Exhibit 99.1

FIRST QUARTER REPORT 2017

All amounts expressed in U.S. dollars unless otherwise indicated

Barrick Reports First Quarter 2017 Results

| • | Barrick reported first quarter net earnings attributable to equity holders (“net earnings”) of $679 million ($0.58 per share), and adjusted net earnings1 of $162 million ($0.14 per share). |

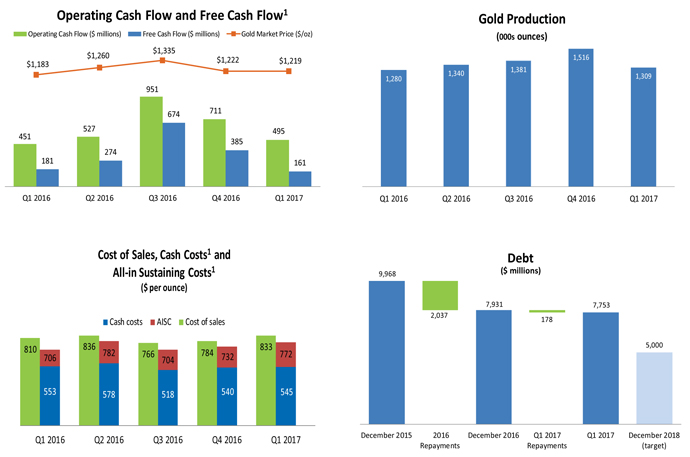

| • | The Company reported first quarter revenues of $1.99 billion, net cash provided by operating activities (“operating cash flow”) of $495 million, and free cash flow2 of $161 million. |

| • | Gold production in the first quarter was 1.31 million ounces, at a cost of sales applicable to gold of $833 per ounce, and all-in sustaining costs3 of $772 per ounce. |

| • | We announced a Strategic Cooperation Agreement with Shandong Gold, including the sale of 50 percent of Veladero for $960 million. As a next step, both companies will jointly explore the potential development of Pascua-Lama, and will evaluate additional investment opportunities. |

| • | We further optimized our portfolio through the creation of a new joint venture with Goldcorp at the Cerro Casale project. |

| • | Total debt was reduced by $178 million in the first quarter. |

| • | Full-year gold production is now expected to be 5.3-5.6 million ounces, down from our previous range of 5.6-5.9 million ounces. Approximately two-thirds of this reduction is attributable to the anticipated sale of 50 percent of Veladero. Cost of sales and all-in sustaining cost guidance for the full year remains unchanged. |

| • | A comprehensive plan to strengthen and improve the Veladero mine’s operating systems is now under review by federal and provincial authorities in Argentina. Our adjusted guidance assumes normal leaching activities will resume in June, pending government approval and the lifting of judicial restrictions. |

| • | Barrick will hold its first Sustainability Briefing for investors on May 9, 2017. Visit www.barrick.com for webcast information. |

TORONTO, April 24, 2017 — Barrick Gold Corporation (NYSE:ABX)(TSX:ABX) (“Barrick” or the “Company”) today reported strong first quarter results, with operating cash flow of $495 million, free cash flow2 of $161 million, and production and costs in line with expectations. Our focus remains on maintaining and growing industry-leading margins, driven by innovation and our digital transformation, managing our portfolio and allocating capital and talent with discipline and rigor, and leveraging our distinctive partnership culture as a competitive advantage.

Reflecting our focus on operational excellence and Best-in-Class performance, the integration of our Cortez and Goldstrike mines in Nevada is on track, with stronger-than-anticipated first quarter results and the accelerated rollout of digital mining solutions. Higher capital expenditures in the first quarter were in line with plan, and underscore our commitment to disciplined investment in 2017, as we re-

invest in our business to deliver high margin ounces and growth in free cash flow per share over the long term.

We further optimized our portfolio through the creation of distinctive new partnerships. In early April, we announced a partnership with Shandong Gold Group that will help us generate more value from the Veladero mine in the short term, while potentially unlocking the untapped mineral wealth of the El Indio Belt in Argentina and Chile over the long term. In addition, we announced the creation of a new joint venture with Goldcorp at the Cerro Casale project in Chile, and new exploration partnerships with ATAC Resources and Osisko Mining, opening up new avenues to grow the long-term value of our portfolio.

FINANCIAL HIGHLIGHTS

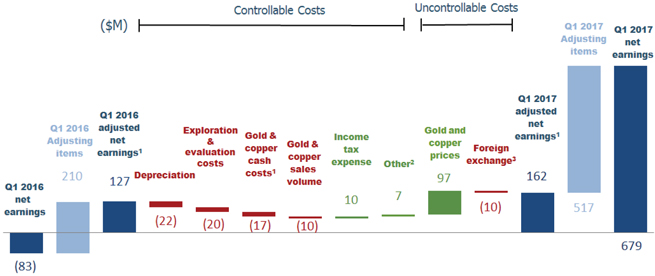

First quarter net earnings were $679 million ($0.58 per share), compared to a net loss of $83 million ($0.07 per share) in the prior-year period. A significant improvement in net earnings was largely due to approximately $1.125 billion of net impairment reversals ($522 million net of tax effect and non-controlling interest) recorded in the first quarter of 2017, reflecting the indicative fair value of the Cerro Casale project resulting from our divestment of 25 percent, and the associated partnership agreement with Goldcorp. Net earnings also benefited from lower currency translation losses compared to the first quarter of 2016, when the Company recorded $91 million of currency translation losses, primarily related to Australian entities.

Adjusted net earnings1 for the first quarter were $162 million ($0.14 per share), compared to $127 million ($0.11 per share) in the prior-year period. Higher adjusted net earnings reflect the impact of higher gold and copper prices, partially offset by higher depreciation, higher exploration and evaluation expenses, and slightly higher direct mining costs.

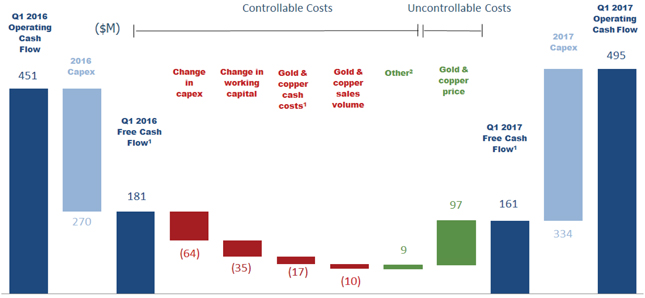

Operating cash flow increased to $495 million, compared to $451 million in the first quarter of 2016. Higher operating cash flow was driven by higher gold and copper prices, as well as lower interest payments, reflecting the impact of significant debt reduction completed over the past year. These favorable movements were partially offset by unfavorable working capital movements compared to the prior-year period. Free cash flow2 for the first quarter was $161 million, compared to $181 million in the first quarter of 2016. Lower free cash flow primarily reflects higher planned sustaining capital expenditures in the first quarter (see page 3 for details), as well as increased project spending at Barrick Nevada, primarily related to the development of Crossroads and the Cortez Hills lower zone, in addition to Goldrush project expenditures. These increases were partially offset by higher operating cash flow.

RESTORING A STRONG BALANCE SHEET

Achieving and maintaining a strong balance sheet remains a top priority. We intend to reduce our total debt from $7.9 billion at the start of 2017, to $5 billion by the end of 2018—half of which we are targeting this year. We will achieve this by using cash flow from operations, further portfolio optimization, and the creation of new joint ventures and partnerships.

In the first quarter, total debt was reduced by $178 million. In early April, the company announced the sale of 50 percent of the Veladero mine in Argentina to Shandong Gold for $960 million, the majority of which will be allocated to debt reduction.

| BARRICK FIRST QUARTER 2017 | 2 | PRESS RELEASE |

At the end of the first quarter, Barrick had a consolidated cash balance of approximately $2.3 billion.4 The Company now has less than $100 million in debt due before 2019. 5 About $5 billion, or 64 percent of our outstanding total debt of $7.8 billion, does not mature until after 2032.

OPERATING HIGHLIGHTS AND OUTLOOK

Barrick produced 1.31 million ounces of gold in the first quarter at a cost of sales of $833 per ounce, in line with plan. This compares to 1.28 million ounces at a cost of sales of $810 per ounce in the prior-year period.

All-in sustaining costs3 in the first quarter were $772 per ounce, compared to $706 per ounce in the first quarter of 2016. Approximately 90 percent of this increase, or roughly $58 per ounce, is a result of higher sustaining capital expenditures compared to the prior-year period. Significant items in the first quarter included planned capitalized stripping at Barrick Nevada, increased expenditures at Veladero relating to phase 4B and 5B of the leach pad, and other equipment purchases. Over the same period, cash costs3 decreased, from $553 per ounce in the first quarter of 2016 to $545 per ounce in the first quarter of 2017.

Gold production in the first quarter was impacted by the timing of autoclave maintenance at the Pueblo Viejo mine in the Dominican Republic. Heavy rains, road closures. and power outages associated with the El Niño weather pattern also impacted production at the Lagunas Norte mine in Peru. Both operations remain on track to achieve their original full-year production guidance.

The Company produced 95 million pounds of copper in the first quarter, at a cost of sales of $1.73 per pound, and all-in sustaining costs6 of $2.19 per pound. This compares to 111 million pounds, at a cost of sales of $1.34 per pound, and all-in sustaining costs6 of $1.97 per pound in the first quarter of 2016. Lower copper production in the first quarter was primarily the result of lower production at the Lumwana mine in Zambia, as a result of lower tonnes processed, combined with lower grades.

Please see page 29 of Barrick’s first quarter MD&A for individual operating segment performance details.

We now expect full-year gold production of 5.3-5.6 million ounces, down from our previous range of 5.6-5.9 million ounces. A significant portion of this reduction is attributable to the anticipated sale of 50 percent of Veladero, which is expected to close at the end of the second quarter. Our updated guidance assumes no change to Acacia’s full-year guidance as a result of the export ban on concentrates currently affecting Acacia’s operations in Tanzania. It also assumes the resumption of normal processing activities at Veladero in June, subject to government approval of proposed modifications to the mine’s operating systems (see Page 4 – Veladero Update).

We continue to expect full-year cost of sales attributable to gold to be $780-$820 per ounce, and all-in sustaining costs3 of $720-$770 per ounce.

Our copper production guidance for 2017 is unchanged at 400-450 million pounds, at a cost of sales applicable to copper between $1.50-1.70 per pound, and all-in sustaining costs6 of $2.10-$2.40 per pound.

Please see Appendix 1 of this press release for individual mine site guidance updates.

| BARRICK FIRST QUARTER 2017 | 3 | PRESS RELEASE |

| Gold

|

First Quarter

|

Current

|

Original

|

|||||||||

| Production7 (000s of ounces) |

1,309 | 5,300-5,600 | 5,600-5,900 | |||||||||

| Cost of sales applicable to gold ($ per ounce) |

833 | 780-820 | 780-820 | |||||||||

| All-in sustaining costs3 ($ per ounce) |

772 | 720-770 | 720-770 | |||||||||

| Copper

|

||||||||||||

| Production7 (millions of pounds) |

95 | 400-450 | 400-450 | |||||||||

| Cost of sales applicable to copper ($ per pound) |

1.73 | 1.50-1.70 | 1.50-1.70 | |||||||||

| All-in sustaining costs6 ($ per pound)

|

|

2.19

|

|

|

2.10-2.40

|

|

|

2.10-2.40

|

| |||

| Total Capital Expenditures8 ($ millions)

|

|

310

|

|

|

1,300-1,500

|

|

|

1,300-1,500

|

| |||

Veladero Update

On March 28, a coupling on a pipe carrying gold-bearing solution at the Veladero mine heap leach facility failed. Solution released from the rupture was contained within the operating site and did not result in any impact to the environment or people. The Company promptly notified San Juan provincial authorities, who inspected the site on March 29. On March 30, the Government of San Juan province temporarily restricted the addition of cyanide to the Veladero mine’s heap leach facility, pending the completion of works to strengthen and improve the mine’s operating systems.

Barrick presented its proposed work plan to San Juan provincial authorities on April 21, following extensive consultation with both federal and provincial officials and regulators. The provincial government has indicated it will take approximately two weeks to review the Company’s proposals, a process that will also include federal authorities, including the national Ministry of Environment and Sustainable Development. Initial work on the proposed modifications to the heap leach facility has already begun, concurrent with the review by provincial and federal authorities. Our updated guidance assumes a resumption of normal leaching activities at the mine in June, subject to approval by the Government of San Juan province, the lifting of operating restrictions by the San Juan provincial court, and the resolution of regulatory and legal matters by the federal and provincial courts (for more information about these matters, please see Note 17 “Contingencies” of Barrick’s first quarter financial statements and the notes thereto). This assumption is based on our assessment of the time required to complete the proposed modifications to the leach pad. The timing of approval for the resumption of leaching activities will depend on the actual progress of work, any potential new requirements, and a final evaluation of the completed modifications by provincial authorities. In parallel with the submission of a new technical plan for the operation, Barrick has also presented an updated community investment and engagement plan to the Government of San Juan and federal authorities for review.

On a 100 percent basis, we now expect full-year production at Veladero of 630,000-730,000 ounces of gold, at a cost of sales of $740-$790 per ounce, and all-in sustaining costs3 of $890-$990 per ounce. Barrick’s share of full-year production, assuming 50 percent ownership from July 1, is expected to be 430,000-480,000 ounces of gold. This compares to our original 2017 guidance of 770,000-830,000 ounces (100 percent basis), at a cost of sales of $750-$800 per ounce, and all-in sustaining costs3 of $840-$940 per ounce.

| BARRICK FIRST QUARTER 2017 | 4 | PRESS RELEASE |

PORTFOLIO OPTIMIZATION AND PARTNERSHIPS

The creation of new partnerships and joint ventures is a core element of our strategy to grow free cash flow per share over the long term. So far this year, we have entered into four new partnerships in support of this long-term strategy.

Strategic Cooperation Agreement with Shandong

On April 6, Barrick announced that it had entered into a strategic cooperation agreement with Shandong Gold Group Co., Ltd., the leading underground mining company in China, based in Jinan, Shandong province. As a first step in the new partnership, Shandong Gold Mining Co., Ltd, the listed company of Shandong Gold Group, will acquire 50 percent of Barrick’s Veladero mine in San Juan province, Argentina, for $960 million. As a second step, Barrick and Shandong will form a working group to explore the joint development of the Pascua-Lama deposit. As a third step, both companies will evaluate additional investment opportunities on the highly prospective El Indio Gold Belt on the border of Argentina and Chile, which hosts a cluster of world-class gold mines and projects including Veladero, Pascua-Lama, and Alturas. The transaction is expected to close at the end of the second quarter.

Cerro Casale Joint Venture

On March 28, Barrick announced that it has reached an agreement with Goldcorp Inc. to form a new partnership at the Cerro Casale Project in Chile. Under the terms of the agreement, Goldcorp has agreed to purchase a 25 percent interest in Cerro Casale from Barrick, as well as Kinross Gold Corporation’s 25 percent interest, resulting in a 50/50 joint venture between Barrick and Goldcorp. The agreement brings a fresh perspective to the project, along with the potential for synergies in the district. It also allows us to direct capital elsewhere in our portfolio, while ensuring Barrick shareholders retain exposure to the optionality associated with one of the largest undeveloped gold and copper deposits in the world. The resulting increase in carrying value illustrates how Barrick’s partnership approach is surfacing value associated with otherwise dormant options within our asset portfolio.

ATAC Resources Exploration Earn-In and Private Placement

On April 10, ATAC Resources announced that it had reached an earn-in agreement with Barrick at ATAC’s Orion project in the Yukon, Canada. The Orion Project hosts the Orion and Anubis Carlin-type gold discoveries, in addition to eight other early stage Carlin-type gold prospects. These form part of the largest Carlin-type mineralized system in North America outside of Nevada. Barrick has extensive experience and expertise with Carlin-type deposits in Nevada. Barrick has the option to spend C$35 million over five years to acquire a 60 percent interest in the project, after which the companies would form a joint venture. We will then have the option to earn an additional 10 percent by spending a further C$20 million at the project. Barrick will also purchase ATAC common shares through a charity flow-through private placement for a total cost to Barrick of C$6.3 million, increasing Barrick’s shareholding in ATAC from approximately 9.2 percent to 19.9 percent.

Osisko Mining Exploration Earn-In

On March 27, Osisko Mining Inc. announced that it had commenced its previously announced earn-in agreement with Barrick on the Kan property in northern Québec. Under the earn-in agreement, Barrick must commit $15 million in exploration expenditures by December 31, 2020, to earn a 70 percent interest in the Kan property, subject to certain annual expenditure thresholds. Following the formation of a joint venture, Barrick may earn a further five percent interest by funding an additional

| BARRICK FIRST QUARTER 2017 | 5 | PRESS RELEASE |

$5 million of project level expenditures. The Labrador Trough in northern Québec is home to numerous well known iron ore deposits and base metal prospects. We believe it has been under appreciated for its gold potential, and could develop into a core mineral district for Barrick. The partnership will leverage the on-the-ground experience and expertise of Osisko in this region, with Barrick Exploration team members embedded at the project.

SUSTAINABILTIY BRIEFING

Barrick will hold its first Sustainability Briefing for investors on Tuesday, May 9. Speakers will include Board Member and Chair of our Corporate Responsibility Committee, Nancy Lockhart, along with our Chief Operating Officer, Chief Sustainability Officer, and other leaders. Please join us for the live webcast from 10 a.m. to 12 p.m. at www.barrick.com.

TECHNICAL INFORMATION

The scientific and technical information contained in this press release has been reviewed and approved by Steven Haggarty, P. Eng., Senior Director, Metallurgy of Barrick, who is a “Qualified Person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects.

| BARRICK FIRST QUARTER 2017 | 6 | PRESS RELEASE |

APPENDIX 1 – Updated 2017 Operating and Capital Expenditure Guidance

GOLD PRODUCTION AND COSTS

| Production (millions of ounces) |

Cost of sales ($ per ounce) |

All-in sustaining costs3 ($ per ounce) |

Cash costs3 ($ per ounce) | |||||

| Barrick Nevada |

2.180-2.260 | 820-860 | 630-680 | 480-510 | ||||

| Pueblo Viejo (60%) |

0.625-0.650 | 650-680 | 540-570 | 420-440 | ||||

| Veladero |

0.430-0.480 | 740-790 | 890-990 | 520-560 | ||||

| Lagunas Norte |

0.380-0.420 | 710-780 | 540-600 | 430-470 | ||||

|

Sub-total |

3.600-3.800 | 770-810 | 650-710 | 470-500 | ||||

| Acacia (63.9%) |

0.545-0.575 | 860-910 | 880-920 | 580-620 | ||||

| KCGM (50%) |

0.360-0.400 | 750-790 | 680-720 | 600-630 | ||||

| Turquoise Ridge (75%) |

0.260-0.280 | 550-600 | 630-710 | 440-470 | ||||

| Porgera (47.5%) |

0.240-0.260 | 780-840 | 900-970 | 650-700 | ||||

| Hemlo |

0.205-0.220 | 830-890 | 890-990 | 660-710 | ||||

| Golden Sunlight |

0.035-0.050 | 900-1,200 | 950-1,040 | 900-950 | ||||

| Total Gold |

5.300-5.6009 | 780-820 | 720-770 | 510-535 | ||||

| COPPER PRODUCTION AND COSTS

| ||||||||

| Production (millions of pounds) |

Cost of sales ($ per pound) |

All-in sustaining costs6 ($ per pound) |

C1 cash costs6 ($ per pound) | |||||

| Zaldívar (50%) |

120-135 | 2.00-2.20 | 1.90-2.10 | ~1.50 | ||||

| Lumwana |

250-275 | 1.20-1.40 | 2.10-2.30 | 1.40-1.60 | ||||

| Jabal Sayid (50%) |

35-45 | 2.10-2.80 | 2.10-2.60 | 1.50-1.90 | ||||

| Total Copper |

400-4509 | 1.50-1.70 | 2.10-2.40 | 1.40-1.60 | ||||

CAPITAL EXPENDITURES

| ($ millions) | ||

| Mine site sustaining |

1,050-1,200 | |

| Project |

250-300 | |

|

Total Capital Expenditures |

1,300-1,500 |

| BARRICK FIRST QUARTER 2017 | 7 | PRESS RELEASE |

APPENDIX 2 – 2017 Outlook Assumptions and Economic Sensitivity Analysis

| 2017 Guidance Assumption |

Hypothetical Change |

Impact on Revenue (millions) |

Impact on Cost of sales (millions) |

Impact on All-in sustaining costs3,6 | ||||||

| Gold revenue, net of royalties |

$1,050/oz | +/- $100/oz | +/- $415 | +/- $11 | +/- $3/oz | |||||

| Copper revenue, net of royalties10 |

$2.25/lb | + $0.50/lb | + $166 | + $11 | + $0.03/lb | |||||

| Copper revenue, net of royalties10 |

$2.25/lb | - $0.50/lb | - $133 | - $9 | - $0.03/lb | |||||

| Gold all-in sustaining costs3 |

||||||||||

| WTI crude oil price11 |

$55/bbl | +/- $10/bbl | n/a | +/- $16 | +/- $4/oz | |||||

| Australian dollar exchange rate |

0.75 : 1 | +/- 10% | n/a | +/- $22 | +/- $5/oz | |||||

| Canadian dollar exchange rate |

1.32 : 1 | +/- 10% | n/a | +/- $25 | +/- $6/oz | |||||

| Copper all-in sustaining costs6 |

||||||||||

| WTI crude oil price11 |

$55/bbl | +/- $10/bbl | n/a | +/- $4 | +/- $0.01/lb | |||||

| Chilean peso exchange rate |

675 : 1 | +/- 10% | n/a | +/- $5 | +/- $0.01/lb |

ENDNOTE 1

“Adjusted net earnings” and “adjusted net earnings per share” are non-GAAP financial performance measures. Adjusted net earnings excludes the following from net earnings: certain impairment charges (reversals) related to intangibles, goodwill, property, plant and equipment, and investments; gains (losses) and other one-time costs relating to acquisitions or dispositions: foreign currency translation gains (losses); significant tax adjustments not related to current period earnings; unrealized gains (losses) on non-hedge derivative instruments; and the tax effect and non-controlling interest of these items. The Company uses this measure internally to evaluate our underlying operating performance for the reporting periods presented and to assist with the planning and forecasting of future operating results. Barrick believes that adjusted net earnings is a useful measure of our performance because these adjusting items do not reflect the underlying operating performance of our core mining business and are not necessarily indicative of future operating results. Adjusted net earnings and adjusted net earnings per share are intended to provide additional information only and do not have any standardized meaning under IFRS and may not be comparable to similar measures of performance presented by other companies. They should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Further details on these non-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Reconciliation of Net Earnings to Net Earnings per Share, Adjusted Net Earnings and Adjusted Net Earnings per Share

| ($ millions, except per share amounts in dollars) | For the three months ended March 31 | |||

|

2017 |

2016 | |||

| Net earnings (loss) attributable to equity holders of the Company |

$679 | $(83) | ||

| Impairment charges (reversals) related to intangibles, goodwill, property, plant and equipment, and investments1 |

(1,125) | 1 | ||

| Acquisition/disposition (gains)/losses |

3 | 8 | ||

| Foreign currency translation (gains)/losses |

3 | 139 | ||

| Significant tax adjustments |

(3) | 51 | ||

| Other expense adjustments |

6 | 68 | ||

| Unrealized gains on non-hedge derivative instruments |

3 | (6) | ||

| Tax effect and non-controlling interest2 |

596 | (51) | ||

| Adjusted net earnings |

$162 | $127 | ||

| Net earnings (loss) per share3 |

0.58 | (0.07) | ||

| Adjusted net earnings per share3 |

0.14 | 0.11 | ||

| 1 | Net impairment reversals for the current year primarily relate to impairment reversals at the Cerro Casale project upon reclassification of the project’s net assets as held-for-sale as at March 31, 2017. |

| 2 | Tax effect and non-controlling interest primarily relates to the impairment reversals at the Cerro Casale project discussed above. |

| 3 | Calculated using weighted average number of shares outstanding under the basic method of earnings per share. |

| BARRICK FIRST QUARTER 2017 | 8 | PRESS RELEASE |

ENDNOTE 2

“Free cash flow” is a non-GAAP financial performance measure which excludes capital expenditures from Net cash provided by operating activities. Barrick believes this to be a useful indicator of our ability to operate without reliance on additional borrowing or usage of existing cash. Free cash flow is intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to similar measures of performance presented by other companies. Free cash flow should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Further details on these non-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow

| ($ millions) | For the three months ended March 31 | |||||

| 2017 | 2016 | |||||

| Net cash provided by operating activities |

$ 495 | $ 451 | ||||

| Capital expenditures |

(334) | (270) | ||||

| Free cash flow |

$ 161 | $ 181 | ||||

ENDNOTE 3

“Cash costs” per ounce and “All-in sustaining costs” per ounce are non-GAAP financial performance measures. “Cash costs” per ounce starts with cost of sales related to gold production, but excludes the impact of depreciation, the non-controlling interest of cost of sales, and includes by-product credits. “All-in sustaining costs” per ounce begin with “Cash costs” per ounce and add further costs which reflect the additional costs of operating a mine, primarily sustaining capital expenditures, general & administrative costs, minesite exploration and evaluation costs, and reclamation cost accretion and amortization. Barrick believes that the use of “cash costs” per ounce and “all-in sustaining costs” per ounce will assist investors, analysts and other stakeholders in understanding the costs associated with producing gold, understanding the economics of gold mining, assessing our operating performance and also our ability to generate free cash flow from current operations and to generate free cash flow on an overall Company basis. “Cash costs” per ounce and “All-in sustaining costs” per ounce are intended to provide additional information only and do not have any standardized meaning under IFRS. Although a standardized definition of all-in sustaining costs was published in 2013 by the World Gold Council (a market development organization for the gold industry comprised of and funded by 18 gold mining companies from around the world, including Barrick), it is not a regulatory organization, and other companies may calculate this measure differently. These measures should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Further details on these non-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Reconciliation of Gold Cost of Sales to Cash costs, All-in sustaining costs and All-in costs, including on a per ounce basis

| ($ millions, except per ounce information in dollars) | For the three months ended March 31 | |||||||

| Footnote | 2017 | 2016 | ||||||

| Cost of sales related to gold production | $ 1,238 | $ 1,202 | ||||||

| Depreciation | (385) | (368) | ||||||

| By-product credits | 1 | (41) | (38) | |||||

| Realized (gains)/losses on hedge and non-hedge derivatives | 2 | - | 31 | |||||

| Non-recurring items | 3 | - | (10) | |||||

| Other | 4 | (20) | (10) | |||||

| Non-controlling interests (Pueblo Viejo and Acacia) | 5 | (81) | (85) | |||||

| Cash costs | $ 711 | $ 722 | ||||||

| General & administrative costs | 72 | 58 | ||||||

| Minesite exploration and evaluation costs | 6 | 7 | 8 | |||||

| Minesite sustaining capital expenditures | 7 | 262 | 175 | |||||

| Rehabilitation - accretion and amortization (operating sites) | 8 | 17 | 17 | |||||

| BARRICK FIRST QUARTER 2017 | 9 | PRESS RELEASE |

|

Non-controlling interest, copper operations and other |

9 | (61) | (56) | |||||

| All-in sustaining costs |

$ 1,008 | $ 924 | ||||||

| Project exploration and evaluation and project costs |

6 | 68 | 47 | |||||

| Community relations costs not related to current operations |

1 | 2 | ||||||

| Project capital expenditures |

7 | 56 | 40 | |||||

| Rehabilitation - accretion and amortization (non-operating sites) |

8 | 3 | 2 | |||||

|

Non-controlling interest and copper operations |

9 | (7) | (17) | |||||

| All-in costs |

$ 1,129 | $ 998 | ||||||

| Ounces sold - equity basis (000s ounces) |

10 | 1,305 | 1,306 | |||||

| Cost of sales per ounce |

11,12 | $833 | $ 810 | |||||

| Cash costs per ounce |

12 | $ 545 | $ 553 | |||||

| Cash costs per ounce (on a co-product basis) |

12,13 | $ 568 | $ 577 | |||||

| All-in sustaining costs per ounce |

12 | $ 772 | $ 706 | |||||

| All-in sustaining costs per ounce (on a co-product basis) |

12,13 | $ 795 | $ 730 | |||||

| All-in costs per ounce |

12 | $ 865 | $ 764 | |||||

| All-in costs per ounce (on a co-product basis) |

12,13 | $ 888 | $ 788 |

| 1 | By-product credits |

Revenues include the sale of by-products for our gold and copper mines for the three months ended March 31, 2017 of $41 million (2016: $28 million) and energy sales from the Monte Rio power plant at our Pueblo Viejo mine for the three months ended March 31, 2017 of $nil (2016: $10 million) up until its disposition on August 18, 2016.

| 2 | Realized (gains)/losses on hedge and non-hedge derivatives |

Includes realized hedge losses of $6 million for the three months ended March 31, 2017 (2016: $24 million), and realized non-hedge gains of $6 million for the three months ended March 31, 2017 (2016: $7 million losses). Refer to Note 5 of the Financial Statements for further information.

| 3 | Non-recurring items |

Non-recurring items in the first quarter of 2016 consist of $10 million in abnormal costs at Veladero relating to the administrative fine in connection with the cyanide incident that occurred in 2015. These costs are not indicative of our cost of production and have been excluded from the calculation of cash costs.

| 4 | Other |

Other adjustments for the three months ended March 31, 2017 include adding the net margins related to power sales at Pueblo Viejo of $nil (2016: $2 million), adding the cost of treatment and refining charges of $1 million (2016: $4 million) and the removal of cash costs and by-product credits associated with our Pierina mine, which is mining incidental ounces as it enters closure, of $21 million (2016: $14 million).

| 5 | Non-controlling interests (Pueblo Viejo and Acacia) |

Non-controlling interests include non-controlling interests related to gold production of $116 million for the three months ended March 31, 2017 (2016: $126 million). Refer to Note 5 of the Financial Statements for further information.

| 6 | Exploration and evaluation costs |

Exploration, evaluation and project expenses are presented as minesite sustaining if it supports current mine operations and project if it relates to future projects. Refer to page 25 of the MD&A accompanying Barrick’s financial statements.

| 7 | Capital expenditures |

Capital expenditures are related to our gold sites only and are presented on a 100% accrued basis. They are split between minesite sustaining and project capital expenditures. Project capital expenditures are distinct projects designed to increase the net present value of the mine and are not related to current production. Significant projects in the current year are stripping at Cortez Crossroads, underground development at Cortez Hills Lower Zone and the range front declines, Lagunas Norte Refractory Ore Project and Goldrush. Refer to page 24 of the MD&A.

| 8 | Rehabilitation - accretion and amortization |

Includes depreciation on the assets related to rehabilitation provisions of our gold operations and accretion on the rehabilitation provision of our gold operations, split between operating and non-operating sites.

| 9 | Non-controlling interest and copper operations |

Removes general & administrative costs related to non-controlling interests and copper based on a percentage allocation of revenue. Also removes exploration, evaluation and project costs, rehabilitation costs and capital expenditures incurred by our copper sites and the non-controlling interest of our Acacia and Pueblo Viejo operating segment and Arturo. Figures remove the impact of Pierina. The impact is summarized as the following:

| ($ millions) | For the three months ended March 31 | |||

| Non-controlling interest, copper operations and other | 2017 | 2016 | ||

| BARRICK FIRST QUARTER 2017 | 10 | PRESS RELEASE |

| General & administrative costs | ($ 9) | ($ 10) | ||||||

| Minesite exploration and evaluation costs | (1) | (2) | ||||||

| Rehabilitation - accretion and amortization (operating sites) | (3) | (2) | ||||||

| Minesite sustaining capital expenditures | (48) | (42) | ||||||

| All-in sustaining costs total | ($ 61) | ($ 56) | ||||||

| Project exploration and evaluation and project costs | (6) | (4) | ||||||

| Project capital expenditures | (1) | (13) | ||||||

| All-in costs total | ($ 7) | ($ 17) |

| 10 | Ounces sold - equity basis |

Figures remove the impact of Pierina as the mine is currently going through closure.

| 11 | Cost of sales per ounce |

Figures remove the cost of sales impact of Pierina of $34 million for the three months ended March 31, 2017 (2016: $19 million), as the mine is currently going through closure. Cost of sales per ounce excludes non-controlling interest related to gold production. Cost of sales related to gold per ounce is calculated using cost of sales on an attributable basis (removing the non-controlling interest of 40% Pueblo Viejo and 36.1% Acacia from cost of sales), divided by attributable gold ounces.

| 12 | Per ounce figures |

Cost of sales per ounce, cash costs per ounce, all-in sustaining costs per ounce and all-in costs per ounce may not calculate based on amounts presented in this table due to rounding.

| 13 | Co-product costs per ounce |

Cash costs per ounce, all-in sustaining costs per ounce and all-in costs per ounce presented on a co-product basis removes the impact of by-product credits of our gold production (net of non-controlling interest) calculated as:

| ($ millions) | For the three months ended March 31 | |||||

| 2017 | 2016 | |||||

| By-product credits |

$ 41 | $ 38 | ||||

| Non-controlling interest |

(8) | (13) | ||||

| By-product credits (net of non-controlling interest) |

$ 33 | $ 25 | ||||

ENDNOTE 4

Includes $598 million of cash primarily held at Acacia and Pueblo Viejo, which may not be readily deployed outside of Acacia and/or Pueblo Viejo.

ENDNOTE 5

Amount excludes capital leases and includes project financing payments at Pueblo Viejo (60 percent basis) and Acacia (100 percent basis).

ENDNOTE 6

“C1 cash costs” per pound and “All-in sustaining costs” per pound are non-GAAP financial performance measures. “C1 cash costs” per pound is based on cost of sales but excludes the impact of depreciation and royalties and includes treatment and refinement charges. “All-in sustaining costs” per pound begins with “C1 cash costs” per pound and adds further costs which reflect the additional costs of operating a mine, primarily sustaining capital expenditures, general & administrative costs and royalties. Barrick believes that the use of “C1 cash costs” per pound and “all-in sustaining costs” per pound will assist investors, analysts, and other stakeholders in understanding the costs associated with producing copper, understanding the economics of copper mining, assessing our operating performance, and also our ability to generate free cash flow from current operations and to generate free cash flow on an overall Company basis. “C1 cash costs” per pound and “All-in sustaining costs” per pound are intended to provide additional information only, do not have any standardized meaning under IFRS, and may not be comparable to similar measures of performance presented by other companies. These measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Further details on these non-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

| BARRICK FIRST QUARTER 2017 | 11 | PRESS RELEASE |

Reconciliation of Copper Cost of Sales to C1 cash costs and All-in sustaining costs, including on a per pound basis

| ($ millions, except per pound information in dollars) | For the three months ended March 31 | |||||

| 2017 | 2016 | |||||

| Cost of sales |

$ 82 | $ 89 | ||||

| Depreciation/amortization1 |

(14) | (11) | ||||

| Treatment and refinement charges |

32 | 46 | ||||

| Cash cost of sales applicable to equity method investments2 |

61 | 41 | ||||

| Less: royalties |

(7) | (14) | ||||

| C1 cash cost of sales |

$ 154 | $ 151 | ||||

| General & administrative costs |

3 | 7 | ||||

| Rehabilitation - accretion and amortization |

2 | 1 | ||||

| Royalties |

7 | 14 | ||||

| Minesite sustaining capital expenditures |

37 | 30 | ||||

| All-in sustaining costs |

$ 203 | $ 203 | ||||

| Pounds sold - consolidated basis (millions pounds) |

93 | 103 | ||||

| Cost of sales per pound3,4 |

$1.73 | $ 1.34 | ||||

| C1 cash cost per pound3 |

$1.65 | $ 1.47 | ||||

| All-in sustaining costs per pound3 |

$2.19 | $1.97 | ||||

| 1 | For the three months ended March 31, 2017, depreciation excludes $18 million (2016: $8 million) of depreciation applicable to equity method investments. |

| 2 | For the three months ended March 31, 2017, figures include $46 million (2016: $41 million) of cash costs related to our 50% share of Zaldívar and $15 million (2016: $nil) of cash costs related to our 50% share of Jabal Sayid due to their accounting as equity method investments. |

| 3 | Cost of sales per pound, C1 cash costs per pound and all-in sustaining costs per pound may not calculate based on amounts presented in this table due to rounding. |

| 4 | Cost of sales related to copper per pound is calculated using cost of sales including our proportionate share of cost of sales attributable to equity method investments (Zaldívar and Jabal Sayid), divided by consolidated copper pounds (including our proportionate share of copper pounds from our equity method investments). |

ENDNOTE 7

Barrick’s share.

ENDNOTE 8

Barrick’s share on an accrued basis.

ENDNOTE 9

Operating unit guidance ranges for production reflect expectations at each individual operating unit, but do not add up to corporate-wide guidance range total.

ENDNOTE 10

Utilizing option collar strategies, the Company has protected the downside on approximately 72 million pounds of expected remaining 2017 copper production at an average floor price of $2.30 per pound, and can participate in the upside on the same amount up to an average of $2.92 per pound. Our remaining copper production is subject to market prices.

ENDNOTE 11

Due to our hedging activities, which are reflected in these sensitivities, we are partially protected against changes in these factors.

| BARRICK FIRST QUARTER 2017 | 12 | PRESS RELEASE |

Key Statistics

| Barrick Gold Corporation (in United States dollars) |

Three months ended March 31 | |||||||

| 2017 | 2016 | |||||||

| Financial Results (millions) |

||||||||

| Revenues |

$ 1,993 | $ 1,930 | ||||||

| Cost of sales |

1,342 | 1,324 | ||||||

| Net earnings (loss)1 |

679 | (83 | ) | |||||

| Adjusted net earnings2 |

162 | 127 | ||||||

| Adjusted EBITDA2 |

904 | 697 | ||||||

| Total project capital expenditures3 |

56 | 40 | ||||||

| Total capital expenditures - sustaining3 |

262 | 175 | ||||||

| Net cash provided by operating activities |

495 | 451 | ||||||

| Free cash flow2 |

161 | 181 | ||||||

| Per share data (dollars) |

||||||||

| Net earnings (loss) (basic and diluted) |

0.58 | (0.07 | ) | |||||

| Adjusted net earnings (basic)2 |

0.14 | 0.11 | ||||||

| Weighted average basic common shares (millions) |

1,166 | 1,165 | ||||||

| Weighted average diluted common shares (millions) |

1,166 | 1,165 | ||||||

| Operating Results |

||||||||

| Gold production (thousands of ounces)4 |

1,309 | 1,280 | ||||||

| Gold sold (thousands of ounces)4 |

1,305 | 1,306 | ||||||

| Per ounce data |

||||||||

| Average spot gold price |

$ 1,219 | $ 1,183 | ||||||

| Average realized gold price2 |

1,220 | 1,181 | ||||||

| Cost of sales (Barrick’s share)5 |

833 | 810 | ||||||

| All-in sustaining costs2 |

772 | 706 | ||||||

| Copper production (millions of pounds)6 |

95 | 111 | ||||||

| Copper sold (millions of pounds) |

93 | 103 | ||||||

| Per pound data |

||||||||

| Average spot copper price |

$ 2.65 | $ 2.12 | ||||||

| Average realized copper price2 |

2.76 | 2.18 | ||||||

| Cost of sales (Barrick’s share)7 |

1.73 | 1.34 | ||||||

| All-in sustaining costs2 |

2.19 | 1.97 | ||||||

| As at March 31, | As at December 31, | |||||||

| 2017 | 2016 | |||||||

| Financial Position (millions) |

||||||||

| Cash and equivalents |

$ 2,277 | $ 2,389 | ||||||

| Working capital (excluding cash)8 |

883 | 1,155 | ||||||

| 1 | Net earnings (loss) represents net earnings attributable to the equity holders of the Company. |

| 2 | Adjusted net earnings, adjusted EBITDA, free cash flow, adjusted net earnings per share, realized gold price, all-in sustaining costs and realized copper price are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure to the most directly comparable IFRS measure, please see pages 43 to 53 of this MD&A. |

| 3 | Amounts presented on a 100% accrued basis. Project capital expenditures are included in our calculation of all-in costs, but not included in our calculation of all-in sustaining costs. |

| 4 | Includes Acacia on a 63.9% basis and Pueblo Viejo on a 60% basis, both of which reflect our equity share of production. 2016 includes production and sales from Bald Mountain and Round Mountain up to January 11, 2016, the effective date of sale of the assets. |

| 5 | Cost of sales per ounce (Barrick’s share) is calculated as cost of sales - gold on an attributable basis excluding Pierina divided by gold ounces sold. |

| 6 | Amounts reflect production from Jabal Sayid and Zaldívar on a 50% basis, which reflects our equity share of production, and 100% of Lumwana. |

| 7 | Cost of sales per pound (Barrick’s share) is calculated as cost of sales - copper plus our equity share of cost of sales attributable to Zaldívar and Jabal Sayid divided by copper pounds sold. |

| 8 | 2017 figures exclude assets classified as held-for-sale as at March 31, 2017. |

| BARRICK FIRST QUARTER 2017 | 13 | SUMMARY INFORMATION |

Production and Cost Summary

| Production | ||||||

| Three months ended March 31, | ||||||

| 2017 | 2016 | |||||

| Gold (equity ounces (000s)) |

||||||

| Barrick Nevada |

521 | 496 | ||||

| Pueblo Viejo1 |

143 | 172 | ||||

| Lagunas Norte |

88 | 100 | ||||

| Veladero |

151 | 132 | ||||

| Turquoise Ridge |

55 | 50 | ||||

| Acacia2 |

140 | 122 | ||||

| Other Mines - Gold3 |

211 | 208 | ||||

| Total |

1,309 | 1,280 | ||||

| Copper (equity pounds (millions))4 |

95 | 111 | ||||

| Cost of Sales per unit (Barrick’s share) | ||||||

| Three months ended March 31, | ||||||

| 2017 | 2016 | |||||

| Gold Cost of Sales per ounce ($/oz)5 |

||||||

| Barrick Nevada |

$ | 916 | $ 885 | |||

| Pueblo Viejo1 |

694 | 606 | ||||

| Lagunas Norte |

573 | 666 | ||||

| Veladero |

846 | 842 | ||||

| Turquoise Ridge |

680 | 715 | ||||

| Acacia2 |

816 | 914 | ||||

| Total |

$ | 833 | $ 810 | |||

| Copper Cost of Sales per pound ($/lb)6 |

$ | 1.73 | $ 1.34 | |||

| All-in sustaining costs7 | ||||||

| Three months ended March 31, | ||||||

| 2017 | 2016 | |||||

| Gold All-in Sustaining Costs ($/oz) |

||||||

| Barrick Nevada |

$ | 694 | $ 582 | |||

| Pueblo Viejo1 |

541 | 496 | ||||

| Lagunas Norte |

428 | 551 | ||||

| Veladero |

890 | 675 | ||||

| Turquoise Ridge |

714 | 728 | ||||

| Acacia2 |

934 | 959 | ||||

| Total |

$ | 772 | $ 706 | |||

| Copper All-in Sustaining Costs ($/lb) |

$ | 2.19 | $ 1.97 | |||

| 1 | Reflects production from Pueblo Viejo on a 60% basis, which reflects our equity share of production. |

| 2 | Reflects production from Acacia on a 63.9% basis, which reflects our equity share of production. |

| 3 | In 2017, Other Mines - Gold includes Golden Sunlight, Hemlo, Porgera on a 47.5% basis and Kalgoorlie on a 50% basis. In 2016, Other Mines - Gold includes Golden Sunlight, Hemlo, Porgera on a 47.5% basis, Kalgoorlie on a 50% basis and production from Bald Mountain and Round Mountain up to January 11, 2016, the effective date of sale of the assets. |

| 4 | Reflects production from Jabal Sayid and Zaldívar on a 50% basis, which reflects our equity share of production, and 100% of Lumwana. |

| 5 | Cost of sales per ounce (Barrick’s share) is calculated as cost of sales - gold on an attributable basis excluding Pierina divided by gold ounces sold. |

| 6 | Cost of sales per pound (Barrick’s share) is calculated as cost of sales - copper plus our equity share of cost of sales attributable to Zaldívar and Jabal Sayid divided by copper pounds sold. |

| 7 | All-in sustaining costs is a non-GAAP financial performance measure with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of this non-GAAP measure to the most directly comparable IFRS measure, please see pages 43 to 53 of this MD&A. |

| BARRICK FIRST QUARTER 2017 | 14 | SUMMARY INFORMATION |

MANAGEMENT’S DISCUSSION AND ANALYSIS (“MD&A”)

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

| BARRICK FIRST QUARTER 2017 | 15 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2017 | 16 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

USE OF NON-GAAP FINANCIAL PERFORMANCE MEASURES

| BARRICK FIRST QUARTER 2017 | 17 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

OVERVIEW

FINANCIAL AND OPERATING HIGHLIGHTS

| ($ millions, except per share amounts in dollars) | For the three months ended March 31 | |||||||||

|

2017 |

2016 | |||||||||

| Net earnings (loss) attributable to equity holders of the Company |

$ 679 | $ (83) | ||||||||

| Per share (dollars)1 |

0.58 | (0.07) | ||||||||

| Adjusted net earnings2 |

162 | 127 | ||||||||

| Per share (dollars)1,2 |

0.14 | 0.11 | ||||||||

| Operating cash flow |

495 | 451 | ||||||||

| Free cash flow2 |

$ 161 | $ 181 | ||||||||

| 1 | Calculated using weighted average number of shares outstanding under the basic method of earnings per share of 1,166 million shares for the three months ended March 31, 2017 (2016: 1,165 million shares). |

| 2 | Adjusted net earnings and free cash flow are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures of performance presented by other issuers. For further information and a detailed reconciliation of the non-GAAP measures used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 43 to 53 of this MD&A. |

| BARRICK FIRST QUARTER 2017 | 18 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Net Earnings (Loss), Adjusted Net Earnings, Operating Cash Flow and Free Cash Flow

Factors affecting net earnings (loss) and adjusted net earnings1

| 1 | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure to the most directly comparable IFRS measure, please see pages 43 to 53 of this MD&A. | |||

| 2 | Primarily consists of finance costs, closure costs and general & administrative costs. |

|||

| 3 | Estimated impact of foreign exchange. |

Net earnings attributable to equity holders of Barrick (“net earnings”) for the first quarter of 2017 were $679 million compared with a net loss of $83 million in the same prior year period. This significant improvement was largely due to $1,125 million of net impairment reversals ($522 million net of tax and non-controlling interest) recorded in the first quarter of 2017, as a result of the indicative fair value of the Cerro Casale project resulting from our divestment of 25% and signing a partnership agreement with Goldcorp. In addition, the first quarter of 2016 included $91 million of losses on currency translation ($91 million net of tax), primarily related to the realization of deferred currency translation losses in Australian entities. After adjusting for items that are not indicative of future operating earnings, including the net impairment reversal in the first quarter of 2017 and the deferred currency translation losses in the first quarter of 2016, adjusted net earnings1 of $162 million in the first quarter of 2017 were 28% higher than the same prior year period. The increase in adjusted net earnings was primarily due to the impact of higher gold and copper prices partially offset by 8% higher depreciation, a 36% increase in exploration and evaluation costs and a 2% increase in direct mining costs.

| BARRICK FIRST QUARTER 2017 | 19 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Factors affecting Operating Cash Flow and Free Cash Flow1

| 1 | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure to the most directly comparable IFRS measure, please see pages 43 to 53 of this MD&A. |

|||

| 2 | Consists of cash flows related primarily to a decrease in cash interest paid and closure related settlement payments. |

In the first quarter of 2017, we generated $495 million in operating cash flow, compared to $451 million in the same prior year period. We benefited from higher market gold and copper prices combined with lower cash interest paid as a result of debt repayments over the last year. These favorable movements were partially offset by unfavorable working capital movements compared to the same prior year period combined with higher direct mining costs.

Free cash flow1 for the first quarter of 2017 was $161 million compared to $181 million in the same prior year period. The decrease primarily reflects higher capital expenditures, partly offset by higher operating cash flows. In the first quarter of 2017, capital expenditures on a cash basis were $334 million compared to $270 million in the first quarter of 2016. The increase of $64 million is primarily due to a planned increase in minesite sustaining capital expenditures at Barrick Nevada relating to higher capitalized stripping costs and the timing of a greater number of minesite sustaining projects in the current period, as well as greater spending at Veladero relating to phase 4B and 5B of the leach pad expansion and equipment purchases. The increase in capital expenditures was also impacted by an $11 million increase in project capital expenditures primarily at Barrick Nevada relating to development of Crossroads and Cortez Hills Lower Zone, and the Goldrush project, partially offset by a decrease in pre-production stripping at the Arturo pit, which entered commercial production in August 2016.

| BARRICK FIRST QUARTER 2017 | 20 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Key Business Developments

Barrick Nevada

| BARRICK FIRST QUARTER 2017 | 21 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2017 | 22 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

REVIEW OF FINANCIAL RESULTS

Revenue

| BARRICK FIRST QUARTER 2017 | 23 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Production Costs

| BARRICK FIRST QUARTER 2017 | 24 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2017 | 25 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2017 | 26 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

FINANCIAL CONDITION REVIEW

Summary Balance Sheet and Key Financial Ratios

| ($ millions, except ratios and share amounts) | As at March 31, 2017 | As at December 31, 2016 | ||||||

|

Total cash and equivalents |

|

$ 2,277 |

|

|

$ 2,389 |

| ||

|

Current assets |

|

5,541 |

|

|

2,485 |

| ||

|

Non-current assets |

|

18,593 |

|

|

20,390 |

| ||

|

Total Assets |

|

$ 26,411 |

|

|

$ 25,264 |

| ||

|

Current liabilities excluding short-term debt |

|

$ 2,508 |

|

|

$ 1,676 |

| ||

|

Non-current liabilities excluding long-term debt1 |

|

5,068 |

|

|

5,344 |

| ||

|

Debt (current and long-term) |

|

7,753 |

|

|

7,931 |

| ||

|

Total Liabilities |

|

$ 15,329 |

|

|

$ 14,951 |

| ||

|

Total shareholders’ equity |

|

8,584 |

|

|

7,935 |

| ||

|

Non-controlling interests |

|

2,498 |

|

|

2,378 |

| ||

|

Total Equity |

|

$ 11,082 |

|

|

$ 10,313 |

| ||

|

Total common shares outstanding (millions of shares)2 |

|

1,166 |

|

|

1,166 |

| ||

|

Key Financial Ratios: |

||||||||

|

Current ratio3 |

|

2.70:1 |

|

|

2.68:1 |

| ||

|

Debt-to-equity4 |

|

0.70:1 |

|

|

0.77:1 |

| ||

| 1 | Non-current financial liabilities as at March 31, 2017 were $7,840 million (December 31, 2016: $8,002 million). | |||

| 2 | Total common shares outstanding do not include 1.4 million stock options. | |||

| 3 | Represents current assets (excluding assets held-for-sale) divided by current liabilities (including short-term debt and excluding liabilities held-for-sale) as at March 31, 2017 and December 31, 2016. | |||

| 4 | Represents debt divided by total shareholders’ equity (including minority interest) as at March 31, 2017 and December 31, 2016. |

| BARRICK FIRST QUARTER 2017 | 27 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2017 | 28 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

OPERATING SEGMENTS PERFORMANCE

Review of Operating Segments Performance

| BARRICK FIRST QUARTER 2017 | 29 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| Barrick Nevada1, Nevada USA | ||||||||||||

| Summary of Operating and Financial Data | For the three months ended March 31 | |||||||||||

| 2017 | 2016 | % Change | ||||||||||

| Total tonnes mined (000s) |

48,432 | 46,980 | 3% | |||||||||

| Open pit |

47,706 | 46,288 | 3% | |||||||||

| Underground |

726 | 692 | 5% | |||||||||

| Average grade (grams/tonne) |

||||||||||||

| Open pit mined |

2.29 | 1.20 | 91% | |||||||||

| Underground mined |

10.48 | 12.41 | (16%) | |||||||||

| Processed |

2.81 | 2.38 | 18% | |||||||||

| Ore tonnes processed (000s) |

6,872 | 9,076 | (24%) | |||||||||

| Oxide mill |

1,054 | 984 | 7% | |||||||||

| Roaster |

1,152 | 1,294 | (11%) | |||||||||

| Autoclave |

1,032 | 673 | 53% | |||||||||

| Heap leach |

3,634 | 6,125 | (41%) | |||||||||

| Gold produced (000s/oz) |

521 | 496 | 5% | |||||||||

| Oxide mill |

201 | 144 | 40% | |||||||||

| Roaster |

219 | 262 | (16%) | |||||||||

| Autoclave |

59 | 46 | 28% | |||||||||

| Heap leach |

42 | 44 | (5%) | |||||||||

| Gold sold (000s/oz) |

531 | 524 | 1% | |||||||||

| Segment revenue ($ millions) |

$ 646 | $ 616 | 5% | |||||||||

| Cost of sales ($ millions) |

487 | 464 | 5% | |||||||||

| Segment income ($ millions) |

148 | 147 | 1% | |||||||||

| Segment EBITDA ($ millions)2 |

355 | 345 | 3% | |||||||||

| Capital expenditures ($ millions) |

130 | 59 | 120% | |||||||||

| Minesite sustaining |

81 | 35 | 131% | |||||||||

| Project |

49 | 24 | 104% | |||||||||

| Cost of sales (per oz) |

916 | 885 | 4% | |||||||||

| Cash costs (per oz)2 |

525 | 508 | 3% | |||||||||

| All-in sustaining costs (per oz)2 |

694 | 582 | 19% | |||||||||

| All-in costs (per oz)2 |

$ 790 | $ 633 | 25% | |||||||||

| 1 | Includes our 60% share of Arturo. |

| 2 | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 43 to 53 of this MD&A. |

Financial Results

| BARRICK FIRST QUARTER 2017 | 30 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2017 | 31 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| Pueblo Viejo (60% basis)1, Dominican Republic | ||||||||

| Summary of Operating and Financial Data | For the three months ended March 31 | |||||||

|

2017 |

2016 | % Change | ||||||

| Open pit tonnes mined (000s) |

5,153 | 6,319 | (18%) | |||||

| Average grade (grams/tonne) |

||||||||

| Open pit mined |

2.97 | 2.80 | 6% | |||||

| Processed |

4.50 | 5.34 | (16%) | |||||

| Autoclave ore tonnes processed (000s) |

1,095 | 1,146 | (4%) | |||||

| Gold produced (000s/oz) |

143 | 172 | (17%) | |||||

| Gold sold (000s/oz) |

143 | 169 | (15%) | |||||

| Segment revenue ($ millions) |

$186 | $209 | (11%) | |||||

| Cost of sales ($ millions) |

99 | 102 | (3%) | |||||

| Segment income ($ millions) |

87 | 106 | (18%) | |||||

| Segment EBITDA ($ millions)2 |

113 | 133 | (15%) | |||||

| Capital expenditures ($ millions) |

13 | 13 | - | |||||

| Minesite sustaining |

13 | 13 | - | |||||

| Project |

- | - | - | |||||

| Cost of sales (per oz) |

694 | 606 | 15% | |||||

| Cash costs (per oz)2 |

437 | 411 | 6% | |||||

| All-in sustaining costs (per oz)2 |

541 | 496 | 9% | |||||

| All-in costs (per oz)2 |

$541 | $496 | 9% | |||||

| 1 | Pueblo Viejo is accounted for as a subsidiary with a 40% non-controlling interest. The results in the table and the discussion that follows are based on our 60% share only. |

| 2 | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 43 to 53 of this MD&A. |

Financial Results

| BARRICK FIRST QUARTER 2017 | 32 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| Lagunas Norte, Peru | ||||||||

| Summary of Operating and Financial Data | For the three months ended March 31 | |||||||

|

2017 |

2016 | % Change | ||||||

| Open pit tonnes mined (000s) |

8,762 | 10,003 | (12%) | |||||

| Average grade (grams/tonne) |

||||||||

| Open pit mined |

1.26 | 1.04 | 21% | |||||

| Processed |

1.09 | 0.93 | 17% | |||||

| Heap leach ore tonnes processed (000s) |

4,073 | 4,415 | (8%) | |||||

| Gold produced (000s/oz) |

88 | 100 | (12%) | |||||

| Gold sold (000s/oz) |

91 | 101 | (10%) | |||||

| Segment revenue ($ millions) |

$115 | $124 | (7%) | |||||

| Cost of sales ($ millions) |

53 | 68 | (22%) | |||||

| Segment income ($ millions) |

59 | 55 | 7% | |||||

| Segment EBITDA ($ millions)1 |

75 | 83 | (10%) | |||||

| Capital expenditures ($ millions) |

5 | 19 | (74%) | |||||

| Minesite sustaining |

4 | 19 | (79%) | |||||

| Project |

1 | - | - | |||||

| Cost of sales (per oz) |

573 | 666 | (14%) | |||||

| Cash costs (per oz)1 |

356 | 341 | 4% | |||||

| All-in sustaining costs (per oz)1 |

428 | 551 | (22%) | |||||

| All-in costs (per oz)1 |

$437 | $551 | (21%) | |||||

| 1 | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 43 to 53 of this MD&A. |

Financial Results

| BARRICK FIRST QUARTER 2017 | 33 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Veladero, Argentina

| Summary of Operating and Financial Data | For the three months ended March 31 | |||||||||||

|

|

2017 |

|

|

2016 |

|

|

% Change |

| ||||

| Open pit tonnes mined (000s) |

18,705 | 22,314 | (16%) | |||||||||

| Average grade (grams/tonne) |

||||||||||||

| Open pit mined |

0.98 | 0.75 | 31% | |||||||||

| Processed |

1.04 | 0.75 | 39% | |||||||||

| Heap leach ore tonnes processed (000s) |

7,256 | 7,271 | - | |||||||||

| Gold produced (000s/oz) |

151 | 132 | 14% | |||||||||

| Gold sold (000s/oz) |

165 | 124 | 33% | |||||||||

| Segment revenue ($ millions) |

$ 210 | $ 152 | 38% | |||||||||

| Cost of sales ($ millions) |

140 | 105 | 33% | |||||||||

| Segment income ($ millions) |

70 | 47 | 49% | |||||||||

| Segment EBITDA ($ millions)1 |

108 | 72 | 50% | |||||||||

| Capital expenditures ($ millions) |

50 | 19 | 163% | |||||||||

| Minesite sustaining |

50 | 19 | 163% | |||||||||

| Project |

- | - | - | |||||||||

| Cost of sales (per oz) |

846 | 842 | - | |||||||||

| Cash costs (per oz)1 |

580 | 513 | 13% | |||||||||

| All-in sustaining costs (per oz)1 |

890 | 675 | 32% | |||||||||

| All-in costs (per oz)1 |

$ 890 | $ 675 | 32% | |||||||||

| 1 | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 43 to 53 of this MD&A. |

| BARRICK FIRST QUARTER 2017 | 34 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2017 | 35 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2017 | 36 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Turquoise Ridge (75% basis), Nevada USA

| Summary of Operating and Financial Data | For the three months ended March 31 | |||||||||||

|

|

2017 |

|

|

2016 |

|

|

% Change |

| ||||

| Underground tonnes mined (000s) |

151 | 130 | 16% | |||||||||

| Average grade (grams/tonne) |

||||||||||||

| Underground mined |

15.80 | 16.89 | (6%) | |||||||||

| Processed |

14.32 | 16.86 | (15%) | |||||||||

| Autoclave ore tonnes processed (000s) |

130 | 101 | 29% | |||||||||

| Gold produced (000s/oz) |

55 | 50 | 10% | |||||||||

| Gold sold (000s/oz) |

54 | 48 | 13% | |||||||||

| Segment revenue ($ millions) |

$ 67 | $ 56 | 20% | |||||||||

| Cost of sales ($ millions) |

37 | 35 | 6% | |||||||||

| Segment income ($ millions) |

30 | 20 | 50% | |||||||||

| Segment EBITDA ($ millions)1 |

37 | 26 | 42% | |||||||||

| Capital expenditures ($ millions) |

9 | 6 | 50% | |||||||||

| Minesite sustaining |

9 | 6 | 50% | |||||||||

| Project |

- | - | - | |||||||||

| Cost of sales (per oz) |

680 | 715 | (5%) | |||||||||

| Cash costs (per oz)1 |

553 | 600 | (8%) | |||||||||

| All-in sustaining costs (per oz)1 |

714 | 728 | (2%) | |||||||||

| All-in costs (per oz)1 |

$ 714 | $ 728 | (2%) | |||||||||

| 1 | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 43 to 53 of this MD&A. |

| BARRICK FIRST QUARTER 2017 | 37 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Acacia Mining plc (100% basis), Africa

| Summary of Operating and Financial Data | For the three months ended March 31 | |||||||||||

|

|

2017 |

|

|

2016 |

|

|

% Change |

| ||||

| Total tonnes mined (000s) |

9,481 | 9,407 | 1% | |||||||||

| Open pit |

9,122 | 9,039 | 1% | |||||||||

| Underground |

359 | 368 | (2%) | |||||||||

| Average grade processed (grams/tonne)1 |

3.10 | 2.80 | 11% | |||||||||

| Ore tonnes processed (000s) |

2,420 | 2,488 | (3%) | |||||||||

| Gold produced (000s/oz) |

220 | 190 | 16% | |||||||||

| Gold sold (000s/oz) |

185 | 184 | 1% | |||||||||

| Segment revenue ($ millions) |

$ 232 | $ 219 | 6% | |||||||||

| Cost of sales ($ millions) |

151 | 169 | (11%) | |||||||||

| Segment income ($ millions) |

75 | 40 | 88% | |||||||||

| Segment EBITDA ($ millions)1 |

110 | 76 | 45% | |||||||||

| Capital expenditures ($ millions) |

46 | 34 | 35% | |||||||||

| Minesite sustaining |

46 | 34 | 35% | |||||||||

| Project |

- | - | - | |||||||||

| Cost of sales (per oz) |

816 | 914 | (11%) | |||||||||

| Cash costs (per oz)2 |

577 | 693 | (17%) | |||||||||

| All-in sustaining costs (per oz)2 |

934 | 959 | (3%) | |||||||||

| All-in costs (per oz)2 |

$ 937 | $ 960 | (2%) | |||||||||

| 1 | Includes processing of tailings retreatment. |

| 2 | These are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 43 to 53 of this MD&A. |

| BARRICK FIRST QUARTER 2017 | 38 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| BARRICK FIRST QUARTER 2017 | 39 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Pascua-Lama, Argentina/Chile

| BARRICK FIRST QUARTER 2017 | 40 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

COMMITMENTS AND CONTINGENCIES

Litigation and Claims

We are currently subject to various litigation proceedings as disclosed in note 17 to the Financial Statements, and we may be involved in disputes with other parties in the future that may result in litigation. If we are unable to resolve these disputes favorably, it may have a material adverse impact on our financial condition, cash flow and results of operations.

Contractual Obligations and Commitments

In the normal course of business, we enter into contracts that give rise to commitments for future minimum payments. The following table summarizes the remaining contractual maturities of our financial liabilities and operating and capital commitments shown on an undiscounted basis:

| ($ millions) | |

Payments due as at March 31, 2017 |

| |||||||||||||||||||||||||

| 2017 | 2018 | 2019 | 2020 | 2021 |

|

2022

and |

|

Total | ||||||||||||||||||||

| Debt1 |

||||||||||||||||||||||||||||

| Repayment of principal |

$ 42 | $ 83 | $ 360 | $ 291 | $ 665 | $ 6,264 | $ 7,705 | |||||||||||||||||||||

| Capital leases |

28 | 31 | 16 | 9 | 6 | 14 | 104 | |||||||||||||||||||||

| Interest |

397 | 424 | 410 | 390 | 368 | 5,406 | 7,395 | |||||||||||||||||||||

| Provisions for environmental rehabilitation2 |

75 | 72 | 67 | 103 | 95 | 1,847 | 2,259 | |||||||||||||||||||||

| Operating leases |

18 | 17 | 11 | 10 | 8 | 8 | 72 | |||||||||||||||||||||

| Restricted share units |

30 | 26 | 8 | 7 | - | - | 71 | |||||||||||||||||||||

| Pension benefits and other post-retirement benefits |

15 | 20 | 20 | 20 | 20 | 408 | 503 | |||||||||||||||||||||

| Derivative liabilities3 |

44 | 31 | 3 | - | - | - | 78 | |||||||||||||||||||||

| Purchase obligations for supplies and consumables4 |

518 | 236 | 172 | 122 | 84 | 3 | 1,135 | |||||||||||||||||||||

| Capital commitments5 |

62 | 5 | 4 | 4 | 4 | 23 | 102 | |||||||||||||||||||||

| Social development costs6 |

12 | 3 | 4 | 2 | 1 | 188 | 210 | |||||||||||||||||||||

| Total |

$ 1,241 | $ 948 | $ 1,075 | $ 958 | $ 1,251 | $ 14,161 | $ 19,634 | |||||||||||||||||||||

| 1 | Debt and Interest - Our debt obligations do not include any subjective acceleration clauses or other clauses that enable the holder of the debt to call for early repayment, except in the event that we breach any of the terms and conditions of the debt or for other customary events of default. The debt and interest amounts include 100% of the Pueblo Viejo financing, even though our attributable share is 60% of this total, consistent with our ownership interest in the mine. We are not required to post any collateral under any debt obligations. Projected interest payments on variable rate debt were based on interest rates in effect at March 31, 2017. Interest is calculated on our long-term debt obligations using both fixed and variable rates. |

| 2 | Provisions for Environmental Rehabilitation - Amounts presented in the table represent the undiscounted uninflated future payments for the expected cost of provisions for environmental rehabilitation. |

| 3 | Derivative Liabilities - Amounts presented in the table relate to derivative contracts disclosed under note 25C to the 2016 Annual Report. Payments related to derivative contracts may be subject to change given variable market conditions. |

| 4 | Purchase Obligations for Supplies and Consumables - Includes commitments related to new purchase obligations to secure a supply of acid, tires and cyanide for our production process. |

| 5 | Capital Commitments - Purchase obligations for capital expenditures include only those items where binding commitments have been entered into. |

| 6 | Social Development Costs – Includes Pascua-Lama’s commitment of $147 million related to the potential funding of a power transmission line in Argentina, the majority of which is not expected to be paid prior to 2022. |

| BARRICK FIRST QUARTER 2017 | 41 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

REVIEW OF QUARTERLY RESULTS

Quarterly Information1

| 2017 | 2016 | 2015 | ||||||||||||||||||||||||||||||

| ($ millions, except where indicated) |

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

|

Q2 |

|

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

|

Q2 |

| ||||||||

| Revenues |

$1,993 | $ 2,319 | $ 2,297 | $ 2,012 | $ 1,930 | $ 2,238 | $ 2,315 | $ 2,231 | ||||||||||||||||||||||||

| Realized price per ounce - gold2 |

1,220 | 1,217 | 1,333 | 1,259 | 1,181 | 1,105 | 1,125 | 1,190 | ||||||||||||||||||||||||

| Realized price per pound - copper2 |

2.76 | 2.62 | 2.18 | 2.14 | 2.18 | 2.16 | 2.18 | 2.66 | ||||||||||||||||||||||||

| Cost of sales |

1,342 | 1,454 | 1,291 | 1,336 | 1,324 | 1,768 | 1,742 | 1,689 | ||||||||||||||||||||||||

| Net earnings (loss) |

679 | 425 | 175 | 138 | (83) | (2,622) | (264) | (9) | ||||||||||||||||||||||||

| Per share (dollars)3 |

0.58 | 0.36 | 0.15 | 0.12 | (0.07) | (2.25) | (0.23) | (0.01) | ||||||||||||||||||||||||

| Adjusted net earnings2 |

162 | 255 | 278 | 158 | 127 | 91 | 131 | 60 | ||||||||||||||||||||||||

| Per share (dollars)2,3 |

0.14 | 0.22 | 0.24 | 0.14 | 0.11 | 0.08 | 0.11 | 0.05 | ||||||||||||||||||||||||

| Operating cash flow4 |

495 | 711 | 951 | 527 | 451 | 698 | 1,255 | 525 | ||||||||||||||||||||||||

| Cash capital expenditures |

334 | 326 | 277 | 253 | 270 | 311 | 389 | 499 | ||||||||||||||||||||||||

| Free cash flow2,4 |

$161 | $ 385 | $ 674 | $ 274 | $ 181 | $ 387 | $ 866 | $ 26 | ||||||||||||||||||||||||

| 1 | Sum of all the quarters may not add up to the annual total due to rounding. |

| 2 | Realized price, adjusted net earnings, adjusted net earnings per share and free cash flow are non-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures of performance presented by other issuers. For further information and a detailed reconciliation of each non-GAAP measure used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 43 to 53 of this MD&A. |

| 3 | Calculated using weighted average number of shares outstanding under the basic method of earnings per share. |

| 4 | Q3 2015 includes $610 million of proceeds from the gold and silver streaming transaction with Royal Gold, Inc. |

INTERNAL CONTROL OVER FINANCIAL REPORTING AND DISCLOSURE CONTROLS AND PROCEDURES

| BARRICK FIRST QUARTER 2017 | 42 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

IFRS CRITICAL ACCOUNTING POLICIES AND ACCOUNTING ESTIMATES

NON-GAAP FINANCIAL PERFORMANCE MEASURES

Adjusted Net Earnings and Adjusted Net Earnings per Share

| BARRICK FIRST QUARTER 2017 | 43 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Reconciliation of Net Earnings to Net Earnings per Share, Adjusted Net Earnings and Adjusted Net Earnings per Share

| ($ millions, except per share amounts in dollars) | For the three months ended March 31 | |||||||

|

|

2017 |

|

|

2016 |

| |||

| Net earnings (loss) attributable to equity holders of the Company |

$ 679 | $ (83) | ||||||

| Impairment charges (reversals) related to intangibles, goodwill, property, plant and equipment, and investments1 |

(1,125) | 1 | ||||||

| Acquisition/disposition (gains)/losses |

3 | 8 | ||||||

| Foreign currency translation (gains)/losses |

3 | 139 | ||||||

| Significant tax adjustments |

(3) | 51 | ||||||

| Other expense adjustments |

6 | 68 | ||||||

| Unrealized gains on non-hedge derivative instruments |

3 | (6) | ||||||

| Tax effect and non-controlling interest2 |

596 | (51) | ||||||

| Adjusted net earnings |

$ 162 | $ 127 | ||||||

| Net earnings (loss) per share3 |

0.58 | (0.07) | ||||||

| Adjusted net earnings per share3 |

0.14 | 0.11 | ||||||

| 1 | Net impairment reversals for the current year primarily relate to impairment reversals at the Cerro Casale project upon reclassification of the project’s net assets as held-for-sale as at March 31, 2017. |

| 2 | Tax effect and non-controlling interest primarily relates to the impairment reversals at the Cerro Casale project discussed above. |