| Inst | Fidelity Small Cap Value Fund | ||||||||||||||||||||||||||||||||

| Fund Summary Fund/Class: Fidelity® Small Cap Value Fund/Fidelity Advisor® Small Cap Value Fund Institutional |

||||||||||||||||||||||||||||||||

| Investment Objective | ||||||||||||||||||||||||||||||||

| The fund seeks capital appreciation. | ||||||||||||||||||||||||||||||||

| Fee Table | ||||||||||||||||||||||||||||||||

| The following table describes the fees and expenses that may be incurred when you buy and hold shares of the fund. | ||||||||||||||||||||||||||||||||

| Shareholder fees (fees paid directly from your investment) |

||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||

| Annual operating expenses (expenses that you pay each year as a % of the value of your investment) |

||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||

| This example helps compare the cost of investing in the fund with the cost of investing in other funds. Let's say, hypothetically, that the annual return for shares of the fund is 5% and that your shareholder fees and the annual operating expenses for shares of the fund are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated: |

||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||

| Portfolio Turnover | ||||||||||||||||||||||||||||||||

| The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual operating expenses or in the example, affect the fund's performance. During the most recent fiscal year, the fund's portfolio turnover rate was 26% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||

| Principal Investment Strategies | ||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||

| Principal Investment Risks | ||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||

| Performance | ||||||||||||||||||||||||||||||||

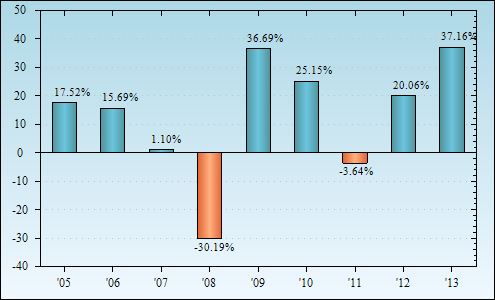

| The following information is intended to help you understand the risks of investing in the fund. The information illustrates the changes in the performance of the fund's shares from year to year and compares the performance of the fund's shares to the performance of a securities market index over various periods of time. The index description appears in the Additional Index Information section of the prospectus. Past performance (before and after taxes) is not an indication of future performance. Visit www.advisor.fidelity.com for updated return information. |

||||||||||||||||||||||||||||||||

| Year-by-Year Returns Calendar Years |

||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||

| Average Annual Returns | ||||||||||||||||||||||||||||||||

| After-tax returns are calculated using the historical highest individual federal marginal income tax rates, but do not reflect the impact of state or local taxes. Actual after-tax returns may differ depending on your individual circumstances. The after-tax returns shown are not relevant if you hold your shares in a retirement account or in another tax-deferred arrangement. For the periods ended December 31, 2013 |

||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||

| X | ||||||||||

|

- Definition

Contains a command for the SEC Viewer for the role corresponding to OperatingExpensesData. No definition available.

|

| X | ||||||||||

|

- Definition

If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. When a Multiple Class Fund offers more than one Class in the prospectus, provide annual total returns in the bar chart for only one of those Classes. The Fund can select which Class to include (e.g., the oldest Class, the Class with the greatest net assets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Risk/Return Bar Chart and Table. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

If the Fund has annual returns for at least one calendar year, provide a bar chart showing the Fund's annual total returns for each of the last 10 calendar years (or for the life of the Fund if less than 10 years), but only for periods subsequent to the effective date of the Fund's registration statement. Present the corresponding numerical return adjacent to each bar. If the Fund's fiscal year is other than a calendar year, include the year-to-date return information as of the end of the most recent quarter in a footnote to the bar chart. Following the bar chart, disclose the Fund's highest and lowest return for a quarter during the 10 years or other period of the bar chart. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Risk/Return Bar Chart and Table. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Contains a command for the SEC Viewer for the role corresponding to BarChartData. No definition available.

|

| X | ||||||||||

|

- Definition

Distribution [and/or Service] (12b-1) Fees" include all distribution or other expenses incurred during the most recent fiscal year under a plan adopted pursuant to rule 12b-1 [17 CFR 270.12b-1]. Under an appropriate caption or a subcaption of "Other Expenses," disclose the amount of any distribution or similar expenses deducted from the Fund's assets other than pursuant to a rule 12b-1 plan. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

The Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Contains a command for the SEC Viewer for the role corresponding to ExpenseExample. No definition available.

|

| X | ||||||||||

|

- Definition

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then you redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return per year and that the Fund's operating expenses remained the same. Although your actual costs may be higher or lower. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then you redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return per year and that the Fund's operating expenses remained the same. Although your actual costs may be higher or lower. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then you redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return per year and that the Fund's operating expenses remained the same. Although your actual costs may be higher or lower. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then you redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return per year and that the Fund's operating expenses remained the same. Although your actual costs may be higher or lower. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Risk/Return Summary Fee Table Includes the following information, in plain English under rule 421(d) under the Securities Act, after Item 2 Fees and expenses of the Fund This table describes the fees and expenses that you may pay if you buy and hold shared of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $[_____] in [name of fund family] funds. Shareholder Fees (fees paid directly from your investment) Example This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then you redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return per year and that the Fund's operating expenses remained the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be You would pay the following expenses if you did not redeem your shares The Example does not reflect sales charges (loads) on reinvested dividends [and other distributions]. If these sales charges (loads) were included, your costs would be higher. Portfolio Turnover The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was __% of the average value of its whole portfolio. Instructions. A.3.instructions.6 New Funds. For purposes of this Item, a "New Fund" is a Fund that does not include in Form N-1A financial statements reporting operating results or that includes financial statements for the Fund's initial fiscal year reporting operating results for a period of 6 months or less. The following Instructions apply to New Funds. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

This table describes the fees and expenses that you may pay if you buy and hold shared of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $[_____] in [name of fund family] funds. Include the narrative explanations in the order indicated. A Fund may modify the narrative explanations if the explanation contains comparable information to that shown. The narrative explanation regarding sales charge discounts is only required by a Fund that offers such discounts and should specify the minimum level of investment required to qualify for a discount. Modify the narrative explanation to state that Fund shares are sold on a national securities exchange at the end of the time periods indicated, and that brokerage commissions for buying and selling Fund shares through a broker are not reflected. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Total Annual Fund Operating Expenses. If the Fund is a Feeder Fund, reflect the aggregate expenses of the Feeder Fund and the Master Fund in a single fee table using the captions provided. In a footnote to the fee table, state that the table and Example reflect the expenses of both the Feeder and Master Funds. If the prospectus offers more than one Class of a Multiple Class Fund or more than one Feeder Fund that invests in the same Master Fund, provide a separate response for each Class or Feeder Fund. Base the percentages of "Annual Fund Operating Expenses" on amounts incurred during the Fund's most recent fiscal year, but include in expenses amounts that would have been incurred absent expense reimbursement or fee waiver arrangements. If the Fund has changed its fiscal year and, as a result, the most recent fiscal year is less than three months, use the fiscal year prior to the most recent fiscal year as the basis for determining "Annual Fund Operating Expenses." Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Management Fees include investment advisory fees (including any fees based on the Fund's performance), any other management fees payable to the investment adviser or its affiliates, and administrative fees payable to the investment adviser or its affiliates that are not included as "Other Expenses." Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Investment Objectives/Goals. Disclose the Fund's investment objectives or goals. A Fund also may identify its type or category (e.g., that it is a Money Market Fund or a balanced fund). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Investment Objectives/Goals. Disclose the Fund's investment objectives or goals. A Fund also may identify its type or category (e.g., that it is a Money Market Fund or a balanced fund). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Annual Fund Operating Expenses (ongoing expenses that you pay each year as a percentage of the value of your investment) Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

"Other Expenses" include all expenses not otherwise disclosed in the table that are deducted from the Fund's assets or charged to all shareholder accounts. The amount of expenses deducted from the Fund's assets are the amounts shown as expenses in the Fund's statement of operations (including increases resulting from complying with paragraph 2(g) of rule 6-07 of Regulation S-X [17 CFR 210.6-07]). "Other Expenses" do not include extraordinary expenses as determined under generally accepted accounting principles (see Accounting Principles Board Opinion No. 30). If extraordinary expenses were incurred that materially affected the Fund's "Other Expenses," disclose in a footnote to the table what "Other Expenses" would have been had the extraordinary expenses been included. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Risk/Return Bar Chart and Table. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

This item represents Average Anuual Total Returns. If a Multiple Class Fund offers a Class in the prospectus that converts into another Class after a stated period, compute average annual total returns in the table by using the returns of the other Class for the period after conversion. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

If the Fund has annual returns for at least one calendar year, provide a table showing the Fund's (A) average annual total return; (B) average annual total return (after taxes on distributions); and (C) average annual total return (after taxes on distributions and redemption). A Money Market Fund should show only the returns described in clause (A) of the preceding sentence. All returns should be shown for 1-, 5-, and 10- calendar year periods ending on the date of the most recently completed calendar year (or for the life of the Fund, if shorter), but only for periods subsequent to the effective date of the Fund's registration statement. The table also should show the returns of an appropriate broad-based securities market index as defined in Instruction 5 to Item 22(b)(7) for the same periods. A Fund that has been in existence for more than 10 years also may include returns for the life of the Fund. A Money Market Fund may provide the Fund's 7-day yield ending on the date of the most recent calendar year or disclose a toll-free (or collect) telephone number that investors can use to obtain the Fund's current 7-day yield. For a Fund (other than a Money Market Fund or a Fund described in General Instruction C.3.(d)(iii)), provide the information in the following table with the specified captions AVERAGE ANNUAL TOTAL RETURNS (For the periods ended December 31, _____). For a Fund that provides annual total returns for only one calendar year or for a Fund that does not include the bar chart because it does not have annual returns for a full calendar year, modify, as appropriate, the narrative explanation required by paragraph (c)(2)(i) (e.g., by stating that the information gives some indication of the risks of an investment in the Fund by comparing the Fund's performance with a broad measure of market performance). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Contains a command for the SEC Viewer for the role corresponding to PerformanceTableData. No definition available.

|

| X | ||||||||||

|

- Definition

Disclose the portfolio turnover rate provided in response to Item 14(a) for the most recent fiscal year (or for such shorter period as the Fund has been in operation). Disclose the period for which the information is provided if less than a full fiscal year. A Fund that is a Money Market Fund may omit the portfolio turnover information required by this Item. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Disclose the portfolio turnover rate provided in response to Item 14(a) for the most recent fiscal year (or for such shorter period as the Fund has been in operation). Disclose the period for which the information is provided if less than a full fiscal year. A Fund that is a Money Market Fund may omit the portfolio turnover information required by this Item. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

"Redemption Fee" (as a percentage of amount redeemed, if applicable) If the Fund is an Exchange-Traded Fund and issues or redeems shares in creation units of not less than 25,000 shares each, exclude any fees charged for the purchase and redemption of the Fund's creation units. "Redemption Fee" includes a fee charged for any redemption of the Fund's shares, but does not include a deferred sales charge (load) imposed upon redemption. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Narrative Risk Disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Narrative Risk Disclosure. A Fund may, in responding to this Item, describe the types of investors for whom the Fund is intended or the types of investment goals that may be consistent with an investment in the Fund. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Risk/Return Summary Investment Objectives/Goals Include the following information, in plain English under rule 421(d) under the Securities Act, in the order and subject matter indicated Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Shareholder Fees (fees paid directly from your investment). Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Contains a command for the SEC Viewer for the role corresponding to ShareholderFeesData. No definition available.

|

| X | ||||||||||

|

- Definition

Principal investment strategies of the Fund. Summarize how the Fund intends to achieve its investment objectives by identifying the Fund's principal investment strategies (including the type or types of securities in which the Fund invests or will invest principally) and any policy to concentrate in securities of issuers in a particular industry or group of industries. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|

| X | ||||||||||

|

- Definition

Principal investment strategies of the Fund. Summarize how the Fund intends to achieve its investment objectives by identifying the Fund's principal investment strategies (including the type or types of securities in which the Fund invests or will invest principally) and any policy to concentrate in securities of issuers in a particular industry or group of industries. Reference 1: http://www.xbrl.org/2003/role/presentationRef

|