UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4118

Fidelity Securities Fund

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | July 31 |

|

|

Date of reporting period: | July 31, 2018 |

Item 1.

Reports to Stockholders

|

Fidelity® OTC Portfolio Annual Report July 31, 2018 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2018 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended July 31, 2018 | Past 1 year | Past 5 years | Past 10 years |

| Fidelity® OTC Portfolio | 24.34% | 18.75% | 15.42% |

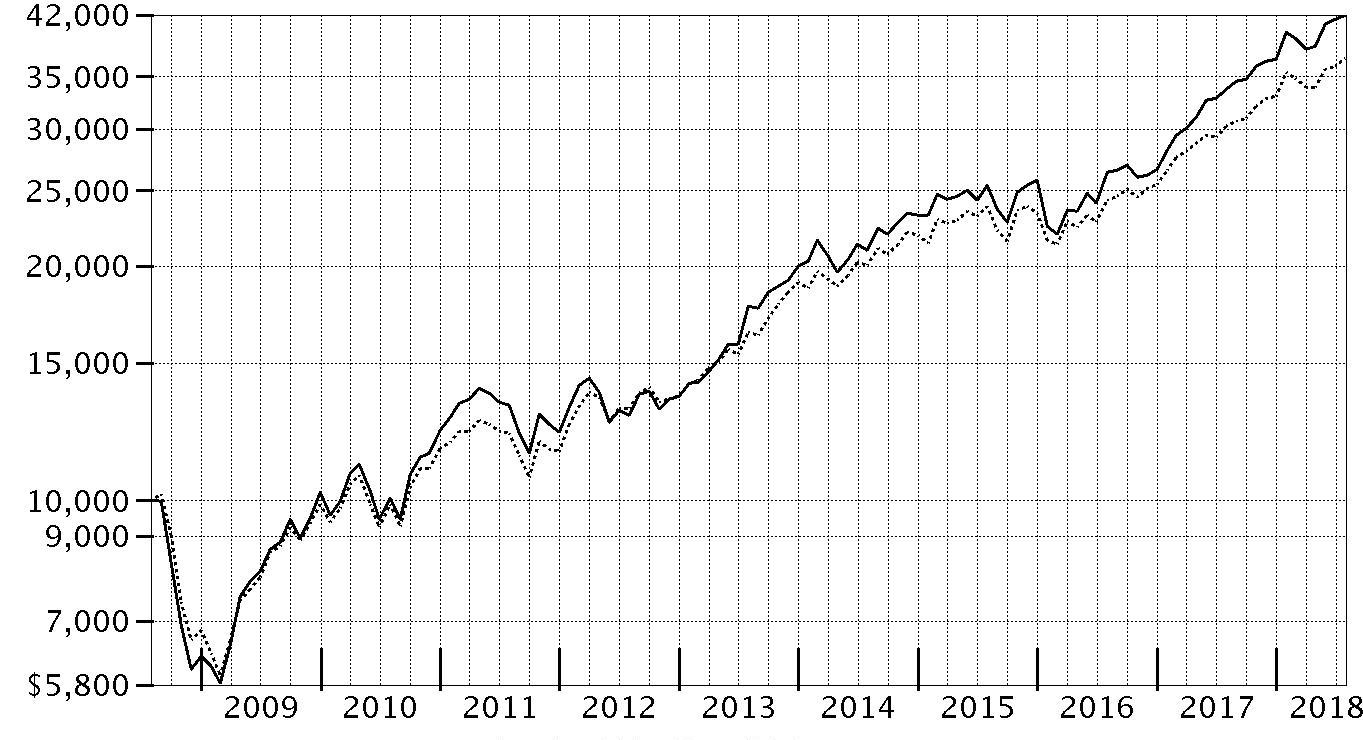

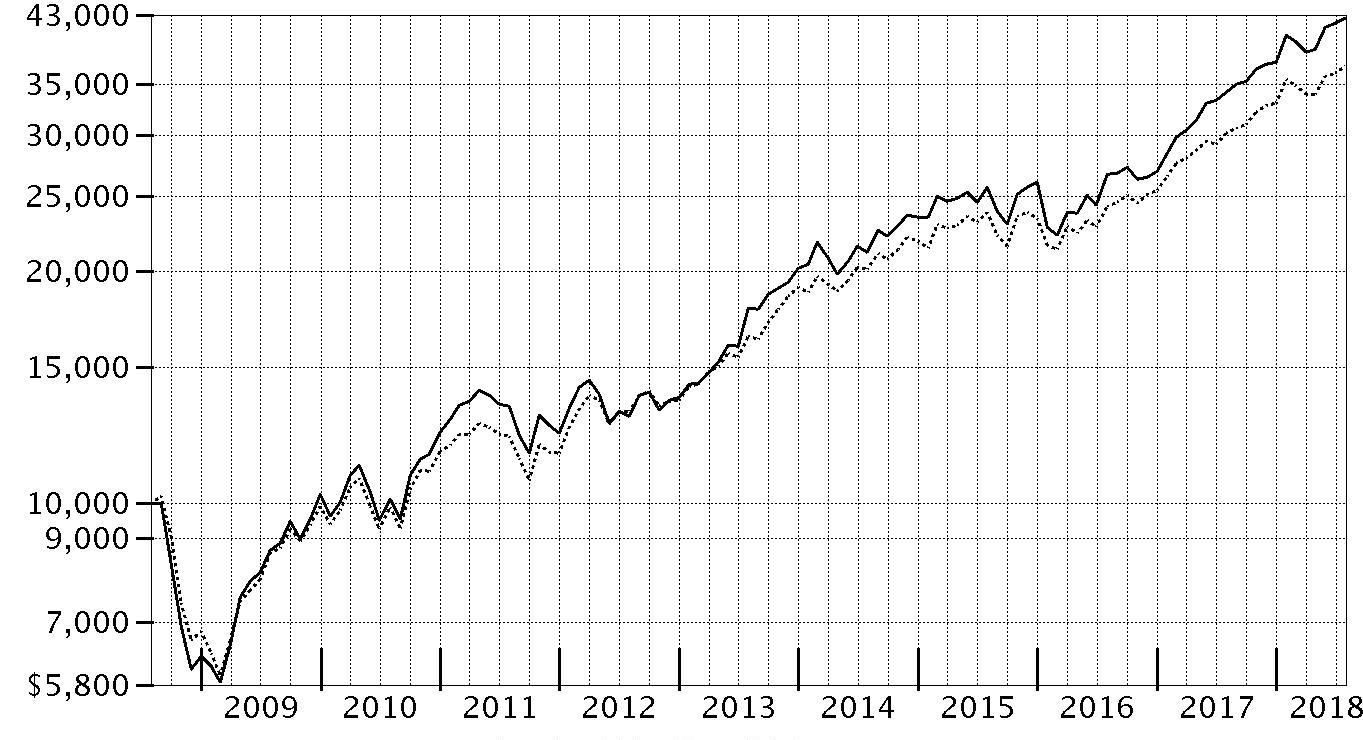

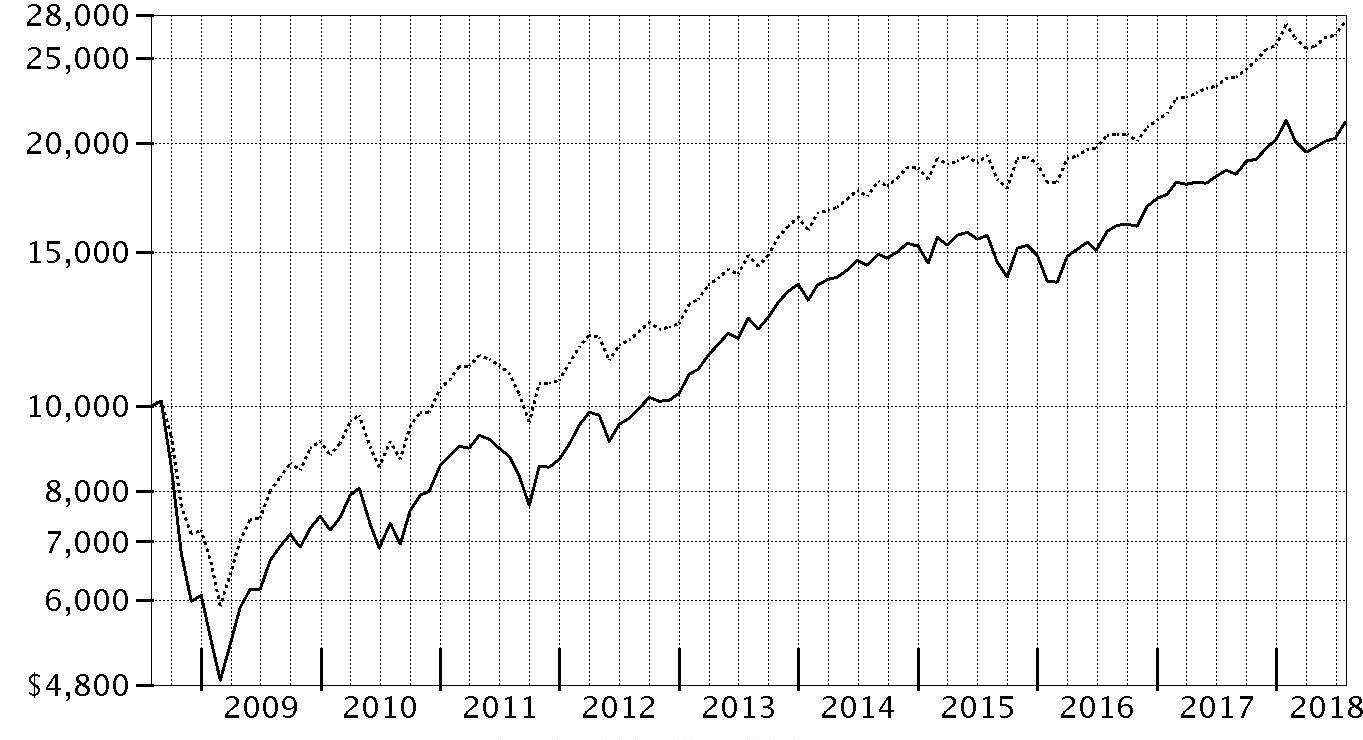

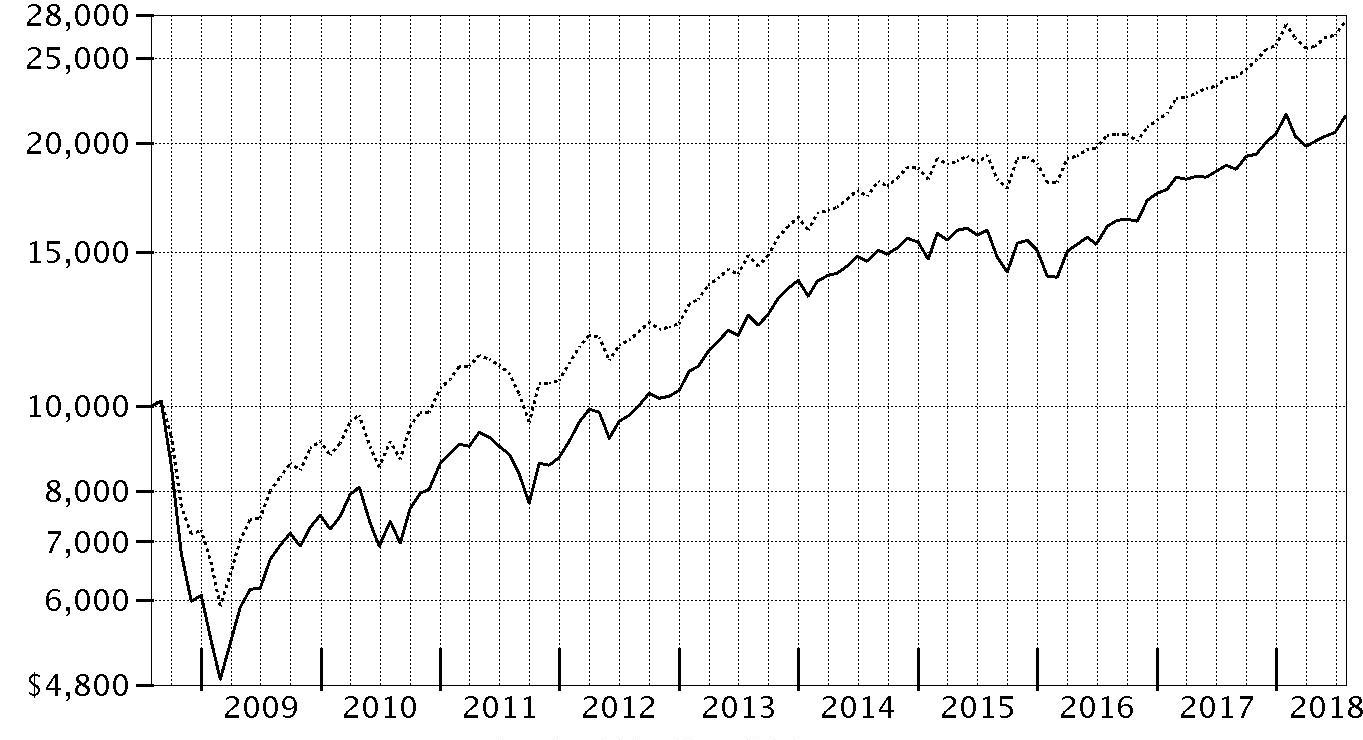

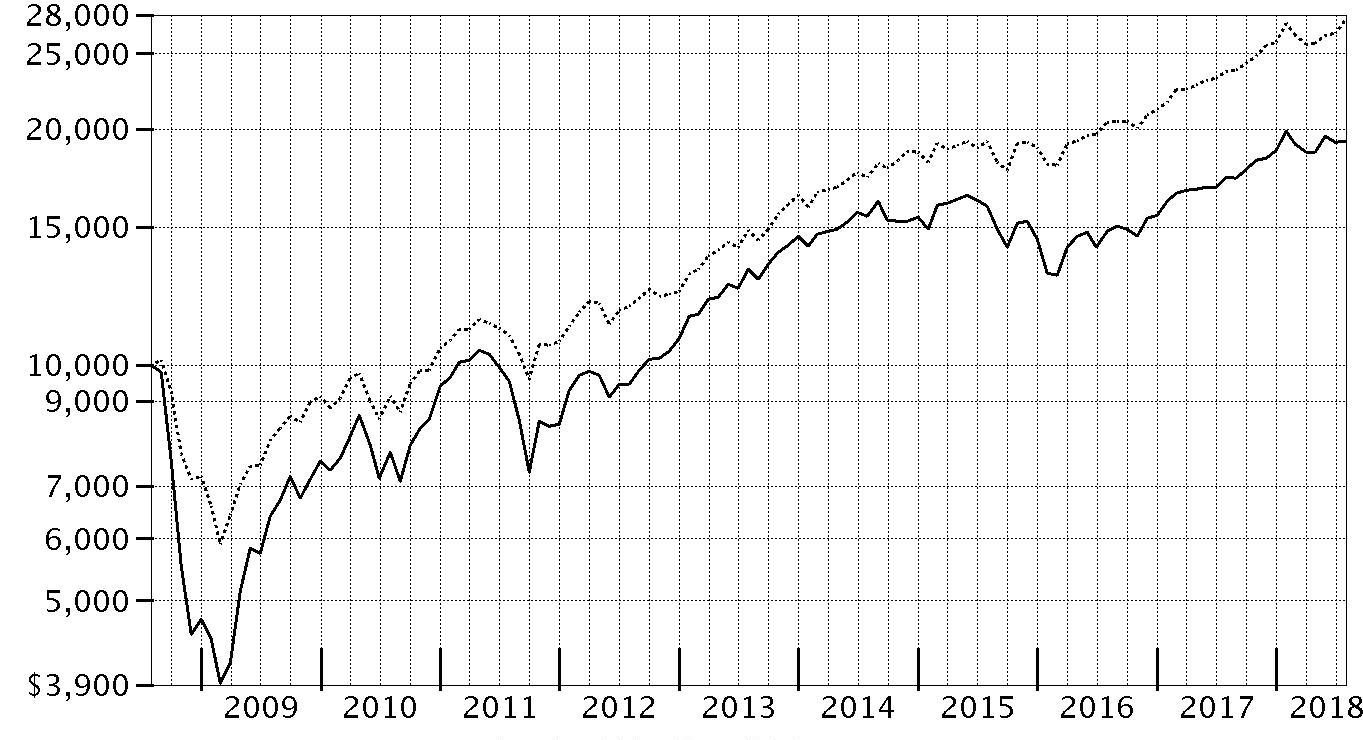

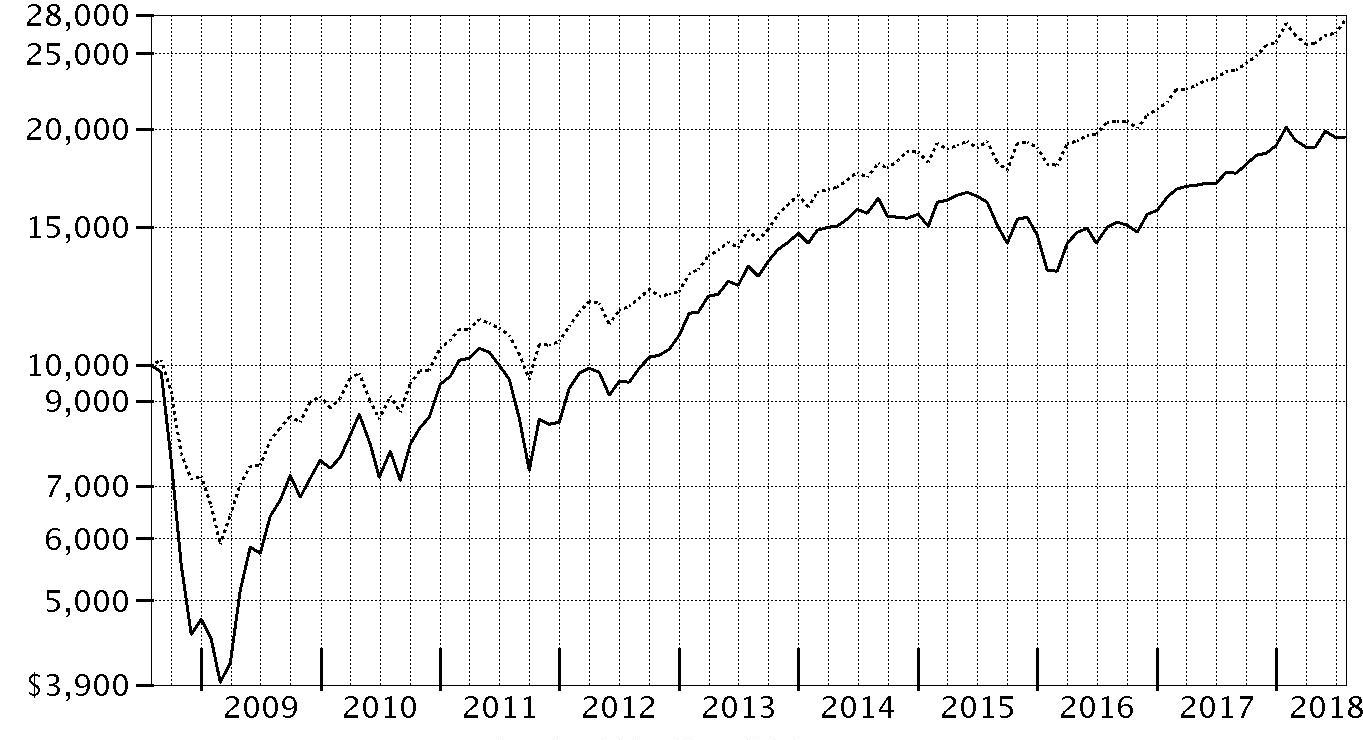

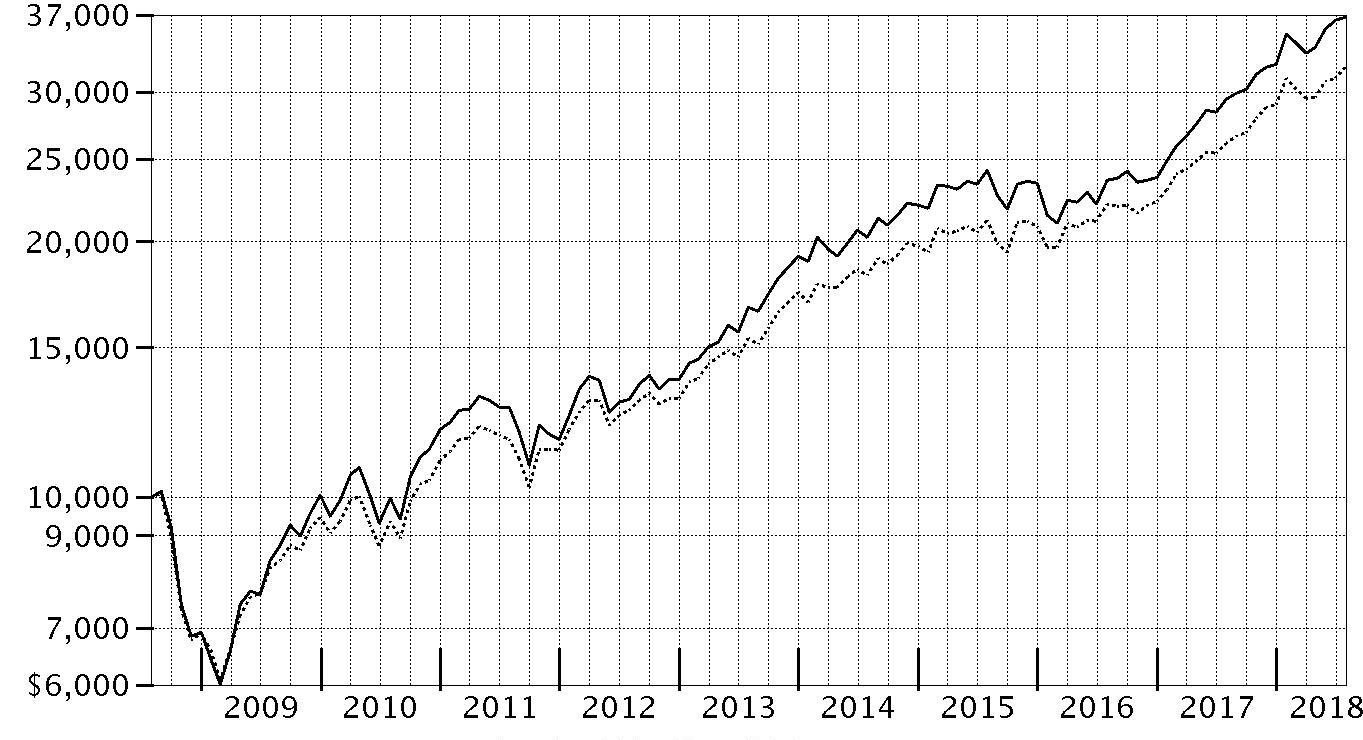

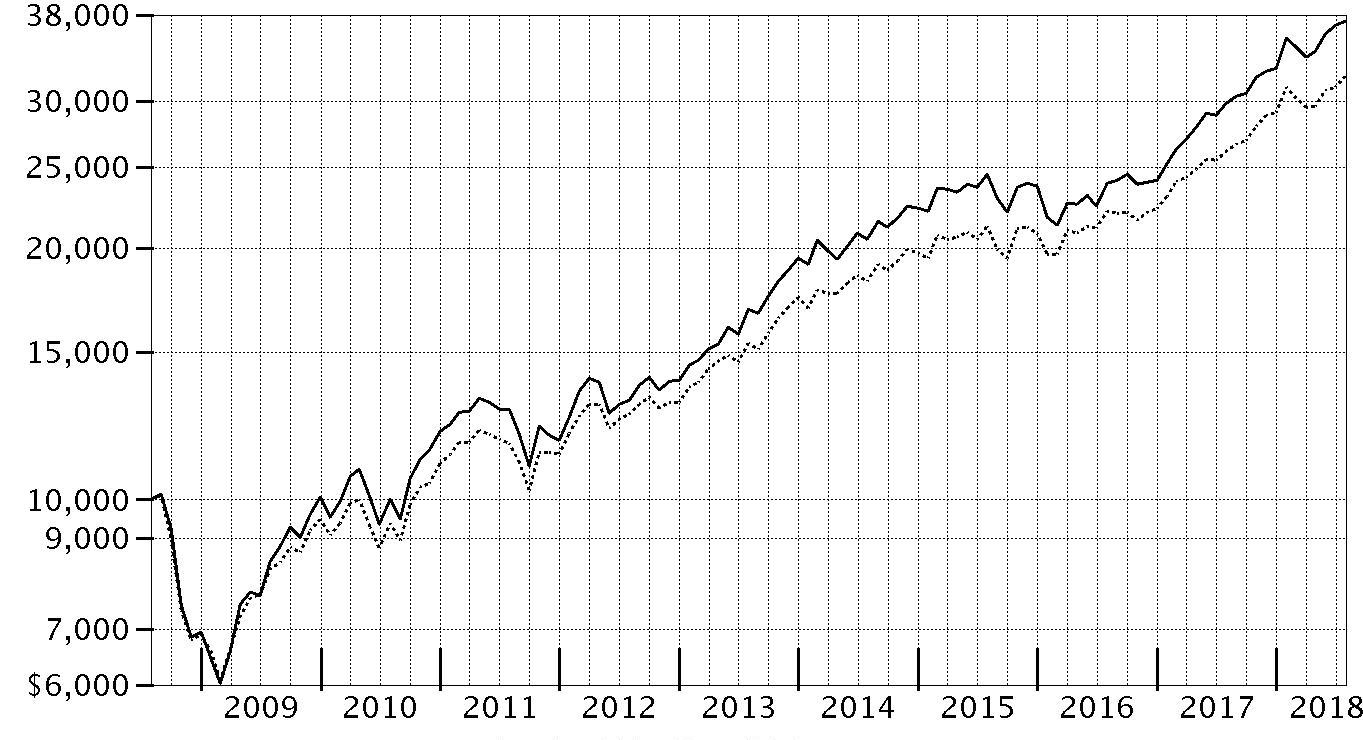

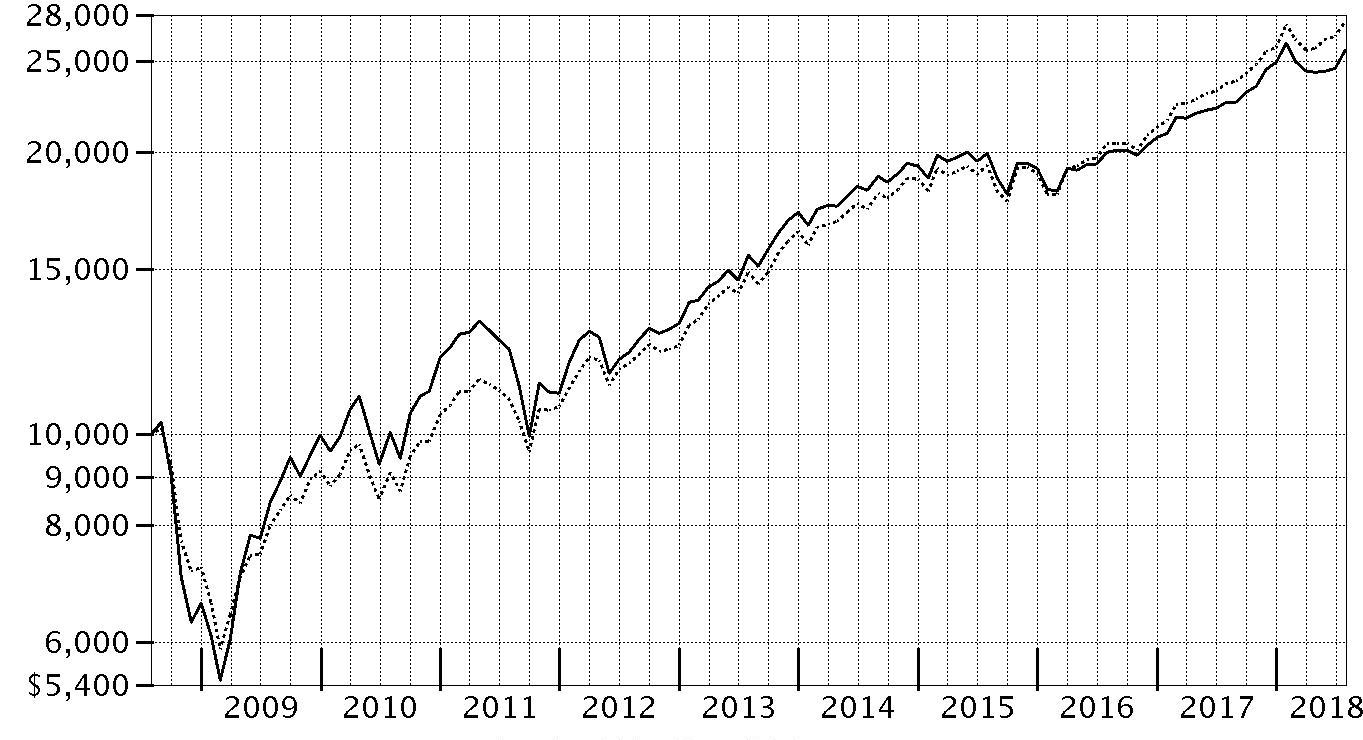

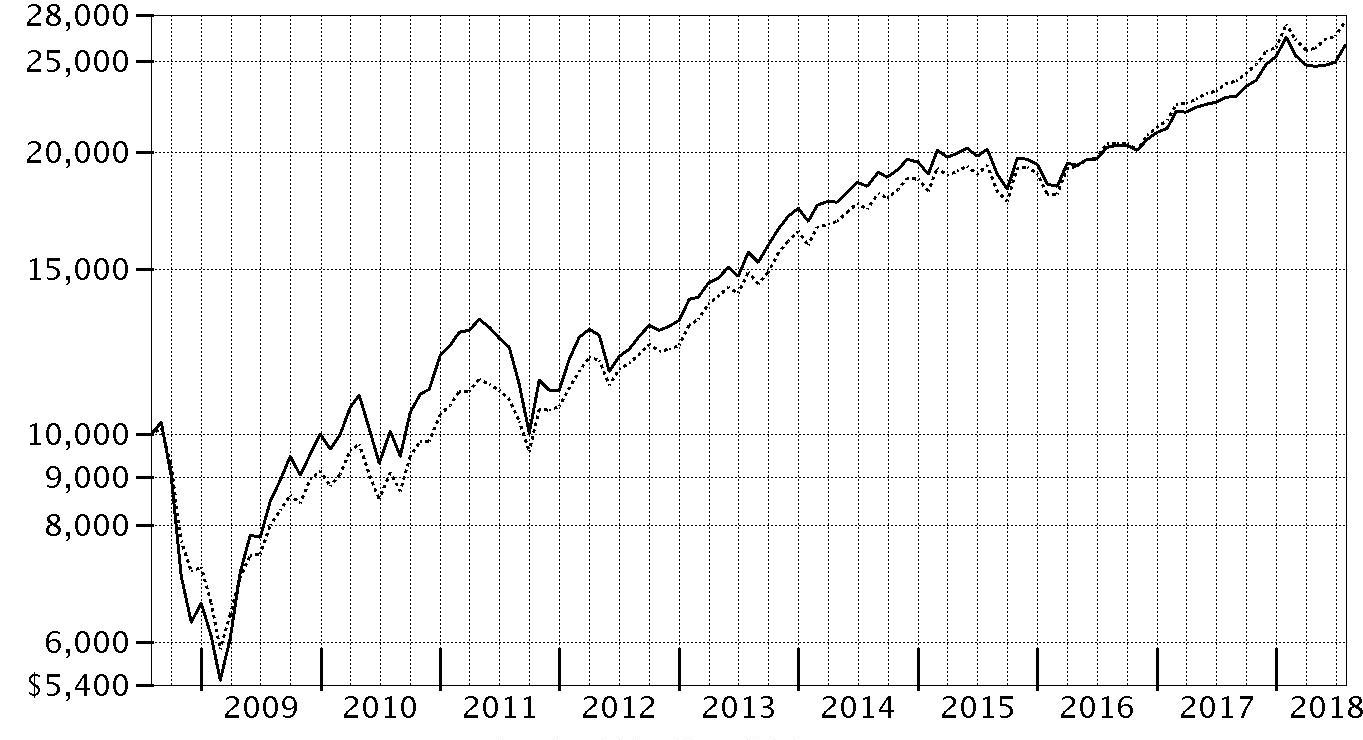

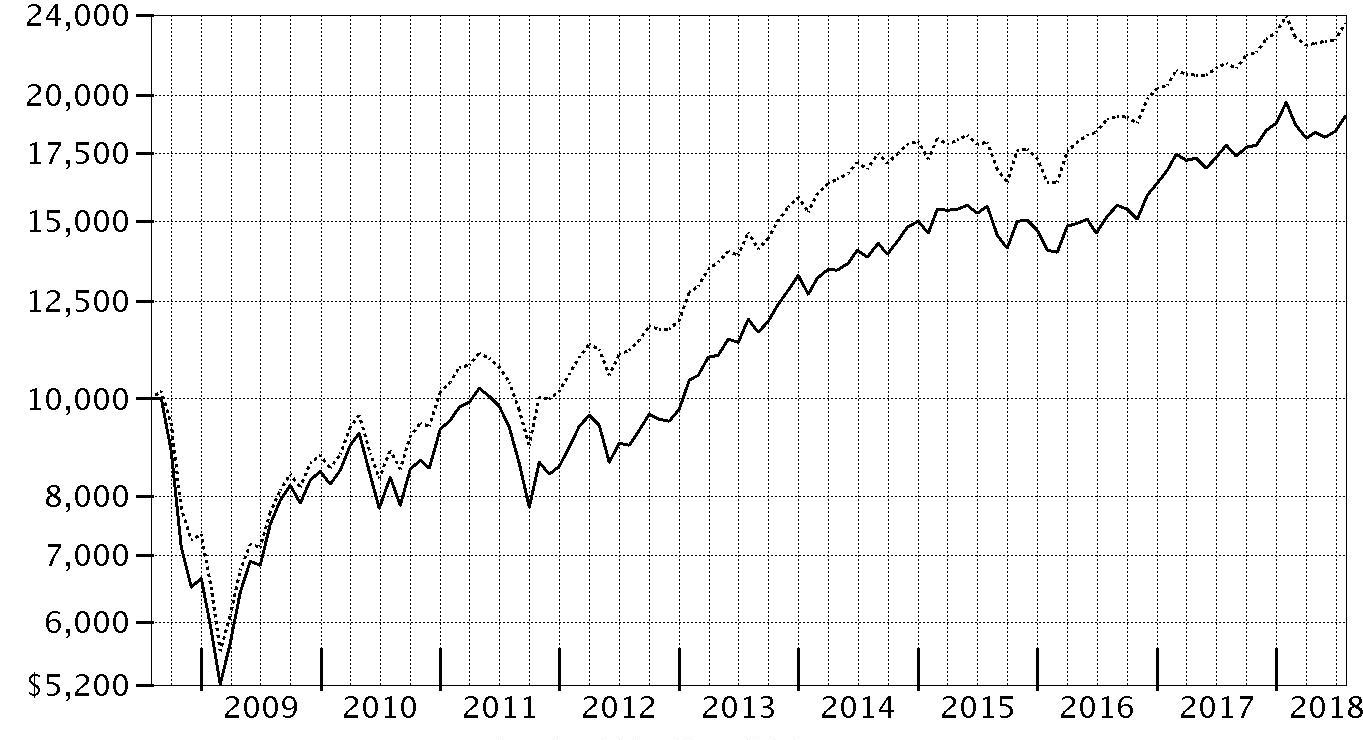

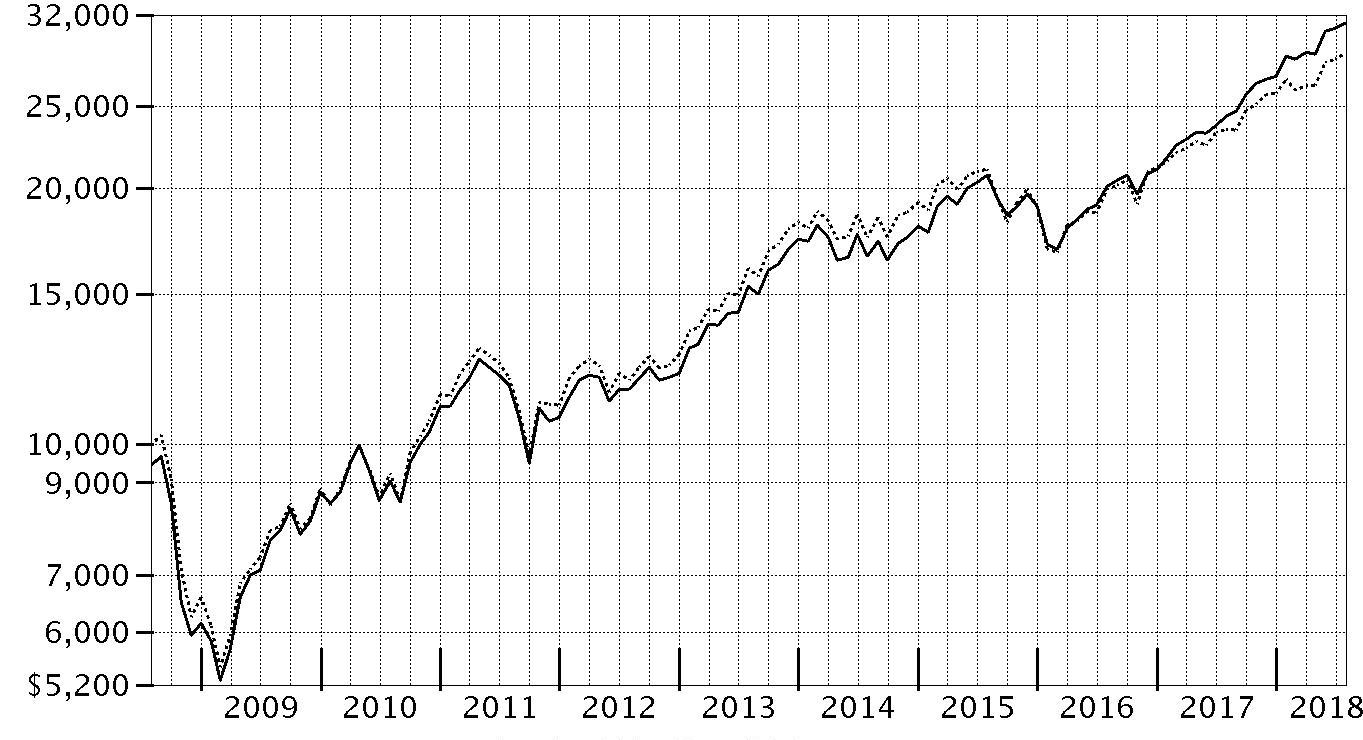

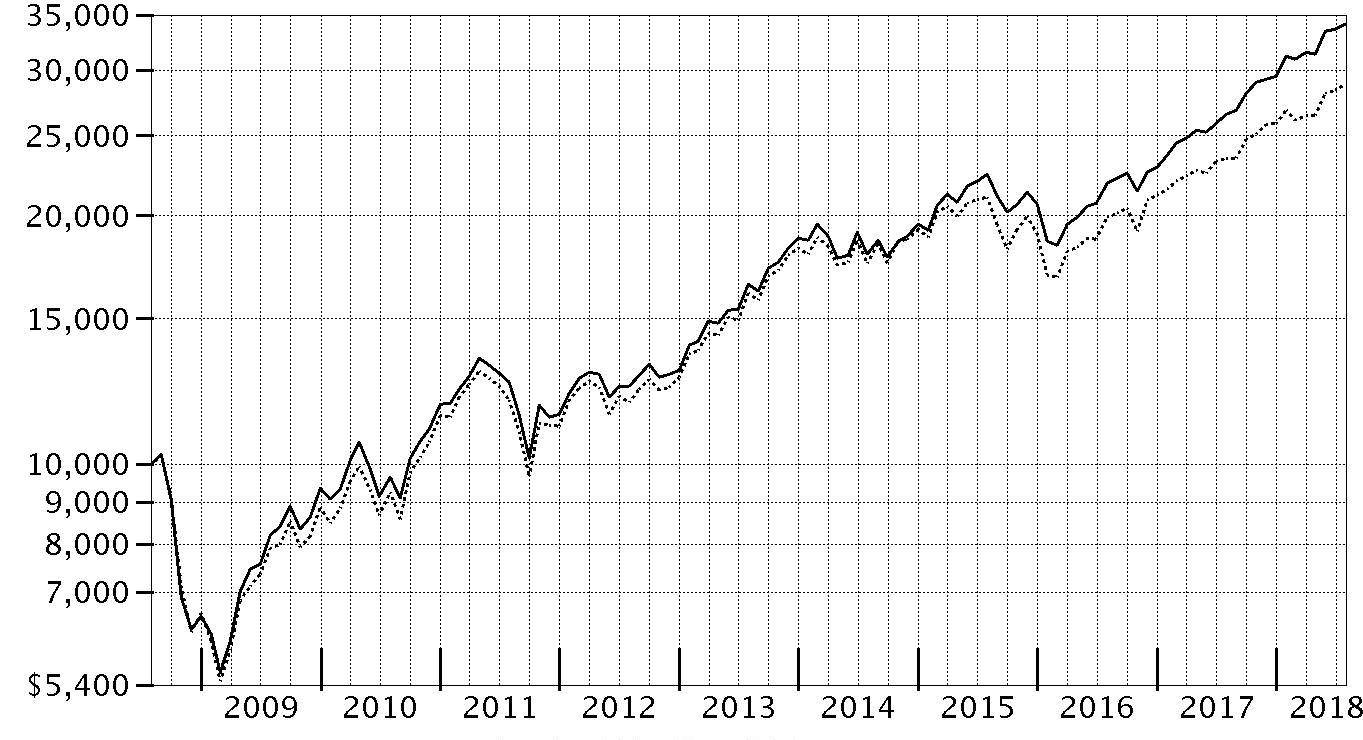

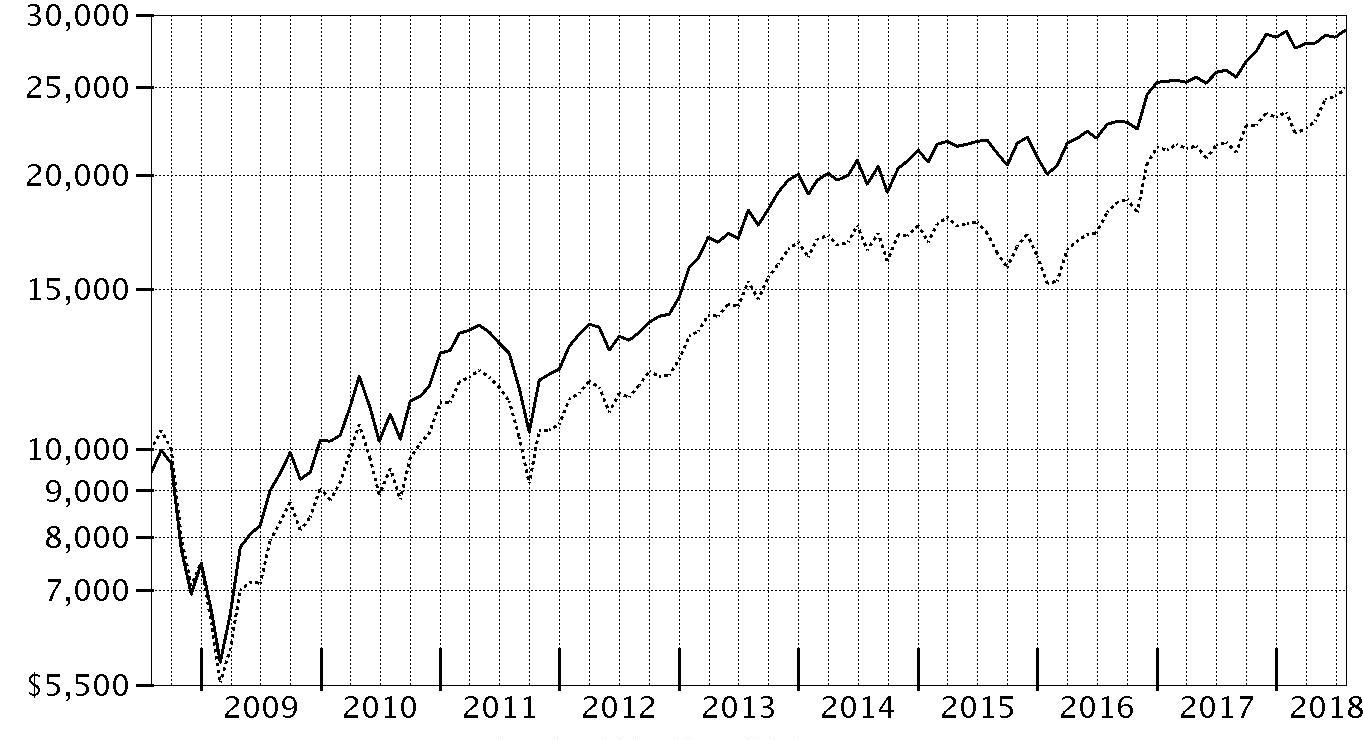

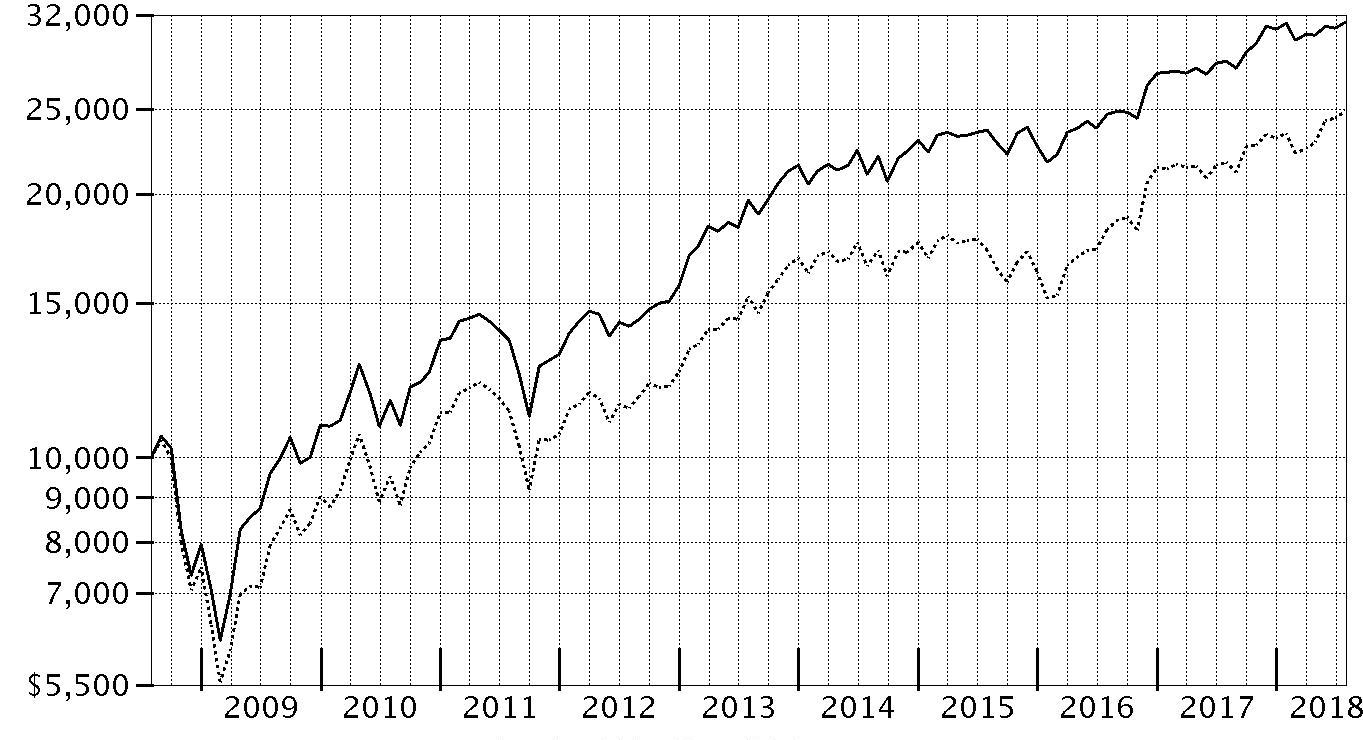

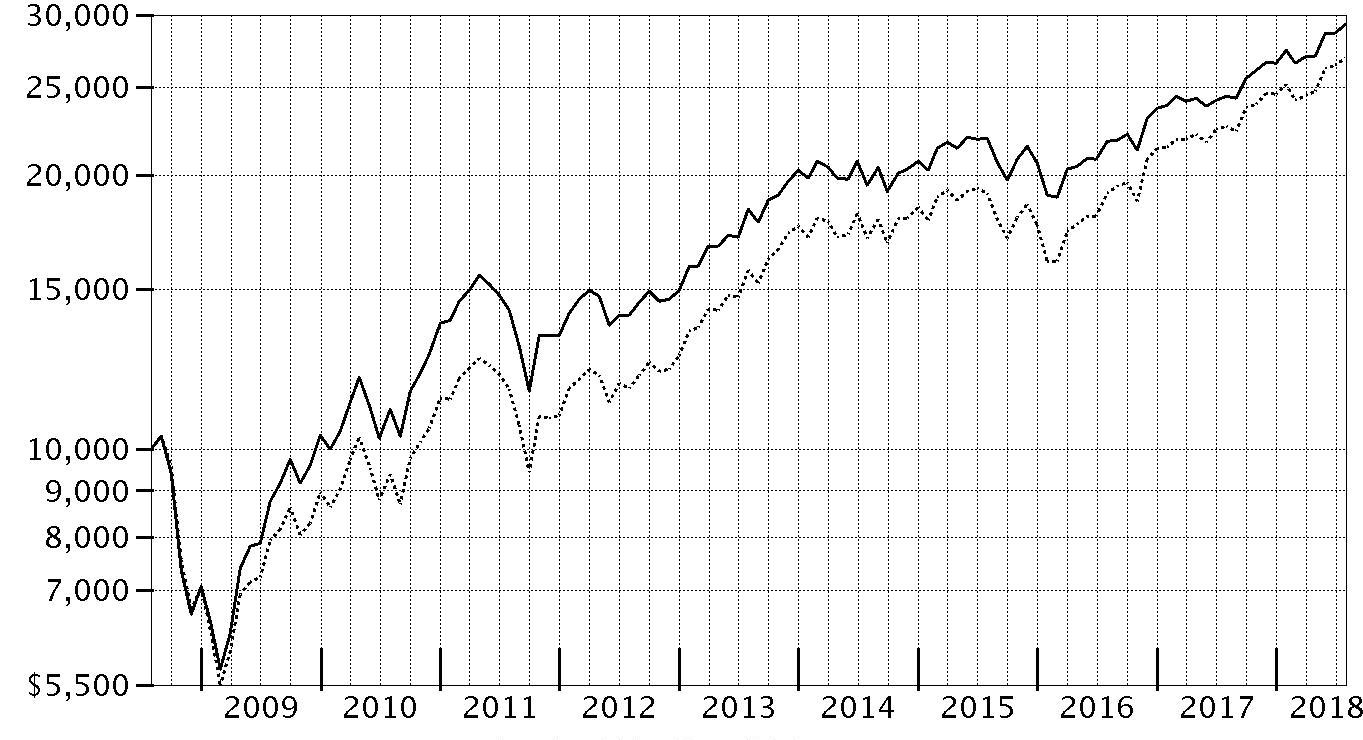

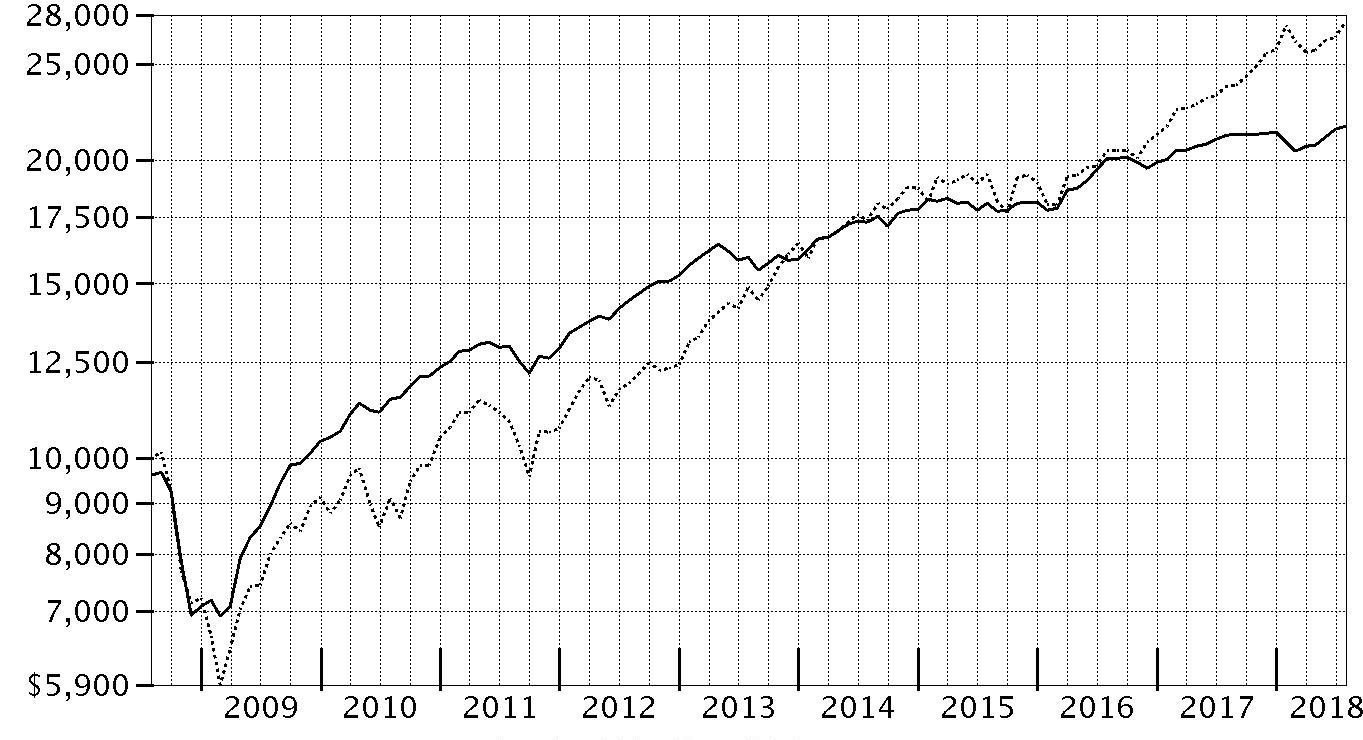

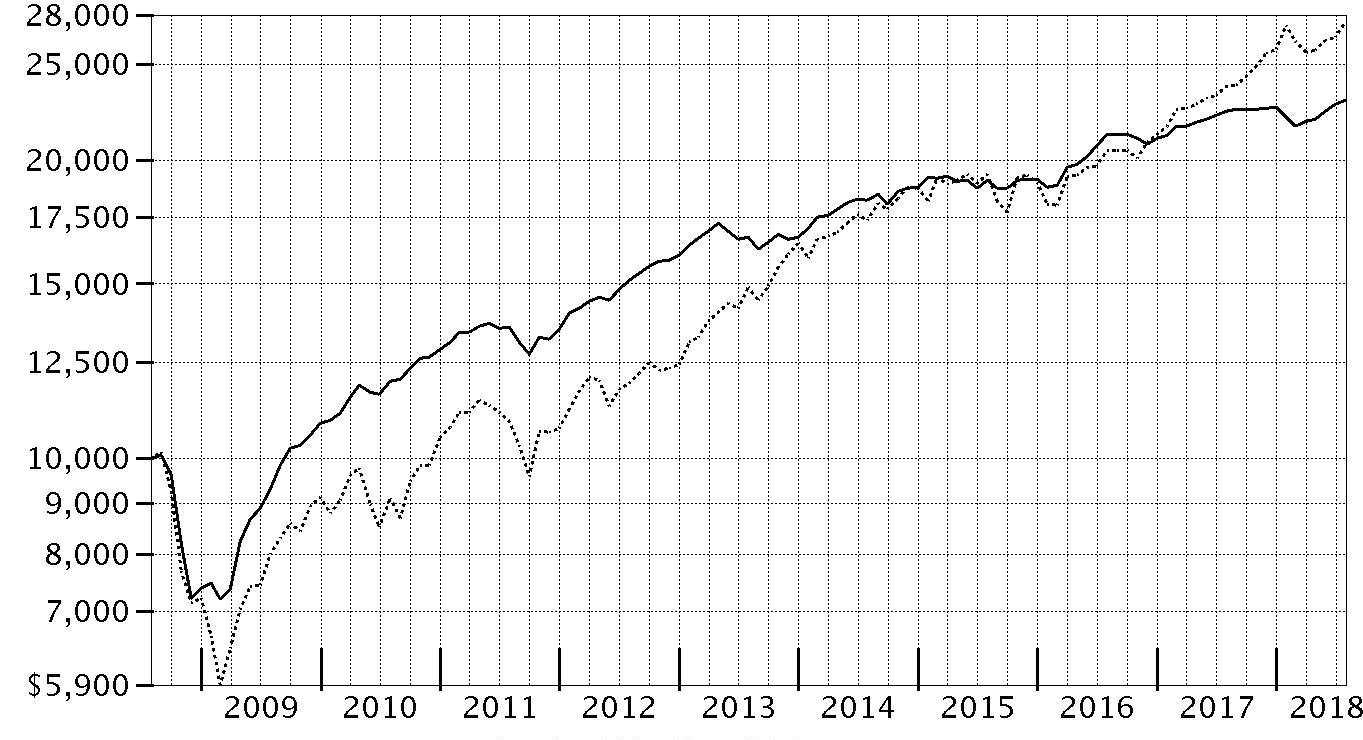

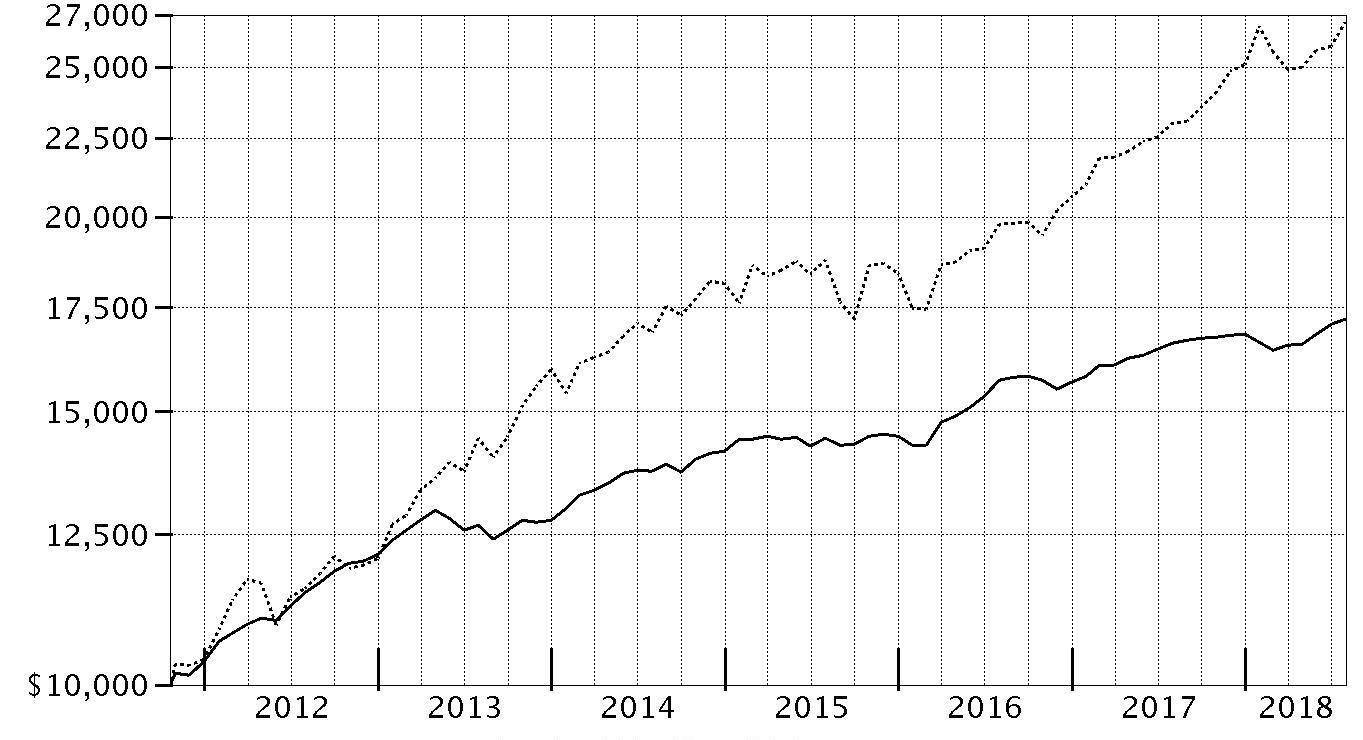

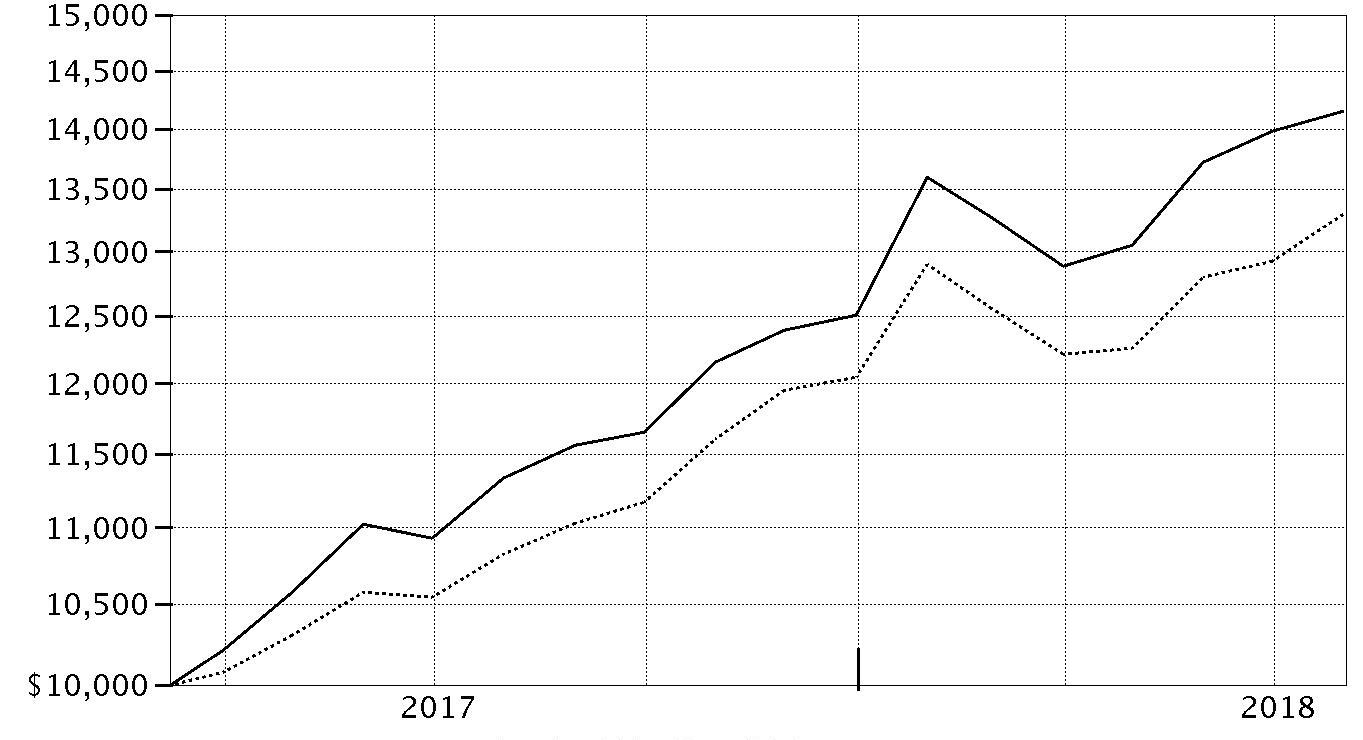

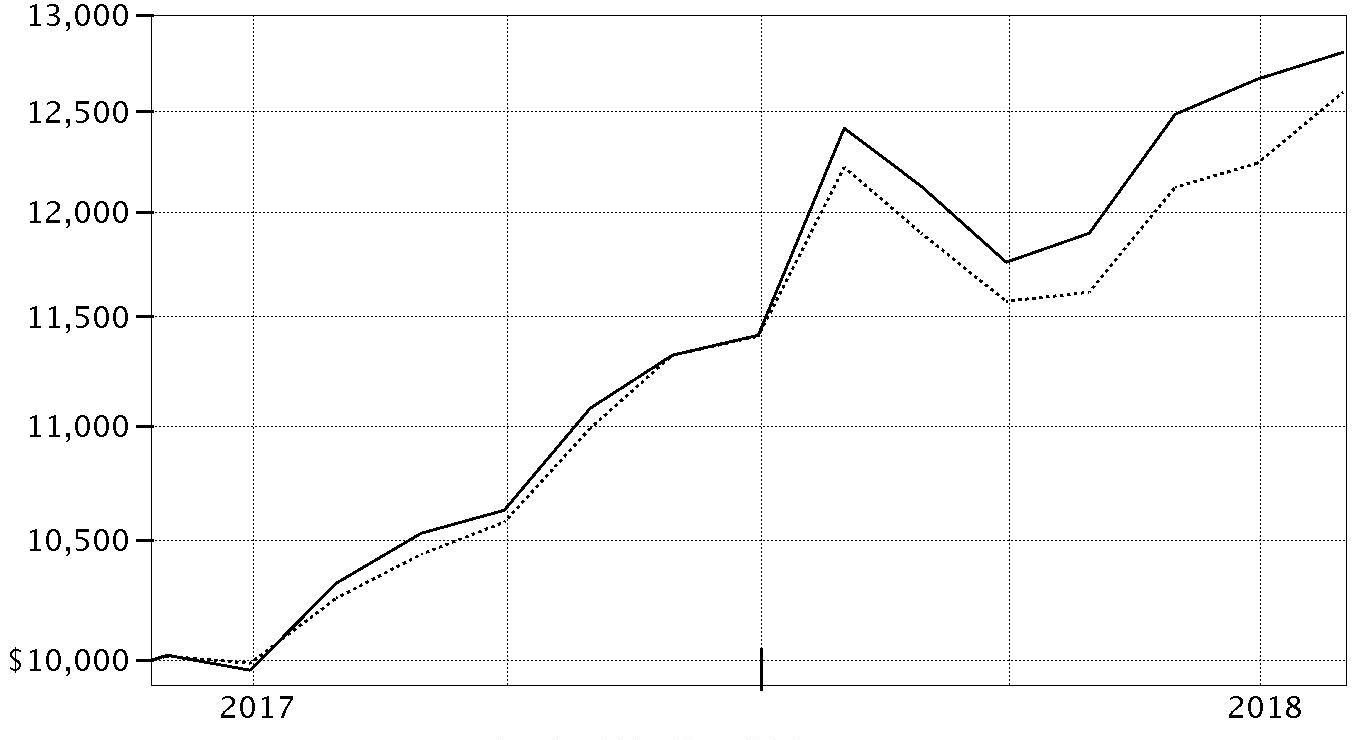

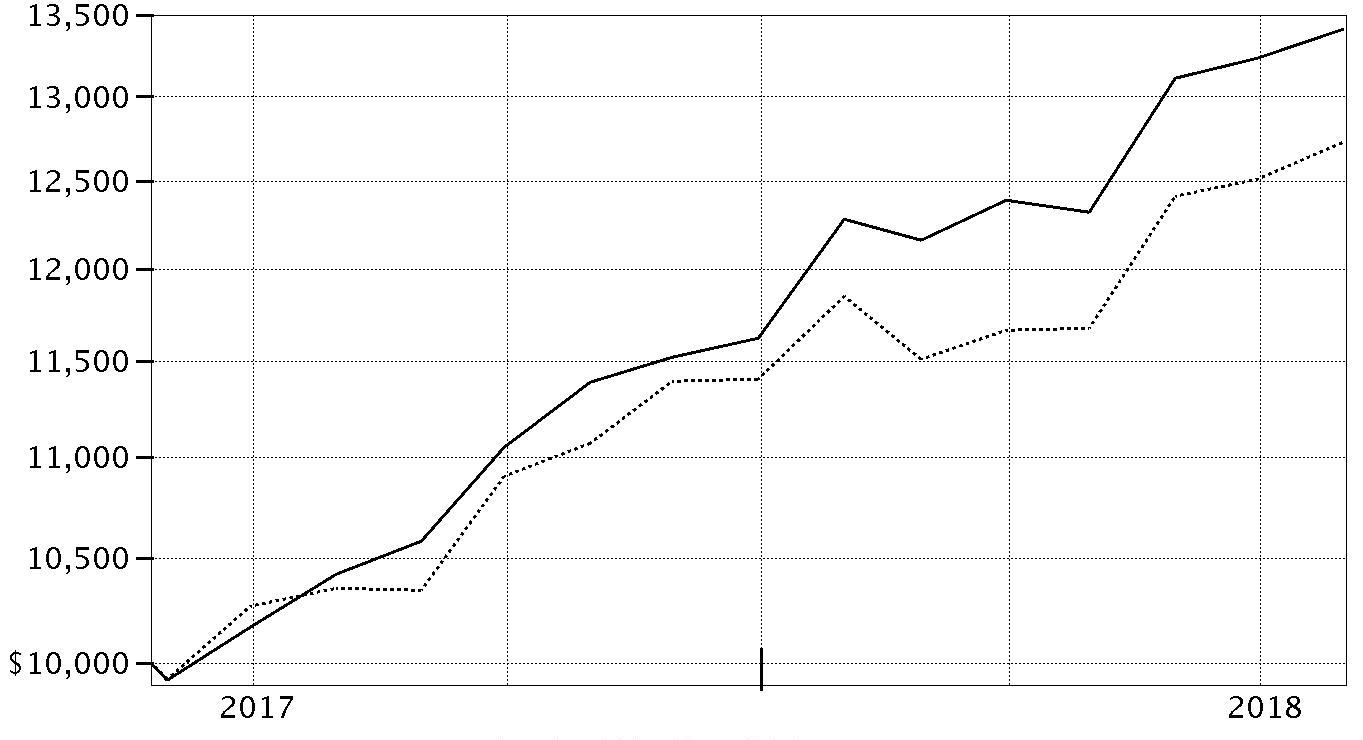

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® OTC Portfolio, a class of the fund, on July 31, 2008.

The chart shows how the value of your investment would have changed, and also shows how the Nasdaq Composite Index® performed over the same period.

See above for additional information regarding the performance of Fidelity® OTC Portfolio.

| Period Ending Values | ||

|

| $41,958 | Fidelity® OTC Portfolio |

|

| $36,912 | Nasdaq Composite Index® |

Management's Discussion of Fund Performance

Market Recap: The U.S. equity bellwether S&P 500® index gained 16.24% for the 12 months ending July 31, 2018, despite a resurgence in volatility that challenged the multiyear bull market. Stocks maintained their steady growth until a sharp reversal in February, as volatility spiked amid fear that rising inflation and the potential for the economy to overheat would prompt the U.S. Federal Reserve to pick up the pace of interest rate hikes. The index posted its first negative monthly result since October 2016, and then lost further ground in March on fear of a global trade war. The market stabilized in April and turned upward through mid-June, when escalating trade tension between the U.S. and China soured investor sentiment. The resulting uncertainty lingered into July, but strong corporate earnings helped the S&P 500 rise 3.72% that month to cap the period. For the full one-year period, growth handily topped value, while small-caps bested large-caps. By sector, information technology (+28%) led the way, boosted by strong earnings growth from several major index constituents. Consumer discretionary rose roughly 24%, driven by retailers (+49%). Energy (+20%) gained alongside higher oil prices. Laggards were telecommunication services (-2%), consumer staples (0%) and utilities (+3%), defensive groups that struggled amid rising interest rates and a general preference for risk. Real estate (+5%) fared a bit better but still lagged, as did financials, industrials, health care (each up 13%) and materials (+11%). Comments from Lead Portfolio Manager Sonu Kalra: For the fiscal year, the fund's share classes advanced about 24%, outpacing the 22.13% gain of the benchmark, the Nasdaq Composite Index®. Versus the benchmark, choices in information technology, which made up more than half of the fund's assets for the 12 months, contributed the most. Picks in the consumer discretionary sector also helped versus the index. French videogame maker UbiSoft Entertainment, a non-index stock, added more value than any other position. The fund's shares of UbiSoft returned about 74% for the period. This firm reported strong quarterly financial results, driven by sales of popular titles, such as Far Cry® 5 and Assassin's Creed® Origins. An overweighting in Nutanix (+130%), a cloud-based storage provider, also contributed notably. Of note, we pared the fund’s positions in each of these holdings by period end to take profits. Conversely, choices in health care detracted. This included the fund’s stake in Tesaro (-72%). The biotechnology firm’s drug for ovarian cancer got off to a slow start, disappointing investors. The fund’s sizable position in Tesla (-8%) also hurt.The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Note to Shareholders: On September 16, 2017, Sonu Kalra and Chris Lin became the fund's Lead Portfolio Manager and Co-Manager, respectively, succeeding Gavin Baker.Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2018

| % of fund's net assets | |

| Apple, Inc. | 8.7 |

| Amazon.com, Inc. | 7.6 |

| Alphabet, Inc. Class A | 7.2 |

| Microsoft Corp. | 4.9 |

| Facebook, Inc. Class A | 4.3 |

| Activision Blizzard, Inc. | 3.6 |

| NVIDIA Corp. | 3.2 |

| Alphabet, Inc. Class C | 2.7 |

| Ubisoft Entertainment SA | 2.2 |

| Tesla, Inc. | 2.1 |

| 46.5 |

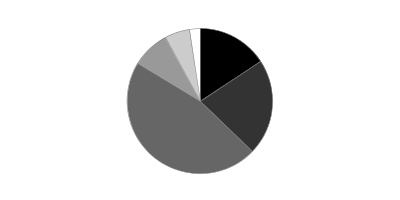

Top Five Market Sectors as of July 31, 2018

| % of fund's net assets | |

| Information Technology | 58.8 |

| Consumer Discretionary | 19.9 |

| Health Care | 9.7 |

| Financials | 4.7 |

| Consumer Staples | 3.1 |

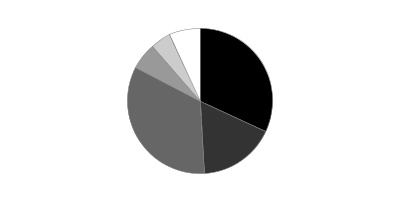

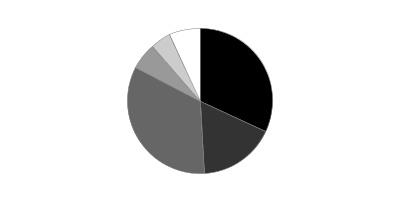

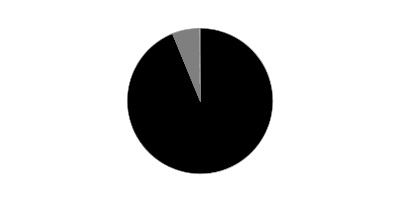

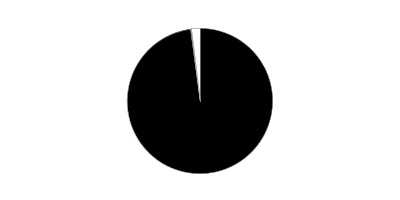

Asset Allocation (% of fund's net assets)

| As of July 31, 2018* | ||

| Stocks | 97.4% | |

| Convertible Securities | 2.6% | |

* Foreign investments - 8.2%

Schedule of Investments July 31, 2018

Showing Percentage of Net Assets

| Common Stocks - 97.4% | |||

| Shares | Value (000s) | ||

| CONSUMER DISCRETIONARY - 19.9% | |||

| Auto Components - 0.0% | |||

| Veoneer, Inc. (a) | 43,800 | $2,291 | |

| Automobiles - 2.1% | |||

| Tesla, Inc. (a)(b) | 1,441,421 | 429,745 | |

| Diversified Consumer Services - 0.1% | |||

| Adtalem Global Education, Inc. (a) | 117,500 | 6,410 | |

| Weight Watchers International, Inc. (a) | 198,200 | 17,745 | |

| 24,155 | |||

| Hotels, Restaurants & Leisure - 2.5% | |||

| Bluegreen Vacations Corp. | 483,200 | 12,423 | |

| Caesars Entertainment Corp. (a) | 734,800 | 8,303 | |

| Chipotle Mexican Grill, Inc. (a) | 67,300 | 29,185 | |

| Churchill Downs, Inc. | 311,800 | 89,159 | |

| Del Frisco's Restaurant Group, Inc. (a) | 494,300 | 4,226 | |

| Eldorado Resorts, Inc. (a) | 44,900 | 1,924 | |

| Hilton Grand Vacations, Inc. (a) | 517,000 | 17,883 | |

| Hilton Worldwide Holdings, Inc. | 121,000 | 9,518 | |

| International Game Technology PLC | 245,700 | 6,211 | |

| Marriott International, Inc. Class A | 1,664,600 | 212,802 | |

| Marriott Vacations Worldwide Corp. | 27,400 | 3,264 | |

| Planet Fitness, Inc. (a) | 462,400 | 21,973 | |

| Restaurant Brands International, Inc. | 69,100 | 4,408 | |

| Royal Caribbean Cruises Ltd. | 142,200 | 16,034 | |

| Texas Roadhouse, Inc. Class A | 161,100 | 10,124 | |

| U.S. Foods Holding Corp. (a) | 1,111,300 | 37,573 | |

| Vail Resorts, Inc. | 9,362 | 2,592 | |

| Wingstop, Inc. | 508,520 | 25,095 | |

| Wyndham Destinations, Inc. | 46,000 | 2,122 | |

| 514,819 | |||

| Internet & Direct Marketing Retail - 10.9% | |||

| Amazon.com, Inc. (a) | 882,608 | 1,568,783 | |

| Groupon, Inc. (a) | 15,337,853 | 71,781 | |

| JD.com, Inc. sponsored ADR (a) | 757,350 | 27,159 | |

| Netflix, Inc. (a) | 836,460 | 282,263 | |

| The Booking Holdings, Inc. (a) | 96,060 | 194,879 | |

| Wayfair LLC Class A (a)(b) | 970,868 | 105,650 | |

| 2,250,515 | |||

| Media - 0.1% | |||

| China Literature Ltd. (a)(c) | 743,800 | 6,221 | |

| The Walt Disney Co. | 94,000 | 10,675 | |

| Turn, Inc. (Escrow) (a)(d)(e) | 1,199,041 | 797 | |

| 17,693 | |||

| Multiline Retail - 1.8% | |||

| Avenue Supermarts Ltd. (a)(c) | 101,832 | 2,462 | |

| Dollar Tree, Inc. (a) | 3,976,200 | 362,948 | |

| 365,410 | |||

| Specialty Retail - 1.2% | |||

| Burlington Stores, Inc. (a) | 164,900 | 25,198 | |

| Five Below, Inc. (a) | 306,300 | 29,760 | |

| Lowe's Companies, Inc. | 666,300 | 66,190 | |

| Michaels Companies, Inc. (a) | 112,100 | 2,288 | |

| Ross Stores, Inc. | 1,121,000 | 98,009 | |

| Ulta Beauty, Inc. (a) | 112,410 | 27,472 | |

| Urban Outfitters, Inc. (a) | 200,100 | 8,884 | |

| 257,801 | |||

| Textiles, Apparel & Luxury Goods - 1.2% | |||

| Carbon Black, Inc. | 30,800 | 639 | |

| Columbia Sportswear Co. | 77,800 | 6,767 | |

| Crinetics Pharmaceuticals, Inc. (a) | 95,500 | 2,350 | |

| Despegar.com Corp. (b) | 406,400 | 8,543 | |

| G-III Apparel Group Ltd. (a) | 194,900 | 8,907 | |

| GreenSky, Inc. Class A | 170,400 | 2,948 | |

| Homology Medicines, Inc. (a)(b) | 152,300 | 2,682 | |

| Kering SA | 111,200 | 59,294 | |

| lululemon athletica, Inc. (a) | 1,052,474 | 126,244 | |

| LVMH Moet Hennessy - Louis Vuitton SA | 5,927 | 2,065 | |

| Pinduoduo, Inc. ADR | 162,900 | 3,680 | |

| Prada SpA | 1,916,400 | 9,119 | |

| PVH Corp. | 78,700 | 12,082 | |

| Rubius Therapeutics, Inc. (a) | 100,500 | 2,111 | |

| Scholar Rock Holding Corp. | 100,500 | 1,632 | |

| Under Armour, Inc. Class C (non-vtg.) (a) | 146,700 | 2,749 | |

| 251,812 | |||

| TOTAL CONSUMER DISCRETIONARY | 4,114,241 | ||

| CONSUMER STAPLES - 2.9% | |||

| Beverages - 0.8% | |||

| Keurig Dr. Pepper, Inc. | 318,900 | 7,657 | |

| Monster Beverage Corp. (a) | 975,540 | 58,552 | |

| PepsiCo, Inc. | 831,700 | 95,646 | |

| 161,855 | |||

| Food & Staples Retailing - 1.5% | |||

| BJ's Wholesale Club Holdings, Inc. | 892,000 | 22,113 | |

| Costco Wholesale Corp. | 1,145,683 | 250,572 | |

| Performance Food Group Co. (a) | 1,114,900 | 39,969 | |

| 312,654 | |||

| Food Products - 0.5% | |||

| Darling International, Inc. (a) | 425,700 | 8,552 | |

| Mondelez International, Inc. | 863,752 | 37,470 | |

| The Kraft Heinz Co. | 1,021,600 | 61,551 | |

| 107,573 | |||

| Personal Products - 0.1% | |||

| Coty, Inc. Class A | 1,139,100 | 15,275 | |

| TOTAL CONSUMER STAPLES | 597,357 | ||

| ENERGY - 1.2% | |||

| Oil, Gas & Consumable Fuels - 1.2% | |||

| Anadarko Petroleum Corp. | 40,900 | 2,992 | |

| Andeavor | 31,400 | 4,712 | |

| BP PLC sponsored ADR | 126,314 | 5,695 | |

| Cenovus Energy, Inc. | 189,900 | 1,905 | |

| Centennial Resource Development, Inc. Class A (a) | 1,030,700 | 18,511 | |

| Delek U.S. Holdings, Inc. | 76,600 | 4,084 | |

| Diamondback Energy, Inc. | 852,000 | 112,421 | |

| EOG Resources, Inc. | 15,700 | 2,024 | |

| Extraction Oil & Gas, Inc. (a) | 401,108 | 6,065 | |

| Marathon Petroleum Corp. | 24,500 | 1,980 | |

| Reliance Industries Ltd. | 1,937,273 | 33,561 | |

| Valero Energy Corp. | 49,500 | 5,858 | |

| Whiting Petroleum Corp. (a) | 821,700 | 40,797 | |

| 240,605 | |||

| FINANCIALS - 4.7% | |||

| Banks - 1.7% | |||

| Bank of America Corp. | 644,700 | 19,908 | |

| Bank of the Ozarks, Inc. | 347,100 | 14,196 | |

| BOK Financial Corp. | 55,600 | 5,412 | |

| Citigroup, Inc. | 300,100 | 21,574 | |

| Commerce Bancshares, Inc. | 711,986 | 47,561 | |

| Cullen/Frost Bankers, Inc. | 81,400 | 8,994 | |

| Fifth Third Bancorp | 334,700 | 9,904 | |

| Huntington Bancshares, Inc. | 7,737,500 | 119,467 | |

| Investors Bancorp, Inc. | 2,669,000 | 33,416 | |

| PacWest Bancorp | 1,035,200 | 51,988 | |

| UMB Financial Corp. | 346,200 | 24,888 | |

| 357,308 | |||

| Capital Markets - 2.4% | |||

| BlackRock, Inc. Class A | 46,100 | 23,177 | |

| Carlyle Group LP | 630,500 | 15,353 | |

| Cboe Global Markets, Inc. | 40,800 | 3,963 | |

| Charles Schwab Corp. | 337,300 | 17,223 | |

| CME Group, Inc. | 155,600 | 24,759 | |

| E*TRADE Financial Corp. (a) | 906,520 | 54,219 | |

| Monex Group, Inc. (b) | 600,400 | 2,985 | |

| Morgan Stanley | 167,900 | 8,489 | |

| Northern Trust Corp. | 888,700 | 97,064 | |

| T. Rowe Price Group, Inc. | 16,600 | 1,977 | |

| TD Ameritrade Holding Corp. | 4,029,500 | 230,286 | |

| Virtu Financial, Inc. Class A | 389,200 | 7,842 | |

| 487,337 | |||

| Consumer Finance - 0.6% | |||

| Capital One Financial Corp. | 1,227,300 | 115,759 | |

| Diversified Financial Services - 0.0% | |||

| Allakos, Inc. (a) | 59,700 | 2,434 | |

| GDS Holdings Ltd. ADR (a) | 67,900 | 1,482 | |

| 3,916 | |||

| TOTAL FINANCIALS | 964,320 | ||

| HEALTH CARE - 9.2% | |||

| Biotechnology - 6.7% | |||

| Acceleron Pharma, Inc. (a) | 44,100 | 1,921 | |

| Adamas Pharmaceuticals, Inc. (a)(b) | 143,100 | 3,403 | |

| Agios Pharmaceuticals, Inc. (a) | 148,535 | 12,835 | |

| Alexion Pharmaceuticals, Inc. (a) | 1,094,089 | 145,470 | |

| Alkermes PLC (a) | 1,236,536 | 54,222 | |

| Alnylam Pharmaceuticals, Inc. (a) | 277,300 | 26,344 | |

| Amgen, Inc. | 1,173,434 | 230,638 | |

| AnaptysBio, Inc. (a) | 101,300 | 7,934 | |

| Arena Pharmaceuticals, Inc. (a) | 134,300 | 5,183 | |

| Atara Biotherapeutics, Inc. (a) | 40,700 | 1,528 | |

| Audentes Therapeutics, Inc. (a) | 49,600 | 1,867 | |

| BeiGene Ltd. ADR (a) | 52,900 | 10,033 | |

| BioMarin Pharmaceutical, Inc. (a) | 152,256 | 15,311 | |

| bluebird bio, Inc. (a) | 389,726 | 60,369 | |

| Blueprint Medicines Corp. (a) | 151,900 | 9,044 | |

| Celgene Corp. (a) | 171,000 | 15,405 | |

| Cellectis SA sponsored ADR (a)(b) | 402,400 | 11,629 | |

| Chimerix, Inc. (a) | 52,700 | 236 | |

| Coherus BioSciences, Inc. (a) | 1,199,902 | 22,858 | |

| CytomX Therapeutics, Inc. (a) | 485,000 | 12,775 | |

| CytomX Therapeutics, Inc. (a)(c) | 244,269 | 6,434 | |

| DBV Technologies SA sponsored ADR (a) | 1,065,500 | 19,211 | |

| Deciphera Pharmaceuticals, Inc. (a) | 50,800 | 1,748 | |

| Denali Therapeutics, Inc. (a)(b) | 829,800 | 10,447 | |

| Dicerna Pharmaceuticals, Inc. (a) | 307,207 | 3,871 | |

| Editas Medicine, Inc. (a) | 200,244 | 5,955 | |

| Epizyme, Inc. (a) | 127,000 | 1,638 | |

| FibroGen, Inc. (a) | 195,200 | 12,317 | |

| Flexion Therapeutics, Inc. (a)(b) | 124,500 | 2,971 | |

| GenSight Biologics SA (a)(c) | 243,848 | 613 | |

| Heron Therapeutics, Inc. (a) | 1,252,815 | 46,918 | |

| ImmunoGen, Inc.(a) | 373,100 | 3,470 | |

| Intercept Pharmaceuticals, Inc. (a) | 417,919 | 38,089 | |

| Ionis Pharmaceuticals, Inc. (a) | 428,902 | 18,734 | |

| Iovance Biotherapeutics, Inc. (a) | 360,400 | 5,118 | |

| Ironwood Pharmaceuticals, Inc. Class A (a) | 1,934,842 | 37,304 | |

| Jounce Therapeutics, Inc. (a)(b) | 561,463 | 3,964 | |

| Macrogenics, Inc. (a) | 162,600 | 3,358 | |

| Madrigal Pharmaceuticals, Inc. (a) | 6,500 | 1,671 | |

| Neurocrine Biosciences, Inc. (a) | 811,400 | 81,538 | |

| Ovid Therapeutics, Inc. (a) | 300,536 | 2,999 | |

| Portola Pharmaceuticals, Inc. (a) | 319,598 | 11,442 | |

| Regeneron Pharmaceuticals, Inc. (a) | 561,800 | 206,748 | |

| Sage Therapeutics, Inc. (a) | 233,275 | 33,666 | |

| Sarepta Therapeutics, Inc. (a) | 289,300 | 33,628 | |

| Spark Therapeutics, Inc. (a) | 334,290 | 25,647 | |

| Spectrum Pharmaceuticals, Inc. (a) | 371,400 | 7,907 | |

| Surface Oncology, Inc. | 133,100 | 1,472 | |

| TESARO, Inc. (a)(b) | 701,600 | 24,437 | |

| Trevena, Inc. (a) | 512,521 | 789 | |

| Ultragenyx Pharmaceutical, Inc. (a) | 112,096 | 8,868 | |

| uniQure B.V. (a) | 535,500 | 16,542 | |

| Vertex Pharmaceuticals, Inc. (a) | 145,900 | 25,540 | |

| Xencor, Inc. (a) | 744,287 | 27,702 | |

| Zai Lab Ltd. ADR | 130,900 | 2,869 | |

| 1,384,630 | |||

| Health Care Equipment & Supplies - 0.8% | |||

| Align Technology, Inc. (a) | 42,700 | 15,229 | |

| AxoGen, Inc. (a) | 86,000 | 3,864 | |

| Boston Scientific Corp. (a) | 812,400 | 27,305 | |

| DexCom, Inc. (a) | 122,300 | 11,634 | |

| Inogen, Inc. (a) | 32,500 | 6,476 | |

| Insulet Corp. (a) | 103,500 | 8,607 | |

| Intuitive Surgical, Inc. (a) | 146,746 | 74,575 | |

| Quanterix Corp. (a) | 229,300 | 3,437 | |

| ViewRay, Inc. (a)(b) | 431,200 | 5,140 | |

| 156,267 | |||

| Health Care Providers & Services - 0.3% | |||

| G1 Therapeutics, Inc. (a) | 322,672 | 16,569 | |

| National Vision Holdings, Inc. | 597,595 | 24,298 | |

| Neuronetics, Inc. | 44,300 | 1,105 | |

| OptiNose, Inc. | 472,328 | 9,612 | |

| OptiNose, Inc. (c) | 382,170 | 7,777 | |

| R1 RCM, Inc. (a) | 723,402 | 5,802 | |

| UnitedHealth Group, Inc. | 8,100 | 2,051 | |

| 67,214 | |||

| Health Care Technology - 0.5% | |||

| athenahealth, Inc. (a) | 615,283 | 92,729 | |

| Castlight Health, Inc. Class B (a) | 53,000 | 175 | |

| Teladoc, Inc. (a) | 197,200 | 11,802 | |

| 104,706 | |||

| Life Sciences Tools & Services - 0.0% | |||

| Illumina, Inc. (a) | 7,100 | 2,303 | |

| Pharmaceuticals - 0.9% | |||

| Akcea Therapeutics, Inc. | 119,720 | 3,786 | |

| Allergan PLC | 26,500 | 4,878 | |

| AstraZeneca PLC sponsored ADR | 612,800 | 23,979 | |

| Castle Creek Pharmaceuticals, LLC Class A-2 unit (a)(d)(e)(f)(g) | 30,303 | 15,454 | |

| Chiasma, Inc. (a) | 779,500 | 1,091 | |

| Collegium Pharmaceutical, Inc. (a)(b) | 659,300 | 12,705 | |

| Dova Pharmaceuticals, Inc. (a)(b) | 313,700 | 6,767 | |

| Intra-Cellular Therapies, Inc. (a) | 127,636 | 2,562 | |

| Jazz Pharmaceuticals PLC (a) | 151,600 | 26,239 | |

| MyoKardia, Inc. (a) | 112,731 | 6,471 | |

| Nektar Therapeutics (a) | 859,200 | 45,194 | |

| The Medicines Company (a) | 237,700 | 9,444 | |

| Theravance Biopharma, Inc. (a) | 180,900 | 4,333 | |

| Zogenix, Inc. (a) | 284,300 | 16,134 | |

| 179,037 | |||

| TOTAL HEALTH CARE | 1,894,157 | ||

| INDUSTRIALS - 1.4% | |||

| Aerospace & Defense - 0.2% | |||

| Space Exploration Technologies Corp.: | |||

| Class A (a)(d)(e) | 203,488 | 34,389 | |

| Class C (d)(e) | 7,092 | 1,199 | |

| United Technologies Corp. | 31,500 | 4,276 | |

| 39,864 | |||

| Air Freight & Logistics - 0.0% | |||

| Air Transport Services Group, Inc. (a) | 46,124 | 1,039 | |

| Expeditors International of Washington, Inc. | 27,100 | 2,064 | |

| 3,103 | |||

| Airlines - 0.6% | |||

| American Airlines Group, Inc. | 1,272,432 | 50,312 | |

| Spirit Airlines, Inc. (a) | 677,700 | 29,439 | |

| United Continental Holdings, Inc. (a) | 537,300 | 43,199 | |

| Wheels Up Partners Holdings LLC Series B (a)(d)(e)(f) | 1,760,377 | 2,764 | |

| 125,714 | |||

| Commercial Services & Supplies - 0.1% | |||

| Copart, Inc. (a) | 89,600 | 5,142 | |

| Evoqua Water Technologies Corp. (a) | 268,400 | 5,728 | |

| Tomra Systems ASA | 194,000 | 4,010 | |

| 14,880 | |||

| Construction & Engineering - 0.0% | |||

| Dycom Industries, Inc. (a) | 21,300 | 1,899 | |

| Machinery - 0.1% | |||

| Deere & Co. | 53,300 | 7,717 | |

| PACCAR, Inc. | 162,200 | 10,660 | |

| 18,377 | |||

| Professional Services - 0.0% | |||

| CoStar Group, Inc. (a) | 4,900 | 2,038 | |

| Recruit Holdings Co. Ltd. | 72,800 | 1,995 | |

| 4,033 | |||

| Road & Rail - 0.3% | |||

| J.B. Hunt Transport Services, Inc. | 328,191 | 39,350 | |

| Knight-Swift Transportation Holdings, Inc. Class A | 426,000 | 13,866 | |

| Old Dominion Freight Lines, Inc. | 92,100 | 13,520 | |

| 66,736 | |||

| Trading Companies & Distributors - 0.1% | |||

| HD Supply Holdings, Inc. (a) | 283,900 | 12,486 | |

| TOTAL INDUSTRIALS | 287,092 | ||

| INFORMATION TECHNOLOGY - 57.2% | |||

| Communications Equipment - 0.0% | |||

| Arista Networks, Inc. (a) | 20,800 | 5,319 | |

| Cisco Systems, Inc. | 83,900 | 3,548 | |

| Lumentum Holdings, Inc. (a)(b) | 39,200 | 2,048 | |

| 10,915 | |||

| Electronic Equipment & Components - 0.0% | |||

| II-VI, Inc. (a) | 47,100 | 1,846 | |

| IPG Photonics Corp. (a) | 25,000 | 4,101 | |

| Jabil, Inc. | 72,500 | 2,042 | |

| 7,989 | |||

| Internet Software & Services - 19.8% | |||

| 2U, Inc. (a) | 198,241 | 14,999 | |

| Akamai Technologies, Inc. (a) | 527,100 | 39,670 | |

| Alibaba Group Holding Ltd. sponsored ADR (a) | 95,600 | 17,899 | |

| Alphabet, Inc.: | |||

| Class A(a) | 1,212,827 | 1,488,406 | |

| Class C (a) | 452,169 | 550,407 | |

| ANGI Homeservices, Inc. Class A (a) | 1,465,100 | 23,017 | |

| Carbonite, Inc. (a) | 112,300 | 3,852 | |

| CarGurus, Inc. Class A (b) | 1,818,249 | 78,821 | |

| Delivery Hero AG (c) | 45,500 | 2,585 | |

| DocuSign, Inc. (b) | 53,400 | 2,878 | |

| Dropbox, Inc.: | |||

| Class A (a)(b) | 92,800 | 2,484 | |

| Class B | 221,016 | 5,621 | |

| eBay, Inc. (a) | 990,500 | 33,132 | |

| Facebook, Inc. Class A (a) | 5,135,614 | 886,304 | |

| GMO Internet, Inc. | 352,000 | 7,464 | |

| GoDaddy, Inc. (a) | 875,100 | 64,425 | |

| GrubHub, Inc. (a) | 29,400 | 3,584 | |

| HUYA, Inc. ADR (b) | 312,900 | 10,075 | |

| IAC/InterActiveCorp (a) | 250,745 | 36,922 | |

| Instructure, Inc. (a) | 190,579 | 7,375 | |

| Match Group, Inc. (a)(b) | 541,900 | 19,573 | |

| MercadoLibre, Inc. | 188,600 | 64,673 | |

| Mercari, Inc. (a) | 43,600 | 1,837 | |

| Mimecast Ltd. (a) | 50,900 | 1,828 | |

| MINDBODY, Inc. (a) | 881,900 | 32,939 | |

| Momo, Inc. ADR (a) | 402,600 | 16,515 | |

| NetEase, Inc. ADR | 175,440 | 45,264 | |

| New Relic, Inc. (a) | 682,083 | 66,640 | |

| Nutanix, Inc.: | |||

| Class A (a) | 2,940,440 | 143,758 | |

| Class B (a)(c) | 311,503 | 15,229 | |

| Shopify, Inc. Class A (a) | 538,726 | 75,049 | |

| Stamps.com, Inc. (a) | 23,600 | 6,160 | |

| Tencent Holdings Ltd. | 1,503,800 | 68,445 | |

| Tencent Holdings Ltd. sponsored ADR | 935,500 | 42,752 | |

| The Trade Desk, Inc. (a) | 167,400 | 14,115 | |

| Twilio, Inc. Class A (a) | 264,558 | 15,315 | |

| Twitter, Inc. (a) | 61,500 | 1,960 | |

| Wix.com Ltd. (a) | 245,500 | 23,323 | |

| Yahoo!, Inc. (a) | 1,518,000 | 111,497 | |

| YY, Inc. ADR (a) | 117,300 | 10,936 | |

| Zillow Group, Inc.: | |||

| Class A (a) | 1,300 | 73 | |

| Class C (a) | 351,800 | 19,595 | |

| 4,077,396 | |||

| IT Services - 2.3% | |||

| Adyen BV (c) | 32,075 | 20,494 | |

| Alliance Data Systems Corp. | 36,800 | 8,276 | |

| AppNexus, Inc. warrants (a)(d)(e) | 1 | 0 | |

| FleetCor Technologies, Inc. (a) | 18,500 | 4,015 | |

| Global Payments, Inc. | 138,200 | 15,557 | |

| MasterCard, Inc. Class A | 163,600 | 32,393 | |

| Netcompany Group A/S | 74,400 | 2,706 | |

| PayPal Holdings, Inc. (a) | 3,272,700 | 268,820 | |

| Square, Inc. (a) | 1,030,199 | 66,602 | |

| Total System Services, Inc. | 24,200 | 2,215 | |

| Visa, Inc. Class A | 252,500 | 34,527 | |

| Worldpay, Inc. (a) | 120,500 | 9,904 | |

| 465,509 | |||

| Semiconductors & Semiconductor Equipment - 9.0% | |||

| Acacia Communications, Inc. (a) | 384,200 | 12,348 | |

| Advanced Micro Devices, Inc. (a) | 1,535,100 | 28,138 | |

| Analog Devices, Inc. | 1,147,200 | 110,292 | |

| ASML Holding NV | 48,800 | 10,443 | |

| Broadcom, Inc. | 1,028,166 | 228,016 | |

| Intel Corp. | 1,604,600 | 77,181 | |

| Marvell Technology Group Ltd. | 6,968,936 | 148,508 | |

| Micron Technology, Inc. (a) | 3,247,544 | 171,438 | |

| Monolithic Power Systems, Inc. | 48,600 | 6,448 | |

| NVIDIA Corp. | 2,658,901 | 651,058 | |

| NXP Semiconductors NV (a) | 306,500 | 29,222 | |

| Qorvo, Inc. (a) | 261,800 | 21,405 | |

| Qualcomm, Inc. | 4,882,276 | 312,905 | |

| Renesas Electronics Corp. (a) | 1,366,600 | 12,173 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | 297,900 | 12,276 | |

| United Microelectronics Corp. sponsored ADR | 3,297,983 | 9,234 | |

| Xilinx, Inc. | 109,000 | 7,856 | |

| 1,848,941 | |||

| Software - 17.4% | |||

| Activision Blizzard, Inc. | 10,202,309 | 749,054 | |

| Adobe Systems, Inc. (a) | 947,300 | 231,785 | |

| Altair Engineering, Inc. Class A (a) | 70,500 | 2,475 | |

| Atlassian Corp. PLC (a) | 1,271,585 | 92,075 | |

| Atom Tickets LLC (a)(d)(e)(f) | 516,103 | 3,000 | |

| Autodesk, Inc. (a) | 1,356,720 | 174,257 | |

| Avalara, Inc. | 27,368 | 1,049 | |

| Ceridian HCM Holding, Inc. | 62,200 | 2,038 | |

| Citrix Systems, Inc. (a) | 122,400 | 13,460 | |

| Dataminr, Inc. Series E (e) | 950,001 | 18,905 | |

| Electronic Arts, Inc. (a) | 183,300 | 23,600 | |

| Ellie Mae, Inc. (a) | 38,600 | 3,830 | |

| HIVE Blockchain Technologies Ltd. (a)(b) | 2,883,100 | 1,862 | |

| HIVE Blockchain Technologies Ltd. warrants 11/14/19 (a) | 2,163,600 | 166 | |

| HubSpot, Inc. (a) | 742,480 | 92,142 | |

| Intuit, Inc. | 604,900 | 123,545 | |

| Microsoft Corp. | 9,501,999 | 1,007,972 | |

| Nintendo Co. Ltd. ADR | 389,500 | 16,620 | |

| Parametric Technology Corp. (a) | 54,900 | 5,046 | |

| Paycom Software, Inc. (a)(b) | 274,632 | 29,180 | |

| Paylocity Holding Corp. (a) | 188,400 | 10,927 | |

| Pegasystems, Inc. | 31,900 | 1,774 | |

| Pluralsight, Inc. | 210,500 | 4,886 | |

| Proofpoint, Inc. (a) | 125,600 | 14,325 | |

| Red Hat, Inc. (a) | 252,700 | 35,689 | |

| SailPoint Technologies Holding, Inc. (a) | 224,700 | 5,413 | |

| Salesforce.com, Inc. (a) | 1,605,048 | 220,132 | |

| SendGrid, Inc. (a) | 313,200 | 7,996 | |

| ServiceNow, Inc. (a) | 13,700 | 2,411 | |

| Smartsheet, Inc. | 43,000 | 925 | |

| Snap, Inc. Class A (a)(b) | 1,077,300 | 13,466 | |

| Splunk, Inc. (a) | 76,200 | 7,323 | |

| Take-Two Interactive Software, Inc. (a) | 85,600 | 9,675 | |

| Talend SA ADR (a) | 82,000 | 4,850 | |

| Tanium, Inc. Class B (a)(d)(e) | 392,200 | 2,661 | |

| Ubisoft Entertainment SA (a) | 4,094,652 | 452,186 | |

| Ultimate Software Group, Inc. (a) | 23,500 | 6,507 | |

| Workday, Inc. Class A (a) | 165,700 | 20,550 | |

| Zendesk, Inc. (a) | 3,134,284 | 170,724 | |

| Zynga, Inc. (a) | 448,800 | 1,701 | |

| 3,586,182 | |||

| Technology Hardware, Storage & Peripherals - 8.7% | |||

| Apple, Inc. | 9,448,260 | 1,797,913 | |

| TOTAL INFORMATION TECHNOLOGY | 11,794,845 | ||

| MATERIALS - 0.5% | |||

| Chemicals - 0.5% | |||

| CF Industries Holdings, Inc. | 182,400 | 8,102 | |

| FMC Corp. | 52,180 | 4,690 | |

| LG Chemical Ltd. | 13,965 | 4,703 | |

| LyondellBasell Industries NV Class A | 794,800 | 88,056 | |

| Nutrien Ltd. | 37,400 | 2,031 | |

| The Chemours Co. LLC | 96,100 | 4,402 | |

| 111,984 | |||

| Construction Materials - 0.0% | |||

| Loma Negra Compania Industrial Argentina SA ADR (a) | 268,400 | 3,017 | |

| TOTAL MATERIALS | 115,001 | ||

| REAL ESTATE - 0.3% | |||

| Equity Real Estate Investment Trusts (REITs) - 0.3% | |||

| Ant International Co. Ltd. (d)(e) | 6,818,398 | 38,251 | |

| Equinix, Inc. | 44,300 | 19,460 | |

| 57,711 | |||

| Real Estate Management & Development - 0.0% | |||

| WeWork Companies, Inc. Class A (a)(d)(e) | 29,911 | 3,065 | |

| TOTAL REAL ESTATE | 60,776 | ||

| TELECOMMUNICATION SERVICES - 0.1% | |||

| Wireless Telecommunication Services - 0.1% | |||

| Boingo Wireless, Inc. (a) | 191,700 | 4,430 | |

| T-Mobile U.S., Inc. (a) | 200,890 | 12,053 | |

| 16,483 | |||

| TOTAL COMMON STOCKS | |||

| (Cost $12,037,918) | 20,084,877 | ||

| Convertible Preferred Stocks - 2.6% | |||

| CONSUMER DISCRETIONARY - 0.0% | |||

| Diversified Consumer Services - 0.0% | |||

| Handy Technologies, Inc. Series C (a)(d)(e) | 415,643 | 2,436 | |

| Internet & Direct Marketing Retail - 0.0% | |||

| One Kings Lane, Inc. Series E (Escrow) (a)(d)(e) | 648,635 | 259 | |

| The Honest Co., Inc. Series D (a)(d)(e) | 75,268 | 1,476 | |

| 1,735 | |||

| TOTAL CONSUMER DISCRETIONARY | 4,171 | ||

| CONSUMER STAPLES - 0.2% | |||

| Food & Staples Retailing - 0.2% | |||

| Roofoods Ltd. Series F (d)(e) | 93,930 | 38,507 | |

| FINANCIALS - 0.0% | |||

| Insurance - 0.0% | |||

| Clover Health Series D (a)(d)(e) | 620,983 | 5,823 | |

| HEALTH CARE - 0.5% | |||

| Biotechnology - 0.3% | |||

| 23andMe, Inc.: | |||

| Series E (a)(d)(e) | 1,817,170 | 31,528 | |

| Series F (d)(e) | 683,367 | 11,856 | |

| Moderna Therapeutics, Inc.: | |||

| Series B (a)(d)(e) | 1,193,491 | 12,007 | |

| Series C (a)(d)(e) | 453,177 | 4,559 | |

| 59,950 | |||

| Health Care Providers & Services - 0.2% | |||

| Mulberry Health, Inc. Series A8 (a)(d)(e) | 4,342,250 | 30,981 | |

| TOTAL HEALTH CARE | 90,931 | ||

| INDUSTRIALS - 0.1% | |||

| Aerospace & Defense - 0.1% | |||

| Space Exploration Technologies Corp.: | |||

| Series G (a)(d)(e) | 62,037 | 10,484 | |

| Series H (d)(e) | 65,670 | 11,098 | |

| 21,582 | |||

| Professional Services - 0.0% | |||

| YourPeople, Inc. Series C (a)(d)(e) | 335,546 | 1,735 | |

| TOTAL INDUSTRIALS | 23,317 | ||

| INFORMATION TECHNOLOGY - 1.6% | |||

| Internet Software & Services - 1.0% | |||

| Jet.Com, Inc. Series B1 (Escrow) (a)(d)(e) | 4,896,249 | 222 | |

| Lyft, Inc.: | |||

| Series H (d)(e) | 595,228 | 28,186 | |

| Series I (d)(e) | 642,291 | 30,415 | |

| Pinterest, Inc. Series G, 8.00% (a)(d)(e) | 139,290 | 826 | |

| Reddit, Inc.: | |||

| Series B (d)(e) | 1,337,584 | 45,411 | |

| Series C (d)(e) | 300,673 | 10,208 | |

| Starry, Inc. Series B (a)(d)(e) | 1,811,120 | 1,670 | |

| Uber Technologies, Inc.: | |||

| Series D, 8.00% (a)(d)(e) | 2,234,768 | 89,391 | |

| Series E, 8.00% (a)(d)(e) | 148,620 | 5,945 | |

| 212,274 | |||

| IT Services - 0.2% | |||

| AppNexus, Inc.: | |||

| Series E (a)(d)(e) | 1,416,796 | 28,478 | |

| Series F (a)(d)(e) | 90,913 | 2,364 | |

| 30,842 | |||

| Software - 0.4% | |||

| Bracket Computing, Inc. Series C (a)(d)(e) | 1,877,241 | 3,360 | |

| Cloudflare, Inc. Series D, 8.00% (a)(d)(e) | 395,787 | 3,946 | |

| Dataminr, Inc. Series D (a)(d)(e) | 2,219,446 | 44,167 | |

| Delphix Corp. Series D (a)(d)(e) | 427,177 | 3,110 | |

| Jello Labs, Inc. Series C (a)(d)(e) | 302,678 | 3,823 | |

| Taboola.Com Ltd. Series E (a)(d)(e) | 1,918,392 | 33,438 | |

| 91,844 | |||

| TOTAL INFORMATION TECHNOLOGY | 334,960 | ||

| REAL ESTATE - 0.2% | |||

| Real Estate Management & Development - 0.2% | |||

| WeWork Companies, Inc.: | |||

| Series E (a)(d)(e) | 269,198 | 27,587 | |

| Series F (a)(d)(e) | 14,513 | 1,487 | |

| 29,074 | |||

| TELECOMMUNICATION SERVICES - 0.0% | |||

| Wireless Telecommunication Services - 0.0% | |||

| Altiostar Networks, Inc. Series A1 (a)(d)(e) | 2,113,909 | 2,706 | |

| TOTAL CONVERTIBLE PREFERRED STOCKS | |||

| (Cost $375,723) | 529,489 | ||

| Money Market Funds - 2.4% | |||

| Fidelity Cash Central Fund, 1.96% (h) | 16,085,085 | 16,088 | |

| Fidelity Securities Lending Cash Central Fund 1.97% (h)(i) | 484,788,035 | 484,837 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $500,925) | 500,925 | ||

| TOTAL INVESTMENT IN SECURITIES - 102.4% | |||

| (Cost $12,914,566) | 21,115,291 | ||

| NET OTHER ASSETS (LIABILITIES) - (2.4)% | (486,893) | ||

| NET ASSETS - 100% | $20,628,398 |

Values shown as $0 in the Schedule of Investments may reflect amounts less than $500.

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $61,815,000 or 0.3% of net assets.

(d) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $631,069,000 or 3.1% of net assets.

(e) Level 3 security

(f) Investment is owned by a wholly-owned subsidiary (Subsidiary) that is treated as a corporation for U.S. tax purposes.

(g) Investment represents common shares and preferred shares.

(h) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(i) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost (000s) |

| 23andMe, Inc. Series E | 6/18/15 | $19,675 |

| 23andMe, Inc. Series F | 8/31/17 | $9,488 |

| Altiostar Networks, Inc. Series A1 | 1/10/17 | $9,724 |

| Ant International Co. Ltd. | 5/16/18 | $38,251 |

| AppNexus, Inc. Series E | 8/1/14 - 9/17/14 | $28,382 |

| AppNexus, Inc. Series F | 8/23/16 | $2,364 |

| AppNexus, Inc. warrants | 8/23/16 | $0 |

| Atom Tickets LLC | 8/15/17 | $3,000 |

| Bracket Computing, Inc. Series C | 9/9/15 | $14,766 |

| Castle Creek Pharmaceuticals, LLC Class A-2 unit | 9/29/16 | $10,000 |

| Cloudflare, Inc. Series D, 8.00% | 11/5/14 | $2,424 |

| Clover Health Series D | 6/7/17 | $5,823 |

| Dataminr, Inc. Series D | 2/18/15 - 3/6/15 | $28,298 |

| Delphix Corp. Series D | 7/10/15 | $3,845 |

| Handy Technologies, Inc. Series C | 10/14/15 | $2,436 |

| Jello Labs, Inc. Series C | 12/22/16 | $4,899 |

| Jet.Com, Inc. Series B1 (Escrow) | 9/9/16 | $0 |

| Lyft, Inc. Series H | 11/22/17 | $23,658 |

| Lyft, Inc. Series I | 6/27/18 | $30,415 |

| Moderna Therapeutics, Inc. Series B | 4/13/17 | $6,922 |

| Moderna Therapeutics, Inc. Series C | 4/13/17 | $2,633 |

| Mulberry Health, Inc. Series A8 | 1/20/16 | $29,331 |

| One Kings Lane, Inc. Series E (Escrow) | 1/29/14 | $429 |

| Pinterest, Inc. Series G, 8.00% | 2/27/15 | $1,000 |

| Reddit, Inc. Series B | 7/26/17 | $18,989 |

| Reddit, Inc. Series C | 7/24/17 | $4,743 |

| Roofoods Ltd. Series F | 9/12/17 | $33,211 |

| Space Exploration Technologies Corp. Class A | 10/16/15 - 9/11/17 | $21,156 |

| Space Exploration Technologies Corp. Class C | 9/11/17 | $957 |

| Space Exploration Technologies Corp. Series G | 1/20/15 | $4,805 |

| Space Exploration Technologies Corp. Series H | 8/4/17 | $8,865 |

| Starry, Inc. Series B | 12/1/16 | $980 |

| Taboola.Com Ltd. Series E | 12/22/14 | $20,000 |

| Tanium, Inc. Class B | 4/21/17 | $1,947 |

| The Honest Co., Inc. Series D | 8/3/15 | $3,444 |

| Turn, Inc. (Escrow) | 4/11/17 | $863 |

| Uber Technologies, Inc. Series D, 8.00% | 6/6/14 | $34,668 |

| Uber Technologies, Inc. Series E, 8.00% | 12/5/14 | $4,952 |

| WeWork Companies, Inc. Class A | 6/23/15 | $984 |

| WeWork Companies, Inc. Series E | 6/23/15 | $8,854 |

| WeWork Companies, Inc. Series F | 12/1/16 | $728 |

| Wheels Up Partners Holdings LLC Series B | 9/18/15 | $5,000 |

| YourPeople, Inc. Series C | 5/1/15 | $5,000 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| (Amounts in thousands) | |

| Fidelity Cash Central Fund | $738 |

| Fidelity Securities Lending Cash Central Fund | 7,477 |

| Total | $8,215 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations if applicable.

Other Affiliated Issuers

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows:

| Affiliate (Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds(a) | Dividend Income | Realized Gain (loss) | Change in Unrealized appreciation (depreciation) | Value, end of period |

| athenahealth, Inc. | $326,198 | $-- | $234,957 | $-- | $32,563 | $(31,075) | $-- |

| Criteo SA sponsored ADR | 266,048 | -- | 185,723 | -- | 3,728 | (84,053) | -- |

| Groupon, Inc. | 209,589 | -- | 196,964 | -- | (134,828) | 193,984 | -- |

| Ubisoft Entertainment SA | 677,873 | -- | 599,925 | -- | 519,851 | (145,613) | -- |

| Wingstop, Inc. | 49,616 | -- | 42,831 | 1,174 | 9,346 | 10,012 | -- |

| Total | $1,529,324 | $-- | $1,260,400 | $1,174 | $430,660 | $(56,745) | $-- |

(a) Includes the value of securities delivered through in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of July 31, 2018, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| (Amounts in thousands) | ||||

| Investments in Securities: | ||||

| Equities: | ||||

| Consumer Discretionary | $4,118,412 | $4,111,379 | $2,065 | $4,968 |

| Consumer Staples | 635,864 | 597,357 | -- | 38,507 |

| Energy | 240,605 | 240,605 | -- | -- |

| Financials | 970,143 | 964,320 | -- | 5,823 |

| Health Care | 1,985,088 | 1,878,703 | -- | 106,385 |

| Industrials | 310,409 | 246,745 | 1,995 | 61,669 |

| Information Technology | 12,129,805 | 11,696,213 | 74,066 | 359,526 |

| Materials | 115,001 | 115,001 | -- | -- |

| Real Estate | 89,850 | 19,460 | -- | 70,390 |

| Telecommunication Services | 19,189 | 16,483 | -- | 2,706 |

| Money Market Funds | 500,925 | 500,925 | -- | -- |

| Total Investments in Securities: | $21,115,291 | $20,387,191 | $78,126 | $649,974 |

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value:

| (Amounts in thousands) | |

| Investments in Securities: | |

| Equities - Information Technology | |

| Beginning Balance | $276,076 |

| Net Realized Gain (Loss) on Investment Securities | 1,696 |

| Net Unrealized Gain (Loss) on Investment Securities | 26,769 |

| Cost of Purchases | 71,458 |

| Proceeds of Sales | (16,473) |

| Amortization/Accretion | -- |

| Transfers into Level 3 | -- |

| Transfers out of Level 3 | -- |

| Ending Balance | $359,526 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at July 31, 2018 | $30,294 |

| Other Investments in Securities | |

| Beginning Balance | $210,038 |

| Net Realized Gain (Loss) on Investment Securities | -- |

| Net Unrealized Gain (Loss) on Investment Securities | 23,441 |

| Cost of Purchases | 97,811 |

| Proceeds of Sales | (40,842) |

| Amortization/Accretion | -- |

| Transfers into Level 3 | -- |

| Transfers out of Level 3 | -- |

| Ending Balance | $290,448 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at July 31, 2018 | $44,787 |

The information used in the above reconciliations represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliations are included in Net Gain (Loss) on the Fund's Statement of Operations.

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amounts) | July 31, 2018 | |

| Assets | ||

| Investment in securities, at value (including securities loaned of $485,891) — See accompanying schedule: Unaffiliated issuers (cost $12,413,641) | $20,614,366 | |

| Fidelity Central Funds (cost $500,925) | 500,925 | |

| Total Investment in Securities (cost $12,914,566) | $21,115,291 | |

| Cash | 619 | |

| Foreign currency held at value (cost $51) | 51 | |

| Receivable for investments sold | 59,116 | |

| Receivable for fund shares sold | 18,589 | |

| Dividends receivable | 1,471 | |

| Distributions receivable from Fidelity Central Funds | 746 | |

| Prepaid expenses | 53 | |

| Other receivables | 907 | |

| Total assets | 21,196,843 | |

| Liabilities | ||

| Payable for investments purchased | $45,740 | |

| Payable for fund shares redeemed | 21,282 | |

| Accrued management fee | 12,784 | |

| Other affiliated payables | 1,972 | |

| Other payables and accrued expenses | 1,832 | |

| Collateral on securities loaned | 484,835 | |

| Total liabilities | 568,445 | |

| Net Assets | $20,628,398 | |

| Net Assets consist of: | ||

| Paid in capital | $11,676,525 | |

| Accumulated net investment loss | (19,053) | |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | 771,238 | |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | 8,199,688 | |

| Net Assets | $20,628,398 | |

| OTC: | ||

| Net Asset Value, offering price and redemption price per share ($13,340,445 ÷ 1,067,232 shares) | $12.50 | |

| Class K: | ||

| Net Asset Value, offering price and redemption price per share ($7,287,953 ÷ 575,304 shares) | $12.67 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | Year ended July 31, 2018 | |

| Investment Income | ||

| Dividends (including $1,174 earned from other affiliated issuers) | $121,380 | |

| Interest | 136 | |

| Income from Fidelity Central Funds (including $7,477 from security lending) | 8,215 | |

| Total income | 129,731 | |

| Expenses | ||

| Management fee | ||

| Basic fee | $108,402 | |

| Performance adjustment | 23,144 | |

| Transfer agent fees | 21,942 | |

| Accounting and security lending fees | 1,807 | |

| Custodian fees and expenses | 368 | |

| Independent trustees' fees and expenses | 77 | |

| Registration fees | 404 | |

| Audit | 97 | |

| Legal | 44 | |

| Interest | 20 | |

| Miscellaneous | 120 | |

| Total expenses before reductions | 156,425 | |

| Expense reductions | (920) | |

| Total expenses after reductions | 155,505 | |

| Net investment income (loss) | (25,774) | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 560,040 | |

| Fidelity Central Funds | 82 | |

| Other affiliated issuers | 430,660 | |

| Foreign currency transactions | (18) | |

| Total net realized gain (loss) | 990,764 | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers (net of increase in deferred foreign taxes of $1,007) | 3,007,727 | |

| Fidelity Central Funds | (26) | |

| Other affiliated issuers | (56,745) | |

| Assets and liabilities in foreign currencies | 2 | |

| Total change in net unrealized appreciation (depreciation) | 2,950,958 | |

| Net gain (loss) | 3,941,722 | |

| Net increase (decrease) in net assets resulting from operations | $3,915,948 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Year ended July 31, 2018 | Year ended July 31, 2017 |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $(25,774) | $(18,864) |

| Net realized gain (loss) | 990,764 | 1,654,079 |

| Change in net unrealized appreciation (depreciation) | 2,950,958 | 1,836,371 |

| Net increase (decrease) in net assets resulting from operations | 3,915,948 | 3,471,586 |

| Distributions to shareholders from net realized gain | (808,260) | (413,520) |

| Total distributions | (808,260) | (413,520) |

| Share transactions - net increase (decrease) | 1,722,903 | (614,015) |

| Total increase (decrease) in net assets | 4,830,591 | 2,444,051 |

| Net Assets | ||

| Beginning of period | 15,797,807 | 13,353,756 |

| End of period | $20,628,398 | $15,797,807 |

| Other Information | ||

| Accumulated net investment loss end of period | $(19,053) | $(136) |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity OTC Portfolio

| Years ended July 31, | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share DataA | |||||

| Net asset value, beginning of period | $10.57 | $8.53 | $8.70 | $8.12 | $7.90 |

| Income from Investment Operations | |||||

| Net investment income (loss)B | (.02) | (.02) | (.01) | (.01) | (.01) |

| Net realized and unrealized gain (loss) | 2.48 | 2.33 | .29 | 1.62 | 1.28 |

| Total from investment operations | 2.46 | 2.31 | .28 | 1.61 | 1.27 |

| Distributions from net investment income | – | – | – | – | (.01) |

| Distributions from net realized gain | (.53) | (.27) | (.45) | (1.03) | (1.04) |

| Total distributions | (.53) | (.27) | (.45) | (1.03) | (1.05) |

| Net asset value, end of period | $12.50 | $10.57 | $8.53 | $8.70 | $8.12 |

| Total ReturnC | 24.34% | 27.97% | 3.68% | 21.34% | 17.96% |

| Ratios to Average Net AssetsD,E | |||||

| Expenses before reductions | .88% | .81% | .91% | .83% | .77% |

| Expenses net of fee waivers, if any | .88% | .81% | .91% | .83% | .77% |

| Expenses net of all reductions | .88% | .81% | .90% | .83% | .76% |

| Net investment income (loss) | (.17)% | (.16)% | (.07)% | (.13)% | (.08)% |

| Supplemental Data | |||||

| Net assets, end of period (in millions) | $13,340 | $12,136 | $9,845 | $9,710 | $7,870 |

| Portfolio turnover rateF | 38%G | 71%G | 56%G | 66%G | 106% |

A Per share amounts have been adjusted to reflect the impact of the 10 for 1 share split that occurred on May 11, 2018.

B Calculated based on average shares outstanding during the period.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

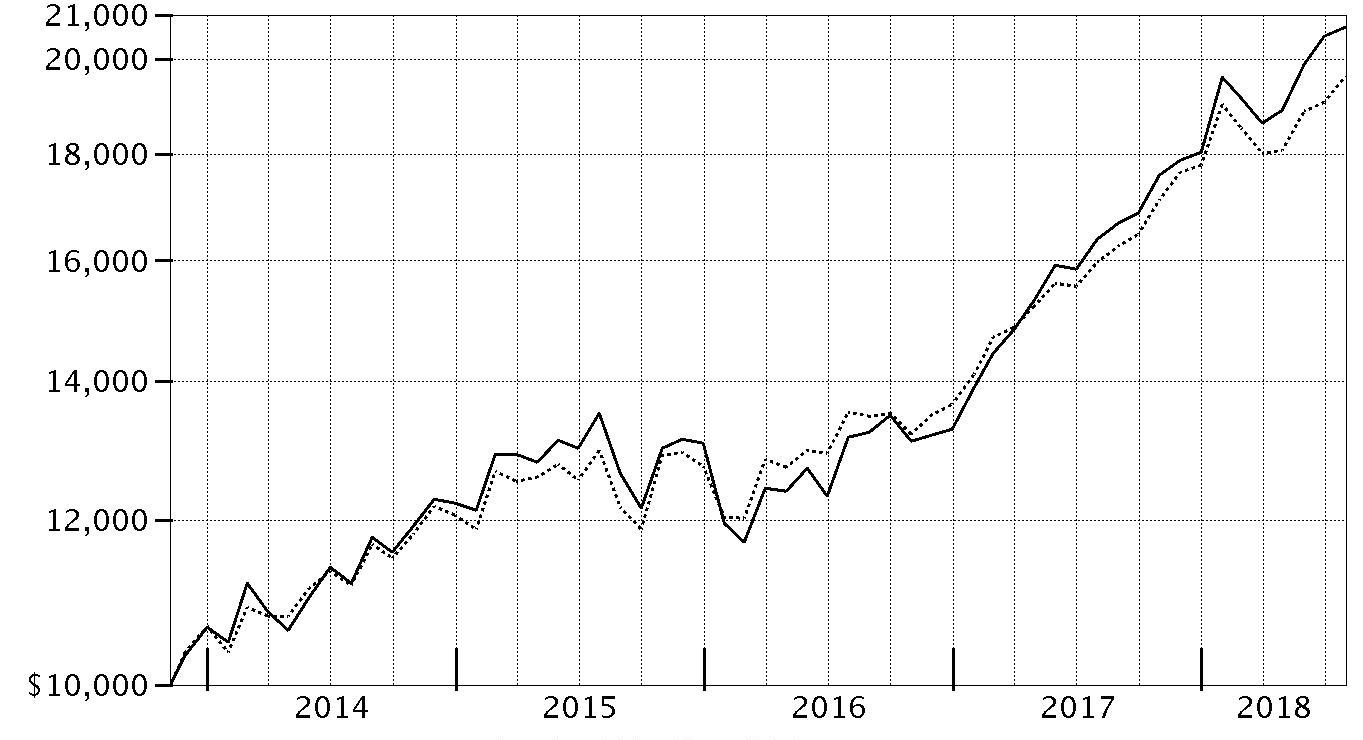

Fidelity OTC Portfolio Class K

| Years ended July 31, | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share DataA | |||||

| Net asset value, beginning of period | $10.70 | $8.62 | $8.79 | $8.20 | $7.96 |

| Income from Investment Operations | |||||

| Net investment income (loss)B | (.01) | (.01) | –C | –C | –C |

| Net realized and unrealized gain (loss) | 2.52 | 2.36 | .29 | 1.63 | 1.30 |

| Total from investment operations | 2.51 | 2.35 | .29 | 1.63 | 1.30 |

| Distributions from net investment income | – | – | – | – | (.01) |

| Distributions from net realized gain | (.54) | (.27) | (.46) | (1.04) | (1.05) |

| Total distributions | (.54) | (.27) | (.46) | (1.04) | (1.06) |

| Net asset value, end of period | $12.67 | $10.70 | $8.62 | $8.79 | $8.20 |

| Total ReturnD | 24.48% | 28.12% | 3.80% | 21.49% | 18.10% |

| Ratios to Average Net AssetsE,F | |||||

| Expenses before reductions | .78% | .70% | .79% | .72% | .65% |

| Expenses net of fee waivers, if any | .78% | .70% | .79% | .72% | .65% |

| Expenses net of all reductions | .77% | .70% | .79% | .71% | .64% |

| Net investment income (loss) | (.07)% | (.05)% | .05% | (.02)% | .05% |

| Supplemental Data | |||||

| Net assets, end of period (in millions) | $7,288 | $3,662 | $3,508 | $3,836 | $2,906 |

| Portfolio turnover rateG | 38%H | 71%H | 56%H | 66%H | 106% |

A Per share amounts have been adjusted to reflect the impact of the 10 for 1 share split that occurred on May 11, 2018.

B Calculated based on average shares outstanding during the period.

C Amount represents less than $.005 per share.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended July 31, 2018

(Amounts in thousands except percentages)

1. Organization.

Fidelity OTC Portfolio (the Fund) is a non-diversified fund of Fidelity Securities Fund (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers OTC and Class K shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class.

Effective May 11, 2018, each class underwent a 10 for 1 share split. The effect of the share split transaction was to multiply the number of outstanding share of each Class by a split factor of 10:1, with a corresponding decrease in net asset value (NAV) per share. This event does not impact the overall net assets of each class. The per share data presented in the Financial Highlights and Share Transactions presented in the Notes to Financial Statements have been retroactively adjusted to reflect this share split.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy. Equity securities, including restricted securities, for which observable inputs are not available are valued using alternate valuation approaches, including the market approach and the income approach and are categorized as Level 3 in the hierarchy. The market approach generally consists of using comparable market transactions while the income approach generally consists of using the net present value of estimated future cash flows, adjusted as appropriate for liquidity, credit, market and/or other risk factors.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

The following provides information on Level 3 securities held by the Fund that were valued at period end based on unobservable inputs. These amounts exclude valuations provided by a broker.

| Asset Type | Fair Value | Valuation Technique(s) | Unobservable Input | Amount or Range/Weighted Average | Impact to Valuation from an Increase in Input(a) |

| Equities | $649,974 | Market comparable | Enterprise value/Sales multiple (EV/S) | 1.5 - 12.2 / 7.0 | Increase |

| Transaction price | $10.06 - $330.00 / $164.48 | Increase | |||

| Discount rate | 6.0% - 76.0% / 51.7% | Decrease | |||

| Conversion ratio | 3.0 | Increase | |||

| Discount for lack of marketability | 10.0% - 25.0% / 15.2% | Decrease | |||

| Premium rate | 7.5% - 76.0% / 72.4% | Increase | |||

| Proxy premium | 54.5% | Increase | |||

| Liquidity preference | $14.90 | Increase | |||

| Market approach | Transaction price | $0.81 - $169.00 / $44.50 | Increase | ||

| Conversion ratio | 1.6 | Increase | |||

| Book value | Book value multiple | 1.0 | Increase | ||

| Discount rate | 70.0% | Decrease | |||

| Discount cash flow | Discount rate | 9.0% | Decrease | ||

| Discount for lack of marketability | 20.0% | Decrease | |||

| Growth rate | 3.0% | Increase | |||

| Recovery value | Recovery value | 0.0% - 0.7% / 0.5% | Increase |

(a) Represents the expected directional change in the fair value of the Level 3 investments that would result from an increase in the corresponding input. A decrease to the unobservable input would have the opposite effect. Significant changes in these inputs could result in significantly higher or lower fair value measurements.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of July 31, 2018, as well as a roll forward of Level 3 investments, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), certain independent Trustees have elected to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees of $592 are included in the accompanying Statement of Assets and Liabilities in other receivables and other payables and accrued expenses, respectively.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of July 31, 2018, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital gains by certain countries in which it invests. An estimated deferred tax liability for net unrealized appreciation on the applicable securities is included in Other payables and accrued expenses on the Statement of Assets & Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, certain foreign taxes, passive foreign investment companies (PFIC), redemptions in kind, partnerships, deferred trustees compensation, net operating losses and losses deferred due to wash sales, and excise tax regulations.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $8,726,352 |

| Gross unrealized depreciation | (565,033) |

| Net unrealized appreciation (depreciation) | $8,161,319 |

| Tax Cost | $12,953,972 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed long-term capital gain | $810,643 |

| Net unrealized appreciation (depreciation) on securities and other investments | $8,161,290 |

The Fund intends to elect to defer to its next fiscal year $18,461 of ordinary losses recognized during the period January 1, 2018 to July, 31 2018.

The tax character of distributions paid was as follows:

| July 31, 2018 | July 31, 2017 | |

| Ordinary Income | $115,477 | $ 51,166 |

| Long-term Capital Gains | 692,783 | 362,354 |

| Total | $808,260 | $ 413,520 |

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

Consolidated Subsidiary. The Fund invests in certain investments through a wholly-owned subsidiary ("Subsidiary"), which may be subject to federal and state taxes upon disposition.

As of period end, the Fund held an investment of $21,218 in these Subsidiaries, representing .10% of the Fund's net assets. The financial statements have been consolidated and include accounts of the Fund and each Subsidiary. Accordingly, all inter-company transactions and balances have been eliminated.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and in-kind transactions, aggregated $7,931,522 and $6,927,301, respectively.

Redemptions In-Kind.

During the period, 6,067* shares of the Fund held by unaffiliated entities were redeemed in-kind for investments and cash with a value of $65,932. The net realized gain of $35,542 on investments delivered through in-kind redemptions is included in the accompanying Statement of Operations. The amount of the in-kind redemptions is included in share transactions in the accompanying Statement of Changes in Net Assets as well as the Notes to Financial Statements. The Fund recognized no gain or loss for federal income tax purposes.

* Share activity prior to May 11, 2018 has been adjusted to reflect the impact of the 10 for 1 share split occurred on that date.

Prior Fiscal Year Redemptions In-Kind.

During the prior period, 116,155* shares of the Fund held by unaffiliated entities were redeemed in-kind for investments and cash with a value of $1,105,548. The Fund had a net realized gain of $441,424 on investments delivered through the in-kind redemptions. The amount of the in-kind redemptions is included in share transactions in the accompanying Statement of Changes in Net Assets as well as the Notes to Financial Statements. The Fund recognized no gain or loss for federal income tax purposes.

* Share activity prior to May 11, 2018 has been adjusted to reflect the impact of the 10 for 1 share split occurred on that date.

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .35% of the Fund's average net assets and an annualized group fee rate that averaged .24% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of +/- .20% of the Fund's average net assets over a 36 month performance period. The upward or downward adjustment to the management fee is based on the relative investment performance of OTC as compared to its benchmark index, the Nasdaq Composite Index, over the same 36 month performance period. For the reporting period, the total annual management fee rate, including the performance adjustment, was .72% of the Fund's average net assets. The performance adjustment included in the management fee rate may be higher or lower than the maximum performance adjustment rate due to the difference between the average net assets for the reporting and performance periods.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of OTC, except for Class K. FIIOC receives an asset-based fee of Class K's average net assets. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| Amount | % of Class-Level Average Net Assets | |

| OTC | $19,702 | .15 |

| Class K | 2,240 | .05 |

| $21,942 |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions. For the period, the fees were equivalent to an annual rate of .01%.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $173 for the period.

Interfund Lending Program. Pursuant to an Exemptive Order issued by the SEC, the Fund, along with other registered investment companies having management contracts with Fidelity Management & Research Company (FMR) or other affiliated entities of FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the funds to borrow from, or lend money to, other participating affiliated funds. At period end, there were no interfund loans outstanding. The Fund's activity in this program during the period for which loans were outstanding was as follows:

| Borrower or Lender | Average Loan Balance | Weighted Average Interest Rate | Interest Expense |