Tax Valuation |

| Repurchase Agreements: The purchase of a security and the simultaneous commitment to return the security to the seller at an agreed upon price on an agreed upon date. This is treated as a loan. |

1–8 |

Credit Liquidity Market |

| Reverse Repurchase Agreements1: The sale of a security and the simultaneous commitment to buy the security back at an agreed upon price on an agreed upon date. This is treated as borrowing by a Fund. |

1, 4, 6 |

Credit Leverage Market |

| Securities Issued in Connection with Reorganizations and Corporate Restructurings: In connection with reorganizing or restructuring of an issuer, an issuer may issue common stock or other securities to holders of its debt securities. |

6 |

Market |

| Short Selling: A Fund sells a security it does not own in anticipation of a decline in the market value of the security. To complete the transaction, a Fund must borrow the security to make delivery to the buyer. A Fund is obligated to replace the security borrowed by purchasing it subsequently at the market price at the time of replacement. |

6 |

Credit Liquidity Market |

| Short-Term Funding Agreements: Agreements issued by banks and highly rated U.S. insurance companies such as Guaranteed Investment Contracts (GICs) and Bank Investment Contracts (BICs). |

1–8 |

Credit Liquidity Market |

| Sovereign Obligations: Investments in debt obligations issued or guaranteed by a foreign sovereign government or its agencies, authorities or political subdivisions. |

2, 6 |

Credit Foreign Investment Liquidity Political Valuation |

| Stripped Mortgage-Backed Securities: Derivative multi-class mortgage securities which are usually structured with two classes of shares that receive different proportions of the interest and principal from a pool of mortgage assets. These include Interest Only (IO) and Principal Only (PO) securities issued outside a Real Estate Mortgage Investment Conduit (REMIC) or CMO structure. |

1–3, 5–8 |

Credit Liquidity Market Political Prepayment Valuation |

| Structured Investments: A security having a return tied to an underlying index or other security or asset class. Structured investments generally are individually negotiated agreements and may be traded over-the-counter. Structured investments are organized and operated to restructure the investment characteristics of the underlying security. |

1–8 |

Credit Foreign Investment Liquidity Management Market Valuation |

| INSTRUMENT |

FUND CODE |

RISK TYPE |

| Swaps and Related Swap Products: Swaps involve an exchange of obligations by two parties. Caps and floors entitle a purchaser to a principal amount from the seller of the cap or floor to the extent that a specified index exceeds or falls below a predetermined interest rate or amount. A Fund may enter into these transactions to manage its exposure to changing interest rates and other factors. |

1–8 |

Credit Currency Interest Rate Leverage Liquidity Management Market Political Valuation |

| Synthetic Variable Rate Instruments: Instruments that generally involve the deposit of a long- term tax exempt bond in a custody or trust arrangement and the creation of a mechanism to adjust the long-term interest rate on the bond to a variable short-term rate and a right (subject to certain conditions) on the part of the purchaser to tender it periodically to a third party at par. |

1–8 |

Credit Liquidity Market |

| Temporary Defensive Positions: To respond to unusual circumstances a Fund may invest in cash and cash equivalents for temporary defensive purposes. |

1–8 |

Credit Interest Rate Liquidity Market |

| Treasury Receipts: A Fund may purchase interests in separately traded interest and principal component parts of U.S. Treasury obligations that are issued by banks or brokerage firms and that are created by depositing U.S. Treasury notes and U.S. Treasury bonds into a special account at a custodian bank. Receipts include Treasury Receipts (TRs), Treasury Investment Growth Receipts (TIGRs) and Certificates of Accrual on Treasury Securities (CATS). |

1–8 |

Market |

| Trust Preferreds: Securities with characteristics of both subordinated debt and preferred stock. Trust preferreds are generally long term securities that make periodic fixed or variable interest payments. |

6 |

Credit Currency Interest Rate Liquidity Market Political Valuation |

| U.S. Government Agency Securities: Securities issued or guaranteed by agencies and instrumentalities of the U.S. government. These include all types of securities issued by the Government National Mortgage Association (Ginnie Mae), the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac), including funding notes, subordinated benchmark notes, CMOs and Real Estate Mortgage Investment Conduits (REMICs). |

1–8 |

Credit Government Securities Interest Rate Market |

| U.S. Government Obligations: May include direct obligations of the U.S. Treasury, including Treasury bills, notes and bonds, all of which are backed as to principal and interest payments by the full faith and credit of the United States, and separately traded principal and interest component parts of such obligations that are transferable through the Federal book-entry system known as Separate Trading of Registered Interest and Principal of Securities (STRIPS) and Coupons Under Book Entry Safekeeping (CUBES). |

1–8 |

Interest Rate Market |

| Variable and Floating Rate Instruments: Obligations with interest rates which are reset daily, weekly, quarterly or some other frequency and which may be payable to a Fund on demand or at the expiration of a specified term. |

1–8 |

Credit Liquidity Market Valuation |

| When-Issued Securities, Delayed Delivery Securities and Forward Commitments: Purchase or contract to purchase securities at a fixed price for delivery at a future date. |

1–8 |

Credit Leverage Liquidity Market Valuation |

| INSTRUMENT |

FUND CODE |

RISK TYPE |

| Zero-Coupon, Pay-in-Kind and Deferred Payment Securities: Zero-coupon securities are securities that are sold at a discount to par value and on which interest payments are not made during the life of the security. Pay-in-kind securities are securities that have interest payable by delivery of additional securities. Deferred payment securities are zero-coupon debt securities which convert on a specified date to interest bearing debt securities. |

1–8 |

Credit Currency Interest Rate Liquidity Market Political Valuation Zero-Coupon Bond |

| |

|

Per share operating performance | |||||

| |

|

Investment operations |

Distributions | ||||

| |

Net asset value, beginning of period |

Net investment income (loss) (a) |

Net realized and unrealized gains (losses) on investments |

Total from investment operations |

Net investment income |

Net realized gain |

Total distributions |

| JPMorgan Sustainable Municipal Income Fund |

|

|

|

|

|

|

|

| Class A |

|

|

|

|

|

|

|

| Year Ended February 28, 2022 |

$9.96 |

$0.18 |

$(0.29) |

$(0.11) |

$(0.18) |

$— |

$(0.18) |

| Year Ended February 28, 2021 |

10.02 |

0.17 |

(0.06) |

0.11 |

(0.17) |

— |

(0.17) |

| Year Ended February 29, 2020 |

9.55 |

0.20 |

0.47 |

0.67 |

(0.20) |

— |

(0.20) |

| Year Ended February 28, 2019 |

9.52 |

0.21 |

0.08 |

0.29 |

(0.21) |

(0.05) |

(0.26) |

| Year Ended February 28, 2018 |

9.70 |

0.23 (d) |

(0.11) |

0.12 |

(0.23) |

(0.07) |

(0.30) |

| Class C |

|

|

|

|

|

|

|

| Year Ended February 28, 2022 |

9.86 |

0.12 |

(0.30) |

(0.18) |

(0.12) |

— |

(0.12) |

| Year Ended February 28, 2021 |

9.92 |

0.11 |

(0.06) |

0.05 |

(0.11) |

— |

(0.11) |

| Year Ended February 29, 2020 |

9.45 |

0.14 |

0.47 |

0.61 |

(0.14) |

— |

(0.14) |

| Year Ended February 28, 2019 |

9.42 |

0.16 |

0.08 |

0.24 |

(0.16) |

(0.05) |

(0.21) |

| Year Ended February 28, 2018 |

9.61 |

0.17 (d) |

(0.12) |

0.05 |

(0.17) |

(0.07) |

(0.24) |

| Class I |

|

|

|

|

|

|

|

| Year Ended February 28, 2022 |

9.88 |

0.20 |

(0.29) |

(0.09) |

(0.20) |

— |

(0.20) |

| Year Ended February 28, 2021 |

9.95 |

0.19 |

(0.07) |

0.12 |

(0.19) |

— |

(0.19) |

| Year Ended February 29, 2020 |

9.48 |

0.22 |

0.47 |

0.69 |

(0.22) |

— |

(0.22) |

| Year Ended February 28, 2019 |

9.45 |

0.24 |

0.08 |

0.32 |

(0.24) |

(0.05) |

(0.29) |

| Year Ended February 28, 2018 |

9.63 |

0.25 (d) |

(0.11) |

0.14 |

(0.25) |

(0.07) |

(0.32) |

| |

Ratios/Supplemental data | |||||

| |

|

|

Ratios to average net assets |

| ||

| Net asset value, end of period |

Total return (excludes sales charge) (b) |

Net assets, end of period (000’s) |

Net expenses (c) |

Net investment income (loss) |

Expenses without waivers, reimbursements and earnings credits |

Portfolio turnover rate |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| $9.67 |

(1.16)% |

$107,969 |

0.70% |

1.79% |

0.96% |

18% |

| 9.96 |

1.09 |

125,754 |

0.69 |

1.71 |

0.96 |

22 |

| 10.02 |

7.04 |

96,844 |

0.70 |

2.02 |

0.99 |

7 |

| 9.55 |

3.15 |

60,078 |

0.70 |

2.26 |

1.01 |

13 |

| 9.52 |

1.16 |

66,258 |

0.69 |

2.33 (d) |

1.01 |

21 |

| |

|

|

|

|

|

|

| 9.56 |

(1.82) |

7,156 |

1.25 |

1.24 |

1.46 |

18 |

| 9.86 |

0.54 |

9,178 |

1.24 |

1.16 |

1.46 |

22 |

| 9.92 |

6.52 |

12,868 |

1.25 |

1.49 |

1.51 |

7 |

| 9.45 |

2.61 |

12,833 |

1.25 |

1.71 |

1.51 |

13 |

| 9.42 |

0.51 |

15,138 |

1.24 |

1.78 (d) |

1.51 |

21 |

| |

|

|

|

|

|

|

| 9.59 |

(0.92) |

116,395 |

0.45 |

2.04 |

0.71 |

18 |

| 9.88 |

1.25 |

111,724 |

0.44 |

1.96 |

0.71 |

22 |

| 9.95 |

7.36 |

114,772 |

0.44 |

2.28 |

0.74 |

7 |

| 9.48 |

3.43 |

74,386 |

0.45 |

2.51 |

0.76 |

13 |

| 9.45 |

1.42 |

71,161 |

0.44 |

2.57 (d) |

0.74 |

21 |

| |

|

Per share operating performance | |||

| |

|

Investment operations |

Distributions | ||

| |

Net asset value, beginning of period |

Net investment income (loss) (a) |

Net realized and unrealized gains (losses) on investments |

Total from investment operations |

Net investment income |

| JPMorgan Short-Intermediate Municipal Bond Fund |

|

|

|

|

|

| Class A |

|

|

|

|

|

| Year Ended February 28, 2022 |

$10.78 |

$0.11 |

$(0.32) |

$(0.21) |

$(0.11) |

| Year Ended February 28, 2021 |

10.86 |

0.13 |

(0.08) |

0.05 |

(0.13) |

| Year Ended February 29, 2020 |

10.49 |

0.16 |

0.37 |

0.53 |

(0.16) |

| Year Ended February 28, 2019 |

10.39 |

0.16 |

0.10 |

0.26 |

(0.16) |

| Year Ended February 28, 2018 |

10.48 |

0.12 |

(0.09) |

0.03 |

(0.12) |

| Class C |

|

|

|

|

|

| Year Ended February 28, 2022 |

10.88 |

0.06 |

(0.32) |

(0.26) |

(0.06) |