UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4118

Fidelity Securities Fund

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

|

Date of fiscal year end: |

July 31 |

|

|

|

|

Date of reporting period: |

January 31, 2011 |

Item 1. Reports to Stockholders

Fidelity®

Blue Chip Growth

Fund

Semiannual Report

January 31, 2011

(2_fidelity_logos) (Registered_Trademark)

Contents

|

Chairman's Message |

The Chairman's message to shareholders. |

|

|

Shareholder Expense Example |

An example of shareholder expenses. |

|

|

Investment Changes |

A summary of major shifts in the fund's investments over the past six months. |

|

|

Investments |

A complete list of the fund's investments with their market values. |

|

|

Financial Statements |

Statements of assets and liabilities, operations, and changes in net

assets, |

|

|

Notes |

Notes to the financial statements. |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Chairman's Message

(photo_of_James_C_Curvey)

Dear Shareholder:

Following a year in which the investment environment was volatile but generally supportive of most major asset classes, 2011 began on a positive note. U.S. equities gained ground in January, reaching their highest point since August 2008, amid indications the U.S. economy had turned a corner. Still, questions remained about the longer-term outlook, most notably persistently high unemployment. Financial markets are always unpredictable, of course, but there also are several time-tested investment principles that can help put the odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There can be tax advantages and cost benefits to consider as well. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or by phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

(The acting chairman's signature appears here.)

James C. Curvey

Acting Chairman

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2010 to January 31, 2011).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Semiannual Report

Shareholder Expense Example - continued

|

|

Annualized Expense Ratio |

Beginning |

Ending |

Expenses Paid |

|

Blue Chip Growth |

.93% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,231.20 |

$ 5.23 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,020.52 |

$ 4.74 |

|

Class K |

.76% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,232.30 |

$ 4.28 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,021.37 |

$ 3.87 |

|

Class F |

.71% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,232.40 |

$ 4.00 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,021.63 |

$ 3.62 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one- half year period).

Semiannual Report

Investment Changes (Unaudited)

|

Top Ten Stocks as of January 31, 2011 |

||

|

|

% of fund's |

% of fund's net assets |

|

Apple, Inc. |

6.9 |

6.6 |

|

Google, Inc. Class A |

3.7 |

3.2 |

|

Exxon Mobil Corp. |

3.1 |

2.4 |

|

QUALCOMM, Inc. |

3.0 |

1.7 |

|

Amazon.com, Inc. |

2.0 |

2.1 |

|

NVIDIA Corp. |

1.7 |

0.0 |

|

Philip Morris International, Inc. |

1.5 |

1.6 |

|

Target Corp. |

1.5 |

1.4 |

|

The Coca-Cola Co. |

1.5 |

1.4 |

|

Oracle Corp. |

1.5 |

0.4 |

|

|

26.4 |

|

|

Top Five Market Sectors as of January 31, 2011 |

||

|

|

% of fund's |

% of fund's net assets |

|

Information Technology |

36.7 |

35.1 |

|

Consumer Discretionary |

16.9 |

15.1 |

|

Industrials |

12.5 |

13.6 |

|

Energy |

10.4 |

7.4 |

|

Consumer Staples |

7.3 |

8.1 |

|

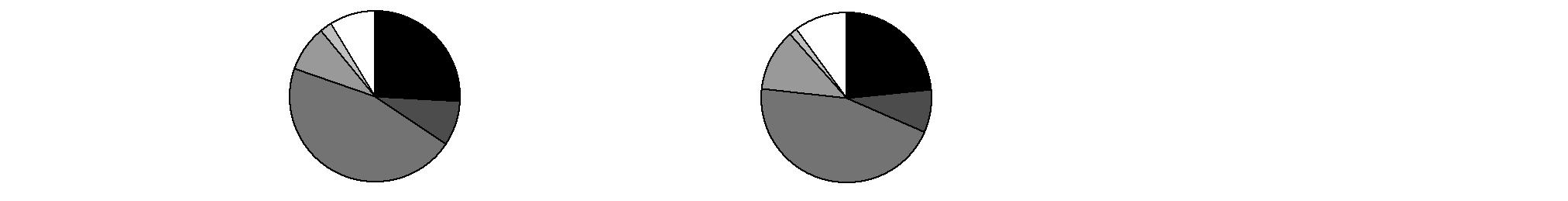

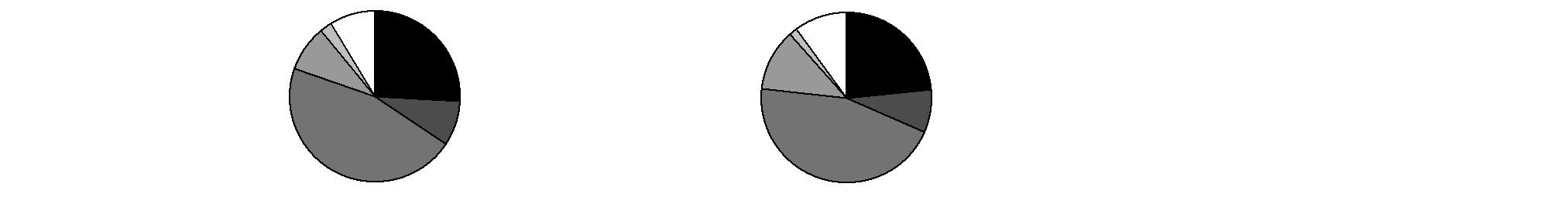

Asset Allocation (% of fund's net assets) |

|||||||

|

As of January 31, 2011* |

As of July 31, 2010** |

||||||

|

Stocks 99.8% |

|

|

Stocks 99.5% |

|

||

|

Short-Term |

|

|

Short-Term |

|

||

|

* Foreign investments |

11.2% |

|

** Foreign investments |

8.6% |

|

||

Semiannual Report

Investments January 31, 2011 (Unaudited)

Showing Percentage of Net Assets

|

Common Stocks - 99.0% |

|||

|

Shares |

Value (000s) |

||

|

CONSUMER DISCRETIONARY - 16.1% |

|||

|

Auto Components - 0.8% |

|||

|

Johnson Controls, Inc. |

500,500 |

$ 19,214 |

|

|

Lear Corp. (a) |

210,600 |

22,246 |

|

|

TRW Automotive Holdings Corp. (a) |

773,200 |

46,129 |

|

|

Visteon Corp. (a)(d) |

389,100 |

27,330 |

|

|

|

114,919 |

||

|

Automobiles - 2.8% |

|||

|

Bajaj Auto Ltd. |

340,995 |

9,271 |

|

|

Bayerische Motoren Werke AG (BMW) |

616,358 |

47,320 |

|

|

Fiat SpA |

617,600 |

5,995 |

|

|

Ford Motor Co. (a) |

7,453,300 |

118,880 |

|

|

General Motors Co. |

3,829,100 |

139,724 |

|

|

Hyundai Motor Co. |

95,676 |

15,293 |

|

|

Maruti Suzuki India Ltd. |

94,097 |

2,580 |

|

|

Tesla Motors, Inc. (a)(d) |

2,272,900 |

54,777 |

|

|

|

393,840 |

||

|

Diversified Consumer Services - 0.1% |

|||

|

Coinstar, Inc. (a) |

293,594 |

12,152 |

|

|

Everonn Education Ltd. |

325,512 |

4,192 |

|

|

|

16,344 |

||

|

Hotels, Restaurants & Leisure - 3.4% |

|||

|

Bravo Brio Restaurant Group, Inc. |

322,300 |

5,253 |

|

|

Chipotle Mexican Grill, Inc. (a) |

119,300 |

26,117 |

|

|

Hyatt Hotels Corp. Class A (a) |

469,794 |

22,827 |

|

|

Las Vegas Sands Corp. (a) |

1,757,900 |

81,725 |

|

|

Marriott International, Inc. Class A |

489,200 |

19,319 |

|

|

McDonald's Corp. |

1,447,230 |

106,617 |

|

|

Starbucks Corp. |

3,885,900 |

122,522 |

|

|

Starwood Hotels & Resorts Worldwide, Inc. |

650,600 |

38,366 |

|

|

WMS Industries, Inc. (a) |

739,200 |

31,009 |

|

|

Wyndham Worldwide Corp. |

1,278,785 |

35,972 |

|

|

|

489,727 |

||

|

Household Durables - 0.3% |

|||

|

Beazer Homes USA, Inc. (a)(d) |

3,151,700 |

16,862 |

|

|

Tempur-Pedic International, Inc. (a) |

575,900 |

25,132 |

|

|

|

41,994 |

||

|

Internet & Catalog Retail - 2.7% |

|||

|

Amazon.com, Inc. (a) |

1,709,100 |

289,932 |

|

|

E-Commerce China Dangdang, Inc. ADR |

457,000 |

12,933 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (000s) |

||

|

CONSUMER DISCRETIONARY - continued |

|||

|

Internet & Catalog Retail - continued |

|||

|

Netflix, Inc. (a) |

141,800 |

$ 30,357 |

|

|

Priceline.com, Inc. (a) |

126,700 |

54,293 |

|

|

|

387,515 |

||

|

Media - 0.2% |

|||

|

ReachLocal, Inc. (d) |

720,300 |

15,703 |

|

|

The Walt Disney Co. |

259,300 |

10,079 |

|

|

|

25,782 |

||

|

Multiline Retail - 2.4% |

|||

|

Macy's, Inc. |

5,266,700 |

121,924 |

|

|

Target Corp. |

3,892,800 |

213,442 |

|

|

|

335,366 |

||

|

Specialty Retail - 2.1% |

|||

|

Ascena Retail Group, Inc. (a) |

421,000 |

11,413 |

|

|

Bed Bath & Beyond, Inc. (a) |

374,400 |

17,971 |

|

|

China ZhengTong Auto Services Holdings Ltd. |

2,268,000 |

1,882 |

|

|

Express, Inc. |

774,100 |

13,469 |

|

|

Foot Locker, Inc. |

2,721,000 |

48,597 |

|

|

Guess?, Inc. |

480,800 |

20,569 |

|

|

Home Depot, Inc. |

1,222,400 |

44,948 |

|

|

Limited Brands, Inc. |

262,600 |

7,678 |

|

|

Lowe's Companies, Inc. |

2,880,000 |

71,424 |

|

|

rue21, Inc. (a)(d) |

150,000 |

4,425 |

|

|

TJX Companies, Inc. |

1,072,400 |

50,821 |

|

|

Tractor Supply Co. |

59,000 |

3,027 |

|

|

Williams-Sonoma, Inc. |

280,600 |

9,035 |

|

|

|

305,259 |

||

|

Textiles, Apparel & Luxury Goods - 1.3% |

|||

|

Cia Hering SA |

254,600 |

3,909 |

|

|

Coach, Inc. |

194,600 |

10,526 |

|

|

Columbia Sportswear Co. (d) |

264,500 |

16,129 |

|

|

Deckers Outdoor Corp. (a) |

256,300 |

18,810 |

|

|

Gitanjali Gems Ltd. |

2,187,799 |

9,570 |

|

|

NIKE, Inc. Class B |

154,800 |

12,768 |

|

|

Pandora A/S |

325,500 |

20,773 |

|

|

Polo Ralph Lauren Corp. Class A |

211,400 |

22,658 |

|

|

Provogue (India) Ltd. |

2,190,561 |

2,170 |

|

|

Steven Madden Ltd. (a) |

238,100 |

9,088 |

|

|

Timberland Co. Class A (a) |

571,100 |

15,266 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (000s) |

||

|

CONSUMER DISCRETIONARY - continued |

|||

|

Textiles, Apparel & Luxury Goods - continued |

|||

|

Under Armour, Inc. Class A (sub. vtg.) (a) |

132,800 |

$ 7,949 |

|

|

Vera Bradley, Inc. (d) |

961,625 |

33,075 |

|

|

|

182,691 |

||

|

TOTAL CONSUMER DISCRETIONARY |

2,293,437 |

||

|

CONSUMER STAPLES - 7.3% |

|||

|

Beverages - 2.6% |

|||

|

Anheuser-Busch InBev SA NV |

798,981 |

44,081 |

|

|

Central European Distribution Corp. (a) |

562,800 |

12,911 |

|

|

Coca-Cola Enterprises, Inc. |

454,100 |

11,425 |

|

|

Dr Pepper Snapple Group, Inc. |

2,644,400 |

93,691 |

|

|

The Coca-Cola Co. |

3,355,600 |

210,899 |

|

|

|

373,007 |

||

|

Food & Staples Retailing - 2.7% |

|||

|

Costco Wholesale Corp. |

509,400 |

36,595 |

|

|

CVS Caremark Corp. |

2,281,800 |

78,038 |

|

|

Droga Raia SA |

462,700 |

7,270 |

|

|

Drogasil SA |

930,300 |

6,695 |

|

|

Fresh Market, Inc. |

785,326 |

28,876 |

|

|

United Natural Foods, Inc. (a) |

474,000 |

17,538 |

|

|

Walgreen Co. |

3,265,800 |

132,069 |

|

|

Whole Foods Market, Inc. |

1,360,000 |

70,326 |

|

|

|

377,407 |

||

|

Food Products - 0.5% |

|||

|

Archer Daniels Midland Co. |

319,500 |

10,438 |

|

|

Diamond Foods, Inc. (d) |

427,800 |

21,292 |

|

|

Green Mountain Coffee Roasters, Inc. (a)(d) |

961,300 |

32,280 |

|

|

Mead Johnson Nutrition Co. Class A |

169,700 |

9,838 |

|

|

|

73,848 |

||

|

Personal Products - 0.0% |

|||

|

Nu Skin Enterprises, Inc. Class A |

139,300 |

4,190 |

|

|

Tobacco - 1.5% |

|||

|

Philip Morris International, Inc. |

3,734,000 |

213,734 |

|

|

TOTAL CONSUMER STAPLES |

1,042,186 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value (000s) |

||

|

ENERGY - 10.4% |

|||

|

Energy Equipment & Services - 3.8% |

|||

|

Atwood Oceanics, Inc. (a) |

1,097,900 |

$ 44,377 |

|

|

Baker Hughes, Inc. |

756,800 |

51,848 |

|

|

Dresser-Rand Group, Inc. (a) |

276,600 |

12,704 |

|

|

Halliburton Co. |

2,702,700 |

121,622 |

|

|

National Oilwell Varco, Inc. |

1,109,800 |

82,014 |

|

|

Oceaneering International, Inc. (a) |

292,500 |

22,590 |

|

|

Schlumberger Ltd. |

1,301,200 |

115,794 |

|

|

Transocean Ltd. (a) |

1,132,800 |

90,545 |

|

|

|

541,494 |

||

|

Oil, Gas & Consumable Fuels - 6.6% |

|||

|

Alpha Natural Resources, Inc. (a) |

885,200 |

47,562 |

|

|

Amyris, Inc. |

142,400 |

4,494 |

|

|

Anadarko Petroleum Corp. |

160,700 |

12,387 |

|

|

Chevron Corp. |

366,700 |

34,811 |

|

|

ConocoPhillips |

233,500 |

16,686 |

|

|

Exxon Mobil Corp. |

5,376,400 |

433,768 |

|

|

Hess Corp. |

321,400 |

27,036 |

|

|

Massey Energy Co. |

2,872,053 |

180,537 |

|

|

Occidental Petroleum Corp. |

1,086,600 |

105,052 |

|

|

Paladin Energy Ltd. (a) |

884,432 |

4,310 |

|

|

Tesoro Corp. (a) |

773,100 |

14,882 |

|

|

Uranium One, Inc. |

1,982,900 |

12,974 |

|

|

Valero Energy Corp. |

852,100 |

21,609 |

|

|

Whiting Petroleum Corp. (a) |

125,800 |

15,886 |

|

|

|

931,994 |

||

|

TOTAL ENERGY |

1,473,488 |

||

|

FINANCIALS - 5.7% |

|||

|

Capital Markets - 1.5% |

|||

|

BlackRock, Inc. Class A |

177,200 |

35,089 |

|

|

Goldman Sachs Group, Inc. |

201,700 |

33,002 |

|

|

Invesco Ltd. |

289,800 |

7,170 |

|

|

Money Matters Financial Services Ltd. |

1,633,500 |

4,408 |

|

|

Morgan Stanley |

4,198,400 |

123,433 |

|

|

TD Ameritrade Holding Corp. |

841,700 |

17,188 |

|

|

|

220,290 |

||

|

Commercial Banks - 0.6% |

|||

|

HDFC Bank Ltd. |

252,493 |

11,305 |

|

|

ICICI Bank Ltd. |

666,777 |

14,980 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (000s) |

||

|

FINANCIALS - continued |

|||

|

Commercial Banks - continued |

|||

|

Regions Financial Corp. |

1,070,500 |

$ 7,601 |

|

|

SunTrust Banks, Inc. |

1,236,300 |

37,621 |

|

|

Synovus Financial Corp. |

3,843,600 |

10,147 |

|

|

|

81,654 |

||

|

Consumer Finance - 0.5% |

|||

|

Discover Financial Services |

1,400,200 |

28,830 |

|

|

Green Dot Corp. |

214,800 |

13,513 |

|

|

Manappuram General Finance & Leasing Ltd. |

3,328,852 |

8,416 |

|

|

Shriram Transport Finance Co. Ltd. |

1,309,840 |

19,630 |

|

|

|

70,389 |

||

|

Diversified Financial Services - 2.5% |

|||

|

Bank of America Corp. |

2,236,300 |

30,704 |

|

|

Citigroup, Inc. (a) |

33,307,200 |

160,541 |

|

|

CME Group, Inc. |

205,600 |

63,440 |

|

|

IntercontinentalExchange, Inc. (a) |

163,900 |

19,748 |

|

|

JPMorgan Chase & Co. |

1,795,300 |

80,681 |

|

|

|

355,114 |

||

|

Insurance - 0.3% |

|||

|

Genworth Financial, Inc. Class A (a) |

3,172,300 |

43,048 |

|

|

Real Estate Management & Development - 0.3% |

|||

|

CB Richard Ellis Group, Inc. Class A (a) |

858,600 |

19,052 |

|

|

Parsvnath Developers Ltd. (a)(e) |

21,771,340 |

22,306 |

|

|

|

41,358 |

||

|

Thrifts & Mortgage Finance - 0.0% |

|||

|

Housing Development Finance Corp. Ltd. |

335,144 |

4,595 |

|

|

TOTAL FINANCIALS |

816,448 |

||

|

HEALTH CARE - 6.7% |

|||

|

Biotechnology - 2.0% |

|||

|

Alkermes, Inc. (a) |

917,100 |

11,840 |

|

|

Amgen, Inc. (a) |

476,700 |

26,257 |

|

|

Amylin Pharmaceuticals, Inc. (a) |

1,832,100 |

29,643 |

|

|

ARIAD Pharmaceuticals, Inc. (a) |

885,726 |

5,647 |

|

|

Dendreon Corp. (a) |

735,781 |

25,782 |

|

|

Exelixis, Inc. (a) |

1,194,000 |

10,352 |

|

|

Gilead Sciences, Inc. (a) |

890,200 |

34,166 |

|

|

Human Genome Sciences, Inc. (a) |

1,012,500 |

24,563 |

|

|

InterMune, Inc. (a) |

399,463 |

14,928 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (000s) |

||

|

HEALTH CARE - continued |

|||

|

Biotechnology - continued |

|||

|

Micromet, Inc. (a) |

1,322,420 |

$ 8,503 |

|

|

SIGA Technologies, Inc. (a) |

918,000 |

10,534 |

|

|

Theravance, Inc. (a) |

208,800 |

4,393 |

|

|

Vertex Pharmaceuticals, Inc. (a) |

2,001,500 |

77,838 |

|

|

|

284,446 |

||

|

Health Care Equipment & Supplies - 0.4% |

|||

|

C. R. Bard, Inc. |

91,200 |

8,605 |

|

|

Covidien PLC |

477,000 |

22,643 |

|

|

Edwards Lifesciences Corp. (a) |

165,100 |

13,916 |

|

|

Elekta AB (B Shares) |

135,000 |

5,458 |

|

|

Opto Circuits India Ltd. |

1,026,246 |

5,476 |

|

|

William Demant Holding AS (a) |

126,000 |

10,089 |

|

|

|

66,187 |

||

|

Health Care Providers & Services - 2.7% |

|||

|

Express Scripts, Inc. (a) |

3,314,380 |

186,699 |

|

|

McKesson Corp. |

1,379,100 |

103,667 |

|

|

Medco Health Solutions, Inc. (a) |

1,539,900 |

93,965 |

|

|

|

384,331 |

||

|

Health Care Technology - 0.5% |

|||

|

Allscripts-Misys Healthcare Solutions, Inc. (a) |

597,100 |

12,605 |

|

|

Cerner Corp. (a) |

489,100 |

48,348 |

|

|

SXC Health Solutions Corp. (a) |

163,800 |

7,886 |

|

|

|

68,839 |

||

|

Life Sciences Tools & Services - 0.7% |

|||

|

Agilent Technologies, Inc. (a) |

1,396,255 |

58,405 |

|

|

Covance, Inc. (a) |

126,400 |

7,126 |

|

|

Illumina, Inc. (a) |

391,000 |

27,112 |

|

|

Thermo Fisher Scientific, Inc. (a) |

74,500 |

4,267 |

|

|

|

96,910 |

||

|

Pharmaceuticals - 0.4% |

|||

|

Allergan, Inc. |

161,300 |

11,389 |

|

|

AVANIR Pharmaceuticals Class A (a)(d) |

1,264,000 |

5,119 |

|

|

Novo Nordisk AS Series B |

76,779 |

8,643 |

|

|

Perrigo Co. |

50,000 |

3,637 |

|

|

Questcor Pharmaceuticals, Inc. (a) |

181,600 |

2,808 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (000s) |

||

|

HEALTH CARE - continued |

|||

|

Pharmaceuticals - continued |

|||

|

Ranbaxy Laboratories Ltd. (a) |

560,099 |

$ 6,659 |

|

|

Teva Pharmaceutical Industries Ltd. sponsored ADR |

269,300 |

14,717 |

|

|

|

52,972 |

||

|

TOTAL HEALTH CARE |

953,685 |

||

|

INDUSTRIALS - 12.5% |

|||

|

Aerospace & Defense - 3.7% |

|||

|

Bombardier, Inc. Class B (sub. vtg.) |

4,930,700 |

28,074 |

|

|

Honeywell International, Inc. |

746,800 |

41,828 |

|

|

Precision Castparts Corp. |

954,700 |

136,513 |

|

|

Rockwell Collins, Inc. |

398,700 |

25,573 |

|

|

The Boeing Co. |

1,665,800 |

115,740 |

|

|

United Technologies Corp. |

2,201,300 |

178,966 |

|

|

|

526,694 |

||

|

Air Freight & Logistics - 0.5% |

|||

|

United Parcel Service, Inc. Class B |

1,008,600 |

72,236 |

|

|

Airlines - 0.5% |

|||

|

Copa Holdings SA Class A |

216,000 |

12,150 |

|

|

United Continental Holdings, Inc. (a) |

2,587,455 |

65,721 |

|

|

|

77,871 |

||

|

Building Products - 0.3% |

|||

|

Armstrong World Industries, Inc. |

670,000 |

27,209 |

|

|

Lennox International, Inc. |

196,000 |

9,631 |

|

|

|

36,840 |

||

|

Construction & Engineering - 1.2% |

|||

|

Fluor Corp. |

1,360,600 |

94,140 |

|

|

Jacobs Engineering Group, Inc. (a) |

968,471 |

49,750 |

|

|

Shaw Group, Inc. (a) |

616,400 |

23,281 |

|

|

|

167,171 |

||

|

Electrical Equipment - 0.8% |

|||

|

Emerson Electric Co. |

1,044,700 |

61,512 |

|

|

Polypore International, Inc. (a) |

539,800 |

25,991 |

|

|

Regal-Beloit Corp. |

108,300 |

7,228 |

|

|

Rockwell Automation, Inc. |

295,100 |

23,906 |

|

|

|

118,637 |

||

|

Industrial Conglomerates - 0.1% |

|||

|

Textron, Inc. |

572,000 |

15,038 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (000s) |

||

|

INDUSTRIALS - continued |

|||

|

Machinery - 4.0% |

|||

|

Beml Ltd. |

504,883 |

$ 9,586 |

|

|

Caterpillar, Inc. |

1,237,200 |

120,021 |

|

|

Cummins, Inc. |

892,900 |

94,540 |

|

|

Danaher Corp. |

1,490,300 |

68,643 |

|

|

Dover Corp. |

513,100 |

32,890 |

|

|

Fiat Industrial SpA (a) |

617,600 |

8,358 |

|

|

Ingersoll-Rand Co. Ltd. |

2,120,100 |

100,069 |

|

|

PACCAR, Inc. |

1,208,600 |

68,274 |

|

|

Pall Corp. |

686,200 |

38,022 |

|

|

Parker Hannifin Corp. |

168,600 |

15,075 |

|

|

WABCO Holdings, Inc. (a) |

294,200 |

17,181 |

|

|

|

572,659 |

||

|

Professional Services - 0.1% |

|||

|

Manpower, Inc. |

285,800 |

18,454 |

|

|

Road & Rail - 1.2% |

|||

|

CSX Corp. |

664,500 |

46,914 |

|

|

Kansas City Southern (a) |

100,000 |

4,998 |

|

|

Swift Transporation Co. |

1,145,300 |

16,366 |

|

|

Union Pacific Corp. |

1,004,500 |

95,056 |

|

|

|

163,334 |

||

|

Trading Companies & Distributors - 0.1% |

|||

|

Mills Estruturas e Servicos de Engenharia SA |

827,400 |

10,365 |

|

|

TOTAL INDUSTRIALS |

1,779,299 |

||

|

INFORMATION TECHNOLOGY - 36.7% |

|||

|

Communications Equipment - 5.1% |

|||

|

Acme Packet, Inc. (a) |

464,200 |

24,965 |

|

|

Ciena Corp. (a) |

373,700 |

8,233 |

|

|

Cisco Systems, Inc. (a) |

4,640,200 |

98,140 |

|

|

HTC Corp. |

1,787,000 |

60,244 |

|

|

Juniper Networks, Inc. (a) |

1,955,400 |

72,584 |

|

|

Motorola Mobility Holdings, Inc. (a) |

527,651 |

14,706 |

|

|

QUALCOMM, Inc. |

7,794,600 |

421,922 |

|

|

Research In Motion Ltd. (a) |

564,700 |

33,379 |

|

|

|

734,173 |

||

|

Computers & Peripherals - 9.5% |

|||

|

Apple, Inc. (a) |

2,886,200 |

979,345 |

|

|

EMC Corp. (a) |

3,529,900 |

87,859 |

|

|

Hewlett-Packard Co. |

946,200 |

43,232 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (000s) |

||

|

INFORMATION TECHNOLOGY - continued |

|||

|

Computers & Peripherals - continued |

|||

|

NetApp, Inc. (a) |

2,039,100 |

$ 111,600 |

|

|

SanDisk Corp. (a) |

763,700 |

34,649 |

|

|

Seagate Technology (a) |

2,907,600 |

40,706 |

|

|

Western Digital Corp. (a) |

1,463,200 |

49,778 |

|

|

|

1,347,169 |

||

|

Electronic Equipment & Components - 0.3% |

|||

|

HLS Systems International Ltd. (a) |

50,000 |

803 |

|

|

Jabil Circuit, Inc. |

1,833,400 |

37,053 |

|

|

TPK Holdings Co. |

16,000 |

391 |

|

|

|

38,247 |

||

|

Internet Software & Services - 6.9% |

|||

|

Akamai Technologies, Inc. (a) |

2,271,600 |

109,764 |

|

|

Alibaba.com Ltd. |

4,368,000 |

8,628 |

|

|

Baidu.com, Inc. sponsored ADR (a) |

600,400 |

65,221 |

|

|

Bitauto Holdings Ltd. ADR |

1,106,400 |

11,993 |

|

|

Demand Media, Inc. (a) |

286,500 |

5,810 |

|

|

eBay, Inc. (a) |

3,717,518 |

112,864 |

|

|

Google, Inc. Class A (a) |

884,200 |

530,838 |

|

|

INFO Edge India Ltd. |

293,110 |

3,487 |

|

|

Mail.ru Group Ltd. GDR unit (a)(f) |

764,100 |

27,202 |

|

|

OpenTable, Inc. (a) |

264,051 |

20,760 |

|

|

Rackspace Hosting, Inc. (a) |

2,061,200 |

69,071 |

|

|

VistaPrint Ltd. (a) |

138,400 |

7,009 |

|

|

YouKu.com, Inc. ADR (a)(d) |

411,900 |

12,205 |

|

|

|

984,852 |

||

|

IT Services - 2.9% |

|||

|

Accenture PLC Class A |

548,000 |

28,206 |

|

|

Cognizant Technology Solutions Corp. Class A (a) |

1,141,900 |

83,302 |

|

|

MasterCard, Inc. Class A |

543,600 |

128,567 |

|

|

VeriFone Systems, Inc. (a) |

362,700 |

14,486 |

|

|

Visa, Inc. Class A |

2,310,200 |

161,367 |

|

|

|

415,928 |

||

|

Semiconductors & Semiconductor Equipment - 6.3% |

|||

|

Altera Corp. |

188,300 |

7,074 |

|

|

Applied Materials, Inc. |

1,867,200 |

29,296 |

|

|

Atmel Corp. (a) |

2,932,500 |

39,706 |

|

|

Avago Technologies Ltd. |

3,661,100 |

105,110 |

|

|

Broadcom Corp. Class A |

2,335,100 |

105,290 |

|

|

GT Solar International, Inc. (a)(d) |

1,761,900 |

19,460 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (000s) |

||

|

INFORMATION TECHNOLOGY - continued |

|||

|

Semiconductors & Semiconductor Equipment - continued |

|||

|

Lam Research Corp. (a) |

701,200 |

$ 34,983 |

|

|

Marvell Technology Group Ltd. (a) |

4,307,800 |

81,891 |

|

|

Maxim Integrated Products, Inc. |

1,000,800 |

25,841 |

|

|

Micron Technology, Inc. (a) |

895,000 |

9,433 |

|

|

National Semiconductor Corp. |

3,163,000 |

47,951 |

|

|

NVIDIA Corp. (a) |

9,794,422 |

234,283 |

|

|

NXP Semiconductors NV |

2,790,200 |

71,820 |

|

|

Silicon Laboratories, Inc. (a) |

364,700 |

16,222 |

|

|

Skyworks Solutions, Inc. (a) |

974,800 |

30,969 |

|

|

Spreadtrum Communications, Inc. ADR (a) |

720,700 |

15,495 |

|

|

Teradyne, Inc. (a) |

1,000,000 |

16,680 |

|

|

|

891,504 |

||

|

Software - 5.7% |

|||

|

Adobe Systems, Inc. (a) |

252,300 |

8,339 |

|

|

BMC Software, Inc. (a) |

181,100 |

8,638 |

|

|

BroadSoft, Inc. (a) |

930,000 |

25,770 |

|

|

Check Point Software Technologies Ltd. (a) |

1,510,800 |

67,306 |

|

|

Citrix Systems, Inc. (a) |

913,600 |

57,721 |

|

|

Informatica Corp. (a) |

1,193,700 |

55,388 |

|

|

Intuit, Inc. (a) |

712,600 |

33,442 |

|

|

Microsoft Corp. |

54,500 |

1,511 |

|

|

Nuance Communications, Inc. (a) |

1,387,000 |

28,198 |

|

|

Oracle Corp. |

6,488,000 |

207,811 |

|

|

QLIK Technologies, Inc. |

961,763 |

22,323 |

|

|

RealPage, Inc. |

1,106,300 |

30,302 |

|

|

Red Hat, Inc. (a) |

2,268,900 |

93,751 |

|

|

Rovi Corp. (a) |

456,600 |

28,200 |

|

|

salesforce.com, Inc. (a) |

722,518 |

93,306 |

|

|

SuccessFactors, Inc. (a) |

199,100 |

5,798 |

|

|

Velti Ltd. (a) |

298,100 |

4,239 |

|

|

VMware, Inc. Class A (a) |

417,900 |

35,739 |

|

|

|

807,782 |

||

|

TOTAL INFORMATION TECHNOLOGY |

5,219,655 |

||

|

MATERIALS - 3.5% |

|||

|

Chemicals - 1.5% |

|||

|

Cabot Corp. |

439,900 |

19,026 |

|

|

Celanese Corp. Class A |

436,600 |

18,115 |

|

|

CF Industries Holdings, Inc. |

504,600 |

68,141 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value (000s) |

||

|

MATERIALS - continued |

|||

|

Chemicals - continued |

|||

|

Grasim Industries Ltd. |

176,744 |

$ 9,382 |

|

|

LyondellBasell Industries NV Class A (a) |

1,460,600 |

52,494 |

|

|

Methanex Corp. |

228,300 |

6,207 |

|

|

Monsanto Co. |

98,200 |

7,206 |

|

|

PPG Industries, Inc. |

51,300 |

4,324 |

|

|

Rockwood Holdings, Inc. (a) |

384,600 |

15,611 |

|

|

Sherwin-Williams Co. |

51,200 |

4,338 |

|

|

Valspar Corp. |

118,200 |

4,417 |

|

|

|

209,261 |

||

|

Construction Materials - 0.0% |

|||

|

ACC Ltd. |

150,000 |

3,246 |

|

|

Containers & Packaging - 0.1% |

|||

|

Ball Corp. |

220,500 |

15,684 |

|

|

Metals & Mining - 1.9% |

|||

|

Allegheny Technologies, Inc. |

66,300 |

4,322 |

|

|

Carpenter Technology Corp. |

699,325 |

28,777 |

|

|

Freeport-McMoRan Copper & Gold, Inc. |

708,700 |

77,071 |

|

|

Reliance Steel & Aluminum Co. |

502,700 |

26,286 |

|

|

Silver Wheaton Corp. (a) |

260,500 |

8,038 |

|

|

Stillwater Mining Co. (a) |

393,700 |

8,535 |

|

|

United States Steel Corp. (d) |

1,705,100 |

98,333 |

|

|

Walter Energy, Inc. |

188,000 |

24,491 |

|

|

|

275,853 |

||

|

TOTAL MATERIALS |

504,044 |

||

|

TELECOMMUNICATION SERVICES - 0.1% |

|||

|

Wireless Telecommunication Services - 0.1% |

|||

|

NII Holdings, Inc. (a) |

460,200 |

19,319 |

|

|

TOTAL COMMON STOCKS (Cost $10,352,785) |

14,101,561 |

||

|

Nonconvertible Preferred Stocks - 0.8% |

|||

|

Shares |

Value (000s) |

||

|

CONSUMER DISCRETIONARY - 0.8% |

|||

|

Automobiles - 0.8% |

|||

|

Porsche Automobil Holding SE |

416,200 |

$ 38,654 |

|

|

Volkswagen AG |

469,600 |

75,860 |

|

|

|

114,514 |

||

|

TOTAL NONCONVERTIBLE PREFERRED STOCKS (Cost $77,268) |

114,514 |

||

|

Money Market Funds - 1.5% |

|||

|

|

|

|

|

|

Fidelity Cash Central Fund, 0.19% (b) |

49,595,621 |

49,596 |

|

|

Fidelity Securities Lending Cash Central Fund, 0.21% (b)(c) |

159,497,250 |

159,497 |

|

|

TOTAL MONEY MARKET FUNDS (Cost $209,093) |

209,093 |

||

|

TOTAL INVESTMENT PORTFOLIO - 101.3% (Cost $10,639,146) |

14,425,168 |

||

|

NET OTHER ASSETS (LIABILITIES) - (1.3)% |

(189,793) |

||

|

NET ASSETS - 100% |

$ 14,235,375 |

||

|

Legend |

|

(a) Non-income producing |

|

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

|

(c) Investment made with cash collateral received from securities on loan. |

|

(d) Security or a portion of the security is on loan at period end. |

|

(e) Affiliated company |

|

(f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $27,202,000 or 0.2% of net assets. |

|

Affiliated Central Funds |

|

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

|

Fund |

Income earned |

|

Fidelity Cash Central Fund |

$ 35 |

|

Fidelity Securities Lending Cash Central Fund |

472 |

|

Total |

$ 507 |

|

Other Affiliated Issuers |

|

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows: |

|

Affiliates |

Value, |

Purchases |

Sales |

Dividend |

Value, |

|

Furniture Brands International, Inc. |

$ 16,160 |

$ - |

$ 14,466 |

$ - |

$ - |

|

Parsvnath Developers Ltd. |

18,023 |

14,168 |

- |

- |

22,306 |

|

Total |

$ 34,183 |

$ 14,168 |

$ 14,466 |

$ - |

$ 22,306 |

|

Other Information |

|

The following is a summary of the inputs used, as of January 31, 2011, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the tables below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

|

Valuation Inputs at Reporting Date: |

||||

|

Description |

Total |

Level 1 |

Level 2 |

Level 3 |

|

Investments in Securities: |

||||

|

Equities: |

||||

|

Consumer Discretionary |

$ 2,407,951 |

$ 2,405,371 |

$ 2,580 |

$ - |

|

Consumer Staples |

1,042,186 |

998,105 |

44,081 |

- |

|

Energy |

1,473,488 |

1,473,488 |

- |

- |

|

Financials |

816,448 |

790,163 |

26,285 |

- |

|

Health Care |

953,685 |

945,042 |

8,643 |

- |

|

Industrials |

1,779,299 |

1,779,299 |

- |

- |

|

Information Technology |

5,219,655 |

5,219,655 |

- |

- |

|

Materials |

504,044 |

494,662 |

9,382 |

- |

|

Telecommunication Services |

19,319 |

19,319 |

- |

- |

|

Money Market Funds |

209,093 |

209,093 |

- |

- |

|

Total Investments in Securities: |

$ 14,425,168 |

$ 14,334,197 |

$ 90,971 |

$ - |

|

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value: |

|

(Amounts in thousands) |

|

|

Investments in Securities: |

|

|

Beginning Balance |

$ 6,774 |

|

Total Realized Gain (Loss) |

(1,136) |

|

Total Unrealized Gain (Loss) |

174 |

|

Cost of Purchases |

- |

|

Proceeds of Sales |

(5,812) |

|

Amortization/Accretion |

- |

|

Transfers in to Level 3 |

- |

|

Transfers out of Level 3 |

- |

|

Ending Balance |

$ - |

|

The change in unrealized gain (loss) for the period attributable to Level 3 securities held at January 31, 2011 |

$ - |

|

The information used in the above reconciliation represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's Statement of Operations. |

|

Distribution of investments by country of issue, as a percentage of total net assets, is as follows: (Unaudited) |

|

United States of America |

88.8% |

|

Ireland |

1.3% |

|

Germany |

1.1% |

|

India |

1.1% |

|

Others (Individually Less Than 1%) |

7.7% |

|

|

100.0% |

|

Income Tax Information |

|

At July 31, 2010, the Fund had a capital loss carryforward of approximately $1,028,059,000 of which $671,371,000 and $356,688,000 will expire in fiscal 2017 and 2018, respectively. Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements

Statement of Assets and Liabilities

|

Amounts in thousands (except per-share amounts) |

January 31, 2011 (Unaudited) |

|

|

|

|

|

|

Assets |

|

|

|

Investment in securities, at value (including securities loaned of $158,006) - See accompanying schedule: Unaffiliated issuers (cost $10,399,202) |

$ 14,193,769 |

|

|

Fidelity Central Funds (cost $209,093) |

209,093 |

|

|

Other affiliated issuers (cost $30,851) |

22,306 |

|

|

Total Investments (cost $10,639,146) |

|

$ 14,425,168 |

|

Foreign currency held at value (cost $820) |

|

820 |

|

Receivable for investments sold |

|

265,133 |

|

Receivable for fund shares sold |

|

32,727 |

|

Dividends receivable |

|

2,801 |

|

Distributions receivable from Fidelity Central Funds |

|

191 |

|

Prepaid expenses |

|

30 |

|

Other receivables |

|

946 |

|

Total assets |

|

14,727,816 |

|

|

|

|

|

Liabilities |

|

|

|

Payable to custodian bank |

$ 374 |

|

|

Payable for investments purchased |

306,929 |

|

|

Payable for fund shares redeemed |

14,250 |

|

|

Accrued management fee |

8,434 |

|

|

Other affiliated payables |

2,379 |

|

|

Other payables and accrued expenses |

578 |

|

|

Collateral on securities loaned, at value |

159,497 |

|

|

Total liabilities |

|

492,441 |

|

|

|

|

|

Net Assets |

|

$ 14,235,375 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 10,921,318 |

|

Accumulated net investment loss |

|

(10,769) |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

(461,169) |

|

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies |

|

3,785,995 |

|

Net Assets |

|

$ 14,235,375 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Assets and Liabilities - continued

|

Amounts in thousands (except per-share amounts) |

January 31, 2011 (Unaudited) |

|

|

|

|

|

|

Blue Chip Growth: |

|

$ 46.29 |

|

|

|

|

|

Class K: |

|

$ 46.28 |

|

|

|

|

|

Class F: |

|

$ 46.30 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Operations

|

Amounts in thousands |

Six months ended January 31, 2011 (Unaudited) |

|

|

|

|

|

|

Investment Income |

|

|

|

Dividends |

|

$ 52,561 |

|

Interest |

|

3 |

|

Income from Fidelity Central Funds |

|

507 |

|

Total income |

|

53,071 |

|

|

|

|

|

Expenses |

|

|

|

Management fee |

$ 35,632 |

|

|

Performance adjustment |

8,114 |

|

|

Transfer agent fees |

13,009 |

|

|

Accounting and security lending fees |

712 |

|

|

Custodian fees and expenses |

271 |

|

|

Independent trustees' compensation |

35 |

|

|

Registration fees |

74 |

|

|

Audit |

66 |

|

|

Legal |

43 |

|

|

Interest |

12 |

|

|

Miscellaneous |

63 |

|

|

Total expenses before reductions |

58,031 |

|

|

Expense reductions |

(894) |

57,137 |

|

Net investment income (loss) |

|

(4,066) |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities: |

|

|

|

Unaffiliated issuers |

664,639 |

|

|

Other affiliated issuers |

(10,044) |

|

|

Foreign currency transactions |

(1,905) |

|

|

Total net realized gain (loss) |

|

652,690 |

|

Change in net unrealized appreciation (depreciation) on: Investment securities (net of decrease in deferred foreign taxes of $49) |

1,984,810 |

|

|

Assets and liabilities in foreign currencies |

148 |

|

|

Total change in net unrealized appreciation (depreciation) |

|

1,984,958 |

|

Net gain (loss) |

|

2,637,648 |

|

Net increase (decrease) in net assets resulting from operations |

|

$ 2,633,582 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

|

Amounts in thousands |

Six months ended January 31, 2011 (Unaudited) |

Year ended |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

|

|

|

Net investment income (loss) |

$ (4,066) |

$ 13,622 |

|

Net realized gain (loss) |

652,690 |

1,055,028 |

|

Change in net unrealized appreciation (depreciation) |

1,984,958 |

793,347 |

|

Net increase (decrease) in net assets resulting |

2,633,582 |

1,861,997 |

|

Distributions to shareholders from net investment income |

(8,765) |

(57,433) |

|

Distributions to shareholders from net realized gain |

(6,091) |

- |

|

Total distributions |

(14,856) |

(57,433) |

|

Share transactions - net increase (decrease) |

68,429 |

(538,131) |

|

Total increase (decrease) in net assets |

2,687,155 |

1,266,433 |

|

|

|

|

|

Net Assets |

|

|

|

Beginning of period |

11,548,220 |

10,281,787 |

|

End of period (including accumulated net investment loss of $10,769 and undistributed net investment income of $2,062, respectively) |

$ 14,235,375 |

$ 11,548,220 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Blue Chip Growth

|

|

Six months ended January 31, 2011 |

Years ended July 31, |

||||

|

|

(Unaudited) |

2010 |

2009 |

2008 |

2007 |

2006 |

|

Selected Per-Share Data |

|

|

|

|

|

|

|

Net asset value, beginning of period |

$ 37.63 |

$ 31.97 |

$ 39.06 |

$ 46.88 |

$ 41.54 |

$ 42.60 |

|

Income from Investment Operations |

|

|

|

|

|

|

|

Net investment income (loss) D |

(.02) |

.04 |

.27 |

.35 |

.32 |

.23 |

|

Net realized and unrealized gain (loss) |

8.72 |

5.80 |

(6.36) |

(2.89) |

6.19 |

(1.06) |

|

Total from investment operations |

8.70 |

5.84 |

(6.09) |

(2.54) |

6.51 |

(.83) |

|

Distributions from net investment income |

(.02) |

(.18) |

(.29) |

(.33) |

(.24) |

(.23) |

|

Distributions from net realized gain |

(.02) |

- |

(.71) |

(4.95) |

(.93) |

- |

|

Total distributions |

(.04) |

(.18) |

(1.00) |

(5.28) |

(1.17) |

(.23) |

|

Net asset value, end of period |

$ 46.29 |

$ 37.63 |

$ 31.97 |

$ 39.06 |

$ 46.88 |

$ 41.54 |

|

Total Return B, C |

23.12% |

18.29% |

(15.85)% |

(6.30)% |

16.02% |

(1.97)% |

|

Ratios to Average Net Assets E, G |

|

|

|

|

|

|

|

Expenses before reductions |

.93% A |

.94% |

.76% |

.58% |

.60% |

.63% |

|

Expenses net of fee waivers, if any |

.93% A |

.94% |

.76% |

.58% |

.60% |

.63% |

|

Expenses net of all reductions |

.92% A |

.93% |

.76% |

.57% |

.59% |

.61% |

|

Net investment income (loss) |

(.09)% A |

.10% |

.93% |

.81% |

.72% |

.54% |

|

Supplemental Data |

|

|

|

|

|

|

|

Net assets, end of period (in millions) |

$ 12,294 |

$ 10,295 |

$ 9,691 |

$ 13,349 |

$ 18,616 |

$ 19,571 |

|

Portfolio turnover rate F |

126% A |

135% |

134% |

82% |

87% |

48% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class K

|

|

Six months ended January 31, 2011 |

Years ended July 31, |

||

|

|

(Unaudited) |

2010 |

2009 |

2008G |

|

Selected Per-Share Data |

|

|

|

|

|

Net asset value, beginning of period |

$ 37.66 |

$ 32.01 |

$ 39.07 |

$ 41.81 |

|

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) D |

.02 |

.11 |

.32 |

.10 |

|

Net realized and unrealized gain (loss) |

8.72 |

5.79 |

(6.33) |

(2.84) |

|

Total from investment operations |

8.74 |

5.90 |

(6.01) |

(2.74) |

|

Distributions from net investment income |

(.10) |

(.25) |

(.34) |

- |

|

Distributions from net realized gain |

(.02) |

- |

(.71) |

- |

|

Total distributions |

(.12) |

(.25) |

(1.05) |

- |

|

Net asset value, end of period |

$ 46.28 |

$ 37.66 |

$ 32.01 |

$ 39.07 |

|

Total Return B, C |

23.23% |

18.48% |

(15.61)% |

(6.55)% |

|

Ratios to Average Net Assets E, H |

|

|

|

|

|

Expenses before reductions |

.76% A |

.75% |

.53% |

.41% A |

|

Expenses net of fee waivers, if any |

.76% A |

.75% |

.53% |

.41% A |

|

Expenses net of all reductions |

.74% A |

.74% |

.52% |

.41% A |

|

Net investment income (loss) |

.09% A |

.30% |

1.16% |

1.09% A |

|

Supplemental Data |

|

|

|

|

|

Net assets, end of period |

$ 1,237,872 |

$ 931,601 |

$ 590,673 |

$ 93 |

|

Portfolio turnover rate F |

126% A |

135% |

134% |

82% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period May 9, 2008 (commencement of sale of shares) to July 31, 2008.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class F

|

|

Six months ended January 31, 2011 |

Years ended July 31, |

|

|

|

(Unaudited) |

2010 |

2009 G |

|

Selected Per-Share Data |

|

|

|

|

Net asset value, beginning of period |

$ 37.69 |

$ 31.98 |

$ 29.16 |

|

Income from Investment Operations |

|

|

|

|

Net investment income (loss) D |

.03 |

.13 |

- I |

|

Net realized and unrealized gain (loss) |

8.71 |

5.80 |

2.82 |

|

Total from investment operations |

8.74 |

5.93 |

2.82 |

|

Distributions from net investment income |

(.11) |

(.22) |

- |

|

Distributions from net realized gain |

(.02) |

- |

- |

|

Total distributions |

(.13) |

(.22) |

- |

|

Net asset value, end of period |

$ 46.30 |

$ 37.69 |

$ 31.98 |

|

Total Return B, C |

23.24% |

18.59% |

9.67% |

|

Ratios to Average Net Assets E, H |

|

|

|

|

Expenses before reductions |

.71% A |

.70% |

.51%A |

|

Expenses net of fee waivers, if any |

.71%A |

.70% |

.51%A |

|

Expenses net of all reductions |

.69%A |

.68% |

.51%A |

|

Net investment income (loss) |

.14%A |

.35% |

(.05)%A |

|

Supplemental Data |

|

|

|

|

Net assets, end of period (000 omitted) |

$ 703,873 |

$ 321,409 |

$ 261 |

|

Portfolio turnover rate F |

126%A |

135% |

134% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period June 26, 2009 (commencement of sale of shares) to July 31, 2009.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Notes to Financial Statements

For the period ended January 31, 2011 (Unaudited)

(Amounts in thousands except ratios)

1. Organization.

Fidelity Blue Chip Growth Fund (the Fund) is a fund of Fidelity Securities Fund (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Blue Chip Growth, Class K and Class F shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Class F shares of the Fund are only available for purchase by mutual funds for which Fidelity Management & Research Company (FMR) or an affiliate serves as investment manager. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions may also differ by class.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies available only to other investment companies and accounts managed by FMR and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) web site at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC web site or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of

Semiannual Report

3. Significant Accounting Policies - continued

the financial statements. The following summarizes the significant accounting policies of the Fund:

Security Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Fund uses independent pricing services approved by the Board of Trustees to value its investments. When current market prices or quotations are not readily available or reliable, valuations may be determined in good faith in accordance with procedures adopted by the Board of Trustees. Factors used in determining value may include market or security specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The value used for net asset value (NAV) calculation under these procedures may differ from published prices for the same securities.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below.

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of January 31, 2011, as well as a roll forward of Level 3 securities, is included at the end of the Fund's Schedule of Investments. Valuation techniques used to value the Fund's investments by major category are as follows.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when significant market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-traded funds (ETFs) and certain indexes as well as quoted prices for similar securities are used and are categorized as Level 2 in the hierarchy in these circumstances. Utilizing these techniques may result in transfers between Level 1 and Level 2. For restricted equity securities and private placements where

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

(Amounts in thousands except ratios)

3. Significant Accounting Policies - continued

Security Valuation - continued

observable inputs are limited, assumptions about market activity and risk are used and are categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value each business day and are categorized as Level 1 in the hierarchy.

Foreign Currency. The Fund uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The Fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.