ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

(Address of principal executive offices) |

(Zip Code) | |

Title of each class |

Trading Symbol |

Name of each exchange of which registered | ||

Item |

Description |

Page | ||

PART I |

||||

1. |

3 | |||

3 | ||||

4 | ||||

6 | ||||

7 | ||||

7 | ||||

7 | ||||

1A. |

8 | |||

1B. |

15 | |||

2. |

15 | |||

3. |

16 | |||

4. |

16 | |||

PART II |

||||

5. |

17 | |||

6. |

19 | |||

7. |

19 | |||

7A. |

35 | |||

8. |

36 | |||

9. |

84 | |||

9A. |

84 | |||

9B. |

84 | |||

9C. |

84 | |||

PART III |

||||

10. |

85 | |||

11. |

85 | |||

12. |

85 | |||

13. |

85 | |||

14. |

85 | |||

PART IV |

||||

15. |

86 | |||

SIGNATURES |

||||

93 | ||||

| • | numerous hazards and operating risks relating to the Company’s electric and natural gas distribution activities, which could result in accidents and other operating risks and costs; |

| • | fluctuations in the supply of, demand for, and the prices of, electric and gas energy commodities and transmission and transportation capacity and the Company’s ability to recover energy supply costs in its rates; |

| • | catastrophic events; |

| • | cyber-attacks, acts of terrorism, acts of war, severe weather, a solar event, an electromagnetic event, a natural disaster, the age and condition of information technology assets, human error, or other factors could disrupt the Company’s operations and cause the Company to incur unanticipated losses and expense; |

| • | outsourcing of services to third parties could expose us to substandard quality of service delivery or substandard deliverables, which may result in missed deadlines or other timeliness issues, non-compliance (including with applicable legal requirements and industry standards) or reputational harm, which could negatively affect our results of operations; |

| • | the coronavirus (COVID-19) pandemic (the coronavirus pandemic) could adversely affect the Company’s business, financial condition, results of operations and cash flows, including by disrupting the Company’s employees’ and contractors’ ability to provide ongoing services to the Company, by reducing customer demand for electricity or natural gas, or by reducing the supply of electricity or natural gas; |

| • | unforeseen or changing circumstances, which could adversely affect the reduction of Company-wide direct greenhouse gas emissions; |

| • | the Company’s regulatory and legislative environment (including laws and regulations relating to climate change, greenhouse gas emissions and other environmental matters) could affect the rates the Company is able to charge, the Company’s authorized rate of return, the Company’s ability to recover costs in its rates, the Company’s financial condition, results of operations and cash flows, and the scope of the Company’s regulated activities; |

| • | general economic conditions, which could adversely affect (i) the Company’s customers and, consequently, the demand for the Company’s distribution services, (ii) the availability of credit and liquidity resources, and (iii) certain of the Company’s counterparty’s obligations (including those of its insurers and lenders); |

| • | the Company’s ability to obtain debt or equity financing on acceptable terms; |

| • | increases in interest rates, which could increase the Company’s interest expense; |

| • | declines in capital markets valuations, which could require the Company to make substantial cash contributions to cover its pension obligations, and the Company’s ability to recover pension obligation costs in its rates; |

| • | restrictive covenants contained in the terms of the Company’s and its subsidiaries’ indebtedness, which restrict certain aspects of the Company’s business operations; |

| • | customers’ preferred energy sources; |

| • | severe storms and the Company’s ability to recover storm costs in its rates; |

| • | variations in weather, which could decrease demand for the Company’s distribution services; |

| • | long-term global climate change, which could adversely affect customer demand or cause extreme weather events that could disrupt the Company’s electric and natural gas distribution services; |

| • | the Company’s ability to retain its existing customers and attract new customers; |

| • | increased competition; and |

| • | other presently unknown or unforeseen factors. |

Item |

1. Business |

| Company Name |

State and Year of Organization |

Principal Business | ||

| Unitil Energy Systems, Inc. (Unitil Energy) |

NH - 1901 | Electric Distribution Utility | ||

| Fitchburg Gas and Electric Light Company (Fitchburg) |

MA - 1852 | Electric & Natural Gas Distribution Utility | ||

| Northern Utilities, Inc. (Northern Utilities) |

NH - 1979 | Natural Gas Distribution Utility | ||

| Granite State Gas Transmission, Inc. (Granite State) |

NH - 1955 | Natural Gas Transmission Pipeline | ||

| Unitil Power Corp. (Unitil Power) |

NH - 1984 | Wholesale Electric Power Utility | ||

| Unitil Service Corp. (Unitil Service) |

NH - 1984 | Utility Service Company | ||

| Unitil Realty Corp. (Unitil Realty) |

NH - 1986 | Real Estate Management | ||

| Unitil Resources, Inc. (Unitil Resources) |

NH - 1993 | Non-regulated Energy Services | ||

Customers Served as of December 31, 2021 |

||||||||||||

Residential |

Commercial & Industrial (C&I) |

Total |

||||||||||

| Electric: |

||||||||||||

| Unitil Energy |

66,331 | 11,315 | 77,646 | |||||||||

| Fitchburg |

25,983 | 4,051 | 30,034 | |||||||||

| |

|

|

|

|

|

|||||||

| Total Electric |

92,314 | 15,366 | 107,680 | |||||||||

| |

|

|

|

|

|

|||||||

| Natural Gas: |

||||||||||||

| Northern Utilities |

53,700 | 16,698 | 70,398 | |||||||||

| Fitchburg |

14,482 | 1,715 | 16,197 | |||||||||

| |

|

|

|

|

|

|||||||

| Total Natural Gas |

68,182 | 18,413 | 86,595 | |||||||||

| |

|

|

|

|

|

|||||||

| Total Customers Served |

160,496 | 33,779 | 194,275 | |||||||||

| |

|

|

|

|

|

|||||||

Employees Covered |

CBA Expiration |

|||||||

| Fitchburg |

43 | 05/31/2022 | ||||||

| Northern Utilities NH Division |

37 | 06/07/2025 | ||||||

| Northern Utilities ME Division |

38 | 03/31/2026 | ||||||

| Granite State |

4 | 03/31/2026 | ||||||

| Unitil Energy |

40 | 05/31/2023 | ||||||

| Unitil Service |

5 | 05/31/2023 | ||||||

| • | Internet Account Access is available at www.computershare.com/investor |

| • | Dividend Reinvestment and Stock Purchase Plan: |

| • | Dividend Direct Deposit Service: |

| • | Direct Registration: |

Item 1A. |

Risk Factors |

| • | the actual and projected earnings and cash flow, capital requirements and general financial condition of the Company’s subsidiaries; |

| • | the prior rights of holders of existing and future preferred stock, mortgage bonds, long-term notes and other debt issued by the Company’s subsidiaries; |

| • | the restrictions on the payment of dividends contained in the existing loan agreements of the Company’s subsidiaries and that may be contained in future debt agreements of the Company’s subsidiaries, if any; and |

| • | limitations that may be imposed by New Hampshire, Massachusetts and Maine state regulatory authorities. |

Item 1B. |

Unresolved Staff Comments |

Item 2. |

Properties |

| Description |

Unitil Energy |

Fitchburg |

Total |

|||||||||

| Primary Transmission and Distribution Pole Miles—Overhead |

1,294 | 455 | 1,749 | |||||||||

| Conduit Distribution Bank Miles—Underground |

240 | 68 | 308 | |||||||||

| Transmission and Distribution Substations |

34 | 15 | 49 | |||||||||

| Transformer Capacity of Transmission and Distribution Substations* (MVA) |

470.1 | 429.4 | 899.5 | |||||||||

| * | Does not include load served directly from sub-transmission. |

Northern Utilities |

Fitchburg |

Granite State |

Total |

|||||||||||||||||

| Description |

NH |

ME |

||||||||||||||||||

| Underground Natural Gas Mains—Miles |

576 | 604 | 272 | — | 1,452 | |||||||||||||||

| Natural Gas Transmission Pipeline—Miles |

— | — | — | 86 | 86 | |||||||||||||||

| Service Pipes |

24,494 | 23,556 | 11,211 | — | 59,261 | |||||||||||||||

Item 3. |

Legal Proceedings |

Item 4. |

Mine Safety Disclosures |

Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

| Dividends per Common Share |

2021 |

2020 |

||||||

| 1st Quarter |

$ |

0.380 |

$ | 0.375 | ||||

| 2nd Quarter |

0.380 |

0.375 | ||||||

| 3rd Quarter |

0.380 |

0.375 | ||||||

| 4th Quarter |

0.380 |

0.375 | ||||||

| |

|

|

|

|||||

| Total for Year |

$ |

1.52 |

$ | 1.50 | ||||

| |

|

|

|

|||||

(a) |

(b) |

(c) |

||||||||||

| Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

|||||||||

| Equity compensation plans approved by security holders (1) |

— |

— |

190,677 | |||||||||

| Equity compensation plans not approved by security holders |

— |

— |

— |

|||||||||

| |

|

|

|

|

|

|||||||

| Total |

— |

— |

190,677 | |||||||||

| |

|

|

|

|

|

|||||||

(1) |

Consists of the Second Amended and Restated 2003 Stock Plan (the Plan). On April 19, 2012, shareholders approved the Plan, and a total of 677,500 shares of our common stock were reserved for issuance pursuant to awards of restricted stock, restricted stock units and common stock under the Plan. A total of 466,975 shares of restricted stock have been awarded and 33,528 restricted stock units have been settled and issued as shares of common stock by Plan participants through December 31, 2021. As of December 31, 2021, a total of 13,680 shares of restricted stock were forfeited and once again became available for issuance under the Plan. |

(1) |

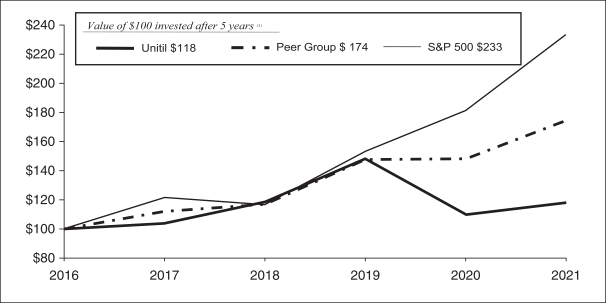

The graph above assumes $100 invested on December 31, 2016, in each category and the reinvestment of all dividends during the five-year period. The Peer Group is comprised of the S&P 500 Utilities Index. |

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs |

||||||||||||

| 10/1/21 – 10/31/21 |

8,012 | $ | 43.746 | 8,012 | $ | 11 | ||||||||||

| 11/1/21 – 11/30/21 |

— | — | — | $ | 11 | |||||||||||

| 12/1/21 – 12/31/21 |

— | — | — | $ | 11 | |||||||||||

| |

|

|

|

|||||||||||||

| Total |

8,012 | $ | 43.746 | 8,012 | ||||||||||||

| |

|

|

|

|||||||||||||

Item 6. |

Reserved |

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) (Note references are to the Notes to the Consolidated Financial Statements included in Item 8.) |

| i) | Unitil Energy, which provides electric service in the southeastern seacoast and state capital regions of New Hampshire; |

| ii) | Fitchburg, which provides both electric and natural gas service in the greater Fitchburg area of north central Massachusetts; and |

| iii) | Northern Utilities, which provides natural gas service in southeastern New Hampshire and portions of southern and central Maine, including the city of Portland and the Lewiston-Auburn area. |

| Twelve Months Ended December 31, 2021 ($ millions) |

||||||||||||||||

Electric |

Gas |

Non-Regulated and Other |

Total |

|||||||||||||

| Total Operating Revenue |

$ | 248.5 | $ | 224.8 | $ | — | $ | 473.3 | ||||||||

| Less: Cost of Sales |

(151.1 | ) | (91.7 | ) | — | (242.8 | ) | |||||||||

| Less: Depreciation and Amortization |

(25.9 | ) | (32.6 | ) | (1.0 | ) | (59.5 | ) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| GAAP Gross Margin |

71.5 | 100.5 | (1.0 | ) | 171.0 | |||||||||||

| Depreciation and Amortization |

25.9 | 32.6 | 1.0 | 59.5 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Adjusted Gross Margin |

$ | 97.4 | $ | 133.1 | $ | — | $ | 230.5 | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Twelve Months Ended December 31, 2020 ($ millions) |

||||||||||||||||

Electric |

Gas |

Non-Regulated and Other |

Total |

|||||||||||||

| Total Operating Revenue |

$ | 227.2 | $ | 191.4 | $ | — | $ | 418.6 | ||||||||

| Less: Cost of Sales |

(134.3 | ) | (68.8 | ) | — | (203.1 | ) | |||||||||

| Less: Depreciation and Amortization |

(23.8 | ) | (29.8 | ) | (0.9 | ) | (54.5 | ) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| GAAP Gross Margin |

69.1 | 92.8 | (0.9 | ) | 161.0 | |||||||||||

| Depreciation and Amortization |

23.8 | 29.8 | 0.9 | 54.5 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Adjusted Gross Margin |

$ | 92.9 | $ | 122.6 | $ | — | $ | 215.5 | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Twelve Months Ended December 31, 2019 ($ millions) |

||||||||||||||||

Electric |

Gas |

Non-Regulated and Other |

Total |

|||||||||||||

| Total Operating Revenue |

$ | 233.9 | $ | 203.4 | $ | 0.9 | $ | 438.2 | ||||||||

| Less: Cost of Sales |

(142.0 | ) | (81.2 | ) | — | (223.2 | ) | |||||||||

| Less: Depreciation and Amortization |

(22.6 | ) | (28.5 | ) | (0.9 | ) | (52.0 | ) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| GAAP Gross Margin |

69.3 | 93.7 | — | 163.0 | ||||||||||||

| Depreciation and Amortization |

22.6 | 28.5 | 0.9 | 52.0 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Adjusted Gross Margin |

$ | 91.9 | $ | 122.2 | $ | 0.9 | $ | 215.0 | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| kWh Sales (millions) |

Change |

|||||||||||||||||||||||||||

2021 vs. 2020 |

2020 vs. 2019 |

|||||||||||||||||||||||||||

2021 |

2020 |

2019 |

kWh |

% |

kWh |

% |

||||||||||||||||||||||

| Residential |

694.2 |

690.6 | 648.2 | 3.6 | 0.5 | % | 42.4 | 6.5 | % | |||||||||||||||||||

| Commercial & Industrial |

936.8 |

905.3 | 947.5 | 31.5 | 3.5 | % | (42.2 | ) | (4.5 | %) | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total kWh Sales |

1,631.0 |

1,595.9 | 1,595.7 | 35.1 | 2.2 | % | 0.2 | — | ||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Electric Operating Revenues and Electric Adjusted Gross Margin (millions) |

||||||||||||||||||||||||||||

Change |

||||||||||||||||||||||||||||

2021 vs. 2020 |

2020 vs. 2019 |

|||||||||||||||||||||||||||

2021 |

2020 |

2019 |

$ |

% |

$ |

% |

||||||||||||||||||||||

| Electric Operating Revenue: |

||||||||||||||||||||||||||||

| Residential |

$ |

140.8 |

$ | 134.7 | $ | 133.8 | $ | 6.1 | 4.5 | % | $ | 0.9 | 0.7% | |||||||||||||||

| Commercial & Industrial |

107.7 |

92.5 | 100.1 | 15.2 | 16.4 | % | (7.6 | ) | (7.6%) | |||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Electric Operating Revenue |

$ |

248.5 |

$ | 227.2 | $ | 233.9 | $ | 21.3 | 9.4 | % | $ | (6.7 | ) | (2.9%) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Cost of Electric Sales |

$ |

151.1 |

$ | 134.3 | $ | 142.0 | $ | 16.8 | 12.5 | % | $ | (7.7 | ) | (5.4%) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Electric Adjusted Gross Margin |

$ |

97.4 |

$ | 92.9 | $ | 91.9 | $ | 4.5 | 4.8 | % | $ | 1.0 | 1.1% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Therm Sales (millions) |

Change |

|||||||||||||||||||||||||||

2021 vs. 2020 |

2020 vs. 2019 |

|||||||||||||||||||||||||||

2021 |

2020 |

2019 |

Therms |

% |

Therms |

% |

||||||||||||||||||||||

| Residential |

44.4 |

44.7 | 48.0 | (0.3 | ) | (0.7 | %) | (3.3 | ) | (6.9 | %) | |||||||||||||||||

| Commercial & Industrial |

177.5 |

170.1 | 184.1 | 7.4 | 4.4 | % | (14.0 | ) | (7.6 | %) | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Therm Sales |

221.9 |

214.8 | 232.1 | 7.1 | 3.3 | % | (17.3 | ) | (7.5 | %) | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Gas Operating Revenues and Gas Adjusted Gross Margin (millions) |

||||||||||||||||||||||||||||

Change |

||||||||||||||||||||||||||||

2021 vs. 2020 |

2020 vs. 2019 |

|||||||||||||||||||||||||||

2021 |

2020 |

2019 |

$ |

% |

$ |

% |

||||||||||||||||||||||

| Gas Operating Revenue: |

||||||||||||||||||||||||||||

| Residential |

$ |

90.6 |

$ | 78.0 | $ | 81.2 | $ | 12.6 | 16.2 | % | $ | (3.2 | ) | (3.9%) | ||||||||||||||

| Commercial & Industrial |

134.2 |

113.4 | 122.2 | 20.8 | 18.3 | % | (8.8 | ) | (7.2%) | |||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Gas Operating Revenue |

$ |

224.8 |

$ | 191.4 | $ | 203.4 | $ | 33.4 | 17.5 | % | $ | (12.0 | ) | (5.9%) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Cost of Gas Sales |

$ |

91.7 |

$ | 68.8 | $ | 81.2 | $ | 22.9 | 33.3 | % | $ | (12.4 | ) | (15.3%) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Gas Adjusted Gross Margin |

$ |

133.1 |

$ | 122.6 | $ | 122.2 | $ | 10.5 | 8.6 | % | $ | 0.4 | 0.3% | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Revolving Credit Facility (millions) |

||||||||

December 31, |

||||||||

2021 |

2020 |

|||||||

| Limit |

$ |

120.0 |

$ | 120.0 | ||||

| Short-Term Borrowings Outstanding |

$ |

64.1 |

$ | 54.7 | ||||

| Letters of Credit Outstanding |

$ |

— |

$ | 0.1 | ||||

| Available |

$ |

55.9 |

$ | 65.2 | ||||

2021 |

2020 |

|||||||

| Cash Provided by Operating Activities |

$ |

107.8 |

$ | 75.7 | ||||

| |

|

|

|

|||||

2021 |

2020 |

|||||||

| Cash Used in Investing Activities |

$ |

(115.0 |

) |

$ | (122.6 | ) | ||

| |

|

|

|

|||||

2021 |

2020 |

|||||||

| Cash Provided by Financing Activities |

$ |

7.7 |

$ | 47.7 | ||||

| |

|

|

|

|||||

| • | the actual and projected earnings and cash flow, capital requirements and general financial condition of the Company’s subsidiaries; |

| • | the prior rights of holders of existing and future preferred stock, mortgage bonds, long-term notes and other debt issued by the Company’s subsidiaries; |

| • | the restrictions on the payment of dividends contained in the existing loan agreements of the Company’s subsidiaries and that may be contained in future debt agreements of the Company’s subsidiaries, if any; and |

| • | limitations that may be imposed by New Hampshire, Massachusetts and Maine state regulatory agencies. |

Item 7A. |

Quantitative and Qualitative Disclosures about Market Risk |

Item 8. |

Financial Statements and Supplementary Data |

• |

We tested the effectiveness of controls over the relevant regulatory account balances and disclosures, including management’s controls over the monitoring and evaluation of regulatory developments that may affect the likelihood of recovering costs in future rates or of a future reduction in rates. |

• |

We evaluated the Company’s disclosures related to the impacts of rate regulation, including the balances recorded and regulatory developments. |

• |

We made inquiries of management and read relevant regulatory orders and settlements issued by the Commissions in Massachusetts, New Hampshire and Maine, regulatory statutes, interpretations, procedural memorandums, filings made by interveners or the Company, and other publicly available information to assess the likelihood of recovery in future rates or of a future reduction in rates based on precedents of the Commissions’ treatment of similar costs under similar circumstances. We evaluated this external information and compared to management’s recorded regulatory asset and liability balances and searched for any evidence that might contradict management’s assertions. |

• |

We obtained an analysis from management describing the orders and filings that support management’s assertions regarding the probability of recovery for regulatory assets or refund or future reduction in rates for regulatory liabilities to assess management’s assertion that amounts are probable of recovery or a future reduction in rates. |

Year Ended December 31, |

2021 |

2020 |

2019 |

|||||||||

Operating Revenues: |

||||||||||||

Electric |

$ |

$ | $ | |||||||||

Gas |

||||||||||||

Other |

— |

— | ||||||||||

Total Operating Revenues |

||||||||||||

Operating Expenses: |

||||||||||||

Cost of Electric Sales |

||||||||||||

Cost of Gas Sales |

||||||||||||

Operation and Maintenance |

||||||||||||

Depreciation and Amortization |

||||||||||||

Taxes Other Than Income Taxes |

||||||||||||

Total Operating Expenses |

||||||||||||

Operating Income |

||||||||||||

Interest Expense, Net |

||||||||||||

Other Expense (Income), Net |

( |

) | ||||||||||

Income Before Income Taxes |

||||||||||||

Provision for Income Taxes |

||||||||||||

Net Income Applicable to Common Shares |

$ |

$ | $ | |||||||||

Earnings per Common Share—Basic and Diluted |

$ |

$ | $ | |||||||||

Weighted Average Common Shares Outstanding—(Basic and Diluted) |

||||||||||||

| December 31, |

2021 |

2020 |

||||||

| Current Assets: |

||||||||

| Cash and Cash Equivalents |

$ |

$ | ||||||

| Accounts Receivable, Net |

||||||||

| Accrued Revenue |

||||||||

| Exchange Gas Receivable |

||||||||

| Gas Inventory |

||||||||

| Materials and Supplies |

||||||||

| Prepayments and Other |

||||||||

| |

|

|

|

|||||

| Total Current Assets |

||||||||

| |

|

|

|

|||||

| Utility Plant: |

||||||||

| Electric |

||||||||

| Gas |

||||||||

| Common |

||||||||

| Construction Work in Progress |

||||||||

| |

|

|

|

|||||

| Utility Plant |

||||||||

| Less: Accumulated Depreciation |

||||||||

| |

|

|

|

|||||

| Net Utility Plant |

||||||||

| |

|

|

|

|||||

| Other Noncurrent Assets: |

||||||||

| Regulatory Assets |

||||||||

| Operating Lease Right of Use Assets |

||||||||

| Other Assets |

||||||||

| |

|

|

|

|||||

| Total Other Noncurrent Assets |

||||||||

| |

|

|

|

|||||

| TOTAL ASSETS |

$ |

$ |

||||||

| |

|

|

|

|||||

December 31, |

2021 |

2020 |

||||||

Current Liabilities: |

||||||||

Accounts Payable |

$ |

$ | ||||||

Short-Term Debt |

||||||||

Long-Term Debt, Current Portion |

||||||||

Regulatory Liabilities |

||||||||

Energy Supply Obligations |

||||||||

Environmental Obligations |

||||||||

Other Current Liabilities |

||||||||

Total Current Liabilities |

||||||||

Noncurrent Liabilities: |

||||||||

Retirement Benefit Obligations |

||||||||

Deferred Income Taxes, Net |

||||||||

Cost of Removal Obligations |

||||||||

Regulatory Liabilities |

||||||||

Environmental Obligations |

||||||||

Other Noncurrent Liabilities |

||||||||

Total Noncurrent Liabilities |

||||||||

Capitalization: |

||||||||

Long-Term Debt, Less Current Portion |

||||||||

Stockholders’ Equity: |

||||||||

Common Equity (Outstanding |

||||||||

Retained Earnings |

||||||||

Total Common Stock Equity |

||||||||

Preferred Stock |

||||||||

Total Stockholders’ Equity |

||||||||

Total Capitalization |

||||||||

Commitments and Contingencies 7 ) |

||||||||

TOTAL LIABILITIES AND CAPITALIZATION |

$ |

$ | ||||||

| Year Ended December 31, |

2021 |

2020 |

2019 |

|||||||||

| Operating Activities: |

||||||||||||

| Net Income |

$ |

$ | $ | |||||||||

| Adjustments to Reconcile Net Income to Cash Provided by Operating Activities: |

||||||||||||

| Depreciation and Amortization |

||||||||||||

| Deferred Tax Provision |

||||||||||||

| Gain on Divestiture, net (See Note 1) |

— |

— | ( |

) | ||||||||

| Changes in Working Capital Items: |

||||||||||||

| Accounts Receivable |

( |

) |

( |

) | ||||||||

| Accrued Revenue |

( |

) |

( |

) | ||||||||

| Regulatory Liabilities |

( |

) | ( |

) | ||||||||

| Exchange Gas Receivable |

( |

) |

||||||||||

| Accounts Payable |

( |

) | ( |

) | ||||||||

| Other Changes in Working Capital Items |

( |

) | ||||||||||

| Deferred Regulatory and Other Charges |

( |

) |

( |

) | ( |

) | ||||||

| Other, net |

( |

) |

— | |||||||||

| |

|

|

|

|

|

|||||||

| Cash Provided by Operating Activities |

||||||||||||

| |

|

|

|

|

|

|||||||

| Investing Activities: |

||||||||||||

| Property, Plant and Equipment Additions |

( |

) |

( |

) | ( |

) | ||||||

| Proceeds from Divestiture, Net (See Note 1) |

— |

— | ||||||||||

| |

|

|

|

|

|

|||||||

| Cash Used In Inves t ing Activities |

( |

) |

( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Financing Activities: |

||||||||||||

| Proceeds from (Repayment of) Short-Term Debt, net |

( |

) | ( |

) | ||||||||

| Issuance of Long-Term Debt |

— |

|||||||||||

| Repayment of Long-Term Debt |

( |

) |

( |

) | ( |

) | ||||||

| Long-Term Debt Issuance Costs |

— |

( |

) | ( |

) | |||||||

| Decrease in Capital Lease Obligations |

( |

) |

( |

) | ( |

) | ||||||

| Net Increase (Decrease) in Exchange Gas Financing |

( |

) | ( |

) | ||||||||

| Dividends Paid |

( |

) |

( |

) | ( |

) | ||||||

| Proceeds from Issuance of Common Stock |

||||||||||||

| |

|

|

|

|

|

|||||||

| Cash Provided by (Used In) Financing Activities |

( |

) | ||||||||||

| |

|

|

|

|

|

|||||||

| Net Increase (Decrease) in Cash and Cash Equivalents |

( |

) | ||||||||||

| Cash and Cash Equivalents at Beginning of Year |

||||||||||||

| |

|

|

|

|

|

|||||||

| Cash and Cash Equivalents at End of Year |

$ |

$ | $ | |||||||||

| |

|

|

|

|

|

|||||||

| Supplemental Information: |

||||||||||||

| Interest Paid |

$ |

$ | $ | |||||||||

| Income Taxes Paid |

$ |

$ | $ | |||||||||

| Payments on Capital Leases |

$ |

$ | $ | |||||||||

| Capital Expenditures Included in Accounts Payable |

$ |

$ | $ | |||||||||

| Right-of-Use |

$ |

$ | $ | |||||||||

Common Equity |

Retained Earnings |

Total |

||||||||||

| Balance at January 1, 2019 |

$ | $ | $ |

|||||||||

| Net Income for 2019 |

||||||||||||

| Dividends ($ |

( |

) | ( |

) | ||||||||

| Shares Issued Under Stock Plans |

||||||||||||

| Issuance of 5 ) |

||||||||||||

| |

|

|

|

|

|

|||||||

| Balance at December 31, 2019 |

||||||||||||

| Net Income for 2020 |

||||||||||||

| Dividends ($ |

( |

) | ( |

) | ||||||||

| Shares Issued Under Stock Plans |

||||||||||||

| Issuance of 5 ) |

||||||||||||

| |

|

|

|

|

|

|||||||

| Balance at December 31, 2020 |

||||||||||||

| Net Income for 2020 |

||||||||||||

| Dividends ($ |

( |

) | ( |

) | ||||||||

| Shares Issued Under Stock Plans |

||||||||||||

| Issuance of 5 ) |

||||||||||||

| |

|

|

|

|

|

|||||||

| Balance at December 31, 2021 |

$ | $ | $ |

|||||||||

| |

|

|

|

|

|

|||||||

Level 1— |

Inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date. | |

Level 2— |

Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly. | |

Level 3— |

Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable. | |

Twelve Months Ended December 31, 2021 |

||||||||||||

Electric and Gas Operating Revenues (millions): |

Electric |

Gas |

Total |

|||||||||

| Billed and Unbilled Revenue: |

||||||||||||

| Residential |

$ | $ | $ | |||||||||

| Commercial & Industrial |

||||||||||||

| Other |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total Billed and Unbilled Revenue |

||||||||||||

| Rate Adjustment Mechanism Revenue |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total Electric and Gas Operating Revenues |

$ |

$ |

$ |

|||||||||

| |

|

|

|

|

|

|||||||

Twelve Months Ended December 31, 2020 |

||||||||||||

Electric and Gas Operating Revenues (millions): |

Electric |

Gas |

Total |

|||||||||

| Billed and Unbilled Revenue: |

||||||||||||

| Residential |

$ | $ | $ | |||||||||

| Commercial & Industrial |

||||||||||||

| Other |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total Billed and Unbilled Revenue |

||||||||||||

| Rate Adjustment Mechanism Revenue |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total Electric and Gas Operating Revenues |

$ |

$ |

$ |

|||||||||

| |

|

|

|

|

|

|||||||

Twelve Months Ended December 31, 2019 |

||||||||||||

Electric and Gas Operating Revenues (millions): |

Electric |

Gas |

Total |

|||||||||

| Billed and Unbilled Revenue: |

||||||||||||

| Residential |

$ | $ | $ | |||||||||

| Commercial & Industrial |

||||||||||||

| Other |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total Billed and Unbilled Revenue |

||||||||||||

| Rate Adjustment Mechanism Revenue |

( |

) | ||||||||||

| |

|

|

|

|

|

|||||||

| Total Electric and Gas Operating Revenues |

$ |

$ |

$ |

|||||||||

| |

|

|

|

|

|

|||||||

| Accrued Revenue (millions) |

December 31, |

|||||||

2021 |

2020 |

|||||||

| Regulatory Assets—Current |

$ |

$ | ||||||

| Unbilled Revenues |

||||||||

| |

|

|

|

|||||

| Total Accrued Revenue |

$ |

$ | ||||||

| |

|

|

|

|||||

| Exchange Gas Receivable (millions) |

December 31, |

|||||||

2021 |

2020 |

|||||||

| Northern Utilities |

$ |

$ | ||||||

| Fitchburg |

||||||||

| |

|

|

|

|||||

| Total Exchange Gas Receivable |

$ |

$ | ||||||

| |

|

|

|

|||||

| Gas Inventory (millions) |

December 31, |

|||||||

2021 |

2020 |

|||||||

| Natural Gas |

$ |

$ | ||||||

| Propane |

||||||||

| Liquefied Natural Gas & Other |

||||||||

| |

|

|

|

|||||

| Total Gas Inventory |

$ |

$ | ||||||

| |

|

|

|

|||||

Regulatory Assets consist of the following (millions) |

December 31, |

|||||||

2021 |

2020 |

|||||||

Retirement Benefits |

$ |

$ | ||||||

Energy Supply & Other Rate Adjustment Mechanisms |

||||||||

Deferred Storm Charges |

||||||||

Environmental |

||||||||

Income Taxes |

||||||||

Other Deferred Charges |

||||||||

Total Regulatory Assets |

||||||||

Less: Current Portion of Regulatory Assets (1) |

||||||||

Regulatory Assets—noncurrent |

$ |

$ | ||||||

(1) |

Reflects amounts included in the Accrued Revenue on the Company’s Consolidated Balance Sheets. |

Regulatory Liabilities consist of the following (millions) |

December 31, |

|||||||

2021 |

2020 |

|||||||

Rate Adjustment Mechanisms |

$ |

$ | ||||||

Income Taxes |

||||||||

Other |

||||||||

Total Regulatory Liabilities |

||||||||

Less: Current Portion of Regulatory Liabilities |

||||||||

Regulatory Liabilities—noncurrent |

$ |

$ | ||||||

| Fair Value of Marketable Securities (millions) |

December 31, |

|||||||

2021 |

2020 |

|||||||

| Money Market Funds |

$ |

$ | ||||||

| |

|

|

|

|||||

| Total Marketable Securities |

$ |

$ | ||||||

| |

|

|

|

|||||

| Fair Value of Marketable Securities (millions) |

December 31, |

|||||||

2021 |

2020 |

|||||||

| Equity Funds |

$ |

$ | ||||||

| Money Market Funds |

||||||||

| |

|

|

|

|||||

| Total Marketable Securities |

$ |

$ | ||||||

| |

|

|

|

|||||

December 31, |

||||||||

| Energy Supply Obligations consist of the following: (millions) |

2021 |

2020 |

||||||

| Renewable Energy Portfolio Standards |

$ |

$ | ||||||

| Exchange Gas Obligation |

||||||||

| Power Supply Contract Divestitures |

||||||||

| |

|

|

|

|||||

| Total Energy Supply Obligations |

$ |

$ | ||||||

| |

|

|

|

|||||

| Year Ended December 31, 2021 |

Electric |

Gas |

Non- Regulated |

Other |

Total |

|||||||||||||||

| Revenues: |

||||||||||||||||||||

| Billed and Unbilled Revenue |

$ |

$ |

$ |

— |

$ |

— |

$ |

|||||||||||||

| Rate Adjustment Mechanism Revenue |

— |

— |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Operating Revenues |

— |

— |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Interest Income |

— |

|||||||||||||||||||

| Interest Expense |

— |

|||||||||||||||||||

| Depreciation & Amortization Expense |

— |

|||||||||||||||||||

| Income Tax Expense (Benefit) |

( |

) |

( |

) |

||||||||||||||||

| Segment Profit (Loss) |

( |

) |

||||||||||||||||||

| Segment Assets |

— |

|||||||||||||||||||

| Capital Expenditures |

— |

|||||||||||||||||||

| Year Ended December 31, 2020 |

||||||||||||||||||||

| Revenues: |

||||||||||||||||||||

| Billed and Unbilled Revenue |

$ | $ | $ | — | $ | — | $ | |||||||||||||

| Rate Adjustment Mechanism Revenue |

— | — | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Operating Revenues |

— | — | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Interest Income |

— | |||||||||||||||||||

| Interest Expense |

— | |||||||||||||||||||

| Depreciation & Amortization Expense |

— | |||||||||||||||||||

| Income Tax Expense (Benefit) |

— | ( |

) | |||||||||||||||||

| Segment Profit |

— | — | ||||||||||||||||||

| Segment Assets |

— | |||||||||||||||||||

| Capital Expenditures |

— | |||||||||||||||||||

| Year Ended December 31, 2019 |

||||||||||||||||||||

| Revenues: |

||||||||||||||||||||

| Billed and Unbilled Revenue |

$ | $ | $ | — | $ | — | $ | |||||||||||||

| Rate Adjustment Mechanism Revenue |

(8.7 | ) | — | — | ||||||||||||||||

| Other Operating Revenue—Non-Regulated |

— | — | — | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Operating Revenues |

— | |||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Interest Income |

||||||||||||||||||||

| Interest Expense |

— | |||||||||||||||||||

| Depreciation & Amortization Expense |

— | |||||||||||||||||||

| Income Tax Expense (Benefit) |

( |

) | ||||||||||||||||||

| Segment Profit |

||||||||||||||||||||

| Segment Assets |

||||||||||||||||||||

| Capital Expenditures |

— | |||||||||||||||||||

Balance at Beginning of Period |

Provision |

Recoveries |

Accounts Written Off |

Regulatory Deferrals* |

Balance at End of Period |

|||||||||||||||||||

| Year Ended December 31, 2021 |

||||||||||||||||||||||||

| Electric |

$ |

$ |

$ |

$ |

$ |

$ |

||||||||||||||||||

| Gas |

— |

|||||||||||||||||||||||

| Other |

— |

— |

— |

— |

— |

— |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Year Ended December 31, 2020 |

||||||||||||||||||||||||

| Electric |

$ | $ | $ | $ | $ | $ | ||||||||||||||||||

| Gas |

||||||||||||||||||||||||

| Other |

— | — | — | — | — | — | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Year Ended December 31, 2019 |

||||||||||||||||||||||||

| Electric |

$ | $ | $ | $ | $ | — | $ | |||||||||||||||||

| Gas |

— | |||||||||||||||||||||||

| Other |

— | — | — | — | — | — | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| $ | $ | $ | $ | $ | — | $ | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| * | The Company has incurred greater than normal bad debt expense due to the coronavirus pandemic. Incremental bad debt expense amounts have been deferred as regulatory assets based on certain regulatory proceedings and management’s belief that such amounts are probable of recovery (See the “Financial Effects of COVID-19 Pandemic” section in Note 7 (Commitments and Contingencies). The Company will track the collection of receivables and to the extent incremental bad debt amounts are collected in the future, such amounts will reduce the regulatory assets recorded. |

| Estimated Fair Value of Long-Term Debt (millions) |

December 31, |

|||||||

2021 |

2020 |

|||||||

| Estimated Fair Value of Long-Term Debt |

$ |

$ | ||||||

| Long-Term Debt (millions) |

December 31, |

|||||||

2021 |

2020 |

|||||||

| Unitil Corporation: |

||||||||

| |

$ |

— |

$ | |||||

| |

||||||||

| |

||||||||

| Unitil Energy First Mortgage Bonds: |

||||||||

| |

||||||||

| |

||||||||

| |

||||||||

| |

||||||||

| |

||||||||

| |

||||||||

| Fitchburg: |

||||||||

| |

— |

|||||||

| |

||||||||

| |

||||||||

| |

||||||||

| |

||||||||

| |

||||||||

| |

||||||||

| |

||||||||

| Northern Utilities: |

||||||||

| |

||||||||

| |

||||||||

| |

||||||||

| |

||||||||

| |

||||||||

| |

||||||||

| Granite State: |

||||||||

| |

||||||||

| Unitil Realty Corp.: |

||||||||

| |

||||||||

| |

|

|

|

|||||

| Total Long-Term Debt |

||||||||

| Less: Unamortized Debt Issuance Costs |

||||||||

| |

|

|

|

|||||

| Total Long-Term Debt, net of Unamortized Debt Issuance Costs |

||||||||

| Less: Current Portion (1) |

||||||||

| |

|

|

|

|||||

| Total Long-Term Debt, Less Current Portion |

$ |

$ | ||||||

| |

|

|

|

|||||

(1) |

The Current Portion of Long-Term Debt includes sinking fund payments. |

| Interest Expense, Net (millions) |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

| Interest Expense |

||||||||||||

| Long-Term Debt |

$ |

$ | $ | |||||||||

| Short-Term Debt |

||||||||||||

| Regulatory Liabilities |

||||||||||||

| |

|

|

|

|

|

|||||||

| Subtotal Interest Expense |

||||||||||||

| |

|

|

|

|

|

|||||||

| Interest Income |

||||||||||||

| Regulatory Assets |

( |

) |

( |

) | ( |

) | ||||||

| AFUDC (1) and Other |

( |

) |

( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Subtotal Interest Income |

( |

) |

( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Total Interest Expense, Net |

$ |

$ | $ | |||||||||

| |

|

|

|

|

|

|||||||

(1) |

AFUDC—Allowance for Funds Used During Construction |

| Revolving Credit Facility (millions) |

||||||||

December 31, |

||||||||

2021 |

2020 |

|||||||

| Limit |

$ |

$ | ||||||

| Short-Term Borrowings Outstanding |

$ |

$ | ||||||

| Letters of Credit Outstanding |

$ |

— |

$ | |||||

| Available |

$ |

$ | ||||||

Payments Due by Period |

||||||||||||||||||||||||||||

| Long-Term Debt Contractual Obligations (millions) as of December 31, 2021 |

Total |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 & Beyond |

|||||||||||||||||||||

| Long-Term Debt |

$ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| Interest on Long-Term Debt |

||||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

December 31, |

||||||||

| Lease Obligations (millions) |

2021 |

2020 |

||||||

| Operating Lease Obligations: |

||||||||

| Other Current Liabilities (current portion) |

$ |

$ | ||||||

| Other Noncurrent Liabilities (long-term portion) |

||||||||

| |

|

|

|

|||||

| Total Operating Lease Obligations |

||||||||

| |

|

|

|

|||||

| Capital Lease Obligations: |

||||||||

| Other Current Liabilities (current portion) |

||||||||

| Other Noncurrent Liabilities (long-term portion) |

||||||||

| |

|

|

|

|||||

| Total Capital Lease Obligations |

||||||||

| |

|

|

|

|||||

| Total Lease Obligations |

$ |

$ |

||||||

| |

|

|

|

|||||

| Lease Payments ($000’s) Year Ending December 31, |

Operating Leases |

Capital Leases |

||||||

| 2022 |

$ | $ | ||||||

| 2023 |

||||||||

| 2024 |

||||||||

| 2025 |

||||||||

| 2026 |

— | |||||||

| 2027-2031 |

— | |||||||

| |

|

|

|

|||||

| Total Payments |

||||||||

| |

|

|

|

|||||

| Less: Interest |

||||||||

| |

|

|

|

|||||

| Amount of Lease Obligations Recorded on Consolidated Balance Sheets |

$ |

$ |

||||||

| |

|

|

|

|||||

Issuance Date |

Shares |

Aggregate Market Value (millions) | ||

| $ | ||||

| $ | ||||

| $ | ||||

| $ |

Restricted Stock Units (Equity Portion) |

||||||||||||||||

2021 |

2020 |

|||||||||||||||

Units |

Weighted Average Stock Price |

Units |

Weighted Average Stock Price |

|||||||||||||

Beginning Restricted Stock Units |

$ |

$ | ||||||||||||||

Restricted Stock Units Granted |

$ |

$ | ||||||||||||||

Dividend Equivalents Earned |

$ |

$ | ||||||||||||||

Restricted Stock Units Settled |

— |

$ |

— |

( |

) | $ | ||||||||||

Ending Restricted Stock Units |

$ |

$ | ||||||||||||||

(Millions except shares and per share data) |

2021 |

2020 |

2019 |

|||||||||

Earnings Available to Common Shareholders |

$ |

$ | $ | |||||||||

Weighted Average Common Shares Outstanding—Basic (000’s) |

||||||||||||

Plus: Diluted Effect of Incremental Shares (000’s) |

||||||||||||

Weighted Average Common Shares Outstanding—Diluted (000’s) |

||||||||||||

Earnings per Share—Basic and Diluted |

$ |

$ | $ | |||||||||

2021 |

2020 |

2019 |

||||||||||

Weighted Average Non-Vested Restricted Shares Not Included in EPS Computation |

— | |||||||||||

Payments Due by Period |

||||||||||||||||||||||||||||

| Gas and Electric Supply Contractual Obligations (millions) as of December 31, 2021 |

Total |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 & Beyond |

|||||||||||||||||||||

| Gas Supply Contracts |

$ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| Electric Supply Contracts |

||||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

December 31, |

||||||||

2021 |

2020 |

|||||||

| Total Balance at Beginning of Period |

$ |

$ |

||||||

| Additions |

||||||||

| Less: Payments / Reductions |

||||||||

| |

|

|

|

|||||

| Total Balance at End of Period |

||||||||

| |

|

|

|

|||||

| Less: Current Portion |

||||||||

| |

|

|

|

|||||

| Noncurrent Balance at End of Period |

$ |

$ |

||||||

| |

|

|

|

|||||

(in millions) |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

| Current Income Tax Provision |

||||||||||||

| Federal |

$ |

— |

$ | $ | — | |||||||

| State |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total Current Income Taxes |

$ |

$ | $ | |||||||||

| |

|

|

|

|

|

|||||||

| Deferred Income Tax Provision |

||||||||||||

| Federal |

$ |

$ | $ | |||||||||

| State |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total Deferred Income Taxes |

||||||||||||

| |

|

|

|

|

|

|||||||

| Total Income Tax Expense |

$ |

$ | $ | |||||||||

| |

|

|

|

|

|

|||||||

2021 |

2020 |

2019 |

||||||||||

| Statutory Federal Income Tax Rate |

% |

% | % | |||||||||

| Income Tax Effects of: |

||||||||||||

| State Income Taxes, net |

||||||||||||

| Utility Plant Differences |

( |

) |

( |

) | ( |

) | ||||||

| Other, net |

— |

— | ||||||||||

| |

|

|

|

|

|

|||||||

| Effective Income Tax Rate |

% |

% | % | |||||||||

| |

|

|

|

|

|

|||||||

| Temporary Differences (in millions) |

2021 |

2020 |

||||||

| Deferred Tax Assets |

||||||||

| Retirement Benefit Obligations |

$ |

$ | ||||||

| Net Operating Loss Carryforwards |

— | |||||||

| Tax Credit Carryforwards |

||||||||

| Other, net |

||||||||

| |

|

|

|

|||||

| Total Deferred Tax Assets |

$ |

$ | ||||||

| |

|

|

|

|||||

| Deferred Tax Liabilities |

||||||||

| Utility Plant Differences |

$ | |||||||

| Regulatory Assets & Liabilities |

||||||||

| Other, net |

||||||||

| |

|

|

|

|||||

| Total Deferred Tax Liabilities |

||||||||

| |

|

|

|

|||||

| Net Deferred Tax Liabilities |

$ |

$ | ||||||

| |

|

|

|

|||||

• |

The Unitil Corporation Retirement Plan (Pension Plan)—The Pension Plan is a defined benefit pension plan. Under the Pension Plan, retirement benefits are based upon an employee’s level of compensation and length of service. Effective January 1, 2010, the Pension Plan was closed to new non-union employees. For union employees, the Pension Plan was closed on various dates between December 31, 2010 and June 1, 2013, depending on the various Collective Bargaining Agreements of each union. |

• |

The Unitil Retiree Health and Welfare Benefits Plan (PBOP Plan)—The PBOP Plan provides health care and life insurance benefits to retirees. The Company has established Voluntary Employee Benefit Trusts, into which it funds contributions to the PBOP Plan. |

• |

The Unitil Corporation Supplemental Executive Retirement Plan (SERP)—The SERP is a non-qualified retirement plan, with participation limited to executives selected by the Board of Directors. |

2021 |

2020 |

2019 |

||||||||||

| Used to Determine Plan costs for years ended December 31: |

||||||||||||

| Discount Rate |

% |

% | % | |||||||||

| Rate of Compensation Increase |

% |

% | % | |||||||||

| Expected Long-term rate of return on plan assets |

% |

% | % | |||||||||

| Health Care Cost Trend Rate Assumed for Next Year |

% |

% | % | |||||||||

| Ultimate Health Care Cost Trend Rate |

% |

% | % | |||||||||

| Year that Ultimate Health Care Cost Trend Rate is reached |

||||||||||||

| Used to Determine Benefit Obligations at December 31: |

||||||||||||

| Discount Rate |

% |

% | % | |||||||||

| Rate of Compensation Increase |

% |

% | % | |||||||||

| Health Care Cost Trend Rate Assumed for Next Year |

% |

% | % | |||||||||

| Ultimate Health Care Cost Trend Rate |

% |

% | % | |||||||||

| Year that Ultimate Health Care Cost Trend Rate is reached |

||||||||||||

Pension Plan |

PBOP Plan |

SERP |

||||||||||||||||||||||||||||||||||

2021 |

2020 |

2019 |

2021 |

2020 |

2019 |

2021 |

2020 |

2019 |

||||||||||||||||||||||||||||

| Service Cost |

$ |

$ | $ | $ |

$ | $ | $ |

$ | $ | |||||||||||||||||||||||||||

| Interest Cost |

||||||||||||||||||||||||||||||||||||

| Expected Return on Plan Assets |

( |

) |

( |

) | ( |

) | ( |

) |

( |

) | ( |

) | — |

— | — | |||||||||||||||||||||

| Prior Service Cost Amortization |

||||||||||||||||||||||||||||||||||||

| Actuarial Loss Amortization |

||||||||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Sub-total |

||||||||||||||||||||||||||||||||||||

| Amounts Capitalized or Deferred |

( |

) |

( |

) | ( |

) | ( |

) |

( |

) | ( |

) | ( |

) |

( |

) | ( |

) | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| NPBC Recognized |

$ |

$ | $ | $ |

$ | $ | $ |

$ | $ | |||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Pension Plan |

PBOP Plan |

SERP |

||||||||||||||||||||||

| Change in Plan Assets: |

2021 |

2020 |

2021 |

2020 |

2021 |

2020 |

||||||||||||||||||

| Plan Assets at Beginning of Year |

$ |

$ | $ |

$ | $ |

— |

$ | — | ||||||||||||||||

| Actual Return on Plan Assets |

— |

— | ||||||||||||||||||||||

| Employer Contributions |

||||||||||||||||||||||||

| Participant Contributions |

— |

— | — |

— | ||||||||||||||||||||

| Benefits Paid |

( |

) |

( |

) | ( |

) |

( |

) | ( |

) |

( |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Plan Assets at End of Year |

$ |

$ | $ |

$ | $ |

— |

$ | — | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Change in PBO: |

||||||||||||||||||||||||

| PBO at Beginning of Year |

$ |

$ | $ |

$ | $ |

$ | ||||||||||||||||||

| Service Cost |

||||||||||||||||||||||||

| Interest Cost |

||||||||||||||||||||||||

| Participant Contributions |

— |

— | — |

— | ||||||||||||||||||||

| Plan Amendments |

— |

— | — |

— | ||||||||||||||||||||

| Benefits Paid |

( |

) |

( |

) | ( |

) |

( |

) | ( |

) |

( |

) | ||||||||||||

| Actuarial (Gain) or Loss |

( |

) |

( |

) |

||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| PBO at End of Year |

$ |

$ | $ |

$ | $ |

$ | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Funded Status: Assets vs PBO |

$ |

( |

) |

$ |

( |

) |

$ |

( |

) |

$ |

( |

) |

$ |

( |

) |

$ |

( |

) | ||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Pension Plan |

PBOP Plan |

SERP |

||||||||||||||||||||||||||||||||||

2021 |

2020 |

2019 |

2021 |

2020 |

2019 |

2021 |

2020 |

2019 |

||||||||||||||||||||||||||||

| Employer Contributions |

$ |

$ | $ | $ |

$ | $ | $ |

$ | $ | |||||||||||||||||||||||||||

| Participant Contributions |

$ |

— |

$ | — | $ | — | $ |

$ | $ | $ |

— |

$ | — | $ | — | |||||||||||||||||||||

| Benefit Payments |

$ |

$ | $ | $ |

$ | $ | $ |

$ | $ | |||||||||||||||||||||||||||

| Estimated Future Benefit Payments |

||||||||||||

Pension |

PBOP |

SERP |

||||||||||

| 2022 |

$ | $ | $ | |||||||||

| 2023 |

||||||||||||

| 2024 |

||||||||||||

| 2025 |

||||||||||||

| 2026 |

||||||||||||

| 2027—2031 |

||||||||||||

| Pension Plan |

Target Allocation 2022 |

Actual Allocation at December 31, |

||||||||||||||

2021 |

2020 |

2019 |

||||||||||||||

| Equity Funds |

% | % |

% | % | ||||||||||||

| Debt Funds |

% | % |

% | % | ||||||||||||

| Real Estate Fund |

% | % |

% | % | ||||||||||||

| Other (1) |

— | % |

% | % | ||||||||||||

| |

|

|

|

|

|

|||||||||||

| Total |

% |

% | % | |||||||||||||

| |

|

|

|

|

|

|||||||||||

(1) |

Represents investments being held in cash equivalents as of December 31, 2021, December 31, 2020 and December 31, 2019 pending payment of benefits. |

| PBOP Plan |

Target Allocation 2022 |

Actual Allocation at December 31, |

||||||||||||||

2021 |

2020 |

2019 |

||||||||||||||

| Equity Funds |

% | % |

% | % | ||||||||||||

| Debt Funds |

% | % |

% | % | ||||||||||||

| |

|

|

|

|

|

|||||||||||

| Total |

% |

% | % | |||||||||||||

| |

|

|

|

|

|

|||||||||||

Fair Value Measurements at Reporting Date Using |

||||||||||||||||

| Description |

Balance as of December 31, |

Quoted Prices in Active Markets for Identical Assets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

||||||||||||

| 2021 |

||||||||||||||||

| Pension Plan Assets: |

||||||||||||||||

| Mutual Funds: |

||||||||||||||||

| Equity Funds |

$ | $ | $ | — | $ | — | ||||||||||

| Fixed Income Funds |

— | — | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total Mutual Funds |

— | — | ||||||||||||||

| Cash Equivalents |

||||||||||||||||

| |

|

|

|

|||||||||||||

| Total Assets in the Fair Value Hierarchy |

$ | $ | $ | — | $ | — | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Real Estate Fund–Measured at Net Asset Value |

||||||||||||||||

| |

|

|||||||||||||||

| Total Assets |

$ | |||||||||||||||

| |

|

|||||||||||||||

| 2020 |

||||||||||||||||

| Pension Plan Assets: |

||||||||||||||||

| Mutual Funds: |

||||||||||||||||

| Equity Funds |

$ | $ | $ | — | $ | — | ||||||||||

| Fixed Income Funds |

— | — | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total Mutual Funds |

— | — | ||||||||||||||

| Cash Equivalents |

||||||||||||||||

| |

|

|

|

|||||||||||||

| Total Assets in the Fair Value Hierarchy |

$ | $ | $ | — | $ | — | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Real Estate Fund–Measured at Net Asset Value |

||||||||||||||||

| |

|

|||||||||||||||

| Total Assets |

$ | |||||||||||||||

| |

|

|||||||||||||||

Fair Value Measurements at Reporting Date Using |

||||||||||||||||

| Description |

Balance as of December 31, |

Quoted Prices in Active Markets for Identical Assets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

||||||||||||

| 2021 |

||||||||||||||||

| PBOP Plan Assets: |

||||||||||||||||

| Mutual Funds: |

||||||||||||||||

| Fixed Income Funds |

$ | $ | $ | — | $ | — | ||||||||||

| Equity Funds |

— | — | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total Assets |

$ | $ | $ | — | $ | — | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| 2020 |

||||||||||||||||

| PBOP Plan Assets: |

||||||||||||||||

| Mutual Funds: |

||||||||||||||||

| Fixed Income Funds |

$ | $ | $ | — | $ | — | ||||||||||

| Equity Funds |

— | — | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total Assets |

$ | $ | $ | — | $ | — | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

Item 9A. |

Controls and Procedures |

Item 9B. |

Other Information |

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections. |

Item 10. |

Directors, Executive Officers and Corporate Governance |

Item 11. |

Executive Compensation |

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

Item 14. |

Principal Accountant Fees and Services |

Item 15. |

Exhibits and Financial Statement Schedules |

| • | Report of Independent Registered Public Accounting Firm (Deloitte & Touche LLP; PCAOB ID No. |

| • | Consolidated Statements of Earnings for the years ended December 31, 2021, 2020 and 2019 |

| • | Consolidated Balance Sheets—December 31, 2021 and 2020 |

| • | Consolidated Statements of Cash Flows for the years ended December 31, 2021, 2020 and 2019 |

| • | Consolidated Statements of Changes in Common Stock Equity for the years ended December 31, 2021, 2020 and 2019 |

| • | Notes to Consolidated Financial Statements |

| Exhibit Number |

Description of Exhibit |

Reference* | ||

10.14*** |

||||

10.15*** |

||||

10.16*** |

||||

10.17*** |

||||

10.18*** |

||||

10.19*** |

||||

10.20*** |

||||

10.21*** |

||||

10.22 |

||||

11.1 |

||||

21.1 |

||||

23.1 |

||||

31.1 |

||||

31.2 |

||||

31.3 |

||||

32.1 |

||||

| Exhibit Number |

Description of Exhibit |

Reference* | ||

99.1 |

Unitil Corporation Press Release Dated February 1, 2022 Announcing Earnings For the Year Ended December 31, 2021. | Furnished herewith | ||

101.INS |

Inline XBRL Instance Document – The instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. | Filed herewith | ||

101.SCH |

Inline XBRL Taxonomy Extension Schema Document. | Filed herewith | ||

101.CAL |

Inline XBRL Taxonomy Extension Calculation Linkbase Document. | Filed herewith | ||

101.DEF |

Inline XBRL Taxonomy Extension Definition Linkbase Document. | Filed herewith | ||

101.LAB |

Inline XBRL Taxonomy Extension Label Linkbase Document. | Filed herewith | ||

101.PRE |

Inline XBRL Taxonomy Extension Presentation Linkbase Document. | Filed herewith | ||

104 |

Cover Page Interactive Data File – The cover page interactive data file does not appear in the interactive data file because its XBRL tags are embedded within the inline XBRL document. | Filed herewith | ||

| * | The exhibits referred to in this column by specific designations and dates have heretofore been filed with or furnished to the Securities and Exchange Commission under such designations and are hereby incorporated by reference. |

| ** | In accordance with Item 601(b)(4)(iii)(A) of Regulation S-K, the instrument defining the debt of the Registrant and its subsidiary, described above, has been omitted but will be furnished to the Commission upon request. |

| *** | These exhibits represent a management contract or compensatory plan. |

| **** | This Note or Bond (each, an “Instrument”) is substantially identical in all material respects to other Instruments that are otherwise required to be filed as exhibits, except as to the registered payee of such Instrument, the identifying number of such Instrument, and the principal amount of such Instrument. In accordance with instruction no. 2 to Item 601 of Regulation S-K, the registrant has filed a copy of only one of such Instruments, with a schedule identifying the other Instruments omitted and setting forth the material details in which such Instruments differ from the Instrument that was filed. The registrant acknowledges that the Securities and Exchange Commission may at any time in its discretion require filing of copies of any Instruments so omitted. |

| (P) | Paper exhibit. |

| U NITIL CORPORATION | ||||||

| Date February 1, 2022 |

By |

/ S / THOMAS P. MEISSNER , JR . | ||||

Thomas P. Meissner, Jr. | ||||||

| Chairman of the Board of Directors, Chief Executive Officer and President | ||||||

| Signature |

Capacity |

Date | ||

| / S / THOMAS P. MEISSNER , JR .Thomas P. Meissner, Jr. |

Principal Executive Officer; Director | February 1, 2022 | ||

| / S / ROBERT B. HEVERT Robert B. Hevert |

Principal Financial Officer | February 1, 2022 | ||

| / S / DANIEL J. HURSTAK Daniel J. Hurstak |

Principal Accounting Officer | February 1, 2022 | ||

| / S / MICHAEL B. GREEN Michael B. Green |

Director | February 1, 2022 | ||

| / S / EBEN S. MOULTON Eben S. Moulton |

Director | February 1, 2022 | ||

| / S / EDWARD F. GODFREY Edward F. Godfrey |

Director | February 1, 2022 | ||

| / S / WINFIELD S. BROWN Winfield S. Brown |

Director | February 1, 2022 | ||

| / S / LISA CRUTCHFIELD Lisa Crutchfield |

Director | February 1, 2022 | ||

| / S / DAVID A. WHITELEY David A. Whiteley |

Director | February 1, 2022 | ||

| / S / SUZANNE FOSTER Suzanne Foster |

Director | February 1, 2022 | ||

| / S / JUSTINE VOGEL Justine Vogel |

Director | February 1, 2022 | ||

| / S / MARK H. COLLIN Mark H. Collin |

Director | February 1, 2022 | ||