This Agreement of Lease (“Lease”) between the parties set forth below incorporates the Basic Lease Provisions and the General Lease Provisions attached hereto. In addition to other terms elsewhere defined in this Lease, the following terms whenever used in this Lease shall have only the meanings set forth in this Section, unless such meanings are expressly modified, limited or expanded elsewhere herein.

|

1.

|

BASIC LEASE PROVISIONS:

|

|

1.

|

Effective Date:

|

__________________, 2011

|

|

|

2.

|

Tenant:

|

Healthwarehouse.com, Inc., a Delaware corporation

|

|

|

3.

|

Landlord:

|

CIVF I-KY1M01-KY1M06 & KY1W01, LLC, a Delaware limited liability company

|

|

|

4.

|

Premises:

|

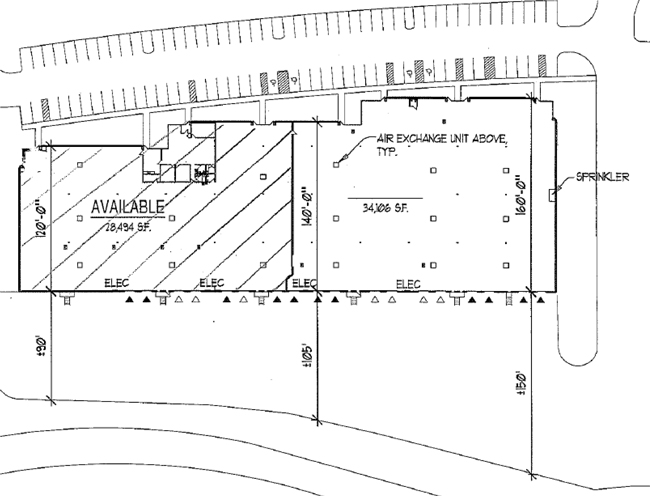

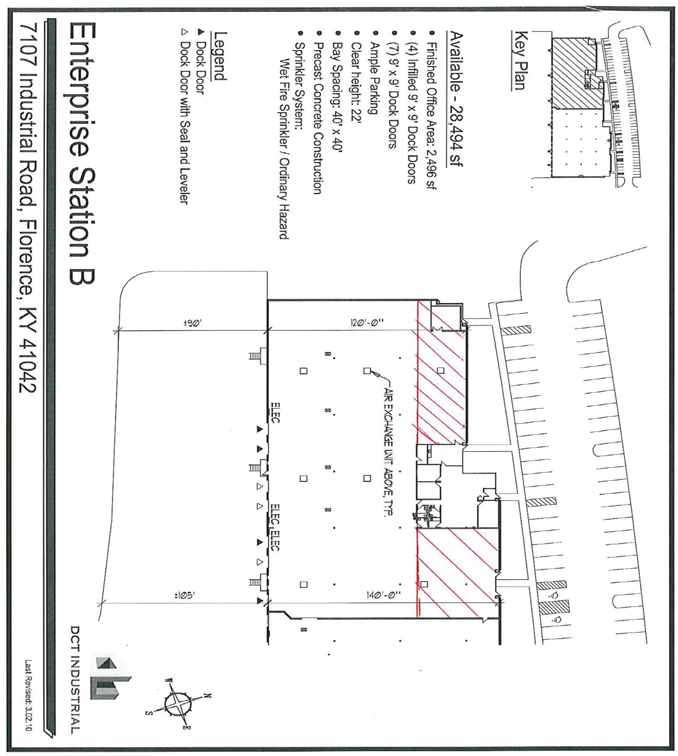

The space in the Building cross-hatched on Exhibit A, containing approximately 28,494 rentable square feet (“Rentable Area”) (more or less) of area referred herein as Suite 1.

|

|

|

5.

|

Building:

|

That certain approximately 62,600 square foot warehouse building located at 7107 Industrial Road, Florence, Kentucky.

|

|

|

6.

|

Land:

|

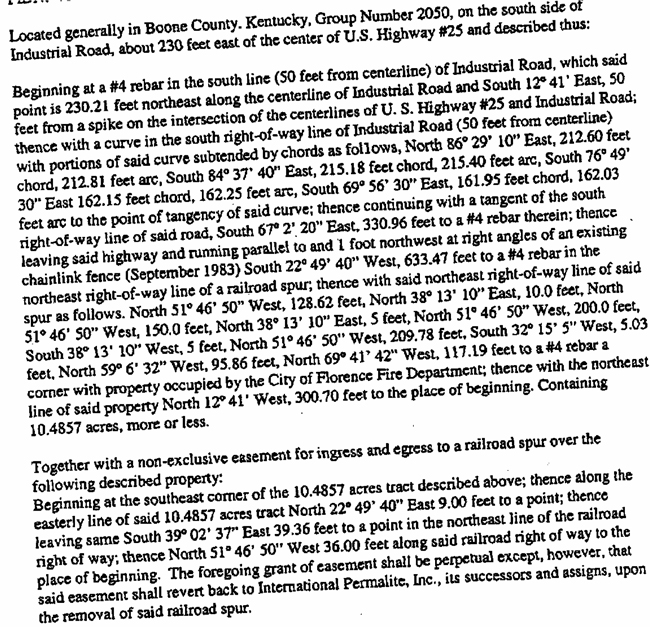

That certain tract of real property more particularly described on Exhibit B hereto.

|

|

|

7.

|

Property:

|

The Land and all improvements located thereon.

|

|

|

8.

|

Initial Term:

|

Sixty-six (66) full calendar months

|

|

|

9.

|

Commencement Date (Paragraph 2):

|

Upon Substantial Completion of the Tenant Improvements as set forth in Exhibit C

|

|

|

10.

|

Expiration Date (Paragraph 2):

|

The last day of the 66th full calendar month of the Initial Term

|

|

|

11.

|

Base Rent (Paragraph 4):

|

|

Months:

|

Annual Rate per Rentable Area:

|

Monthly Rate:

|

|||||||||

|

1

|

through

|

6

|

, inclusive

|

$ | 0.00 p.s.f. | $ | 0.00 | * | |||

|

7

|

through

|

30

|

, inclusive

|

$ | 1.85 p.s.f. | $ | 4,392.83 | ||||

|

31

|

through

|

54

|

, inclusive

|

$ | 2.10 p.s.f. | $ | 4,986.45 | ||||

|

55

|

through

|

66

|

, inclusive

|

$ | 2.35 p.s.f. | $ | 5,580.08 | ||||

* Tenant shall not be responsible for the payment of Base Rent during Months 1-6 of the Initial Term; provided, however, Tenant shall remain responsible for the payment of Estimated Initial Monthly Expenses during Months 1-6 of the Initial Term..

|

12.

|

Installment Payable Upon Execution:

|

$6,173.70 (first month’s Base Rent and Estimated Initial Monthly Expenses)

|

|

|

13.

|

Tenant’s Pro Rata Share (Paragraph 4):

|

45.52% (28,494/62,600)

|

|

|

14.

|

Estimated Initial Monthly Expenses (Paragraph 4):

|

Taxes = $664.86, Insurance = $94.98, CAM = $1,021.04 (Property Management Fees included in CAM estimate), Total = $1,780.88

|

|

|

15.

|

Security Deposit (Paragraph 26):

|

None

|

1

|

16.

|

Rent Payment Address:

|

STANDARD MAIL:

|

|

|

DCT Industrial Op Partnership LP

|

|||

|

c/o DCT Property Management LLC

|

|||

|

Department 1379

|

|||

|

Denver, CO 80256

|

|||

|

OVERNIGHT MAIL:

|

|||

|

U.S. Bank Denver Lockbox

|

|||

|

Attn: DCT Industrial Op Ptnsp. Dept #1379

|

|||

|

10035 East 40th Avenue

|

|||

|

Denver, CO 80238

|

|||

|

17.

|

Tenant Improvements:

|

SEE EXHIBIT C

|

|

|

18.

|

Permitted Use of the Premises (Paragraph 3):

|

General warehouse and distribution and office space.

|

|

|

19.

|

Tenant’s Business:

|

On-line pharmaceutical sales and distribution

|

|

|

20.

|

Landlord’s Address:

|

518 17th Street, Suite 800

|

|

|

Denver, Colorado 80202

|

|||

|

Attention: Legal Department

|

|||

|

With a copy to:

|

4701 Creek Road

|

||

|

Suite 230

|

|||

|

Cincinnati, OH 45242

|

|||

|

21.

|

Tenant’s Address:

|

Attn: Aniket Dhadphale

|

|

|

7107 Industrial Road

|

|||

|

Florence, KY 41042

|

|||

|

22.

|

Guarantor:

|

None

|

|

|

23.

|

Landlord’s Broker(s) (Paragraph 31):

|

Mike Lowe and Doug Whitten

|

|

|

CB Richard Ellis

|

|||

|

PNC Center

|

|||

|

201 E. Fifth Street, Suite 100

|

|||

|

Cincinnati, OH 45202

|

|||

|

24.

|

Tenant’s Broker:

|

Tim Schenke

|

|

|

201 E. Fifth Street, Suite 1200

|

|||

|

Cincinnati, OH 45202

|

2

|

25.

|

Additional Agreements:

|

EXHIBIT A – Premises

|

|

|

EXHIBIT B – Legal Description of Property

|

|||

|

EXHIBIT C – Construction Work Letter (Turnkey)

|

|||

|

EXHIBIT D – Rules and Regulations

|

|||

|

EXHIBIT E – HVAC Maintenance Contract

|

|||

|

EXHIBIT F – Move-Out Conditions

|

|||

|

EXHIBIT G – Renewal Option

|

|||

|

EXHIBIT H – Right of First Offer

|

|||

|

EXHIBIT I – Lease Confirmation Certificate

|

|||

|

EXHIBIT J – Alterations and Improvements

|

|||

|

EXHIBIT J-1 – Office Plan

|

|||

|

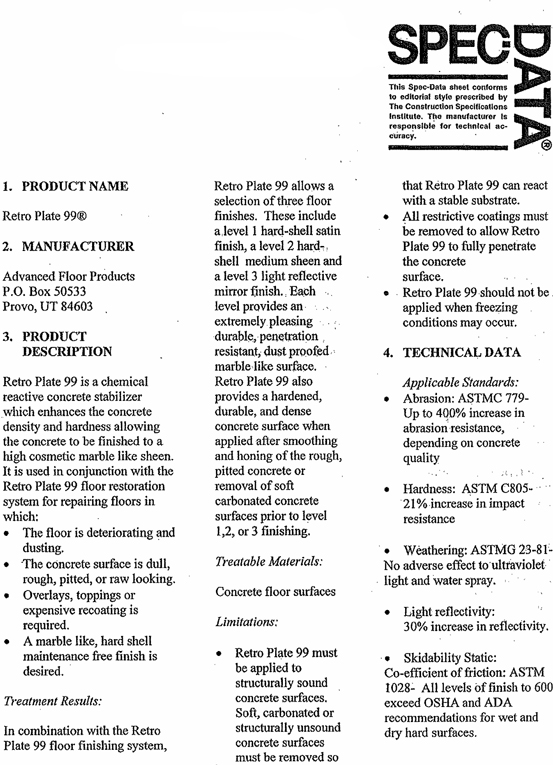

EXHIBIT J-2 – Resurfacing Specs

|

|

LANDLORD:

|

TENANT:

|

|||

|

CIVF I-KY1M01-KY1M06 & KY1W01, LLC,

|

Healthwarehouse.com, Inc., a Delaware corporation

|

|||

|

a Delaware limited liability company

|

||||

|

By:

|

DCT Industrial Value Fund I, L.P.,

|

|||

|

a Delaware limited partnership,

|

||||

|

its Sole Member

|

||||

|

By:

|

DCT Industrial Value Fund I, Inc.

|

|||

|

a Maryland corporation, its General Partner

|

||||

|

By:

|

|

By:

|

|

|

|

Name:

|

William E. Chester

|

Name:

|

|

|

|

Title:

|

Vice President

|

Title:

|

|

|

|

Date:

|

|

Date:

|

|

3

GENERAL LEASE PROVISIONS

2. COMMENCEMENT. The Initial Term of this Lease shall be for the period shown in Item 8 of the Basic Lease Provisions (the “Lease Term”), commencing on date that the Tenant Improvements are Substantially Completed (the “Commencement Date”). Unless earlier terminated in accordance with the provisions hereof, the Initial Term of this Lease shall be the period shown in Item 8 of the Basic Lease Provisions and Tenant shall be entitled to one Extension Term as set forth in and subject to the terms of Exhibit G attached hereto. This Lease shall be a binding contractual obligation effective upon execution hereof by Landlord and Tenant, notwithstanding the later commencement of the Lease Term. The terms “Tenant Improvements” and “Substantial Completion” or “Substantially Completed” are defined in the attached Exhibit C Work Letter. Except as otherwise provided herein, Tenant accepts the Premises in its current “AS-IS”, “WHERE-IS” and “WITH ALL FAULTS” condition and Landlord shall have no obligation to refurbish or otherwise improve the Premises for the Lease Term.

Upon the Commencement Date, the parties hereto shall execute a written statement in the form attached hereto as Exhibit I, attached hereto and by this reference incorporated herein (the “Lease Confirmation Certificate”) confirming the Commencement Date of the Lease, the Expiration Date of the Initial Term of the Lease and the Base Rent schedule during the Initial Term of the Lease, but the enforceability of this Lease shall not be affected should either party fail or refuse to execute such statement.

3. USE.

(a) The Premises shall be used only for the purpose set forth in Item 18 of the Basic Lease Provisions and for reasonable and customary uses ancillary thereto, and shall not be used for any other purpose. Landlord shall have the right to deny its consent to any change in the permitted use of the Premises in its sole and absolute discretion.

(b) Outside storage including, without limitation, drop shipments, dock storage, trucks and other vehicles, is prohibited without Landlord’s prior written consent. Tenant shall obtain, at Tenant’s sole cost and expense, any and all licenses and permits necessary for Tenant’s contemplated use of the Premises. Tenant shall comply with all existing and future governmental laws, ordinances and regulations applicable to the use of the Premises, as well as all reasonable requirements of Landlord’s insurance carrier. Tenant shall not permit any objectionable or unpleasant odors, smoke, dust, gas, noise or vibrations to emanate from the Premises, nor take any other action which would constitute a nuisance or which would disturb or endanger any other tenants of the Property, or unreasonably interfere with such other tenants’ use of their respective space. Tenant shall not receive, store or otherwise handle any product, material or merchandise which is explosive or highly inflammable.

(c) If any Legal Requirement shall, by reason of the nature of Tenant’s particular use or occupancy of the Premises (as opposed to laws that generally apply to use of the Premises or Property), impose any duty upon Tenant or Landlord with respect to (i) modification or other maintenance of the Premises or the Property, or (ii) the use, alteration or occupancy thereof, Tenant shall comply with such Legal Requirements at Tenant’s sole cost and expense. Notwithstanding the foregoing, Tenant, at its sole cost and expense, shall be responsible for the Premises complying with all sprinkler and high pile storage Legal Requirements. If the Building and/or the Premises is determined by applicable governmental agencies to not be in compliance with Legal Requirements applicable to the Property as of the Commencement Date and such non-compliance is not related to Tenant’s particular use or occupancy of the Premises, then Landlord shall be fully responsible, at its sole cost and expense (which shall not be included in CAM), for making all alterations and repairs to the Property and/or the Premises required by such governmental agencies so that the Property and/or the Premises complies with all such Legal Requirements. The term “Legal Requirements” shall mean all covenants and restrictions of record (if any), laws, statutes, building and zoning codes, ordinances, and governmental orders, conditions of approval, rules and regulations (including, but not limited to, Title III of the Americans With Disabilities Act of 1990), as well as the same may be amended and supplemented from time to time, including, without limitation, all Legal Requirements that pertain to the building structure. Notwithstanding the foregoing sentence, if there is a “new” Legal Requirement (a Legal Requirement first enacted or made applicable to the Property after the Commencement Date of this Lease) affecting the Property (excluding the Premises), which require Landlord to make capital expenditures or repairs to the Property (excluding the Premises) (a “New Legal Requirement”), the annual amortized portion of such capital expenditures or repairs shall be included in CAM which shall be reimbursed by the tenants in the Property over a commercially reasonable period not to exceed 10 years. Subject to applicable New Legal Requirements (including any “grandfather” provisions pertaining thereto), Landlord agrees to maintain the Property (except the Premises) in compliance with all Legal Requirements.

4

(d) Tenant shall not at any time use or occupy the Premises in violation of the certificates of occupancy issued for the Building or the Premises or the restrictive covenants pertaining to the Building or the Premises, and in the event that any architectural control committee or department of the State or the city or county in which the Property is located shall at any time contend or declare that the Premises are used or occupied in violation of such certificate or certificates of occupancy or such restrictive covenants, Tenant shall, upon five (5) days’ notice from Landlord or any such governmental agency, immediately discontinue such use of the Premises (and otherwise remedy such violation). Tenant shall not place weight upon any portion of the Premises exceeding the structural floor load (per square foot of area) which such area was designated (and is permitted by Legal Requirements) to carry or otherwise use any Building system in excess of its capacity or in any other manner which may damage such system or the Building. Tenant shall not create within the Premises a working environment with a density of greater than two (2) persons per 1,000 square feet of rentable area.

4. RENT. Tenant shall pay the Base Rent (as defined in Item 11 of the Basic Lease Provisions), Additional Rent (hereinafter defined) and any other amounts required to be paid by Tenant to Landlord under this Lease (collectively referred to as “Rent”) during the Lease Term, in advance, on the first day of each calendar month, or as otherwise set forth in this Lease, without setoff or deduction, at the address set forth in Item 16 of the Basic Lease Provisions and without relief from valuation and appraisement laws. In the event any Rent is due for a partial calendar month or year, the Rent shall be equitably adjusted to reflect that portion of the Lease Term within such month or year. All accrued Rent shall survive the expiration or earlier termination of the Lease Term. The obligation of Tenant to pay Rent and other sums to Landlord and the obligations of Landlord under this Lease are independent obligations. The first full monthly installment of Base Rent (as set forth in Item 12 of the Basic Lease Provisions) shall be payable upon Tenant’s execution of this Lease.

(a) Base Rent. Tenant shall pay to Landlord, as Base Rent, the sums and amounts set forth in Item 11 of the Basic Lease Provisions.

(b) Additional Rent. Tenant shall pay to Landlord, as Additional Rent, Rent Tax and Tenant’s Pro Rata Share of the Taxes, Insurance and CAM charges (as such terms are hereinafter defined) incurred by Landlord for and on behalf of the Property.

(i) Rental Taxes. If any governmental taxing authority levy, assess, or impose any tax, excise or assessment (other than income or franchise tax) upon or against the rents payable by Tenant to Landlord (“Rent Tax”), either by way of substitution for or in addition to any existing tax on land, buildings or otherwise, Tenant shall directly pay, or reimburse Landlord for, the Rent Tax, as the case may be.

(ii) Taxes. Taxes shall include, without limitation, any tax, assessment (both general and special), trustees’ fee, impositions, license fees, or governmental charge (herein collectively referred to as “Tax”) imposed against the Property, or against any of Landlord’s personal property located therein or the rents collected by Landlord therefrom (excluding any income or franchise tax, unless such taxes are in substitution for ad valorem taxes). Taxes, as herein defined, are predicated upon the present system of taxation in the State of Kentucky. Therefore, if due to a future change in the method of taxation any rent, franchise, use, profit or other tax shall be levied against Landlord in lieu of any Tax which would otherwise constitute a “real estate tax”, such rent, franchise, use, profit or other tax shall be deemed to be a Tax for the purposes herein. In the event Landlord is assessed with a Tax which Landlord, in its sole discretion, deems excessive, Landlord may challenge said Tax or may defer compliance therewith to the extent legally permitted; and, in the event thereof, Tenant shall be liable for Tenant’s Pro Rata Share of all reasonable costs in connection with such challenge. The estimated monthly amount of Tenant’s Pro Rata Share of Taxes is set forth in Item 14 of the Basic Lease Provisions, which amount is subject to increase as provided for herein.

(iii) Insurance. Insurance shall include, without limitation, premiums for liability, property damage, fire, workers compensation, rent and any and all other insurance (herein collectively referred to as “Insurance”) which Landlord deems necessary to carry on, for, or in connection with Landlord’s operation of the Property. In addition thereto, in the event Tenant’s use of the Premises shall result in an increase of any of Landlord’s Insurance premiums, Tenant shall pay to Landlord, upon demand, as Additional Rent, an amount equal to such increase in Insurance. Such payments of Insurance shall be in addition to all premiums of insurance which Tenant is required to carry pursuant to Paragraph 19 of this Lease. The estimated monthly amount of Tenant’s Pro Rata Share of Insurance is set forth in Item 14 of the Basic Lease Provisions, which amount is subject to increase as provided for herein.

5

(iv) Common Area Maintenance. Common area maintenance charges (hereinafter referred to as “CAM”) shall mean any and all costs, expenses and obligations incurred by Landlord in connection with the operation, ownership, management, repair and replacement, if necessary, of the Building and the Property, including, without limitation, the following: the maintenance, repair and replacement, if necessary, of the downspouts, gutters and the non-structural portions of the roof; the paving of all parking facilities, access roads, driveways, truck ways, sidewalks and passageways; loading docks and access ramps, trunk-line plumbing (as opposed to branch-line plumbing); common utilities and exterior lighting; landscaping; snow removal; fire protection; exterior painting and interior painting of the common areas of the Property; market-rate management fees; additions or alterations made by Landlord to the Property or the Building in order to comply with Legal Requirements (other than those expressly required herein to be made by Tenant) or that are appropriate to the continued operation of the Property or the Building as a bulk warehouse facility in the market area, provided that the cost of additions or alterations that are required to be capitalized for federal income tax purposes shall be amortized on a straight line basis over a period equal to the lesser of the useful life thereof for federal income tax purposes or 10 years; and all other similar maintenance and repair expenses incurred by Landlord for or on behalf of the Property. Additionally, CAM does not include costs for any items which are depreciable or amortizable by Landlord, debt service under mortgages or ground rent under ground leases, costs of restoration resulting from fire or casualty (except for Landlord’s deductible related thereto, not to exceed $25,000.00), leasing commissions, the costs of renovating space for tenants depreciation, fees or expenses of a related party in excess of the amount that would be paid in an arm’s length transaction for materials or services of a similar quality, legal expenses incident to Landlord’s enforcement of any lease (except as otherwise may be expressly provided for herein), the cost of any work or services performed exclusively for any tenants of the Building or the Property, costs to correct any penalty or fine incurred by Landlord due to Landlord’s violation of any Legal Requirements, or costs of repairs necessitated by Landlord’s negligence or willful misconduct or for correcting any latent defects or original design defects in the building construction, materials or equipment. The estimated monthly amount of Tenant’s Pro Rata Share of CAM is set forth in Item 14 of the Basic Lease Provisions, which amount is subject to increase as provided for herein. Landlord shall at all times during the Lease Term maintain, service and repair (and replace if necessary) common areas and elements of the Building and Property in order to keep the same in good order and condition, including, without limitation, the following: the downspouts, gutters, and non-structural portion of the roof, the paving of all parking facilities, access roads, driveways, truck ways, sidewalks, and passenger ways), loading docks and access ramps, truck-line plumbing, common utilities and exterior lighting, landscaping, snow removal, fire protection, exterior painting and interior painting of the common areas.

(v) Payment of Additional Rent. Landlord shall have the right to invoice Tenant monthly, quarterly, or otherwise from time to time (but in no case more frequently than monthly nor less frequently than annually), for Tenant’s Pro Rata Share of the actual Taxes, Insurance and CAM expenses payable by Tenant under this Lease; and Tenant shall pay to Landlord, as Additional Rent, those amounts for which Tenant is invoiced within thirty (30) days after receipt of said invoice.

Alternatively, at Landlord’s election, Landlord shall have the right to invoice Tenant monthly for Tenant’s Pro Rata Share of such Taxes, Insurance and CAM expenses, as reasonably estimated by Landlord. Any monies paid in advance to Landlord by Tenant shall not accrue interest thereon. Following the end of each calendar year or property fiscal year, Landlord shall deliver a statement to Tenant setting forth the difference between Tenant’s actual Pro Rata Share of Taxes, Insurance and/or CAM expenses and the total amount of monthly payments, paid by Tenant to Landlord. Tenant shall thereafter pay to Landlord the full amount of any difference between Tenant’s actual obligation over the total amount of Tenant’s estimated payments, within thirty (30) days after receipt of said statement; conversely, in the event Tenant’s estimated payments exceed Tenant’s actual obligation, Landlord shall either refund the overpayment to Tenant or credit said overpayment against Tenant’s monthly obligation in the forthcoming year.

For purposes of this Lease, Tenant’s Pro Rata Share is hereinafter defined as a fraction, the numerator of which shall be the square footage of the Premises, and the denominator of which shall be the square footage of the rentable area of the Building, which Pro Rata Share is hereby agreed to be as set forth in Item 13 of the Basic Lease Provisions. In the event this Lease expires on a date other than the end of a billing period, Tenant’s obligation with respect to any amounts owed to Landlord shall survive the expiration of the Lease Term, and shall be invoiced to Tenant when the same have been accurately determined or, at Landlord’s option, such amounts shall be reasonably estimated by Landlord to reflect the period of time the Lease was in effect during such billing period.

Landlord and Tenant acknowledge and agree that, in accordance with the terms and conditions of this Lease, Tenant pays to Landlord Tenant’s Pro Rata Share (which Tenant’s Pro Rata Share is, in accordance with Item 13 of the Basic Lease Provisions, based on the total square footage of the Building) of (i) CAM, (ii) Taxes, and (iii) Insurance. Notwithstanding anything contained herein to the contrary, however, to the extent Taxes, Insurance or any component of CAM are allocable or attributable to a larger or smaller set of buildings than the Building (or buildings) that comprises the Property, such Taxes, Insurance or component of CAM shall first be allocated among all of such larger or smaller (as applicable) set of buildings on a proportionate basis and, notwithstanding anything contained herein to the contrary, Tenant shall only be responsible for paying Tenant’s equitable or proportionate share (as reasonably determined by Landlord) of any such amounts (or the excess of such amounts over the amounts payable with respect to the applicable lease year, as the case may be).

6

For a period of one (1) year following a year-end statement, Landlord shall keep records showing in reasonable detail all expenses incurred by Landlord for Taxes, Insurance and CAM expenses during such period covered in the year-end statement. Upon five (5) days prior written notice from Tenant, such records shall be made available for inspection (“Audit”) at the office of Landlord’s managing agent during normal business hours. The Audit will be conducted at Tenant’s expense by a certified public accountant licensed in the state in which the Premises are situated who may be employed by Tenant (“Tenant’s Auditor”). Notwithstanding anything herein to the contrary, in no event shall Tenant’s Auditor be compensated or paid on a contingency fee or other similar basis. If Tenant’s Audit reveals that the Taxes, Insurance and CAM expenses charged to Tenant for such calendar year covered by the year-end statement exceed or were less than Tenant’s Pro Rata Share of the actual expenses thereto, and such variance is confirmed by Landlord’s certified public accountant, then Landlord will reimburse Tenant for any overcharge, or Tenant will pay to Landlord any undercharge, as applicable, promptly after such final determination. In the event of a confirmed overcharge of such expenses to Tenant in excess of 10% of Tenant’s Pro Rata Share of actual expenses thereto in such year, Landlord also shall reimburse Tenant for the reasonable cost of Tenant’s Audit, but not in excess of an amount equal to 100% of the overcharge. Notwithstanding the aforesaid, unless Tenant (i) asserts specific errors within ninety (90) days after receipt of any year-end statement, or (ii) exercises such right to Audit as granted hereunder within ninety (90) days after receipt of any year-end statement, it shall be deemed that said year-end statement is correct and Tenant shall have no further right to Audit Landlord’s records for Taxes, Insurance and CAM expenses for the period covered in the year-end statement.

The terms and provisions of this Paragraph 4 shall survive the expiration or earlier termination of this Lease.

5. LATE CHARGE. Tenant acknowledges and agrees that in the event Tenant is late in the payment of any Rent or other charge due Landlord for a period of five (5) days after which such rent or other charge is first due and payable, Landlord will suffer damages that are extremely difficult to estimate and, therefore, as a reasonable forecast of the damages that are likely to result from such late payment, Tenant shall be assessed a late charge for Landlord’s increased administrative expenses, which late charge shall be equal to five percent (5%) of all overdue amounts owed Landlord.

6. UTILITIES. Landlord agrees to supply water, gas, electricity and sewer connections to the Premises. Tenant shall pay for all gas, electricity, water and sewer used by Tenant in, on or about the Premises, together with any taxes, penalties, surcharges or the like pertaining thereto, and Tenant shall be liable for all maintenance and equipment with respect to the continued operation thereof including, without limitation, all electric light bulbs and tubes. In no event shall Landlord be liable for any interruption or failure of any utility servicing the Property. Landlord may cause at Tenant’s expense any utilities used by Tenant to be separately metered or charged directly to Tenant by the provider.

7. LANDLORD’S REPAIRS AND MAINTENANCE. Landlord, at Landlord’s sole cost and expense, shall maintain, repair and replace, if necessary, the foundation, the structural portions of the roof and the exterior walls. Notwithstanding the aforesaid, in the event any such maintenance or repairs are caused by the negligence of Tenant or Tenant’s employees, agents or invitees, Tenant shall reimburse to Landlord, as Additional Rent, the cost of all such maintenance and repairs within thirty (30) days after receipt of Landlord’s invoice for same. For purposes of this Paragraph, the term “exterior walls” shall not include windows, plate glass, office doors, dock doors, dock bumpers, office entries, or any exterior improvement made by Tenant. Landlord reserves the right to designate all sources of services in connection with Landlord’s obligations under this Lease.

8. TENANT’S REPAIRS AND MAINTENANCE. Except as provided below in the Paragraph 8 or as otherwise provided in Paragraph 4(b)(iv) above with respect to Landlord’s obligation relating to common and other areas, Tenant, at Tenant’s sole cost and expense, shall at all times during the Lease Term and in accordance with all Legal Requirements, maintain, service, repair and replace, if necessary, and keep in good condition and repair all portions of the Premises which are not expressly the responsibility of Landlord (as set forth in Paragraph 7 above), including, but not limited to, fixtures, equipment and appurtenances thereto, any windows, plate glass, office doors, dock doors and ancillary equipment, all heating, ventilation and air conditioning equipment serving the Premises, office entries, interior walls and finish work, floors and floor coverings, water heaters, electrical systems and fixtures, sprinkler systems, dock bumpers, dock levelers, trailer lights and fans, shelters/seals and restraints, branch plumbing and fixtures, and pest extermination. In addition thereto, Tenant shall keep the Premises and the dock area servicing the Premises in a clean and sanitary condition, and shall keep the common parking areas, driveways and loading docks free of Tenant’s debris. Tenant shall not store materials, waste or pallets outside of the Premises, and shall timely arrange for the removal and/or disposal of all pallets, crates and refuse owned by Tenant which cannot be disposed of in the dumpster servicing the Property. If replacement of equipment, fixtures, and appurtenances thereto are necessary, then Tenant shall replace the same with equipment, fixtures and appurtenances of the same quality, and shall repair all damage done in or by such replacement. Such replacements for which Tenant is solely responsible hereunder which are capital in nature and that are required to be capitalized for federal income tax purposes shall be amortized on a straight line basis over a period equal to the useful life thereof for federal income tax purposes, and shall be amortized in accordance with the Formula (defined hereafter) over the remainder of the Lease Term, without regard to any extension or renewal option not then exercised. The “Formula” shall mean that number, the numerator of which shall be the number of months of the Lease Term remaining after the replacement of any such capital replacement, and the denominator of which shall be the amortization period (in months) equal to the useful life thereof for federal income tax purposes. Landlord shall pay for such capital replacement and Tenant shall reimburse Landlord, as Additional Rent, for its amortized share of same (determined as hereinabove set forth) in equal monthly installments throughout the remainder of the Lease Term, without regard to any extension or renewal option not then exercised.

7

Notwithstanding anything contained herein to the contrary, Tenant’s responsibility with respect to repairs or replacements to the HVAC system servicing the Premises shall be limited to $1,000.00 per occurrence per unit, and Landlord shall be responsible for any repairs or replacements to such HVAC system in excess of such amount, provided, however, such limitation shall not be effective for any repairs or replacements necessitated due to the lack of maintenance or misuse of, or damages caused by, Tenant, its agents, employees, contractors, assignees, subtenants or invitees, nor shall such limitation be effective after replacement of any HVAC unit or replacement of any particular part of such HVAC system, in which case the costs related thereto shall be solely borne by Tenant, regardless of cost.

As set forth on Exhibit E hereto, Tenant, at its own cost and expense, shall enter into a regularly scheduled preventive maintenance/service contract with a maintenance contractor approved by Landlord for servicing all hot water, heating and air conditioning systems and equipment serving the Premises. The service contract must include all services suggested by the equipment manufacturer in its operations/maintenance manual and an executed copy of such contract must be provided to Landlord prior to the date Tenant takes possession of the Premises. Notwithstanding the aforesaid, Landlord shall have the option to enter into a regularly scheduled preventative maintenance/service contract on items for and on behalf of Tenant. Such contract may include, without limitation, all services suggested or recommended by the equipment manufacturer in the operation and maintenance of such system. In the event Landlord elects such option, Tenant shall reimburse to Landlord, as Additional Rent, all of Landlord’s costs in connection with said contract, as well as Landlord’s actual costs of repair and maintenance of the HVAC system (subject to the limitations set forth in the preceding paragraph).

Upon the expiration or earlier termination of this Lease, Tenant shall return the Premises to Landlord in substantially the same condition as when received, reasonable wear and tear and damages by fire or other casualty excepted. Tenant shall perform all repairs and maintenance in a good and workmanlike manner, using materials and labor of the same character, kind and quality as originally employed in, on or about the Property; and all such repairs and maintenance shall be in compliance with all governmental and quasi-governmental laws, ordinances and regulations, as well as all requirements of Landlord’s insurance carrier. In the event Tenant fails to properly perform any such repairs or maintenance within a reasonable period of time following notice from Landlord, Landlord shall have the option to perform such repairs on behalf of Tenant, in which event Tenant shall reimburse to Landlord, as Additional Rent, the costs thereof within thirty (30) days after receipt of Landlord’s invoice for same.

9. ALTERATIONS. Tenant shall not make any alterations, additions or improvements to the Premises or Property, except as provided in this Paragraph 9 (“Alterations”) without the prior written consent of Landlord. Landlord hereby consents to Tenant making the alterations and improvements set forth on Exhibit J attached hereto and incorporated herein, subject to applicable Legal Requirements, and subject, further, to Landlord’s approval of the plans and specifications related thereto, as well as Landlord’s approval of the contractors performing such alterations and improvements. Tenant shall otherwise have the right at any time during the Lease Term, without needing Landlord’s prior written consent, to make cosmetic, non-material and non-structural alterations to the Premises which cost shall not exceed Ten Thousand Dollars ($10,000.00) in any one calendar year. Tenant shall make no Alterations to the Premises, including, without limitation any Alterations (i) which will adversely impact the Building’s mechanical, electrical or heating, ventilation or air conditioning systems, or (ii) which will adversely impact the structure of the Building, or (iii) which are visible from the exterior of the Premises or (iv) which will result in the penetration or puncturing of the roof, without first obtaining Landlord’s prior written consent or approval to such Alterations (which consent or approval shall be in the Landlord’s sole and absolute discretion). Notwithstanding the aforesaid, Tenant, at Tenant’s sole cost and expense, may install such trade fixtures as Tenant may deem necessary, so long as such trade fixtures do not penetrate or disturb the structural integrity and support provided by the roof, exterior walls or sub floors. All such trade fixtures shall be constructed and/or installed by contractors approved by Landlord, in a good and workmanlike manner, and in compliance with all applicable governmental and quasi-governmental laws, ordinances and regulations, as well as all requirements of Landlord’s insurance carrier.

8

Notwithstanding anything contained herein to the contrary, Landlord shall contribute up to a maximum amount of $15,000.00 (the “TI Allowance”), toward the costs of certain alterations to the Premises to be performed by Tenant, subject to approval by Landlord of the plans and specifications related thereto (“Initial Alterations”), which such payment shall be made by Landlord to Tenant within 30 days following (i) completion of such Initial Alterations, (ii) Landlord’s receipt of Tenant’s invoice substantiating the costs related thereto, (iii) Landlord’s receipt of final lien waivers from all contractors and subcontractors who did work on such Initial Alterations, and (iv) Landlord’s receipt of a copy of the final permit approved by the applicable governing authority to the extent required for such Initial Alterations. Landlord shall be under no obligation to pay for any Initial Alterations or other alterations to the Premises in excess of the TI Allowance. Further, such TI Allowance shall only be available for Tenant’s use through December 31, 2011, and Tenant hereby waives any and all rights to any unused portion of the TI Allowance remaining as of January 1, 2012.

Upon the expiration or earlier termination of this Lease, Tenant shall remove all trade fixtures and any other Alterations installed by Tenant in, on or about the Premises; and, upon such removal, Tenant shall restore the Premises to a condition substantially similar to that condition when received by Tenant. However, notwithstanding the aforesaid, upon Landlord’s written election, such Alterations shall revert to Landlord and shall remain as Landlord’s property. In no event shall Landlord have any right to any of Tenant’s trade fixtures; and, except as otherwise set forth in this Lease, Tenant may remove such trade fixtures upon the termination of this Lease, provided Tenant repairs any damage caused by such removal. If Tenant does not timely remove such property, then Tenant shall be conclusively presumed to have, at Landlord’s election (i) conveyed such property to Landlord without compensation or (ii) abandoned such property, and Landlord may dispose of or store any part thereof in any manner at Tenant’s sole cost, without waiving Landlord’s right to claim from Tenant all expenses arising out of Tenant’s failure to remove the property, and without liability to Tenant or any other person. Landlord shall have no duty to be a bailee of any such personal property. If Landlord elects abandonment, Tenant shall pay to Landlord, upon demand, any expenses incurred for disposition.

10. DESTRUCTION. If the Premises or the Property are damaged in whole or in part by casualty so as to render the Premises untenantable, and if the damages cannot be repaired as reasonably determined by Landlord within one hundred twenty (120) days from the date of said casualty, this Lease shall terminate as of the date of such casualty. If the damages can be repaired within said one hundred twenty (120) days, and Landlord does not elect within thirty (30) days after the date of such casualty to repair same, then either party may terminate this Lease by written notice served upon the other. In the event of any such termination, the parties shall have no further obligations to the other, except for those obligations accrued through the effective date of such termination; and, upon such termination, Tenant shall immediately surrender possession of the Premises to Landlord. Should Landlord elect to make such repairs, this Lease shall remain in full force and effect, and Landlord shall proceed with all due diligence to repair and restore the Premises to a condition substantially similar to that condition which existed prior to such casualty. In the event the repair and restoration of the Premises extends beyond one hundred twenty (120) days after the date of such casualty due to causes beyond the control of Landlord, this Lease shall remain in full force and effect, and Landlord shall not be liable therefor; but Landlord shall continue to complete such repairs and restoration with all due diligence. Landlord and Tenant acknowledge and agree that Rent shall abate during the period the Premises is untenantable due to a casualty loss under this Paragraph 10. In the event only a portion of the Premises are untenantable, Tenant’s Rent shall be equitably abated in proportion to that portion of the Premises which are so unfit.

11. INSPECTION. Upon prior written notice to Tenant (except in the event of an emergency when no such notice shall be necessary), Landlord shall have the right to enter and inspect the Premises at any reasonable time for the purpose of ascertaining the condition of the Premises, or in order to make such repairs as may be required or permitted to be made by Landlord under the terms of this Lease; provided, however, Landlord shall use reasonable efforts to minimize any disruption to Tenant’s business in the Premises during such entry by Landlord. Tenant shall have the duty to periodically inspect the Premises and notify Landlord should Tenant observe a need for repairs or maintenance of any obligation to be performed by Landlord under this Lease. Upon receipt of Tenant’s notice, Landlord shall have a commercially reasonable period of time to make such repairs or maintenance. In addition thereto, during the last six (6) months of the Lease Term, Landlord shall have the right to enter the Premises at any reasonable time for the purpose of showing the Premises to prospective third-party tenants; and, during said six (6) months, Landlord shall have the right to erect on the Property and/or Premises suitable signs indicating that the Premises are available for lease.

Tenant shall give Landlord thirty (30) days written notice prior to Tenant vacating the Premises, for the purpose of arranging a joint inspection of the Premises with respect to any obligation to be performed therein by Tenant, including, without limitation, the necessity of any repair or restoration of the Premises. In the event Tenant fails to notify Landlord of such inspection, Landlord’s inspection after Tenant vacates shall be conclusively deemed correct for purposes of determining Tenant’s responsibility for repairs and restoration.

12. SIGNS. Tenant shall not place or permit any signs, lights, awnings or poles in or about the Premises or the Property, other than the standard building signage as per Landlord specifications, without the prior written consent of Landlord; nor shall Tenant change the uniform architecture, paint, landscape, or otherwise alter or modify the exterior of the Property without the prior written consent of Landlord.

9

13. ASSIGNMENT AND SUBLETTING.

(a) Tenant shall not directly or indirectly, by operation of law or otherwise, assign, sublet, mortgage, hypothecate or otherwise encumber all or any portion of its interest in this Lease or in the Premises or grant any license in any person other than Tenant or its employees to use or occupy the Premises or any part thereof without obtaining the prior written consent of Landlord, which consent shall not be unreasonably withheld or delayed. Any such attempted assignment, subletting, license, mortgage, hypothecation, other encumbrance or other use or occupancy without the consent of Landlord shall be null and void and of no effect. Any mortgage, hypothecation or encumbrance of all or any portion of Tenant’s interest in this Lease or in the Premises, any grant of a license or sufferance of any person other than Tenant or its employees to use or occupy the Premises or any part thereof, or any transfer by operation of law (whether voluntary or involuntary), merger, consolidation, dissolution, liquidation or any assignment to a receiver or trustee in any federal or state bankruptcy proceeding, shall be deemed to be an “assignment” of this Lease. In addition, as used in this Paragraph 13, the term “Tenant” shall also mean any entity that has guaranteed Tenant’s obligations under this Lease, and the restrictions applicable to Tenant contained herein shall also be applicable to such guarantor. Provided no event of monetary default has occurred and is continuing under this Lease, upon thirty (30) days prior written notice to Landlord, Tenant may, without Landlord’s prior written consent, assign this Lease to an entity into which Tenant is merged or consolidated or to an entity to which substantially all of Tenant’s assets are transferred or to an entity controlled by or is commonly controlled with Tenant, provided (i) such merger, consolidation, or transfer of assets is for a good business purpose and not principally for the purpose of transferring Tenant’s leasehold estate, and (ii) the assignee or successor entity has a tangible net worth, calculated in accordance with generally accepted accounting principles (and evidenced by financial statements in form reasonably satisfactory to Landlord) at least equal to the tangible net worth of Tenant immediately prior to such merger, consolidation, or transfer. The term “controlled by” or “commonly controlled with” shall mean the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of such controlled person or entity; the ownership, directly or indirectly, of at least fifty-one percent (51%) of the voting securities of, or possession of the right to vote, in the ordinary direction of its affairs, at least fifty-one percent (51%) of the voting interest in, any person or entity shall be presumed to constitute such control.

(b) No permitted assignment or subletting shall relieve Tenant of its obligation to pay the Rent and to perform all of the other obligations to be performed by Tenant hereunder. The acceptance of Rent by Landlord from any other person shall not be deemed to be a waiver by Landlord of any provision of this Lease or to be a consent to any subletting or assignment. Consent by Landlord to one subletting or assignment shall not be deemed to constitute a consent to any other or subsequent attempted subletting or assignment. If Tenant desires at any time to assign this Lease or to sublet the Premises or any portion thereof, it shall first notify Landlord of its desire to do so and shall submit in writing to Landlord all pertinent information relating to the proposed assignee or sublessee, all pertinent information relating to the proposed assignment or sublease, and all such financial information as Landlord may reasonably request concerning the proposed assignee or subtenant. Any approved assignment or sublease shall be expressly subject to the terms and conditions of this Lease.

(c) At any time within thirty (30) days after Landlord’s receipt of the information specified in subparagraph (b) above, Landlord may by written notice to Tenant elect to terminate this Lease as to the portion of the Premises so proposed to be subleased or assigned (which may include all of the Premises), with a proportionate abatement in the Rent payable hereunder, provided, however, that Landlord shall have no such termination right with respect to an assignment of this Lease described in subparagraph (a) above that does not require Landlord’s prior written consent.

(d) Tenant acknowledges that it shall be reasonable for Landlord to withhold its consent to a proposed assignment or sublease in any of the following instances:

(i) The assignee or sublessee is not, in Landlord’s reasonable opinion, sufficiently creditworthy to perform the obligations such assignee or sublessee will have under this Lease;

(ii) The intended use of the Premises by the assignee or sublessee is not the same as set forth in this Lease or otherwise reasonably satisfactory to Landlord;

(iii) The intended use of the Premises by the assignee or sublessee would materially increase the pedestrian or vehicular traffic to the Premises or the Property;

(iv) Occupancy of the Premises by the assignee or sublessee would, in the good faith judgment of Landlord, violate any agreement binding upon Landlord, or the Property with regard to the identity of tenants, usage in the Property, or similar matters;

10

(v) The assignee or sublessee is then actively negotiating with Landlord or has negotiated with Landlord within the previous six (6) months, or is a current tenant or subtenant within the Premises or Property;

(vi) The identity or business reputation of the assignee or sublessee will, in the good faith judgment of Landlord, tend to damage the goodwill or reputation of the Premises or Property; or

(vii) In the case of a sublease, the subtenant has not acknowledged that the Lease controls over any inconsistent provision in the sublease.

The foregoing criteria shall not exclude any other reasonable basis for Landlord to refuse its consent to such assignment or sublease.

(e) Any consent by Landlord to any assignment or subletting shall apply only to the specific transaction thereby authorized. Such consent shall not be construed as (i) a waiver of the duty of Tenant, or the assigns of Tenant, to obtain Landlord’s consent to any subsequent assignment or subletting of all or any portion of Tenant’s interest in this Lease or in the Premises or (ii) modifying or limiting the rights of Landlord under the covenant by Tenant not to assign or sublet all or any portion of Tenant’s interest in this Lease or in the Premises without obtaining the prior written consent of Landlord.

(f) Notwithstanding any assignment or subletting, Tenant and any guarantor or surety of Tenant’s obligations under this Lease shall at all times during the Initial Term and any subsequent renewals or extensions remain fully responsible and liable for the payment of the Rent and for compliance with all of Tenant’s other obligations under this Lease. In the event that the Rent due and payable by a sublessee or assignee (or a combination of the rental payable under such sublease or assignment, plus any bonus or other consideration therefor or incident thereto) exceeds the Rent payable under this Lease, then Tenant, after the recovery of all reasonable expenses associated with the sublease or assignment, including tenant improvement costs, architectural fees, commissions, and any other commercially reasonable concessions provided, shall be bound and obligated to pay Landlord, as additional rent hereunder, one-half of all such excess Rent and other excess consideration within ten (10) days following receipt thereof by Tenant.

(g) If this Lease is assigned or if the Premises is subleased (whether in whole or in part), or in the event of the mortgage, pledge, or hypothecation of Tenant’s leasehold interest, or grant of any concession or license related to the Premises, or if the Premises are occupied in whole or in part by anyone other than Tenant, then upon a default by Tenant hereunder Landlord may collect Rent from the assignee, sublessee, mortgagee, pledgee, party to whom the leasehold interest was hypothecated, concessionee or licensee or other occupant and, except to the extent set forth in the preceding paragraph, apply the amount collected to the next Rent payable hereunder; and all such Rent collected by Tenant shall be held in deposit for Landlord and immediately forwarded to Landlord. No such transaction or collection of Rent or application thereof by Landlord, however, shall be deemed a waiver of these provisions or a release of Tenant from the further performance by Tenant of its covenants, duties, or obligations hereunder.

(h) Should Tenant request of Landlord the right to assign or sublet its rights under this Lease, Landlord shall charge Tenant and Tenant shall pay to Landlord the actual cost of Landlord’s legal fees and administrative costs up to a maximum amount of One Thousand and No/100 Dollars ($1,000.00).

14. DEFAULT. This Lease and Tenant’s right to possession of the Premises is made subject to and conditioned upon Tenant performing all of the covenants and obligations to be performed by Tenant hereunder, at the times and pursuant to terms and conditions set forth herein. If Tenant (i) fails to pay any Rent or other charge when the same is due and such monetary default continues to exist in full or part at the expiration of ten (10) days after written notice is given by Landlord to Tenant; provided, however, Landlord shall only be obligated to provide such written notice to Tenant two (2) timed within any calendar year and in the event Tenant fails to timely pay Rent or any other sums for a third time during any calendar year, then Tenant shall be in default for such late payment and Landlord shall have no obligation or duty to provide notice of such non-payment to Tenant prior to declaring an event of default under this Lease, (ii) fails to comply with or observe any other provision of this Lease and such failure shall continue for thirty (30) days after written notice to Tenant except that if such failure can not reasonably be cured within such 30 day period, Tenant shall be afforded such additional cure period as shall be reasonably necessary to effect cure (provided that Tenant is acting in good faith and with constant diligence to cure such failure); (iii) makes an assignment for the benefit of creditors, (iv) vacates or abandons the Premises for more than thirty (30) days, (v) files or has filed against it a petition in bankruptcy, (vi) has a receiver, trustee or liquidator appointed over a substantial portion of its property, or (vii) is adjudicated insolvent (each of the foregoing each being referred to hereafter as a “Default”), then Tenant shall be in default under this Lease. In the event of a Default under this Lease by Tenant, Landlord may either (a) terminate this Lease, or (b) terminate Tenant’s right of possession to the Premises without terminating this Lease. In either event, Landlord shall have the right to dispossess Tenant, or any other person in occupancy, together with their property, and re-enter the Premises. Upon such re-entry, Tenant shall be liable for all expenses incurred by Landlord in recovering the Premises, including, without limitation, clean-up costs, legal fees, removal, storage or disposal of Tenant’s property, and restoration costs. Notwithstanding the foregoing, in the event of the filing of a bankruptcy or similar proceeding against (rather than by) Tenant, Tenant shall not be deemed in Default hereunder if such proceeding is vacated within ninety (90) days after the filing thereof.

11

In the event Landlord elects to terminate this Lease, all Rent through the effective date of termination shall immediately become due, together with any late fees payable to Landlord and the aforesaid expenses incurred by Landlord to recover possession, plus an amount equal to all tenant concessions granted to Tenant including, but not limited to, free or reduced rent, all tenant finish constructed in, on or about the Premises, or any contribution paid to Tenant in lieu thereof.

In the event Landlord elects not to terminate this Lease, but only to terminate Tenant’s right of possession to the Premises, Landlord may re-enter the Premises without process of law if Tenant has vacated the Premises or, if Tenant has not vacated the Premises by an action for ejection, unlawful detainer, or other process of law. No such dispossession of Tenant or re-entry by Landlord shall constitute or be construed as an election by Landlord to terminate this Lease, unless Landlord delivers written notice to Tenant specifically terminating this Lease. Upon Landlord recovering possession, to the extent required by law, Landlord shall use reasonable efforts to mitigate its damages and relet the Premises upon terms and conditions satisfactory to Landlord; however, (i) Landlord shall have no duty to prioritize the reletting of the Premises over the leasing of other vacant space in, on or about the Property, and (ii) Landlord shall not be obligated to accept any prospective tenant proposed by Tenant, unless such proposed tenant meets all of Landlord’s reasonable leasing criteria. Tenant shall remain liable for all past due Rent and late fees, plus the aforesaid expenses incurred by Landlord to recover possession of the Premises. In addition, Tenant shall be liable for all Rent thereafter accruing under this Lease, payable at Landlord’s election: (a) monthly as such Rent accrues, in an amount equal to the Rent payable under this Lease less the rent (if any) collected from any reletting, or (b) in a lump sum within thirty (30) days after Landlord repossesses the Premises, in an amount equal to the total Rent payable under this Lease for the unexpired term, in excess if the then fair market rental value of the Premises, such lump sum discounted at the rate of six percent (6%), per annum. In the event the Premises are relet, Tenant shall also be liable for all costs of reletting, including, without limitation, any broker’s fees, legal fees, and/or tenant finish required to be paid in connection with any reletting.

No payment of money by Tenant after the termination of this Lease, service of any notice, commencement of any suit, or after final judgment for possession of the Premises, shall reinstate this Lease or affect any such notice, demand or suit, or imply consent for any action for which Landlord’s consent is required. Tenant shall pay all costs and reasonable attorney’s fees incurred by Landlord from enforcing the covenants of this Lease. Should Landlord elect not to exercise its rights in the event of a Default, it shall not be deemed a waiver of such rights as to subsequent Defaults. All of the aforesaid remedies afforded Landlord under this Lease shall be cumulative and nonexclusive of each other and shall be in addition to, and not in lieu of, any right or remedy which may be available to Landlord at law or in equity.

15. HOLDOVER. Upon the expiration or earlier termination of this Lease, Tenant shall surrender the Premises to Landlord, without demand, in as good condition as when delivered to Tenant, reasonable wear and tear and damage by other fire or casualty excepted. If Tenant shall remain in possession of the Premises after the termination of this Lease, and hold over for any reason, Tenant shall be deemed guilty of unlawful detainer; or, at Landlord’s election, Tenant shall be deemed a holdover tenant and shall pay to Landlord, in addition to Additional Rent, monthly Base Rent equal to one hundred and fifty percent (150%) of the total Base Rent payable hereunder during the last month prior to any such holdover. In addition, Tenant shall be liable for all damages incurred by Landlord as a result of such holding over. Should any of Tenant’s property remain in, on or about the Premises after the termination of this Lease, it shall be deemed abandoned, and Landlord shall have the right to store or dispose of it at Tenant’s cost and expense.

16. RIGHT TO CURE TENANT’S DEFAULT. In the event Tenant is in Default under any provision of this Lease, other than for the payment of Rent, and Tenant has not cured same within ten (10) days after receipt of Landlord’s written notice, Landlord may cure such Default on behalf of Tenant, at Tenant’s expense. Landlord may also perform any obligation of Tenant, without notice to Tenant, should Landlord deem the performance of same to be an emergency. Any monies expended by Landlord to cure any such Default(s), or resolve any deemed emergency shall be payable by Tenant as Additional Rent. If Landlord incurs any expense, including reasonable attorney’s fees, in prosecuting and/or defending any action or proceeding by reason of any emergency or Default, Tenant shall reimburse Landlord for same, as Additional Rent, with interest thereon at twelve percent (12%) annually from the date such payment is due Landlord.

12

17. HOLD HARMLESS. Except to the extent caused by Landlord’s gross negligence or willful misconduct, Tenant hereby releases, discharges and shall indemnify, hold harmless and defend Landlord, at Tenant’s sole cost and expense, from all losses, claims, liability, damages, and expenses (including reasonable attorney’s fees) due to (i) any damage or injury to persons or property of third persons, (ii) Tenant’s use or occupancy of the Premises, (iii) Tenant’s breach of any covenant under this Lease, or (iv) Tenant’s use of any equipment, facilities or property in, on, or adjacent to the Property. In the event any suit shall be instituted against Landlord by any third person for which Tenant is hereby indemnifying and holding Landlord harmless, Tenant shall defend such suit at Tenant’s sole cost and expense with counsel reasonably satisfactory to Landlord; or, in Landlord’s discretion, Landlord may elect to defend such suit, in which event Tenant shall pay Landlord, as Additional Rent, Landlord’s costs of such defense. This Paragraph shall survive the expiration or earlier termination of this Lease.

18. CONDEMNATION. If the whole or any part of the Property or the Premises shall be taken in condemnation, or transferred by agreement in lieu of condemnation, which in Tenant’s reasonable judgment, materially adversely affects Tenant’s Permitted Use of the Premises, or in Landlord’s reasonable judgment, would materially interfere with or impair its ownership or operation of the Property, then either Tenant or Landlord may terminate this Lease by serving the other party with written notice of same, effective as of the taking date. If neither Tenant nor Landlord elect to terminate this Lease as aforesaid, then this Lease shall terminate on the taking date only as to that portion of the Premises so taken, and the Rent and other charges payable by Tenant shall be reduced proportionally. Landlord shall be entitled to, and Tenant hereby assigns to Landlord any interests it might have in, the entire condemnation award for all realty and improvements and the value of Tenant’s leasehold interest. Tenant shall, to the extent available from the condemning authority and separately awarded to Tenant, be entitled to an award for Tenant’s fixtures, personal property, and reasonable moving expenses only, provided Tenant independently petitions the condemning authority for same. Notwithstanding the aforesaid, if any condemnation takes a portion of the parking area the result of which does not reduce the minimum required parking ratio below that established by local code or ordinance, this Lease shall continue in full force and effect without modification.

19. INSURANCE. Landlord shall maintain in full force and effect policies of insurance covering the Property in an amount not less than ninety percent (90%) of the Property’s “replacement cost”, as such term is defined in the Replacement Cost Endorsement attached to such policy, insuring against physical loss or damage generally included in the classification of “all risk” or “special form” coverage. Except as set forth below, such insurance shall be for the sole benefit of Landlord, and under Landlord’s sole control.

Tenant shall maintain in full force and effect throughout the term of this Lease policies providing “all risk” or “special form” insurance coverage protecting against physical damage (including, but not limited to, fire, lightning, extended coverage perils, vandalism, sprinkler leakage, water damage, collapse, and other special extended perils) to the extent of 100% of the replacement cost of Tenant’s property and improvements, as well as broad form comprehensive or commercial general liability insurance, in an occurrence form, insuring Landlord and Tenant jointly against any liability (including bodily injury, property damage and contractual liability) arising out of Tenant’s use or occupancy of the Premises, with a combined single limit of not less than $2,000,000, or for a greater amount as may be reasonably required by Landlord from time to time. All such policies shall be of a form and content satisfactory to Landlord; and Landlord, its Property Manager, and any Mortgagee, shall be named as an additional insured on all such policies. All policies shall be with companies licensed to do business in the State of Kentucky, with financial ratings not lower than VII in Best’s Insurance Guide (most current edition). Tenant shall furnish Landlord with certificates of all policies at least ten (10) days prior to occupancy; and, further, such policies shall provide that not less than thirty (30) days written notice be given to Landlord before any such policies are canceled or substantially changed to reduce the insurance provided thereby. All such policies shall be primary and non-contributing with or in excess of any insurance carried by Landlord. Tenant shall not do any act which may make void or voidable any insurance on the Premises or Property; and, in the event Tenant’s use of the Premises shall result in an increase in Landlord’s insurance premiums, Tenant shall pay to Landlord upon demand, as Additional Rent, an amount equal to such increase in insurance.

Notwithstanding any provision in this Lease to the contrary, Landlord, Tenant, and all parties claiming under them, each mutually release and discharge each other from responsibility for that portion of any loss or damage paid or reimbursed by an insurer of Landlord or Tenant under any fire, extended coverage or other property insurance policy maintained by Tenant with respect to its Premises or by Landlord with respect to the Building or the Property (or which would have been paid had the insurance required to be maintained hereunder been in full force and effect), no matter how caused, including negligence, and each waives any right of recovery from the other including, but not limited to, claims for contribution or indemnity, which might otherwise exist on account thereof. Any fire, extended coverage or property insurance policy maintained by Tenant with respect to the Premises, or Landlord with respect to the Building or the Property, shall contain, in the case of Tenant’s policies, a waiver of subrogation provision or endorsement in favor of Landlord, and in the case of Landlord’s policies, a waiver of subrogation provision or endorsement in favor of Tenant, or, in the event that such insurers cannot or shall not include or attach such waiver of subrogation provision or endorsement, Tenant and Landlord shall obtain the approval and consent of their respective insurers, in writing, to the terms of this Lease. Each party agrees to indemnify, protect, defend and hold harmless the other party, and its agents, officers, employees and contractors from and against any claim, suit or cause of action asserted or brought by such indemnifying party’s insurers for, on behalf of, or in the name of such indemnifying party, including, but not limited to, claims for contribution, indemnity or subrogation, brought in contravention of this Paragraph 19. The mutual releases, discharges and waivers contained in this provision shall apply EVEN IF THE LOSS OR DAMAGE TO WHICH THIS PROVISION APPLIES IS CAUSED SOLELY OR IN PART BY THE NEGLIGENCE OR STRICT LIABILITY OF LANDLORD OR TENANT.

13

Landlord shall not be responsible for, and Tenant releases and discharges Landlord from, and Tenant further waives any right of recovery from Landlord for, any loss for or from business interruption or loss of use of the Premises suffered by Tenant in connection with Tenant’s use or occupancy of the Premises, EVEN IF SUCH LOSS IS CAUSED SOLELY OR IN PART BY THE NEGLIGENCE OR STRICT LIABILITY OF LANDLORD, except as to Landlord’s gross negligence and intentional willful misconduct.

20. MORTGAGES. This Lease is subject and subordinated to any mortgages, deeds of trust or underlying leases, as well as to any extensions or modifications thereof (hereinafter collectively referred to as “Mortgages”), now of record or hereafter placed of record. In the event Landlord exercises its option to further subordinate this Lease, Tenant shall at the option of the holder of said Mortgage attorn to said holder. Any subordination shall be self-executing, but Tenant shall, at the written request of Landlord, execute such further reasonable assurances as Landlord deems desirable to confirm such subordination. In the event any existing or future lender, holding a mortgage, deed of trust or other commercial paper, requires a modification of this Lease which does not increase Tenant’s Rent hereunder, or does not materially change any obligation of Tenant hereunder, Tenant agrees to execute appropriate instruments to reflect such modification, upon request by Landlord.

21. LIENS. Tenant shall not mortgage or otherwise encumber or allow to be encumbered its interest herein without obtaining the prior written consent of Landlord. Tenant shall not allow any liens to be filed against the Premises or the Property, and Tenant shall keep the Premises and the Property free and clear of any mechanic’s and materialman’s liens arising in connection with any repair or alteration to the Premises performed by Tenant or its contractors. Should Tenant cause any mortgage, lien or other encumbrance (hereinafter singularly or collectively referred to as “Encumbrance”) to be filed, against the Premises or the Property, Tenant shall dismiss or bond against same within fifteen (15) days after the filing thereof. If Tenant fails to remove said Encumbrance within said fifteen (15) days, Landlord shall have the absolute right to remove said Encumbrance by whatever measures Landlord shall deem convenient including, without limitation, payment of such Encumbrance, in which event Tenant shall reimburse Landlord, as Additional Rent, all costs expended by Landlord, including reasonable attorneys fees, in removing said Encumbrance. Tenant shall indemnify, defend and hold harmless Landlord and its agents, employees and contractors from and against any damages, losses or costs arising out of any such claim and from any liens or encumbrances arising from any work performed by Tenant or on behalf of Tenant in the Premises or the Property. Tenant’s indemnification of Landlord contained in this Paragraph shall survive the expiration or earlier termination of this Lease. All of the aforesaid rights of Landlord shall be in addition to any remedies which either Landlord or Tenant may have available to them at law or in equity. Notwithstanding anything in this Lease to the contrary, Tenant is not authorized to act for or on behalf of Landlord as Landlord’s agent or otherwise, for any purposes of constructing improvements, additions or alterations to the Premises.

22. GOVERNMENT REGULATIONS. Tenant, at Tenant’s sole cost and expense, shall conform with all laws and requirements of any Municipal, State, or Federal, authorities now in force, or which may hereafter be in force, pertaining to the Premises, as well as any requirement of Landlord’s insurance carrier with respect to Tenant’s use of the Premises. The judgment of any court, or an admission of Tenant in any action or proceeding at law, whether Landlord be a party thereto or not, shall be conclusive of the fact as between Landlord and Tenant. The foregoing provisions of this Paragraph 22 shall be subject to the requirements of Paragraph 3(c) above relating to Landlord’s obligations pertaining to Legal Requirements.

23. NOTICES. All notices which are required to be given hereunder shall be in writing, and delivered by either (a) hand delivery, or (b) United States registered or certified mail, or (c) an overnight commercial package courier/delivery service with a follow-up letter sent by United States mail; and such notices shall be sent postage prepaid, addressed to the parties hereto at their respective addresses set forth in Items 20 and 21 of the Basic Lease Provisions. Either party may designate a different address by giving notice to the other party of same at the address set forth above. Notices shall be deemed received on the date of the return receipt, or in the case of hand delivery, immediately upon such delivery. If any such notices are refused, or if the party to whom any such notice is sent has relocated without leaving a forwarding address, then the notice shall be deemed received on the date the notice-receipt is returned stating that the same was refused or is undeliverable at such address.

14

24. PARKING. Tenant shall be liable for all vehicles owned, rented or used by Tenant or Tenant’s agents, employees, contractors and invitees in or about the Property. Tenant shall not store any equipment, inventory or other property in any trucks, nor store any trucks on the parking lot of the Property. Notwithstanding the aforesaid, in the event the Premises have access to a loading dock which exclusively services the Premises, then Tenant shall have the right to park overnight its operable trucks in front of such loading docks; provided, however, such operable trucks shall not block or restrict access to and from the Building and the parking lot. Tenant shall not park or store any motor vehicles within the Premises. In the event the Premises have access to a loading dock which does not exclusively service the Premises, Tenant shall not park its trucks in the dock area longer than the time it takes to reasonably load or unload its trucks. In no event shall Tenant park any vehicle in or about a loading dock which exclusively services another tenant in, on or about the Property, or in a thoroughfare, driveway, street, or other area not specifically designated for parking. Landlord reserves the right to establish uniform rules and regulations for the loading and unloading of trucks upon the Property, which rules may include the right to designate specific parking spaces for tenants’ use. Upon request by Landlord, Tenant shall move its trucks and vehicles if, in Landlord’s reasonable opinion, said vehicles are in violation of any of the above restrictions.

25. OWNERSHIP.

(a) In the event of a sale or conveyance by Landlord of the Building or the Property, Landlord shall be released from any and all liability under this Lease accruing from and after such sale or conveyance. If the Security Deposit has been made by Tenant prior to such sale or conveyance, Landlord shall transfer the Security Deposit to the purchaser, and upon delivery to Tenant of notice thereof, Landlord shall be discharged from any further liability in reference thereto.

(b) Landlord shall not be in default of any obligation of Landlord hereunder unless Landlord fails to perform any of its obligations under this Lease within thirty (30) days after receipt of written notice of such failure from Tenant; provided, however, that if the nature of Landlord’s obligation is such that more than thirty (30) days are required for its performance, Landlord shall not be in default if Landlord commences to cure such default within the thirty (30) day period and thereafter diligently prosecutes the same to completion. All obligations of Landlord under this Lease will be binding upon Landlord only during the period of its ownership of the Premises and not thereafter. All obligations of Landlord hereunder shall be construed as covenants, not conditions.

(c) Any liability of Landlord for a default by Landlord under this Lease, or a breach by Landlord of any of its obligations under the Lease, shall be limited solely to its interest in the Property, and in no event shall any personal liability be asserted against Landlord in connection with this Lease nor shall any recourse be had to any other property or assets of Landlord. For purposes of this Paragraph 25(c), Landlord’s interest in the Property shall be deemed to include: (i) the rents or other income from the Property received by Landlord after Tenant obtains a final judgment against Landlord, (ii) the net proceeds received by Landlord from the sale or other disposition of all or any part of Landlord’s right, title and interest in the Property after Tenant obtains a final judgment against Landlord, (iii) the net proceeds received by Landlord from any condemnation or conveyance in lieu of condemnation of all or any portion of the Property after Tenant obtains a final judgment against Landlord, and (iv) the net proceeds of insurance received by Landlord from any casualty loss of all or any portion of the Property after Tenant obtains a final judgment against Landlord. If such default by Landlord shall occur, Tenant may pursue any legal or equitable remedy for which it is entitled; provided, however, Tenant hereby expressly waives and agrees that Tenant shall have no offset rights on account of any breach or default by Landlord under this Lease. Under no circumstances whatsoever shall Landlord or Tenant ever be liable for punitive, consequential or special damages under this Lease (except if in the case of Tenant as the same relates to estoppels matters, a holding over in the Premises or environmental matters which are Tenant’s responsibility under this Lease) and Tenant and Landlord each waives any rights it may have to such damages under this Lease in the event of a breach or default by the other under this Lease, except as otherwise expressly set forth herein.

26. INTENTIONALLY DELETED.