Filed by Barrick Gold Corporation (Commission File No. 001-09059)

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Newmont Mining Corporation

Commission File No.: 001-31240

The following presentation was made available by Barrick Gold Corporation on February 25, 2019.

Capturing the Missing Billions Unlocking Over $7 Billion NPV of Real Synergies Unprecedented Value Creation Opportunity for Barrick and Newmont Shareholders

Cautionary Statements 1 Non-Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.Additional Information and Where to Find ItBarrick may file a registration statement on Form F-4 containing a prospectus of Barrick with the SEC in connection with the proposed transaction or a proxy statement (the “Barrick Proxy”) in connection with Newmont’s special meeting of stockholders. Any definitive proxy statement or final prospectus will be sent to the stockholders of Newmont. Investors and security holders are urged to read the Barrick Proxy, the prospectus and any other relevant document filed with the SEC if and when they become available, because they will contain important information about Barrick, Newmont and the proposed transaction. The Barrick Proxy, the prospectus and other documents relating to the proposed transaction (if and when they become available) can be obtained free of charge from the SEC’s website at www.sec.gov. These documents (if and when they become available) can also be obtained free of charge from Barrick by directing a request to Barrick Investor Relations: +1 416 861-991, toll free (North America) at 1-800-720-7415 and 161 Bay Street, Suite 3700, Toronto, Ontario M5J 2S1, Canada.Participants in Solicitation This communication is a not a solicitation of a proxy from any investor or securityholder. However, Barrick and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies from Newmont stockholders in connection with Newmont's special meeting of stockholders under the rules of the SEC. Certain information about the directors and executive officers of Barrick may be found in its 2017 Annual Report on Form 40-F filed with the SEC on March 26, 2018. Additional information regarding the interests of these participants will also be included in the proxy statement and the prospectus regarding the proposed transaction if and when they become available. These documents can be obtained free of charge from the sources indicated above.Forward-Looking InformationThis presentation (including information incorporated by reference in this presentation), oral statements made regarding Barrick’s proposal, and other information published by Barrick contain statements which are, or may be deemed to be, “forward-looking statements” (or “forward-looking information”), under applicable securities laws including for the purposes of the US Private Securities Litigation Reform Act of 1995. Forward-looking statements are prospective in nature and are not based on historical facts, but rather on current expectations and projections of the management of Barrick about future events, and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. The forward-looking statements contained in this presentation include statements relating to: (i) Barrick’s proposal to merge with Newmont in an all-share transaction, (ii) the expected impact of such a transaction, including potential real pre-tax synergies (and the net present value of such synergies) as well as effects on and, as applicable, estimates of, Barrick’s portfolio of Tier One Gold Assets, potential uplift to unaffected share prices, and reserves and resources, (iii) creation of the industry’s best gold investment vehicle, and Barrick’s ability to attract gold and generalist investors, (iv) the potential optimization of Barrick’s asset portfolio, (v) the expected timing and scope of such a transaction, including receipt of necessary regulatory approvals and satisfaction of conditions, (vi) Barrick’s future dividend payments or policies, and (vii) other statements other than historical facts.Although Barrick believes that the expectations reflected in such forward-looking statements are reasonable, Barrick can give no assurance that such expectations will prove to be correct. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. There are a number of factors that could cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements. These factors include: risks relating to Barrick and Newmont’s respective credit ratings; local and global political and economic conditions; Barrick’s economic model; liquidity risks; fluctuations in the spot and forward price of gold, copper, or certain other commodities (such as silver, diesel fuel, natural gas, and electricity); financial services risk; the risks associated with each of Barrick’s and Newmont’s brand, reputation and trust; environmental risks; safety and technology risks; the ability to realise the anticipated benefits of the proposed transaction (including estimated synergies and financial benefits) or implementing the business plan for Barrick following such transaction, should it occur, including as a result of a delay in its completion or difficulty in integrating the businesses of the companies involved; risks that Barrick may not be able to pay targeted annualised dividends following a successful completion of a possible transaction; risks relating to the ultimate outcome of any possible transaction between Barrick and Newmont, including the possibilities that Newmont will reject a transaction with Barrick or that Barrick will not pursue a transaction with Newmont; the risk that the conditions to completion of the transaction will not be satisfied; the risk that any shareholder approval of the transaction will not be obtained from the relevant shareholders; the risk that required regulatory approvals necessary to complete the transaction will not be obtained, or that conditions will be imposed in connection with such approvals that will increase the costs associated with the transaction or have other negative implications for Barrick following the transaction; the risk that litigation relating to the transaction may be commenced which may prevent, delay or give rise to significant costs or liabilities on the part of Barrick and/or Newmont; the risk that the focus of management's time and attention on the transaction may detract from other aspects of the respective businesses of Barrick and Newmont; the risk that a material decrease in the trading price of Barrick common shares may occur; the risk that Barrick may not be able to retain key employees of Newmont following the transaction; changes in or enforcement of national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices, expropriation or nationalization of property and political or economic developments in Canada, the United States and other jurisdictions in which Barrick and Newmont carry on business or in which Barrick may carry on business in the future; lack of certainty with respect to foreign legal systems, corruption and other factors that are inconsistent with the rule of law; legal or regulatory developments and changes; the outcome of any litigation, arbitration or other dispute proceeding; the impact of any acquisitions or similar transactions; competition and market risks; the impact of foreign exchange rates; pricing pressures; the possibility that future exploration results will not be consistent with expectations; risks that exploration data may be incomplete and considerable additional work may be required to complete further evaluation, including but not limited to drilling, engineering and socioeconomic studies and investment; risk of loss due to acts of war, terrorism, sabotage and civil disturbances; contests over title to properties, particularly title to undeveloped properties, or over access to water, power and other required infrastructure; and business continuity and crisis management. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. Such forward-looking statements should therefore be construed in the light of such factors.Neither Barrick nor any of its associates or directors, officers or advisers, provides any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements in this presentation will actually occur. You are cautioned not to place undue reliance on these forward-looking statements. Other than in accordance with their legal or regulatory obligations, Barrick is not under any obligation, and Barrick expressly disclaims any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Free Cash Flow Uplift Drives Future Growth and Sustainable Shareholder Returns Over $7 Billion NPV (Pre-Tax) of Real Synergies2 Best-in-Class Management Team With Track Record of Delivering Significant Shareholder Value Unrivaled Position in Long-Life, Low Cost Nevada Assets with 20+ Year Mine Life Strong Balance Sheet to Fund Growth and Returns to Investors World’s Best Portfolio of Tier One Gold Assets1 Every Year We Delay This Merger Costs Shareholders Over $750 Million3 Barrick Newmont Merger Offers Shareholders Unprecedented Value Creation 2 See Endnote 1.Represents the NPV of pre-tax synergies projected over a twenty year period, assuming analyst consensus commodity prices and a 5% discount rate.Annual average pre-tax synergies for first five full years (2020 - 2024). World Class Business Attractive to Both Gold and Generalist Investors Further Re-Rating Potential from Synergies and Superior Quality Relative to Peers

Few Mining M&A Transactions Create Significant Real and Long-Term Value Premiums Paid Negate Potential Value Creation for Shareholders O Size for the Sake of Size Only O Transaction Rationale Based On Short-Term Share Price Movements and Trading Multiple Differences O Operations Too Distant Or Dissimilar To Provide Real Synergies O 3 Management Exiting? Dilution of Asset Quality Premium Paid Rationale:Size for the Sake of Size Lack Of Material,Real Synergies Newmont / Goldcorp – An Old Style Mining Transaction Goldcorp Transaction Significantly Dilutes Newmont’s World Class Asset Base and Attractiveness Multiple HQOverheads

Potential to Unlock ~$5 Billion NPV (Pre-Tax) of Real Synergies From Nevada1 Only Gold District With Multi-Billion Dollar Synergies 4 Twin Creeks TurquoiseRidge Phoenix Cortez Goldrush / Fourmile Goldstrike Carlin Long Canyon Producing Mine Heap Leach SX-EW Plant Barrick Land Holding Newmont Land Holding Elko 20 10 0 Miles Wells BattleMountain Winnemucca Major Project Represents the NPV of pre-tax synergies projected over a twenty year period, assuming analyst consensus commodity prices and a 5% discount rate.

Barrick has the majority of high-grade reserves and resources and Newmont has the majority of processing plant capacity and infrastructureCombination of Barrick and Newmont’s highly complementary assets enables optimisation across the complex, providing the opportunity to unlock 20+ years of profitable production in Nevada Unlocks 20+ Years of Profitable and Responsible Production in Nevada Nevada Operations – Obvious Synergies 5 2018 Gold Production1 (Moz) # of Mines and Major Projects # of ProcessingFacilities # of Roasters # of Autoclaves Proven and Probable Reservesand Grade1(Moz; g/t Au) Measured and Indicated Resources and Grade1(Moz; g/t Au) Metrics are shown on an attributable basis and based on latest company disclosures. See Endnote 2, 3 and 4.

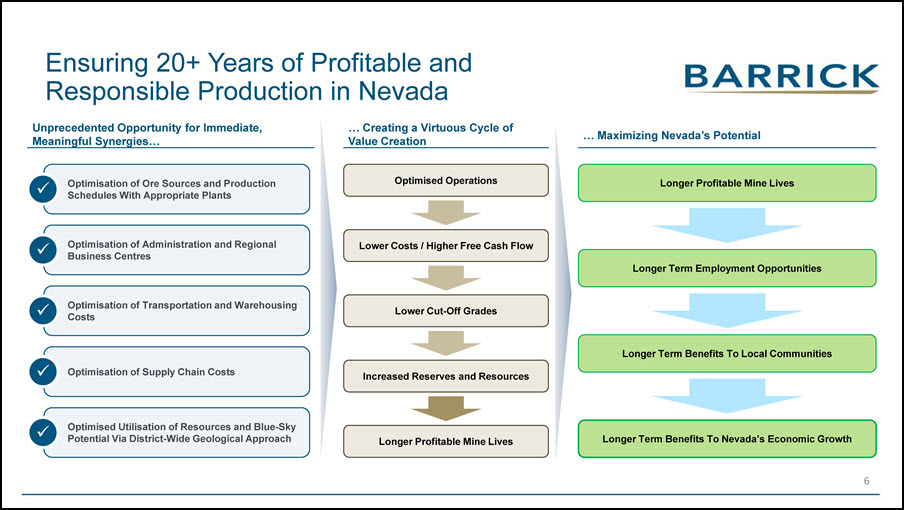

… Creating a Virtuous Cycle of Value Creation Unprecedented Opportunity for Immediate, Meaningful Synergies… Ensuring 20+ Years of Profitable and Responsible Production in Nevada 6 … Maximizing Nevada’s Potential Optimised Operations Lower Costs / Higher Free Cash Flow Lower Cut-Off Grades Increased Reserves and Resources Longer Profitable Mine Lives Optimisation of Administration and Regional Business Centres Optimisation of Supply Chain Costs Optimised Utilisation of Resources and Blue-Sky Potential Via District-Wide Geological Approach Optimisation of Transportation and Warehousing Costs Optimisation of Ore Sources and Production Schedules With Appropriate Plants Longer Profitable Mine Lives Longer Term Employment Opportunities Longer Term Benefits To Local Communities Longer Term Benefits To Nevada’s Economic Growth

NPV (Pre-Tax) of Real Synergies1 1 2 3 4 Integration and optimisation of Nevada assets will allow for 20+ years of profitable production through enhanced mine planning, processing and logistics Nevada Complex 1 Reduction in corporate and regional G&A through elimination of redundancies and decentralization Corporate G&A Savings 2 Rationalization of exploration spend and project planning to focus on priority regions Exploration and Project Planning 3 Supply Chain 4 Supply chain efficiencies derived from leveraging economies of scale across the organization Capturing the Missing Billions – Over $7 Billion NPV (Pre-Tax) of Real Synergies1 7 Represents the NPV of pre-tax synergies projected over a twenty year period, assuming analyst consensus commodity prices and a 5% discount rate.

Barrick’s Recent Value Creation Track Record Since closing of the Barrick Randgold Merger:Implemented “Miner’s, not Manager’s” ethosIntegrated Barrick / Randgold management teamsRationalised and re-purposed head officeEmpowered regional management structure focused on operationsDeployed mineral resource teams at each operationRepurposed technology and innovation initiatives to mine sitesMade significant progress in streamlining, including a budgeted year-over-year reduction of $135 million in corporate G&A1 Annual procurement savings of $200 million identified: $50 million secured already, $10 million in progress, $84 million targeted for remainder of 2019 and further $56 million in 2020 without material operational synergies The Barrick Randgold Merger Has Already Created Over $5 Billion of Shareholder Value2 8 From 2018A to 2019E.Based on market capitalisation of Barrick as of February 20, 2019 versus combined market capitalisation of Barrick and Randgold at announcement (September 21, 2018). Source: Bloomberg Financial Markets.

Proposal To Newmont Key Conditions Newmont / Goldcorp transaction terminatedApprovals from shareholders of Barrick and NewmontRegulatory clearance from relevant authoritiesNo financing condition Dividends1 The combined company intends to match Newmont’s annual dividend of $0.56 per share which, based on the proposed exchange ratio, will represent a pro forma annual dividend of $0.22 per Barrick share (compared to the current annual dividend of $0.16 per Barrick share). The Proposal Business combination on an at-market basisExchange ratio of 2.5694 Barrick shares per Newmont share Barrick shareholders to own 55.9% of the combined company, Newmont shareholders to own 44.1% 9 See Endnote 5.

Source: Thomson One Analytics, company reports and announcements.See Endnote 1.Stated US$100 million pre-tax synergies.Annual average pre-tax synergies for first five full years (2020 – 2024). A Merger With Barrick Creates Far More Real Value for Newmont Shareholders Newmont has estimated total pre-tax synergies of only $100 million per year in the Goldcorp transaction Illustrative Comparison of Annual (Pre-Tax) Synergies Substantial Value Creation vs. Goldcorp Transaction 10 Newmont Goldcorp 3 Creates World’s LargestGold Company Increase Ownership ofTier One Gold Assets1 Significant, Real Synergies Asset Quality Enhancementfor Newmont Significant Value Creation Irrelevant Metrics: Proven and CommittedBest-in-Class Management 2 >7.5x Barrick Newmont A Far More Attractive Transaction For Newmont Shareholders

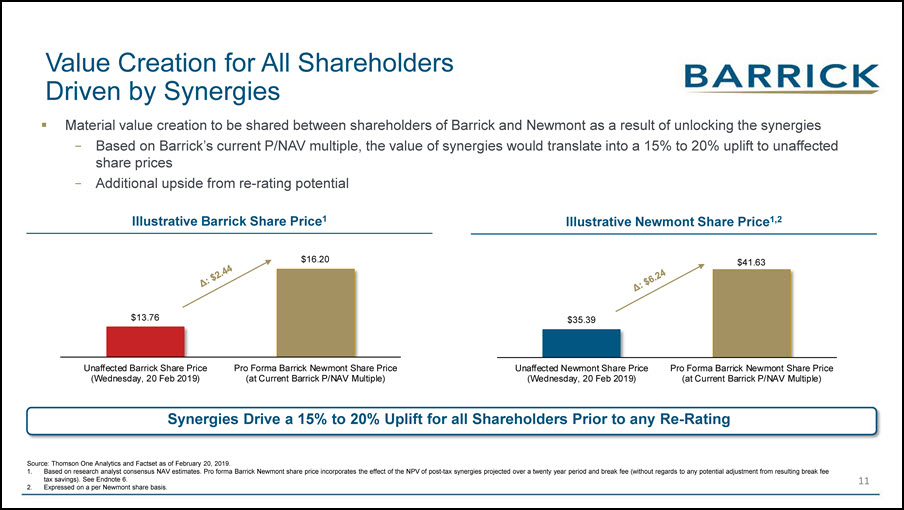

Value Creation for All ShareholdersDriven by Synergies 11 Source: Thomson One Analytics and Factset as of February 20, 2019.Based on research analyst consensus NAV estimates. Pro forma Barrick Newmont share price incorporates the effect of the NPV of post-tax synergies projected over a twenty year period and break fee (without regards to any potential adjustment from resulting break fee tax savings). See Endnote 6. Expressed on a per Newmont share basis. Illustrative Barrick Share Price1 Illustrative Newmont Share Price1,2 Δ: $6.24 Synergies Drive a 15% to 20% Uplift for all Shareholders Prior to any Re-Rating Δ: $2.44 Material value creation to be shared between shareholders of Barrick and Newmont as a result of unlocking the synergiesBased on Barrick’s current P/NAV multiple, the value of synergies would translate into a 15% to 20% uplift to unaffected share pricesAdditional upside from re-rating potential

Benefits of the Proposed Merger 12 Financial Benefits Operational Benefits Increases Number of Tier One Gold Assets2 High Quality Exploration and Development Pipeline Creates Nevada Mining Powerhouse with Fully Optimised Nevada Operations Best Assets Run by Best Management Adds High Quality Assets Clear Path to Share Over $7 Billion NPV (Pre-Tax) of Real Synergies1 Further Re-Rating Potential Increased Free Cash Flow for Growth and Shareholder Returns Strong Pro Forma Balance Sheet “Must-own Stock” for Gold and Generalist Investors $0.22 Dividend per New Barrick Share Opportunity for Portfolio Optimisation Represents the NPV of pre-tax synergies projected over a twenty year period, assuming analyst consensus commodity prices and a 5% discount rate.See Endnote 1.

Leading Portfolio of Eight Tier One Gold Assets1 13 Majority of combined gold asset value would be comprised of Tier One Gold Assets:CortezGoldstrike / CarlinTurquoise Ridge / Twin CreeksPueblo Viejo Merian Loulo-GounkotoKibali Newmont GhanaOne Tier One Gold Asset expected to be created by the merger:Combination of Turquoise Ridge and Twin Creeks with synergy driven cost reductions and combined scale One existing Tier One Gold Asset increased in scale: Combination of Carlin with the already Tier One Goldstrike See Endnote 1.Consensus Gold Asset NAV based on research analyst estimates where analysts have disclosed breakdown by asset / region. Excludes copper assets and NAV attributed to exploration that is not asset specific. Tier One Gold Asset NAV includes NAV for Goldrush / Fourmile as a potential Tier One Gold Asset. Source: Thomson One Analytics. Pro Forma Consensus Gold Asset NAV2

Maintains Balanced Political Risk Exposure 14 Barrick Newmont Pro Forma Barrick Newmont Based on company disclosure. 2018 production shown on an attributable basis. Barrick’s production figure include Randgold’s 2018 production figure which was separately reported.Based on company disclosure. Proven and probable gold reserves. Shown on an attributable basis. Barrick’s reserves shown as of December 31, 2018 and exclude reserves categorised as “Other”. Barrick’s reserves include Randgold’s reserves which were reported separately and shown as of December 31, 2018. Newmont’s reserves shown as of December 31, 2018.Consensus Mining NAV based on research analyst estimates where analysts have disclosed breakdown by asset / region. Source: Thomson One Analytics.Note: The calculations above categorise Barrick’s interest in Pueblo Viejo (60%) within Latin America. Consensus Mining NAV3 Gold Production1 Gold Reserves2

Barrick Newmont Merger Offers Shareholders Unprecedented Value Creation 15 See Endnote 1.Represents the NPV of pre-tax synergies projected over a twenty year period, assuming analyst consensus commodity prices and a 5% discount rate. Free Cash Flow Uplift Drives Future Growth and Sustainable Shareholder Returns Over $7 Billion NPV (Pre-Tax) of Real Synergies2 Best-in-Class Management Team With Track Record of Delivering Significant Shareholder Value Unrivaled Position in Long-Life, Low Cost Nevada Assets with 20+ Year Mine Life Strong Balance Sheet to Fund Growth and Returns to Investors World’s Best Portfolio of Tier One Gold Assets1 World Class Business Attractive to Both Gold and Generalist Investors Further Re-Rating Potential from Synergies and Superior Quality Relative to Peers

Disclaimer 16 Technical InformationThe scientific and technical information contained in this presentation in respect of Barrick has been reviewed and approved for release by Rodney Quick, Mineral Resource Management and Evaluation Executive of Barrick and Rick Sims, Registered Member SME, Vice President, Reserves and Resources of Barrick, each a “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.Non-GAAP Financial Performance MeasuresCertain financial performance measures used in this presentation – namely total cash costs per ounce, NAV (or “net asset value”) and P/NAV (or “price to net asset value”) – are not prescribed by IFRS. These non-GAAP financial performance measures are included because management has used the information to analyse the business performance and financial position of Barrick and the combined business performance and financial position of Barrick if a merger transaction with Newmont was to occur on the terms proposed. These non-GAAP financial measures are intended to provide additional information only and do not have any standardised meaning under IFRS and may not be comparable to similar measures presented by other companies. These non-GAAP financial measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.In order to provide the combined business performance and financial position of Barrick after giving effect to its proposed merger transaction with Newmont, certain non-GAAP financial performance measures of each of Barrick and Newmont have been combined to show an aggregate number. Such pro forma combined numbers are illustrative only and actual figures may vary materially.Third Party Data and QuotationsCertain comparisons of Barrick, Newmont and their industry peers are based on data obtained from Wood Mackenzie, Factset, Bloomberg Financial Markets or Thomson One Analytics. Wood Mackenzie is an independent third party research and consultancy firm that provides data for, among others, the metals and mining industry. Factset is a financial data and software company which provides financial information and analytic software for, among others, investment professionals. Bloomberg Financial Markets is a software, data and media company which delivers business and market news, data and analysis. Thomson One Analytics is a web-based investment research and analytic tool. None of Wood Mackenzie, Factset, Bloomberg Financial Markets nor Thomson One Analytics has any affiliation to Barrick.Other than in respect of its own mines, Barrick does not have the ability to verify the data or information obtained from Wood Mackenzie, Factset, Bloomberg Financial Markets or Thomson One Analytics and the non-GAAP financial performance measures used by Wood Mackenzie, Factset, Bloomberg Financial Markets and Thomson One Analytics may not correspond to the non-GAAP financial performance measures calculated by Barrick, Newmont or their respective industry peers. For more information on these non-GAAP financial performance measures see Endnote 1 and 6. Barrick has neither sought nor obtained consent from any third party to be quoted in this presentation.

Endnotes 1. A Tier One Gold Asset is a mine with a stated mine life in excess of 10 years with annual production of at least five hundred thousand ounces of gold and total cash cost per ounce within the bottom half of Wood Mackenzie’s cost curve (excluding state-owned and privately owned mines). Total cash costs per ounce is based on data from Wood Mackenzie, except in respect of Barrick’s mines where Barrick relied on its internal data which is more current and reliable. The Wood Mackenzie calculation of total cash cost per ounce may not be identical to the manner in which Barrick calculates comparable measures. Total cash costs per ounce is a non-GAAP financial performance measure with no standardised meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. Total cash costs per ounce should not be considered by investors as an alternative to costs of sales or to other IFRS measures. Barrick believes that total cash cost per ounce is a useful indicator for investors and management of a mining company’s performance as it provides an indication of a company’s profitability and efficiency, the trends in cash costs as the company’s operations mature, and a benchmark of performance to allow for comparison against other companies. 2. Proven and probable gold reserves and measured and indicated gold resources of Barrick in Nevada are stated on an attributable basis as of December 31, 2018 and include Goldstrike, Cortez, Goldrush, South Arturo (60%) and Turquoise Ridge (75%). Proven reserves of 84.4 million tonnes grading 4.36 g/t, representing 11.8 million ounces of gold. Probable reserves of 155.6 million tonnes grading 2.93 g/t, representing 14.7 million ounces of gold. Measured resources of 13.5 million tonnes grading 4.22 g/t, representing 1.8 million ounces of gold. Indicated resources of 101.6 million tonnes grading 4.34 g/t, representing 14.2 million ounces of gold. Measured and indicated resources are shown exclusive of reserves. Complete mineral reserve and mineral resource data for all Barrick mines and projects referenced in this presentation, including tonnes, grades, and ounces, as well as the assumptions on which the mineral reserves and resources for Barrick are reported, are set out in Barrick’s Q4 2018 Report issued on February 13, 2019. 3. Proven and probable gold reserves and measured and indicated gold resources of Newmont in Nevada are stated on an attributable basis as of December 31, 2018 and include Carlin, Phoenix, Twin Creeks (including Newmont’s 25% equity in Turquoise Ridge) and Long Canyon. Proven reserves of 46.6 million tonnes grading 3.84 g/t, representing 5.8 million ounces of gold. Probable reserves of 378.1 million tonnes grading 1.32 g/t, representing 16.0 million ounces of gold. Measured resources of 19.7 million tonnes grading 2.19 g/t, representing 1.4 million ounces of gold. Indicated resources of 260.7 million tonnes grading 1.23 g/t, representing 10.3 million ounces of gold. Measured and indicated resources are shown exclusive of reserves. Complete mineral reserve and mineral resource data for all Newmont mines and projects referenced in this presentation, including tonnes, grades, and ounces, as well as the assumptions on which the mineral reserves and resources for Newmont are reported, are set out in Newmont’s press release dated February 21, 2019 reporting its 2018 Reserves and Resources and its annual report on Form 10-K for the fiscal year ended December 31, 2018. 4. The potential pro forma reserves and resources figures from combining Barrick and Newmont’s operations in Nevada were derived by adding the reserves and resources reported by Barrick in its Q4 2018 Report and Newmont in its press release dated February 20, 2019 reporting its 2018 Reserves and Resources and its annual report on Form 10-K for the fiscal year ended December 31, 2018. See Endnotes 2 and 3. The pro forma reserves and resources are provided for illustrative purposes only. Barrick and Newmont calculate such figures based on different standards and assumptions, and accordingly such figures may not be directly comparable and the potential pro forma reserves and resources may be subject to adjustments due to such differing standards and assumptions. In particular, Barrick mineral reserves and resources have been prepared according to Canadian Institute of Mining, Metallurgy and Petroleum 2014 Definition Standards for Mineral Resources and Mineral Reserves as incorporated by National Instrument 43-101 – Standards of Disclosure for Mineral Projects, which differ from the requirements of U.S. securities laws. Newmont’s reported reserves are prepared in compliance with Industry Guide 7 published by the SEC, however, the SEC does not recognise the terms “resources” and “measured and indicated resources”. According to its public disclosure, Newmont has determined that its reported “resources” would be substantively the same as those prepared using Guidelines established by the Society of Mining, Metallurgy and Exploration (SME) and that its reported measured and indicated resources (combined) are equivalent to “Mineralised Material” disclosed in its annual report on Form 10-K. 5. Targeted annualised dividends represents management’s current expectations and are “forward-looking statements”. See cautionary statement above regarding forward-looking statements. Dividends for the last three quarters of 2019 have not yet been approved or declared by Barrick’s Board of Directors. Investors are cautioned that such statements with respect to future dividends are non-binding. The declaration and payment of future dividends remain at the discretion of the Board of Directors and will be determined based on Barrick’s financial results, balance sheet strength, cash and liquidity requirements, future prospects, gold and commodity prices, and other factors deemed relevant by the Board. The Board of Directors reserves all powers related to the declaration and payment of dividends. Consequently, in determining the dividend to be declared and paid on the common shares of Barrick, the Board of Directors may revise or terminate the payment level at any time without prior notice. As a result, investors should not place undue reliance on such statements. 6. “NAV” or “net asset value” is a non-GAAP financial performance measure with no standardised meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. NAV is based on research analyst consensus estimates. NAV is intended to provide additional information only and does not have a standardised meaning under IFRS and may not be comparable to similar measures presented by other companies. Barrick uses NAV because it believes that this non-GAAP measure is a metric commonly used across the industry to compare the relative value of the asset portfolios of mining companies. “P/NAV” or “price to net asset value ratio” is a non-GAAP financial performance measure with no standardised meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. P/NAV was calculated by dividing the closing share price on February 20, 2019 by NAV. Barrick uses the P/NAV ratio because it believes this non-GAAP financial performance measure is useful for comparing production and pre-production companies as well as companies which have a mixture of assets at both stages of development. Unlike other common metrics such as reserve and cash flow based metrics, P/NAV also effectively differentiates between assets of differing quality. P/NAV is commonly quoted by research analysts and also by companies in their normal course of business corporate presentations.