Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2018 |

OR |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number 1-8864

USG CORPORATION

(Exact name of Registrant as Specified in its Charter)

|

| | |

Delaware | | 36-3329400 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

550 W. Adams Street, Chicago, Illinois | | 60661-3676 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (312) 436-4000 |

| | |

Securities Registered Pursuant to Section 12(b) of the Act: |

Title of Each Class | | Name of Exchange on Which Registered |

Common Stock, $0.10 par value | | New York Stock Exchange |

| Chicago Stock Exchange |

| |

Preferred Stock Purchase Rights (subject to Rights | | New York Stock Exchange |

Agreement dated December 21, 2006, as amended) | | Chicago Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer | | x | | Accelerated filer | | o |

Non-accelerated filer | | o | | Smaller reporting company | | o |

| | | | Emerging growth company | | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes o No x

The aggregate market value of the registrant’s common stock held by non-affiliates computed by reference to the New York Stock Exchange closing price on June 30, 2018 (the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $3,488,342,026. Solely for this purpose, directors, executive officers and greater than 10% record shareholders are considered the affiliates of the registrant.

The number of shares of the registrant’s common stock outstanding as of January 31, 2019 was 140,099,470.

Documents Incorporated By Reference: None.

TABLE OF CONTENTS

|

| | |

| | Page |

|

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

|

|

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

|

|

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

|

|

Item 15. | | |

Item 16. | | |

| |

| |

PART I

In this annual report on Form 10-K, “USG,” “we,” “our” and “us” refer to USG Corporation, a Delaware corporation, and its subsidiaries included in the consolidated financial statements, except as otherwise indicated or as the context otherwise requires.

General

USG, through our subsidiaries and joint ventures, is a leading manufacturer of building materials and innovative solutions that was originally formed in 1902. We produce a wide range of products for use in new residential, new nonresidential, and residential and nonresidential repair and remodel construction as well as products used in certain industrial processes. Our businesses are cyclical in nature and sensitive to changes in general economic conditions, including conditions in the North American housing and construction-based markets. Our expansion through two 50/50 joint ventures, referred to as USG Boral Building Products, or UBBP, we formed in 2014 with Boral Limited, or Boral, into the markets of Asia, Australasia, and the Middle East has significantly increased our exposure to the economic conditions in those areas.

The effects of market conditions on our operations are discussed in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Merger Agreement with Knauf

On June 10, 2018, we entered into an Agreement and Plan of Merger, as it may be amended from time to time, or the Merger Agreement, with Gebr. Knauf KG, a limited partnership (Kommanditgesellschaft) organized under the laws of Germany, or Knauf, and World Cup Acquisition Corporation, a Delaware corporation and an indirect, wholly-owned subsidiary of Knauf, or Merger Sub. The Merger Agreement provides that, subject to the satisfaction of customary closing conditions, Merger Sub will be merged with and into USG, or the Merger, with USG continuing as the surviving corporation and an indirect, wholly-owned subsidiary of Knauf. Pursuant to the terms of the Merger Agreement, at the effective time of the Merger, each share of common stock, par value $0.10, of USG issued and outstanding immediately prior to the effective time of the Merger (other than shares of common stock owned by Knauf and its subsidiaries, USG and its subsidiaries and certain excluded holders) will be converted into the right to receive $43.50 in cash, without interest and subject to tax withholding, or the closing consideration. In addition, as contemplated by the Merger Agreement, we announced on August 9, 2018 that USG had declared a conditional special cash dividend of $0.50 per share, or the conditional special dividend, payable to holders of record of our common stock as of the close of business on August 21, 2018. Payment of the conditional special dividend was conditioned on adoption of the Merger Agreement by our stockholders at the special meeting held on September 26, 2018, or the special meeting. The Merger Agreement was adopted by our stockholders at the special meeting and following certification of the vote in favor of adoption, the conditional special dividend was paid on October 2, 2018.

The Merger, which is currently expected to close in early 2019, is subject to the satisfaction or waiver of certain customary closing conditions, including, among others, receipt of certain regulatory approvals. The Merger Agreement contains certain termination rights for both USG and Knauf. If the Merger Agreement is terminated under certain specified circumstances, we will be required to pay Knauf a termination fee of $215 million.

See Note 4, Equity Method Investments, to the consolidated financial statements in Part II, Item 8 of this report for additional information regarding the default notice under the UBBP Shareholders Agreement delivered by Boral in connection with the Merger. Additional information about the Merger Agreement is set forth in Note 19, Merger Agreement, to the consolidated financial statements in Part II, Item 8 of this report, and our Current Report on Form 8-K filed with the Securities and Exchange Commission, or the SEC, on June 11, 2018.

Segments

Our reportable segments align with how we manage our businesses, review operating performance and allocate resources considering the discrete information available for the geographies within those divisions. Our operating structure is generally aligned by product type and consists of three divisions, in addition to UBBP: Gypsum, Performance Materials and Ceilings. The operations of the divisions are similar throughout North America.

Our operations are organized into five reportable segments: U.S. Wallboard and Surfaces, U.S. Performance Materials, U.S. Ceilings, Canada, and UBBP. See Note 13, Segments, to the consolidated financial statements in Part II, Item 8 of this report for financial information regarding our reportable segments.

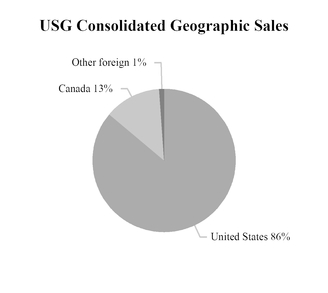

The following graph reflects the breakdown by segment of our 2018 consolidated net sales of $3.3 billion.

Net sales of UBBP of $1.2 billion are excluded from the graph above as the joint ventures are accounted for as equity method investments.

Gypsum

BUSINESS

Our Gypsum division manufactures and markets gypsum and related products in the United States, Canada and Mexico. It is composed of our U.S. Wallboard and Surfaces segment, the Gypsum operations of our Canada segment and the Gypsum operations in Mexico, which do not rise to the level of a reportable segment and thus are included in Other. We are the largest manufacturer of gypsum wallboard in the United States and accounted for approximately 24.5% of total industry shipments of gypsum board in 2018. The gypsum board market, as determined by the Gypsum Association, includes gypsum wallboard, other gypsum-related paneling products and imports. As such, we've included the Gypsum products of USG Sheetrock® brand gypsum wallboard and Securock® brand glass mat sheathing and the Performance Materials product of Fiberock® brand gypsum fiber panels in our estimate of our market share of the gypsum board market. In Canada, we accounted for approximately 31% of Canadian domestic shipments of gypsum board in 2018.

PRODUCTS

Gypsum's products are used in a variety of building applications to construct walls and ceilings of residential, nonresidential and institutional buildings. We also produce gypsum-based products for agricultural and industrial customers to use in a wide variety of applications, including soil conditioning, road repair, fireproofing and ceramics. The major product lines within the Gypsum division are:

|

| |

WALLBOARD |

USG Sheetrock® brand gypsum wallboard and Securock® brand glass mat sheathing portfolios | Gypsum panels that provide aesthetic as well as sound-dampening, fire-retarding, abuse-resistance and moisture-control value |

SURFACES |

USG Sheetrock® brand joint compound portfolio, as well as corner bead, joint tape, and plaster | Used for finishing wallboard joints |

Construction plaster products, sold under the brand names Red Top®, Imperial®, Diamond® and Supremo™ and industrial gypsum | Used to provide a custom finish for residential and commercial interiors and provide aesthetic, sound-dampening, fire-retarding and abuse-resistance value |

As the leader in lightweight innovation, we offer the industry's broadest portfolio of lightweight gypsum panels for use in interior wall and ceiling applications including our USG Sheetrock® Brand UltraLight Panels and USG Sheetrock® Brand EcoSmart Panels. See Note 13, Segments, to the consolidated financial statements in Part II, Item 8 of this report for additional information regarding product types that accounted for more than 10% of our consolidated net sales.

MANUFACTURING

Our Gypsum division manufactures products at plants located throughout the United States, Canada and Mexico, some of which are shared with the Performance Materials division. See Item 2, Properties.

Gypsum rock is mined or quarried at company-owned locations in North America. See Item 2, Properties. Our mines and quarries provided approximately 53% of the gypsum used by our plants in North America in 2018. Some of our manufacturing plants purchase or acquire synthetic gypsum and natural gypsum rock from outside sources. In 2018, outside sources of synthetic gypsum and natural gypsum rock accounted for approximately 39% and 8%, respectively, of the gypsum used in our North American plants.

Synthetic gypsum is a byproduct of flue gas desulphurization carried out by electricity generation or industrial plants that burn coal as a fuel. The suppliers of this kind of gypsum are primarily power companies, which are required to operate scrubbing equipment for their coal-fired generating plants under federal environmental regulations. We have entered into a number of long-term supply agreements to acquire synthetic gypsum. Certain power companies have switched to using natural gas instead of coal for their electricity generation needs. In the event more power companies switch to using natural gas instead of coal, the availability of synthetic gypsum may decrease which could result in an increase to our cost. See Item 1A, Risk Factors.

We produce wallboard paper at four company-owned production facilities located in the United States. Vertical integration in paper helps to ensure a continuous supply of high-quality paper that is tailored to the specific needs of our production processes. We augment our paper needs through purchases from outside suppliers when necessary. We did not make any material purchases of paper from outside suppliers in 2018.

MARKETING AND DISTRIBUTION

Our Gypsum products are marketed and distributed through specialty wallboard distributors, building materials dealers, home improvement centers and other retailers and contractors. Sales of Gypsum products are seasonal in the sense that sales are generally greater from spring through autumn than during the remaining part of the year.

Based on our estimates using publicly available data, internal surveys and industry shipment data for gypsum board, as reported by the Gypsum Association, we estimate that during 2018 volume demand for gypsum board was generated by:

| |

• | residential and nonresidential repair and remodel activity of about 50%, |

| |

• | new residential construction of about 35%, |

| |

• | new nonresidential construction of about 10%, and |

| |

• | other activities, such as exports and temporary construction, of about 5%. |

COMPETITION

Industry shipments of gypsum board in the United States (including gypsum wallboard, other gypsum-related paneling products and imports), as reported by the Gypsum Association, were an estimated 25.4 billion square feet in 2018, down approximately 1% from 25.7 billion square feet in 2017. Our share of the gypsum board market in the United States, which includes for comparability shipments of USG Sheetrock® brand gypsum wallboard, Fiberock® brand gypsum fiber panels and Securock® brand glass mat sheathing, decreased to 24.5% in 2018 from 25.4% in 2017.

The principal methods of competition are product quality and performance, range of products, product availability, product pricing, compatibility of systems and customer service. Our principal competitors include:

|

| | | | | |

| United States | | Canada | | Mexico |

American Gypsum Company LLC (a unit of Eagle Materials Inc.) | x | | | | |

Cabot Gypsum Company | | | x | | |

CertainTeed Corporation (a subsidiary of Compagnie de Saint-Gobain SA) | x | | x | | |

Continental Building Products, Inc. | x | | x | | |

Georgia-Pacific (a subsidiary of Koch Industries, Inc.) | x | | x | | |

National Gypsum Company | x | | | | |

PABCO Gypsum (a division of PABCO Building Products) | x | | | | |

Panel Rey, S.A. (a Grupo Promax Company) | x | | | | x |

Plaka (a unit of Knauf International GmbH) | | | | | x |

Performance Materials

BUSINESS

Our Performance Materials division manufactures and markets a series of innovative products in the United States that provide solutions to our customers to help close the skilled labor gap and increase job site efficiency. It consists solely of our U.S. Performance Materials segment.

PRODUCTS

Performance Materials products are used in a variety of interior and exterior building applications of residential and nonresidential buildings, as well as in certain industrial applications. These products can be grouped under three product categories of underlayment, building envelope and structural. The major products within these three categories are as follows:

|

| |

UNDERLAYMENT |

USG Durock® brand cement board | Provides water and fire-resistant assemblies for both interior and exterior applications |

Fiberock® brand backerboard | Includes abuse-resistant interior wall panels, tile backer boards and flooring underlayments |

USG Durock™ brand shower systems | A fully bonded waterproofing system for tiled shower installations |

USG Performance Flooring, including Levelrock® brand systems of poured gypsum flooring | Provides surface leveling, enhanced sound-dampening and fire-resistant performance for residential and commercial flooring applications |

BUILDING ENVELOPE |

Securock® ExoAir® 430 air barrier system | Integrated gypsum sheathing panels with pre-applied fluid air barrier membrane that provides structural performance and moisture, mold and air control |

Securock® brand roof board portfolios | Roof boards for use in low-slope commercial roofing systems that provides moisture, mold and fire resistant value |

STRUCTURAL |

USG Structural Panels | High-strength, glass fiber, reinforced structural concrete panels for use in subfloor, roof deck, foundation walls and other noncombustible applications |

MANUFACTURING

Our Performance Materials division manufactures products at plants located throughout the United States, most of which are shared with our Gypsum division. See Item 2, Properties.

MARKETING AND DISTRIBUTION

Our Performance Materials products are marketed and distributed through specialty distributors, home improvement centers, contractors and other retailers. Sales of Performance Materials products are generally greater from spring through autumn than during the remaining part of the year. Based on our estimates using internal surveys, we estimate that during 2018 volume demand was generated by:

| |

• | residential and nonresidential repair and remodel activity of about 49%, |

| |

• | new residential construction of about 13%, |

| |

• | new nonresidential construction of about 33%, and |

| |

• | other activity, including exports, of about 5%. |

COMPETITION

The principal methods of competition are product quality and performance, range of products, product availability, product pricing, compatibility of systems and customer service. Our principal competitors include National Gypsum Company, Georgia Pacific, James Hardie Building Products, Schluter Systems, the ARDEX Group and Laticrete.

Ceilings

BUSINESS

Our Ceilings division manufactures and markets interior ceiling systems products in the United States, Canada and Mexico. It consists of our U.S. Ceilings segment, the ceilings operations of our Canada segment and our ceilings operations in Mexico, which do not rise to the level of a reportable segment and are included in Other. We are a leading manufacturer and supplier of

interior ceilings products including ceiling tile, ceiling grid and specialty ceilings used primarily in nonresidential applications. In 2017, we acquired Ceilings Plus, a leader in the specialty ceilings market. We estimate that we are the second-largest manufacturer of ceiling grid and acoustical ceiling tile.

PRODUCTS

The major product lines within the Ceilings division are:

|

| |

CEILING TILE |

Radar™, Eclipse™, Mars™ and Halcyon™ | Provides qualities such as sound absorption, fire retardation and convenient access to the space above the ceiling for electrical and mechanical systems, air distribution and maintenance |

CEILING GRID |

Donn®, DX®, Fineline®, Centricitee™ and Identitee® DXI™ | Provides qualities such as fire retardation and convenient access to the space above the ceiling for electrical and mechanical systems, air distribution and maintenance |

SPECIALTY CEILINGS |

Curvatura™, Compasso®, Radians®, Illusions™, Multiples™, Runways™, Barz™, Planx™, Mirra™, Corniche™, Wallforms™ and Parti™ | Provides qualities such as aesthetics, sound absorption, fire retardation and convenient access to the space above the ceiling for electrical and mechanical systems, air distribution and maintenance |

ENSEMBLE® |

Ensemble® Acoustical Drywall Ceiling | Provides a monolithic drywall look with acoustical performance |

MANUFACTURING

Our Ceilings division manufactures products at plants located in the United States and Canada. See Item 2, Properties. Principal raw materials used to produce Ceilings’ products include mineral fiber, aluminum, steel, perlite and starch. We produce mineral fiber and obtain all other raw materials from outside suppliers.

MARKETING AND DISTRIBUTION

Ceilings sells products primarily in markets related to the construction and renovation of nonresidential buildings. During 2018, based on our estimates using internal surveys, approximately:

| |

• | 75% of net sales were from repair and remodel activity, primarily nonresidential, |

| |

• | 20% of net sales were from new nonresidential construction, and |

| |

• | 5% of net sales were from new residential construction. |

Products are marketed and distributed through a network of distributors, installation contractors and home improvement centers. Sales of Ceilings’ products are seasonal in nature and are generally lower in the fourth quarter of the calendar year as compared to the first three quarters of the year.

COMPETITION

Principal methods of competition are product quality and performance, range of products, product availability, product pricing, compatibility of systems and customer service. Our principal competitors include the following:

|

| | | | | |

| United States | | Canada | | Mexico |

Ceiling Tile | | | | | |

Armstrong World Industries, Inc., | x | | x | | x |

CertainTeed Corporation (a subsidiary of Compagnie de Saint-Gobain SA) | x | | x | | x |

Odenwald Faserplattenwerk GmbH (OWA) | x | | x | | x |

Rockfon (a subsidiary of Rockwool International A/S) | x | | x | | |

| | | | | |

Ceiling Grid | | | | | |

CertainTeed Corporation (a subsidiary of Compagnie de Saint-Gobain SA) | x | | x | | x |

Chicago Metallic Corporation (a subsidiary of Rockwool International A/S) | x | | x | | x |

WAVE (a joint venture between Armstrong World Industries Inc. and Worthington Industries) | x | | x | | |

USG Boral Building Products

BUSINESS

In 2014, we and certain of our subsidiaries formed UBBP, 50/50 joint ventures, with Boral. UBBP manufactures, distributes and sells certain building products, mines raw gypsum and sells natural and synthetic gypsum throughout Asia, Australasia and the Middle East. UBBP is a leader in most of the markets it serves. See Note 4, Equity Method Investments, to the consolidated financial statements in Part II, Item 8 of this report for additional information related to our equity method investments.

PRODUCTS

UBBP manufactures and distributes products for wall, ceiling, floor lining and exterior systems that utilize gypsum wallboard, referred to as plasterboard in the regions in which UBBP operates, mineral fiber ceiling tiles, steel grid and joint compound. UBBP's significant brand names include USG Boral Sheetrock® Brand premium plasterboard, USG Boral NextGen®, Elephant®, Jayaboard®, Durock® and Donn® DX®. UBBP launched USG Boral Sheetrock® Brand products, which leverages USG technology, in Australia, South Korea, Indonesia, Vietnam, China, Thailand, India and Oman. UBBP is able to sell USG Boral Sheetrock® Brand at a premium price in some markets and acceptance of lightweight technology continues to increase, which is led by Australia with a conversion rate above 90%.

MANUFACTURING

UBBP has 23 plasterboard lines, three gypsum mines and 36 other non-board lines for metal products, metal ceiling grid, ceiling tile, joint compound and cornice throughout twelve countries in Asia, Australasia and the Middle East.

Executive Officers of the Registrant

See Part III, Item 10, Directors, Executive Officers and Corporate Governance - Executive Officers of the Registrant (as of February 14, 2019).

Other Information

RESEARCH AND DEVELOPMENT

To differentiate through innovation and strengthen our leadership in the building materials industry, we perform extensive research and development at the USG Corporate Innovation Center in Libertyville, Illinois, using open innovation models and external partnerships. New technologies and products are developed by collaborating with suppliers, universities and national research laboratories to provide solutions to customer needs. With fire, acoustical, structural and environmental testing capabilities, the research center allows us to conduct our own on-site evaluation of products and systems. Chemical analysis and materials characterization support product development and safety/quality assessment programs. Development activities can be taken to an on-site pilot plant before being transferred to a full-size plant. Research and development activities have been focused on industry challenges including shortage of skilled labor, speed of construction and sustainability. UBBP also operates a research and development center in Thailand.

SUSTAINABILITY

The adoption of green building codes and standards, such as the Leadership in Energy and Environmental Design, or LEED, rating system established by the U.S. Green Building Council to encourage the design and construction of buildings that are environmentally friendly, combined with an increase in customer preference for products that can assist in obtaining LEED credit, or are otherwise environmentally preferable, has increased demand for products, systems and services that contribute to building sustainable spaces. Many of our products meet the requirements for the awarding of LEED credits, and we continue to develop new products and systems to address market demand for products that enable construction of buildings that require fewer natural resources to build, operate and maintain. Our competitors also have developed and introduced to the market more environmentally responsible products.

We expect that there will be increased demand over time for products, systems and services that meet regulatory and customer sustainability standards and preferences and decreased demand for products that produce significant greenhouse gas emissions. We also believe that our ability to continue to provide these products and systems to our customers will be necessary to maintain our competitive position in the marketplace.

ENERGY

Our primary supplies of energy have been adequate, and we have not been required to curtail operations as a result of insufficient supplies. Supplies are likely to remain sufficient for our projected requirements. Currently, we are using swap

contracts to hedge a significant portion of our anticipated purchases of natural gas to be used in our manufacturing operations over the next 12 months and beyond. We review our positions regularly and make adjustments as market conditions warrant.

SIGNIFICANT CUSTOMERS

On a worldwide basis, for each of the years ended December 31, 2018, 2017, and 2016, The Home Depot accounted for 24%, 23% and 23% of our net consolidated sales, respectively, and L&W Supply Corporation, or L&W, accounted for 14%, 16% and 19% of our consolidated net sales, respectively. On October 31, 2016, we completed the sale of L&W to American Builders & Contractors Supply Co., Inc., or ABC Supply, for $675 million. Our U.S. Wallboard and Surfaces, U.S. Performance Materials, U.S. Ceilings and Canada segments each had net sales to these customers in each of those years.

INTELLECTUAL PROPERTY

We consider patents, copyrights, trademarks, trade secrets, proprietary technology and similar intellectual property as critical to our success. We hold numerous patents and have registered numerous trademarks of varying duration in multiple legal jurisdictions. Further, we have filed patent applications and applications for the registration of trademarks in the United States and internationally. Although we consider our patents, trademarks, trade secrets and licenses to constitute valuable assets, we do not regard any of our businesses as being materially dependent upon an individual patent, trademark, trade secret, or license.

OTHER

Because we generally fill orders upon receipt, no segment has any significant order backlog.

None of our segments have any special working capital requirements.

No material part of our business is subject to renegotiation of profits or termination of contracts or subcontracts at the election of any government.

As of December 31, 2018, we had approximately 7,300 employees worldwide in our consolidated operations.

See Item 1A, Risk Factors, for information regarding the risks associated with conducting business in international locations, as well as the possible effects that compliance with environmental laws and regulations may have on our businesses and operating results.

Available Information

We maintain a website at www.usg.com and make available free of charge at this website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after they are electronically filed with or furnished to the SEC. The information on our website is not, and will not be deemed to be, a part of this annual report on Form 10-K, or incorporated into any of our other filings with the SEC, except where we expressly incorporated such information. If you wish to receive a paper copy of any exhibit to our reports filed with or furnished to the SEC, the exhibit may be obtained, upon payment of reasonable expenses, by writing to: Corporate Secretary, USG Corporation, 550 West Adams Street, Chicago, Illinois 60661-3676.

Our business, financial condition, operating results and cash flows are subject to various risks and uncertainties. We have described below significant factors that may adversely affect us and our industry. You should carefully consider these factors, together with all of the other information in this annual report on Form 10-K and in other documents that we file with the SEC, before making any investment decision about our securities.

The Merger may not be completed within the expected timeframe, or at all, and the failure to complete the Merger could adversely affect the market price of our common stock, as well as our business, results of operations, and financial condition.

There can be no assurance that the Merger will be completed in the expected timeframe, or at all. The Merger Agreement contains a number of conditions that must be satisfied or waived prior to the completion of the Merger, including (i) the receipt of all consents, approvals or authorizations of, declarations or filings under applicable competition laws and foreign investment laws; (ii) the absence of certain legal impediments preventing the completion of the Merger; and (iii) the accuracy of the representations and warranties of the parties and the compliance by the parties with their respective covenants in the Merger Agreement. There can be no assurance that these conditions will be satisfied or waived, or the conditions to, or timing of, satisfying these conditions.

Many of the conditions to completion of the Merger are not within our control, and we cannot predict when or if these conditions will be satisfied (or waived, as applicable). Even if regulatory approval is obtained, it is possible conditions will be imposed that could result in a material delay in, or the abandonment of, the Merger or otherwise have an adverse effect on us. Further, though not a condition to completion of the Merger, there is a risk of availability of sufficient financing available to Knauf to allow it to pay the closing consideration.

If the Merger is not completed within the expected timeframe or at all, we may be subject to a number of material risks. The price of our common stock will likely decline to the extent that current market prices reflect a market assumption that the Merger will be completed, as opposed to our current operational performance and market conditions. In addition, some costs related to the Merger must be paid whether or not the Merger is completed, and we have incurred, and will continue to incur, significant fees for professional services and other transaction costs in connection with the Merger, as well as the diversion of management and resources towards the Merger, for which we will have received little or no benefit if completion of the Merger does not occur. We may also experience negative reactions from our investors, employees, suppliers and customers. In addition, if the Merger Agreement is terminated under certain specified circumstances, we will be required to pay Knauf a termination fee of $215 million. Boral may also exercise its right to purchase our 50% interest in UBBP, as discussed further in Note 4, Equity Method Investments, to the consolidated financial statements in Part II, Item 8 of this report, in the event the Merger is not completed.

The pendency of the Merger could adversely affect our business, results of operations, financial condition and the market price of our common stock.

The pendency of the Merger has caused disruptions in, and created uncertainty surrounding, our business, which could have an adverse effect on our business, results of operations, financial condition and the market price of our common stock. These risks to our business include the following, all of which could be exacerbated by a delay in the completion of the Merger: (i) the potential negative impact on UBBP's business, results of operations and financial condition as a result of the uncertainty around the future ownership of UBBP; (ii) the effect of restrictions placed on us and our subsidiaries’ ability to operate our businesses under the Merger Agreement, including our ability to pursue alternatives to the Merger; (iii) the risk of disruption resulting from the Merger, including the diversion of our management’s attention from ongoing business operations; (iv) the effect of the pendency of the Merger on our ability to retain and hire employees; (v) the effect of the pendency of the Merger on our business relationships, operating results and businesses generally; (vi) the occurrence of any event giving rise to the right of a party to terminate the Merger Agreement; and (vii) the outcome of legal proceedings that have been instituted against us related to the Merger and any additional proceedings that may be instituted in the future.

Our businesses are cyclical, regional and seasonal in nature and subject to industry downturns.

Our businesses are cyclical and sensitive to changes in general economic conditions, including conditions in the North American housing and construction-based markets. Housing starts in the United States remain below the long-term historical average of 1.44 million, while new nonresidential construction and the residential and nonresidential repair and remodel market in the United States have experienced slower than average growth over the past several years. Moreover, we operate in a variety of regional markets, so our businesses are subject not only to general economic conditions, but also to localized economic conditions in each of those regions. Housing and construction-based markets are impacted by broader economic circumstances, including employment levels, the availability of skilled labor, household formation, home ownership rate, new and existing home price trends, availability of mortgage financing, interest rates, deductibility of mortgage interest and real estate taxes, consumer confidence, job growth and discretionary business investment, and these markets may experience a downturn. Adverse conditions in the markets or regions where we operate, or the failure of these markets or regions to return to historical levels, may have a material adverse effect on our business, financial condition, operating results and cash flows.

In addition, our businesses are seasonal and impacted by pre-buy activity in advance of price increases, which has caused in the past, and will likely cause in the future, our quarterly results to vary significantly. This variability in our sales impacts our cost structure as we may need to maintain staffing levels and consistency of supply to meet anticipated demand in future quarters. In addition, unfavorable weather conditions, such as snow, heavy rainfall or natural disasters could reduce construction activity and adversely affect demand for our products.

We operate in highly competitive markets, and we may not be able to maintain current price levels for our products or achieve price increases for our products.

The markets for our products are competitive, and competition varies by region. Principal methods of competition include product quality and performance, range of products, product availability, product pricing, compatibility of systems and customer service. Prices for our products are affected by demand and available supply in the markets for our products. Currently, there is excess wallboard production capacity in the United States and Canada. Several of our competitors have also recently added, or are in the process of adding, capacity in the United States, and new competitors have entered certain markets, including wallboard imports from Mexico into certain regions in the South. Excess production capacity could negatively impact our ability to implement price increases or cause us to reduce pricing to maintain or grow our sales. Any inability to maintain or increase prices, particularly in light of cost inflation, including in raw materials, transportation and labor, could further adversely affect our business, financial condition, operating results and cash flows.

We are dependent on sales to our major customers, and the number of our customers with significant buying power is increasing.

For the year ended December 31, 2018, our two largest customers, The Home Depot and L&W, collectively accounted for approximately 38% of our sales, while our top four customers collectively accounted for approximately 50% of our sales. We face strong competition for these and our other major customers. As is customary in our industry, we generally do not enter into long-term contracts with our customers, which may choose to reduce or delay purchases of our products at any time. If one or more of our major customers reduces or delays substantial orders, our business, financial condition, operating results and cash flows may be materially and adversely affected, particularly for the period in which the reduction or delay occurs and also possibly for subsequent periods.

Certain of our customers are also large companies with significant buying power. The ongoing consolidation taking place in the gypsum specialty dealer channel will likely further enhance the ability of certain of our customers to seek more favorable terms, including pricing, for the products that they purchase from us. Accordingly, our ability to maintain or raise prices in the future may be limited, including during periods of raw material and other cost increases such as 2018. If we are forced to reduce prices or to maintain prices during periods of increased costs, or if we lose customers because of pricing or other methods of competition, our business, financial condition, operating results and cash flows may be materially and adversely affected.

L&W is currently our largest customer in the gypsum specialty dealer channel, accounting for 14% of our consolidated net sales in 2018. Specialty dealers often have multiple suppliers for product categories. Following the sale of L&W in 2016, L&W diversified its supplier base, resulting in a reduction in our sales to L&W, and this diversification continued in 2018. To address the loss of sales to L&W, we have made efforts to grow our business with current customers and serve new customers. However, our efforts to replace the loss of sales to L&W may not be successful, and we may experience market share loss or unfavorable pricing, in which case our net sales, operating results and cash flows may be materially and adversely impacted.

A small number of our stockholders could significantly influence our business, affairs and stock price.

Based on filings made with the SEC, as of January 31, 2019 Berkshire Hathaway Inc. controlled approximately 31% of our common stock and Knauf controlled approximately 10.5% of our common stock. Accordingly, a small number of our stockholders have affected, and in the future may continue to affect, matters requiring approval by stockholders, including the election of directors. One or more of these stockholders may have interests that differ from other stockholders and may vote on such matters in a way that is adverse to the interests of those other stockholders. In addition, if one or more of these stockholders engage in sales of our common stock, our share price may decline.

Increased costs, or decreased availability, of key raw materials, transportation or energy will increase our cost of products sold.

The cost and availability of raw materials, transportation and energy are critical to our operations. We use substantial quantities of natural gypsum, synthetic gypsum, wastepaper, mineral fiber, steel, perlite, starch, siloxane and plastic pails. We have experienced significant inflation in the cost of many of these items. In addition, the cost of certain of these items has been volatile, and availability has sometimes been limited. We obtain some of these materials from a limited number of suppliers or sole source suppliers, which increases the risk of unavailability. We are not always able to pass increased costs on to our customers due to market conditions or existing agreements with our customers at agreed prices. In addition, imposition of more or new tariffs, quotas, trade barriers, and similar restrictions on the importation of raw materials used in our products may increase our costs. If price increases for our finished products significantly trail the increase in costs, our business, financial condition, operating results and cash flows may be materially and adversely affected. As an example, in 2018 we were not able to completely offset the significant increases in raw material costs, in particular for synthetic gypsum, natural gypsum and siloxane, which negatively impacted operating profit.

Approximately 39% of the gypsum used in our plants is synthetic gypsum. Nine of our Gypsum plants in operation use synthetic gypsum for all of their needs, while another four use it for some of their needs. The suppliers of synthetic gypsum are primarily coal-fired electricity generating plants, many of whom have switched to using natural gas instead of coal for their electricity generation needs due to its lower cost. As a result, we have experienced increases in the cost of synthetic gypsum and the cost to transport synthetic gypsum to our plants. In addition, existing or future changes in environmental regulations may make it more difficult or costly for power companies to burn coal, which may result in a further shift away from coal-based sources of energy. If this occurs, the availability of synthetic gypsum will likely continue to decrease. We could incur substantial costs in connection with any significant reduction in the availability of synthetic gypsum, including costs to convert our plants to use natural gypsum, costs to obtain or develop additional sources of natural gypsum or increased costs to transport synthetic gypsum to our plants from farther away, which may materially and adversely affect our business, financial condition, operating results and cash flows.

Transportation costs are a significant portion of our variable costs because we are responsible in most cases for delivering our products to our customers. Reductions in the availability of certain modes of transportation, such as trucking, could limit our ability to deliver our products to our customers on time or obtain raw materials, which may materially and adversely affect our business, financial condition, operating results and cash flows. During 2018 we experienced a shortage of available trucks and truck drivers, which resulted in significant increases in our transportation costs and adversely impacted our profitability. Increases in the cost of fuel, or if we are required to transport raw materials or finished products over longer distances, could result in further material increases in the cost of transportation that could also materially and adversely affect our operating profits.

Similarly, paper is also a significant component of our variable costs. We produce a majority of our wallboard paper at our paper mill in Otsego, Michigan with the remainder produced at three other company-owned production facilities, and augment our paper needs through purchases from outside suppliers when necessary. If our utilization increases or if our current supply of wallboard paper is disrupted, particularly at our Otsego paper mill, we may be required to purchase additional paper from outside suppliers, which may only be available at increased cost. We also buy various grades of wastepaper, and shortages occur periodically in one or more grades and may vary among geographic regions. As a result, we have experienced, and in the future may experience, volatility in wastepaper availability and cost, affecting the mix of products manufactured at particular locations or the cost of producing them.

We use natural gas extensively in the production of our products in the United States, Canada and Mexico. The price of natural gas can fluctuate significantly because of weather, environmental or other regulatory changes, which can materially impact our results of operations for a particular period. In an attempt to reduce our price risk related to fluctuations in natural gas prices, we enter into hedging agreements using swaps for natural gas purchases in the United States and Canada. Because we hedge the majority of our exposures, we would not be able to participate, for the portion we hedged, in substantial or extended declines in natural gas prices. As a result, our costs would remain elevated in such an environment. During periods of rising natural gas prices on the other hand, our production costs will rise to a lesser extent because of our hedging activities.

Our facilities may experience unexpected operational difficulties or catastrophic events.

Our facilities may be forced to cease operations unexpectedly due to equipment failures or events beyond our control, such as hurricanes, fires, floods, earthquakes or other environmental catastrophes. Any equipment downtime or facility damage may hinder our ability to meet customer demand, reduce our sales or impede our ability to deliver our products in an efficient and cost-effective manner, and could require that we make significant capital expenditures. Several of our plants, and production lines within our plants, are dedicated to specific products. If any of those plants or lines are unable to operate for a prolonged period, it would reduce our ability to effectively compete in the markets for those products, which could materially and adversely affect our business, financial condition, operating results and cash flows.

We do not have majority control over UBBP, which involves risks not otherwise present when we operate our business through wholly-owned entities.

A substantial portion of our international operations are conducted through UBBP, which are operated in accordance with the terms of a Shareholders Agreement. UBBP involves risks not otherwise present when we operate our business through wholly-owned entities, including:

| |

• | Entering into the Merger Agreement to be acquired by Knauf constituted a change of control under the Shareholders Agreement such that, even if the Merger is not completed, or if certain other events of default under the Shareholders Agreement occur with respect to us, we may be required to sell our entire interest in UBBP to Boral at fair market value, as determined in accordance with the Shareholders Agreement. In the event we are forced to sell our interest in UBBP, it may be under terms that we do not consider favorable to us. On August 28, 2018, Boral delivered a default notice under the Shareholders Agreement to commence the process to establish the fair market value of our 50% interest in UBBP. Once fair market value is established, Boral will have the right to purchase our 50% interest in UBBP in accordance with the Shareholders Agreement. Boral’s exercise of its right to purchase our 50% interest in UBBP could occur prior to the closing of the Merger Agreement, in which case we would receive the cash proceeds for our interest, and we would no longer own an interest in UBBP. |

| |

• | In the event we are required to sell our interest in UBBP to Boral, we may be restricted from competing in UBBP’s markets for a period of time, many of which we anticipate to be high-growth markets. In addition, in the event we are required to sell our interest in UBBP to Boral, certain of our intellectual property will continue to be licensed to UBBP on an exclusive basis for a period of time. |

| |

• | Certain major decisions with respect to UBBP require the majority or unanimous approval of the joint ventures’ boards or shareholders, which could result in a deadlock given the 50/50 ownership and equal board representation structure. Boral may have economic or other business interests or goals that are or become inconsistent with ours, and we may not be able to obtain approval of certain matters that would be in our or UBBP’s best interests. In addition, we may be required to spend additional resources to resolve any dispute with Boral. |

| |

• | A deadlock with respect to certain fundamental decisions may result in the triggering of a sale process of UBBP. In such a case, the terms of the sale may be less attractive than if we had held onto our investment. |

| |

• | The Shareholders Agreement limits our ability to transfer our interest in UBBP. As a result, we may be unable to sell our interest in UBBP when we would otherwise like. |

| |

• | UBBP may not pay dividends if such payments are, among other things, restricted pursuant to the terms of the credit facilities maintained by UBBP, inconsistent with the then-applicable strategic plan, or illegal. Accordingly, we may not receive dividend payments from UBBP in the amounts that we currently anticipate or at all, which may adversely impact our ability to receive any economic benefit from UBBP. |

| |

• | In the event Boral is subject to a change of control, or if certain other events of default under the Shareholders Agreement occur with respect to Boral, we will have the right to acquire Boral’s interest in UBBP at fair market value, but it may be on terms that we do not find favorable. In this circumstance, if we do not complete the |

acquisition due to lack of funding or otherwise, we would remain in the joint venture, but possibly under ownership that we do not find acceptable.

| |

• | In certain circumstances, a capital call may be issued to the shareholders of UBBP in order to obtain additional funding for the joint ventures' operations. If we do not provide capital and Boral does, Boral may receive additional shares in UBBP, thereby diluting our interest and diminishing our rights under the Shareholders Agreement. Further, although we intend for UBBP to be self-funding, we may nonetheless determine in the future that we need to provide additional capital in order for UBBP to continue operating. |

| |

• | Boral may become insolvent, refuse to make additional capital contributions or fail to meet its obligations under the Shareholders Agreement or the two share sale and subscription agreements entered into with Boral, which may result in certain liabilities to us. |

| |

• | UBBP has relied in part on new products and technology we have developed. UBBP is contractually entitled to some, but not all, of our new products and recently licensed several new products and technologies from us, including USG Sheetrock® Brand EcoSmart Panels and Ensemble® Acoustical Drywall Ceiling. If UBBP is unable to successfully commercialize on our innovation efforts, the opportunity to grow the joint ventures or for us to deploy our products in UBBP’s territory will be adversely impacted. |

| |

• | UBBP is required to protect our licensed trade secrets and confidential intellectual property in its territory, which includes countries where there is a high risk of intellectual property loss, and we also expend significant efforts to secure and enforce our intellectual property rights in UBBP’s territory. If UBBP is not diligent with its protections or our efforts are insufficient and competitors acquire our trade secrets and confidential intellectual property, then there may be a material adverse impact on our business both inside and outside of UBBP’s territory. |

If any of these risks were to materialize, our business, financial condition, operating results and cash flows could be materially and adversely impacted.

Our international operations expose us to risks that would not otherwise be present in our U.S. operations.

Our international business operations in the countries within the territory of UBBP and in Canada and Mexico, including our ability to introduce new products into these markets, are important to our operations, growth and prospects. Our foreign operations and our international expansion subject us to a number of risks, including:

| |

• | sensitivity to general economic conditions in each of the countries in which we or UBBP operate, including, in particular, the housing and construction-based markets; |

| |

• | compliance with United States laws affecting operations outside of the United States, such as the Foreign Corrupt Practices Act or similar anti-bribery laws and regulations, or corruption in foreign countries; |

| |

• | compliance with a variety of local laws and regulations, including environmental and safety laws and regulations; |

| |

• | changes in U.S. or foreign tax laws and the interpretation of those laws; |

| |

• | imposition of more or new tariffs, quotas, trade barriers, and similar restrictions on our sales outside the United States, including cross-border intercompany sales; |

| |

• | fluctuations in currency values and the impact on our consolidated results; |

| |

• | changes in foreign currency exchange controls; |

| |

• | discriminatory or conflicting fiscal policies; |

| |

• | difficulties enforcing intellectual property and contractual rights, and securing information and infrastructure, in certain jurisdictions; |

| |

• | greater risk of uncollectible accounts and longer collection cycles; and |

| |

• | nationalization of properties by foreign governments. |

Moreover, political and economic changes or volatility, geopolitical regional conflicts, terrorist activity, political unrest, civil strife, acts of war, epidemics, public corruption and other economic or political uncertainties could interrupt and negatively affect our business operations. All of these factors could result in increased costs or decreased revenues, and could materially and adversely affect our business, financial condition, operating results and cash flows.

Our success is dependent on our ability to innovate and protect our intellectual property and other proprietary rights.

We believe that we maintain a leadership position and price premium in part because of our innovation and introduction of new products. As a result, our success also depends, in part, upon securing and enforcing our intellectual property rights. We rely on a combination of contractual rights and patent, copyright, trademark and trade secret laws to establish and protect our intellectual property. Despite our efforts to safeguard and maintain our intellectual property, the steps we have taken may be limited in their effect. Existing patent, copyright, trademark and trade secret laws offer only limited protection, and it may be expensive and time consuming to assert these protections against competitors who infringe on our rights, and our patents could be invalidated or circumvented. In addition, others may develop substantially equivalent or superseding proprietary technology, or competitors may offer similar competing products that do not infringe on our intellectual property rights, thereby substantially reducing the value of our proprietary rights. Moreover, the laws of some foreign countries in which our products are or may be manufactured or sold may not protect our products or intellectual property rights to the same extent as do the laws of the United States. This risk may be heightened in connection with our investments in UBBP because it results in the use of our intellectual property in additional foreign jurisdictions, some of which lack robust or accessible intellectual property protection enforcement mechanisms.

We intend to continue making investments in research and development to develop new and improved products and more efficient manufacturing methods in order to maintain our market leadership position. If we do not make these investments, or we are not able to successfully commercialize our innovation efforts, our revenues, operating results and market share may be materially and adversely affected.

Our businesses are capital intensive, leading to high levels of fixed costs, and capital expenditures to maintain our market leadership position and expand our businesses may not achieve their intended results.

Our businesses are capital intensive, and regularly require capital expenditures to maintain equipment, expand operations, improve efficiency and comply with applicable laws and regulations. We are limited in our ability to quickly reduce fixed costs in response to reduced demand for our products, so these fixed costs may result in higher average unit costs and lower margins if we are unable to offset with price increases. Alternatively, we may not be able to quickly respond to unanticipated increased demand for our products, which could result in our inability to satisfy customer demand and loss of market share.

In order to standardize and automate production across our businesses, we are investing in capital improvement projects, including an anticipated $300 million investment in Advanced Manufacturing that began in late 2016, which we believe will materially improve our operating results. Future downturns in our industry or businesses may prevent us from having the funds necessary to make anticipated capital expenditures, and there may be delays or cost increases in completing these projects. Our return on investment from our Advanced Manufacturing investments or other capital expenditures may not be sufficient to recover the expenses associated with these initiatives and we may not achieve the expected $100 million in incremental EBITDA from Advanced Manufacturing in the anticipated timeframe. See Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity Outlook for additional information regarding our Advanced Manufacturing initiatives.

A disruption in our information technology systems due to a catastrophic event or security breach could interrupt or damage our operations.

In the conduct of our business we collect, use, transmit and store data on information systems. We have put in place security measures designed to protect against unauthorized access to, or corruption of, our information systems and data or disruption of our operations. However, advanced cybersecurity threats are increasingly difficult to identify and prevent. The security measures we have implemented may not be sufficient to prevent breaches, and we may be required to incur additional costs to strengthen our systems as cyber-attacks continue to evolve. Any security breach or compromise of our information systems could significantly impact our operations, damage our reputation, cause the disclosure of confidential customer, employee, supplier or company information, including our intellectual property, and result in significant losses, litigation, fines and costs. The regulatory environment related to information security, data collection and privacy is also growing more rigorous, with new and constantly changing requirements applicable to our business, and compliance with those requirements could result in additional costs.

We also compete through our use and improvement of information technology. In order to remain competitive, we need to provide customers with timely, accurate, easy-to-access information about product availability, orders and delivery status. While we have provided manual processes for short-term failures and disaster recovery capability, a prolonged disruption of systems or other failure to meet customers’ expectations regarding the capabilities and reliability of our systems may materially and adversely affect our operating results.

Compliance with environmental and safety laws and regulations or product safety concerns could cause us to make modifications to how we manufacture our products, negatively affect our results and also require that we make significant capital investments or otherwise increase our costs.

We operate plants, mines and quarries in North America. As a result, we are subject to numerous federal, state, local and foreign laws and regulations governing the protection of the environment and occupational health and safety, including laws regulating air emissions, wastewater discharges, the management and disposal of hazardous materials and wastes, and the health and safety of our employees. We are also required to obtain permits from governmental authorities for certain operations. If we were to fail to comply with these laws, regulations or permits, we could incur fines, penalties or other sanctions and be subject to private litigation. In addition, in the past we have been, and in the future could be, held responsible for costs and damages arising from any contamination at our past or present facilities or at third-party waste disposal sites. Further, new environmental and safety laws and regulations may cause us to incur material expenses relating to compliance, impact the availability and cost of raw materials and have a material and adverse impact on our operations and results.

Many U.S. and foreign jurisdictions have adopted or are considering measures to reduce greenhouse gas, or GHG, emissions, including carbon dioxide and methane. Legislation or regulations requiring reductions in GHG emissions could affect future expansions or modifications at our plants, mines and quarries and may require that we incur significant costs and additional capital investment to satisfy permitting requirements. In addition, enactment of new climate change legislation, regulatory initiatives or treaties impacting the locations where we conduct business could have a material adverse effect on our operations. For example, legislation establishing a “carbon tax” on energy use or a “cap and trade” could materially and adversely increase the cost of energy used in our manufacturing processes.

Legal challenges to the U.S. EPA’s final rule regarding the use of synthetic gypsum, or subsequent state legislation, could also result in laws or regulations that adversely affect the classification, use, storage and disposal of synthetic gypsum. Such laws or regulations may require significant capital investments to convert those plants and lines that use synthetic gypsum to natural gypsum.

The building materials industry has been subject to claims relating to raw materials, as well as claims for incidents of catastrophic loss, such as building fires. We have rigorous product safety and quality standards and a strong commitment to product safety and quality. However, if our products do not meet applicable safety standards or customers’ expectations regarding safety, we could experience decreased sales, increased costs and/or be exposed to legal and reputational risks. Events that give rise to actual, potential or perceived product safety concerns could expose us to government enforcement action and/or private litigation. Reputational damage caused by real or perceived product safety concerns could negatively affect our business and results of operations, and product liability insurance coverage may not be available or adequate in all circumstances to cover claims that may arise in the future.

Legal and governmental proceedings, including those involving antitrust, tax, environmental, intellectual property, the Merger or other matters, may result in significant costs.

We are party to litigation and governmental proceedings, including legal proceedings in connection with the Merger. We could become subject to additional legal claims in the future, some of which could become material. We may also initiate legal proceedings to defend and enforce our proprietary rights. The outcome of legal and governmental proceedings may differ from our expectations because the outcomes of litigation and governmental proceedings are often difficult to reliably predict. Various developments can lead to changes in management’s estimates of liabilities. Those developments include judicial rulings or judgments, settlements, or regulatory developments or changes in applicable law. A future adverse ruling, settlement or unfavorable development could result in charges that could have a material adverse effect on our results of operations in any particular period, or we could be unsuccessful in protecting our intellectual property. For a more detailed discussion of certain of the legal proceedings in which we are involved, see Item 3, Legal Proceedings, below.

We may pursue acquisitions, joint ventures and other transactions to complement or expand our businesses, which even if completed, may involve a number of risks, or we may not be able to pursue a desired transaction under the Merger Agreement.

We may pursue additional opportunities to acquire businesses or technologies and to form joint ventures that we believe could complement, enhance or expand our current businesses or product lines or that might otherwise offer us growth opportunities. Such pursuits may be costly and unsuccessful and cause diversion of management’s attention from day-to-day operations. Even if completed, potential issues associated with these activities could include, among other things, difficulty with integrating

business operations, infrastructure and personnel, and our ability to realize the full extent of the expected returns, benefits, cost savings or synergies as a result of a transaction within the anticipated time frame, or at all.

Under the Merger Agreement, we and our subsidiaries are prohibited from acquiring any business or forming any joint venture, subject to certain exceptions. This restriction to pursue a transaction that we may otherwise believe to be in our best interest could have an adverse effect on our business, financial condition, operating results and cash flows.

Significant changes in factors and assumptions used to measure our defined benefit plan obligations, actual investment returns on pension assets and other factors could negatively impact our operating results and cash flows.

The recognition of costs and liabilities associated with the pension and postretirement plans is affected by assumptions made by management and used by actuaries engaged by us to calculate the benefit obligations and the expenses recognized for these plans. The inputs used in developing the required estimates are calculated using a number of assumptions, which represent management’s best estimate of the future. The assumptions that have the most significant impact on costs and liabilities are the discount rate, the estimated long-term return on plan assets for the funded plans, retirement rates, and mortality rates. These assumptions are generally updated annually.

As of December 31, 2018, our pension plans were underfunded by $137 million and our unfunded postretirement plan liabilities were approximately $132 million. While discount rates have increased in 2018, in recent years declining interest rates have negatively impacted the funded status of our pension and postretirement plans. If the interest rates decline again, funding requirements for our pension plans may become more significant. If our cash flows and capital resources are insufficient to fund our obligations under these pension and postretirement plans, we could be forced to reduce or delay investments and capital expenditures, seek additional capital, or incur indebtedness.

We are generally not permitted to return capital to our stockholders under the Merger Agreement, and even if we are able to do so, we may not be able to fully execute our stock repurchase program and may not otherwise return capital to our stockholders in the foreseeable future.

In February 2018 we announced an increase in our stock repurchase program, bringing the total size of the program to $500 million. However, the Merger Agreement limits our ability to repurchase shares of our common stock, subject to certain exceptions, and share repurchases under the program will not continue so long as the Merger Agreement is in effect and has not been terminated. If the program were to recommence, there is no guarantee as to the exact number of shares or value that will be repurchased and we may discontinue purchases at any time. Whether we make any further repurchases would depend on many factors, including but not limited to our business and financial performance, the business and market conditions at the time, including the price of our shares, and other factors that management considers relevant. Additionally, we expect to fund any repurchases under our stock repurchase program through cash on hand, which may impact our ability to pursue potential strategic opportunities. Although our stock repurchase program is intended to enhance long-term stockholder value, short-term stock price fluctuations could reduce the program’s effectiveness and there can be no assurance that any stock repurchases will enhance stockholder value.

In addition, the Merger Agreement also limits our ability to declare any dividend in respect of our common stock, other than the conditional special dividend paid to holders of our common stock in connection with the Merger. Other than the conditional special dividend, we have not paid a dividend on our common stock since the first quarter of 2001, and there can be no assurance that we will do so in the foreseeable future.

Our credit agreement also limits our ability to pay a dividend or repurchase our stock unless specified borrowing availability and fixed charge coverage ratio tests are met, and it prohibits payment of a dividend or repurchase of our stock if a default exists under the agreement. Accordingly, we may be required to cease repurchasing stock for periods of time in order to maintain compliance with our credit agreement terms. If we do not pay dividends or continue to execute on our stock repurchase program, investors will have to rely on the possibility of stock appreciation and sell their shares to realize a return on their investment.

We may not be able to pursue certain strategic opportunities unless we increase our indebtedness and leverage ratio. Our level of indebtedness also requires us to dedicate a portion of our cash flow to debt payments and limits our ability to engage in certain business activities.

As of December 31, 2018, we had $1.1 billion of outstanding debt, consisting of senior notes and industrial revenue bonds, which is slightly above our target leverage ratio range of 1.5x to 2.0x adjusted debt/EBITDA. We may not be able to pursue certain strategic opportunities that may otherwise be available to us without incurring additional indebtedness and thereby increasing our leverage ratio outside of our target range.

Our current debt service obligations also require us to dedicate a portion of our cash flow from operating activities to payments on our indebtedness, which reduces the availability to use our cash flow for other purposes, including capital expenditures, research and development efforts, potential acquisitions or investments. If we are unable to fund our business activities, meet our obligations under our debt agreements or are contractually restricted from pursuing activities or transactions that we believe are in our long-term best interests, including any activities prohibited by the Merger Agreement, our business, financial condition, results of operations and cash flows could be adversely affected. Our indebtedness also may increase our vulnerability to economic and industry downturns and changing market conditions and place us at a competitive disadvantage relative to competitors that have less debt. We are required to post letters of credit or cash as collateral primarily in connection with our hedging transactions, insurance programs and bonding activities. The amounts of collateral we are required to post may vary based on our financial position and credit ratings. Use of letters of credit as collateral reduces our borrowing availability under our domestic revolving credit agreement and, therefore, like the use of cash as collateral, reduces our overall liquidity and our ability to fund other business activities.

The terms of our debt agreements, including our credit facility, may also limit our ability to engage in certain activities and transactions that may be in our long-term interest. Among other things, unless we obtain approval, the covenants contained in our debt agreements may restrict or limit our ability to incur additional indebtedness, pay dividends or repurchase our common stock, make guarantees, sell our assets or make other fundamental changes, engage in mergers, acquisitions and dispositions, make investments, change our business purpose, or enter into certain transactions with affiliates. We may also be required to maintain specified financial ratios, which may require that we take action to reduce our debt or to act in a manner contrary to our current business plans. Our ability to comply with these covenants and financial ratios may be affected by events beyond our control, and we may not be able to continue to meet those covenants and ratios. Breach of any of the covenants or ratios contained in the agreements governing our debt, or our inability to pay interest on, or principal of, our outstanding debt as it becomes due, could result in an event of default, in which case, our lenders could declare all amounts outstanding to be immediately due and payable. If this occurs, we may not be able to refinance the accelerated debt on favorable terms, or at all, or repay the accelerated debt, and our liquidity may be adversely impacted.

| |

Item 1B. | UNRESOLVED STAFF COMMENTS |

None

Item 2.PROPERTIES

Our leased corporate headquarters is located in Chicago, Illinois. We operate plants, mines, quarries, and other facilities throughout North America. The locations of our production properties in operation for our consolidated segments as of December 31, 2018 are as follows (plants are owned unless otherwise indicated):

|

| | | | | | | | | | | | | | | | |

| | U.S. Wallboard and Surfaces | | U.S. Performance Materials | | U.S. Ceilings |

| | Gypsum wallboard and other gypsum products | | Surface preparation and joint treatment products | | Under-layment | | Building Envelope | | Structural | | Ceiling Tile | | Ceiling Grid | | Specialty Ceilings |

Alabaster (Tawas City), Michigan | | x | | | | | | | | | | | | | | |

Aliquippa, Pennsylvania1 | | x | | | | | | | | | | | | | | |

Atlanta, Georgia3 | | | | | | | | | | | | | | | | x |

Auburn, Washington | | | | x | | | | | | | | | | | | |

Baltimore, Maryland1 | | x | | x | | x | | | | | | | | | | |

Bridgeport, Alabama1 | | x | | x | | | | | | | | | | | | |

Cartersville, Georgia | | | | | | | | | | | | | | x | | |

Chamblee, Georgia | | | | x | | | | | | | | | | | | |

Cloquet, Minnesota | | | | | | | | | | | | x | | | | |

Commerce, California3 | | | | | | | | | | | | | | | | x |

Dallas, Texas | | | | x | | | | | | | | | | | | |

Delavan, Wisconsin | | | | | | | | | | x | | | | | | |

Detroit (River Rouge), Michigan | | x | | | | x | | | | | | | | | | |

East Chicago, Indiana1 | | x | | x | | | | | | | | | | | | |

Fort Dodge, Iowa | | x | | x | | x | | | | | | | | | | |

Galena Park, Texas1 | | x | | x | | | | | | | | | | | | |

Greenville, Mississippi | | | | | | | | | | | | x | | | | |

Gypsum, Ohio1 | | | | x | | x | | x | | | | | | | | |

Jacksonville, Florida1 | | x | | x | | | | x | | | | | | | | |

New Orleans, Louisiana1 | | | | | | x | | | | | | | | | | |

Norfolk, Virginia1 | | x | | | | | | | | | | | | | | |