Like securities of all mutual funds, these securities have not been approved or disapproved by the Securities and Exchange Commission, and the Securities and Exchange Commission has not determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Fidelity®

Blue Chip Growth

Fund

(fund number 312, trading symbol FBGRX)

Prospectus

September 28, 2001

(fidelity_logo_graphic)

82 Devonshire Street, Boston, MA 02109

Prospectus

Contents

|

Fund Summary |

Investment Summary |

|

|

|

Performance |

|

|

|

Fee Table |

|

|

Fund Basics |

Investment Details |

|

|

|

Valuing Shares |

|

|

Shareholder Information |

Buying and Selling Shares |

|

|

|

Exchanging Shares |

|

|

|

Features and Policies |

|

|

|

Dividends and Capital Gain Distributions |

|

|

|

Tax Consequences |

|

|

Fund Services |

Fund Management |

|

|

|

Fund Distribution |

|

|

Appendix |

Financial Highlights |

|

|

|

Additional Performance Information |

Prospectus

Fund Summary

Investment Objective

Blue Chip Growth Fund seeks growth of capital over the long term.

Principal Investment Strategies

Fidelity Management & Research Company (FMR)'s principal investment strategies include:

- Normally investing primarily in common stocks of well-known and established companies.

- Normally investing at least 65% of total assets in blue chip companies (those with a market capitalization of at least $200 million, if the company's stock is included in the Standard & Poor's 500SM Index (S&P 500®) or the Dow Jones Industrial AverageSM (DJIASM ), or $1 billion if not included in either index).

- Investing in companies that it believes have above-average growth potential (stocks of these companies are often called "growth" stocks).

- Investing in securities of domestic and foreign issuers.

- Using fundamental analysis of each issuer's financial condition and industry position and market and economic conditions to select investments.

Principal Investment Risks

The fund is subject to the following principal investment risks:

- Stock Market Volatility. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Different parts of the market can react differently to these developments.

- Foreign Exposure. Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market, or economic developments and can perform differently from the U.S. market.

- Issuer-Specific Changes. The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole.

- "Growth" Investing. "Growth" stocks can perform differently from the market as a whole and other types of stocks and can be more volatile than other types of stocks.

An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

When you sell your shares of the fund, they could be worth more or less than what you paid for them.

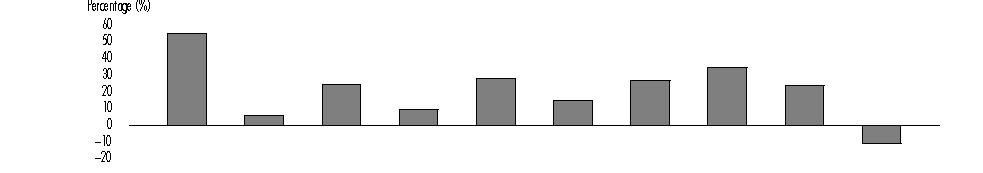

The following information illustrates the changes in the fund's performance from year to year and compares the fund's performance to the performance of a market index and an average of the performance of similar funds over various periods of time. Returns are based on past results and are not an indication of future performance.

|

Blue Chip Growth |

||||||||||

|

Calendar Years |

1991 |

1992 |

1993 |

1994 |

1995 |

1996 |

1997 |

1998 |

1999 |

2000 |

|

|

54.81% |

6.17% |

24.50% |

9.85% |

28.38% |

15.38% |

27.02% |

34.76% |

24.26% |

-10.54% |

During the periods shown in the chart for Blue Chip Growth, the highest return for a quarter was 23.35% (quarter ended December 31, 1998) and the lowest return for a quarter was -12.33% (quarter ended December 31, 2000).

The year-to-date return as of June 30, 2001 for Blue Chip Growth was -9.76%.

Prospectus

Fund Summary - continued

|

For the periods ended |

Past 1 |

Past 5 |

Past 10 |

|

Blue Chip Growth |

-10.54% |

17.03% |

20.28% |

|

S&P 500® |

-9.10% |

18.33% |

17.46% |

|

Russell 1000® Growth Index |

-22.42% |

18.15% |

17.33% |

|

LipperSM Growth Funds Average |

-7.61% |

16.63% |

16.38% |

Standard & Poor's 500 Index (S&P 500) is a market capitalization-weighted index of common stocks.

Russell 1000® Growth Index is a market capitalization-weighted index of growth-oriented stocks of the largest U.S. domiciled companies.

The Lipper Funds Average reflects the performance (excluding sales charges) of mutual funds with similar objectives.

The following table describes the fees and expenses that are incurred when you buy, hold, or sell shares of the fund. The annual fund operating expenses provided below for the fund do not reflect the effect of any reduction of certain expenses during the period.

Shareholder fees (paid by the investor directly)

|

Sales charge (load) on purchases and reinvested distributions |

None |

|

Deferred sales charge (load) on redemptions |

None |

Annual fund operating expenses (paid from fund assets)

|

Management fee |

0.66% |

|

Distribution and Service (12b-1) fees |

None |

|

Other expenses |

0.23% |

|

Total annual fund operating expenses |

0.89% |

A portion of the brokerage commissions that the fund pays is used to reduce the fund's expenses. In addition, through arrangements with the fund's custodian and transfer agent, credits realized as a result of uninvested cash balances are used to reduce custodian and transfer agent expenses. Including these reductions, the total fund operating expenses would have been 0.87%.

This example helps you compare the cost of investing in the fund with the cost of investing in other mutual funds.

Let's say, hypothetically, that the fund's annual return is 5% and that your shareholder fees and the fund's annual operating expenses are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated:

|

1 year |

$ 91 |

|

3 years |

$ 284 |

|

5 years |

$ 493 |

|

10 years |

$ 1,096 |

Prospectus

Fund Basics

Investment Objective

Blue Chip Growth Fund seeks growth of capital over the long term.

Principal Investment Strategies

FMR normally invests the fund's assets primarily in common stocks of well-known and established companies.

FMR normally invests at least 65% of the fund's total assets in blue chip companies. FMR defines blue chip companies to include those with a market capitalization of at least $200 million, if the company's stock is included in the S&P 500 or the DJIA, or $1 billion if not included in either index.

FMR invests the fund's assets in companies FMR believes have above-average growth potential. Growth may be measured by factors such as earnings or revenue. Companies with high growth potential tend to be companies with higher than average price/earnings (P/E) or price/book (P/B) ratios. Companies with strong growth potential often have new products, technologies, distribution channels, or other opportunities, or have a strong industry or market position. The stocks of these companies are often called "growth" stocks.

FMR may invest the fund's assets in securities of foreign issuers in addition to securities of domestic issuers.

In buying and selling securities for the fund, FMR relies on fundamental analysis of each issuer and its potential for success in light of its current financial condition, its industry position, and economic and market conditions. Factors considered include growth potential, earnings estimates, and management.

FMR may lend the fund's securities to broker-dealers or other institutions to earn income for the fund.

FMR may use various techniques, such as buying and selling futures contracts and exchange traded funds, to increase or decrease the fund's exposure to changing security prices or other factors that affect security values. If FMR's strategies do not work as intended, the fund may not achieve its objective.

Description of Principal Security Types

Equity securities represent an ownership interest, or the right to acquire an ownership interest, in an issuer. Different types of equity securities provide different voting and dividend rights and priority in the event of the bankruptcy of the issuer. Equity securities include common stocks, preferred stocks, convertible securities, and warrants.

Principal Investment Risks

Many factors affect the fund's performance. The fund's share price changes daily based on changes in market conditions and interest rates and in response to other economic, political, or financial developments. The fund's reaction to these developments will be affected by the types of securities in which the fund invests, the financial condition, industry and economic sector, and geographic location of an issuer, and the fund's level of investment in the securities of that issuer. When you sell your shares of the fund, they could be worth more or less than what you paid for them.

The following factors can significantly affect the fund's performance:

Stock Market Volatility. The value of equity securities fluctuates in response to issuer, political, market, and economic developments. In the short term, equity prices can fluctuate dramatically in response to these developments. Different parts of the market and different types of equity securities can react differently to these developments. For example, large cap stocks can react differently from small cap stocks, and "growth" stocks can react differently from "value" stocks. Issuer, political, or economic developments can affect a single issuer, issuers within an industry or economic sector or geographic region, or the market as a whole.

Foreign Exposure. Foreign securities, foreign currencies, and securities issued by U.S. entities with substantial foreign operations can involve additional risks relating to political, economic, or regulatory conditions in foreign countries. These risks include fluctuations in foreign currencies; withholding or other taxes; trading, settlement, custodial, and other operational risks; and the less stringent investor protection and disclosure standards of some foreign markets. All of these factors can make foreign investments, especially those in emerging markets, more volatile and potentially less liquid than U.S. investments. In addition, foreign markets can perform differently from the U.S. market.

Issuer-Specific Changes. Changes in the financial condition of an issuer, changes in specific economic or political conditions that affect a particular type of security or issuer, and changes in general economic or political conditions can affect the value of an issuer's securities. The value of securities of smaller, less well-known issuers can be more volatile than that of larger issuers.

"Growth" Investing. "Growth" stocks can react differently to issuer, political, market, and economic developments than the market as a whole and other types of stocks. "Growth" stocks tend to be more expensive relative to their earnings or assets compared to other types of stocks. As a result, "growth" stocks tend to be sensitive to changes in their earnings and more volatile than other types of stocks.

In response to market, economic, political, or other conditions, FMR may temporarily use a different investment strategy for defensive purposes. If FMR does so, different factors could affect the fund's performance and the fund may not achieve its investment objective.

Fundamental Investment Policies

The policy discussed below is fundamental, that is, subject to change only by shareholder approval.

Blue Chip Growth Fund seeks growth of capital over the long term by investing primarily in a diversified portfolio of common stocks of well-known and established companies.

Prospectus

Fund Basics - continued

The fund is open for business each day the New York Stock Exchange (NYSE) is open.

The fund's net asset value per share (NAV) is the value of a single share. Fidelity normally calculates the fund's NAV as of the close of business of the NYSE, normally 4:00 p.m. Eastern time. However, NAV may be calculated earlier if trading on the NYSE is restricted or as permitted by the Securities and Exchange Commission (SEC). The fund's assets are valued as of this time for the purpose of computing the fund's NAV.

To the extent that the fund's assets are traded in other markets on days when the NYSE is closed, the value of the fund's assets may be affected on days when the fund is not open for business. In addition, trading in some of the fund's assets may not occur on days when the fund is open for business.

The fund's assets are valued primarily on the basis of market quotations. Certain short-term securities are valued on the basis of amortized cost. If market quotations are not readily available or do not accurately reflect fair value for a security or if a security's value has been materially affected by events occurring after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), that security may be valued by another method that the Board of Trustees believes accurately reflects fair value. A security's valuation may differ depending on the method used for determining value.

Prospectus

Shareholder Information

Fidelity Investments was established in 1946 to manage one of America's first mutual funds. Today, Fidelity is the largest mutual fund company in the country, and is known as an innovative provider of high-quality financial services to individuals and institutions.

In addition to its mutual fund business, the company operates one of America's leading brokerage firms, Fidelity Brokerage Services LLC (FBS LLC). Fidelity is also a leader in providing tax-advantaged retirement plans for individuals investing on their own or through their employer.

You may buy or sell shares of a fund through a Fidelity brokerage account or a Fidelity mutual fund account. If you buy or sell shares of a fund (other than by exchange) through a Fidelity brokerage account, your transactions generally involve your Fidelity brokerage core (a settlement vehicle included as part of your Fidelity brokerage account).

If you do not currently have a Fidelity brokerage account or a Fidelity mutual fund account and would like to invest in a fund, you may need to complete an application. For more information about a Fidelity brokerage account or a Fidelity mutual fund account, please visit Fidelity's web site at www.fidelity.com, call 1-800-FIDELITY, or visit a Fidelity Investor Center (call 1-800-544-9797 for the center nearest you).

You may also buy or sell shares of the fund through a retirement account (such as an IRA or an account funded through salary deduction) or an investment professional. Retirement specialists are available at 1-800-544-4774 to answer your questions about Fidelity retirement products. If you buy or sell shares of a fund through a retirement account or an investment professional, the procedures for buying, selling, and exchanging shares of the fund and the account features and policies may differ from those discussed in this prospectus. Fees in addition to those discussed in this prospectus may also apply. For example, you may be charged a transaction fee if you buy or sell shares of the fund through a non-Fidelity broker or other investment professional.

|

Buying and Selling Information |

|

Internet www.fidelity.com |

|

Phone Fidelity Automated Service Telephone (FAST®) 1-800-544-5555 To reach a Fidelity representative 1-800-544-6666 |

|

Additional purchases: Redemptions: |

|

TDD-Service for the Deaf and Hearing Impaired 1-800-544-0118 |

|

You should include the following information with any order to buy, sell, or exchange shares:

|

Certain methods of contacting Fidelity, such as by telephone or electronically, may be unavailable or delayed (for example, during periods of unusual market activity). In addition, the level and type of service available may be restricted based on criteria established by Fidelity.

|

Fund Minimums |

|

|

Initial Purchase |

$2,500 |

|

For certain Fidelity retirement accountsA |

$500 |

|

Subsequent Purchase |

$250 |

|

For certain Fidelity retirement accountsA |

$250 |

|

Through regular investment plans |

$100 |

|

Balance |

$2,000 |

|

For certain Fidelity retirement accountsA |

$500 |

A Fidelity Traditional IRA, Roth IRA, Rollover IRA, Simplified Employee Pension-IRA, and Keogh accounts.

There is no minimum balance or initial or subsequent purchase minimum for investments through Portfolio Advisory ServicesSM , a mutual fund or a qualified state tuition program for which FMR or an affiliate serves as investment manager, certain Fidelity retirement accounts funded through salary deduction, or fund positions opened with the proceeds of distributions from such retirement accounts.

In addition, the fund may waive or lower purchase minimums in other circumstances.

Prospectus

Shareholder Information - continued

The price to buy one share of the fund is the fund's NAV. The fund's shares are sold without a sales charge.

Your shares will be bought at the next NAV calculated after your investment is received in proper form.

Short-term or excessive trading into and out of the fund may harm performance by disrupting portfolio management strategies and by increasing expenses. Accordingly, the fund may reject any purchase orders, including exchanges, particularly from market timers or investors who, in FMR's opinion, have a pattern of short-term or excessive trading or whose trading has been or may be disruptive to the fund. For these purposes, FMR may consider an investor's trading history in the fund or other Fidelity funds, and accounts under common ownership or control.

The fund may stop offering shares completely or may offer shares only on a limited basis, for a period of time or permanently.

If you place an order to buy shares and your payment is not received and collected, your purchase may be canceled and you could be liable for any losses or fees a fund or Fidelity has incurred.

Certain financial institutions that have entered into sales agreements with Fidelity Distributors Corporation (FDC) may enter confirmed purchase orders on behalf of customers by phone, with payment to follow no later than the time when the fund is priced on the following business day. If payment is not received by that time, the order will be canceled and the financial institution could be held liable for resulting fees or losses.

The price to sell one share of the fund is the fund's NAV.

Your shares will be sold at the next NAV calculated after your order is received in proper form.

Certain requests must include a signature guarantee. It is designed to protect you and Fidelity from fraud. If you hold your shares in a Fidelity mutual fund account, your request must be made in writing and include a signature guarantee if any of the following situations apply:

- You wish to sell more than $100,000 worth of shares;

- The address on your account (record address) has changed within the last 15 or 30 days, depending on your account, and you wish to sell $10,000 or more of shares;

- You are requesting that a check be mailed to a different address than the record address;

- You are requesting that redemption proceeds be paid to someone other than the account owner; or

- The redemption proceeds are being transferred to a Fidelity mutual fund account with a different registration.

You should be able to obtain a signature guarantee from a bank, broker (including Fidelity Investor Centers), dealer, credit union (if authorized under state law), securities exchange or association, clearing agency, or savings association. A notary public cannot provide a signature guarantee.

When you place an order to sell shares, note the following:

- If you are selling some but not all of your shares, keep your fund balance above $2,000 to keep your fund position open ($500 for fund balances in retirement accounts), except fund positions not subject to balance minimums.

- Normally, redemptions will be processed by the next business day, but may take up to seven days to be processed if making immediate payment would adversely affect the fund.

- Redemption proceeds (other than exchanges) may be delayed until money from prior purchases sufficient to cover your redemption has been received and collected. This can take up to seven business days after a purchase.

- Redemptions may be suspended or payment dates postponed when the NYSE is closed (other than weekends or holidays), when trading on the NYSE is restricted, or as permitted by the SEC.

- Redemption proceeds may be paid in securities or other property rather than in cash if FMR determines it is in the best interests of the fund.

- You will not receive interest on amounts represented by uncashed redemption checks.

To sell shares issued with certificates, call Fidelity for instructions. The fund no longer issues share certificates.

An exchange involves the redemption of all or a portion of the shares of one fund and the purchase of shares of another fund.

As a shareholder, you have the privilege of exchanging shares of the fund for shares of other Fidelity funds.

However, you should note the following policies and restrictions governing exchanges:

- The fund may temporarily or permanently terminate the exchange privilege of any investor who makes more than four exchanges out of the fund per calendar year. Accounts under common ownership or control will be counted together for purposes of the four exchange limit.

- The exchange limit may be modified for accounts held by certain institutional retirement plans to conform to plan exchange limits and Department of Labor regulations. See your retirement plan materials for further information.

- The fund may refuse exchange purchases by any person or group if, in FMR's judgment, the fund would be unable to invest the money effectively in accordance with its investment objective and policies, or would otherwise potentially be adversely affected.

- Before exchanging into a fund, read its prospectus.

Prospectus

Shareholder Information - continued

- The fund you are exchanging into must be available for sale in your state.

- Exchanges may have tax consequences for you.

- If you are exchanging between accounts that are not registered in the same name, address, and taxpayer identification number, there may be additional requirements.

The fund may terminate or modify the exchange privilege in the future.

Other funds may have different exchange restrictions, and may impose trading fees of up to 2.00% of the amount exchanged. Check each fund's prospectus for details.

The following features may be available to buy and sell shares of the fund or to move money to and from your account, depending on whether you are investing through a Fidelity brokerage account or a Fidelity mutual fund account. Please visit Fidelity's web site at www.fidelity.com or call 1-800-544-6666 for more information.

|

Electronic Funds Transfer: electronic money movement through the Automated Clearing House

- Make periodic (automatic) purchases of Fidelity fund shares or payments to your Fidelity brokerage account. - Make periodic (automatic) redemptions of Fidelity fund shares or withdrawals from your Fidelity brokerage account. |

||

|

Wire: electronic money movement through the Federal Reserve wire system

|

||

|

Automatic Transactions: periodic (automatic) transactions

|

The following policies apply to you as a shareholder.

Statements that Fidelity sends to you include the following:

- Confirmation statements (after transactions affecting your fund balance except reinvestment of distributions in the fund or another fund and certain transactions through automatic investment or withdrawal programs).

- Monthly or quarterly account statements (detailing fund balances and all transactions completed during the prior month or quarter).

To reduce expenses, only one copy of most financial reports and prospectuses may be mailed to households, even if more than one person in the household holds shares of the fund. Call Fidelity at 1-800-544-8544 if you need additional copies of financial reports or prospectuses. If you do not want the mailing of these documents to be combined with those for other members of your household, contact Fidelity in writing at P.O. Box 5000, Cincinnati, Ohio 45273-8692.

Electronic copies of most financial reports and prospectuses are available at Fidelity's web site. To participate in Fidelity's electronic delivery program, call Fidelity or visit Fidelity's web site for more information.

You may initiate many transactions by telephone or electronically. Fidelity will not be responsible for any losses resulting from unauthorized transactions if it follows reasonable security procedures designed to verify the identity of the investor. Fidelity will request personalized security codes or other information, and may also record calls. For transactions conducted through the Internet, Fidelity recommends the use of an Internet browser with 128-bit encryption. You should verify the accuracy of your confirmation statements immediately after you receive them. If you do not want the ability to sell and exchange by telephone, call Fidelity for instructions.

Fidelity may deduct a small balance maintenance fee of $12.00 from a fund balance with a value of less than $2,000. It is expected that fund balances will be valued on the second Friday in November of each calendar year. Fund positions opened after September 30 will not be subject to the fee for that calendar year. The fee, which is payable to Fidelity, is designed to offset in part the relatively higher costs of servicing smaller fund positions. This fee will not be deducted from fund positions opened after January 1 of that calendar year if those positions use regular investment plans.

Prospectus

Shareholder Information - continued

You will be given 30 days' notice to reestablish the minimum balance if your fund balance falls below $2,000 ($500 for fund balances in retirement accounts), for any reason, including solely due to declines in the fund's NAV. If you do not increase your balance, Fidelity may sell all of your shares and send the proceeds to you. Your shares will be sold at the NAV on the day Fidelity closes your fund position. Certain fund positions are not subject to these balance requirements and will not be closed for failure to maintain a minimum balance.

Fidelity may charge a fee for certain services, such as providing historical account documents.

Dividends and Capital Gain Distributions

The fund earns dividends, interest, and other income from its investments, and distributes this income (less expenses) to shareholders as dividends. The fund also realizes capital gains from its investments, and distributes these gains (less any losses) to shareholders as capital gain distributions.

The fund normally pays dividends and capital gain distributions in September and December.

When you open an account, specify on your application how you want to receive your distributions. The following distribution options are available for the fund:

1. Reinvestment Option. Your dividends and capital gain distributions will be automatically reinvested in additional shares of the fund. If you do not indicate a choice on your application, you will be assigned this option.

2. Income-Earned Option. Your capital gain distributions will be automatically reinvested in additional shares of the fund. Your dividends will be paid in cash.

3. Cash Option. Your dividends and capital gain distributions will be paid in cash.

4. Directed Dividends® Option. Your dividends will be automatically invested in shares of another identically registered Fidelity fund. Your capital gain distributions will be automatically invested in shares of another identically registered Fidelity fund, automatically reinvested in additional shares of the fund, or paid in cash.

If the distribution option you prefer is not listed on your account application, or if you want to change your current distribution option, visit Fidelity's web site at www.fidelity.com or call 1-800-544-6666 for more information.

If you elect to receive distributions paid in cash by check and the U.S. Postal Service does not deliver your checks, your distribution option may be converted to the Reinvestment Option. You will not receive interest on amounts represented by uncashed distribution checks.

As with any investment, your investment in the fund could have tax consequences for you. If you are not investing through a tax-advantaged retirement account, you should consider these tax consequences.

Taxes on distributions. Distributions you receive from the fund are subject to federal income tax, and may also be subject to state or local taxes.

For federal tax purposes, certain of the fund's distributions, including dividends and distributions of short-term capital gains, are taxable to you as ordinary income, while certain of the fund's distributions, including distributions of long-term capital gains, are taxable to you generally as capital gains.

If you buy shares when a fund has realized but not yet distributed income or capital gains, you will be "buying a dividend" by paying the full price for the shares and then receiving a portion of the price back in the form of a taxable distribution.

Any taxable distributions you receive from the fund will normally be taxable to you when you receive them, regardless of your distribution option.

Taxes on transactions. Your redemptions, including exchanges, may result in a capital gain or loss for federal tax purposes. A capital gain or loss on your investment in the fund generally is the difference between the cost of your shares and the price you receive when you sell them.

Prospectus

Fund Services

Blue Chip Growth is a mutual fund, an investment that pools shareholders' money and invests it toward a specified goal.

FMR is the fund's manager.

As of January 31, 2001, FMR and its affiliate, FMR Co., Inc. (FMRC) had approximately $612 billion in discretionary assets under management.

As the manager, FMR is responsible for choosing the fund's investments and handling its business affairs.

Affiliates assist FMR with foreign investments:

- Fidelity Management & Research (U.K.) Inc. (FMR U.K.), in London, England, serves as a sub-adviser for the fund. FMR U.K. was organized in 1986 to provide investment research and advice to FMR. FMR U.K. may provide investment research and advice on issuers based outside the United States and may also provide investment advisory services for the fund.

- Fidelity Management & Research (Far East) Inc. (FMR Far East) serves as a sub-adviser for the fund. FMR Far East was organized in 1986 to provide investment research and advice to FMR. FMR Far East may provide investment research and advice on issuers based outside the United States and may also provide investment advisory services for the fund.

- Fidelity Investments Japan Limited (FIJ), in Tokyo, Japan, serves as a sub-adviser for the fund. As of March 31, 2001, FIJ had approximately $22 billion in discretionary assets under management. FIJ may provide investment research and advice on issuers based outside the United States and may also provide investment advisory and order execution services for the fund from time to time.

FMRC serves as a sub-adviser for the fund. FMRC is primarily responsible for choosing investments for the fund.

John McDowell is vice president and manager of Blue Chip Growth, which he has managed since March 1996. He also manages other Fidelity funds, and serves as the Group Leader for Fidelity's Growth Funds. Mr. McDowell joined Fidelity in 1985.

From time to time a manager, analyst, or other Fidelity employee may express views regarding a particular company, security, industry, or market sector. The views expressed by any such person are the views of only that individual as of the time expressed and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

The fund pays a management fee to FMR. The management fee is calculated and paid to FMR every month. The fee is determined by calculating a basic fee and then applying a performance adjustment. The performance adjustment either increases or decreases the management fee, depending on how well the fund has performed relative to the S&P 500.

|

Management fee |

= |

Basic fee |

+/- |

Performance adjustment |

The basic fee is calculated by adding a group fee rate to an individual fund fee rate, dividing by twelve, and multiplying the result by the fund's average net assets throughout the month.

The group fee rate is based on the average net assets of all the mutual funds advised by FMR. This rate cannot rise above 0.52%, and it drops as total assets under management increase.

For July 2001, the group fee rate was 0.2785%. The individual fund fee rate is 0.30%.

The basic fee for the fiscal year ended July 31, 2001 was 0.58% of the fund's average net assets.

The performance adjustment rate is calculated monthly by comparing over the performance period the fund's performance to that of the S&P 500.

The performance period is the most recent 36 month period.

The maximum annualized performance adjustment rate is ±0.20% of the fund's average net assets over the performance period. The performance adjustment rate is divided by twelve and multiplied by the fund's average net assets over the performance period, and the resulting dollar amount is then added to or subtracted from the basic fee.

The total management fee for the fiscal year ended July 31, 2001, was 0.66%, of the fund's average net assets.

FMR pays FMRC, FMR U.K., and FMR Far East for providing sub-advisory services. FMR Far East in turn pays FIJ for providing sub-advisory services.

FMR may, from time to time, agree to reimburse the fund for management fees and other expenses above a specified limit. FMR retains the ability to be repaid by the fund if expenses fall below the specified limit prior to the end of the fiscal year. Reimbursement arrangements, which may be discontinued by FMR at any time, can decrease the fund's expenses and boost its performance.

FDC distributes the fund's shares.

The fund has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the Investment Company Act of 1940 that recognizes that FMR may use its management fee revenues, as well as its past profits or its resources from any other source, to pay FDC for expenses incurred in connection with providing services intended to result in the sale of fund shares and/or shareholder support services. FMR, directly or through FDC, may pay significant amounts to intermediaries, such as banks, broker-dealers, and other service-providers, that provide those services. Currently, the Board of Trustees of the fund has authorized such payments.

Prospectus

Fund Services - continued

If payments made by FMR to FDC or to intermediaries under the Distribution and Service Plan were considered to be paid out of the fund's assets on an ongoing basis, they might increase the cost of your investment and might cost you more than paying other types of sales charges.

To receive payments made pursuant to a Distribution and Service Plan, intermediaries must sign the appropriate agreement with FDC in advance.

From time to time, FDC may offer special promotional programs to investors who purchase shares of Fidelity funds. For example, FDC may offer merchandise, discounts, vouchers, or similar items to investors who purchase shares of certain Fidelity funds during certain periods. To determine if you qualify for any such programs, contact Fidelity or visit our web site at www.fidelity.com.

FMR may allocate brokerage transactions in a manner that takes into account the sale of shares of the fund, provided that the fund receives brokerage services and commission rates comparable to those of other broker-dealers.

No dealer, sales representative, or any other person has been authorized to give any information or to make any representations, other than those contained in this prospectus and in the related statement of additional information (SAI), in connection with the offer contained in this prospectus. If given or made, such other information or representations must not be relied upon as having been authorized by the fund or FDC. This prospectus and the related SAI do not constitute an offer by the fund or by FDC to sell shares of the fund to or to buy shares of the fund from any person to whom it is unlawful to make such offer.

Prospectus

Appendix

The financial highlights table is intended to help you understand the fund's financial history for the past 5 years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund (assuming reinvestment of all dividends and distributions). This information has been audited by Deloitte & Touche LLP, independent accountants, whose report, along with the fund's financial highlights and financial statements, are included in the fund's annual report. A free copy of the annual report is available upon request.

Selected Per-Share Data and Ratios

|

Years ended July 31, |

2001 |

2000 |

1999 |

1998 |

1997 |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, beginning of period |

$ 60.25 |

$ 53.20 |

$ 47.06 |

$ 41.21 |

$ 30.76 |

|

Income from Investment Operations |

|

|

|

|

|

|

Net investment income (loss) C |

.01 |

(.01) |

.16 |

.22 |

.28 |

|

Net realized and unrealized gain (loss) |

(12.66) |

9.27 |

8.14 |

7.64 |

12.70 |

|

Total from investment operations |

(12.65) |

9.26 |

8.30 |

7.86 |

12.98 |

|

Less Distributions |

|

|

|

|

|

|

From net investment income |

- |

(.14) |

(.10) |

(.26) |

(.28) |

|

From net realized gain |

(2.52) |

(2.07) |

(2.06) |

(1.75) |

(2.25) |

|

Total distributions |

(2.52) |

(2.21) |

(2.16) |

(2.01) |

(2.53) |

|

Net asset value, end of period |

$ 45.08 |

$ 60.25 |

$ 53.20 |

$ 47.06 |

$ 41.21 |

|

Total Return A, B |

(21.92)% |

17.97% |

19.30% |

20.17% |

45.50% |

|

Ratios and Supplemental Data |

|

|

|

|

|

|

Net assets, end of period (in millions) |

$ 23,032 |

$ 29,154 |

$ 23,684 |

$ 17,006 |

$ 12,877 |

|

Ratio of expenses to average net assets |

.89% |

.88% |

.71% |

.72% |

.80% |

|

Ratio of expenses to average net assets after all expense reductions |

.87% D |

.86% D |

.70% D |

.70% D |

.78% D |

|

Ratio of net investment income (loss) to average net assets |

.01% |

(.02)% |

.32% |

.52% |

.81% |

|

Portfolio turnover rate |

46% |

40% |

38% |

49% |

51% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the former one time sales charge.

C Net investment income (loss) per share has been calculated based on average shares outstanding during the period.

D FMR or the fund has entered into varying arrangements with third parties who either paid or reduced a portion of the fund's expenses.

Prospectus

Appendix - continued

Additional Performance Information

Lipper has created additional comparison categories that group funds according to portfolio characteristics and capitalization, as well as by capitalization only. The Lipper Large-Cap Growth Funds Average reflects the performance (excluding sales charges) of mutual funds with similar portfolio characteristics and capitalization. The Lipper Large-Cap Supergroup reflects the performance (excluding sales charges) of mutual funds with similar capitalization. The following information compares the performance of the fund to two additional Lipper comparison categories.

Average Annual Returns

|

For the periods ended |

Past 1 |

Past 5 |

Past 10 |

|

Blue Chip Growth |

-10.54% |

17.03% |

20.28% |

|

Lipper Large-Cap Growth Funds Average |

-16.25% |

18.10% |

16.96% |

|

Lipper Large-Cap Supergroup Average |

-8.96% |

16.86% |

16.18% |

Prospectus

Notes

Notes

Notes

You can obtain additional information about the fund. The fund's SAI includes more detailed information about the fund and its investments. The SAI is incorporated herein by reference (legally forms a part of the prospectus). The fund's annual and semi-annual reports include a discussion of the fund's holdings and recent market conditions and the fund's investment strategies that affected performance.

For a free copy of any of these documents or to request other information or ask questions about the fund, call Fidelity at 1-800-544-8544. In addition, you may visit Fidelity's web site at www.fidelity.com for a free copy of a prospectus or an annual or semi-annual report or to request other information.

|

The SAI, the fund's annual and semi-annual reports and other related materials are available from the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) Database on the SEC's web site (http://www.sec.gov). You can obtain copies of this information, after paying a duplicating fee, by sending a request by e-mail to publicinfo@sec.gov or by writing the Public Reference Section of the SEC, Washington, D.C. 20549-0102. You can also review and copy information about the fund, including the fund's SAI, at the SEC's Public Reference Room in Washington, D.C. Call 1-202-942-8090 for information on the operation of the SEC's Public Reference Room. Investment Company Act of 1940, File Number, 811-4118 |

<R>Fidelity, Fidelity Investments & (Pyramid) Design, FAST, and Directed Dividends are registered trademarks of FMR Corp.</R>

<R>Portfolio Advisory Services is a service mark of FMR Corp.</R>

The th<R>ird party marks a</R>ppearing above are the marks of their respective owners.

1.7<R>33076</R>.10<R>2 </R>BCF-pro-0901 L