Exhibit 99.1

THIRD QUARTER REPORT 2017

All amounts expressed in U.S. dollars unless otherwise indicated

Barrick Reports Third Quarter 2017 Results

| ● | Barrick reported a net loss attributable to equity holders (“net loss”) of $11 million ($0.01 per share), and adjusted net earnings1 of $186 million ($0.16 per share) for the third quarter. |

| ● | The Company generated third quarter revenues of $1.993 billion, net cash provided by operating activities (“operating cash flow”) of $532 million, and free cash flow2 of $225 million. |

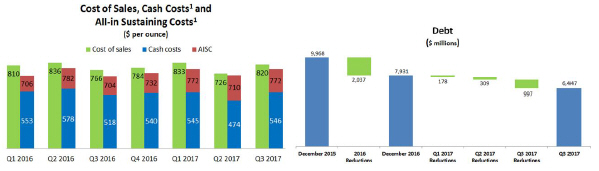

| ● | Gold production in the third quarter was 1.243 million ounces, at a cost of sales applicable to gold3 of $820 per ounce, and all-in sustaining costs4 of $772 per ounce. |

| ● | We have reduced our total debt by nearly $1.5 billion year to date, exceeding our target for 2017. |

| ● | We have narrowed full-year gold production guidance to 5.3-5.5 million ounces, at a cost of sales3 of $790-$810 per ounce, and all-in sustaining costs4 of $740-$770 per ounce. |

| ● | Feasibility level projects at Cortez Deep South, Goldrush, Turquoise Ridge, and Lagunas Norte continue to advance on schedule and within budget. A prefeasibility study for Pascua-Lama remains underway. |

| ● | Barrick and the Government of Tanzania have reached an agreement on a proposed framework that would redefine Acacia’s relationship with the Government, creating a path for the resolution of outstanding matters impacting Acacia’s operations. |

TORONTO, October 25, 2017 — Barrick Gold Corporation (NYSE:ABX)(TSX:ABX) (“Barrick” or the “Company”) today reported third quarter results for the period ending September 30, 2017. Lower revenues, earnings, and cash flow for the quarter reflect lower gold production compared to the prior-year period, as well as the impact of lower sales from Acacia. Despite these factors, a stronger balance sheet and robust cash flow generation allowed us to increase investments in the future of our business, with the ultimate objective of growing free cash flow per share over the long term.

We allocated more capital to our pipeline of low risk, organic projects, located at or near Barrick’s core operations. These projects have the potential to contribute more than one million ounces of annual production to Barrick, beginning in 2020. In addition to organic growth and exploration, the impact of our ongoing investments in digital transformation and innovation, including improvements in safety, productivity, efficiency, and transparency, are expected to accelerate as we broaden the implementation of these projects across our operations.

FINANCIAL HIGHLIGHTS

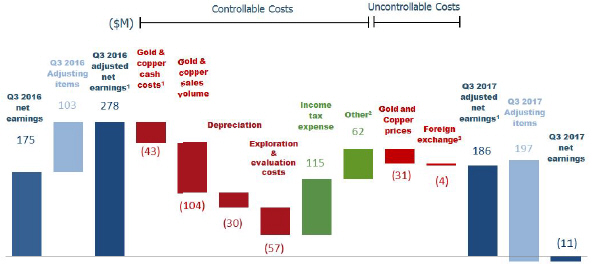

The Company reported a net loss of $11 million ($0.01 per share) for the third quarter, compared to net earnings of $175 million ($0.15 per share) in the prior-year period. The decrease in net earnings primarily reflects lower gold production and lower gold prices, as well as the impact of Tanzania’s concentrate export ban on Acacia.

Net earnings were also impacted by a tax provision of $172 million related to the proposed framework for Acacia’s operations in Tanzania (see page 4 for more details).

In addition, debt extinguishment costs, direct mining costs, exploration and evaluation costs, and depreciation expenses were higher than the prior-year period. These increases were partially offset by higher earnings from equity investees, lower interest costs as a result of debt repayments, and lower tax expense.

Adjusted net earnings1 for the third quarter were $186 million ($0.16 per share), compared to $278 million ($0.24 per share) in the prior-year period. Significant adjusting items (pre-tax and non-controlling interest effects) in the third quarter include:

| ● | $101 million in losses on debt extinguishment; and |

| ● | $172 million in a tax provision relating to the proposed framework for Acacia operations in Tanzania; partially offset by |

| ● | $93 million in tax effects and non-controlling interest impacts, primarily in relation to the two adjustments discussed above. |

Refer to page 50 of Barrick’s third quarter MD&A for a full list of reconciling items between net earnings and adjusted net earnings for the current and prior-year periods.

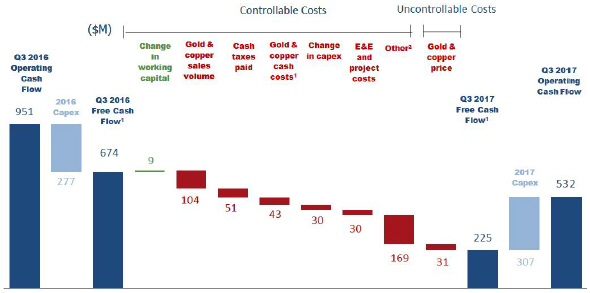

Operating cash flow was $532 million, compared to $951 million in the third quarter of 2016. Lower operating cash flow primarily reflects lower gold sales, combined with higher cash taxes paid, and higher direct mining costs. Operating cash flow was also impacted by lower cash flows attributable to non-controlling interests, an increase in exploration, evaluation and project expenses, and lower gold prices.

Free cash flow2 for the third quarter was $225 million, compared to $674 million in the third quarter of 2016. Lower free cash flow primarily reflects higher capital expenditures combined with lower operating cash flows. In the third quarter of 2017, capital expenditures on a cash basis were $307 million, compared to $277 million in the third quarter of 2016. This includes a $27 million increase in project capital expenditures, primarily at Barrick Nevada, relating to the development of Crossroads, the Cortez Hills Lower Zone, and the Goldrush project. Minesite sustaining capital expenditures were also higher at Barrick Nevada and Veladero, in line with plans.

RESTORING A STRONG BALANCE SHEET

Achieving and maintaining a strong balance sheet remains a top priority. So far this year, we have reduced our total debt by nearly $1.5 billion, exceeding our target of $1.45 billion for 2017. During the third quarter, we completed the redemption of approximately $731 million of May 2023 notes, and fully repaid the amounts outstanding on our Pueblo Viejo project financing agreement.

Our goal is to reduce our total debt to $5 billion by the end of 2018, using cash flow from operations, and through further portfolio optimization, including potential divestments and the creation of new joint ventures and partnerships. The Company will continue to pursue debt reduction with discipline, taking only those actions that make sense for the business, on terms we consider favorable to our shareholders.

At the end of the third quarter, Barrick had a consolidated cash balance of approximately $2.0 billion5. The Company has less than $100 million6 in debt due before 2020. Three-quarters of our outstanding total debt of $6.4 billion does not mature until after 2032.

| BARRICK THIRD QUARTER 2017 | 2 | PRESS RELEASE |

OPERATING HIGHLIGHTS AND OUTLOOK

Barrick produced 1.243 million ounces of gold in the third quarter, at a cost of sales3 of $820 per ounce. This compares to 1.381 million ounces, at a cost of sales3 of $766 per ounce in the prior-year period. Production levels were expected to be lower in the third quarter, with higher gold production and lower costs expected in the fourth quarter. On a per ounce basis, cost of sales applicable to gold was higher due to the impact of fewer ounces sold, combined with higher direct mining costs, and depreciation expense.

All-in sustaining costs4 in the third quarter were $772 per ounce, compared to $704 per ounce in the third quarter of 2016. Higher all-in sustaining costs primarily reflect a planned increase in minesite sustaining capital expenditures at Barrick Nevada and Veladero, and higher cost of sales on a per ounce basis.

Cash costs3 increased from $518 per ounce in the third quarter of 2016, to $546 per ounce in the third quarter of 2017, primarily driven by higher direct mining costs. Cash costs have decreased by five percent over the first nine months of 2017, compared to the same period in 2016.

We have narrowed our full-year gold production and cost guidance ranges. We expect full-year gold production to be 5.3-5.5 million ounces, at a cost of sales3 of $790-$810 per ounce, and all-in sustaining costs4 of $740-$770 per ounce. This compares to our most recent production guidance of 5.3-5.6 million ounces, at a cost of sales3 of $780-$820 per ounce, and all-in sustaining costs4 of $720-$770 per ounce.

The Company produced 115 million pounds of copper in the third quarter, at a cost of sales3 of $1.67 per pound, and all-in sustaining costs7 of $2.24 per pound. This compares to 100 million pounds, at a cost of sales3 of $1.43 per pound, and all-in sustaining costs7 of $2.02 per pound, in the third quarter of 2016.

Our full-year copper production guidance range has narrowed to 420-440 million pounds. We have increased our copper cost of sales3 guidance to $1.70-$1.85 per pound, primarily as a result of higher costs in Zambia. Our copper all-in sustaining cost7 guidance range has narrowed to $2.20-$2.40 per pound.

Please see page 34 of Barrick’s third quarter MD&A for individual operating segment performance details. Detailed mine site guidance information can be found in Appendix 1 of this press release.

| Gold | Third Quarter 2017 |

Current 2017 Guidance |

Original 2017 Guidance |

|||||||||

| Production8 (000s of ounces) |

1.243 | 5.300-5.500 | 5.600-5.900* | |||||||||

| Cost of sales applicable to gold3 ($ per ounce) |

820 | 790-810 | 780-820 | |||||||||

| All-in sustaining costs4 ($ per ounce) |

772 | 740-770 | 720-770 | |||||||||

| Copper |

||||||||||||

| Production8 (millions of pounds) |

115 | 420-440 | 400-450 | |||||||||

| Cost of sales applicable to copper3 ($ per pound) |

1.67 | 1.70-1.85 | 1.50-1.70 | |||||||||

| All-in sustaining costs7 ($ per pound)

|

|

2.24

|

|

|

2.20-2.40

|

|

|

2.10-2.40

|

| |||

| Total Attributable Capital Expenditures9 ($ millions) |

296 | 1,350-1,500 | 1,300-1,500 | |||||||||

*Original 2017 gold production guidance was adjusted to 5.3-5.6 million ounces to reflect the sale of 50 percent of Veladero to Shandong Gold Mining Co., Ltd effective June 30, 2017.

| BARRICK THIRD QUARTER 2017 | 3 | PRESS RELEASE |

APPOINTMENT OF CHIEF DIGITAL OFFICER

Digital transformation is helping Barrick generate more value from its assets by leveraging data, analytics, and deep machine learning to make our business more safe, productive, and transparent.

In August, we appointed Sham Chotai as Barrick’s first Chief Digital Officer. Under Mr. Chotai’s leadership, Barrick will accelerate its digital transformation by bringing together the Company’s Information Technology, Digital, and Operating Technology groups. This will ensure an integrated approach to developing and adopting digital solutions across the Company, and will build on the success of our pilot implementations this year.

Those pilots have demonstrated the ability to capture productivity gains and cost reductions at the Cortez mine by optimizing mining cycle times, digitizing maintenance work, and introducing autonomous operations. As we scale up the use of these products across Cortez and other Barrick operations, we expect to see a corresponding acceleration of the benefits we have achieved thus far.

Mr. Chotai comes to Barrick with 25 years of experience in digital technology, business intelligence, and software development. Prior to joining Barrick, he was Chief Technology Officer and Head of Software for GE’s Power business. Mr. Chotai also served as Vice President, Cloud Computing for Hewlett-Packard.

PROPOSAL FOR A NEW PARTNERSHIP BETWEEN ACACIA AND TANZANIA

Following three months of discussions, the Government of Tanzania and Barrick have agreed on a proposed framework, which, if adopted, would redefine Acacia’s relationship with Tanzania for the long term, moving to a partnership characterized by trust and transparency. This proposal is subject to review and approval by Acacia.

We believe the proposed framework represents the optimal path for the resolution of outstanding disputes between Acacia and the Government of Tanzania, and for the resumption of normal operations. Such a partnership has the potential to provide greater near-term certainty to Acacia and Barrick shareholders, and mitigate risk of future business disruptions; thereby improving the long-term stability and sustainability of Acacia’s operations in Tanzania.

Under the proposed framework, economic benefits from Acacia’s operations would be split on a 50/50 basis with the Government of Tanzania. The Government’s portion will be delivered in the form of royalties, taxes, and a 16 percent free carried interest in Acacia’s Tanzanian operations, in line with the country’s new mining law.

A new Tanzanian operating company will be created to manage Bulyanhulu, Buzwagi, and North Mara. The principle of transparency between partners will define how this company operates. The Government of Tanzania will participate in decisions related to operations, investment, planning, procurement, and marketing. This operating company will maximize employment of Tanzanians, building local capacity at all levels of the business, from board membership to operations. It will also increase procurement of goods and services within Tanzania.

Having agreed on a proposed partnership framework, the Government of Tanzania and Barrick have created a working group to resolve outstanding tax matters relating to Acacia. In support of the working group’s ongoing efforts, the proposed framework agreed between Barrick and the Government of Tanzania provides for the payment of $300 million to the Government of Tanzania by Acacia, on terms to be settled by the working group. Given Acacia’s current financial position, these payments would be made over time, using Acacia’s ongoing cash flows. As such, payment would be also conditional on Acacia’s ability to sell doré and concentrate.

| BARRICK THIRD QUARTER 2017 | 4 | PRESS RELEASE |

Barrick will also be working with the Government of Tanzania to establish the basis upon which the concentrate export ban can be lifted as expediently as possible, including protocols for joint oversight and verification of concentrate shipments.

Barrick and the Government of Tanzania will now work to complete detailed documentation and final agreements for review and approval by Acacia. We expect this work to be completed in the first half of 2018. Barrick has engaged with independent directors of Acacia during this process, and will continue to do so.

PROJECTS UPDATE

Our four most advanced projects continue to progress according to schedule and in line with initial capital estimates, with the potential to contribute more than one million ounces of annual gold production to Barrick beginning in 2020, at costs well below our current portfolio average.

This includes three significant projects in Nevada: the Cortez Deep South underground expansion; the development of an underground mine at Goldrush; and the construction of a third shaft at the Turquoise Ridge mine. At Lagunas Norte in Peru, we are advancing a phased approach to extending the life of the mine by optimizing the recovery of carbonaceous oxide ores, followed by mining and processing of refractory material.

In addition, we continue to advance a prefeasibility study for underground mining at the Pascua-Lama project on the border between Argentina and Chile.

Cortez Hills Deep South Underground Project, Nevada, USA10

The Deep South project, located within the Lower Zone of the Cortez Hills underground mine, is expected to contribute average underground production of more than 300,000 ounces per year. The prefeasibility study anticipated a cost of sales3 of $840 per ounce, and average all-in sustaining costs4 of $580 per ounce, for mining in the Deep South area. The project remains on schedule and within budget, with initial capital costs estimated to be $153 million.

The Deep South project will utilize infrastructure which has already been approved under current plans to expand mining in the Lower Zone. This includes construction of new twin declines, a conveyor haulage system, fuel and lubrication system, shotcrete and cemented rock fill plants, and an underground maintenance shop.

At the end of the third quarter, the twin declines had advanced a total of 6,581 feet, or 44 percent of the total distance, in line with schedule. Mass excavations for key underground infrastructure have also begun, and contracts for underground construction works have been awarded. Activities in the fourth quarter will include mobilizing contractors, advancing the twin declines, and completing temporary warehouses, in addition to continued procurement for construction activities.

Permitting for Deep South was initiated in 2016 with the submission of an amendment to the current Mine Plan of Operations to the Bureau of Land Management. Permitting is expected to take approximately three to four years, including the preparation of an Environmental Impact Statement. A record of decision is expected by 2020. On this basis, initial production from Deep South could commence by 2023.

Goldrush Project, Cortez District, Nevada, USA

Goldrush has the potential to become Barrick’s newest underground operation in Nevada, with first production expected as early as 2021, and sustained production by 2023. The mine is expected to produce approximately

| BARRICK THIRD QUARTER 2017 | 5 | PRESS RELEASE |

450,000 ounces of gold per year during its first full five years in operation. Cost of sales3 is expected to be $800 per ounce, with average all-in sustaining costs4 of $665 per ounce. We continue to anticipate initial capital costs of approximately $1 billion.

The first phase of the project involves the construction of an exploration twin decline to provide access to the orebody at depth, which will enable further exploration drilling, as well as the conversion of existing resources to reserves. The exploration declines can be converted into full production declines in the future.

Initial site preparation works for the portal have been completed, and construction on the portal pad is now under way. We have also completed a surface drilling program in the Red Hill zone of the deposit, which is expected to support additional resource conversion.

Work during the fourth quarter will focus on advancing portal pad construction, and the selection of an underground contractor for decline development, which is expected to begin in early 2018. Permitting is expected to commence in 2018, initiating a three- to four-year Environmental Impact Statement process.

Turquoise Ridge Third Shaft Project, Nevada, USA

Through the development of a third shaft, combined with improvements in mining productivity, Turquoise Ridge has the potential to increase output to an average of 500,000 ounces per year (100 percent basis) at a cost of sales3 of $750-$800 per ounce, and all-in sustaining costs4 of about $625-$675 per ounce. The project is expected to require capital expenditures of approximately $300-$325 million (100 percent basis) for additional underground development and shaft construction. All necessary permits for a third shaft are already in place.

Surface preparation works began in the third quarter, and included moving 95,000 cubic yards of earth, setting up storm water diversion infrastructure, and extending utilities to the shaft site. This work is expected to be complete by the end of 2017. Contracts and materials to support medium and high voltage electrical distribution, water handling and sewage treatment have been purchased, and a tender process is now open for the shaft sinking contract.

In keeping with our phased approach, construction on a ventilation shaft could begin in the second half of 2018, at roughly half the total capital expenditure of a full production shaft. This ventilation shaft would allow for expanded underground mining using existing infrastructure, and could be equipped and converted to a full production shaft to increase the mine’s output to approximately 500,000 ounces per year.

During the quarter, Turquoise Ridge also took delivery of its first road header. Building on the successful use of this technology at Cortez, the road header will enable the mine to transition to mechanical cutting, rather than traditional drilling and blasting, improving overall productivity and throughput at the operation, and supporting the increased hoisting capacity that a third shaft will support.

Lagunas Norte Life Extension Project, La Libertad, Peru11

In 2016, the Company completed a prefeasibility study for a 6,000 tonne per day grinding-flotation-autoclave and carbon-in-leach processing circuit. The project has the potential to extend the life of the Lagunas Norte mine by approximately 10 years by treating refractory material located under the mine’s existing oxide ore body. By employing strategies to optimize and increase the recovery of carbonaceous oxide ore from existing stockpiles at the mine, we have been able to re-sequence this project in two parts, deferring the capital expenditures necessary for refractory ore processing.

| BARRICK THIRD QUARTER 2017 | 6 | PRESS RELEASE |

The first component of the project would involve the construction of a grinding and carbon-in-leach processing circuit that would treat remaining carbonaceous oxide material at Lagunas Norte. Environmental permits for these facilities are already in hand. Pending completion of the feasibility study, a positive investment decision, and receipt of construction permits, work on these facilities could begin in late 2018, with first production in 2020. Construction of the flotation and pressure oxidation circuits would follow this, subject to Environmental Impact Assessment approval and a positive investment decision by the Company.

Work in 2017 has focused on completing a feasibility study, including additional drilling to improve orebody knowledge, and further metallurgical testing.

Pascua-Lama Project, San Juan, Argentina/Atacama Region, Chile

We have made significant progress on a prefeasibility study for the development of an underground, block caving operation at Pascua-Lama. The project would utilize the existing process plant and tailings facility on the Argentinean side of the border, construction of which is already well advanced.

In order to complete the prefeasibility study, de-risk the project and improve economics, we are undertaking a number of optimization studies, along with a focused drilling campaign during the 2017/2018 summer season in the southern hemisphere. Previous drilling on the deposit was primarily undertaken in support of open pit mining plans. This campaign will focus on improving ore body knowledge on the Argentinean side of the deposit where further data is needed to validate underground development plans and metallurgy.

A switch to underground mining addresses a number of stakeholder concerns by significantly reducing surface land disturbance and therefore the overall environmental footprint of the project, as compared to an open pit operation. In addition, an underground mine would be less susceptible to weather-related production interruptions during the winter season.

In keeping with Barrick’s strategic cooperation agreement with Shandong Gold, representatives from Shandong will also work with the project team to exchange knowledge, experience and technologies that have the potential to further optimize Pascua-Lama.

TECHNICAL INFORMATION

The scientific and technical information contained in this press release has been reviewed and approved by Steven Haggarty, P. Eng., Senior Director, Metallurgy of Barrick, Rick Sims, Registered Member SME, Senior Director, Resources and Reserves of Barrick, and Patrick Garretson, Registered Member SME, Senior Director, Life of Mine Planning of Barrick, each a “Qualified Person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects.

| BARRICK THIRD QUARTER 2017 | 7 | PRESS RELEASE |

Appendix 1

2017 Updated Operating and Capital Expenditure Guidance

GOLD PRODUCTION AND COSTS

| Production

|

Cost of sales3

|

All-in

|

Cash costs4

| |||||

| Barrick Nevada |

2.280-2.320 | 790-830 | 620-650 | 450-470 | ||||

| Pueblo Viejo (60%) |

0.635-0.650 | 650-670 | 540-560 | 410-430 | ||||

| Veladero (50%)* |

0.430-0.465 | 870-940 | 920-990 | 580-610 | ||||

| Lagunas Norte |

0.380-0.400 | 610-650 | 470-510 | 390-410 | ||||

| Sub-total |

3.700-3.800 | 770-800 | 640-660 | 450-470 | ||||

|

| ||||||||

| Acacia (63.9%) |

~0.480 | 860-900 | 880-920 | 580-620 | ||||

| KCGM (50%) |

0.375-0.425 | 810-900 | 665-715 | 585-635 | ||||

| Turquoise Ridge (75%) |

0.210-0.230 | 700-750 | 770-830 | 580-610 | ||||

| Porgera (47.5%) |

0.235-0.255 | 850-910 | 940-1,010 | 700-750 | ||||

| Hemlo |

0.195-0.210 | 940-1,010 | 1,020-1,130 | 780-810 | ||||

| Golden Sunlight |

0.035-0.050 | 1,200-1,550 | 1,200-1,300 | 1,150-1,250 | ||||

| Total Gold |

5.300-5.50012 | 790-810 | 740-770 | 520-535 | ||||

*Reflects our 50% equity share of Veladero from July 1, 2017 onwards.

COPPER PRODUCTION AND COSTS

| Production (millions of pounds)

|

Cost of sales3

|

All-in

|

C1 cash costs7

| |||||

| Zaldívar (50%) |

115-125 | 2.10-2.30 | 2.10-2.30 | ~1.60 | ||||

| Lumwana |

250-270 | 1.40-1.60 | 2.20-2.40 | 1.50-1.70 | ||||

| Jabal Sayid (50%) |

35-45 | 2.00-2.70 | 2.10-2.60 | 1.50-1.90 | ||||

| Total Copper |

420-44012 | 1.70-1.85 | 2.20-2.40 | 1.60-1.75 | ||||

CAPITAL EXPENDITURES

| ($ millions)

| ||

| Mine site sustaining |

1,100-1,200 | |

| Project |

250-300 | |

| Total Attributable Capital Expenditures9 |

1,350-1,500 | |

| BARRICK THIRD QUARTER 2017 | 8 | PRESS RELEASE |

Appendix 2

2017 Outlook Assumptions and Economic Sensitivity Analysis

| 2017 Guidance

|

Hypothetical

|

Impact on

|

Impact on

|

Impact

on

| ||||||

| Gold revenue, net of royalties |

$1,050/oz | +/- $100/oz | +/- $142 | +/- $4 | +/- $3/oz | |||||

| Copper revenue, net of royalties13 |

$2.25/lb | + $0.50/lb | + $58 | + $4 | + $0.03/lb | |||||

| Copper revenue, net of royalties13 |

$2.25/lb | - $0.50/ lb | - $46 | - $3 | - $0.03/ lb | |||||

| Gold all-in sustaining costs4 |

||||||||||

| WTI crude oil price14 |

$55/bbl | +/- $10/bbl | n/a | +/- $5 | +/- $3/oz | |||||

| Australian dollar exchange rate |

0.75 :1 | +/- 10% | n/a | +/- $8 | +/- $5/oz | |||||

| Argentine peso exchange rate |

16.50 : 1 | +/- 10% | n/a | +/- $2 | +/- $1/oz | |||||

| Canadian dollar exchange rate |

1.32 : 1 | +/- 10% | n/a | +/- $8 | +/- $6/oz | |||||

| Copper all-in sustaining costs7 |

||||||||||

| WTI crude oil price14 |

$55/bbl | +/- $10/bbl | n/a | +/- $1 | +/- $0.01/lb | |||||

| Chilean peso exchange rate |

675 : 1 | +/- 10% | n/a | +/- $1 | +/- $0.01/lb | |||||

| BARRICK THIRD QUARTER 2017 | 9 | PRESS RELEASE |

Endnotes

ENDNOTE 1

“Adjusted net earnings” and “adjusted net earnings per share” are non-GAAP financial performance measures. Adjusted net earnings excludes the following from net earnings: certain impairment charges (reversals) related to intangibles, goodwill, property, plant and equipment, and investments; gains (losses) and other one-time costs relating to acquisitions or dispositions; foreign currency translation gains (losses); significant tax adjustments not related to current period earnings; unrealized gains (losses) on non-hedge derivative instruments; and the tax effect and non-controlling interest of these items. The Company uses this measure internally to evaluate our underlying operating performance for the reporting periods presented and to assist with the planning and forecasting of future operating results. Barrick believes that adjusted net earnings is a useful measure of our performance because these adjusting items do not reflect the underlying operating performance of our core mining business and are not necessarily indicative of future operating results. Adjusted net earnings and adjusted net earnings per share are intended to provide additional information only and do not have any standardized meaning under IFRS and may not be comparable to similar measures of performance presented by other companies. They should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Further details on these non-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Reconciliation of Net Earnings to Net Earnings per Share, Adjusted Net Earnings and Adjusted Net Earnings per Share

| ($ millions, except per share amounts in dollars) | For the three months ended September 30 | For the nine months ended September 30 | ||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Net earnings (loss) attributable to equity holders of the Company |

$ | (11) | $ | 175 | $ | 1,752 | $ | 230 | ||||||||

| Impairment charges (reversals) related to intangibles, goodwill, property, plant and equipment, and investments1 |

2 | 49 | (1,128) | 54 | ||||||||||||

| Acquisition/disposition (gains)/losses2 |

(5) | 37 | (882) | 35 | ||||||||||||

| Foreign currency translation (gains)/losses |

25 | 19 | 60 | 181 | ||||||||||||

| Significant tax adjustments3 |

174 | 5 | 183 | 59 | ||||||||||||

| Other expense adjustments4 |

103 | 1 | 130 | 75 | ||||||||||||

| Unrealized gains on non-hedge derivative instruments |

(9) | (12) | (6) | (23) | ||||||||||||

| Tax effect and non-controlling interest5 |

(93) | 4 | 500 | (48) | ||||||||||||

| Adjusted net earnings |

$ | 186 | $ | 278 | $ | 609 | $ | 563 | ||||||||

| Net earnings (loss) per share6 |

(0.01) | 0.15 | 1.50 | 0.20 | ||||||||||||

| Adjusted net earnings per share6 |

0.16 | 0.24 | 0.52 | 0.48 | ||||||||||||

| 1 | Net impairment reversals for the nine month period ended September 30, 2017 primarily relate to impairment reversals at the Cerro Casale project upon reclassification of the project’s net assets as held-for-sale as at March 31, 2017. |

| 2 | Disposition gains for the three and nine month periods ended September 30, 2017 primarily relate to the sale of a 50% interest in the Veladero mine and the gain related to the sale of a 25% interest in the Cerro Casale project. |

| 3 | Significant tax adjustments for the three and nine month periods ended September 30, 2017 primarily relate to a tax provision relating to the impact of the proposed framework for Acacia operations in Tanzania. |

| 4 | Other expense adjustments for the three and nine month periods ended September 30, 2017 primarily relate to debt extinguishment costs. |

| 5 | Tax effect and non-controlling interest for the nine month period ended September 30, 2017 primarily relates to the impairment reversals at the Cerro Casale project discussed above. |

| 6 | Calculated using weighted average number of shares outstanding under the basic method of earnings per share. |

ENDNOTE 2

“Free cash flow” is a non-GAAP financial performance measure which excludes capital expenditures from net cash provided by operating activities. Barrick believes this to be a useful indicator of our ability to operate without reliance on additional borrowing or usage of existing cash. Free cash flow is intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to similar measures of performance presented by other companies. Free cash flow should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Further details on these non-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

| BARRICK THIRD QUARTER 2017 | 10 | PRESS RELEASE |

Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow

| ($ millions) | For the three months ended September 30 | For the nine months ended September 30 | ||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Net cash provided by operating activities |

$ | 532 | $ | 951 | $ | 1,475 | $ | 1,929 | ||||||||

| Capital expenditures |

(307) | (277) | (1,046) | (800) | ||||||||||||

| Free cash flow |

$ | 225 | $ | 674 | $ | 429 | $ | 1,129 | ||||||||

ENDNOTE 3

Cost of sales applicable to gold per ounce is calculated using cost of sales applicable to gold on an attributable basis (removing the non-controlling interest of 40% Pueblo Viejo and 36.1% Acacia from cost of sales), divided by attributable gold ounces. Cost of sales applicable to copper per pound is calculated using cost of sales applicable to copper including our proportionate share of cost of sales attributable to equity method investments (Zaldívar and Jabal Sayid), divided by consolidated copper pounds (including our proportionate share of copper pounds from our equity method investments).

ENDNOTE 4

“Cash costs” per ounce and “All-in sustaining costs” per ounce are non-GAAP financial performance measures. “Cash costs” per ounce starts with cost of sales applicable to gold production, but excludes the impact of depreciation, the non-controlling interest of cost of sales, and includes by-product credits. “All-in sustaining costs” per ounce begin with “Cash costs” per ounce and add further costs which reflect the additional costs of operating a mine, primarily sustaining capital expenditures, general & administrative costs, minesite exploration and evaluation costs, and reclamation cost accretion and amortization. Barrick believes that the use of “cash costs” per ounce and “all-in sustaining costs” per ounce will assist investors, analysts and other stakeholders in understanding the costs associated with producing gold, understanding the economics of gold mining, assessing our operating performance and also our ability to generate free cash flow from current operations and to generate free cash flow on an overall Company basis. “Cash costs” per ounce and “All-in sustaining costs” per ounce are intended to provide additional information only and do not have any standardized meaning under IFRS. Although a standardized definition of all-in sustaining costs was published in 2013 by the World Gold Council (a market development organization for the gold industry comprised of and funded by 18 gold mining companies from around the world, including Barrick), it is not a regulatory organization, and other companies may calculate this measure differently. These measures should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Further details on these non-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

| BARRICK THIRD QUARTER 2017 | 11 | PRESS RELEASE |

Reconciliation of Gold Cost of Sales to Cash costs, All-in sustaining costs and All-in costs, including on a per ounce basis

| ($ millions, except per ounce information in dollars) | For the three months ended September 30 |

For the nine months ended September 30 |

||||||||||||||||||

| Footnote | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||

| Cost of sales applicable to gold production |

$ | 1,147 | $ | 1,202 | $ | 3,544 | $ | 3,633 | ||||||||||||

| Depreciation |

(357) | (373) | (1,125) | (1,108) | ||||||||||||||||

| By-product credits |

1 | (32) | (59) | (105) | (143) | |||||||||||||||

| Realized (gains)/losses on hedge and non-hedge derivatives |

2 | 9 | 15 | 19 | 71 | |||||||||||||||

| Non-recurring items |

3 | — | 34 | — | 24 | |||||||||||||||

| Other |

4 | (24) | (9) | (71) | (24) | |||||||||||||||

| Non-controlling interests (Pueblo Viejo and Acacia) |

5 | (73) | (92) | (218) | (267) | |||||||||||||||

| Cash costs |

$ | 670 | $ | 718 | $ | 2,044 | $ | 2,186 | ||||||||||||

| General & administrative costs |

69 | 71 | 186 | 217 | ||||||||||||||||

| Minesite exploration and evaluation costs |

6 | 16 | 10 | 39 | 26 | |||||||||||||||

| Minesite sustaining capital expenditures |

7 | 248 | 236 | 830 | 646 | |||||||||||||||

| Rehabilitation - accretion and amortization (operating sites) |

8 | 14 | 16 | 51 | 41 | |||||||||||||||

| Non-controlling interest, copper operations and other |

9 | (67) | (75) | (199) | (209) | |||||||||||||||

| All-in sustaining costs |

$ | 950 | $ | 976 | $ | 2,951 | $ | 2,907 | ||||||||||||

| Project exploration and evaluation and project costs |

6 | 84 | 34 | 217 | 129 | |||||||||||||||

| Community relations costs not related to current operations |

1 | 1 | 3 | 6 | ||||||||||||||||

| Project capital expenditures |

7 | 53 | 35 | 192 | 124 | |||||||||||||||

| Rehabilitation - accretion and amortization (non-operating sites) |

8 | 3 | 2 | 16 | 7 | |||||||||||||||

| Non-controlling interest and copper operations |

9 | (6) | (7) | (12) | (38) | |||||||||||||||

| All-in costs |

$ | 1,085 | $ | 1,041 | $ | 3,367 | $ | 3,135 | ||||||||||||

| Ounces sold - equity basis (000s ounces) |

11 | 1,227 | 1,386 | 3,930 | 3,984 | |||||||||||||||

| Cost of sales per ounce |

10 | $ | 820 | $ | 766 | $ | 791 | $ | 803 | |||||||||||

| Cash costs per ounce |

12 | $ | 546 | $ | 518 | $ | 520 | $ | 549 | |||||||||||

| Cash costs per ounce (on a co-product basis) |

11,12 | $ | 565 | $ | 550 | $ | 539 | $ | 575 | |||||||||||

| All-in sustaining costs per ounce |

12 | $ | 772 | $ | 704 | $ | 750 | $ | 730 | |||||||||||

| All-in sustaining costs per ounce (on a co-product basis) |

12,13 | $ | 791 | $ | 736 | $ | 769 | $ | 756 | |||||||||||

| All-in costs per ounce |

12 | $ | 884 | $ | 751 | $ | 856 | $ | 787 | |||||||||||

| All-in costs per ounce (on a co-product basis) |

12,13 | $ | 903 | $ | 783 | $ | 875 | $ | 813 | |||||||||||

| 1 | By-product credits |

| Revenues include the sale of by-products for our gold and copper mines for the three and nine months ended September 30, 2017 of $32 million and $105 million, respectively, (2016: $50 million and $110 million, respectively) and energy sales from the Monte Rio power plant at our Pueblo Viejo mine for the three and nine months ended September 30, 2017 of $nil and $nil, respectively, (2016: $9 million and $33 million, respectively) up until its disposition on August 18, 2016. |

| 2 | Realized (gains)/losses on hedge and non-hedge derivatives |

| Includes realized hedge losses of $8 million and $22 million, respectively, for the three and nine month periods ended September 30, 2017 (2016: $15 million and $59 million, respectively), and realized non-hedge losses of $1 million and gains of $3 million, respectively, for the three and nine month periods ended September 30, 2017 (2016: losses of $nil and $12 million, respectively). Refer to Note 5 to the Financial Statements for further information. |

| 3 | Non-recurring items |

| Non-recurring items in 2016 consist of $34 million in a reduction in cost of sales attributed to insurance proceeds recorded in the third quarter of 2016 related to the 2015 oxygen plant motor failure at Pueblo Viejo and $10 million in abnormal costs at Veladero. These costs are not indicative of our cost of production and have been excluded from the calculation of cash costs. |

| 4 | Other |

| Other adjustments for the three and nine month periods ended September 30, 2017 include adding the net margins related to power sales at Pueblo Viejo of $nil and $nil, respectively, (2016: $1 million and $5 million, respectively), adding the cost of treatment and refining charges of $nil and $1 million, respectively, (2016: $3 million and $12 million, respectively) and the removal of cash costs and by-product credits associated with our Pierina mine, which is mining incidental ounces as it enters closure, of $25 million and $73 million, respectively (2016: $14 million and $42 million, respectively). |

| 5 | Non-controlling interests (Pueblo Viejo and Acacia) |

| Non-controlling interests include non-controlling interests related to gold production of $103 million and $317 million, respectively, for the three and nine month periods ended September 30, 2017 (2016: $124 million and $381 million, respectively). Refer to Note 5 to the Financial Statements for further information. |

| BARRICK THIRD QUARTER 2017 | 12 | PRESS RELEASE |

| 6 | Exploration and evaluation costs |

| Exploration, evaluation and project expenses are presented as minesite sustaining if it supports current mine operations and project if it relates to future projects. Refer to page 30 of Barrick’s third quarter MD&A. |

| 7 | Capital expenditures |

| Capital expenditures are related to our gold sites only and are presented on a 100% accrued basis. They are split between minesite sustaining and project capital expenditures. Project capital expenditures are distinct projects designed to increase the net present value of the mine and are not related to current production. Significant projects in the current year are stripping at Cortez Crossroads, underground development at Cortez Hills Lower Zone and the range front declines, Lagunas Norte Refractory Ore Project and Goldrush. Refer to page 29 of Barrick’s third quarter MD&A. |

| 8 | Rehabilitation—accretion and amortization |

| Includes depreciation on the assets related to rehabilitation provisions of our gold operations and accretion on the rehabilitation provision of our gold operations, split between operating and non-operating sites. |

| 9 | Non-controlling interest and copper operations |

| Removes general & administrative costs related to non-controlling interests and copper based on a percentage allocation of revenue. Also removes exploration, evaluation and project expenses, rehabilitation costs and capital expenditures incurred by our copper sites and the non-controlling interest of our Acacia and Pueblo Viejo operating segments and South Arturo. Figures remove the impact of Pierina. The impact is summarized as the following: |

| ($ millions) | For the three months ended September 30 |

For the nine months ended September 30 |

||||||||||||||

| Non-controlling interest, copper operations and other | 2017 | 2016 | 2017 | 2016 | ||||||||||||

| General & administrative costs | $ | (5 | ) | $ | (8 | ) | $ | (13 | ) | $ | (31 | ) | ||||

| Minesite exploration and evaluation expenses | (6 | ) | (2 | ) | (13 | ) | (6 | ) | ||||||||

| Rehabilitation - accretion and amortization (operating sites) | (2 | ) | (2 | ) | (8 | ) | (5 | ) | ||||||||

| Minesite sustaining capital expenditures | (54 | ) | (63 | ) | (165 | ) | (167 | ) | ||||||||

| All-in sustaining costs total | $ | (67 | ) | $ | (75 | ) | $ | (199 | ) | $ | (209 | ) | ||||

| Project exploration and evaluation and project costs | (3 | ) | (3 | ) | (9 | ) | (8 | ) | ||||||||

| Project capital expenditures | (3 | ) | (4 | ) | (3 | ) | (30 | ) | ||||||||

| All-in costs total |

$ | (6 | ) | $ | (7 | ) | $ | (12 | ) | $ | (38 | ) | ||||

| 10 | Ounces sold - equity basis |

| Figures remove the impact of Pierina as the mine is currently going through closure. |

| 11 | Cost of sales per ounce |

| Figures remove the cost of sales impact of Pierina of $38 million and $119 million, respectively, for the three and nine month periods ended September 30, 2017 (2016: $17 million and $52 million, respectively), as the mine is currently going through closure. Cost of sales per ounce excludes non-controlling interest related to gold production. Cost of sales applicable to gold per ounce is calculated using cost of sales on an attributable basis (removing the non-controlling interest of 40% Pueblo Viejo and 36.1% Acacia from cost of sales), divided by attributable gold ounces. |

| 12 | Per ounce figures |

| Cost of sales per ounce, cash costs per ounce, all-in sustaining costs per ounce and all-in costs per ounce may not calculate based on amounts presented in this table due to rounding. |

| 13 | Co-product costs per ounce |

| Cash costs per ounce, all-in sustaining costs per ounce and all-in costs per ounce presented on a co-product basis removes the impact of by-product credits of our gold production (net of non-controlling interest) calculated as: |

| ($millions) | For the three months ended September 30 |

For the nine months ended September 30 |

||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| By-product credits |

$ | 32 | $ | 59 | $ | 105 | $ | 143 | ||||||||

| Non-controlling interest |

(7 | ) | (14 | ) | (24 | ) | (40 | ) | ||||||||

| By-product credits (net of non-controlling interest) |

$ | 25 | $ | 45 | $ | 81 | $ | 103 | ||||||||

ENDNOTE 5

Includes $105 million of cash, primarily held at Acacia, which may not be readily deployed.

ENDNOTE 6

Amount excludes capital leases and includes Acacia (100% basis).

ENDNOTE 7

“C1 cash costs” per pound and “All-in sustaining costs” per pound are non-GAAP financial performance measures. “C1 cash costs” per pound is based on cost of sales but excludes the impact of depreciation and royalties and includes treatment and refinement charges. “All-in sustaining costs” per pound begins with “C1 cash costs” per pound and adds further costs which reflect the additional costs of operating a mine, primarily sustaining capital expenditures, general & administrative costs and royalties. Barrick believes that the use of “C1 cash costs” per pound and “all-in sustaining costs” per pound will assist investors, analysts, and other stakeholders in understanding the costs associated with producing copper, understanding the economics of copper mining, assessing our operating performance, and also our ability to generate free cash flow from current operations and to generate free cash flow on an overall Company basis. “C1 cash costs” per pound and “All-in sustaining costs” per pound are intended to provide additional information only, do not have any

| BARRICK THIRD QUARTER 2017 | 13 | PRESS RELEASE |

standardized meaning under IFRS, and may not be comparable to similar measures of performance presented by other companies. These measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Further details on these non-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Reconciliation of Copper Cost of Sales to C1 cash costs and All-in sustaining costs, including on a per pound basis

| ($ millions, except per pound information in dollars) | For the three months ended September 30 | For the nine months ended September 30 | ||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Cost of sales |

$108 | $66 | $292 | $235 | ||||||||||||

| Depreciation/amortization |

(26) | (10) | (59) | (30) | ||||||||||||

| Treatment and refinement charges |

44 | 40 | 116 | 124 | ||||||||||||

| Cash cost of sales applicable to equity method investments |

53 | 64 | 170 | 150 | ||||||||||||

| Less: royalties |

(12) | (7) | (27) | (32) | ||||||||||||

| By-product credits |

(1) | — | (4) | — | ||||||||||||

| C1 cash cost of sales |

$166 | $153 | $488 | $447 | ||||||||||||

| General & administrative costs |

3 | — | 9 | 11 | ||||||||||||

| Rehabilitation - accretion and amortization |

4 | 1 | 9 | 5 | ||||||||||||

| Royalties |

12 | 7 | 27 | 32 | ||||||||||||

| Minesite exploration and evaluation costs |

4 | — | 5 | — | ||||||||||||

| Minesite sustaining capital expenditures |

50 | 44 | 137 | 121 | ||||||||||||

| All-in sustaining costs |

$239 | $205 | $675 | $616 | ||||||||||||

| Pounds sold - consolidated basis (millions pounds) |

107 | 102 | 298 | 298 | ||||||||||||

| Cost of sales per pound1,2 |

$1.67 | $1.43 | $1.72 | $1.41 | ||||||||||||

| C1 cash cost per pound1 |

$1.56 | $1.50 | $1.64 | $1.50 | ||||||||||||

| All-in sustaining costs per pound1 |

$2.24 | $2.02 | $2.27 | $2.08 | ||||||||||||

| 1 | Cost of sales per pound, C1 cash costs per pound and all-in sustaining costs per pound may not calculate based on amounts presented in this table due to rounding. |

| 2 | Cost of sales applicable to copper per pound is calculated using cost of sales including our proportionate share of cost of sales attributable to equity method investments (Zaldívar and Jabal Sayid), divided by consolidated copper pounds (including our proportionate share of copper pounds from our equity method investments). |

ENDNOTE 8

Barrick’s share.

ENDNOTE 9

Includes our 60% share of Pueblo Viejo and South Arturo, our 63.9% share of Acacia, our 50% share of Zaldívar and Jabal Sayid and our share of joint operations, including our 50% sale of Veladero from July 1, 2017 onwards.

ENDNOTE 10

For additional detail, see the Technical Report on the Cortez Joint Venture Operations, Lander and Eureka Counties, State of Nevada, USA, dated March 21, 2016, and filed on SEDAR and EDGAR on March 28, 2016.

ENDNOTE 11

For addition detail, see the Technical Report on the Lagunas Norte Mine, La Libertad Region, Peru, dated March 21, 2016, and filed on SEDAR and EDGAR on March 28, 2016.

ENDNOTE 12

Operating unit guidance ranges for production reflect expectations at each individual operating unit, but do not necessarily add up to the corporate-wide guidance range total.

ENDNOTE 13

As at September 30, 2017, utilizing option collar strategies, the Company has protected the downside on approximately 33 million pounds of expected remaining 2017 copper production at an average floor price of $2.39 per pound and can participate in the upside on the same amount up to an average of $2.97 per pound. In addition, the Company has protected the downside on approximately 60 million pounds of expected copper production for the first half of 2018 at an average floor price of $2.83 per pound and can participate in the upside on the same amount up to an average of $3.25 per pound. Our remaining copper production is subject to market prices.

ENDNOTE 14

Due to our hedging activities, which are reflected in these sensitivities, we are partially protected against changes in these factors.

| BARRICK THIRD QUARTER 2017 | 14 | PRESS RELEASE |

Key Statistics

| Barrick Gold Corporation | ||||||||||||||||

| (in United States dollars) | Three months ended September 30, | Nine months ended September 30, | ||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Financial Results (millions) |

||||||||||||||||

| Revenues |

$1,993 | $2,297 | $6,146 | $6,239 | ||||||||||||

| Cost of sales |

1,270 | 1,291 | 3,889 | 3,951 | ||||||||||||

| Net earnings1 |

(11) | 175 | 1,752 | 230 | ||||||||||||

| Adjusted net earnings2 |

186 | 278 | 609 | 563 | ||||||||||||

| Adjusted EBITDA2 |

899 | 1,211 | 2,932 | 2,976 | ||||||||||||

| Total capital expenditures - sustaining3 |

248 | 236 | 830 | 646 | ||||||||||||

| Total project capital expenditures3 |

53 | 35 | 192 | 124 | ||||||||||||

| Net cash provided by operating activities |

532 | 951 | 1,475 | 1,929 | ||||||||||||

| Free cash flow2 |

225 | 674 | 429 | 1,129 | ||||||||||||

| Per share data (dollars) |

||||||||||||||||

| Net earnings (basic and diluted) |

(0.01) | 0.15 | 1.50 | 0.20 | ||||||||||||

| Adjusted net earnings (basic)2 |

$0.16 | $0.24 | $0.52 | $0.48 | ||||||||||||

| Weighted average diluted common shares (millions) |

1,166 | 1,165 | 1,166 | 1,165 | ||||||||||||

| Operating Results |

||||||||||||||||

| Gold production (thousands of ounces)4 |

1,243 | 1,381 | 3,984 | 4,001 | ||||||||||||

| Gold sold (thousands of ounces)4 |

1,227 | 1,386 | 3,930 | 3,984 | ||||||||||||

| Per ounce data |

||||||||||||||||

| Average spot gold price |

$1,278 | $1,335 | $1,251 | $1,260 | ||||||||||||

| Average realized gold price2,4 |

1,274 | 1,333 | 1,250 | 1,259 | ||||||||||||

| Cost of sales (Barrick’s share)4,5 |

820 | 766 | 791 | 803 | ||||||||||||

| All-in sustaining costs2,4 |

$772 | $704 | $750 | $730 | ||||||||||||

| Copper production (millions of pounds)6 |

115 | 100 | 314 | 314 | ||||||||||||

| Copper sold (millions of pounds)6 |

107 | 102 | 298 | 298 | ||||||||||||

| Per pound data |

||||||||||||||||

| Average spot copper price |

$2.88 | $2.16 | $2.70 | $2.14 | ||||||||||||

| Average realized copper price2,6 |

3.05 | 2.18 | 2.81 | 2.17 | ||||||||||||

| Cost of sales (Barrick’s share)6,7 |

1.67 | 1.43 | 1.72 | 1.41 | ||||||||||||

| C1 cash costs2,6 |

1.56 | 1.50 | 1.64 | 1.50 | ||||||||||||

| All-in sustaining costs2,6 |

$2.24 | $2.02 | $2.27 | $2.08 | ||||||||||||

|

As at September 30, |

As at December 31, |

|||||||||||||||

| 2017 | 2016 | |||||||||||||||

| Financial Position (millions) |

||||||||||||||||

| Cash and equivalents |

$2,025 | $2,389 | ||||||||||||||

| Working capital (excluding cash) |

$1,346 | $1,155 | ||||||||||||||

| 1 | Net earnings represents net earnings attributable to the equity holders of the Company. |

| 2 | Adjusted net earnings, adjusted EBITDA, free cash flow, adjusted net earnings per share, realized gold price, all-in sustaining costs and realized copper price are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure to the most directly comparable IFRS measure, please see pages 49 to 63 of this MD&A. |

| 3 | Amounts presented on a consolidated accrued basis. Project capital expenditures are included in our calculation of all-in costs, but not included in our calculation of all-in sustaining costs. |

| 4 | Includes Acacia on a 63.9% basis, Pueblo Viejo on a 60% basis, South Arturo on a 60% basis, and Veladero on a 100% basis up to June 30, 2017 and a 50% basis thereafter, which reflects our equity share of production and sales. 2016 includes production and sales from Bald Mountain and Round Mountain up to January 11, 2016, the effective date of sale of the assets. |

| 5 | Cost of sales per ounce (Barrick’s share) is calculated as cost of sales - gold on an attributable basis excluding Pierina divided by gold ounces sold. |

| 6 | Amounts reflect production and sales from Jabal Sayid and Zaldívar on a 50% basis, which reflects our equity share of production, and Lumwana. |

| 7 | Cost of sales per pound (Barrick’s share) is calculated as cost of sales - copper plus our equity share of cost of sales attributable to Zaldívar and Jabal Sayid divided by copper pounds sold. |

| BARRICK THIRD QUARTER 2017 | 15 | SUMMARY INFORMATION |

Production and Cost Summary

| Production | ||||||||||||||||

| Three months ended September 30, | Nine months ended September 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Gold (equity ounces (000s)) |

||||||||||||||||

| Barrick Nevada1 |

520 | 547 | 1,782 | 1,554 | ||||||||||||

| Pueblo Viejo2 |

154 | 189 | 468 | 511 | ||||||||||||

| Lagunas Norte |

96 | 101 | 274 | 325 | ||||||||||||

| Veladero3 |

99 | 116 | 322 | 367 | ||||||||||||

| Turquoise Ridge |

68 | 72 | 147 | 201 | ||||||||||||

| Acacia4 |

122 | 131 | 396 | 394 | ||||||||||||

| Other Mines - Gold5 |

184 | 225 | 595 | 649 | ||||||||||||

| Total |

1,243 | 1,381 | 3,984 | 4,001 | ||||||||||||

| Copper (equity pounds (millions))6 |

115 | 100 | 314 | 314 | ||||||||||||

| Cost of Sales per unit (Barrick’s share) |

||||||||||||||||

| Three months ended September 30, | Nine months ended September 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Gold Cost of Sales per ounce ($/oz)7 |

||||||||||||||||

| Barrick Nevada |

$ | 762 | $ | 838 | $ | 791 | $ | 881 | ||||||||

| Pueblo Viejo |

717 | 514 | 661 | 609 | ||||||||||||

| Lagunas Norte |

612 | 658 | 601 | 662 | ||||||||||||

| Veladero |

1,187 | 912 | 878 | 860 | ||||||||||||

| Turquoise Ridge |

755 | 558 | 740 | 605 | ||||||||||||

| Acacia |

808 | 840 | 796 | 861 | ||||||||||||

| Total |

$ | 820 | $ | 766 | $ | 791 | $ | 803 | ||||||||

| Copper Cost of Sales per pound ($/lb)8 |

$ | 1.67 | $ | 1.43 | $ | 1.72 | $ | 1.41 | ||||||||

| All-in sustaining costs9 |

||||||||||||||||

| Three months ended September 30, | Nine months ended September 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

|

Gold All-in Sustaining Costs ($/oz) |

||||||||||||||||

| Barrick Nevada1 |

$ | 597 | $ | 611 | $ | 603 | $ | 613 | ||||||||

| Pueblo Viejo2 |

604 | 425 | 536 | 509 | ||||||||||||

| Lagunas Norte |

470 | 530 | 457 | 557 | ||||||||||||

| Veladero3 |

890 | 651 | 1,000 | 693 | ||||||||||||

| Turquoise Ridge |

793 | 583 | 788 | 631 | ||||||||||||

| Acacia4 |

939 | 998 | 907 | 961 | ||||||||||||

| Total |

$ | 772 | $ | 704 | $ | 750 | $ | 730 | ||||||||

|

Copper All-in Sustaining Costs ($/lb)6 |

$ | 2.24 | $ | 2.02 | $ | 2.27 | $ | 2.08 | ||||||||

| 1 | Reflects production and sales from Goldstrike, Cortez, and South Arturo on a 60% basis, which reflects our equity share. |

| 2 | Reflects production and sales from Pueblo Viejo on a 60% basis, which reflects our equity share. |

| 3 | Reflects production and sales from Veladero on a 100% basis up to June 30, 2017 and a 50% basis thereafter, which reflects our equity share. |

| 4 | Reflects production and sales from Acacia on a 63.9% basis, which reflects our equity share. |

| 5 | In 2017, Other Mines - Gold includes Golden Sunlight, Hemlo, Porgera on a 47.5% basis and Kalgoorlie on a 50% basis. In 2016, Other Mines - Gold includes Golden Sunlight, Hemlo, Porgera on a 47.5% basis, Kalgoorlie on a 50% basis and production from Bald Mountain and Round Mountain up to January 11, 2016, the effective date of sale of the assets. |

| 6 | Reflects production and sales from Lumwana, Jabal Sayid and Zaldívar on a 50% basis, which reflects our equity share. |

| 7 | Cost of sales per ounce (Barrick’s share) is calculated as cost of sales - gold on an attributable basis excluding Pierina divided by gold equity ounces sold. |

| 8 | Cost of sales per pound (Barrick’s share) is calculated as cost of sales - copper plus our equity share of cost of sales attributable to Zaldívar and Jabal Sayid divided by copper pounds sold. |

| 9 | All-in sustaining costs is a non-GAAP financial performance measure with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of this non-GAAP measure to the most directly comparable IFRS measure, please see pages 49 to 63 of our third quarter MD&A. |

| BARRICK THIRD QUARTER 2017 | 16 | SUMMARY INFORMATION |

MANAGEMENT’S DISCUSSION AND ANALYSIS (“MD&A”)

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

| BARRICK THIRD QUARTER 2017 | 17 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK THIRD QUARTER 2017 | 18 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK THIRD QUARTER 2017 | 19 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

OVERVIEW

Financial and Operating Highlights

| ($ millions, except per share amounts in dollars) | For the three months ended September 30 |

For the nine months ended September 30 |

||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Net earnings (loss) attributable to equity holders of the Company |

$ | (11) | $ | 175 | $ | 1,752 | $ | 230 | ||||||||

| Per share (dollars)1 |

(0.01) | 0.15 | 1.50 | 0.20 | ||||||||||||

| Adjusted net earnings2 |

186 | 278 | 609 | 563 | ||||||||||||

| Per share (dollars)1,2 |

0.16 | 0.24 | 0.52 | 0.48 | ||||||||||||

| Operating cash flow |

532 | 951 | 1,475 | 1,929 | ||||||||||||

| Free cash flow2 |

$ | 225 | $ | 674 | $ | 429 | $ | 1,129 | ||||||||

| 1 | Calculated using weighted average number of shares outstanding under the basic method of earnings per share of 1,166 million shares for the three and nine months ended September 30, 2017 (2016: 1,165 million shares). |

| 2 | Adjusted net earnings and free cash flow are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures of performance presented by other issuers. For further information and a detailed reconciliation of the non-GAAP measures used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 49 to 63 of this MD&A. |

| BARRICK THIRD QUARTER 2017 | 20 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Net Earnings, Adjusted Net Earnings, Operating Cash Flow and Free Cash Flow

Factors affecting net earnings and adjusted net earnings1 - three months ended September 30, 2017

| 1 | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures of performance presented by other issuers. For further information and a detailed reconciliation of the non-GAAP measures used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 49 to 63 of this MD&A. |

| 2 | Primarily consists of earnings from equity investees (~$28 million) and finance costs (~$20 million). |

| 3 | Estimated impact of foreign exchange. |

Net earnings attributable to equity holders of Barrick (“net earnings”) for the third quarter of 2017 were a net loss of $11 million compared with net earnings of $175 million in the same prior year period. The decrease was due to lower revenues attributed to the decrease in gold sales volume, mainly due to lower grades at Pueblo Viejo, Hemlo and Lagunas Norte and the Tanzanian concentrate export ban, and market gold prices which were $57 per ounce lower compared to the prior year period. We had higher debt extinguishment costs associated with our $1 billion of debt repayments in the third quarter of 2017 combined with higher direct mining costs, higher exploration and evaluation costs and higher depreciation expense. We also recognized a $172 million tax provision relating to the impact of the proposed framework for Acacia operations in Tanzania. These decreases in net earnings were partially offset by higher earnings from equity investees and a decrease in interest expense associated with debt repayments. After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 were $186 million in the third quarter of 2017, 33% lower than the same prior year period.

Significant adjusting items (pre-tax and non-controlling interest effects) in the third quarter of 2017 include:

| ● | $101 million in losses on debt extinguishment; and |

| ● | $172 million in a tax provision relating to the impact of the proposed framework for Acacia operations in Tanzania; partially offset by; |

| ● | $93 million in tax effects and non-controlling interest impact mainly in relation to the two adjustments discussed above. |

Refer to page 50 for a full list of reconciling items between net earnings and adjusted net earnings for the current and prior year periods.

| BARRICK THIRD QUARTER 2017 | 21 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Factors affecting net earnings and adjusted net earnings1 - nine months ended September 30, 2017

| 1 | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures of performance presented by other issuers. For further information and a detailed reconciliation of the non-GAAP measures used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 49 to 63 of this MD&A. |

| 2 | Primarily consists of earnings from equity investees (~$45 million) and finance costs (~$27 million). |

| 3 | Estimated impact of foreign exchange. |

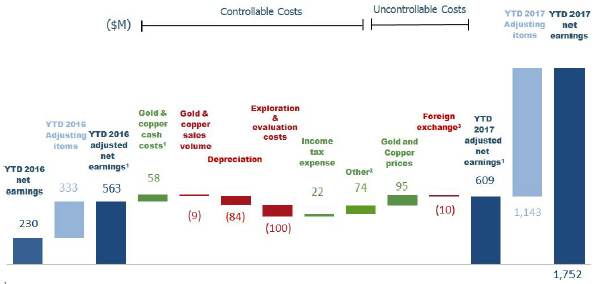

Net earnings for the nine months ended September 30, 2017 were $1,752 million compared with $230 million in the same prior year period. The significant increase was primarily due to a $1,120 million impairment reversal ($518 million net of tax and non-controlling interest) recorded in the first quarter of 2017 as a result of the indicative fair value of the Cerro Casale project related to our divestment of 25% of the project. This was combined with a $689 million ($686 million net of tax and non-controlling interest) gain on the sale of a 50% interest in the Veladero mine and a $193 million ($192 million net of tax and non-controlling interest) gain on the sale of a 25% interest in the Cerro Casale project during the second quarter of 2017. Partially offsetting these increases in net earnings was an increase in income tax expense. After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $609 million in the nine months ended September 30, 2017 were 8% higher than the same prior year period. The increase in adjusted net earnings was primarily due to an increase in copper prices, combined with reduced interest expense associated with debt repayments, as well as lower direct mining costs driven by sales mix with higher sales volume from the lower cost Barrick Nevada and lower relative sales volume from Hemlo and Acacia. This was further positively impacted by higher capitalized waste stripping costs at Barrick Nevada, and negatively impacted by an increase in exploration and evaluation costs and higher depreciation expense.

Significant adjusting items (pre-tax and non-controlling interest effects) in the nine months ended September 30, 2017 include:

| ● | $1,128 million in net impairment reversals primarily as a result of the indicative fair value of the Cerro Casale project related to our divestment of 25%; |

| ● | $689 million in a gain relating to the sale of a 50% interest in the Veladero mine; |

| ● | $193 million in a gain related to the sale of a 25% interest in the Cerro Casale project; partially offset by |

| ● | $500 million in tax effects and non-controlling interest impact mainly in relation to the Cerro Casale impairment reversal discussed above; |

| ● | $172 million in a tax provision relating to the impact of the proposed framework for Acacia operations in Tanzania; |

| ● | $127 million in losses on debt extinguishment; and |

| ● | $60 million in foreign currency translation losses primarily related to the devaluation of the Argentine Peso on VAT receivables. |

Refer to page 50 for a full list of reconciling items between net earnings and adjusted net earnings for the current and prior year periods.

| BARRICK THIRD QUARTER 2017 | 22 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Factors affecting Operating Cash Flow and Free Cash Flow1 - three months ended September 30, 2017

| 1 | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures of performance presented by other issuers. For further information and a detailed reconciliation of the non-GAAP measures used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 49 to 63 of this MD&A. |

| 2 | Other primarily includes the negative impacts on free cash flow attributable to non-controlling interest (~$95 million) combined with an increase in legal costs (~$10 million) and in reclamation payments (~$5 million). |

In the third quarter of 2017, we generated $532 million in operating cash flow, compared to $951 million in the same prior year period. The decrease of $419 million was primarily due to lower gold sales resulting from lower grades at Pueblo Viejo, Hemlo and Lagunas Norte, and the Tanzanian concentrate export ban and related buildup of inventory at Acacia. This was combined with higher cash taxes paid mainly related to income tax refunds received in the third quarter of 2016, as well as higher direct mining costs as discussed previously. Operating cash flow was further negatively impacted by cash flows attributable to non-controlling interest, combined with an increase in exploration, evaluation and project expenses and the impact of lower gold prices.

Free cash flow1 for the third quarter of 2017 was $225 million compared to $674 million in the same prior year period. The decrease primarily reflects lower operating cash flows combined with higher capital expenditures. In the third quarter of 2017 capital expenditures on a cash basis were $307 million compared to $277 million in the third quarter of 2016. The increase in capital expenditures of $30 million is primarily due to a planned $27 million increase in project capital expenditures primarily at Barrick Nevada relating to the development of Crossroads and Cortez Hills Lower Zone, and the Goldrush project, partially offset by a decrease in pre-production stripping at the South Arturo pit, which entered commercial production in August 2016. The increase in capital expenditures was also impacted by an increase in minesite sustaining capital expenditures at Barrick Nevada relating to higher capitalized stripping costs and the timing of a greater number of minesite sustaining projects, as well as greater spending at Veladero relating to phases 4B and 5B of the leach pad expansion and additional equipment purchases.

The free cash flow1 generated in the third quarter of 2017 was combined with existing cash balances, including the $960 million proceeds from the sale of a 50% interest in Veladero in the second quarter of 2017, to repay approximately $1 billion in debt in the third quarter of 2017. This allowed us to fully achieve our 2017 debt reduction target, reducing total debt by $1.5 billion for the year to date.

| BARRICK THIRD QUARTER 2017 | 23 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Factors affecting Operating Cash Flow and Free Cash Flow1 - nine months ended September 30, 2017

| 1 | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures of performance presented by other issuers. For further information and a detailed reconciliation of the non-GAAP measures used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 49 to 63 of this MD&A. |

| 2 | Other primarily includes the negative impacts on free cash flow attributable to non-controlling interest (~$100 million) combined with an increase in legal costs (~$20 million) and the change in VAT balances (~$25 million). |

In the nine months ended September 30, 2017, we generated $1,475 million in operating cash flow, compared to $1,929 million in the same prior year period. The decrease of $454 million was primarily due to higher cash taxes paid during the second quarter of 2017 at Pueblo Viejo compared to the same prior year period as we made our final 2016 tax payment and our first tax payment for 2017. This decrease in operating cash flows was combined with the buildup of working capital, specifically inventory balances at Acacia resulting from the Tanzania concentrate export ban, as well as an increase in exploration, evaluation and project expenses. This decrease was partially offset by higher copper prices and lower direct mining costs, as discussed in the above discussion of net earnings.

Free cash flow1 for the nine months ended September 30, 2017 was $429 million compared to $1,129 million in the same prior year period. The decrease primarily reflects lower operating cash flows combined with higher capital expenditures. In the nine months ended September 30, 2017, capital expenditures on a cash basis were $1,046 million compared to $800 million in the nine months ended September 30, 2016. The increase in capital expenditures of $246 million is primarily due to a planned increase in minesite sustaining capital expenditures at Barrick Nevada relating to higher capitalized stripping costs and the timing of a greater number of minesite sustaining projects in the current period, as well as greater spending at Veladero relating to phase 4B and 5B of the leach pad expansion and equipment purchases. The increase in capital expenditures was also impacted by a $69 million increase in project capital expenditures primarily at Barrick Nevada relating to the development of Crossroads and Cortez Hills Lower Zone, and the Goldrush project, partially offset by a decrease in pre-production stripping at the South Arturo pit, which entered commercial production in August 2016.

The free cash flow1 generated in the first nine months of 2017 was combined with existing cash balances, including the $960 million proceeds from the sale of a 50% interest in Veladero in the second quarter of 2017, to repay approximately $1.5 billion in debt in the first nine months of 2017. This allowed us to fully achieve our 2017 debt reduction target in the third quarter of 2017.

| BARRICK THIRD QUARTER 2017 | 24 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK THIRD QUARTER 2017 | 25 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK THIRD QUARTER 2017 | 26 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK THIRD QUARTER 2017 | 27 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK THIRD QUARTER 2017 | 28 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK THIRD QUARTER 2017 | 29 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK THIRD QUARTER 2017 | 30 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK THIRD QUARTER 2017 | 31 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

FINANCIAL CONDITION REVIEW

Summary Balance Sheet and Key Financial Ratios

| ($ millions, except ratios and share amounts) | As at September 30, 2017 | As at December 31, 2016 | ||||||

| Total cash and equivalents |

$ | 2,025 | $ | 2,389 | ||||

| Current assets |

2,717 | 2,485 | ||||||

| Non-current assets |

20,330 | 20,390 | ||||||

| Total Assets |

$ | 25,072 | $ | 25,264 | ||||

| Current liabilities excluding short-term debt |

$ | 1,675 | $ | 1,676 | ||||

| Non-current liabilities excluding long-term debt1 |

5,328 | 5,344 | ||||||

| Debt (current and long-term) |

6,447 | 7,931 | ||||||

| Total Liabilities |

$ | 13,450 | $ | 14,951 | ||||

| Total shareholders’ equity |

9,614 | 7,935 | ||||||

| Non-controlling interests |

2,008 | 2,378 | ||||||

| Total Equity |

$ | 11,622 | $ | 10,313 | ||||

| Total common shares outstanding (millions of shares)2 |

1,166 | 1,166 | ||||||

| Key Financial Ratios: |

||||||||

| Current ratio3 |

2.73:1 | 2.68:1 | ||||||

| Debt-to-equity4 |

0.55:1 | 0.77:1 | ||||||

| 1 | Non-current financial liabilities as at September 30, 2017 were $6,608 million (December 31, 2016: $8,002 million). |

| 2 | Total common shares outstanding do not include 1.2 million stock options. |

| 3 | Represents current assets divided by current liabilities (including short-term debt) as at September 30, 2017 and December 31, 2016. |

| 4 | Represents debt divided by total shareholders’ equity (including minority interest) as at September 30, 2017 and December 31, 2016. |

| BARRICK THIRD QUARTER 2017 | 32 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK THIRD QUARTER 2017 | 33 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

OPERATING SEGMENTS PERFORMANCE

Review of Operating Segments Performance

| BARRICK THIRD QUARTER 2017 | 34 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Barrick Nevada1, Nevada USA

| Summary of Operating and Financial Data | For the three months ended September 30 | For the nine months ended September 30 | ||||||||||||||||||||||

| 2017 | 2016 | % Change | 2017 | 2016 | % Change | |||||||||||||||||||

| Total tonnes mined (000s) |

52,650 | 48,414 | 9% | 158,304 | 148,071 | 7% | ||||||||||||||||||

| Open pit |

51,950 | 47,697 | 9% | 156,168 | 145,967 | 7% | ||||||||||||||||||

| Underground |

700 | 717 | (2)% | 2,136 | 2,104 | 2% | ||||||||||||||||||

| Average grade (grams/tonne) |

||||||||||||||||||||||||

| Open pit mined |

2.61 | 1.59 | 64% | 2.82 | 1.54 | 83% | ||||||||||||||||||

| Underground mined |

11.04 | 11.26 | (2)% | 10.67 | 11.81 | (10)% | ||||||||||||||||||

| Processed |

3.47 | 2.48 | 40% | 3.47 | 2.59 | 34% | ||||||||||||||||||

| Ore tonnes processed (000s) |

5,747 | 8,677 | (34)% | 18,550 | 24,520 | (24)% | ||||||||||||||||||

| Oxide mill |

1,175 | 1,103 | 7% | 3,472 | 3,071 | 13% | ||||||||||||||||||

| Roaster |

1,217 | 1,264 | (4)% | 3,560 | 3,580 | (1)% | ||||||||||||||||||

| Autoclave |

993 | 937 | 6% | 3,173 | 2,502 | 27% | ||||||||||||||||||

| Heap leach |

2,362 | 5,373 | (56)% | 8,345 | 15,367 | (46)% | ||||||||||||||||||

| Gold produced (000s/oz) |

520 | 547 | (5)% | 1,782 | 1,554 | 15% | ||||||||||||||||||

| Oxide mill |