10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

or

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission file number: 000-03134

PARK-OHIO HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

|

| | |

Ohio | | 34-1867219 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

6065 Parkland Boulevard, Cleveland, Ohio | | 44124 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (440) 947-2000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, Par Value $1.00 Per Share | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Park-Ohio Holdings Corp. is a successor issuer to Park-Ohio Industries, Inc.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | |

Large accelerated filer | ¨ | | Accelerated filer | þ |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes þ No

Aggregate market value of the registrant’s Common Stock held by non-affiliates of the registrant: Approximately $423,938,000 based on the closing price of $48.46 per share of the registrant’s Common Stock on June 30, 2015.

Number of shares outstanding of registrant’s Common Stock, par value $1.00 per share, as of February 29, 2016: 12,392,626 shares of the registrant’s common stock, $1 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the Annual Meeting of Shareholders to be held on or about May 19, 2016 are incorporated by reference into Part III of this Form 10-K.

PARK-OHIO HOLDINGS CORP.

FORM 10-K ANNUAL REPORT

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015

TABLE OF CONTENTS

|

| | |

Item No. | | Page |

| |

1. | | |

1A. | | |

1B. | | |

2. | | |

3. | | |

4. | | |

| |

5. | | |

6. | | |

7. | | |

7A. | | |

8. | | |

9. | | |

9A. | | |

9B. | | |

| |

10. | | |

11. | | |

12 | | |

13. | | |

14. | | |

| |

15. |

| |

| |

Part I

Item 1. Business

Overview

Park-Ohio Holdings Corp. (“Holdings”) was incorporated as an Ohio corporation in 1998. Holdings, primarily through the subsidiaries owned by its direct subsidiary, Park-Ohio Industries, Inc. (“Park-Ohio”), is an industrial supply chain logistics and diversified manufacturing business operating in three segments: Supply Technologies, Assembly Components and Engineered Products.

References herein to “we” or “the Company” include, where applicable, Holdings, Park-Ohio and Holdings’ other direct and indirect subsidiaries.

The Company operates through three reportable segments: Supply Technologies, Assembly Components and Engineered Products. Supply Technologies provides our customers with Total Supply Management™ services for a broad range of high-volume, specialty production components. Total Supply Management™ manages the efficiencies of every aspect of supplying production parts and materials to our customers’ manufacturing floor, from strategic planning to program implementation, and includes such services as engineering and design support, part usage and cost analysis, supplier selection, quality assurance, bar coding, product packaging and tracking, just-in-time and point-of-use delivery, electronic billing services and ongoing technical support. The principal customers of Supply Technologies are in the following industries: heavy-duty truck; automotive, truck and vehicle parts; power sports and recreational equipment; bus and coaches; electrical distribution and controls; agricultural and construction equipment; consumer electronics; HVAC; lawn and garden; semiconductor equipment; aerospace and defense; and plumbing. Assembly Components manufactures products oriented toward fuel efficiency and reduced emission requirements. Assembly Components manufactures cast and machined aluminum components, automotive and industrial rubber and thermoplastic products, gasoline direct injection systems, fuel filler and hydraulic assemblies for automotive, agricultural equipment, construction equipment, heavy-duty truck and marine equipment industries. Assembly Components also provides value-added services such as design and engineering, machining and assembly. Engineered Products operates a diverse group of niche manufacturing businesses that design and manufacture a broad range of high quality products engineered for specific customer applications. The principal customers of Engineered Products are original equipment manufacturers (“OEMs”) and end users in the ferrous and non-ferrous metals, silicon, coatings, forging, foundry, heavy-duty truck, construction equipment, automotive, oil and gas, rail and locomotive manufacturing and aerospace and defense industries.

Our sales are made through our own sales organization, distributors and independent sales representatives. Intersegment sales are immaterial and eliminated in consolidation and are not included in the financial results presented. Income allocated to segments excludes certain corporate expenses, interest expense, and certain other infrequent or unusual charges or credits. Identifiable assets by segment include assets directly identified with those operations. As of December 31, 2015, we employed approximately 6,000 persons.

The following chart reflects our end-use market mix for the year ended December 31, 2015:

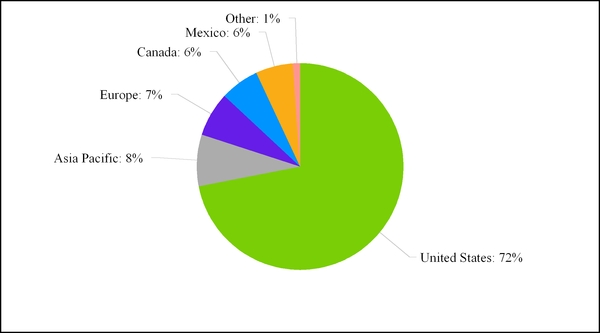

The following chart reflects our geographic mix for the year ended December 31, 2015:

The following table summarizes the key attributes of each of our business segments:

|

| | | | | |

| Supply Technologies | | Assembly Components | | Engineered Products |

| | | |

NET SALES FOR 2015 | $578.7 million (40% of total) | | $569.2 million (39% of total) | | $315.9 million (21% of total) |

SELECTED PRODUCTS | Sourcing, planning and procurement of over 190,000 production components, including: • Fasteners • Pins • Valves • Hoses • Wire harnesses • Clamps and fittings • Rubber and plastic components | | • Control arms • Knuckles • Injection molded rubber products • Pump housings • Clutch retainers/pistons • Rubber and thermoplastic hose • Oil pans • Flywheel spacers • Fuel filler assemblies • Gasoline direct injection systems

| | • Induction heating and melting systems • Pipe threading systems • Industrial oven systems • Forging presses • Forged steel and machined products

|

SELECTED INDUSTRIES SERVED | • Heavy-duty truck • Power sports and recreational equipment • Electrical distribution and controls • Consumer electronics • Bus and coaches • Automotive • Agricultural and construction equipment • HVAC • Lawn and garden • Semiconductor equipment • Aerospace and defense • Plumbing • Medical

| | • Automotive • Agricultural equipment • Construction equipment • Heavy-duty truck • Marine equipment | | • Ferrous and non-ferrous metals • Coatings • Forging • Foundry • Heavy-duty truck • Construction equipment • Silicon • Automotive • Oil and gas • Rail and locomotive manufacturing • Aerospace and defense |

Supply Technologies

Our Supply Technologies business provides our customers with Total Supply Management™, a proactive solutions approach that manages the efficiencies of every aspect of supplying production parts and materials to our customers’ manufacturing floor, from strategic planning to program implementation. Total Supply Management™ includes such services as engineering and design support, part usage and cost analysis, supplier selection, quality assurance, bar coding, product packaging and tracking, just-in-time and point-of-use delivery, electronic billing services and ongoing technical support. We operate 54 logistics service centers in the United States, Mexico, Canada, Puerto Rico, Scotland, Hungary, China, Taiwan, Singapore, India, United Kingdom, Poland and Ireland, as well as production sourcing and support centers in Asia. Through our supply chain management programs, we supply more than 190,000 globally-sourced production components, many of which are specialized and customized to meet individual customers’ needs.

Products and Services. Total Supply Management™ provides our customers with an expert partner in strategic planning, global sourcing, technical services, parts and materials, logistics, distribution and inventory management of production components. Some production components are characterized by low per unit supplier prices relative to the indirect costs of supplier management, quality assurance, inventory management and delivery to the production line. In addition, Supply

Technologies delivers an increasingly broad range of higher-cost production components including valves, electro-mechanical hardware, labels, fittings, steering components and many others. Applications engineering specialists and the direct sales force work closely with the engineering staff of OEM customers to recommend the appropriate production components for a new product or to suggest alternative components that reduce overall production costs, streamline assembly or enhance the appearance or performance of the end product. As an additional service, Supply Technologies also provides spare parts and aftermarket products to end users of its customers’ products.

Total Supply Management™ services are typically provided to customers pursuant to sole-source arrangements. We believe our services distinguish us from traditional buy/sell distributors, as well as manufacturers who supply products directly to customers, because we outsource our customers’ high-volume production components supply chain management, providing processes customized to each customer’s needs and replacing numerous current suppliers with a sole-source relationship. Our highly-developed, customized, information systems provide transparency and flexibility through the complete supply chain. This enables our customers to: (1) significantly reduce the direct and indirect cost of production component processes by outsourcing internal purchasing, quality assurance and inventory fulfillment responsibilities; (2) reduce the amount of working capital invested in inventory and floor space; (3) reduce component costs through purchasing efficiencies, including bulk buying and supplier consolidation; and (4) receive technical expertise in production component selection and design and engineering. Our sole-source arrangements foster long-term, entrenched supply relationships with our customers and, as a result, the average tenure of service for our top 50 Supply Technologies clients exceeds six years. Supply Technologies’ remaining sales are generated through the wholesale supply of industrial products to other manufacturers and distributors pursuant to master or authorized distributor relationships.

The Supply Technologies segment also engineers and manufactures precision cold formed and cold extruded products, including locknuts, SPAC® nuts and wheel hardware, which are principally used in applications where controlled tightening is required due to high vibration. Supply Technologies produces both standard items and specialty products to customer specifications, which are used in large volumes by customers in the automotive, heavy-duty truck and rail industries.

Markets and Customers. For the year ended December 31, 2015, approximately 71% of Supply Technologies’ net sales were to domestic customers. Remaining sales were primarily to manufacturing facilities of large, multinational customers located in Canada, Mexico, Europe and Asia. Total Supply Management™ services and production components are used extensively in a variety of industries, and demand is generally related to the state of the economy and to the overall level of manufacturing activity.

Supply Technologies markets and sells its services to over 7,800 customers domestically and internationally. The principal industries served by Supply Technologies are the heavy-duty truck; automotive, truck and vehicle parts; power sports and recreational equipment; bus and coaches; electrical distribution and controls; agricultural and construction equipment; consumer electronics; HVAC; lawn and garden; semiconductor equipment; aerospace and defense; and plumbing. The five largest customers, within which Supply Technologies sells through sole-source contracts to multiple operating divisions or locations, accounted for approximately 34% of the sales of Supply Technologies in 2015 and 32% in 2014. The loss of any two of its top five customers could have a material adverse effect on the results of operations and financial condition of this segment.

Competition. A limited number of companies compete with Supply Technologies to provide supply management services for production parts and materials. Some global competitors include Bossard, Fastenal, Optimus, Wolseley and Wurth. Supply Technologies competes in North America, Mexico, Europe and Asia, primarily on the basis of its Total Supply Management™ services, including engineering and design support, part usage and cost analysis, supplier selection, quality assurance, bar coding, product packaging and tracking, just-in-time and point-of-use delivery, electronic billing services and ongoing technical support, and its geographic reach, extensive product selection, price and reputation for high service levels. Numerous North American and foreign companies compete with Supply Technologies in manufacturing cold-formed and cold-extruded products.

Assembly Components

Assembly Components manufactures products oriented towards fuel efficiency and reduced emission standards. Assembly Components designs, develops and manufactures aluminum products and highly efficient, high pressure Direct Fuel Injection fuel rails and pipes, fuel filler pipes that mount on to the gas tank, as well as flexible multi-layer plastic and rubber

assemblies used to transport fuel to the vehicle's gas tank and then, at extreme high pressure, to the engine's fuel injector nozzles. These advanced products coupled with Turbo Enabled engines make up large and growing engine architecture for all worldwide car manufacturers. Assembly Components also designs and manufactures Turbo Charging hoses along with Turbo Coolant hoses that will be required as engines get downsized to 3 and 4 cylinders from 6 or 8 cylinders. This engine downsizing increases efficiency, while dramatically decreasing pollution levels. In addition, our Assembly Components segment operates what we believe is one of the few aluminum component suppliers that have the capability to provide a wide range of high-volume, high-quality products utilizing a broad range of processes including gravity and low pressure permanent mold, die-cast and lost-foam, as well as emerging alternative casting technologies. In 2012, we added machining capabilities to our aluminum products service offerings.

Products and Services. Assembly Components manufactures cast aluminum components, automotive and industrial rubber and thermoplastic products, fuel filler, gasoline direct injection systems and hydraulic assemblies for automotive, agricultural equipment, construction equipment, heavy-duty truck and marine equipment industries. Assembly Components’ principal products include control arms, knuckles, pump housings, clutch retainers and pistons, master cylinders, oil pans and flywheel spacers, injected molded rubber and silicone products, including wire harnesses, shock and vibration mounts, spark plug boots and nipples and general sealing gaskets, rubber and thermoplastic hose, fuel filler assemblies and gasoline direct injection systems. We produce our Assembly Components at twenty-five manufacturing facilities in Ohio, Michigan, Indiana, Tennessee, Florida, Mexico, China and the Czech Republic. In addition, we also provide value-added services such as design engineering, machining and part assembly.

Markets and Customers. The five largest customers, to which Assembly Components sells to multiple operating divisions through sole-source contracts, accounted for approximately 49% of Assembly Components sales for 2015 and 46% for 2014. The loss of any one of these customers could have a material adverse effect on the results of operations and financial condition of this segment.

Competition. Assembly Components competes principally on the basis of its ability to: (1) engineer and manufacture high-quality, cost-effective, assemblies utilizing multiple technologies in large volumes; (2) provide timely delivery; and (3) retain the manufacturing flexibility necessary to quickly adjust to the needs of its customers. There are few domestic companies with capabilities able to meet the customers’ stringent quality and service standards and lean manufacturing techniques. As one of these suppliers, Assembly Components is well-positioned to benefit as customers continue to consolidate their supplier base. Principal competitors in the Assembly Components segment are Chassix, Compass Automotive, Martinrea and Stant.

Engineered Products

Our Engineered Products segment operates a diverse group of niche manufacturing businesses that design and manufacture a broad range of highly-engineered products, including induction heating and melting systems, pipe threading systems and forged and machined products. We manufacture these products in twelve domestic facilities and twelve international facilities in Canada, Mexico, the United Kingdom, Belgium, Germany, China, Italy, India and Japan.

Products and Services. Our induction heating and melting business utilizes proprietary technology and specializes in the engineering, construction, service and repair of induction heating and melting systems, primarily for the ferrous and non-ferrous metals, silicon, coatings, forging, foundry, automotive and construction equipment industries. Our induction heating and melting systems are engineered and built to customer specifications and are used primarily for melting, heating, and surface hardening of metals and curing of coatings. Approximately 46% of our induction heating and melting systems’ revenues are derived from the sale of replacement parts and provision of field service, primarily for the installed base of our own products. Our pipe threading business serves the oil and gas industry. We also engineer and install mechanical forging presses, sell spare parts and provide field service for the large existing base of mechanical forging presses and hammers in North America. We machine, induction harden and surface finish crankshafts and camshafts, used primarily in locomotives. We forge aerospace and defense structural components such as landing gears and struts, as well as rail products such as railcar center plates and draft lugs.

Markets and Customers. We sell induction heating and other capital equipment to component manufacturers and OEMs in the ferrous and non-ferrous metals, silicon, coatings, forging, foundry, automotive, truck, construction equipment and oil and

gas industries. We sell forged and machined products to locomotive manufacturers, machining companies and sub-assemblers who finish aerospace and defense products for OEMs, and railcar builders and maintenance providers.

Competition. We compete with small-to medium-sized domestic and international equipment manufacturers on the basis of service capability, ability to meet customer specifications, delivery performance and engineering expertise. We compete domestically and internationally with small-to medium-sized forging and machining businesses on the basis of product quality and precision.

Sales and Marketing

Supply Technologies markets its products and services in the United States, Mexico, Canada, Western and Eastern Europe and East and South Asia primarily through its direct sales force, which is assisted by applications engineers who provide the technical expertise necessary to assist the engineering staff of OEM customers in designing new products and improving existing products. Assembly Components primarily markets and sells its products in North America through internal sales personnel and independent sales representatives. Engineered Products primarily markets and sells its products in North America through both internal sales personnel and independent sales representatives. Induction heating and pipe threading equipment is also marketed and sold in Europe, Asia, Latin America and Africa through both internal sales personnel and independent sales representatives. In some instances, the internal engineering staff assists in the sales and marketing effort through joint design and applications-engineering efforts with major customers.

Raw Materials and Suppliers

Supply Technologies purchases substantially all of its production components from third-party suppliers. Supply Technologies has multiple sources of supply for its components. An increasing portion of Supply Technologies’ production components are purchased from suppliers in foreign countries, primarily Canada, Taiwan, China, South Korea, Singapore, India and multiple European countries. Supply Technologies is dependent upon the ability of such suppliers to meet stringent quality and performance standards and to conform to delivery schedules. Assembly Components and Engineered Products purchase substantially all of their raw materials, principally metals and certain component parts incorporated into their products, from third-party suppliers and manufacturers. Most raw materials required by Assembly Components and Engineered Products are commodity products available from several domestic suppliers. Management believes that raw materials and component parts other than certain specialty products are available from alternative sources.

Our suppliers of raw materials and component parts may significantly and quickly increase their prices in response to increases in costs of the raw materials, such as steel, that they use to manufacture our raw materials and component parts. We generally attempt to pass along increased raw materials prices to our customers in the form of price increases, there may be a time delay between the increased raw materials prices and our ability to increase the price of our products, or we may be unable to increase the prices of our products due to pricing pressure or other factors. See the discussion of risks associated with raw material supply and costs in Item 1A "Risk Factors".

Backlog

Management believes that backlog is not a meaningful measure for Supply Technologies, as a majority of Supply Technologies’ customers require just-in-time delivery of production components. Management believes that Assembly Components’ backlog as of any particular date is not a meaningful measure of sales for any future period as a significant portion of sales are on a release or firm order basis. The backlog of Engineered Products’ orders believed to be firm as of December 31, 2015 was $147.2 million compared with $199.7 million as of December 31, 2014. Approximately 90% of Engineered Products’ backlog as of December 31, 2015 is scheduled to be shipped in 2016.

Environmental, Health and Safety Regulations

We are subject to numerous federal, state and local laws and regulations designed to protect public health and the environment, particularly with regard to discharges and emissions, as well as handling, storage, treatment and disposal, of various substances and wastes. Our failure to comply with applicable environmental laws and regulations and permit requirements could result in civil and criminal fines or penalties or enforcement actions, including regulatory or judicial orders enjoining or curtailing operations or requiring corrective measures. Pursuant to certain environmental laws, owners or operators of facilities may be liable for the costs of response or other corrective actions for contamination identified at or emanating from

current or former locations, without regard to whether the owner or operator knew of, or was responsible for, the presence of any such contamination, and for related damages to natural resources. Additionally, persons who arrange for the disposal or treatment of hazardous substances or materials may be liable for costs of response at sites where they are located, whether or not the site is owned or operated by such person.

From time to time, we have incurred, and are presently incurring, costs and obligations for correcting environmental noncompliance and remediating environmental conditions at certain of our properties. In general, we have not experienced difficulty in complying with environmental laws in the past, and compliance with environmental laws has not had a material adverse effect on our financial condition, liquidity and results of operations. Our capital expenditures on environmental control facilities were not material during the past five years and such expenditures are not expected to be material to us in the foreseeable future.

We are currently, and may in the future be, required to incur costs relating to the investigation or remediation of property, including property where we have disposed of our waste, and for addressing environmental conditions. For instance, we have been identified as a potentially responsible party at third-party sites under the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, or comparable state laws, which provide for strict and, under certain circumstances, joint and several liability. We are participating in the cost of certain clean-up efforts at several of these sites. The availability of third-party payments or insurance for environmental remediation activities is subject to risks associated with the willingness and ability of the third party to make payments. However, our share of such costs has not been material and, based on available information, we do not expect our exposure at any of these locations to have a material adverse effect on our results of operations, liquidity or financial condition.

Information as to Segment Reporting and Geographic Areas

The information contained in Note 2 to the consolidated financial statements included elsewhere herein relating to (1) net sales, income before income taxes, identifiable assets and other information by segment and (2) net sales and assets by geographic region for the years ended December 31, 2015, 2014 and 2013 is incorporated herein by reference.

Recent Developments

IPSCO Tubulars Inc. d/b/a TMK IPSCO sued Ajax Tocco Magnethermic Corporation ("ATM"), a subsidiary of Holdings, in the United States District Court for the Eastern District of Arkansas claiming that equipment supplied by ATM for heat treating certain steel pipe at IPSCO’s Blytheville, Arkansas facility did not perform as required by the contract. The complaint alleged causes of action for breach of contract, gross negligence, and constructive fraud. IPSCO sought approximately $10 million in damages plus an unspecified amount of punitive damages. ATM denied the allegations. ATM subsequently obtained summary judgment on the constructive fraud claim, which was dismissed by the district court prior to trial. The remaining claims were the subject of a bench trial that occurred in May 2013. After IPSCO presented its case, the district court entered partial judgment in favor of ATM, dismissing the gross negligence claim, a portion of the breach of contract claim, and any claim for punitive damages. The trial proceeded with respect to the remainder of IPSCO’s claim for breach of contract. In September 2013, the district court issued a judgment in favor of IPSCO in the amount of $5.2 million, which the Company recognized and accrued for at that time. IPSCO subsequently filed a motion seeking to recover $3.8 million in attorneys’ fees and costs. The district court reserved ruling on that issue pending an appeal. In October 2013, ATM filed an appeal with the U.S. Court of Appeals for the Eighth Circuit seeking reversal of the judgment in favor of IPSCO. In November 2013, IPSCO filed a cross-appeal seeking reversal of the dismissal of its claims for gross negligence and punitive damages. The Eighth Circuit issued an opinion in March 2015 affirming in part, reversing in part, and remanding the case. It affirmed the district court's determination that ATM was liable for breach of contract. It also affirmed the district court's dismissal of IPSCO's claims for gross negligence and punitive damages. However, the Eighth Circuit reversed nearly all of the damages awarded by the district court and remanded for further findings on the issue of damages, including whether consequential damages are barred under the express language of the contract. Because IPSCO did not appeal the award of $5.2 million in its favor, those damages could be decreased, but could not be increased, on remand. On remand, the district court entered an order once again awarding IPSCO $5.2 million in damages. In December 2015, ATM filed a second appeal with the Eighth Circuit seeking reversal of the damages award. In March 2016, the district court issued an order granting, in part, IPSCO's motion for fees and costs and awarding $2.2 million to IPSCO. ATM expects to appeal that decision.

Available Information

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K proxy statements and other information, including amendments to these reports and statements, with the Securities and Exchange Commission (“SEC”). The public can obtain copies of these materials by visiting the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549, by calling the SEC at 1-800-SEC-0330, or by accessing the SEC’s website at http://www.sec.gov. In addition, as soon as reasonably practicable after such materials are filed with or furnished to the SEC, we make such materials available on our website free of charge at http://www.pkoh.com. The information on our website is not a part of this annual report on Form 10-K.

Executive Officers of the Registrant

Information with respect to our executive officers as of March 14, 2016 is as follows:

|

| | | | | |

Name | Age | Position |

Edward F. Crawford | | 76 |

| | Chairman of the Board, Chief Executive Officer and Director |

Matthew V. Crawford | | 46 |

| | President and Chief Operating Officer and Director |

Patrick W. Fogarty | | 54 |

| | Vice President and Chief Financial Officer |

Robert D. Vilsack | | 55 |

| | Secretary and General Counsel |

Mr. E. Crawford has been a director and our Chairman of the Board and Chief Executive Officer since 1992. He has also served as the Chairman of Crawford Group, Inc., a management company for a group of manufacturing companies, since 1964.

Mr. M. Crawford has been President and Chief Operating Officer since 2003 and joined us in 1995 as Assistant Secretary and Corporate Counsel. He was also our Senior Vice President from 2001 to 2003. Mr. M. Crawford became one of our directors in August 1997 and has served as President of Crawford Group, Inc. since 1995. Mr. E. Crawford is the father of Mr. M. Crawford.

Mr. Fogarty has been Vice President and Chief Financial Officer since 2015. Prior to that, Mr. Fogarty was Director of Corporate Development since 1997 and served as Director of Finance from 1995 to 1997. Prior to 1995, Mr. Fogarty was employed by Ernst & Young from 1983 to 1995.

Mr. Vilsack has been Secretary and General Counsel since joining us in 2002. From 1999 until his employment with us, Mr. Vilsack was engaged in the private practice of law. From 1997 to 1999, Mr. Vilsack was Vice President, General Counsel and Secretary of Medusa Corporation, a manufacturer of Portland cement, and prior to that he was Vice President, General Counsel and Secretary of Figgie International Inc., a manufacturing conglomerate.

Item 1A. Risk Factors

The following are certain risk factors that could affect our business, results of operations and financial condition. These risks are not the only ones we face. If any of the following risks occur, our business, results of operations or financial condition could be adversely affected.

Adverse credit market conditions may significantly affect our access to capital, cost of capital and ability to meet liquidity needs.

Disruptions, uncertainty or volatility in the credit markets may adversely impact our ability to access credit already arranged and the availability and cost of credit to us in the future. These market conditions may limit our ability to replace, in a timely manner, maturing liabilities and access the capital necessary to grow and maintain our business. Accordingly, we may be forced to delay raising capital or pay unattractive interest rates, which could increase our interest expense, decrease our profitability and significantly reduce our financial flexibility. Longer-term disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation, reduced alternatives or failures of significant financial institutions could adversely affect our access to liquidity needed for our business. Any disruption could require us to take measures to conserve cash until the markets stabilize or until alternative credit arrangements or other funding for our business needs can be arranged.

Such measures could include deferring capital expenditures and reducing or eliminating future share repurchases or other discretionary uses of cash. Overall, our results of operations, financial condition and cash flows could be materially adversely affected by disruptions in the credit markets.

Adverse global economic conditions may have significant effects on our customers and suppliers that could result in material adverse effects on our business and operating results.

Significant reductions in available capital and liquidity from banks and other providers of credit, substantial reductions and fluctuations in equity and currency values worldwide, volatility in commodity prices for such items as crude oil, and concerns that the worldwide economy may enter into a prolonged recessionary period, may materially adversely affect our customers’ access to capital or willingness to spend capital on our products or their ability to pay for products that they will order or have already ordered from us. In addition, unfavorable global economic conditions may materially adversely affect our suppliers’ access to capital and liquidity with which they maintain their inventories, production levels and product quality, which could cause them to raise prices or lower production levels.

These potential effects of adverse global economic conditions are difficult to forecast and mitigate. As a consequence, our operating results for a particular period are difficult to predict, and, therefore, prior results are not necessarily indicative of results to be expected in future periods. Any of the foregoing effects could have a material adverse effect on our business, results of operations and financial condition.

Adverse global economic conditions may have significant effects on our customers that would result in our inability to borrow or to meet our debt service coverage ratio in our revolving credit facility.

As of December 31, 2015, we were in compliance with our debt service coverage ratio covenant and other covenants contained in our revolving credit facility. While we expect to remain in compliance throughout 2016, declines in demand in the automotive industry and in sales volumes could adversely impact our ability to remain in compliance with certain of these financial covenants. Additionally, to the extent our customers are adversely affected by a decline in the economy in general, they may not be able to pay their accounts payable to us on a timely basis or at all, which would make the accounts receivable ineligible for purposes of the revolving credit facility and could reduce our borrowing base and our ability to borrow.

The industries in which we operate are cyclical and are affected by the economy in general.

We sell products to customers in industries that experience cyclicality (expectancy of recurring periods of economic growth and slowdown) in demand for products and may experience substantial increases and decreases in business volume throughout economic cycles. Industries we serve, including the automotive and vehicle parts, heavy-duty truck, industrial equipment, steel, rail, oil and gas, electrical distribution and controls, aerospace and defense, recreational equipment, HVAC, electrical components, appliance and semiconductor equipment industries, are affected by consumer spending, general economic conditions and the impact of international trade. A downturn in any of the industries we serve could have a material adverse effect on our financial condition, liquidity and results of operations.

Because a significant portion of our sales is to the automotive and heavy-duty truck industries, a decrease in the demand of these industries or the loss of any of our major customers in these industries could adversely affect our financial health.

Demand for certain of our products is affected by, among other things, the relative strength or weakness of the automotive and heavy-duty truck industries. The domestic automotive and heavy-duty truck industries are highly cyclical and may be adversely affected by international competition. In addition, the automotive and heavy-duty truck industries are significantly unionized and subject to work slowdowns and stoppages resulting from labor disputes. We derived 43% and 7% of our net sales during the year ended December 31, 2015 from the automotive and heavy-duty truck industries, respectively.

The loss of a portion of business to any of our major automotive or heavy-duty truck customers could have a material adverse effect on our financial condition, cash flow and results of operations. We cannot assure you that we will maintain or improve our relationships in these industries or that we will continue to supply these customers at current levels.

Our Supply Technologies customers are generally not contractually obligated to purchase products and services from us.

Most of the products and services are provided to our Supply Technologies customers under purchase orders as opposed to long-term contracts. When we do enter into long-term contracts with our Supply Technologies customers, many of them only establish pricing terms and do not obligate our customers to buy required minimum amounts from us or to buy from us exclusively. Accordingly, many of our Supply Technologies customers may decrease the amount of products and services that they purchase from us or even stop purchasing from us altogether, either of which could have a material adverse effect on our net sales and profitability.

We are dependent on key customers.

We rely on several key customers. For the year ended December 31, 2015, our ten largest customers accounted for approximately 35% of our net sales. Many of our customers place orders for products on an as-needed basis and operate in cyclical industries and, as a result, their order levels have varied from period to period in the past and may vary significantly in the future. Due to competitive issues, we have lost key customers in the past and may again in the future. Customer orders are dependent upon their markets and may be subject to delays or cancellations. As a result of dependence on our key customers, we could experience a material adverse effect on our business and results of operations if any of the following were to occur:

| |

• | the loss of any key customer, in whole or in part; |

| |

• | the insolvency or bankruptcy of any key customer; |

| |

• | a declining market in which customers reduce orders or demand reduced prices; or |

| |

• | a strike or work stoppage at a key customer facility, which could affect both their suppliers and customers. |

If any of our key customers become insolvent or file for bankruptcy, our ability to recover accounts receivable from that customer would be adversely affected and any payments we received in the preference period prior to a bankruptcy filing may be potentially recoverable, which could adversely impact our results of operations.

We operate in highly competitive industries.

The markets in which all three of our segments sell their products are highly competitive. Some of our competitors are large companies that have greater financial resources than we have. We believe that the principal competitive factors for our Supply Technologies segment are an approach reflecting long-term business partnership and reliability, sourced product quality and conformity to customer specifications, timeliness of delivery, price and design and engineering capabilities. We believe that the principal competitive factors for our Assembly Components and Engineered Products segments are product quality and conformity to customer specifications, design and engineering capabilities, product development, timeliness of delivery and price. The rapidly evolving nature of the markets in which we compete may attract new entrants as they perceive opportunities, and our competitors may foresee the course of market development more accurately than we do. In addition, our competitors may develop products that are superior to our products or may adapt more quickly than we do to new technologies or evolving customer requirements.

We expect competitive pressures in our markets to remain strong. These pressures arise from existing competitors, other companies that may enter our existing or future markets and, in some cases, our customers, which may decide to internally produce items we sell. We cannot assure you that we will be able to compete successfully with our competitors. Failure to compete successfully could have a material adverse effect on our financial condition, liquidity and results of operations.

The loss of key executives could adversely impact us.

Our success depends upon the efforts, abilities and expertise of our executive officers and other senior managers, including Edward Crawford, our Chairman and Chief Executive Officer, and Matthew Crawford, our President and Chief Operating Officer, as well as the president of each of our operating units. An event of default occurs under our revolving credit facility if Messrs. E. Crawford and M. Crawford or certain of their related parties own in the aggregate less than 15% of Holdings’ outstanding common stock and if at such time neither Mr. E. Crawford nor Mr. M. Crawford holds the office of chairman, chief executive officer or president. The loss of the services of Messrs. E. Crawford and M. Crawford, senior and executive officers, and/or other key individuals could have a material adverse effect on our financial condition, liquidity and results of operations.

We may encounter difficulty in expanding our business through targeted acquisitions.

We have pursued, and may continue to pursue, targeted acquisition opportunities that we believe would complement our business. We cannot assure you that we will be successful in consummating any acquisitions.

Any targeted acquisitions will be accompanied by the risks commonly encountered in acquisitions of businesses. We may not successfully overcome these risks or any other problems encountered in connection with any of our acquisitions, including the possible inability to integrate an acquired business’ operations, information technology, services and products into our business, diversion of management’s attention, the assumption of unknown liabilities, increases in our indebtedness, the failure to achieve the strategic objectives of those acquisitions and other unanticipated problems, some or all of which could materially and adversely affect us. The process of integrating operations could cause an interruption of, or loss of momentum in, our activities. Any delays or difficulties encountered in connection with any acquisition and the integration of our operations could have a material adverse effect on our business, results of operations, financial condition or prospects of our business.

Our Supply Technologies business depends upon third parties for substantially all of our component parts.

Our Supply Technologies business purchases substantially all of its component parts from third-party suppliers and manufacturers. As such, it is subject to the risk of price fluctuations and periodic delays in the delivery of component parts. Failure by suppliers to continue to supply us with these component parts on commercially reasonable terms, or at all, could have a material adverse effect on us. We depend upon the ability of these suppliers, among other things, to meet stringent performance and quality specifications and to conform to delivery schedules. Failure by third-party suppliers to comply with these and other requirements could have a material adverse effect on our financial condition, liquidity and results of operations.

The raw materials used in our production processes and by our suppliers of component parts are subject to price and supply fluctuations that could increase our costs of production and adversely affect our results of operations.

Our supply of raw materials for our Assembly Components and Engineered Products businesses could be interrupted for a variety of reasons, including availability and pricing. Prices for raw materials necessary for production have fluctuated significantly in the past and significant increases could adversely affect our results of operations and profit margins. While we generally attempt to pass along increased raw materials prices to our customers in the form of price increases, there may be a time delay between the increased raw materials prices and our ability to increase the price of our products, or we may be unable to increase the prices of our products due to pricing pressure or other factors.

Our suppliers of component parts, particularly in our Supply Technologies business, may significantly and quickly increase their prices in response to increases in costs of the raw materials, such as steel, that they use to manufacture our component parts. We may not be able to increase our prices commensurate with our increased costs. Consequently, our results of operations and financial condition may be materially adversely affected.

The energy costs involved in our production processes and transportation are subject to fluctuations that are beyond our control and could significantly increase our costs of production.

Our manufacturing process and the transportation of raw materials, components and finished goods are energy intensive. Our manufacturing processes are dependent on adequate supplies of electricity and natural gas. A substantial increase in the cost of transportation fuel, natural gas or electricity could have a material adverse effect on our margins. We may experience higher than anticipated gas costs in the future, which could adversely affect our results of operations. In addition, a disruption or curtailment in supply could have a material adverse effect on our production and sales levels.

Potential product liability risks exist from the products that we sell.

Our businesses expose us to potential product liability risks that are inherent in the design, manufacture and sale of our products and products of third-party vendors that we use or resell. While we currently maintain what we believe to be suitable and adequate product liability insurance, we cannot assure you that we will be able to maintain our insurance on acceptable terms or that our insurance will provide adequate protection against potential liabilities. In the event of a claim against us, a lack of sufficient insurance coverage could have a material adverse effect on our financial condition, liquidity and results of operations. Moreover, even if we maintain adequate insurance, any successful claim could have a material adverse effect on our financial condition, liquidity and results of operations.

Some of our employees belong to labor unions, and strikes or work stoppages could adversely affect our operations.

As of December 31, 2015, we were a party to seven collective bargaining agreements with various labor unions that covered approximately 600 full-time employees. Our inability to negotiate acceptable contracts with these unions could result in, among other things, strikes, work stoppages or other slowdowns by the affected workers and increased operating costs as a result of higher wages or benefits paid to union members. If the unionized workers were to engage in a strike, work stoppage or other slowdown, or other employees were to become unionized, we could experience a significant disruption of our operations and higher ongoing labor costs, which could have a material adverse effect on our business, financial condition and results of operations.

We operate and source internationally, which exposes us to the risks of doing business abroad.

Our operations are subject to the risks of doing business abroad, including the following:

| |

• | fluctuations in currency exchange rates; |

| |

• | limitations on ownership and on repatriation of earnings; |

| |

• | transportation delays and interruptions; |

| |

• | political, social and economic instability and disruptions; |

| |

• | potential disruption that could be caused with the partial or complete reconfiguration of the European Union; |

| |

• | government embargoes or foreign trade restrictions; |

| |

• | the imposition of duties and tariffs and other trade barriers; |

| |

• | import and export controls; |

| |

• | labor unrest and current and changing regulatory environments; |

| |

• | the potential for nationalization of enterprises; |

| |

• | disadvantages of competing against companies from countries that are not subject to U.S. laws and regulations including the U.S. Foreign Corrupt Practices Act (“FCPA”); |

| |

• | difficulties in staffing and managing multinational operations; |

| |

• | limitations on our ability to enforce legal rights and remedies; and |

| |

• | potentially adverse tax consequences. |

In addition, we could be adversely affected by violations of the FCPA and similar worldwide anti-bribery laws. The FCPA and similar anti-bribery laws in other jurisdictions generally prohibit companies and their intermediaries from making improper payments to non-U.S. officials for the purpose of obtaining or retaining business. Our policies mandate compliance with these anti-bribery laws. We operate in many parts of the world that have experienced governmental corruption to some degree and, in certain circumstances, strict compliance with anti-bribery laws may conflict with local customs and practices. We cannot assure you that our internal controls and procedures always will protect us from the reckless or criminal acts committed by our employees or agents. For example, in connection with responding to a subpoena from the staff of the SEC, regarding a third party, we disclosed to the staff that the third party participated in a payment on our behalf to a foreign tax official that implicates the FCPA. If we are found to be liable for FCPA violations (either due to our own acts or our inadvertence or due to the acts or inadvertence of others), we could suffer from criminal or civil penalties or other sanctions, which could have a material adverse effect on our business.

Any of the events enumerated above could have an adverse effect on our operations in the future by reducing the demand for our products and services, decreasing the prices at which we can sell our products or otherwise having an adverse effect on our business, financial condition or results of operations. We cannot assure you that we will continue to operate in compliance with applicable customs, currency exchange control regulations, transfer pricing regulations or any other laws or regulations to which we may be subject. We also cannot assure you that these laws will not be modified.

We are subject to significant environmental, health and safety laws and regulations and related compliance expenditures and liabilities.

Our businesses are subject to many foreign, federal, state and local environmental, health and safety laws and regulations, particularly with respect to the use, handling, treatment, storage, discharge and disposal of substances and hazardous wastes used or generated in our manufacturing processes. Compliance with these laws and regulations is a significant factor in our business. We have incurred and expect to continue to incur significant expenditures to comply with applicable environmental laws and regulations. Our failure to comply with applicable environmental laws and regulations and permit requirements could

result in civil or criminal fines or penalties or enforcement actions, including regulatory or judicial orders enjoining or curtailing operations or requiring corrective measures, installation of pollution control equipment or remedial actions.

We are currently, and may in the future be, required to incur costs relating to the investigation or remediation of property, including property where we have disposed of our waste, and for addressing environmental conditions. Some environmental laws and regulations impose liability and responsibility on present and former owners, operators or users of facilities and sites for contamination at such facilities and sites without regard to causation or knowledge of contamination. In addition, we occasionally evaluate various alternatives with respect to our facilities, including possible dispositions or closures. Investigations undertaken in connection with these activities may lead to discoveries of contamination that must be remediated, and closures of facilities may trigger compliance requirements that are not applicable to operating facilities. Consequently, we cannot assure you that existing or future circumstances, the development of new facts or the failure of third parties to address contamination at current or former facilities or properties will not require significant expenditures by us.

We expect to continue to be subject to increasingly stringent environmental and health and safety laws and regulations. It is difficult to predict the future interpretation and development of environmental and health and safety laws and regulations or their impact on our future earnings and operations. We anticipate that compliance will continue to require increased capital expenditures and operating costs. Any increase in these costs, or unanticipated liabilities arising from, among other things, discovery of previously unknown conditions or more aggressive enforcement actions, could adversely affect our results of operations, and there is no assurance that they will not exceed our reserves or have a material adverse effect on our financial condition.

If our information systems fail, our business could be materially affected.

We believe that our information systems are an integral part of the Supply Technologies segment and, to a lesser extent, the Assembly Components and Engineered Products segments. We depend on our information systems to process orders, manage inventory and accounts receivable collections, purchase products, maintain cost-effective operations, route and re-route orders, maintain confidential and proprietary information and provide superior service to our customers. These systems are subject to failure due to design flaws, improper use, cyber intrusions and other electronic service breaches. We cannot assure you that a failure of or a disruption in the operation of our information systems used by Supply Technologies, including the failure of the supply chain management software to function properly, or those used by Assembly Components and Engineered Products, will not occur. Any such failure or disruption could damage our relation with our customer in our industries or otherwise have a material adverse effect on our financial condition, liquidity and results of operations.

Operating problems in our business may materially adversely affect our financial condition and results of operations.

We are subject to the usual hazards associated with manufacturing and the related storage and transportation of raw materials, products and waste, including explosions, fires, leaks, discharges, inclement weather, natural disasters, mechanical failure, unscheduled downtime and transportation interruption or calamities. The occurrence of material operating problems at our facilities may have a material adverse effect on our operations as a whole, both during and after the period of operational difficulties.

We have a significant amount of goodwill, and any future goodwill impairment charges could adversely impact our results of operations.

As of December 31, 2015, we had goodwill of $82.0 million. The future occurrence of a potential indicator of impairment, such as a significant adverse change in legal factors or business climate, unanticipated competition, a material negative change in relationships with significant customers, strategic decisions made in response to economic or competitive conditions, loss of key personnel or a more-likely-than-not expectation that a reporting unit or a significant portion of a reporting unit will be sold or disposed of, could result in goodwill impairment charges, which could adversely impact our results of operations. We have recorded goodwill impairment charges in the past, and such charges materially impacted our historical results of operations. For additional information, see Note 5, Goodwill, to the consolidated financial statements included elsewhere herein.

Our Chairman of the Board and Chief Executive Officer and our President and Chief Operating Officer collectively beneficially own a significant portion of Holdings’ outstanding common stock and their interests may conflict with yours.

As of December 31, 2015, Edward Crawford, our Chairman of the Board and Chief Executive Officer, and Matthew Crawford, our President and Chief Operating Officer, collectively beneficially owned approximately 28% of Holdings’ common stock. Mr. E. Crawford is Mr. M. Crawford’s father. Their interests could conflict with your interests. For example, if we encounter financial difficulties or are unable to pay our debts as they mature, the interests of Messrs. E. Crawford and M. Crawford may conflict with your interests.

Our business and operating results may be adversely affected by natural disasters or other catastrophic events beyond our control.

While we have taken precautions to prevent production and service interruptions at our global facilities, severe weather conditions such as hurricanes or tornadoes, as well as major earthquakes and other natural disasters, in areas in which we have manufacturing facilities or from which we obtain products may cause physical damage to our properties, closure of one or more of our business facilities, lack of adequate work force in a market, temporary disruption in the supply of inventory, disruption in the transport of products and utilities, and delays in the delivery of products to our customers. Any of these factors may disrupt our operations and adversely affect our financial condition and results of operations.

The insurance that we maintain may not fully cover all potential expenses.

We maintain property, business interruption and casualty insurance, but such insurance may not cover all risks associated with the hazards of our business and is subject to limitation, including deductible and maximum liabilities covered. We are potentially at risk if one or more of our insurance carries fail. Additionally, severe disruptions in the domestic and global financial markets could adversely impact the ratings and survival of some insurers. In the future, we may not be able to obtain coverage at current levels, and our premiums may increase significantly on coverage that we maintain.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

As of December 31, 2015, our operations included numerous manufacturing and supply chain logistics services facilities located in 25 states in the United States and in Puerto Rico, as well as in Asia, Canada, Europe and Mexico. We lease our world headquarters located in Cleveland, Ohio, which includes the world headquarters for certain of our businesses. We believe our manufacturing, logistics and corporate office facilities are well-maintained and are suitable and adequate, and have sufficient productive capacity to meet our current needs.

The following table provides information relative to our principal facilities as of December 31, 2015.

|

| | | | | | | | |

Related Industry Segment | Location | | Owned or Leased | | Approximate Square Footage | | Use |

SUPPLY | Mississauga, Ontario, Canada | | Leased | | 145,000 |

| | Manufacturing |

TECHNOLOGIES (1) | Lawrence, PA | | Leased | | 116,000 |

| | Logistics and Manufacturing |

| Minneapolis, MN | | Leased | | 87,100 |

| | Logistics |

| Cleveland, OH (2) | | Leased | | 60,450 |

| | Supply Technologies Corporate Office |

| Dayton, OH | | Leased | | 56,000 |

| | Logistics |

| Carol Stream, IL | | Leased | | 51,000 |

| | Logistics |

| Memphis, TN | | Leased | | 48,750 |

| | Logistics |

| Solon, OH | | Leased | | 47,100 |

| | Logistics |

| Streetsboro, OH | | Leased | | 45,000 |

| | Manufacturing |

| Allentown, PA | | Leased | | 43,800 |

| | Logistics |

| Suwanee, GA | | Leased | | 42,500 |

| | Logistics |

| Dublin, VA | | Leased | | 40,000 |

| | Logistics |

| Tulsa, OK | | Leased | | 40,000 |

| | Logistics |

| Lenexa, KS | | Leased | | 29,500 |

| | Logistics |

ASSEMBLY | Ocala, FL | | Owned | | 433,000 |

| | Manufacturing |

COMPONENTS | Conneaut, OH (4) | | Leased/Owned | | 283,800 |

| | Manufacturing |

| Lexington, TN | | Owned | | 240,000 |

| | Manufacturing |

| Lobelville, TN (5) | | Owned | | 208,700 |

| | Manufacturing |

| Rootstown, OH | | Owned | | 208,000 |

| | Manufacturing |

| Cleveland, OH (3) | | Leased/Owned | | 190,000 |

| | Manufacturing |

| Wapakoneta, OH | | Owned | | 188,000 |

| | Manufacturing |

| Angola, IN | | Owned | | 135,000 |

| | Manufacturing |

| Huntington, IN | | Leased | | 124,500 |

| | Manufacturing |

| Fremont, IN | | Owned | | 112,000 |

| | Manufacturing |

| Big Rapids, MI | | Owned | | 97,000 |

| | Manufacturing |

| Ravenna, OH | | Owned | | 69,000 |

| | Manufacturing |

| Delaware, OH | | Owned | | 45,000 |

| | Manufacturing |

ENGINEERED | Cicero, IL | | Owned | | 450,000 |

| | Manufacturing |

PRODUCTS (6) | Cuyahoga Heights, OH | | Owned | | 427,000 |

| | Manufacturing |

| Pune, India | | Owned | | 275,000 |

| | Manufacturing |

| Newport, AR | | Owned | | 200,000 |

| | Manufacturing |

| Warren, OH | | Owned | | 195,000 |

| | Manufacturing |

| Leini, Italy | | Owned | | 161,500 |

| | Manufacturing |

| Madison Heights, MI | | Leased | | 128,000 |

| | Manufacturing |

| Canton, OH | | Leased | | 124,000 |

| | Manufacturing |

| La Roeulx, Belgium | | Owned | | 120,000 |

| | Manufacturing |

| Brookfield, WI | | Leased | | 116,000 |

| | Manufacturing |

| Wickliffe, OH | | Owned | | 110,000 |

| | Manufacturing |

| Albertville, AL | | Leased | | 56,000 |

| | Office |

| Leini, Italy | | Leased | | 53,800 |

| | Manufacturing |

| Leini, Italy | | Leased | | 37,700 |

| | Manufacturing |

| Cortland, OH | | Owned | | 30,000 |

| | Office and Manufacturing |

| |

(1) | Supply Technologies has other facilities, none of which is deemed to be a principal facility. |

| |

(2) | Includes 20,150 square feet used by Holdings’ and Park-Ohio’s corporate office. |

| |

(3) | Includes one leased property with 150,000 square feet and one owned property with 40,000 square feet. |

| |

(4) | Includes three leased properties with square footage of 91,800, 64,000 and 45,700, respectively, and one owned property with 82,300 square feet. |

| |

(5) | Includes five facilities, which make up the total square footage of 208,700. |

| |

(6) | Engineered Products has other owned and leased facilities, none of which is deemed to be a principal facility. |

Item 3. Legal Proceedings

We are subject to various pending and threatened lawsuits in which claims for monetary damages are asserted in the ordinary course of business. While any litigation involves an element of uncertainty, in the opinion of management, liabilities, if any, arising from currently pending or threatened litigation are not expected to have a material adverse effect on our financial condition, liquidity or results of operations.

In addition to the routine lawsuits and asserted claims noted above, we were a party to the lawsuits and legal proceedings described below as of December 31, 2015:

We were a co-defendant in approximately 110 cases asserting claims on behalf of approximately 287 plaintiffs alleging personal injury as a result of exposure to asbestos. These asbestos cases generally relate to production and sale of asbestos-containing products and allege various theories of liability, including negligence, gross negligence and strict liability, and seek compensatory and, in some cases, punitive damages.

In every asbestos case in which we are named as a party, the complaints are filed against multiple named defendants. In substantially all of the asbestos cases, the plaintiffs either claim damages in excess of a specified amount, typically a minimum amount sufficient to establish jurisdiction of the court in which the case was filed (jurisdictional minimums generally range from $25,000 to $75,000), or do not specify the monetary damages sought. To the extent that any specific amount of damages is sought, the amount applies to claims against all named defendants.

There are only eight asbestos cases, involving 26 plaintiffs, that plead specified damages against named defendants. In each of the eight cases, the plaintiff is seeking compensatory and punitive damages based on a variety of potentially alternative causes of action. In three cases, the plaintiff has alleged compensatory damages in the amount of $3.0 million for four separate causes of action and $1.0 million for another cause of action and punitive damages in the amount of $10.0 million. In the fourth case, the plaintiff has alleged compensatory and punitive damages, each in the amount of $10.0 million, for seven separate causes of action. In the fifth case, the plaintiff has alleged compensatory damages in the amount of $20.0 million for eight separate causes of action and punitive damages in the amount of $20.0 million. In two cases, the plaintiff has alleged compensatory damages in the amount of $10.0 million for five separate causes of action and $5.0 million for the sixth cause of action and punitive damages in the amount for $10.0 million for each cause of action. In the eighth case the plaintiff has alleged compensatory and punitive damages, each in the amount $10.0 million, for five separate causes of action.

Historically, we have been dismissed from asbestos cases on the basis that the plaintiff incorrectly sued one of our subsidiaries or because the plaintiff failed to identify any asbestos-containing product manufactured or sold by us or our subsidiaries. We intend to vigorously defend these asbestos cases, and believe we will continue to be successful in being dismissed from such cases. However, it is not possible to predict the ultimate outcome of asbestos-related lawsuits, claims and proceedings due to the unpredictable nature of personal injury litigation. Despite this uncertainty, and although our results of operations and cash flows for a particular period could be adversely affected by asbestos-related lawsuits, claims and proceedings, management believes that the ultimate resolution of these matters will not have a material adverse effect on our financial condition, liquidity or results of operations. Among the factors management considered in reaching this conclusion were: (a) our historical success in being dismissed from these types of lawsuits on the bases mentioned above; (b) many cases have been improperly filed against one of our subsidiaries; (c) in many cases the plaintiffs have been unable to establish any causal relationship to us or our products or premises; (d) in many cases, the plaintiffs have been unable to demonstrate that they have suffered any identifiable injury or compensable loss at all or that any injuries that they have incurred did in fact result from alleged exposure to asbestos; and (e) the complaints assert claims against multiple defendants and, in most cases, the damages alleged are not attributed to individual defendants. Additionally, we do not believe that the amounts claimed in any of the asbestos cases are meaningful indicators of our potential exposure because the amounts claimed typically bear no relation to the extent of the plaintiff's injury, if any.

Our cost of defending these lawsuits has not been material to date and, based upon available information, our management does not expect its future costs for asbestos-related lawsuits to have a material adverse effect on our results of operations, liquidity or financial position.

IPSCO Tubulars Inc. d/b/a TMK IPSCO sued ATM, a subsidiary of Holdings, in the United States District Court for the Eastern District of Arkansas claiming that equipment supplied by ATM for heat treating certain steel pipe at IPSCO’s Blytheville, Arkansas facility did not perform as required by the contract. The complaint alleged causes of action for breach of contract, gross negligence, and constructive fraud. IPSCO sought approximately $10 million in damages plus an unspecified amount of punitive damages. ATM denied the allegations. ATM subsequently obtained summary judgment on the constructive fraud claim, which was dismissed by the district court prior to trial. The remaining claims were the subject of a bench trial that occurred in May 2013. After IPSCO presented its case, the district court entered partial judgment in favor of ATM, dismissing the gross negligence claim, a portion of the breach of contract claim, and any claim for punitive damages. The trial proceeded with respect to the remainder of IPSCO’s claim for breach of contract. In September 2013, the district court issued a judgment in favor of IPSCO in the amount of $5.2 million, which the Company recognized and accrued for at that time. IPSCO subsequently filed a motion seeking to recover $3.8 million in attorneys’ fees and costs. The district court reserved ruling on that issue pending an appeal. In October 2013, ATM filed an appeal with the U.S. Court of Appeals for the Eighth Circuit seeking reversal of the judgment in favor of IPSCO. In November 2013, IPSCO filed a cross-appeal seeking reversal of the dismissal of its claims for gross negligence and punitive damages. The Eighth Circuit issued an opinion in March 2015 affirming in part, reversing in part, and remanding the case. It affirmed the district court's determination that ATM was liable for breach of contract. It also affirmed the district court's dismissal of IPSCO's claims for gross negligence and punitive damages. However, the Eighth Circuit reversed nearly all of the damages awarded by the district court and remanded for further findings on the issue of damages, including whether consequential damages are barred under the express language of the contract. Because IPSCO did not appeal the award of $5.2 million in its favor, those damages could be decreased, but could not be increased, on remand. On remand, the district court entered an order once again awarding IPSCO $5.2 million in damages. In December 2015, ATM filed a second appeal with the Eighth Circuit seeking reversal of the damages award. In March 2016, the district court issued an order granting, in part, IPSCO's motion for fees and costs and awarding $2.2 million to IPSCO. ATM expects to appeal that decision.

In August 2013, we received a subpoena from the staff of the SEC in connection with the staff’s investigation of a third party. At that time, we also learned that the Department of Justice (“DOJ”) is conducting a criminal investigation of the third party. In connection with its initial response to the staff’s subpoena, we disclosed to the staff of the SEC that, in November 2007, the third party participated in a payment on behalf of us to a foreign tax official that implicates the Foreign Corrupt Practices Act.

The Board of Directors formed a special committee to review our transactions with the third party and to make any recommendations to the Board of Directors with respect thereto.

The Company intends to cooperate fully with the SEC and the DOJ in connection with their investigations of the third party and with the SEC in light of our disclosure. We are unable to predict the outcome or impact of the special committee’s investigation or the length, scope or results of the SEC’s review or the impact on our results of operations.

Item 4. Mine Safety Disclosures

Not applicable.

Part II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock, par value $1.00 per share, trades on the Nasdaq Global Select Market under the symbol “PKOH”. The table below presents the high and low sales prices of the common stock during the periods presented. The Company declared and paid a quarterly dividend of $0.125 per share commencing in the second quarter of 2014 and has continued with quarterly dividends of $0.125 per share through the first quarter of 2016. Prior to the second quarter of 2014, no dividends were declared or paid during the prior quarterly periods in the last four years. Additionally, the terms of the credit agreement governing our revolving credit facility and the indenture governing the 8.125% senior notes due 2021 provide some restrictions on the amounts of dividends.

|

| | | | | | | | | | | | | | | | |

Quarterly Common Stock Price Ranges |

| | | | |

| | 2015 | | 2014 |

Quarter | | High | | Low | | High | | Low |

1st | | $ | 61.33 |

| | $ | 49.00 |

| | $ | 57.21 |

| | $ | 44.06 |

|

2nd | | $ | 54.35 |

| | $ | 44.97 |

| | $ | 60.67 |

| | $ | 51.05 |

|

3rd | | $ | 50.97 |

| | $ | 28.30 |

| | $ | 60.98 |

| | $ | 47.86 |

|

4th | | $ | 42.73 |

| | $ | 28.82 |

| | $ | 64.74 |

| | $ | 45.01 |

|

The number of shareholders of record for our common stock as of February 29, 2016 was 412.

Issuer Purchases of Equity Securities

Set forth below is information regarding repurchases of our common stock during the fourth quarter of the fiscal year ended December 31, 2015.

|

| | | | | | | | | | | | | | | |

Period | | Total Number of Shares Purchased | | | | Average Price Paid Per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans (1) | | Maximum Number of Shares That May Yet Be Purchased Under the Plans or Program (1) |

October 1 — October 31, 2015 | | 796 |

| | (2) | | $ | 33.63 |

| | — |

| | 988,334 |

|

November 1 — November 30, 2015 | | 149,834 |

| | | | 39.25 |

| | 149,834 |

| | 838,500 |

|

December 1 — December 31, 2015 | | 116,867 |

| | (2) | | 39.45 |

| | 112,473 |

| | 726,027 |

|

Total | | 267,497 |

| | | | $ | 39.32 |

| | 262,307 |

| | 726,027 |

|

| |

(1) | On March 4, 2013, we announced a share repurchase program whereby we may repurchase up to 1.0 million shares of our outstanding common stock. |

| |