Exhibit 99.1

Chemung Financial Corporation 2023 Janney Community Bank Forum 1

With Y ou Today Anders Tomson President and Chief Executive Officer Dale McKim Executive Vice President and Chief Financial Officer 2

Safe Harbor Statement This presentation contains certain statements that may be considered forward - looking statements within the meaning of Section 27 A of the Securities Act, Section 21 E of the Exchange Act, and the Private Securities Litigation Reform Act of 1995 , which are subject to numerous risks and uncertainties . Forward looking statements can be identified by words such as "anticipates," "believes," "contemplates," "feels", "expects," "estimates," "seeks," "strives," "plans," "intends," "outlook," "forecast," "position," "target," "mission," "assume," "achievable," "potential," "strategy," "goal," "aspiration," "opportunity," "initiative," "outcome," "continue," "remain," "maintain," "on course," "trend," "objective," "looks forward," "projects," "models" and variations of such words and similar expressions, or future or conditional verbs such as "will," "would," "should," "could," "might," "can," "may," or similar expressions, which predict or indicate future events or trends and which do not relate to historical matters . These forward - looking statements are predicated on the beliefs and assumptions of Chemung Financial Corporation’s management based on information known to management as of the date of this presentation and do not purport to speak as of any other date . Forward looking statements should not be relied upon, because they involve known and unknown risks, uncertainties and other factors, some of which are beyond the control of the company . Should one or more of these risks materialize or should underlying beliefs or assumptions prove incorrect, the Corporation’s actual results, performance or achievements could differ materially from those discussed . Factors that could cause or contribute to such differences include but are not limited to : changes in general economic, political or industry conditions ; changes in monetary and fiscal policies, including changes in interest rates ; volatility and disruptions in capital and credit markets ; changes in regulation or oversight ; unfavorable developments concerning credit quality ; the effects of more stringent capital or liquidity requirements ; declines or other changes in the businesses or industries of customers of the Corporation’s and its subsidiaries ; operational difficulties, failure of technology, infrastructure or information security incidents ; the implementation of the Corporation’s strategies and business initiatives ; changes in the financial markets, including fluctuations in interest rates ; competitive product and pricing pressures among financial institutions within the Corporation’s markets ; changes in customer behavior ; any future strategic acquisitions or divestitures ; management's ability to maintain and expand customer relationships ; management's ability to retain key officers and employees ; the impact of legal and regulatory proceedings or determinations ; the effectiveness of methods of reducing risk exposures ; the effects of terrorist activities and other hostilities ; the effects of catastrophic events including, but not limited to, severe weather events and storms ; and changes in accounting standards . The Corporation cautions that the foregoing list of factors is not exclusive . For a discussion of factors that may cause actual results to differ from expectations, please refer to "Item 1 A . Risk Factors" of the Chemung Financial Corporation’s Annual Report on Form 10 - K for the year ended December 31 , 2022 , as updated by our filings on Form 10 - Q and other filings with the SEC . Forward - looking statements speak only as of the date they are made . The Corporation does not undertake to update forward - looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward - looking statements are made . For any forward - looking statements made in this presentation or in any documents, the Corporation claims the protection of the safe harbor for forward - looking statements contained in the Private Securities Litigation Reform Act of 1995 . 3

Key Takeaways 4 Continued strength and momentum in underlying business High customer engagement across all business lines and geographies. Stable deposit base and ample liquidity Majority of deposits sourced from stable, legacy markets. Commercial loan growth throughout footprint Demand remained strong through first half of 2023; 8.7% annualized growth rate . Continued confidence in the strategy Expansion of the franchise in higher growth markets of Albany and Buffalo Solid and stable credit quality Consistently low non - performing assets and charge - offs. Valuable wealth management business High touch relationships with affluent borrowers provides dependable non - interest income stream.

About Us History • Oldest locally owned and managed community bank in New York State, dating to 1833 . Operations • Subsidiary bank - Chemung Canal Trust Company - operates with 31 branches over 14 counties in New York and Pennsylvania. Operating as Capital Bank division in Albany, New York market. • Trust and Wealth Management division with $2.2 bn in assets under management or administration. Legal & Market • New York chartered bank and member of the Federal Reserve • Listed on NASDAQ Global Select (Ticker: CHMG) • Market Capitalization of $181.1 million at June 30, 2023 Elmira, New York 5

Core Strategies Build through organic growth and acquisitions x 3 whole bank acquisitions since 1994 plus 12 branches acquired. x Drive growth in Albany and Buffalo with legacy market deposits. Be a disciplined acquirer x Well positioned to opportunistically acquire when operational model and pricing is right. x New York and contiguous states remain focus. x Seeking wealth management, whole bank or branch opportunities. Manage capital effectively x Maintain pricing discipline on loan and deposits. x Retain appropriate levels of capital to maintain optionality. Execute on community banking model x Believe and behave like a community bank. x Recognized community partner within our markets. x Relationship focus. Strong credit culture x Robust corporate - wide risk management process. x Disciplined underwriting and low historical losses. 6

Second Quarter 2023 Highlights EPS: Net Income: Returns: Asset Quality: ACL - to - total loans 1.07% ROA 0.95% ROE 13.97% ROTE 15.89% $6.3 million $1.33 Non - performing loans - to - total loans 0.39% • Net interest income $1.0 million, or 5.4%, over Q2 2022. • Net interest margin 2.87% • Efficiency ratio 66.19% • Tangible common equity to tangible assets improved by 36 basis points from 12/31/2022 to 5.87%. • Loans - to - deposits 79.24% • Available liquidity to uninsured deposits 142% • Dividend of $0.31 declared • Added to Russell 2000 Index 7

Company and Financial Highlights 2 Loans Page 15 x Loan Growth x Portfolio Composition x Commercial Portfolio x CECL Adoption x Non - Performers Investments Page 23 x Portfolio Composition x Yield and Duration x Fair Value and AOCI 3 4 Deposits Page 27 x Deposit Costs x Deposits Composition x Liquidity 5 Performance Page 31 Appendices 1 8 Background Page 9 x Corporate Organization x Markets and Share x Management Team x Core Strategies x Community x Net Income Trend x Net Interest Margin x Non - Interest Income x Non - Interest Expense x Expense Management x Capital Management

Background 9

Corporate Organization Nevada based captive insurer Trust and Wealth Management services Provides mutual funds, securities and insurance brokerage services through LPL Financial Banking operations in Southern Tier and Western New York Chemung Risk Management, Inc. Wealth Management Group Banking operations in the Capital District of New York 10

Markets Legacy Markets Long, deep relationships since 1833 provide stable funding and earnings engine. Steady and even economy, powered by large corporations (Corning, Inc.), higher education (Cornell University, SUNY Binghamton) and tourism. Growth Opportunity New York’s Capital and Western New York regions offer larger population centers undergoing economic renaissances. Large bank consolidation providing market disruption opportunities. 11

Market Share Legacy Markets Dominant market share of deposits Growth Markets Small share of much larger markets; a lot of room to grow. Competitive Advantage Deployment of lower cost deposits to higher growth markets . Share 2022 Deposits County 54.80% $792,545,000 Chemung 1.51% $331,755,000 Albany 27.94% $156,083,000 Tioga 68.61% $190,265,000 Schuyler 9.92% $133,306,000 Steuben 7.72% $122,081,000 Cayuga 4.00% $110,248,000 Tompkins 4.01% $62,655,000 Bradford (PA) 2.51% $93,469,000 Broome 1.44% $96,594,000 Saratoga 4.71% $32,937,000 Seneca 2.22% $20,936,000 Cortland 1.05% $40,182,000 Schenectady 0.00% $2,696,000 Erie $2,185,752,000 Total Albany, New York 12

Experienced Management Team Anders Tomson President and CEO Industry Experience: 30 years Years with CHMG: 12 years Previously with Citizens Dale McKim EVP & CFO Industry Experience: 27 years Previously with KPMG LLP and Evans Bancorp Jeffrey Kenefick Regional President Industry Experience: 34 years Years with CHMG: 4 Previously with Five Star Bank Daniel Fariello President, Capital Bank Industry Experience: 22 years Years with CHMG: 10 Previously with First Niagara Thomas Wirth EVP, Wealth Management Industry Experience: 36 years Years with CHMG: 36 years Kimberly Hazelton EVP, Senior Banking Officer Industry Experience: 30 years Years with CHMG: 7 years Previously with TD Bank 13 Peter Cosgrove EVP, Chief Credit and Risk Officer Industry Experience: 41 years Years with CHMG: 4 years Previously with First Niagara Dale Cole EVP and Chief Information Officer Industry Experience: 25 years Years with CHMG: 6 years Previously with BOK Financial

Supporting our Communities Volunteering over 8,000 Hours Distributing nearly $550,000 in donations and sponsorships 14

Loans 15

• Total loans: $1.894 billion at June 30, 2023 • Originated $178.4MM in Commercial Loans through June 2023 • Originated $48.1MM in Indirect Loans through June 2023 • Originated $15.3MM in Home Equity Loans through June 2023 • Opened Loan Production Office in Buffalo, NY in 2021. $83.3MM in loans as of 06/30/2023. Summary of Loan Growth *CAGR: 12/31/18 to 06/30/2023 Q2 2023 2022 2021 2020 2019 35.20% 60.40% 4.40% 35.60% 60.00% 4.40% 39.00% 57.91% 3.09% 42.86% 57.14% N/A 44.03% 55.97% N/A Chemung Capital Buffalo 17.7% 14.3% 14.2% 14.0% 13.6% 49.4% 46.5% 52.7% 54.2% 55.1% 9.8% 14.4% 15.6% 17.1% 2.9% 15.6% 15.1% 10.3% 7.9% 7.8% 11.1% 11.1% 8.2% 5.9% 5.3% 5.1% 5.1% 100.0% 90.0% 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% Loans by Type (%) Other Cons. Indirect Cons. Res. Mort. PPP Comm. Mort. Comm. & Ag. $576.4 $658.5 $592.2 $650.9 $666.7 $732.8 $878.0 $879.0 $1,098.7 $1,143.9 $47.0 $79.8 $83.3 $ - $200 $400 $600 $2,000 $1,800 $1,600 $1,400 $1,200 $1,000 $800 Loans by Division ($ Millions) Chemung Capital Buffalo 16 *June 30, 2023 figures unaudited

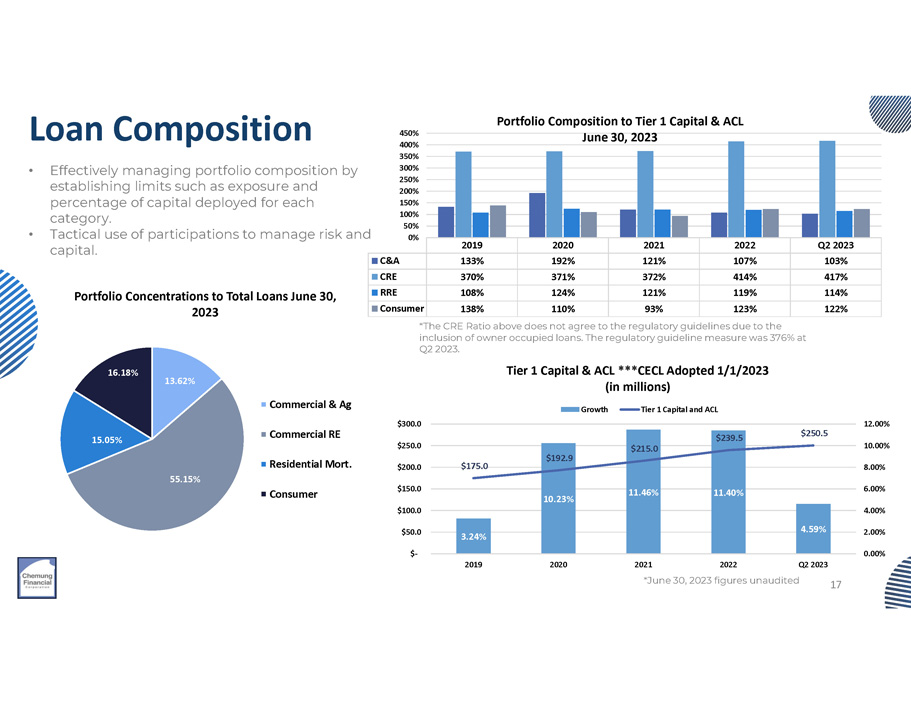

• Effectively managing portfolio composition by establishing limits such as exposure and percentage of capital deployed for each category. • Tactical use of participations to manage risk and Loan Composition capital. Portfolio Concentrations to Total Loans June 30, 2023 13.62% 55.15% 15.05% 16.18% Commercial & Ag Commercial RE Residential Mort. Consumer Q2 2023 2022 2021 2020 2019 103% 107% 121% 192% 133% C&A 417% 414% 372% 371% 370% CRE 114% 119% 121% 124% 108% RRE 122% 123% 93% 110% 138% Consumer 300% 250% 200% 150% 100% 50% 0% 350% 400% Portfolio Composition to Tier 1 Capital & ACL 450% June 30, 2023 3.24% 10.23% 11.46% 11.40% 4.59% $175.0 $192.9 $215.0 $239.5 $250.5 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% $ - $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 2019 2020 2021 2022 Q2 2023 *The CRE Ratio above does not agree to the regulatory guidelines due to the inclusion of owner occupied loans. The regulatory guideline measure was 376% at Q2 2023. Tier 1 Capital & ACL ***CECL Adopted 1/1/2023 (in millions) Growth Tier 1 Capital and ACL 17 *June 30, 2023 figures unaudited

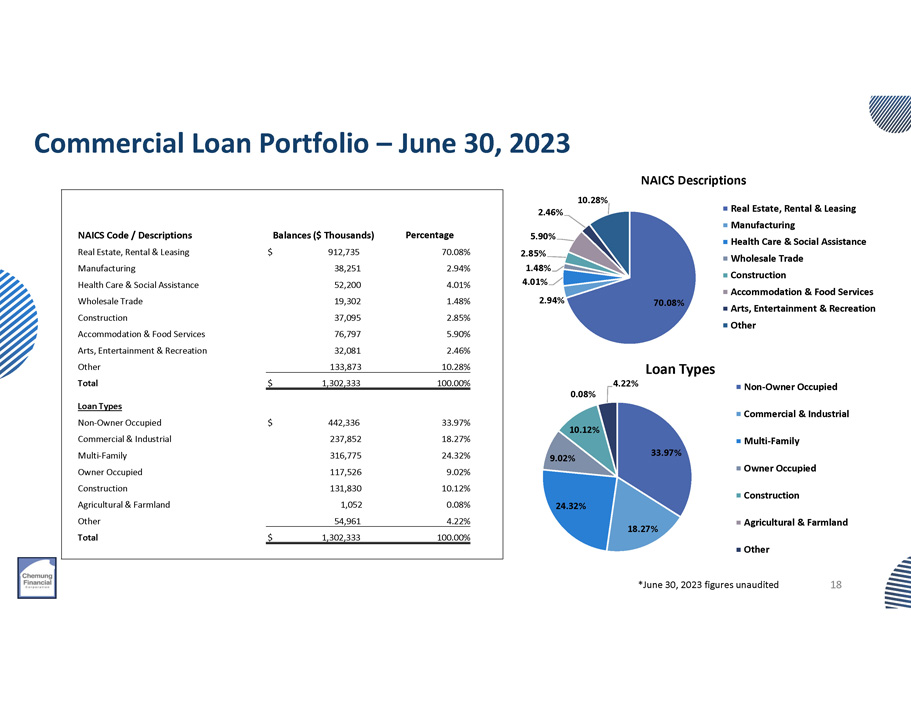

Commercial Loan Portfolio – June 30, 2023 70.08% 2.94% 5.90% 2.85% 1.48% 4.01% 2.46% 10.28% NAICS Descriptions Real Estate, Rental & Leasing Manufacturing Health Care & Social Assistance Wholesale Trade Construction Accommodation & Food Services Arts, Entertainment & Recreation Other 33.97% 18.27% 24.32% 9.02% 10.12% 0.08% 4.22% Loan Types Non - Owner Occupied Commercial & Industrial Multi - Family Owner Occupied Construction Agricultural & Farmland Other Percentage *June 30, 2023 figures unaudited 18 Balances ($ Thousands) NAICS Code / Descriptions 70.08% $ 912,735 Real Estate, Rental & Leasing 2.94% 38,251 Manufacturing 4.01% 52,200 Health Care & Social Assistance 1.48% 19,302 Wholesale Trade 2.85% 37,095 Construction 5.90% 76,797 Accommodation & Food Services 2.46% 32,081 Arts, Entertainment & Recreation 10.28% 133,873 Other 100.00% $ 1,302,333 Total 33.97% $ 442,336 Loan Types Non - Owner Occupied 18.27% 237,852 Commercial & Industrial 24.32% 316,775 Multi - Family 9.02% 117,526 Owner Occupied 10.12% 131,830 Construction 0.08% 1,052 Agricultural & Farmland 4.22% 54,961 Other 100.00% $ 1,302,333 Total

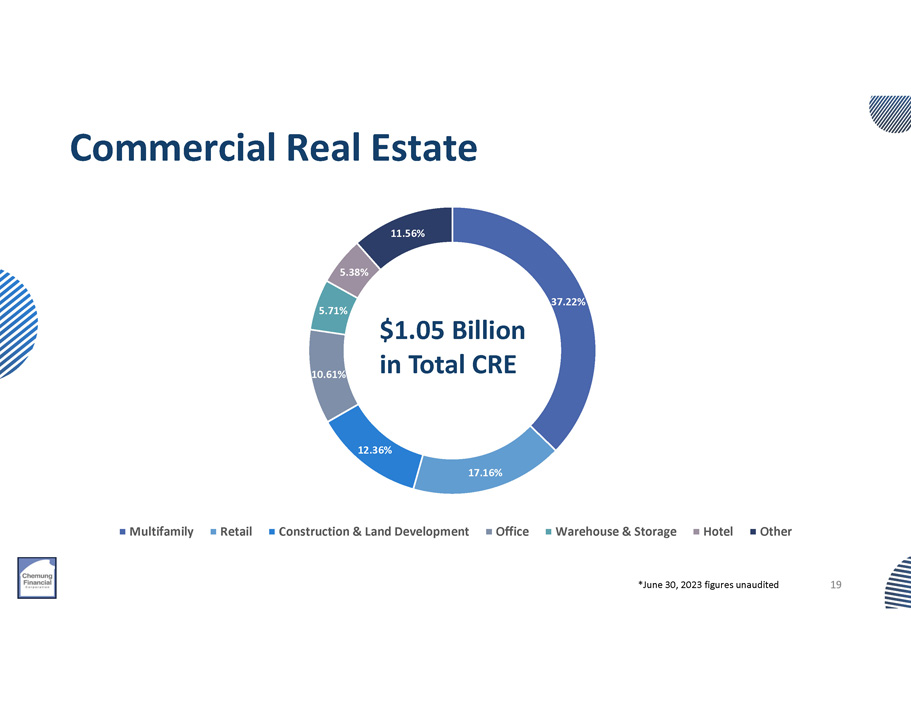

Commercial Real Estate 37.22% 17.16% 12.36% 10.61% 5.71% 11.56% 5.38% Multifamily Retail Construction & Land Development Office Warehouse & Storage Hotel Other $1.05 Billion in Total CRE *June 30, 2023 figures unaudited 19

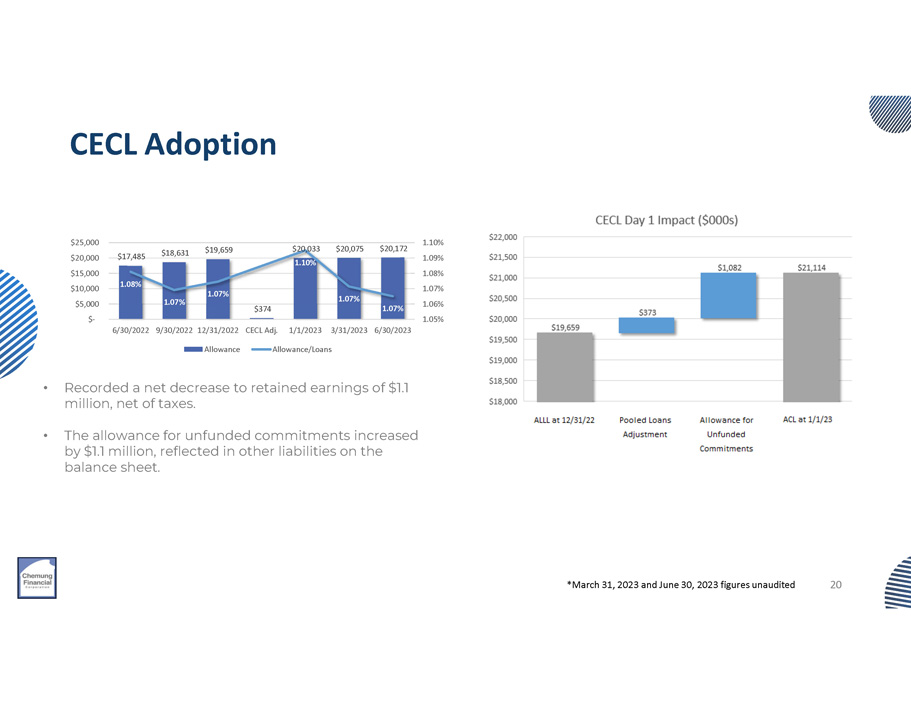

CECL Adoption • Recorded a net decrease to retained earnings of $1.1 million, net of taxes. • The allowance for unfunded commitments increased by $1.1 million, reflected in other liabilities on the balance sheet. $17,485 $18,631 $19,659 $374 $20,033 $20,075 $20,172 1.08% 1.07% 1.07% 1.10% 1.07% 1.07% 1.10% 1.09% 1.08% 1.07% 1.06% 1.05% $25,000 $20,000 $15,000 $10,000 $5,000 $ - 6/30/2022 9/30/2022 12/31/2022 CECL Adj. 1/1/2023 3/31/2023 6/30/2023 Allowance Allowance/Loans *March 31, 2023 and June 30, 2023 figures unaudited 20

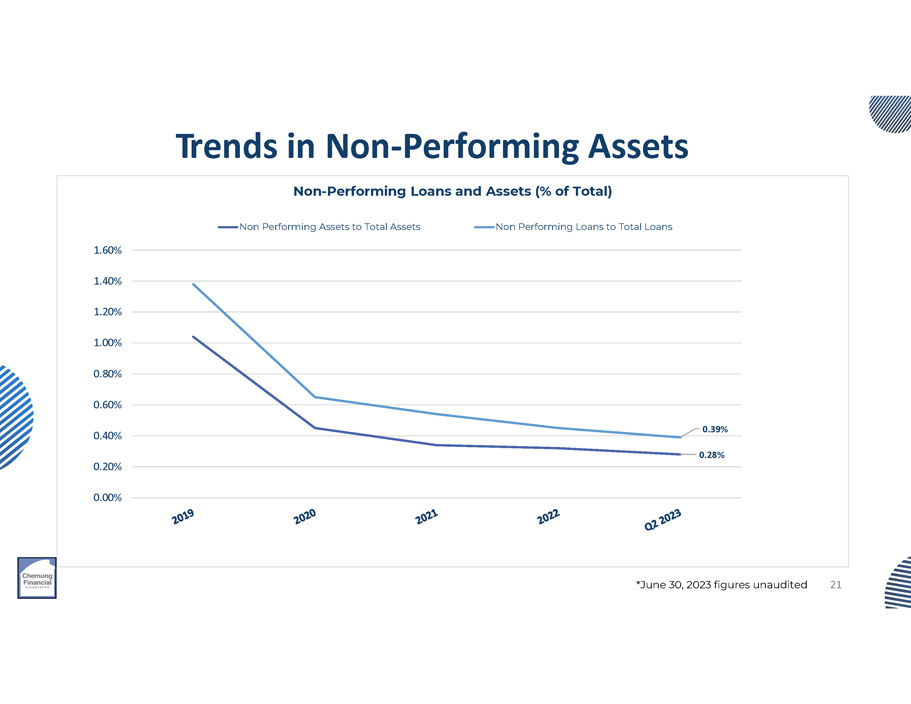

Trends in Non - Performing Assets 0.39% 0.28% 0.20% 0.00% 1.60% 1.40% 1.20% 1.00% 0.80% 0.60% 0.40% Non - Performing Loans and Assets (% of Total) Non Performing Assets to Total Assets Non Performing Loans to Total Loans *June 30, 2023 figures unaudited 21

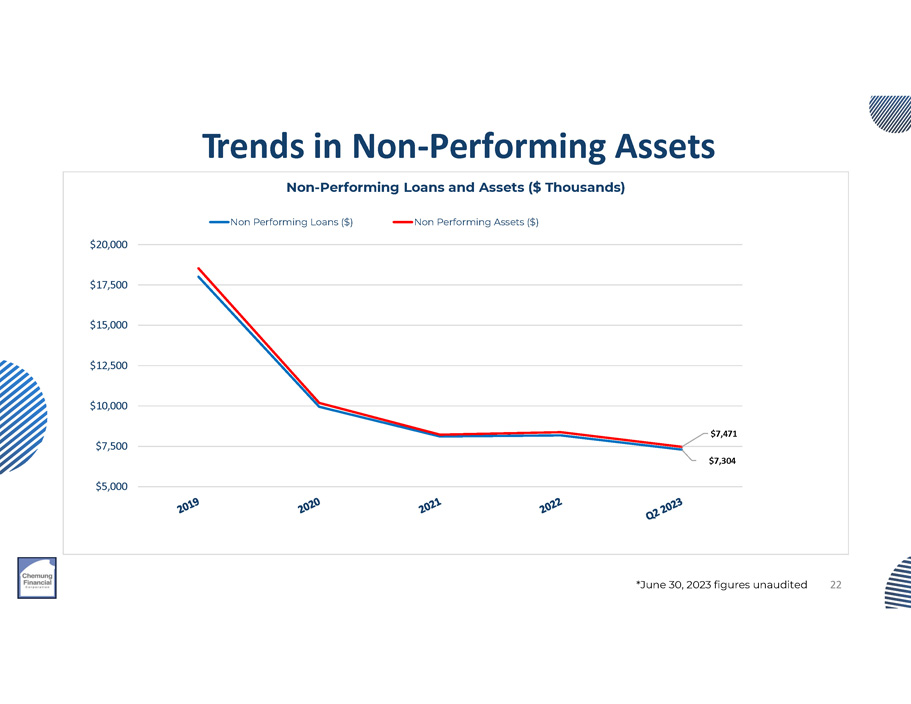

Trends in Non - Performing Assets $7,304 $7,471 $5,000 $7,500 $20,000 $17,500 $15,000 $12,500 $10,000 Non - Performing Loans and Assets ($ Thousands) Non Performing Loans ($) Non Performing Assets ($) *June 30, 2023 figures unaudited 22

Investments 23

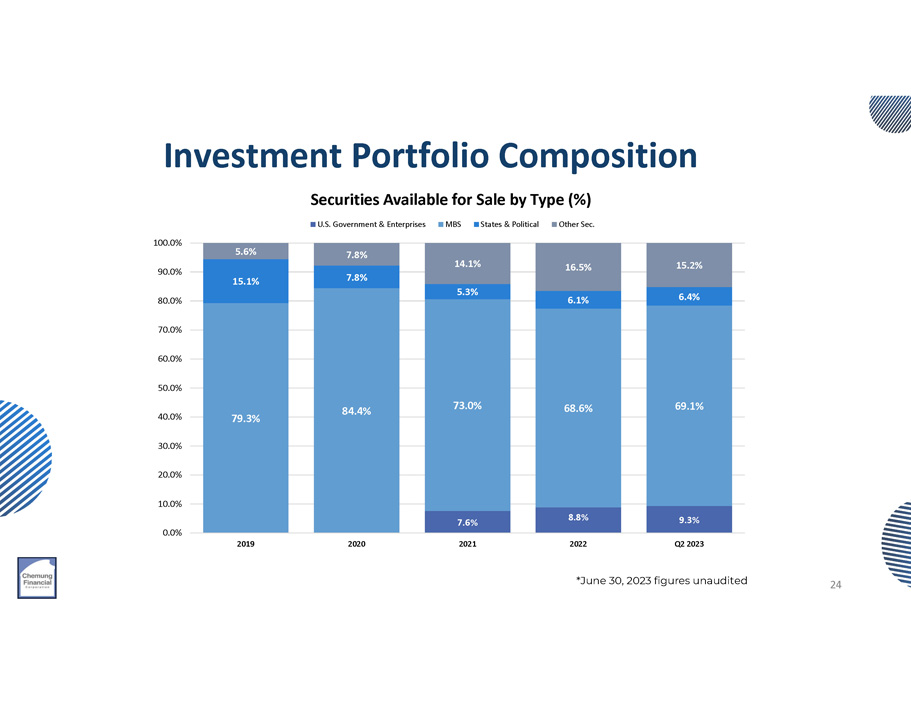

Investment Portfolio Composition 15.2% 16.5% 14.1% 7.8% 5.6% 15.1% 7.8% 6.4% 6.1% 5.3% 84.4% 73.0% 79.3% 69.1% 68.6% 9.3% 8.8% 7.6% 100.0% 90.0% 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% 2019 2020 2021 2022 Q2 2023 Securities Available for Sale by Type (%) U.S. Government & Enterprises MBS States & Political Other Sec. *June 30, 2023 figures unaudited 24

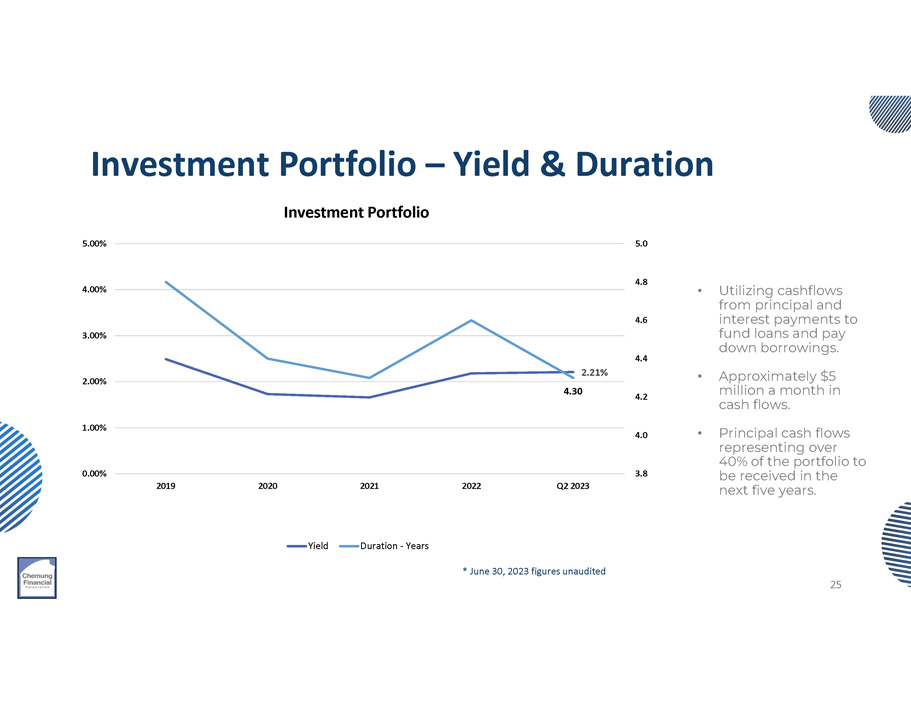

Investment Portfolio – Yield & Duration * June 30, 2023 figures unaudited • Utilizing cashflows from principal and interest payments to fund loans and pay down borrowings. • Approximately $5 million a month in cash flows. • Principal cash flows representing over 40% of the portfolio to be received in the next five years. 25 2.21% 4.30 3.8 4.0 4.2 4.4 4.6 4.8 Investment Portfolio 5.00% 5.0 0.00% 1.00% 2.00% 3.00% 4.00% 2019 2020 2021 2022 Q2 2023 Yield Duration - Years

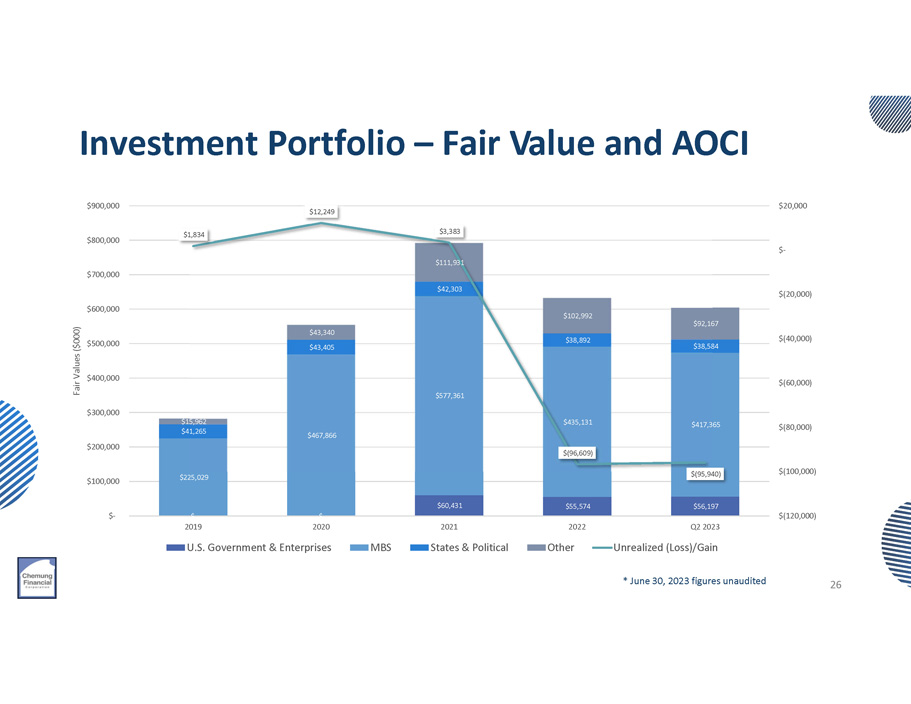

Investment Portfolio – Fair Value and AOCI 26 * June 30, 2023 figures unaudited $ - $ - $60,431 $55,574 $56,197 $225,029 $467,866 $577,361 $435,131 $417,365 $43,405 $42,303 $38,892 $38,584 $15,962 $41,265 $43,340 $111,931 $102,992 $92,167 $1,834 $12,249 $3,383 $(96,609) $(95,940) $(120,000) $(100,000) $(80,000) $(60,000) $(40,000) $(20,000) $ - $20,000 $ - $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 $900,000 2021 2022 Q2 2023 Fair Values ($000) 2019 2020 U.S. Government & Enterprises MBS States & Political Other Unrealized (Loss)/Gain

Deposits 27

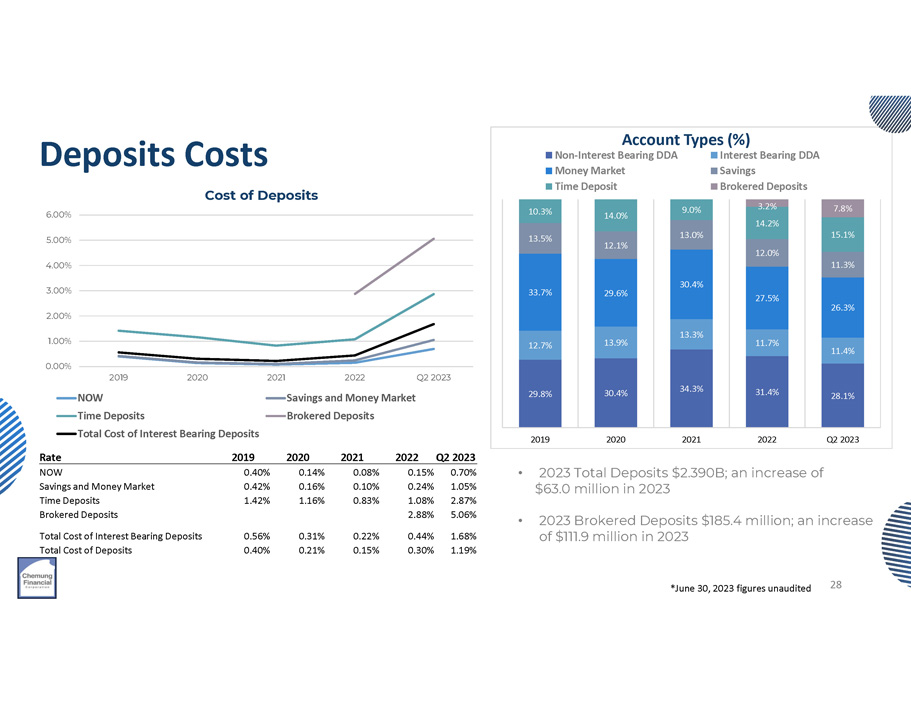

Deposits Costs *June 30, 2023 figures unaudited • 2023 Total Deposits $2.390B; an increase of $63.0 million in 2023 • 2023 Brokered Deposits $185.4 million; an increase of $111.9 million in 2023 Q2 2023 2022 2021 2020 2019 Rate 0.70% 0.15% 0.08% 0.14% 0.40% NOW 1.05% 0.24% 0.10% 0.16% 0.42% Savings and Money Market 2.87% 1.08% 0.83% 1.16% 1.42% Time Deposits 5.06% 2.88% Brokered Deposits 1.68% 0.44% 0.22% 0.31% 0.56% Total Cost of Interest Bearing Deposits 1.19% 0.30% 0.15% 0.21% 0.40% Total Cost of Deposits 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2019 2020 NOW Time Deposits Total Cost of Interest Bearing Deposits 2021 2022 Q2 2023 Cost of Deposits Savings and Money Market Brokered Deposits 29.8% 30.4% 34.3% 31.4% 28.1% 12.7% 13.9% 13.3% 11.7% 11.4% 33.7% 29.6% 30.4% 27.5% 26.3% 13.5% 12.1% 13.0% 12.0% 11.3% 10.3% 14.0% 9.0% 15.1% 3.2% 14.2% 7.8% 2019 2020 2021 2022 Q2 2023 Account Types (%) Non - Interest Bearing DDA Money Market Time Deposit Interest Bearing DDA Savings Brokered Deposits 28

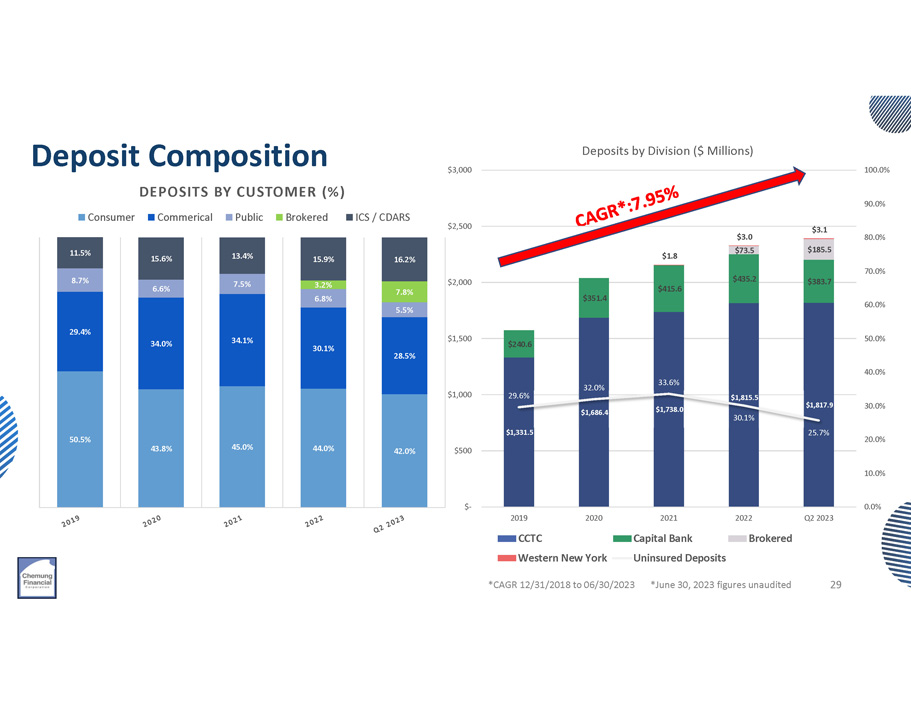

Deposit Composition *June 30, 2023 figures unaudited *CAGR 12/31/2018 to 06/30/2023 29 $1,331.5 $1,815.5 $1,817.9 $240.6 $351.4 $415.6 $435.2 $383.7 $73.5 $185.5 $1.8 $3.0 $3.1 29.6% 32.0% $1,686.4 33.6% $1,738.0 30.1% 25.7% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% $ - $500 $1,000 $1,500 $2,000 $2,500 $3,000 2021 2022 Q2 2023 Deposits by Division ($ Millions) Capital Bank Uninsured Deposits Brokered 2019 2020 CCTC Western New York 50.5% 43.8% 45.0% 44.0% 42.0% 29.4% 34.0% 34.1% 30.1% 28.5% 8.7% 6.6% 7.5% 6.8% 5.5% 3.2% 7.8% 11.5% 15.6% 13.4% 15.9% 16.2% DEPOSITS BY CUSTOMER (%) Consumer Commerical Public Brokered ICS / CDARS

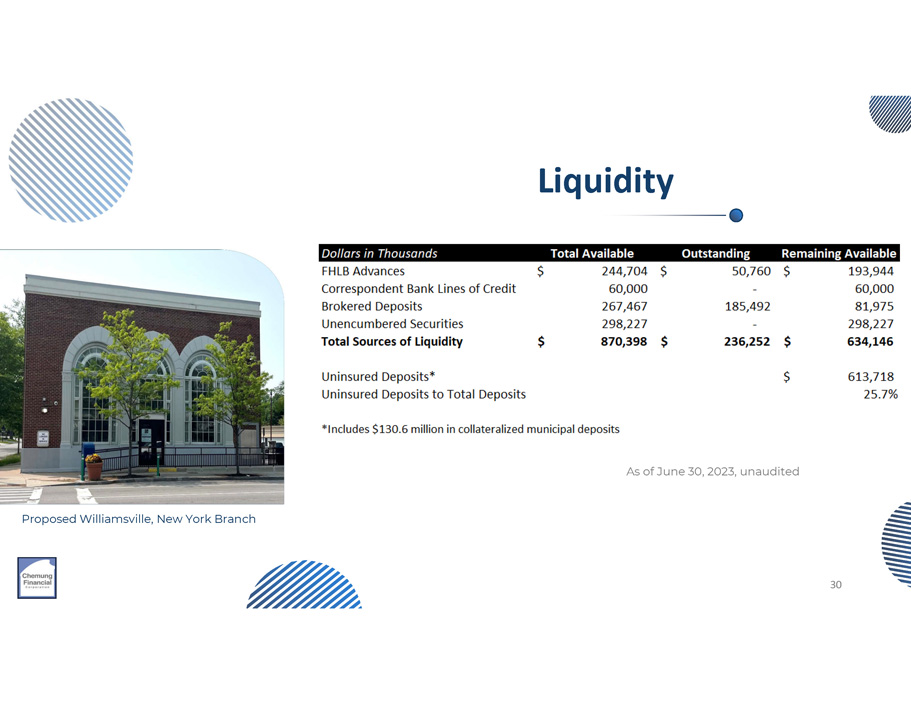

Liquidity As of June 30, 2023, unaudited Proposed Williamsville, New York Branch 30

Performance 31

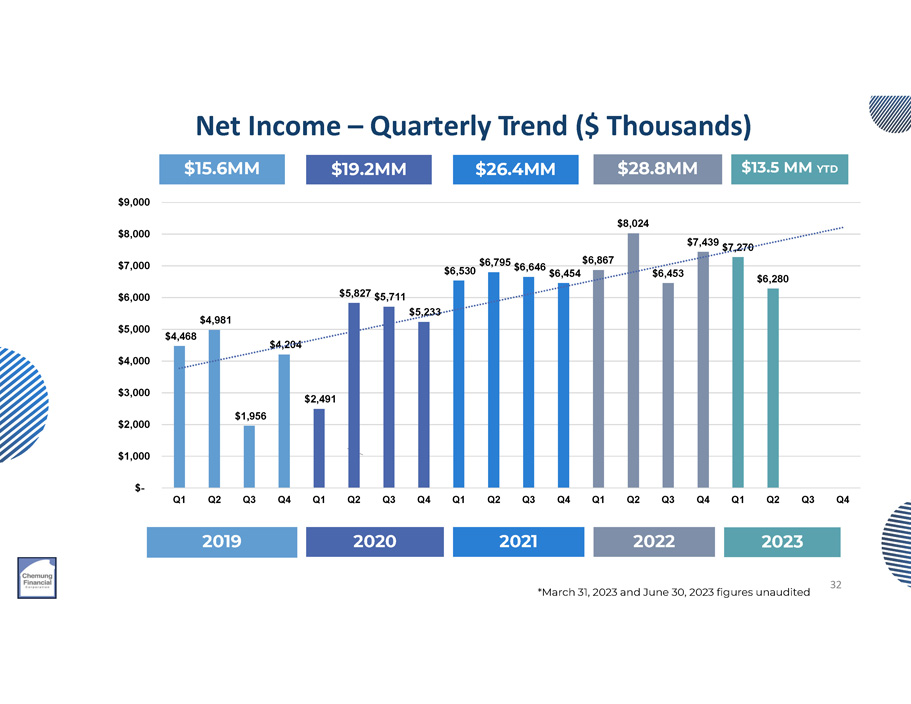

Net Income – Quarterly Trend ($ Thousands) *March 31, 2023 and June 30, 2023 figures unaudited $15.6MM $19.2MM $26.4MM 2020 $28.8MM 2022 $13.5 MM YTD 2023 2019 2021 $4,468 $4,981 $1,956 $4,204 $2,491 $5,827 $5,711 $5,233 $6,795 $6,646 $6,454 $6,530 $6,867 $8,024 $6,453 $7,439 $7,270 $6,280 $1,000 $ - $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 32

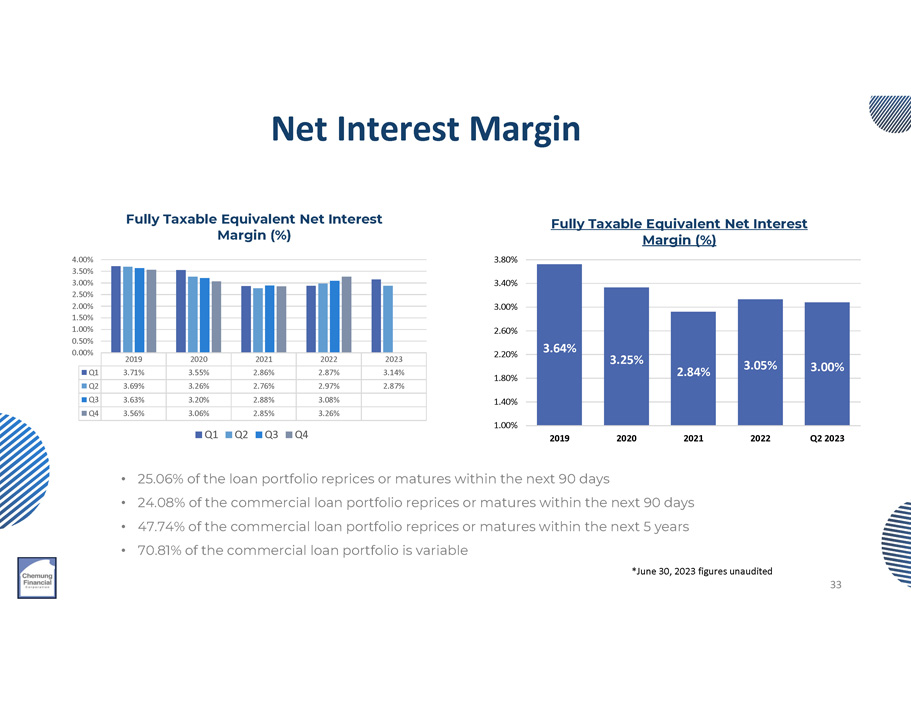

Net Interest Margin 2023 2022 2021 2020 2019 3.14% 2.87% 2.86% 3.55% 3.71% Q1 2.87% 2.97% 2.76% 3.26% 3.69% Q2 3.08% 2.88% 3.20% 3.63% Q3 3.26% 2.85% 3.06% 3.56% Q4 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00% 4.00% 3.50% Fully Taxable Equivalent Net Interest Margin (%) Q1 Q2 Q3 Q4 3.64% 3.25% 2.84% 3.05% 3.00% 1.40% 1.00% 1.80% 2.20% 2.60% 3.00% 3.40% 3.80% 2019 2020 2021 2022 Q2 2023 Fully Taxable Equivalent Net Interest Margin (%) • 25.06% of the loan portfolio reprices or matures within the next 90 days • 24.08% of the commercial loan portfolio reprices or matures within the next 90 days • 47.74% of the commercial loan portfolio reprices or matures within the next 5 years • 70.81% of the commercial loan portfolio is variable *June 30, 2023 figures unaudited 33

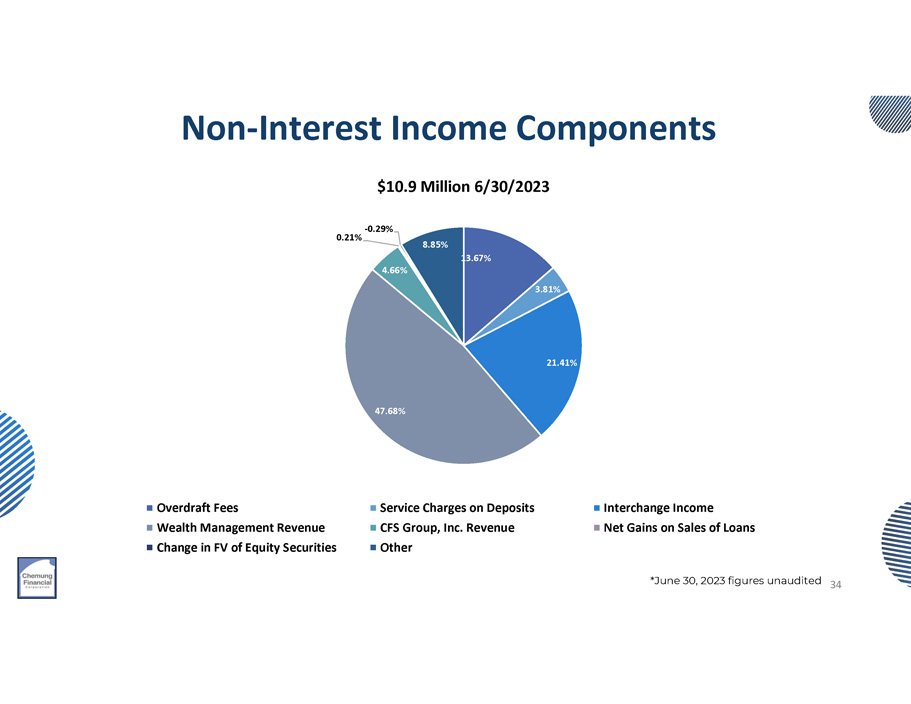

Non - Interest Income Components 21.41% 47.68% 13.67% 4.66% 3.81% 0.21% - 0.29% 8.85% $10.9 Million 6/30/2023 Overdraft Fees Wealth Management Revenue Change in FV of Equity Securities Service Charges on Deposits CFS Group, Inc. Revenue Other Interchange Income Net Gains on Sales of Loans 34 *June 30, 2023 figures unaudited

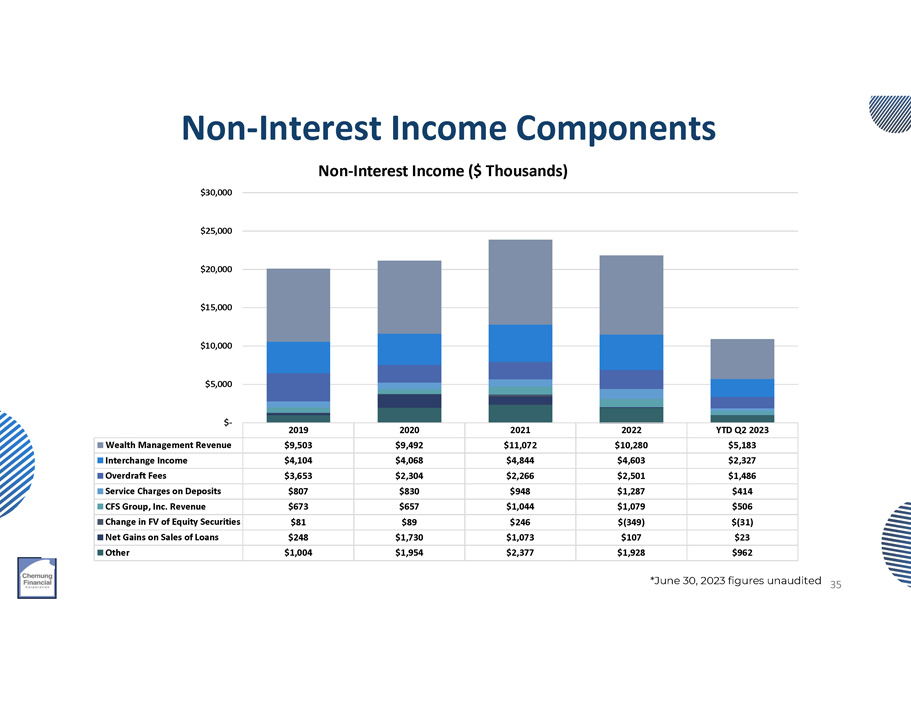

Non - Interest Income Components YTD Q2 2023 2022 2021 2020 2019 $5,183 $10,280 $11,072 $9,492 $9,503 Wealth Management Revenue $2,327 $4,603 $4,844 $4,068 $4,104 Interchange Income $1,486 $2,501 $2,266 $2,304 $3,653 Overdraft Fees $414 $1,287 $948 $830 $807 Service Charges on Deposits $506 $1,079 $1,044 $657 $673 CFS Group, Inc. Revenue $(31) $(349) $246 $89 $81 Change in FV of Equity Securities $23 $107 $1,073 $1,730 $248 Net Gains on Sales of Loans $962 $1,928 $2,377 $1,954 $1,004 Other $30,000 $25,000 $20,000 $15,000 $10,000 $5,000 $ - 35 *June 30, 2023 figures unaudited Non - Interest Income ($ Thousands)

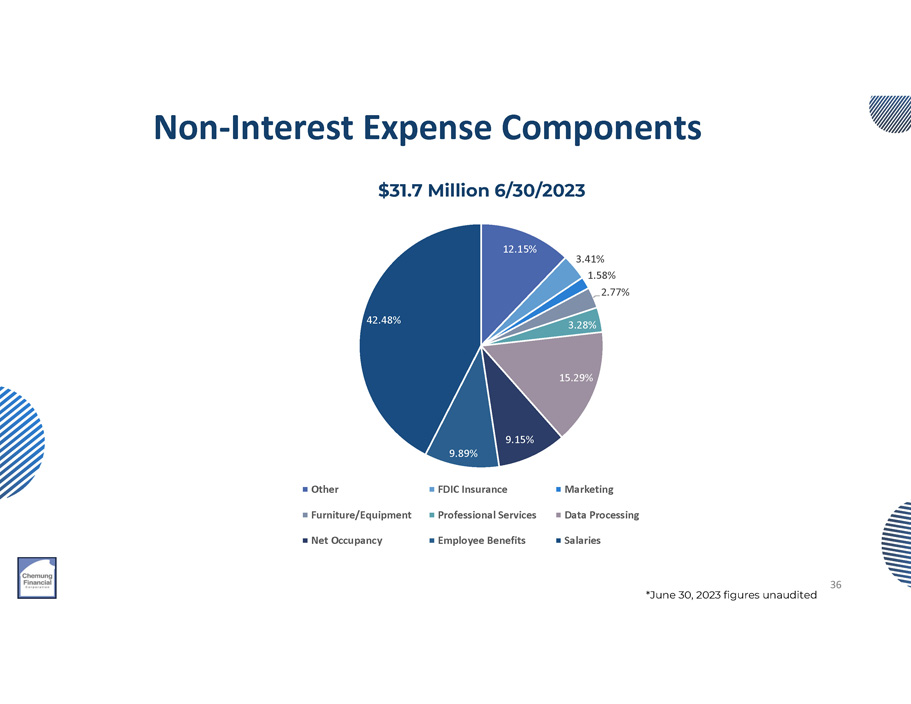

Non - Interest Expense Components 12.15% 3.41% 1.58% 2.77% 3.28% 15.29% 9.15% 9.89% 42.48% $31.7 Million 6/30/2023 Other FDIC Insurance Marketing Furniture/Equipment Professional Services Data Processing Net Occupancy Employee Benefits Salaries 36 *June 30, 2023 figures unaudited

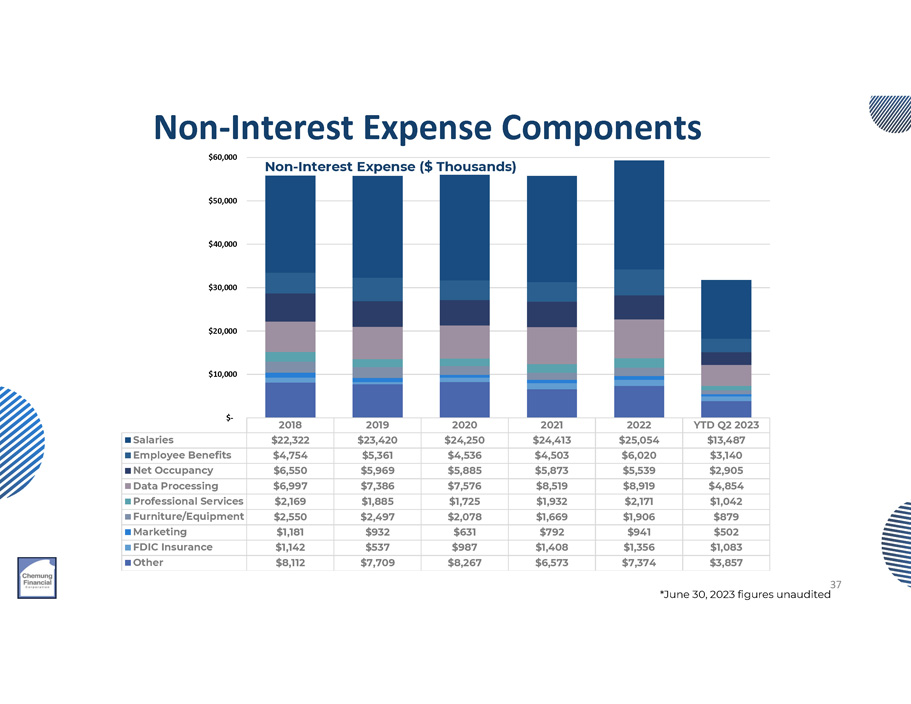

Non - Interest Expense Components *June 30, 2023 figures unaudited $ - $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 Non - Interest Expense ($ Thousands) YTD Q2 2023 2022 2021 2020 2019 2018 $13,487 $25,054 $24,413 $24,250 $23,420 $22,322 Salaries $3,140 $6,020 $4,503 $4,536 $5,361 $4,754 Employee Benefits $2,905 $5,539 $5,873 $5,885 $5,969 $6,550 Net Occupancy $4,854 $8,919 $8,519 $7,576 $7,386 $6,997 Data Processing $1,042 $2,171 $1,932 $1,725 $1,885 $2,169 Professional Services $879 $1,906 $1,669 $2,078 $2,497 $2,550 Furniture/Equipment $502 $941 $792 $631 $932 $1,181 Marketing $1,083 $1,356 $1,408 $987 $537 $1,142 FDIC Insurance $3,857 $7,374 $6,573 $8,267 $7,709 $8,112 Other 37

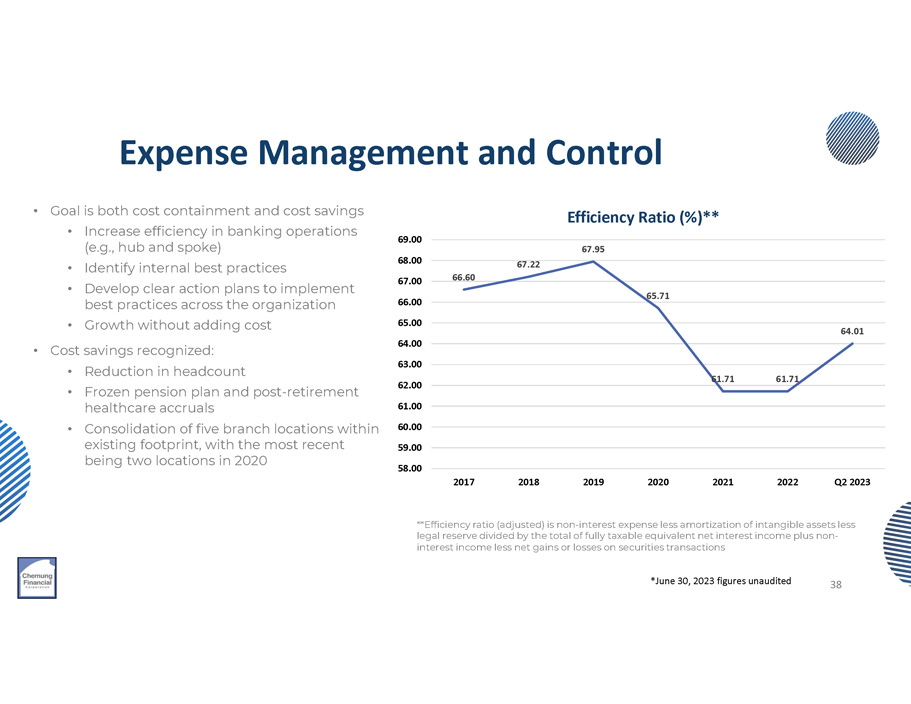

• Goal is both cost containment and cost savings • Increase efficiency in banking operations (e.g., hub and spoke) • Identify internal best practices • Develop clear action plans to implement best practices across the organization • Growth without adding cost • Cost savings recognized: • Reduction in headcount • Frozen pension plan and post - retirement healthcare accruals • Consolidation of five branch locations within existing footprint, with the most recent being two locations in 2020 Expense Management and Control **Efficiency ratio (adjusted) is non - interest expense less amortization of intangible assets less legal reserve divided by the total of fully taxable equivalent net interest income plus non - interest income less net gains or losses on securities transactions 66.60 67.22 67.95 65.71 61.71 61.71 64.01 58.00 59.00 60.00 61.00 62.00 63.00 64.00 65.00 66.00 67.00 68.00 69.00 2017 2018 2019 2020 2021 2022 Q2 2023 Efficiency Ratio (%)** *June 30, 2023 figures unaudited 38

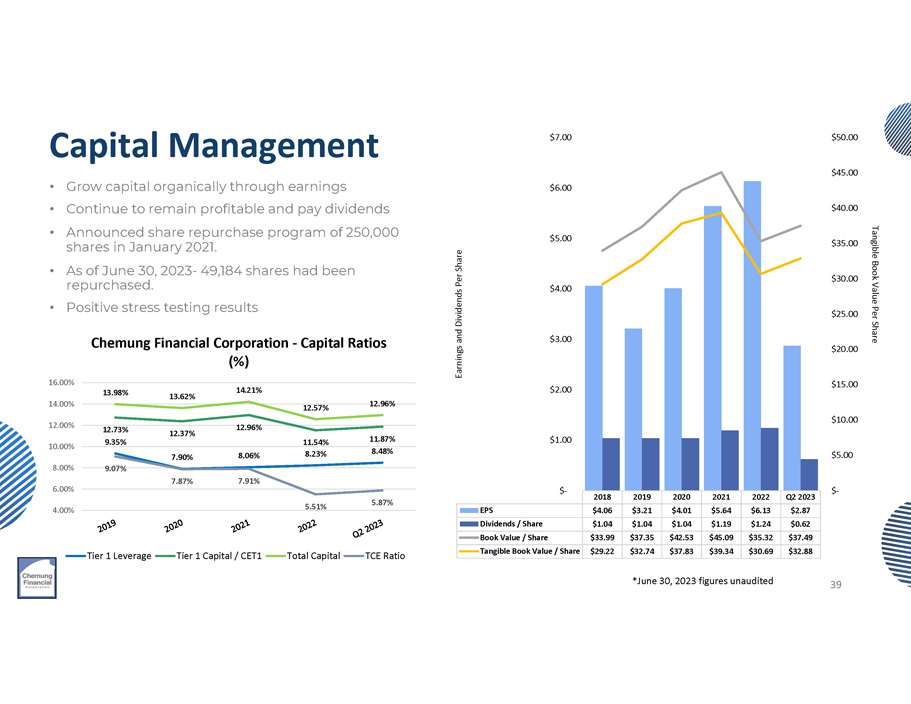

• Grow capital organically through earnings • Continue to remain profitable and pay dividends • Announced share repurchase program of 250,000 shares in January 2021. • As of June 30, 2023 - 49,184 shares had been repurchased. • Positive stress testing results Capital Management Q2 2023 2022 2021 2020 2019 2018 $2.87 $6.13 $5.64 $4.01 $3.21 $4.06 EPS $0.62 $1.24 $1.19 $1.04 $1.04 $1.04 Dividends / Share $37.49 $35.32 $45.09 $42.53 $37.35 $33.99 Book Value / Share $32.88 $30.69 $39.34 $37.83 $32.74 $29.22 Tangible Book Value / Share $ - $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $ - $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 $45.00 $50.00 Earnings and Dividends Per Share Tangible Book Value Per Share 7.90% 8.06% 8.23% 8.48% 12.73% 9.35% 12.37% 12.96% 11.54% 11.87% 13.98% 13.62% 14.21% 12.57% 12.96% 9.07% 7.87% 7.91% 5.51% 5.87% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% Chemung Financial Corporation - Capital Ratios (%) Tier 1 Leverage Tier 1 Capital / CET1 Total Capital TCE Ratio *June 30, 2023 figures unaudited 39

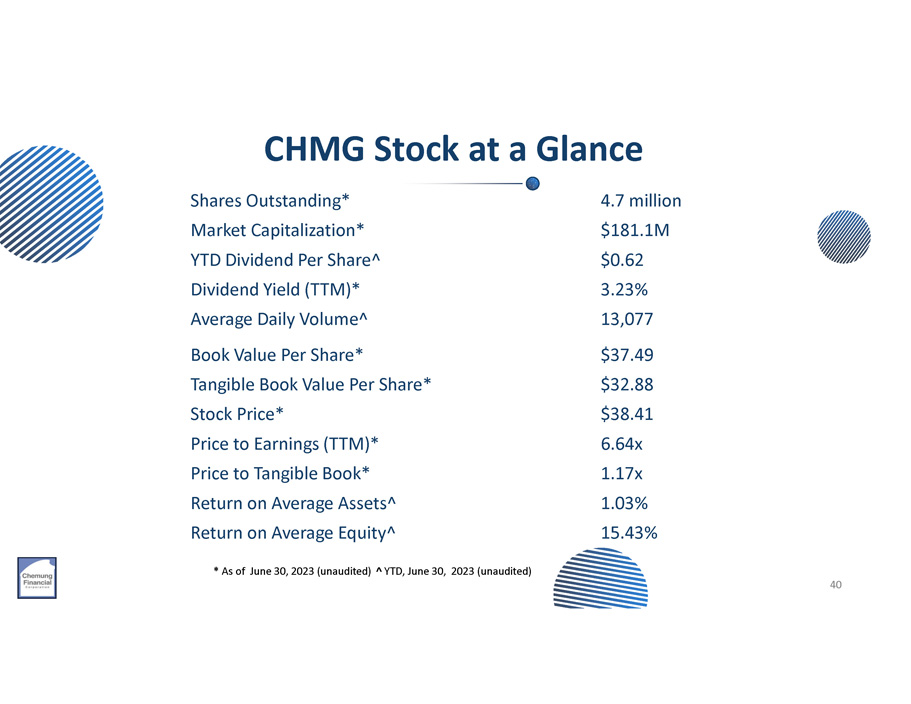

4.7 million Shares Outstanding* $181.1M Market Capitalization* $0.62 YTD Dividend Per Share^ 3.23% Dividend Yield (TTM)* 13,077 Average Daily Volume^ $37.49 Book Value Per Share* $32.88 Tangible Book Value Per Share* $38.41 Stock Price* 6.64x Price to Earnings (TTM)* 1.17x Price to Tangible Book* 1.03% Return on Average Assets^ 15.43% Return on Average Equity^ * As of June 30, 2023 (unaudited) ^ YTD, June 30, 2023 (unaudited) CHMG Stock at a Glance 40

Get In Touch Chemung Financial Corporation is a $2.7 billion financial services holding company headquartered in Elmira, New York and operates 31 retail offices through its principal subsidiary, Chemung Canal Trust Company, a full service community bank with trust powers. Established in 1833, Chemung Canal Trust Company is the oldest locally - owned and managed community bank in New York State. Chemung Financial Corporation is also the parent of CFS Group, Inc., a financial services subsidiary offering non - traditional services including mutual funds, annuities, brokerage services, tax preparation services and insurance, and Chemung Risk Management, Inc., a captive insurance company based in the State of Nevada. Dale McKim atomson@chemungcanal.com One Chemung Canal Plaza Elmira, New York 14901 607 737 - 3756 41 Anders Tomson 607 737 - 3714 dmckim@chemungcanal.com