Management's Discussion and Analysis (“MD&A”)

Quarterly Report on the Second Quarter of 2022

This portion of the Quarterly Report provides management’s discussion and analysis (“MD&A”) of the financial condition and results of operations, to enable a reader to assess material changes in financial condition and results of operations as at, and for the three and six month periods ended June 30, 2022, in comparison to the corresponding prior-year periods. The MD&A is intended to help the reader understand Barrick Gold Corporation (“Barrick”, “we”, “our”, the “Company” or the "Group"), our operations, financial performance and present and future business environment. This MD&A, which has been prepared as of August 5, 2022, is intended to supplement and complement the condensed unaudited interim consolidated financial statements and notes thereto, prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board (“IASB”), including International Accounting Standard 34 Interim Financial Reporting (“IAS 34”), for the three and six month periods ended June 30, 2022 (collectively, the “Financial Statements”), which are included in this Quarterly Report on pages 80 to 84. You are encouraged to review the Financial Statements in conjunction with your review of this MD&A. This MD&A should be read in conjunction with both the

annual audited consolidated financial statements for the two years ended December 31, 2021, the related annual MD&A included in the 2021 Annual Report, and the most recent Form 40–F/Annual Information Form on file with the U.S. Securities and Exchange Commission (“SEC”) and Canadian provincial securities regulatory authorities. These documents and additional information relating to the Company are available on SEDAR at www.sedar.com and EDGAR at www.sec.gov. Certain notes to the Financial Statements are specifically referred to in this MD&A and such notes are incorporated by reference herein. All dollar amounts in this MD&A are in millions of United States dollars (“$” or “US$”), unless otherwise specified.

For the purposes of preparing our MD&A, we consider the materiality of information. Information is considered material if: (i) such information results in, or would reasonably be expected to result in, a significant change in the market price or value of our shares; (ii) there is a substantial likelihood that a reasonable investor would consider it important in making an investment decision; or (iii) it would significantly alter the total mix of information available to investors. We evaluate materiality with reference to all relevant circumstances, including potential market sensitivity.

Cautionary Statement on Forward-Looking Information

Certain information contained or incorporated by reference in this MD&A, including any information as to our strategy, projects, plans or future financial or operating performance, constitutes “forward-looking statements”. All statements, other than statements of historical fact, are forward-looking statements. The words “believe”, “expect”, “anticipated”, “vision”, “aim”, “strategy”, “target”, “plan”, “opportunities”, “guidance”, “forecast”, “outlook”, “objective”, “intend”, “project”, “pursue”, “goal”, “continue”, “committed” “budget”, “estimate”, “potential”, “prospective”, “future”, “focus”, “during”, “ongoing”, “following”, “subject to”, “scheduled”, “may”, “will”, “can”, “could”, “would”, “should” and similar expressions identify forward-looking statements. In particular, this MD&A contains forward-looking statements including, without limitation, with respect to: Barrick’s forward-looking production guidance; estimates of future cost of sales per ounce for gold and per pound for copper, total cash costs per ounce and C1 cash costs per pound, and all-in-sustaining costs per ounce/pound; cash flow forecasts; projected capital, operating and exploration expenditures; the share buyback program and performance dividend policy, including the criteria for dividend payments; mine life and production rates; Barrick’s engagement with local communities to manage the Covid-19 pandemic, including Covid-19 vaccination initiatives and Covid-19 protocols at Barrick’s minesites; projected capital estimates and anticipated permitting timelines related to the Goldrush Project; the process for the reconstitution of a joint venture to carry out the future development and operation of the Reko Diq project; the planned updating of the historical Reko Diq feasibility study and our plans upon the project’s reconstitution; the proposed fiscal terms applicable to the Reko Diq project and the joint venture through which it is

held; our plans and expected completion and benefits of our growth projects, including the Goldrush Project, Turquoise Ridge Third Shaft, Pueblo Viejo plant expansion and mine life extension project, and Veladero Phase 7 leach pad and power transmission projects; capital expenditures related to upgrades and ongoing management initiatives, including at North Mara; Barrick’s global exploration strategy and planned exploration activities; the impact of Nevada’s new mining excise tax on Nevada Gold Mines; the timeline for execution and effectiveness of definitive agreements and formation of a new joint venture to implement the Framework Agreement between Papua New Guinea and Barrick Niugini Limited (“BNL”); the duration of the temporary suspension of operations at Porgera, the conditions for the reopening of the mine and the timeline to recommence operations; our pipeline of high confidence projects at or near existing operations; potential mineralization and metal or mineral recoveries; our ability to convert resources into reserves; asset sales, joint ventures and partnerships; Barrick’s strategy, plans, targets and goals in respect of environmental and social governance issues, including climate change, greenhouse gas emissions reduction targets (including with respect to our Scope 3 emissions), responsible water use, tailings storage facility management, biodiversity and human rights initiatives; and expectations regarding future price assumptions, financial performance and other outlook or guidance. Forward-looking statements are necessarily based upon a number of estimates and assumptions including material estimates and assumptions related to the factors set forth below that, while considered reasonable by the Company as at the date of this MD&A in light of management’s experience and perception of current

|

|

|

|

|

|

|

|

|

| BARRICK SECOND QUARTER 2022 |

1 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

conditions and expected developments, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information. Such factors include, but are not limited to: fluctuations in the spot and forward price of gold, copper or certain other commodities (such as silver, diesel fuel, natural gas and electricity); risks associated with projects in the early stages of evaluation and for which additional engineering and other analysis is required; risks related to the possibility that future exploration results will not be consistent with the Company’s expectations, that quantities or grades of reserves will be diminished, and that resources may not be converted to reserves; risks associated with the fact that certain of the initiatives described in this MD&A are still in the early stages and may not materialize; changes in mineral production performance, exploitation and exploration successes; risks that exploration data may be incomplete and considerable additional work may be required to complete further evaluation, including but not limited to drilling, engineering and socioeconomic studies and investment; the speculative nature of mineral exploration and development; lack of certainty with respect to foreign legal systems, corruption and other factors that are inconsistent with the rule of law; changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices; the potential impact of proposed changes to Chilean law on the status of value added tax (“VAT”) refunds received in Chile in connection with the development of the Pascua-Lama project; expropriation or nationalization of property and political or economic developments in Canada, the United States or other countries in which Barrick does or may carry on business in the future; risks relating to political instability in certain of the jurisdictions in which Barrick operates; timing of receipt of, or failure to comply with, necessary permits and approvals, including the issuance of a Record of Decision for the Goldrush Project and/or whether the Goldrush Project will be permitted to advance as currently designed under its Feasibility Study; non-renewal of or failure to obtain key licenses by governmental authorities, including the new special mining lease for Porgera; failure to comply with environmental and health and safety laws and regulations; contests over title to properties, particularly title to undeveloped properties, or over access to water, power and other required infrastructure; the liability associated with risks and hazards in the mining industry, and the ability to maintain insurance to cover such losses; increased costs and physical risks, including extreme weather events and resource shortages, related to climate change; damage to the Company’s reputation due to the actual or perceived occurrence of any number of events, including negative publicity with respect to the Company’s handling of environmental matters or dealings with community groups, whether true or not; risks related to operations near communities that may regard Barrick’s operations as being detrimental to them; litigation and legal and administrative proceedings; operating or technical difficulties in connection with mining or development activities, including geotechnical challenges, tailings dam and storage facilities failures, and disruptions in the maintenance or provision of required infrastructure and information technology systems; increased costs, delays, suspensions and technical challenges associated with the construction of capital

projects; risks associated with working with partners in jointly controlled assets; risks related to disruption of supply routes which may cause delays in construction and mining activities; risk of loss due to acts of war, terrorism, sabotage and civil disturbances; risks associated with artisanal and illegal mining; risks associated with Barrick’s infrastructure, information technology systems and the implementation of Barrick’s technological initiatives; the impact of global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future cash flows; the impact of inflation, including global inflationary pressures driven by supply chain disruptions caused by the ongoing Covid-19 pandemic and global energy cost increases following the invasion of Ukraine by Russia; adverse changes in our credit ratings; fluctuations in the currency markets; changes in U.S. dollar interest rates; risks arising from holding derivative instruments (such as credit risk, market liquidity risk and mark-to-market risk); risks related to the demands placed on the Company’s management, the ability of management to implement its business strategy and enhanced political risk in certain jurisdictions; uncertainty whether some or all of Barrick's targeted investments and projects will meet the Company’s capital allocation objectives and internal hurdle rate; whether benefits expected from recent transactions being realized; business opportunities that may be presented to, or pursued by, the Company; our ability to successfully integrate acquisitions or complete divestitures; risks related to competition in the mining industry; employee relations including loss of key employees; availability and increased costs associated with mining inputs and labor; risks associated with diseases, epidemics and pandemics, including the effects and potential effects of the global Covid-19 pandemic; risks related to the failure of internal controls; and risks related to the impairment of the Company’s goodwill and assets. Barrick also cautions that its 2022 guidance may be impacted by the unprecedented business and social disruption caused by the spread of Covid-19.

In addition, there are risks and hazards associated with the business of mineral exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion, copper cathode or gold or copper concentrate losses (and the risk of inadequate insurance, or inability to obtain insurance, to cover these risks).

Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance. All of the forward-looking statements made in this MD&A are qualified by these cautionary statements. Specific reference is made to the most recent Form 40-F/Annual Information Form on file with the SEC and Canadian provincial securities regulatory authorities for a more detailed discussion of some of the factors underlying forward-looking statements and the risks that may affect Barrick’s ability to achieve the expectations set forth in the forward-looking statements contained in this MD&A. We disclaim any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

|

|

|

|

|

|

|

|

|

| BARRICK SECOND QUARTER 2022 |

2 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Use of Non-GAAP Financial Performance Measures

We use the following non-GAAP financial performance measures in our MD&A:

■"adjusted net earnings"

■"free cash flow"

■"EBITDA"

■"adjusted EBITDA"

■"minesite sustaining capital expenditures"

■"project capital expenditures"

■"total cash costs per ounce"

■"C1 cash costs per pound"

■"all-in sustaining costs per ounce/pound"

■"all-in costs per ounce" and

■"realized price"

For a detailed description of each of the non-GAAP financial performance measures used in this MD&A and a detailed reconciliation to the most directly comparable measure under IFRS, please refer to the Non-GAAP Financial Performance Measures section of this MD&A on pages 57 to 74. Each non-GAAP financial performance measure has been annotated with a reference to an endnote on page 75. The non-GAAP financial performance measures set out in this MD&A are intended to provide additional information to investors and do not have any standardized meaning under IFRS, and therefore may not be comparable to other issuers, and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Index

|

|

|

|

|

|

|

|

|

|

Overview |

|

|

|

|

|

Financial and Operating Highlights |

|

|

Key Business Developments |

|

|

Environmental, Social and Governance |

|

|

Outlook |

|

|

Production and Cost Summary |

|

|

|

|

Operating Performance |

|

|

|

|

|

Nevada Gold Mines |

|

|

Carlin |

|

|

Cortez |

|

|

Turquoise Ridge |

|

|

Other Mines - Nevada Gold Mines |

|

|

Pueblo Viejo |

|

|

Loulo-Gounkoto |

|

|

Kibali |

|

|

Veladero |

|

|

|

|

|

North Mara |

|

|

Bulyanhulu |

|

|

Other Mines - Gold |

|

|

Other Mines - Copper |

|

|

|

|

Growth Projects |

|

|

|

|

Exploration and Mineral Resource Management |

|

|

|

|

Review of Financial Results |

|

|

|

|

|

Revenue |

|

|

Production Costs |

|

|

Capital Expenditures |

|

|

General and Administrative Expenses |

|

|

Exploration, Evaluation and Project Expenses |

|

|

Finance Costs, Net |

|

|

Additional Significant Statement of Income Items |

|

|

Income Tax Expense |

|

|

|

|

Financial Condition Review |

|

|

|

|

|

Balance Sheet Review |

|

|

Shareholders’ Equity |

|

|

Financial Position and Liquidity |

|

|

Summary of Cash Inflow (Outflow) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies |

|

|

|

|

Review of Quarterly Results |

|

|

|

|

Internal Control over Financial Reporting and

Disclosure Controls and Procedures |

|

|

|

|

IFRS Critical Accounting Policies and Accounting Estimates |

|

|

|

|

Non-GAAP Financial Performance Measures |

|

|

|

|

Technical Information |

|

|

|

|

Endnotes |

|

|

|

|

Financial Statements |

|

|

|

|

Notes to Consolidated Financial Statements |

|

|

|

|

|

|

|

|

|

| BARRICK SECOND QUARTER 2022 |

3 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Overview

Financial and Operating Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

For the six months ended |

| |

6/30/22 |

3/31/22 |

% Change |

|

6/30/21 |

% Change |

|

6/30/22 |

6/30/21 |

% Change |

Financial Results ($ millions) |

|

|

|

|

|

|

|

|

|

|

| Revenues |

2,859 |

2,853 |

0 |

% |

|

2,893 |

(1) |

% |

|

5,712 |

5,849 |

(2) |

% |

| Cost of sales |

1,850 |

1,739 |

6 |

% |

|

1,704 |

9 |

% |

|

3,589 |

3,416 |

5 |

% |

Net earningsa |

488 |

438 |

11 |

% |

|

411 |

19 |

% |

|

926 |

949 |

(2) |

% |

Adjusted net earningsb |

419 |

463 |

(10) |

% |

|

513 |

(18) |

% |

|

882 |

1,020 |

(14) |

% |

Adjusted EBITDAb |

1,527 |

1,645 |

(7) |

% |

|

1,719 |

(11) |

% |

|

3,172 |

3,519 |

(10) |

% |

Adjusted EBITDA marginc |

53 |

% |

58 |

% |

(9) |

% |

|

59 |

% |

(10) |

% |

|

56 |

% |

60 |

% |

(7) |

% |

Minesite sustaining capital expendituresb,d |

523 |

420 |

25 |

% |

|

452 |

16 |

% |

|

943 |

857 |

10 |

% |

Project capital expendituresb,d |

226 |

186 |

22 |

% |

|

203 |

11 |

% |

|

412 |

334 |

23 |

% |

Total consolidated capital expendituresd,e |

755 |

611 |

24 |

% |

|

658 |

15 |

% |

|

1,366 |

1,197 |

14 |

% |

| Net cash provided by operating activities |

924 |

1,004 |

(8) |

% |

|

639 |

45 |

% |

|

1,928 |

1,941 |

(1) |

% |

Net cash provided by operating activities marginf |

32 |

% |

35 |

% |

(9) |

% |

|

22 |

% |

45 |

% |

|

34 |

% |

33 |

% |

3 |

% |

Free cash flowb |

169 |

393 |

(57) |

% |

|

(19) |

989 |

% |

|

562 |

744 |

(24) |

% |

| Net earnings per share (basic and diluted) |

0.27 |

0.25 |

8 |

% |

|

0.23 |

17 |

% |

|

0.52 |

0.53 |

(2) |

% |

Adjusted net earnings (basic)b per share |

0.24 |

0.26 |

(8) |

% |

|

0.29 |

(17) |

% |

|

0.50 |

0.57 |

(12) |

% |

| Weighted average diluted common shares (millions of shares) |

1,777 |

1,779 |

0 |

% |

|

1,779 |

0 |

% |

|

1,778 |

1,779 |

0 |

% |

| Operating Results |

|

|

|

|

|

|

|

|

|

|

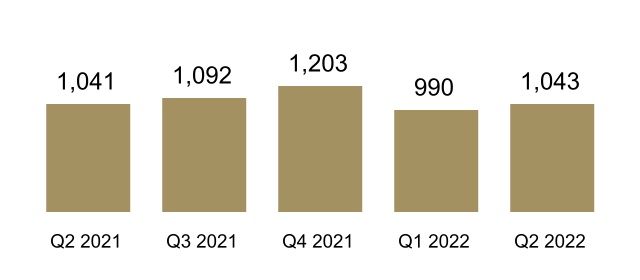

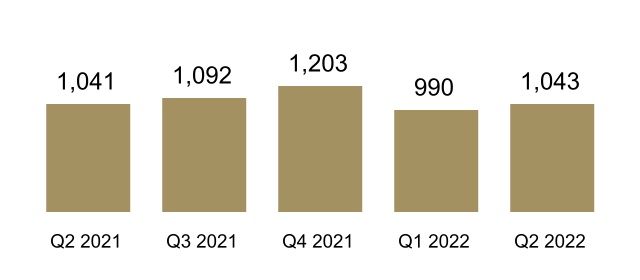

Gold production (thousands of ounces)g |

1,043 |

990 |

5 |

% |

|

1,041 |

0 |

% |

|

2,033 |

2,142 |

(5) |

% |

Gold sold (thousands of ounces)g |

1,040 |

993 |

5 |

% |

|

1,070 |

(3) |

% |

|

2,033 |

2,163 |

(6) |

% |

| Market gold price ($/oz) |

1,871 |

1,877 |

0 |

% |

|

1,816 |

3 |

% |

|

1,874 |

1,805 |

4 |

% |

Realized gold priceb,g ($/oz) |

1,861 |

1,876 |

(1) |

% |

|

1,820 |

2 |

% |

|

1,868 |

1,798 |

4 |

% |

Gold cost of sales (Barrick’s share)g,h ($/oz) |

1,216 |

1,190 |

2 |

% |

|

1,107 |

10 |

% |

|

1,203 |

1,090 |

10 |

% |

Gold total cash costsb,g ($/oz) |

855 |

832 |

3 |

% |

|

729 |

17 |

% |

|

844 |

723 |

17 |

% |

Gold all-in sustaining costsb,g ($/oz) |

1,212 |

1,164 |

4 |

% |

|

1,087 |

11 |

% |

|

1,188 |

1,052 |

13 |

% |

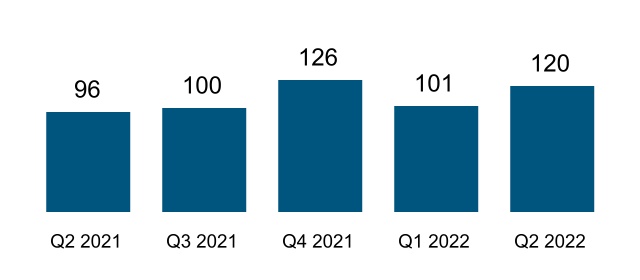

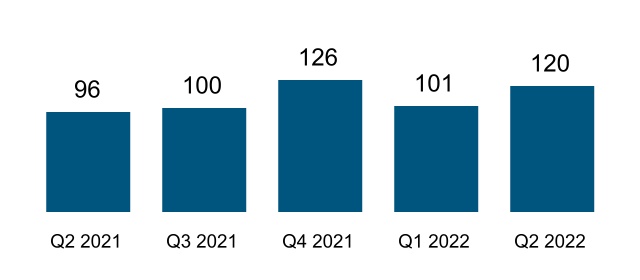

Copper production (millions of pounds)g |

120 |

101 |

19 |

% |

|

96 |

25 |

% |

|

221 |

189 |

17 |

% |

Copper sold (millions of pounds)g |

113 |

113 |

0 |

% |

|

96 |

18 |

% |

|

226 |

209 |

8 |

% |

| Market copper price ($/lb) |

4.32 |

4.53 |

(5) |

% |

|

4.40 |

(2) |

% |

|

4.43 |

4.12 |

8 |

% |

Realized copper priceb,g ($/lb) |

3.72 |

4.68 |

(21) |

% |

|

4.57 |

(19) |

% |

|

4.20 |

4.32 |

(3) |

% |

Copper cost of sales (Barrick’s share)g,i ($/lb) |

2.11 |

2.21 |

(5) |

% |

|

2.43 |

(13) |

% |

|

2.16 |

2.26 |

(4) |

% |

Copper C1 cash costsb,g ($/lb) |

1.70 |

1.81 |

(6) |

% |

|

1.83 |

(7) |

% |

|

1.75 |

1.71 |

2 |

% |

Copper all-in sustaining costsb,g ($/lb) |

2.87 |

2.85 |

1 |

% |

|

2.74 |

5 |

% |

|

2.86 |

2.48 |

15 |

% |

|

|

|

|

|

|

|

|

|

|

|

| |

As at 6/30/22 |

As at 3/31/22 |

% Change |

|

As at 6/30/21 |

% Change |

|

|

|

|

Financial Position ($ millions) |

|

|

|

|

|

|

|

|

|

|

| Debt (current and long-term) |

5,144 |

5,144 |

0 |

% |

|

5,152 |

0 |

% |

|

|

|

|

| Cash and equivalents |

5,780 |

5,887 |

(2) |

% |

|

5,138 |

12 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Debt, net of cash |

(636) |

(743) |

(14) |

% |

|

14 |

(4,643) |

% |

|

|

|

|

a.Net earnings represents net earnings attributable to the equity holders of the Company.

b.Further information on these non-GAAP financial performance measures, including detailed reconciliations, is included on pages 57 to 74 of this MD&A.

c.Represents adjusted EBITDA divided by revenue.

d.Amounts presented on a consolidated cash basis. Project capital expenditures are included in our calculation of all-in costs, but not included in our calculation of all-in sustaining costs.

e.Total consolidated capital expenditures also includes capitalized interest of $6 million and $11 million, respectively, for the three and six month periods ended June 30, 2022 (March 31, 2022: $5 million and June 30, 2021: $3 million and $6 million, respectively).

f.Represents net cash provided by operating activities divided by revenue.

g.On an attributable basis.

h.Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in closure or care and maintenance) divided by ounces sold (both on an attributable basis using Barrick's ownership share).

i.Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick's ownership share).

|

|

|

|

|

|

|

|

|

| BARRICK SECOND QUARTER 2022 |

4 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

|

|

|

|

|

GOLD PRODUCTIONa (thousands of ounces) |

COPPER PRODUCTIONa (millions of pounds) |

|

|

|

|

|

|

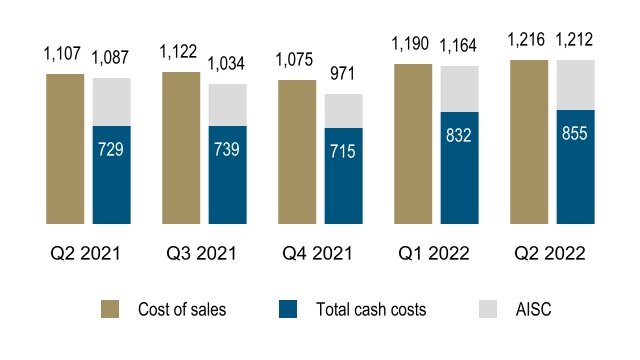

GOLD COST OF SALESb, TOTAL CASH COSTSc, |

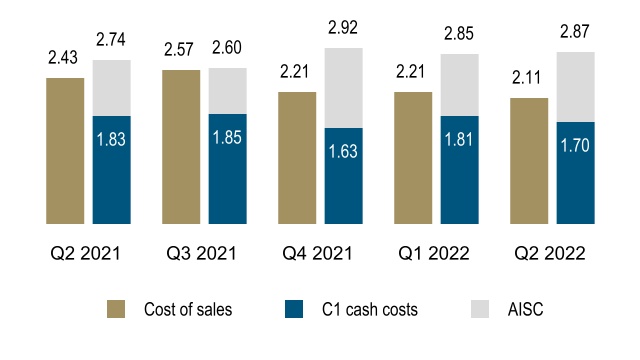

COPPER COST OF SALESb, C1 CASH COSTSc, |

AND ALL-IN SUSTAINING COSTSc ($ per ounce) |

AND ALL-IN SUSTAINING COSTSc ($ per pound) |

|

|

|

|

|

|

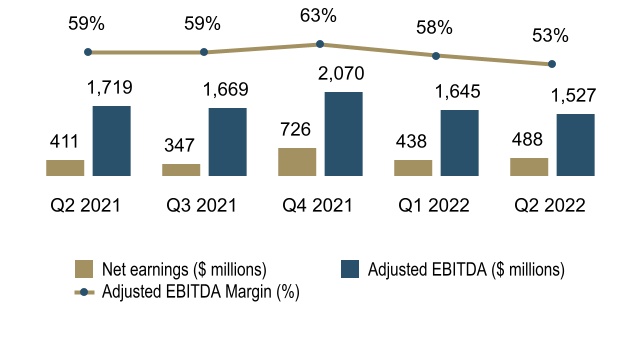

NET EARNINGS, ADJUSTED EBITDAc AND |

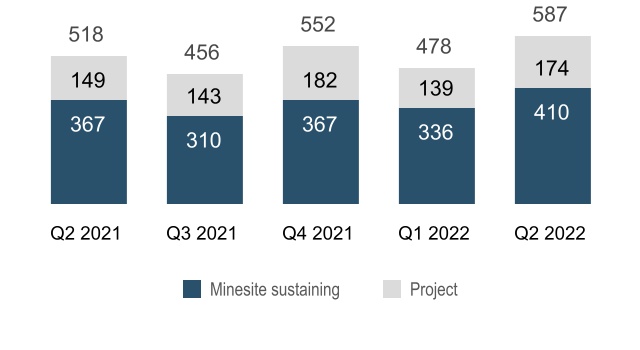

ATTRIBUTABLE CAPITAL EXPENDITURESe

|

ADJUSTED EBITDA MARGINd |

($ millions) |

|

|

|

|

|

|

OPERATING CASH FLOW AND FREE CASH FLOWc |

DIVIDENDSf (cents per share) |

a.On an attributable basis.

b.Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in closure or care and maintenance) divided by ounces sold (both on an attributable basis using Barrick's ownership share). Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick's ownership share).

c.Further information on these non-GAAP financial performance measures, including detailed reconciliations, is included on pages 57 to 74 of this MD&A.

d.Represents adjusted EBITDA divided by revenue.

e.Total attributable capital expenditures also includes capitalized interest. Minesite sustaining and project capital expenditures are non-GAAP financial performance measures. Further information on non-GAAP financial performance measures, including detailed reconciliations, is included on pages 57 to 74 of this MD&A.

f.Dividend per share declared in respect of the stated period inclusive of the performance dividend.

|

|

|

|

|

|

|

|

|

| BARRICK SECOND QUARTER 2022 |

5 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Factors affecting net earnings and adjusted net earnings1 - three months ended June 30, 2022 versus March 31, 2022

Net earnings attributable to equity holders of Barrick ("net earnings") for the three months ended June 30, 2022 were $488 million compared to $438 million in the prior quarter. The increase was primarily due to changes in our closed mine rehabilitation as a result of higher discount rate assumptions, in addition to the drivers described immediately below.

After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $419 million for the three months ended June 30, 2022 were 10% lower than the prior quarter. The decrease was primarily due to higher gold cost of sales per ounce2 and lower realized gold and copper prices1. The increase in gold cost of sales per ounce2 is a result of higher input prices driven by energy and consumables from inflationary pressures initially related to global supply chain constraints, and then exacerbated by the Russian invasion of Ukraine. The realized gold price1 was $1,861 per ounce in the three months ended June 30, 2022 compared to $1,876 per ounce in the prior quarter. The realized copper price1 was $3.72 per pound in the three months ended June 30, 2022 compared to $4.68 per pound in the prior quarter. Adjusted net earnings1 was positively impacted by higher gold sales volume due to a stronger performance across the portfolio, mainly at Carlin, Veladero, North Mara, Bulyanhulu and Turquoise Ridge, partially offset by lower sales volume at Cortez due to mine sequencing as it transitions from the end of open pit mining at Pipeline to the next phase at Crossroads, which is expected to underpin stronger performance for the asset in the fourth quarter of 2022.

Factors affecting net earnings and adjusted net earnings1 - three months ended June 30, 2022 versus June 30, 2021

Net earnings for the second quarter of 2022 were $488 million compared to $411 million in the same prior year period. The increase was primarily due to changes in our closed mine rehabilitation as a result of higher discount rate assumptions, in addition to the drivers described immediately below.

After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $419 million in the second quarter of 2022 were $94 million lower than the same prior year period. The decrease was primarily due to higher gold cost of sales per ounce2 and a lower realized copper price1, partially offset by a higher realized gold price1. The increase in gold cost of sales per ounce2 compared to the same prior year period was primarily due to higher input prices driven by energy, labor and consumables due to inflationary pressures initially related to supply chain issues, and then exacerbated by the Russian invasion of Ukraine. The realized copper price1 was $3.72 per pound in the three months ended June 30, 2022 compared to $4.57 per pound in the same prior year period. These impacts were partially offset by a higher realized gold price1. The realized gold price1 was $1,861 per ounce in the three months ended June 30, 2022 compared to $1,820 per ounce in the same prior year period.

The significant adjusting item in the three months ended June 30, 2022 was:

■$101 million ($95 million before tax and non-controlling interests) in other income adjustments primarily due to changes in our closed mine rehabilitation as a result of higher discount rate assumptions, partially offset by care and maintenance expenses at Porgera.

Refer to page 58 for a full list of reconciling items between net earnings and adjusted net earnings1 for the current and previous periods.

Factors affecting net earnings and adjusted net earnings1 - six months ended June 30, 2022 versus June 30, 2021

Net earnings for the six months ended June 30, 2022 were $926 million compared to $949 million in the same prior year period. The decrease was mainly due to the factors described further below, although also impacted by the following items:

■$92 million ($82 million before tax and non-controlling interests) in other income adjustments in the current year, primarily due to changes in our closed mine rehabilitation as a result of higher discount rate assumptions, partially offset by care and maintenance expenses at Porgera.

■an impairment reversal of $86 million (no tax impact) at Lagunas Norte following the agreement to sell our 100% interest in the Lagunas Norte mine, occurring in the prior year period.

After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $882 million for the six months ended June 30, 2022 were $138 million lower than the same prior year period. The decrease in adjusted net earnings was primarily due to higher gold cost of sales per ounce1 and lower gold sales volumes, partially offset by a higher realized gold price1. The increase in gold cost of sales per ounce2 compared to the same prior year period was primarily due to higher input prices driven by energy, labor and consumables due to inflationary pressures initially related to supply chain issues, and then exacerbated by the Russian invasion of Ukraine. The lower gold sales volume was primarily a result of lower grades processed at Pueblo Viejo, the completion of Phase 1 mining at Long Canyon in May 2022, and the end of mining at Buzwagi as the operation transitioned into closure in the third quarter of 2021. This was partially offset by higher production at Carlin as a result of the mechanical mill failure at the Goldstrike roaster which occurred in the same prior year period, at Veladero as the mine was transitioning to Phase 6 of the leach pad in the first half of 2021, and at Bulyanhulu due to the successful ramp-up of the underground mining and processing operations. These impacts were partially offset by a higher realized gold price1. The realized gold price1 was $1,868 per ounce in the six months ended June 30, 2022, compared to $1,798 per ounce in the same prior year period.

Refer to page 58 for a full list of reconciling items between net earnings and adjusted net earnings1 for the current and previous periods.

1Numerical annotations throughout the text of this document refer to the endnotes found on page 75.

|

|

|

|

|

|

|

|

|

| BARRICK SECOND QUARTER 2022 |

6 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Factors affecting Operating Cash Flow and Free Cash Flow1 - three months ended June 30, 2022 versus March 31, 2022

In the three months ended June 30, 2022, we generated $924 million in operating cash flow, compared to $1,004 million in the prior quarter. The decrease of $80 million was primarily due to higher interest paid as a result of the timing of semi-annual interest payments on our bonds, combined with higher total cash costs per ounce1 and lower realized gold and copper prices1. This was partially offset by a favorable movement in working capital, mainly in accounts payable and other current assets. Operating cash flow was further positively impacted by higher gold sales volumes.

For the three months ended June 30, 2022, we recorded free cash flow1 of $169 million, compared to $393 million in the prior quarter, reflecting higher capital expenditures and lower operating cash flows. In the second quarter of 2022, capital expenditures on a cash basis were $755 million compared to $611 million in the prior quarter, due to an increase in both minesite sustaining capital expenditures1 and project capital expenditures1. Higher minesite sustaining capital expenditures1 mainly relates to increased capitalized stripping at Cortez and Lumwana. The increase in project capital expenditures1 primarily relates to the ramp-up of open pit operations at North Mara as well as the commencement of the solar plant expansion and increased expenditure on underground development at Loulo-Gounkoto.

Factors affecting Operating Cash Flow and Free Cash Flow1 - three months ended June 30, 2022 versus June 30, 2021

In the second quarter of 2022, we generated $924 million in operating cash flow, compared to $639 million in the same prior year period. The increase of $285 million was primarily due to lower cash taxes paid and a favorable movement in working capital, mainly in accounts receivable and inventory. Operating cash flow was positively impacted further by a higher realized gold price1 and negatively impacted by higher total cash costs per ounce1, lower gold sales volumes and a lower realized copper price1.

In the second quarter of 2022, we generated free cash flow1 of $169 million compared to a negative free cash flow of $19 million in the same prior year period. The increase primarily reflects higher operating cash flows, partially offset by higher capital expenditures. In the second quarter of 2022, capital expenditures on a cash basis were $755 million compared to $658 million in the second quarter of 2021. The increase in capital expenditures of $97 million was due to an increase in both minesite sustaining capital expenditures1 and project capital expenditures1. The increase in minesite sustaining capital expenditures1 is mainly due to increased capitalized stripping at Cortez and Lumwana, partially offset by lower capitalized stripping at Loulo-Gounkoto. Project capital expenditures1 increased compared to the same prior year period, primarily due to the ramp-up of open pit operations at North Mara and the expansion of power capacity, including the commencement of the solar plant expansion, at Loulo-Gounkoto.

Factors affecting Operating Cash Flow and Free Cash Flow1 - six months ended June 30, 2022 versus June 30, 2021

For the six months ended June 30, 2022, we generated $1,928 million in operating cash flow, compared to $1,941

million in the same prior year period. The decrease of $13 million was primarily due to higher total cash costs per ounce1 and lower gold sales volumes, partially offset by a higher realized gold price1. Operating cash flow was positively impacted further by lower cash taxes paid and a favorable movement in working capital, mainly in accounts payable and accounts receivable, partially offset by an unfavorable movement in other current assets.

For the six months ended June 30, 2022, we generated free cash flow1 of $562 million compared to $744 million in the same prior year period. The decrease primarily reflects higher capital expenditures. In the six months ended June 30, 2022, capital expenditures on a cash basis were $1,366 million compared to $1,197 million in the same prior year period resulting from an increase in both minesite sustaining capital expenditures1 and project capital expenditures1. Higher minesite sustaining capital expenditures1 is mainly due to increased capitalized stripping at Lumwana and Cortez, partially offset by lower capitalized stripping at Loulo-Gounkoto. The increase in project capital expenditures1 was primarily the result of the ongoing investment in the ramp-up of open pit operations that will continue throughout 2022 at North Mara; the expansion of power capacity, including the commencement of the solar plant expansion, at Loulo-Gounkoto; and the development of the Phase 7 leach pad expansion at Veladero.

Key Business Developments

Credit Facility Extended and Sustainability-Linked Metrics Established

In May 2022, we completed an amendment and restatement of the company’s undrawn $3.0 billion revolving credit facility, including an extension of the termination date by one year to May 2027, replacement of LIBOR with SOFR as the reference rate for floating interest on any US dollar funds drawn (currently nil), and the establishment of sustainability-linked metrics.

The sustainability-linked metrics incorporated into the revolving credit facility are made up of annual environmental and social performance targets directly influenced by Barrick’s actions, rather than based on external ratings. The performance targets include Scope 1 and Scope 2 greenhouse gas emissions intensity, water use efficiency (reuse and recycling rates), and Total Recordable Injury Frequency Rate ("TRIFR")3. Barrick may incur positive or negative pricing adjustments on drawn credit spreads and standby fees based on its sustainability performance versus the targets that have been set.

Performance Dividend Policy

At the February 15, 2022 meeting, the Board of Directors approved a performance dividend policy that will enhance the return to shareholders when the Company’s liquidity is strong. In addition to our base dividend, the amount of the performance dividend on a quarterly basis will be based on the amount of cash, net of debt, on our consolidated balance sheet at the end of each quarter as per the schedule below. Reflecting this policy, a quarterly dividend payment of $0.20 per share was declared by the Board of Directors at the August 5, 2022 meeting, comprised of a base dividend of $0.10 per share and a performance dividend enhancement of $0.10 per share based on our June 30, 2022 consolidated balance sheet. This follows an equivalent dividend payment of $0.20 per share declared

|

|

|

|

|

|

|

|

|

| BARRICK SECOND QUARTER 2022 |

7 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

on May 3, 2022 based on the March 31, 2022 consolidated balance sheet.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performance Dividend Level |

Threshold Level |

Quarterly Base Dividend |

Quarterly Performance Dividend |

Quarterly Total Dividend |

| Level I |

Net cash <$0 |

$0.10

per share |

$0.00

per share |

$0.10

per share |

| Level II |

Net cash

>$0 and <$0.5B |

$0.10

per share |

$0.05

per share |

$0.15

per share |

| Level III |

Net cash

>$0.5B and <$1B |

$0.10

per share |

$0.10

per share |

$0.20

per share |

| Level IV |

Net cash >$1B |

$0.10

per share |

$0.15

per share |

$0.25

per share |

The declaration and payment of dividends is at the discretion of the Board of Directors, and will depend on the company’s financial results, cash requirements, future prospects, the number of outstanding common shares, and other factors deemed relevant by the Board.

Share Buyback Program

At the February 15, 2022 meeting, the Board of Directors authorized a share buyback program for the repurchase of up to $1.0 billion of the Company’s outstanding common shares over the next 12 months. As at June 30, 2022, we purchased $182 million of shares under the program, including $9 million that settled in July 2022.

The actual number of common shares that may be purchased, if any, and the timing of any such purchases, will be determined by Barrick based on a number of factors, including the Company’s financial performance, the availability of cash flows, and the consideration of other uses of cash, including capital investment opportunities, returns to shareholders, and debt reduction.

The repurchase program does not obligate the Company to acquire any particular number of common shares, and the repurchase program may be suspended or discontinued at any time at the Company’s discretion.

Reconstituted Reko Diq Project

Barrick and the governments of Pakistan and Balochistan have reached agreement in principle on a framework that provides for the reconstitution of the Reko Diq project in the country’s Balochistan province. The project, which was suspended in 2011 due to a dispute over the legality of its licensing process, hosts one of the world’s largest undeveloped open pit copper-gold porphyry deposits.

The reconstituted project will be held 50% by Barrick and 50% by Pakistani stakeholders, comprising a 10% free-carried, non-contributing share held by the Government of Balochistan, an additional 15% held by a special purpose company owned by the Government of Balochistan and 25% owned by other federal state-owned enterprises.

Barrick will be the operator of the project and will be granted mining leases, an exploration license, surface rights and a mineral agreement stabilizing the fiscal regime applicable to the project for a specified period. The process to finalize and approve definitive agreements, including the stabilization of the fiscal regime pursuant to the mineral agreement, will involve the federal and provincial governments, as well as the Supreme Court of Pakistan. If the definitive agreements are executed and the conditions to closing are satisfied, the project will be reconstituted,

including the resolution of the damages originally awarded by the International Centre for the Settlement of Investment Disputes and disputed in the International Chamber of Commerce. On closing, Barrick will start a full update of the project’s 2010 feasibility and 2011 expansion prefeasibility studies. Refer to notes 13 and 17 to the Financial Statements for more information.

Porgera Special Mining Lease

On April 9, 2021, BNL signed a binding Framework Agreement with the Independent State of Papua New Guinea (“PNG”) and Kumul Minerals Holdings Limited (“Kumul Minerals”), a state-owned mining company, setting out the terms and conditions for the reopening of the Porgera mine. On February 3, 2022, the Framework Agreement was replaced by the more detailed Porgera Project Commencement Agreement (the “Commencement Agreement”). The Commencement Agreement was signed by PNG, Kumul Minerals, BNL and its affiliate Porgera (Jersey) Limited on October 15, 2021, and it became effective on February 3, 2022, following signature by Mineral Resources Enga Limited (“MRE”), the holder of the remaining 5% of the original Porgera joint venture. The Commencement Agreement reflects the commercial terms previously agreed to under the Framework Agreement, namely that PNG stakeholders will receive a 51% equity stake in the Porgera mine, with the remaining 49% to be held by BNL or an affiliate. BNL is jointly owned on a 50/50 basis by Barrick and Zijin Mining Group. Accordingly, following the implementation of the Commencement Agreement, Barrick’s current 47.5% interest in the Porgera mine is expected to be reduced to a 24.5% interest as reflected in Barrick’s reserve and resource estimates for Porgera. BNL will retain operatorship of the mine. The Commencement Agreement also provides that PNG stakeholders and BNL and its affiliates will share the economic benefits derived from the reopened Porgera Mine on a 53% and 47% basis over the remaining life of mine, respectively, and that the Government of PNG will retain the option to acquire BNL’s or its affiliate’s 49% equity participation at fair market value after 10 years.

The provisions of the Commencement Agreement will be implemented, and work to recommence full mine operations at Porgera will begin, following the execution of a number of definitive agreements and satisfaction of a number of conditions. On April 7, 2022, one such definitive agreement, the Shareholders' Agreement for the new Porgera joint venture company was signed by BNL’s affiliate, Porgera (Jersey) Limited, and the state-owned Kumul Minerals (Porgera) Limited, and is awaiting signature by MRE to take effect. This would clear the way for the incorporation of a new Porgera joint venture company and the application for a new Special Mining Lease, a condition of the Porgera mine's reopening. On April 21, 2022, the PNG National Parliament passed legislation to provide, among other things, certain agreed tax exemptions and tax stability for the new Porgera joint venture. The passage of this legislation marks an important step toward the reopening of the Porgera mine and satisfies one of the key obligations of the PNG Government under the Commencement Agreement. This legislation was certified on May 30, 2022 and will come into effect following a public notice process under PNG law.

Other definitive agreements, which remain to be concluded, include an Operatorship Agreement pursuant to

|

|

|

|

|

|

|

|

|

| BARRICK SECOND QUARTER 2022 |

8 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

which BNL will operate the Porgera mine, as well as a Mine Development Contract to accompany the new SML that the new Porgera joint venture company will apply for following its incorporation. Under the terms of the Commencement Agreement, BNL will remain in possession of the site and maintain the mine on care and maintenance.

Porgera continues to be excluded from our 2022 guidance. We expect to update our guidance following both the execution of all of the definitive agreements to implement the binding Commencement Agreement and the finalization of a timeline for the resumption of full mine operations. Refer to notes 13 and 17 to the Financial Statements for more information.

Covid-19 Pandemic

Barrick continues to work closely with our local communities on managing the impacts of the Covid-19 pandemic on our people and business. Our operations are not currently being impacted in any significant manner, although we recognize the situation remains dynamic. We continue to monitor developments around the world and believe we have positioned Barrick as best we can.

Mineral Resource Management Executive Changes

After 26 years of dedicated service, Rod Quick, Mineral Resource Management and Evaluation Executive, will be departing Barrick later in 2022. Mr. Quick joined Randgold Resources in 1996 and was involved in the exploration, evaluation, and production phases of all of Randgold’s projects since the discovery and development of the Morila gold mine. He became responsible for all project development and evaluation for Randgold in 2009, and assumed the Mineral Resource Management and Evaluation Executive role with Barrick upon the merger with Randgold in 2019. Mr. Quick will be succeeded by Simon Bottoms. Mr. Bottoms joined Randgold in 2013 and has served as the Mineral Resource Manager for Barrick’s Africa and Middle East region since the merger with Randgold.

Nevada Gold Mines Management Changes

Greg Walker, Executive Managing Director, Nevada Gold Mines, will be retiring later in 2022. Mr. Walker joined Barrick in 2003 and has held progressively senior operational leadership roles during his tenure at Barrick, including as Senior Vice President, Operational and Technical Excellence before his appointment as Executive Managing Director, Nevada Gold Mines in 2019. Mr. Walker will be succeeded by Peter Richardson who was appointed Executive Managing Director Designate, Nevada Gold Mines on August 5, 2022. Mr. Richardson brings a diversified background having worked in process engineering, project management, strategy and business development, as well as mining operations leadership. He was formerly Senior Vice President and Chief Operating Officer for Lundin Mining Corp. Mr. Richardson will work with Mr. Walker, Christine Keener, Chief Operating Officer, North America, and Mark Bristow, Barrick’s President and Chief Executive Officer and the Chairman of Nevada Gold Mines, as we plan for Mr. Walker’s retirement toward the end of 2022.

Africa and Middle East Regional Management Changes

After 13 years of dedicated service, Willem Jacobs retired as Barrick's Chief Operating Officer for the Africa and the

Middle East region at the end of June 2022. Mr. Jacobs was initially employed by Randgold Resources as the Chief Operating Officer for Central and East Africa before assuming his current role at the time of the merger with Randgold.

Mr. Jacobs is succeeded by Sebastiaan Bock. Mr. Bock joined Randgold in 2008 and has served as Senior Vice-President, Chief Financial Officer for Barrick's Africa and Middle East region since the merger with Randgold.

Legal Executive Changes

On April 1, 2022, after 25 years of distinguished service, Rich Haddock transitioned from his position as General Counsel to a new role as Legal Advisor to Barrick. Over his tenure, Mr. Haddock played a critical role across the business, including most recently the framework agreement that provides for the reconstitution of the Reko Diq project.

Poupak Bahamin was appointed to the role of General Counsel on April 1, 2022. Ms. Bahamin has over 25 years of experience practicing law and joined Barrick in February 2020, after nine years as a partner with Norton Rose Fulbright.

Environmental, Social and Governance ("ESG")

At Barrick, sustainability is entrenched in our DNA: our sustainability strategy is incorporated into our business plan.

Our sustainability strategy has four main pillars: (1) ensuring we respect human rights; (2) protecting the health and safety of our people and local communities; (3) sharing the benefits of our operations; and (4) managing our impacts on the environment. Although our sustainability strategy has four pillars, our approach to sustainability is integrated and holistic; sustainability aspects and impacts do not occur in silos, but rather overlap and interlink, and must be tackled in conjunction with and reference to each other.

We implement this strategy by blending top-down accountability with bottom-up responsibility. This means we place the day-to-day ownership of sustainability, and the associated risks and opportunities, in the hands of individual sites. In the same way that each site must manage its geological, operational and technical capabilities to meet business objectives, it must also manage and identify programs, metrics, and targets that measure progress and deliver real value for the business and our stakeholders, including our host countries and local communities. The Group Sustainability Executive, supported by regional sustainability leads, provides oversight and direction over this site-level ownership, to ensure alignment with the strategic priorities of the overall business.

Governance

The bedrock of our sustainability strategy is strong governance. Our most senior management-level body dedicated to sustainability is the Environmental and Social Oversight Committee ("E&S Committee"), which connects site-level ownership of our sustainability strategy with the leadership of the Group. It is chaired by the President and Chief Executive Officer and includes: (1) regional Chief Operating Officers; (2) minesite General Managers; (3) Health, Safety, Environment and Closure Leads; (4) the Group Sustainability Executive; (5) in-house legal counsel; and (6) an independent sustainability consultant in an

|

|

|

|

|

|

|

|

|

| BARRICK SECOND QUARTER 2022 |

9 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

advisory role. The E&S Committee meets on a quarterly basis to review our performance across a range of key performance indicators, and to provide independent oversight and review of sustainability management.

The President and Chief Executive Officer reviews the reports of the E&S Committee with the Board's Environmental, Social, Governance & Nominating Committee (“ESG & Nominating Committee”). The reports are reviewed to ensure the implementation of our sustainability policies and to drive performance of our environmental, health and safety, corporate social responsibility, and human rights programs.

This is supplemented by weekly meetings, at a minimum, between the Regional Sustainability Leads and the Group Sustainability Executive. These meetings examine the sustainability-related risks and opportunities facing the business in real time, as well as the progress and issues integrated into weekly Executive Committee review meetings.

Our 2021 Sustainability Report has again highlighted our performance in our industry-first Sustainability Scorecard, which accounts for 25% of the long-term incentive awards for senior leaders as part of the Barrick Partnership Plan. As we strive for continued strong performance, the Sustainability Scorecard targets and metrics were updated in the 2021 Sustainability Report for 2022. The E&S Committee tracks our progress against the 2022 metrics.

We completed the annual Dow Jones Sustainability Index ("DJSI") Corporate Sustainability Assessment during the quarter, an index that focuses on a company's ESG policy commitments, data and performance. We expect the results for the DJSI to be announced towards the end of the year.

Human rights

Our commitment to respect human rights is codified in our standalone Human Rights Policy and informed by the expectations of the UN Guiding Principles on Business and Human Rights ("UNGPs"), the Voluntary Principles on Security and Human Rights and the OECD Guidelines for Multinational Enterprises. This commitment is fulfilled on the ground via our Human Rights Program, the fundamental principles of which include: monitoring and reporting, due diligence, training, as well as disciplinary action and remedy.

We continue to assess and manage security and human rights risks at all our operations, and provide security and human rights training to security forces across our sites. In May 2022, we attended the annual Voluntary Principles on Security and Human Rights Plenary in Toronto, the first in-person plenary hosted since 2019 due to the Covid-19 pandemic. The Plenary provides a forum from the Corporate, NGO and Government pillars, as well as other stakeholders and observers, to collaborate, share experiences and training and approaches to security and human rights challenges faced by members.

Safety

We are committed to the safety, health and well-being of our people, their families and the communities in which we operate. Our safety vision is “Every person going home safe and healthy every day.”

We continue to implement our “Journey to Zero Harm” initiative which is focused on engagement with our

workforce through Visible Felt Leadership, and by aligning and improving our standards across the Group, ensuring accountability to our safety commitments, and ensuring our employees are fit for duty.

We report our safety performance quarterly as both part of our E&S Committee meetings and to the ESG & Nominating Committee. Our safety performance is a regular standing agenda item on our weekly Executive Committee review meeting.

Safety key performance indicators for the second quarter of 2022 include our Lost Time Injury Frequency Rate ("LTIFR")3 at 0.33 and our Total Recordable Injury Frequency Rate ("TRIFR")3 at 1.19. The LTIFR increased by 14% from the first quarter, but the TRIFR decreased from the first quarter of 2022 by 34%.

Safety starts with our people and their behavior, and ensuring this message gets to all of our workforce on the ground, and emphasis is being placed to ensure our people live and demonstrate safe behaviors and do not compromise on safety standards.

We continue to monitor and track Covid-19 across our sites and countries of operation, with the focus on safeguarding our employees and operations from Covid-19 outbreaks. Strict screening and prevention measures remain in place at our mine gates, including ‘test to enter’ policies at some higher risk operations. We continue to implement extensive vaccination awareness campaigns to encourage uptake of the vaccines, including booster shots, by our employees.

Social

We regard our host communities and countries as important partners in our business. Our sustainability policies commit us to transparency in our relationships with host communities, government authorities, the public and other key stakeholders. Through these policies, we commit to conducting our business with integrity and with absolute opposition to corruption. We require our suppliers to operate ethically and responsibly as a condition of doing business with us.

Community and economic development

Our commitment to social and economic development is set out in our overarching Sustainable Development and Social Performance policies. Mining has been identified as vital for the achievement of the UN Sustainable Development Goals ("SDGs"), not only for its role in providing the minerals needed to enable the green transition, but also because of its ability to drive socio-economic development and build resilience. Creating long-term value and sharing economic benefits is at the heart of our approach to sustainability, as well as community development. This approach is encapsulated in three concepts:

The primacy of partnership: this means that we invest in real partnerships with mutual responsibility. Partnerships include local communities, suppliers, government, and organizations, and this approach is epitomized through our community development committees ("CDCs") with community development initiatives and investments.

Sharing the benefits: We hire and buy local wherever possible as this injects and keeps money in our local communities and host countries. By doing this, we build capacity, community resilience and create opportunity. We also invest in community development through our

|

|

|

|

|

|

|

|

|

| BARRICK SECOND QUARTER 2022 |

10 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

CDCs. Sharing the benefits also means paying our fair share of taxes, royalties and dividends and doing so transparently, primarily through the reporting mechanism of the Canadian Extractive Sector Transparency Measures Act (‘’ESTMA’’). In April 2022, we published our first Tax Contribution Report which sets out, in detail, our economic contributions to host governments.

Engaging and listening to stakeholders: We develop tailored stakeholder engagement plans for every operation and the business as a whole. These plans guide and document how often we engage with various stakeholder groups and allow us to proactively deal with issues before they escalate into significant risks.

We continued our community development initiatives through the CDCs during the quarter. We invested approximately $8 million in local community development projects during the second quarter of 2022.

Environment

We know the environment in which we work and our host communities are inextricably linked, and we apply a holistic and integrated approach to sustainability management. Being responsible stewards of the environment by applying the highest standards of environmental management, using natural resources and energy efficiently, recycling and reducing waste and working to protect biodiversity, we can deliver significant cost savings to our business, reduce future liabilities and help build stronger stakeholder relationships. Environmental matters such as how we use water, prevent incidents, manage tailings, respond to changing climate, and protection of biodiversity are key focuses.

We maintained our strong track record of stewardship and did not record any Class 14 environmental incidents during the second quarter of 2022 or for the year to date.

Climate Change

The ESG & Nominating Committee is responsible for overseeing Barrick’s policies, programs and performance relating to sustainability and the environment, including climate change. The Audit & Risk Committee assists the Board in overseeing the Group’s management of enterprise risks as well as the implementation of policies and standards for monitoring and mitigating such risks. Climate change is built into our formal risk management process, outputs of which are regularly reviewed by the Audit & Risk Committee.

Barrick’s climate change strategy has three pillars: (1) identify, understand and mitigate the risks associated with climate change; (2) measure and reduce our greenhouse gas ("GHG") emissions across our operations and value chain; and (3) improve our disclosure on climate change. The three pillars of our climate change strategy do not focus solely on the development of emissions reduction targets, rather, we integrate and consider aspects of biodiversity protection, water management and community resilience in our approach.

We are acutely aware of the impacts that climate change has on our host communities and countries, particularly developing nations who are often most vulnerable. As the world economy transitions to renewable power, it is imperative that developing nations are not left behind. As a responsible business, we have focused our efforts on building resilience in our host communities and

countries, just as we do for our business. Our climate disclosure is based on the recommendations of the Task Force on Climate-Related Financial Disclosures ("TCFD").

Identify, understand and mitigate the risks associated with climate change

We identify and manage risks, build resilience to climate change, as well as position ourselves for new opportunities. Climate change-related factors continue to be incorporated into our formal risk assessment process. We have identified several climate-related risks and opportunities for our business including: physical impacts of climate change; an increase in regulations that seek to address climate change; and an increase in global investment in innovation and low-carbon technologies. The risk assessment process includes scenario analysis, which is being rolled out to all sites with an initial focus on our Tier One Gold Assets5, to assess site-specific climate related risks and opportunities. For example, when assessing site weather-related risks, we also consider availability and access to water and the impact of increased precipitation, drought and severe storms on operations, as well as on communities near our operations.

Measure and reduce the Group’s impact on climate change

Mining is an energy-intensive business, and we understand the important link between energy use and GHG emissions. By measuring and effectively managing our energy use, we can reduce our GHG emissions, achieve more efficient production, and reduce our costs.

We have climate champions at each site that are tasked with identifying roadmaps and assessing feasibility for our GHG emissions reductions and carbon offsets for hard-to-abate emissions. Any carbon offsets that we pursue must have appropriate socioeconomic and/or biodiversity benefits. We have published an achievable emissions reduction roadmap and continue to assess further reduction opportunities across our operations. This roadmap is published in our 2021 Sustainability Report and includes committed-capital projects and projects under investigation that are reliant on technological advances.

We have also undertaken extensive work across our value chain in quantifying our Scope 3 (indirect value chain) emissions. This work has enabled us to develop a Scope 3 engagement roadmap that we will implement with our suppliers to set meaningful and measurable reduction targets, in line with the commitments made through the ICMM Climate Position Paper. Our Scope 3 emissions and engagement roadmap are also included in our 2021 Sustainability Report.

Improve our disclosure on climate change

As part of our commitment to improve our disclosure on climate change, our Sustainability Report is developed in line with the TCFD recommendations. In addition, we complete the annual CDP (formerly known as the Carbon Disclosure Project) Climate Change and Water Security questionnaires. This ensures our investor-relevant water use, emissions and climate data is widely available. The 2021 CDP Climate Change and Water Security questionnaires were completed in July 2022, and will be published by the CDP and made publicly available in the coming months.

|

|

|

|

|

|

|

|

|

| BARRICK SECOND QUARTER 2022 |

11 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Emissions

As detailed in our 2021 Sustainability Report, Barrick’s GHG emissions reduction target is for a minimum 30% reduction by 2030 against our 2018 baseline, while maintaining a steady production profile. The basis of this reduction is against a 2018 baseline of 7,541 ktCO2-e.

Our emissions reduction target is grounded in climate science and has a detailed pathway for achievement. Our target is not static and will be updated as we continue to identify and implement new GHG reduction opportunities.

Ultimately, our vision is net zero GHG emissions by 2050, achieved primarily through GHG reductions, with some offsets for hard-to-abate emissions. Site-level plans to improve energy efficiency, integrate clean and renewable energy sources and reduce GHG emissions will also be strengthened, and we plan to supplement our corporate emissions reduction target with context-based site-specific emissions reduction targets.

During the second quarter of 2022, the Group's total Scope 1 and 2 (Location-Based) emissions were 1,778 kt CO2-e which is in line with emissions during the first quarter.

Water

Water is a vital and increasingly scarce global resource. Managing and using water responsibly is one of the most critical parts of our sustainability strategy. Our commitment to responsible water use is codified in our Environmental Policy. Steady, reliable access to water is critical to the effective operation of our mines. Access to water is also a fundamental human right.

Understanding the water stress in the regions we operate enables us to better understand the risks and manage our water resources through site-specific water balances, based on the International Council on Mining and Metals’ (“ICMM”) Water Accounting Framework, aimed at minimizing our water withdrawal and maximizing water reuse and recycling within our operations.

We include each mine’s water risks in its operational risk register. These risks are then aggregated and incorporated into the corporate risk register. Our

identified water-related risks include: (1) managing excess water in regions with high rainfall; (2) maintaining access to water in arid areas and regions prone to water scarcity; and (3) regulatory risks related to permitting limits as well as municipal and national regulations for water use.

We set a water recycling and reuse rate annual target of 80% for 2022. Our water recycling and reuse rate for the second quarter of 2022 was 83%.

Tailings

We are committed to ensuring our tailings storage facilities ("TSFs") meet global best practices for safety. Our TSFs are carefully engineered and regularly inspected, particularly those in regions with high rainfall and seismic events.

We continue to progress our compliance to the Global Industry Standard for Tailings Management ("GISTM"), and have completed the consequence classification for a majority of sites. Sites are currently working to complete a gap assessment against the GISTM using the Conformance Protocols developed by the ICMM.

Biodiversity

Biodiversity underpins many of the ecosystem services on which our mines and their surrounding communities depend. If improperly managed, mining and exploration activities have the potential to negatively affect biodiversity and ecosystem services. Protecting biodiversity and preventing nature loss is also critical and inextricably linked to the fight against climate change. We work to proactively manage our impact on biodiversity and strive to protect the ecosystems in which we operate. Wherever possible, we aim to achieve a net neutral biodiversity impact, particularly for ecologically sensitive environments.

We continue to work to implement our Biodiversity Action Plans (“BAPs”), which have been established at all our operational sites, during 2022. The BAPs outline our strategy to achieve net-neutral impacts for all Key Biodiversity Features and their associated management plans.

|

|

|

|

|

|

|

|

|

| BARRICK SECOND QUARTER 2022 |

12 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Full Year 2022 Outlook

We continue to expect 2022 gold production to be in the range of 4.2 to 4.6 million ounces, anchored by stable year-over-year performance across our portfolio of our six Tier One Gold Assets5 highlighting the importance of a world class asset base in delivering consistent performance. As previously guided, the Company's gold production is expected to improve over the second half of 2022, with the fourth quarter forecasted to be the strongest. This is mainly driven by Cortez due to production from the next mining phase at Crossroads, higher grades from Phoenix and Tongon, as well as improved underground productivity at Hemlo.

Across the rest of the Group, we continue to expect the following changes in year-over-year production versus 2021. As expected and per our previous disclosures, mining of Phase 1 at Long Canyon ceased in the second quarter of 2022 with residual heap leach production slated for the remainder of the year. This is partially offset by Veladero, where we expect a stronger performance in 2022 after the commissioning of Phase 6 in the second quarter of 2021. Furthermore, we expect higher production at Bulyanhulu in 2022 following the successful ramp-up of underground operations achieved at the end of 2021.

Our 2022 gold guidance continues to exclude Porgera. We expect to update our guidance to include Porgera following both the execution of all of the definitive agreements to implement the Commencement Agreement and the finalization of a timeline for the resumption of full mine operations.

Our 2022 gold cost guidance remains unchanged, including cost of sales of $1,070 to $1,150 per ounce2, total cash costs of $730 to $790 per ounce1 and all-in sustaining costs of $1,040 to $1,120 per ounce1. As previously disclosed, these ranges were based on a gold price assumption of $1,700 per ounce and a WTI oil price assumption of $65 per barrel. We have previously disclosed a sensitivity of approximately $5 per ounce and $6 per ounce on our 2022 gold cost guidance metrics, respectively, for every $100 per ounce change in the gold price and $10 per barrel change in the WTI oil price. Accordingly, given the higher gold price environment and the impact that the invasion of Ukraine by Russia has had on global energy prices, we now expect to be either at the top end or slightly above our gold cost guidance ranges for 2022. However, global energy prices remain extremely volatile and consequently, the ultimate impact on our cost profile is difficult to predict.

We continue to expect 2022 copper production to be in the range of 420 to 470 million pounds, with slightly higher production expected in the second half of the year. Notably in the second quarter of 2022, Lumwana achieved stronger performance earlier than anticipated for the year, with increased waste stripping now expected in the fourth quarter. Our copper cost guidance metrics for 2022 remain unchanged, which are based on a copper price assumption of $4.00 per pound.

We continue to monitor the impact of the Covid-19 pandemic and the emergence of new strains of the virus.

Our 2022 guidance may be further impacted if the operation or development of our mines and projects are disrupted due to efforts to mitigate the impact of the virus.

Notwithstanding the risks discussed above, 2022 Company guidance remains unchanged. Detailed below are the key assumptions that were used as the basis for our 2022 guidance as released on February 16, 2022.

|

|

|

|

|

|

Company Guidance ($ millions, except per ounce/pound data) |

2022

Estimate |

| Gold production (millions of ounces) |

4.20 - 4.60 |

| Gold cost metrics |

|

| Cost of sales - gold ($/oz) |

1,070 - 1,150 |

Total cash costs ($/oz)a |

730 - 790 |

| Depreciation ($/oz) |

300 - 330 |

All-in sustaining costs ($/oz)a |

1,040 - 1,120 |

| Copper production (millions of pounds) |

420 - 470 |

| Copper cost metrics |

|

| Cost of sales - copper ($/lb) |

2.20 - 2.50 |

C1 cash costs ($/lb)a |

1.70 - 1.90 |

| Depreciation ($/lb) |

0.70 - 0.80 |

All-in sustaining costs ($/lb)a |

2.70 - 3.00 |

| Exploration and project expenses |

310 - 350 |

| Exploration and evaluation |

180 - 200 |

| Project expenses |

130 - 150 |

| General and administrative expenses |

~180 |

| Corporate administration |

~130 |

Share-based compensationb |

~50 |

|

|

| Other expense |

50 - 70 |

| Finance costs, net |

330 - 370 |

| Attributable capital expenditures: |

|

Attributable minesite sustaininga |

1,350 - 1,550 |

Attributable projecta |

550 - 650 |

| Total attributable capital expenditures |

1,900 - 2,200 |

Effective income tax ratec |

27% - 32% |

| Key assumptions (used for guidance) |

| Gold Price ($/oz) |

1,700 |

|

| Copper Price ($/lb) |

4.00 |

|

| Oil Price (WTI) ($/barrel) |

65 |

|

| AUD Exchange Rate (AUD:USD) |

0.75 |

|

| ARS Exchange Rate (USD:ARS) |

100 |

|

| CAD Exchange Rate (USD:CAD) |

1.30 |

|

| CLP Exchange Rate (USD:CLP) |

800 |

|

| EUR Exchange Rate (EUR:USD) |

1.20 |

|

|

|