JPMorgan TRUST II

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04236

JPMorgan Trust II

(Exact name of registrant as specified in charter)

270 Park

Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J.

Nasta

270 Park Avenue

New York, NY 10017

(Name

and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: Last day of February

Date of reporting period: March 1, 2017 through February 28, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days

after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR

270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this

information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”)

control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC

20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company

Act of 1940 (17 CFR 270.30e-1).

Annual Report

J.P. Morgan Municipal Bond Funds

February 28, 2018

JPMorgan Municipal Income Fund

JPMorgan Short-Intermediate Municipal Bond Fund

JPMorgan Tax Free Bond

Fund

JPMorgan Ultra-Short Municipal Fund

CONTENTS

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or

guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are

subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be,

and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P.

Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

CEO’S LETTER

March 29, 2018 (Unaudited)

Dear Shareholder,

The global economic expansion continued through its ninth consecutive year, supported by central bank policies, corporate earnings growth, consumer confidence and stable energy prices. Global equity and bond

prices generally rose throughout the twelve months ended February 28, 2018, but fought to rebound from a sharp sell-off in early February.

|

|

|

|

|

“Key fundamental drivers of asset prices remain in place even as financial market volatility has risen from the

historic lows seen throughout 2017.” — George C.W. Gatch |

During the reporting period, the U.S. Federal Reserve (the “Fed”) raised benchmark interest rates three times in

response to a tightening labor market and early but muted signs of price inflation. Meanwhile, U.S. gross domestic product (GDP) surged to a better-than-expected 2.9% in the final quarter of 2017, and early indicators pointed to a continued seasonal

pattern of weaker but positive GDP growth for the first quarter of 2018.

Labor markets in the U.S. continued to tighten, with the unemployment

rate falling to 4.1% in October and remaining at that level through February. Labor force participation rates also rose somewhat but wage growth remained subdued.

Meanwhile, surging U.S. consumer confidence, record low volatility in financial markets and the December enactment of tax cut legislation appeared to provide additional fuel to the rally in equities that

lasted from March through January. The Standard & Poor’s 500 Index (the “S&P 500”) reached record closing highs throughout the reporting period until February’s sell-off, which snapped a 15-month run of gains. Amid the

sell-off, prices for government and corporate bonds plummeted.

Analysts largely attributed the sell-off to investor concerns that signs of rising

inflation would prompt the Fed to accelerate the rollout of future interest rates increases. Historically high equity market valuations added fuel to the sell-off. While equity prices had somewhat rebounded by the end of February, bond prices

remained under pressure.

In response to continued economic growth, the European Central Bank in January reduced its monthly asset purchases by

half, though it left its benchmark interest rate unchanged at 0%. In November, the Bank of England raised interest rates for the first time in a decade and preparations for Britain’s exit

from the European Union continued to move forward. Political uncertainty in Europe appeared to recede somewhat. In May, centrist politician Emmanuel Macron decisively defeated a challenge from far-right candidate Marine Le Pen to become

France’s president. In October, a separatist movement in Spain’s Catalonia region was largely thwarted by the central government in Madrid. And at the end of the reporting period, German Chancellor Angela Merkel ended a political stalemate

by successfully forming a governing coalition.

Emerging market nations continued to benefit from robust growth in China, rising commodity prices

and strong global demand for goods. Emerging markets debt, which generated strong returns for investors during most of the reporting period, began to weaken late in 2017 amid a decline in the value of the U.S. dollar, which effectively raises export

prices.

Key fundamental drivers of asset prices remain in place even as financial market volatility has risen from the historic lows seen

throughout 2017. While leading central banks have edged toward policy normalization, they largely continue to be accommodative to financial markets. Corporate earnings have increased and business investment began to rise in the latter part of the

reporting period. Consumer sentiment is buoyant and the global economy continued to expand in a synchronized fashion. Investors who hold a long-term outlook, while remaining fully invested in a well-diversified portfolio, will be best positioned, we

believe, to navigate the current market environment.

We look forward to managing your investment needs for years to come. Should you have any

questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

George C.W. Gatch

CEO, Global Funds Management

J.P. Morgan Asset

Management

|

|

|

|

|

|

|

|

|

|

|

|

|

| FEBRUARY 28, 2018 |

|

J.P. MORGAN MUNICIPAL BOND FUNDS |

|

|

|

|

1 |

|

J.P. Morgan Municipal Bond Funds

MARKET OVERVIEW

TWELVE MONTHS ENDED FEBRUARY 28,

2018 (Unaudited)

Returns for U.S. municipal bonds were modestly

positive. Interest rates rose during the second half of the reporting period and bond yields, which move in the opposite direction of prices, rose most among bonds with shorter maturities. In early February 2018, a sharp sell-off pushed down prices

for both fixed income and equity securities. Generally, investors blamed the sell-off on a surge in U.S. Treasury bond yields, uncertainty about U.S. Federal Reserve policy and historically high equity valuations.

By the end of the reporting period, U.S. stock prices had rebounded somewhat, while yields on corporate bonds and U.S. Treasury bonds remained at elevated

levels. Overall, bond prices were weighed down by expectations of accelerating inflation rising and interest rates as the U.S. economic expansion neared its ninth year.

For the twelve months ended February 28, 2018, the Bloomberg Barclays Municipal Bond Index returned 2.50%.

|

|

|

|

|

|

|

|

|

|

|

| 2 |

|

|

|

J.P. MORGAN MUNICIPAL BOND FUNDS |

|

FEBRUARY 28, 2018 |

JPMorgan Municipal Income Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2018 (Unaudited)

|

|

|

|

|

| REPORTING PERIOD RETURN: |

|

| Fund (Class I Shares)1, * |

|

|

1.42% |

|

| Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index |

|

|

1.76% |

|

|

|

| Net Assets as of 2/28/2018 (In Thousands) |

|

|

$217,295 |

|

| Duration as of 2/28/2018 |

|

|

5.0 years |

|

INVESTMENT OBJECTIVE**

The JPMorgan Municipal Income Fund (the “Fund”) seeks current income exempt from federal income taxes.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the twelve months ended

February 28, 2018, the Fund’s Class I Shares underperformed the Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index (the “Benchmark”).

Relative to the Benchmark, the Fund’s underweight position in the intermediate and longer portions of the yield curve detracted from performance. The

yield curve shows the relationship between yields and maturity dates for a set of similar bonds at a given point in time. The Fund’s overweight positions in the housing sector and in bonds rated AAA also detracted from relative performance.

The Fund’s overweight position in revenue bonds was a leading contributor to performance relative to the Benchmark. The Fund had no

allocation to pre-refunded bonds, which contributed to relative performance. The Fund’s overweight allocation to education bonds and its underweight allocation to bonds rated AA also helped relative performance.

HOW WAS THE FUND POSITIONED?

The Fund’s

portfolio managers continued to emphasize higher yielding sectors, particularly the housing sector. At the end of

the twelve month period, the Fund’s overall duration was roughly in line with that of the Benchmark. Duration measures the price sensitivity for a portfolio of bonds. Bonds with a longer

duration will experience a larger increase in price than short duration bonds when interest rates fall.

|

|

|

|

|

| CREDIT QUALITY ALLOCATIONS*** |

|

| AAA |

|

|

24.3 |

% |

| AA |

|

|

44.8 |

|

| A |

|

|

23.8 |

|

| BBB |

|

|

6.0 |

|

| BB |

|

|

0.1 |

|

| NR |

|

|

1.0 |

|

| 1 |

|

On April 3, 2017, the Fund’s Select Class Shares were renamed Class I Shares. |

| * |

|

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects

adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** |

|

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** |

|

Percentages indicated are based on total investments as of February 28, 2018. The Fund’s portfolio composition is subject to change.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FEBRUARY 28, 2018 |

|

J.P. MORGAN MUNICIPAL BOND FUNDS |

|

|

|

|

3 |

|

JPMorgan Municipal Income Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2018 (Unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28,

2018 |

|

|

|

|

|

|

| |

|

INCEPTION DATE OF

CLASS |

|

1 YEAR |

|

|

5 YEAR |

|

|

10 YEAR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CLASS A SHARES |

|

February 23, 1993 |

|

|

|

|

|

|

|

|

|

|

|

|

| With Sales Charge* |

|

|

|

|

(2.65 |

)% |

|

|

0.92 |

% |

|

|

2.93 |

% |

| Without Sales Charge |

|

|

|

|

1.16 |

|

|

|

1.71 |

|

|

|

3.33 |

|

| CLASS C SHARES |

|

November 4, 1997 |

|

|

|

|

|

|

|

|

|

|

|

|

| With CDSC** |

|

|

|

|

(0.49 |

) |

|

|

1.11 |

|

|

|

2.73 |

|

| Without CDSC |

|

|

|

|

0.51 |

|

|

|

1.11 |

|

|

|

2.73 |

|

| CLASS I SHARES (FORMERLY SELECT CLASS SHARES) |

|

February 9, 1993 |

|

|

1.42 |

|

|

|

1.96 |

|

|

|

3.58 |

|

| CLASS R6 SHARES |

|

November 6, 2017 |

|

|

1.46 |

|

|

|

1.96 |

|

|

|

3.59 |

|

| * |

|

Sales Charge for Class A Shares is 3.75%. |

| ** |

|

Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

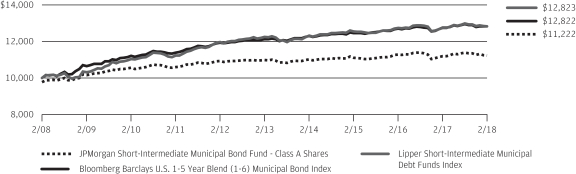

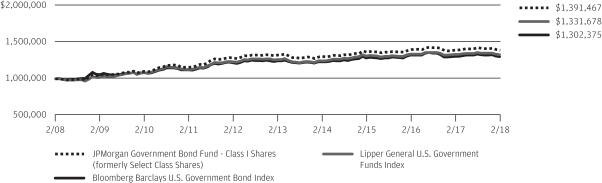

TEN YEAR PERFORMANCE (2/29/08 TO 2/28/18)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are

subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower

than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

Returns for Class R6 Shares prior to its

inception date are based on the performance of Class I Shares. The actual returns of Class R6 Shares would have been different than those shown because Class R6 Shares had different expenses than Class I Shares.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Municipal Income Fund, the Bloomberg Barclays U.S.

1-15 Year Blend (1-17) Municipal Bond Index and the Lipper Intermediate Municipal Debt Funds Index from February 29, 2008 to February 28, 2018. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any,

and does not include a sales charge. The performance of the Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to

reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Intermediate Municipal Debt Funds Index

includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index represents the performance of municipal bonds with maturities from 1 to 17 years. The Lipper Intermediate Municipal Debt Funds Index is an index based on the total returns

of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Capital gain distributions are subject to federal income tax; a portion of the Fund’s income distributions may be subject to the alternative minimum tax

and some investors may be subject to certain state and local taxes.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these

waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights,

which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

|

|

|

|

|

|

|

|

|

|

|

| 4 |

|

|

|

J.P. MORGAN MUNICIPAL BOND FUNDS |

|

FEBRUARY 28, 2018 |

JPMorgan Short-Intermediate Municipal Bond Fund

FUND COMMENTARY

TWELVE MONTHS ENDED

FEBRUARY 28, 2018 (Unaudited)

|

|

|

|

|

| REPORTING PERIOD RETURN: |

|

| Fund (Class A Shares, without a sales charge)* |

|

|

0.26% |

|

| Bloomberg Barclays U.S. 1-5 Year Blend (1-6) Municipal Bond Index |

|

|

0.59% |

|

|

|

| Net Assets as of 2/28/2018 (In Thousands) |

|

|

$1,719,586 |

|

| Duration as of 2/28/2018 |

|

|

3.8 years |

|

INVESTMENT OBJECTIVE**

The JPMorgan Short-Intermediate Municipal Bond Fund (the “Fund”) seeks as high a level of current income exempt from federal income tax as is consistent with relative stability of principal.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the twelve months ended February 28, 2018, the Fund underperformed the Bloomberg Barclays U.S. 1-5 Year Blend (1-6) Municipal Bond Index (the

“Benchmark”). During the reporting period, interest rates in the U.S. generally rose, particularly for bonds with shorter maturities, and investors generally continued to favor lower quality fixed income securities.

Relative to the Benchmark, the Fund’s underweight position in lower quality sectors, including industrial development revenue/pollution control revenue

bonds and bonds issued by New Jersey, detracted from performance. The Fund’s overweight position in electricity sector bonds and its underweight position in bonds rated BBB also detracted from relative performance.

The Fund’s overall duration was longer than that of the Benchmark and contributed to relative performance. Duration measures the price sensitivity of a

portfolio of bonds to changes in interest rates. Generally, bonds with longer duration will experience a larger increase in price as interest rates fall. The Fund’s overweight positions in the short and long ends of the yield curve also helped

relative performance. The yield curve

shows the relationship between yields and maturity dates for a set of similar bonds at a given point in time. The Fund’s overweight position in revenue bonds and its underweight position in

pre-refunded bonds also helped relative performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund employed a bottom-up, security selection-based investment approach. The Fund’s portfolio managers sought to take

advantage of opportunities stemming from increased volatility, supply pressures and headline credit risk, while maintaining the Fund’s bias toward higher quality issuances.

|

|

|

|

|

| CREDIT QUALITY ALLOCATIONS*** |

|

| AAA |

|

|

23.4 |

% |

| AA |

|

|

51.4 |

|

| A |

|

|

20.0 |

|

| BBB |

|

|

3.4 |

|

| NR |

|

|

1.8 |

|

| * |

|

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects

adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** |

|

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** |

|

Percentages indicated are based on total investments as of February 28, 2018. The Fund’s portfolio composition is subject to change.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FEBRUARY 28, 2018 |

|

J.P. MORGAN MUNICIPAL BOND FUNDS |

|

|

|

|

5 |

|

JPMorgan Short-Intermediate Municipal Bond Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2018 (Unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28,

2018 |

|

| |

|

INCEPTION DATE OF

CLASS |

|

|

1 YEAR |

|

|

5 YEAR |

|

|

10 YEAR |

|

| CLASS A SHARES |

|

|

May 4, 1998 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| With Sales Charge* |

|

|

|

|

|

|

(1.99 |

)% |

|

|

(0.02 |

)% |

|

|

1.16 |

% |

| Without Sales Charge |

|

|

|

|

|

|

0.26 |

|

|

|

0.43 |

|

|

|

1.39 |

|

| CLASS C SHARES |

|

|

November 1, 2001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| With CDSC** |

|

|

|

|

|

|

(1.19 |

) |

|

|

(0.06 |

) |

|

|

0.88 |

|

| Without CDSC |

|

|

|

|

|

|

(0.19 |

) |

|

|

(0.06 |

) |

|

|

0.88 |

|

| CLASS I SHARES (FORMERLY INSTITUTIONAL CLASS SHARES) |

|

|

June 19, 2009 |

|

|

|

0.70 |

|

|

|

0.92 |

|

|

|

1.85 |

|

| * |

|

Sales Charge for Class A Shares is 2.25%. |

| ** |

|

Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

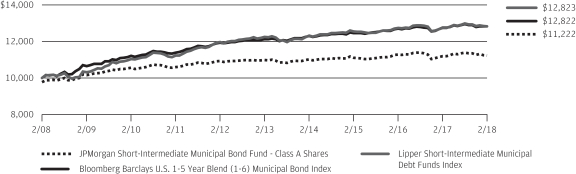

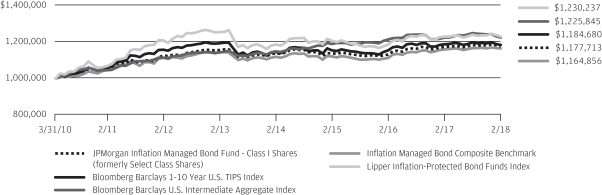

TEN YEAR PERFORMANCE (2/29/08 TO 2/28/18)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are

subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower

than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

Returns for Class I Shares

prior to its inception date are based on the performance of Class A Shares. The actual returns of Class I Shares would have been different than those shown because Class I Shares had different expenses than Class A Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Short-Intermediate Municipal Bond Fund, the

Bloomberg Barclays U.S. 1-5 Year Blend (1-6) Municipal Bond Index and the Lipper Short-Intermediate Municipal Debt Funds Index from February 29, 2008 to February 28, 2018. The performance of the Fund assumes reinvestment of all dividends and

capital gain distributions, if any, and does not include a sales charge. The performance of the Bloomberg Barclays U.S. 1-5 Year Blend (1-6) Municipal Bond Index does not reflect the deduction of expenses or a sales charge associated with a mutual

fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Short-Intermediate Municipal Debt Funds Index includes

expenses associated with a mutual fund,

such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Bloomberg Barclays U.S. 1-5 Year Blend (1-6) Municipal Bond Index is an unmanaged index of investment grade tax-exempt municipal bonds with maturities of 1–5.999 years. The Lipper Short-Intermediate Municipal

Debt Funds Index represents the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Capital gain distributions are subject to federal income tax; a portion of the Fund’s income distributions may be subject to the alternative minimum tax and some investors may be subject to certain

state and local taxes.

Class A Shares have a $1,000 minimum initial investment and carry a 2.25% sales charge.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these

waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights,

which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

|

|

|

|

|

|

|

|

|

|

|

| 6 |

|

|

|

J.P. MORGAN MUNICIPAL BOND FUNDS |

|

FEBRUARY 28, 2018 |

JPMorgan Tax Free Bond Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2018 (Unaudited)

|

|

|

|

|

| Bloomberg Barclays U.S. Municipal Index (formerly Bloomberg Barclays Municipal Bond Index) |

|

|

|

|

|

| REPORTING PERIOD RETURN: |

|

| Fund (Class A Shares, without a sales charge)* |

|

|

2.36% |

|

| Bloomberg Barclays Municipal Bond Index |

|

|

2.50% |

|

|

|

| Net Assets as of 2/28/2018 (In Thousands) |

|

|

$316,025 |

|

| Duration as of 2/28/2018 |

|

|

6.2 years |

|

INVESTMENT OBJECTIVE**

The JPMorgan Tax Free Bond Fund (the “Fund”) seeks as high a level of current income exempt from federal income tax as is consistent with relative stability of principal.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the twelve months ended February 28, 2018, the Fund underperformed the Bloomberg Barclays Municipal Bond Index (the “Benchmark”). During the reporting period, interest rates generally rose

and investors continued to favor lower rated bonds.

Relative to the Benchmark, the Fund’s overweight position in pre-refunded bonds was a

leading detractor from performance. The Fund’s overweight position in the electricity sector and its underweight position in the housing sector also detracted from relative performance.

The Fund’s overweight position in bonds with maturities of eight years or longer was a leading contributor to performance relative to the Benchmark. The Fund’s longer duration positions in the

transportation and hospital sectors also made a positive contribution to relative performance. Duration measures the price sensitivity of a portfolio of bonds to relative changes in interest rates. Generally, bonds with longer duration will

experience a larger increase or decrease in price as interest

rates fall or rise, respectively, versus bonds with shorter duration.

HOW WAS THE FUND

POSITIONED?

The Fund continued to employ a bottom-up, security selection-based investment approach and sought to take advantage of

opportunities stemming from increased volatility, supply pressures and headline credit risk.

|

|

|

|

|

| CREDIT QUALITY ALLOCATIONS*** |

|

| AAA |

|

|

16.3 |

% |

| AA |

|

|

60.5 |

|

| A |

|

|

13.3 |

|

| BBB |

|

|

6.2 |

|

| NR |

|

|

3.7 |

|

| * |

|

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects

adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** |

|

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** |

|

Percentages indicated are based on total investments as of February 28, 2018. The Fund’s portfolio composition is subject to change.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FEBRUARY 28, 2018 |

|

J.P. MORGAN MUNICIPAL BOND FUNDS |

|

|

|

|

7 |

|

JPMorgan Tax Free Bond Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2018 (Unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28,

2018 |

|

| |

|

INCEPTION DATE OF

CLASS |

|

1 YEAR |

|

|

5 YEAR |

|

|

10 YEAR |

|

| CLASS A SHARES |

|

March 1, 1988 |

|

|

|

|

|

|

|

|

|

|

|

|

| With Sales Charge* |

|

|

|

|

(1.44 |

)% |

|

|

1.79 |

% |

|

|

3.62 |

% |

| Without Sales Charge |

|

|

|

|

2.36 |

|

|

|

2.57 |

|

|

|

4.01 |

|

| CLASS C SHARES |

|

July 1, 2008 |

|

|

|

|

|

|

|

|

|

|

|

|

| With CDSC** |

|

|

|

|

0.70 |

|

|

|

1.88 |

|

|

|

3.32 |

|

| Without CDSC |

|

|

|

|

1.70 |

|

|

|

1.88 |

|

|

|

3.32 |

|

| CLASS I SHARES (FORMERLY SELECT CLASS SHARES) |

|

February 1, 1995 |

|

|

2.60 |

|

|

|

2.76 |

|

|

|

4.20 |

|

| * |

|

Sales Charge for Class A Shares is 3.75%. |

| ** |

|

Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

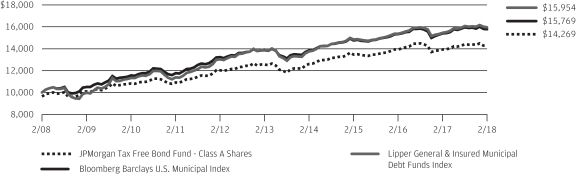

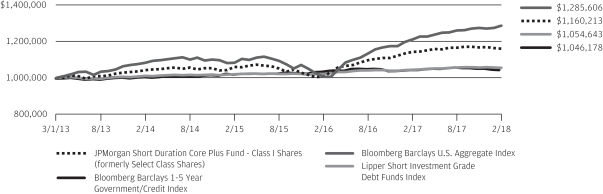

TEN YEAR PERFORMANCE (2/29/08 TO 2/28/18)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are

subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower

than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

Returns for Class C Shares prior to its

inception date are based on the performance of Class B Shares, all of which converted to Class A Shares on June 19, 2015. The actual returns of Class C Shares would have been similar to those shown because Class C Shares had similar expenses to

Class B Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Tax Free Bond Fund, the

Bloomberg Barclays U.S. Municipal Index and the Lipper General & Insured Municipal Debt Funds Index from February 29, 2008 to February 28, 2018. The performance of the Fund assumes reinvestment of all dividends and capital gain

distributions, if any, and includes a sales charge. The performance of the Bloomberg Barclays U.S. Municipal Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect

reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper General & Insured Municipal Debt Funds Index includes expenses associated with a

mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Bloomberg Barclays U.S. Municipal Index is a total return

performance benchmark for the long-term, investment-grade tax-exempt bond market. The Lipper General & Insured Municipal Debt Funds Index represents the total returns of certain mutual funds within the

Fund’s designated category as defined by Lipper, Inc. Investors cannot invest directly in an index.

Capital gain distributions are subject

to federal income tax; a portion of the Fund’s income distributions may be subject to the alternative minimum tax and some investors may be subject to certain state and local taxes.

Class A Shares have a $1,000 minimum initial investment and carry a 3.75% sales charge.

Fund

performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this

section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns

shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally

accepted in the United States of America.

|

|

|

|

|

|

|

|

|

|

|

| 8 |

|

|

|

J.P. MORGAN MUNICIPAL BOND FUNDS |

|

FEBRUARY 28, 2018 |

JPMorgan Ultra-Short Municipal Fund

FUND SUMMARY

TWELVE MONTHS ENDED

FEBRUARY 28, 2018 (Unaudited)

|

|

|

|

|

| REPORTING PERIOD RETURN: |

|

| Fund (Class I Shares)1, * |

|

|

0.63% |

|

| Bloomberg Barclays 1 Year Municipal Bond Index |

|

|

0.68% |

|

|

|

| Net Assets as of 2/28/2018 (In Thousands) |

|

|

$2,065,069 |

|

| Duration as of 2/28/2018 |

|

|

0.6 years |

|

INVESTMENT OBJECTIVE**

The JPMorgan Ultra-Short Municipal Fund (the “Fund”) seeks as high a level of current income exempt from federal income tax as is consistent with relative stability of principal.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the twelve months ended February 28, 2018, the Fund underperformed the Bloomberg Barclays 1 Year Municipal Bond Index (the “Benchmark”). Interest rates generally fell during the first half

of the reporting period before rising somewhat during the latter portion of the period. Investor appetite for lower rated bonds remained strong throughout the period.

Relative to the Benchmark, the Fund’s underweight position in bonds rated single-A and BBB detracted from performance. The Fund’s underweight positions in the transportation and water &

sewer sectors also detracted from relative performance.

The Fund’s allocation to floating rate bonds, which are not held in the Benchmark,

was a leading contributor to relative performance. The Fund’s underweight position in pre-refunded bonds also contributed to relative performance.

Relative to the Benchmark, the Fund’s shorter duration profile was a leading detractor from performance. Generally, a portfolio of bonds with shorter duration will experience a smaller increase in price

as interest rates fall versus bonds with longer duration. The Fund’s underweight position in bond rated

single-A and BBB detracted from performance as lower quality bonds outperformed higher rated bonds.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s managers sought to

maintain an average weighted maturity of two years or less and used a risk/reward analysis to identify investments that they believed would perform well over market cycles.

|

|

|

|

|

| CREDIT QUALITY ALLOCATIONS*** |

|

| AAA |

|

|

18.6 |

% |

| AA |

|

|

40.8 |

|

| A |

|

|

11.8 |

|

| BBB |

|

|

3.2 |

|

| BB |

|

|

0.2 |

|

| NR |

|

|

25.4

|

|

| 1 |

|

On April 3, 2017, the Fund’s Select Class Shares were renamed Class I Shares. |

| * |

|

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects

adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** |

|

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** |

|

Percentages indicated are based on total investments as of February 28, 2018. The Fund’s portfolio composition is subject to change.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FEBRUARY 28, 2018 |

|

J.P. MORGAN MUNICIPAL BOND FUNDS |

|

|

|

|

9 |

|

JPMorgan Ultra-Short Municipal Fund

FUND SUMMARY

TWELVE MONTHS ENDED FEBRUARY 28, 2018 (Unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28, 2018

|

|

| |

|

INCEPTION DATE OF

CLASS |

|

|

1 YEAR |

|

|

SINCE

INCEPTION |

|

| CLASS A SHARES |

|

|

May 31, 2016 |

|

|

|

|

|

|

|

|

|

| With Sales Charge* |

|

|

|

|

|

|

(1.78 |

)% |

|

|

(0.73 |

)% |

| Without Sales Charge |

|

|

|

|

|

|

0.47 |

|

|

|

0.57 |

|

| CLASS I SHARES (FORMERLY SELECT CLASS SHARES) |

|

|

May 31, 2016 |

|

|

|

0.63 |

|

|

|

0.73 |

|

| * |

|

Sales Charge for Class A Shares is 2.25%. |

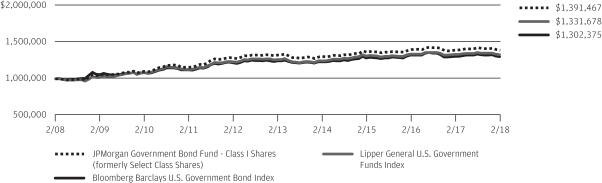

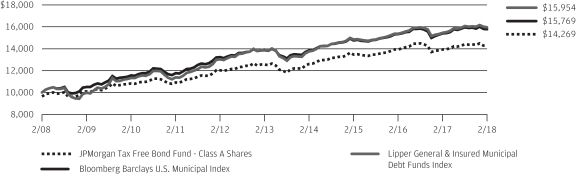

LIFE OF

FUND PERFORMANCE (5/31/16 TO 2/28/18)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are

subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower

than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

The Fund commenced

operations on May 31, 2016.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Ultra-Short

Municipal Fund, the Bloomberg Barclays 1 Year Municipal Bond Index and the Lipper Short Municipal Debt Funds Index from May 31, 2016 to February 28, 2018. The performance of the Fund assumes reinvestment of all dividends and capital gain

distributions, if any, and does not include a sales charge. The performance of the Bloomberg Barclays 1 Year Municipal Bond Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted

to reflect reinvestment of all dividends and capital gain distributions of securities included in the benchmark, if applicable. The performance of the Lipper Short Municipal Debt Funds Index includes expenses associated with a mutual fund, such as

investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Bloomberg Barclays 1 Year Municipal Bond Index is an unmanaged index that includes bonds with a minimum credit rating of BAA3, are issued as

part of a deal of at least $50 million, have an amount

outstanding of at least $5 million, and have maturities of 1 to 2 years. The Lipper Short Municipal Debt Funds Index is an index based on the total returns of certain mutual funds within the

Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Capital gain distributions are

subject to federal income tax; a portion of the Fund’s income distributions may be subject to the alternative minimum tax and some investors may be subject to certain state and local taxes.

Class I Shares have a $1,000,000 minimum initial investment.

Subsequent to the inception of the Fund on May 31, 2016 until August 31, 2016, the Fund did not experience any shareholder activity. If such shareholder activity had occurred, the Fund’s performance may

have been impacted.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the

inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund

shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the

financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

|

|

|

|

|

|

|

|

|

|

|

| 10 |

|

|

|

J.P. MORGAN MUNICIPAL BOND FUNDS |

|

FEBRUARY 28, 2018 |

JPMorgan Municipal Income Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2018

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

| |

Municipal Bonds — 96.8% (t) |

|

|

|

|

|

Alabama — 1.1% |

|

|

|

|

|

Utility — 1.1% |

|

| |

2,000 |

|

|

The Lower Alabama Gas District, Gas Project, Series A, Rev., 5.00%, 09/01/2031 |

|

|

2,338 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alaska — 0.4% |

|

|

|

|

|

Housing — 0.4% |

|

| |

945 |

|

|

Alaska Housing Finance Corp., General Mortgage, Series A, Rev., 3.50%, 06/01/2046 |

|

|

981 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Arizona — 2.5% |

|

|

|

|

|

Water & Sewer — 2.5% |

|

| |

2,645 |

|

|

City of Scottsdale, Water & Sewer System, Rev., 5.25%, 07/01/2022 |

|

|

3,011 |

|

| |

2,150 |

|

|

City of Tucson, Water System, Rev., 5.00%, 07/01/2024 |

|

|

2,501 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Arizona |

|

|

5,512 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

California — 1.0% |

|

|

|

|

|

General Obligation — 0.4% |

|

| |

1,000 |

|

|

Salinas Union High School District, GO, BAN, Zero Coupon, 08/01/2020 |

|

|

953 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hospital — 0.2% |

|

| |

410 |

|

|

California Municipal Finance Authority, Eisenhower Medical Center, Series B, Rev., 5.00%, 07/01/2026 |

|

|

473 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Revenue — 0.4% |

|

| |

715 |

|

|

State of California, Department of Veterans Affairs, Series B, Rev., 3.50%, 12/01/2045 |

|

|

745 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total California |

|

|

2,171 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Colorado — 1.0% |

|

|

|

|

|

Education — 0.5% |

|

|

|

|

|

Colorado Educational & Cultural Facilities Authority, University Corp. for Atmospheric Research Project, |

|

|

|

|

| |

450 |

|

|

Rev., 4.00%, 09/01/2020 |

|

|

472 |

|

| |

470 |

|

|

Rev., 5.00%, 09/01/2022 |

|

|

524 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

996 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hospital — 0.5% |

|

| |

1,000 |

|

|

University of Colorado Hospital Authority, Series C-1, Rev., 4.00%, 03/01/2020 (z) |

|

|

1,033 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Housing — 0.0% (g) |

|

| |

55 |

|

|

Denver City & County, Single Family Home Mortgage, Metropolitan Mayors Caucus Program, Rev., GNMA COLL, 6.15%,

11/01/2034 |

|

|

55 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Colorado |

|

|

2,084 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

|

|

|

|

|

|

|

|

|

|

Connecticut — 3.1% |

|

|

|

|

|

Education — 1.5% |

|

|

|

|

|

Connecticut State Higher Education Supplemental Loan Authority, CHESLA Loan Program, |

|

|

|

|

| |

1,560 |

|

|

Series A, Rev., 5.25%, 11/15/2023 |

|

|

1,688 |

|

| |

1,500 |

|

|

Series A, Rev., 5.25%, 11/15/2024 |

|

|

1,623 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,311 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Housing — 1.6% |

|

|

|

|

|

Connecticut Housing Finance Authority, Housing Mortgage Finance Program, |

|

|

|

|

| |

1,300 |

|

|

Series D, Subseries D-1, Rev., GNMA/FNMA/FHLMC, 4.00%, 11/15/2047 |

|

|

1,380 |

|

| |

550 |

|

|

Subseries A-1, Rev., 4.00%, 11/15/2045 |

|

|

575 |

|

| |

490 |

|

|

Subseries A-1, Rev., 4.00%, 11/15/2047 |

|

|

519 |

|

| |

925 |

|

|

Subseries E-1, Rev., 3.50%, 11/15/2046 |

|

|

964 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Connecticut |

|

|

6,749 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware — 0.2% |

|

|

|

|

|

Housing — 0.2% |

|

|

|

|

|

Delaware State Housing Authority, Senior Single Family Mortgage, |

|

|

|

|

| |

300 |

|

|

Series A-1, Rev., AMT, 4.90%, 07/01/2029 |

|

|

312 |

|

| |

160 |

|

|

Series D-1, Rev., AMT, GNMA/FNMA/FHLMC, 4.63%, 01/01/2023 |

|

|

160 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Delaware |

|

|

472 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

District of Columbia — 2.1% |

|

|

|

|

|

Transportation — 0.5% |

|

| |

1,000 |

|

|

Washington Metropolitan Area Transit Authority, Gross Revenue Transit Bonds, Series B, Rev., 5.00%, 07/01/2025 |

|

|

1,171 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Water & Sewer — 1.6% |

|

| |

3,000 |

|

|

District of Columbia Water & Sewer Authority Public Utility, Subordinate Lien, Green Bonds, Series A, Rev., 5.00%,

10/01/2045 |

|

|

3,374 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total District of Columbia |

|

|

4,545 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida — 9.0% |

|

|

|

|

|

Certificate of Participation/Lease — 2.8% |

|

| |

2,250 |

|

|

South Florida Water Management District, COP, 5.00%, 10/01/2032 |

|

|

2,573 |

|

| |

3,000 |

|

|

The School Board of Miami-Dade County, Series D, COP, 5.00%, 02/01/2027 |

|

|

3,458 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,031 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hospital — 0.5% |

|

| |

1,100 |

|

|

Palm Beach County Health Facilities Authority, Hospital, BRRH Corp. Obligated Group, Rev., 5.00%, 12/01/2021 |

|

|

1,199 |

|

|

|

|

|

|

|

|

|

|

SEE NOTES TO

FINANCIAL STATEMENTS.

|

|

|

|

|

|

|

|

|

|

|

|

|

| FEBRUARY 28, 2018 |

|

J.P. MORGAN MUNICIPAL BOND FUNDS |

|

|

|

|

11 |

|

JPMorgan Municipal Income Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2018 (continued)

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

| |

Municipal Bonds — continued |

|

|

|

|

|

Housing — 0.6% |

|

| |

280 |

|

|

Broward County Housing Finance Authority, Series B, Rev., AMT, GNMA/FNMA/FHLMC, 4.50%, 04/01/2027 |

|

|

280 |

|

|

|

|

|

Florida Housing Finance Corp., Homeowner Mortgage, Special Program, |

|

|

|

|

| |

290 |

|

|

Series A, Rev., GNMA/FNMA/FHLMC, 5.00%, 07/01/2028 |

|

|

294 |

|

| |

355 |

|

|

Series B, Rev., GNMA/FNMA/FHLMC, 4.50%, 01/01/2029 |

|

|

366 |

|

| |

330 |

|

|

Series B, Rev., GNMA COLL, 4.50%, 01/01/2029 |

|

|

337 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,277 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial Development Revenue/Pollution Control Revenue — 0.6% |

|

| |

835 |

|

|

Broward County Fuel System, Fort Lauderdale Fuel Facilities LLC Project, Series A, Rev., AMT, AGM, 5.00%,

04/01/2024 |

|

|

920 |

|

| |

500 |

|

|

County of Escambia, Pollution Control, Gulf Power Company Project, Rev., 2.10%, 04/11/2019 (z) |

|

|

501 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,421 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Revenue — 1.0% |

|

| |

2,000 |

|

|

Miami Beach Redevelopment Agency, Historic Convention Village, Series A, Rev., 5.00%, 02/01/2027 |

|

|

2,263 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transportation — 0.8% |

|

| |

1,500 |

|

|

Tampa-Hillsborough County Expressway Authority, Series A, Rev., 5.00%, 07/01/2027 |

|

|

1,665 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Utility — 2.7% |

|

| |

5,000 |

|

|

City of Port St. Lucie, Utility Systems, Rev., NATL-RE, 5.25%,

09/01/2024 |

|

|

5,824 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Florida |

|

|

19,680 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Georgia — 1.4% |

|

|

|

|

|

Hospital — 0.4% |

|

| |

860 |

|

|

Gainesville & Hall County Hospital Authority, Northeast Georgia Health System, Inc. Project, Series A, Rev., RAN, 5.00%,

02/15/2026 |

|

|

990 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Housing — 1.0% |

|

|

|

|

|

Georgia Housing & Finance Authority, Single Family Mortgage, |

|

|

|

|

| |

750 |

|

|

Series A, Rev., 4.00%, 12/01/2047 |

|

|

795 |

|

| |

1,250 |

|

|

Series B, Rev., 4.00%, 12/01/2047 |

|

|

1,334 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,129 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Georgia |

|

|

3,119 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Guam — 0.3% |

|

|

|

|

|

Water & Sewer — 0.3% |

|

|

|

|

|

Guam Government Waterworks Authority, Water & Wastewater System, |

|

|

|

|

| |

375 |

|

|

Rev., 5.00%, 07/01/2023 |

|

|

415 |

|

| |

300 |

|

|

Rev., 5.00%, 07/01/2024 |

|

|

333 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Guam |

|

|

748 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Illinois — 0.9% |

|

|

|

|

|

Hospital — 0.2% |

|

| |

365 |

|

|

Illinois Finance Authority, Healthcare Enterprises, Inc., Series C, Rev., 5.00%, 03/01/2033 |

|

|

406 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Housing — 0.7% |

|

|

|

|

|

City of Aurora, Single Family Mortgage, |

|

|

|

|

| |

156 |

|

|

Series A, Rev., AMT, GNMA/FNMA/FHLMC, 5.50%, 12/01/2039 |

|

|

157 |

|

| |

140 |

|

|

Series B, Rev., GNMA/FNMA/FHLMC, 5.45%, 12/01/2039 |

|

|

141 |

|

| |

15 |

|

|

City of Peoria, City of Moline & City of Freeport, Collateralized Single Family Mortgage, Series A, Rev., GNMA COLL,

7.60%, 04/01/2027 |

|

|

15 |

|

| |

1,170 |

|

|

Illinois Housing Development Authority, Homeowner Mortgage, Series C, Rev., 3.50%, 08/01/2046 |

|

|

1,213 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,526 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Illinois |

|

|

1,932 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indiana — 2.7% |

|

|

|

|

|

Hospital — 0.9% |

|

| |

1,670 |

|

|

Indiana Health Facility Financing Authority, Ascension Health Credit Group, Series A-1, Rev., 5.00%, 11/15/2034 |

|

|

1,891 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Housing — 0.2% |

|

| |

430 |

|

|

Indiana Housing & Community Development Authority, Home First Mortgage, Series A, Rev., GNMA/FNMA/FHLMC, 4.50%,

06/01/2028 |

|

|

439 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial Development Revenue/Pollution Control Revenue — 1.0% |

|

| |

1,880 |

|

|

County of St. Joseph, Economic Development, St. Mary’s College Project, Series A, Rev., 5.00%, 04/01/2026 |

|

|

2,163 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Water & Sewer — 0.6% |

|

| |

1,250 |

|

|

Indiana State Finance Authority, First Lien Wastewater Utility, CWA Authority Project, Series A, Rev., 5.00%,

10/01/2030 |

|

|

1,383 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Indiana |

|

|

5,876 |

|

|

|

|

|

|

|

|

|

|

SEE NOTES TO

FINANCIAL STATEMENTS.

|

|

|

|

|

|

|

|

|

|

|

| 12 |

|

|

|

J.P. MORGAN MUNICIPAL BOND FUNDS |

|

FEBRUARY 28, 2018 |

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

| |

Municipal Bonds — continued |

|

|

|

|

|

Iowa — 1.8% |

|

|

|

|

|

Education — 0.5% |

|

| |

1,000 |

|

|

Iowa Student Loan Liquidity Corp., Student Loan, Series A, Rev., AMT, 5.00%, 12/01/2025 |

|

|

1,112 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Housing — 1.3% |

|

|

|

|

|

Iowa Finance Authority, Single Family Mortgage, Mortgage-Backed Securities Program, |

|

|

|

|

| |

1,990 |

|

|

Rev., GNMA/FNMA/FHLMC COLL, 3.50%, 01/01/2047 |

|

|

2,077 |

|

| |

40 |

|

|

Series 1, Rev., GNMA/FNMA/FHLMC, 5.00%, 07/01/2028 |

|

|

41 |

|

| |

590 |

|

|

Series A, Rev., GNMA/FNMA/FHLMC, 4.00%, 07/01/2046 |

|

|

623 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,741 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Iowa |

|

|

3,853 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kentucky — 0.5% |

|

|

|

|

|

Education — 0.3% |

|

| |

515 |

|

|

Kentucky Higher Education Student Loan Corp., Series A, Rev., AMT, 5.00%, 06/01/2020 |

|

|

543 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial Development Revenue/Pollution Control Revenue — 0.2% |

|

| |

500 |

|

|

County of Carroll, Pollution Control, Kentucky Utilities Company Project, Series A, Rev., 1.05%, 09/01/2019 (z) |

|

|

493 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Kentucky |

|

|

1,036 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Louisiana — 0.8% |

|

|

|

|

|

Housing — 0.2% |

|

| |

113 |

|

|

East Baton Rouge Mortgage Finance Authority, Single Family Mortgage, Mortgage-Backed Securities Program, Series A-2, Rev.,

GNMA/FNMA/FHLMC, 5.25%, 10/01/2039 |

|

|

115 |

|

| |

260 |

|

|

Louisiana Housing Finance Agency, Single Family Mortgage, Home Ownership Program, Series A, Rev., GNMA/FNMA/FHLMC, 5.50%,

06/01/2040 |

|

|

264 |

|

| |

45 |

|

|

Louisiana Housing Finance Agency, Single Family Mortgage, Mortgage-Backed Securities Program, Series A, Rev., GNMA/FNMA/FHLMC,

4.60%, 12/01/2028 |

|

|

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

424 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Revenue — 0.6% |

|

| |

670 |

|

|

Louisiana Local Government Environmental Facilities & Community Development Authority, LCTCS Act 391 Project, Rev., 5.00%,

10/01/2028 |

|

|

786 |

|

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Revenue — continued |

|

|

|

|

|

Louisiana Public Facilities Authority, Archdiocese of New Orleans Project, |

|

|

|

|

| |

165 |

|

|

Rev., 5.00%, 07/01/2021 |

|

|

177 |

|

| |

250 |

|

|

Rev., 5.00%, 07/01/2022 |

|

|

272 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,235 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Louisiana |

|

|

1,659 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maine — 0.7% |

|

|

|

|

|

Housing — 0.7% |

|

|

|

|

|

Maine State Housing Authority, |

|

|

|

|

| |

925 |

|

|

Series A, Rev., 4.00%, 11/15/2045 |

|

|

973 |

|

| |

245 |

|

|

Series A-1, Rev., AMT, 4.50%, 11/15/2028 |

|

|

253 |

|

| |

205 |

|

|

Series B, Rev., 4.00%, 11/15/2043 |

|

|

212 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Maine |

|

|

1,438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland — 0.7% |

|

|

|

|

|

Housing — 0.7% |

|

| |

1,460 |

|

|

Montgomery County Housing Opportunities Commission, Single Family Mortgage, Series A, Rev., 4.00%, 07/01/2048 |

|

|

1,551 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Massachusetts — 8.1% |

|

|

|

|

|

Education — 1.0% |

|

| |

1,000 |

|

|

Massachusetts Educational Financing Authority, Education Loan, Rev., AMT, 5.00%, 07/01/2021 |

|

|

1,083 |

|

| |

820 |

|

|

Massachusetts Health & Educational Facilities Authority, Massachusetts Institute of Technology, Series L, Rev., 5.25%,

07/01/2033 |

|

|

1,042 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,125 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Housing — 0.4% |

|

|

|

|

|

Massachusetts Housing Finance Agency, Single Family Housing, |

|

|

|

|

| |

305 |

|

|

Series 169, Rev., 4.00%, 12/01/2044 |

|

|

315 |

|

| |

430 |

|

|

Series 183, Rev., 3.50%, 12/01/2046 |

|

|

448 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

763 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Water & Sewer — 6.7% |

|

| |

5,000 |

|

|

Massachusetts Water Pollution Abatement Trust, Pool Program, Rev., 5.25%, 08/01/2024 |

|

|

5,919 |

|

|

|

|

|

Massachusetts Water Resources Authority, |

|

|

|

|

| |

5,000 |

|

|

Series B, Rev., AGM, 5.25%, 08/01/2028 |

|

|

6,219 |

|

| |

2,000 |

|

|

Series B, Rev., AGM, 5.25%, 08/01/2029 |

|

|

2,510 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14,648 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Massachusetts |

|

|

17,536 |

|

|

|

|

|

|

|

|

|

|

SEE NOTES TO

FINANCIAL STATEMENTS.

|

|

|

|

|

|

|

|

|

|

|

|

|

| FEBRUARY 28, 2018 |

|

J.P. MORGAN MUNICIPAL BOND FUNDS |

|

|

|

|

13 |

|

JPMorgan Municipal Income Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2018 (continued)

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

| |

Municipal Bonds — continued |

|

|

|

|

|

Michigan — 1.6% |

|

|

|

|

|

Education — 0.3% |

|

| |

575 |

|

|

Eastern Michigan University, Series A, Rev., 5.00%, 03/01/2030 |

|

|

676 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Housing — 0.5% |

|

| |

1,180 |

|

|

Michigan State Housing Development Authority, Single-Family Mortgage, Series B, Rev., 3.50%, 06/01/2047 |

|

|

1,221 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial Development Revenue/Pollution Control Revenue — 0.8% |

|

| |

570 |

|

|

Michigan Strategic Fund, The Detroit Edison Company Pollution Control Bonds Project, Series CC, Rev., 1.45%, 09/01/2021

(z) |

|

|

556 |

|

| |

1,075 |

|

|

Saginaw County Economic Development Corp., BGI South LLC-Recovery Zone, Rev., 5.00%, 12/01/2020 |

|

|

1,113 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,669 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Michigan |

|

|

3,566 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minnesota — 3.1% |

|

|

|

|

|

General Obligation — 0.0% (g) |

|

| |

35 |

|

|

State of Minnesota, Series A, GO, 5.00%, 10/01/2021 (p) |

|

|

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Housing — 3.1% |

|

|

|

|

|

Dakota County Community Development Agency, Single Family Mortgage, Mortgage-Backed Securities Program, |

|

|

|

|

| |

335 |

|

|

Series A, Rev., GNMA/FNMA/FHLMC, 4.50%, 06/01/2035 |

|

|

346 |

|

| |

284 |

|

|

Series A, Rev., GNMA/FNMA/FHLMC, 5.13%, 12/01/2040 |

|

|

285 |

|

| |

14 |

|

|

Series B, Rev., GNMA/FNMA/FHLMC, 5.15%, 12/01/2038 |

|

|

14 |

|

| |

405 |

|

|

Minneapolis Community Development Agency, Multi-Family Housing, Riverside Homes Project, Rev., 6.10%, 09/01/2019 |

|

|

406 |

|

|

|

|

|

Minneapolis/St. Paul Housing Finance Board, Single Family Mortgage, Mortgage-Backed Securities Program, City Living Home

Programs, |

|

|

|

|

| |

120 |

|

|

Series A-1, Rev., GNMA/FNMA/FHLMC, 5.25%, 12/01/2040 |

|

|

121 |

|

| |

410 |

|

|

Series A-2, Rev., GNMA/FNMA/FHLMC, 5.52%, 03/01/2041 |

|

|

416 |

|

|

|

|

|

Minnesota Housing Finance Agency, Homeownership Finance, Mortgage-Backed Securities Program, |

|

|

|

|

| |

295 |

|

|

Series A, Rev., GNMA/FNMA/FHLMC, 4.25%, 07/01/2028 |

|

|

298 |

|

| |

205 |

|

|

Series D, Rev., GNMA/FNMA/FHLMC, 4.50%, 07/01/2034 |

|

|

210 |

|

|

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT($) |

|

|

SECURITY DESCRIPTION |

|

VALUE($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Housing — continued |

|

|

|

|

|