UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended

June 30, 2015

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period From

(Not Applicable)

Commission File Number 001-36636

CITIZENS FINANCIAL GROUP, INC.

(Exact name of the registrant as specified in its charter)

Delaware | 05-0412693 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |

One Citizens Plaza, Providence, RI 02903

(Address of principal executive offices, including zip code)

(401) 456-7000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer (Do not check if a smaller reporting company) [X] Smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [X] No

There were 527,534,073 shares of Registrant’s common stock ($0.01 par value) outstanding on August 3, 2015.

| ||||

Table of Contents | ||||

Page | ||||

1

CITIZENS FINANCIAL GROUP, INC.

GLOSSARY OF ACRONYMS AND TERMS

The following listing provides a comprehensive reference of common acronyms and terms we regularly use in our financial reporting:

AFS | Available for Sale | |

ALLL | Allowance for Loan and Lease Losses | |

AOCI | Accumulated Other Comprehensive Income | |

ASU | Accounting Standards Update | |

ATM | Automatic Teller Machine | |

BHC | Bank Holding Company | |

bps | Basis Points | |

C&I | Commercial and Industrial | |

Capital Plan Rule | Federal Reserve’s Regulation Y Capital Plan Rule | |

CBNA | Citizens Bank, N.A. | |

CBPA | Citizens Bank of Pennsylvania | |

CCAR | Comprehensive Capital Analysis and Review | |

CCO | Chief Credit Officer | |

CET1 | Common Equity Tier 1 | |

CEO | Chief Executive Officer | |

CFO | Chief Financial Officer | |

Citizens or CFG or the Company | Citizens Financial Group, Inc. and its Subsidiaries | |

CLTV | Combined Loan-to-Value | |

CMO | Collateralized Mortgage Obligation | |

CRE | Commercial Real Estate | |

CRO | Chief Risk Officer | |

DFAST | Dodd-Frank Act Stress Test | |

Dodd-Frank Act | The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 | |

EPS | Earnings Per Share | |

ESPP | Employee Stock Purchase Program | |

ERISA | Employee Retirement Income Security Act of 1974 | |

Fannie Mae (FNMA) | Federal National Mortgage Association | |

FASB | Financial Accounting Standards Board | |

FDIC | Federal Deposit Insurance Corporation | |

FHLB | Federal Home Loan Bank | |

FICO | Fair Isaac Corporation (credit rating) | |

FRB | Federal Reserve Bank | |

FRBG | Federal Reserve Board of Governors | |

Freddie Mac (FHLMC) | Federal Home Loan Mortgage Corporation | |

FTP | Funds Transfer Pricing | |

GAAP | Accounting Principles Generally Accepted in the United States of America | |

GDP | Gross Domestic Product | |

Ginnie Mae (GNMA) | Government National Mortgage Association | |

HELOC | Home Equity Line of Credit | |

HTM | Held To Maturity | |

IPO | Initial Public Offering | |

LCR | Liquidity Coverage Ratio | |

2

CITIZENS FINANCIAL GROUP, INC.

LGD | Loss Given Default | |

LIBOR | London Interbank Offered Rate | |

LIHTC | Low Income Housing Tax Credit | |

LTV | Loan-to-Value | |

MBS | Mortgage-Backed Securities | |

MD&A | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

MSR | Mortgage Servicing Right | |

NSFR | Net Stable Funding Ratio | |

OCC | Office of the Comptroller of the Currency | |

OCI | Other Comprehensive Income | |

OIS | Overnight Index Swap | |

OTC | Over the Counter | |

PD | Probability of Default | |

peers or peer banks or peer regional banks | BB&T, Comerica, Fifth Third, KeyCorp, M&T, PNC, Regions, SunTrust and U.S. Bancorp | |

RBS | The Royal Bank of Scotland Group plc or any of its subsidiaries | |

ROTCE | Return on Average Tangible Common Equity | |

RPA | Risk Participation Agreement | |

RWA | Risk-weighted Assets | |

SBO | Serviced by Others loan portfolio | |

SVaR | Stress Value-at-Risk | |

TDR | Troubled Debt Restructuring | |

VaR | Value-at-Risk | |

3

CITIZENS FINANCIAL GROUP, INC.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Page | ||

4

CITIZENS FINANCIAL GROUP, INC.

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(in millions, except share data) | June 30, 2015 | December 31, 2014 | |||||

ASSETS: | |||||||

Cash and due from banks | $961 | $1,171 | |||||

Interest-bearing cash and due from banks | 1,908 | 2,105 | |||||

Interest-bearing deposits in banks | 186 | 370 | |||||

Securities available for sale, at fair value | 18,662 | 18,656 | |||||

Securities held to maturity (fair value of $5,611 and $5,193, respectively) | 5,567 | 5,148 | |||||

Other investment securities | 866 | 872 | |||||

Loans held for sale, at fair value | 397 | 256 | |||||

Other loans held for sale | 300 | 25 | |||||

Loans and leases | 96,538 | 93,410 | |||||

Less: Allowance for loan and lease losses | 1,201 | 1,195 | |||||

Net loans and leases | 95,337 | 92,215 | |||||

Derivative assets (related party balances of $36 and $1, respectively) | 665 | 629 | |||||

Premises and equipment, net | 580 | 595 | |||||

Bank-owned life insurance | 1,543 | 1,527 | |||||

Goodwill | 6,876 | 6,876 | |||||

Due from broker | 939 | — | |||||

Other assets (related party balances of $5 and $7, respectively) | 2,464 | 2,412 | |||||

TOTAL ASSETS | $137,251 | $132,857 | |||||

LIABILITIES AND STOCKHOLDERS’ EQUITY: | |||||||

LIABILITIES: | |||||||

Deposits: | |||||||

Noninterest-bearing | $26,678 | $26,086 | |||||

Interest-bearing (related party balances of $5 and $5, respectively) | 73,937 | 69,621 | |||||

Total deposits | 100,615 | 95,707 | |||||

Federal funds purchased and securities sold under agreements to repurchase | 3,784 | 4,276 | |||||

Other short-term borrowed funds | 6,762 | 6,253 | |||||

Derivative liabilities (related party balances of $300 and $387, respectively) | 556 | 612 | |||||

Deferred taxes, net | 558 | 493 | |||||

Long-term borrowed funds (related party balances of $2,000 and $2,000, respectively) | 3,890 | 4,642 | |||||

Other liabilities (related party balances of $29 and $30, respectively) | 1,500 | 1,606 | |||||

TOTAL LIABILITIES | $117,665 | $113,589 | |||||

Contingencies (refer to Note 13) | |||||||

STOCKHOLDERS’ EQUITY: | |||||||

Preferred stock, $25.00 par value, authorized 100,000,000 shares: | |||||||

Series A, non-cumulative perpetual, $25.00 par value (liquidation preference $1,000), 250,000 shares authorized and issued net of issuance costs and related premium at June 30, 2015, and no shares outstanding at December 31, 2014 | $247 | $— | |||||

Common stock: | |||||||

$0.01 par value, 1,000,000,000 shares authorized, 562,838,179 shares issued and 537,149,717 shares outstanding at June 30, 2015 and 1,000,000,000 shares authorized, 560,262,638 shares issued and 545,884,519 shares outstanding at December 31, 2014 | 6 | 6 | |||||

Additional paid-in capital | 18,714 | 18,676 | |||||

Retained earnings | 1,585 | 1,294 | |||||

Treasury Stock, at cost, 25,688,462 and 14,378,119 shares at June 30, 2015 and December 31, 2014, respectively | (607 | ) | (336 | ) | |||

Accumulated other comprehensive loss | (359 | ) | (372 | ) | |||

TOTAL STOCKHOLDERS’ EQUITY | $19,586 | $19,268 | |||||

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $137,251 | $132,857 | |||||

The accompanying Notes to unaudited interim Consolidated Financial Statements are an integral part of these statements.

5

CITIZENS FINANCIAL GROUP, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||

(in millions, except share and per-share data) | 2015 | 2014 | 2015 | 2014 | ||||||||

INTEREST INCOME: | ||||||||||||

Interest and fees on loans and leases (related party balances of $17, $18, $35 and $36, respectively) | $790 | $751 | $1,569 | $1,481 | ||||||||

Interest and fees on loans held for sale, at fair value | 2 | 1 | 3 | 2 | ||||||||

Interest and fees on other loans held for sale | 4 | 10 | 6 | 22 | ||||||||

Investment securities | 155 | 154 | 314 | 303 | ||||||||

Interest-bearing deposits in banks | 1 | 1 | 2 | 2 | ||||||||

Total interest income | 952 | 917 | 1,894 | 1,810 | ||||||||

INTEREST EXPENSE: | ||||||||||||

Deposits | 60 | 34 | 112 | 67 | ||||||||

Deposits held for sale | — | 2 | — | 4 | ||||||||

Federal funds purchased and securities sold under agreements to repurchase (related party balances of ($1), $0, $4 and $13, respectively) | 2 | 1 | 9 | 16 | ||||||||

Other short-term borrowed funds (related party balances of $15, $28, $25 and $44, respectively) | 19 | 30 | 34 | 49 | ||||||||

Long-term borrowed funds (related party balances of $20, $13, $40 and $25, respectively) | 31 | 17 | 63 | 33 | ||||||||

Total interest expense | 112 | 84 | 218 | 169 | ||||||||

Net interest income | 840 | 833 | 1,676 | 1,641 | ||||||||

Provision for credit losses | 77 | 49 | 135 | 170 | ||||||||

Net interest income after provision for credit losses | 763 | 784 | 1,541 | 1,471 | ||||||||

NONINTEREST INCOME: | ||||||||||||

Service charges and fees (related party balances of $1, $1, $2 and $3, respectively) | 139 | 147 | 274 | 286 | ||||||||

Card fees | 60 | 61 | 112 | 117 | ||||||||

Trust and investment services fees | 41 | 42 | 77 | 81 | ||||||||

Mortgage banking fees | 30 | 14 | 63 | 34 | ||||||||

Capital markets fees (related party balances of $3, $2, $6 and $5, respectively) | 30 | 26 | 52 | 44 | ||||||||

Foreign exchange and trade finance fees (related party balances of ($19), ($1), $16 and ($7), respectively) | 22 | 22 | 45 | 44 | ||||||||

Bank-owned life insurance income | 14 | 12 | 26 | 23 | ||||||||

Securities gains, net | 9 | — | 17 | 25 | ||||||||

Net impairment losses recognized in earnings | (2 | ) | (2 | ) | (3 | ) | (6 | ) | ||||

Other income (related party balances of $18, ($82), ($50) and ($135), respectively) | 17 | 318 | 44 | 350 | ||||||||

Total noninterest income | 360 | 640 | 707 | 998 | ||||||||

NONINTEREST EXPENSE: | ||||||||||||

Salaries and employee benefits | 411 | 467 | 830 | 872 | ||||||||

Outside services (related party balances of $3, $8, $5 and $16, respectively) | 99 | 125 | 178 | 208 | ||||||||

Occupancy (related party balances of $1, $0, $1 and $0, respectively) | 90 | 87 | 170 | 168 | ||||||||

Equipment expense | 65 | 65 | 128 | 129 | ||||||||

Amortization of software | 37 | 33 | 73 | 64 | ||||||||

Other operating expense | 139 | 171 | 272 | 317 | ||||||||

Total noninterest expense | 841 | 948 | 1,651 | 1,758 | ||||||||

Income before income tax expense | 282 | 476 | 597 | 711 | ||||||||

Income tax expense | 92 | 163 | 198 | 232 | ||||||||

NET INCOME | $190 | $313 | $399 | $479 | ||||||||

Net income available to common stockholders | $190 | $313 | $399 | $479 | ||||||||

Weighted-average common shares outstanding: | ||||||||||||

Basic | 537,729,248 | 559,998,324 | 541,986,653 | 559,998,324 | ||||||||

Diluted | 539,909,366 | 559,998,324 | 544,804,268 | 559,998,324 | ||||||||

Per common share information: | ||||||||||||

Basic earnings | $0.35 | $0.56 | $0.74 | $0.86 | ||||||||

Diluted earnings | 0.35 | 0.56 | 0.73 | 0.86 | ||||||||

Dividends declared and paid | 0.10 | 0.61 | 0.20 | 0.66 | ||||||||

The accompanying Notes to unaudited interim Consolidated Financial Statements are an integral part of these statements.

6

CITIZENS FINANCIAL GROUP, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||

(in millions) | 2015 | 2014 | 2015 | 2014 | |||||||||

Net income | $190 | $313 | $399 | $479 | |||||||||

Other comprehensive income (loss): | |||||||||||||

Net unrealized derivative instrument gains (losses) arising during the periods, net of income taxes of ($3), $36, $36 and $70, respectively | (5 | ) | 61 | 60 | 120 | ||||||||

Reclassification adjustment for net derivative (losses) gains included in net income, net of income taxes of ($1), $3, ($2) and $7, respectively | (2 | ) | 6 | (4 | ) | 13 | |||||||

Net unrealized securities available for sale (losses) gains arising during the periods, net of income taxes of ($66), $68, ($12) and $109, respectively | (110 | ) | 117 | (20 | ) | 188 | |||||||

Other-than-temporary impairment not recognized in earnings on securities, net of income taxes of $0, ($1), ($11) and ($12), respectively | 1 | (2 | ) | (18 | ) | (21 | ) | ||||||

Reclassification of net securities gains to net income, net of income taxes of ($2), $0, ($5) and ($7), respectively | (5 | ) | 2 | (9 | ) | (12 | ) | ||||||

Defined benefit pension plans: | |||||||||||||

Amortization of actuarial loss, net of income taxes $2, $0, $3 and $1, respectively | 2 | 1 | 4 | 2 | |||||||||

Total other comprehensive income (loss), net of income taxes | (119 | ) | 185 | 13 | 290 | ||||||||

Total comprehensive income | $71 | $498 | $412 | $769 | |||||||||

The accompanying Notes to unaudited interim Consolidated Financial Statements are an integral part of these statements.

7

CITIZENS FINANCIAL GROUP, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (UNAUDITED)

Preferred Stock | Common Stock | Additional Paid-in Capital | Retained Earnings | Treasury Stock, at Cost | Accumulated Other Comprehensive Income (Loss) | Total | |||||||||||||||||||

(in millions) | Shares | Amount | Shares | Amount | |||||||||||||||||||||

Balance at January 1, 2014 | — | $— | 560 | $6 | $18,603 | $1,235 | $— | ($648 | ) | $19,196 | |||||||||||||||

Dividends to RBS | — | — | — | — | — | (35 | ) | — | — | (35 | ) | ||||||||||||||

Dividends to RBS — exchange transactions | — | — | — | — | — | (333 | ) | — | — | (333 | ) | ||||||||||||||

Total comprehensive income: | |||||||||||||||||||||||||

Net income | — | — | — | — | — | 479 | — | — | 479 | ||||||||||||||||

Other comprehensive income | — | — | — | — | — | — | — | 290 | 290 | ||||||||||||||||

Total comprehensive income | — | — | — | — | — | 479 | — | 290 | 769 | ||||||||||||||||

Balance at June 30, 2014 | — | $— | 560 | $6 | $18,603 | $1,346 | $— | ($358 | ) | $19,597 | |||||||||||||||

Balance at January 1, 2015 | — | $— | 546 | $6 | $18,676 | $1,294 | ($336 | ) | ($372 | ) | $19,268 | ||||||||||||||

Dividends to common stockholders | — | — | — | — | — | (48 | ) | — | — | (48 | ) | ||||||||||||||

Dividends to RBS | — | — | — | — | — | (60 | ) | — | — | (60 | ) | ||||||||||||||

Issuance of preferred stock | — | 247 | — | — | — | — | — | — | 247 | ||||||||||||||||

Treasury stock purchased | — | — | (10 | ) | — | — | — | (250 | ) | — | (250 | ) | |||||||||||||

Share-based compensation plans | — | — | 1 | — | 34 | — | (21 | ) | — | 13 | |||||||||||||||

Employee stock purchase plan shares issued | — | — | — | — | 4 | — | — | — | 4 | ||||||||||||||||

Total comprehensive income: | |||||||||||||||||||||||||

Net income | — | — | — | — | — | 399 | — | — | 399 | ||||||||||||||||

Other comprehensive income | — | — | — | — | — | — | — | 13 | 13 | ||||||||||||||||

Total comprehensive income | — | — | — | — | — | 399 | — | 13 | 412 | ||||||||||||||||

Balance at June 30, 2015 | — | $247 | 537 | $6 | $18,714 | $1,585 | ($607 | ) | ($359 | ) | $19,586 | ||||||||||||||

The accompanying Notes to unaudited interim Consolidated Financial Statements are an integral part of these statements.

8

CITIZENS FINANCIAL GROUP, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

Six Months Ended June 30, | |||||||

(in millions) | 2015 | 2014 | |||||

OPERATING ACTIVITIES | |||||||

Net income | $399 | $479 | |||||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Provision for credit losses | 135 | 170 | |||||

Originations of mortgage loans held for sale | (1,182 | ) | (684 | ) | |||

Proceeds from sales of mortgage loans held for sale | 1,111 | 688 | |||||

Purchases of commercial loans held for sale | (632 | ) | — | ||||

Proceeds from sales of commercial loans held for sale | 594 | — | |||||

Amortization of terminated cash flow hedges (related party balances of $9 and $12, respectively) | 9 | 24 | |||||

Depreciation, amortization and accretion | 234 | 196 | |||||

Mortgage servicing rights valuation recovery | (7 | ) | (3 | ) | |||

Securities impairment | 3 | 6 | |||||

Deferred income taxes | 56 | 36 | |||||

Share-based compensation | 15 | 19 | |||||

Loss on disposal/impairment of premises and equipment | — | 11 | |||||

Loss on sale of other branch assets held for sale | — | 9 | |||||

Gain on sales of: | |||||||

Debt securities available for sale | (17 | ) | (25 | ) | |||

Marketable equity securities available for sale | (3 | ) | — | ||||

Other loans held for sale | — | (11 | ) | ||||

Deposits held for sale | — | (286 | ) | ||||

(Increase) decrease in other assets (related party balances of ($34) and $47, respectively) | (138 | ) | 57 | ||||

(Decrease) increase in other liabilities (related party balances of ($88) and ($147), respectively) | (62 | ) | 335 | ||||

Net cash provided by operating activities | 515 | 1,021 | |||||

INVESTING ACTIVITIES | |||||||

Investment securities: | |||||||

Purchases of securities available for sale | (4,089 | ) | (4,318 | ) | |||

Proceeds from maturities and paydowns of securities available for sale | 1,804 | 1,421 | |||||

Proceeds from sales of securities available for sale | 1,251 | 711 | |||||

Purchases of other investment securities | (14 | ) | (68 | ) | |||

Proceeds from sales of other investment securities | 20 | 55 | |||||

Purchases of securities held to maturity | (811 | ) | (1,174 | ) | |||

Proceeds from maturities and paydowns of securities held to maturity | 394 | 120 | |||||

Net decrease (increase) in interest-bearing deposits in banks | 184 | (76 | ) | ||||

Net increase in loans and leases | (3,573 | ) | (2,171 | ) | |||

Net increase in bank-owned life insurance | (16 | ) | (22 | ) | |||

Premises and equipment: | |||||||

Purchases | (43 | ) | (37 | ) | |||

Proceeds from sales | 15 | 29 | |||||

Capitalization of software | (92 | ) | (80 | ) | |||

Net cash used in investing activities | (4,970 | ) | (5,610 | ) | |||

FINANCING ACTIVITIES | |||||||

Net increase (decrease) in deposits | 4,908 | (238 | ) | ||||

Net (decrease) increase in federal funds purchased and securities sold under agreements to repurchase | (492 | ) | 2,016 | ||||

Net (decrease) increase in other short-term borrowed funds | (251 | ) | 5,450 | ||||

Proceeds from issuance of long-term borrowed funds (related party balances of $0 and $333, respectively) | — | 333 | |||||

Repayments of long-term borrowed funds | (6 | ) | (5 | ) | |||

Treasury stock purchased | (250 | ) | — | ||||

Net proceeds from issuance of preferred stock | 247 | — | |||||

Dividends declared and paid to common stockholders | (48 | ) | — | ||||

Dividends declared and paid to RBS | (60 | ) | (368 | ) | |||

Net cash provided by financing activities | 4,048 | 7,188 | |||||

(Decrease) increase in cash and cash equivalents | (407 | ) | 2,599 | ||||

Cash and cash equivalents at beginning of period | 3,276 | 2,757 | |||||

Cash and cash equivalents at end of period | $2,869 | $5,356 | |||||

The accompanying Notes to unaudited interim Consolidated Financial Statements are an integral part of these statements.

9

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 1 - BASIS OF PRESENTATION

Basis of Presentation

The unaudited interim Consolidated Financial Statements, including the Notes thereto of Citizens Financial Group, Inc., have been prepared in accordance with GAAP interim reporting requirements, and therefore do not include all information and Notes included in the audited Consolidated Financial Statements in conformity with GAAP. These unaudited interim Consolidated Financial Statements and Notes thereto should be read in conjunction with the Company’s audited Consolidated Financial Statements and accompanying Notes included in the Company’s Form 10-K for the year ended December 31, 2014. The Company is an indirect subsidiary of The Royal Bank of Scotland Group plc. The Company’s principal business activity is banking, conducted through its subsidiaries, Citizens Bank, N.A. and Citizens Bank of Pennsylvania.

The unaudited interim Consolidated Financial Statements include all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the results for the interim periods. The results for interim periods are not necessarily indicative of results for a full year.

On August 22, 2014, the Company’s Board of Directors declared a 165,582-for-1 stock split. Except for the amount of authorized shares and par value, all references to share and per share amounts in the unaudited interim Consolidated Financial Statements and accompanying Notes have been restated to reflect the stock split.

Certain prior period amounts have been reclassified to conform to current period presentation. These reclassifications had no effect on net income, total comprehensive income, total assets or total stockholders’ equity as previously reported.

Recent Accounting Pronouncements

In April 2015, the FASB issued ASU No. 2015-05 “Intangibles - Goodwill and Other - Internal Use Software” which will assist entities in evaluating the accounting for fees paid by a customer in a cloud computing arrangement. The ASU, which allows for early adoption, is effective for the Company beginning on January 1, 2016. Adoption of this guidance is not expected to have a material impact on the Company’s unaudited interim Consolidated Financial Statements.

In April 2015, the FASB issued ASU No. 2015-03 “Interest - Imputation of Interest: Simplifying the Presentation of Debt Issuance Costs”. This standard requires debt issuance costs to be presented in the consolidated balance sheet as a direct deduction from the carrying value of the associated debt liability, consistent with the presentation of a debt discount. The ASU, which allows for early adoption, is effective for the Company beginning on January 1, 2016. Adoption of this guidance is not expected to have a material impact on the Company’s unaudited interim Consolidated Financial Statements.

In February 2015, the FASB issued ASU No. 2015-02 “Consolidation (Topic 810): Amendments to the Consolidation Analysis”. This standard focuses on the consolidation evaluation for reporting organizations that are required to evaluate whether they should consolidate certain legal entities such as limited partnerships, limited liability corporations, and securitization structures (e.g., collateralized debt obligations, collateralized loan obligations, and mortgage-backed security transactions). This new standard simplifies consolidation accounting by reducing the number of consolidation models. The ASU will be effective for the Company beginning on January 1, 2016. Early adoption is permitted, including adoption in an interim period. The potential impact the adoption of this guidance will have to the Company’s unaudited interim Consolidated Financial Statements is under review.

In January 2015, the FASB issued ASU No. 2015-01 “Income Statement: Extraordinary and Unusual Items.” This ASU eliminates from GAAP the concept of extraordinary items. Accounting Standards Codification Subtopic 225-20 required that an entity separately classify, present, and disclose extraordinary events and transactions that were unusual in nature and infrequent in occurrence. This ASU, which allows for early adoption, is effective for the Company beginning on January 1, 2016. The adoption of this guidance is not expected to have a material impact on the Company’s unaudited interim Consolidated Financial Statements.

10

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 - SECURITIES

The following table provides the major components of securities at amortized cost and fair value:

June 30, 2015 | December 31, 2014 | ||||||||||||||||||||||||

(in millions) | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | |||||||||||||||||

Securities Available for Sale | |||||||||||||||||||||||||

U.S. Treasury | $30 | $— | $— | $30 | $15 | $— | $— | $15 | |||||||||||||||||

State and political subdivisions | 9 | — | — | 9 | 10 | — | — | 10 | |||||||||||||||||

Mortgage-backed securities: | |||||||||||||||||||||||||

Federal agencies and U.S. government sponsored entities | 17,830 | 227 | (56 | ) | 18,001 | 17,683 | 301 | (50 | ) | 17,934 | |||||||||||||||

Other/non-agency | 631 | 4 | (30 | ) | 605 | 703 | 4 | (35 | ) | 672 | |||||||||||||||

Total mortgage-backed securities | 18,461 | 231 | (86 | ) | 18,606 | 18,386 | 305 | (85 | ) | 18,606 | |||||||||||||||

Total debt securities available for sale | 18,500 | 231 | (86 | ) | 18,645 | 18,411 | 305 | (85 | ) | 18,631 | |||||||||||||||

Marketable equity securities | 5 | — | — | 5 | 10 | 3 | — | 13 | |||||||||||||||||

Other equity securities | 12 | — | — | 12 | 12 | — | — | 12 | |||||||||||||||||

Total equity securities available for sale | 17 | — | — | 17 | 22 | 3 | — | 25 | |||||||||||||||||

Total securities available for sale | $18,517 | $231 | ($86 | ) | $18,662 | $18,433 | $308 | ($85 | ) | $18,656 | |||||||||||||||

Securities Held to Maturity | |||||||||||||||||||||||||

Mortgage-backed securities: | |||||||||||||||||||||||||

Federal agencies and U.S. government sponsored entities | $4,253 | $28 | ($12 | ) | $4,269 | $3,728 | $22 | ($31 | ) | $3,719 | |||||||||||||||

Other/non-agency | 1,314 | 28 | — | 1,342 | 1,420 | 54 | — | 1,474 | |||||||||||||||||

Total securities held to maturity | $5,567 | $56 | ($12 | ) | $5,611 | $5,148 | $76 | ($31 | ) | $5,193 | |||||||||||||||

Other Investment Securities | |||||||||||||||||||||||||

Federal Reserve Bank stock | $468 | $— | $— | $468 | $477 | $— | $— | $477 | |||||||||||||||||

Federal Home Loan Bank stock | 393 | — | — | 393 | 390 | — | — | 390 | |||||||||||||||||

Venture capital and other investments | 5 | — | — | 5 | 5 | — | — | 5 | |||||||||||||||||

Total other investment securities | $866 | $— | $— | $866 | $872 | $— | $— | $872 | |||||||||||||||||

11

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The Company has reviewed its securities portfolio for other-than-temporary impairments. The following table presents the net impairment losses (gains) recognized in earnings:

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||

(in millions) | 2015 | 2014 | 2015 | 2014 | |||||||||

Other-than-temporary impairment: | |||||||||||||

Total other-than-temporary impairment losses | ($1 | ) | ($5 | ) | ($32 | ) | ($39 | ) | |||||

Portions of loss (gains) recognized in other comprehensive income (before taxes) | (1 | ) | 3 | 29 | 33 | ||||||||

Net impairment losses recognized in earnings | ($2 | ) | ($2 | ) | ($3 | ) | ($6 | ) | |||||

The following tables summarize those securities whose fair values are below carrying values, segregated by those that have been in a continuous unrealized loss position for less than twelve months and those that have been in a continuous unrealized loss position for twelve months or longer:

June 30, 2015 | ||||||||||||||||||||||||||

Less than 12 Months | 12 Months or Longer | Total | ||||||||||||||||||||||||

(dollars in millions) | Number of Issues | Fair Value | Gross Unrealized Losses | Number of Issues | Fair Value | Gross Unrealized Losses | Number of Issues | Fair Value | Gross Unrealized Losses | |||||||||||||||||

State and political subdivisions | 1 | $9 | $— | — | $— | $— | 1 | $9 | $— | |||||||||||||||||

Mortgage-backed securities: | ||||||||||||||||||||||||||

Federal agencies and U.S. government sponsored entities | 109 | 5,222 | (40 | ) | 37 | 970 | (28 | ) | 146 | 6,192 | (68 | ) | ||||||||||||||

Other/non-agency | 3 | 37 | (1 | ) | 19 | 398 | (29 | ) | 22 | 435 | (30 | ) | ||||||||||||||

Total mortgage-backed securities | 112 | 5,259 | (41 | ) | 56 | 1,368 | (57 | ) | 168 | 6,627 | (98 | ) | ||||||||||||||

Total | 113 | $5,268 | ($41 | ) | 56 | $1,368 | ($57 | ) | 169 | $6,636 | ($98 | ) | ||||||||||||||

December 31, 2014 | ||||||||||||||||||||||||||

Less than 12 Months | 12 Months or Longer | Total | ||||||||||||||||||||||||

(dollars in millions) | Number of Issues | Fair Value | Gross Unrealized Losses | Number of Issues | Fair Value | Gross Unrealized Losses | Number of Issues | Fair Value | Gross Unrealized Losses | |||||||||||||||||

State and political subdivisions | — | $— | $— | 1 | $10 | $— | 1 | $10 | $— | |||||||||||||||||

Mortgage-backed securities: | ||||||||||||||||||||||||||

Federal agencies and U.S. government sponsored entities | 75 | 3,282 | (24 | ) | 52 | 1,766 | (57 | ) | 127 | 5,048 | (81 | ) | ||||||||||||||

Other/non-agency | 6 | 80 | (2 | ) | 17 | 397 | (33 | ) | 23 | 477 | (35 | ) | ||||||||||||||

Total mortgage-backed securities | 81 | 3,362 | (26 | ) | 69 | 2,163 | (90 | ) | 150 | 5,525 | (116 | ) | ||||||||||||||

Total | 81 | $3,362 | ($26 | ) | 70 | $2,173 | ($90 | ) | 151 | $5,535 | ($116 | ) | ||||||||||||||

For each debt security identified with an unrealized loss, the Company reviews the expected cash flows to determine if the impairment in value is temporary or other-than-temporary. If the Company has determined that the present value of the debt security’s expected cash flows is less than its amortized cost basis, an other-than-temporary impairment is deemed to have occurred. The amount of impairment loss that is recognized in current period earnings is dependent on the Company’s intent to sell (or not sell) the debt security.

12

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

If the Company intends to sell the impaired debt security, the impairment loss recognized in current period earnings equals the difference between the debt security’s fair value and its amortized cost. If the Company does not intend to sell the impaired debt security, and it is not likely that the Company will be required to sell the impaired security, the credit-related impairment loss is recognized in current period earnings and equals the difference between the amortized cost of the debt security and the present value of the expected cash flows that have currently been projected.

In addition to these cash flow projections, several other characteristics of each debt security are reviewed when determining whether a credit loss exists and the period over which the debt security is expected to recover. These characteristics include: (1) the type of investment, (2) various market factors affecting the fair value of the security (e.g., interest rates, spread levels, liquidity in the sector, etc.), (3) the length and severity of impairment, and (4) the public credit rating of the instrument.

The Company estimates the portion of loss attributable to credit using a cash flow model. The inputs to this model include prepayment, default and loss severity assumptions that are based on industry research and observed data. The loss projections generated by the model are reviewed on a quarterly basis by a cross-functional governance committee. This governance committee determines whether security impairments are other-than-temporary based on this review.

The following table presents the cumulative credit related losses recognized in earnings on debt securities held by the Company:

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||

(in millions) | 2015 | 2014 | 2015 | 2014 | |||||||||

Cumulative balance at beginning of period | $62 | $59 | $62 | $56 | |||||||||

Credit impairments recognized in earnings on securities that have been previously impaired | 2 | 2 | 3 | 6 | |||||||||

Reductions due to increases in cash flow expectations on impaired securities | (2 | ) | (1 | ) | (3 | ) | (2 | ) | |||||

Cumulative balance at end of period | $62 | $60 | $62 | $60 | |||||||||

Cumulative credit losses recognized in earnings for impaired AFS debt securities held as of June 30, 2015 and 2014 were $62 million and $60 million, respectively. There were no credit losses recognized in earnings for the Company’s HTM portfolio as of June 30, 2015 and 2014. For the three months ended June 30, 2015 and 2014, the Company recognized credit related other-than-temporary impairment losses in earnings of $2 million related to non-agency MBS in the AFS portfolio. For the six months ended June 30, 2015 and 2014, the Company recognized credit related other-than-temporary impairment losses in earnings of $3 million and $6 million, respectively. There were no credit impaired debt securities sold during the three or six months ended June 30, 2015 and 2014, respectively. Reductions in credit losses due to increases in cash flow expectations were $2 million and $1 million for the three months ended June 30, 2015 and 2014, respectively, and $3 million and $2 million for the six months ended June 30, 2015 and 2014, respectively, and were presented in interest income from investment securities on the Consolidated Statements of Operations. The Company does not currently have the intent to sell these debt securities, and it is not likely that the Company will be required to sell these debt securities prior to the recovery of their amortized cost bases.

The Company has determined that credit losses are not expected to be incurred on the remaining agency and non-agency MBS identified with unrealized losses as of the current reporting date. The unrealized losses on these debt securities reflect the reduced liquidity in the MBS market and the increased risk spreads due to the uncertainty of the U.S. macroeconomic environment. Therefore, the Company has determined that these debt securities are not other-than-temporarily impaired because the Company does not currently have the intent to sell these debt securities, and it is not likely that the Company will be required to sell these debt securities prior to the recovery of their amortized cost bases. Any subsequent increases in the valuation of impaired debt securities do not impact their recorded cost bases. As of June 30, 2015 and 2014, $29 million and $33 million, respectively, of pre-tax non-credit related losses were deferred in OCI.

13

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The amortized cost and fair value of debt securities at June 30, 2015 by contractual maturity are shown below. Expected maturities may differ from contractual maturities because issuers may have the right to call or prepay obligations with or without incurring penalties.

Distribution of Maturities | |||||||||||||||

(in millions) | 1 Year or Less | 1-5 Years | 5-10 Years | After 10 Years | Total | ||||||||||

Amortized Cost: | |||||||||||||||

Debt securities available for sale | |||||||||||||||

U.S. Treasury | $30 | $— | $— | $— | $30 | ||||||||||

State and political subdivisions | — | — | — | 9 | 9 | ||||||||||

Mortgage-backed securities: | |||||||||||||||

Federal agencies and U.S. government sponsored entities | — | 52 | 2,002 | 15,776 | 17,830 | ||||||||||

Other/non-agency | — | 75 | 13 | 543 | 631 | ||||||||||

Total debt securities available for sale | 30 | 127 | 2,015 | 16,328 | 18,500 | ||||||||||

Debt securities held to maturity | |||||||||||||||

Mortgage-backed securities: | |||||||||||||||

Federal agencies and U.S. government sponsored entities | — | — | — | 4,253 | 4,253 | ||||||||||

Other/non-agency | — | — | — | 1,314 | 1,314 | ||||||||||

Total debt securities held to maturity | — | — | — | 5,567 | 5,567 | ||||||||||

Total amortized cost of debt securities | $30 | $127 | $2,015 | $21,895 | $24,067 | ||||||||||

Fair Value: | |||||||||||||||

Debt securities available for sale | |||||||||||||||

U.S. Treasury | $30 | $— | $— | $— | $30 | ||||||||||

State and political subdivisions | — | — | — | 9 | 9 | ||||||||||

Mortgage-backed securities: | |||||||||||||||

Federal agencies and U.S. government sponsored entities | — | 55 | 2,014 | 15,932 | 18,001 | ||||||||||

Other/non-agency | — | 76 | 13 | 516 | 605 | ||||||||||

Total debt securities available for sale | 30 | 131 | 2,027 | 16,457 | 18,645 | ||||||||||

Debt securities held to maturity | |||||||||||||||

Mortgage-backed securities: | |||||||||||||||

Federal agencies and U.S. government sponsored entities | — | — | — | 4,269 | 4,269 | ||||||||||

Other/non-agency | — | — | — | 1,342 | 1,342 | ||||||||||

Total debt securities held to maturity | — | — | — | 5,611 | 5,611 | ||||||||||

Total fair value of debt securities | $30 | $131 | $2,027 | $22,068 | $24,256 | ||||||||||

The following table reports the amounts recognized in interest income from investment securities on the Consolidated Statements of Operations:

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||

(in millions) | 2015 | 2014 | 2015 | 2014 | |||||||||

Taxable | $155 | $154 | $314 | $303 | |||||||||

Non-taxable | — | — | — | — | |||||||||

Total interest income from investment securities | $155 | $154 | $314 | $303 | |||||||||

14

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Realized gains and losses on AFS securities are shown below:

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||

(in millions) | 2015 | 2014 | 2015 | 2014 | |||||||||

Gains on sale of debt securities | $10 | $— | $22 | $25 | |||||||||

Losses on sale of debt securities | (1 | ) | — | (5 | ) | — | |||||||

Debt securities gains, net | $9 | $— | $17 | $25 | |||||||||

Equity securities gains | $1 | $— | $3 | $— | |||||||||

The amortized cost and fair value of securities pledged are shown below:

June 30, 2015 | December 31, 2014 | ||||||||||||

(in millions) | Amortized Cost | Fair Value | Amortized Cost | Fair Value | |||||||||

Pledged against repurchase agreements | $3,749 | $3,785 | $3,650 | $3,701 | |||||||||

Pledged against FHLB borrowed funds | 1,254 | 1,280 | 1,355 | 1,407 | |||||||||

Pledged against derivatives, to qualify for fiduciary powers, and to secure public and other deposits as required by law | 3,955 | 4,013 | 3,453 | 3,520 | |||||||||

There were no loan securitizations for the three or six months ended June 30, 2015 and 2014.

The Company regularly enters into security repurchase agreements with unrelated counterparties. Repurchase agreements are financial transactions that involve the transfer of a security from one party to another and a subsequent transfer of the same (or “substantially the same”) security back to the original party. The Company’s repurchase agreements are typically short-term transactions, but they may be extended to longer terms to maturity. Such transactions are accounted for as secured borrowed funds on the Company’s financial statements. When permitted by GAAP, the Company offsets the short-term receivables associated with its reverse repurchase agreements with the short-term payables associated with its repurchase agreements.

The effects of this offsetting on the Consolidated Balance Sheets are presented in the following table:

June 30, 2015 | December 31, 2014 | ||||||||||||||||||

(in millions) | Gross Assets (Liabilities) | Gross Assets (Liabilities) Offset | Net Amounts of Assets (Liabilities) | Gross Assets (Liabilities) | Gross Assets (Liabilities) Offset | Net Amounts of Assets (Liabilities) | |||||||||||||

Securities sold under agreements to repurchase | ($3,050 | ) | $— | ($3,050 | ) | ($2,600 | ) | $— | ($2,600 | ) | |||||||||

Note: The Company also offsets certain derivative assets and derivative liabilities on the Consolidated Balance Sheets. For further information see Note 12 “Derivatives.”

Securities under the agreements to repurchase or resell are accounted for as secured borrowings. The following table presents the Company's related activity, by collateral type and remaining contractual maturity, at June 30, 2015:

Remaining Contractual Maturity of the Agreements | |||||||||||||||

(in millions) | Overnight and Continuous | Up to 30 Days | 30-90 Days | Greater Than 90 Days | Total | ||||||||||

Securities sold under agreements to repurchase | |||||||||||||||

Mortgage-backed securities - Agency | $— | $250 | $1,000 | $1,800 | $3,050 | ||||||||||

For these securities sold under the agreements to repurchase, the Company would be obligated to provide additional collateral in the event of a significant decline in fair value of the collateral pledged. The Company manages the risk by monitoring the liquidity and credit quality of the collateral, as well as the maturity profile of the transactions.

15

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 3 - LOANS AND LEASES

A summary of the loans and leases portfolio follows:

(in millions) | June 30, 2015 | December 31, 2014 | |||||

Commercial | $33,027 | $31,431 | |||||

Commercial real estate | 8,157 | 7,809 | |||||

Leases | 3,884 | 3,986 | |||||

Total commercial | 45,068 | 43,226 | |||||

Residential mortgages | 12,253 | 11,832 | |||||

Home equity loans | 3,022 | 3,424 | |||||

Home equity lines of credit | 14,917 | 15,423 | |||||

Home equity loans serviced by others (1) | 1,126 | 1,228 | |||||

Home equity lines of credit serviced by others (1) | 494 | 550 | |||||

Automobile | 13,727 | 12,706 | |||||

Student | 3,355 | 2,256 | |||||

Credit cards | 1,613 | 1,693 | |||||

Other retail | 963 | 1,072 | |||||

Total retail | 51,470 | 50,184 | |||||

Total loans and leases (2) (3) | $96,538 | $93,410 | |||||

(1) The Company’s SBO portfolio consists of purchased home equity loans and lines that were originally serviced by others. The Company now services a portion of this portfolio internally.

(2) Excluded from the table above are loans held for sale totaling $697 million as of June 30, 2015 and $281 million as of December 31, 2014.

(3) Mortgage loans serviced for others by the Company’s subsidiaries are not included above, and amounted to $17.8 billion and $17.9 billion at June 30, 2015 and December 31, 2014, respectively.

Loans held for sale at fair value totaled $397 million and $256 million at June 30, 2015 and December 31, 2014, respectively, and consisted of residential mortgages originated for sale of $318 million and the commercial trading portfolio of $79 million as of June 30, 2015. As of December 31, 2014, residential mortgages originated for sale were $213 million, and commercial trading portfolio totaled $43 million. Other loans held for sale totaled $300 million as of June 30, 2015 and consisted of $260 million of commercial loan syndications and a $40 million credit card portfolio. Other loans held for sale totaled $25 million as of December 31, 2014 and consisted of commercial loan syndications.

In March 2015, the Company transferred $41 million to loans held for sale associated with a terminated agent credit card services agreement consisting of $43 million of outstanding credit card balances and a $2 million valuation allowance. The terms of the agreement provided the agent an option, after a designated period of time, to purchase the credit card relationships covered under the agreement from Citizens or cause another financial institution to purchase the interests in these credit card relationships. The transaction is expected to close in August 2015.

Loans pledged as collateral for FHLB borrowed funds totaled $22.3 billion and $22.0 billion at June 30, 2015 and December 31, 2014, respectively. This collateral consists primarily of residential mortgages and home equity loans. Loans pledged as collateral to support the contingent ability to borrow at the FRB discount window, if necessary, totaled $12.9 billion and $11.8 billion at June 30, 2015 and December 31, 2014, respectively.

During the six months ended June 30, 2015, the Company purchased a portfolio of residential mortgages with an outstanding principal balance of $636 million, a portfolio of automobile loans with an outstanding principal balance of $809 million, and a portfolio of student loans with an outstanding principal balance of $463 million. During the six months ended June 30, 2014, the Company purchased a portfolio of residential loans with an outstanding principal balance of $878 million, a portfolio of auto loans with an outstanding principal balance of $759 million and a portfolio of student loans with an outstanding principal balance of $59 million.

During the six months ended June 30, 2015, the Company sold a portfolio of residential mortgages with an outstanding principal balance of $273 million. During the six months ended June 30, 2014, in addition to the $1.1 billion loans sold as part of the Company's sale of its Chicago-area retail branches, the Company sold portfolios of residential mortgage loans with outstanding principal balances of $126 million and student loans of $357 million as well as commercial loans with an outstanding principal balance of $132 million.

16

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 4 - ALLOWANCE FOR CREDIT LOSSES, NONPERFORMING ASSETS, AND CONCENTRATIONS OF CREDIT RISK

The allowance for credit losses consists of the ALLL and the reserve for unfunded commitments. It is increased through a provision for credit losses that is charged to earnings, based on the Company’s quarterly evaluation of the loan portfolio, and is reduced by net charge-offs and the ALLL associated with sold loans. See Note 1 “Significant Accounting Policies” to the Company’s audited Consolidated Financial Statements in the Annual Report on Form 10-K for the year ended December 31, 2014, for a detailed discussion of ALLL reserve methodologies and estimation techniques.

On a quarterly basis, the Company reviews and refines its estimate of the allowance for credit losses, taking into consideration changes in portfolio size and composition, historical loss experience, internal risk ratings, current economic conditions, industry performance trends and other pertinent information.

There were no material changes in assumptions or estimation techniques compared with prior periods that impacted the determination of the current period’s ALLL and the reserve for unfunded lending commitments.

The following is a summary of changes in the allowance for credit losses:

Six Months Ended June 30, 2015 | |||||||||

(in millions) | Commercial | Retail | Total | ||||||

Allowance for loan and lease losses as of January 1, 2015 | $544 | $651 | $1,195 | ||||||

Charge-offs | (21 | ) | (215 | ) | (236 | ) | |||

Recoveries | 36 | 68 | 104 | ||||||

Net (charge-offs) recoveries | 15 | (147 | ) | (132 | ) | ||||

Sales/Other | — | (2 | ) | (2 | ) | ||||

Provision charged to income | 6 | 134 | 140 | ||||||

Allowance for loan and lease losses as of June 30, 2015 | 565 | 636 | 1,201 | ||||||

Reserve for unfunded lending commitments as of January 1, 2015 | 61 | — | 61 | ||||||

Credit for unfunded lending commitments | (5 | ) | — | (5 | ) | ||||

Reserve for unfunded lending commitments as of June 30, 2015 | 56 | — | 56 | ||||||

Total allowance for credit losses as of June 30, 2015 | $621 | $636 | $1,257 | ||||||

Six Months Ended June 30, 2014 | |||||||||

(in millions) | Commercial | Retail | Total | ||||||

Allowance for loan and lease losses as of January 1, 2014 | $498 | $723 | $1,221 | ||||||

Charge-offs | (14 | ) | (231 | ) | (245 | ) | |||

Recoveries | 35 | 55 | 90 | ||||||

Net (charge-offs) recoveries | 21 | (176 | ) | (155 | ) | ||||

Provision charged to income | (11 | ) | 155 | 144 | |||||

Allowance for loan and lease losses as of June 30, 2014 | 508 | 702 | 1,210 | ||||||

Reserve for unfunded lending commitments as of January 1, 2014 | 39 | — | 39 | ||||||

Credit for unfunded lending commitments | 26 | — | 26 | ||||||

Reserve for unfunded lending commitments as of June 30, 2014 | 65 | — | 65 | ||||||

Total allowance for credit losses as of June 30, 2014 | $573 | $702 | $1,275 | ||||||

The recorded investment in loans and leases based on the Company’s evaluation methodology is as follows:

June 30, 2015 | December 31, 2014 | ||||||||||||||||||

(in millions) | Commercial | Retail | Total | Commercial | Retail | Total | |||||||||||||

Individually evaluated | $156 | $1,189 | $1,345 | $205 | $1,208 | $1,413 | |||||||||||||

Formula-based evaluation | 44,912 | 50,281 | 95,193 | 43,021 | 48,976 | 91,997 | |||||||||||||

Total | $45,068 | $51,470 | $96,538 | $43,226 | $50,184 | $93,410 | |||||||||||||

17

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The following is a summary of the allowance for credit losses by evaluation method:

June 30, 2015 | December 31, 2014 | ||||||||||||||||||

(in millions) | Commercial | Retail | Total | Commercial | Retail | Total | |||||||||||||

Individually evaluated | $21 | $107 | $128 | $20 | $109 | $129 | |||||||||||||

Formula-based evaluation | 600 | 529 | 1,129 | 585 | 542 | 1,127 | |||||||||||||

Allowance for credit losses | $621 | $636 | $1,257 | $605 | $651 | $1,256 | |||||||||||||

For commercial loans and leases, the Company utilizes regulatory classification ratings to monitor credit quality. Loans with a “pass” rating are those that the Company believes will be fully repaid in accordance with the contractual loan terms. Commercial loans and leases that are “criticized” are those that have some weakness that indicates an increased probability of future loss. For retail loans, the Company primarily uses the loan’s payment and delinquency status to monitor credit quality. The further a loan is past due, the greater the likelihood of future credit loss. These credit quality indicators for both commercial and retail loans are continually updated and monitored.

The recorded investment in classes of commercial loans and leases based on regulatory classification ratings is as follows:

June 30, 2015 | |||||||||||||||

Criticized | |||||||||||||||

(in millions) | Pass | Special Mention | Substandard | Doubtful | Total | ||||||||||

Commercial | $31,443 | $865 | $635 | $84 | $33,027 | ||||||||||

Commercial real estate | 7,949 | 133 | 34 | 41 | 8,157 | ||||||||||

Leases | 3,831 | 4 | 49 | — | 3,884 | ||||||||||

Total | $43,223 | $1,002 | $718 | $125 | $45,068 | ||||||||||

December 31, 2014 | |||||||||||||||

Criticized | |||||||||||||||

(in millions) | Pass | Special Mention | Substandard | Doubtful | Total | ||||||||||

Commercial | $30,022 | $876 | $427 | $106 | $31,431 | ||||||||||

Commercial real estate | 7,354 | 329 | 61 | 65 | 7,809 | ||||||||||

Leases | 3,924 | 12 | 50 | — | 3,986 | ||||||||||

Total | $41,300 | $1,217 | $538 | $171 | $43,226 | ||||||||||

18

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The recorded investment in classes of retail loans, categorized by delinquency status is as follows:

June 30, 2015 | |||||||||||||||

(in millions) | Current | 1-29 Days Past Due | 30-89 Days Past Due | 90 Days or More Past Due | Total | ||||||||||

Residential mortgages | $11,853 | $89 | $65 | $246 | $12,253 | ||||||||||

Home equity loans | 2,652 | 187 | 48 | 135 | 3,022 | ||||||||||

Home equity lines of credit | 14,253 | 406 | 73 | 185 | 14,917 | ||||||||||

Home equity loans serviced by others (1) | 1,027 | 58 | 20 | 21 | 1,126 | ||||||||||

Home equity lines of credit serviced by others (1) | 390 | 61 | 22 | 21 | 494 | ||||||||||

Automobile | 12,817 | 784 | 104 | 22 | 13,727 | ||||||||||

Student | 3,209 | 87 | 24 | 35 | 3,355 | ||||||||||

Credit cards | 1,542 | 39 | 18 | 14 | 1,613 | ||||||||||

Other retail | 889 | 57 | 14 | 3 | 963 | ||||||||||

Total | $48,632 | $1,768 | $388 | $682 | $51,470 | ||||||||||

(1) The Company’s SBO portfolio consists of purchased home equity loans and lines that were originally serviced by others. The Company now services a portion of this portfolio internally.

December 31, 2014 | |||||||||||||||

(in millions) | Current | 1-29 Days Past Due | 30-89 Days Past Due | 90 Days or More Past Due | Total | ||||||||||

Residential mortgages | $11,352 | $114 | $97 | $269 | $11,832 | ||||||||||

Home equity loans | 2,997 | 222 | 60 | 145 | 3,424 | ||||||||||

Home equity lines of credit | 14,705 | 447 | 73 | 198 | 15,423 | ||||||||||

Home equity loans serviced by others (1) | 1,101 | 78 | 26 | 23 | 1,228 | ||||||||||

Home equity lines of credit serviced by others (1) | 455 | 66 | 10 | 19 | 550 | ||||||||||

Automobile | 11,839 | 758 | 93 | 16 | 12,706 | ||||||||||

Student | 2,106 | 108 | 25 | 17 | 2,256 | ||||||||||

Credit cards | 1,615 | 39 | 22 | 17 | 1,693 | ||||||||||

Other retail | 985 | 65 | 18 | 4 | 1,072 | ||||||||||

Total | $47,155 | $1,897 | $424 | $708 | $50,184 | ||||||||||

(1) The Company’s SBO portfolio consists of purchased home equity loans and lines that were originally serviced by others. The Company now services a portion of this portfolio internally.

19

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Nonperforming Assets

A summary of nonperforming loans and leases by class is as follows:

June 30, 2015 | December 31, 2014 | ||||||||||||||||||

(in millions) | Nonaccruing | Accruing and 90 Days or More Delinquent | Total Nonperforming Loans and Leases | Nonaccruing | Accruing and 90 Days or More Delinquent | Total Nonperforming Loans and Leases | |||||||||||||

Commercial | $81 | $2 | $83 | $113 | $1 | $114 | |||||||||||||

Commercial real estate | 42 | — | 42 | 50 | — | 50 | |||||||||||||

Leases | — | — | — | — | — | — | |||||||||||||

Total commercial | 123 | 2 | 125 | 163 | 1 | 164 | |||||||||||||

Residential mortgages | 329 | — | 329 | 345 | — | 345 | |||||||||||||

Home equity loans | 189 | — | 189 | 203 | — | 203 | |||||||||||||

Home equity lines of credit | 254 | — | 254 | 257 | — | 257 | |||||||||||||

Home equity loans serviced by others (1) | 44 | — | 44 | 47 | — | 47 | |||||||||||||

Home equity lines of credit serviced by others (1) | 26 | — | 26 | 25 | — | 25 | |||||||||||||

Automobile | 30 | — | 30 | 21 | — | 21 | |||||||||||||

Student | 30 | 5 | 35 | 11 | 6 | 17 | |||||||||||||

Credit cards | 14 | — | 14 | 16 | 1 | 17 | |||||||||||||

Other retail | 3 | 1 | 4 | 5 | — | 5 | |||||||||||||

Total retail | 919 | 6 | 925 | 930 | 7 | 937 | |||||||||||||

Total | $1,042 | $8 | $1,050 | $1,093 | $8 | $1,101 | |||||||||||||

(1) The Company’s SBO portfolio consists of purchased home equity loans and lines that were originally serviced by others. The Company now services a portion of this portfolio internally.

The recorded investment in mortgage loans collateralized by residential real estate property for which formal foreclosure proceedings are in process was $260 million as of June 30, 2015.

A summary of other nonperforming assets is as follows:

(in millions) | June 30, 2015 | December 31, 2014 | |||||

Nonperforming assets, net of valuation allowance: | |||||||

Commercial | $1 | $3 | |||||

Retail | 37 | 39 | |||||

Nonperforming assets, net of valuation allowance | $38 | $42 | |||||

Nonperforming assets consist primarily of other real estate owned and are presented in other assets on the Consolidated Balance Sheets.

20

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

A summary of key performance indicators is as follows:

June 30, 2015 | December 31, 2014 | ||||

Nonperforming commercial loans and leases as a percentage of total loans and leases | 0.13 | % | 0.18 | % | |

Nonperforming retail loans as a percentage of total loans and leases | 0.96 | 1.00 | |||

Total nonperforming loans and leases as a percentage of total loans and leases | 1.09 | % | 1.18 | % | |

Nonperforming commercial assets as a percentage of total assets | 0.09 | % | 0.13 | % | |

Nonperforming retail assets as a percentage of total assets | 0.70 | 0.73 | |||

Total nonperforming assets as a percentage of total assets | 0.79 | % | 0.86 | % | |

The following is an analysis of the age of the past due amounts (accruing and nonaccruing):

June 30, 2015 | December 31, 2014 | ||||||||||||||||||

(in millions) | 30-89 Days Past Due | 90 Days or More Past Due | Total Past Due | 30-89 Days Past Due | 90 Days or More Past Due | Total Past Due | |||||||||||||

Commercial | $58 | $83 | $141 | $57 | $114 | $171 | |||||||||||||

Commercial real estate | 25 | 42 | 67 | 26 | 50 | 76 | |||||||||||||

Leases | 2 | — | 2 | 3 | — | 3 | |||||||||||||

Total commercial | 85 | 125 | 210 | 86 | 164 | 250 | |||||||||||||

Residential mortgages | 65 | 246 | 311 | 97 | 269 | 366 | |||||||||||||

Home equity loans | 48 | 135 | 183 | 60 | 145 | 205 | |||||||||||||

Home equity lines of credit | 73 | 185 | 258 | 73 | 198 | 271 | |||||||||||||

Home equity loans serviced by others (1) | 20 | 21 | 41 | 26 | 23 | 49 | |||||||||||||

Home equity lines of credit serviced by others (1) | 22 | 21 | 43 | 10 | 19 | 29 | |||||||||||||

Automobile | 104 | 22 | 126 | 93 | 16 | 109 | |||||||||||||

Student | 24 | 35 | 59 | 25 | 17 | 42 | |||||||||||||

Credit cards | 18 | 14 | 32 | 22 | 17 | 39 | |||||||||||||

Other retail | 14 | 3 | 17 | 18 | 4 | 22 | |||||||||||||

Total retail | 388 | 682 | 1,070 | 424 | 708 | 1,132 | |||||||||||||

Total | $473 | $807 | $1,280 | $510 | $872 | $1,382 | |||||||||||||

(1) The Company’s SBO portfolio consists of purchased home equity loans and lines that were originally serviced by others. The Company now services a portion of this portfolio internally.

21

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Impaired loans include: (1) nonaccruing larger balance commercial loans (greater than $3 million carrying value); and (2) commercial and retail TDRs. The following is a summary of impaired loan information by class:

June 30, 2015 | |||||||||||||||

(in millions) | Impaired Loans With a Related Allowance | Allowance on Impaired Loans | Impaired Loans Without a Related Allowance | Unpaid Contractual Balance | Total Recorded Investment in Impaired Loans | ||||||||||

Commercial | $80 | $21 | $44 | $152 | $124 | ||||||||||

Commercial real estate | 13 | — | 19 | 30 | 32 | ||||||||||

Total commercial | 93 | 21 | 63 | 182 | 156 | ||||||||||

Residential mortgages | 124 | 17 | 314 | 599 | 438 | ||||||||||

Home equity loans | 98 | 13 | 179 | 342 | 277 | ||||||||||

Home equity lines of credit | 24 | 2 | 128 | 184 | 152 | ||||||||||

Home equity loans serviced by others (1) | 57 | 9 | 27 | 96 | 84 | ||||||||||

Home equity lines of credit serviced by others (1) | 3 | 1 | 8 | 15 | 11 | ||||||||||

Automobile | 3 | — | 10 | 18 | 13 | ||||||||||

Student | 166 | 48 | 1 | 168 | 167 | ||||||||||

Credit cards | 30 | 12 | — | 30 | 30 | ||||||||||

Other retail | 15 | 5 | 2 | 20 | 17 | ||||||||||

Total retail | 520 | 107 | 669 | 1,472 | 1,189 | ||||||||||

Total | $613 | $128 | $732 | $1,654 | $1,345 | ||||||||||

(1) The Company’s SBO portfolio consists of purchased home equity loans and lines that were originally serviced by others. The Company now services a portion of this portfolio internally.

December 31, 2014 | |||||||||||||||

(in millions) | Impaired Loans With a Related Allowance | Allowance on Impaired Loans | Impaired Loans Without a Related Allowance | Unpaid Contractual Balance | Total Recorded Investment in Impaired Loans | ||||||||||

Commercial | $124 | $19 | $36 | $178 | $160 | ||||||||||

Commercial real estate | 7 | 1 | 38 | 62 | 45 | ||||||||||

Total commercial | 131 | 20 | 74 | 240 | 205 | ||||||||||

Residential mortgages | 157 | 18 | 288 | 605 | 445 | ||||||||||

Home equity loans | 129 | 11 | 141 | 335 | 270 | ||||||||||

Home equity lines of credit | 75 | 3 | 86 | 193 | 161 | ||||||||||

Home equity loans serviced by others (1) | 75 | 9 | 16 | 102 | 91 | ||||||||||

Home equity lines of credit serviced by others (1) | 4 | 1 | 7 | 14 | 11 | ||||||||||

Automobile | 2 | 1 | 9 | 16 | 11 | ||||||||||

Student | 167 | 48 | — | 167 | 167 | ||||||||||

Credit cards | 32 | 13 | — | 32 | 32 | ||||||||||

Other retail | 17 | 5 | 3 | 23 | 20 | ||||||||||

Total retail | 658 | 109 | 550 | 1,487 | 1,208 | ||||||||||

Total | $789 | $129 | $624 | $1,727 | $1,413 | ||||||||||

(1) The Company’s SBO portfolio consists of purchased home equity loans and lines that were originally serviced by others. The Company now services a portion of this portfolio internally.

22

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Additional information on impaired loans is as follows:

Three Months Ended June 30, | |||||||||||||

2015 | 2014 | ||||||||||||

(in millions) | Interest Income Recognized | Average Recorded Investment | Interest Income Recognized | Average Recorded Investment | |||||||||

Commercial | $1 | $129 | $1 | $96 | |||||||||

Commercial real estate | — | 51 | — | 94 | |||||||||

Total commercial | 1 | 180 | 1 | 190 | |||||||||

Residential mortgages | 4 | 436 | 4 | 444 | |||||||||

Home equity loans | 3 | 272 | 2 | 257 | |||||||||

Home equity lines of credit | 1 | 151 | 1 | 160 | |||||||||

Home equity loans serviced by others (1) | 1 | 84 | 2 | 101 | |||||||||

Home equity lines of credit serviced by others (1) | — | 10 | — | 8 | |||||||||

Automobile | — | 12 | — | 8 | |||||||||

Student | 2 | 164 | 2 | 159 | |||||||||

Credit cards | — | 30 | — | 37 | |||||||||

Other retail | — | 18 | — | 22 | |||||||||

Total retail | 11 | 1,177 | 11 | 1,196 | |||||||||

Total | $12 | $1,357 | $12 | $1,386 | |||||||||

(1) The Company’s SBO portfolio consists of purchased home equity loans and lines that were originally serviced by others. The Company now services a portion of this portfolio internally.

Six Months Ended June 30, | |||||||||||||

2015 | 2014 | ||||||||||||

(in millions) | Interest Income Recognized | Average Recorded Investment | Interest Income Recognized | Average Recorded Investment | |||||||||

Commercial | $1 | $133 | $1 | $102 | |||||||||

Commercial real estate | 1 | 54 | — | 96 | |||||||||

Total commercial | 2 | 187 | 1 | 198 | |||||||||

Residential mortgages | 8 | 433 | 7 | 437 | |||||||||

Home equity loans | 5 | 266 | 4 | 249 | |||||||||

Home equity lines of credit | 2 | 150 | 2 | 157 | |||||||||

Home equity loans serviced by others (1) | 2 | 84 | 3 | 100 | |||||||||

Home equity lines of credit serviced by others (1) | — | 10 | — | 8 | |||||||||

Automobile | — | 11 | — | 8 | |||||||||

Student | 4 | 162 | 4 | 156 | |||||||||

Credit cards | 1 | 29 | 1 | 36 | |||||||||

Other retail | — | 18 | — | 23 | |||||||||

Total retail | 22 | 1,163 | 21 | 1,174 | |||||||||

Total | $24 | $1,350 | $22 | $1,372 | |||||||||

(1) The Company’s SBO portfolio consists of purchased home equity loans and lines that were originally serviced by others. The Company now services a portion of this portfolio internally.

23

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Troubled Debt Restructurings

A loan modification is identified as a TDR when the Company or a bankruptcy court grants the borrower a concession the Company would not otherwise make in response to the borrower’s financial difficulties. TDRs typically result from the Company’s loss mitigation efforts and are undertaken in order to improve the likelihood of recovery and continuity of the relationship. The Company’s loan modifications are handled on a case-by-case basis and are negotiated to achieve mutually agreeable terms that maximize loan collectability and meet the borrower’s financial needs. Concessions granted in TDRs for all classes of loans may include lowering the interest rate, forgiving a portion of principal, extending the loan term, lowering scheduled payments for a specified period of time, principal forbearance, or capitalizing past due amounts. A rate increase can be a concession if the increased rate is lower than a market rate for debt with risk similar to that of the restructured loan. TDRs for commercial loans and leases may also involve creating a multiple note structure, accepting non-cash assets, accepting an equity interest, or receiving a performance-based fee. In some cases, a TDR may involve multiple concessions. The financial effects of TDRs for all loan classes may include lower income (either due to a lower interest rate or a delay in the timing of cash flows), larger loan loss provisions, and accelerated charge-offs if the modification renders the loan collateral-dependent. In some cases, interest income throughout the term of the loan may increase if, for example, the loan is extended or the interest rate is increased as a result of the restructuring.

Because TDRs are impaired loans, the Company measures impairment by comparing the present value of expected future cash flows, or when appropriate, the fair value of collateral, to the loan’s recorded investment. Any excess of recorded investment over the present value of expected future cash flows or collateral value is recognized by creating a valuation allowance or increasing an existing valuation allowance. Any portion of the loan’s recorded investment the Company does not expect to collect as a result of the modification is charged off at the time of modification.

Commercial TDRs were $124 million and $176 million on June 30, 2015 and December 31, 2014, respectively. Retail TDRs totaled $1.2 billion on June 30, 2015 and December 31, 2014. Commitments to lend additional funds to debtors owing receivables which were TDRs were $18 million and $53 million on June 30, 2015 and December 31, 2014, respectively.

The following table summarizes how loans were modified during the three months ended June 30, 2015, the charge-offs related to the modifications, and the impact on the ALLL. The reported balances include loans that became TDRs during 2015 and were paid off in full, charged off, or sold prior to June 30, 2015.

Primary Modification Types | |||||||||||||||||

Interest Rate Reduction (1) | Maturity Extension (2) | ||||||||||||||||

(dollars in millions) | Number of Contracts | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment | Number of Contracts | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment | |||||||||||

Commercial | 7 | $1 | $1 | 36 | $2 | $2 | |||||||||||

Commercial real estate | — | — | — | — | — | — | |||||||||||

Total commercial | 7 | 1 | 1 | 36 | 2 | 2 | |||||||||||

Residential mortgages | 20 | 3 | 3 | 9 | 2 | 2 | |||||||||||

Home equity loans | 26 | 1 | 1 | 49 | 11 | 11 | |||||||||||

Home equity lines of credit | — | — | — | — | — | — | |||||||||||

Home equity loans serviced by others (3) | 5 | — | — | — | — | — | |||||||||||

Home equity lines of credit serviced by others (3) | — | — | — | — | — | — | |||||||||||

Automobile | 18 | 1 | 1 | 1 | — | — | |||||||||||

Student | — | — | — | — | — | — | |||||||||||

Credit cards | 630 | 3 | 3 | — | — | — | |||||||||||

Other retail | — | — | — | — | — | — | |||||||||||

Total retail | 699 | 8 | 8 | 59 | 13 | 13 | |||||||||||

Total | 706 | $9 | $9 | 95 | $15 | $15 | |||||||||||

24

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Primary Modification Types | |||||||||||||||

Other (4) | |||||||||||||||

(dollars in millions) | Number of Contracts | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment | Net Change to ALLL Resulting from Modification | Charge-offs Resulting from Modification | ||||||||||

Commercial | 3 | $— | $— | $— | $— | ||||||||||

Commercial real estate | — | — | — | — | — | ||||||||||

Total commercial | 3 | — | — | — | — | ||||||||||

Residential mortgages | 42 | 4 | 4 | — | — | ||||||||||

Home equity loans | 97 | 7 | 7 | — | — | ||||||||||

Home equity lines of credit | 78 | 5 | 5 | — | 1 | ||||||||||

Home equity loans serviced by others (3) | 25 | 1 | 1 | — | — | ||||||||||

Home equity lines of credit serviced by others (3) | 15 | 1 | 1 | — | — | ||||||||||

Automobile | 172 | 3 | 2 | — | — | ||||||||||

Student | 369 | 7 | 7 | 1 | — | ||||||||||

Credit card | — | — | — | 1 | — | ||||||||||

Other retail | 4 | — | — | — | — | ||||||||||

Total retail | 802 | 28 | 27 | 2 | 1 | ||||||||||

Total | 805 | $28 | $27 | $2 | $1 | ||||||||||

(1) Includes modifications that consist of multiple concessions, one of which is an interest rate reduction.

(2) Includes modifications that consist of multiple concessions, one of which is a maturity extension (unless one of the other concessions was an interest rate reduction).

(3) The Company’s SBO portfolio consists of purchased home equity loans and lines that were originally serviced by others. The Company now services a portion of this portfolio internally.

(4) Includes modifications other than interest rate reductions or maturity extensions, such as lowering scheduled payments for a specified period of time, principal forbearance, capitalizing arrearages, and principal forgiveness. Also included are the following: deferrals, trial modifications, certain bankruptcies, loans in forbearance and prepayment plans. Modifications can include the deferral of accrued interest resulting in post-modification balances being higher than pre-modification.

The following table summarizes how loans were modified during the three months ended June 30, 2014, the charge-offs related to the modifications, and the impact on the ALLL. The reported balances include loans that became TDRs during 2014 and were paid off in full, charged off, or sold prior to June 30, 2014.

Primary Modification Types | |||||||||||||||||

Interest Rate Reduction (1) | Maturity Extension (2) | ||||||||||||||||

(dollars in millions) | Number of Contracts | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment | Number of Contracts | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment | |||||||||||

Commercial | 8 | $6 | $6 | 15 | $1 | $1 | |||||||||||

Commercial real estate | 1 | — | — | 2 | — | — | |||||||||||

Total commercial | 9 | 6 | 6 | 17 | 1 | 1 | |||||||||||

Residential mortgages | 24 | 4 | 4 | 10 | 1 | 2 | |||||||||||

Home equity loans | 37 | 2 | 2 | 10 | 1 | — | |||||||||||

Home equity lines of credit | 1 | — | — | 106 | 7 | 6 | |||||||||||

Home equity loans serviced by others (3) | 4 | — | — | — | — | — | |||||||||||

Home equity lines of credit serviced by others(3) | 1 | — | — | 1 | — | — | |||||||||||

Automobile | 33 | 1 | 1 | 7 | — | — | |||||||||||

Student | — | — | — | — | — | — | |||||||||||

Credit cards | 608 | 3 | 3 | — | — | — | |||||||||||

Other retail | 1 | — | — | — | — | — | |||||||||||

Total retail | 709 | 10 | 10 | 134 | 9 | 8 | |||||||||||

Total | 718 | $16 | $16 | 151 | $10 | $9 | |||||||||||

25

CITIZENS FINANCIAL GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Primary Modification Types | |||||||||||||||

Other (4) | |||||||||||||||

(dollars in millions) | Number of Contracts | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment | Net Change to ALLL Resulting from Modification | Charge-offs Resulting from Modification | ||||||||||

Commercial | 1 | $— | $— | $— | $— | ||||||||||

Commercial real estate | — | — | — | — | — | ||||||||||

Total commercial | 1 | — | — | — | — | ||||||||||

Residential mortgages | 132 | 15 | 14 | (1 | ) | — | |||||||||

Home equity loans | 210 | 14 | 14 | — | — | ||||||||||

Home equity lines of credit | 81 | 6 | 5 | — | 2 | ||||||||||

Home equity loans serviced by others (3) | 46 | 3 | 2 | — | — | ||||||||||

Home equity lines of credit serviced by others (3) | 13 | — | — | — | — | ||||||||||

Automobile | 145 | 2 | 2 | — | 1 | ||||||||||

Student | 457 | 8 | 8 | — | — | ||||||||||

Credit card | — | — | — | — | — | ||||||||||

Other retail | 9 | — | — | — | — | ||||||||||

Total retail | 1,093 | 48 | 45 | (1 | ) | 3 | |||||||||

Total | 1,094 | $48 | $45 | ($1 | ) | $3 | |||||||||

(1) Includes modifications that consist of multiple concessions, one of which is an interest rate reduction.

(2) Includes modifications that consist of multiple concessions, one of which is a maturity extension (unless one of the other concessions was an interest rate reduction).

(3) The Company’s SBO portfolio consists of purchased home equity loans and lines that were originally serviced by others. The Company now services a portion of this portfolio internally.

(4) Includes modifications other than interest rate reductions or maturity extensions, such as lowering scheduled payments for a specified period of time, principal forbearance, capitalizing arrearages, and principal forgiveness. Also included are the following: deferrals, trial modifications, certain bankruptcies, loans in forbearance and prepayment plans. Modifications can include the deferral of accrued interest resulting in post-modification balances being higher than pre-modification.

The following table summarizes how loans were modified during the six months ended June 30, 2015, the charge-offs related to the modifications, and the impact on the ALLL. The reported balances include loans that became TDRs during 2015 and were paid off in full, charged off, or sold prior to June 30, 2015.

Primary Modification Types | |||||||||||||||||

Interest Rate Reduction (1) | Maturity Extension (2) | ||||||||||||||||

(dollars in millions) | Number of Contracts | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment | Number of Contracts | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment | |||||||||||

Commercial | 14 | $3 | $3 | 64 | $12 | $12 | |||||||||||

Commercial real estate | 1 | — | — | — | — | — | |||||||||||

Total commercial | 15 | 3 | 3 | 64 | 12 | 12 | |||||||||||

Residential mortgages | 53 | 9 | 9 | 19 | 4 | 4 | |||||||||||

Home equity loans | 47 | 2 | 2 | 86 | 16 | 16 | |||||||||||

Home equity lines of credit | — | — | — | 3 | — | — | |||||||||||

Home equity loans serviced by others (3) | 22 | 1 | 1 | — | — | — | |||||||||||

Home equity lines of credit serviced by others (3) | — | — | — | — | — | — | |||||||||||

Automobile | 38 | 1 | 1 | 2 | — | — | |||||||||||

Student | — | — | — | — | — | — | |||||||||||

Credit cards | 1,234 | 7 | 7 | — | — | — | |||||||||||

Other retail | — | — | — | — | — | — | |||||||||||

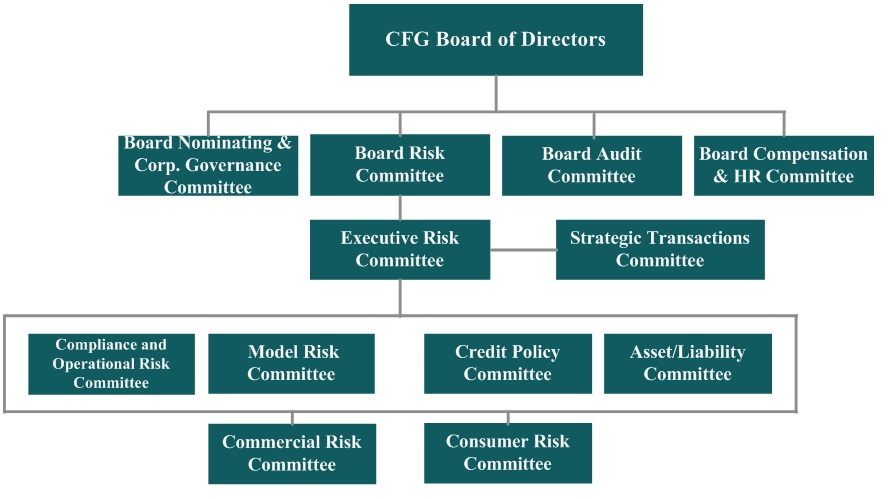

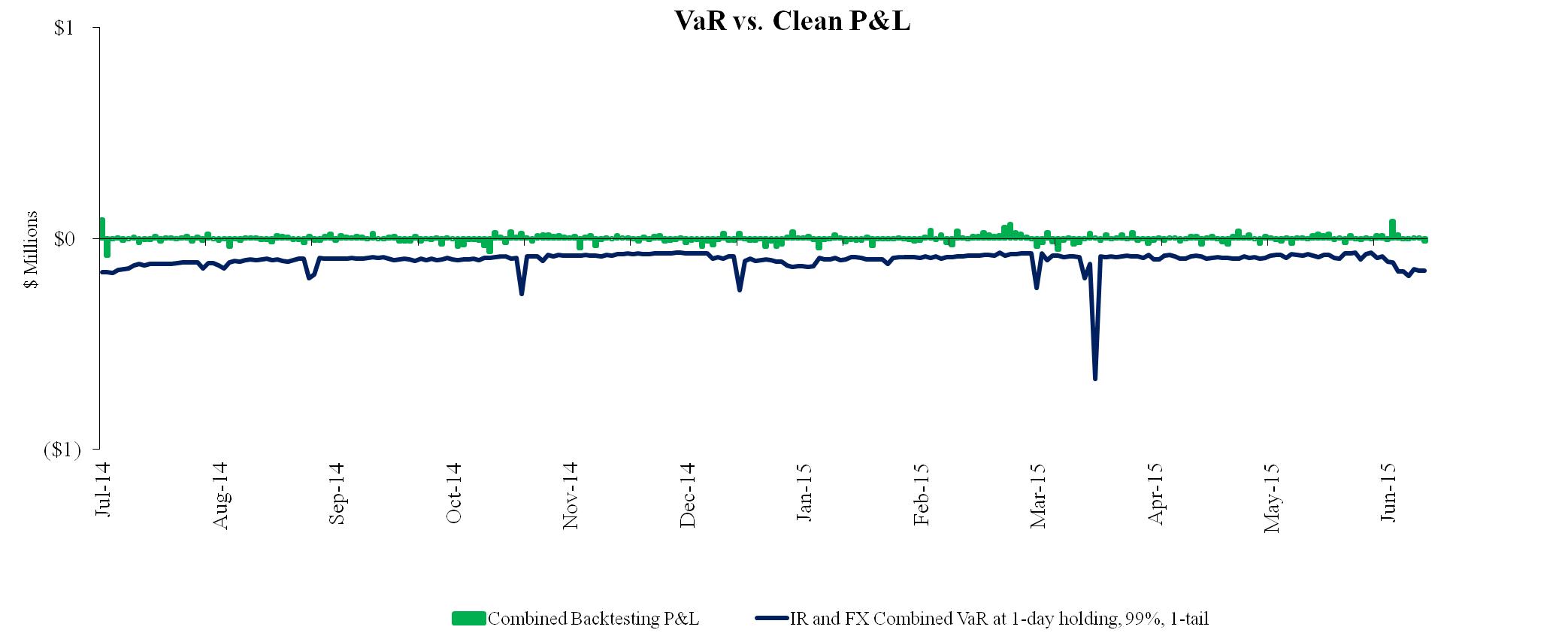

Total retail | 1,394 | 20 | 20 | 110 | 20 | 20 | |||||||||||