london6po50x100fibondpolicy2.htm - Generated by SEC Publisher for SEC Filing

Lloyd’s Policy

We, Underwriting Members of the Syndicates whose definitive numbers and proportions are shown in the Table attached hereto (hereinafter referred to as 'the Underwriters'), hereby agree, in consideration of the payment to Us by or on behalf of the Assured of the Premium specified in the Schedule, to insure against loss, including but not limited to associated expenses specified herein, if any, to the extent and in the manner provided in this Policy.

The Underwriters hereby bind themselves severally and not jointly, each for his own part and not one for another, and therefore each of the Underwriters (and his Executors and Administrators) shall be liable only for his own share of his Syndicate's proportion of any such Loss and of any such Expenses. The identity of each of the Underwriters and the amount of his share may be ascertained by the Assured or the Assured's representative on application to Lloyd's Policy Signing Office, quoting the Lloyd's Policy Signing Office number and date or reference shown in the Table.

If the Assured shall make any claim knowing the same to be false or fraudulent, as regards amount or otherwise, this Policy shall become void and all claim hereunder shall be forfeited.

In Witness whereof the General Manager of Lloyd's Policy Signing Office has signed this Policy on behalf of each of Us.

LLOYD'S POLICY SIGNING OFFICE

General Manager

If this policy (or any subsequent endorsement) has been produced to you in electronic form, the original document is stored on the Insurer's Market Repository to which your broker has access.

J(A) NMA2421 (3/1/95) Form approved by Lloyd’s Market Association

|

|

|

|

WILLIS EXCESS FINANCIAL LINES POLICY |

|

|

|

Please read this Policy carefully. |

|

|

|

|

|

SCHEDULE |

|

|

|

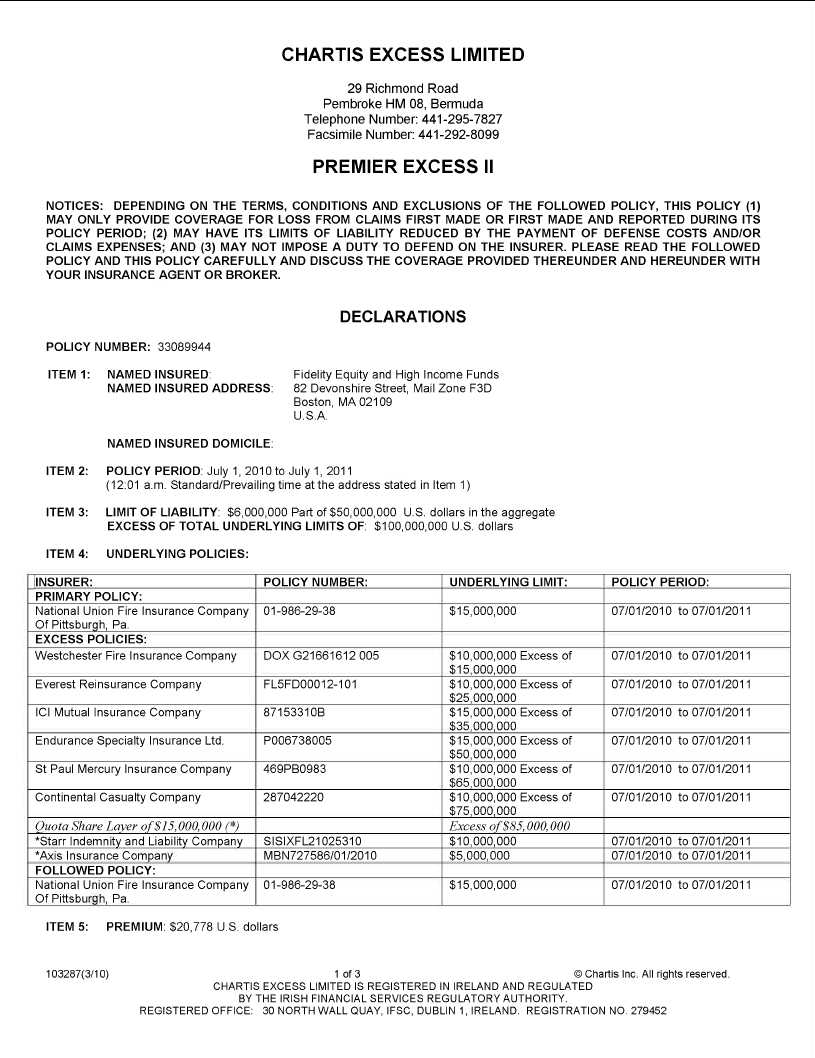

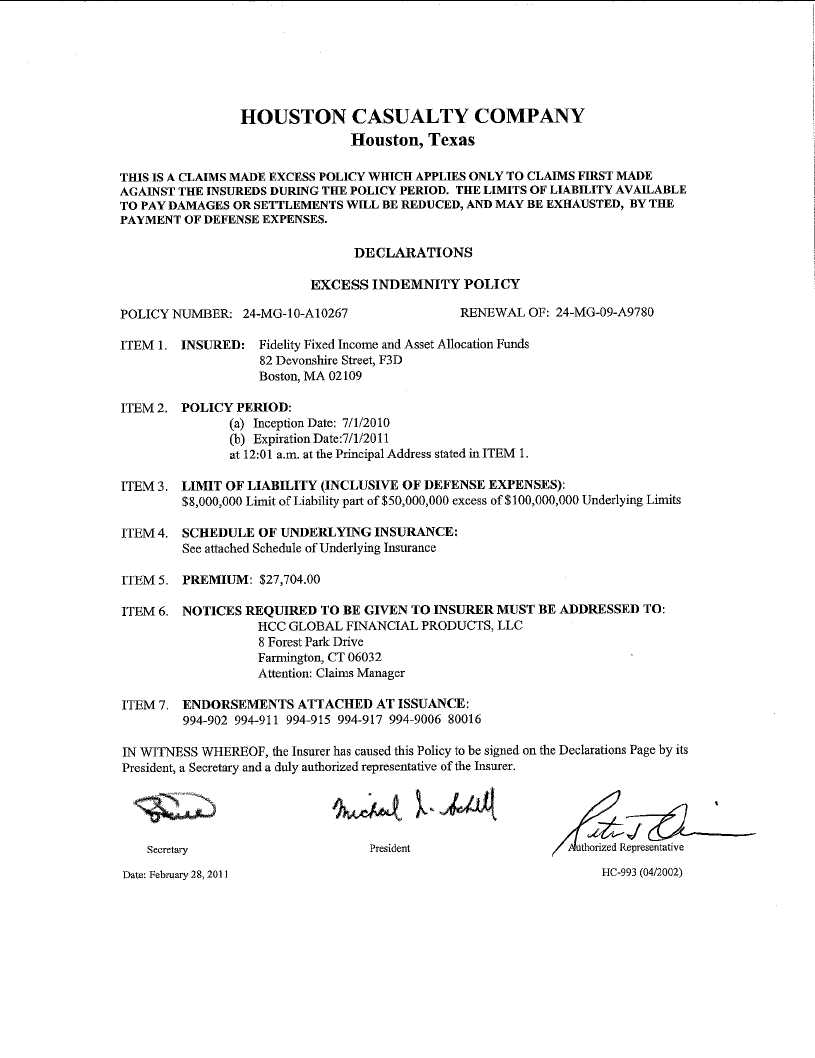

Policy Number: B080113012P10 |

|

|

|

|

Item 1: |

Insured: |

Fidelity Fixed Income and Asset Allocation Funds and as |

|

|

|

more fully defined in the Contract Wording. |

|

|

|

|

Principal Address: |

82 Devonshire Street, |

|

|

|

Mailstop F3D, |

|

|

|

Boston, |

|

|

|

Massachusetts 02109, |

|

|

|

United States of America |

|

|

|

Item 2: |

Insurer(s): |

Lloyd’s Syndicates: |

|

|

|

Antares AUL 1274 and ACE AGM 2488 |

|

|

|

Item 3: |

Period of Insurance: 1 July 2010 to 1 July 2011 |

|

|

|

Both Days at 00:01 local standard time at the Principal |

|

address |

|

shown at Item 1 above. |

|

|

|

Item 4: |

Limit of Liability: |

USD 6,000,000 any one loss/claim and in the aggregate |

|

|

|

for theperiod |

|

|

|

part of USD 50,000,000 any one loss/claim and in the |

|

|

|

aggregate for the period |

|

|

|

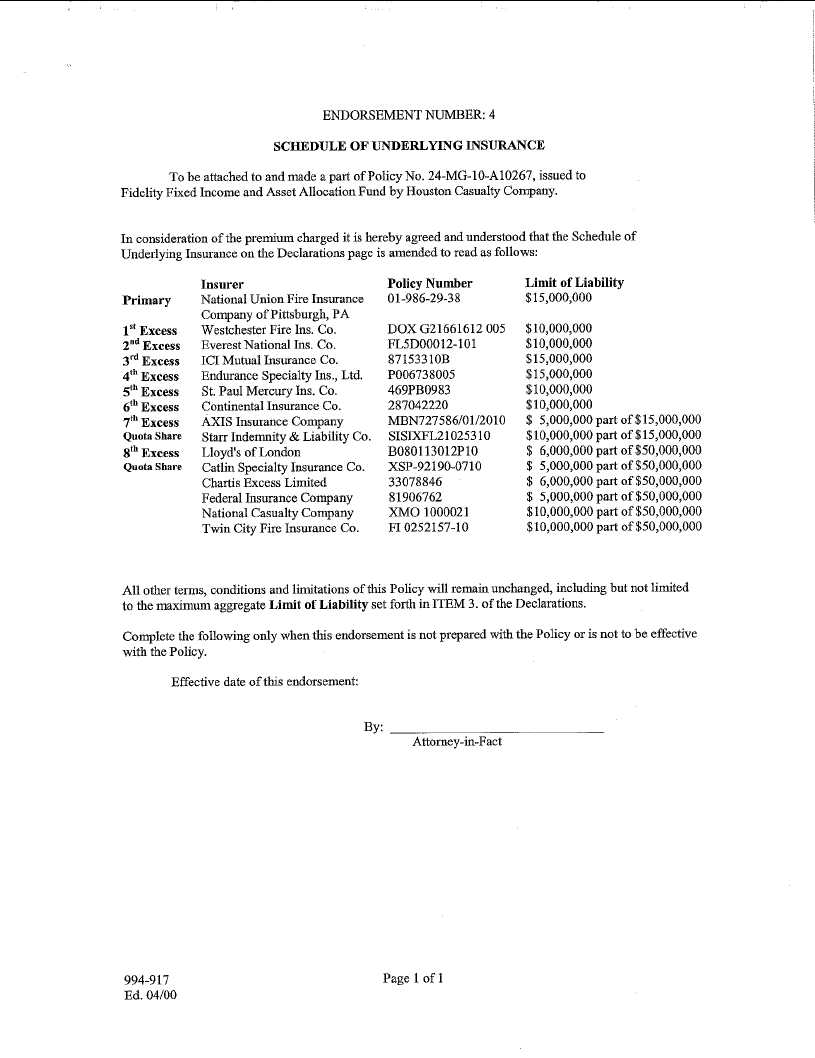

Item 5: |

Underlying |

|

|

|

Policy(ies): |

in excess of underlying contracts for |

|

|

|

USD 100,000,000 any one loss/claim and in the aggregate |

|

|

|

for the period the details of which are held on file in the |

|

|

|

offices of Willis Limited |

|

|

|

|

Retention: |

Primary Contract Retentions detailed as per National |

|

|

|

Union Fire Insurance Company of Pittsburgh, PA Policy |

|

No: 01-988-33-82. |

|

|

|

|

|

|

|

|

|

Item 6: |

Premium: |

USD 22,265 per annum for 100% for USD 6,000,000 |

|

|

|

|

|

order |

|

|

|

|

|

|

|

|

plus TRIA being USD 222 |

|

|

|

Taxes: |

|

USD None |

|

|

|

|

|

|

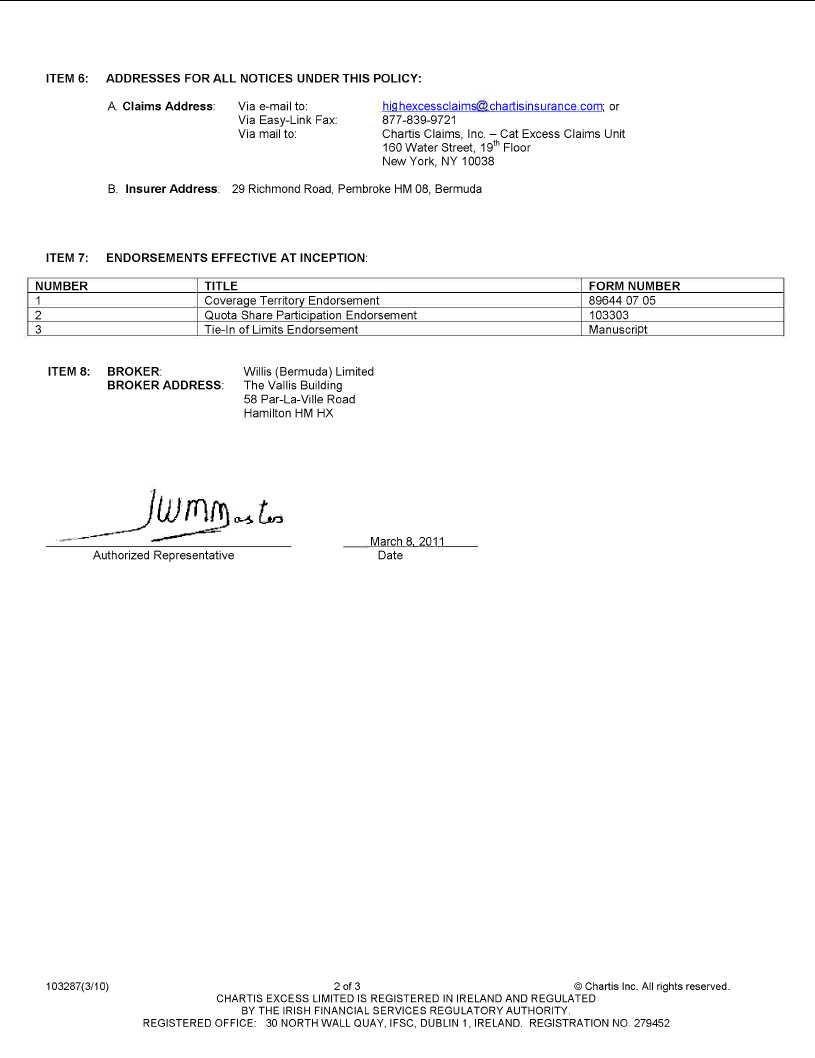

Item 7: |

Notification(s) in accordance with clause 5 required to be |

|

|

|

addressed to: |

Willis Limited, |

|

|

|

|

|

FINEX - Claims Department, |

|

|

51 Lime Street, |

|

|

|

|

London EC3M 7DQ |

|

|

|

|

|

United Kingdom. |

|

|

|

|

Item 8: |

Endorsements are as attached at issue of this Contract. |

|

|

|

|

Item 9: |

Additional premium required: |

Nil |

|

|

|

|

|

|

Item 10: |

Addressees for complaints: |

|

|

|

|

|

|

|

|

(a) |

For Insurers who are Lloyd's insurers: |

|

|

|

|

|

|

|

Policyholder and Market Assistance |

|

|

|

|

|

Lloyd’s Market Services |

|

|

One Lime Street |

|

|

|

|

London |

|

|

|

|

|

|

|

EC3M 7HA |

|

|

|

|

|

|

|

United Kingdom. |

|

|

|

|

|

|

|

Telephone: |

+ |

44 |

(0)207 327 5693 |

|

|

|

|

Facsimile: |

+ |

44 |

(0)207 327 5225 |

|

|

|

|

Email: |

|

|

Complaints@Lloyds.com |

|

|

(b) |

For all other Insurers: |

| |

Willis Limited will provide details on request. |

Dated in London:

30 June 2010

WILLIS EXCESS FINANCIAL LINES POLICY

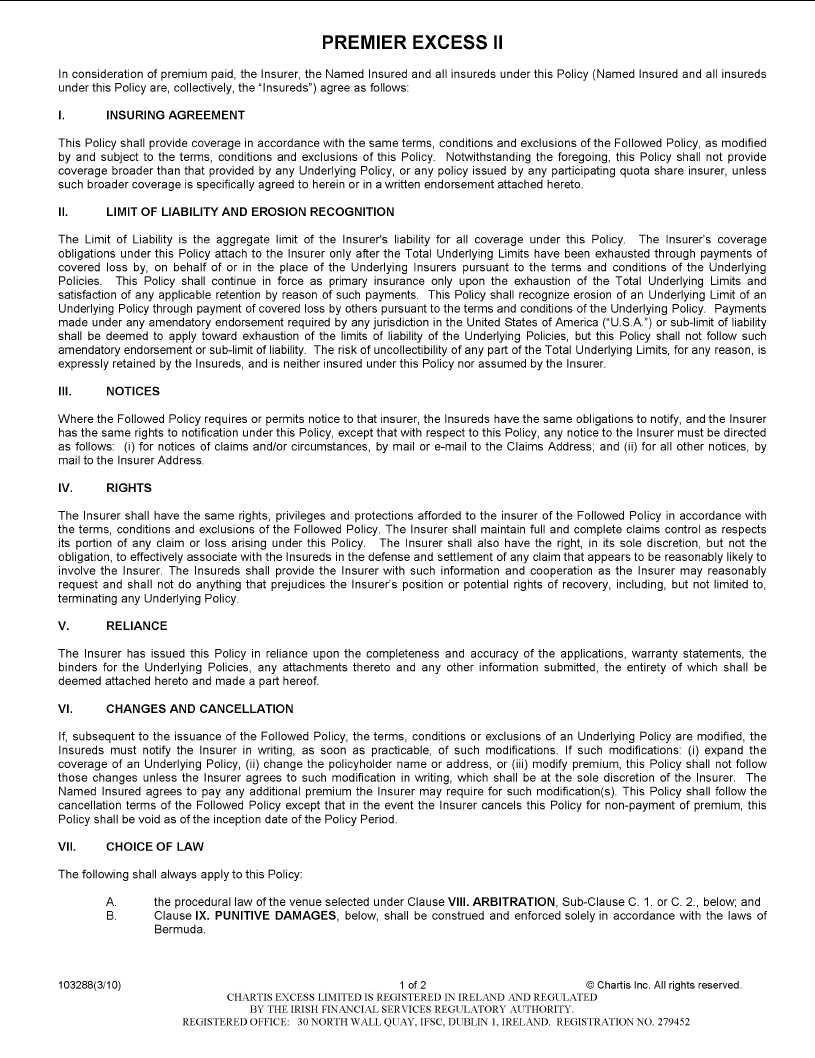

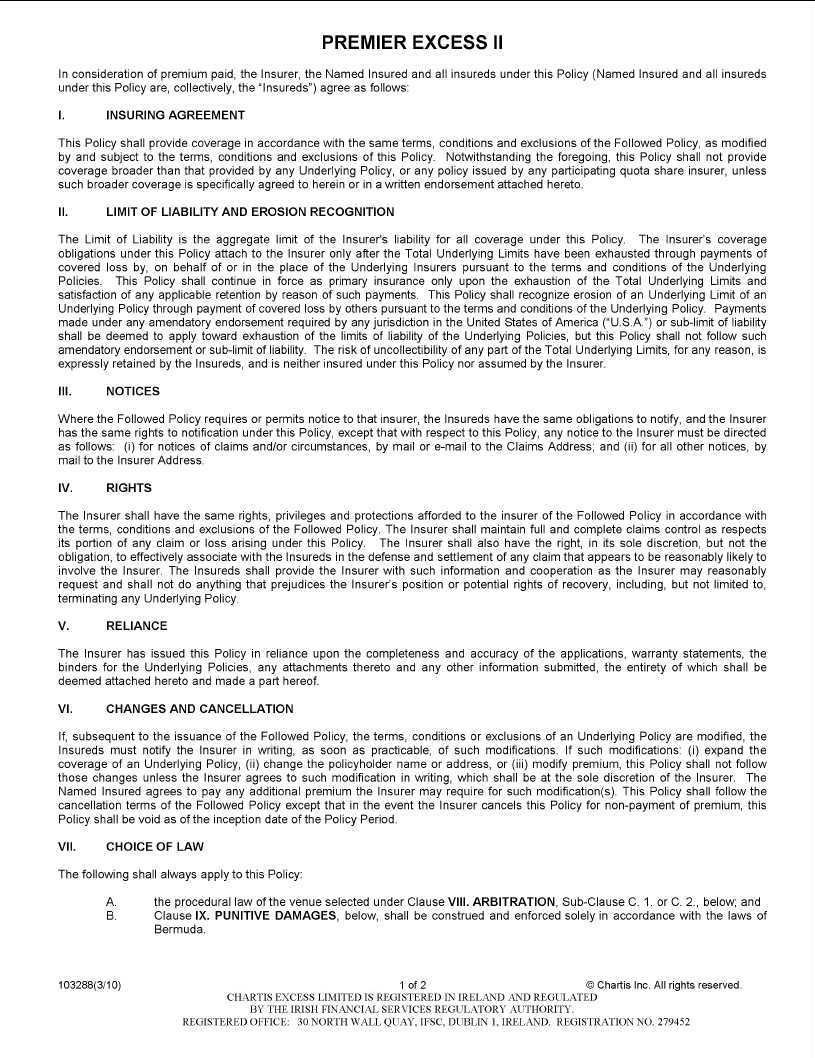

In consideration of the Insured having paid or agreed to pay the Premium and subject to all of the definitions, terms, conditions and limitations of this Policy, Insurers and the Insured agree as follows:

|

1. |

Insuring Agreement |

|

1.1 |

Except insofar as the express terms of this Policy: |

| |

(a) |

make specific provision in respect of any matter for which specific provision is also made in the Primary Policy, in which case the express terms of this Policy shall prevail; or |

| |

(b) |

make specific provision in respect of any matter for which no specific provision is made in the Primary Policy, in which case the express terms of this Policy shall apply; |

| |

this |

Policy shall take effect and operate in accordance with the terms of the Primary |

| |

Policy. |

|

|

1.2 |

Subject to the Limit of Liability, the Insurers shall pay to or on behalf of the Insured |

| |

that |

proportion of Loss which exceeds the Underlying Limit. |

|

1.3 |

Except as provided specifically to the contrary in this Policy, the Insurers shall have no |

| |

liability |

to make payment for any Loss under this Policy until the Underlying Limit has |

| |

been |

completely eroded by amounts which the insurers of the Underlying Policy(ies): |

| |

(i) |

shall have paid; or, |

| |

(ii) |

shall have agreed to pay; or, |

| |

(iii) |

shall have had their liability to pay established by judgment, arbitration award or other final binding adjudication; |

| |

whichever |

of (i) to (iii) above as shall occur first. Furthermore, in determining whether |

| |

and |

the extent to which erosion has occurred, where, as part of any agreement to pay |

| |

loss |

or liability (as applicable) under an Underlying Policy, an insurer agrees to pay an |

| |

amount |

which is less than the applicable limit of liability thereunder on terms that such |

| |

payment |

shall be treated as or equivalent to payment in full of such limit of liability, the |

| |

Insurers |

will pay Loss under this Policy as if such insurer had paid the applicable limit |

| |

of |

liability in full. However, in such circumstances the Insurers shall pay Loss only to |

| |

the |

extent that, in the absence of agreement of the kind referred to in the previous |

| |

sentence, |

the Loss of the Insured would have exceeded the Underlying Limit. |

2. Definitions

Wherever the following words and phrases appear in bold and italics in this Policy they shall have the meanings given to them below:

"Claim" or "Circumstance" shall mean “claim”, “circumstance” or any other term by which the Primary Policy identifies matters potentially giving rise to payments thereunder in respect of

Loss.

"Insured" shall mean those persons and organisations identified at Item 1 of the Schedule and all other persons and organisations as are insured or otherwise entitled to indemnity under the

Primary Policy.

"Insurers" shall mean the insurers of this Policy identified at Item 2 of the Schedule.

"Limit of Liability" shall mean the sum(s) shown at Item 4 of the Schedule being the maximum sum(s) the Insurers are liable to pay under this Policy for all Loss, subject to any reinstatement of limit expressly provided for at Item 4 of the Schedule. For the avoidance of doubt, there shall be no reinstatement of the Limit of Liability unless expressly provided for at Item 4, notwithstanding that the Primary Policy may provide for one or more reinstatements.

"Loss" shall mean all and any amounts for which Insurers are liable to the Insured pursuant to the terms and conditions of this Policy and, for the avoidance of doubt and subject only to the operation of any express terms hereof in accordance with clause 1.1 above, this Policy shall be liable to pay as Loss all losses, costs, liabilities or damages and other expenses of the Insured as are covered by the Primary Policy of whatever nature and howsoever described by the Primary Policy. However, and notwithstanding any provision to the contrary in the Primary Policy, the liability of the Insurers of this Policy to the Insured for costs and expenses of any kind whatsoever shall be part of, and not in addition to, the Limit of Liability.

"Period of Insurance" shall mean the period set out at Item 3 of the Schedule.

"Policy" shall mean this insurance contract which includes any endorsements and schedules hereto.

"Premium" shall mean the sum shown at Item 6 of the Schedule.

“Primary Limits” shall mean the limits of liability of the Primary Policy applicable to any loss or liability (as applicable) as set out in Item 5(a) of the Schedule.

"Primary Policy" shall mean the policy identified at Item 5(a) of the Schedule or any policy(ies) issued in substitution thereof.

"Relevant Provision" shall mean any provision of an Underlying Policy which reduces the limit of liability of the Underlying Policy automatically by reference to the amount paid or payable under another policy of insurance, or by reference to the limit of liability under another policy of insurance. For the avoidance of doubt, a provision which provides that an Underlying Policy shall pay only the amount by which any loss or liability (as applicable) exceeds the amount paid or payable under any other policy or policies, or which allows the insurer credit for the value of other insurance or indemnification, or which requires the Insured to pursue such insurance or indemnification prior to claiming under the Underlying Policy (such as an “other insurance” or “non-contribution” or other similar provision), shall not be a Relevant Provision.

"Schedule" shall mean the schedule to this Policy.

"Sublimit(s)" shall mean any limit or limits of insurers' liability in the Primary Policy imposed in respect of a particular category of loss or liability (as applicable) and which specifies that the maximum liability of the insurer shall be less than the otherwise generally applicable limit of liability of the Primary Policy.

"Underlying Limit" shall mean the cumulative total of the limits of liability of the insurer(s) of the Underlying Policy(ies) applicable to any loss or liability (as applicable) as set out in Item 5 of the Schedule.

"Underlying Policy(ies)" shall mean the policies listed at Item 5 of the Schedule.

3. Maintenance of the Underlying Policy(ies)

The Primary Policy, or any policies issued in substitution thereof, shall be maintained in full force and effect during the Period of Insurance save to the extent that it is eroded. This obligation shall cease to apply in the event that the Primary Policy is completely eroded. Clause 1.3 hereof shall apply for the purposes of determining whether and to what extent erosion has occurred. Where an Underlying Policy other than the Primary Policy does not continue in full force and effect (other than by reason of erosion) such policy shall be deemed for all purposes of this Policy to have been maintained. The Primary Policy shall be deemed maintained if it is replaced by the operation of clause 4 hereof.

4. Step-Down of Cover

Subject always to the Limit of Liability:

|

4.1 |

In the event of the reduction of the amount of indemnity available under any Underlying Policy by reason of partial erosion of the Underlying Limit (and in determining the existence and extent of such erosion the provisions of clause 1.3 shall apply) this Policy shall, subject to the Limit of Liability and to the other terms, conditions and limitations of this Policy, continue to be available to pay that proportion of Loss which exceeds the amount of indemnity remaining under the Underlying Policy(ies). |

|

4.2 |

In the event of there being no indemnity available under the Underlying Policy(ies) by reason of the complete erosion of the Underlying Limit (and in determining the existence and extent of such erosion the provisions of clause 1.3 shall apply), the remaining limits available under this Policy shall, subject to the Limit of Liability and to the other terms, conditions and limitations of this Policy, continue for subsequent Loss as primary insurance and, in that event, any retention, excess or deductible and the remainder of any Sublimit specified in the Primary Policy shall apply under this Policy in respect of Loss. |

|

5. |

Notification |

Any notification to the Primary Policy of a Claim or Circumstance which is required to be given in accordance with the terms and conditions of the Primary Policy shall also be given to the Insurers in writing.

|

6. |

Claims Participation |

|

6.1 |

The Insurers shall have no liability to pay costs and expenses incurred by or on behalf of the Insured unless their consent to the incurring of such costs and expenses has first been obtained, such consent not to be unreasonably delayed or withheld. |

|

6.2 |

No settlement of a claim brought by a third party shall be effected by or on behalf of the Insured for such a sum as will require payment by Insurers under this Policy unless the consent of the Insurers has first been obtained, such consent not to be unreasonably delayed or withheld. |

|

7. |

Cancellation and Termination |

This Policy may be terminated or cancelled or shall become automatically terminated or cancelled in the same manner and on the same basis or bases as the Primary Policy. However, breach by the Insured of any obligation to pay premium in respect of the Primary Policy or in respect of any other of the Underlying Policy(ies) shall not entitle the Insurers to terminate or cancel this Policy.

8. Recoveries

Where, following payment of Loss by Insurers, recovery is effected, then such recovery, net of the expenses of its being effected, shall be distributed in the following order to the following parties:

|

(i) |

to the Insured or, to such extent, if any, as appropriate, to any insurer of a policy applying excess of this Policy, but only to the extent (if any) by which such loss or liability (as applicable) exceeded the sum of the excess, deductible or retention of the Primary Policy, the Underlying Limit and the amount paid hereunder; and, |

|

(ii) |

if any balance remains following the application of (i) above, to the Insurers to the extent of the amount(s) paid by them hereunder in respect of Loss; and, |

|

(iii) |

if any balance remains following the application of (i) and (ii) above, to those, if any, entitled pursuant to the operation of the Underlying Policies to such extent, if any, of the entitlements conferred thereunder; and |

For the avoidance of doubt, nothing in this Policy shall be construed as limiting or delaying the Insured's right to payment of any Loss hereunder until such time as it has effected any recovery.

9. Alteration

No material amendment to the terms of the Primary Policy shall apply in respect of this Policy unless and until agreed in writing by the Insurers.

10. Reporting Period

Where the terms of the Primary Policy provide:

|

(i) |

the Insured with a period of time immediately following the policy period of the Primary Policy during which notice may be given to the insurers of the Primary Policy of any Claims or Circumstances; and/or, |

|

(ii) |

the right to purchase such a period, |

then the Insured shall have the same period and/or right under this Policy in the same manner and on the same terms as those provided for in the Primary Policy except in relation to the premium payable (if any). The premium (if any) payable in respect of any such period available hereunder is set out in Item 9 of the Schedule.

11. Governing Law and Jurisdiction

This insurance shall be governed by and construed in accordance with the laws of the State of Massachusetts and any dispute arising hereunder shall be subject to the exclusive jurisdiction of the courts of United States of America as per NMA1998 Service of Suit Clause U.S.A. as attached.

12. Complaints

The Insurers aim to provide a high standard at all times but if the Insured is not satisfied with the service provided it should contact the following:

In respect of Lloyd's underwriters: the person(s) identified in Item 10(a) of the Schedule.

In respect of Insurers other than Lloyd's underwriters, Willis Limited will provide on request details of the relevant persons.

In the event that the Insured remains dissatisfied it may be possible for the Insured's complaint to be referred to the Financial Ombudsman Service who may review the matter. The Financial Ombudsman Service address is:

Financial Ombudsman Service

South Quay Plaza

183 Marsh Wall

London E14 9SR

Telephone: 0845 0801800

Email: enquiries@financial-ombudsman.org.uk

Website: www.financial-ombudsman.org.uk

ENDORSEMENT No 1

This Endorsement, effective at 00.01 on 1 July 2010 forms part of Policy No. B080113012P10

SPECIAL CANCELLATION CLAUSE

In the event that an Underwriter:

|

a) |

ceases underwriting; or |

|

b) |

is the subject of an order or resolution for winding up or formally proposes a scheme of arrangement; or |

|

c) |

has its authority to carry on insurance business withdrawn, |

|

d) |

has its financial strength rating reduced by A.M.Best's, Standard & Poor's or equivalent rating agency to less than A-. |

the Insured may terminate that Underwriter's participation on this risk forthwith by giving notice and the premium payable to that Underwriter shall be pro rata to the time on risk. In the event there are any notified, reserved or paid losses or circumstances, premium shall be deemed fully earned. Any return of premium shall also be subject to a written full release of liability from the Insured.

NMA2975 (amended)

30/05/03

ENDORSEMENT No 2

This Endorsement, effective at 00.01 on 1 July 2010 forms part of Policy No. B080113012P10

U.S. TERRORISM RISK INSURANCE ACT OF 2002 AS AMENDED

NEW & RENEWAL BUSINESS ENDORSEMENT

This Endorsement is issued in accordance with the terms and conditions of the "U.S. Terrorism Risk Insurance Act of 2002" as amended as summarized in the disclosure notice.

In consideration of an additional premium of USD222 paid, it is hereby noted and agreed with effect from inception that the Terrorism exclusion to which this Insurance is subject, shall not apply to any “insured loss” directly resulting from any "act of terrorism" as defined in the "U.S. Terrorism Risk Insurance Act of 2002", as amended ("TRIA").

The coverage afforded by this Endorsement is only in respect of any “insured loss” of the type insured by this Insurance directly resulting from an "act of terrorism" as defined in TRIA. The coverage provided by this Endorsement shall expire at 12:00 midnight December 31, 2014, the date on which the TRIA Program is scheduled to terminate, or the expiry date of the policy whichever occurs first, and shall not cover any losses or events which arise after the earlier of these dates. The Terrorism exclusion, to which this Insurance is subject, applies in full force and effect to any other losses and any act or events that are not included in said definition of "act of terrorism".

This Endorsement only affects the Terrorism exclusion to which this Insurance is subject. All other terms, conditions, insured coverage and exclusions of this Insurance including applicable limits and deductibles remain unchanged and apply in full force and effect to the coverage provided by this Insurance.

Furthermore the Underwriter(s) will not be liable for any amounts for which they are not responsible under the terms of TRIA (including subsequent action of Congress pursuant to the Act) due to the application of any clause which results in a cap on the Underwriter's liability for payment for terrorism losses.

21/12/2007

LMA5091

Form approved by Lloyd's Market Association

ENDORSEMENT No 3

This Endorsement, effective at 00.01 on 1 July 2010 forms part of Policy No. B080113012P10

WAR AND TERRORISM EXCLUSION ENDORSEMENT

Notwithstanding any provision to the contrary within this insurance or any endorsement thereto it is agreed that this insurance excludes loss, damage, cost or expense of whatsoever nature directly or indirectly caused by, resulting from or in connection with any of the following regardless of any other cause or event contributing concurrently or in any other sequence to the loss;

|

(1) |

war, invasion, acts of foreign enemies, hostilities or warlike operations (whether war be declared or not), civil war, rebellion, revolution, insurrection, civil commotion assuming the proportions of or amounting to an uprising, military or usurped power; or |

|

(2) |

any act of terrorism. |

For the purpose of this endorsement an act of terrorism means an act, including but not limited to the use of force or violence and/or the threat thereof, of any person or group(s) of persons, whether acting alone or on behalf of or in connection with any organisation(s) or government(s), committed for political, religious, ideological or similar purposes including the intention to influence any government and/or to put the public, or any section of the public, in fear.

This endorsement also excludes loss, damage, cost or expense of whatsoever nature directly or indirectly caused by, resulting from or in connection with any action taken in controlling, preventing, suppressing or in any way relating to (1) and/or (2) above.

In the event any portion of this endorsement is found to be invalid or unenforceable, the remainder shall remain in full force and effect.

NMA2918 (amended)

08/10/2001

ENDORSEMENT No 4

This Endorsement, effective at 00.01 on 1 July 2010 forms part of Policy No. B080113012P10

PREMIUM PAYMENT CLAUSE

Notwithstanding any provision to the contrary within this contract or any endorsement hereto, in respect of non payment of premium only the following clause will apply.

The (Re)Insured undertakes that premium will be paid in full to (Re)Insurers by 29 August 2010.

If the premium due under this contract has not been so paid to (Re)Insurers by 29 August 2010 (Re)Insurers shall have the right to cancel this contract by notifying the (Re)Insured via the broker in writing. In the event of cancellation, premium is due to (Re)Insurers on a pro rata basis for the period that (Re)Insurers are on risk but the full contract premium shall be payable to (Re)Insurers in the event of a loss or occurrence prior to the date of termination which gives rise to a valid claim under this contract.

It is agreed that (Re)Insurers shall give not less than 15 days prior notice of cancellation to the (Re)Insured via the broker. If premium due is paid in full to (Re)Insurers before the notice period expires, notice of cancellation shall automatically be revoked. If not, the contract shall automatically terminate at the end of the notice period.

If any provision of this clause is found by any court or administrative body of competent jurisdiction to be invalid or unenforceable, such invalidity or unenforceability will not affect the other provisions of this clause which will remain in full force and effect.

30/09/08

LSW3001

WILLIS ADDENDUM TO PREMIUM PAYMENT CLAUSE LSW 3001

Notice of Cancellation in writing for the purposes of the Premium Payment Clause (LSW3001) shall be notice in writing to the Group's Compliance Officer at the Willis Building, 51 Lime Street, London EC3M 7DQ, and delivered by registered post or received and acknowledged personally by the Compliance Officer. The notice will only be accepted if the risk is properly identified, and includes at least the name of the Insured, the Willis slip reference number, the class of business and any other information which will enable the risk to be clearly identified. Further, for the avoidance of doubt, a notice of cancellation sent by e-mail to the Company shall not constitute notice in writing for the purposes of the application of the Premium Payment Clause (LSW3001).

ENDORSEMENT No 5

This Endorsement, effective at 00.01 on 1 July 2010 forms part of Policy No. B080113012P10

U.S.A.

NUCLEAR INCIDENT EXCLUSION CLAUSE-LIABILITY-DIRECT (BROAD)

For attachment to insurances of the following classifications in the U.S.A., its Territories and Possessions, Puerto Rico and the Canal Zone:-Owners, Landlords and Tenants Liability, Contractual Liability, Elevator Liability, Owners or Contractors (including railroad) Protective Liability, Manufacturers and Contractors Liability, Product Liability, Professional and Malpractice Liability, Storekeepers Liability, Garage Liability, Automobile Liability (including Massachusetts Motor Vehicle or Garage Liability), not being insurances of the classifications to which the Nuclear Incident Exclusion Clause-Liability-Direct (Limited) applies.

This policy* does not apply:-

|

I. |

Under any Liability Coverage, to injury, sickness, disease, death or destruction |

| |

(a) |

with respect to which an insured under the policy is also an insured under a nuclear energy liability policy issued by Nuclear Energy Liability Insurance Association, Mutual Atomic Energy Liability Underwriters or Nuclear Insurance Association of Canada, or would be an insured under any such policy but for its termination upon exhaustion of its limit of liability; or |

| |

(b) |

resulting from the hazardous properties of nuclear material and with respect to which (1) any person or organization is required to maintain financial protection pursuant to the Atomic Energy Act of 1954, or any law amendatory thereof, or (2) the insured is, or had this policy not been issued would be, entitled to indemnity from the United States of America, or any agency thereof, under any agreement entered into by the United States of America, or any agency thereof, with any person or organization. |

|

II. |

Under any Medical Payments Coverage, or under any Supplementary Payments Provision |

| |

relating |

to immediate medical or surgical relief, to expenses incurred with respect of bodily |

| |

injury, |

sickness, disease or death resulting from the hazardous properties of nuclear material |

| |

and |

arising out of the operation of a nuclear facility by any person or organization. |

|

III. |

Under any Liability Coverage, to injury, sickness, disease, death or destruction resulting from |

| |

the |

hazardous properties of nuclear material, if |

| |

(a) |

the nuclear material (1) is at any nuclear facility owned by, or operated by or on behalf of, an insured or (2) has been discharged or dispersed therefrom; |

| |

(b) |

the nuclear material is contained in spent fuel or waste at any time possessed, handled, used, processed, stored, transported or disposed of by or on behalf of an insured; or |

| |

(c) |

the injury, sickness, disease, death or destruction arises out of the furnishing by an insured of services, materials, parts or equipment in connection with the planning, construction, maintenance, operation or use of any nuclear facility, but if such facility is located within the United States of America, its territories or possessions or Canada, this exclusion (c) applies only to injury to or destruction of property at such nuclear facility. |

|

IV. |

As used in this endorsement: |

| |

“hazardous |

properties” include radioactive, toxic or explosive properties; “nuclear |

| |

material” |

means source material, special nuclear material or byproduct material; “source |

| |

material”, |

“special nuclear material”, and "byproduct material" have the meanings |

| |

given |

them in the Atomic Energy Act 1954 or in any law amendatory thereof; “spent fuel” |

| |

means |

any fuel element or fuel component, solid or liquid, which has been used or exposed to |

| |

radiation |

in a nuclear reactor; “waste” means any waste material (1) containing byproduct |

| |

material |

and (2) resulting from the operation by any person or organization of any nuclear |

| |

facility |

included within the definition of nuclear facility under paragraph (a) or (b) thereof; |

| |

“nuclear |

facility” means |

| |

(a) |

any nuclear reactor, |

| |

(b) |

any equipment or device designed or used for (1) separating the isotopes of uranium or plutonium, (2) processing or utilizing spent fuel, or (3) handling, processing or packaging waste, |

| |

(c) |

any equipment or device used for the processing, fabricating or alloying of special nuclear material if at any time the total amount of such material in the custody of the insured at the premises where such equipment or device is located consists of or contains more than 25 grams of plutonium or uranium 233 or any combination thereof, or more than 250 grams of uranium 235, |

| |

(d) |

any structure, basin, excavation, premises or place prepared or used for the storage or disposal of waste, and includes the site on which any of the foregoing is located, all operations conducted on such site and all premises used for such operations; “nuclear reactor” means any apparatus designed or used to sustain nuclear fission in a self- supporting chain reaction or to contain a critical mass of fissionable material. With respect to injury to or destruction of property, the word “injury” or “destruction” includes all forms of radioactive contamination of property. |

It is understood and agreed that, except as specifically provided in the foregoing to the contrary, this clause is subject to the terms, exclusions, conditions and limitations of the Policy to which it is attached.

*NOTE:- As respects policies which afford liability coverages and other forms of coverage in addition, the words underlined should be amended to designate the liability coverage to which this clause is to apply.

17/3/60

ENDORSEMENT No 6

This Endorsement, effective at 00.01 on 1 July 2010 forms part of Policy No. B080113012P10

U.S.A.

RADIOACTIVE CONTAMINATION EXCLUSION CLAUSE

-LIABILITY-DIRECT

(Approved by Lloyd's Underwriters' Non-Marine Association)

For attachment (in addition to the appropriate Nuclear Incident Exclusion Clause - Liability -Direct) to liability insurances affording worldwide coverage.

In relation to liability arising outside the U.S.A., its Territories or Possessions, Puerto Rico or the Canal Zone, this Policy does not cover any liability of whatsoever nature directly or indirectly caused by or contributed to by or arising from ionising radiations or contamination by radioactivity from any nuclear fuel or from any nuclear waste from the combustion of nuclear fuel.

13/2/64

N.M.A. 1477

All other terms, conditions and limitations of this Policy shall remain unchanged.

ENDORSEMENT No 7

This Endorsement, effective at 00.01 on 1 July 2010 forms part of Policy No. B080113012P10

SERVICE OF SUIT CLAUSE (U.S.A.)

It is agreed that in the event of the failure of the Underwriters hereon to pay any amount claimed to be due hereunder, the Underwriters hereon, at the request of the Assured (or Reinsured), will submit to the jurisdiction of a Court of competent jurisdiction within the United States. Nothing in this Clause constitutes or should be understood to constitute a waiver of Underwriters’ rights to commence an action in any Court of competent jurisdiction in the United States, to remove an action to a United States District Court, or to seek a transfer of a case to another Court as permitted by the laws of the United States or of any State in the United States. It is further agreed that service of process in such suit may be made upon Mendes & Mount LLP, 750 Seventh Avenue, New York New York 10019-6829, United States of America and that in any suit instituted against any one of them upon this contract, Underwriters will abide by the final decision of such Court or of any Appellate Court in the event of an appeal.

The above-named are authorized and directed to accept service of process on behalf of Underwriters in any such suit and/or upon the request of the Assured (or Reinsured) to give a written undertaking to the Assured (or Reinsured) that they will enter a general appearance upon Underwriters’ behalf in the event such a suit shall be instituted.

Further, pursuant to any statute of any state, territory or district of the United States which makes provision therefor, Underwriters hereon hereby designate the Superintendent, Commissioner or Director of Insurance or other officer specified for that purpose in the statute, or his successor or successors in office, as their true and lawful attorney upon whom may be served any lawful process in any action, suit or proceeding instituted by or on behalf of the Assured (or Reinsured) or any beneficiary hereunder arising out of this contract of insurance (or reinsurance), and hereby designate the above-named as the person to whom the said officer is authorized to mail such process or a true copy thereof.

N.M.A. 1998 (24/4/86)

All other terms, conditions and limitations of this Policy shall remain unchanged.

ENDORSEMENT No 8

This Endorsement, effective at 00.01 on 1 July 2010 forms part of Policy No. B080113012P10

This policy contains a Tie-in of limits between this Fidelity Fixed Income and Asset Allocation Funds Bond Policy and Fidelity Fixed Income and Asset Allocation Funds Professional Policy.

All other terms, conditions and limitations of this Policy shall remain unchanged.

ENDORSEMENT No 9

This Endorsement, effective at 00.01 on 1 July 2010 forms part of Policy No.B080113012P10

The language used for Contract interpretation shall be English as set out in the contract Wording.

All other terms, conditions and limitations of this Policy shall remain unchanged.

ENDORSEMENT No 10

This Endorsement, effective at 00.01 on 1 July 2010 forms part of Policy No.B080113012P10

Where any date on which the Premium is due to be paid falls on a weekend or Public Holiday, presentation to Insurers or their agents on the next working day will be deemed to comply with the relevant premium payment requirement. For the purposes of this clause, Public Holiday shall mean any public or statutory holiday in any territory through which the Premium must pass between the Insured and Insurers or their agents.

All other terms, conditions and limitations of this Policy shall remain unchanged.

ENDORSEMENT No 11

This Endorsement, effective at 00.01 on 1 July 2010 forms part of Policy No.B080113012P10

This contract is subject to US State Surplus Lines requirements. It is the responsibility of the Surplus Lines Broker to affix a Surplus Lines Notice to the contract document before it is provided to the insured. In the event that the Surplus Lines Notice is not affixed to the contract document the insured should contact the Surplus Lines broker.

All other terms, conditions and limitations of this Policy shall remain unchanged.

(RE)INSURERS LIABILITY CLAUSE

(Re)insurer’s liability several not joint

The liability of a (re)insurer under this contract is several and not joint with other (re)insurers party to this contract. A (re)insurer is liable only for the proportion of liability it has underwritten. A (re)insurer is not jointly liable for the proportion of liability underwritten by any other (re)insurer. Nor is a (re)insurer otherwise responsible for any liability of any other (re)insurer that may underwrite this contract.

The proportion of liability under this contract underwritten by a (re)insurer (or, in the case of a Lloyd’s syndicate, the total of the proportions underwritten by all the members of the syndicate taken together) is shown next to its stamp. This is subject always to the provision concerning “signing” below.

In the case of a Lloyd’s syndicate, each member of the syndicate (rather than the syndicate itself) is a (re)insurer. Each member has underwritten a proportion of the total shown for the syndicate (that total itself being the total of the proportions underwritten by all the members of the syndicate taken together). The liability of each member of the syndicate is several and not joint with other members. A member is liable only for that member’s proportion. A member is not jointly liable for any other member’s proportion. Nor is any member otherwise responsible for any liability of any other (re)insurer that may underwrite this contract. The business address of each member is Lloyd’s, One Lime Street, London EC3M 7HA. The identity of each member of a Lloyd’s syndicate and their respective proportion may be obtained by writing to Market Services, Lloyd’s, at the above address.

Proportion of liability

Unless there is “signing” (see below), the proportion of liability under this contract underwritten by each (re)insurer (or, in the case of a Lloyd’s syndicate, the total of the proportions underwritten by all the members of the syndicate taken together) is shown next to its stamp and is referred to as its “written line”.

Where this contract permits, written lines, or certain written lines, may be adjusted (“signed”). In that case a schedule is to be appended to this contract to show the definitive proportion of liability under this contract underwritten by each (re)insurer (or, in the case of a Lloyd’s syndicate, the total of the proportions underwritten by all the members of the syndicate taken together). A definitive proportion (or, in the case of a Lloyd’s syndicate, the total of the proportions underwritten by all the members of a Lloyd’s syndicate taken together) is referred to as a “signed line”. The signed lines shown in the schedule will prevail over the written lines unless a proven error in calculation has occurred.

Although reference is made at various points in this clause to “this contract” in the singular, where the circumstances so require this should be read as a reference to contracts in the plural.

21/6/07

LMA3333

NMA LINES CLAUSE

This Insurance, being signed for 100% of 100% insures only that proportion of any loss, whether total or partial, including but not limited to that proportion of associated expenses, if any, to the extent and in the manner provided in this Insurance.

The percentages signed in the Table are percentages of 100% of the amount(s) of Insurance stated herein.

NMA 2419

|

|

|

|

BUREAU REFERENCE |

61635 09/07/2010 |

BROKER NUMBER 0801 |

|

PROPORTION % |

SYNDICATE |

UNDERWRITER'S REFERENCE |

|

83.33------------------------- |

1274------------------------- |

300563800010 |

|

16.67------------------------- |

2488------------------------- |

AKFH6ALL5002 |

|

TOTAL LINE |

No. OF SYNDICATES |

|

|

100.00 |

2 |

|

|

|

|

|

THE LIST OF UNDERWRITING MEMBERS |

|

OF LLOYD'S IS IN RESPECT OF 2010 |

|

YEAR OF ACCOUNT |

|

|

|

EFFECTIVE FROM: 01 JUL 2010 |

|

BUREAU USE ONLY |

|

Page 1 of 1 |

|

USL1 72 3762 |

RISK CODE: BB |

|

|

|

|

|

BUREAU REFERENCE |

61636 09/07/2010 |

BROKER NUMBER 0801 |

|

PROPORTION % |

SYNDICATE |

UNDERWRITER'S REFERENCE |

|

83.33------------------------- |

1274------------------------- |

300563800010 |

|

16.67------------------------- |

2488------------------------- |

AKFT6ALL5002 |

|

TOTAL LINE |

No. OF SYNDICATES |

|

|

100.00 |

2 |

|

|

|

|

|

THE LIST OF UNDERWRITING MEMBERS |

|

OF LLOYD'S IS IN RESPECT OF 2010 |

|

YEAR OF ACCOUNT |

|

|

|

EFFECTIVE FROM: 01 JUL 2010 |

|

BUREAU USE ONLY |

|

Page 1 of 1 |

|

USL1 72 3762 |

RISK CODE: 7T |

|

One Lime Street London EC3M 7HA