Management's Discussion and Analysis (“MD&A”)

Quarterly Report on the Second Quarter of 2024

This portion of the Quarterly Report provides management’s discussion and analysis (“MD&A”) of the financial condition and results of operations, to enable a reader to assess material changes in financial condition and results of operations as at, and for the three and six month periods ended June 30, 2024, in comparison to the corresponding prior-year periods. The MD&A is intended to help the reader understand Barrick Gold Corporation (“Barrick”, “we”, “our”, the “Company” or the “Group”), our operations, financial performance as well as our present and future business environment. This MD&A, which has been prepared as of August 9, 2024, is intended to supplement and complement the condensed unaudited interim consolidated financial statements and notes thereto, prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board applicable to the preparation of interim financial statements, under International Accounting Standard 34, Interim Financial Reporting, for the three and six month periods ended June 30, 2024 (collectively, the “Financial Statements”), which are included in this Quarterly Report on pages 83 to 87. You are encouraged to review the Financial Statements in conjunction with your review of this MD&A. This MD&A should be read in conjunction with both the

annual audited consolidated financial statements for the two years ended December 31, 2023, the related annual MD&A included in the 2023 Annual Report, and the most recent Form 40–F/Annual Information Form on file with the U.S. Securities and Exchange Commission (“SEC”) and Canadian provincial securities regulatory authorities. These documents and additional information relating to the Company are available on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov. Certain notes to the Financial Statements are specifically referred to in this MD&A and such notes are incorporated by reference herein. All dollar amounts in this MD&A are in millions of United States dollars (“$” or “US$”), unless otherwise specified.

For the purposes of preparing our MD&A, we consider the materiality of information. Information is considered material if: (i) such information results in, or would reasonably be expected to result in, a significant change in the market price or value of our shares; (ii) there is a substantial likelihood that a reasonable investor would consider it important in making an investment decision; or (iii) it would significantly alter the total mix of information available to investors. We evaluate materiality with reference to all relevant circumstances, including potential market sensitivity.

Abbreviations

|

|

|

|

|

|

|

|

| BAP |

Biodiversity Action Plans |

|

|

|

|

|

|

| BNL |

Barrick Niugini Limited |

|

|

| CDCs |

Community Development Committees |

|

|

|

|

| CIL |

Carbon-in-leach |

| Commencement Agreement |

Detailed Porgera Project Commencement Agreement between PNG and BNL |

|

|

|

|

|

|

|

|

| CTSF |

Kibali Cyanide Tailings Storage Facility |

| DRC |

Democratic Republic of Congo |

|

|

| E&S Committee |

Environmental and Social Oversight Committee |

|

|

|

|

|

|

|

|

| ESG |

Environmental, Social and Governance |

| ESG & Nominating Committee |

Environmental, Social, Governance & Nominating Committee |

| ESIA |

Environmental and Social Impact Assessment |

|

|

|

|

|

|

|

|

| G&A |

General and administrative |

| GHG |

Greenhouse Gas |

| GISTM |

Global Industry Standard for Tailings Management |

| GoT |

Government of Tanzania |

|

|

| IASB |

International Accounting Standards Board |

| ICMM |

International Council on Mining and Metals |

| IFRS |

IFRS Accounting Standards as issued by the International Accounting Standards Board |

|

|

|

|

|

|

|

|

| ISSB |

International Sustainability Standards Board |

| KCD |

Karagba, Chauffeur and Durba |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ktpa |

Thousand tonnes per annum |

| LTI |

Lost Time Injury |

| LTIFR |

Lost Time Injury Frequency Rate |

|

|

|

|

|

|

|

|

|

|

| Mtpa |

Million tonnes per annum |

| MVA |

Megavolt-amperes |

| MW |

Megawatt |

|

|

| NGM |

Nevada Gold Mines |

| OECD |

Organisation for Economic Co-operation and Development |

|

|

| PFS |

Prefeasibility Study |

| PJL |

Porgera Jersey Limited |

| PNG |

Papua New Guinea |

|

|

| Randgold |

Randgold Resources Limited |

| RC |

Reverse Circulation |

| RIL |

Resin-in-leach |

| ROD |

Record of Decision |

|

|

| SDG |

Sustainable Development Goals |

|

|

| TCFD |

Task Force for Climate-related Financial Disclosures |

| TRIFR |

Total Recordable Injury Frequency Rate |

|

|

| TSF |

Tailings Storage Facilities |

|

|

|

|

|

|

|

|

|

|

|

|

| VAT |

Value-Added Tax |

| VTEM |

Versatile Time Domain Electromagnetic |

| WGC |

World Gold Council |

| WTI |

West Texas Intermediate |

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2024 |

1 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Cautionary Statement on Forward-Looking Information

Certain information contained or incorporated by reference in this MD&A, including any information as to our strategy, projects, plans or future financial or operating performance, constitutes “forward-looking statements”. All statements, other than statements of historical fact, are forward-looking statements. The words “believe”, “expect”, “anticipated”, “vision”, “aim”, “on track”, “strategy”, “target”, “plan”, “opportunities”, “guidance”, “forecast”, “outlook”, “objective”, “intend”, “project”, “pursue”, “develop”, “progress”, “in progress”; “continue”, “committed”, “budget”, “estimate”, “potential”, “prospective”, “future”, “focus”, “during”, “ongoing”, “following”, “subject to”, “scheduled”, “may”, “will”, “can”, “could”, “would”, “should” and similar expressions identify forward-looking statements. In particular, this MD&A contains forward-looking statements including, without limitation, with respect to: Barrick’s forward-looking production guidance, including the anticipated increase in gold and copper production during the remainder of 2024; estimates of future cost of sales per ounce for gold and per pound for copper, total cash costs per ounce and C1 cash costs per pound, and all-in-sustaining costs per ounce/pound; cash flow forecasts; projected capital, operating and exploration expenditures; the share buyback program and performance dividend policy, including the criteria for dividend payments; mine life and production rates; the resumption of operations at the Porgera mine and expected ramp up of mining and processing in 2024; our plans and expected completion and benefits of our growth and capital projects, including the Goldrush Project, Fourmile, Donlin Gold, Pueblo Viejo plant expansion and mine life extension project, Veladero Phase 7 leach pad project, the Reko Diq project, solar power projects at NGM and Loulo-Gounkoto, the Jabal Sayid Lode 1 project and the development of the Lumwana Super Pit; expected timing for production for Goldrush, Reko Diq and the Lumwana Super Pit; expected copper and gold production from Reko Diq; Barrick’s global exploration strategy and planned exploration activities, including our plans and anticipated timelines for commencement and completion of drilling at our existing exploration projects; the new mining code in Mali and the status of the establishment conventions for the Loulo-Gounkoto complex; capital expenditures related to upgrades and ongoing management initiatives; our ability to identify new Tier One assets and the potential for existing assets to attain Tier One status; our pipeline of high confidence projects at or near existing operations; potential mineralization and metal or mineral recoveries; our ability to convert resources into reserves; asset sales, joint ventures and partnerships; Barrick’s strategy, plans and targets in respect of environmental and social governance issues, including climate change, GHG emissions reduction targets, safety performance, responsible water use, TSF management, including Barrick’s conformance with the GISTM, community development, biodiversity and human rights initiatives; and expectations regarding future price assumptions, financial performance and other outlook or guidance.

Forward-looking statements are necessarily based upon a number of estimates and assumptions including material estimates and assumptions related to the factors set forth below that, while considered reasonable by the Company as at the date of this MD&A in light of management’s experience and perception of current

conditions and expected developments, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information. Such factors include, but are not limited to: fluctuations in the spot and forward price of gold, copper or certain other commodities (such as silver, diesel fuel, natural gas and electricity); risks associated with projects in the early stages of evaluation and for which additional engineering and other analysis is required; risks related to the possibility that future exploration results will not be consistent with the Company’s expectations, that quantities or grades of reserves will be diminished, and that resources may not be converted to reserves; risks associated with the fact that certain of the initiatives described in this MD&A are still in the early stages and may not materialize; changes in mineral production performance, exploitation and exploration successes; risks that exploration data may be incomplete and considerable additional work may be required to complete further evaluation, including but not limited to drilling, engineering and socioeconomic studies and investment; the speculative nature of mineral exploration and development; lack of certainty with respect to foreign legal systems, corruption and other factors that are inconsistent with the rule of law; changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices, including the potential impact of proposed changes to Chilean law on the status of VAT refunds received in Chile in connection with the development of the Pascua-Lama project; expropriation or nationalization of property and political or economic developments in Canada, the United States or other countries in which Barrick does or may carry on business in the future; risks relating to political instability in certain of the jurisdictions in which Barrick operates; timing of receipt of, or failure to comply with, necessary permits and approvals; non-renewal of key licenses by governmental authorities; failure to comply with environmental and health and safety laws and regulations; increased costs and physical and transition risks related to climate change, including extreme weather events, resource shortages, emerging policies and increased regulations related to GHG emission levels, energy efficiency and reporting of risks; the Company’s ability to achieve its sustainability goals, including its climate-related goals and GHG emissions reduction targets, in particular its ability to achieve its Scope 3 emissions targets which requires reliance on entities within Barrick’s value chain, but outside of the Company’s direct control, to achieve such targets within the specified time frames; contests over title to properties, particularly title to undeveloped properties, or over access to water, power and other required infrastructure; the liability associated with risks and hazards in the mining industry, and the ability to maintain insurance to cover such losses; damage to the Company’s reputation due to the actual or perceived occurrence of any number of events, including negative publicity with respect to the Company’s handling of environmental matters or dealings with community groups, whether true or not; risks related to operations near communities that may regard Barrick’s operations as being

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2024 |

2 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

detrimental to them; litigation and legal and administrative proceedings; operating or technical difficulties in connection with mining or development activities, including geotechnical challenges, tailings dam and storage facilities failures, and disruptions in the maintenance or provision of required infrastructure and information technology systems; increased costs, delays, suspensions and technical challenges associated with the construction of capital projects; risks associated with working with partners in jointly controlled assets; risks related to disruption of supply routes which may cause delays in construction and mining activities, including disruptions in the supply of key mining inputs due to the invasion of Ukraine by Russia and conflicts in the Middle East; risk of loss due to acts of war, terrorism, sabotage and civil disturbances; risks associated with artisanal and illegal mining; risks associated with Barrick’s infrastructure, information technology systems and the implementation of Barrick’s technological initiatives, including risks related to cybersecurity incidents, including those caused by computer viruses, malware, ransomware and other cyberattacks, or similar information technology system failures, delays and/or disruptions; the impact of global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future cash flows; the impact of inflation, including global inflationary pressures driven by ongoing global supply chain disruptions, global energy cost increases following the invasion of Ukraine by Russia and country-specific political and economic factors in Argentina; adverse changes in our credit ratings; fluctuations in the currency markets; changes in U.S. dollar interest rates; risks arising from holding derivative instruments (such as credit risk, market liquidity risk and mark-to-market risk); risks related to the demands placed on the Company’s management, the ability of management to implement its business strategy and enhanced political risk in certain jurisdictions; uncertainty whether some or all of Barrick's targeted investments and projects will meet the Company’s capital allocation objectives and internal hurdle rate; whether

benefits expected from recent transactions are realized; business opportunities that may be presented to, or pursued by, the Company; our ability to successfully integrate acquisitions or complete divestitures; risks related to competition in the mining industry; employee relations including loss of key employees; availability and increased costs associated with mining inputs and labor; risks associated with diseases, epidemics and pandemics, including the effects and potential effects of the global Covid-19 pandemic; risks related to the failure of internal controls; and risks related to the impairment of the Company’s goodwill and assets.

In addition, there are risks and hazards associated with the business of mineral exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion, copper cathode or gold or copper concentrate losses (and the risk of inadequate insurance, or inability to obtain insurance, to cover these risks).

Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance. All of the forward-looking statements made in this MD&A are qualified by these cautionary statements. Specific reference is made to the most recent Form 40-F/Annual Information Form on file with the SEC and Canadian provincial securities regulatory authorities for a more detailed discussion of some of the factors underlying forward-looking statements and the risks that may affect Barrick’s ability to achieve the expectations set forth in the forward-looking statements contained in this MD&A. We disclaim any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2024 |

3 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Use of Non-GAAP Financial Measures

We use the following non-GAAP financial measures and ratios in our MD&A:

■"adjusted net earnings"

■"free cash flow"

■"EBITDA"

■"adjusted EBITDA"

■"attributable EBITDA"

■“attributable EBITDA margin”

■“net leverage”

■"minesite sustaining capital expenditures"

■"project capital expenditures"

■"total cash costs per ounce"

■"C1 cash costs per pound"

■"all-in sustaining costs per ounce/pound"

■"all-in costs per ounce" and

■"realized price"

For a detailed description of each of the non-GAAP financial measures used in this MD&A and a detailed reconciliation to the most directly comparable measure under IFRS, please refer to the Non-GAAP Financial Measures section of this MD&A on pages 58 to 76. Each non-GAAP financial measure has been annotated with a reference to an endnote on page 77. The non-GAAP financial measures set out in this MD&A are intended to provide additional information to investors and do not have any standardized meaning under IFRS, and therefore may not be comparable to other issuers, and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Changes in Presentation of Non-GAAP Financial Performance Measures

Net Leverage

Starting with this MD&A, we are presenting net leverage as a non-GAAP ratio. It is calculated as debt, net of cash divided by the sum of adjusted EBITDA of the last four consecutive quarters. We believe this ratio will assist analysts, investors and other stakeholders of Barrick in monitoring our leverage and evaluating our balance sheet.

Index

|

|

|

|

|

|

|

|

|

|

Overview |

|

|

|

|

|

Financial and Operating Highlights |

|

|

Key Business Developments |

|

|

Sustainability |

|

|

Outlook |

|

|

Production and Cost Summary |

|

|

|

|

Operating Performance |

|

|

|

|

|

Nevada Gold Mines |

|

|

Carlin |

|

|

Cortez |

|

|

Turquoise Ridge |

|

|

Other Mine - Nevada Gold Mines |

|

|

Pueblo Viejo |

|

|

Loulo-Gounkoto |

|

|

Kibali |

|

|

|

|

|

|

|

|

North Mara |

|

|

Bulyanhulu |

|

|

Other Mines - Gold |

|

|

Lumwana |

|

|

Other Mines - Copper |

|

|

|

|

Growth Projects |

|

|

|

|

Exploration and Mineral Resource Management |

|

|

|

|

Review of Financial Results |

|

|

|

|

|

Revenue |

|

|

Production Costs |

|

|

Capital Expenditures |

|

|

General and Administrative Expenses |

|

|

Exploration, Evaluation and Project Expenses |

|

|

Finance Costs, Net |

|

|

Additional Significant Statement of Income Items |

|

|

Income Tax Expense |

|

|

|

|

Financial Condition Review |

|

|

|

|

|

Balance Sheet Review |

|

|

Shareholders’ Equity |

|

|

Financial Position and Liquidity |

|

|

Summary of Cash Inflow (Outflow) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies |

|

|

|

|

Review of Quarterly Results |

|

|

|

|

Internal Control over Financial Reporting and

Disclosure Controls and Procedures |

|

|

|

|

IFRS Critical Accounting Policies and Accounting Estimates |

|

|

|

|

Non-GAAP Financial Measures |

|

|

|

|

Technical Information |

|

|

|

|

Endnotes |

|

|

|

|

Financial Statements |

|

|

|

|

Notes to Consolidated Financial Statements |

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2024 |

4 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Overview

Financial and Operating Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

For the six months ended |

| |

6/30/24 |

3/31/24 |

% Change |

|

6/30/23 |

% Change |

|

6/30/24 |

6/30/23 |

% Change |

Financial Results ($ millions) |

|

|

|

|

|

|

|

|

|

|

| Revenues |

3,162 |

2,747 |

15 |

% |

|

2,833 |

12 |

% |

|

5,909 |

5,476 |

8 |

% |

| Cost of sales |

1,979 |

1,936 |

2 |

% |

|

1,937 |

2 |

% |

|

3,915 |

3,878 |

1 |

% |

Net earningsa |

370 |

295 |

25 |

% |

|

305 |

21 |

% |

|

665 |

425 |

56 |

% |

Adjusted net earningsb |

557 |

333 |

67 |

% |

|

336 |

66 |

% |

|

890 |

583 |

53 |

% |

Attributable EBITDAb |

1,289 |

907 |

42 |

% |

|

988 |

30 |

% |

|

2,196 |

1,839 |

19 |

% |

Attributable EBITDA marginb |

48 |

% |

41 |

% |

17 |

% |

|

42 |

% |

14 |

% |

|

45 |

% |

41 |

% |

10 |

% |

Minesite sustaining capital expendituresb,c |

631 |

550 |

15 |

% |

|

524 |

20 |

% |

|

1,181 |

978 |

21 |

% |

Project capital expendituresb,c |

176 |

165 |

7 |

% |

|

238 |

(26) |

% |

|

341 |

464 |

(27) |

% |

Total consolidated capital expendituresc,d |

819 |

728 |

13 |

% |

|

769 |

7 |

% |

|

1,547 |

1,457 |

6 |

% |

| Net cash provided by operating activities |

1,159 |

760 |

53 |

% |

|

832 |

39 |

% |

|

1,919 |

1,608 |

19 |

% |

Net cash provided by operating activities margine |

37 |

% |

28 |

% |

32 |

% |

|

29 |

% |

28 |

% |

|

32 |

% |

29 |

% |

10 |

% |

Free cash flowb |

340 |

32 |

963 |

% |

|

63 |

440 |

% |

|

372 |

151 |

146 |

% |

| Net earnings per share (basic and diluted) |

0.21 |

0.17 |

24 |

% |

|

0.17 |

24 |

% |

|

0.38 |

0.24 |

58 |

% |

Adjusted net earnings (basic)b per share |

0.32 |

0.19 |

68 |

% |

|

0.19 |

68 |

% |

|

0.51 |

0.33 |

55 |

% |

| Weighted average diluted common shares (millions of shares) |

1,755 |

1,756 |

0 |

% |

|

1,755 |

0 |

% |

|

1,755 |

1,775 |

(1) |

% |

| Operating Results |

|

|

|

|

|

|

|

|

|

|

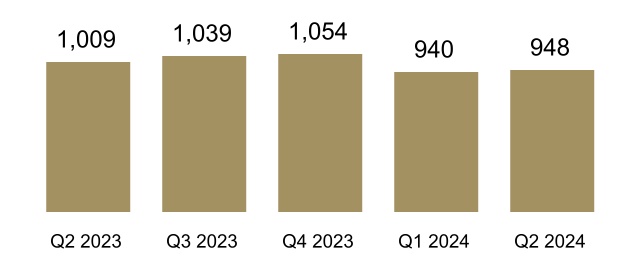

Gold production (thousands of ounces)f |

948 |

940 |

1 |

% |

|

1,009 |

(6) |

% |

|

1,888 |

1,961 |

(4) |

% |

Gold sold (thousands of ounces)f |

956 |

910 |

5 |

% |

|

1,001 |

(4) |

% |

|

1,866 |

1,955 |

(5) |

% |

| Market gold price ($/oz) |

2,338 |

2,070 |

13 |

% |

|

1,976 |

18 |

% |

|

2,203 |

1,932 |

14 |

% |

Realized gold priceb,f ($/oz) |

2,344 |

2,075 |

13 |

% |

|

1,972 |

19 |

% |

|

2,213 |

1,938 |

14 |

% |

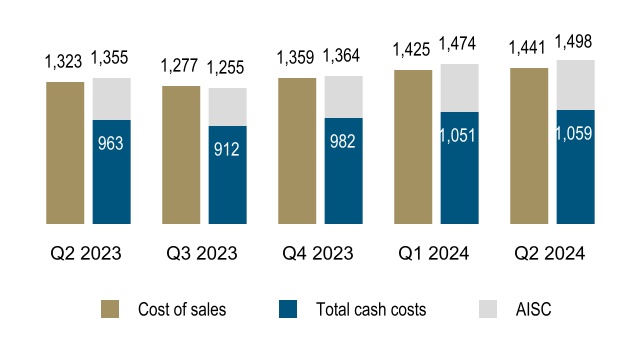

Gold cost of sales (Barrick’s share)f,g ($/oz) |

1,441 |

1,425 |

1 |

% |

|

1,323 |

9 |

% |

|

1,433 |

1,350 |

6 |

% |

Gold total cash costsb,f ($/oz) |

1,059 |

1,051 |

1 |

% |

|

963 |

10 |

% |

|

1,055 |

974 |

8 |

% |

Gold all-in sustaining costsb,f ($/oz) |

1,498 |

1,474 |

2 |

% |

|

1,355 |

11 |

% |

|

1,489 |

1,362 |

9 |

% |

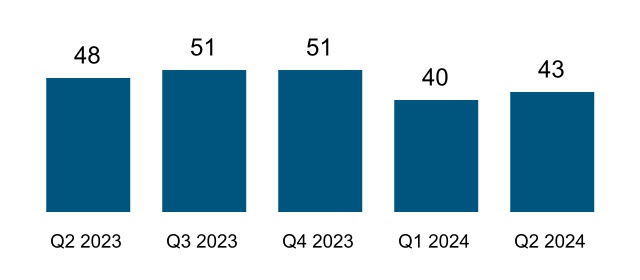

Copper production (thousands of tonnes)f,h |

43 |

40 |

8 |

% |

|

48 |

(10) |

% |

|

83 |

88 |

(6) |

% |

Copper sold (thousands of tonnes)f,h |

42 |

39 |

8 |

% |

|

46 |

(9) |

% |

|

81 |

86 |

(6) |

% |

| Market copper price ($/lb) |

4.42 |

3.83 |

15 |

% |

|

3.84 |

15 |

% |

|

4.12 |

3.95 |

4 |

% |

Realized copper priceb,f ($/lb) |

4.53 |

3.86 |

17 |

% |

|

3.70 |

22 |

% |

|

4.21 |

3.93 |

7 |

% |

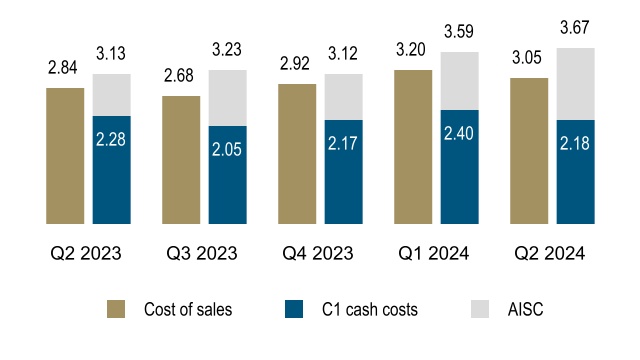

Copper cost of sales (Barrick’s share)f,i ($/lb) |

3.05 |

3.20 |

(5) |

% |

|

2.84 |

7 |

% |

|

3.12 |

3.02 |

3 |

% |

Copper C1 cash costsb,f ($/lb) |

2.18 |

2.40 |

(9) |

% |

|

2.28 |

(4) |

% |

|

2.28 |

2.48 |

(8) |

% |

Copper all-in sustaining costsb,f ($/lb) |

3.67 |

3.59 |

2 |

% |

|

3.13 |

17 |

% |

|

3.64 |

3.26 |

12 |

% |

|

|

|

|

|

|

|

|

|

|

|

| |

As at 6/30/24 |

As at 3/31/24 |

% Change |

|

As at 6/30/23 |

% Change |

|

|

|

|

Financial Position ($ millions) |

|

|

|

|

|

|

|

|

|

|

| Debt (current and long-term) |

4,724 |

4,725 |

0 |

% |

|

4,774 |

(1) |

% |

|

|

|

|

| Cash and equivalents |

4,036 |

3,942 |

2 |

% |

|

4,157 |

(3) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Debt, net of cash |

688 |

783 |

(12) |

% |

|

617 |

12 |

% |

|

|

|

|

a.Net earnings represents net earnings attributable to the equity holders of the Company.

b.Further information on these non-GAAP financial measures, including detailed reconciliations, is included on pages 58 to 76 of this MD&A.

c.Amounts presented on a consolidated cash basis. Project capital expenditures are included in our calculation of all-in costs, but not included in our calculation of all-in sustaining costs.

d.Total consolidated capital expenditures also includes capitalized interest of $12 million and $25 million, respectively, for the three and six month periods ended June 30, 2024 (March 31, 2024: $13 million and June 30, 2023: $7 million and $15 million, respectively).

e.Represents net cash provided by operating activities divided by revenue.

f.On an attributable basis.

g.Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in closure or care and maintenance) divided by ounces sold (both on an attributable basis using Barrick's ownership share).

h.Starting in 2024, we have presented our copper production and sales quantities in tonnes rather than pounds (1 tonne is equivalent to 2,204.6 pounds). Production and sales amounts for prior periods have been restated for comparative purposes. Our copper cost metrics are still reported on a per pound basis.

i.Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick's ownership share).

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2024 |

5 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

|

|

|

|

|

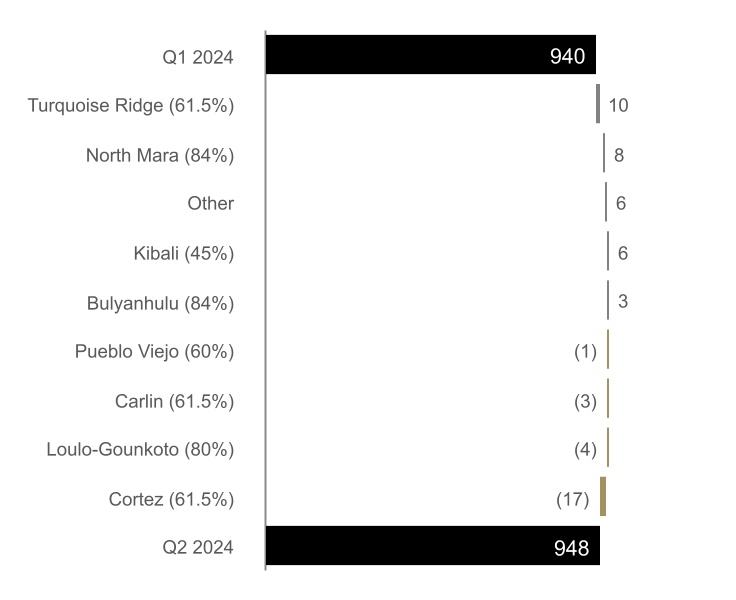

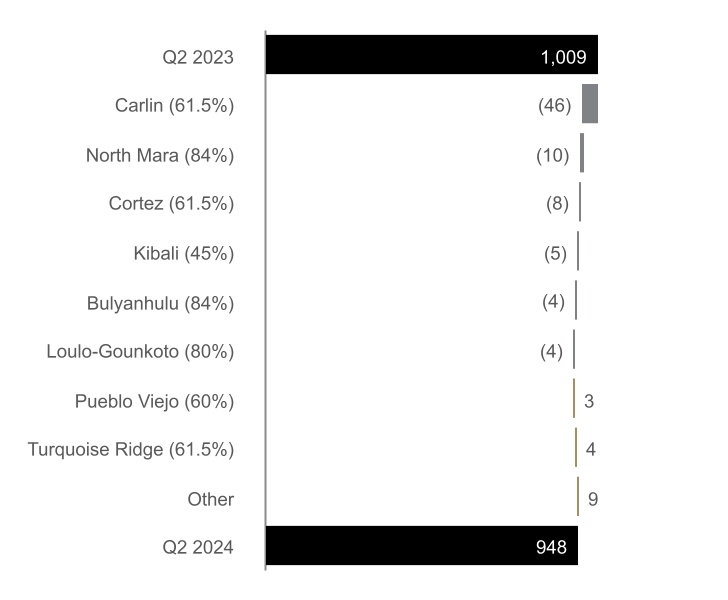

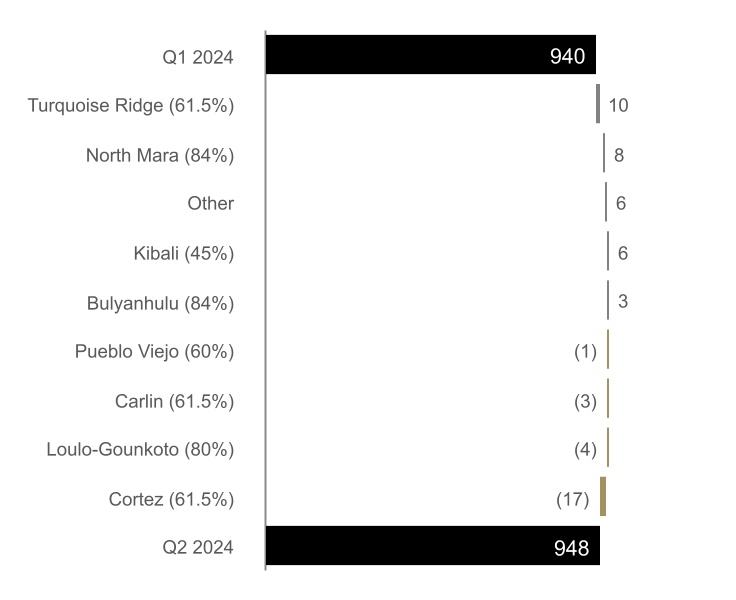

GOLD PRODUCTIONa (thousands of ounces) |

COPPER PRODUCTIONa,b (thousands of tonnes) |

|

|

|

|

|

|

GOLD COST OF SALESc, TOTAL CASH COSTSd, |

COPPER COST OF SALESc, C1 CASH COSTSd, |

AND ALL-IN SUSTAINING COSTSd ($ per ounce) |

AND ALL-IN SUSTAINING COSTSd ($ per pound) |

|

|

|

|

|

|

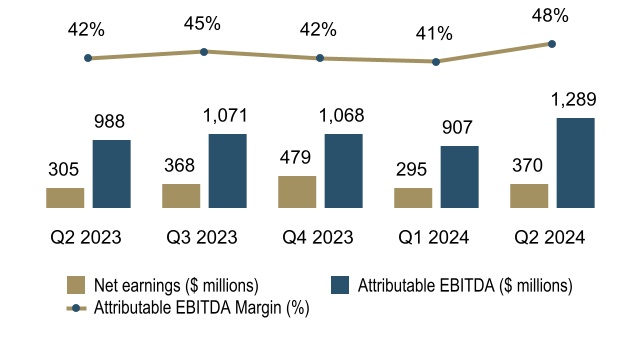

NET EARNINGS, ATTRIBUTABLE EBITDAd |

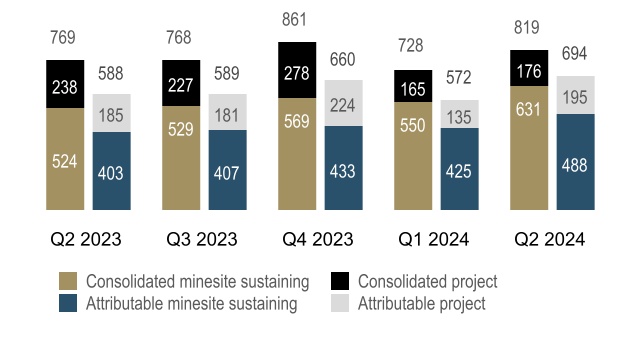

CAPITAL EXPENDITURESd,e

|

AND ATTRIBUTABLE EBITDA MARGINd |

($ millions) |

|

|

|

|

|

|

|

|

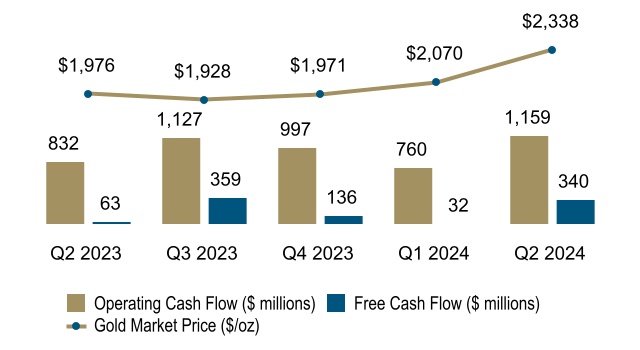

OPERATING CASH FLOW AND FREE CASH FLOWd |

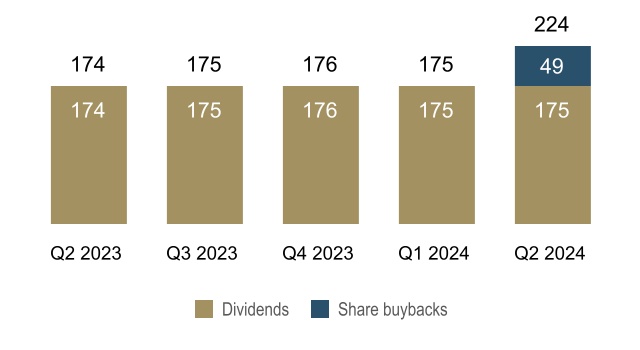

RETURNS TO SHAREHOLDERSf ($ millions) |

a.On an attributable basis.

b.Starting in 2024, we have presented our copper production and sales quantities in tonnes rather than pounds (1 tonne is equivalent to 2,204.6 pounds). Production and sales amounts for prior periods have been restated for comparative purposes. Our copper cost metrics are still reported on a per pound basis.

c.Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in closure or care and maintenance) divided by ounces sold (both on an attributable basis using Barrick's ownership share). Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick's ownership share). Refer to endnote 2 for further details.

d.Further information on these non-GAAP financial measures, including detailed reconciliations, is included on pages 58 to 76 of this MD&A.

e.Capital expenditures also includes capitalized interest.

f.Dividends declared are inclusive of the performance dividend.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2024 |

6 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Factors affecting net earnings and adjusted net earnings1 - three months ended June 30, 2024 versus March 31, 2024 Net earnings attributable to equity holders of Barrick ("net earnings") for the three months ended June 30, 2024 were $370 million compared to $295 million in the prior quarter. Among the drivers of the increase were higher realized gold and copper prices1, increased gold and copper sales volumes, partially offset by a higher gold cost of sales per ounce2. Net earnings were also impacted by the provision recognized following the proposed settlement of the Zaldívar Tax Assessments in Chile (refer to note 15 of the Financial Statements).

After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $557 million for the three months ended June 30, 2024 was $224 million higher than the prior quarter. This increase was mainly due to higher realized gold and copper prices1, increased gold and copper sales volumes, partially offset by a higher gold cost of sales per ounce2, as described above. The realized gold and copper prices1 were $2,344 per ounce and $4.53 per pound, respectively, in the three months ended June 30, 2024, compared to $2,075 per ounce and $3.86 per pound, respectively, in the prior quarter. The increase in gold sales volumes was mainly as a result of the planned autoclave shutdown at Turquoise Ridge in the first quarter of 2024, the continued successful ramp up at Porgera, combined with higher throughput and grade at Tongon, North Mara and Kibali. These impacts were partially offset by planned lower production at Cortez due to lower grade oxide ore processed at the oxide mill and fewer tonnes placed on the leach pad compared to the prior quarter and at Phoenix, as a result of lower grade. The higher copper sales volumes was driven by higher grades and recoveries at Lumwana following the ramp up in stripping activities in the first quarter of 2024 as well as the planned shutdown in the prior quarter. Higher gold cost of sales per ounce2 was mainly due to the impact of the higher royalties due to the increase in realized gold price1 compared to the prior quarter.

Factors affecting net earnings and adjusted net earnings1 - three months ended June 30, 2024 versus June 30, 2023

Net earnings for the second quarter of 2024 were $370 million compared to $305 million in the same prior year period. Among the drivers of the increase were higher realized gold and copper prices1, partially offset by lower gold and copper sales volumes and higher gold and copper cost of sales per ounce/pound2. Net earnings were also impacted by the provision recognized following the proposed settlement of the Zaldívar Tax Assessments in Chile (refer to note 15 of the Financial Statements), as discussed above.

After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $557 million in the second quarter of 2024 were $221 million higher than the same prior year period. This increase was mainly due to higher realized gold and copper prices1, partially offset by lower gold and copper sales volumes and higher gold and copper cost of sales per ounce/pound2, as described above. The realized gold and copper prices1 were $2,344 per ounce and $4.53 per pound, respectively, in the three months ended June 30, 2024 compared to $1,972 per ounce and $3.70 per pound, respectively, in the same prior year period. The decrease in gold sales volume was primarily due to lower open pit ore grades processed at the Carlin roasters and autoclave as mining in the Goldstar

open pit was substantially completed at the beginning of the third quarter of 2023, lower grades processed and lower recovery at North Mara, and less open pit oxide ore mined at Cortez following the transition to Crossroads Phase 6. This was partially offset by higher production at Porgera as significant ramp up progress was achieved during the second quarter of 2024. Lower copper sales volumes were mainly due to lower grades processed and recoveries at Lumwana, in line with the mine plan. The increase in gold cost of sales per ounce2 was mainly due to higher royalties as explained above, combined with lower recoveries, higher electricity consumption and higher plant maintenance costs at Pueblo Viejo, as well as lower grades processed and lower recoveries at Carlin, Bulyanhulu and North Mara. Higher copper cost of sales per pound2 resulted from higher depreciation due to higher capitalization related to new assets capitalized, including new equipment, at Lumwana partially offset by lower C1 cash costs1 primarily due to improved mining efficiencies and lower site G&A costs at Lumwana.

The significant adjusting items in the three months ended June 30, 2024 include:

■$137 million in significant tax adjustments and $48 million in other expense adjustments. Included in these adjustments is the proposed settlement of the Zaldívar Tax Assessments in Chile, as discussed above.

Refer to page 58 for a full list of reconciling items between net earnings and adjusted net earnings1 for the current and previous periods.

Factors affecting net earnings and adjusted net earnings1 - six months ended June 30, 2024 versus June 30, 2023

Net earnings for the six months ended June 30, 2024 were $665 million compared to $425 million in the same prior year period. Among the drivers of the increase were higher realized gold and copper prices1, partially offset by lower gold and copper sales volumes, higher gold and copper cost of sales per ounce/pound2 and the provision recognized following the proposed settlement of the Zaldívar Tax Assessments in Chile (refer to note 15 of the Financial Statements), as discussed above. The increase in net earnings was further impacted by the $30 million commitment we made towards the expansion of education infrastructure in Tanzania, per our community investment obligations under the Twiga partnership, occurring in the same prior year period.

After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $890 million for the six months ended June 30, 2024 were $307 million higher than the same prior year period. The increase in adjusted net earnings1 was primarily due to higher realized gold and copper prices1, partially offset by lower gold and copper sales volumes and higher gold and copper cost of sales per ounce/pound2, as discussed above. The realized gold and copper prices1 were $2,213 per ounce and $4.21 per pound, respectively, in the six months ended June 30, 2024, compared to $1,938 per ounce and $3.93 per pound, respectively, in the same prior year period. The lower gold sales volume was primarily at North Mara resulting from lower grades processed, throughput and recovery as we transitioned to a higher contribution from the lower grade open pit ore in the feed mix, and at Cortez as a result of lower leach ore mined at the Crossroads open pit and lower oxide ore mined from Cortez Hills underground in line with the mine plan. The

1Numerical annotations throughout the text of this document refer to the endnotes found starting on page 77.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2024 |

7 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

decrease in copper sales volume was mainly due to lower production at Lumwana resulting from lower grades processed, in line with the mine plan. The increase in gold cost of sales per ounce2 compared to the same prior year period was primarily due to lower recoveries, higher power consumption and higher plant maintenance costs at Pueblo Viejo, combined with lower grades processed and lower recoveries at Carlin, Bulyanhulu and North Mara, while the increase in copper cost of sales per pound2 was mainly due to higher depreciation due to higher capitalization related to new assets capitalized, including new equipment, at Lumwana.

The significant adjusting items in the six months ended June 30, 2024 include:

■$166 million in significant tax adjustments and $39 million in other expense adjustments. Included in these adjustments is the proposed settlement of the Zaldívar Tax Assessments in Chile, as discussed above. Significant tax adjustments also include the de-recognition of deferred tax assets, and adjustments in respect of prior years and the re-measurement of deferred tax balances.

Refer to page 58 for a full list of reconciling items between net earnings and adjusted net earnings1 for the current and previous periods.

Factors affecting Operating Cash Flow and Free Cash Flow1 - three months ended June 30, 2024 versus March 31, 2024

In the three months ended June 30, 2024, we generated $1,159 million in operating cash flow, compared to $760 million in the prior quarter. The increase of $399 million was primarily due to higher realized gold and copper prices1, increased gold and copper sales volumes, as well as lower C1 cash costs per pound1, partially offset by higher total cash costs per ounce1. Operating cash flow was further impacted by a favorable movement in working capital, mainly in accounts payable. These results were partially offset by an increase in cash taxes paid and higher interest paid as a result of the timing of semi-annual interest payments on our bonds, which primarily occur in the second and fourth quarters.

For the three months ended June 30, 2024, we recorded free cash flow1 of $340 million, compared to $32 million in the prior quarter, mainly reflecting higher operating cash flows as explained above, partially offset by higher capital expenditures. In the second quarter of 2024, capital expenditures on a cash basis were $819 million compared to $728 million in the prior quarter, due to an increase in both minesite sustaining and project capital expenditures1. Increases in minesite sustaining capital expenditures1 were primarily driven by increased capitalized stripping at Carlin, Lumwana and Loulo-Gounkoto, combined with equipment purchases at Carlin and Loulo-Gounkoto. The increase in project capital expenditures1 was mainly due to early works expenditures at Reko Diq.

Factors affecting Operating Cash Flow and Free Cash Flow1 - three months ended June 30, 2024 versus June 30, 2023

In the second quarter of 2024, we generated $1,159 million in operating cash flow, compared to $832 million in the same prior year period. The increase of $327 million was primarily due to higher realized gold and copper prices1 and lower C1 cash costs per pound1, partially offset by lower gold and copper sales volumes and higher total cash costs per ounce1. Operating cash flow was further impacted by a

favorable movement in working capital, mainly in accounts receivable and inventory. These results were partially offset by an increase in cash taxes paid.

In the second quarter of 2024, we generated free cash flow1 of $340 million compared to $63 million in the same prior year period. The increase primarily reflects higher operating cash flows as explained above, partially offset by higher capital expenditures. In the second quarter of 2024, capital expenditures on a cash basis were $819 million compared to $769 million in the second quarter of 2023. The increase in capital expenditures of $50 million was due to an increase in minesite sustaining capital expenditures1, partially offset by a decrease in project capital expenditures1. Minesite sustaining capital expenditures1 increased compared to the same prior year period, mainly due to higher capitalized waste stripping at Carlin and Lumwana, combined with increased underground development and mobile equipment purchases at Carlin. The decrease in project capital expenditures1 is primarily due to lower expenditures at Pueblo Viejo and NGM as the plant expansion project and TS Solar Project respectively were substantially completed in the prior year.

Factors affecting Operating Cash Flow and Free Cash Flow1 - six months ended June 30, 2024 versus June 30, 2023

For the six months ended June 30, 2024, we generated $1,919 million in operating cash flow, compared to $1,608 million in the same prior year period. The increase of $311 million was primarily due to higher realized gold and copper prices1 and lower C1 cash costs per pound1, partially offset by lower gold and copper sales volumes and higher total cash costs per ounce1. This was combined with a favorable change in working capital, mainly in accounts receivable and inventory, partially offset by an unfavorable change in VAT receivables and other current assets. Operating cash flow was also negatively impacted by higher cash taxes paid.

For the six months ended June 30, 2024, we generated free cash flow1 of $372 million compared to $151 million in the same prior year period. The increase of $221 million primarily reflects higher operating cash flows as explained above, partially offset by higher capital expenditures. In the six months ended June 30, 2024, capital expenditures on a cash basis were $1,547 million compared to $1,457 million in the same prior year period resulting from an increase in minesite sustaining capital expenditures1, partially offset by a decrease in project capital expenditures1. Higher minesite sustaining capital expenditures1 were mainly due to higher capitalized waste stripping at Carlin and Lumwana, combined with mobile equipment purchases at Carlin. The decrease in project capital expenditures1 was primarily the result of lower expenditures at Pueblo Viejo and NGM as the plant expansion project and TS Solar Project respectively were substantially completed in the prior year.

Key Business Developments

Nevada Gold Mines Management Change

On August 9, 2024, Henri Gonin was appointed Managing Director for Nevada Gold Mines, succeeding Peter Richardson, the former Executive Managing Director, Nevada Gold Mines, who departed from Barrick at the end of the second quarter of 2024. Mr. Gonin has over 30 years of experience in the mining industry, including 13 years working for Barrick in Nevada where he most recently held

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2024 |

8 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

the role of Head of Operations for Nevada Gold Mines. Mr Gonin will work with Christine Keener, Chief Operating Officer, North America, and Mark Bristow, Barrick’s President and Chief Executive Officer and the Chairman of Nevada Gold Mines, as we plan for the next phase of Nevada Gold Mines’ development.

Sustainability

Sustainability, including our license to operate, is entrenched in our DNA: our sustainability strategy is our business plan.

Barrick’s vision for sustainability is underpinned by the knowledge that sustainability aspects are interconnected and must be tackled in conjunction with, and reference to, each other. We call this approach Holistic and Integrated Sustainability Management. We must tackle all sustainability aspects holistically and concurrently to make meaningful progress in any single aspect. Although we integrate our sustainability management, we discuss our sustainability strategy within four overarching pillars: (1) respecting human rights; (2) protecting the health and safety of our people and local communities; (3) sharing the benefits of our operations; and (4) managing our impacts on the environment.

We implement this strategy by blending top-down accountability with bottom-up responsibility. This means we place the day-to-day ownership of sustainability, and the associated risks and opportunities, in the hands of individual sites. In the same way that each site must manage its geological, operational and technical capabilities to meet business objectives, it must also manage and identify programs, metrics, and targets that measure progress and deliver real value for the business and our stakeholders, including our host countries and local communities. The Group Sustainability Executive, supported by regional sustainability leads, provides oversight and direction over this site-level ownership, to ensure alignment with the strategic priorities of the overall business.

Governance

The bedrock of our sustainability strategy is strong governance. Our most senior management-level body dedicated to sustainability is the E&S Committee, which connects site-level ownership of our sustainability strategy with the leadership of the Group. It is chaired by the President and Chief Executive Officer and includes: (1) regional Chief Operating Officers; (2) minesite General Managers; (3) Health, Safety, Environment and Closure Leads; (4) the Group Sustainability Executive; (5) in-house legal counsel; and (6) an independent sustainability consultant in an advisory role. The E&S Committee meets on a quarterly basis to review our performance across a range of key performance indicators, and to provide independent oversight and review of sustainability management.

The President and Chief Executive Officer reviews the reports of the E&S Committee at every quarterly meeting of the Board's ESG & Nominating Committee. The reports are reviewed to ensure the implementation of our sustainability policies and to drive performance of our environmental, health and safety, community relations and development, and human rights programs.

This is supplemented by weekly meetings, at a minimum, between the Regional Sustainability Leads and the Group Sustainability Executive. These meetings examine the sustainability-related risks and opportunities

facing the business in real time, as well as the progress and issues integrated into weekly Executive Committee review meetings.

Incentive payments for senior leaders under Barrick’s Partnership Plan are tied to Sustainability performance. In 2023, this comprised a 10% weighting under the annual incentive program based on our annual safety and environment performance, and a 20% weighting under our Long-Term Company Scorecard linked to the assessment of our industry-first Sustainability Scorecard. As we strive for ongoing strong performance, the Sustainability Scorecard targets and metrics are updated annually. The results of the 2023 Sustainability Scorecard were published in the Sustainability Report in May 2024. The E&S Committee tracks our progress against all metrics.

Human rights

Our commitment to respect human rights is codified in our standalone Human Rights Policy and informed by the expectations of the United Nations Guiding Principles on Business and Human Rights, the Voluntary Principles on Security and Human Rights and the OECD Guidelines for Multinational Enterprises. This commitment is fulfilled on the ground via our Human Rights Program, the fundamental principles of which include: monitoring and reporting, due diligence, training, as well as disciplinary action and remedy.

We continue to assess and manage security and human rights risks at all our operations and provide security and human rights training to private and public security forces across our sites. During 2023, independent human rights assessments were undertaken at the following sites: North Mara and Bulyanhulu in Tanzania; Jabal Sayid in Saudi Arabia; Loulo-Gounkoto in Mali; and Kibali in the DRC, and in the first quarter of 2024 at Reko Diq in Pakistan. Over the remainder of 2024, Barrick will carry out independent assessments and training at Tongon in Côte d’Ivoire, Pueblo Viejo in Dominican Republic, Lumwana in Zambia, and Porgera in Papua New Guinea.

In June 2024, Barrick published a detailed response to a widely circulated “Joint Communication” from the United Nations Human Rights Council (“UNHRC”) Special Procedures Branch making allegations regarding, predominantly, police conduct in the areas related to the North Mara gold mine in Tanzania. These allegations were unsubstantiated in the Joint Communication. Barrick has made its fulsome response publicly available to address both the contents of the Joint Communication, as well as to ensure transparency in how these risks are managed. No response has been received to date from the UNHRC, or any of the Special Rapporteurs.

Safety

We are committed to the safety, health and well-being of our people, their families and the communities in which we operate. Our safety vision is “Everyone to go home safe and healthy every day.”

Our Management-Level Safety Committee continues to drive the implementation of the “Journey to Zero” initiative. The current priority is the roll out and training of the revised and standardized Fatal Risks and associated operating standards.

We report our safety performance quarterly as part of both our E&S Committee meetings and our reports to the ESG & Nominating Committee. Our safety performance is a regular standing agenda item on our weekly Executive Committee review meeting.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2024 |

9 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

As part of our Journey to Zero, we have identified four key elements in developing a culture that fosters a strong and effective focus on safety: (1) Leadership and Culture, (2) Zero Fatalities, (3) Risk Management, and (4) Prevention of Injuries.

In terms of key performance indicators, for the second quarter of 2024, our LTIFR3 was 0.16, a 30% improvement quarter on quarter, as well as a 38% decrease against the same period in 2023. Our TRIFR3 was 0.82, a 35% improvement quarter on quarter, and a 20% decrease against the same period in 2023.

Social

We regard our host communities and countries as important partners in our business. Our sustainability policies commit us to transparency in our relationships with host communities, government authorities, the public and other key stakeholders. Through these policies, we commit to conducting our business with integrity and with absolute opposition to corruption. We require our suppliers to operate ethically and responsibly as a condition of doing business with us.

Community and economic development

Our commitment to social and economic development is set out in our overarching Sustainable Development and Social Performance policies. Mining has been identified as vital for the achievement of the United Nations SDGs, not only for its role in providing the minerals needed to enable the transition to a lower carbon intensive economy, but more importantly because of its ability to drive socio-economic development and build resilience. Creating long-term value and sharing economic benefits is at the heart of our approach to sustainability, as well as community development. This approach is encapsulated in three concepts:

The primacy of partnership: this means that we invest in real partnerships with mutual responsibility. Partnerships include local communities, suppliers, government, and organizations, and this approach is epitomized through our CDCs with development initiatives and investments.

Sharing the benefits: We hire and buy local wherever possible as this injects money into and keeps it in our local communities and host countries. By doing this, we build capacity, community resilience and create opportunity. We also invest in community development through our CDCs. Sharing the benefits also means paying our fair share of taxes, royalties and dividends and doing so transparently, primarily through the reporting mechanism of the Canadian Extractive Sector Transparency Measures Act. Our annual Tax Contribution Report, published in May 2024, sets out, in detail, our economic contributions to host governments.

Engaging and listening to stakeholders: We develop tailored stakeholder engagement plans for every operation and the business as a whole. These plans guide and document how often we engage with various stakeholder groups and allow us to proactively deal with issues before they escalate into significant risks.

Our community development spend during the second quarter was $10.4 million.

Environment

We know the environment in which we work and our host communities are inextricably linked, and we apply a holistic and integrated approach to sustainability management. Being responsible stewards of the environment by applying the highest standards of environmental management, using natural resources and energy efficiently, recycling and reducing waste as well as working to protect biodiversity, we can deliver significant cost savings to our business, reduce future liabilities and help build stronger stakeholder relationships. Environmental matters such as how we use water, prevent incidents, manage tailings, respond to changing climate, and protect biodiversity are key areas of focus.

We maintained our strong track record of stewardship and did not record any Class 14 environmental incidents in the first half of 2024.

Climate Change

The ESG & Nominating Committee is responsible for overseeing Barrick’s policies, programs and performance relating to sustainability and the environment, including climate change. The Audit & Risk Committee assists the Board in overseeing the Group’s management of enterprise risks as well as the implementation of policies and standards for monitoring and mitigating such risks. Climate change is built into our formal risk management process, outputs of which are regularly reviewed by the Audit & Risk Committee.

Barrick’s climate change strategy has three pillars: (1) identify, understand and mitigate the risks associated with climate change; (2) measure and reduce our GHG emissions across our operations and value chain; and (3) improve our disclosure on climate change. The three pillars of our climate change strategy do not focus solely on the development of emissions reduction targets, rather, we integrate and consider aspects of biodiversity protection, water management and community resilience in our approach.

We are acutely aware of the impacts that climate change and extreme weather events have on our host communities and countries, particularly developing nations which are often the most vulnerable. As the world economy transitions to renewable power, it is imperative that developing nations are not left behind. As a responsible business, we have focused our efforts on building resilience in our host communities and countries, just as we do for our business. Our climate disclosure is based on the recommendations of the TCFD.

Identify, understand and mitigate the risks associated with climate change

We identify and manage risks, build resilience to a changing climate and extreme weather events, as well as position ourselves for new opportunities. These factors continue to be incorporated into our formal risk assessment process. We have identified several risks and opportunities for our business including: physical impacts of extreme weather events; an increase in regulations that seek to address climate change; and an increase in global investment in innovation and low-carbon technologies.

The risk assessment process includes scenario analysis, which has been rolled out to all our Tier One Gold Assets5, to assess site-specific climate related risks and opportunities. The key findings and a summary of this asset-level physical and transitional risk assessment at Loulo-Gounkoto and Kibali were disclosed as part of our CDP (formerly known as the Carbon Disclosure Project)

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2024 |

10 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Climate Change and Water Security questionnaires, submitted to CDP in July 2023, with the results of the NGM risk assessment to be included in the 2024 CDP submission.

Measure and reduce the Group’s impact on climate change

Mining is an energy-intensive business, and we understand the important link between energy use and GHG emissions. By measuring and effectively managing our energy use, we can reduce our GHG emissions, achieve more efficient production, and reduce our costs.

We have climate champions at each site who are tasked with identifying roadmaps and assessing feasibility for our GHG emissions reductions and carbon offsets for hard-to-abate emissions. Any carbon offsets that we pursue must have appropriate socio-economic and/or biodiversity benefits. We have published an achievable emissions reduction roadmap and continue to assess further reduction opportunities across our operations. The detailed roadmap was first published in our 2021 Sustainability Report and includes committed capital projects and projects under investigation that rely on technological advances, with a progress summary contained in the 2023 Sustainability Report.

We continue to progress our extensive work across our value chain in understanding our Scope 3 (indirect emissions associated with the value chain) emissions and implementing our engagement roadmap to enable our key suppliers to set meaningful and measurable reduction targets, in line with the commitments made through the ICMM Climate Position Paper.

In November 2023, Barrick announced its Scope 3 emissions targets which it developed to promote awareness and action in its value chain and empower those actors to set their own net zero commitments, with short- and medium-term targets. These targets are both quantitative and qualitative and are focused on high emission areas in our value chain and are available on the Barrick website.

Improve our disclosure on climate change

Our disclosure on climate change, including in our Sustainability Report and on our website, is developed in line with the TCFD recommendations. Barrick continues to monitor the various regulatory climate disclosure standards being developed around the world, including the ISSB’s S2 Climate-related Disclosures standard. In addition, we complete the annual CDP Climate Change and Water Security questionnaires. This ensures our investor-relevant water use, emissions and climate data is widely available.

Emissions

Barrick’s interim GHG emissions reduction target is for a minimum 30% reduction by 2030 against our 2018 baseline, while maintaining a steady production profile. The basis of this reduction is against a 2018 baseline of 7,541 kt CO2-e.

Our GHG emissions reduction target is grounded in science and has a detailed pathway for achievement. Our target is not static and will be updated as we continue to identify and implement new GHG reduction opportunities.

Ultimately, our vision is net zero GHG emissions by 2050, achieved primarily through GHG reductions, with some offsets for hard-to-abate emissions. Site-level plans to improve energy efficiency, integrate clean and renewable energy sources and reduce GHG emissions will also be strengthened. We plan to supplement our corporate emissions reduction targets with context-based site-specific emissions reduction targets.

During the second quarter of 2024, the Group's total Scope 1 and 2 (location-based) GHG emissions were 1,730 kt CO2-e. Emissions are trending above 2023 levels due predominantly to the restart of Porgera, and emissions from the TS Power Plant at NGM, which underwent maintenance in Spring of 2023 and reduced last year’s emissions comparatively.

Water

Water is a vital and increasingly scarce global resource. Managing and using water responsibly is one of the most critical parts of our sustainability strategy. Our commitment to responsible water use is codified in our Environmental Policy and standalone Water Policy. Steady, reliable access to water is critical to the effective operation of our mines. Access to water is also a fundamental human right.

Understanding the water stress in the regions in which we operate enables us to better understand the risks and manage our water resources through site-specific water balances, based on the ICMM Water Accounting Framework, aimed at minimizing our water withdrawal and maximizing water reuse and recycling within our operations.

We include each mine’s water risks in its operational risk register. These risks are then aggregated and incorporated into the corporate risk register. Our identified water-related risks include: (1) managing excess water in regions with high rainfall; (2) maintaining access to water in arid areas and regions prone to water scarcity; and (3) regulatory risks related to permitting limits as well as municipal and national regulations for water use.

We set an annual water recycling and reuse target of 80%. Our water recycling and reuse rate for the second quarter of 2024 was approximately 85%, and the first half of 2024 reuse is 84%.

Tailings

We are committed to having our TSFs meet global best practices for safety. Our TSFs are carefully engineered and regularly inspected, particularly those in regions with high rainfall and seismic events.

We disclosed our conformance to the GISTM for all Extreme and Very High consequence facilities on the Barrick website in August 2023, within the committed disclosure timeframe. All of our sites that are classified as Very High or Extreme consequence are in conformance with the GISTM. We continue to progress with our conformance for lower consequence facilities in accordance with the GISTM. Disclosures for lower consequence facilities will be completed by August 2025, also in accordance with the GISTM.

Biodiversity

Biodiversity underpins many of the ecosystem services on which our mines and their surrounding communities depend. If improperly managed, mining and exploration activities have the potential to negatively affect biodiversity and ecosystem services. Protecting biodiversity and preventing nature loss is also critical and inextricably linked to the fight against climate change. We work to proactively manage our impact on biodiversity and strive to protect the ecosystems in which we operate. Wherever possible, we aim to achieve a net neutral biodiversity impact, particularly for ecologically sensitive environments.

We continue to work to implement our BAPs. The BAPs outline our strategy to achieve no-net loss for all key biodiversity features and their associated management plans.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2024 |

11 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Full Year 2024 Outlook

We continue to expect our 2024 gold production to be in the range of 3.9 to 4.3 million ounces. We expect stronger year-over-year performances from Pueblo Viejo and to a lesser extent Turquoise Ridge, together with stable delivery across the remaining Tier One Gold Assets1 with the exception of Cortez. Production at Cortez is expected to be lower in 2024 relative to 2023 due to lower oxide grades and tonnes at Crossroads open pit partially offset by a higher contribution from Goldrush underground mine.

Across the four quarters of 2024, the Company’s gold production is expected to steadily increase throughout the year as the Pueblo Viejo plant expansion ramps up from the third quarter of 2024 and the Porgera mine restart continues in line with our plans. We therefore remain on track to achieve our full year gold production guidance with a step up in the second half of 2024.

Our 2024 gold cost guidance remains unchanged, including cost of sales of $1,320 to $1,420 per ounce2, total cash costs of $940 to $1,020 per ounce1 and all-in sustaining costs of $1,320 to $1,420 per ounce1. As the production increases with each quarter, we expect a corresponding reduction in our per ounce cost metrics based on the benefit of diluting the fixed costs over more ounces. These ranges were based on a gold price assumption of $1,900 per ounce and we have previously disclosed a sensitivity of $5 per ounce on our 2024 gold cost guidance metrics for every $100 per ounce change in the gold price which is driven by higher royalties. On the basis of this sensitivity, if the gold price were to average $2,200 per ounce for the 2024 year, the above mentioned cost guidance ranges would increase by $15 per ounce. We are on track to achieve our 2024 gold cost guidance metrics taking into account this gold price royalty impact.

We continue to expect 2024 copper production to be in the range of 180 to 210 thousand tonnes. Production in the second half of 2024 is expected to be materially stronger than the first half, mainly due to steadily increasing throughput at Lumwana as the new owner mining truck fleet is anticipated to be fully commissioned and ramped up by the end of August 2024. We are on track to achieve our copper cost guidance metrics for 2024, which are based on a copper price assumption of $3.50 per pound. We have previously disclosed a sensitivity of $0.01 per pound on our 2024 copper cost guidance metrics for every $0.25 per pound change in the copper price which is driven by higher royalties. On the basis of this sensitivity, if the copper price were to average $4.75 per pound for the 2024 year, the copper all-in sustaining cost1 guidance range would increase by $0.05 per pound (note royalties are excluded from C1 cash costs1).

Further detail on our 2024 company guidance is provided below, inclusive of the key assumptions that were used as the basis for this guidance as released on February 14, 2024 and as qualified by the risks and uncertainties discussed above.

|

|

|

|

|

|

Company Guidance ($ millions, except per ounce/pound data) |

2024

Estimate |

| Gold production (millions of ounces) |

3.90 - 4.30 |

| Gold cost metrics |

|

| Cost of sales - gold ($/oz) |

1,320 - 1,420 |

Total cash costs ($/oz)a |

940 - 1,020 |

| Depreciation ($/oz) |

340 - 370 |

All-in sustaining costs ($/oz)a |

1,320 - 1,420 |

Copper production (thousands of tonnes)b |

180 - 210 |

| Copper cost metrics |

|

| Cost of sales - copper ($/lb) |

2.65 - 2.95 |

C1 cash costs ($/lb)a |

2.00 - 2.30 |

| Depreciation ($/lb) |

0.90 - 1.00 |

All-in sustaining costs ($/lb)a |

3.10 - 3.40 |

| Exploration and project expenses |

400 - 440 |

| Exploration and evaluation |

180 - 200 |

| Project expenses |

220 - 240 |

| General and administrative expenses |

~180 |

| Corporate administration |

~130 |

Share-based compensationc |

~50 |

|

|

| Other expense |

70 - 90 |

| Finance costs, net |

260 - 300 |

| Attributable capital expenditures: |

|

Attributable minesite sustaininga |

1,550 - 1,750 |

Attributable projecta |

950 - 1,150 |

| Total attributable capital expenditures |

2,500 - 2,900 |

Effective income tax rated |

26% - 30% |

| Key assumptions (used for guidance) |

| Gold Price ($/oz) |

1,900 |

|

| Copper Price ($/lb) |

3.50 |

|

| Oil Price (WTI) ($/barrel) |

80 |

|

| AUD Exchange Rate (AUD:USD) |

0.75 |

|

| ARS Exchange Rate (USD:ARS) |

800 |

|

| CAD Exchange Rate (USD:CAD) |

1.30 |

|

| CLP Exchange Rate (USD:CLP) |

900 |

|

| EUR Exchange Rate (EUR:USD) |

1.10 |

|

|

|

a.Further information on these non-GAAP financial measures, including detailed reconciliations, is included on pages 58 to 76 of this MD&A.

b.Starting in 2024, we have presented our copper production and sales quantities in tonnes rather than pounds (1 tonne is equivalent to 2,204.6 pounds). Production and sales amounts for prior periods have been restated for comparative purposes. Our copper cost metrics are still reported on a per pound basis.

c.Based on a one-month trailing average ending December 31, 2023 of US$17.61 per share.

d.Based on key assumptions included in this table.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2024 |

12 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Operating Division Guidance

Our 2024 forecast gold and copper production, cost of salesa, total cash costsb, all-in sustaining costsb, and C1 cash costsb ranges by operating division are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Division |

2024 forecast attributable production (000s ozs) |

2024 forecast cost of salesa ($/oz) |

2024 forecast total cash costsb ($/oz) |

2024 forecast all-in sustaining costsb ($/oz) |

| Gold |

|

|

|

|

| Carlin (61.5%) |

800 - 880 |

1,270 - 1,370 |

1,030 - 1,110 |

1,430 - 1,530 |

Cortez (61.5%)c |

380 - 420 |

1,460 - 1,560 |

1,040 - 1,120 |

1,390 - 1,490 |

Turquoise Ridge (61.5%) |

330 - 360 |

1,230 - 1,330 |

850 - 930 |

1,090 - 1,190 |

| Phoenix (61.5%) |

120 - 140 |

1,640 - 1,740 |

810 - 890 |

1,100 - 1,200 |

|

|

|

|

|

Nevada Gold Mines (61.5%) |

1,650 - 1,800 |

1,340 - 1,440 |

980 - 1,060 |

1,350 - 1,450 |

Hemlo |

140 - 160 |

1,470 - 1,570 |

1,210 - 1,290 |

1,600 - 1,700 |

| North America |

1,750 - 1,950 |

1,350 - 1,450 |

1,000 - 1,080 |

1,370 - 1,470 |

|

|

|

|

|

Pueblo Viejo (60%) |

420 - 490 |

1,340 - 1,440 |

830 - 910 |

1,100 - 1,200 |

Veladero (50%) |

210 - 240 |

1,340 - 1,440 |

1,010 - 1,090 |

1,490 - 1,590 |

Porgera (24.5%)d |

50 - 70 |

1,670 - 1,770 |

1,220 - 1,300 |

1,900 - 2,000 |

|

|

|

|

|

| Latin America & Asia Pacific |

700 - 800 |

1,370 - 1,470 |

920 - 1,000 |

1,290 - 1,390 |

|

|

|

|

|

Loulo-Gounkoto (80%) |

510 - 560 |

1,190 - 1,290 |

780 - 860 |

1,150 - 1,250 |

Kibali (45%) |

320 - 360 |

1,140 - 1,240 |

740 - 820 |

950 - 1,050 |

| North Mara (84%) |

230 - 260 |

1,250 - 1,350 |

970 - 1,050 |

1,270 - 1,370 |

| Bulyanhulu (84%) |

160 - 190 |

1,370 - 1,470 |

990 - 1,070 |

1,380 - 1,480 |

| Tongon (89.7%) |

160 - 190 |

1,520 - 1,620 |

1,200 - 1,280 |

1,440 - 1,540 |

|

|

|

|

|

| Africa & Middle East |

1,400 - 1,550 |

1,250 - 1,350 |

880 - 960 |

1,180 - 1,280 |

|

|

|

|

|

Total Attributable to Barricke,f,g |

3,900 - 4,300 |

1,320 - 1,420 |

940 - 1,020 |

1,320 - 1,420 |

|

|

|

|

|

| |

2024 forecast attributable production (000s tonnes)h |

2024 forecast cost of salesa ($/lb) |

2024 forecast C1 cash costsb ($/lb) |

2024 forecast all-in sustaining costsb ($/lb) |

| Copper |

|

|

|

|

| Lumwana |

120 - 140 |

2.50 - 2.80 |

1.85 - 2.15 |

3.30 - 3.60 |

| Zaldívar (50%) |

35 - 40 |

3.70 - 4.00 |

2.80 - 3.10 |

3.40 - 3.70 |

| Jabal Sayid (50%) |

25 - 30 |

1.75 - 2.05 |

1.40 - 1.70 |

1.70 - 2.00 |

Total Copperg |

180 - 210 |

2.65 - 2.95 |

2.00 - 2.30 |

3.10 - 3.40 |

a.Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in closure or care and maintenance) divided by ounces sold (both on an attributable basis using Barrick's ownership share). Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick's ownership share).

b.Further information on these non-GAAP financial measures, including detailed reconciliations, is included on pages 58 to 76 of this MD&A.

c.Includes Goldrush.

d.Porgera was placed on care and maintenance from April 25, 2020 until December 22, 2023. On December 22, 2023, the Porgera Project Commencement Agreement was completed and recommissioning of the mine commenced. As a result, Porgera is included in our 2024 guidance at 24.5%.

e.Total cash costs and all-in sustaining costs per ounce include costs allocated to non-operating sites.

f.Operating division guidance ranges reflect expectations at each individual operating division and may not add up to the company-wide guidance range total.

g.Includes corporate administration costs.