Fidelity® Real Estate Income Fund

Class/Ticker

Fidelity Advisor® Real Estate Income Fund

A/FRINX M/FRIQX C/FRIOX I/FRIRX Z/FIKMX

Summary Prospectus

September 29, 2020

Before you invest, you may want to review the fund's prospectus, which contains more information about the fund and its risks. You can find the fund's prospectus, reports to shareholders, and other information about the fund (including the fund's SAI) online at institutional.fidelity.com/fafunddocuments. You can also get this information at no cost by calling 1-866-997-1254 or by sending an e-mail request to funddocuments@fmr.com. The fund's prospectus and SAI dated September 29, 2020 are incorporated herein by reference.

See the inside front cover for important information about access to your fund's shareholder reports.

245 Summer Street, Boston, MA 02210

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Fund Summary

Fund/Class:

Fidelity® Real Estate Income Fund/Fidelity Advisor® Real Estate Income Fund A, M, C, I, Z

Investment Objective

The fund seeks higher than average income. As a secondary objective, the fund also seeks capital growth.

Fee Table

The following table describes the fees and expenses that may be incurred when you buy and hold shares of the fund. In addition to the fees and expenses described below, your broker may also require you to pay brokerage commissions on purchases and sales of certain share classes of the fund.

You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the fund or certain other Fidelity® funds. More information about these and other discounts is available from your investment professional and in the "Fund Distribution" section beginning on page 29 of the prospectus. Different intermediaries may provide additional waivers or reductions of the sales charge. Please see “Sales Charge Waiver Policies Applied by Certain Intermediaries” in the “Appendix” section of the prospectus.

Shareholder fees

(fees paid directly from your investment)

| Class A | Class M | Class C | Class I | Class Z | |

| Maximum sales charge (load) on purchases (as a % of offering price) | 4.00% | 4.00% | None | None | None |

| Maximum contingent deferred sales charge (as a % of the lesser of original purchase price or redemption proceeds) | None(a) | None(a) | 1.00%(b) | None | None |

(a) Class A and Class M purchases of $1 million or more will not be subject to a front-end sales charge. Such Class A and Class M purchases may be subject, upon redemption, to a contingent deferred sales charge (CDSC) of 1.00% or 0.25%, respectively.

(b) On Class C shares redeemed less than one year after purchase.

Annual Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

| Class A | Class M | Class C | Class I | Class Z | |

| Management fee | 0.53% | 0.53% | 0.53% | 0.53% | 0.53% |

| Distribution and/or Service (12b-1) fees | 0.25% | 0.25% | 1.00% | None | None |

| Other expenses | 0.23% | 0.25% | 0.23% | 0.21% | 0.09% |

| Total annual operating expenses | 1.01% | 1.03% | 1.76% | 0.74% | 0.62% |

This example helps compare the cost of investing in the fund with the cost of investing in other funds.

Let's say, hypothetically, that the annual return for shares of the fund is 5% and that your shareholder fees and the annual operating expenses for shares of the fund are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated and if you hold your shares:

| Class A | Class M | Class C | Class I | Class Z | ||||||

| Sell All Shares |

Hold Shares |

Sell All Shares |

Hold Shares |

Sell All Shares |

Hold Shares |

Sell All Shares |

Hold Shares |

Sell All Shares |

Hold Shares |

|

| 1 year | $499 | $499 | $501 | $501 | $279 | $179 | $76 | $76 | $63 | $63 |

| 3 years | $709 | $709 | $715 | $715 | $554 | $554 | $237 | $237 | $199 | $199 |

| 5 years | $936 | $936 | $946 | $946 | $954 | $954 | $411 | $411 | $346 | $346 |

| 10 years | $1,587 | $1,587 | $1,609 | $1,609 | $2,073 | $2,073 | $918 | $918 | $774 | $774 |

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual operating expenses or in the example, affect the fund's performance. During the most recent fiscal year, the fund's portfolio turnover rate was 32% of the average value of its portfolio.

Principal Investment Strategies

- Normally investing primarily in preferred and common stocks of Real Estate Investment Trusts (REITs); debt securities of real estate entities; and commercial and other mortgage-backed securities, with an emphasis on lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds).

- Normally investing at least 80% of assets in securities of companies principally engaged in the real estate industry and other real estate related investments.

- Investing in domestic and foreign issuers.

- Using fundamental analysis of each issuer's financial condition and industry position and market and economic conditions to select investments.

Principal Investment Risks

- Stock Market Volatility. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Different parts of the market, including different market sectors, and different types of securities can react differently to these developments.

- Interest Rate Changes. Interest rate increases can cause the price of a debt security to decrease.

- Foreign Exposure. Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market, or economic developments and can perform differently from the U.S. market.

- Real Estate Industry Concentration. Changes in real estate values or economic downturns can have a significant negative effect on issuers in the real estate industry. The value of securities of issuers in the real estate industry can be affected by changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, and the management skill and creditworthiness of the issuer.

- Prepayment. The ability of an issuer of a debt security to repay principal prior to a security's maturity can cause greater price volatility if interest rates change.

- Issuer-Specific Changes. The value of an individual security or particular type of security can be more volatile than, and can perform differently from, the market as a whole. Lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds) and certain types of other securities involve greater risk of default or price changes due to changes in the credit quality of the issuer. The value of lower-quality debt securities and certain types of other securities can be more volatile due to increased sensitivity to adverse issuer, political, regulatory, market, or economic developments and can be difficult to resell. Lower-quality debt securities can be thinly traded or have restrictions on resale, making them difficult to sell at an acceptable price, and often are considered to be speculative.

An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You could lose money by investing in the fund.

Performance

The following information is intended to help you understand the risks of investing in the fund. The information illustrates the changes in the performance of the fund's shares from year to year and compares the performance of the fund's shares to the performance of a securities market index and a hypothetical composite of market indexes over various periods of time. The indexes have characteristics relevant to the fund's investment strategies. Index descriptions appear in the "Additional Index Information" section of the prospectus. Past performance (before and after taxes) is not an indication of future performance.

Visit institutional.fidelity.com for more recent performance information.

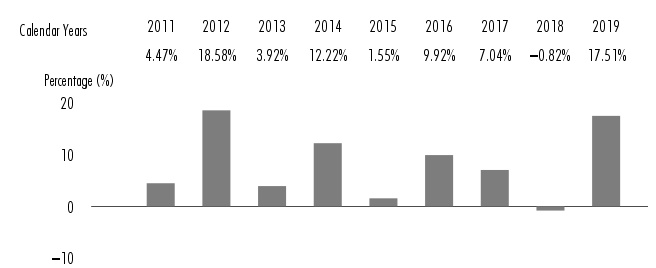

Year-by-Year Returns

The returns in the bar chart do not reflect any applicable sales charges; if sales charges were reflected, returns would be lower than those shown.

| During the periods shown in the chart for Class A: | Returns | Quarter ended |

| Highest Quarter Return | 8.23% | March 31, 2019 |

| Lowest Quarter Return | (5.96)% | September 30, 2011 |

| Year-to-Date Return | (13.10)% | June 30, 2020 |

Average Annual Returns

Unlike the returns in the bar chart, the returns in the table reflect the maximum applicable sales charges. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, but do not reflect the impact of state or local taxes. After-tax returns for Class A are shown in the table below and after-tax returns for other classes will vary. Actual after-tax returns may differ depending on your individual circumstances. The after-tax returns shown are not relevant if you hold your shares in a retirement account or in another tax-deferred arrangement, such as an employee benefit plan (profit sharing, 401(k), or 403(b) plan). Return After Taxes on Distributions and Sale of Fund Shares may be higher than other returns for the same period due to a tax benefit of realizing a capital loss upon the sale of fund shares.

| For the periods ended December 31, 2019 | Past 1 year | Past 5 years | Life of class |

| Class A - Return Before Taxes | 12.81% | 5.97% | 7.99%(a) |

| Return After Taxes on Distributions | 10.85% | 3.95% | 5.79%(a) |

| Return After Taxes on Distributions and Sale of Fund Shares | 8.06% | 3.81% | 5.41%(a) |

| Class M - Return Before Taxes | 12.87% | 5.94% | 7.97%(a) |

| Class C - Return Before Taxes | 15.73% | 6.04% | 7.64%(a) |

| Class I - Return Before Taxes | 17.88% | 7.12% | 8.73%(a) |

| Class Z - Return Before Taxes | 18.02% | — | 11.81%(b) |

| S&P 500® Index (reflects no deduction for fees, expenses, or taxes) |

31.49% | 11.70% | 12.95%(a) |

| Fidelity Real Estate Income Composite Index℠ (reflects no deduction for fees, expenses, or taxes) |

18.43% | 6.10% | 7.77%(a) |

(a) From April 14, 2010

(b) From October 2, 2018

Investment Adviser

Fidelity Management & Research Company LLC (FMR) (the Adviser) is the fund's manager. Other investment advisers serve as sub-advisers for the fund.

Portfolio Manager(s)

Mark Snyderman (co-manager) has managed the fund since February 2003.

Bill Maclay (co-manager) has managed the fund since March 2019.

Purchase and Sale of Shares

You may buy or sell shares through a retirement account or through an investment professional. You may buy or sell shares in various ways:

Internet

institutional.fidelity.com

Phone

To reach a Fidelity representative 1-877-208-0098

| Fidelity Investments P.O. Box 770002 Cincinnati, OH 45277-0081 |

Overnight Express: Fidelity Investments 100 Crosby Parkway Covington, KY 41015 |

Class I and Class Z eligibility requirements are listed in the "Additional Information about the Purchase and Sale of Shares" section of the prospectus.

The price to buy one share of Class A or Class M is its offering price, if you pay a front-end sales charge, or its net asset value per share (NAV), if you qualify for a front-end sales charge waiver. The price to buy one share of Class C, Class I, or Class Z is its NAV. Shares will be bought at the offering price or NAV, as applicable, next calculated after an order is received in proper form.

The price to sell one share of Class A, Class M, or Class C is its NAV, minus any applicable contingent deferred sales charge (CDSC). The price to sell one share of Class I or Class Z is its NAV. Shares will be sold at the NAV next calculated after an order is received in proper form, minus any applicable CDSC.

The fund is open for business each day the New York Stock Exchange (NYSE) is open.

There is no purchase minimum for fund shares.

Tax Information

Distributions you receive from the fund are subject to federal income tax and generally will be taxed as ordinary income or capital gains, and may also be subject to state or local taxes, unless you are investing through a tax-advantaged retirement account (in which case you may be taxed later, upon withdrawal of your investment from such account).

Payments to Broker-Dealers and Other Financial Intermediaries

The fund, the Adviser, Fidelity Distributors Company LLC (FDC), and/or their affiliates may pay intermediaries, which may include banks, broker-dealers, retirement plan sponsors, administrators, or service-providers (who may be affiliated with the Adviser or FDC), for the sale of fund shares and related services. These payments may create a conflict of interest by influencing your intermediary and your investment professional to recommend the fund over another investment. Ask your investment professional or visit your intermediary's web site for more information.

Current regulations allow Fidelity to send a single copy of shareholder documents for Fidelity® funds, such as prospectuses, annual and semi-annual reports, and proxy materials, to certain mutual fund customers whom we believe are members of the same family who share the same address. For certain types of accounts, we will not send multiple copies of these documents to you and members of your family who share the same address. Instead, we will send only a single copy of these documents. This will continue for as long as you are a shareholder, unless you notify us otherwise. If at any time you choose to receive individual copies of any documents, please call 1-877-208-0098. We will begin sending individual copies to you within 30 days of receiving your call.

Fidelity Distributors Company LLC (FDC) is a member of the Securities Investor Protection Corporation (SIPC). You may obtain information about SIPC, including the SIPC brochure, by visiting www.sipc.org or calling SIPC at 202-371-8300.

Fidelity, Fidelity Advisor, Fidelity Investments & Pyramid Design, Fidelity Advisor Money Line, and Directed Dividends are registered service marks of FMR LLC. © 2020 FMR LLC. All rights reserved.

Any third-party marks that may appear above are the marks of their respective owners.

| 1.915437.113 | REIA-SUM-0920 |

Fidelity® Real Estate Income Fund

Class/Ticker

Fidelity® Real Estate Income Fund/FRIFX

In this summary prospectus, the term "shares" (as it relates to the fund) means the class of shares offered through this summary prospectus.

Summary Prospectus

September 29, 2020

Before you invest, you may want to review the fund's prospectus, which contains more information about the fund and its risks. You can find the fund's prospectus, reports to shareholders, and other information about the fund (including the fund's SAI) online at www.fidelity.com/funddocuments. You can also get this information at no cost by calling 1-800-FIDELITY or by sending an e-mail request to fidfunddocuments@fidelity.com. The fund's prospectus and SAI dated September 29, 2020 are incorporated herein by reference.

See the inside front cover for important information about access to your fund's shareholder reports.

245 Summer Street, Boston, MA 02210

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Fund Summary

Fund/Class:

Fidelity® Real Estate Income Fund/Fidelity® Real Estate Income Fund

Investment Objective

The fund seeks higher than average income. As a secondary objective, the fund also seeks capital growth.

Fee Table

The following table describes the fees and expenses that may be incurred when you buy and hold shares of the fund.

Shareholder fees

| (fees paid directly from your investment) | None |

Annual Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

| Management fee | 0.53% | |

| Distribution and/or Service (12b-1) fees | None | |

| Other expenses | 0.20% | |

| Total annual operating expenses | 0.73% |

This example helps compare the cost of investing in the fund with the cost of investing in other funds.

Let's say, hypothetically, that the annual return for shares of the fund is 5% and that your shareholder fees and the annual operating expenses for shares of the fund are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated:

| 1 year | $75 |

| 3 years | $233 |

| 5 years | $406 |

| 10 years | $906 |

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual operating expenses or in the example, affect the fund's performance. During the most recent fiscal year, the fund's portfolio turnover rate was 32% of the average value of its portfolio.

Principal Investment Strategies

- Normally investing primarily in preferred and common stocks of Real Estate Investment Trusts (REITs); debt securities of real estate entities; and commercial and other mortgage-backed securities, with an emphasis on lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds).

- Normally investing at least 80% of assets in securities of companies principally engaged in the real estate industry and other real estate related investments.

- Investing in domestic and foreign issuers.

- Using fundamental analysis of each issuer's financial condition and industry position and market and economic conditions to select investments.

Principal Investment Risks

- Stock Market Volatility. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Different parts of the market, including different market sectors, and different types of securities can react differently to these developments.

- Interest Rate Changes. Interest rate increases can cause the price of a debt security to decrease.

- Foreign Exposure. Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market, or economic developments and can perform differently from the U.S. market.

- Real Estate Industry Concentration. Changes in real estate values or economic downturns can have a significant negative effect on issuers in the real estate industry. The value of securities of issuers in the real estate industry can be affected by changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, and the management skill and creditworthiness of the issuer.

- Prepayment. The ability of an issuer of a debt security to repay principal prior to a security's maturity can cause greater price volatility if interest rates change.

- Issuer-Specific Changes. The value of an individual security or particular type of security can be more volatile than, and can perform differently from, the market as a whole. Lower-quality debt securities (those of less than investment-grade quality, also referred to as high yield debt securities or junk bonds) and certain types of other securities involve greater risk of default or price changes due to changes in the credit quality of the issuer. The value of lower-quality debt securities and certain types of other securities can be more volatile due to increased sensitivity to adverse issuer, political, regulatory, market, or economic developments and can be difficult to resell. Lower-quality debt securities can be thinly traded or have restrictions on resale, making them difficult to sell at an acceptable price, and often are considered to be speculative.

An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You could lose money by investing in the fund.

Performance

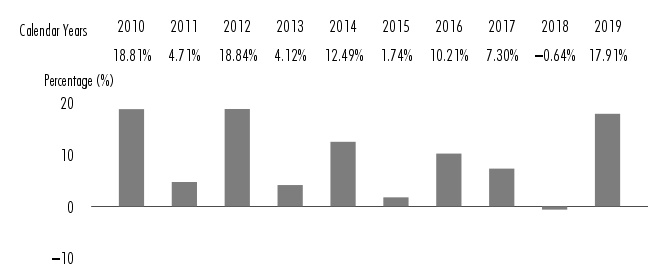

The following information is intended to help you understand the risks of investing in the fund. The information illustrates the changes in the performance of the fund's shares from year to year and compares the performance of the fund’s shares to the performance of a securities market index and a hypothetical composite of market indexes over various periods of time. The indexes have characteristics relevant to the fund's investment strategies. Index descriptions appear in the "Additional Index Information" section of the prospectus. Past performance (before and after taxes) is not an indication of future performance.

Visit www.fidelity.com for more recent performance information.

Year-by-Year Returns

| During the periods shown in the chart: | Returns | Quarter ended |

| Highest Quarter Return | 8.41% | March 31, 2019 |

| Lowest Quarter Return | (5.91)% | September 30, 2011 |

| Year-to-Date Return | (13.01)% | June 30, 2020 |

Average Annual Returns

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, but do not reflect the impact of state or local taxes. Actual after-tax returns may differ depending on your individual circumstances. The after-tax returns shown are not relevant if you hold your shares in a retirement account or in another tax-deferred arrangement, such as an employee benefit plan (profit sharing, 401(k), or 403(b) plan). Return After Taxes on Distributions and Sale of Fund Shares may be higher than other returns for the same period due to a tax benefit of realizing a capital loss upon the sale of fund shares.

| For the periods ended December 31, 2019 | Past 1 year | Past 5 years | Past 10 years |

| Fidelity® Real Estate Income Fund | |||

| Return Before Taxes | 17.91% | 7.11% | 9.33% |

| Return After Taxes on Distributions | 15.76% | 4.97% | 7.07% |

| Return After Taxes on Distributions and Sale of Fund Shares | 11.09% | 4.65% | 6.53% |

| S&P 500® Index (reflects no deduction for fees, expenses, or taxes) |

31.49% | 11.70% | 13.56% |

| Fidelity Real Estate Income Composite Index℠ (reflects no deduction for fees, expenses, or taxes) |

18.43% | 6.10% | 8.50% |

Investment Adviser

Fidelity Management & Research Company LLC (FMR) (the Adviser) is the fund's manager. Other investment advisers serve as sub-advisers for the fund.

Portfolio Manager(s)

Mark Snyderman (co-manager) has managed the fund since February 2003.

Bill Maclay (co-manager) has managed the fund since March 2019.

Purchase and Sale of Shares

You may buy or sell shares through a Fidelity® brokerage or mutual fund account, through a retirement account, or through an investment professional. You may buy or sell shares in various ways:

Internet

www.fidelity.com

Phone

Fidelity Automated Service Telephone (FAST®) 1-800-544-5555

To reach a Fidelity representative 1-800-544-6666

|

Additional purchases: Fidelity Investments |

Redemptions: Fidelity Investments |

TDD- Service for the Deaf and Hearing Impaired

1-800-544-0118

The price to buy one share is its net asset value per share (NAV). Shares will be bought at the NAV next calculated after an order is received in proper form.

The price to sell one share is its NAV. Shares will be sold at the NAV next calculated after an order is received in proper form.

The fund is open for business each day the New York Stock Exchange (NYSE) is open.

There is no purchase minimum for fund shares.

Tax Information

Distributions you receive from the fund are subject to federal income tax and generally will be taxed as ordinary income or capital gains, and may also be subject to state or local taxes, unless you are investing through a tax-advantaged retirement account (in which case you may be taxed later, upon withdrawal of your investment from such account).

Payments to Broker-Dealers and Other Financial Intermediaries

The fund, the Adviser, Fidelity Distributors Company LLC (FDC), and/or their affiliates may pay intermediaries, which may include banks, broker-dealers, retirement plan sponsors, administrators, or service-providers (who may be affiliated with the Adviser or FDC), for the sale of fund shares and related services. These payments may create a conflict of interest by influencing your intermediary and your investment professional to recommend the fund over another investment. Ask your investment professional or visit your intermediary's web site for more information.

Current regulations allow Fidelity to send a single copy of shareholder documents for Fidelity® funds, such as prospectuses, annual and semi-annual reports, and proxy materials, to certain mutual fund customers whom we believe are members of the same family who share the same address. For certain types of accounts, we will not send multiple copies of these documents to you and members of your family who share the same address. Instead, we will send only a single copy of these documents. This will continue for as long as you are a shareholder, unless you notify us otherwise. If at any time you choose to receive individual copies of any documents, please call 1-800-544-8544. We will begin sending individual copies to you within 30 days of receiving your call.

Fidelity Distributors Company LLC (FDC) is a member of the Securities Investor Protection Corporation (SIPC). You may obtain information about SIPC, including the SIPC brochure, by visiting www.sipc.org or calling SIPC at 202-371-8300.

Fidelity, Fidelity Investments & Pyramid Design, and FAST are registered service marks of FMR LLC. © 2020 FMR LLC. All rights reserved.

Fidelity Real Estate Income Composite Index is a service mark of FMR LLC.

Any third-party marks that may appear above are the marks of their respective owners.

| 1.915428.112 | REI-SUM-0920 |