UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-04215 | |||||

| BNY Mellon U.S. Mortgage Fund, Inc. | ||||||

| (Exact name of Registrant as specified in charter) | ||||||

|

c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 |

||||||

| (Address of principal executive offices) (Zip code) | ||||||

|

Deirdre Cunnane, Esq. 240 Greenwich Street New York, New York 10286 |

||||||

| (Name and address of agent for service) | ||||||

| Registrant's telephone number, including area code: | (212) 922-6400 | |||||

|

Date of fiscal year end:

|

04/30 | |||||

| Date of reporting period: |

04/30/24

|

|||||

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon U.S. Mortgage Fund, Inc.

ANNUAL REPORT April 30, 2024 |

|

IMPORTANT NOTICE – UPCOMING CHANGES TO ANNUAL AND SEMI-ANNUAL REPORTS The Securities and Exchange Commission (the “SEC”) has adopted rule and form amendments that will result in changes to the design and delivery of annual and semi-annual fund reports (“Reports”). Beginning in July 2024, Reports will be streamlined to highlight key information. Certain information currently included in Reports, including financial statements, will no longer appear in the Reports but will be available online, delivered free of charge to shareholders upon request, and filed with the SEC. If you previously elected to receive the fund’s Reports electronically, you will continue to do so. Otherwise, you will receive paper copies of the fund’s re-designed Reports by USPS mail in the future. If you would like to receive the fund’s Reports (and/or other communications) electronically instead of by mail, please contact your financial advisor or, if you are a direct investor, please log into your mutual fund account at www.bnymellonim.com/us and select “E-Delivery” under the Profile page. You must be registered for online account access before you can enroll in E-Delivery. |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes a few minutes. |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

F O R M O R E I N F O R M AT I O N

Back Cover

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from May 1, 2023, through April 30, 2024, as provided by Eric Seasholtz, Portfolio Manager employed by the fund’s sub-adviser, Amherst Capital Management LLC.

Market and Fund Performance Overview

For the 12-month period ended April 30, 2024, BNY Mellon U.S. Mortgage Fund (the “fund”) produced a total return of -1.60% for Class A shares, -2.30% for Class C shares, -1.35% for Class I shares, -1.35% for Class Y shares and -1.44% for Class Z shares.1 In comparison, the fund’s benchmark, the Bloomberg GNMA Index (the “Index”), produced a total return of −1.65% for the same period.2

Mortgage-backed securities (“MBS”) lost ground over the reporting period amid rising interest rates and the U.S. Federal Reserve’s (the “Fed”) shift from purchasing mortgages to balance sheet reduction. The fund outperformed the Index, primarily due to out-of-Index allocations in structured products.

The Fund’s Investment Approach

The fund seeks to maximize total return, consisting of capital appreciation and current income. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in U.S. mortgage-related securities. These mortgage-related securities may include certificates issued and guaranteed as to timely payment of principal and interest by the Government National Mortgage Association (“GNMA” or “Ginnie Mae”); securities issued by government-related organizations such as Fannie Mae and Freddie Mac; residential and commercial mortgage-backed securities issued by governmental agencies or private entities; and collateralized mortgage obligations (“CMOs”). The fund will invest at least 65% of its net assets in Ginnie Maes. The fund can invest in privately issued, mortgage-backed securities with a BBB or higher credit quality but currently intends to invest only in those securities with an A or higher credit quality.

Easing Inflation and a Tight Housing Market Bolster Mortgages

During the first half of the reporting period, MBS came under pressure from increasing volatility, excess mortgage supply from bank liquidations, inflationary pressures and rising interest rates. Before the period began, the Fed increased the federal funds rate from near zero in early 2022 to a range of 4.75%–5.00%. Rates increased another 0.50% during the period, driving Treasury yields significantly higher. During the period, the 10-year Treasury yield backed up from 3.59% to 4.99% in mid-October 2023, before easing to 3.80% in January 2024, and increasing again to 4.69% as of April 30, 2024. The two-year Treasury yield followed a similar pattern but at slightly higher levels, as the yield curve remained inverted throughout the period. While the Fed appeared to near the end of the current rate hike cycle, hawkish comments reinforced the central bank’s determination to keep rates elevated as long as needed to bring inflation down to its 2% target. Accordingly, investors began to accept the likelihood that rates would remain elevated for longer than previously thought. Volatility rose as well in response to a variety of macroeconomic and geopolitical uncertainties.

2

Early in the second half of the period, the Fed pivoted to a more dovish stance, noting that moderating inflation made interest-rate cuts a possibility in 2024. Markets, including the MBS market, responded positively to the shift in tone. Although inflation remained stubbornly high as the period wore on, and expectations for rate cuts were pushed farther into the future, the fact that interest rates plateaued created a more stable foundation for the MBS market. The market also benefited from tight housing market conditions, and the strong underlying credit quality of existing MBS. Reduced MBS issuance in the prevailing high-but-stable interest-rate environment further contributed to the tightening of spreads and the performance of the market, which recovered much of the ground it had lost in the first half.

Out-of-Index Positions Enhance Relative Performance

The unprecedented changes that occurred in mortgage markets over the reporting period made it more challenging to position the fund. However, we took some effective steps to protect the fund in the face of these headwinds. We allocated some of the fund’s assets to collateralized mortgage obligations (“CMOs”) and commercial mortgage-backed securities (“CMBS”), which offered slightly better extension protection than MBS. As yields backed up, these out-of-Index positions remained stable, while maintaining attractive carry potential. Although these positions underperformed during the fourth quarter of 2023, they more than recovered in 2024, contributing positively to the fund’s outperformance for the reporting period. We also bolstered performance at the margin by adopting underweight exposure to some underperforming discount coupons, particularly bonds issued by Fannie Mae with a coupon rate of 2% and 2.5%. In addition, the fund held short exposure to the mortgage basis—a positive as spreads widened. Conversely, the fund’s performance relative to the Index suffered slightly due to a position in bonds issued by Fannie Mae with a coupon rate of 3%, backed by FICO borrowers, typically with lower credit scores.

The fund held a small position in mortgage interest-rate derivatives during the period, which mildly enhanced returns. As this position approached full value, we began to pare it back during the second half of the period—a trend we expect to continue.

Emphasizing Well-Structured Assets

As of the end of the period, inflation, interest rates and the Fed’s role continue to drive mortgage markets. Late in the period, we saw some indications that the economy may be starting to slow, offering hope that inflation could ease further in the coming months. However, employment numbers remain strong, and given the persistence of inflation in the 3%−4% range despite interest rates at their highest levels in decades, we expect the Fed to delay cutting rates until late 2024, if not later. Nevertheless, despite high mortgage rates, the housing market remains strong, with economic growth creating wealth that leads more people to shop for housing at a time when fewer houses are coming to market.

In light of this backdrop, we have emphasized well-structured, out-of-Index assets with higher carrying characteristics that can earn additional spread as the curve steepens. Specifically, the fund continues to hold out-of-Index exposure to agency CMOs and

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

non-agency CMBS, which represent a substantial percentage of the portfolio. However, while such positions have performed well for the fund, they entail a slight additional credit profile; accordingly, we may reevaluate the size of the fund’s positions in these out-of-Index assets going forward.

May 15, 2024

1 Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Class I, Class Y and Class Z are not subject to any initial or deferred sales charge. Share price, yield and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. The fund’s return reflects the absorption of certain fund expenses by BNY Mellon Investment Adviser, Inc. pursuant to an agreement in effect through September 1, 2024, at which time it may be extended, modified or terminated. Had these expenses not been absorbed, returns would have been lower. Past performance is no guarantee of future results.

2 Source: Lipper Inc. — The Bloomberg GNMA Index tracks agency mortgage-backed, pass-through securities guaranteed by Ginnie Mae (GNMA). The Index is constructed by grouping individual To-Be-Announced (“TBA”)-deliverable MBS pools into aggregates or generics based on program, coupon and vintage. Investors cannot invest directly in any index.

Bonds are subject generally to interest-rate, credit, liquidity and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines.

Ginnie Maes and other securities backed by the full faith and credit of the United States are guaranteed only as to the timely payment of interest and principal when held to maturity. The market prices for such securities are not guaranteed and will fluctuate. Privately issued mortgage-related securities also are subject to credit risks associated with the underlying mortgage properties. These securities may be more volatile and less liquid than more traditional, government backed debt securities.

4

FUND PERFORMANCE (Unaudited)

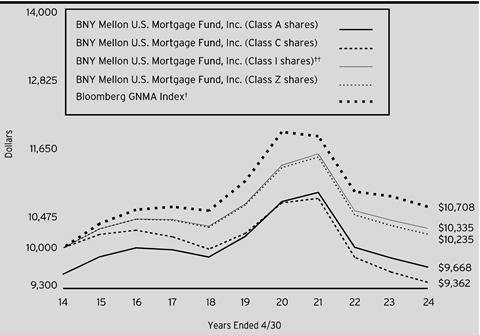

Comparison of change in value of a $10,000 investment in Class A shares, Class C shares, Class I shares and Class Z shares of BNY Mellon U.S. Mortgage Fund, Inc. with a hypothetical investment of $10,000 in the Bloomberg GNMA Index (the “Index”).

† Source: Lipper Inc.

†† The total return figures presented for Class I shares of the fund reflect the performance of the fund’s Class Z shares for the period prior to 8/31/16 (the inception date for Class I shares).

Past performance is not predictive of future performance.

The above line graph compares a hypothetical $10,000 investment made in each of the Class A shares, Class C shares, Class I shares and Class Z shares of BNY Mellon U.S. Mortgage Fund, Inc. on 4/30/14 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses of the applicable classes. The Index tracks agency mortgage-backed pass-through securities guaranteed by Ginnie Mae (GNMA). The Index is constructed by grouping individual TBA-deliverable MBS pools into aggregates or generics based on program, coupon and vintage. These factors can contribute to the Index potentially outperforming or underperforming the fund. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

5

FUND PERFORMANCE (Unaudited) (continued)

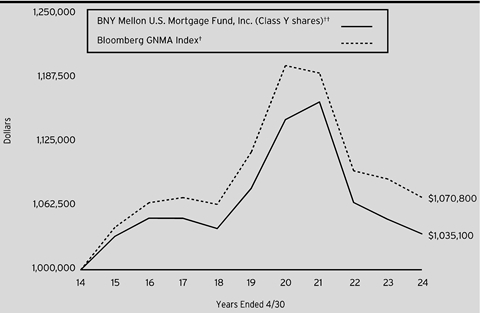

Comparison of change in value of a $1,000,000 investment in Class Y shares of BNY Mellon U.S. Mortgage Fund, Inc. with a hypothetical investment of $1,000,000 in the Bloomberg GNMA Index (the “Index”).

† Source: Lipper Inc.

†† The total return figures presented for Class Y shares of the fund reflect the performance of the fund’s Class Z shares for the period prior to 9/1/15 (the inception date for Class Y shares).

Past performance is not predictive of future performance.

The above line graph compares a hypothetical $1,000,000 investment made in Class Y shares of BNY Mellon U.S. Mortgage Fund, Inc. on 4/30/14 to a hypothetical investment of $1,000,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses of the fund’s Class Y shares. The Index tracks agency mortgage-backed pass-through securities guaranteed by Ginnie Mae (GNMA). The Index is constructed by grouping individual TBA-deliverable MBS pools into aggregates or generics based on program, coupon and vintage. These factors can contribute to the Index potentially outperforming or underperforming the fund. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

Average Annual Total Returns as of 4/30/2024 | |||||||

| Inception Date | 1 Year | 5 Years | 10 Years | |||

Class A shares | |||||||

with maximum sales charge (4.50%) | 5/3/07 | -6.00% | -1.96% | -.34% | |||

without sales charge | 5/3/07 | -1.60% | -1.06% | .13% | |||

Class C shares | |||||||

with applicable redemption charge † | 5/3/07 | -3.25% | -1.79% | -.66% | |||

without redemption | 5/3/07 | -2.30% | -1.79% | -.66% | |||

Class I shares | 8/31/16 | -1.35% | -.80% | .33% | †† | ||

Class Y shares | 9/1/15 | -1.35% | -.84% | .35% | †† | ||

Class Z shares | 5/29/85 | -1.44% | -.95% | .23% | |||

Bloomberg GNMA Index | -1.65% | -.81% | .69% | ||||

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

†† The total return figures presented for Class I shares of the fund reflect the performance of the fund’s Class Z shares for the period prior to 8/31/16 (the inception date for Class I shares).

The total return figures presented for Class Y shares of the fund reflect the performance of the fund’s Class Z shares for the period prior to 9/1/15 (the inception date for Class Y shares).

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to www.im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graphs and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon U.S. Mortgage Fund, Inc. from November 1, 2023 to April 30, 2024. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment |

| ||||||

Assume actual returns for the six months ended April 30, 2024 |

| ||||||

|

|

|

|

|

|

|

|

|

| Class A | Class C | Class I | Class Y | Class Z |

|

Expenses paid per $1,000† | $3.82 | $7.78 | $2.60 | $2.65 | $3.26 |

| |

Ending value (after expenses) | $1,049.20 | $1,045.50 | $1,050.50 | $1,049.70 | $1,049.50 |

| |

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment |

| ||||||

Assuming a hypothetical 5% annualized return for the six months ended April 30, 2024 |

| ||||||

|

|

|

|

|

|

|

|

|

| Class A | Class C | Class I | Class Y | Class Z |

|

Expenses paid per $1,000† | $3.77 | $7.67 | $2.56 | $2.61 | $3.22 |

| |

Ending value (after expenses) | $1,021.13 | $1,017.26 | $1,022.33 | $1,022.28 | $1,021.68 |

| |

† | Expenses are equal to the fund’s annualized expense ratio of .75% for Class A, 1.53% for Class C, .51% for Class I, .52% for Class Y and .64% for Class Z, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). | ||||||

8

STATEMENT OF INVESTMENTS

April 30, 2024

Description | Coupon

| Maturity Date | Principal Amount ($) | Value ($) | |||||

Bonds and Notes - 118.4% | |||||||||

Commercial Mortgage Pass-Through Certificates - 9.8% | |||||||||

Alen Mortgage Trust, Ser. 2021-ACEN, Cl. A, (1 Month TSFR +1.26%) | 6.59 | 4/15/2034 | 6,000,000 | a,b | 5,460,307 | ||||

GS Mortgage Securities Corp. Trust, Ser. 2017-375H, CI. A | 3.59 | 9/10/2037 | 1,500,000 | b | 1,356,244 | ||||

KNDR Trust, Ser. 2021-KIND, Cl. A, (1 Month TSFR +1.06%) | 6.39 | 8/15/2038 | 7,338,727 | a,b | 7,214,389 | ||||

Morgan Stanley Capital I Trust, Ser. 2015-420, CI. A | 3.73 | 10/12/2050 | 3,195,770 | b | 3,063,455 | ||||

17,094,395 | |||||||||

U.S. Government Agencies Collateralized Mortgage Obligations - 27.9% | |||||||||

Federal Home Loan Mortgage Corp., REMIC, Ser. 3785, CI. LS, (1 Month SOFR +9.67%) | 6.37 | 1/15/2041 | 764,267 | a,c | 616,601 | ||||

Federal Home Loan Mortgage Corp., REMIC, Ser. 4423, CI. Z | 3.50 | 12/15/2044 | 975,114 | c | 867,151 | ||||

Federal National Mortgage Association, REMIC, Ser. 2015-9, Cl. ZA | 3.50 | 3/25/2045 | 6,980,463 | c | 5,964,192 | ||||

Federal National Mortgage Association, REMIC, Ser. 2018-9, Cl. EZ | 3.00 | 2/25/2048 | 1,447,138 | c | 1,121,729 | ||||

Government National Mortgage Association, Ser. 2010-101, Cl. SH (Interest Only) | 1.22 | 8/16/2040 | 2,427,570 | 232,951 | |||||

Government National Mortgage Association, Ser. 2010-89, Cl. Z | 5.00 | 7/20/2040 | 3,862,500 | 3,764,892 | |||||

Government National Mortgage Association, Ser. 2013-188, Cl. CG | 4.00 | 12/20/2043 | 228,534 | 207,721 | |||||

Government National Mortgage Association, Ser. 2014-145, Cl. KA | 3.50 | 1/20/2038 | 2,137,563 | 2,011,375 | |||||

Government National Mortgage Association, Ser. 2015-176, CI. QZ | 3.50 | 11/20/2045 | 815,940 | 724,114 | |||||

Government National Mortgage Association, Ser. 2015-185, Cl. PZ | 3.00 | 12/20/2045 | 196,846 | 168,590 | |||||

Government National Mortgage Association, Ser. 2017-176, Cl. BZ | 3.50 | 11/20/2047 | 4,782,156 | 4,188,269 | |||||

Government National Mortgage Association, Ser. 2017-93, Cl. GY | 3.50 | 6/20/2047 | 5,880,543 | 5,202,370 | |||||

Government National Mortgage Association, Ser. 2018-115, Cl. SJ (Interest Only) | 0.77 | 8/20/2048 | 1,684,584 | 128,325 | |||||

Government National Mortgage Association, Ser. 2018-120, Cl. PU | 3.50 | 9/20/2048 | 496,942 | 427,501 | |||||

9

STATEMENT OF INVESTMENTS (continued)

Description | Coupon

| Maturity Date | Principal Amount ($) | Value ($) | |||||

Bonds and Notes - 118.4% (continued) | |||||||||

U.S. Government Agencies Collateralized Mortgage Obligations - 27.9% (continued) | |||||||||

Government National Mortgage Association, Ser. 2018-131, Cl. ML | 3.50 | 9/20/2048 | 4,850,385 | 4,283,010 | |||||

Government National Mortgage Association, Ser. 2018-138, Cl. SK (Interest Only) | 0.77 | 10/20/2048 | 686,944 | 44,426 | |||||

Government National Mortgage Association, Ser. 2018-146, CI. BL | 4.00 | 10/20/2048 | 324,045 | 293,598 | |||||

Government National Mortgage Association, Ser. 2018-160, Cl. PD | 3.50 | 1/20/2048 | 4,789,611 | 4,217,710 | |||||

Government National Mortgage Association, Ser. 2018-164, Cl. SW (Interest Only) | 0.67 | 12/20/2048 | 4,824,855 | 376,059 | |||||

Government National Mortgage Association, Ser. 2018-46, Cl. CZ | 3.20 | 3/20/2048 | 1,796,960 | 1,490,905 | |||||

Government National Mortgage Association, Ser. 2018-65, Cl. SL (Interest Only) | 0.82 | 5/20/2048 | 1,232,996 | 100,334 | |||||

Government National Mortgage Association, Ser. 2019-112, Cl. JZ | 3.00 | 9/20/2049 | 737,199 | 633,389 | |||||

Government National Mortgage Association, Ser. 2019-119, Cl. IT (Interest Only) | 5.50 | 9/20/2049 | 2,287,766 | 533,854 | |||||

Government National Mortgage Association, Ser. 2019-132, Cl. SB (Interest Only) | 1.00 | 10/20/2049 | 1,193,371 | 69,431 | |||||

Government National Mortgage Association, Ser. 2019-140, Cl. DI (Interest Only) | 5.50 | 11/20/2049 | 964,175 | 213,514 | |||||

Government National Mortgage Association, Ser. 2019-23, Cl. SB (Interest Only) | 0.62 | 2/20/2049 | 1,168,619 | 93,092 | |||||

Government National Mortgage Association, Ser. 2019-3, CI. JZ | 4.00 | 1/20/2049 | 428,488 | 387,976 | |||||

Government National Mortgage Association, Ser. 2019-5, Cl. P | 3.50 | 7/20/2048 | 226,765 | 204,171 | |||||

Government National Mortgage Association, Ser. 2019-5, Cl. SM (Interest Only) | 0.67 | 1/20/2049 | 1,934,380 | 152,074 | |||||

Government National Mortgage Association, Ser. 2019-57, Cl. NS (Interest Only) | 0.80 | 5/20/2049 | 3,054,414 | 25,212 | |||||

Government National Mortgage Association, Ser. 2019-59, Cl. KA | 3.00 | 12/20/2048 | 694,244 | 611,349 | |||||

Government National Mortgage Association, Ser. 2019-6, Cl. JK | 3.50 | 1/20/2049 | 897,402 | 758,479 | |||||

10

Description | Coupon

| Maturity Date | Principal Amount ($) | Value ($) | |||||

Bonds and Notes - 118.4% (continued) | |||||||||

U.S. Government Agencies Collateralized Mortgage Obligations - 27.9% (continued) | |||||||||

Government National Mortgage Association, Ser. 2019-70, Cl. AS (Interest Only) | 0.72 | 6/20/2049 | 692,413 | 52,181 | |||||

Government National Mortgage Association, Ser. 2020-11, Cl. CB | 3.50 | 1/20/2050 | 2,224,885 | 1,960,500 | |||||

Government National Mortgage Association, Ser. 2020-141, Cl. AI (Interest Only) | 2.50 | 9/20/2050 | 2,456,010 | 323,092 | |||||

Government National Mortgage Association, Ser. 2020-15, Cl. CB | 2.50 | 2/20/2050 | 692,765 | 579,867 | |||||

Government National Mortgage Association, Ser. 2020-162, Cl. DI (Interest Only) | 2.50 | 10/20/2050 | 2,745,439 | 372,990 | |||||

Government National Mortgage Association, Ser. 2020-164, Cl. KI (Interest Only) | 2.50 | 11/20/2050 | 3,521,913 | 464,092 | |||||

Government National Mortgage Association, Ser. 2020-4, CI. BS (Interest Only) | 3.32 | 1/20/2050 | 2,354,102 | 90,557 | |||||

Government National Mortgage Association, Ser. 2020-63, Cl. AI (Interest Only) | 4.00 | 5/20/2035 | 1,421,914 | 181,223 | |||||

Government National Mortgage Association, Ser. 2022-9, Cl. P | 2.00 | 9/20/2051 | 5,449,720 | 4,524,913 | |||||

48,663,779 | |||||||||

U.S. Government Agencies Collateralized Municipal-Backed Securities - .3% | |||||||||

Federal Home Loan Mortgage Corp. Multifamily Structured Pass-Through Certificates, Ser. Q007, Cl. APT1 | 6.71 | 10/25/2047 | 450,524 | c | 450,048 | ||||

U.S. Government Agencies Mortgage-Backed - 80.4% | |||||||||

Federal National Mortgage Association: | |||||||||

2.50%, 10/1/2051 | 1,559,158 | c | 1,213,594 | ||||||

3.00%, 12/1/2051-2/1/2052 | 20,772,193 | c | 17,313,842 | ||||||

5.00%, 6/1/2052 | 6,924,072 | c | 6,568,781 | ||||||

6.50%, 5/1/2053 | 1,717,209 | c | 1,711,322 | ||||||

7.00% | 16,000,000 | c,d | 16,333,750 | ||||||

7.00%, 2/1/2053 | 1,549,106 | c | 1,564,670 | ||||||

Government National Mortgage Association I: | |||||||||

3.50%, 9/15/2041-10/15/2044 | 1,705,315 | 1,540,927 | |||||||

4.00%, 10/15/2039-6/15/2045 | 3,626,968 | 3,354,401 | |||||||

4.50%, 4/15/2039-10/15/2041 | 2,808,921 | 2,685,152 | |||||||

Government National Mortgage Association II: | |||||||||

2.00%, 3/20/2052 | 3,669,992 | 2,893,177 | |||||||

11

STATEMENT OF INVESTMENTS (continued)

Description | Coupon

| Maturity Date | Principal Amount ($) | Value ($) | |||||

Bonds and Notes - 118.4% (continued) | |||||||||

U.S. Government Agencies Mortgage-Backed - 80.4% (continued) | |||||||||

2.50%, 12/20/2050-7/20/2052 | 39,513,954 | 31,625,814 | |||||||

3.00%, 8/20/2046-9/20/2052 | 4,934,735 | 4,216,691 | |||||||

3.50%, 9/20/2042-3/20/2050 | 18,601,087 | 16,778,884 | |||||||

4.00%, 10/20/2047-11/20/2052 | 5,422,244 | 5,150,902 | |||||||

4.01%, 7/20/2053, (1 Year U.S.Treasury Yield Curve Constant Rate +1.50%) | 8,440,220 | a | 8,052,661 | ||||||

6.00% | 12,000,000 | d | 11,975,865 | ||||||

7.00%, 2/20/2054 | 1,989,195 | 2,027,643 | |||||||

7.50% | 5,000,000 | d | 5,106,338 | ||||||

140,114,414 | |||||||||

Total Bonds

and Notes | 206,322,636 | ||||||||

1-Day | Shares | ||||||||

Investment Companies - .7% | |||||||||

Registered Investment Companies - .7% | |||||||||

Dreyfus Institutional Preferred Government

Plus Money Market Fund, Institutional Shares | 5.41 | 1,177,034 | e | 1,177,034 | |||||

Total Investments (cost $238,490,420) | 119.1% | 207,499,670 | |||||||

Liabilities, Less Cash and Receivables | (19.1%) | (33,241,580) | |||||||

Net Assets | 100.0% | 174,258,090 | |||||||

REMIC—Real Estate Mortgage Investment Conduit

SOFR—Secured Overnight Financing Rate

TSFR—Term Secured Overnight Financing Rate Reference Rates

a Variable rate security—interest rate resets periodically and rate shown is the interest rate in effect at period end. Security description also includes the reference rate and spread if published and available.

b Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At April 30, 2024, these securities were valued at $17,094,395 or 9.81% of net assets.

c The Federal Housing Finance Agency (“FHFA”) placed the Federal Home Loan Mortgage Corporation and Federal National Mortgage Association into conservatorship with FHFA as the conservator. As such, the FHFA oversees the continuing affairs of these companies.

d Purchased on a forward commitment basis.

e Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

Portfolio Summary (Unaudited) † | Value (%) |

Mortgage Securities | 118.4 |

Investment Companies | .7 |

119.1 |

† Based on net assets.

See notes to financial statements.

12

Affiliated Issuers | ||||||

Description | Value ($) 4/30/2023 | Purchases ($)† | Sales ($) | Value ($) 4/30/2024 | Dividends/ | |

Registered Investment Companies - .7% | ||||||

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares - .7% | 1,437,946 | 60,524,203 | (60,785,115) | 1,177,034 | 69,733 | |

† Includes reinvested dividends/distributions.

See notes to financial statements.

13

STATEMENT OF ASSETS AND LIABILITIES

April 30, 2024

|

|

|

|

|

|

|

|

|

| Cost |

| Value |

|

Assets ($): |

|

|

|

| ||

Investments in securities—See Statement of Investments |

|

|

| |||

Unaffiliated issuers | 237,313,386 |

| 206,322,636 |

| ||

Affiliated issuers |

| 1,177,034 |

| 1,177,034 |

| |

Receivable for investment securities sold |

| 11,996,719 |

| |||

Dividends and interest receivable |

| 586,625 |

| |||

Receivable for shares of Common Stock subscribed |

| 331 |

| |||

Prepaid expenses |

|

|

|

| 46,335 |

|

|

|

|

|

| 220,129,680 |

|

Liabilities ($): |

|

|

|

| ||

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(c) |

| 98,876 |

| |||

Payable for investment securities purchased |

| 45,661,719 |

| |||

Payable for shares of Common Stock redeemed |

| 7,198 |

| |||

Directors’ fees and expenses payable |

| 6,300 |

| |||

Other accrued expenses |

|

|

|

| 97,497 |

|

|

|

|

|

| 45,871,590 |

|

Net Assets ($) |

|

| 174,258,090 |

| ||

Composition of Net Assets ($): |

|

|

|

| ||

Paid-in capital |

|

|

|

| 227,288,322 |

|

Total distributable earnings (loss) |

|

|

|

| (53,030,232) |

|

Net Assets ($) |

|

| 174,258,090 |

| ||

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | Class Z |

|

Net Assets ($) | 11,742,222 | 223,369 | 1,914,732 | 807 | 160,376,960 |

|

Shares Outstanding | 957,052 | 18,177 | 155,803 | 65.75 | 13,063,961 |

|

Net Asset Value Per Share ($) | 12.27 | 12.29 | 12.29 | 12.27 | 12.28 |

|

|

|

|

|

|

|

|

See notes to financial statements. |

|

|

|

|

|

|

14

STATEMENT OF OPERATIONS

Year Ended April 30, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Income ($): |

|

|

|

| ||

Income: |

|

|

|

| ||

Interest |

|

| 6,368,295 |

| ||

Dividends from affiliated issuers |

|

| 69,733 |

| ||

Total Income |

|

| 6,438,028 |

| ||

Expenses: |

|

|

|

| ||

Management fee—Note 3(a) |

|

| 934,453 |

| ||

Service plan fees—Note 3(b) |

|

| 353,031 |

| ||

Shareholder servicing costs—Note 3(c) |

|

| 217,559 |

| ||

Professional fees |

|

| 107,444 |

| ||

Registration fees |

|

| 79,285 |

| ||

Prospectus and shareholders’ reports |

|

| 23,002 |

| ||

Chief Compliance Officer fees—Note 3(c) |

|

| 20,359 |

| ||

Directors’ fees and expenses—Note 3(d) |

|

| 18,195 |

| ||

Custodian fees—Note 3(c) |

|

| 8,794 |

| ||

Loan commitment fees—Note 2 |

|

| 5,695 |

| ||

Miscellaneous |

|

| 39,130 |

| ||

Total Expenses |

|

| 1,806,947 |

| ||

Less—reduction in expenses due to undertaking—Note 3(a) |

|

| (479,964) |

| ||

Less—reduction in fees due to earnings credits—Note 3(c) |

|

| (108,658) |

| ||

Net Expenses |

|

| 1,218,325 |

| ||

Net Investment Income |

|

| 5,219,703 |

| ||

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

|

| ||||

Net realized gain (loss) on investments | (2,313,308) |

| ||||

Net change in unrealized appreciation (depreciation) on investments | (5,898,627) |

| ||||

Net Realized and Unrealized Gain (Loss) on Investments |

|

| (8,211,935) |

| ||

Net (Decrease) in Net Assets Resulting from Operations |

| (2,992,232) |

| |||

|

|

|

|

|

|

|

See notes to financial statements. | ||||||

15

STATEMENT OF CHANGES IN NET ASSETS

|

|

|

| Year Ended April 30, | |||||

|

|

|

| 2024 |

| 2023 |

| ||

Operations ($): |

|

|

|

|

|

|

|

| |

Net investment income |

|

| 5,219,703 |

|

|

| 4,554,248 |

| |

Net realized gain (loss) on investments |

| (2,313,308) |

|

|

| (5,935,728) |

| ||

Net

change in unrealized appreciation |

| (5,898,627) |

|

|

| (3,048,601) |

| ||

Net Increase

(Decrease) in Net Assets | (2,992,232) |

|

|

| (4,430,081) |

| |||

Distributions ($): |

| ||||||||

Distributions to shareholders: |

|

|

|

|

|

|

|

| |

Class A |

|

| (364,689) |

|

|

| (400,534) |

| |

Class C |

|

| (5,294) |

|

|

| (4,162) |

| |

Class I |

|

| (60,382) |

|

|

| (60,530) |

| |

Class Y |

|

| (25) |

|

|

| (21) |

| |

Class Z |

|

| (4,911,116) |

|

|

| (4,663,936) |

| |

Total Distributions |

|

| (5,341,506) |

|

|

| (5,129,183) |

| |

Capital Stock Transactions ($): |

| ||||||||

Net proceeds from shares sold: |

|

|

|

|

|

|

|

| |

Class A |

|

| 158,335 |

|

|

| 243,483 |

| |

Class C |

|

| 3,600 |

|

|

| 5,000 |

| |

Class I |

|

| 296,054 |

|

|

| 1,669,266 |

| |

Class Z |

|

| 753,597 |

|

|

| 1,622,813 |

| |

Distributions reinvested: |

|

|

|

|

|

|

|

| |

Class A |

|

| 325,845 |

|

|

| 367,437 |

| |

Class C |

|

| 5,268 |

|

|

| 4,142 |

| |

Class I |

|

| 60,382 |

|

|

| 60,530 |

| |

Class Z |

|

| 4,463,621 |

|

|

| 4,243,113 |

| |

Cost of shares redeemed: |

|

|

|

|

|

|

|

| |

Class A |

|

| (3,105,516) |

|

|

| (5,828,169) |

| |

Class C |

|

| (43,986) |

|

|

| (20,332) |

| |

Class I |

|

| (461,594) |

|

|

| (2,034,311) |

| |

Class Z |

|

| (22,389,753) |

|

|

| (23,131,249) |

| |

Increase

(Decrease) in Net Assets | (19,934,147) |

|

|

| (22,798,277) |

| |||

Total Increase (Decrease) in Net Assets | (28,267,885) |

|

|

| (32,357,541) |

| |||

Net Assets ($): |

| ||||||||

Beginning of Period |

|

| 202,525,975 |

|

|

| 234,883,516 |

| |

End of Period |

|

| 174,258,090 |

|

|

| 202,525,975 |

| |

16

|

|

|

| Year Ended April 30, | |||||

|

|

|

| 2024 |

| 2023 |

| ||

Capital Share Transactions (Shares): |

| ||||||||

Class Aa |

|

|

|

|

|

|

|

| |

Shares sold |

|

| 12,629 |

|

|

| 18,950 |

| |

Shares issued for distributions reinvested |

|

| 26,214 |

|

|

| 28,538 |

| |

Shares redeemed |

|

| (249,107) |

|

|

| (460,713) |

| |

Net Increase (Decrease) in Shares Outstanding | (210,264) |

|

|

| (413,225) |

| |||

Class Ca |

|

|

|

|

|

|

|

| |

Shares sold |

|

| 289 |

|

|

| 388 |

| |

Shares issued for distributions reinvested |

|

| 423 |

|

|

| 322 |

| |

Shares redeemed |

|

| (3,480) |

|

|

| (1,617) |

| |

Net Increase (Decrease) in Shares Outstanding | (2,768) |

|

|

| (907) |

| |||

Class I |

|

|

|

|

|

|

|

| |

Shares sold |

|

| 23,752 |

|

|

| 130,401 |

| |

Shares issued for distributions reinvested |

|

| 4,851 |

|

|

| 4,703 |

| |

Shares redeemed |

|

| (37,108) |

|

|

| (159,270) |

| |

Net Increase (Decrease) in Shares Outstanding | (8,505) |

|

|

| (24,166) |

| |||

Class Z |

|

|

|

|

|

|

|

| |

Shares sold |

|

| 60,663 |

|

|

| 126,795 |

| |

Shares issued for distributions reinvested |

|

| 358,924 |

|

|

| 329,846 |

| |

Shares redeemed |

|

| (1,800,095) |

|

|

| (1,802,087) |

| |

Net Increase (Decrease) in Shares Outstanding | (1,380,508) |

|

|

| (1,345,446) |

| |||

|

|

|

|

|

|

|

|

|

|

a | During the period ended April 30, 2024, 49 Class C shares representing $612 were automatically converted to 49 Class A shares. | ||||||||

See notes to financial statements. | |||||||||

17

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. These figures have been derived from the fund’s financial statements.

Class A Shares | Year Ended April 30, | |||||||||

2024 | 2023 | 2022 | 2021 | 2020 | ||||||

Per Share Data ($): | ||||||||||

Net asset value, | 12.82 | 13.36 | 15.03 | 15.21 | 14.69 | |||||

Investment Operations: | ||||||||||

Net investment incomea | .34 | .26 | .24 | .21 | .29 | |||||

Net

realized and unrealized | (.54) | (.50) | (1.51) | .01 | .56 | |||||

Total from Investment Operations | (.20) | (.24) | (1.27) | .22 | .85 | |||||

Distributions: | ||||||||||

Dividends from | (.35) | (.30) | (.40) | (.40) | (.33) | |||||

Net asset value, end of period | 12.27 | 12.82 | 13.36 | 15.03 | 15.21 | |||||

Total Return (%)b | (1.60) | (1.82) | (8.63) | 1.46 | 5.87 | |||||

Ratios/Supplemental Data (%): | ||||||||||

Ratio of total expenses | 1.06 | 1.01 | .97 | .96 | .95 | |||||

Ratio

of net expenses | .74 | .78 | .80 | .81 | .91 | |||||

Ratio of net investment income to average net assets | 2.70 | 2.02 | 1.65 | 1.36 | 1.94 | |||||

Portfolio Turnover Ratec | 236.03 | 236.39 | 386.69 | 392.94 | 238.60 | |||||

Net Assets, end of period ($ x 1,000) | 11,742 | 14,960 | 21,110 | 27,483 | 25,920 | |||||

a Based on average shares outstanding.

b Exclusive of sales charge.

c The portfolio turnover rates excluding mortgage dollar roll transactions for the periods ended April 30, 2024, 2023, 2022, 2021 and 2020 were 82.38%, 100.99%, 200.45%, 198.94% and 165.75%, respectively.

See notes to financial statements.

18

Class C Shares | Year Ended April 30, | |||||||||

2024 | 2023 | 2022 | 2021 | 2020 | ||||||

Per Share Data ($): | ||||||||||

Net asset value, | 12.84 | 13.38 | 15.06 | 15.23 | 14.69 | |||||

Investment Operations: | ||||||||||

Net investment incomea | .24 | .16 | .13 | .10 | .16 | |||||

Net

realized and unrealized | (.53) | (.50) | (1.52) | .01 | .59 | |||||

Total from Investment Operations | (.29) | (.34) | (1.39) | .11 | .75 | |||||

Distributions: | ||||||||||

Dividends from | (.26) | (.20) | (.29) | (.28) | (.21) | |||||

Net asset value, end of period | 12.29 | 12.84 | 13.38 | 15.06 | 15.23 | |||||

Total Return (%)b | (2.30) | (2.57) | (9.37) | .71 | 5.14 | |||||

Ratios/Supplemental Data (%): | ||||||||||

Ratio of total expenses | 1.94 | 1.96 | 1.94 | 1.85 | 1.91 | |||||

Ratio

of net expenses | 1.49 | 1.53 | 1.55 | 1.56 | 1.66 | |||||

Ratio of net investment income to average net assets | 1.95 | 1.27 | .89 | .62 | 1.14 | |||||

Portfolio Turnover Ratec | 236.03 | 236.39 | 386.69 | 392.94 | 238.60 | |||||

Net Assets, end of period ($ x 1,000) | 223 | 269 | 292 | 437 | 766 | |||||

a Based on average shares outstanding.

b Exclusive of sales charge.

c The portfolio turnover rates excluding mortgage dollar roll transactions for the periods ended April 30, 2024, 2023, 2022, 2021 and 2020 were 82.38%, 100.99%, 200.45%, 198.94% and 165.75%, respectively.

See notes to financial statements.

19

FINANCIAL HIGHLIGHTS (continued)

Class I Shares | Year Ended April 30, | ||||||||||

2024 | 2023 | 2022 | 2021 | 2020 | |||||||

Per Share Data ($): | |||||||||||

Net asset value, beginning of period | 12.84 | 13.37 | 15.04 | 15.20 | 14.67 | ||||||

Investment Operations: | |||||||||||

Net investment incomea | .37 | .30 | .27 | .25 | .34 | ||||||

Net realized and unrealized | (.54) | (.51) | (1.51) | .02 | .55 | ||||||

Total from Investment Operations | (.17) | (.21) | (1.24) | .27 | .89 | ||||||

Distributions: | |||||||||||

Dividends

from | (.38) | (.32) | (.43) | (.43) | (.36) | ||||||

Net asset value, end of period | 12.29 | 12.84 | 13.37 | 15.04 | 15.20 | ||||||

Total Return (%) | (1.35) | (1.53) | (8.42) | 1.71 | 6.18 | ||||||

Ratios/Supplemental Data (%): | |||||||||||

Ratio of total expenses | .81 | .77 | .75 | .73 | .75 | ||||||

Ratio

of net expenses | .49 | .53 | .55 | .56 | .66 | ||||||

Ratio of net investment income | 2.95 | 2.27 | 1.88 | 1.62 | 2.28 | ||||||

Portfolio Turnover Rateb | 236.03 | 236.39 | 386.69 | 392.94 | 238.60 | ||||||

Net Assets, end of period ($ x 1,000) | 1,915 | 2,109 | 2,520 | 2,743 | 2,354 | ||||||

a Based on average shares outstanding.

b The portfolio turnover rates excluding mortgage dollar roll transactions for the periods ended April 30, 2024, 2023, 2022, 2021 and 2020 were 82.38%, 100.99%, 200.45%, 198.94% and 165.75%, respectively.

See notes to financial statements.

20

Year Ended April 30, | ||||||||||||

Class Y Shares | 2024 | 2023 | 2022 | 2021 | 2020 | |||||||

Per Share Data ($): | ||||||||||||

Net asset value, beginning of period | 12.82 | 13.35 | 15.01 | 15.21 | 14.68 | |||||||

Investment Operations: | ||||||||||||

Net investment incomea | .37 | .29 | .28 | .26 | .33 | |||||||

Net realized and unrealized | (.54) | (.50) | (1.51) | (.03) | .57 | |||||||

Total from Investment Operations | (.17) | (.21) | (1.23) | .23 | .90 | |||||||

Distributions: | ||||||||||||

Dividends

from | (.38) | (.32) | (.43) | (.43) | (.37) | |||||||

Net asset value, end of period | 12.27 | 12.82 | 13.35 | 15.01 | 15.21 | |||||||

Total Return (%) | (1.35) | (1.54) | (8.44) | 1.51 | 6.20 | |||||||

Ratios/Supplemental Data (%): | ||||||||||||

Ratio of total expenses | .81 | .76 | 1.42 | .76 | .68 | |||||||

Ratio

of net expenses | .49 | .53 | .55 | .56 | .66 | |||||||

Ratio of net investment income | 2.95 | 2.26 | 1.90 | 1.62 | 2.19 | |||||||

Portfolio Turnover Rateb | 236.03 | 236.39 | 386.69 | 392.94 | 238.60 | |||||||

Net Assets, end of period ($ x 1,000) | 1 | 1 | 1 | 1 | 84 | |||||||

a Based on average shares outstanding.

b The portfolio turnover rates excluding mortgage dollar roll transactions for the periods ended April 30, 2024, 2023, 2022, 2021 and 2020 were 82.38%, 100.99%, 200.45%, 198.94% and 165.75%, respectively.

See notes to financial statements.

21

FINANCIAL HIGHLIGHTS (continued)

Class Z Shares | Year Ended April 30, | |||||||||

2024 | 2023 | 2022 | 2021 | 2020 | ||||||

Per Share Data ($): | ||||||||||

Net asset value, | 12.82 | 13.36 | 15.04 | 15.21 | 14.69 | |||||

Investment Operations: | ||||||||||

Net investment incomea | .35 | .27 | .25 | .22 | .31 | |||||

Net

realized and unrealized | (.53) | (.50) | (1.52) | .02 | .56 | |||||

Total from Investment Operations | (.18) | (.23) | (1.27) | .24 | .87 | |||||

Distributions: | ||||||||||

Dividends from | (.36) | (.31) | (.41) | (.41) | (.35) | |||||

Net asset value, end of period | 12.28 | 12.82 | 13.36 | 15.04 | 15.21 | |||||

Total Return (%) | (1.44) | (1.72) | (8.62) | 1.62 | 5.98 | |||||

Ratios/Supplemental Data (%): | ||||||||||

Ratio of total expenses | .96 | .91 | .86 | .85 | .85 | |||||

Ratio

of net expenses | .65 | .68 | .70 | .71 | .81 | |||||

Ratio

of net investment income | 2.80 | 2.12 | 1.75 | 1.47 | 2.05 | |||||

Portfolio Turnover Rateb | 236.03 | 236.39 | 386.69 | 392.94 | 238.60 | |||||

Net Assets, end of period ($ x 1,000) | 160,377 | 185,187 | 210,960 | 255,948 | 274,710 | |||||

a Based on average shares outstanding.

b The portfolio turnover rates excluding mortgage dollar roll transactions for the periods ended April 30, 2024, 2023, 2022, 2021 and 2020 were 82.38%, 100.99%, 200.45%, 198.94% and 165.75%, respectively.

See notes to financial statements.

22

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

BNY Mellon U.S. Mortgage Fund, Inc. (the “fund”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), is a diversified open–end management investment company. The fund’s investment objective is to seek to maximize total return, consisting of capital appreciation and current income. BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Amherst Capital Management LLC (the “Sub-Adviser”), serves as the fund’s sub-adviser.

BNY Mellon Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s shares. The fund is authorized to issue 1.4 billion shares of $.001 par value Common Stock. The fund currently has authorized five classes of shares: Class A (100 million shares authorized), Class C (100 million shares authorized), Class I (150 million shares authorized), Class Y (150 million shares authorized) and Class Z (900 million shares authorized). Class A and Class C shares are sold primarily to retail investors through financial intermediaries and bear Distribution and/or Shareholder Services Plan fees. Class A shares generally are subject to a sales charge imposed at the time of purchase. Class A shares bought without an initial sales charge as part of an investment of $1 million or more may be charged a contingent deferred sales charge (“CDSC”) of 1.00% if redeemed within one year. Class C shares are subject to a CDSC imposed on Class C shares redeemed within one year of purchase. Class C shares automatically convert to Class A shares eight years after the date of purchase, without the imposition of a sales charge. Class I shares are sold primarily to bank trust departments and other financial service providers (including BNY Mellon and its affiliates), acting on behalf of customers having a qualified trust or an investment account or relationship at such institution, and bear no Distribution or Shareholder Services Plan fees. Class Y shares are sold at net asset value per share generally to institutional investors, and bear no Distribution or Shareholder Services Plan fees. Class Z shares are sold at net asset value per share to certain shareholders of the fund. Class Z shares generally are not available for new accounts and bear Shareholder Services Plan fees. Class I, Class Y and Class Z shares are offered without a front-end sales charge or CDSC. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and

23

NOTES TO FINANCIAL STATEMENTS (continued)

unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

As of April 30, 2024, MBC Investments Corporation, an indirect subsidiary of BNY Mellon, held all of the outstanding Class Y shares of the fund.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

24

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

The fund’s Board of Directors (the “Board”) has designated the Adviser as the fund’s valuation designee to make all fair value determinations with respect to the fund’s portfolio investments, subject to the Board’s oversight and pursuant to Rule 2a-5 under the Act.

Registered investment companies that are not traded on an exchange are valued at their net asset value and are generally categorized within Level 1 of the fair value hierarchy.

Investments in debt securities excluding short-term investments (other than U.S. Treasury Bills) are valued each business day by one or more independent pricing services (each, a “Service”) approved by the Board. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of a Service are valued at the mean between the quoted bid prices (as obtained by a Service from dealers in such securities) and asked prices (as calculated by a Service based upon its evaluation of the market for such securities). Securities are valued as determined by a Service, based on methods which include consideration of the following: yields or prices of securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions. The Services are engaged under the general supervision of the Board. These securities are generally categorized within Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and

25

NOTES TO FINANCIAL STATEMENTS (continued)

duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

The following is a summary of the inputs used as of April 30, 2024 in valuing the fund’s investments:

Level 1-Unadjusted Quoted Prices | Level 2- Other Significant Observable Inputs | Level 3-Significant Unobservable Inputs | Total | |||

Assets ($) | ||||||

Investments in Securities:† | ||||||

Commercial Mortgage-Backed | - | 17,094,395 | - | 17,094,395 | ||

Investment Companies | 1,177,034 | - | - | 1,177,034 | ||

U.S. Government Agencies Collateralized Mortgage Obligations | - | 48,663,779 | - | 48,663,779 | ||

U.S. Government Agencies Collateralized Municipal-Backed Securities | - | 450,048 | - | 450,048 | ||

U.S. Government Agencies Mortgage-Backed | - | 140,114,414 | - | 140,114,414 | ||

† See Statement of Investments for additional detailed categorizations, if any.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

(c) Affiliated issuers: Investments in other investment companies advised by the Adviser are considered “affiliated” under the Act.

26

(d) Market Risk: The value of the securities in which the fund invests may be affected by political, regulatory, economic and social developments, and developments that impact specific economic sectors, industries or segments of the market. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed-income markets may negatively affect many issuers, which could adversely affect the fund. Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other circumstances, such risks might affect companies world-wide.

Fixed-Income Market Risk: The market value of a fixed-income security may decline due to general market conditions that are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. The fixed-income securities market can be susceptible to increases in volatility and decreases in liquidity. Liquidity can decline unpredictably in response to overall economic conditions or credit tightening. Increases in volatility and decreases in liquidity may be caused by a rise in interest rates (or the expectation of a rise in interest rates). An unexpected increase in fund redemption requests, including requests from shareholders who may own a significant percentage of the fund’s shares, which may be triggered by market turmoil or an increase in interest rates, could cause the fund to sell its holdings at a loss or at undesirable prices and adversely affect the fund’s share price and increase the fund’s liquidity risk, fund expenses and/or taxable distributions. Federal Reserve policy in response to market conditions, including with respect to interest rates, may adversely affect the value, volatility and liquidity of dividend and interest paying securities. Policy and legislative changes worldwide are affecting many aspects of financial regulation. The impact of these changes on the markets and the practical implications for market participants may not be fully known for some time.

Mortgage-Related Securities Risk: Mortgage-related securities are complex derivative instruments, subject to credit, prepayment and extension risk, and may be more volatile, less liquid and more difficult to price accurately than more traditional debt securities. The fund is subject to the credit risk associated with these securities, including the market’s perception of the creditworthiness of the issuing federal agency, as well as the credit quality of the underlying assets. Although certain mortgage-related securities are guaranteed as to the timely payment of interest and

27

NOTES TO FINANCIAL STATEMENTS (continued)

principal by a third party (such as a U.S. government agency or instrumentality with respect to government-related mortgage securities) the market prices for such securities are not guaranteed and will fluctuate. As with other interest-bearing securities, the prices of certain mortgage-related securities are inversely affected by changes in interest rates. However, although the value of a mortgage-related security may decline when interest rates rise, the converse is not necessarily true, since in periods of declining interest rates the mortgages underlying the security are more likely to be prepaid causing the fund to purchase new securities at current market rates, which usually will be lower. The loss of higher yielding underlying mortgages and the reinvestment of proceeds at lower interest rates, known as prepayment risk, can reduce the fund’s potential price gain in response to falling interest rates, reduce the fund’s yield and/or cause the fund’s share price to fall. When interest rates rise, the effective duration of the fund’s mortgage-related and other asset-backed securities may lengthen due to a drop in prepayments of the underlying mortgages or other assets. This is known as extension risk and would increase the fund’s sensitivity to rising interest rates and its potential for price declines.

Portfolio Turnover Risk: The fund may engage in short-term trading, which could produce higher transaction costs and taxable distributions, and lower the fund’s after-tax performance. The fund’s forward roll transactions will increase its portfolio turnover rate.

(e) Dividends and distributions to shareholders: Dividends and distributions are recorded on the ex-dividend date. Dividends from net investment income are normally declared and paid on a monthly basis. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

On April 30, 2024, the Board declared a cash dividend of $.030, $.022, $.033, $.033 and $.031 per share from undistributed net investment income for Class A, Class C, Class I, Class Y and Class Z shares, respectively, payable on May 1, 2024, to shareholders of record as of the close of business on April 30, 2024. The ex-dividend date was May 1, 2024.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable

28

provisions of the Code, and to make distributions of taxable income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended April 30, 2024, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended April 30, 2024, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended April 30, 2024 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At April 30, 2024, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $532,435 accumulated capital losses $22,537,588 and unrealized depreciation $31,025,079.

The fund is permitted to carry forward capital losses for an unlimited period. Furthermore, capital loss carryovers retain their character as either short-term or long-term capital losses.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net realized capital gains, if any, realized subsequent to April 30, 2024. The fund has $12,635,889 of short-term capital losses and $9,901,699 of long-term capital losses which can be carried forward for an unlimited period.

The tax character of distributions paid to shareholders during the fiscal years ended April 30, 2024 and April 30, 2023 were as follows: ordinary income $5,341,506 and $5,129,183, respectively.

NOTE 2—Bank Lines of Credit:

The fund participates with other long-term open-end funds managed by the Adviser in a $738 million unsecured credit facility led by Citibank, N.A. (the “Citibank Credit Facility”) and a $300 million unsecured credit facility provided by BNY Mellon (the “BNYM Credit Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions (each, a “Facility”). The Citibank Credit Facility is available in two tranches: (i) Tranche A is in an amount equal to $618 million and is available to all long-term open-ended funds, including the fund, and (ii) Tranche B is an amount equal to $120 million and is available only to BNY Mellon Floating Rate Income Fund, a series of BNY Mellon Investment Funds IV, Inc. Prior to September 27, 2023, the Citibank Credit Facility was $823.5 million with Tranche A available in an amount equal to $688.5 million and Tranche B available in an amount equal to

29

NOTES TO FINANCIAL STATEMENTS (continued)

$135 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for Tranche A of the Citibank Credit Facility and the BNYM Credit Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended April 30, 2024, the fund did not borrow under the Facilities.

NOTE 3—Management Fee, Sub-Advisory Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement (the “Agreement”) with the Adviser, the management fee is computed at the annual rate of .50% of the value of the fund’s average daily net assets and is payable monthly. The Agreement provides that if in any full fiscal year, the aggregate expenses of Class Z shares (excluding taxes, brokerage fees, interest on borrowings and extraordinary expenses) exceed 1½% of the value of Class Z shares’ average daily net assets, the fund may deduct these expenses from payments to be made to the Adviser, or the Adviser will bear, such excess expense with respect to Class Z shares. There was no reimbursement pursuant to the Agreement for Class Z shares during the period ended April 30, 2024.

The Adviser has contractually agreed, from May 1, 2023 until September 1, 2024, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of the fund’s Class A, Class C, Class I, Class Y and Class Z shares (excluding taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) do not exceed an annual rate of .80%, 1.55%, .55%, .55% and .70%, respectively, of the value of the fund’s average daily net assets. On or after September 1, 2024, the Adviser may terminate this expense limitation at any time. The reduction in expenses, pursuant to the undertaking, amounted to $479,964 during the period ended April 30, 2024.

Pursuant to a sub-investment advisory agreement between the Adviser and the Sub-Adviser, the Adviser pays the Sub-Adviser a monthly fee at an annual rate of .24% of the value of the fund’s average daily net assets.

During the period ended April 30, 2024, the Distributor retained $19 from commissions earned on sales of the fund’s Class A shares.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of its average daily net assets. The Distributor may pay one or more Service Agents in respect of advertising, marketing and other distribution services, and determines the amounts, if

30

any, to be paid to Service Agents and the basis on which such payments are made. During the period ended April 30, 2024, Class C shares were charged $1,916 pursuant to the Distribution Plan.

Under the Service Plan adopted pursuant to Rule 12b-1 under the Act, Class Z shares reimburse the Distributor for distributing its shares, for advertising and marketing relating to Class Z shares and servicing shareholder accounts at an amount not to exceed an annual rate of .20% of the value of the average daily net assets of Class Z shares. The Distributor determines the amounts, if any, to be paid to Service Agents (securities dealers, financial institutions or other industry professionals) and the basis on which such payments are made.

The Service Plan also separately provides for Class Z shares to bear the costs of preparing, printing and distributing certain of Class Z prospectuses and statements of additional information and costs associated with implementing and operating the Service Plan, not to exceed the greater of $100,000 or .005% of the value of its average daily net assets for any full fiscal year. During the period ended April 30, 2024, Class Z shares were charged $351,115 pursuant to the Service Plan.

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services. The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (securities dealers, financial institutions or other industry professionals) with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended April 30, 2024, Class A and Class C shares were charged $32,629 and $639, respectively, pursuant to the Shareholder Services Plan.

The fund has an arrangement with BNY Mellon Transfer, Inc., (the “Transfer Agent”), a subsidiary of BNY Mellon and an affiliate of the Adviser, whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset Transfer Agent fees. For financial reporting purposes, the fund includes transfer agent net earnings credits, if any, as an expense offset in the Statement of Operations.

The fund has an arrangement with The Bank of New York Mellon (the “Custodian”), a subsidiary of BNY Mellon and an affiliate of the Adviser, whereby the fund will receive interest income or be charged overdraft fees when cash balances are maintained. For financial reporting purposes, the

31

NOTES TO FINANCIAL STATEMENTS (continued)

fund includes this interest income and overdraft fees, if any, as interest income in the Statement of Operations.

The fund compensates the Transfer Agent, under a transfer agency agreement, for providing transfer agency and cash management services for the fund. The majority of Transfer Agent fees are comprised of amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended April 30, 2024, the fund was charged $110,258 for transfer agency services. These fees are included in Shareholder servicing costs in the Statement of Operations. These fees were partially offset by earnings credits of $108,658.

The fund compensates the Custodian, under a custody agreement, for providing custodial services for the fund. These fees are determined based on net assets, geographic region and transaction activity. During the period ended April 30, 2024, the fund was charged $8,794 pursuant to the custody agreement.

The fund compensates the Custodian, under a shareholder redemption draft processing agreement, for providing certain services related to the fund’s check writing privilege. During the period ended April 30, 2024, the fund was charged $10,355 pursuant to the agreement, which is included in Shareholder servicing costs in the Statement of Operations.

During the period ended April 30, 2024, the fund was charged $20,359 for services performed by the fund’s Chief Compliance Officer and his staff. These fees are included in Chief Compliance Officer fees in the Statement of Operations.

The components of “Due to BNY Mellon Investment Adviser, Inc. and affiliates” in the Statement of Assets and Liabilities consist of: management fee of $72,248, Distribution Plan fees of $33,773, Shareholder Services Plan fees of $2,484, Custodian fees of $3,200, Chief Compliance Officer fees of $4,206 and Transfer Agent fees of $25,680, which are offset against an expense reimbursement currently in effect in the amount of $42,715.

(d) Each board member of the fund also serves as a board member of other funds in the BNY Mellon Family of Funds complex. Annual retainer fees and meeting attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales (including paydowns) of investment securities, excluding short-term securities during the period ended April 30, 2024, amounted to $505,448,237 and $519,717,488,

32

respectively, of which $329,028,085 in purchases and $329,385,000 in sales were from mortgage dollar roll transactions.

Mortgage Dollar Rolls: A mortgage dollar roll transaction involves a sale by the fund of mortgage related securities that it holds with an agreement by the fund to repurchase similar securities at an agreed upon price and date. The securities purchased will bear the same interest rate as those sold, but generally will be collateralized by pools of mortgages with different prepayment histories than those securities sold. The fund accounts for mortgage dollar rolls as purchases and sales transactions. The fund executes mortgage dollar rolls entirely in the TBA market.

At April 30, 2024, the cost of investments for federal income tax purposes was $238,524,749; accordingly, accumulated net unrealized depreciation on investments was $31,025,079, consisting of $456,311 gross unrealized appreciation and $31,481,390 gross unrealized depreciation.

33

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Directors of BNY Mellon U.S. Mortgage Fund, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of BNY Mellon U.S. Mortgage Fund, Inc. (the “Fund”), including the statement of investments, as of April 30, 2024, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund at April 30, 2024, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.