UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended March 1, 2020 |

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from ________ to _______ |

Commission file number 1-4415

PARK AEROSPACE CORP.,

FORMERLY PARK ELECTROCHEMICAL CORP.

(Exact Name of Registrant as Specified in Its Charter)

|

New York |

11-1734643 |

|

(State or Other Jurisdiction of Incorporation of Organization) |

(I.R.S. Employer Identification No.) |

|

1400 Old Country Road, Westbury, New York (Address of Principal Executive Offices) |

11590 (Zip Code) |

Registrant’s telephone number, including area code (631) 465-3600

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

|

Common Stock, par value $.10 per share |

PKE |

New York Stock Exchange |

|

Securities registered pursuant to Section 12(g) of the Act: |

None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☐ Accelerated Filer ☐ Non-Accelerated Filer ☒ Smaller Reporting Company ☒ Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked prices of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

|

Title of Class |

Aggregate Market Value |

As of Close of Business On |

|

Common Stock, par value $.10 per share |

$346,705,646 |

August 30, 2019 |

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

Title of Class |

Shares Outstanding |

As of Close of Business On |

|

Common Stock, par value $.10 per share |

20,518,823 |

May 1, 2020 |

DOCUMENTS INCORPORATED BY REFERENCE

Proxy Statement for Annual Meeting of Shareholders to be held July 16, 2020 incorporated by reference into Part III of this Report.

|

TABLE OF CONTENTS |

||

|

Page |

||

|

PART I |

||

|

Item 1. |

Business |

4 |

| Item 1A. | Risk Factors | 11 |

| Item 1B. | Unresolved Staff Comments | 16 |

|

Item 2. |

Properties |

16 |

|

Item 3. |

Legal Proceedings |

17 |

|

Item 4. |

Mine Safety Disclosures |

17 |

|

Executive Officers of the Registrant |

18 |

|

|

PART II |

||

|

Item 5. |

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

20 |

|

Item 6. |

Selected Financial Data |

23 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

25 |

|

Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

40 |

|

Item 8. |

Financial Statements and Supplementary Data |

41 |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

73 |

|

Item 9A. |

Controls and Procedures |

73 |

|

Item 9B. |

Other Information |

74 |

|

PART III |

||

|

Item 10. |

Directors, Executive Officers and Corporate Governance |

75 |

|

Item 11. |

Executive Compensation |

75 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

75 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

75 |

|

Item 14. |

Principal Accountant Fees and Services |

75 |

|

PART IV |

||

|

Item 15. |

Exhibits and Financial Statement Schedule |

76 |

|

FINANCIAL STATEMENT SCHEDULE |

||

|

Schedule II – Valuation and Qualifying Accounts. |

77 |

|

|

EXHIBIT INDEX |

78 |

|

|

SIGNATURES |

80 |

|

PART I

ITEM 1. BUSINESS.

General

Park Aerospace Corp. (“Park”), and its subsidiaries, formerly known as Park Electrochemical Corp. and its subsidiaries (unless the context otherwise requires, Park and its subsidiaries are hereinafter called the “Company”), is an aerospace company which develops and manufactures solution and hot-melt advanced composite materials used to produce composite structures for the global aerospace markets. Park’s advanced composite materials include film adhesives (undergoing qualification) and lightning strike materials. Park offers an array of composite materials specifically designed for hand lay-up or automated fiber placement (AFP) manufacturing applications. Park’s advanced composite materials are used to produce primary and secondary structures for jet engines, large and regional transport aircraft, military aircraft, Unmanned Aerial Vehicles (UAVs commonly referred to as “drones”), business jets, general aviation aircraft and rotary wing aircraft. Park also offers specialty ablative materials for rocket motors and nozzles and specially designed materials for radome applications. As a complement to Park’s advanced composite materials offering, Park designs and fabricates composite parts, structures and assemblies and low-volume tooling for the aerospace industry. Target markets for Park’s composite parts and structures (which include Park’s proprietary composite Sigma Strut and Alpha Strut product lines) are, among others, prototype and development aircraft, special mission aircraft, spares for legacy military and civilian aircraft and exotic spacecraft. Park’s core capabilities are in the areas of polymer chemistry formulation and coating technology.

In December 2019, an outbreak of a novel strain of coronavirus originated in Wuhan, China (“COVID-19”) and has since spread worldwide, including to the United States (the “U.S.”), posing public health risks that have reached pandemic proportions (the “COVID-19 Pandemic”). The COVID-19 Pandemic poses a threat to the health and economic wellbeing of the Company’s employees, suppliers, customers and original equipment manufacturers (“OEMs”), as well as the end users of aircraft manufactured by OEMs served by the Company. Currently, Park’s manufacturing operations have been deemed essential by the Federal Government of the United States and by the State of Kansas, and we are actively working with federal, state and local government officials to ensure that we continue to satisfy their requirements for continuing our manufacturing operations. The continued operation of the Company’s Kansas facility is critically dependent on maintaining the wellbeing of the employees that staff the facility. The Company has provided all employees at its manufacturing facility with detailed health and safety literature on COVID-19. In addition, the Company’s procurement and safety teams have updated and developed new safety-oriented guidelines to support daily operations, and the Company is in the process of providing appropriate personal protection equipment to its employees. The Company has implemented work from home policies at its office in the State of New York. The COVID-19 Pandemic will likely impact Park financially; however, the Company cannot presently predict the scope and severity with which COVID-19 will impact its business, results of operations and cash flows. The Company believes its balance sheet and financial condition to be very strong, and the Company believes it is well positioned to weather the impact of the Pandemic as a result. As a result of the pandemic, year to date global passenger air travel has decreased dramatically, precipitating production rate cuts for many commercial aerospace programs and business jet/general aviation programs which the Company supports. The military aerospace end market has not experienced this same production rate decline but would also be at risk as it relates to uncertainty about suppliers and employee health.

On December 4, 2018, Park completed the previously announced sale of its digital and radio frequency/microwave printed circuit materials business (collectively, the “Electronics Business”), including manufacturing facilities in Singapore, France, California and Arizona and R&D facilities in Singapore and Arizona, to AGC Inc. for an aggregate purchase price of $145 million in cash, subject to post-closing adjustments for changes in working capital compared to the target net working capital, excluding cash in certain acquired subsidiaries and certain accrued and unpaid taxes of certain acquired subsidiaries. Therefore, the results of operations for the Electronics Business are reported as discontinued operations. Continuing operations discussed below refer to Park’s aerospace business unless otherwise indicated, and prior periods in such discussion have been restated to reflect results excluding the Electronics Business. See Note 13, “Discontinued Operations”, of the Notes to Consolidated Financial Statements elsewhere in this Report for additional information on the sale.

The Company's manufacturing and research and development facilities are located in Kansas. The Company also maintains dormant facilities in California and Singapore.

Park was founded in 1954 by Jerry Shore, who was the Company’s Chairman of the Board until July 14, 2004.

The Company makes available free of charge on its website, www.parkaerospace.com, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission. None of the information on the Company's website shall be deemed to be a part of this Report.

AEROGLIDE®, COREFIX®, EASYCURE E-710®, ELECTROGLIDE®, and TIN CITY AIRCRAFT WORKS® are registered trademarks of Park Aerospace Corp., and ALPHASTRUT™, PEELCOTE™, RADARWAVE™ and SIGMASTRUT™ are common law trademarks of Park Aerospace Corp. A trademark application for RADARWAVE™ is pending.

Operations

The Company designs, develops and manufactures engineered, advanced composite materials and advanced composite structures and assemblies and low-volume tooling for the aerospace markets and prototype tooling for such structures and assemblies.

The Company’s aerospace composite materials are designed, developed and manufactured at its facility located at the Newton, Kansas Airport. Prior to the Company’s sale of its Electronics Business, aerospace composite materials were also manufactured by the Company’s Nelco Products Pte. Ltd. business unit in Singapore at a facility that was transferred to a subsidiary of the Company in connection with the sale and is currently idle. The Company’s aerospace composite structures and assemblies and low-volume tooling are also developed and manufactured at its facility located in Newton, Kansas.

Park offers a wide range of aerospace composite materials manufacturing capability, as well as composite structures design, assembly and production capability, all in its Newton facility. Park offers composite aircraft and space vehicle structures design and assembly services, in addition to “build-to-print” services. The Company believes that the ability to manufacture and develop both composite materials and structures at a single location can facilitate the needs of the aircraft and space vehicle industries.

Industry Background

The aerospace composite materials manufactured by the Company and its competitors are used primarily to fabricate light-weight, high-strength structures with specifically designed performance properties. Composite materials are typically highly specified combinations of resin formulations and reinforcements. Reinforcements can be unidirectional fibers, woven fabrics, or non-woven goods such as mats or felts. Resin formulations are typically highly proprietary, and include various chemical and physical mixtures. The Company produces resin formulations using various epoxies, polyesters, phenolics, cyanate esters, polyimides and other complex matrices. The reinforcement combined with the resin is referred to as a “prepreg”. Aerospace composite materials can be broadly categorized as either thermosets or thermoplastics. While both material types require the addition of heat to form a consolidated laminate, thermoplastics can be reformed using additional heat. Once fully cured, thermoset materials cannot be further reshaped. The Company believes that the demand for thermoset advanced materials is greater than that for thermoplastics due to the fact that parts fabrication processes for continuous fiber reinforced thermoplastics require much higher temperatures and pressures and are, therefore, typically more capital intensive than parts fabrication processes for most thermoset materials.

The Company works with aerospace OEMs, such as general aviation aircraft manufacturers and commercial aircraft manufacturers, and certain tier 1 suppliers to qualify its aerospace composite materials or structures and assemblies for use on current and upcoming programs. The Company’s customers typically design and specify a material specifically to meet the requirements of the customer’s application and processing methods. Such customers sometimes work with a supplier to develop the specific resin system and reinforcement combination to match the application. Composite structure fabrication methods may include hand lay-up, resin infusion or more advanced automated lay-up processes. Automated lay-up processes include automated tape lay-up, automated fiber placement and filament winding. These automated fabrication processes required different material formats but similar materials to hand lay-up. After the lay-up process is completed, the material is cured by the addition of heat and pressure. Cure and consolidation processes typically include vacuum bag/oven curing, high pressure autoclave and press forming. After the structure has been cured, final finishing and trimming, and assembly of the structure, is performed by the fabricator or the Company.

Products

The aerospace composite materials products manufactured by the Company are primarily thermoset curing prepregs. The Company has developed proprietary resin formulations to suit the needs of the markets in which it participates by analyzing the needs of the markets and working with its customers. The complex process of developing resin formulations and selecting the proper reinforcement is accomplished through a collaborative effort of the Company’s research and development, materials and process engineering and technical sales and marketing resources working with the customers’ technical staff. The Company focuses on developing a thorough understanding of its customers’ businesses, product lines, processes and technical challenges. The Company develops innovative solutions which utilize technologically advanced materials and concepts for its customers.

The Company’s aerospace composite materials products include prepregs manufactured from proprietary formulations using modified epoxies, phenolics, polyesters, cyanate esters and polyimides combined with woven, non-woven and unidirectional reinforcements. Reinforcement materials used to produce the Company’s products include polyacrylonitrile (“PAN”) based carbon fiber, E-glass (fiberglass), S2 glass, quartz, aramids, such as Kevlar® (“Kevlar” is a registered trademark of E.I. du Pont de Nemours & Co.), Twaron® (“Twaron” is a registered trademark of Teijin Twaron B.V. LLC), polyester and other synthetic materials. The Company also sells certain specialty prepregs with carbonized rayon fabric reinforcements that are used mainly in the rocket motor industry.

The Company’s composite structures and assemblies are manufactured with carbon, fiberglass and other reinforcements impregnated with formulated resins. The Company also provides low-volume tooling in connection with its manufacture and sale of composite structures and assemblies.

Customers and End Markets

The Company’s aerospace composite materials, structures and assemblies customers include manufacturers of turbofan engines, aircraft primary and secondary structures and radomes. Radomes includes military aircraft, unmanned aerial vehicles (“UAVs”), business jets and turboprops, large and regional transport aircraft and helicopters, space vehicles, rocket motors and specialty industrial products. The Company’s aerospace composite materials are marketed primarily by sales personnel and, to a lesser extent, by independent distributors. The Company’s aerospace composite structures and assemblies are marketed primarily by sales personnel.

During the Company’s 2020, 2019 and 2018 fiscal years, 48.2%, 42.8% and 30.5%, respectively, of the Company’s total worldwide net sales were to affiliate and non-affiliate subtier suppliers of General Electric Company, a leading manufacturer of aerospace engines. Sales to AAE Aerospace were 10.6% of the Company’s total worldwide sales in the 2018 fiscal year. During the 2020, 2019 and 2018 fiscal years, sales to no other customer of the Company equaled or exceeded 10% of the Company’s total worldwide sales. In April 2019, Middle River Aircraft Systems, the General Electric Company subsidiary that used the Company’s products to manufacture aircraft nacelles, was sold to ST Engineering Aerospace. The aircraft nacelles manufactured with the Company’s products continue to be sold by ST Engineering Aerospace to affiliates of General Electric Company. The loss of a major customer or of a group of customers could have a material adverse effect on the Company’s business or its consolidated results of operations or financial position.

The Company’s aerospace customers include fabricators of aircraft composite structures and assemblies. The Company’s aerospace composite materials are used by such fabricators and by the Company to produce primary and secondary structures, aircraft interiors and various other aircraft components. The Company’s customers for aerospace materials, and the Company itself, produce structures and assemblies for commercial aircraft and for the general aviation and business aviation, kit aircraft, special mission, UAVs and military markets. Many of the Company’s composite materials are used in the manufacture of aircraft certified by the Federal Aviation Administration (the “FAA”).

Customers for the Company’s rocket motor materials include United States defense prime contractors and subcontractors. These customers fabricate rocket motors for heavy lift space launchers, strategic defense weapons, tactical motors and various other applications. The Company’s materials are used to produce heat shields, exhaust gas management devices and insulative and ablative nozzle components. Rocket motors are primarily used for commercial and military space launch, and for tactical and strategic weapons. The Company also has customers for these materials outside of the United States.

The Company sells composite materials for use in RF electrical applications. Customers buying these materials typically fabricate antennas and radomes engineered to preserve electrical signal integrity. A radome is a protective cover over an electrical antenna or signal generator. The radome is designed to minimize signal loss and distortion.

Manufacturing

The Company’s manufacturing facilities for aerospace composite materials and for composite structures and assemblies are currently located in Newton, Kansas. On August 19, 2019, the Company broke ground on the expansion of its facilities located in Newton, Kansas, which will include the construction of a redundant manufacturing facility located adjacent to the existing facility. The 90,000 square feet expansion will essentially double the size of the Company’s existing Newton, Kansas facilities. The new facility was originally conceived of as a redundant manufacturing facility for Park’s major aerospace customer and the large aerospace OEMs it supports, but will also support additional manufacturing capacity. The expansion will include enhanced and upgraded hot-melt film and tape lines and mixing and delivery systems, an expanded production lab, a new R&D lab, additional freezer and storage space and additional infrastructure to support the expanded operation. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Other Liquidity Factors” included in Item 7 of Part II of this Report and Note 11 of the Notes to Consolidated Financial Statements included in Item 8 of Part II of this Report. Prior to the Company’s sale of its Electronics Business, aerospace composite materials were also manufactured by the Company’s Nelco Products Pte. Ltd. business unit in Singapore at a facility that was transferred to a subsidiary of the Company in connection with the Sale, and is currently idle. See “Operations” elsewhere in this Report.

The process for manufacturing composite materials, structures and assemblies is capital intensive and requires sophisticated equipment, significant technical know-how and very tight process controls. The key steps used in the manufacturing process include resin mixing, resin film casting and reinforcement impregnation via hot-melt process or a solution process.

Prepreg is manufactured by the Company using either solvent (solution) coating methods on a treater or by hot-melt impregnation. A solution treater is a roll-to-roll continuous process machine which sequences reinforcement through tension controllers and combines solvated resin with the reinforcement. The reinforcement is dipped in resin, passed through a drying oven which removes most of the solvent and advances (or partially cures) the resin. The prepreg material is interleafed with a carrier and cut to the roll lengths desired by the customer. The Company also manufactures prepreg using hot-melt impregnation methods which use no solvent. Hot-melt prepreg manufacturing is achieved by mixing a resin formulation in a heated resin vessel, casting a thin film on a carrier paper, and laminating the reinforcement with the resin film.

The Company also completes additional processing services, such as slitting, sheeting, biasing, sewing and cutting, if needed by the customer. Many of the products manufactured by the Company also undergo extensive testing of the chemical, physical and mechanical properties of the product. These testing requirements are completed in the laboratories and facilities located at the Company’s manufacturing facilities.

The Company’s laboratories have been approved by several aerospace OEMs, and the Company has achieved certification pursuant to the National Aerospace and Defense Contractors Accreditation Program (“NADCAP”) for both non-metallic materials manufacturing and testing and composites fabrication. Once the process has been completed, the product is tested and packaged for shipment to the customer. The Company typically supplies final product to the customer in roll form. The Company’s Kansas facility has received accreditation by NADCAP for composite structures manufacturing and for composite materials manufacturing, and the Company believes that the Kansas facility is one of the few facilities in the world with NADCAP accreditation for manufacturing both composite materials and composite structures. The Company has also received AS9100C certification for its quality management system for the manufacture of advanced composite materials and design and manufacturing of structures for aircraft and aerospace industries.

Materials and Sources of Supply

The Company designs and manufactures its aerospace composite materials to its own specifications and to the specifications of its customers. Product development efforts are focused on developing prepreg materials that meet the specifications of the customers. The materials used in the manufacture of these engineered materials include graphite and carbon fibers and fabrics, aramids, such as Kevlar® ("Kevlar" is a registered trademark of E.I. du Pont de Nemours & Co.) and Twaron® (“Twaron” is a registered trademark of Teijin Twaron B.V. LLC), quartz, fiberglass, polyester, specialty chemicals, resins, films, plastics, adhesives and certain other synthetic materials. The Company purchases these materials from several suppliers. Substitutes for many of these materials are not readily available. The qualification and certification of aerospace composite materials for certain FAA certified aircraft typically include specific requirements for raw material supply and may restrict the Company’s flexibility in qualifying alternative sources of supply for certain key raw materials. The Company continues to work to determine acceptable alternatives for several raw materials.

The Company manufactures composite structures and assemblies primarily to its customers’ specifications using its own composite materials or composite materials supplied by third parties, based on the specific requirements of the Company’s customers.

Competition

The Company has many competitors in the aerospace composite materials, structures and assemblies markets, ranging in size from large international corporations to small regional producers. Several of the Company’s largest competitors are vertically integrated, producing raw materials, such as carbon fiber and woven fabric, as well as composite structures and assemblies. Some of the Company’s competitors may also serve as a supplier to the Company. The Company competes for business primarily on the basis of responsiveness, product performance and consistency, product qualification, FAA data base design allowables and innovative new product development.

Backlog

The Company considers an item as backlog when it receives a purchase order specifying the number of units to be purchased, the purchase price, specifications and other customary terms and conditions. At April 26, 2020, the unfilled portion of all purchase orders received by the Company, and believed by it to be firm, was $18,935,709, compared to $24,171,828 at May 1, 2019. A major portion of the Company’s backlog consists of composite materials.

Various factors contribute to the size of the Company’s backlog. Accordingly, the foregoing information may not be indicative of the Company’s results of operations for any period subsequent to the fiscal year ended March 1, 2020.

Patents and Trademarks

The Company holds several patents and trademarks or licenses thereto. In the Company’s opinion, some of these patents and trademarks are important to its products. Generally, however, the Company does not believe that an inability to obtain new; or to defend existing, patents and trademarks would have a material adverse effect on the Company.

Employees

At March 1, 2020, the Company had 136 employees. Of these employees, 96 were engaged in the Company’s manufacturing operations, and 40 consisted of executive, sales and marketing, research and development personnel and general administrative staff.

Environmental Matters

The Company is subject to stringent environmental regulation of its use, storage, treatment, disposal of hazardous materials and the release of emissions into the environment. The Company believes that it currently is in substantial compliance with the applicable Federal, state and local and foreign environmental laws and regulations to which it is subject and that continuing compliance therewith will not have a material effect on its capital expenditures, earnings or competitive position. The Company does not currently anticipate making material capital expenditures for environmental control facilities for its existing manufacturing operations during the remainder of its current fiscal year or its succeeding fiscal year. However, developments, such as the enactment or adoption of even more stringent environmental laws and regulations, could conceivably result in substantial additional costs to the Company.

The Company and certain of its subsidiaries have been named by the Environmental Protection Agency (the “EPA”) or a comparable state agency under the Comprehensive Environmental Response, Compensation and Liability Act (the “Superfund Act”) or similar state law as potentially responsible parties in connection with alleged releases of hazardous substances at three sites.

Under the Superfund Act and similar state laws, all parties who may have contributed any waste to a hazardous waste disposal site or contaminated area identified by the EPA or comparable state agency may be jointly and severally liable for the cost of cleanup. Generally, these sites are locations at which numerous persons disposed of hazardous waste. In the case of the Company’s subsidiaries, generally the waste was removed from their manufacturing facilities and disposed at the waste sites by various companies which contracted with the subsidiaries to provide waste disposal services. Neither the Company nor any of its subsidiaries has been accused of or charged with any wrongdoing or illegal acts in connection with any such sites. The Company believes it maintains an effective and comprehensive environmental compliance program. Management believes the ultimate disposition of known environmental matters will not have a material adverse effect on the liquidity, capital resources, business, consolidated results of operations or financial position of the Company.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Environmental Matters” included in Item 7 of Part II of this Report and Note 12 of the Notes to Consolidated Financial Statements included in Item 8 of Part II of this Report.

Factors That May Affect Future Results

The Private Securities Litigation Reform Act of 1995 provides a "safe harbor" for forward-looking statements to encourage companies to provide prospective information about their companies without fear of litigation so long as those statements are identified as forward-looking and are accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those projected in the statement. Certain portions of this Report which do not relate to historical financial information may be deemed to constitute forward-looking statements that are subject to various factors which could cause actual results to differ materially from Park's expectations or from results which might be projected, forecasted, estimated or budgeted by the Company in forward-looking statements.

Generally, forward-looking statements can be identified by the use of words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “goal,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue” and similar expressions or the negative or other variations thereof. Such forward-looking statements are based on current expectations that involve a number of uncertainties and risks that may cause actual events or results to differ materially from the Company’s expectations.

The factors described under “Risk Factors” in Item 1A of this Report could cause the Company's actual results to differ materially from any such results which might be projected, forecasted, estimated or budgeted by the Company in forward-looking statements.

|

ITEM 1A. |

RISK FACTORS. |

The business of the Company faces numerous risks, including those set forth below or those described elsewhere in this Form 10-K Annual Report or in the Company's other filings with the Securities and Exchange Commission. The risks described below are not the only risks that the Company faces, nor are they necessarily listed in order of significance. Other risks and uncertainties may also affect the Company’s business. Any of these risks may have a material adverse effect on the Company's business, financial condition, results of operations or cash flow.

The recent coronavirus outbreak likely will have an adverse effect on our business.

The COVID-19 Pandemic is having an unprecedented impact on the U.S. economy as federal, state and local governments react to this public health crisis by mandating restrictions on social activity. These impacts include, but are not limited to, the potential adverse effect of the COVID-19 Pandemic on the economy, the Company’s vendors, employees, customers and OEMs, as well as end-users of the Company’s products, including the commercial and business aircraft industries. Continued impacts of the pandemic could materially adversely impact global economic conditions, the Company’s business, results of operations and cash flows, and may require actions in response, including but not limited to expense reductions, in an effort to mitigate such impacts. The extent of the impact of the COVID-19 Pandemic on the Company’s business and financial results will depend largely on future developments, including the duration of the spread of the outbreak, the impact on capital and financial markets and the related impact on the financial circumstances of the Company’s customers and OEMs, as well as end-users of the Company’s products, including the commercial and business aviation industries, all of which are highly uncertain and cannot be predicted. This situation is changing rapidly, and additional impacts may arise that the Company is not aware of currently. Although it is not possible to predict the extent or length of the impact, it is almost certain the Company’s sales to the commercial and business aircraft industries will be negatively impacted.

The Company's business could suffer if the Company is unable to develop new products on a timely basis.

The Company's operating results could be negatively affected if the Company were unable to maintain and increase its technological and manufacturing capability and expertise to develop new products on a timely basis. Although the Company believes that it has certain technological and other advantages over its competitors, maintaining such advantages will require the Company to continue investing in research and development and sales and marketing. There can be no assurance that the Company will be able to make the technological advances necessary to maintain such competitive advantages or that the Company can recover major research and development expenses.

The industries in which the Company operates are very competitive.

Certain of the Company's principal competitors are substantially larger and have greater financial resources than the Company, and the Company's operating results will be affected by its ability to maintain its competitive positions in these industries. The aerospace composite materials and composite structures and assemblies industries are intensely competitive, and the Company competes worldwide in the markets for such products.

The Company is vulnerable to an increase in the cost of gas or electricity.

Changes in the cost or availability of gas or electricity could materially increase the Company's cost of operations. The Company's production processes require the use of substantial amounts of gas and electricity, the cost and available supply of which are beyond the control of the Company.

The Company is vulnerable to disruptions and shortages in the supply of, and increases in the prices of, certain raw materials.

There are a limited number of qualified suppliers of the principal materials used by the Company in its manufacture of aerospace composite materials and composite structures and assemblies. The Company has qualified alternate sources of supply for many, but not all, of its raw materials, but certain raw materials are produced by only one supplier. In some cases, substitutes for certain raw materials are not always readily available, and in the past there have been shortages in the market for certain of these materials. Raw material substitutions for certain aircraft related products may require governmental (such as Federal Aviation Administration) approval. While the Company considers its relationships with its suppliers to be strong, a shortage of these materials or a disruption of the supply of these materials caused by a natural disaster or otherwise could materially increase the Company’s cost of operations and could materially adversely affect the business and results of operations of the Company. Likewise, significant increases in the cost of materials purchased by the Company could also materially increase the Company’s cost of operations and could have a material adverse effect on the Company’s business and results of operations if the Company were unable to pass such increases through to its customers. The COVID-19 Pandemic could negatively impact the Company’s suppliers. If, due to the impact, one or more of the Company’s suppliers is required to temporarily close manufacturing facilities, the Company’s ability to procure raw materials for its manufacturing processes may become limited and this could ultimately limit the Company’s ability to manufacture its products.

The Company's customer base is highly concentrated, and the loss of one or more customers could adversely affect the Company's business.

A loss of one or more key customers could adversely affect the Company's profitability. The Company's customer base is concentrated, in part, because the Company's business strategy has been to develop long-term relationships with a select group of customers. During the Company's fiscal years ended March 1, 2020, March 3, 2019 and February 25, 2018, the Company's ten largest customers accounted for approximately 76%, 74% and 72%, respectively, of net sales. The Company expects the sales to a relatively small number of customers will continue to account for a significant portion of its net sales for the foreseeable future. “Customers and End Markets” in Item 1 of Part I of this Report. The COVID-19 Pandemic could negatively impact the Company’s customers. If one or more of the Company’s customers is negatively impacted by the COVID-19 Pandemic the Company’s customer base could become more concentrated.

The Company's business is dependent on the aerospace industry, which is cyclical in nature.

The aerospace industry is cyclical and has experienced downturns. The downturns can occur at any time as a result of events that are industry specific or macroeconomic, and in the event of a downturn, the Company may have no way of knowing if, when and to what extent there might be a recovery. Deterioration in the market for aerospace products has often reduced demand for, and prices of, advanced composite materials, structures and assemblies. A potential future reduction in demand and prices could have a negative impact on the Company’s business and operating results.

In addition, the Company is subject to the effects of general regional and global economic and financial conditions. The COVID-19 Pandemic is negatively impacting the aerospace industry, and the commercial aerospace industry in particular. Commercial airlines are already instituting cost reduction initiatives including limiting capacity, reducing workforces, limiting discretionary operational expenditures and delaying capital expenditures. If commercial airlines continue to be negatively impacted by the COVID-19 Pandemic, including due to temporary or permanent reductions in commercial airline passenger traffic, orders for Company products could be negatively impacted.

The Company relies on short-term orders from its customers.

A variety of conditions, both specific to the individual customer and generally affecting the customer’s industry, can cause a customer to reduce or delay orders previously anticipated by the Company, which could negatively impact the Company’s business and operating results. While some customers place orders based on long-term pricing agreements, such agreements are typically requirements-based and do not set forth minimum purchase obligations. As a result, the Company must continually communicate with its customers to validate forecasts and anticipate the future volume of purchase orders. The COVID-19 Pandemic could negatively impact short-term orders of the Company’s products.

The Company’s customers may require the Company to undergo a lengthy and expensive qualification process with respect to its products, with no assurance of sales. Any delay or failure in such qualification process could negatively affect the Company’s business and operating results.

The Company’s customers frequently require that the Company’s products undergo an extensive qualification process, which may include testing for performance, structural integrity and reliability. This qualification process may be lengthy and does not assure any sales of the product to that customer. The Company devotes substantial resources, including design, engineering, sales, marketing and management efforts, and often substantial expense, to qualifying the Company’s products with customers in anticipation of sales. Any delay or failure in qualifying any of its products with a customer may preclude or delay sales of those products to the customer, which may impede the Company’s growth and cause its business to suffer.

In addition, the Company engages in product development efforts with OEMs. The Company will not recover the cost of this product development directly even if the Company actually produces and sells any resulting product. There can be no guarantee that such efforts will result in any sales.

Consolidation among the Company’s customers could negatively impact the Company’s business.

A number of the Company’s customers have combined in recent years and consolidation of other customers may occur. If an existing customer is not the controlling entity following a combination, the Company may not be retained as a supplier. While there is potential for increasing the Company’s position with the combined customer, the Company’s revenues may decrease if the Company is not retained as a supplier. The COVID-19 Pandemic could result in further consolidation among the Company’s customers. One or more of the Company’s customers could be acquired due to financial difficulty, distress or insolvency, fluctuations in the market price of its securities, or other factors resulting from the COVID-19 Pandemic.

The Company faces extensive capital expenditure costs.

The Company’s business is capital intensive and, in addition, the introduction of new technologies could substantially increase the Company’s capital expenditures. In order to remain competitive, the Company must continue to make significant investments in capital equipment, which could adversely affect the Company’s results of operations. The Company is in the process of expanding its Newton, Kansas manufacturing facilities. The anticipated costs of this and any other expansion cannot be determined with precision and may vary materially from those budgeted. In addition, any expansion will increase the Company's fixed costs. The Company's future profitability depends upon its ability to utilize its manufacturing capacity in an effective manner.

The Company is subject to a variety of environmental regulations.

The Company’s production processes require the use, storage, treatment and disposal of certain materials which are considered hazardous under applicable environmental laws, and the Company is subject to a variety of regulatory requirements relating to the handling of such materials and the release of emissions and effluents into the environment, non-compliance with which could have a negative impact on the Company’s business or results of operations. Other possible developments, such as the enactment or adoption of additional environmental laws, could result in substantial costs to the Company.

If the Company’s efforts to protect its proprietary information are not sufficient, the Company may be adversely affected.

The Company’s business relies upon proprietary information, trade secrets and know-how in its product formulations and its manufacturing and research and development activities. The Company takes steps to protect its proprietary rights and information, including the use of confidentiality and other agreements with employees and consultants and in commercial relationships, including with suppliers and customers. If these steps prove to be inadequate or are violated, the Company’s competitors might gain access to the Company’s trade secrets, and there may be no adequate remedy available to the Company.

The Company depends upon the experience and expertise of its senior management team and key technical employees, and the loss of any key employee may impair the Company’s ability to operate effectively.

The Company’s success depends, to a certain extent, on the continued availability of its senior management team and key technical employees. Each of the Company’s executive officers, key technical personnel and other employees could terminate his or her employment at any time. The loss of any member of the Company’s senior management team might significantly delay or prevent the achievement of the Company’s business objectives and could materially harm the Company’s business and customer relationships. In addition, because of the highly technical nature of the Company’s business, the loss of any significant number of the Company’s key technical personnel could have a material adverse effect on the Company. The Company competes for manufacturing and engineering talent in a competitive labor market. Personnel turnover and training costs could negatively impact the Company’s operations. The COVID-19 Pandemic could place the continued availability of its senior management team and key employees at risk. Certain members of the Company’s senior management team and key employees do not reside near their place of work and rely heavily on commercial airline travel, which is currently restricted.

The Company’s business and operations may be adversely affected by cybersecurity breaches or other information technology system or network intrusions.

The Company depends on information technology and computerized systems to communicate and operate effectively. The Company stores sensitive data including proprietary business information, intellectual property and confidential employee or other personal data on our servers and databases. Attempts by others to gain unauthorized access to the Company’s information technology system have become more sophisticated. These attempts, which might be related to industrial or foreign government espionage, activism or other motivations, include covertly introducing malware to the Company’s computers and networks, performing reconnaissance, impersonating authorized users, stealing, corrupting or restricting the Company’s access to data, among other activities. The Company continues to update its infrastructure, security tools, employee training and processes to protect against security incidents, including both external and internal threats and to prevent their recurrence. While Company personnel have been tasked to detect and investigate such incidents, cybersecurity attacks could still occur and may lead to potential data corruption and exposure of proprietary and confidential information. The unauthorized use of the Company’s intellectual property and/or confidential business information could harm its competitive position, reduce the value of the Company’s investment in research and development and other strategic initiatives or otherwise adversely affect the Company’s business or results of operations. Any intrusion may also cause operational stoppages, fines, penalties, litigation of governmental investigations and proceedings, diminished competitive advantages through reputational damages and increased operational costs. Additionally, the Company may incur additional costs to comply with its customers’, including the U.S. Government’s, increased cybersecurity protections and standards.

Acquisitions, mergers, business combinations or joint ventures may entail certain operational and financial risks.

The Company may acquire businesses, product lines or technologies that expand or complement those of the Company. It may also enter into mergers, business combinations or joint ventures for similar purposes. The integration and management of an acquired company or business may strain the Company's management resources and technical, financial and operating systems. In addition, implementation of acquisitions can result in large one-time charges and costs. A given acquisition, if consummated, may materially affect the Company's business, financial condition and results of operations.

The Company’s securities may fluctuate in value.

The market price of the Company’s securities can be subject to fluctuations in response to quarter-to-quarter variations in operating results, changes in analyst earnings estimates, market conditions in the aerospace composite materials and composite structures and assemblies industries, as well as general economic conditions and other factors external to the Company. The COVID-19 Pandemic has exacerbated fluctuations in the market price of most securities, including aerospace companies.

|

ITEM 1B. |

UNRESOLVED STAFF COMMENTS. |

None.

|

ITEM 2. |

PROPERTIES. |

Set forth below are the locations of the significant properties owned and leased by the Company, the businesses which use the properties and the size of each such property. Such properties, except for the Westbury, New York property, are used principally as manufacturing and warehouse facilities.

|

Location |

Owned or Leased |

Use |

Size (Square Footage) |

|||||

|

Westbury, NY |

Leased |

Administrative Offices |

2,000 | |||||

|

Newton, KS |

Leased |

Advanced Composite Materials, Parts and Assemblies |

89,000 | |||||

|

Singapore |

Leased |

Advanced Composite Materials |

21,000 | |||||

The Company believes its facilities and equipment to be in good condition and reasonably suited and adequate for its current needs. Most of the Company’s manufacturing facilities have the capacity to substantially increase their production levels.

During the 2019 fiscal year, the Company sold its dormant facility in Newburgh, New York. The Company’s Nelco Products, Inc. business unit located in California and its Neltec, Inc. business unit located in Arizona, as well as the properties leased by those business units, were transferred to AGC Inc. in connection with the Sale, except that the dormant Fullerton facility was transferred to, and is retained by, a newly organized subsidiary of the Company. Prior to the Company’s sale of its Electronics Business, aerospace composite materials were also manufactured by the Company’s Nelco Products Pte. Ltd. business unit in Singapore at a facility that was transferred to a subsidiary of the Company in connection with the Sale, and is currently idle.

ITEM 3. LEGAL PROCEEDINGS.

No material pending legal proceedings.

ITEM 4. MINE SAFETY DISCLOSURES.

None.

Executive Officers of the Registrant.

|

Name |

Title |

Age |

|||

|

Brian E. Shore |

Chief Executive Officer and Chairman of the Board of Directors |

68 | |||

|

Stephen E. Gilhuley |

Executive Vice President – Administration and Secretary |

75 | |||

|

P. Matthew Farabaugh |

Senior Vice President and Chief Financial Officer |

59 | |||

|

Benjamin W. Shore |

Senior Vice President – Sales, Marketing and Business Development |

32 | |||

|

Mark A. Esquivel |

Executive Vice President and Chief Operating Officer |

47 | |||

|

Constantine Petropoulos |

Senior Vice President and General Counsel |

42 | |||

Mr. Brian Shore has served as a Director of the Company since 1983 and as Chairman of the Board of Directors since July 2004. He was elected a Vice President of the Company in January 1993, Executive Vice President in May 1994, President in March 1996, and Chief Executive Officer in November 1996. He was President until July 28, 2014. Mr. Shore also served as General Counsel of the Company from April 1988 until April 1994.

Mr. Gilhuley was elected Executive Vice President – Administration on April 5, 2012, and he has been Secretary of the Company since July 1996. Prior to April 5, 2012, he had been Executive Vice President of the Company since October 2006 and Senior Vice President from March 2001 to October 2006. He also was General Counsel of the Company from April 1994 to October 2011, when he was succeeded by Stephen M. Banker, who was Vice President and General Counsel from October 2011 to May 2014 and who was succeeded by Mr. Petropoulos. Mr. Gilhuley resigned as Executive Vice President – Administration effective as of January 3, 2020. In connection with his retirement, Mr. Gilhuley entered into a Consulting Agreement with the Company, pursuant to which he is paid a monthly fee for advisory and consulting services that he may provide the Company from time to time.

Mr. Farabaugh was elected Senior Vice President and Chief Financial Officer on March 10, 2016. He had been Vice President and Chief Financial Officer of the Company since April 2012 and Vice President and Controller of the Company since October 2007. Prior to joining the Company, Mr. Farabaugh was Corporate Controller of American Technical Ceramics, a publicly traded international company and a manufacturer of electronic components, located in Huntington Station, New York, from 2004 to September 2007 and Assistant Controller from 2000 to 2004. Prior thereto, Mr. Farabaugh was Assistant Controller of Park Aerospace Corp. from 1989 to 2000. Prior to joining Park in 1989, Mr. Farabaugh had been a senior accountant with KPMG.

Mr. Benjamin Shore was elected Senior Vice President – Sales, Marketing and Business Development of the Company in December 2018, after having served as Senior Vice President – Business Development of the Company since October 2017. Prior to joining the Company, he was employed by athenahealth, Inc. located in Watertown, Massachusetts, through September 2017, where most recently he was Manager, Corporate Development, working on mergers and acquisitions, strategic partnerships and investments. From 2011 to 2014, he was an Investment Analyst and subsequently a Senior Investment Analyst at Prudential Capital Group in New York, New York, where he invested capital in middle market companies in many different industries; and in 2010 and 2011, he was an Associate in Economic and Valuation Services at KPMG LLP in New York, New York, working on financial and tax consulting projects. He is a CFA Charterholder.

Mr. Esquivel was promoted to Executive Vice President and Chief Operating Officer of the Company on May 7, 2019 after having been elected Senior Vice President and Chief Operating Officer in December 2018. He had been Senior Vice President – Aerospace of the Company since October 2017 and Vice President – Aerospace of the Company and President of the Company’s Park Aerospace Technologies Corp. business unit in Newton, Kansas since April 2015. Mr. Esquivel has been employed by the Company and its subsidiaries in various positions since 1994. He was Vice President of Aerospace Composite Structures of Park Aerospace Technologies Corp. from March 2012 to April 2015 and President of Park Aerospace Technologies Corp. from June 2010 to March 2012. Prior to June 2010, Mr. Esquivel was Vice President and General Manager of the Company’s former Neltec, Inc. business unit located in Tempe, Arizona, and was responsible for the day-to-day operations of Neltec, Inc. since his appointment to that position in September 2008, having held various positions since he originally joined Neltec, Inc. in 1994.”

Mr. Petropoulos was promoted to Senior Vice President and General Counsel of the Company on May 7, 2019. He had been Vice President and General Counsel since September 2014. Prior to joining the Company, Mr. Petropoulos had been Managing Attorney at Scientific Games Corporation in New York City since November 2011. From September 2007 to October 2011, he was Senior Corporate Counsel, Finance & Strategic Development at Coca-Cola HBC SA in Attica, Greece; and from October 2002 to September 2007 he was an attorney at Latham & Watkins LLP in New York City.

There are no family relationships between the directors or executive officers of the Company, except that Benjamin Shore is the nephew of Brian Shore.

Each executive officer of the Company serves at the pleasure of the Board of Directors of the Company.

PART II

|

ITEM 5. |

MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

The Company’s Common Stock is listed and trades on the New York Stock Exchange (trading symbol PKE). (The Common Stock also trades on the Chicago Stock Exchange.) The following table sets forth, for each of the quarterly periods indicated, the high and low sales prices for the Common Stock as reported on the New York Stock Exchange Composite Tape and dividends declared on the Common Stock.

|

For the Fiscal Year Ended |

Stock Price |

Dividends |

||||||||||

|

March 1, 2020 |

High |

Low |

Declared |

|||||||||

|

First Quarter |

$ | 17.48 | $ | 14.94 | $ | 0.10 | ||||||

|

Second Quarter |

19.16 | 15.09 | 0.10 | |||||||||

|

Third Quarter |

18.90 | 15.78 | 0.10 | |||||||||

|

Fourth Quarter |

17.45 | 13.91 | 1.10 |

(a) |

||||||||

|

For the Fiscal Year Ended |

Stock Price |

Dividends |

||||||||||

|

March 3, 2019 |

High |

Low |

Declared |

|||||||||

|

First Quarter |

$ | 20.64 | $ | 16.45 | $ | 0.10 | ||||||

|

Second Quarter |

24.16 | 19.84 | 0.10 | |||||||||

|

Third Quarter |

21.63 | 17.30 | 0.10 | |||||||||

|

Fourth Quarter |

23.30 | 16.90 | 4.35 |

(b) |

||||||||

|

(a) |

During the 2020 fiscal year fourth quarter, the Company declared its regular cash dividend of $0.10 per share in December 2019, payable February 4, 2020 to shareholders of record on January 2, 2020, and declared a special cash dividend of $1.00 per share in January 2020, payable February 20, 2020 to shareholders of record on January 21, 2020. |

|||||||

|

(b) |

During the 2019 fiscal year fourth quarter, the Company declared its regular cash dividend of $0.10 per share in December 2018, payable February 5, 2019 to shareholders of record on January 2, 2019, and declared a special cash dividend of $4.25 per share in January 2019, payable February 26, 2019 to shareholders of record on February 5, 2019. |

|||||||

As of April 24, 2020, there were 496 holders of record of Common Stock.

The Company expects, for the foreseeable future, to continue to pay regular cash dividends.

The following table provides information with respect to shares of the Company’s Common Stock acquired by the Company during each month included in the Company’s 2020 fiscal year fourth quarter ended March 1, 2020.

|

Period |

Total Number of Shares (or Units) Purchased |

Average Price Paid Per Share (or Unit) |

Total Number of Shares (or Units) Purchased As Part of Publicly Announced Plans or Programs |

Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs |

|||||||||

|

December 2 - January 1 |

0 | $ | - | 0 | |||||||||

|

January 2 - February 1 |

0 | $ | - | 0 | |||||||||

|

February 2 - March 1 |

0 | $ | - | 0 | |||||||||

|

Total |

0 | $ | - | 0 |

1,531,412 (a) |

||||||||

|

(a) |

Aggregate number of shares available to be purchased by the Company pursuant to share purchase authorizations announced on January 8, 2015 and March 10, 2016. Pursuant to such authorizations, the Company is authorized to purchase its shares from time to time on the open market or in privately negotiated transactions. |

||||||||||||

As a result of the authorizations announced on January 8, 2015 and March 10, 2016, the Company is authorized to purchase up to a total of 1,531,412 shares of its common stock, representing approximately 7.5% of the Company’s 20,518,823 total outstanding shares as of the close of business on March 1, 2020.

As previously announced by the Company, shares purchased by the Company will be retained as treasury stock and will be available for use under the Company’s stock option plan and for other corporate purposes.

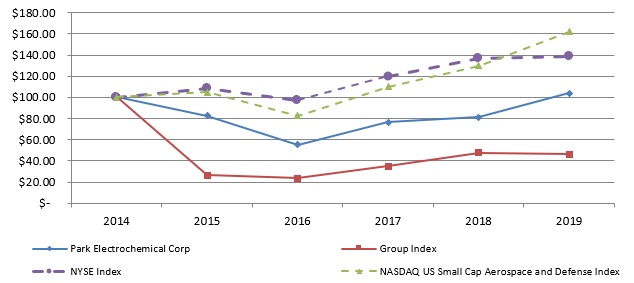

Stock Performance Graph

The graph set forth below compares the annual cumulative total return for the Company’s five fiscal years ended March 1, 2020 among the Company, the New York Stock Exchange Market Index (the “NYSE Index”), the Nasdaq US Small Cap Aerospace and Defense Index (the “Nasdaq Index”) and a Zachs Investment Research, Inc. (formerly Morningstar Inc., formerly Hemscott, Inc.) index for electronic components and accessories manufacturers (the “Group Index”) comprised of the Company and 202 other companies. The companies in the Group Index are classified in the same three-digit industry group in the Standard Industrial Classification Code system and are described as companies primarily engaged in the manufacture of electronic components and accessories. The returns of each company in the Group Index and the Nasdaq Index have been weighted according to the company’s stock market capitalization. The Company is transitioning from the Group Index to the Nasdaq Index, because the Company sold its Electronics Business in December 2018 and is now engaged only in the aerospace business. The graph has been prepared based on an assumed investment of $100 on February 28, 2015 and the reinvestment of dividends (where applicable).

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

|||||||||||||||||||

|

Park Aerospace Corp. |

$ | 100.00 | $ | 66.59 | $ | 92.64 | $ | 98.05 | $ | 125.39 | $ | 108.87 | ||||||||||||

|

NYSE Index |

$ | 100.00 | $ | 89.34 | $ | 110.10 | $ | 126.07 | $ | 127.79 | $ | 127.77 | ||||||||||||

|

NASDAQ US Small Cap Aerospace and Defense Index |

$ | 100.00 | $ | 78.86 | $ | 105.06 | $ | 123.97 | $ | 154.82 | $ | 151.47 | ||||||||||||

|

ITEM 6. |

SELECTED FINANCIAL DATA. |

The following selected consolidated financial data of Park and its subsidiaries is qualified by reference to, and should be read in conjunction with, the Consolidated Financial Statements, related Notes, and Management’s Discussion and Analysis of Financial Condition and Results of Operations contained elsewhere herein. Insofar as such consolidated financial information relates to the three fiscal years ended March 1, 2020 and is as of the end of the fiscal years ended March 1, 2020 and March 3, 2019, it is derived from the Consolidated Financial Statements for each of the three fiscal years in the period ended March 1, 2020 and as of the fiscal years ended March 1, 2020 and March 3, 2019 audited by the Company’s independent registered public accounting firm. The Consolidated Financial Statements as of March 1, 2020 and March 3, 2019 and for the three fiscal years ended March 1, 2020, March 3, 2019 and February 25, 2018, together with the report of the independent registered public accounting firm for the fiscal years ended March 1, 2020, March 3, 2019 and February 25, 2018, appear in Item 8 of Part II of this Report.

On December 4, 2018, the Company completed the previously announced sale of its Electronics Business, including manufacturing facilities in Singapore, France, California and Arizona and R&D facilities in Singapore and Arizona, to AGC Inc. for an aggregate purchase price of $145 million in cash, subject to post-closing adjustments for changes in working capital compared to target net working capital, excluding cash in certain acquired subsidiaries and certain accrued and unpaid taxes of certain acquired subsidiaries. See Note 13, “Discontinued Operations”, of the Notes to Consolidated Financial Statements elsewhere in this Report for additional information on the Sale. All periods presented in the following selected consolidated financial data have been adjusted to reflect the Electronics Business results as discontinued operations. Fiscal year ended February 28, 2016 and information as of February 26, 2017 and February 28, 2016 are based on previously audited financial statements, but such reclassifications for discontinued operations have not been audited for such periods.

|

Fiscal Year Ended |

||||||||||||||||||||

|

(Amounts in thousands, except per share amounts) |

||||||||||||||||||||

|

March 1, |

March 3, |

February 25, |

February 26, |

February 28, |

||||||||||||||||

|

2020 |

2019 |

2018 |

2017 |

2016 |

||||||||||||||||

|

CONSOLIDATED STATEMENT OF EARNINGS INFORMATION |

||||||||||||||||||||

|

Net sales |

$ | 60,014 | $ | 51,116 | $ | 40,230 | $ | 31,837 | $ | 38,763 | ||||||||||

|

Cost of sales |

41,341 | 34,932 | 28,942 | 23,538 | 29,900 | |||||||||||||||

|

Gross profit |

18,673 | 16,184 | 11,288 | 8,299 | 8,863 | |||||||||||||||

|

Selling, general and administative expenses |

7,932 | 8,968 | 9,862 | 10,309 | 10,944 | |||||||||||||||

|

Restructuring charges |

- | - | 146 | - | - | |||||||||||||||

|

Earnings (loss) from continuing operations |

10,741 | 7,216 | 1,280 | (2,010 | ) | (2,081 | ) | |||||||||||||

|

Interest expense |

- | - | 2,269 | 1,432 | 1,657 | |||||||||||||||

|

Interest and other income |

3,330 | 2,379 | 2,641 | 1,637 | 1,078 | |||||||||||||||

|

Loss on sale of marketable securities |

- | (1,498 | ) | (1,342 | ) | - | - | |||||||||||||

|

Earnings (loss) from continuing operations before income taxes |

14,071 | 8,097 | 310 | (1,805 | ) | (2,660 | ) | |||||||||||||

|

Income tax provision (benefit) |

3,866 | 1,791 | (18,162 | ) | (711 | ) | (1,679 | ) | ||||||||||||

|

Net earnings (loss) from continuing operations |

10,205 | 6,306 | 18,472 | (1,094 | ) | (981 | ) | |||||||||||||

| (Loss) earnings from discontinued operations, net of tax | (653 | ) | 107,239 | 2,123 | 10,377 | 19,010 | ||||||||||||||

|

Net earnings |

$ | 9,552 | $ | 113,545 | $ | 20,595 | $ | 9,283 | $ | 18,029 | ||||||||||

|

Earnings (loss) per share: |

||||||||||||||||||||

|

Basic earnings per share: |

||||||||||||||||||||

|

Basic earnings (loss) per share from continuing operations |

$ | 0.50 | $ | 0.31 | $ | 0.91 | $ | (0.05 | ) | $ | (0.05 | ) | ||||||||

| Basic (loss) earnings per share from discontinued operations | (0.03 | ) | 5.29 | 0.11 | 0.51 | 0.94 | ||||||||||||||

|

Basic earnings per share |

$ | 0.47 | $ | 5.60 | $ | 1.02 | $ | 0.46 | $ | 0.89 | ||||||||||

|

Diluted earnings per share: |

||||||||||||||||||||

|

Diluted earnings (loss) per share from continuing operations |

$ | 0.50 | $ | 0.31 | $ | 0.91 | $ | (0.05 | ) | $ | (0.05 | ) | ||||||||

| Diluted (loss) earnings per share from discontinued operations | (0.03 | ) | 5.26 | 0.11 | 0.51 | 0.94 | ||||||||||||||

|

Diluted earnings per share |

$ | 0.47 | $ | 5.57 | $ | 1.02 | $ | 0.46 | $ | 0.89 | ||||||||||

|

Cash dividends per common share |

$ | 1.40 | $ | 4.65 | $ | 3.40 | $ | 0.40 | $ | 0.40 | ||||||||||

|

Weighted average number of common shares outstanding: |

||||||||||||||||||||

|

Basic |

20,507 | 20,288 | 20,237 | 20,235 | 20,347 | |||||||||||||||

|

Diluted |

20,595 | 20,385 | 20,267 | 20,239 | 20,352 | |||||||||||||||

|

BALANCE SHEET INFORMATION |

||||||||||||||||||||

|

Working capital |

$ | 136,487 | $ | 156,778 | $ | 129,041 | $ | 255,007 | $ | 255,507 | ||||||||||

|

Total assets |

171,786 | 188,851 | 170,146 | 315,616 | 321,376 | |||||||||||||||

|

Long-term debt |

- | - | - | 68,500 | 72,000 | |||||||||||||||

|

Shareholders' equity |

141,675 | 159,011 | 135,261 | 182,826 | 180,867 | |||||||||||||||

|

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

General:

Park Aerospace Corp. (“Park” or the “Company”) formerly known as Park Electrochemical Corp. is an aerospace company which develops and manufactures solution and hot-melt advanced composite materials used to produce composite structures for the global aerospace markets. Park’s advanced composite materials include film adhesives (undergoing qualification) and lightning strike materials. Park offers an array of composite materials specifically designed for hand lay-up or automated fiber placement (AFP) manufacturing applications. Park’s advanced composite materials are used to produce primary and secondary structures for jet engines, large and regional transport aircraft, military aircraft, Unmanned Aerial Vehicles (UAVs commonly referred to as “drones”), business jets, general aviation aircraft and rotary wing aircraft. Park also offers specialty ablative materials for rocket motors and nozzles and specially designed materials for radome applications. As a complement to Park’s advanced composite materials offering, Park designs and fabricates composite parts, structures and assemblies and low volume tooling for the aerospace industry. Target markets for Park’s composite parts and structures (which include Park’s proprietary composite Sigma Strut and Alpha Strut product lines) are, among others, prototype and development aircraft, special mission aircraft, spares for legacy military and civilian aircraft and exotic spacecraft.

The Company’s fiscal year is the 52- or 53-week period ending the Sunday nearest to the last day of February. The 2020, 2019 and 2018 fiscal years ended on March 1, 2020, March 3, 2019 and February 25, 2018, respectively. The 2019 fiscal year consisted of 53 weeks. The 2020 and 2018 fiscal years each consisted of 52 weeks. Unless otherwise indicated in this Discussion and Analysis, all references to years and quarters in this Discussion and Analysis are to the Company’s fiscal years and fiscal quarters and all annual and quarterly information in this Discussion and Analysis is for such fiscal years and quarters, respectively.

2020 Financial Overview

On December 4, 2018, Park completed the previously announced sale of its Electronics Business, including manufacturing facilities in Singapore, France, California and Arizona and R&D facilities in Singapore and Arizona, to AGC Inc. for an aggregate purchase price of $145 million in cash, subject to post-closing adjustments for changes in working capital compared to target net working capital, excluding cash in certain acquired subsidiaries and certain accrued and unpaid taxes of certain acquired subsidiaries. See Note 13, “Discontinued Operations”, of the Notes to Consolidated Financial Statements elsewhere in this Report for additional information on the Sale. As a result, the discussion below is of the Company’s continuing operations, which is comprised of the aerospace business.

The Company paid a special cash dividend of $1.00 per share on February 20, 2020 to shareholders of record at the close of business on February 3, 2020. The special cash dividend was funded from the Company’s cash balances. This special dividend, together with the Company’s regular quarterly dividend of $0.10 per share paid February 2, 2020 to shareholders of record on January 3, 2020, brings the total amount of dividends paid to shareholders to $26.15 per share, a total of approximately $536 million, since the Company’s 2005 fiscal year.

In 2019, the Company announced the major expansion of its aerospace manufacturing, development and design facilities located at the Newton City-County Airport in Newton, Kansas. This expansion includes the construction of a redundant manufacturing facility located adjacent to Park’s existing Newton, Kansas facilities. This facility, which is being constructed in part to support a major aerospace customer, will include approximately 90,000 square feet of manufacturing and office space, and will essentially double the size of Park’s existing Newton, Kansas manufacturing footprint. The total cost of the expansion is expected to be approximately $21 million, and the expansion is expected to be completed in the second half of the 2020 calendar year. The expansion includes new resin mixing and delivery systems, new hot-melt film and tape manufacturing lines, space to accommodate an additional hot-melt tape line or solution treating line, space to accommodate a confidential joint development project with a major aerospace customer, additional slitting capability, significant additional freezer and storage space, an expanded production lab, a new R&D lab and additional office space. Through March 1, 2020, the Company had incurred $7.6 million on the expansion.

During 2020, the Company recorded a non-cash charge of $0.2 million in connection with the modification of previously granted employee stock options resulting from the $1.00 per share special cash dividend paid by the Company in February 2020. Selling, general and administrative expenses in 2020 included $0.7 million of stock option expense.

The Company's total net sales worldwide in 2020 were 17% higher than in 2019 due primarily to the “end customer” of a major Company customer ramping up commercial jet production and the Company’s customer restocking depleted inventory, particularly in the fourth quarter, and to an increase in military sales during 2020.

The Company’s gross profit margin, measured as a percentage of sales, decreased to 31.1% in 2020 from 31.7% in 2019. Higher sales and production levels combined with the fixed nature of certain overhead costs were more than offset by increased direct labor and supplies expenses.

The Company’s earnings from continuing operations in 2020 were 49% higher than in 2019, primarily as a result of the aforementioned increases in sales and gross profit and a 12% reduction in selling, general and administrative expenses, which included the additional stock option modification charge of $0.2 million. The Company’s net earnings from continuing operations in 2020 were 62% higher than in 2019, primarily due to higher sales and lower selling, general and administrative expenses and to a loss on sales of marketable securities of $1.5 million incurred in 2019 to raise funds for the special cash dividend of $4.25 per share paid in February 2019.

The Company has a number of long-term contracts pursuant to which certain of its customers, some of which represent a substantial portion of the Company’s revenue, place orders. Long-term contracts with the Company’s customers are primarily requirements based and do not guarantee quantities. An order forecast is generally agreed concurrently with pricing for any applicable long-term contract. This order forecast is then typically updated periodically during the term of the underlying contract. Purchase orders generally are received in excess of three months in advance of delivery.