Exhibit 99.1

Barrick Gold Corporation 161 Bay Street, Suite 3700 Toronto, Ontario M5J 2S1 Annual Information Form For the year ended December 31, 2021 Dated as of March 18, 2022

BARRICK GOLD CORPORATION

ANNUAL INFORMATION FORM

TABLE OF CONTENTS

| GLOSSARY OF TECHNICAL AND BUSINESS TERMS | 4 | |||

| REPORTING CURRENCY, FINANCIAL AND RESERVE INFORMATION | 10 | |||

| FORWARD-LOOKING INFORMATION | 12 | |||

| SCIENTIFIC AND TECHNICAL INFORMATION | 14 | |||

| GENERAL INFORMATION | 15 | |||

| Organizational Structure |

15 | |||

| Subsidiaries |

15 | |||

| Areas of Interest |

17 | |||

| General Development of the Business |

17 | |||

| History |

17 | |||

| Significant Transactions |

17 | |||

| Strategy |

19 | |||

| Results of Operations in 2021 |

23 | |||

| NARRATIVE DESCRIPTION OF THE BUSINESS | 27 | |||

| Production and Guidance |

27 | |||

| Reportable Operating Segments |

27 | |||

| Nevada Gold Mines (61.5% basis) |

28 | |||

| Carlin |

28 | |||

| Cortez |

29 | |||

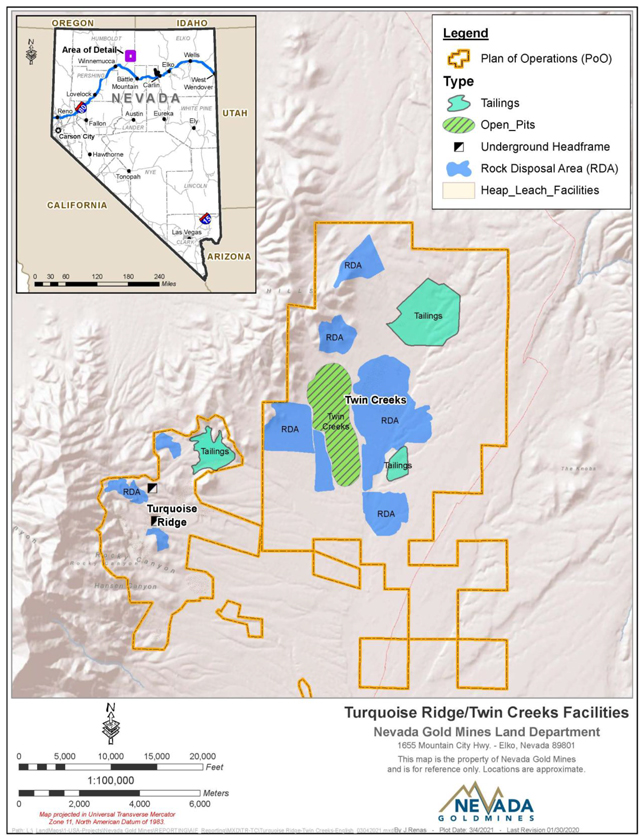

| Turquoise Ridge |

29 | |||

| Other Mines - Nevada Gold Mines |

29 | |||

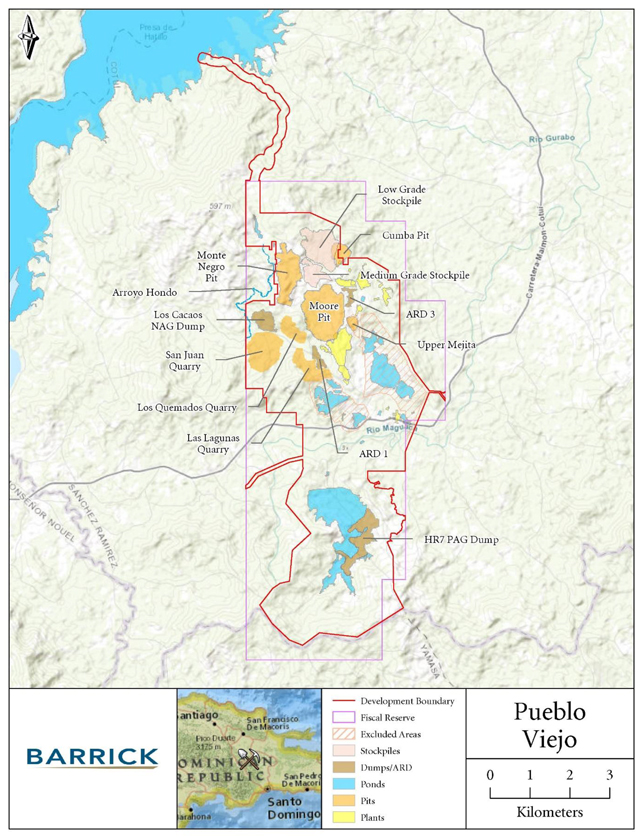

| Pueblo Viejo (60% basis) |

30 | |||

| Loulo-Gounkoto (80% basis) |

30 | |||

| Kibali (45% basis) |

31 | |||

| Veladero (50% basis) |

31 | |||

| North Mara (84% basis) |

32 | |||

| Bulyanhulu (84% basis) |

32 | |||

| Other Mines (Gold) |

32 | |||

| Other Mines (Copper) |

33 | |||

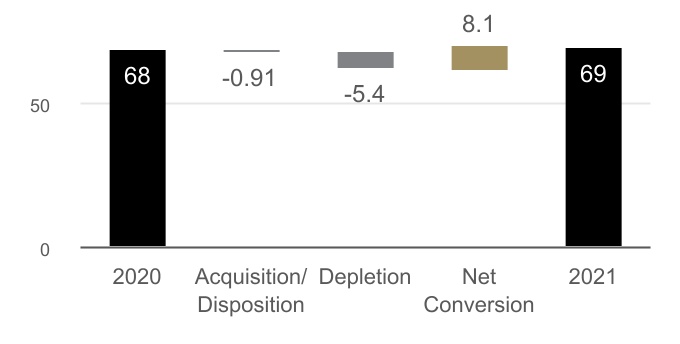

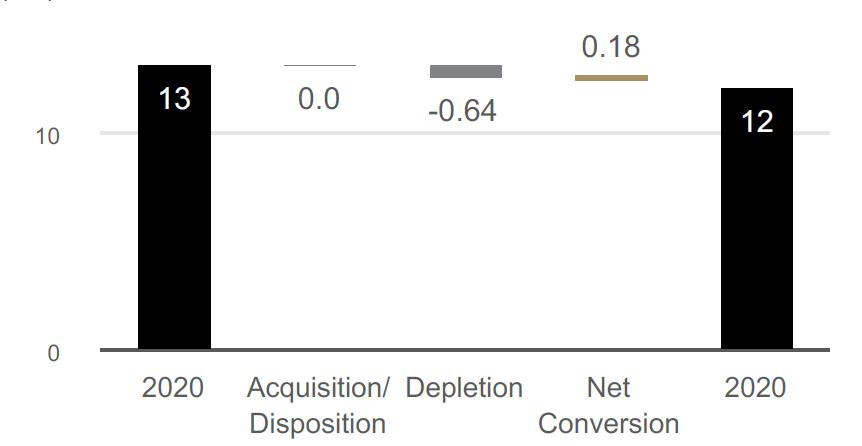

| Mineral Reserves and Mineral Resources |

34 | |||

| Marketing and Distribution |

48 | |||

| Employees and Labor Relations |

49 | |||

| Competition |

49 | |||

| Sustainability |

49 | |||

- i -

| Operations in Emerging Markets: Corporate Governance and Internal Controls |

58 | |||

| Board and Management Experience and Oversight |

59 | |||

| Local Presence |

60 | |||

| Internal Controls and Cash Management Practices |

61 | |||

| MATERIAL PROPERTIES | 61 | |||

| Cortez Property |

61 | |||

| Carlin Complex |

68 | |||

| Turquoise Ridge Complex |

77 | |||

| Pueblo Viejo Mine |

84 | |||

| Kibali Mine |

92 | |||

| Loulo-Gounkoto Mine Complex |

100 | |||

| EXPLORATION AND GROWTH PROJECTS | 106 | |||

| LEGAL MATTERS | 120 | |||

| Government Controls and Regulations |

120 | |||

| Legal Proceedings |

127 | |||

| RISK FACTORS | 144 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 166 | |||

| CONSOLIDATED FINANCIAL STATEMENTS | 166 | |||

| CAPITAL STRUCTURE | 166 | |||

| RATINGS | 167 | |||

| MARKET FOR SECURITIES | 168 | |||

| MATERIAL CONTRACTS | 169 | |||

| TRANSFER AGENTS AND REGISTRARS | 171 | |||

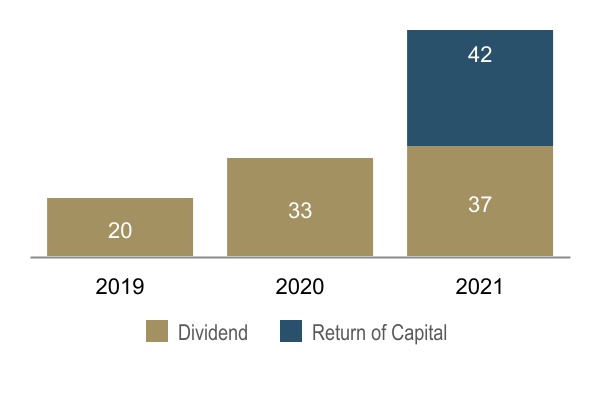

| DIVIDEND POLICY | 171 | |||

| RETURN OF CAPITAL | 172 | |||

| SHARE BUYBACK PROGRAM | 173 | |||

| DIRECTORS AND OFFICERS OF THE COMPANY | 173 | |||

| AUDIT & RISK COMMITTEE | 180 | |||

- ii -

| Audit & Risk Committee Mandate |

180 | |||

| Composition of the Audit & Risk Committee |

180 | |||

| Relevant Education and Experience |

181 | |||

| Participation on Other Audit Committees |

183 | |||

| Audit & Risk Committee Pre-Approval Policies and Procedures |

183 | |||

| External Auditor Service Fees |

184 | |||

| INTERNAL CONTROL OVER FINANCIAL REPORTING AND DISCLOSURE CONTROLS AND PROCEDURES | 184 | |||

| NON-GAAP FINANCIAL MEASURES | 185 | |||

| INTERESTS OF EXPERTS | 216 | |||

| ADDITIONAL INFORMATION | 216 | |||

| SCHEDULE “A” AUDIT & RISK COMMITTEE MANDATE | A-1 | |||

- iii -

GLOSSARY OF TECHNICAL AND BUSINESS TERMS

Assay

A chemical analysis to determine the amount or proportion of the element of interest contained within a sample, typically base metals or precious metals.

Autoclave

Oxidation process in which high temperatures and oxygen are applied within a highly pressurized closed vessel to convert refractory sulfide mineralization into amenable oxide ore.

By-product

A payable secondary metal or mineral product that is recovered along with the primary metal or mineral product during the concentration process.

Carbonaceous

Naturally occurring carbon present in the ore from the decay of organic material which can result in an inadvertent loss of precious metals during the cyanidation process.

Carbon-in-leach (CIL)

A recovery process in which precious metals are dissolved from finely ground ore during cyanidation and simultaneously adsorbed on relatively coarse activated carbon (burnt coconut shell) granules. The loaded carbon particles are separated from the slurry and recycled in the process following precious metal removal and reactivation through chemical and thermal means.

Class 1 - High Significance Environmental Incident

An incident that causes significant negative impacts on human health or the environment, or an incident that extends onto publicly accessible land and has the potential to cause significant adverse impact to surrounding communities, livestock or wildlife.

Class 2 - Medium Significance Environmental Incident

An incident that has the potential to cause negative impact on human health or the environment but is reasonably anticipated to result in only localized and short-term environmental or community impact requiring minor remediation.

Concentrate

A product from a mineral processing facility, such as gravity separation or flotation, in which the valuable constituents have been concentrated and upgraded and unwanted gangue materials rejected as waste.

Contained ounces

A measure of in-situ or contained metal based on an estimate of tonnage and grade.

Crushing

A unit operation that reduces the size of material delivered as run of mine ore for further processing.

Cut-off grade

A calculated minimum metal grade at which material can be mined and processed at break-even cost.

Development

Work carried out for the purpose of preparing a mineral deposit for production. In an underground mine, development includes shaft sinking, crosscutting, drifting and raising. In an open pit mine, development includes the removal of overburden and/or waste rock.

- 4 -

Dilution

The effect of waste or low-grade ore which is unavoidably included in the mined ore, lowering the recovered grade.

Doré

Composite gold and silver bullion usually consisting of approximately 90% precious metals that will be further refined to separate pure metals.

Drift

A horizontal tunnel generally driven within or alongside an orebody and aligned parallel to the long dimension of the ore.

Drift-and-fill

A method of underground mining used for flat-lying mineralization or where ground conditions are less competent.

Drilling

Core: a drilling method that uses a rotating barrel and an annular-shaped, diamond-impregnated rock-cutting bit to produce cylindrical rock cores and lift such cores to the surface, where they may be collected, examined and assayed.

Reverse circulation: a drilling method that uses a rotating cutting bit within a double-walled drill pipe and produces rock chips rather than core. Air or water is circulated down to the bit between the inner and outer wall of the drill pipe. The chips are forced to the surface through the center of the drill pipe and are collected, examined and assayed.

Conventional rotary: a drilling method that produces rock chips similar to reverse circulation except that the sample is collected using a single-walled drill pipe. Air or water circulates down through the center of the drill pipe and returns chips to the surface around the outside of the pipe.

In-fill: the completion of additional drillholes between existing drillholes, used to provide greater geological confidence and to provide more closely-spaced assay data.

Exploration

Prospecting, sampling, mapping, drilling and other work involved in locating the presence of economic deposits and establishing their nature, shape and grade.

Flotation

A process that concentrates minerals by taking advantage of specific surface properties and applying chemicals such as collectors, depressants, modifiers and frothers in the presence of water and finely dispersed air bubbles.

Grade

The concentration of an element of interest expressed as relative mass units (percentage, parts per million, ounces per ton, grams per tonne, etc.).

Grinding (Milling)

Involves the size reduction of material fed to a process plant though abrasion or attrition to liberate valuable minerals for further metallurgical processing.

Heap leaching

A process whereby precious or base metals are extracted from stacked material placed on top of an impermeable plastic liner and after applying leach solutions that dissolve and transport valuable metals for recovery in the process plant.

- 5 -

Lode

A mineral deposit, consisting of a zone of veins, veinlets or disseminations, in consolidated rock as opposed to a placer deposit.

Long-hole open stoping

A method of underground mining involving the drilling of holes up to 30 meters or longer into an ore bearing zone and then blasting a slice of rock which falls into an open space. The broken rock is extracted and the resulting open chamber may or may not be back filled with supporting material.

Ma

Mega-annums (each mega-annum, equals one million years).

Metric conversion

| Troy ounces |

× |

31.10348 |

= |

Grams | ||||

| Troy ounces per short ton |

× |

34.28600 |

= |

Grams per tonne | ||||

| Pounds |

× |

0.00045 |

= |

Tonnes | ||||

| Tons |

× |

0.90718 |

= |

Tonnes | ||||

| Feet |

× |

0.30480 |

= |

Meters | ||||

| Miles |

× |

1.60930 |

= |

Kilometers | ||||

| Acres |

× |

0.40468 |

= |

Hectares | ||||

| Fahrenheit |

(°F-32) × 5 ÷ 9 |

= |

Celsius | |||||

Mill

A facility where ore is finely ground and thereafter undergoes physical or chemical treatment to extract the valuable metals.

Mineral reserve (Reserve)

The economically mineable portion of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that may occur when the material is mined. Mineral reserves are sub-divided in order of increasing confidence into probable mineral reserves and proven mineral reserves.

Probable mineral reserve: the economically mineable portion of an indicated and, in some circumstances, a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

Proven mineral reserve: the economically mineable part of a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

Mineral resource (Resource)

A concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral

- 6 -

resources are sub-divided, in order of increasing geological confidence, into inferred, indicated and measured categories.

Inferred mineral resource: that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence, limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

Indicated mineral resource: that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

Measured mineral resource: that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are so well-established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

Mineralization

The presence of a target mineral in a mass of host rock.

Mining claim

A footprint of land that a party has staked or marked out in accordance with applicable mining laws to acquire the right to explore for and, in most instances, exploit the minerals under the surface.

Net profits interest royalty

A royalty based on the profit remaining after recapture of certain operating, capital and other costs.

Net smelter return royalty

A royalty based on a percentage of valuable minerals produced with settlement made either in kind or in currency based on the sale proceeds received less all of the offsite smelting, refining and transportation costs associated with the purification of the economic metals.

Open pit mine

A mine where materials are removed in an excavation from surface.

Ore

Material containing metallic or non-metallic minerals that can be mined and processed at a profit.

Orebody

A sufficiently large amount of ore that is contiguous and can be mined economically.

Oxide ore

Mineralized rock in which some of the host rock or original mineralization has been exposed to oxygen and mineralization is thus more amenable to extraction.

- 7 -

Qualified Person

See “Scientific and Technical Information”.

Reclamation

The process by which lands disturbed as a result of mining activity are modified to support beneficial land use. Reclamation activity may include the removal of buildings, equipment, machinery and other physical remnants of mining, closure of tailings storage facilities, leach pads and other mine features, and contouring, covering and re-vegetation of waste rock and other disturbed areas.

Reclamation and closure costs

The cost of reclamation plus other costs, including without limitation certain personnel costs, insurance, property holding costs such as taxes, rental and claim fees, and community programs associated with closing an operating mine.

Recovery rate

A term used in process metallurgy to indicate the proportion of valuable material physically recovered in the processing of ore. It is generally stated as a percentage of the material recovered compared to the total material originally present.

Refining

The final stage of metal production in which impurities are removed from a molten metal.

Refractory material

Mineralized material from which metal is not amenable to recovery by conventional cyanide methods without any pre-treatment. The refractory nature can be due to either silica or sulfide encapsulation of the metal or the presence of naturally occurring carbon or other constituents that reduce gold recovery.

Roasting

The treatment of sulfide ore by heat and air, or oxygen enriched air, in order to oxidize sulfides and remove other elements (carbon, antimony or arsenic).

Shaft

A vertical passageway to an underground mine for ventilation, moving personnel, equipment, supplies and material including ore and waste rock.

Sill Benching

A bulk mining method similar to stoping where a bench is blasted from the floor of an existing drift, but material may be removed from an internal ramp through the bench rather than from a dedicated level.

Strategic Asset

An asset which, in the opinion of Barrick, has the potential to deliver significant unrealized value in the future.

Tailings

The material that remains after economically and technically recoverable metals have been removed from ore during processing.

Tailings storage facility

An area constructed for long term storage of material that remains after processing.

- 8 -

Tier One Copper Asset

An asset with a reserve potential of greater than five million tonnes of contained copper and C1 cash costs per pound over the mine life that are in the lower half of the industry cost curve.

Tier One Gold Asset

An asset with a reserve potential to deliver a minimum 10-year life, annual production of at least 500,000 ounces of gold and total cash costs per ounce over the mine life that are in the lower half of the industry cost curve.

Tier Two Gold Asset

An asset with a reserve potential to deliver a minimum 10-year life, annual production of at least 250,000 ounces of gold and total cash costs per ounce over the mine life that are in the lower half of the industry cost curve.

Tons

Short tons (2,000 pounds or approximately 907 kilograms).

Tonnes

Metric tonnes (1,000 kilograms or approximately 2,205 pounds).

Underhand drift-and-fill

A drift-and-fill method of underground mining that works downward, with cemented fill placed above the working area; best suited where ground conditions are less competent.

- 9 -

REPORTING CURRENCY, FINANCIAL AND RESERVE INFORMATION

All currency amounts in this Annual Information Form are expressed in United States dollars, unless otherwise indicated. References to “C$” are to Canadian dollars. References to “A$” are to Australian dollars. References to “CLP” are to Chilean pesos. References to “ARS” are to Argentine pesos. References to “XOF” are to West African CFA francs. For Canadian dollars to U.S. dollars, the average exchange rate for 2021 and the exchange rate as at December 31, 2021 were one Canadian dollar per 0.80 and 0.79 U.S. dollars, respectively. For Australian dollars to U.S. dollars, the average exchange rate for 2021 and the exchange rate as at December 31, 2021 were one Australian dollar per 0.75 and 0.73 U.S. dollars, respectively. For Chilean pesos to U.S. dollars, the average exchange rate for 2021 and the exchange rate as at December 31, 2021 were one U.S. dollar per 761 and 852 Chilean pesos, respectively. For Argentine pesos to U.S. dollars, the average exchange rate for 2021 and the exchange rate as at December 31, 2021 were one U.S. dollar per 95.14 and 102.74 Argentine pesos, respectively. For West African CFA francs to U.S. dollars, the average exchange rate for 2021 and the exchange rate as at December 31, 2021 were one U.S. dollar per 555 and 579 West African CFA francs, respectively.

For the year ended December 31, 2021 and for the comparative prior periods identified in this Annual Information Form, Barrick Gold Corporation (“Barrick” or the “Company”) prepared its financial statements in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). The audited consolidated financial statements of the Company for the year ended December 31, 2021 (the “Consolidated Financial Statements”) are available electronically from the Canadian System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and from the U.S. Securities and Exchange Commission’s (the “SEC”) Electronic Document Gathering and Retrieval System (“EDGAR”) at www.sec.gov.

Mineral reserves and mineral resources presented in this Annual Information Form have been estimated as at December 31, 2021 (unless otherwise noted) in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“National Instrument 43-101”), as required by Canadian securities regulatory authorities. Barrick’s resources are reported on an inclusive basis and include all areas that form reserves. For United States reporting purposes, the SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”) (see Note 1 of “Notes to the Barrick Mineral Reserves and Resources Tables” in “Narrative Description of the Business – Mineral Reserves and Mineral Resources”). These amendments became effective February 25, 2019 (the “SEC Modernization Rules”), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7 (“Guide 7”), which will be rescinded from and after the required compliance date of the SEC Modernization Rules. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured”, “indicated” and “inferred” mineral resources. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be substantially similar to the corresponding Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) definitions, as required by National Instrument 43-101. Under the multi-jurisdictional disclosure system (“MJDS”), Barrick is permitted to use its Canadian disclosures, including its reserve and resource disclosures pursuant to National Instrument 43-101, to satisfy certain United States periodic reporting obligations. As a result, Barrick does not report its reserves and resources under the SEC Modernization Rules, and as such, Barrick’s mineral reserve and mineral resource disclosure may not be directly comparable to the disclosures made by domestic United States issuers or non-domestic United States issuers that do not rely on MJDS.

Investors are also cautioned that while National Instrument 43-101 and subpart 1300 of SEC Regulation S-K recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”, investors should not assume that any part or all of the mineral deposits in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. These terms have a great amount of uncertainty as to their economic and legal feasibility. Accordingly,

- 10 -

investors are cautioned not to assume that any “measured mineral resources”, “indicated mineral resources”, or “inferred mineral resources” of Barrick are or will be economically or legally mineable. Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. In accordance with Canadian rules, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under National Instrument 43-101.

Barrick uses certain non-GAAP financial performance measures in its financial reports, including total cash costs per ounce, all-in sustaining costs per ounce, all-in costs per ounce, C1 cash costs per pound and all-in sustaining costs per pound. For a description and reconciliation of each of these measures, please see pages 94 to 120 of Barrick’s Management’s Discussion and Analysis of Financial and Operating Results for the year ended December 31, 2021 (the “MD&A”), available electronically from SEDAR and EDGAR. See also “Non-GAAP Financial Measures” at pages 185 to 215 for a detailed discussion of each of the non-GAAP measures used in this Annual Information Form.

- 11 -

FORWARD-LOOKING INFORMATION

Certain information contained in this Annual Information Form, including any information as to Barrick’s strategy, projects, plans or future financial or operating performance, constitutes “forward-looking statements”. All statements, other than statements of historical fact, are forward-looking statements. The words “believe”, “expect”, “anticipate”, “contemplate”, “vision”, “target”, “plan”, “opportunities”, “objective”, “pursuit”, “assume”, “goal”, “aim”, “intend”, “intention”, “project”, “continue”, “budget”, “estimate”, “potential”, “strategy”, “prospective”, “following”, “future”, “aim”, “target”, “commitment”, “guidance”, “outlook”, “forecast”, “may”, “will”, “can”, “could”, “should”, “schedule”, “would” and similar expressions identify forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions including material estimates and assumptions related to the factors set forth below that, while considered reasonable by Barrick as at the date of this Annual Information Form in light of management’s experience and perception of current conditions and expected developments, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information. Such factors include, but are not limited to:

| • | fluctuations in the spot and forward price of gold, copper or certain other commodities (such as silver, diesel fuel, natural gas and electricity); |

| • | risks associated with projects in the early stages of evaluation and for which additional engineering and other analysis is required; |

| • | risks related to the possibility that future exploration results will not be consistent with the Company’s expectations, that quantities or grades of reserves will be diminished, and that resources may not be converted to reserves; |

| • | risks associated with the fact that certain of the initiatives described in this Annual Information Form are still in the early stages and may not materialize; |

| • | changes in mineral production performance, exploitation and exploration successes; |

| • | risks that exploration data may be incomplete and considerable additional work may be required to complete further evaluation, including but not limited to drilling, engineering and socioeconomic studies and investment; |

| • | the speculative nature of mineral exploration and development; |

| • | lack of certainty with respect to foreign legal systems, corruption and other factors that are inconsistent with the rule of law; |

| • | changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies, and practices; |

| • | expropriation or nationalization of property and political or economic developments in Canada, the United States, Argentina, Chile, Côte d’Ivoire, the Dominican Republic, the Democratic Republic of the Congo (the “DRC”), Mali, Papua New Guinea, Peru, Saudi Arabia, Senegal, Tanzania, or Zambia or other countries in which Barrick does or may carry on business in the future; |

| • | steps required prior to the distribution of cash and equivalents held at Kibali in banks in the DRC; |

| • | risks relating to political instability in certain of the jurisdictions in which Barrick operates; |

| • | timing of receipt of, or failure to comply with, necessary permits and approvals, including the issuance of a Record of Decision (“ROD”) for the Goldrush Project and the issuance of a new Special Mining Lease (the “SML”) for the Porgera mine; |

| • | non-renewal of key licences by governmental authorities; |

| • | failure to comply with environmental and health and safety laws and regulations; |

| • | contests over title to properties, particularly title to undeveloped properties, or over access to water, power and other required infrastructure; |

- 12 -

| • | the liability associated with risks and hazards in the mining industry, and the ability to maintain insurance to cover such losses; |

| • | increased costs and physical risks, including extreme weather events and resource shortage, related to climate change; |

| • | the Company’s ability to achieve its climate-related goals and greenhouse gas (“GHG”) emissions reduction targets; |

| • | damage to Barrick’s reputation due to the actual or perceived occurrence of any number of events, including negative publicity with respect to Barrick’s handling of environmental matters or dealings with community groups, whether true or not; |

| • | risks relating to operations near communities that may regard Barrick’s operations as being detrimental to them; |

| • | litigation and legal and administrative proceedings; |

| • | operating or technical difficulties in connection with mining or development activities, including geotechnical challenges, tailings dam and storage facilities failures, and disruptions in the maintenance or provision of required infrastructure and information technology systems; |

| • | increased costs, delays, suspensions and technical challenges associated with the construction of capital projects; |

| • | risks associated with working with partners in jointly controlled assets; |

| • | risks relating to disruption of supply routes which may cause delays in construction and mining activities; |

| • | risk of loss due to acts of war, terrorism, sabotage and civil disturbances; |

| • | risks associated with artisanal and illegal mining; |

| • | risks associated with Barrick infrastructure, information technology systems and the implementation of Barrick’s technological initiatives; |

| • | the impact of global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future cash flows; |

| • | the impact of inflation; |

| • | adverse changes in the Company’s credit ratings; |

| • | risks related to exchange and capital controls; |

| • | fluctuations in the currency markets (such as Canadian and Australian dollars, Chilean, Argentine and Dominican pesos, British pound, Peruvian sol, Zambian kwacha, South African rand, Tanzanian shilling, West African CFA, Congolese franc, and Papua New Guinean kina versus the U.S. dollar); |

| • | changes in U.S. dollar interest rates that could impact the mark-to-market value of outstanding derivative instruments and variable rate debt obligations; |

| • | risks arising from holding derivative instruments (such as credit risk, market liquidity risk and mark-to-market risk); |

| • | risks related to the demands placed on the Company’s management, the ability of management to implement its business strategy and enhanced political risk in certain jurisdictions; |

| • | uncertainty as to whether some or targeted investments and projects will meet the Company’s capital allocation objectives and internal hurdle rate; |

| • | whether benefits expected from recent transactions are realized; |

| • | business opportunities that may be presented to, or pursued by, the Company; |

| • | the Company’s ability to successfully integrate acquisitions or complete divestitures; |

| • | risks related to competition in the mining industry; |

| • | employee relations, including loss of key employees; |

| • | availability and increased costs associated with mining inputs and labor; |

- 13 -

| • | risks associated with diseases, epidemics and pandemics, including the effects and potential effects of the global Covid-19 pandemic; |

| • | risks related to the failure of internal controls; and |

| • | risks related to the impairment of the Company’s goodwill and assets. |

The Company also cautions that its 2022 guidance may be impacted by the unprecedented business and social disruption caused by the spread of Covid-19. In addition, there are risks and hazards associated with the business of mineral exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion, copper cathode or gold or copper concentrate losses (and the risk of inadequate insurance, or inability to obtain insurance, to cover these risks). Many of these uncertainties and contingencies can affect the Company’s actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, the Company. Readers are cautioned that forward-looking statements are not guarantees of future performance. All of the forward-looking statements made in this Annual Information Form are qualified by these cautionary statements. Specific reference is made to “Narrative Description of the Business – Mineral Reserves and Mineral Resources” and “Risk Factors” and to the MD&A (which is available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov as an exhibit to Barrick’s Form 40-F) for a discussion of some of the factors underlying forward-looking statements and the risks that may affect Barrick’s ability to achieve the expectations set forth in the forward-looking statements contained in this Annual Information Form.

The Company may, from time to time, make oral forward-looking statements. The Company advises that the above paragraph and the risk factors described in this Annual Information Form and in the Company’s other documents filed with the Canadian securities regulatory authorities and the SEC should be read for a description of certain factors that could cause the actual results of the Company to materially differ from those in the oral forward-looking statements. The Company disclaims any intention or obligation to update or revise any oral or written forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

SCIENTIFIC AND TECHNICAL INFORMATION

Unless otherwise indicated, scientific or technical information in this Annual Information Form relating to mineral reserves or mineral resources is based on information prepared by employees of Barrick, its joint venture partners or its joint venture operating companies, as applicable, in each case under the supervision of, or following review by: Craig Fiddes, BSc (Geol) (Honours), SME Registered Member, Manager - Resource Modeling, Nevada Gold Mines; Chad Yuhasz, P.Geo, Mineral Resource Manager, Latin America & Asia Pacific; Simon Bottoms, CGeol, MGeol, FGS, FAusIMM, Mineral Resources Manager: Africa & Middle East; Rodney Quick, MSc, Pr. Sci.Nat, Mineral Resource Management and Evaluation Executive; John Steele, CIM, Metallurgy, Engineering and Capital Projects Executive; and Rob Krcmarov, FAusIMM, Technical Advisor to Barrick.

Scientific or technical information in this Annual Information Form relating to the geology of particular properties and exploration programs is based on information prepared by employees of Barrick, its joint venture partners or its joint venture operating companies, as applicable, in each case under the supervision of Rob Krcmarov, FAusIMM, Technical Advisor to Barrick.

Each of Messrs. Fiddes, Yuhasz, Bottoms, Quick, Steele and Krcmarov is a “Qualified Person” as defined in National Instrument 43-101. A “Qualified Person” is an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these, has experience relevant to the subject matter of the mineral project, and is a member in good standing of a professional association.

- 14 -

Each of Messrs. Fiddes, Yuhasz, Bottoms, Quick and Steele is an officer or employee of Barrick and/or an officer, director or employee of one or more of its associates or affiliates. No such person has received or will receive a direct or indirect interest in any property of Barrick or any of its associates or affiliates. As of the date hereof, each such person owns beneficially, directly or indirectly, less than 1% of any outstanding class of securities of Barrick and less than 1% of any outstanding class of securities of Barrick’s associates or affiliates.

GENERAL INFORMATION

Organizational Structure

Barrick is a company governed by the Business Corporations Act (British Columbia) (“BCBCA”). Barrick resulted from the amalgamation, effective July 14, 1984, of Camflo Mines Limited, Bob-Clare Investments Limited and the former Barrick Resources Corporation pursuant to the Business Corporations Act (Ontario) (the “OBCA”). By articles of amendment effective December 9, 1985, the Company changed its name to American Barrick Resources Corporation. Effective January 1, 1995, as a result of an amalgamation with a wholly-owned subsidiary, the Company changed its name from American Barrick Resources Corporation to Barrick Gold Corporation. On December 7, 2001, in connection with its acquisition of Homestake Mining Company, the Company amended its articles to create a special voting share designed to permit holders of Barrick Gold Inc. (formerly Homestake Canada Inc.) (“BGI”) exchangeable shares to vote as a single class with the holders of Barrick common shares. In March 2009, in connection with Barrick’s redemption of all of the outstanding BGI exchangeable shares, the single outstanding special voting share was redeemed and cancelled. In connection with its acquisition of Placer Dome Inc. (“Placer Dome”), Barrick amalgamated with Placer Dome pursuant to articles of amalgamation dated May 9, 2006. In connection with the acquisition of Arizona Star Resource Corp. (“Arizona Star”), Barrick amalgamated with Arizona Star pursuant to articles of amalgamation dated January 1, 2009. On November 27, 2018, pursuant to a continuation application, Barrick continued from the Province of Ontario under the OBCA into the Province of British Columbia under the BCBCA. The notice of articles and articles of Barrick under the BCBCA are substantially similar to Barrick’s previous articles and by-laws. Key changes include a bifurcated approach to amendments to the articles where a special resolution is required for certain matters and an ordinary resolution is required for other matters; authorizing only one class of an unlimited number of common shares (preferred share classes are no longer authorized); and a reduction of the notice period to hold shareholder meetings following the fixing of record dates. Barrick’s registered office is located at 1600 - 925 West Georgia Street, Vancouver, British Columbia V6C 3L2. Barrick’s head office is located at Brookfield Place, TD Canada Trust Tower, 161 Bay Street, Suite 3700, Toronto, Ontario M5J 2S1.

Barrick’s business is organized into operating segments for financial reporting purposes, comprising eighteen individual minesites and one project. For the year ended December 31, 2021, Barrick’s reportable operating segments were Carlin, Cortez, Turquoise Ridge, Pueblo Viejo, Loulo-Gounkoto, Kibali, Veladero, North Mara and Bulyanhulu. For financial reporting purposes, the Company’s remaining operating segments that are not reportable operating segments are grouped into an “other” category and are not reported on individually. Barrick’s material properties presented in this Annual Information Form are: Cortez, Carlin, Turquoise Ridge, Pueblo Viejo, Kibali and Loulo-Gounkoto. See “Narrative Description of the Business – Reportable Operating Segments”.

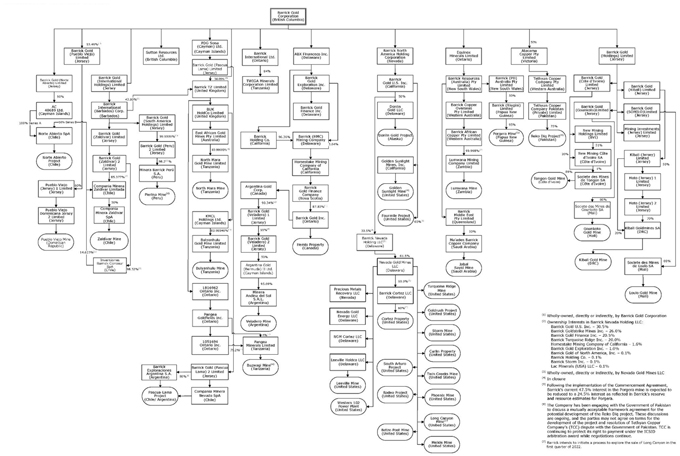

Subsidiaries

A significant portion of Barrick’s business is carried on through its subsidiaries. A chart showing Barrick’s mines, projects, related operating subsidiaries, other significant subsidiaries and certain associated subsidiaries as at March 14, 2022 and their respective locations or jurisdictions of incorporation, as applicable, is set out below. All subsidiaries, mines and projects referred to in the chart are 100% owned, unless otherwise noted.

- 15 -

Significant Subsidiaries, Operating Mines and Projects

- 16 -

Areas of Interest

A map showing Barrick’s mining operations and projects as at March 14, 2022 is set out at the end of this “General Information” section.

General Development of the Business

History

Barrick entered the gold mining business in 1983 and is a leading international gold company. The Company has interests in operating mines or projects in Canada, the United States, Argentina, Chile, Côte d’Ivoire, the Dominican Republic, the DRC, Mali, Papua New Guinea, Saudi Arabia, Tanzania and Zambia. The Company’s principal products and sources of earnings are gold and copper.

During its first ten years, Barrick focused on acquiring and developing properties in North America, notably the Company’s Goldstrike property on the Carlin Trend in Nevada, which was contributed to Nevada Gold Mines (as defined below) on July 1, 2019, as part of the joint venture transaction with Newmont Corporation (“Newmont”). Since 1994, Barrick has strategically expanded beyond its North American base, including through its merger with Randgold on January 1, 2019, and now operates on four continents. See “Significant Transactions – Nevada Gold Mines” and “Significant Transactions – Randgold Resources Limited”.

Significant Transactions

Randgold Resources Limited

On January 1, 2019, Barrick acquired 100% of the issued and outstanding shares of Randgold (the “Merger”). Each Randgold shareholder received 6.1280 common shares of Barrick for each Randgold share, which resulted in the issuance of 583,669,178 Barrick common shares. After this share issuance, Barrick shareholders owned 66.7%, while former Randgold shareholders owned 33.3%, of the shares of the combined company. Based on the December 31, 2018 closing share price of Barrick’s common shares, the total consideration of the acquisition was $7.9 billion.

Randgold was a publicly traded mining company with ownership interests in the following gold mines: Kibali in the DRC; Tongon in Côte d’Ivoire; Loulo-Gounkoto and Morila in Mali (the latter has since been sold, see “Operational Excellence and Sustainable Profitability”) and various exploration properties. Barrick began consolidating the operating results, cash flows and net assets of Randgold from January 1, 2019.

The Company filed a business acquisition report on Form 51-102F4 in connection with the Merger on March 13, 2019 (the “Business Acquisition Report”). The Business Acquisition Report is on file with the SEC and Canadian provincial securities regulatory authorities.

Unless otherwise specified, information included in this Annual Information Form regarding the business of Barrick or Randgold (i) in respect of a date or period on or prior to December 31, 2018, refers to their respective businesses prior to the Merger, and (ii) in respect of a date or period on or after January 1, 2019, refers to the combined business of Barrick and Randgold following the Merger.

Nevada Gold Mines

On March 10, 2019, Barrick entered into an implementation agreement with Newmont to create a joint venture combining the companies’ respective mining operations, assets, reserves and talent in the State of Nevada. This includes Barrick’s Cortez, Goldstrike, Turquoise Ridge and Goldrush properties, and Newmont’s Carlin, Twin Creeks, Phoenix, Long Canyon and Lone Tree (the latter has since been sold as

- 17 -

part of the South Arturo asset exchange, see “Operational Excellence and Sustainable Profitability”) properties. The joint venture excludes Barrick’s Fourmile project and Newmont’s Fiberline and Mike deposits. The contribution of these excluded assets into the joint venture is governed by the terms of the amended and restated limited liability company agreement for the joint venture. On July 1, 2019, the transaction closed, establishing Nevada Gold Mines, and Barrick began consolidating the operating results, cash flows and net assets of Nevada Gold Mines from that date forward. Barrick is the operator of the joint venture and owns 61.5%, with Newmont owning the remaining 38.5% of the joint venture.

Acacia Mining plc

In 2010, Barrick created African Barrick Gold plc, a new London Stock Exchange-listed company to hold Barrick’s African gold mines, gold projects and gold exploration properties. Barrick retained a 73.9% interest in the new company. African Barrick Gold plc subsequently changed its name to Acacia Mining plc (“Acacia”) and Barrick sold off a portion of its interest, reducing its ownership to 63.9%. Acacia’s operations consisted most recently of its Bulyanhulu mine, its North Mara mine and its Buzwagi mine, all located in Tanzania.

Starting in 2017, the business and operations of Acacia were materially affected by ongoing disputes with the Government of Tanzania (the “GoT”). In March 2017, the GoT announced a ban on the export of metallic mineral concentrates (the “Ban”) and, as a consequence, in the second half of 2017, Acacia took the decision to place the Bulyanhulu mine on reduced operations. On July 24, 2017, the Tanzania Revenue Authority delivered a series of Notices of Adjusted Assessments in relation to Bulyanhulu and Buzwagi with a total of $40 billion of alleged unpaid taxes and approximately $150 billion of penalties and interest owed, dating back to the initial establishment of the mine. In August 2017, the Tanzania Revenue Authority delivered a further series of Notices of Adjusted Assessment in relation to a legacy mine in respect of a total of $3 billion of alleged unpaid taxes, penalties and interest owed.

Barrick initiated negotiations with the GoT in an effort to help resolve these and other disputes. For additional information regarding these disputes, see “Legal Matters – Legal Proceedings – Tanzania – Concentrate Export Ban and Related Disputes” and “Legal Matters – Legal Proceedings – Tanzanian Revenue Authority Assessments”.

During the course of these negotiations, the GoT stated that it would not execute final agreements for the resolution of these disputes if Acacia is one of the counterparties to the settlement agreements. In light of this, and in an effort to resolve these ongoing disputes between Acacia and the GoT, Barrick made an offer to acquire all of the outstanding Acacia shares that it did not already own. Barrick and Acacia agreed on the terms of the acquisition in July 2019, which was implemented by means of a court-sanctioned scheme of arrangement under Part 26 of the UK Companies Act 2006 (the “Scheme”).

On September 17, 2019, Barrick completed the share-for-share exchange of 0.168 Barrick shares and any Acacia Exploration Special Dividends for each ordinary share of Acacia. As described below, the Acacia Exploration Special Dividends and any deferred cash consideration dividends (if applicable) will be paid (and some have already been paid) as a consequence of a sales process to realize value from the sale of certain Acacia exploration properties to be undertaken during the two-year period following closing. This transaction resulted in the issuance of 24,836,670 Barrick common shares or approximately 1% of Barrick’s share capital at the time. As a result, Acacia ceased trading on the London Stock Exchange and became a wholly-owned subsidiary of Barrick called Barrick TZ Limited.

On January 24, 2020, Barrick announced that the Company had ratified the creation of Twiga Minerals Corporation (“Twiga”), the operating company formed to manage the Tanzania mines. Effective January 1, 2020, the GoT received a free carried shareholding of 16% in each of Barrick’s Tanzanian mines (Bulyanhulu, Buzwagi and North Mara), a 16% free carried interest in the shareholder loans owed by the operating companies and will receive half of the economic benefits from the Tanzanian operations in the form of taxes, royalties, clearing fees and participation in all cash distributions made by the mines

- 18 -

and Twiga, after the recoupment of capital investments. Twiga is 16% owned by the GoT and provides management services to the mines. See “Legal Matters – Legal Proceedings – Tanzania – Concentrate Export Ban and Related Disputes”.

In furtherance of the aforementioned sales process, on August 19, 2020, Barrick completed the sale of a former Acacia (and now a Barrick) subsidiary, Acacia Exploration (Kenya) Ltd., which owns the West Kenya exploration project, to Shanta Gold Limited for $7 million in cash, 54,650,211 Shanta shares and a 2% net smelter return royalty relating to the project. In addition, in July 2021, through subsidiaries, Barrick agreed to terminate the Frontier joint venture in Burkina Faso in exchange for a 1% net smelter return capped royalty on each of the two permits held thereunder. After completing a competitive sales process, through subsidiaries in October 2021, Barrick completed an agreement to monetize all royalties received in connection with the disposition of the Acacia exploration properties (comprising royalties over the West Kenya, Frontier and Central Houndé projects), for gross cash consideration of $11.75 million. That transaction completed the sale of the Acacia exploration properties and related assets, including all royalties taken back on the sale of underlying properties.

On November 15, 2021, Barrick received notice of a tax claim of approximately $12 million from the Kenya Revenue Authority in relation to the sale of Acacia Exploration (Kenya) Ltd. Any amounts required to be paid in respect of this tax claim, including associated expenses, are deductible against the 2021 net proceeds to be distributed pursuant to the Scheme. As a result, Barrick was not in a position to declare an Acacia Exploration Special Dividend for the year ending December 31, 2021. Barrick disputes the basis of the tax claim and intends to challenge the claim. Once the final amount of the tax claim has been determined, any remaining balance of the 2021 net proceeds, after taking the tax claim and other expenses incurred in respect of the Acacia exploration properties into account, will be distributed to Scheme shareholders.

Strategy

Barrick’s vision is to be the world’s most valued gold and copper mining business by finding, developing and owning the best assets, with the best people, to deliver sustainable returns for Barrick’s owners and partners. The Company’s strategy is to operate as business owners by attracting and developing world-class people who understand and are involved in the value chain of the business, act with integrity and are tireless in their pursuit of excellence. Barrick is focused on returns to its stakeholders by optimizing free cash flow, managing risk to create long-term value for the Company’s shareholders and partnering with host governments and communities to transform their country’s natural resources into sustainable benefits and mutual prosperity. The Company aims to achieve this through continuously improving asset quality, pursuing operational excellence and maintaining a focus on sustainable profitability.

Asset Quality

Barrick aims to grow its portfolio through investments in Tier One Gold Assets, Tier Two Gold Assets, Tier One Copper Assets and Strategic Assets, with an emphasis on organic growth. The Company is focusing its efforts on identifying, investing in and developing assets that meet Barrick’s investment criteria. The required internal rate of return (“IRR”) for Tier One Gold Assets and Tier Two Gold Assets is 15% and 20%, respectively, based on Barrick’s long-term gold price assumption. The required IRR for Tier One Copper Assets is 15% based on Barrick’s long-term copper price assumption. All projects are evaluated against Barrick’s investment filters, which incorporate a broad range of financial, environmental, safety, partnership and social license to operate criteria. In addition, all major projects undergo a peer review process culminating in review by the Executive Committee to confirm that the project is broadly supported across the organization, with identified gaps substantially addressed, and that there is appropriate confidence for a development decision.

- 19 -

Near-term portfolio priorities include advancing projects at Nevada Gold Mines (Goldrush and Turquoise Ridge), Fourmile, as well as Pueblo Viejo. Nevada Gold Mines’ projects at Goldrush and Turquoise Ridge are in execution. Barrick also continues to advance projects at Veladero.

Barrick’s exploration programs strike a balance between high-quality brownfield projects, greenfield exploration and emerging discoveries that have the potential to pass Barrick’s investment filters. In line with Barrick’s focus on growing its exploration portfolio, the Company is expanding its extensive land position in many of the world’s most prolific gold districts.

The Company’s brownfields exploration focus has delivered significant value in 2021, driven by strong results from exploration on the Battle Mountain - Eureka and Carlin Trends at Nevada Gold Mines, as well as Pueblo Viejo, Loulo-Gounkoto, Kibali and at its Tanzanian assets. At the same time, Barrick is continually evaluating prospective third party projects with the potential to become profitable mines under Barrick’s stewardship.

Barrick’s portfolio also contains a number of undeveloped greenfield gold and copper deposits, providing further optionality and leverage to gold and copper prices. These include Alturas-Del Carmen, Donlin Gold, Norte Abierto and Pascua-Lama.

For additional information regarding Barrick’s growth projects, exploration programs and new discoveries, see “Material Properties – Cortez Property”, “Material Properties - Carlin Complex”; “Material Properties – Turquoise Ridge Complex”, “Material Properties – Pueblo Viejo Mine”; “Material Properties – Kibali Mine”; “Material Properties – Loulo-Gounkoto Mine Complex” and “Exploration and Growth Projects”.

In addition, the Company is also focused on portfolio optimization, which includes selling non-core assets over time in a disciplined manner and maximizing the long-term value of Barrick’s strategic copper business. In 2019, the Company initiated a $1.5 billion portfolio rationalization program for non-core assets, which resulted in the sale of Barrick’s 50% interest in non-operated Kalgoorlie Consolidated Gold Mines (“Kalgoorlie”) in November 2019 and the announcement in December 2019 of the disposal of Barrick’s and its minority partner’s combined 90% interest in the Massawa project, which closed in March 2020. In October 2020, the Company sold its interest in the Eskay Creek project in October 2020. Barrick also completed the sale of its interest in the Bullfrog Gold Corp. (“Bullfrog”) mine area to a wholly-owned subsidiary of Bullfrog, and the sale of Barrick’s and AngloGold Ashanti Limited’s combined 80% interest in the Morila gold mine in November 2020. In 2021, the Company continued its non-core asset divestiture strategy. Barrick sold its 100% interest in the Lagunas Norte gold mine in Peru to Boroo Pte Ltd. (“Boroo”) in June 2021. In October 2021, through an asset exchange agreement with i-80 Gold Corp. (“i-80 Gold”), Nevada Gold Mines acquired the 40% interest in South Arturo that Nevada Gold Mines did not already own in exchange for the Lone Tree and Buffalo Mountain properties and infrastructure which were in care and maintenance at the time. These transactions, among various other monetization initiatives, have collectively generated gross proceeds and value in excess of $1.5 billion, and have reinforced Barrick’s strategy of maintaining a concentrated Tier One Gold Asset portfolio. For additional information regarding these transactions, see “Operational Excellence and Sustainable Profitability” below. Barrick will continue to pursue sales of non-core assets that are not aligned with the Company’s strategic investment filters. Barrick will only proceed with transactions that make sense for the business, on terms management considers favorable to Barrick’s shareholders. In this regard, in February 2022, Barrick announced its intention to initiate a process to explore the sale of Long Canyon in the first quarter of 2022.

Operational Excellence and Sustainable Profitability

Barrick has implemented a flat management structure with a strong ownership culture by streamlining management and operations and holding management accountable for the businesses they manage. The Company aims to leverage innovation and technology to drive industry-leading efficiencies, and is striving to achieve a zero harm workplace.

- 20 -

The Company is focused on building trust-based partnerships with host governments, business partners, and local communities to drive shared long-term value. Barrick is taking a disciplined approach to growth, emphasizing long-term value for all stakeholders. In so doing, the Company aims to increase returns to shareholders, driven by a focus on return on capital, internal rate of return and free cash flow.

The Company seeks to maintain a robust balance sheet, with total debt at December 31, 2021 of $5.2 billion. Since the second quarter of 2013, Barrick has reduced its total debt by over $10 billion. Barrick’s net debt to total capitalization ratio was 0.00:1 as at December 31, 2021. Barrick’s focus on strengthening its balance sheet in recent years has given the Company the financial strength to endure any short-term impacts to its operations from the Covid-19 pandemic, while supporting its strategy of participating in the future consolidation of the gold industry. As at December 31, 2021, Barrick had approximately $5.3 billion in cash, leaving it with zero debt, net of cash, an undrawn $3.0 billion credit facility and no significant debt repayments due until 2033, providing the Company with sufficient liquidity to execute on its strategic goals.

Driving an ownership culture across the Company is another key element of Barrick’s strategy. In 2018, the Company created the Barrick Share Purchase Plan to provide a simple and accessible way for those who work at Barrick to purchase Barrick Shares, fostering a culture of ownership across the organization.

In addition to the Merger, the formation of Nevada Gold Mines and the Acacia transactions described above, Barrick also carried out the following initiatives in 2019, 2020, and 2021 to optimize its portfolio, strengthen its balance sheet and deliver value to all of its stakeholders:

| • | In 2019, Barrick reduced its total debt by $202 million, or 4%. |

| • | On November 28, 2019, Barrick completed the sale of its 50% interest in Kalgoorlie in Western Australia to Saracen Mineral Holdings Limited for total cash consideration of $750 million. |

| • | On January 31, 2020, Barrick completed a make-whole repurchase of the outstanding $337 million of principal of the 3.85% notes due 2022, which reduced Barrick’s total debt to approximately $5.2 billion. |

| • | On March 4, 2020, Barrick and its Senegalese joint venture partner completed the sale of their combined 90% interest in the Massawa project (“Massawa”) in Senegal to Teranga Gold Corporation (“Teranga”), now Endeavour Mining Corporation, for total consideration fair valued at $440 million on the date of closing. Barrick received 92.5% of the consideration for its interest in the Massawa project, with the balance received by Barrick’s local Senegalese partner. Barrick received a net of $256 million in cash and 19,164,403 Teranga common shares (worth $104 million at the date of closing) plus a contingent payment of up to $46.25 million based on the three-year average gold price, which was valued at $28 million at the date of closing. The cash consideration received was net of $25 million that Barrick provided through its participation in the $225 million syndicated debt financing facility secured by Teranga in connection with the transaction. Subsequent to year-end, Barrick received full repayment of the outstanding loan. |

| • | On August 4, 2020, Barrick entered into a definitive agreement with Skeena Resources Limited (“Skeena”) pursuant to which Skeena exercised its option to acquire the Eskay Creek project in British Columbia and Barrick waived its back-in right on the project. The consideration under the definitive agreement consisted of: (i) the issuance by Skeena of 22,500,000 units (the “Units”) to Barrick, with each Unit comprising one common share of Skeena and one half of a warrant, and each whole warrant entitling Barrick to purchase one additional common share of Skeena at an exercise price of C$2.70 per share until the second anniversary of the closing date; (ii) the grant of a 1% net smelter return royalty on the entire Eskay Creek land package; and (iii) a contingent |

- 21 -

| payment of C$15 million payable during a 24-month period after closing. The transaction closed on October 5, 2020. |

| • | On October 13, 2020, Barrick announced that wholly-owned subsidiaries of Barrick and Bullfrog entered into a definitive agreement pursuant to which Barrick sold to Bullfrog all of Barrick’s mining claims, historical resources, permits, rights of way and water rights in the Bullfrog mine area (the “Barrick Lands”). Consideration for the transaction consisted of: (i) the issuance by Bullfrog to Barrick of 54,600,000 units, with each unit comprising one common share of Bullfrog and one warrant entitling Barrick to purchase one additional common share of Bullfrog at an exercise price of C$0.30 per share until the fourth anniversary of the closing date; and (ii) a 2% net smelter return royalty on all minerals produced from the Barrick Lands, subject to a maximum aggregate net smelter return royalty of 5.5% on any individual mining claim and a minimum 0.5% net smelter return royalty granted to Barrick on any individual mining claim. The transaction closed on October 26, 2020. |

| • | On November 10, 2020, Barrick and AngloGold Ashanti Limited completed the sale of their combined 80% interest in the Morila gold mine in Mali to Firefinch Limited (previously Mali Lithium Limited) for $28.8 million cash consideration. The State of Mali continues to hold the remaining 20% of the Morila gold mine. The consideration received was allocated between Barrick and AngloGold Ashanti in proportion to their respective interests in Morila. |

| • | On February 16, 2021, Barrick announced it had entered into an agreement to sell its 100% interest in the Lagunas Norte gold mine in Peru to Boroo for total consideration of up to $81 million, with $20 million of cash consideration on closing, additional cash consideration of $10 million payable on the first anniversary of closing and $20 million payable on the second anniversary of closing, a 2% net smelter return royalty, which may be purchased by Boroo for a fixed period after closing for $16 million, plus a contingent payment of up to $15 million based on the two-year average gold price. The transaction closed on June 1, 2021, based on a final fair value of consideration of $65 million. Barrick remains contractually liable for all tax matters that existed prior to the divestiture until these matters are resolved. In addition, Boroo assumed 50% of the $173 million reclamation bond obligations for Lagunas Norte upon closing and will assume the other 50% within one year of closing. |

| • | At the Annual and Special Meeting of shareholders held on May 4, 2021, shareholders approved a $750 million return of capital distribution. This distribution was derived from a portion of the proceeds from the divestiture of Kalgoorlie in November 2019 and from other recent dispositions made by Barrick and its affiliates in line with Barrick’s strategy of focusing on its core assets. The total return of capital distribution was paid in three equal tranches of $250 million on June 15, 2021, September 15, 2021 and December 15, 2021. See “Return of Capital”. |

| • | On September 7, 2021, Barrick announced that Nevada Gold Mines had entered into a definitive asset exchange agreement (the “Exchange Agreement”) with i-80 Gold to acquire the 40% interest in South Arturo that Nevada Gold Mines did not already own, in exchange for the Lone Tree and Buffalo Mountain properties and infrastructure, which were in care and maintenance at the time. The exchange transaction closed on October 14, 2021. |

| • | At the February 15, 2022 meeting, Barrick’s Board of Directors authorized a share buyback program for the repurchase of up to $1.0 billion of the Company’s outstanding common shares over the next 12 months. The actual number of common shares that may be purchased, if any, and the timing of any such purchases, will be determined by Barrick based on a number of factors, including the Company’s financial performance, the availability of cash flows, and the consideration of other uses of cash, including capital investment opportunities, returns to shareholders, and debt reduction. The repurchase program does not obligate the Company to acquire any particular number of common shares, and the repurchase program may be |

- 22 -

| suspended or discontinued at any time at the Company’s discretion. For more information, see “Share Buyback Program”. |

| • | Also at the February 15, 2022 meeting, the Board of Directors approved a performance dividend policy that will enhance the return to shareholders when the Company’s liquidity is strong. In addition to Barrick’s base dividend, the amount of the performance dividend on a quarterly basis will be based on the amount of cash, net of debt, on Barrick’s consolidated balance sheet at the end of each quarter. This performance dividend calculation will commence after the Company’s March 31, 2022 consolidated balance sheet, with a potential payment in the second quarter of the year. The declaration and payment of dividends is at the discretion of the Board of Directors, and will depend on the Company’s financial results, cash requirements, future prospects, the number of outstanding common shares, and other factors deemed relevant by the Board. For additional information on Barrick’s performance dividend, see “Dividend Policy.” |

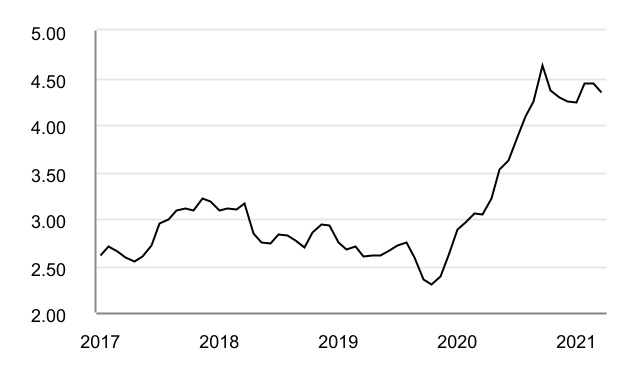

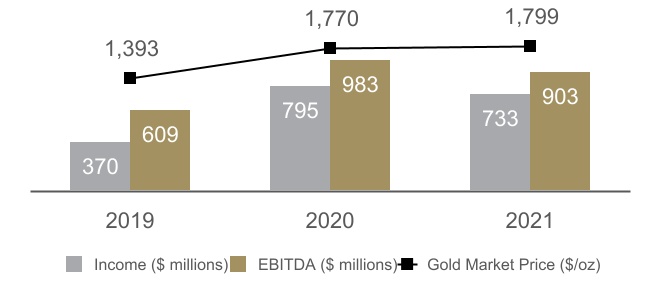

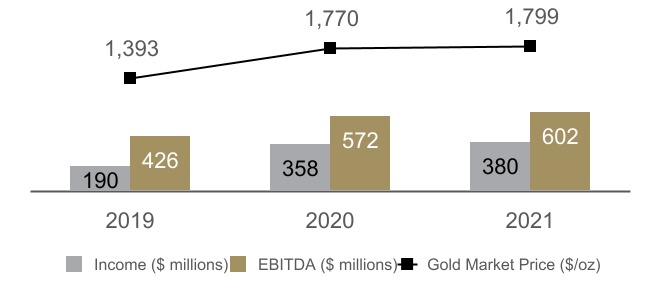

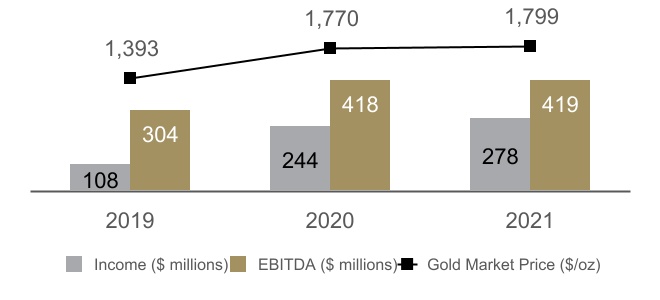

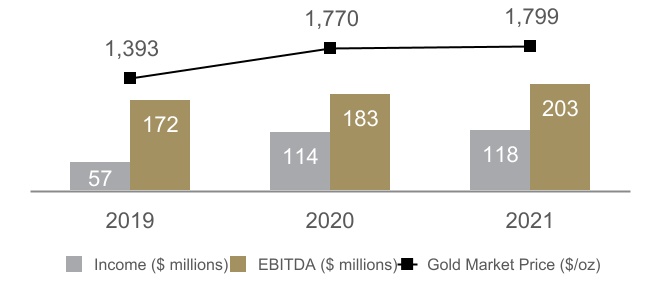

Results of Operations in 2021

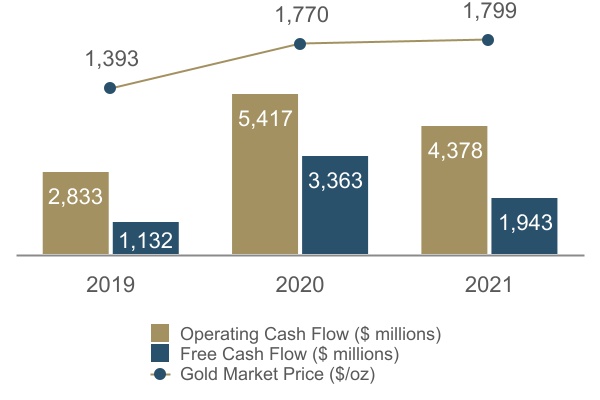

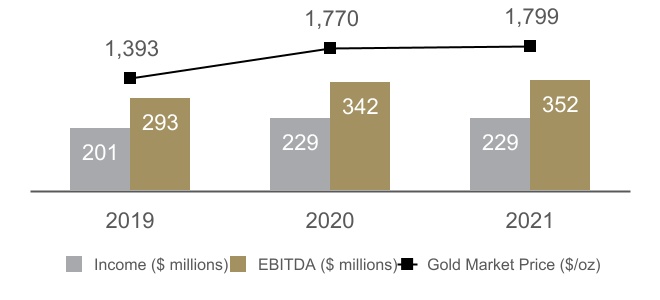

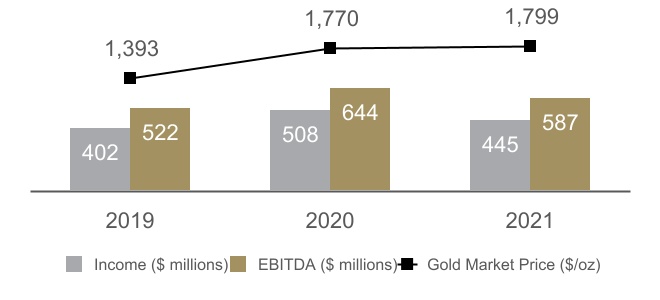

Total revenues in 2021 were $12.0 billion, a $0.6 billion, or 5%, decrease compared to 2020, primarily due to a decrease in gold and copper sales volumes, partially offset by an increase in realized gold and copper prices. In 2021, gold and copper revenues totaled $10.7 billion and $962 million, respectively, with gold revenues down $0.9 billion, compared to the prior year mainly due to a decrease in sales volumes, partially offset by higher realized gold prices, and copper revenues up $265 million compared to the prior year due to higher realized copper prices, partially offset by lower copper sales volume. Realized gold prices of $1,790 per ounce in 2021 were up $12 per ounce compared to the prior year, principally due to higher market prices. Realized copper prices for 2021 were $4.32 per pound, up $1.40 per pound compared to the prior year due to higher market prices. For an explanation of realized price, see “Non-GAAP Financial Measures – Realized Prices”. In 2021, Barrick reported net earnings attributable to equity holders of $2.0 billion, compared to $2.3 billion in 2020. Net earnings in 2021 included $125 million in significant tax expense items mainly due to deferred tax expense as a result of tax reform measures in Argentina, the foreign exchange impact on current tax expense in Peru and the remeasurement of current and deferred tax balances, the acquisition of the 40% interest in South Arturo that Nevada Gold Mines did not already own, the sale of Lagunas Norte, the settlement of the Massawa Senegalese tax dispute and the recognition/derecognition of the Company’s deferred taxes in various jurisdictions. This was combined with a gain of $94 million ($213 million before tax and non-controlling interest) in acquisition/disposition gains, primarily resulting from the sale of Lone Tree, and an impairment reversal of $64 million ($63 million before tax and non-controlling interests), primarily resulting from the sale of Barrick’s 100% interest in the Lagunas Norte mine. These items were also the significant adjustments used to derive adjusted net earnings of $2,065 million in 2021. This compares to adjusted net earnings of $2,042 million in 2020 (for an explanation of adjusted net earnings, see “Non-GAAP Financial Measures – Adjusted Net Earnings and Adjusted Net Earnings per Share”).

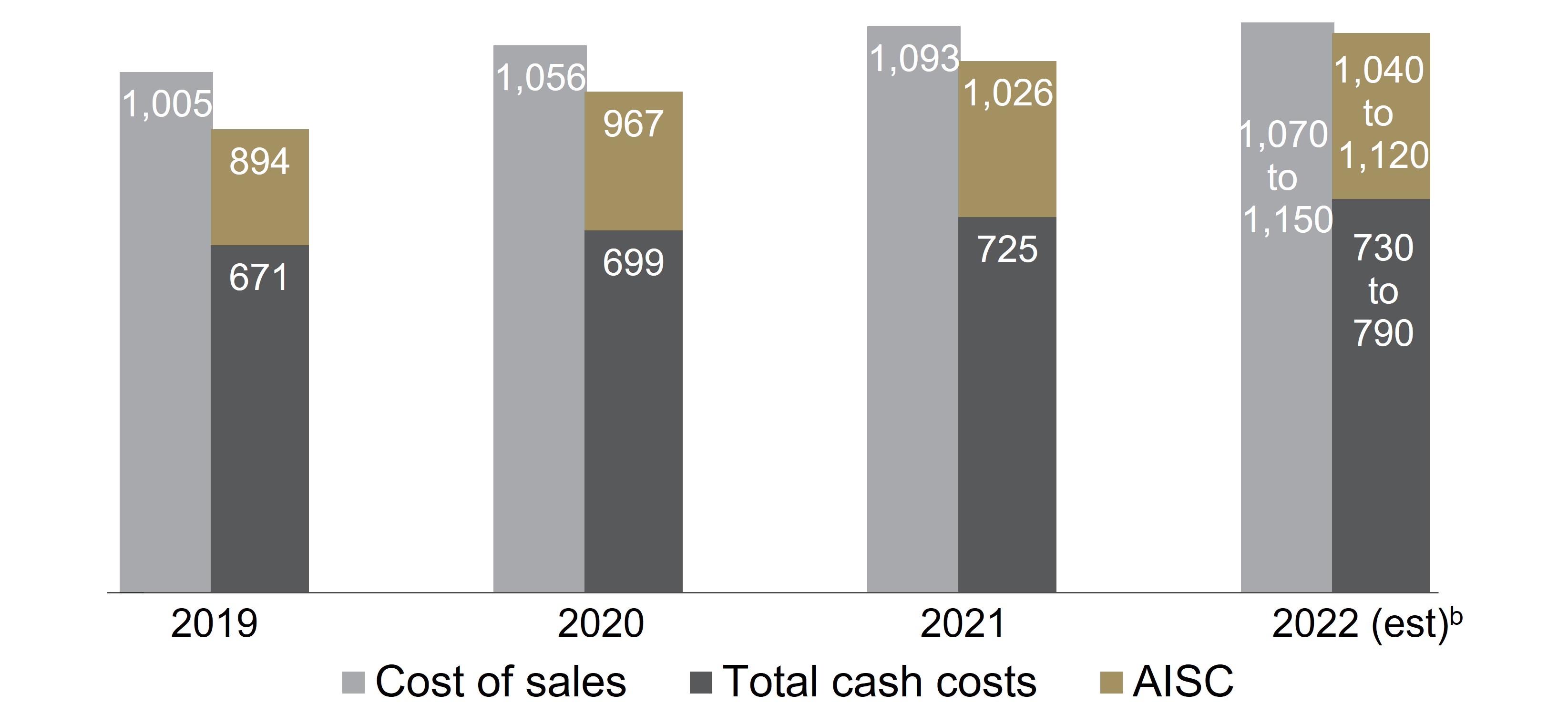

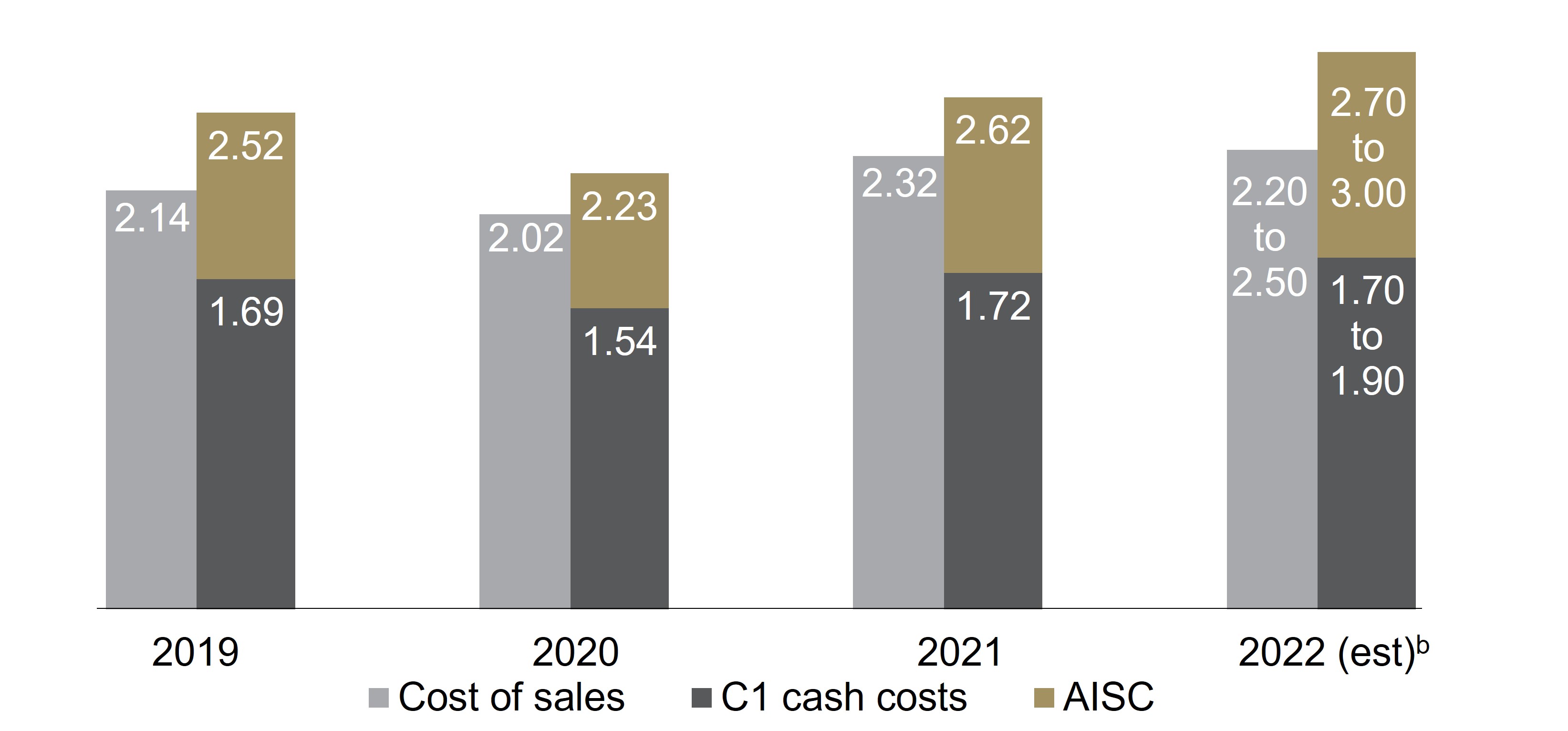

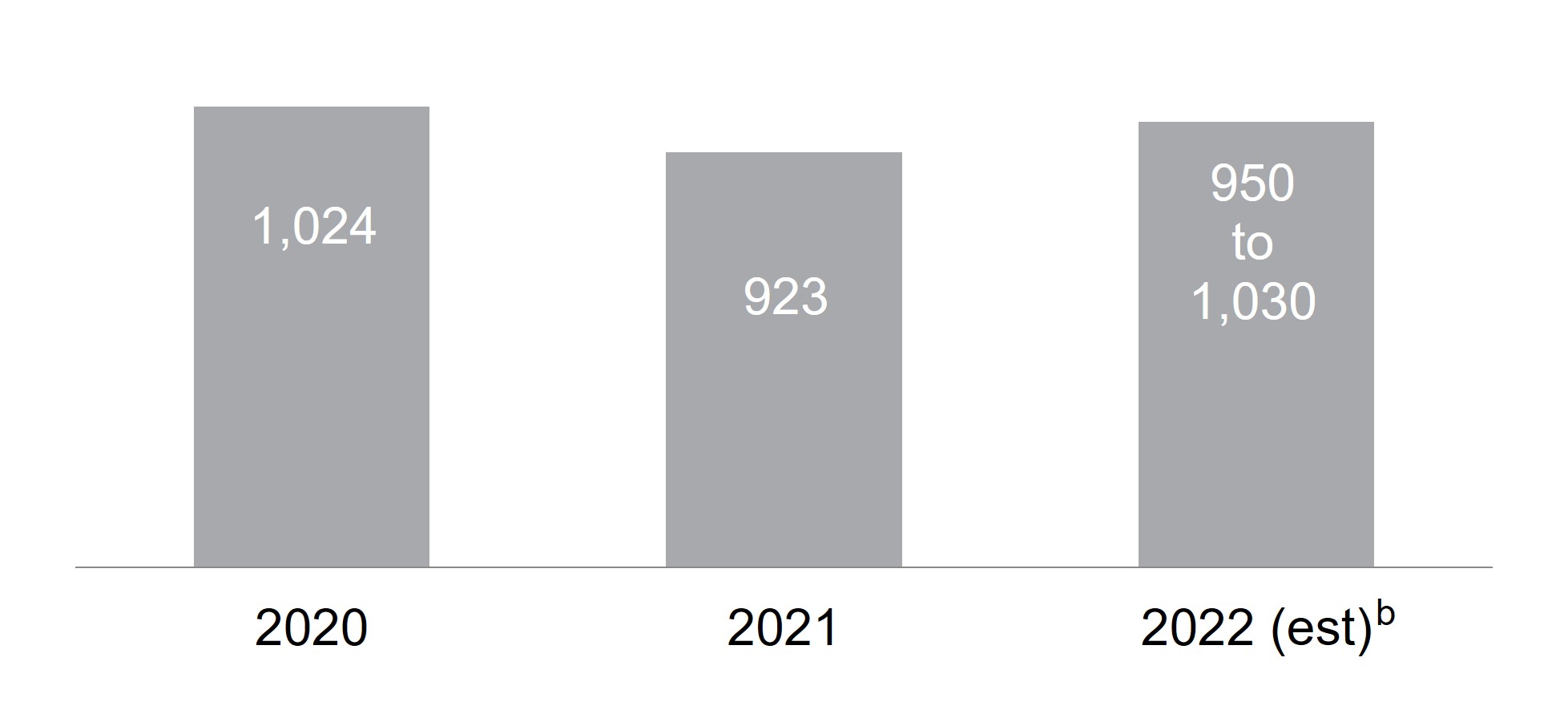

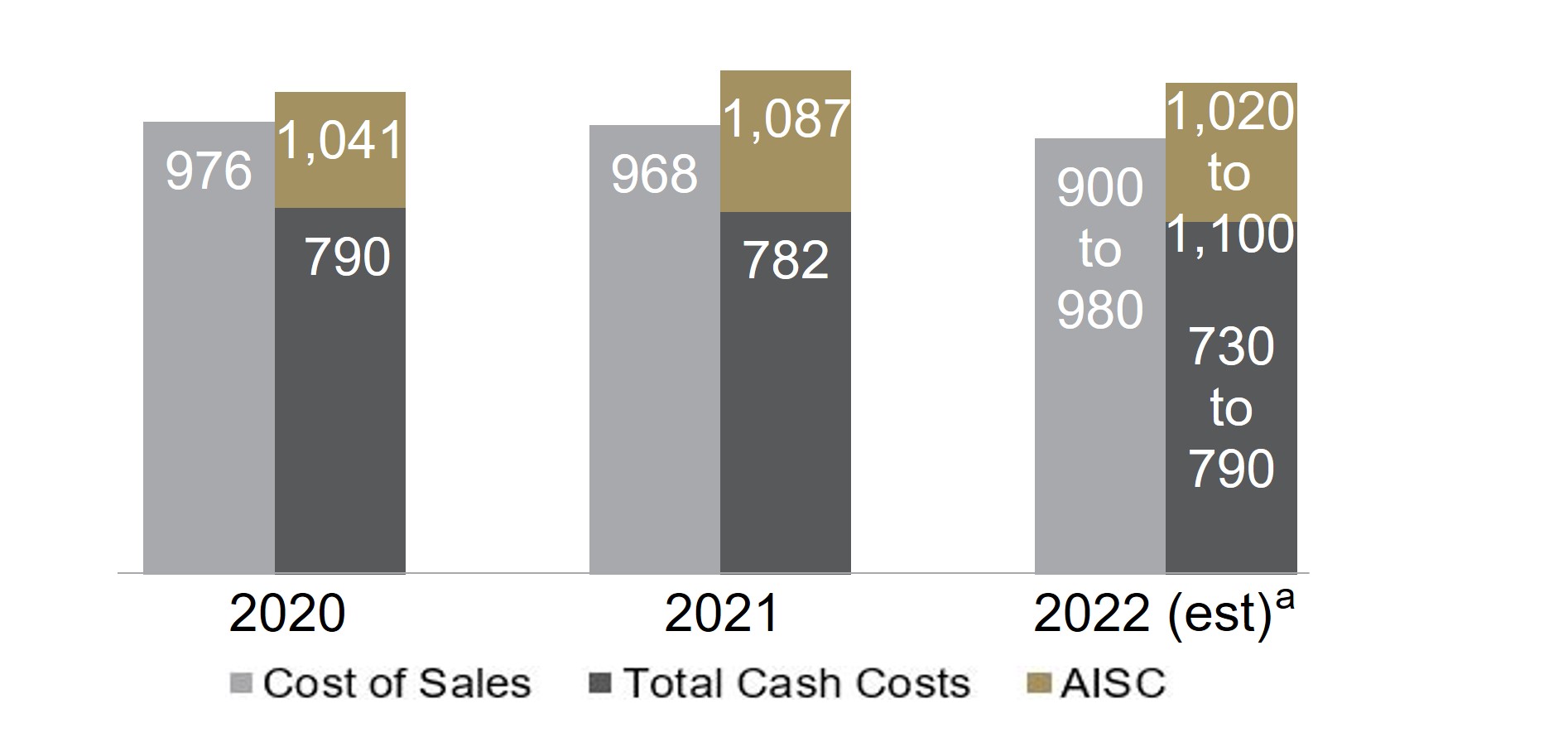

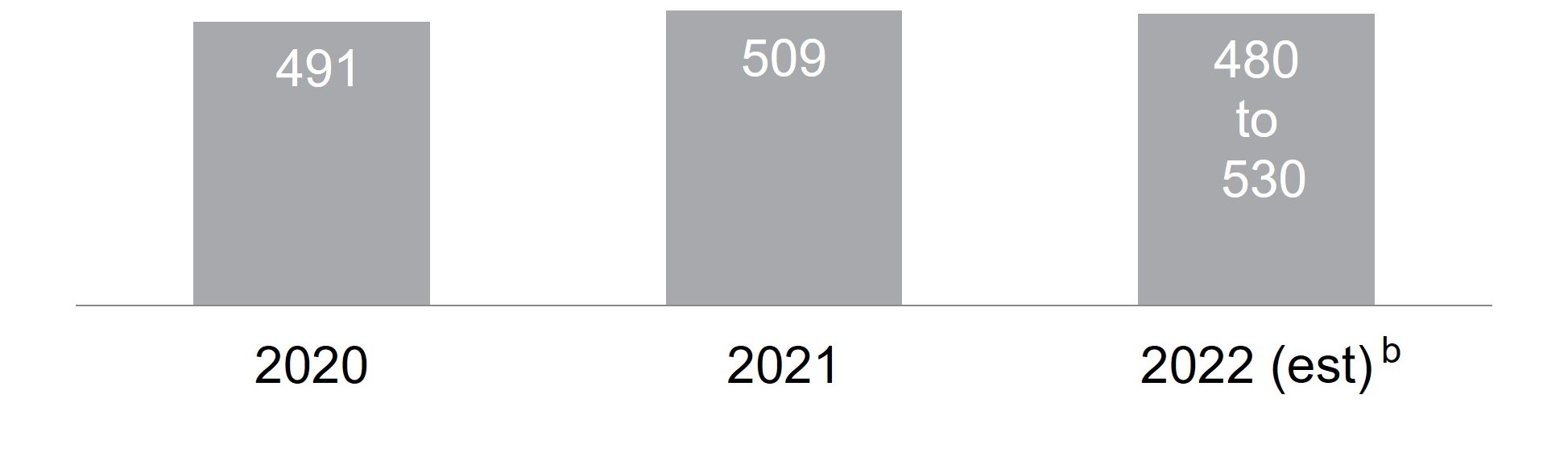

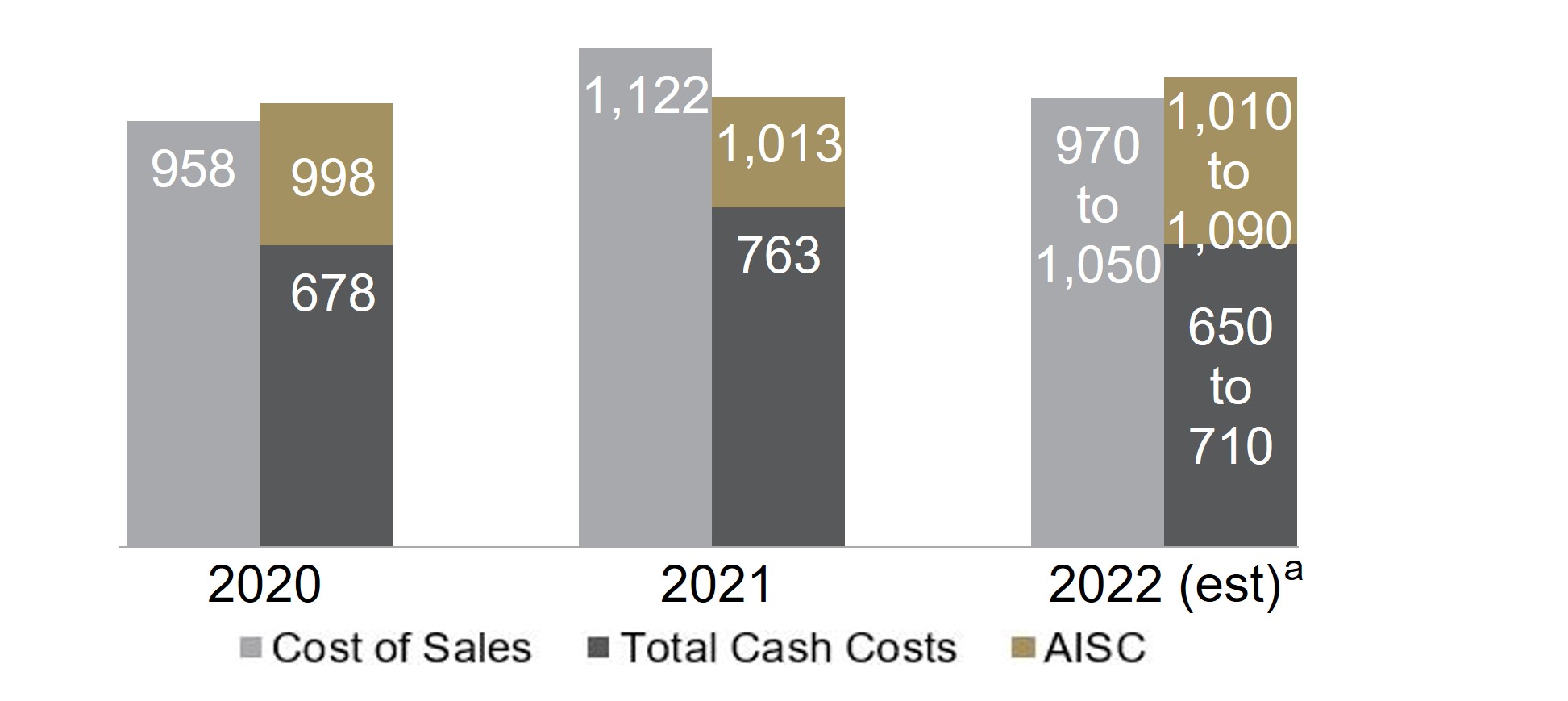

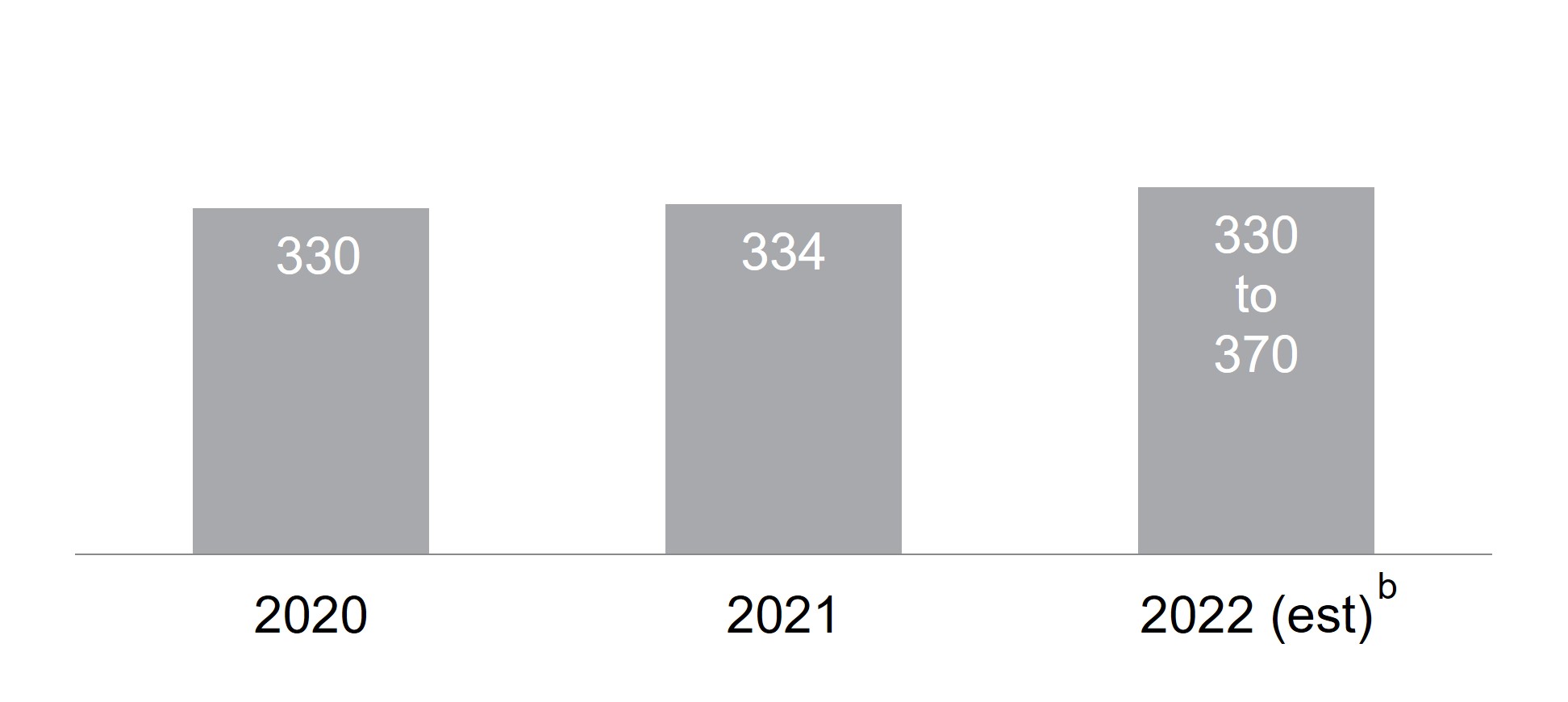

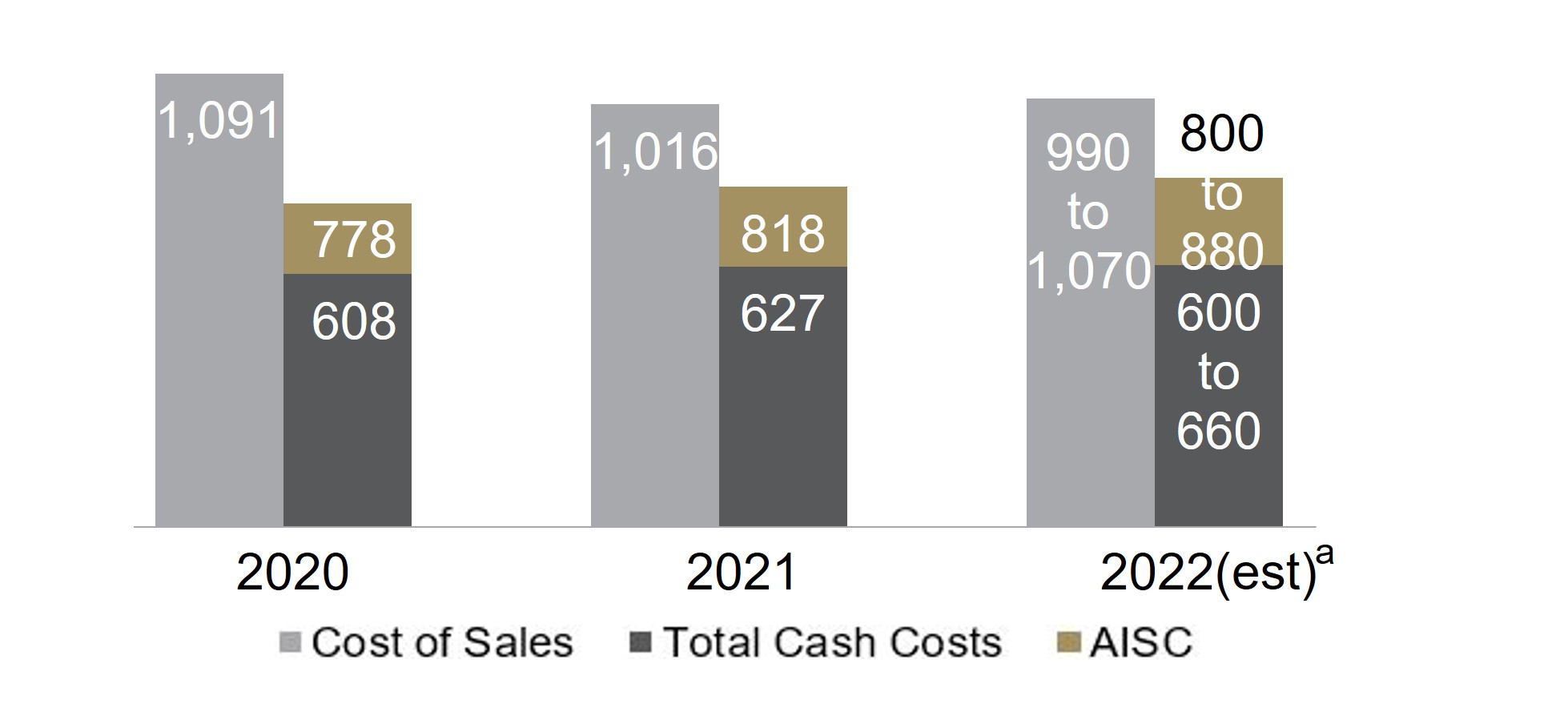

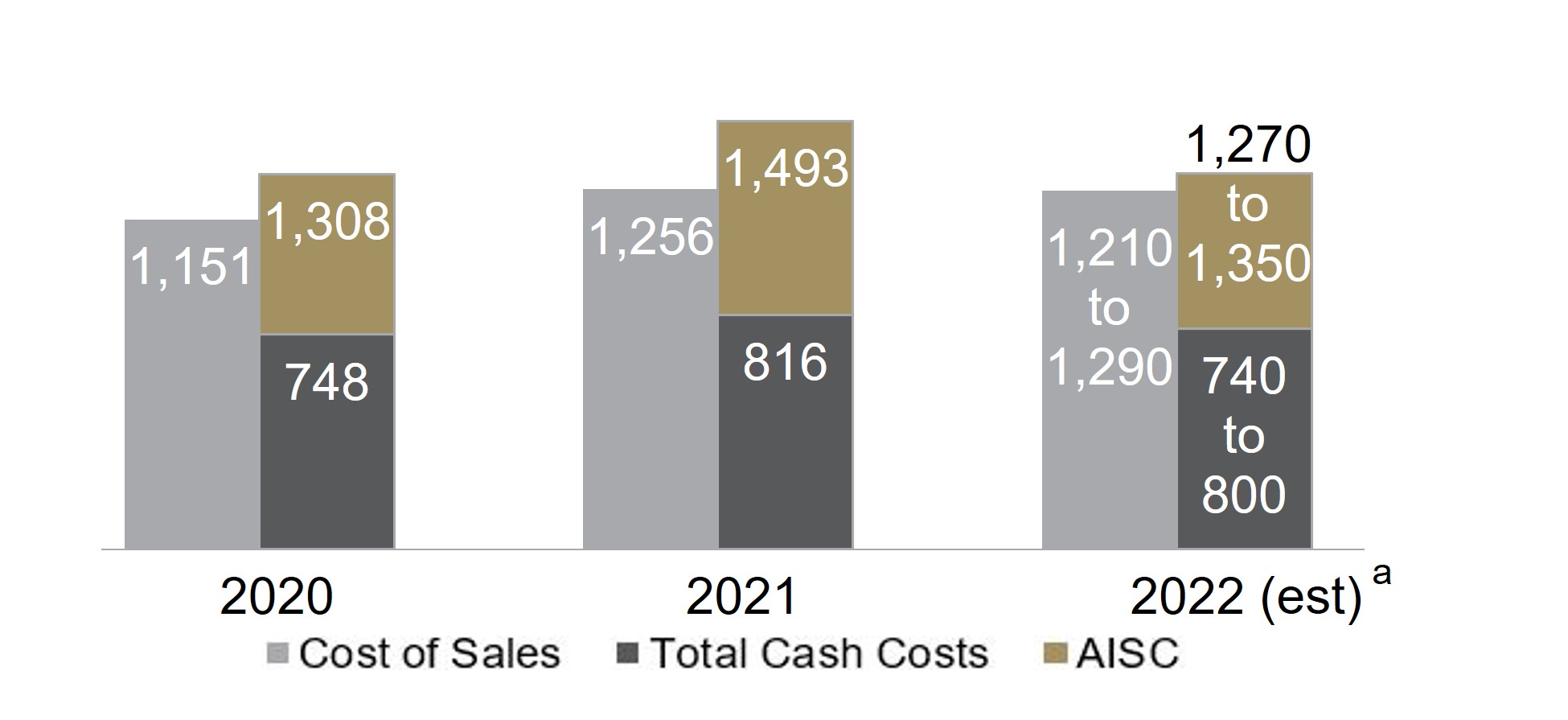

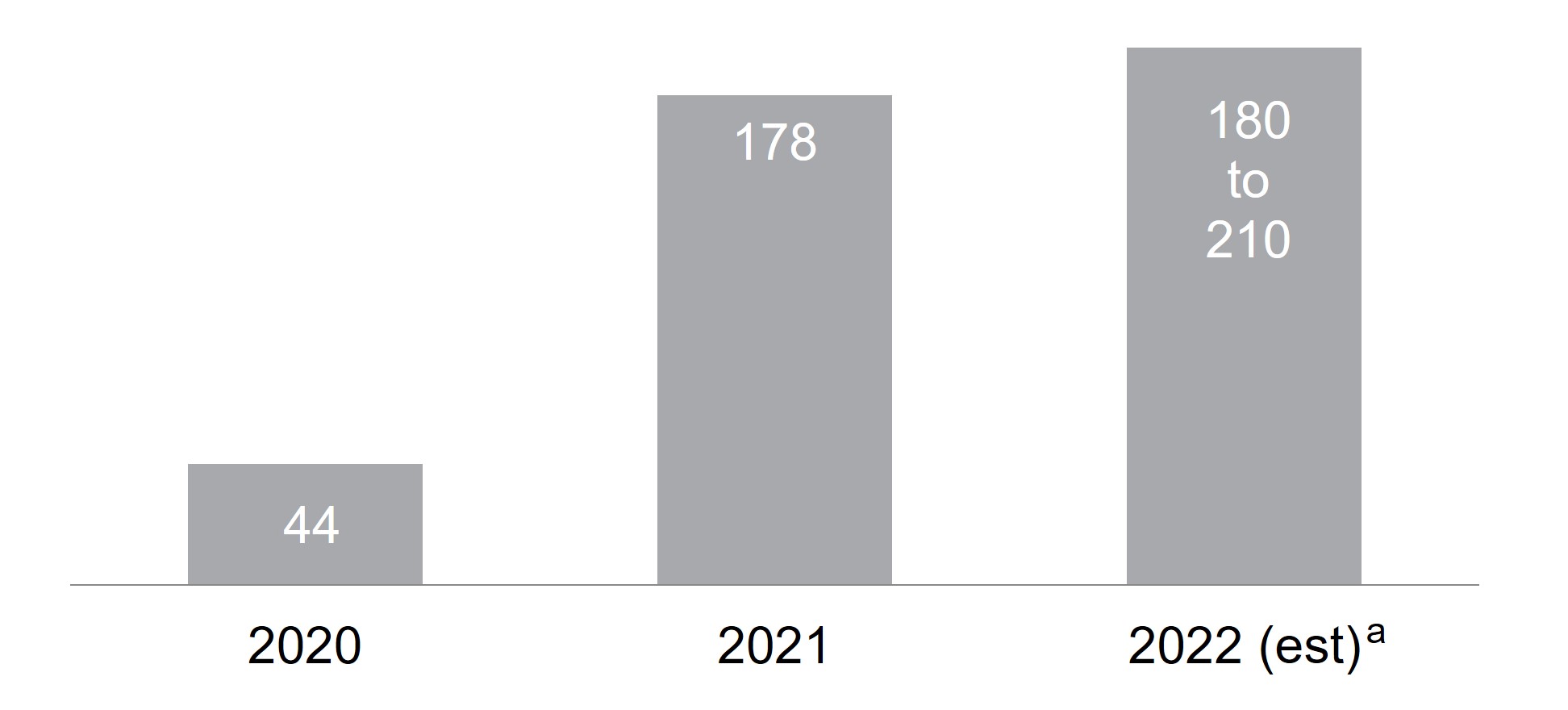

In 2021, Barrick’s gold production was 4.44 million ounces, 323 thousand ounces lower than 2020 gold production, with costs of sales applicable to gold of $1,093 per ounce, all-in sustaining costs of $1,026 per ounce and total cash costs of $725 per ounce. Barrick’s copper production in 2021 was 415 million pounds of copper, 42 million lower than 2020 copper production, with cost of sales applicable to copper of $2.32 per pound, all-in sustaining costs of $2.62 per pound and C1 cash costs of $1.72 per pound. In 2020, Barrick produced 4.76 million ounces of gold, with costs of sales applicable to gold of $1,056 per ounce, all-in sustaining costs of $967 per ounce and total cash costs of $699 per ounce, and 457 million pounds of copper, with cost of sales applicable to copper of $2.02 per pound, all-in sustaining costs of $2.23 per pound and C1 cash costs of $1.54 per pound. “All-in sustaining costs” and “total cash costs” per ounce and “All-in sustaining costs” and “C1 cash costs” per pound are non-GAAP financial performance measures. For an explanation of all-in sustaining costs per ounce, total cash costs per ounce, all-in sustaining costs per pound and C1 cash costs per pound, refer to “Non-GAAP Financial Measures – Total cash costs per ounce, All-in sustaining costs per ounce, All-in costs per ounce, C1 cash

- 23 -

costs per pound and All-in sustaining costs per pound” at pages 185 to 212 of this Annual Information Form.

The following table summarizes Barrick’s interest in its producing mines and its share of gold production from these mines for the periods indicated:

| (000s ozs, attributable share) | ||||

| Twelve months ended December 311 | 2021 | 2020 | ||

| Carlin (61.5%)2 |

923 | 1,024 | ||

| Cortez (61.5%)3 |

509 | 491 | ||

| Turquoise Ridge (61.5%) |

334 | 330 | ||

| Phoenix (61.5%) |

109 | 126 | ||

| Long Canyon (61.5%) |

161 | 160 | ||

| Nevada Gold Mines (61.5%)4 |

2,036 | 2,131 | ||

| Pueblo Viejo (60%) |

488 | 542 | ||

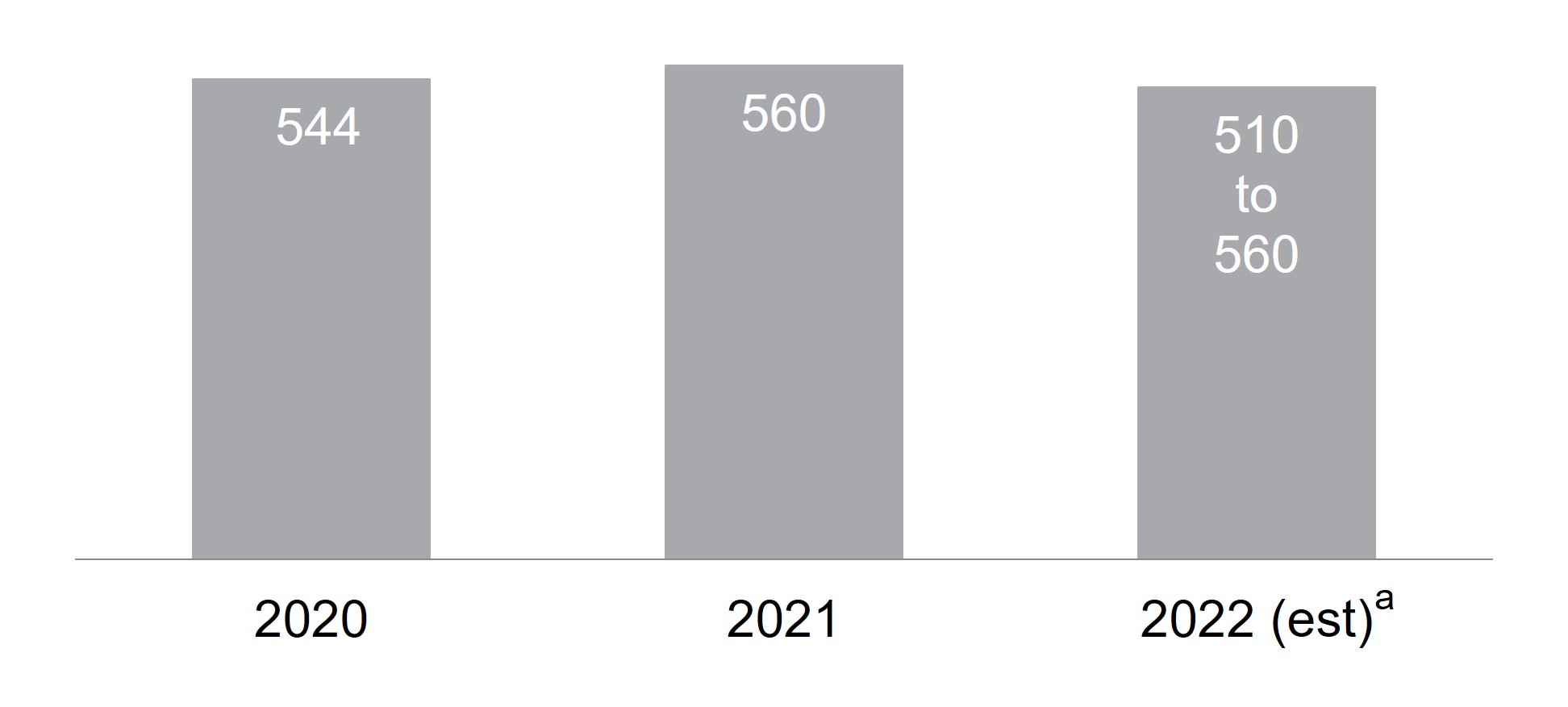

| Loulo-Gounkoto (80%) |

560 | 544 | ||

| Kibali (45%) |

366 | 364 | ||

| Tongon (89.7%) |

187 | 255 | ||

| North Mara (84%) |

260 | 261 | ||

| Veladero (50%) |

172 | 226 | ||

| Hemlo |

150 | 223 | ||

| Bulyanhulu (84%) |

178 | 44 | ||

| Buzwagi (84%)5 |

40 | 84 | ||

| Porgera (47.5%)6 |

— | 86 | ||

| Total Attributable Gold7 |

4,437 | 4,760 | ||

| 1 | Barrick’s interest is subject to royalty obligations at certain mines. |

| 2 | Includes Barrick’s share of South Arturo. On September 7, 2021, Barrick announced that Nevada Gold Mines had entered into an Exchange Agreement with i-80 Gold to acquire the 40% interest in South Arturo that Nevada Gold Mines did not already own in exchange for the Lone Tree and Buffalo Mountain properties and infrastructure. Operating results within the Company’s 61.5% interest in Carlin includes Nevada Gold Mines’ 60% interest in South Arturo up until May 30, 2021, and 100% interest thereafter, reflecting the terms of the Exchange Agreement which closed on October 14, 2021. For additional information, see Strategy - Operational Excellence and Sustainable Profitability. |

| 3 | Starting in the first quarter of 2021, Goldrush is reported as part of Cortez as it is operated by Cortez management. Comparative periods have been restated to include Goldrush. |

| 4 | These amounts represent Barrick’s 61.5% interest in Carlin (including Nevada Gold Mine’s 60% interest in South Arturo up until May 30, 2021 and 100% interest thereafter), Cortez, Turquoise Ridge, Phoenix and Long Canyon. |

| 5 | With the end of mining at Buzwagi in the third quarter of 2021, as previously reported, the Company has ceased to include production metrics for Buzwagi from October 1, 2021 onwards. |

| 6 | As Porgera was placed on care and maintenance on April 25, 2020, no operating data or per ounce data has been provided starting the third quarter of 2020. |

| 7 | Excludes Pierina, Golden Sunlight, Morila (40%) and Lagunas Norte for all periods and Buzwagi starting in the fourth quarter of 2021 as these assets are producing incidental ounces while in closure or care and maintenance. Lagunas Norte was divested in June 2021 and Morila was divested in November 2020. |

The following table summarizes Barrick’s interest in its principal producing copper mines and its share of copper production from these mines for the periods indicated:

- 24 -

| (millions of lbs) | ||||

| Twelve months ended December 311 | 2021 | 2020 | ||

| Zaldívar (50%) |

97 | 106 | ||

| Lumwana |

242 | 276 | ||

| Jabal Sayid (50%) |

76 | 75 | ||

| Total Attributable Copper |

415 | 457 | ||

| 1 | Barrick’s interest is subject to royalty obligations at certain mines. |

See “Narrative Description of the Business” in this Annual Information Form, Note 5 “Segment Information” to the Consolidated Financial Statements and the MD&A for further information on the Company’s operating segments. See “Narrative Description of the Business – Mineral Reserves and Mineral Resources” for information on the Company’s mineral reserves and resources.

- 25 -

- 26 -

NARRATIVE DESCRIPTION OF THE BUSINESS

Barrick is engaged in the production and sale of gold, as well as related activities such as exploration and mine development. Barrick also produces significant amounts of copper, principally from its Zaldívar joint venture, Jabal Sayid joint venture and its Lumwana mine and holds other interests. Unless otherwise specified, the description of Barrick’s business, including products, principal markets, distribution methods, employees and labor relations contained in this Annual Information Form, applies to each of its operating segments and Barrick as a whole.

Production and Guidance

For the year ended December 31, 2021, Barrick produced 4.437 million ounces of gold at cost of sales applicable to gold of $1,093 per ounce, all-in sustaining costs of $1,026 per ounce and total cash costs of $725 per ounce. Barrick’s 2022 gold production is currently targeted at 4.2 to 4.6 million ounces, and Barrick expects cost of sales applicable to gold of $1,070 to $1,150 per ounce in 2022, all-in sustaining costs of $1,040 to $1,120 per ounce and total cash costs of $730 to $790 per ounce, assuming a market gold price of $1,700/oz. See “Forward-Looking Information”. The Company’s 2022 gold production guidance currently excludes Porgera. This is due to the uncertainty related to the timing and scope of future operations at Porgera, following the decision to place the mine on temporary care and maintenance on April 25, 2020, to ensure the safety and security of Barrick’s employees and adjacent communities. The Company remains in constructive discussions with the Government of Papua New Guinea and is optimistic about finding a solution to allow operations at Porgera to resume in 2022. Outside of its Tier One Gold Assets, Barrick expects the following significant changes in year-over-year production. As previously disclosed, mining will cease at Long Canyon towards the middle of 2022, with residual leaching to commence thereafter. The focus at Long Canyon is now shifting to permitting Phase 2, which is expected to begin production in 2026. This is partially offset by Veladero, where Barrick expects stronger performance in 2022 following the commissioning of Phase 6 in the second quarter of 2021. Furthermore, the Company expects higher production at Bulyanhulu in 2022 following the successful ramp-up of underground operations achieved at the end of 2021. Across the four quarters of 2022, the Company’s gold production is expected to be the lowest in the first quarter mainly due to planned maintenance at Pueblo Viejo, Kibali and North Mara, as well as mine sequencing at Phoenix and Tongon. Barrick expects the fourth quarter to be the strongest quarter for gold production as it continues to expect Goldrush to ramp up towards the end of the year, based on the issuance of a ROD in the second half of 2022, as well as higher grades from Phoenix and Tongon, and improved underground productivity at Hemlo. “All-in sustaining costs” and “total cash costs” per ounce are non-GAAP financial performance measures. For an explanation of all-in sustaining costs and total cash costs per ounce, refer to “Non-GAAP Financial Measures – Total cash costs per ounce, All-in sustaining costs per ounce, All-in costs per ounce, C1 cash costs per pound and All-in sustaining costs per pound” at pages 185 to 212 of this Annual Information Form.