UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

|

x

|

QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Quarterly Period Ended March 31, 2015

|

¨

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to ___________

Commission File Number 0-13117

HealthWarehouse.com, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

22-2413505

|

|

|

(State or Other Jurisdiction

|

(I.R.S. Employer

|

|

|

of Incorporation or Organization)

|

Identification No.)

|

|

7107 Industrial Road, Florence, Kentucky

|

41042

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(800) 748-7001

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer o | Accelerated Filer o |

| Non-accelerated Filer o | Smaller Reporting Company x |

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

There were 37,570,383 shares of Common Stock outstanding as of May 7, 2015

HEALTHWAREHOUSE.COM, INC.

QUARTERLY REPORT ON FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2015

|

Page

|

|||||

| PART I – FINANCIAL INFORMATION | |||||

| Item 1. | 3 | ||||

| Item 2. | 14 | ||||

| Item 3. | 18 | ||||

| Item 4. | 18 | ||||

| PART II – OTHER INFORMATION | |||||

| Item 1. | 20 | ||||

| Item 1A. | 20 | ||||

| Item 2. | 20 | ||||

| Item 3. | 20 | ||||

| Item 4. | 20 | ||||

| Item 5. | 20 | ||||

| Item 6. | 21 | ||||

| SIGNATURES | 22 | ||||

PART I – FINANCIAL INFORMATION

|

HEALTHWAREHOUSE.COM, INC. AND SUBSIDIARIES

|

|||

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

March 31,

|

December 31,

|

|||||||

|

2015

|

2014

|

|||||||

|

(unaudited)

|

||||||||

|

Assets

|

||||||||

|

Current assets:

|

||||||||

|

Cash

|

$ | 265,848 | $ | 506,019 | ||||

|

Restricted cash

|

195,088 | 195,088 | ||||||

|

Accounts receivable, net of allowance of $47,143 and $47,233 as of March 31, 2015

|

||||||||

|

and December 31, 2014, repectively

|

112,354 | 100,886 | ||||||

|

Inventories - finished goods, net

|

145,270 | 144,236 | ||||||

|

Prepaid expenses and other current assets

|

47,345 | 60,202 | ||||||

|

Total current assets

|

765,905 | 1,006,431 | ||||||

|

Property and equipment, net of accumulated depreciation of $720,228 and $692,903 as of

|

||||||||

|

March 31, 2015 and December 31, 2014

|

489,499 | 511,286 | ||||||

|

Web development costs, net of accumulated amortization of $88,882 and $70,498 as of

|

||||||||

|

March 31, 2015 and December 31, 2014

|

135,148 | 142,541 | ||||||

|

Total assets

|

$ | 1,390,552 | $ | 1,660,258 | ||||

|

Liabilities and Stockholders’ Deficiency

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable – trade

|

$ | 2,411,287 | $ | 2,542,938 | ||||

|

Accounts payable – related parties

|

83,932 | 84,314 | ||||||

|

Accrued expenses and other current liabilities

|

405,747 | 680,506 | ||||||

|

Deferred revenue

|

5,643 | 7,009 | ||||||

|

Current portion of equipment lease payable

|

65,513 | 64,101 | ||||||

|

Notes payable and other advances, net of debt discount of $45,150 and $58,367 as of March 31, 2015

|

||||||||

|

and December 31, 2014, respectively

|

804,850 | 791,633 | ||||||

|

Note payable and other advances – related parties

|

73,095 | 73,095 | ||||||

|

Redeemable preferred stock - Series C; par value $0.001 per share;

|

||||||||

|

10,000 designated Series C: 10,000 issued and outstanding as of

|

||||||||

|

March 31, 2015 and December 31, 2014 (aggregate liquidation preference of $1,000,000)

|

1,000,000 | 1,000,000 | ||||||

|

Total current liabilities

|

4,850,067 | 5,243,596 | ||||||

|

Long term liabilities:

|

||||||||

|

Long term portion of equipment lease payable

|

29,349 | 46,143 | ||||||

|

Total long term liabilities

|

29,349 | 46,143 | ||||||

|

Total liabilities

|

4,879,416 | 5,289,739 | ||||||

|

Commitments and contingencies

|

||||||||

|

Stockholders’ deficiency:

|

||||||||

|

Preferred stock – par value $0.001 per share; authorized 1,000,000 shares; issued and outstanding

|

||||||||

|

as of March 31, 2015 and December 31, 2014 as follows:

|

||||||||

|

Convertible preferred stock - Series A – 200,000 shares designated Series A; 44,443 shares available

|

||||||||

|

to be issued; no shares issued and outstanding

|

- | - | ||||||

|

Convertible preferred stock - Series B – 625,000 shares designated Series B; 483,512 and 451,879

|

||||||||

|

shares issued and outstanding as of March 31, 2015 and December 31, 2014, respectively (aggregate

|

||||||||

|

liquidation preference of $4,649,149 and $4,569,175 as of March 31, 2015 and

|

483 | 452 | ||||||

|

December 31, 2014, respectively)

|

||||||||

|

Common stock – par value $0.001 per share; authorized 100,000,000 shares; 38,749,595 shares

|

||||||||

|

issued and 37,570,383 shares outstanding as of March 31, 2015 and December 31, 2014.

|

38,751 | 38,751 | ||||||

|

Additional paid-in capital

|

30,385,231 | 29,966,039 | ||||||

|

Employee advances

|

- | (2,143 | ) | |||||

|

Treasury stock, at cost, 1,179,212 shares as of March 31, 2015 and December 31, 2014

|

(3,419,715 | ) | (3,419,715 | ) | ||||

|

Accumulated deficit

|

(30,493,614 | ) | (30,212,865 | ) | ||||

|

Total stockholders’ deficiency

|

(3,488,864 | ) | (3,629,481 | ) | ||||

|

Total liabilities and stockholders’ deficiency

|

$ | 1,390,552 | $ | 1,660,258 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

|

HEALTHWAREHOUSE.COM, INC. AND SUBSIDIARIES

|

||||

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

|

||||

|

(Unaudited)

|

|

For the Three Months Ended

|

||||||||

|

March 31,

|

||||||||

|

2015

|

2014

|

|||||||

|

Net sales

|

$ | 1,612,677 | $ | 1,716,964 | ||||

|

Cost of sales

|

631,163 | 731,408 | ||||||

|

Gross profit

|

981,514 | 985,556 | ||||||

|

Operating expenses:

|

||||||||

|

Selling, general and administrative expenses

|

1,107,550 | 1,217,661 | ||||||

|

Loss from operations

|

(126,036 | ) | (232,105 | ) | ||||

|

Other expense:

|

||||||||

|

Interest expense

|

(74,752 | ) | (73,536 | ) | ||||

|

Total other expense

|

(74,752 | ) | (73,536 | ) | ||||

|

Net loss

|

(200,788 | ) | (305,641 | ) | ||||

|

Preferred stock:

|

||||||||

|

Series B convertible contractual dividends

|

(79,961 | ) | (74,730 | ) | ||||

|

Loss attributable to common stockholders

|

$ | (280,749 | ) | $ | (380,371 | ) | ||

|

Per share data:

|

||||||||

|

Net loss – basic and diluted

|

$ | (0.01 | ) | $ | (0.01 | ) | ||

|

Series B convertible contractual dividends

|

(0.00 | ) | (0.00 | ) | ||||

|

Net loss attributable to common stockholders - basic and diluted

|

$ | (0.01 | ) | $ | (0.01 | ) | ||

|

Weighted average number of common shares outstanding - basic and diluted

|

37,570,383 | 26,546,832 | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

|

HEALTHWAREHOUSE.COM, INC. AND SUBSIDIARIES

|

|||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|||

|

(Unaudited)

|

|

For the Three Months Ended

|

||||||||

|

March 31,

|

||||||||

|

2015

|

2014

|

|||||||

|

Cash flows from operating activities

|

||||||||

|

Net loss

|

$ | (200,788 | ) | $ | (305,641 | ) | ||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||

|

Provision for doubtful accounts

|

90 | (41,458 | ) | |||||

|

Provision for employee advance reserve

|

2,143 | (1,714 | ) | |||||

|

Depreciation and amortization

|

45,661 | 41,621 | ||||||

|

Stock-based compensation

|

79,005 | 162,763 | ||||||

|

Gain on settlement of accounts payable

|

(66,179 | ) | (64,597 | ) | ||||

|

Imputed value of services contributed

|

- | 87,500 | ||||||

|

Amortization of debt discount

|

54,517 | 54,035 | ||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts receivable

|

(11,558 | ) | 273,902 | |||||

|

Inventories - finished goods

|

(1,034 | ) | 31,149 | |||||

|

Prepaid expenses and other current assets

|

12,857 | 18,531 | ||||||

|

Accounts payable – trade

|

(65,472 | ) | (318,734 | ) | ||||

|

Accounts payable – related parties

|

(382 | ) | (5,445 | ) | ||||

|

Accrued expenses and other current liabilities

|

(55,802 | ) | 25,172 | |||||

|

Deferred revenue

|

(1,366 | ) | (17,002 | ) | ||||

|

Net cash used in operating activities

|

(208,308 | ) | (59,918 | ) | ||||

|

Cash flows from investing activities

|

||||||||

|

Capital expenditures

|

(5,539 | ) | - | |||||

|

Website development costs

|

(10,942 | ) | (34,866 | ) | ||||

|

Net cash used in investing activities

|

(16,481 | ) | (34,866 | ) | ||||

|

Cash flows from financing activities

|

||||||||

|

Principal payments on equipment leases payable

|

(15,382 | ) | (13,159 | ) | ||||

|

Proceeds from issuance of notes payable

|

- | 100,000 | ||||||

|

Net cash (used in) provided by financing activities

|

(15,382 | ) | 86,841 | |||||

|

Net decrease in cash

|

(240,171 | ) | (7,944 | ) | ||||

|

Cash - beginning of period

|

506,019 | 67,744 | ||||||

|

Cash - end of period

|

$ | 265,848 | $ | 59,800 | ||||

|

Cash paid for:

|

||||||||

|

Interest

|

$ | 19,544 | $ | 25,523 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

|

HEALTHWAREHOUSE.COM, INC. AND SUBSIDIARIES

|

|||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|||

|

(Unaudited - Continued)

|

|

For the Three Months Ended

|

||||||||

|

March 31,

|

||||||||

|

2015

|

2014

|

|||||||

|

Non-cash investing and financing activities:

|

||||||||

|

Issuance of Series B preferred stock for settlement of accrued dividends

|

$ | 298,918 | $ | 279,380 | ||||

|

Warrants issued as debt discount in connection with notes payable

|

$ | 41,300 | $ | 26,000 | ||||

|

Accrual of contractual dividends on Series B convertible preferred stock

|

$ | 79,961 | $ | 74,730 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

HEALTHWAREHOUSE.COM, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

1. Organization and Basis of Presentation

HealthWarehouse.com, Inc., a Delaware company incorporated in 1998, (the “Company”) is a U.S. licensed virtual retail pharmacy (“VRP”) and healthcare e-commerce company that sells brand name and generic prescription drugs as well as over-the-counter (“OTC”) medical products. The Company’s objective is to be viewed by individual healthcare product consumers as a low-cost, reliable and hassle-free provider of prescription drugs and OTC medical products. The Company is presently licensed as a mail-order pharmacy for sales to 50 states in the United States and the District of Columbia.

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information. Accordingly, they do not include all of the information and disclosures required by U.S. GAAP for annual financial statements. In the opinion of management, such statements include all adjustments (consisting only of normal recurring items) which are considered necessary for a fair presentation of the condensed consolidated financial statements of the Company as of March 31, 2015 and for the three months ended March 31, 2015 and 2014. The results of operations for the three months ended March 31, 2015 are not necessarily indicative of the operating results for the full year ending December 31, 2015 or any other period. These condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and related disclosures of the Company as of December 31, 2014 and for the year then ended, which were filed with the Securities and Exchange Commission on Form 10-K on March 30, 2015.

2. Going Concern and Management’s Liquidity Plans

Since inception, the Company has financed its operations primarily through debt and equity financings and advances from related parties. As of March 31, 2015, the Company had a working capital deficiency of $4,084,162 and an accumulated deficit of $30,493,614. During the three months ended March 31, 2015 and the year ended December 31, 2014, the Company incurred net losses of $200,788 and $1,783,279, respectively and used cash in operating activities of $208,308 and $875,769, respectively. These conditions raise substantial doubt about the Company’s ability to continue as a going concern.

Subsequent to March 31, 2015, the Company continues to incur net losses, use cash in operating activities and experience cash and working capital constraints.

On February 13, 2013, the Company received a Notice of Redemption related to its Series C Redeemable Preferred Stock aggregating $1,000,000 (see Note 6). As a result of receiving the Notice of Redemption, the Company must now apply all of its assets to redemption of the Series C Preferred Stock and to no other corporate purpose, except to the extent prohibited by Delaware law governing distributions to stockholders (the Company is not permitted to utilize toward the redemption those assets required to pay its debts as they come due and those assets required to continue as a going concern).

The Company recognizes it will need to raise additional capital in order to fund operations, meet its payment obligations and execute its business plan. There is no assurance that additional financing will be available when needed or that management will be able to obtain financing on terms acceptable to the Company and whether the Company will become profitable and generate positive operating cash flow. If the Company is unable to raise sufficient additional funds, it will have to develop and implement a plan to further extend payables, attempt to extend note repayments, attempt to negotiate the preferred stock redemption and reduce overhead until sufficient additional capital is raised to support further operations. There can be no assurance that such a plan will be successful. If the Company is unable to obtain financing on a timely basis, the Company could be forced to sell its assets, discontinue its operation and /or seek reorganization under the U.S. bankruptcy code.

Accordingly, the accompanying condensed consolidated financial statements have been prepared in conformity with U.S. GAAP, which contemplates continuation of the Company as a going concern and the realization of assets and the satisfaction of liabilities in the normal course of business. The carrying amounts of assets and liabilities presented in the condensed consolidated financial statements do not necessarily represent realizable or settlement values. The condensed consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

3. Summary of Significant Accounting Policies

Principles of Consolidation

The condensed consolidated financial statements include the accounts of HealthWarehouse.com, Inc., Hwareh.com, Inc., Hocks.com, Inc., ION Holding NV and ION Belgium NV, its wholly-owned subsidiaries. ION Holding NV and ION Belgium NV are inactive subsidiaries. All material inter-company balances and transactions have been eliminated in consolidation.

On June 4, 2013, the Company formed a wholly-owned subsidiary called Pagosa Health LLC (“Pagosa”). On January 14, 2014, the Company closed Pagosa and decided to focus on its core consumer prescription business. Pagosa was dissolved in July 2014.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The Company’s significant estimates include reserves related to accounts receivable and inventory, the recoverability and useful lives of long-lived assets, the valuation allowance related to deferred tax assets, the valuation of equity instruments and debt discounts.

Net Earnings (Loss) Per Share of Common Stock

Basic net earnings (loss) per share is computed by dividing net earnings (loss) attributable to Common Stockholders by the weighted average number of common shares outstanding during the period. Diluted net earnings (loss) per share reflects the potential dilution that could occur if securities or other instruments to issue Common Stock were exercised or converted into Common Stock. Potentially dilutive securities are excluded from the computation of diluted net earnings (loss) per share if their inclusion would be anti-dilutive and consist of the following:

|

March 31,

|

||||||||

|

2015

|

2014

|

|||||||

|

Options

|

3,944,557 | 2,514,150 | ||||||

|

Warrants

|

9,839,044 | 2,492,846 | ||||||

|

Series B Convertible Preferred Stock

|

5,507,202 | 3,714,445 | ||||||

|

Total potentially dilutive shares

|

19,290,803 | 8,721,441 | ||||||

The Company has determined there are no new accounting standards that are expected to have a material impact on the Company's condensed consolidated financial statements.

4. Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following:

|

March 31,

|

December 31,

|

|||||||

|

2015

|

2014

|

|||||||

|

Deferred Rent

|

$ | 33,503 | $ | 36,053 | ||||

|

Advertising

|

76,639 | 109,930 | ||||||

|

Salaries and Benefits

|

80,597 | 82,222 | ||||||

|

Customer Payables

|

297 | 635 | ||||||

|

Dividend Payable

|

79,961 | 298,918 | ||||||

|

Accrued Interest

|

49,681 | 48,868 | ||||||

|

Accrued Rent

|

47,942 | 46,604 | ||||||

|

Other

|

37,127 | 57,276 | ||||||

| Total | $ | 405,747 | $ | 680,506 | ||||

5. Notes Payable

The Company is a party to a Loan and Security Agreement (the “Loan Agreement”) with a lender (the "Lender"). Under the terms of the Loan Agreement, the Company borrowed an aggregate of $750,000 from the Lender (the “Loan”). The Loan is evidenced by a promissory note (the “Senior Note”) in the face amount of $750,000 (as amended). Effective March 1, 2015, near the original maturity date, the Lender agreed to extend the maturity date of the Senior Note from March 1, 2015 to September 1, 2015 and agreed to extend the maturity date for an additional six months to March 1, 2016 if the Company meets certain financial requirements. The Senior Note bears interest on the unpaid principal balance of the Note until the full amount of principal has been paid at a floating rate equal to the Prime Rate plus four and one-quarter percent (4.25%) per annum (7.50% as of March 31, 2015). Under the terms of the Loan Agreement, the Company has agreed to make monthly payments of accrued interest on the first day of every month. The principal amount and all unpaid accrued interest on the Note is payable on September 1, 2015, or earlier in the event of default or a sale or liquidation of the Company. The Loan may be prepaid in whole or in part at any time by the Company without penalty. The Senior Note contains financial covenants which require the Company to meet certain minimum targets for earnings before interest, taxes and non-cash expenses, including depreciation, amortization and stock-based compensation (“EBITDAS”). The Company granted the Lender a first, priority security interest in all of the Company’s assets, in order to secure the Company’s obligation to repay the Loan, including a Deposit Account Control Agreement, which grants the Lender a security interest in certain bank accounts.

In connection with the extension of the maturity date of the Senior Note, the Company granted the Lender five-year warrants to purchase 500,000 shares of Common Stock at an exercise price of $0.10 per share. The warrants had a relative fair value of $41,300 using the Black-Scholes model (see Note 6) which was established as debt discount during the three months ended March 31, 2015 and will be amortized using the effective interest method over the remaining term of the Senior Note. Including the value of warrants issued in connection with extension of the maturity date of the Senior Note, the Note had an effective interest rate of 19% per annum.

The Company recorded amortization of debt discount associated with notes payable of $54,517 and $54,035 for the three months ended March 31, 2015 and 2014, respectively.

6. Stockholders’ Deficiency

Preferred Stock

As of March 31, 2015 and December 31, 2014, the Company had accrued contractual dividends of $79,961 and $298,918, respectively, related to the Series B Preferred Stock. On January 1, 2015 and 2014, the Company issued 31,633 and 29,564 shares of Series B convertible preferred stock valued at approximately $299,000 and $279,000, respectively, representing approximately $0.66 in value per share of Series B Preferred Stock outstanding on each date, to the Series B convertible preferred stock owners as payment in kind for dividends.

Stock Options

Stock-based compensation expense related to stock options was recorded in the condensed consolidated statements of operations as a component of selling, general and administrative expenses and totaled $78,789 and $151,853 for the three months ended March 31, 2015 and 2014, respectively.

As of March 31, 2015, stock-based compensation expense related to stock options of $1,060,043 remains unamortized, including $168,474 which is being amortized over the weighted average remaining period of 1.0 years. The remaining $891,569 is related to a performance based option where vesting is currently deemed to be improbable and no amount is being amortized.

Warrants

Valuation

In applying the Black-Scholes option pricing model to stock warrants, the Company used the following weighted average assumptions:

|

For The Three Months Ended

|

||||||||

|

March 31,

|

||||||||

|

2015

|

2014

|

|||||||

|

Risk free interest rate

|

1.50 | % | 1.74 | % | ||||

|

Dividend yield

|

0.00 | % | 0.00 | % | ||||

|

Expected volatility

|

196.0 | % | 171.0 | % | ||||

|

Expected life in years

|

5.00 | 5.00 | ||||||

Grants

The weighted average fair value of the stock warrants granted during the three months ended March 31, 2015 and 2014, was $0.08 and $0.23 per share, respectively.

Stock-based compensation expense related to warrants for the three months ended March 31, 2015 and 2014 was recorded in the condensed consolidated statements of operations as a component of selling, general and administrative expenses and totaled $216 and $264, respectively. As of March 31, 2015, stock-based compensation expense related to warrants of $577,307 remains unamortized, including $467 which is being amortized over the weighted average remaining period of 0.5 years. The remaining $576,840 is related to a performance based warrant where vesting is currently deemed to be improbable and no amount is being amortized.

A summary of the stock warrant activity during the three months ended March 31, 2015 is presented below:

|

Weighted

|

Average

|

|||||||||||||||

|

Average

|

Remaining

|

Aggregate

|

||||||||||||||

|

Number of

|

Exercise

|

Life

|

Intrinsic

|

|||||||||||||

|

Warrants

|

Price

|

In Years

|

Value

|

|||||||||||||

|

Outstanding, January 1, 2015

|

9,339,044 | $ | 0.45 | |||||||||||||

|

Granted

|

500,000 | $ | 0.10 | |||||||||||||

|

Exercised

|

- | $ | - | |||||||||||||

|

Forfeited

|

- | - | ||||||||||||||

|

Outstanding, March 31, 2015

|

9,839,044 | $ | 0.44 | 4.0 | $ | - | ||||||||||

|

Exercisable, March 31, 2015

|

9,579,044 | $ | 0.37 | 4.1 | $ | - | ||||||||||

|

Warrants Outstanding

|

Warrants Exercisable

|

||||||||||||||||||||

|

Weighted

|

Weighted

|

Weighted

|

|||||||||||||||||||

|

Range of

|

Average

|

Outstanding

|

Average

|

Average

|

Exercisable

|

||||||||||||||||

|

Exercise

|

Exercise

|

Number of

|

Exercise

|

Remaining Life

|

Number of

|

||||||||||||||||

|

Price

|

Price

|

Warrants

|

Price

|

In Years

|

Warrants

|

||||||||||||||||

| $0.10 - $0.35 | $ | 0.27 | 9,246,198 | $ | 0.27 | 4.2 | 9,246,198 | ||||||||||||||

| $0.36 - $3.00 | 2.91 | 562,846 | 2.91 | 1.4 | 312,846 | ||||||||||||||||

| $3.01 - $4.95 | 4.95 | 30,000 | 4.95 | 2.5 | 20,000 | ||||||||||||||||

| $0.10 - $4.95 | $ | 0.44 | 9,839,044 | $ | 0.37 | 4.1 | 9,579,044 | ||||||||||||||

7. Commitments and Contingent Liabilities

Operating Leases

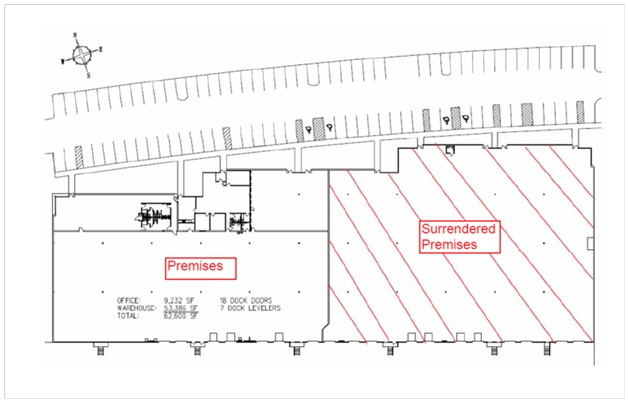

The Company is a party to a lease agreement for approximately 62,000 square feet of office and storage space with an entity. The monthly lease rate is $10,671 for 2015 and $11,975 in year 2016. The Company accounts for rent expense using the straight line method of accounting, deferring the difference between actual rent due and the straight line amount. The lease expires on January 1, 2017. Deferred rent payable of $33,503 and $36,053 as of March 31, 2015 and December 31, 2014, respectively, has been included in accrued expenses and other current liabilities on the condensed consolidated balance sheets.

On June 7, 2013, Pagosa signed a three year lease for $1,000 per month to house an office, pharmacy as well as inventory and is located in Lawrenceburg, IN. On July 8, 2013, the parties agreed to extend the lease for two additional years, such that the new termination date is now June 7, 2018. On January 14, 2014, the Company closed Pagosa Health and vacated the Lawrenceburg facility. The Company is currently in discussions with the Landlord regarding termination of the lease related to the building. The present value of the remaining lease payments of $47,942 is reflected as a component of accrued expenses and other liabilities on the condensed consolidated financial statements as of March 31, 2015.

On December 15, 2014, the Company entered into a sublease agreement for 34,106 square feet of warehouse space at the Company’s corporate headquarters in Florence, Kentucky. The initial term of the sublease expires on June 14, 2015 with rent of $9,948 per month. After the expiration of the initial term, the tenant may extend the term of the sublease agreement on a month to month basis.

Future minimum payments, by year and in the aggregate, under operating leases as of March 31, 2015 are as follows:

|

For years ending December 31,

|

Amount

|

|||

|

2015

|

$ | 105,039 | ||

|

2016

|

155,700 | |||

|

2017

|

12,000 | |||

|

2018

|

5,000 | |||

|

Total future minimum lease payments

|

$ | 277,739 | ||

During the three months ended March 31, 2015 and 2014, the Company recorded aggregate rent expense of $18,342 (net of sub-lease) and $49,229, respectively.

Litigation

In the ordinary course of business, we may become subject to lawsuits and other claims and proceedings that might arise from litigation matters or regulatory audits. Such matters are subject to uncertainty and outcomes are often not predictable with assurance. Our management does not presently expect that any such matters will have a material adverse effect on the Company’s condensed consolidated financial condition or condensed consolidated results of operations. We are not currently involved in any pending or threatened material litigation or other material legal proceedings nor have we been made aware of any penalties from regulatory audits.

8. Concentrations

During the three months ended March 31, 2015, two vendors represented 74% and 10% of total inventory purchases. During the three months ended March 31, 2014, two vendors represented 57% and 16% of total inventory purchases, respectively.

One vendor represented 38% and 36% of the accounts payable balance as of March 31, 2015 and December 31, 2014, respectively.

9. Related Party Transactions

Effective September 4, 2014, the Company entered into a Consulting Agreement with a stockholder to provide consulting services related to business development and marketing activities for the Company and other duties as agreed to by management. The Company is required to pay the related party a monthly fee of $10,000 plus expense reimbursement. Subsequent to the effective date, the related party agreed to defer the payment of the monthly fee for a period of four months beginning with the November 4, 2014 payment. The deferred fees will be payable on the earlier of the termination date or the second anniversary of the effective date. The Consulting Agreement has an initial term of one year and can be automatically renewed for a one year period unless terminated by either party. The Agreement may be terminated by the Company by providing a sixty day notice prior to the first anniversary of the effective date. During the three months ended March 31, 2015, the Company incurred consulting and other expenses of $30,000 related to the Consulting Agreement.

Between June 2009 and April 2012, an employee who is the son of the managing member of a limited liability company that beneficially owns over 5% of the Company’s Common Stock received advances from the Company in various forms which totaled $391,469 including interest. Principal repayments towards the outstanding advances aggregating $235,000 have been made through March 31, 2014. In April 2012, this employee voluntarily resigned from the Company. The individual agreed to repay the remaining balance with interest based on prime rate on the first business day of the calendar quarter. The amount has been included in Stockholders’ Deficiency as the Company has determined to exercise its rights through a pledge agreement for 42,860 shares as collateral. At December 31, 2014, the Company estimated the value of the collateral at $2,143. During the three months ended March 31, 2015, the Company wrote off the value of the collateral to $0.

10. Subsequent Events

The Company evaluates events that have occurred after the balance sheet date but before the financial statements are issued. Based upon the evaluation, the Company did not identify any recognized or non-recognized subsequent events that would have required adjustment or disclosure in the condensed consolidated financial statements, except as disclosed.

Stock Option Grants

On April 3, 2015, the Company granted options to employees of the Company to purchase an aggregate of 922,223 shares of common stock under the 2014 Plan at an exercise price of $0.09 per share for an aggregate grant date value of $81,419. The options have a vesting period ranging from immediate to three years and have a term of ten years.

On April 3, 2015, the Company granted options to consultants of the Company to purchase an aggregate of 149,861 shares of common stock under the 2014 Plan at an exercise price of $0.09 per share for an aggregate grant date value of $13,462. The options vested on the grant date and have a term of ten years.

On April 7, 2015, the Company granted options to directors of the Company to purchase an aggregate of 102,189 shares of common stock under the 2014 Plan at an exercise price of between $0.09 per share for an aggregate grant date value of $9,000. The options vested on the grant date and have a term of ten years. The options were granted as part of director compensation approved by the Compensation Committee.

Warrant Grants

On April 3, 2015, the Company granted warrants to a former employee of the Company to purchase an aggregate of 137,430 shares of common stock under the 2014 Plan at an exercise price of $0.09 per share for an aggregate grant date value of $12,018. The warrants have a term of five years. The warrants were issued as repayment for amounts previously accrued.

Amendment to Lease Agreement

On April 27, 2015, the Company entered in an amendment to the lease agreement related to the Florence, KY location. The amendment reduced the square feet of office and storage space from approximately 62,000 to approximately 28,500 square feet, effective June 15, 2015. Per the amendment, the monthly lease rate will reduce to $7,770 in June 2015, $4,868 for the remainder of 2015 and $5,462 in year 2016.

The following discussion and analysis of the results of operations and financial condition of HealthWarehouse.com, Inc. (and including its subsidiaries, the “Company”) as of March 31, 2015 and December 31, 2014 and for the three months ended March 31, 2015 and 2014 should be read in conjunction with our financial statements and the notes to those financial statements that are included elsewhere in this Quarterly Report on Form 10-Q. References in this Management’s Discussion and Analysis of Financial Condition and Results of Operations to “us,” “we,” “our,” and similar terms refer to the Company. This Quarterly Report contains forward-looking statements as that term is defined in the federal securities laws. The events described in forward-looking statements contained in this Quarterly Report may not occur. Generally these statements relate to business plans or strategies, projected or anticipated benefits or other consequences of our plans or strategies, projected or anticipated benefits from acquisitions to be made by us, or projections involving anticipated revenues, earnings or other aspects of our operating results. The words “may,” “will,” “expect,” “believe,” “anticipate,” “project,” “plan,” “intend,” “estimate,” and “continue,” and their opposites and similar expressions, are intended to identify forward-looking statements. We caution you that these statements are not guarantees of future performance or events and are subject to a number of uncertainties, risks and other influences, many of which are beyond our control, which may influence the accuracy of the statements and the projections upon which the statements are based. Factors that may affect our results include, but are not limited to, the risks and uncertainties discussed in Item 7 (“Management’s Discussion and Analysis of Financial Condition and Results of Operations – Factors That May Affect Results and Financial Condition”) of our Annual Report on Form 10-K for the year ended December 31, 2014 filed with the Securities and Exchange Commission (the “SEC”) on March 30, 2015.

Any one or more of these uncertainties, risks and other influences could materially affect our results of operations and whether forward-looking statements made by us ultimately prove to be accurate. Our actual results, performance and achievements could differ materially from those expressed or implied in these forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether from new information, future events or otherwise.

Overview

HealthWarehouse.com, Inc. (“HEWA” or the “Company”) is America’s Trusted Online Pharmacy, licensed in 50 states to focus on the out-of-pocket prescription drug market, a market which is expected to grow to $80 billion in 2015. HealthWarehouse.com is currently 1 of less than 40 Verified Internet Pharmacy Practice Websites (“VIPPS”) accredited by the National Association of Boards of Pharmacy (“NABP”) and is the only VIPPS accredited pharmacy licensed in all 50 states and the District of Columbia that processes out-of-pocket prescriptions online. The Company markets a complete range of generic, brand name, and pet prescription medications as well as over-the-counter ("OTC") medications and products.

Consumers who pay out of pocket for their prescriptions include those:

|

·

|

With no insurance coverage;

|

|

·

|

With high insurance deductibles or copays;

|

|

·

|

With Medicare Part D plans with high deductibles;

|

|

·

|

With Health Savings Accounts (HSA) or Flexible Savings Accounts (FSA);

|

|

·

|

With insurance through the Affordable Care Act (ACA) with high deductibles;

|

|

·

|

With drug exclusions and quantity restrictions placed by insurance companies.

|

Our objectives are to utilize our proprietary technology to make the pharmaceutical supply chain more efficient and to pass the savings on to the consumer. We are becoming known by consumers as a convenient, reliable, discount provider of over-the-counter products and prescription medications. We intend to continue to expand our product line as our business grows.

Results of Operations

For The Three Months Ended March 31, 2015 Compared to Three Months Ended March 31, 2014

|

For three months ended

Ended March 31, 2015 |

% of

Revenue |

For three months ended

Ended March 31, 2014 |

% of

Revenue |

|||||||||||||

|

Net sales

|

$ | 1,612,677 | 100.0 | % | $ | 1,716,964 | 100.0 | % | ||||||||

|

Cost of sales

|

631,163 | 39.1 | % | 731,408 | 42.6 | % | ||||||||||

|

Gross profit

|

981,514 | 60.9 | % | 985,556 | 57.4 | % | ||||||||||

|

Selling, general & administrative expenses

|

1,107,550 | 68.7 | % | 1,217,661 | 70.9 | % | ||||||||||

|

Loss from operations

|

(126,036 | ) | (7.8 | %) | (232,105 | ) | (13.5 | %) | ||||||||

|

Interest expense

|

(74,752 | ) | (4.6 | %) | (73,536 | ) | (4.3 | %) | ||||||||

|

Net loss

|

$ | (200,788 | ) | (12.4 | %) | $ | (305,641 | ) | (17.8 | %) | ||||||

Net Sales

|

For three months ended

March 31, 2015 |

%

Change |

$

Change |

For three months ended

March 31, 2014 |

|||||||||||

| $ | 1,612,677 | (6.1 | %) | $ | (104,287 | ) | $ | 1,716,964 | ||||||

Net sales for the three months ended March 31, 2015 declined to $1,612,677 from $1,716,964, a decrease of $104,287, or 6.1% due to the reduction in prescription and over-the-counter sales resulting from the decline in orders from existing customers due to minimal advertising during the first three quarters of 2014. Due to cash flow constraints during the first three quarters of 2014, we were unable expand our advertising efforts to grow our core online prescription business and we were not able to maintain over-the-counter inventories to satisfy incoming orders which forced us to narrow our over-the-counter product line. This prompted negative customer reviews that contributed to the decline in sales, in both our new and repeat customer base.

With the liquidity provided by proceeds from the equity raise in August and October 2014, we were able to source and inventory products to fill incoming orders and improved order fill rate to less than three days from the receipt of the order. This has directly resulted in a significant shift to receiving positive customer reviews from the majority of survey participants. We have initiated an advertising and marketing campaign to drive new and repeat customers to our website and dedicated engineering resources to improve the customer experience and optimize search engine results and order conversions. In addition, we continue to dedicate customer support personnel to proactively call customers after prescription orders are received to obtain the required copies of the prescriptions, in order to process the order and improve the Company’s order conversion rate. Through these efforts, we experienced a 37% increase in new customers during the first quarter of the year compared to levels experienced prior to the completion of the equity raise. We also expect our business with repeat customers to begin growing in 2015 through the retention of the new customers acquired over the last six months.

Cost of Sales and Gross Margin

|

For three months ended

March 31, 2015 |

%

Change |

$

Change

|

For three months ended

March 31, 2014 |

|||||||||||||

|

Cost of sales

|

$ | 631,163 | (13.7 | %) | (100,245 | ) | $ | 731,408 | ||||||||

|

Gross margin $

|

$ | 981,514 | (0.4 | %) | (4,042 | ) | $ | 985,556 | ||||||||

|

Gross margin %

|

60.9 | % | 6.1 | % | 3.5 | % | 57.4 | % | ||||||||

Cost of sales were $631,163 for the three months ended March 31, 2015 as compared to $731,408 for the three months ended March 31, 2014, a decrease of $100,245, or 13.7%, primarily as a result of a reduction in order volume and improved costs realized through strategic purchasing efforts. Gross margin percentage increased from 57.4% for the three months ended March 31, 2014 to 60.9% for the three months ended March 31, 2015, primarily due to the purchasing efforts discussed above and the elimination of unprofitable business relations. Management will continue to focus efforts on taking advantage of strategic purchasing opportunities and maintaining profit margins while expanding its product line, particularly in the over-the-counter business.

Selling, General and Administrative Expenses

|

For three months ended

March 31, 2015 |

%

Change |

$

Change |

For three months ended

March 31, 2014 |

|||||||||||||

|

S,G&A

|

$ | 1,107,550 | (9.0 | %) | $ | (110,111 | ) | $ | 1,217,661 | |||||||

|

% of sales

|

68.7 | % | 70.9 | % | ||||||||||||

Selling, general and administrative expenses totaled $1,107,550 for the three months ended March 31, 2015 compared to $1,217,661 for the three months ended March 31, 2014, a decrease of $110,111, or 9.0%. The three months ended March 31, 2015 expense decreases included (a) a decrease in stock based compensation of $83,758 (primarily due to the completion of the vesting period related to certain options during 2014); (b) a reduction in salary and contract labor expense of $44,601 (primarily due to a reduction in headcount); (c) a decrease in rent expense of $30,887 (resulting from the sublease of a portion of our Florence facility) (d) a decrease in legal expense of $28,411 (primarily due to settlement of litigation in 2014); (d) a decrease in freight expense of $24,836 (primarily due to the reduction in the order volume); and (e) a decrease in credit card processing expense of $21,480 (primarily due to the reduction in order volume and lower rates). The expense reductions were partially offset by an increase in advertising and marketing expense of $99,353.

Interest Expense

Interest expense increased from $73,536 in the three months ended March 31, 2014 to $74,752 in the three months ended March 31, 2015, an increase of $1,338, or 2%, primarily due to an increase in amortization of debt discounts and higher notes payable balances.

Adjusted EBITDAS

We believe Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-Based Compensation (“Adjusted EBITDAS”), a non-GAAP financial measure, is useful in evaluating our operating performance compared to that of other companies in our industry, as this metric generally eliminates the effects of certain items that may vary for different companies for reasons unrelated to overall operating performance. We believe that:

|

·

|

Adjusted EBITDAS provides investors and other users of our financial information consistency and comparability with our past financial performance, facilitates period-to-period comparisons of operations and facilitates comparisons with other companies, many of which use similar non-GAAP financial measures to supplement their GAAP results; and

|

|

·

|

Adjusted EBITDAS is useful because it excludes non-cash charges, such as depreciation and amortization, stock-based compensation and one-time charges, which the amount of such expense in any specific period may not directly correlate to the underlying performance of our business operations and these expenses can vary significantly between periods.

|

We use Adjusted EBITDAS in conjunction with traditional GAAP measures as part of our overall assessment of our performance, to evaluate the effectiveness of our business strategies and to communicate with our lenders, stockholders and board of directors concerning our financial performance.

Adjusted EBITDAS should not be considered as a substitute for other measures of financial performance reported in accordance with GAAP. There are limitations to using non-GAAP financial measures, including that other companies may calculate these measures differently than we do. We compensate for the inherent limitations associated with using Adjusted EBITDAS through disclosure of these limitations, presentation of our financial statements in accordance with GAAP and reconciliation of Adjusted EBITDAS to the most directly comparable GAAP measure, specifically net loss.

The following provides a reconciliation of net loss to Adjusted EBITDAS:

|

March 31,

|

||||||||

|

2015

|

2014

|

|||||||

|

(unaudited)

|

||||||||

|

Net loss

|

$ | (200,788 | ) | $ | (305,641 | ) | ||

|

Non-GAAP adjustments:

|

||||||||

|

Gain on settement of accounts payable

|

(66,179 | ) | (64,597 | ) | ||||

|

Interest expense

|

74,752 | 73,536 | ||||||

|

Depreciation and amortization

|

45,661 | 41,621 | ||||||

|

Imputed value of contributed services

|

- | 87,500 | ||||||

|

Stock-based compensation

|

79,005 | 162,499 | ||||||

|

Change in fair value of collateral securing

|

||||||||

|

employee advances

|

2,143 | (1,714 | ) | |||||

|

Adjusted EBITDAS

|

$ | (65,406 | ) | $ | (6,796 | ) | ||

We have not entered into any transactions with unconsolidated entities in which we have financial guarantees, subordinated retained interests, derivative instruments or other contingent arrangements that expose us to material continuing risks, contingent liabilities or any other obligations under a variable interest in an unconsolidated entity that provides us with financing, liquidity, market risk or credit risk support.

Impact of Inflation

We believe that inflation has not had a material impact on our results of operations for the three months ended March 31, 2015 and 2014. We cannot assure you that future inflation will not have an adverse impact on our operating results and financial condition.

Liquidity and Capital Resources

Since inception, we have financed operations primarily through debt and equity financings and advances from stockholders. As of March 31, 2015 we had a working capital deficiency of $4,084,162 and an accumulated deficit of $30,493,614. During the three months ended March 31, 2015 and the year ended December 31, 2014, we incurred net losses of $200,788 and $1,783,279 and used cash in operating activities of $208,308 and $875,769, respectively. These conditions raise substantial doubt about our ability to continue as a going concern.

Subsequent to March 31, 2015, we continue to incur net losses, use cash in operating activities and experience cash and working capital constraints.

On February 13, 2013, we received a Notice of Redemption related to our Series C Redeemable Preferred Stock aggregating $1,000,000. As a result of receiving the Notice of Redemption, we must now apply all of our assets to redemption of the Series C Preferred Stock and to no other corporate purpose, except to the extent prohibited by Delaware law governing distributions to stockholders (we are not permitted to utilize toward the redemption those assets required to pay our debts as they come due and those assets required to continue as a going concern).

We recognize that we will need to raise additional capital in order to fund operations, meet our payment obligations, including the redemption of the Series C Redeemable Preferred Stock, and execute our business plan. There is no assurance that additional financing will be available when needed or that management will be able to obtain financing on terms acceptable to us and whether we will become profitable and generate positive operating cash flow. If we are unable to raise sufficient additional funds, we will have to develop and implement a plan to further extend payables, extend note repayments, extend the preferred stock redemption and reduce overhead until sufficient additional capital is raised to support further operations. There can be no assurance that such a plan will be successful. If we are unable to obtain financing on a timely basis, we could be forced to sell our assets, discontinue our operations and/or seek reorganization under the U.S. bankruptcy code.

Accordingly, the accompanying condensed consolidated financial statements have been prepared in conformity with U.S. GAAP, which contemplate our continuation as a going concern and the realization of assets and the satisfaction of liabilities in the normal course of business. The carrying amounts of assets and liabilities presented in the condensed consolidated financial statements do not necessarily represent realizable or settlement values. The condensed consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

As of March 31, 2015 and December 31, 2014, the Company had cash on hand of $265,848 and $506,019, respectively. Our cash flow from operating, investing and financing activities during these periods were as follows:

For the three months ended March 31, 2015, cash flows included net cash used in operating activities of $208,308. This amount included a decrease in operating cash related to a net loss of $200,788, partially offset by aggregate non-cash adjustments of $115,237, plus aggregate cash used by changes in operating assets and liabilities of $122,757 (primarily a result of a reduction of accounts payable). For the three months ended March 31, 2014, cash flows included net cash used in operating activities of $59,918. This amount included a decrease in operating cash related to a net loss of $305,641, partially offset by aggregate non-cash adjustments of $238,150, plus aggregate cash provided by changes in operating assets and liabilities of $7,573 (primarily a result of a reduction of accounts receivable).

For the three months ended March 31, 2015, net cash utilized by investing activities was $16,481 related to the capitalization of website development costs and the purchase of computer equipment. For the three months ended March 31, 2014, net cash utilized by investing activities was $34,866 related to capitalized website development costs.

For the three months ended March 31, 2015, net cash used by financing activities was $15,382 related to the principal payment on equipment leases. For the three months ended March 31, 2014, net cash provided by financing activities was $86,841 related to the issuance of a notes payable offset by principal payment on equipment leases of $13,159.

Critical Accounting Policies and Estimates

There are no material changes from the critical accounting policies set forth in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Form 10-K filed on March 30, 2015. Please refer to that document for disclosures regarding the critical accounting policies related to our business.

Not applicable.

Evaluation of Disclosure Controls and Procedures

Disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d–15(e) under the Exchange Act) are designed to provide reasonable assurance that information required to be disclosed in reports we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the forms and rules of the SEC and that such information is accumulated and communicated to management, including the Chief Executive Officer, in a manner to allow timely decisions regarding required disclosures.

In connection with the preparation of this Form 10–Q, our management, (Chief Executive and Principal Financial Officer), evaluated the effectiveness of the design and operation of our disclosure controls and procedures as of March 31, 2015. Management had previously identified material weaknesses in our internal control over financial reporting as of December 31, 2014 (see Form 10-K filed with the SEC on March 30, 2015), which is an integral component of our disclosure controls and procedures. During the year ended December 31, 2014, management implemented policies, procedures and controls to address the weaknesses in various areas including operational and financial systems integration, separation of duties in review and approval of disbursement, cash handling, purchasing, receiving, shipping and invoicing functions, daily transaction processing and monthly financial closing procedures and timelines and board approval of related party and other significant transactions. Management believes that the controls implemented in these specific areas are sufficient to address the above weaknesses, however, they have concluded that such controls have not been in place for a sufficient period of time in order to conclude that the identified material weaknesses described above have been fully remediated.

As of March 31, 2015, the material weakness that remains is the lack of accounting personnel with sufficient experience with United States generally accepted accounting principles to address the accounting for complex transactions due to the lack of a full-time Chief Financial Officer. Therefore, based on this evaluation, management has concluded that as of March 31, 2015, our disclosure controls were not effective. We believe that to fully remediate this weakness, the Company will need to retain a full time Chief Financial Officer. The directors plan to pursue the employment of a permanent Chief Financial Officer as the Company’s operations and liquidity position improve during fiscal year 2015.

Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting or in other factors during the three months ended March 31, 2015, that have materially affected, or were reasonably likely to materially affect, our internal control over financial reporting.

Limitations of the Effectiveness of Control

A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Because of the inherent limitations of any control system, no evaluation of controls can provide absolute assurance that all control issues, if any, within a company have been detected.

PART II. OTHER INFORMATION

In the ordinary course of business, we may become subject to lawsuits and other claims and proceedings that might arise from litigation matters or regulatory audits. Such matters are subject to uncertainty and outcomes are often not predictable with assurance. Our management does not presently expect that any such matters will have a material adverse effect on the Company’s consolidated financial condition or consolidated results of operations. We are not currently involved in any pending or threatened material litigation or other material legal proceedings nor have we been made aware of any penalties from regulatory audits, except as described below.

Not applicable.

Recent Repurchases of Common Stock

There were no repurchases of our Common Stock during the three months ended March 31, 2015. The Company does not currently have an announced repurchase program.

Not applicable.

Not applicable.

The following exhibits are provided:

|

4.1

|

|

|

10.1

|

|

|

31.1

|

|

|

31.2

|

|

|

32.1

|

|

|

32.2

|

|

|

101.INS

|

XBRL Instance Document *

|

|

101.SCH

|

XBRL Schema Document *

|

|

101.CAL

|

XBRL Calculation Linkbase Document *

|

|

101.DEF

|

XBRL Definition Linkbase Document *

|

|

101.LAB

|

XBRL Label Linkbase Document *

|

|

101.PRE

|

XBRL Presentation Linkbase Document *

|

_________

* Filed herewith.

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

HEALTHWAREHOUSE.COM, INC.

|

|||

|

Dated: May 11, 2015

|

By:

|

/s/ Lalit Dhadphale | |

| Lalit Dhadphale | |||

| President and Chief Executive Officer | |||

- 22 -