UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Fiscal Year Ended June 30, 2016

or

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the transition period from _____ to _____

Commission File Number 0-13928

U.S. GLOBAL INVESTORS, INC.

Incorporated in the State of Texas

IRS Employer Identification No. 74-1598370

Principal Executive Offices:

7900 Callaghan Road

San Antonio, Texas 78229

Telephone Number: 210-308-1234

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Class A common stock

($0.025 par value per share)

Registered: NASDAQ Capital Market

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Yes ☐ No ☒

Indicate by check mark whether the Company (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

Non-accelerated filer ☐

|

Smaller Reporting Company ☒

|

|

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

The aggregate market value of the 7,702,514 shares of nonvoting class A common stock held by nonaffiliates of the registrant was $9,011,941, based on the last sale price quoted on NASDAQ as of December 31, 2015, the last business day of the registrant’s most recently completed second fiscal quarter. Registrant’s only voting stock is its class C common stock, par value of $0.025 per share, for which there is no active market. The aggregate value of the 4,567 shares of the class C common stock held by nonaffiliates of the registrant on December 31, 2015 (based on the last sale price of the class C common stock in a private transaction) was $1,142. For purposes of this disclosure only, the registrant has assumed that its directors, executive officers, and beneficial owners of 5 percent or more of the registrant’s common stock are affiliates of the registrant.

On September 2, 2016, there were 13,866,421 shares of Registrant’s class A nonvoting common stock issued and13,170,616 shares of Registrant’s class A nonvoting common stock issued and outstanding, no shares of Registrant’s class B nonvoting common stock outstanding, and 2,069,127 shares of Registrant’s class C voting common stock issued and outstanding.

Documents incorporated by reference: None

|

|

1

|

|

|

1

|

|

|

7

|

|

|

10

|

|

|

10

|

|

|

10

|

|

|

10

|

|

|

11

|

|

|

11

|

|

|

13

|

|

|

14

|

|

|

28

|

|

|

30

|

|

|

62

|

|

|

62

|

|

|

62

|

|

|

63

|

|

|

63

|

|

|

66

|

|

|

72

|

|

|

73

|

|

|

74

|

|

|

75

|

|

|

75

|

|

|

77

|

|

Exhibit 21 — Subsidiaries of the Company, Jurisdiction of Incorporation, and Percentage of Ownership

|

|

|

Exhibit 23.1 — BDO USA, LLP consent

|

|

|

Exhibit 31.1 — Rule 13a – 14(a) Certifications (under Section 302 of the Sarbanes-Oxley Act of 2002)

|

|

|

Exhibit 32.1 — Section 1350 Certifications (under Section 906 of the Sarbanes-Oxley Act of 2002)

|

|

Part I of Annual Report on Form 10-K |

|

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, U.S. Global Investors, Inc. and its subsidiaries (collectively, “U.S. Global” or the “Company”) may make other written and oral communications from time to time that contain such statements. Forward-looking statements include statements as to industry trends, future expectations of the Company, and other matters that do not relate strictly to historical facts and are based on certain assumptions by management. These statements are often identified by the use of words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “should,” “estimate,” or “continue,” and similar expressions or variations. These statements are based on the beliefs and assumptions of Company management based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially from the forward-looking statements include, among others, the risks described in Part I, Item 1A, Risk Factors, and elsewhere in this report and other documents filed or furnished by U.S. Global from time to time with the U.S. Securities and Exchange Commission (“SEC”). U.S. Global cautions readers to carefully consider such factors. Furthermore, such forward-looking statements speak only as of the date on which such statements are made. Except to the extent required by applicable law, U.S. Global undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

U.S. Global, a Texas corporation organized in 1968, is a registered investment adviser under the Investment Advisers Act of 1940, as amended (“Advisers Act”). The Company, with principal operations located in San Antonio, Texas, manages three business segments:

|

1.

|

Investment Management Services, through which the Company offers, through U.S. Global Investors Funds (“USGIF” or the “Fund(s)”), offshore clients, and an exchange traded fund (“ETF”) client, a range of investment management products and services to meet the needs of individual and institutional investors;

|

|

2.

|

Investment Management Services - Canada, through which, as of June 1, 2014, the Company owns a 65% controlling interest in Galileo Global Equity Advisors Inc. (“Galileo”), a privately held Toronto-based asset management firm which offers investment management products and services in Canada; and

|

|

3.

|

Corporate Investments, through which the Company invests for its own account in an effort to add growth and value to its cash position. Although the Company generates the majority of its revenues from its investment advisory segments, the Company holds a significant amount of its total assets in investments.

|

As part of its investment management businesses, the Company provides: (1) investment advisory services and (2) administrative services to the mutual funds advised by the Company. The fees from these services, as well as investment income, are the primary sources of the Company’s revenue. The Company also provided transfer agency services through December 2013 and distribution services through December 2015 to USGIF.

Lines of Business

Investment Management Services

Investment Advisory Services. The Company furnishes an investment program for each of the clients it manages and determines, subject to overall supervision by the applicable board of trustees of the clients, the clients’ investments pursuant to an advisory agreement. Consistent with the investment restrictions, objectives and policies of the particular client, the portfolio team for each client determines what investments should be purchased, sold, and held, and makes changes in the portfolio deemed necessary or appropriate. In the advisory agreement, the Company is charged with seeking the best overall terms in executing portfolio transactions and selecting brokers or dealers.

As required by the Investment Company Act of 1940, as amended (“Investment Company Act”), the advisory agreement with USGIF is subject to annual renewal and is terminable upon 60-day notice. This agreement has been renewed through September 2017.

In addition to providing advisory services to USGIF, the Company provides advisory services to two offshore clients and one ETF. A third offshore fund liquidated in November 2013.

Net assets under management on June 30, 2016, and June 30, 2015, are detailed in the following table.

|

Assets Under Management (“AUM”)

|

|

|

Fund

|

|

Ticker

|

|

June 30, 2016

|

|

|

June 30, 2015

|

|

|

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

U.S. Global Investors Funds

|

|

|

|

|

|

|

|

|

|

Natural Resources

|

|

|

|

|

|

|

|

|

|

Global Resources

|

|

PSPFX/PIPFX

|

|

$

|

100,049

|

|

|

$

|

135,732

|

|

|

World Precious Minerals

|

|

UNWPX/UNWIX

|

|

|

179,593

|

|

|

|

94,897

|

|

|

Gold and Precious Metals

|

|

USERX

|

|

|

132,061

|

|

|

|

64,021

|

|

|

Total Natural Resources

|

|

|

|

|

411,703

|

|

|

|

294,650

|

|

|

International Equity

|

|

|

|

|

|

|

|

|

|

|

|

Emerging Europe

|

|

EUROX

|

|

|

42,332

|

|

|

|

58,225

|

|

|

China Region

|

|

USCOX

|

|

|

16,391

|

|

|

|

22,000

|

|

|

Total International Equity

|

|

|

|

|

58,723

|

|

|

|

80,225

|

|

|

Fixed Income

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Government Securities Ultra-Short Bond

|

|

UGSDX

|

|

|

58,277

|

|

|

|

58,332

|

|

|

Near-Term Tax Free

|

|

NEARX

|

|

|

118,965

|

|

|

|

90,251

|

|

|

Total Fixed Income

|

|

|

|

|

177,242

|

|

|

|

148,583

|

|

|

Domestic Equity

|

|

|

|

|

|

|

|

|

|

|

|

Holmes Macro Trends

|

|

MEGAX

|

|

|

37,012

|

|

|

|

46,368

|

|

|

All American Equity

|

|

GBTFX

|

|

|

18,340

|

|

|

|

21,000

|

|

|

Total Domestic Equity

|

|

|

|

|

55,352

|

|

|

|

67,368

|

|

|

Total U.S. Global Investors Funds

|

|

|

|

|

703,020

|

|

|

|

590,826

|

|

|

U.S. Global Jets ETF

|

|

JETS

|

|

|

43,430

|

|

|

|

39,200

|

|

|

Offshore Advisory Clients

|

|

|

|

|

13,777

|

|

|

|

11,527

|

|

| |

|

|

|

|

760,227

|

|

|

|

641,553

|

|

|

Total Canada AUM (see separate discussion)

|

|

|

|

|

122,844

|

|

|

|

150,718

|

|

|

Total AUM

|

|

|

|

$

|

883,071

|

|

|

$

|

792,271

|

|

Administrative Services. The Company also manages, supervises and conducts certain other affairs of USGIF, subject to the control of the Funds’ Board of Trustees pursuant to an administrative services agreement. Prior to December 10, 2015, it provided office space, facilities and certain business equipment as well as the services of executive and clerical personnel for administering the affairs of the Funds. U.S. Global and its affiliates compensated all personnel, officers, directors and interested trustees of the Funds if such persons were also employees of the Company or its affiliates. Effective December 2013, the Funds’ Board of Trustees increased the annual rate from 0.08 percent to 0.10 percent for each investor class and from 0.06 percent to 0.08 percent for each institutional class plus $10,000 per Fund. Effective November 1, 2014, the annual per fund fee changed to $7,000. Effective December 10, 2015, the Company entered into an amended administrative services agreement with USGIF whereby the Company and a third party act as co-administrators to the Funds. The Company continues to assist with certain administrative tasks. Effective December 10, 2015, the annual rate changed to 0.05 percent for each investor class and to 0.04 percent for each institutional class, and the per fund fee was eliminated. The administrative services agreement with USGIF is subject to renewal on an annual basis and is terminable upon 60-day notice. This agreement has been renewed through September 2017.

Distribution Services. Prior to December 10, 2015, the Company provided distribution services to USGIF. In doing so, the Company had registered its wholly-owned subsidiary, U.S. Global Brokerage, Inc. (“USGB”), with the Financial Industry Regulatory Authority (“FINRA”), the SEC and appropriate state regulatory authorities as a limited-purpose broker-dealer for the purpose of distributing Fund shares. Effective December 10, 2015, USGB ceased to be the distributor for USGIF. The Company filed Form BDW, the Uniform Request Withdrawal From Broker-Dealer Registration, with FINRA, which was approved in February 2016. Distribution revenues and the expenses associated with certain distribution operations for USGIF are reflected as discontinued operations in the Consolidated Statement of Operations and are, therefore, excluded from continuing operations results.

Shareholder Services. Prior to December 10, 2015, in connection with obtaining and/or providing administrative services to the beneficial owners of USGIF through broker-dealers, banks, trust companies and similar institutions which provide such services, the Company received shareholder services fees at an annual rate of up to 0.20 percent of the value of shares held in accounts at the institutions, which helped to offset related platform costs. This agreement ceased on December 10, 2015. Shareholder services revenues and related expenses are reflected as discontinued operations in the Consolidated Statement of Operations and are, therefore, excluded from continuing operations results.

Transfer Agency and Other Services. Through December 6, 2013, the Company’s wholly-owned subsidiary, United Shareholder Services, Inc. (“USSI”), a transfer agent registered under the Securities Exchange Act of 1934 (“Exchange Act”), provided transfer agency, printing, and mailing services to investment company clients. The Company’s Board of Directors formally agreed on August 23, 2013, to exit the transfer agency business so that the Company could focus more on its core strength of investment management. USSI served as transfer agent until conversion to the new transfer agent on December 9, 2013. The transfer agency results, together with expenses associated with discontinuing transfer agency operations, are reflected as discontinued operations in the Consolidated Statement of Operations and are, therefore, excluded from continuing operations results.

Investment Management Services - Canada

|

Assets Under Management (“AUM”)

|

|

|

(dollars in thousands)

|

|

Ticker

|

|

|

June 30, 2016

|

|

|

June 30, 2015

|

|

|

Galileo Funds

|

|

|

|

|

|

|

|

|

|

|

Galileo High Income Plus Fund

|

|

N/A1

|

|

|

$

|

45,141

|

|

|

$

|

63,607

|

|

|

Galileo Growth and Income Fund

|

|

N/A1

|

|

|

|

3,266

|

|

|

|

3,964

|

|

|

Total Galileo Funds

|

|

|

|

|

|

48,407

|

|

|

|

67,571

|

|

|

Other Advisory Clients

|

|

|

|

|

|

74,437

|

|

|

|

83,147

|

|

|

Total Canada AUM

|

|

|

|

|

$

|

122,844

|

|

|

$

|

150,718

|

|

|

1.

|

The mutual funds managed by Galileo (“Galileo Funds”) are Canadian registered mutual funds and are not available in the United States.

|

Effective March 31, 2013, the Company, through its wholly-owned subsidiary, U.S. Global Investors (Canada) Limited (“USCAN”), purchased 50 percent of the issued and outstanding shares of Galileo Global Equity Advisors Inc., a privately held Toronto-based asset management firm, for $600,000 cash.

Effective June 1, 2014, the Company, through USCAN, completed its purchase of an additional 15 percent interest in Galileo from the company’s founder, Michael Waring, for $180,000 cash. This strategic investment brought USCAN’s ownership to 65 percent of the issued and outstanding shares of Galileo, which represents controlling interest of Galileo. The non-controlling interest in this subsidiary is included in “non-controlling interest in subsidiaries” in the equity section of the Consolidated Balance Sheets. Frank Holmes, CEO, and Susan McGee, President, General Counsel, and Chief Compliance Officer, serve as directors of Galileo.

Galileo Equity Management Inc. was incorporated under the Business Corporations Act (Ontario) on July 16, 1999. On May 17, 2007, its name changed to Galileo Global Equity Advisors Inc. Galileo is registered as a portfolio manager and exempt market dealer with the Ontario Securities Commission (“OSC”), the Nova Scotia Securities Commission and the Quebec Securities Commission. Additionally, the company is registered as an exempt market dealer with the New Brunswick and Newfoundland and Labrador Securities Commissions. On July 31, 2012, Galileo was also registered as an investment fund manager with the OSC.

Corporate Investments

Investment Activities. In addition to providing management and advisory services, the Company is actively engaged in trading for its own account. See segment information in the Notes to the Consolidated Financial Statements at Note 17, Financial Information by Business Segment, of this Annual Report on Form 10-K.

Additional Segment Information

See additional financial information about business segments in Part II, Item 8, Financial Statements and Supplementary Data at Note 17, Financial Information by Business Segment, of this Annual Report on Form 10-K.

Employees

As of June 30, 2016, U.S. Global and its subsidiaries employed 23 full-time employees and 2 part-time employees; as of June 30, 2015, it employed 40 full-time employees and 2 part-time employees. The Company considers its relationship with its employees to be good.

Competition

The mutual fund industry is highly competitive. According to the Investment Company Institute, at the end of 2015 there were approximately 9,500 domestically registered open-end investment companies and approximately 1,600 exchange-traded funds of varying sizes and investment policies, whose shares are being offered to the public in the U.S. In addition to competition from other mutual fund managers and investment advisers, the Company and the mutual fund industry are in competition with various investment alternatives offered by insurance companies, banks, securities broker-dealers, and other financial institutions. Many of these institutions are able to engage in more liberal advertising than mutual funds and ETFs and may offer accounts at competitive interest rates, which may be insured by federally chartered corporations such as the Federal Deposit Insurance Corporation.

A number of mutual fund groups are significantly larger than the funds managed by U.S. Global, offer a greater variety of investment objectives and have more experience and greater resources to promote the sale of investments therein. However, the Company believes it has the resources, products, and personnel to compete with these other mutual funds. In particular, the Company is known for its expertise in the gold mining and exploration, natural resources and emerging markets. Competition for sales of fund shares is influenced by various factors, including investment objectives and performance, advertising and sales promotional efforts, distribution channels, and the types and quality of services offered to fund shareholders.

Success in the investment advisory business is substantially dependent on each fund’s investment performance, the quality of services provided to shareholders, and the Company’s efforts to market the Funds effectively. Sales of Fund shares generate management and administrative services fees (which are based on the assets of the Funds). Costs of distribution and compliance continue to put pressure on profit margins for the mutual fund industry.

Despite the Company’s expertise in gold mining and exploration, natural resources, and emerging markets, the Company faces the same obstacle many advisers face, namely uncovering undervalued investment opportunities as the markets face further uncertainty and increased volatility. In addition, the growing number of alternative investments, especially in specialized areas, has created pressure on the profit margins and increased competition for available investment opportunities.

Supervision and Regulation

The Company and the clients the Company manages and administers operate under certain laws, including federal and state securities laws, governing their organization, registration, operation, legal, financial, and tax status. Among the potential penalties for violation of the laws and regulations applicable to the Company and its subsidiaries are fines, imprisonment, injunctions, revocation of registration, and certain additional administrative sanctions. Any determination that the Company or its management has violated applicable laws and regulations could have a material adverse effect on the business of the Company. Moreover, there is no assurance that changes to existing laws, regulations, or rulings promulgated by governmental entities having jurisdiction over the Company and the Funds will not have a material adverse effect on the Company’s business. The Company has no control over regulatory rulemaking or the consequences it may have on the mutual fund and investment advisory industry.

Recent and accelerating regulatory pronouncements and oversight have significantly increased the burden of compliance infrastructure with respect to the mutual fund industry and the capital markets. This momentum of new regulations has contributed significantly to the costs of managing and administering mutual funds.

U.S. Global is registered as an investment adviser with the SEC. As a registered investment adviser, it is subject to the requirements of the Advisers Act, and the SEC’s regulations thereunder, as well as to examination by the SEC’s staff. The Advisers Act imposes substantive regulation on virtually all aspects of the Company’s business and relationships with the Company’s clients. Applicable rules relate to, among other things, fiduciary duties to clients, transactions with clients, effective compliance programs, conflicts of interest, advertising, recordkeeping, reporting, and disclosure requirements. The Funds and ETF for which the Company acts as the investment adviser are registered with the SEC under the Investment Company Act. The Investment Company Act imposes additional obligations, including detailed operational requirements for both funds and their advisers. Moreover, an investment adviser’s contract with a registered fund may be terminated by the fund on not more than 60 days’ notice and is subject to annual renewal by the fund’s board after an initial two-year term. Both the Advisers Act and the Investment Company Act regulate the “assignment” of advisory contracts by the investment adviser. The SEC is authorized to institute proceedings and impose sanctions for violations of the Investment Advisers Act and the Investment Company Act, ranging from fines and censures to termination of an investment adviser’s registration. The failure of the Company, or the Funds and ETF which the Company advises, to comply with the requirements of the SEC could have a material adverse effect on the Company. The Company is also subject to federal and state laws affecting corporate governance, including the Sarbanes-Oxley Act of 2002 (“S-Ox Act”), as well as rules adopted by the SEC.

USGB was subject to regulation by the SEC under the Exchange Act and regulation by FINRA, a self-regulatory organization composed of other registered broker-dealers. U.S. Global and USGB are required to keep and maintain certain reports and records, which must be made available to the SEC and FINRA upon request.

Galileo Global Equity Advisors Inc. (“Galileo”) is registered as a portfolio manager and investment fund manager with the Ontario Securities Commission (“OSC”). As a registered portfolio manager, the OSC imposes substantive regulation on virtually all aspects of Galileo's business and relationships with Galileo’s clients. Applicable legislation relate to, among other things, fiduciary duties to clients, transactions with clients, effective compliance programs, conflicts of interest, advertising, recordkeeping, reporting, and disclosure requirements. The Canadian funds for which Galileo acts as the investment fund manager are registered with the OSC follow under National Instrument 81-101/102/106. These National Policies impose additional obligations, including detailed operational requirements for both funds and their managers. The OSC is authorized to institute proceedings and impose sanctions for violations of the rules ranging from fines and censures to termination of a portfolio manager and investment fund manager’s registration. The failure of Galileo, or the Canadian funds which Galileo advises, to comply with the requirements of the OSC could have a material adverse effect on Galileo.

Relationships with Clients

The businesses of the Company are to a very significant degree dependent on their associations and contractual relationships with USGIF. In the event the advisory or administrative agreements with USGIF are canceled or not renewed pursuant to the terms thereof, the Company would be substantially adversely affected. U.S. Global considers its relationships with the Funds to be good, and management has no reason to believe that the management and service contracts will not be renewed in the future; however, there is no assurance that USGIF will choose to continue its relationship with the Company.

In addition, the Company is also dependent on its relationships with its offshore and exchange traded fund clients. Even though the Company views its relationship with its offshore and exchange traded fund clients as stable, the Company could be adversely affected if these relationships ended.

Galileo is also dependent on its relationships with its clients. Even though Galileo views its relationship with its clients as stable, the Company could be adversely affected if these relationships ended.

Available Information

Available Information. The Company’s Internet website address is www.usfunds.com. Information contained on the Company’s website is not part of this annual report on Form 10-K. The Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed with (or furnished to) the SEC are available through a link on the Company’s Internet website, free of charge, soon after such material is filed or furnished. (The link to the Company’s SEC filings can be found at www.usfunds.com by clicking “About Us,” followed by “Investor Relations,” followed by “Financial Information and SEC Filings.”) The Company routinely posts important information on its website.

The Company also posts its Corporate Governance Guidelines, Code of Business Conduct, Code of Ethics for Principal Executive and Senior Financial Officers and the charters of the audit and compensation committees of its Board of Directors on the Company’s website in the “Policies and Procedures” section. The Company’s SEC filings and governance documents are available in print to any stockholder that makes a written request to: Investor Relations, U.S. Global Investors, Inc., 7900 Callaghan Road, San Antonio, Texas 78229.

The Company files reports electronically with the SEC via the SEC’s Electronic Data Gathering, Analysis and Retrieval system (“EDGAR”), which may be accessed through the Internet. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC, at www.sec.gov.

The public may read and copy any materials filed by the Company with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Investors and others should note that we announce material financial information to our investors using the website, SEC filings, press releases, public conference calls and webcasts. We also use social media to communicate with our customers and the public about our company. It is possible that the information we post on social media could be deemed to be material information. Therefore, we encourage investors, the media, and others interested in our company to review the information we post on social media channels listed below. This list may be updated from time to time.

https://www.facebook.com/USFunds

https://twitter.com/USFunds

https://twitter.com/USGlobalETFs

https://www.linkedin.com/company/u-s-global-investors

https://www.instagram.com/usglobal

https://pinterest.com/usfunds

https://www.youtube.com/c/usglobalinvestorssanantonio

https://www.youtube.com/channel/UCDkX1zvbWPyWc99esHOhwRQ

Information contained on our website or on social media channels is not deemed part of this report.

The Company faces a variety of significant and diverse risks, many of which are inherent in the business. Described below are certain risks that could materially affect the Company. Other risks and uncertainties that the Company does not presently consider to be material, or of which the Company is not presently aware, may become important factors that affect it in the future. The occurrence of any of the risks discussed below could materially and adversely affect the business, prospects, financial condition, results of operations, or cash flow.

The investment management business is intensely competitive.

Competition in the investment management business is based on a variety of factors, including:

|

·

|

Investment performance;

|

|

·

|

Investor perception of an investment team’s drive, focus, and alignment of interest with them;

|

|

·

|

Quality of service provided to, and duration of relationships with, clients and shareholders;

|

|

·

|

Business reputation; and

|

|

·

|

Level of fees charged for services.

|

The Company competes with a large number of investment management firms, commercial banks, broker-dealers, insurance companies, and other financial institutions. Competitive risk is heightened by the fact that some competitors may invest according to different investment styles or in alternative asset classes which the markets may perceive as more attractive than the Company’s investment approach. If the Company is unable to compete effectively, revenues and earnings may be reduced and the business could be materially affected.

Poor investment performance could lead to a decline in revenues.

Success in the investment management industry is largely dependent on investment performance relative to market conditions and the performance of competing products. Good relative performance generally attracts additional assets under management, resulting in additional revenues. Conversely, poor performance generally results in decreased sales and increased redemptions with a corresponding decrease in revenues. Therefore, poor investment performance relative to the portfolio benchmarks and to competitors could impair the Company’s revenues and growth. The equity funds within USGIF have a performance fee whereby the base advisory fee is adjusted upwards or downwards by 0.25 percent if there is a performance difference of 5 percent or more between a Fund’s performance and that of its designated benchmark index over the prior rolling 12 months.

The Company’s clients can terminate their agreements with the Company on short notice, which may lead to unexpected declines in revenue and profitability.

The Company’s investment advisory agreements are generally terminable on short notice and subject to annual renewal. If the Company’s investment advisory agreements are terminated, which may occur in a short time frame, the Company may experience a decline in revenues and profitability.

Difficult market conditions can adversely affect the Company by reducing the market value of the assets we manage or causing shareholders to make significant redemptions.

Changes in economic or market conditions may adversely affect the profitability, performance of and demand for the Company’s investment products and services. Under the Company’s advisory fee arrangements, the fees received are primarily based on the market value of assets under management. Accordingly, a decline in the price of securities held in the Funds would be expected to cause revenues and net income to decline, which would result in lower advisory fees, or cause increased shareholder redemptions in favor of investments they perceive as offering greater opportunity or lower risk, which redemptions would also result in lower advisory fees. The ability of the Company to compete and grow is dependent on the relative attractiveness of the types of investment products the Company offers and its investment performance and strategies under prevailing market conditions.

Market-specific risks may negatively impact the Company’s earnings.

The Company manages certain funds in the emerging market and natural resources sectors, which are highly cyclical. The investments in the Funds are subject to significant loss due to political, economic and diplomatic developments, currency fluctuations, social instability, and changes in governmental policies. Foreign trading markets, particularly in some emerging market countries, are often smaller, less liquid, less regulated and significantly more volatile than the U.S. and other established markets.

The market price and trading volume of the Company’s class A common stock may be volatile, which could result in rapid and substantial losses for the Company’s stockholders.

The market price of the Company’s class A common stock may be volatile and the trading volume may fluctuate, causing significant price variations to occur. If the market price of the Company’s class A common stock declines significantly, stockholders may be unable to sell their shares at or above their purchase price. The Company cannot assure that the market price of its class A common stock will not fluctuate or decline significantly in the future. Some of the factors that could negatively affect the price of the Company’s class A common stock, or result in fluctuations in price or trading volume, include:

|

·

|

Decreases in assets under management;

|

|

·

|

Variations in quarterly and annual operating results;

|

|

·

|

Publication of research reports about the Company or the investment management industry;

|

|

·

|

Departures of key personnel;

|

|

·

|

Adverse market reactions to any indebtedness the Company may incur, acquisitions or disposals the Company may make, or securities the Company may issue in the future;

|

|

·

|

Changes in market valuations of similar companies;

|

|

·

|

Changes or proposed changes in laws or regulations, or differing interpretations thereof, affecting the business, or enforcement of these laws and regulations, or announcements relating to these matters;

|

|

·

|

Adverse publicity about the asset management industry, generally, or individual scandals, specifically; and

|

|

·

|

General market and economic conditions.

|

The market price of the Company’s class A common stock could decline due to the large number of shares of the Company’s class C common stock eligible for future sale upon conversion to class A shares.

The market price of the Company’s class A common stock could decline as a result of sales of a large number of shares of class A common stock eligible for future sale upon the conversion of class C shares, or the perception that such sales could occur. These sales, or the possibility that these sales may occur, also might make it more difficult for the Company to raise additional capital by selling equity securities in the future, at a time and price the Company deems appropriate.

Failure to comply with government regulations could result in fines, which could cause the Company’s earnings and stock price to decline.

The Company and its subsidiaries are subject to a variety of federal securities laws and agencies, including, but not limited to, the Advisers Act, the Investment Company Act, the S-Ox Act, the Gramm-Leach-Bliley Act of 1999, the Bank Secrecy Act of 1970, as amended, the USA PATRIOT Act of 2001, the SEC, FINRA, and NASDAQ. Moreover, financial reporting requirements and the processes, controls, and procedures that have been put in place to address them, are comprehensive and complex. While management has focused attention and resources on compliance policies and procedures, non-compliance with applicable laws or regulations could result in fines, sanctions or censures which could affect the Company’s reputation, and thus its revenues and earnings.

Furthermore, Galileo is subject to the rules and regulations of the OSC, and failure of the company or the funds it advises to comply with the requirements of the OSC could have a material adverse effect on the company.

Our business is subject to substantial risk from litigation, regulatory investigations and potential securities laws liability.

Many aspects of U.S. Global’s business involve substantial risks of litigation, regulatory investigations and/or arbitration. The Company is exposed to liability under federal and state securities laws, other federal and state laws and court decisions, as well as rules and regulations promulgated by the SEC and other regulatory bodies. U.S. Global, its subsidiaries, and/or officers could be named as parties in legal actions, regulatory investigations and proceedings. An adverse resolution of any lawsuit, legal or regulatory proceeding or claim against the Company could result in substantial costs or reputational harm to the Company, and have a material adverse effect on the Company’s business, financial condition or results of operations, which, in turn, may negatively affect the market price of the Company’s common stock and U.S. Global’s ability to pay dividends. In addition to these financial costs and risks, the defense of litigation or arbitration may divert resources and management’s attention from operations.

Galileo is also subject to risks of litigation, regulatory investigations and/or arbitration. Galileo is exposed to liability under provincial laws and court decisions, as well as rules and regulations promulgated by the OSC.

Higher insurance premiums and related insurance coverage risks could increase costs and reduce profitability.

While U.S. Global carries insurance in amounts and under terms that it believes are appropriate, the Company cannot assure that its insurance will cover most liabilities and losses to which it may be exposed, or that our insurance policies will continue to be available at acceptable terms and fees. U.S. Global is subject to regulatory and governmental inquiries and civil litigation. An adverse outcome of any such proceeding could involve substantial financial penalties. From time to time, various claims against us arise in the ordinary course of business, including employment-related claims. There has been increased incidence of litigation and regulatory investigations in the financial services industry in recent years, including customer claims and class action suits alleging substantial monetary damages. Certain insurance coverage may not be available or may be prohibitively expensive in future periods. As U.S. Global’s insurance policies come up for renewal, the Company may need to assume higher deductibles or co-insurance liabilities, or pay higher premiums, which would increase the Company’s expenses and reduce net income.

Increased regulatory and legislative actions and reforms could increase costs and negatively impact the Company’s profitability and future financial results.

During the past decade, federal securities laws have been substantially augmented and made significantly more complex by the S-Ox Act and the USA PATRIOT Act of 2001. With new laws and changes in interpretations and enforcement of existing requirements, the associated time the Company must dedicate to, and related costs the Company must incur in, meeting the regulatory complexities of the business have increased. In order to comply with these new requirements, the Company has had to expend additional time and resources, including substantial efforts to conduct evaluations required to ensure compliance with the S-Ox Act.

The Company is subject to financial services laws, regulations, corporate governance requirements, administrative actions and policies. During 2009 and 2010, as many emergency government programs slowed or wound down, global regulatory and legislative focus generally moved to a second phase of broader reform and a restructuring of financial institution regulation. On July 21, 2010, President Obama signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”), which fundamentally changed the U.S. financial regulatory landscape. The full scope of the regulatory changes imposed by the Dodd-Frank Act will only be determined once extensive rules and regulations have been proposed and become effective, which may result in significant changes in the manner in which the Company’s operations are regulated.

Further, adverse results of regulatory investigations of mutual fund, investment advisory, and financial services firms could tarnish the reputation of the financial services industry generally, and mutual funds and investment advisers more specifically, causing investors to avoid further fund investments or redeem their balances. Redemptions would decrease the Company’s assets under management, which would reduce its advisory revenues and net income.

The Company intends to pay regular dividends to its stockholders, but the ability to do so is subject to the discretion of the Board of Directors.

The Company intends to pay cash dividends on a monthly basis, but the Board of Directors, at its discretion, may decrease the level or frequency of dividends or discontinue payment of dividends entirely based on earnings, operations, capital requirements, general financial condition of the Company, and general business conditions.

One person beneficially owns substantially all of our voting stock and controls the outcome of all matters requiring a vote of stockholders, which may influence the value of our publicly traded non-voting stock.

Frank Holmes, CEO, is the beneficial owner of over 99 percent of our class C voting convertible common stock and controls the outcome of all issues requiring a vote of stockholders. All of our publicly traded stock is nonvoting stock. Consequently, except to the extent provided by law, stockholders other than Frank Holmes have no vote with respect to the election of directors or any other matter requiring a vote of stockholders. This lack of voting rights may adversely affect the market value of the publicly traded class A nonvoting common stock.

The loss of key personnel could negatively affect the Company’s financial performance.

The success of the Company depends on key personnel, including the portfolio managers, analysts, and executive officers. Competition for qualified, motivated, and skilled personnel in the asset management industry remains significant. As the business grows, the Company will likely need to increase the number of employees. Moreover, in order to retain certain key personnel, the Company may be required to increase compensation to such individuals, resulting in additional expense. The loss of key personnel or the Company’s failure to attract replacement personnel could negatively affect its financial performance.

The Company could be subject to losses if it fails to properly safeguard sensitive and confidential information.

As part of the Company’s normal operations, it maintains and transmits confidential information about the Company and the Funds’ clients as well as proprietary information relating to its business operations. These systems could be victimized by unauthorized users or corrupted by computer viruses or other malicious software code, or authorized persons could inadvertently or intentionally release confidential or proprietary information. Such a breach could subject the Company to liability for a failure to safeguard client data, result in the termination of relationships with our existing customers, require significant capital and operating expenditures to investigate and remediate the breach and subject the Company to regulatory action.

We rely upon certain critical information systems for the operation of our business, and the failure of any critical information system, including a cyber-security breach, may result in harm to our business.

We are heavily dependent on technology infrastructure and rely upon certain critical information systems for the effective operation of our business. These information systems include data network and telecommunications, internet access and our websites, and various computer hardware equipment and software applications. These information systems are subject to damage or interruption from a number of potential sources including natural disasters, software viruses or other malware, power failures, cyber-attacks and other events to the extent that these information systems are under our control. We have implemented measures, such as virus protection software, intrusion detection systems and emergency recovery processes to address the outlined risks. However, security measures for information systems cannot be guaranteed to be failsafe. Any compromise of our data security or our inability to use or access these information systems at critical points in time could unfavorably impact the timely and efficient operation of our business and subject us to additional costs and liabilities, which could adversely affect our results of operations. Finally, federal legislation relating to cyber-security threats could impose additional requirements on our operations.

Adverse changes in foreign currencies could negatively impact financial results.

Our subsidiary Galileo conducts its business in Canada. We translate Galileo’s foreign currency financial statements into U.S. dollars in the financial statement consolidation process. Adverse changes in foreign currency exchange rates would lower the carrying value of Galileo’s assets and reduce its results in the consolidated U.S. financial statements. We also have certain corporate investments held in foreign currencies. Adverse changes in foreign currency exchange rates would also lower the value of those corporate investments. Certain assets under management also have exposure to foreign currency fluctuations in various markets, which could impact their valuation and thus the revenue we receive.

Item 1B. Unresolved Staff Comments

None

The Company presently owns and occupies an office building as its headquarters in San Antonio, Texas. The office building is approximately 46,000 square feet on approximately 2.5 acres of land. Galileo leases office space in Toronto, Canada.

Item 3. Legal Proceedings

There are no material legal proceedings in which the Company is involved.

Item 4. Mine Safety Disclosures

Not applicable.

| Part II of Annual Report on Form 10-K

|

|

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

Market Information

U.S. Global Investors, Inc. (“U.S. Global” or the “Company”) has three classes of common equity: class A, class B, and class C common stock, par value $0.025 per share.

The Company’s class A common stock is traded over-the-counter and is quoted daily under NASDAQ’s Capital Markets. Trades are reported under the symbol “GROW.”

There is no established public trading market for the Company’s class B and class C common stock.

The Company’s class A and class B common stock have no voting privileges.

The following table sets forth the range of high and low sales prices of “GROW” from NASDAQ for the fiscal years ended June 30, 2016, and June 30, 2015. The quotations represent prices between dealers and do not include any retail markup, markdown, or commission.

| |

|

Sales Price

|

|

| |

|

2016

|

|

|

2015

|

|

| |

|

High ($)

|

|

|

Low ($)

|

|

|

High ($)

|

|

|

Low ($)

|

|

|

First quarter (9/30)

|

|

|

2.92

|

|

|

|

1.67

|

|

|

|

4.00

|

|

|

|

3.26

|

|

|

Second quarter (12/31)

|

|

|

1.78

|

|

|

|

1.00

|

|

|

|

3.60

|

|

|

|

2.57

|

|

|

Third quarter (3/31)

|

|

|

1.90

|

|

|

|

0.96

|

|

|

|

3.51

|

|

|

|

2.74

|

|

|

Fourth quarter (6/30)

|

|

|

2.07

|

|

|

|

1.48

|

|

|

|

3.40

|

|

|

|

2.72

|

|

Holders

On September 2, 2016, there were approximately 159 holders of record of class A common stock, no holders of record of class B common stock, and 34 holders of record of class C common stock.

Dividends

The Company paid $0.005 per share per month in fiscal year 2015 and through September 2015 and $0.0025 per share per month from October 2015 through June 2016. A monthly dividend of $0.0025 has been authorized from July 2016 through December 2016, and will be reviewed by the Board quarterly. Payment of cash dividends is within the discretion of the Company’s Board of Directors and is dependent on earnings, operations, capital requirements, general financial condition of the Company, and general business conditions.

Securities authorized for issuance under equity compensation plans

Information relating to equity compensation plans under which our stock is authorized for issuance is set forth in Item 12 of Part III of this Form 10-K under the heading “Equity Compensation Plan Information.”

Purchases of equity securities by the issuer

Effective January 1, 2013, the Board of Directors approved a share repurchase program authorizing the Company to purchase up to $2.75 million of its outstanding class A common shares as market and business conditions warrant on the open market in compliance with Rule 10b-18 of the Securities Exchange Act of 1934. On December 12, 2013, December 10, 2014, and December 9, 2015, the Board of Directors renewed the repurchase program for calendar years 2014, 2015 and 2016, respectively. The total amount of shares that may be repurchased in 2016 under the renewed program is $2.75 million.

For the quarter ended June 30, 2016, the Company purchased a total of 25,493 class A shares using cash of $44,000. The Company may repurchase class A stock from employees; however, none were repurchased from employees during the quarter ended June 30, 2016. The Company did not repurchase any classes B or C common stock during the quarter ended June 30, 2016.

|

(dollars in thousands, except price data)

Period

|

|

Total Number

of Shares

Purchased 1

|

|

|

Total Amount

Purchased

|

|

|

Average

Price Paid

Per Share 2

|

|

|

Total Number of

Shares Purchased

as Part of Publicly

Announced Plan 3

|

|

|

Approximate Dollar

Value of Shares that

May Yet Be Purchased

Under the Plan

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

04-01-16 to 04-30-16

|

|

|

6,448

|

|

|

$

|

10

|

|

|

$

|

1.61

|

|

|

|

6,448

|

|

|

$

|

2,714

|

|

|

05-01-16 to 05-31-16

|

|

|

11,035

|

|

|

|

20

|

|

|

|

1.79

|

|

|

|

11,035

|

|

|

|

2,694

|

|

|

06-01-16 to 06-30-16

|

|

|

8,010

|

|

|

|

14

|

|

|

|

1.76

|

|

|

|

8,010

|

|

|

|

2,680

|

|

|

Total

|

|

|

25,493

|

|

|

$

|

44

|

|

|

$

|

1.73

|

|

|

|

25,493

|

|

|

|

|

|

|

1.

|

The Board of Directors of the Company approved on December 7, 2012, and renewed on December 12, 2013, December 10, 2014, and December 9, 2015, a repurchase of up to $2.75 million in each of calendar years 2013, 2014, 2015, and 2016, respectively, of its outstanding class A common stock from time to time on the open market in accordance with all applicable rules and regulations.

|

|

2.

|

The average price paid per share of stock repurchased under the stock repurchase program includes the commissions paid to brokers.

|

|

3.

|

The repurchase plan was approved on December 7, 2012, renewed on December 12, 2013, December 10, 2014, and December 9, 2015, and will continue through calendar year 2016. The total dollar amount of shares that may be repurchased in 2016 under the renewed program is $2.75 million.

|

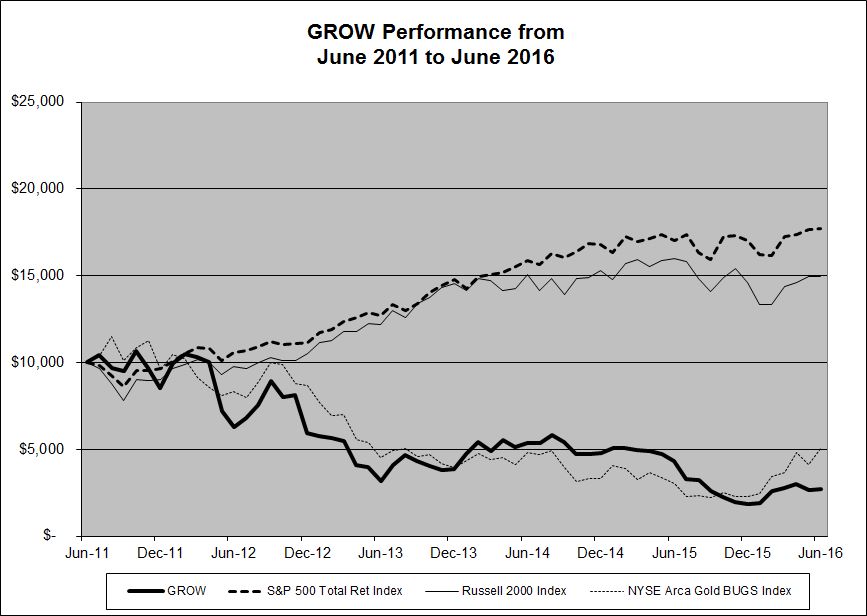

Company Performance Presentation

The following graph compares the cumulative total return for the Company’s class A common stock (GROW) to the cumulative total return for the S&P 500 Index, the Russell 2000 Index, and the NYSE Arca Gold BUGS Index for the Company’s last five fiscal years. The graph assumes an investment of $10,000 in the class A common stock and in each index as of June 30, 2011, and that all dividends are reinvested. The historical information included in this graph is not necessarily indicative of future performance and the Company does not make or endorse any predictions as to future stock performance.

| |

|

Fiscal Year-end Date

|

|

| |

|

2011

|

|

|

2012

|

|

|

2013

|

|

|

2014

|

|

|

2015

|

|

|

2016

|

|

|

U.S. Global Investors, Inc., class A (GROW)

|

|

$

|

10,000

|

|

|

$

|

6,290

|

|

|

$

|

3,156

|

|

|

$

|

5,371

|

|

|

$

|

4,321

|

|

|

$

|

2,704

|

|

|

S&P 500 Index

|

|

$

|

10,000

|

|

|

$

|

10,545

|

|

|

$

|

12,717

|

|

|

$

|

15,846

|

|

|

$

|

17,022

|

|

|

$

|

17,702

|

|

|

Russell 2000 Index

|

|

$

|

10,000

|

|

|

$

|

9,792

|

|

|

$

|

12,163

|

|

|

$

|

15,038

|

|

|

$

|

16,013

|

|

|

$

|

14,935

|

|

|

NYSE Arca Gold BUGS Index

|

|

$

|

10,000

|

|

|

$

|

8,308

|

|

|

$

|

4,507

|

|

|

$

|

4,829

|

|

|

$

|

3,045

|

|

|

$

|

5,053

|

|

Item 6. Selected Financial Data

The following selected financial data is qualified by reference to, and should be read in conjunction with, the Company’s Consolidated Financial Statements and related notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Annual Report on Form 10-K. The selected financial data as of June 30, 2012, through June 30, 2016, and the years then ended, is derived from the Company’s audited Consolidated Financial Statements.

The Company’s Board of Directors formally agreed on August 23, 2013, to exit the transfer agency business so that the Company could focus more on its core strength of investment management. USSI served as transfer agent until conversion to the new transfer agent on December 9, 2013. The transfer agency results, together with expenses associated with discontinuing transfer agency operations, are reflected as discontinued operations in the Consolidated Statement of Operations and are, therefore, excluded from continuing operations results.

In December 2015, USGIF elected a new slate of trustees to the Board of Trustees of the Funds. The Company proposed the election of new trustees with the intention of streamlining the Company’s responsibilities, so it can better focus on strategic activities. The new Board of Trustees of USGIF adopted several new agreements. As anticipated, effective December 10, 2015, the Company, through its wholly-owned subsidiary, U.S. Global Brokerage, Inc., ceased to be the distributor for USGIF and no longer received distribution fees and shareholder services fees from USGIF. Due to this transition, the Company is no longer responsible for paying certain distribution and shareholder servicing related expenses and is reimbursed for certain distribution expenses from the new distributor for USGIF. The distribution and shareholder services revenues and the expenses associated with certain distribution operations for USGIF are reflected as discontinued operations in the Consolidated Statement of Operations and are, therefore, excluded from continuing operations results. Comparative periods shown in the Statement of Operations and below have been adjusted to conform to this presentation.

|

(dollars in thousands, except operating data and per share data)

|

|

Year Ended June 30,

|

|

|

Selected Financial Data

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

Operating revenues

|

|

$

|

5,505

|

|

|

$

|

7,333

|

|

|

$

|

8,534

|

|

|

$

|

13,118

|

|

|

$

|

16,254

|

|

|

Operating expenses

|

|

|

9,681

|

|

|

|

10,840

|

|

|

|

11,811

|

|

|

|

13,087

|

|

|

|

13,748

|

|

|

Operating income (loss)

|

|

|

(4,176

|

)

|

|

|

(3,507

|

)

|

|

|

(3,277

|

)

|

|

|

31

|

|

|

|

2,506

|

|

|

Other income (loss)

|

|

|

485

|

|

|

|

434

|

|

|

|

2,165

|

|

|

|

262

|

|

|

|

(177

|

)

|

|

Income (loss) from continuing operations before income taxes

|

|

|

(3,691

|

)

|

|

|

(3,073

|

)

|

|

|

(1,112

|

)

|

|

|

293

|

|

|

|

2,329

|

|

|

Income tax expense (benefit)

|

|

|

(6

|

)

|

|

|

822

|

|

|

|

(475

|

)

|

|

|

176

|

|

|

|

911

|

|

|

Income (loss) from continuing operations

|

|

|

(3,685

|

)

|

|

|

(3,895

|

)

|

|

|

(637

|

)

|

|

|

117

|

|

|

|

1,418

|

|

|

Income (loss) from discontinued operations

|

|

|

(18

|

)

|

|

|

(81

|

)

|

|

|

(326

|

)

|

|

|

(311

|

)

|

|

|

112

|

|

|

Net income (loss)

|

|

|

(3,703

|

)

|

|

|

(3,976

|

)

|

|

|

(963

|

)

|

|

|

(194

|

)

|

|

|

1,530

|

|

|

Less net income (loss) attributable to non-controlling interest

|

|

|

(28

|

)

|

|

|

54

|

|

|

|

7

|

|

|

|

-

|

|

|

|

-

|

|

|

Net income (loss) attributable to U.S. Global Investors, Inc.

|

|

$

|

(3,675

|

)

|

|

$

|

(4,030

|

)

|

|

$

|

(970

|

)

|

|

$

|

(194

|

)

|

|

$

|

1,530

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Per Share Attributable to U.S. Global Investors, Inc. - Basic

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from continuing operations

|

|

$

|

(0.24

|

)

|

|

$

|

(0.25

|

)

|

|

$

|

(0.04

|

)

|

|

$

|

0.01

|

|

|

$

|

0.09

|

|

|

Income (loss) from discontinued operations

|

|

|

-

|

|

|

|

(0.01

|

)

|

|

|

(0.02

|

)

|

|

|

(0.02

|

)

|

|

|

0.01

|

|

|

Net income (loss) attributable to U.S. Global Investors, Inc.

|

|

$

|

(0.24

|

)

|

|

$

|

(0.26

|

)

|

|

$

|

(0.06

|

)

|

|

$

|

(0.01

|

)

|

|

$

|

0.10

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends per common share

|

|

$

|

0.0375

|

|

|

$

|

0.06

|

|

|

$

|

0.06

|

|

|

$

|

0.17

|

|

|

$

|

0.24

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital

|

|

$

|

16,874

|

|

|

$

|

19,767

|

|

|

$

|

24,673

|

|

|

$

|

22,958

|

|

|

$

|

25,711

|

|

|

Total assets

|

|

|

26,346

|

|

|

|

30,770

|

|

|

|

37,846

|

|

|

|

38,683

|

|

|

|

41,756

|

|

|

Total U.S. Global Investors, Inc. Shareholders' Equity

|

|

|

24,528

|

|

|

|

28,569

|

|

|

|

35,070

|

|

|

|

36,849

|

|

|

|

38,710

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities

|

|

$

|

3,033

|

|

|

$

|

(672

|

)

|

|

$

|

(15,189

|

)

|

|

$

|

461

|

|

|

$

|

1,817

|

|

|

Net cash provided by (used in) used in investing activities

|

|

|

(646

|

)

|

|

|

(390

|

)

|

|

|

4,050

|

|

|

|

(368

|

)

|

|

|

(4,894

|

)

|

|

Net cash used in financing activities

|

|

|

(1,828

|

)

|

|

|

(1,122

|

)

|

|

|

(1,061

|

)

|

|

|

(2,621

|

)

|

|

|

(3,518

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Data (in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average assets under management

|

|

$

|

744

|

|

|

$

|

931

|

|

|

$

|

1,078

|

|

|

$

|

1,552

|

|

|

$

|

2,055

|

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This discussion reviews and analyzes the consolidated results of operations of U.S. Global Investors, Inc. and its subsidiaries (collectively, “U.S. Global” or the “Company”) for the past three fiscal years and other factors that may affect future financial performance. This discussion should be read in conjunction with the Consolidated Financial Statements, Notes to the Consolidated Financial Statements and Selected Financial Data of this Annual Report on Form 10-K.

Recent Trends in Financial Markets

During the fiscal year ended June 30, 2016, global markets faced a number of challenges, including China’s continued drawdown, geopolitical uncertainty in Europe (specifically in the United Kingdom), unrest in the Middle East, a highly contentious and atypical U.S. election cycle and tepid manufacturing activity. Global central banks took center stage during the period, with the Federal Reserve raising interest rates 25 basis points in December 2015 and the possibility of a further hike in 2016. Other banks, the Bank of Japan and the European Central Bank chief among them, implemented experimental monetary policies such as lowering rates into negative territory, which had the effect of pushing many yield-starved foreign investors into gold and American municipal bonds.

Deutsche Bank argued that 2015 will mark the peak in global FX reserve accumulation, with three drivers pointing to further reserve drawdowns in the short term: China’s economic slowdown, impending U.S. monetary tightening and the collapse in the price of oil. On the other hand, central banks have been increasing their exposure to gold as part of their asset mix, presenting a compelling opportunity moving forward.

In 2015, the Bloomberg Commodity Index witnessed its worst performance since 2008, dropping 19 percent. A significant reason for the disappointing performance in commodities was the strong U.S. dollar, which was up 9.40 percent for 2015 against a group of other global currencies. Many of the gold stocks traded below the levels they plummeted to in 2008.

Commodity prices began to recover at the start of 2016, with gold rallying 25 percent as of June 30, 2016, its best first half of the year since 1980. Demand during the first half of 2016 set a new record, reaching 1,064 tonnes, a 16 percent increase over the previous high set in 2009.

Oil prices remained under pressure, however, with worldwide supply staying ahead of demand and inventory builds reaching all-time record levels. The Organization of Petroleum Exporting Countries (“OPEC”) failed to reach a production cap on numerous occasions, while Iran began production following the lifting of sanctions. Lower fuel costs benefited airlines and transportation stocks, not to mention consumers, but put a strain on oil company margins.

Overall merger and acquisition activity on a worldwide scale, in fact, slowed dramatically in the first half of 2016, following a record 2015. The Brexit referendum, coupled with the upcoming U.S. election and tougher anti-trust regulations, were to blame for the lack of business deals.

Mutual funds in general continued to see outflows as mutual funds were relatively out of favor compared to other investment alternatives, including exchange-traded funds (“ETFs”), whose asset flows increased during the period.

Average assets under management declined during the period along with falling emerging markets and resources. However, assets under management (“AUM”) by our June 30, 2016, fiscal year-end increased over the prior fiscal year-end, primarily due to the rally in the gold markets. To manage expenses, the Company maintains a flexible structure for one of its largest costs, compensation expense, by setting relatively low base salaries with bonuses that are tied to fund performance. Thus, our expense model somewhat expands and contracts with asset swings and performance.

Business Segments

The Company, with principal operations located in San Antonio, Texas, manages three business segments:

|

1.

|

Investment management services, through which the Company offers, through U.S. Global Investors Funds (“USGIF” or the “Fund(s)”), offshore clients and an ETF, a range of investment management products and services to meet the needs of individual and institutional investors;

|

|

2.

|

Investment management services - Canada, through which, as of June 1, 2014, the Company owns a 65% controlling interest in Galileo Global Equity Advisors Inc. (“Galileo”), a privately held Toronto-based asset management firm which offers investment management products and services in Canada; and

|

|

3.

|

Corporate investments, through which the Company invests for its own account in an effort to add growth and value to its cash position. Although the Company generates the majority of its revenues from its investment advisory segments, the Company holds a significant amount of its total assets in investments.

|

|

Assets Under Management ("AUM")

|

|

|

(dollars in thousands)

|

|

June 30, 2016

|

|

|

June 30, 2015

|

|

|

Investment Management Services

|

|

|

|

|

|

|

|

USGIF

|

|

$

|

703,020

|

|