UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04118

Fidelity Securities Fund

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | July 31 |

Date of reporting period: | January 31, 2022 |

Item 1.

Reports to Stockholders

Fidelity Flex® Funds

Fidelity Flex® Large Cap Growth Fund

Semi-Annual Report

January 31, 2022

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-3455 (for managed account clients) or 1-800-835-5092 (for retirement plan participants) to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2022 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of COVID-19 emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and corporate earnings. On March 11, 2020, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread. The pandemic prompted a number of measures to limit the spread of COVID-19, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. To help stem the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

In general, the overall impact of the pandemic lessened in 2021, amid a resilient economy and widespread distribution of three COVID-19 vaccines granted emergency use authorization from the U.S. Food and Drug Administration (FDA) early in the year. Still, the situation remains dynamic, and the extent and duration of its influence on financial markets and the economy is highly uncertain, due in part to a recent spike in cases based on highly contagious variants of the coronavirus.

Extreme events such as the COVID-19 crisis are exogenous shocks that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets. Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we continue to take extra steps to be responsive to customer needs. We encourage you to visit us online, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2022

| % of fund's net assets | |

| Apple, Inc. | 14.3 |

| Microsoft Corp. | 8.8 |

| Amazon.com, Inc. | 7.7 |

| Alphabet, Inc. Class A | 7.2 |

| NVIDIA Corp. | 6.3 |

| Meta Platforms, Inc. Class A | 4.9 |

| Tesla, Inc. | 4.2 |

| Marvell Technology, Inc. | 2.5 |

| Lyft, Inc. | 1.7 |

| Lowe's Companies, Inc. | 1.4 |

| 59.0 |

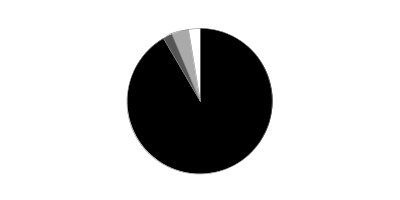

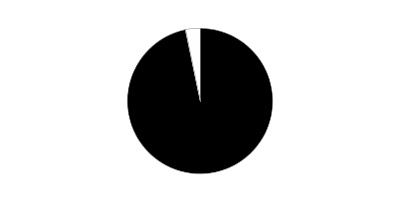

Top Five Market Sectors as of January 31, 2022

| % of fund's net assets | |

| Information Technology | 43.5 |

| Consumer Discretionary | 26.9 |

| Communication Services | 15.3 |

| Industrials | 4.9 |

| Health Care | 4.3 |

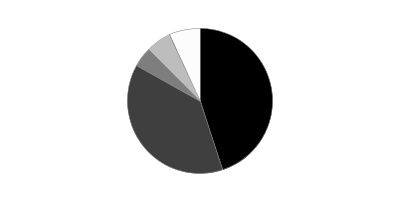

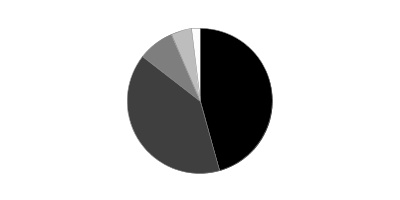

Asset Allocation (% of fund's net assets)

| As of January 31, 2022* | ||

| Stocks | 97.9% | |

| Convertible Securities | 1.5% | |

| Other Investments | 0.1% | |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.5% | |

* Foreign investments - 6.6%

Schedule of Investments January 31, 2022 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 97.8% | |||

| Shares | Value | ||

| COMMUNICATION SERVICES - 15.2% | |||

| Entertainment - 2.0% | |||

| Endeavor Group Holdings, Inc. (a) | 1,187 | $37,236 | |

| Endeavor Group Holdings, Inc. Class A (b) | 1,768 | 55,462 | |

| Netflix, Inc. (a) | 2,542 | 1,085,790 | |

| Roblox Corp. (a) | 1,968 | 129,612 | |

| Roku, Inc. Class A (a) | 834 | 136,818 | |

| Sea Ltd. ADR (a) | 5,088 | 764,777 | |

| 2,209,695 | |||

| Interactive Media & Services - 13.1% | |||

| Alphabet, Inc. Class A (a) | 2,925 | 7,915,255 | |

| Bumble, Inc. | 1,049 | 30,956 | |

| Meta Platforms, Inc. Class A (a) | 17,153 | 5,373,349 | |

| Snap, Inc. Class A (a) | 26,307 | 856,030 | |

| Tencent Holdings Ltd. | 1,382 | 86,599 | |

| ZipRecruiter, Inc. (a) | 1,958 | 42,469 | |

| 14,304,658 | |||

| Media - 0.1% | |||

| Criteo SA sponsored ADR (a) | 636 | 21,497 | |

| DISH Network Corp. Class A (a) | 2,415 | 75,831 | |

| 97,328 | |||

| TOTAL COMMUNICATION SERVICES | 16,611,681 | ||

| CONSUMER DISCRETIONARY - 26.5% | |||

| Automobiles - 4.9% | |||

| Ford Motor Co. | 3,212 | 65,204 | |

| General Motors Co. (a) | 1,933 | 101,927 | |

| Neutron Holdings, Inc. (a)(b)(c) | 9,174 | 642 | |

| Rad Power Bikes, Inc. (a)(b)(c) | 1,815 | 17,395 | |

| Rivian Automotive, Inc. | 6,096 | 360,676 | |

| Tesla, Inc. (a) | 4,897 | 4,587,118 | |

| XPeng, Inc.: | |||

| ADR (a) | 5,002 | 175,520 | |

| Class A | 1,108 | 19,325 | |

| 5,327,807 | |||

| Diversified Consumer Services - 0.0% | |||

| Mister Car Wash, Inc. | 1,212 | 20,846 | |

| Hotels, Restaurants & Leisure - 3.9% | |||

| Airbnb, Inc. Class A (a) | 7,508 | 1,156,007 | |

| Booking Holdings, Inc. (a) | 57 | 139,999 | |

| Caesars Entertainment, Inc. (a) | 5,090 | 387,553 | |

| Chipotle Mexican Grill, Inc. (a) | 174 | 258,491 | |

| Churchill Downs, Inc. | 1,018 | 214,085 | |

| Dutch Bros, Inc. (d) | 1,157 | 60,338 | |

| Evolution AB (e) | 115 | 14,308 | |

| Expedia, Inc. (a) | 1,194 | 218,848 | |

| Flutter Entertainment PLC (a) | 100 | 15,237 | |

| Hilton Worldwide Holdings, Inc. (a) | 2,004 | 290,800 | |

| Marriott International, Inc. Class A (a) | 2,584 | 416,334 | |

| MGM Resorts International | 2,522 | 107,740 | |

| Penn National Gaming, Inc. (a) | 16,246 | 740,980 | |

| Planet Fitness, Inc. (a) | 265 | 23,490 | |

| Sweetgreen, Inc. | 3,497 | 95,206 | |

| Sweetgreen, Inc. Class A | 2,035 | 61,559 | |

| Vail Resorts, Inc. | 220 | 60,962 | |

| 4,261,937 | |||

| Household Durables - 0.2% | |||

| Lennar Corp. Class A | 695 | 66,796 | |

| Tempur Sealy International, Inc. | 2,903 | 115,568 | |

| 182,364 | |||

| Internet & Direct Marketing Retail - 9.0% | |||

| Amazon.com, Inc. (a) | 2,793 | 8,355,176 | |

| BARK, Inc. (a) | 4,794 | 18,073 | |

| BARK, Inc. (b) | 2,983 | 11,246 | |

| Cazoo Group Ltd. | 6,756 | 30,422 | |

| Chewy, Inc. (a) | 3,190 | 151,876 | |

| Deliveroo PLC Class A (a)(e) | 14,772 | 31,035 | |

| Delivery Hero AG (a)(e) | 149 | 11,501 | |

| Doordash, Inc. (a) | 1,138 | 129,152 | |

| Etsy, Inc. (a) | 965 | 151,582 | |

| FSN E-Commerce Ventures Private Ltd. (a)(b) | 30,000 | 564,721 | |

| Global-e Online Ltd. (a) | 1,004 | 35,853 | |

| JD.com, Inc.: | |||

| Class A (a) | 118 | 4,472 | |

| sponsored ADR (a) | 351 | 26,283 | |

| Overstock.com, Inc. (a) | 646 | 30,969 | |

| Pinduoduo, Inc. ADR (a) | 797 | 47,692 | |

| Wayfair LLC Class A (a) | 1,574 | 245,418 | |

| Zomato Ltd. (a)(b) | 46,900 | 51,166 | |

| 9,896,637 | |||

| Leisure Products - 0.0% | |||

| Peloton Interactive, Inc. Class A (a) | 1,446 | 39,519 | |

| Multiline Retail - 0.4% | |||

| Dollar Tree, Inc. (a) | 2,715 | 356,262 | |

| Ollie's Bargain Outlet Holdings, Inc. (a) | 1,964 | 94,154 | |

| 450,416 | |||

| Specialty Retail - 5.0% | |||

| American Eagle Outfitters, Inc. | 19,810 | 452,262 | |

| Aritzia, Inc. (a) | 2,361 | 109,529 | |

| Bath & Body Works, Inc. | 1,019 | 57,135 | |

| Burlington Stores, Inc. (a) | 1,462 | 346,392 | |

| Carvana Co. Class A (a) | 3,532 | 572,396 | |

| Citi Trends, Inc. (a) | 634 | 30,888 | |

| Dick's Sporting Goods, Inc. | 2,394 | 276,268 | |

| Fanatics, Inc. Class A (b)(c) | 3,099 | 210,236 | |

| Five Below, Inc. (a) | 1,987 | 325,868 | |

| Floor & Decor Holdings, Inc. Class A (a) | 1,903 | 206,894 | |

| Foot Locker, Inc. | 2,095 | 93,605 | |

| JD Sports Fashion PLC | 11,315 | 29,014 | |

| Lowe's Companies, Inc. | 6,379 | 1,514,056 | |

| RH (a) | 1,089 | 438,671 | |

| Signet Jewelers Ltd. | 1,102 | 94,915 | |

| The Children's Place, Inc. (a) | 145 | 10,259 | |

| TJX Companies, Inc. | 3,594 | 258,660 | |

| Victoria's Secret & Co. (a) | 4,969 | 277,419 | |

| Warby Parker, Inc. (a)(d) | 4,636 | 172,320 | |

| 5,476,787 | |||

| Textiles, Apparel & Luxury Goods - 3.1% | |||

| Allbirds, Inc.: | |||

| Class A | 400 | 4,944 | |

| Class B | 500 | 5,562 | |

| Capri Holdings Ltd. (a) | 9,625 | 578,174 | |

| Crocs, Inc. (a) | 3,242 | 332,694 | |

| Deckers Outdoor Corp. (a) | 1,347 | 431,350 | |

| Hermes International SCA | 20 | 30,028 | |

| lululemon athletica, Inc. (a) | 1,757 | 586,416 | |

| LVMH Moet Hennessy Louis Vuitton SE | 203 | 166,740 | |

| Moncler SpA | 1,341 | 86,065 | |

| NIKE, Inc. Class B | 4,843 | 717,103 | |

| On Holding AG | 1,550 | 40,874 | |

| PVH Corp. | 2,479 | 235,530 | |

| Tapestry, Inc. | 4,448 | 168,802 | |

| 3,384,282 | |||

| TOTAL CONSUMER DISCRETIONARY | 29,040,595 | ||

| CONSUMER STAPLES - 0.6% | |||

| Beverages - 0.5% | |||

| Boston Beer Co., Inc. Class A (a) | 350 | 147,291 | |

| Celsius Holdings, Inc. (a) | 7,254 | 346,233 | |

| 493,524 | |||

| Food & Staples Retailing - 0.0% | |||

| Blink Health, Inc. Series A1 (a)(b)(c) | 99 | 3,780 | |

| Food Products - 0.0% | |||

| Sovos Brands, Inc. | 565 | 8,289 | |

| The Real Good Food Co., Inc. | 500 | 2,970 | |

| The Real Good Food Co., Inc. Class A | 2,968 | 15,867 | |

| 27,126 | |||

| Household Products - 0.1% | |||

| Procter & Gamble Co. | 299 | 47,975 | |

| Personal Products - 0.0% | |||

| Olaplex Holdings, Inc. | 1,647 | 35,970 | |

| Tobacco - 0.0% | |||

| JUUL Labs, Inc. Class A (a)(b)(c) | 217 | 9,400 | |

| TOTAL CONSUMER STAPLES | 617,775 | ||

| ENERGY - 2.1% | |||

| Energy Equipment & Services - 0.0% | |||

| Halliburton Co. | 1,222 | 37,564 | |

| Oil, Gas & Consumable Fuels - 2.1% | |||

| Cenovus Energy, Inc. (Canada) | 3,090 | 44,947 | |

| Cheniere Energy, Inc. | 482 | 53,936 | |

| Denbury, Inc. (a) | 1,611 | 121,051 | |

| Devon Energy Corp. | 2,678 | 135,426 | |

| Diamondback Energy, Inc. | 1,750 | 220,780 | |

| EOG Resources, Inc. | 2,426 | 270,450 | |

| Hess Corp. | 3,565 | 329,014 | |

| Marathon Oil Corp. | 1,163 | 22,644 | |

| PDC Energy, Inc. | 203 | 12,032 | |

| Phillips 66 Co. | 1,313 | 111,329 | |

| Pioneer Natural Resources Co. | 728 | 159,352 | |

| Range Resources Corp. (a) | 375 | 7,219 | |

| Reliance Industries Ltd. | 19,115 | 616,408 | |

| Reliance Industries Ltd. sponsored GDR (e) | 697 | 44,841 | |

| Tourmaline Oil Corp. | 793 | 28,273 | |

| Valero Energy Corp. | 1,408 | 116,822 | |

| 2,294,524 | |||

| TOTAL ENERGY | 2,332,088 | ||

| FINANCIALS - 1.0% | |||

| Banks - 0.4% | |||

| Bank of America Corp. | 2,138 | 98,647 | |

| Kotak Mahindra Bank Ltd. (a) | 733 | 18,384 | |

| Wells Fargo & Co. | 5,351 | 287,884 | |

| 404,915 | |||

| Capital Markets - 0.3% | |||

| Goldman Sachs Group, Inc. | 424 | 150,384 | |

| Morgan Stanley | 1,840 | 188,674 | |

| 339,058 | |||

| Consumer Finance - 0.1% | |||

| American Express Co. | 690 | 124,076 | |

| LendingClub Corp. (a) | 113 | 2,120 | |

| 126,196 | |||

| Diversified Financial Services - 0.2% | |||

| Ant International Co. Ltd. Class C (a)(b)(c) | 3,606 | 6,419 | |

| Sonder Holdings, Inc. (b) | 2,437 | 20,880 | |

| Sonder Holdings, Inc. | 775 | 6,640 | |

| Sonder Holdings, Inc. | 1,070 | 9,168 | |

| Sonder Holdings, Inc.: | |||

| rights 1/18/27 (a)(c) | 23 | 123 | |

| rights 1/18/27 (a)(c) | 22 | 94 | |

| rights 1/18/27 (a)(c) | 22 | 75 | |

| rights 1/18/27 (a)(c) | 22 | 61 | |

| rights 1/18/27 (a)(c) | 21 | 47 | |

| rights 1/18/27 (a)(c) | 21 | 38 | |

| WeWork, Inc. (a) | 10,992 | 81,671 | |

| WeWork, Inc. (b) | 8,492 | 63,096 | |

| 188,312 | |||

| Thrifts & Mortgage Finance - 0.0% | |||

| Housing Development Finance Corp. Ltd. | 365 | 12,462 | |

| TOTAL FINANCIALS | 1,070,943 | ||

| HEALTH CARE - 4.3% | |||

| Biotechnology - 0.7% | |||

| ADC Therapeutics SA (a) | 696 | 11,059 | |

| Alnylam Pharmaceuticals, Inc. (a) | 1,287 | 177,091 | |

| Arcutis Biotherapeutics, Inc. (a) | 691 | 10,441 | |

| Argenx SE ADR (a) | 108 | 29,080 | |

| Ascendis Pharma A/S sponsored ADR (a) | 382 | 46,466 | |

| Avidity Biosciences, Inc. (a) | 300 | 4,986 | |

| Biohaven Pharmaceutical Holding Co. Ltd. (a) | 179 | 23,784 | |

| Cerevel Therapeutics Holdings (a) | 999 | 26,014 | |

| Day One Biopharmaceuticals, Inc. (a)(d) | 1,528 | 22,538 | |

| Erasca, Inc. | 756 | 8,959 | |

| Generation Bio Co. (a) | 1,151 | 7,482 | |

| Horizon Therapeutics PLC (a) | 2,235 | 208,593 | |

| Instil Bio, Inc. (a) | 1,340 | 15,557 | |

| Karuna Therapeutics, Inc. (a) | 173 | 19,213 | |

| Recursion Pharmaceuticals, Inc. (a) | 1,166 | 13,805 | |

| Relay Therapeutics, Inc. (a) | 546 | 12,083 | |

| Revolution Medicines, Inc. (a) | 903 | 19,433 | |

| Turning Point Therapeutics, Inc. (a) | 849 | 31,608 | |

| Twist Bioscience Corp. (a) | 75 | 4,457 | |

| Verve Therapeutics, Inc. | 1,100 | 31,702 | |

| Xencor, Inc. (a) | 200 | 6,874 | |

| 731,225 | |||

| Health Care Equipment & Supplies - 1.3% | |||

| Axonics Modulation Technologies, Inc. (a) | 1,343 | 63,698 | |

| Boston Scientific Corp. (a) | 849 | 36,422 | |

| DexCom, Inc. (a) | 935 | 402,499 | |

| Edwards Lifesciences Corp. (a) | 202 | 22,058 | |

| Figs, Inc. Class A (a)(d) | 1,441 | 32,394 | |

| Il Makiage Ltd. (b)(c) | 24 | 20,660 | |

| Insulet Corp. (a) | 526 | 130,448 | |

| Intuitive Surgical, Inc. (a) | 1,531 | 435,080 | |

| Outset Medical, Inc. (a) | 559 | 20,789 | |

| Shockwave Medical, Inc. (a) | 788 | 114,236 | |

| Tandem Diabetes Care, Inc. (a) | 1,122 | 132,519 | |

| 1,410,803 | |||

| Health Care Providers & Services - 0.5% | |||

| agilon health, Inc. (a) | 1,568 | 25,997 | |

| Alignment Healthcare, Inc. (a) | 1,793 | 13,627 | |

| Centene Corp. (a) | 407 | 31,648 | |

| Guardant Health, Inc. (a) | 2,036 | 141,604 | |

| LifeStance Health Group, Inc. | 5,584 | 42,606 | |

| Surgery Partners, Inc. (a) | 1,083 | 46,212 | |

| UnitedHealth Group, Inc. | 443 | 209,349 | |

| 511,043 | |||

| Health Care Technology - 0.1% | |||

| Certara, Inc. (a) | 800 | 21,384 | |

| Doximity, Inc. | 1,636 | 74,553 | |

| GoodRx Holdings, Inc. (a) | 477 | 11,453 | |

| Medlive Technology Co. Ltd. (e) | 4,500 | 7,306 | |

| MultiPlan Corp. warrants (a)(b) | 212 | 86 | |

| 114,782 | |||

| Life Sciences Tools & Services - 0.5% | |||

| 10X Genomics, Inc. (a) | 415 | 39,952 | |

| 23andMe Holding Co. Class B (e) | 778 | 3,633 | |

| Avantor, Inc. (a) | 2,411 | 90,003 | |

| Bio-Rad Laboratories, Inc. Class A (a) | 61 | 36,584 | |

| Danaher Corp. | 845 | 241,493 | |

| ICON PLC (a) | 201 | 53,410 | |

| Maravai LifeSciences Holdings, Inc. (a) | 576 | 16,658 | |

| Nanostring Technologies, Inc. (a) | 490 | 17,013 | |

| Olink Holding AB ADR (a) | 1,504 | 24,335 | |

| Pacific Biosciences of California, Inc. (a) | 609 | 6,809 | |

| Seer, Inc. (a) | 924 | 14,535 | |

| Thermo Fisher Scientific, Inc. | 91 | 52,898 | |

| 597,323 | |||

| Pharmaceuticals - 1.2% | |||

| Asymchem Laboratories Tianjin Co. Ltd. (H Shares) (e) | 262 | 9,193 | |

| Eli Lilly & Co. | 2,590 | 635,560 | |

| GH Research PLC | 594 | 10,086 | |

| Intra-Cellular Therapies, Inc. (a) | 838 | 39,797 | |

| Nuvation Bio, Inc. (a) | 1,450 | 8,845 | |

| Zoetis, Inc. Class A | 3,186 | 636,531 | |

| 1,340,012 | |||

| TOTAL HEALTH CARE | 4,705,188 | ||

| INDUSTRIALS - 4.6% | |||

| Aerospace & Defense - 0.3% | |||

| Airbus Group NV (a) | 452 | 57,717 | |

| Howmet Aerospace, Inc. | 2,239 | 69,611 | |

| Space Exploration Technologies Corp. Class A (a)(b)(c) | 100 | 56,000 | |

| The Boeing Co. (a) | 802 | 160,592 | |

| 343,920 | |||

| Airlines - 0.1% | |||

| Delta Air Lines, Inc. (a) | 401 | 15,916 | |

| JetBlue Airways Corp. (a) | 1,104 | 16,152 | |

| Ryanair Holdings PLC sponsored ADR (a) | 477 | 53,243 | |

| 85,311 | |||

| Building Products - 0.0% | |||

| The AZEK Co., Inc. (a) | 1,006 | 33,228 | |

| Commercial Services & Supplies - 0.1% | |||

| ACV Auctions, Inc. Class A (a) | 3,908 | 51,820 | |

| Electrical Equipment - 0.4% | |||

| Acuity Brands, Inc. | 1,746 | 334,411 | |

| Array Technologies, Inc. (a) | 2,516 | 26,519 | |

| Generac Holdings, Inc. (a) | 38 | 10,730 | |

| Sunrun, Inc. (a) | 1,087 | 28,186 | |

| 399,846 | |||

| Industrial Conglomerates - 0.2% | |||

| General Electric Co. | 2,820 | 266,434 | |

| Machinery - 0.2% | |||

| AutoStore Holdings Ltd. | 7,757 | 21,897 | |

| Deere & Co. | 397 | 149,431 | |

| 171,328 | |||

| Professional Services - 0.0% | |||

| KBR, Inc. | 59 | 2,561 | |

| Recruit Holdings Co. Ltd. | 873 | 43,151 | |

| 45,712 | |||

| Road & Rail - 3.3% | |||

| Avis Budget Group, Inc. (a) | 938 | 165,257 | |

| Bird Global, Inc. (b) | 4,242 | 14,974 | |

| Bird Global, Inc. | 11,663 | 37,053 | |

| Bird Global, Inc.: | |||

| rights 11/4/26 (a)(c) | 452 | 746 | |

| rights 11/4/26 (a)(c) | 452 | 411 | |

| rights 11/4/26 (a)(c) | 452 | 212 | |

| Class A (a)(d) | 7,660 | 27,040 | |

| Hertz Global Holdings, Inc. | 4,296 | 82,741 | |

| Lyft, Inc. (a) | 48,165 | 1,855,316 | |

| Uber Technologies, Inc. (a) | 37,618 | 1,406,913 | |

| 3,590,663 | |||

| Transportation Infrastructure - 0.0% | |||

| Delhivery Private Ltd. (b)(c) | 5,700 | 44,885 | |

| TOTAL INDUSTRIALS | 5,033,147 | ||

| INFORMATION TECHNOLOGY - 42.7% | |||

| Communications Equipment - 0.2% | |||

| Arista Networks, Inc. (a) | 1,726 | 214,559 | |

| IT Services - 3.0% | |||

| Block, Inc. Class A (a) | 2,083 | 254,730 | |

| Digitalocean Holdings, Inc. (a) | 2,961 | 169,784 | |

| Endava PLC ADR (a) | 243 | 29,554 | |

| Flywire Corp. (a) | 2,867 | 80,821 | |

| MasterCard, Inc. Class A | 1,134 | 438,155 | |

| MongoDB, Inc. Class A (a) | 438 | 177,438 | |

| Okta, Inc. (a) | 1,154 | 228,365 | |

| PayPal Holdings, Inc. (a) | 4,553 | 782,843 | |

| Shift4 Payments, Inc. (a) | 1,613 | 85,037 | |

| Shopify, Inc. Class A (a) | 302 | 291,499 | |

| TaskUs, Inc. | 1,786 | 57,152 | |

| TDCX, Inc. ADR | 2,090 | 34,255 | |

| Thoughtworks Holding, Inc. | 1,413 | 30,266 | |

| Twilio, Inc. Class A (a) | 2,180 | 449,342 | |

| Visa, Inc. Class A | 543 | 122,810 | |

| 3,232,051 | |||

| Semiconductors & Semiconductor Equipment - 11.7% | |||

| Advanced Micro Devices, Inc. (a) | 1,148 | 131,159 | |

| Allegro MicroSystems LLC (a) | 519 | 14,729 | |

| ASML Holding NV | 126 | 85,327 | |

| Cirrus Logic, Inc. (a) | 1,357 | 121,370 | |

| Enphase Energy, Inc. (a) | 1 | 140 | |

| GlobalFoundries, Inc. | 5,215 | 257,308 | |

| Lam Research Corp. | 126 | 74,330 | |

| Marvell Technology, Inc. | 38,252 | 2,731,193 | |

| Microchip Technology, Inc. | 254 | 19,680 | |

| NVIDIA Corp. | 28,087 | 6,877,383 | |

| NXP Semiconductors NV | 6,790 | 1,394,938 | |

| onsemi (a) | 2,956 | 174,404 | |

| Qualcomm, Inc. | 1,248 | 219,348 | |

| Silergy Corp. | 216 | 29,219 | |

| Synaptics, Inc. (a) | 267 | 56,163 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | 1,121 | 137,468 | |

| Teradyne, Inc. | 2,555 | 300,034 | |

| Wolfspeed, Inc. (a) | 551 | 51,926 | |

| Xilinx, Inc. | 586 | 113,420 | |

| 12,789,539 | |||

| Software - 13.5% | |||

| Adobe, Inc. (a) | 1,799 | 961,206 | |

| Amplitude, Inc. (a) | 2,040 | 80,192 | |

| AppLovin Corp. (a) | 1,605 | 103,394 | |

| Atlassian Corp. PLC (a) | 454 | 147,250 | |

| AvidXchange Holdings, Inc. | 1,632 | 16,908 | |

| Cadence Design Systems, Inc. (a) | 589 | 89,610 | |

| Confluent, Inc. | 1,084 | 70,883 | |

| Coupa Software, Inc. (a) | 993 | 133,330 | |

| Crowdstrike Holdings, Inc. (a) | 703 | 126,990 | |

| Datadog, Inc. Class A (a) | 457 | 66,772 | |

| DoubleVerify Holdings, Inc. (a) | 4,874 | 134,815 | |

| EngageSmart, Inc. | 3,782 | 82,675 | |

| Epic Games, Inc. (a)(b)(c) | 9 | 7,710 | |

| Expensify, Inc. (d) | 1,534 | 44,870 | |

| Freshworks, Inc. | 1,342 | 29,189 | |

| GitLab, Inc. | 488 | 31,237 | |

| HashiCorp, Inc. | 462 | 30,672 | |

| HubSpot, Inc. (a) | 633 | 309,410 | |

| Intuit, Inc. | 728 | 404,207 | |

| Microsoft Corp. | 30,958 | 9,627,319 | |

| Qualtrics International, Inc. | 2,517 | 73,673 | |

| Riskified Ltd.: | |||

| Class A (e) | 475 | 3,311 | |

| Class B (a) | 950 | 6,622 | |

| Salesforce.com, Inc. (a) | 5,909 | 1,374,611 | |

| Samsara, Inc. | 1,868 | 33,811 | |

| SentinelOne, Inc. (d) | 488 | 21,838 | |

| ServiceNow, Inc. (a) | 280 | 164,018 | |

| Stripe, Inc. Class B (a)(b)(c) | 400 | 14,500 | |

| Tanium, Inc. Class B (a)(b)(c) | 131 | 1,555 | |

| The Trade Desk, Inc. (a) | 688 | 47,844 | |

| UiPath, Inc. Class A (a) | 2,517 | 91,946 | |

| Volue A/S (a) | 4,694 | 27,979 | |

| Workday, Inc. Class A (a) | 447 | 113,095 | |

| Zoom Video Communications, Inc. Class A (a) | 2,132 | 328,925 | |

| 14,802,367 | |||

| Technology Hardware, Storage & Peripherals - 14.3% | |||

| Apple, Inc. | 89,526 | 15,647,347 | |

| TOTAL INFORMATION TECHNOLOGY | 46,685,863 | ||

| MATERIALS - 0.7% | |||

| Chemicals - 0.5% | |||

| CF Industries Holdings, Inc. | 1,026 | 70,661 | |

| Corteva, Inc. | 470 | 22,598 | |

| LG Chemical Ltd. | 80 | 42,879 | |

| Nutrien Ltd. | 3,584 | 250,315 | |

| The Mosaic Co. | 3,945 | 157,603 | |

| 544,056 | |||

| Metals & Mining - 0.2% | |||

| Freeport-McMoRan, Inc. | 7,133 | 265,490 | |

| TOTAL MATERIALS | 809,546 | ||

| REAL ESTATE - 0.1% | |||

| Equity Real Estate Investment Trusts (REITs) - 0.1% | |||

| Simon Property Group, Inc. | 768 | 113,050 | |

| TOTAL COMMON STOCKS | |||

| (Cost $67,642,147) | 107,019,876 | ||

| Preferred Stocks - 1.6% | |||

| Convertible Preferred Stocks - 1.5% | |||

| COMMUNICATION SERVICES - 0.1% | |||

| Diversified Telecommunication Services - 0.0% | |||

| Starry, Inc.: | |||

| Series C (a)(b) | 3,181 | 4,851 | |

| Series D (a)(b) | 7,310 | 11,147 | |

| Series E3 (b) | 7,755 | 11,826 | |

| 27,824 | |||

| Interactive Media & Services - 0.1% | |||

| Reddit, Inc.: | |||

| Series E (b)(c) | 103 | 6,365 | |

| Series F (b)(c) | 1,044 | 64,513 | |

| 70,878 | |||

| TOTAL COMMUNICATION SERVICES | 98,702 | ||

| CONSUMER DISCRETIONARY - 0.4% | |||

| Automobiles - 0.0% | |||

| Rad Power Bikes, Inc.: | |||

| Series A (b)(c) | 237 | 2,271 | |

| Series C (b)(c) | 931 | 8,923 | |

| Series D (b)(c) | 2,100 | 20,126 | |

| 31,320 | |||

| Internet & Direct Marketing Retail - 0.3% | |||

| GoBrands, Inc.: | |||

| Series G (b)(c) | 400 | 155,396 | |

| Series H (b)(c) | 235 | 91,295 | |

| Instacart, Inc.: | |||

| Series H (a)(b)(c) | 461 | 43,205 | |

| Series I (b)(c) | 272 | 25,492 | |

| 315,388 | |||

| Textiles, Apparel & Luxury Goods - 0.1% | |||

| Algolia SAS Series D (b)(c) | 624 | 18,249 | |

| CelLink Corp. Series D (b)(c) | 1,546 | 32,194 | |

| Discord, Inc. Series I (b)(c) | 17 | 9,361 | |

| 59,804 | |||

| TOTAL CONSUMER DISCRETIONARY | 406,512 | ||

| CONSUMER STAPLES - 0.0% | |||

| Food & Staples Retailing - 0.0% | |||

| Blink Health, Inc. Series C (a)(b)(c) | 241 | 9,201 | |

| Food Products - 0.0% | |||

| AgBiome LLC Series C (a)(b)(c) | 557 | 3,302 | |

| Bowery Farming, Inc. Series C1 (b)(c) | 378 | 22,774 | |

| 26,076 | |||

| Tobacco - 0.0% | |||

| JUUL Labs, Inc. Series E (a)(b)(c) | 127 | 5,502 | |

| TOTAL CONSUMER STAPLES | 40,779 | ||

| INDUSTRIALS - 0.3% | |||

| Aerospace & Defense - 0.3% | |||

| ABL Space Systems: | |||

| Series B (b)(c) | 629 | 42,770 | |

| Series B2 (b)(c) | 331 | 22,507 | |

| Relativity Space, Inc. Series E (b)(c) | 5,798 | 132,398 | |

| Space Exploration Technologies Corp. Series N (a)(b)(c) | 126 | 70,560 | |

| 268,235 | |||

| Construction & Engineering - 0.0% | |||

| Beta Technologies, Inc. Series A (b)(c) | 231 | 16,925 | |

| TOTAL INDUSTRIALS | 285,160 | ||

| INFORMATION TECHNOLOGY - 0.6% | |||

| Communications Equipment - 0.1% | |||

| Meesho Series F (b)(c) | 1,300 | 99,674 | |

| Xsight Labs Ltd. Series D (b)(c) | 2,700 | 26,946 | |

| 126,620 | |||

| Electronic Equipment & Components - 0.0% | |||

| Enevate Corp. Series E (b)(c) | 24,030 | 26,642 | |

| IT Services - 0.1% | |||

| ByteDance Ltd. Series E1 (a)(b)(c) | 544 | 80,871 | |

| Yanka Industries, Inc. Series F (b)(c) | 1,183 | 37,710 | |

| 118,581 | |||

| Semiconductors & Semiconductor Equipment - 0.1% | |||

| Astera Labs, Inc. Series C (b)(c) | 3,700 | 14,948 | |

| GaN Systems, Inc.: | |||

| Series F1 (b)(c) | 1,539 | 13,051 | |

| Series F2 (b)(c) | 813 | 6,894 | |

| SiMa.ai Series B (b)(c) | 6,600 | 43,098 | |

| Tenstorrent, Inc. Series C1 (b)(c) | 200 | 15,008 | |

| 92,999 | |||

| Software - 0.3% | |||

| Bolt Technology OU Series E (b)(c) | 395 | 102,065 | |

| Databricks, Inc.: | |||

| Series G (b)(c) | 284 | 62,608 | |

| Series H (b)(c) | 217 | 47,838 | |

| Mountain Digital, Inc. Series D (b)(c) | 1,221 | 28,041 | |

| Nuvia, Inc. Series B (a)(b) | 2,764 | 2,259 | |

| Skyryse, Inc. Series B (b)(c) | 1,300 | 32,084 | |

| Stripe, Inc. Series H (b)(c) | 200 | 7,250 | |

| 282,145 | |||

| TOTAL INFORMATION TECHNOLOGY | 646,987 | ||

| MATERIALS - 0.1% | |||

| Metals & Mining - 0.1% | |||

| Diamond Foundry, Inc. Series C (b)(c) | 5,192 | 142,728 | |

| UTILITIES - 0.0% | |||

| Independent Power and Renewable Electricity Producers - 0.0% | |||

| Redwood Materials Series C (b)(c) | 799 | 37,875 | |

| TOTAL CONVERTIBLE PREFERRED STOCKS | 1,658,743 | ||

| Nonconvertible Preferred Stocks - 0.1% | |||

| CONSUMER DISCRETIONARY - 0.0% | |||

| Automobiles - 0.0% | |||

| Neutron Holdings, Inc.: | |||

| Series 1C (a)(b)(c) | 26,100 | 1,827 | |

| Series 1D (a)(b)(c) | 58,561 | 4,099 | |

| Waymo LLC Series A2 (a)(b)(c) | 127 | 11,649 | |

| 17,575 | |||

| INFORMATION TECHNOLOGY - 0.1% | |||

| IT Services - 0.1% | |||

| Gupshup, Inc. (b)(c) | 1,661 | 37,979 | |

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | 55,554 | ||

| TOTAL PREFERRED STOCKS | |||

| (Cost $1,531,569) | 1,714,297 | ||

| Principal Amount | Value | ||

| Convertible Bonds - 0.0% | |||

| CONSUMER DISCRETIONARY - 0.0% | |||

| Automobiles - 0.0% | |||

| Neutron Holdings, Inc.: | |||

| 0% 10/27/25 (b)(c) | 46,400 | 46,400 | |

| 4% 5/22/27 (b)(c) | 5,000 | 5,000 | |

| 4% 6/12/27 (b)(c) | 3,170 | 3,170 | |

| TOTAL CONVERTIBLE BONDS | |||

| (Cost $54,570) | 54,570 | ||

| Preferred Securities - 0.1% | |||

| CONSUMER DISCRETIONARY - 0.0% | |||

| Internet & Direct Marketing Retail - 0.0% | |||

| Circle Internet Financial Ltd. 0% (b)(f) | 47,500 | 53,446 | |

| INFORMATION TECHNOLOGY - 0.1% | |||

| Electronic Equipment & Components - 0.0% | |||

| Enevate Corp. 0% 1/29/23 (b)(c) | 10,231 | 10,231 | |

| Semiconductors & Semiconductor Equipment - 0.1% | |||

| GaN Systems, Inc. 0% (b)(c)(f) | 36,074 | 36,074 | |

| Tenstorrent, Inc. 0% (b)(c)(f) | 10,000 | 10,000 | |

| 46,074 | |||

| TOTAL INFORMATION TECHNOLOGY | 56,305 | ||

| TOTAL PREFERRED SECURITIES | |||

| (Cost $103,805) | 109,751 | ||

| Shares | Value | ||

| Money Market Funds - 0.9% | |||

| Fidelity Cash Central Fund 0.08% (g) | 626,530 | 626,655 | |

| Fidelity Securities Lending Cash Central Fund 0.08% (g)(h) | 317,014 | 317,046 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $943,701) | 943,701 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.4% | |||

| (Cost $70,275,792) | 109,842,195 | ||

| NET OTHER ASSETS (LIABILITIES) - (0.4)% | (468,505) | ||

| NET ASSETS - 100% | $109,373,690 |

Legend

(a) Non-income producing

(b) Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $3,053,431 or 2.8% of net assets.

(c) Level 3 security

(d) Security or a portion of the security is on loan at period end.

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $125,128 or 0.1% of net assets.

(f) Security is perpetual in nature with no stated maturity date.

(g) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(h) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost |

| ABL Space Systems Series B | 3/24/21 | $28,327 |

| ABL Space Systems Series B2 | 10/22/21 | $22,507 |

| AgBiome LLC Series C | 6/29/18 | $3,528 |

| Algolia SAS Series D | 7/23/21 | $18,249 |

| Ant International Co. Ltd. Class C | 5/16/18 | $13,745 |

| Astera Labs, Inc. Series C | 8/24/21 | $12,439 |

| BARK, Inc. | 12/17/20 | $29,830 |

| Beta Technologies, Inc. Series A | 4/9/21 | $16,925 |

| Bird Global, Inc. | 5/11/21 | $42,420 |

| Blink Health, Inc. Series A1 | 12/30/20 | $2,682 |

| Blink Health, Inc. Series C | 11/7/19 - 7/14/21 | $9,200 |

| Bolt Technology OU Series E | 1/3/22 | $102,620 |

| Bowery Farming, Inc. Series C1 | 5/18/21 | $22,774 |

| ByteDance Ltd. Series E1 | 11/18/20 | $59,608 |

| CelLink Corp. Series D | 1/20/22 | $32,194 |

| Circle Internet Financial Ltd. 0% | 5/11/21 | $47,500 |

| Databricks, Inc. Series G | 2/1/21 | $50,372 |

| Databricks, Inc. Series H | 8/31/21 | $47,838 |

| Delhivery Private Ltd. | 5/20/21 | $27,823 |

| Diamond Foundry, Inc. Series C | 3/15/21 | $124,608 |

| Discord, Inc. Series I | 9/15/21 | $9,361 |

| Endeavor Group Holdings, Inc. Class A | 3/29/21 | $42,432 |

| Enevate Corp. Series E | 1/29/21 | $26,642 |

| Enevate Corp. 0% 1/29/23 | 1/29/21 | $10,231 |

| Epic Games, Inc. | 7/30/20 | $5,175 |

| Fanatics, Inc. Class A | 8/13/20 - 12/15/21 | $121,928 |

| FSN E-Commerce Ventures Private Ltd. | 10/7/20 | $82,628 |

| GaN Systems, Inc. Series F1 | 11/30/21 | $13,051 |

| GaN Systems, Inc. Series F2 | 11/30/21 | $6,894 |

| GaN Systems, Inc. 0% | 11/30/21 | $36,074 |

| GoBrands, Inc. Series G | 3/2/21 | $99,887 |

| GoBrands, Inc. Series H | 7/22/21 | $91,295 |

| Gupshup, Inc. | 6/8/21 | $37,979 |

| Il Makiage Ltd. | 1/6/22 | $20,660 |

| Instacart, Inc. Series H | 11/13/20 | $27,660 |

| Instacart, Inc. Series I | 2/26/21 | $34,000 |

| JUUL Labs, Inc. Class A | 12/20/17 - 7/6/18 | $5,804 |

| JUUL Labs, Inc. Series E | 12/20/17 - 7/6/18 | $3,263 |

| Meesho Series F | 9/21/21 | $99,674 |

| Mountain Digital, Inc. Series D | 11/5/21 | $28,041 |

| MultiPlan Corp. warrants | 10/8/20 | $0 |

| Neutron Holdings, Inc. | 2/4/21 | $92 |

| Neutron Holdings, Inc. Series 1C | 7/3/18 | $4,772 |

| Neutron Holdings, Inc. Series 1D | 1/25/19 | $14,201 |

| Neutron Holdings, Inc. 0% 10/27/25 | 10/29/21 | $46,400 |

| Neutron Holdings, Inc. 4% 5/22/27 | 6/4/20 | $5,000 |

| Neutron Holdings, Inc. 4% 6/12/27 | 6/12/20 | $3,170 |

| Nuvia, Inc. Series B | 3/16/21 | $2,259 |

| Rad Power Bikes, Inc. | 1/21/21 | $8,755 |

| Rad Power Bikes, Inc. Series A | 1/21/21 | $1,143 |

| Rad Power Bikes, Inc. Series C | 1/21/21 | $4,491 |

| Rad Power Bikes, Inc. Series D | 9/17/21 | $20,126 |

| Reddit, Inc. Series E | 5/18/21 | $4,375 |

| Reddit, Inc. Series F | 8/11/21 | $64,513 |

| Redwood Materials Series C | 5/28/21 | $37,875 |

| Relativity Space, Inc. Series E | 5/27/21 | $132,398 |

| SiMa.ai Series B | 5/10/21 | $33,841 |

| Skyryse, Inc. Series B | 10/21/21 | $32,084 |

| Sonder Holdings, Inc. | 4/29/21 - 10/27/21 | $23,205 |

| Space Exploration Technologies Corp. Class A | 2/16/21 | $41,999 |

| Space Exploration Technologies Corp. Series N | 8/4/20 | $34,020 |

| Starry, Inc. Series C | 12/8/17 | $2,933 |

| Starry, Inc. Series D | 3/6/19 - 7/30/20 | $10,453 |

| Starry, Inc. Series E3 | 3/31/21 | $13,028 |

| Stripe, Inc. Class B | 5/18/21 | $16,051 |

| Stripe, Inc. Series H | 3/15/21 | $8,025 |

| Tanium, Inc. Class B | 4/21/17 | $650 |

| Tenstorrent, Inc. Series C1 | 4/23/21 | $11,891 |

| Tenstorrent, Inc. 0% | 4/23/21 | $10,000 |

| Waymo LLC Series A2 | 5/8/20 | $10,905 |

| WeWork, Inc. | 3/25/21 | $84,920 |

| Xsight Labs Ltd. Series D | 2/16/21 | $21,589 |

| Yanka Industries, Inc. Series F | 4/8/21 | $37,710 |

| Zomato Ltd. | 12/9/20 - 2/10/21 | $33,690 |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Cash Central Fund 0.08% | $2,415,701 | $9,601,427 | $11,390,473 | $263 | $-- | $-- | $626,655 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 0.08% | 353,805 | 6,069,837 | 6,106,596 | 3,327 | -- | -- | 317,046 | 0.0% |

| Total | $2,769,506 | $15,671,264 | $17,497,069 | $3,590 | $-- | $-- | $943,701 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Investment Valuation

The following is a summary of the inputs used, as of January 31, 2022, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Equities: | ||||

| Communication Services | $16,710,383 | $16,525,082 | $114,423 | $70,878 |

| Consumer Discretionary | 29,464,682 | 27,296,844 | 1,515,478 | 652,360 |

| Consumer Staples | 658,554 | 588,728 | 15,867 | 53,959 |

| Energy | 2,332,088 | 1,670,839 | 661,249 | -- |

| Financials | 1,070,943 | 996,552 | 67,534 | 6,857 |

| Health Care | 4,705,188 | 4,667,943 | 16,585 | 20,660 |

| Industrials | 5,318,307 | 4,771,075 | 159,818 | 387,414 |

| Information Technology | 47,370,829 | 46,607,159 | 57,198 | 706,472 |

| Materials | 952,274 | 766,667 | 42,879 | 142,728 |

| Real Estate | 113,050 | 113,050 | -- | -- |

| Utilities | 37,875 | -- | -- | 37,875 |

| Corporate Bonds | 54,570 | -- | -- | 54,570 |

| Preferred Securities | 109,751 | -- | 53,446 | 56,305 |

| Money Market Funds | 943,701 | 943,701 | -- | -- |

| Total Investments in Securities: | $109,842,195 | $104,947,640 | $2,704,477 | $2,190,078 |

| Net unrealized depreciation on unfunded commitments | $(420) | $-- | $(420) | $-- |

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value:

| Investments in Securities: | |

| Beginning Balance | $1,883,431 |

| Net Realized Gain (Loss) on Investment Securities | -- |

| Net Unrealized Gain (Loss) on Investment Securities | 172,396 |

| Cost of Purchases | 688,800 |

| Proceeds of Sales | (46,592) |

| Amortization/Accretion | -- |

| Transfers into Level 3 | 1,117 |

| Transfers out of Level 3 | (509,074) |

| Ending Balance | $2,190,078 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at January 31, 2022 | $175,049 |

The information used in the above reconciliation represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Cost of purchases and proceeds of sales may include securities received and/or delivered through in-kind transactions. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's Statement of Operations.

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| January 31, 2022 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $309,411) — See accompanying schedule: Unaffiliated issuers (cost $69,332,091) | $108,898,494 | |

| Fidelity Central Funds (cost $943,701) | 943,701 | |

| Total Investment in Securities (cost $70,275,792) | $109,842,195 | |

| Foreign currency held at value (cost $73) | 73 | |

| Receivable for investments sold | 288,117 | |

| Receivable for fund shares sold | 145,986 | |

| Dividends receivable | 12,044 | |

| Interest receivable | 541 | |

| Distributions receivable from Fidelity Central Funds | 389 | |

| Total assets | 110,289,345 | |

| Liabilities | ||

| Payable to custodian bank | $33,944 | |

| Payable for investments purchased | 440,460 | |

| Unrealized depreciation on unfunded commitments | 420 | |

| Payable for fund shares redeemed | 38,321 | |

| Other payables and accrued expenses | 85,464 | |

| Collateral on securities loaned | 317,046 | |

| Total liabilities | 915,655 | |

| Net Assets | $109,373,690 | |

| Net Assets consist of: | ||

| Paid in capital | $65,737,820 | |

| Total accumulated earnings (loss) | 43,635,870 | |

| Net Assets | $109,373,690 | |

| Net Asset Value, offering price and redemption price per share ($109,373,690 ÷ 3,963,087 shares) | $27.60 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Six months ended January 31, 2022 (Unaudited) | ||

| Investment Income | ||

| Dividends | $235,527 | |

| Interest | 216 | |

| Income from Fidelity Central Funds (including $3,327 from security lending) | 3,590 | |

| Total income | 239,333 | |

| Expenses | ||

| Independent trustees' fees and expenses | $233 | |

| Interest | 79 | |

| Total expenses before reductions | 312 | |

| Expense reductions | (1) | |

| Total expenses after reductions | 311 | |

| Net investment income (loss) | 239,022 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 5,588,108 | |

| Foreign currency transactions | (65) | |

| Total net realized gain (loss) | 5,588,043 | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers (net of increase in deferred foreign taxes of $50,738) | (8,941,673) | |

| Unfunded commitments | 38,544 | |

| Assets and liabilities in foreign currencies | 98 | |

| Total change in net unrealized appreciation (depreciation) | (8,903,031) | |

| Net gain (loss) | (3,314,988) | |

| Net increase (decrease) in net assets resulting from operations | $(3,075,966) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six months ended January 31, 2022 (Unaudited) | Year ended July 31, 2021 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $239,022 | $341,190 |

| Net realized gain (loss) | 5,588,043 | 7,041,375 |

| Change in net unrealized appreciation (depreciation) | (8,903,031) | 28,376,372 |

| Net increase (decrease) in net assets resulting from operations | (3,075,966) | 35,758,937 |

| Distributions to shareholders | (6,842,643) | (1,559,042) |

| Share transactions | ||

| Proceeds from sales of shares | 19,264,832 | 70,379,196 |

| Reinvestment of distributions | 6,842,643 | 1,559,042 |

| Cost of shares redeemed | (37,689,743) | (35,089,555) |

| Net increase (decrease) in net assets resulting from share transactions | (11,582,268) | 36,848,683 |

| Total increase (decrease) in net assets | (21,500,877) | 71,048,578 |

| Net Assets | ||

| Beginning of period | 130,874,567 | 59,825,989 |

| End of period | $109,373,690 | $130,874,567 |

| Other Information | ||

| Shares | ||

| Sold | 630,646 | 2,730,883 |

| Issued in reinvestment of distributions | 225,439 | 65,074 |

| Redeemed | (1,217,634) | (1,339,397) |

| Net increase (decrease) | (361,549) | 1,456,560 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Flex Large Cap Growth Fund

| Six months ended (Unaudited) January 31, | Years endedJuly 31, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 A | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $30.26 | $20.86 | $14.76 | $14.04 | $11.33 | $10.00 |

| Income from Investment Operations | ||||||

| Net investment income (loss)B,C | .06 | .09 | .10 | .11 | .11D | .03 |

| Net realized and unrealized gain (loss) | (1.14) | 9.78 | 6.12 | 1.06 | 2.69 | 1.30 |

| Total from investment operations | (1.08) | 9.87 | 6.22 | 1.17 | 2.80 | 1.33 |

| Distributions from net investment income | (.11) | (.09) | (.12) | (.11) | (.06) | – |

| Distributions from net realized gain | (1.48) | (.38) | – | (.35) | (.04) | – |

| Total distributions | (1.58)E | (.47) | (.12) | (.45)E | (.09)E | – |

| Net asset value, end of period | $27.60 | $30.26 | $20.86 | $14.76 | $14.04 | $11.33 |

| Total ReturnF,G | (4.00)% | 47.94% | 42.45% | 8.66% | 24.90% | 13.30% |

| Ratios to Average Net AssetsC,H,I | ||||||

| Expenses before reductionsJ | - %K | -% | -% | -% | -% | - %K |

| Expenses net of fee waivers, if anyJ | - %K | -% | -% | -% | -% | - %K |

| Expenses net of all reductionsJ | - %K | -% | -% | -% | -% | - %K |

| Net investment income (loss) | .36%K | .34% | .62% | .83% | .87%D | .79%K |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $109,374 | $130,875 | $59,826 | $24,333 | $14,641 | $8,576 |

| Portfolio turnover rateL | 41%K | 44% | 70% | 55% | 65% | 17%M |

A For the period March 8, 2017 (commencement of operations) through July 31, 2017.

B Calculated based on average shares outstanding during the period.

C Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

D Net investment income per share reflects one or more large, non-recurring dividend(s) which amounted to $.01 per share. Excluding such non-recurring dividend(s), the ratio of net investment income (loss) to average net assets would have been .77%.

E Total distributions per share do not sum due to rounding.

F Total returns for periods of less than one year are not annualized.

G Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

H Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

J Amount represents less than .005%.

K Annualized

L Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

M Amount not annualized.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended January 31, 2022

1. Organization.

Fidelity Flex Large Cap Growth Fund (the Fund) is a fund of Fidelity Securities Fund (the Trust) and is authorized to issue an unlimited number of shares. Share transactions on the Statement of Changes in Net Assets may contain exchanges between affiliated funds. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund is available only to certain fee-based accounts and advisory programs offered by Fidelity.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio(a) |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

(a) Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – Unadjusted quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, ETFs and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy. Securities, including private placements or other restricted securities, for which observable inputs are not available are valued using alternate valuation approaches, including the market approach, the income approach and cost approach, and are categorized as Level 3 in the hierarchy. The market approach considers factors including the price of recent investments in the same or a similar security or financial metrics of comparable securities. The income approach considers factors including expected future cash flows, security specific risks and corresponding discount rates. The cost approach considers factors including the value of the security's underlying assets and liabilities.

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds and preferred securities are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

The following provides information on Level 3 securities held by the Fund that were valued at period end based on unobservable inputs. These amounts exclude valuations provided by a broker.

| Asset Type | Fair Value | Valuation Technique(s) | Unobservable Input | Amount or Range/Weighted Average | Impact to Valuation from an Increase in Input(a) |

| Equities | $2,079,203 | Market comparable | Discount rate | 40.0% | Decrease |

| Indicative market price | Enterprise value/EBITDA multiple (EV/EBITDA) | 21 | Increase | ||

| Enterprise value/Sales multiple (EV/S) | 3.1 - 13.5 / 8.6 | Increase | |||

| Price/Earnings multiple (P/E) | 7.1 | Increase | |||

| Enterprise value/Gross profit (EV/GP) | 12.5 | Increase | |||

| Discount for lack of marketability | 15.0% | Decrease | |||

| Recovery value | Recovery value | 1.8% - 5.3% / 3.8% | Increase | ||

| Discount for lack of marketability | 5.0% | Decrease | |||

| Market approach | Transaction price | $1.11 - $860.82 / $166.41 | Increase | ||

| Discount for lack of marketability | 10.0% | Decrease | |||

| Premium rate | 20.2% - 27.4% / 25.4% | Increase | |||

| Recovery value | Recovery value | 0.5% - 1.7% / 1.2% | Increase | ||

| Discount for lack of marketability | 5.0% | Decrease | |||

| Corporate Bonds | $54,570 | Market approach | Transaction price | $100.00 | Increase |

| Preferred Securities | $56,305 | Market approach | Transaction price | $100.00 | Increase |

(a) Represents the directional change in the fair value of the Level 3 investments that could have resulted from an increase in the corresponding input as of period end. A decrease to the unobservable input would have had the opposite effect. Significant changes in these inputs may have resulted in a significantly higher or lower fair value measurement at period end.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of January 31, 2022, as well as a roll forward of Level 3 investments, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. Certain Funds may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received, and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of a fund include an amount in addition to trade execution, which may be rebated back to a fund. Any such rebates are included in net realized gain (loss) on investments in the Statement of Operations. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain. Funds may file withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. Any withholding tax reclaims income is included in the Statement of Operations in dividends. Any receivables for withholding tax reclaims are included in the Statement of Assets and Liabilities in dividends receivable.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expenses included in the accompanying financial statements reflect the expenses of that fund and do not include any expenses associated with any underlying mutual funds or exchange-traded funds. Although not included in a fund's expenses, a fund indirectly bears its proportionate share of these expenses through the net asset value of each underlying mutual fund or exchange-traded fund. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital gains by certain countries in which it invests. An estimated deferred tax liability for net unrealized appreciation on the applicable securities is included in Other payables and accrued expenses on the Statement of Assets & Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to futures and options transactions, foreign currency transactions, partnerships, passive foreign investment companies (PFIC), defaulted bonds and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $43,091,241 |

| Gross unrealized depreciation | (3,936,605) |

| Net unrealized appreciation (depreciation) | $39,154,636 |

| Tax cost | $70,687,559 |

Restricted Securities (including Private Placements). Funds may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities held at period end is included at the end of the Schedule of Investments, if applicable.

Special Purpose Acquisition Companies. Funds may invest in stock, warrants, and other securities of special purpose acquisition companies (SPACs) or similar special purpose entities. A SPAC is a publicly traded company that raises investment capital via an initial public offering (IPO) for the purpose of acquiring the equity securities of one or more existing companies via merger, business combination, acquisition or other similar transactions within a designated time frame.

Private Investment in Public Equity. Funds may acquire equity securities of an issuer through a private investment in a public equity (PIPE) transaction, including through commitments to purchase securities on a when-issued basis. A PIPE typically involves the purchase of securities directly from a publicly traded company in a private placement transaction. Securities purchased through PIPE transactions will be restricted from trading and considered illiquid until a resale registration statement for the shares is filed and declared effective.

At the current and/or prior period end, the Fund had commitments to purchase when-issued securities through PIPE transactions with SPACs. The commitments are contingent upon the SPACs acquiring the securities of target companies. Unrealized appreciation (depreciation) on any commitments outstanding at period end is separately presented in the Statements of Assets and Liabilities as Unrealized appreciation (depreciation) on unfunded commitments, and any change in unrealized appreciation (depreciation) on unfunded commitments during the period is separately presented in the Statement of Operations, as applicable. The total amount of commitments outstanding at period end is presented in the table below.

| Commitment Amount | |

| Fidelity Flex Large Cap Growth Fund | $3,760 |

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and in-kind transactions, as applicable, are noted in the table below.

| Purchases ($) | Sales ($) | |

| Fidelity Flex Large Cap Growth Fund | 26,714,371 | 43,015,982 |

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company LLC (the investment adviser) and its affiliates provide the Fund with investment management related services and the Fund does not pay any fees for these services. Under the management contract, the investment adviser or an affiliate pays all other expenses of the Fund, excluding fees and expenses of the independent Trustees, and certain miscellaneous expenses such as proxy and shareholder meeting expenses.

Brokerage Commissions. A portion of portfolio transactions were placed with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were as follows:

| Amount | |

| Fidelity Flex Large Cap Growth Fund | $1,373 |

Interfund Lending Program. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission (the SEC), the Fund, along with other registered investment companies having management contracts with Fidelity Management & Research Company LLC (FMR), or other affiliated entities of FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the Fund to borrow from, or lend money to, other participating affiliated funds. At period end, there were no interfund loans outstanding. Activity in this program during the period for which loans were outstanding was as follows:

| Borrower or Lender | Average Loan Balance | Weighted Average Interest Rate | Interest Expense | |

| Fidelity Flex Large Cap Growth Fund | Borrower | $1,020,571 | .32% | $63 |

Interfund Trades. Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Any interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note. Interfund trades during the period are noted in the table below.

| Purchases ($) | Sales ($) | Realized Gain (Loss) ($) | |

| Fidelity Flex Large Cap Growth Fund | 2,315,479 | 2,263,342 | 309,835 |

6. Committed Line of Credit.

Certain Funds participate with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The commitment fees on the pro-rata portion of the line of credit are borne by the investment adviser. During the period, there were no borrowings on this line of credit.

7. Security Lending.

Funds lend portfolio securities through a lending agent from time to time in order to earn additional income. A fund may lend securities to certain qualified borrowers, including NFS. On the settlement date of the loan, a fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of a fund and any additional required collateral is delivered to a fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund may apply collateral received from the borrower against the obligation. A fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. Any loaned securities are identified as such in the Schedule of Investments, and the value of loaned securities and cash collateral at period end, as applicable, are presented in the Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds.

| Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End | |

| Fidelity Flex Large Cap Growth Fund | $– | $– |

8. Bank Borrowings.

The Fund is permitted to have bank borrowings for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity requirements. The Fund has established borrowing arrangements with certain banks. The interest rate on the borrowings is the bank's base rate, as revised from time to time. Any open loans, including accrued interest, at period end are presented under the caption "Notes payable" in the Statement of Assets and Liabilities, if applicable. Activity in this program during the period for which loans were outstanding was as follows:

| Average Loan Balance | Weighted Average Interest Rate | Interest Expense | |

| Fidelity Flex Large Cap Growth Fund | $144,000 | .58% | $16 |

9. Expense Reductions.

Through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses by $1.

10. Other.

A fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, a fund may also enter into contracts that provide general indemnifications. A fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against a fund. The risk of material loss from such claims is considered remote.

At the end of the period, the investment adviser or its affiliates were owners of record of more than 10% of the outstanding shares as follows:

| Fund | Affiliated % |

| Fidelity Flex Large Cap Growth Fund | 14% |

In March 2022, the Board of Trustees approved a Plan of Liquidation and Dissolution. The Fund will distribute all of its net assets to its shareholders on or about June 10, 2022. The Fund will be closed to new accounts on or about June 3, 2022, with certain exceptions.

11. Coronavirus (COVID-19) Pandemic.

An outbreak of COVID-19 first detected in China during December 2019 has since spread globally and was declared a pandemic by the World Health Organization during March 2020. Developments that disrupt global economies and financial markets, such as the COVID-19 pandemic, may magnify factors that affect the Fund's performance.

Shareholder Expense Example

As a shareholder, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments or redemption proceeds, as applicable and (2) ongoing costs, which generally include management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2021 to January 31, 2022).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class/Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. If any fund is a shareholder of any underlying mutual funds or exchange-traded funds (ETFs) (the Underlying Funds), such fund indirectly bears its proportional share of the expenses of the Underlying Funds in addition to the direct expenses incurred presented in the table. These fees and expenses are not included in the annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes