UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-17287

OUTDOOR CHANNEL HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 33-0074499 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 43445 Business Park Dr., Suite 103 Temecula, California (Address of principal executive offices) |

92590 (Zip Code) |

Registrant’s telephone number, including area code:

(951) 699-6991

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.001 par value | The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | þ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2011 was approximately $102.9 million computed by reference to the closing price on such date.

On March 7, 2012, the number of shares of common stock outstanding of the registrant’s common stock was 25,807,842.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report, to the extent not set forth herein, is incorporated herein by reference from the registrant’s definitive proxy statement relating to the Annual Meeting of Stockholders to be held in 2012, which definitive proxy statement shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

OUTDOOR CHANNEL HOLDINGS, INC.

FORM 10-K

TABLE OF CONTENTS

2

Cautionary Statement Concerning Forward-Looking Statements

The information contained in this Annual Report on Form 10-K contain both historical and forward-looking statements. Our actual results could differ materially from those discussed in any forward-looking statements. All statements other than statements of historical fact are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are necessarily based upon assumptions with respect to the future, involve risks and uncertainties, and are not guarantees of performance. These forward-looking statements represent our estimates and assumptions only as of the date of this report. In this report, when we use words such as “believes,” “expects,” “anticipates,” “plans,” “estimates,” “projects,” “contemplates,” “intends,” “depends,” “should,” “could,” “would,” “may,” “potential,” “target,” “goals,” or similar expressions, or when we discuss our strategy, plans or intentions, we are making forward-looking statements. We intend that such forward-looking statements be subject to the safe-harbor provisions contained in those sections. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. We caution you not to rely unduly on any forward-looking statements. You should review and consider carefully the risks, uncertainties and other factors that affect our business as described in this report and other reports that we file with the Securities and Exchange Commission.

These statements involve significant risks and uncertainties and are qualified by important factors that could cause our actual results to differ materially from those reflected by the forward-looking statements. Such factors include but are not limited to risks and uncertainties which are discussed below under “Item 1A Risk Factors” and other risks and uncertainties discussed elsewhere in this report. In assessing forward-looking statements contained herein, readers are urged to read carefully all cautionary statements contained in this Form 10-K and in our other filings with the Securities and Exchange Commission. For these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements in Section 27A of the Securities Act and Section 21E of the Exchange Act.

3

| ITEM 1. | BUSINESS. |

Outdoor Channel Holdings, Inc. (“Outdoor Channel Holdings”), a Delaware Corporation, is an entertainment and media company with operations in the following three segments:

| • | THE OUTDOOR CHANNEL: The Outdoor Channel, Inc., (or “TOC”), segment is comprised of The Outdoor Channel, Inc., a Nevada corporation and a wholly owned indirect subsidiary of Outdoor Channel Holdings, Inc. It operates Outdoor Channel®, a national television network devoted to traditional outdoor related lifestyle programming and outdoorchannel.com. |

| • | PRODUCTION SERVICES: Our Production Services segment is comprised of Winnercomm, Inc., a Delaware corporation. Winnercomm’s businesses relate principally to the production, development and marketing of sports and outdoor related programming and production activities and to website development, management and hosting services. |

| • | AERIAL CAMERAS: Our Aerial Cameras segment is comprised of CableCam, LLC and SkyCam, LLC, both Delaware limited liability companies. The Aerial Cameras business relates principally to the providing of suspended aerial camera services to media networks for inclusion in those networks’ production of sporting events. |

As used in this Annual Report on Form 10-K, the terms “we,” “us,” “our” and the “Company” refer to Outdoor Channel Holdings, Inc. and its subsidiaries, collectively, except where noted or where the context makes clear the reference is only to Outdoor Channel Holdings, Inc. or one of its subsidiaries.

For the year ended December 31, 2011, contributions to our consolidated revenues from our segments were as follows: TOC 79%, Production Services 9% and Aerial Cameras 12%.

Outdoor Channel Holdings was originally incorporated in Alaska in 1984. On September 8, 2004, we acquired all of the outstanding shares of The Outdoor Channel, Inc. that we did not previously own. Effective September 15, 2004 we reincorporated from Alaska into Delaware. Outdoor Channel Holdings, Inc. wholly owns OC Corporation, a California Corporation, which in turn wholly owns TOC. Outdoor Channel Holdings is also the sole member of 43455 BPD, LLC, the entity that owns the building that houses our broadcast facility. TOC operates Outdoor Channel®, a national television network devoted to traditional outdoor activities such as hunting, fishing and shooting sports, as well as off-road motor sports and other outdoor related lifestyle programming.

On January 12, 2009, we entered into and completed an asset purchase agreement with Winnercomm, Inc., an Oklahoma corporation and wholly owned subsidiary of Winnercomm Holdings, Inc., a Delaware corporation, Cablecam, LLC, an Oklahoma limited liability company, and Skycam, LLC, an Oklahoma limited liability company (collectively, the “Sellers”), pursuant to which we purchased certain assets and assumed certain liabilities of the Sellers and formed Winnercomm, CableCam and SkyCam. Outdoor Channel Holdings wholly owns Winnercomm which in turn wholly owns CableCam and SkyCam.

TOC (79%, 66% and 61% of our consolidated revenues in 2011, 2010 and 2009, respectively)

Outdoor Channel® was established in 1993 and began broadcasting 24 hours a day in May 1994. Since inception, we have been committed to providing excellent programming and customer service to our distribution partners. TOC’s target audience is comprised of sportsmen and outdoor enthusiasts throughout the U.S. As of

4

December 31, 2011, we had relationships or agreements with all of the largest cable and satellite companies, as well as both telephone companies offering video service, in the U.S. According to estimates by Nielsen, Outdoor Channel was subscribed to by approximately 35.4 million households in December 2011.

Nielsen is the leading provider of television audience measurement and advertising information services worldwide, and its estimates and methodology are generally accepted and used in the advertising industry. Please note that the estimate regarding Outdoor Channel’s subscriber base is made by Nielsen Media Research and is theirs alone, and does not represent our opinions, forecasts or predictions. It should not be implied that we endorse nor necessarily concur with such information, simply due to our reference to or distribution of their estimate.

Outdoor Channel Sources of Revenue

Our two predominant sources of revenue at TOC are advertising revenues and subscriber revenues. Advertising revenue is generated from the sale of advertising time on the Outdoor Channel network and on our websites, including advertisements shown during a program (also known as short-form advertising) and infomercials in which the advertisement is the program itself (also known as long-form advertising). Advertising revenue is also generated from fees paid by third-party producers that purchase advertising time in connection with the airing of their programs on Outdoor Channel. Subscriber fees are generated from cable and satellite and telecommunications service providers who pay monthly subscriber fees to us for the right to broadcast our channel. No single customer of ours accounts for greater than 10% of our total revenue. The ability to sell time for commercial announcements and the rates received are primarily dependent on the size and nature of the audience that the network can deliver to the advertiser as well as overall advertiser demand for time on our network.

Advertising Fees

We generate advertising revenues principally from the sale of advertising on our Outdoor Channel network and from the sale of advertising on our websites including outdoorchannel.com, motv.com and downrange.tv.

Short-form Advertising. We sell short-form advertisements on Outdoor Channel for commercial products and services, usually in 30 second increments. The total inventory for our short-form advertising consists of seven minutes per half hour including one minute which is reserved for the local service providers who may preempt the advertisement we insert into the program with a local advertisement. Of the remaining six minutes, we either sell to advertisers for our own account or to third-party producers who then resell this time to advertisers for their own account or use it themselves.

Advertisers purchase from us the one minute of advertising time per half hour that is reserved for the local service providers at a discount understanding that some of the service providers may superimpose their own spots over the advertising that we have inserted in the program, causing these advertisements to be seen by less than all of the viewers of any program. All of this advertising time is sold to direct response advertisers. Direct response advertisers rely on direct appeals to our viewers to purchase products or services from toll-free telephone numbers or websites and generally pay lower rates than national advertisers.

For the advertising time that we retain for our own account, we endeavor to sell this time to national advertisers and their advertising agencies, or endemic advertisers with products or services focused on traditional outdoor activities. The price we are able to charge for this advertising time is dependent on market conditions, perceived desirability of our viewers and, as estimated by Nielsen, the number of households subscribing to Outdoor Channel and actually viewing programs (ratings). If we are unable to sell all of this advertising time to national advertisers or their agencies, or endemic advertisers, we sell the remaining time to direct response advertisers. The majority of our revenue from short-form advertising is a result of arrangements with advertising agencies, for which they take a commission. However, we have relationships with many endemic advertisers who buy directly from us.

5

For the advertising time that we sell to third-party producers, we receive revenue directly from the producers for a portion of the advertising time during their programs and sell for our own account the remaining inventory. The revenue we receive from these third-party producers is generally at a lower rate than we may have received if we were to retain such time and sell it ourselves. The producers then resell this advertising time to others or use this time to advertise their own products or services.

Our advertising revenue tends to reflect seasonal patterns of our endemic advertisers’ advertising demand, which is generally greatest during the third and fourth quarter of each year, driven primarily by the hunting season.

Long-form Advertising. Long form advertisements are infomercials that we typically run for 30 minutes, many of which are during the overnight hours, with some during the weekday morning hours. In the future, we may reduce the programming time used for infomercials by replacing it with traditional outdoor programming.

Website Advertising. We also generate advertising revenue from our websites. We sell advertising on our websites both on a stand-alone basis and as part of advertising packages for Outdoor Channel.

Subscriber Fees

Cable, satellite and telecommunication service providers typically pay monthly subscriber fees to us for the right to broadcast our channel. Our service provider contracts typically range from 1 to 6 years, although some may be shorter, and contain an annual increase in the monthly subscriber fees we charge. Our contracts also contain volume discounts for increased distribution by any one service provider. In order to stimulate distribution growth, we offer a tiered rate card that provides lower subscriber fees for broader carriage on individual systems. This growth incented rate card may cause our average monthly subscriber fee rates to decrease depending on the levels of carriage by the individual cable systems in the future. At present our subscriber fees average approximately $0.05 per subscriber per month. In addition, one of our distributors offers our programming on an a la carte basis, and we charge a fee for those a la carte subscribers based on a revenue sharing arrangement.

Outdoor Channel Programming

We offer our programming in thematic blocks which are nightly programming blocks oriented around the following themes: Mondays — Off-Road Motorsports; Tuesdays — Big Game Hunting; Wednesdays — Shooting Sports; Fridays — Fishing; and Sundays — Big Game Hunting.

We acquire our programming in one of four ways: First, the majority of the shows are “time-buys”, where a third-party production company, retailer or manufacturer, produces a show at its expense and buys a predetermined number of minutes of advertising within each airing on the Outdoor Channel. Such shows generally air three times per week and time-buy producer purchases between 2 and 5 minutes of the available inventory in each airing. Second, we acquire shows from a third-party production company on a “work for hire” basis whereby such programming is produced to the Outdoor Channel’s specifications and we retain all ownership of the show and all ad inventory within all airings of the show. Third, we produce programs in-house, generally through our Winnercomm subsidiary in Tulsa, Oklahoma. Fourth, we license a show from a producer for a fee or for a predetermined amount of advertising inventory provided to such licensor on a barter basis. Ownership of such licensed shows is retained by the licensor. In 2011, there was an average of 89 shows airing on the network during any given month. Programming owned by the Outdoor Channel, including shows produced by Winnercomm and work for hire programming, accounted for approximately 20% of all programming and the balance was made up of “time-buys” or licensed programming. Substantially all of our programming supplied under our “time-buy” contracts allows us exclusive U.S. rights and foreign rights during the term of the licensing agreement.

Outdoor Channel Competition

Our network competes with other television channels for the development and acquisition of content, distribution of our programming, audience viewership and advertising sales. Outdoor Channel competes with

6

other television channels to be included in the offerings of each system provider and for placement in the packaged offerings having the most subscribers. Our ability to secure distribution agreements is necessary to ensure the effective distribution of our programming to our audiences. Our contractual agreements with distributors are renewed or renegotiated from time to time in the ordinary course of business. The ability to secure distribution agreements is dependent upon the production, acquisition and packaging of programming, audience viewership, the marketing and advertising support and incentives provided to distributors, and the prices charged for carriage. In addition, each television channel focusing on a particular form of content competes directly with other channels offering similar programming. In the case of Outdoor Channel, we compete for distribution and for audience viewers with other television networks aimed at our own target audience which consists primarily of males between the ages of 18 and 54. We believe such competitors include NBC Sports Network (formerly Versus), Spike TV, ESPN2 and others. It is possible that these or other competitors, many of which have substantially greater financial and operational resources than us, could revise their programming to offer more traditional outdoor activities such as hunting, fishing, shooting and other topics which are of interest to our viewers.

As Outdoor Channel has become more established, other channels, such as the Sportsman Channel and the Pursuit Channel, have emerged and now offer programming similar to ours and have become our direct competitors. With respect to the sale of advertising time, Outdoor Channel competes with other pay television networks, broadcast networks, local over-the-air television stations, satellite and broadcast radio and other advertising media such as various print media and the internet.

Certain technological advances, including the increased deployment of fiber optic cable, are expected to allow cable systems to continue to expand both their channel and broadband distribution capacities and to increase transmission speeds. Such added capacities could dilute our market share and lead to increased competition for viewers by facilitating the emergence of both additional channels and internet platforms through which viewers could view programming that is similar to that offered by Outdoor Channel.

International Distribution

In 2010, TOC entered into international distribution agreements that allow us to license our programming to third-party foreign operators in parts of Europe, the Middle East, Africa and Asia. We expect to enter into similar distribution agreements for other territories in the future, and while the impact on 2011 operations from our international distribution agreements was insignificant, we expect those revenues to grow over time.

PRODUCTION SERVICES (9%, 23% and 31% of our consolidated revenues in 2011, 2010 and 2009, respectively)

Our Production Services segment is comprised of Winnercomm, which was acquired in January 2009 via an asset purchase agreement.

Winnercomm. Winnercomm produces, develops and markets sports and other outdoor related television programming. Programming produced either for our network or for third parties includes horseracing, rodeo, softball, soccer, college sports, hunting and fishing. Winnercomm markets and sells media advertising and sponsorship opportunities and has sales offices in New York and Tulsa. Winnercomm represents clients for advertising and sponsorship sales including Pro Rodeo Cowboys Association and Amateur Softball Association. Winnercomm also provides website development, management, marketing and maintenance to a range of clients including sports leagues and corporate customers, including U.S. Figure Skating, Breeders’ Cup, LodgeNet, and ESPN.com Horse Racing.

Winnercomm Competition. As a producer of programming, Winnercomm competes with network studios and television production groups, as well as independent producers to win contracts to produce programming. As an advertising and sponsorship representative, Winnercomm competes with other sales representation firms for

7

the rights to market and sell media assets, either on an exclusive or non-exclusive basis. Once selected as sales representative, Winnercomm competes to place advertising with sponsors against television networks, sales representation firms and other media. As a provider of website services, Winnercomm competes against interactive development companies and “in house” teams of prospective clients to win contract-based projects and service agreements.

Production Services Revenues. Production Services revenues are derived from all of the aforementioned services including fees for production services, retainers, commissions, and revenue splits for the sale of sponsorship and advertising, the delivery and maintenance of websites and fees for providing aerial camera equipment and services. Revenue at Production Services is primarily project-based with the majority of these projects generally being scheduled during the second half of the year. Revenues are typically collected once projects have been completed. Consequently, Production Services generally experiences higher revenue recognition during the second half of the year.

AERIAL CAMERAS (12%, 11% and 8% of our consolidated revenues in 2011, 2010 and 2009, respectively)

Our Aerial Cameras segment is comprised of CableCam and SkyCam, which are subsidiaries of Winnercomm and which were acquired as part of our Winnercomm acquisition in January 2009 via an asset purchase agreement.

CableCam and SkyCam. CableCam and SkyCam are companies that design, manufacture and operate suspended mobile aerial camera systems and offers their production services mostly to media network clients. Our cameras capture broadcast quality aerial views of various sporting and entertainment events and have played a significant role in changing the way sports and other entertainment programming are broadcasted both domestically and internationally. During an entertainment or sporting event, the cameras are suspended above the playing or viewing field and are remotely controlled by specially trained personnel hired by each company, who have the ability to move the cameras in up to three dimensions. The majority of CableCam and SkyCam revenues continue to be generated from services provided to broadcast and cable networks airing NFL and NCAA football games. Both companies source proprietary system components from a select group of vendors, and commodity system components from a wide range of vendors. SkyCam and CableCam share joint facilities in Fort Worth, Texas.

CableCam and SkyCam Competition. As a provider of aerial camera equipment and services, our aerial camera entities compete with five to ten providers in the mechanical automation and aerial filming production services market for coverage of entertainment and sporting events both in the U.S. and overseas. SkyCam and CableCam are the largest providers of services in the sports-related aerial filming segment of the market in the U.S., but make up a significantly smaller portion of the worldwide market. For action-oriented events over large areas, an aerial camera is often the only way to put a camera close to the action. While aerial camera equipment is often desired by directors and producers, the systems can be cost prohibitive for smaller production budgets. For this reason, productions often rely on less expensive robotic cameras, track cameras, jib cameras and static cameras. Companies in the industry compete based on price, versatility, the quality of each system’s stability and image quality, the expertise of the personnel trained to operate the systems, the suitability of each system to a particular venue, and the proximity of equipment to the location of a particular event.

Aerial Camera Revenues. Aerial Cameras’ revenues are derived from all of the aforementioned production services. Revenue at Aerial Cameras is primarily project-based with the majority of these projects covering a 2-3 day period and generally being scheduled during the final four months of the calendar year. Consequently, Aerial Cameras generally experiences higher revenue recognition during the second half of the year. Revenues are typically collected once projects have been completed, although a meaningful portion of our revenues are collected in advance based on underlying contractual commitments with certain of our network customers.

8

INTELLECTUAL PROPERTY

Our intellectual property assets principally include copyrights in television programming, websites and other content, patents for our aerial camera systems, trademarks in brands, names and logos, domain names and licenses of intellectual property rights of various kinds. “Outdoor Channel®” is a registered trademark of The Outdoor Channel, Inc., “Winnercomm®” is a registered trademark of Winnercomm, Inc., “Cablecam®” is a registered trademark of CableCam, LLC and “Skycam®” is a registered trademark of SkyCam, LLC. The protection of our brands and content are of primary importance. To protect our intellectual property assets, we rely upon a combination of copyright, trademark, unfair competition, trade secret and Internet/domain name statutes and laws and contract provisions. However, there can be no assurance of the degree to which these measures will be successful in any given case. Moreover, effective intellectual property protection may be either unavailable or limited in certain foreign countries. We seek to limit unauthorized use of our intellectual property through a combination of approaches. However, the steps taken to prevent the infringement by unauthorized third parties of our intellectual property may not work. Third parties may challenge the validity or scope of our intellectual property from time to time, and such challenges could result in the limitation or loss of intellectual property rights. Irrespective of their validity, such claims may result in substantial costs and diversion of resources which could have an adverse effect on our operations.

GOVERNMENT REGULATION

Our operations are subject to and affected by various government regulations, U.S. federal, state and local government authorities, and our international operations are subject to laws and regulations of local countries and international bodies. The operations of cable, satellite and telecommunications service providers, or distributors, are subject to the Communications Act of 1934, as amended, and to regulatory supervision by the Federal Communications Commission (“FCC”). Our uplink facility in Temecula, California is licensed by the FCC and must be operated in conformance with the terms and conditions of that license. The license is also subject to periodic renewal and ongoing regulatory requirements. The rules, regulations, policies and procedures affecting our businesses are constantly subject to change. The following descriptions are summary in nature and do not purport to describe all present and proposed laws and regulations affecting our businesses. Reference should be made to the Communications Act, other legislation, FCC rules and public notices and rulings of the FCC for further information concerning the nature and extent of the FCC’s regulatory authority. FCC laws and regulations are subject to change, and we generally cannot predict whether new legislation, court action or regulations, or a change in the extent of application or enforcement of current laws and regulations, would have an adverse impact on our operations.

Local Cable Regulation

Cable television systems that carry our programming are regulated by municipalities or other local or state government authorities which have the jurisdiction to grant and to assign franchises, and to negotiate generally the terms and conditions of such franchises, including rates for basic service charged to subscribers, except to the extent that such jurisdiction is preempted by federal law. Any such rate regulation could place downward pressure on the potential subscriber fees we can earn.

Effect of “Must-Carry” Requirements

The Cable Act of 1992 imposed “must carry” or “retransmission consent” regulations on cable systems, requiring them to carry the signals of local broadcast television stations. Direct broadcast satellite (“DBS”) systems are also subject to their own must carry rules. The FCC adopted an order requiring cable systems to carry the digital signals of local television stations that have must carry status and to carry the same signal in analog format, or to carry the signal in digital format alone, provided that all subscribers have the necessary equipment to view the broadcast content. The FCC’s implementation of these “must-carry” obligations requires cable and DBS operators to give broadcasters preferential access to channel space. This reduces the amount of channel space that is available for carriage of our network by cable television systems and DBS operators.

9

Congress and the FCC may, in the future, adopt new laws, regulations and policies regarding a wide variety of matters which could affect the Company and Outdoor Channel. We are unable to predict the outcome of future federal legislation, regulation or policies, or the impact of any such laws, regulations or policies on Outdoor Channel’s operations.

Closed Captioning and Advertising Restrictions

Our network must provide closed-captioning of programming for the hearing impaired, and our programming and internet websites must comply with certain limits on advertising.

Obscenity Restrictions

Cable operators and other distributors are prohibited from transmitting obscene programming, and our affiliation agreements generally require us to refrain from including such programming on our network.

Regulation of the Internet

We operate several internet websites which we use to distribute information about and supplement our programs. Internet services are now subject to regulation in the United States relating to the privacy and security of personally identifiable user information and acquisition of personal information from children under 13, including the federal Child Online Protection Act (COPA) and the federal Controlling the Assault of Non-Solicited Pornography and Marketing Act (CAN-SPAM). In addition, a majority of states have enacted laws that impose data security and security breach obligations. Additional federal and state laws and regulations may be adopted with respect to the Internet or other online services, covering such issues as user privacy, child safety, data security, advertising, pricing, content, copyrights and trademarks, access by persons with disabilities, distribution, taxation and characteristics and quality of products and services. In addition, to the extent we offer products and services to online consumers outside the United States, the laws and regulations of foreign jurisdictions, including, without limitation, consumer protection, privacy, advertising, data retention, intellectual property, and content limitations, may impose additional compliance obligations on us.

Other Regulations

In addition to the regulations applicable to the cable television and internet industries in general, we are also subject to various local, state and federal regulations, including, without limitation, regulations promulgated by federal and state environmental, health and labor agencies.

EMPLOYEES

We employed approximately 180 people as of December 31, 2011. None of our personnel are subject to collective bargaining agreements.

FINANCIAL INFORMATION ABOUT SEGMENTS

Information on our revenues, operating income, and identifiable assets appears in Note 12 to the Consolidated Financial Statements included in Item 8 hereof.

AVAILABLE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission. You may read and copy any materials we have filed with the Securities and Exchange Commission, free of charge, at the investor relations section of our website, www.outdoorchannel.com, as soon as reasonably practical after such material is filed with, or furnished to, the SEC. Our corporate governance guidelines, committee charters, code of conduct and ethics, and Board of Directors Code of Conduct are also

10

available on our website. In addition, we will provide, without charge, upon written or oral request, a copy of any or all of the documents referred to above. Requests for such documents should be directed to Attention: General Counsel, 43445 Business Park Drive, Suite 103, Temecula, California 92590 (Telephone: (951) 699-6991). The information included or referred to on our website is not part of this Annual Report on Form 10-K and is not incorporated by reference herein.

Our business and operations are subject to a number of risks and uncertainties, and the following list should not be considered to be a definitive list of all factors that may affect our business, financial condition and future operating results and should be read in conjunction with the risks and uncertainties, including risk factors, contained in our other filings with the Securities and Exchange Commission. Any forward-looking statements made by us are made with the intention of obtaining the benefits of the “safe harbor” provisions of the Securities Litigation Reform Act and a number of factors, including, but not limited to, those discussed below, could cause our actual results and experiences to differ materially from the anticipated results or expectations expressed in any forward-looking statements.

INDUSTRY RISKS AND RISKS RELATING TO OUR BUSINESS

Service providers could discontinue or refrain from carrying Outdoor Channel, or decide to not renew our distribution agreements, which could substantially reduce the number of viewers and harm business and our operating results.

Consolidation among cable and satellite operators has given the largest operators considerable leverage in their relationships with programmers, including us. The success of Outdoor Channel is dependent, in part, on our ability to enter into new carriage agreements and maintain or renew existing agreements or arrangements with, and carriage by, satellite systems, telephone companies, which we refer to as telcos, and cable multiple system operators, which we refer to as “MSO”s, affiliated regional or individual cable systems. Although we currently have arrangements or agreements with, and are being carried by, all the largest MSOs, satellite and telco service providers, having such relationship or agreement with an MSO does not always ensure that an MSO’s affiliated regional or individual cable systems will carry or continue to carry Outdoor Channel or that the satellite or telco service provider will carry our channel. Under our current contracts and arrangements, our subsidiary TOC typically offers the service providers the right to broadcast Outdoor Channel to their subscribers, but not all such contracts or arrangements require that Outdoor Channel be offered to all subscribers of, or any tiers offered by, the service provider or a specific minimum number of subscribers. Because many of our carriage arrangements do not specify on which service levels Outdoor Channel is carried, such as basic versus digital basic, expanded digital or specialty tiers, or in which geographic markets Outdoor Channel will be offered, in many cases we have no assurance that Outdoor Channel will be carried and available to viewers of any particular service provider. In addition, under the terms of some of our agreements, the service providers could decide to discontinue carrying Outdoor Channel. A failure to secure a renewal of our agreements or a renewal on less favorable terms may result in a loss of a substantial number of subscribers, which in turn would reduce our subscriber fees and advertising revenue and may have a material adverse effect on our results of operations and financial position.

If our channel is placed in unpopular program packages by our service providers, or if service fees are increased for our subscribers, the number of viewers of our channel may decline which could harm our business and operating results.

We do not control the channels with which our channel is packaged by providers. The placement by a service provider of our channel in unpopular program packages could reduce or impair the growth of the number of our viewers and subscriber fees paid by service providers to us. In addition, we do not set the prices charged by the service providers to their subscribers when our channel is packaged with other television channels or

11

offered by itself. The prices for the channel packages in which our channel is bundled, or the price for our channel by itself, may be set too high to appeal to individuals who might otherwise be interested in our network. Further, if our channel is bundled by service providers with networks that do not appeal to our viewers or is moved to packages with fewer subscribers, we may lose viewers. These factors may reduce the number of subscribers and/or viewers of our channel, which in turn would reduce our subscriber fees and advertising revenue.

If our viewership declines for any reason, or we fail to develop and distribute popular programs, our advertising and subscriber fee revenues could decrease.

Our viewership is a critical factor affecting both (i) the volume and pricing of advertising revenue that we receive, and (ii) the extent of distribution and subscriber fees we receive under agreements with our distributors. Our advertising revenues are largely dependent on both our ability to consistently create and acquire content and programming that meet the changing preferences of viewers in general and viewers in our target demographic category and our Nielsen ratings, which estimates the number of viewers of Outdoor Channel, thus impacting the level of interest of advertisers and rates we are able to charge. We do not control the methodology used by Nielsen for these estimates, and estimates regarding Outdoor Channel’s subscriber base made by Nielsen is theirs alone and does not represent opinions, forecasts or predictions of Outdoor Channel Holdings or its management. In addition, if Nielsen modifies its methodology or changes the statistical sample it uses for these estimates, such as the demographic characteristics of the households, the size of our subscriber base and our ratings could be negatively affected resulting in a decrease in our advertising revenue.

Our viewership and ratings are also affected by the quality and acceptance of competing programs and other content offered by other networks, the availability of alternative forms of entertainment and leisure time activities, including, general economic conditions, piracy, digital and on-demand distribution and growing competition for consumer discretionary spending. Any decline in our ratings and viewership could cause our advertising revenue to decline and adversely impact our business and operating results. In addition, the number of subscribers to our channel may also decrease, resulting in a decrease in our subscriber fee and advertising revenue.

Expenses relating to programming and production costs are generally increasing and a number of factors can cause cost overruns and delays, and our operating results may be adversely impacted if we are not able to successfully recover the costs of developing, acquiring and producing new programming.

The average cost of programming has increased for the pay TV industry and production companies, and such increases are likely to continue. We plan to build our programming library through the acquisition of long-term broadcasting rights from third-party producers, in-house production and outright acquisition of programming, and this may lead to increases in our programming costs. The development, production and editing of television programming requires a significant amount of capital and there are substantial financial risks inherent in developing and producing television programs. Actual programming and production costs may exceed their budgets. Factors such as labor disputes, death or disability of key spokespersons or program hosts, damage to master tapes and recordings or adverse weather conditions may cause cost overruns and delay or prevent completion of a project. If we are not able to successfully recover the costs of developing or acquiring programming through increased revenues, whether the programming is produced by us or acquired from third-party producers, our business and operating results will be harmed.

If we offer favorable terms or incentives to service providers in order to grow our subscriber base, our operating results may be harmed or your percentage of the Company may be diluted.

Although we currently have plans to offer incentives to service providers in an attempt to increase the number of our subscribers, we may not be able to do so economically or at all. If we are unable to increase the number of our subscribers on a cost-effective basis, or if the benefits of doing so do not materialize, our business and operating results would be harmed. In particular, it may be necessary to reduce our subscriber fees in order to

12

grow or maintain our subscriber base. In addition, if we make any upfront cash payments to service providers for an increase in our subscriber base, our cash flow could be adversely impacted, and we may incur negative cash flow for some time. In addition, if we were to make such upfront cash payments or provide other incentives to service providers, we expect to amortize such amounts ratably over the term of the agreements with the service providers. However, if a service provider terminates any such agreement prior to the expiration of the term of such agreement, then under current accounting rules, we may incur a large expense in the quarter in which the agreement is terminated equal to the remaining un-amortized amounts and our operating results could accordingly be adversely affected. In addition, if we offer equity incentives, the terms and amounts of such equity may not be favorable to us or our stockholders.

We may not be able to grow our subscriber base of Outdoor Channel at a sufficient rate to offset planned increased costs, decreased revenue or at all, and as a result our revenues and profitability may not increase and could decrease.

A major component of our financial growth strategy is based on increasing the number of subscribers to our channel. Growing our subscriber base depends upon many factors, such as the success of our marketing efforts in driving consumer demand for our channel; overall growth in cable, satellite and telco subscribers; the popularity of our programming; our ability to negotiate new carriage agreements, or amendments to, or renewals of, current carriage agreements, and maintenance of existing distribution; plus other factors that are beyond our control. There can be no assurance that we will be able to maintain or increase the subscriber base of our channel on cable, satellite and telco systems or that our current carriage will not decrease as a result of a number of factors or that we will be able to maintain our current subscriber fee rates. In particular, negotiations for new carriage agreements, or amendments to, or renewals of, current carriage agreements, are lengthy and complex, and we are not able to predict with any accuracy when such increases in our subscriber base may occur, if at all, or if we can maintain our current subscriber fee rates. If we are unable to grow our subscriber base or we reduce our subscriber fee rates, our subscriber and advertising revenues may not increase and could decrease. In addition, as we plan and prepare for such projected growth in our subscriber base, we plan to increase our expenses accordingly. If we are not able to increase our revenue to offset these increased expenses, and if our subscriber fee revenue decreases, our profitability could decrease.

We may not be able to secure sufficient or additional advertising revenue, and as a result, our profitability may be negatively impacted.

Our ability to secure additional advertising accounts relating to our Outdoor Channel operations depends upon the size of our audience, the popularity of our programming and the demographics of our viewers, as well as strategies taken by our competitors, strategies taken by advertisers and the relative bargaining power of advertisers. Competition for advertising accounts and related advertising expenditures is intense. We face competition for such advertising expenditures from a variety of sources, including other networks and other media. We cannot assure you that our sponsors will pay advertising rates for commercial air time at levels sufficient for us to make a profit or that we will be able to attract new advertising sponsors or increase advertising revenues. If we are unable to attract advertising accounts in sufficient quantities, our revenues and profitability may be harmed.

In addition, in some projects relating to our recently acquired production capabilities and relationships with television channels other than Outdoor Channel, we may agree to absorb the production costs of a program and retain the rights to sell the advertising in, or sponsorships relating to, such programming. If we are not able to sell sufficient advertising or sponsorships relating to such programs, we may lose money in such project, and our operating results may be significantly harmed.

We may not be able to maintain sufficient revenue relating to our production business to offset its fixed costs, and as a result our profitability may decrease.

Some of the costs relating to our acquired production operations cannot be immediately reduced for various reasons, particularly because some of such costs relate to long-term contracts that we have assumed. As a result,

13

if the projected revenue from such operations is not generated, we may not be able to react quickly enough to decrease our expenses to sufficiently offset the decreased revenue, and as a result we may not be as profitable as we currently project, if at all.

If our goodwill becomes impaired, we will be required to recognize a noncash charge which could have a significant effect on our reported net earnings.

A significant portion of our assets consists of goodwill. We test goodwill for impairment on October 1 of each year, and on an interim date if factors or indicators become apparent that would require an interim test. A significant downward revision in the present value of estimated future cash flows for a reporting unit could result in an impairment of goodwill and a noncash charge would be required. Such a charge could have a significant effect on our reported net earnings.

We may face intellectual property infringement claims that could be time-consuming, costly to defend and result in our loss of significant rights.

Other parties may assert intellectual property infringement claims against us, and our products may infringe the intellectual property rights of third parties. From time to time, we receive letters alleging infringement of intellectual property rights of others. Intellectual property litigation can be expensive and time-consuming and could divert management’s attention from our business. If there is a successful claim of infringement against us, we may be required to pay substantial damages to the party claiming infringement or enter into royalty or license agreements that may not be available on acceptable or desirable terms, if at all. Our failure to license the proprietary rights on a timely basis would harm our business.

Because we expect to become increasingly dependent upon our intellectual property rights, our inability to protect those rights could negatively impact our ability to compete.

We currently produce and own approximately 20% of the programs we air on Outdoor Channel (exclusive of infomercials). In order to build a library of programs and programming distribution rights, we must obtain all of the necessary rights, releases and consents from the parties involved in developing a project or from the owners of the rights in a completed program. There can be no assurance that we will be able to obtain the necessary rights on acceptable terms, or at all or properly maintain and document such rights. We also possess significant proprietary information relating to our aerial camera services. Protecting our intellectual property rights by pursuing those who infringe or dilute our rights can be costly and time consuming. If we are unable to protect our portfolio of patents, trademarks, service marks, copyrighted material and characters, trade names and other intellectual property rights, our business and our ability to compete could be harmed.

If, in our attempt to increase our number of subscribers, we structure favorable terms or incentives with one service provider in a way that would require us to offer the same terms or incentives to all other service providers, our operating results may be harmed.

Many of our existing agreements with service providers contain “most-favored nation” clauses. These clauses typically provide that if we enter into an agreement with another service provider on more favorable terms, these terms must be offered to the existing service provider, subject to some exceptions and conditions. Future agreements with service providers may also contain similar “most-favored nation” clauses. If, in our attempt to increase our number of subscribers, we reduce our subscriber fees or structure launch support fees or other incentives to effectively offer more favorable terms to any service provider, these clauses may require us to offer similar incentives to other service providers or reduce the effective subscriber fee rates that we receive from other service providers, and this could negatively affect our operating results.

14

The market in which we operate is highly competitive, and we may not be able to compete effectively, particularly against competitors with greater financial resources, brand recognition, marketplace presence and relationships with service providers.

We compete for viewers, distribution and advertising with other established pay television and broadcast networks, including NBC Sports (formerly Versus), Spike TV, ESPN2 and others. If these or other competitors, many of which have substantially greater financial and operational resources than us, significantly expand their operations with respect to outdoor-related programming or their market penetration, our business could be harmed. In addition, certain technological advances, including the deployment of fiber optic cable, which are already substantially underway, are expected to allow systems to greatly expand both their current channel and broadband distribution capacities, and increase transmission speed, which could dilute our market share and lead to increased competition for viewers from existing or new programming services. In addition, the satellite and telco service providers generally have more bandwidth capacity than cable service providers allowing them to possibly provide more channels offering the type of programming we offer.

We also compete with television network companies that generally have large subscriber bases and significant investments in, and access to, competitive programming sources. In some cases, we compete with service providers that have the financial and technological resources to create and distribute their own television networks, such as NBC Sports, which is owned and operated by Comcast. In order to compete for subscribers, we may be required to reduce our subscriber fee rates or pay either launch fees or marketing support or both for carriage in certain circumstances in the future which may harm our operating results and margins. We may also issue our securities from time to time in connection with our attempts for broader distribution of Outdoor Channel and the number of such securities could be significant. We compete for advertising sales with other pay television networks, broadcast networks, and local over-the-air television stations. We also compete for advertising sales with satellite and broadcast radio and the print media. We compete with other networks for subscriber fees from, and affiliation agreements with, cable, satellite and telco service providers.

In addition, we face competition in our television production operations. In particular, there are a few other domestic and international aerial camera services with which we compete. If any of these competitors were able to invent improved technology, or we are not able to prevent them from obtaining and using our proprietary technology and trade secrets, our business and operating results, as well as our future growth prospects, could be negatively affected. There can be no assurance that we will be able to compete successfully in the future against existing or new competitors, or that increasing competition will not have a material adverse effect on our business, financial condition or results of operations.

Changes in consumer behavior resulting from new technologies and distribution platforms may impact the performance of our businesses.

Our business is focused on television, and we face emerging competition from other providers of digital media, some of which have greater financial, marketing and other resources than we do. In particular, programming offered over the Internet has become more prevalent as the speed and quality of broadband networks have improved. Providers such as Hulu, Netflix, Apple TV, Amazon and Google TV are aggressively working to establish themselves as alternative providers of video services. These services and the growing availability of online content, coupled with an expanding market for connected devices and internet-connected televisions, may impact our traditional distribution methods for our services and content. Additionally, devices that allow users to view television programs on a time-shifted basis and technologies that enable users to fast-forward or skip programming have caused changes in consumer behavior that may affect the attractiveness of our offerings to advertisers and could therefore adversely affect our revenues. If we cannot ensure that our distribution methods and content are responsive to our target audiences, our business could be adversely affected.

15

Continued consolidation among service providers may harm our business.

Service providers continue to consolidate, making us increasingly dependent on fewer operators. If these operators fail to carry Outdoor Channel, use their increased distribution and bargaining power to negotiate less favorable terms of carriage or to obtain additional volume discounts, our business and operating results would suffer.

Increased competition and demand in price for the carriage of local broadcast networks may limit our ability to add subscribers.

Many of the local broadcast networks that had previously been transmitted free, over-the-air, to the viewers, or provided to the pay television service providers for little to no cost, have recently been demanding substantial increased pricing for the retransmission of their signals by the pay television service providers. If the service providers continue to be required to pay more for the retransmission of such local broadcast networks, this may limit the ability of such service providers to carry other channels such as the Outdoor Channel, thus limiting our ability to add subscribers and possibly even causing a decrease in the number of our subscribers.

Our investments in auction-rate securities are subject to risks which may affect the liquidity of these investments and could cause additional impairment charges.

As of December 31, 2011, our investments in auction-rate securities included $4.9 million of high-grade (at least A3 rated) auction-rate securities comprised of one auction-rate municipal security and one closed-end perpetual preferred auction-rate security. Beginning in February 2008, we were informed that there was insufficient demand at auction for our high-grade auction-rate securities. As a result, these affected securities are currently not liquid, and we could be required to hold them until they are redeemed by the issuer or to maturity. In the event we need to access the funds that are in an illiquid state, we will not be able to do so without a loss of principal, until a future auction on these investments is successful, the securities are redeemed by the issuer or they mature. The market for these investments is presently uncertain. If the credit ratings of the security issuers deteriorate and any decline in market value is determined to be other-than-temporary, we would be required to adjust the carrying value of the investment through an impairment charge.

We could have an aerial camera fall, harming our reputation and possibly causing damage exceeding our liability insurance limits.

The cables or rigging supporting our aerial cameras could fail for a variety of reasons, causing an aerial camera to drop onto the venue in which it is suspended. If such an event were to happen, damages could be significant which may have an adverse effect on our ability to continue our aerial camera business. In addition, if the damages caused by such event exceed our liability and property damage insurance, such an event could have a detrimental effect on our financial resources.

Technologies in the pay television industry are constantly changing, and our failure to acquire or maintain state-of-the-art technology or adapt our business model may harm our business and competitive advantage.

Technology in the video, telecommunications and data services industry is changing rapidly. Many technologies and technological standards are in development and have the potential to significantly transform the ways in which programming is created and transmitted. We cannot accurately predict the effects that implementing new technologies will have on our programming and broadcasting operations. We may be required to incur substantial capital expenditures to implement new technologies, or, if we fail to do so, may face significant new challenges due to technological advances adopted by competitors, which in turn could result in harming our business and operating results.

16

The cable, satellite and telco television industry is subject to substantial governmental regulation for which compliance may increase our costs, hinder our growth and possibly expose us to penalties for failure to comply.

The pay television industry is subject to extensive legislation and regulation at the federal and local levels, and, in some instances, at the state level, and many aspects of such regulation are currently the subject of judicial proceedings and administrative or legislative proposals. Similarly, the satellite television industry is subject to federal regulation. Operating in a regulated industry increases our cost of doing business as a video programmer, and such regulation may in some cases also hinder our ability to increase our distribution. The regulation of programming services is subject to the political process and has been in constant flux over the past decade. Further, material changes in the law and regulatory requirements are difficult to anticipate and our business may be harmed by future legislation, new regulation, deregulation or court decisions interpreting laws and regulations.

The FCC has adopted rules to ensure that pay television subscribers continue to be able to view local broadcast television stations during and after the transition to digital television. In September 2007, the FCC established rules which require operators make local television broadcast programming available to all subscribers. They may do so either by carrying each local station’s digital signal in analog format or in digital format, provided that all subscribers are provided with the necessary equipment to view the station signals. This requirement will remain in effect until February 2012, and possibly longer, depending on a FCC review of the state of technology and the marketplace in the year prior to that date. These broadcast signal carriage requirements could reduce the available capacity on systems to carry channels like Outdoor Channel. We cannot predict how these requirements will affect the Company.

The FCC may adopt rules which would require service providers to make available programming channels on an a la carte basis or as part of packages of “family friendly” programming channels. We cannot predict whether such rules will be adopted or how their adoption would impact our ability to have the Outdoor Channel carried on multichannel programming distribution systems.

A deterioration in general economic conditions along with seasonal increases or decreases in advertising revenue may negatively affect our business.

A slowing economy or recession may impact pay television subscriptions, which could lead to a decrease in our subscription fees and may reduce the rates we can charge for advertising. We derive substantial revenues from the sale of advertising on our network. Expenditures by advertisers tend to be cyclical and seasonal, reflecting overall economic conditions, as well as budgeting and buying patterns. Moreover, seasonal trends are likely to affect our viewership, and consequently, could cause fluctuations in our advertising revenues. For this reason, fluctuations in our revenues and net income could occur from period to period depending upon the availability of advertising revenues and also on economic conditions. Consequently, the results of any one quarter are not necessarily indicative of results for future periods, and our cash flows may not correlate with revenue recognition.

Cable, satellite and telco television programming signals have been stolen or could be stolen in the future, which reduces our potential revenue from subscriber fees and advertising.

The delivery of subscription programming requires the use of conditional access technology to limit access to programming to only those who subscribe to programming and are authorized to view it. Conditional access systems use, among other things, encryption technology to protect the transmitted signal from unauthorized access. It is illegal to create, sell or otherwise distribute software or devices to circumvent conditional access technologies. However, theft of programming has been widely reported, and the access or “smart” cards used in service providers’ conditional access systems have been compromised and could be further compromised in the future. When conditional access systems are compromised, we do not receive the potential subscriber fee revenues from the service providers. Further, measures that could be taken by service providers to limit such

17

theft are not under our control. Piracy of our copyrighted materials could reduce our revenue from subscriber fees and advertising and negatively affect our business and operating results.

Our expansion into international operations has inherent risks, including currency exchange rate fluctuations, possible governmental seizure of property, and our inability or increased costs associated with enforcing our rights, including intellectual property rights.

We have international operations relating to our aerial camera services, and are beginning the distribution of our outdoor programming internationally. In some countries, we may be able to do business only in that country’s currency which may cause us to accept the risk relating to that country’s currency exchange rate. In addition, we may not be able to legally enforce our contractual and property (including but not limited to our intellectual property) rights in such countries, and even if a country is party to an international treaty relating to such legal procedures, the cost of doing so may be prohibitive.

The satellite infrastructure that we use may fail or be preempted by another signal, which could impair our ability to deliver programming to our service providers.

Our ability to deliver programming to service providers, and their subscribers, is dependent upon the satellite equipment and software that we use to work properly to distribute our programming. If this satellite system fails, or a signal with a higher priority replaces our signal, which is determined by our agreement with the owner of the satellite, we could lose our signal for a period of time. A loss of our signal could harm our reputation and reduce our revenues and profits.

RISKS RELATED TO INVESTMENT IN OUR COMMON STOCK

Some of our existing stockholders can exert control over us and may not make decisions that are in the best interests of all stockholders.

Our current officers, directors and greater than 5% stockholders together currently control a very high percentage of our outstanding common stock. As a result, these stockholders, acting together, may be able to exert significant influence over all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. In addition, this concentration of ownership may delay or prevent a change in control of our company, even when a change may be in the best interests of stockholders. In addition, the interests of these stockholders may not always coincide with our interests as a company or the interests of other stockholders. Accordingly, these stockholders could cause us to enter into transactions or agreements that you would not approve.

The market price of our common stock has been and may continue to be subject to wide fluctuations.

Our stock has historically been and continues to be traded at relatively low volumes and therefore has been subject to price volatility. Various factors contribute to the volatility of our stock price, including, for example, low trading volume, quarterly variations in our financial results, increased competition and general economic and market conditions. While we cannot predict the individual effect that these factors may have on the market price of our common stock, these factors, either individually or in the aggregate, could result in significant volatility in our stock price during any given period of time. There can be no assurance that a more active trading market in our stock will develop. As a result, relatively small trades may have a significant impact on the price of our common stock. Moreover, companies that have experienced volatility in the market price of their stock often are subject to securities class action litigation. If we were the subject of such litigation, it could result in substantial costs and divert management’s attention and resources.

We may be unable to access capital, or offer equity as an incentive for increased subscribers or for acquisitions, on acceptable terms to fund our future growth and operations.

Our future capital and subscriber growth requirements will depend on numerous factors, including the success of our efforts to increase advertising revenues, the amount of resources devoted to increasing distribution

18

of Outdoor Channel, acquiring and producing programming and our aerial camera business. As a result, we could be required to raise substantial additional capital through debt or equity financing or offer equity as an incentive for increased distribution or in connection with an acquisition. To the extent that we raise additional capital through the sale of equity or convertible debt securities, or offer equity incentives for subscriber growth or acquisitions, the issuance of such securities could result in dilution to existing stockholders. If we raise additional capital through the issuance of debt securities, the debt securities would have rights, preferences and privileges senior to holders of common stock and the terms of such debt could impose restrictions on our operations. We cannot assure you that additional capital, if required, will be available on acceptable terms, or at all. If we are unable to obtain additional capital, or offer equity incentives for subscriber growth or acquisitions, our current business strategies and plans and ability to fund future operations may be harmed.

Anti-takeover provisions in our certificate of incorporation, our bylaws and under Delaware law may enable our incumbent management to retain control of us and discourage or prevent a change of control that may be beneficial to our stockholders.

Provisions of Delaware law, our certificate of incorporation and bylaws could discourage, delay or prevent a merger, acquisition or other change in control that stockholders may consider favorable, including transactions in which you might otherwise receive a premium for your shares. These provisions also could limit the price that investors might be willing to pay in the future for shares of our common stock, thereby depressing the market price of our common stock. Furthermore, these provisions could prevent attempts by our stockholders to replace or remove our management. These provisions:

| • | allow the authorized number of directors to be changed only by resolution of our board of directors; |

| • | establish a classified board of directors, providing that not all members of the board be elected at one time; |

| • | require a 66 2/3% stockholder vote to remove a director, and only for cause; |

| • | authorize our board of directors to issue without stockholder approval blank check preferred stock that, if issued, could operate as a “poison pill” to dilute the stock ownership of a potential hostile acquirer to prevent an acquisition that is not approved by our board of directors; |

| • | require that stockholder actions must be effected at a duly called stockholder meeting and prohibit stockholder action by written consent; |

| • | establish advance notice requirements for stockholder nominations to our board of directors or for stockholder proposals that can be acted on at stockholder meetings; |

| • | except as provided by law, allow only our board of directors to call a special meeting of the stockholders; and |

| • | require a 66 2/3% stockholder vote to amend our certificate of incorporation or bylaws. |

In addition, because we are incorporated in Delaware, we are governed by the provisions of Section 203 of the Delaware General Corporation Law, which may, unless certain criteria are met, prohibit large stockholders, in particular those owning 15% or more of our outstanding voting stock, from merging or combining with us for a prescribed period of time.

Future issuance by us of preferred shares could adversely affect the holders of existing shares, and therefore reduce the value of existing shares.

We are authorized to issue up to 25,000,000 shares of preferred stock. The issuance of any preferred stock could adversely affect the rights of the holders of shares of our common stock, and therefore reduce the value of such shares. No assurance can be given that we will not issue shares of preferred stock in the future.

19

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

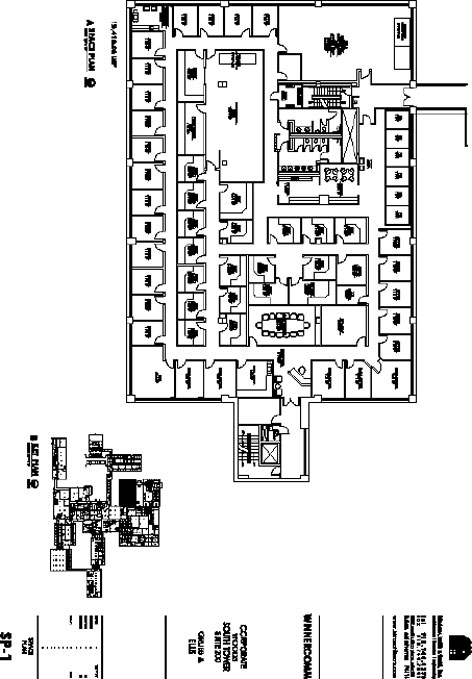

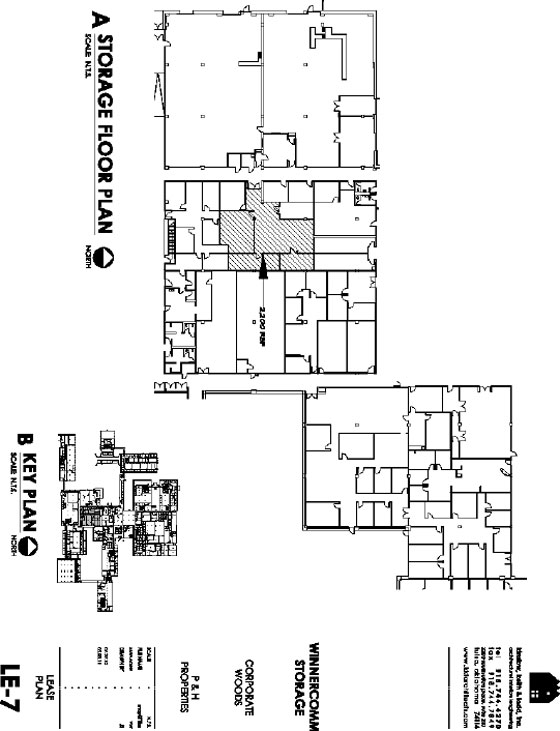

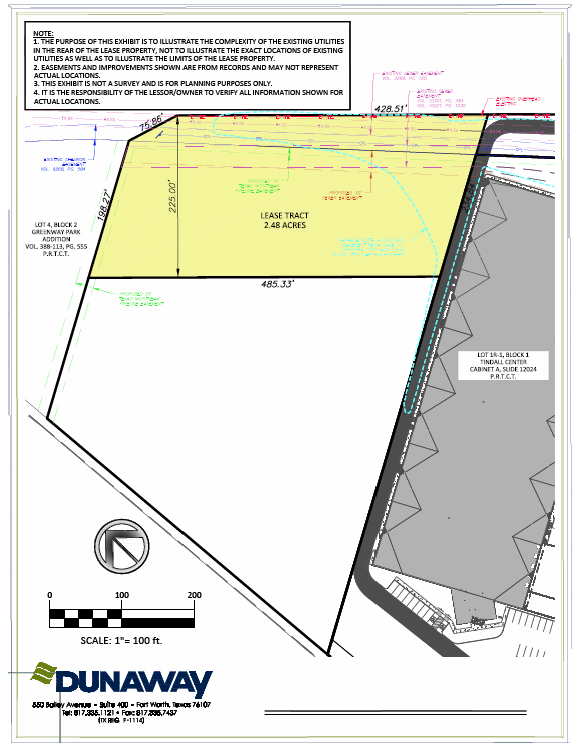

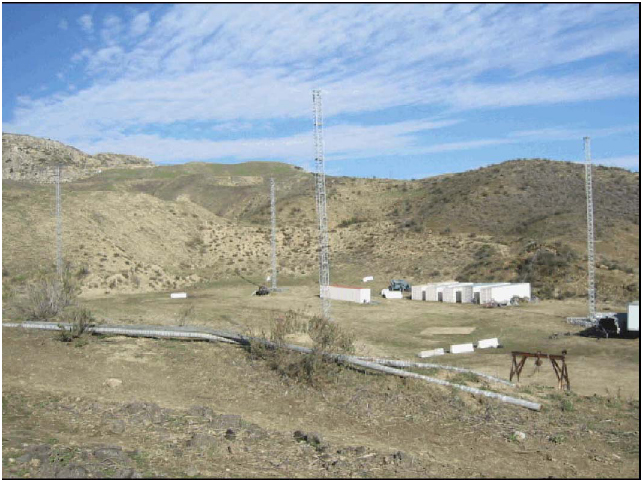

We own a building comprising approximately 36,000 square feet, including 23,000 square feet of office space and 13,000 square feet of warehouse space, located at 43455 Business Park Drive in Temecula, California. We lease approximately 19,000 square feet of commercial property located at 43445 Business Park Drive in Temecula, California. We lease approximately 17,000 square feet of commercial office space located at 4500 S. 129th East Avenue in Tulsa, Oklahoma. We lease, but no longer occupy, approximately 33,000 square feet of warehouse space located at 1501 SW Expressway Drive in Broken Arrow, Oklahoma. We lease approximately 4,000 square feet of office space and approximately 41,000 square feet of warehouse space located at 630 North Freeway in Fort Worth, Texas. We lease executive suite office space at 415 N. La Salle Street in Chicago, Illinois, 130 W 42nd Street in New York, New York and 164 Mason Street in Greenwich, CT. The property located at 43445 Business Park Drive is currently used as our headquarters. The property located at 43455 Business Park Drive houses our broadcast facility. The property located in Tulsa houses our Winnercomm production facility. The property located in Fort Worth houses our SkyCam and CableCam operations. The property located in Greenwich is used as remote executive office space. The properties located in Chicago and New York are used as remote sales offices.

On July 27, 2011, a complaint was filed in the U.S. District Court, Northern District of Texas, by Ewell E. Parker, Jr. against Outdoor Channel Holdings, Inc., The Outdoor Channel, Inc. and a third party production company known as Reel In The Outdoors, Ltd. The complaint alleges contributory copyright infringement against Outdoor Channel Holdings, Inc. and The Outdoor Channel, Inc. This complaint seeks aggregate general damages in excess of $75,000 plus other indeterminable amounts, fees and expenses.

We received a favorable jury verdict on September 2, 2011 regarding our previously disclosed litigation by SkyCam, LLC against ActionCam, LLC and a former employee of SkyCam, LLC, seeking damages for unfair competition, false designation of origin, copyright infringement, misappropriation of trade secrets, breach of written contract and unfair competition. The jury found that the former employee of SkyCam breached his separation agreement and that he, along with ActionCam, misappropriated SkyCam’s trade secrets and engaged in unfair competition. The jury also determined that by clear and convincing evidence, both the former employee and ActionCam were willful and malicious and acted with a reckless disregard of the rights of others. Actual and punitive damages were awarded to SkyCam by the jury, although a final judgment and order has not yet been entered in this case. On September 13, 2011, ActionCam, LLC withdrew its counterclaim with prejudice against SkyCam LLC and its third-party complaints against Outdoor Channel Holdings, Inc. and Winnercomm, Inc. On December 22 and 23, 2011, the court scheduled a bifurcated bench trial related to SkyCam, LLC’s claims against ActionCam, LLC for patent assignment rights and injunctive relief. The judge has not yet issued his ruling with respect to the bifurcated trial.

From time to time we are involved in litigation as both plaintiff and defendant arising in the ordinary course of business. In the opinion of management, the results of any pending litigation should not have a material adverse effect on our consolidated financial position or operating results.

ITEM 4. MINE SAFETY DISCLOSURES.

Not Applicable.

20

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Market Information

The following table sets forth the high and low closing prices of our common stock as reported on The Nasdaq Global Market for the periods indicated.

| High | Low | |||||||

| 2011 |

||||||||

| First Quarter |

8.45 | 6.87 | ||||||

| Second Quarter |

7.50 | 5.66 | ||||||

| Third Quarter |

7.35 | 5.72 | ||||||

| Fourth Quarter |

7.56 | 5.18 | ||||||

| 2010 |

||||||||

| First Quarter |

6.77 | 5.02 | ||||||

| Second Quarter |

7.14 | 4.48 | ||||||

| Third Quarter |

6.01 | 4.58 | ||||||

| Fourth Quarter |

7.17 | 5.20 | ||||||

As of December 31, 2011, there were approximately 593 holders of record of our common stock.

The information under the principal heading “Securities Authorized for Issuance under the Equity Compensation Plans” is included in our Proxy Statement relating to our 2012 Annual Meeting of Stockholders and is incorporated herein by reference.

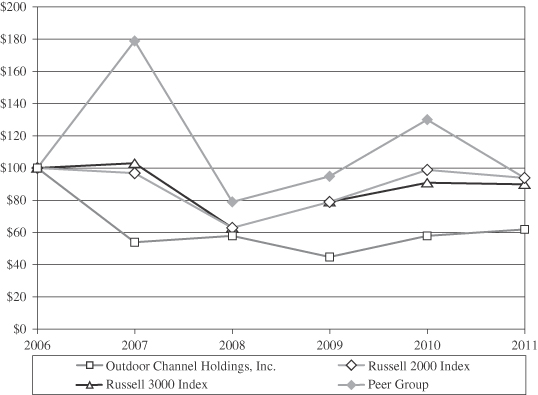

DIVIDEND POLICY