Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

Annual Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2014

Commission File No. 001-14817

PACCAR Inc

(Exact name of Registrant as specified in its charter)

| Delaware | 91-0351110 | |

| (State of incorporation) | (I.R.S. Employer Identification No.) | |

| 777 - 106th Ave. N.E., Bellevue, WA | 98004 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code (425) 468-7400

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $1 par value | The NASDAQ Global Select Market LLC |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2014:

Common Stock, $1 par value - $21.84 billion

The number of shares outstanding of the registrant’s classes of common stock, as of January 31, 2015:

Common Stock, $1 par value - 354,515,811 shares

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the annual stockholders meeting to be held on April 21, 2015 are incorporated by reference into Part III.

Table of Contents

INDEX

| Page | ||||||

| PART I | ||||||

| ITEM 1. |

3 | |||||

| ITEM 1A. |

7 | |||||

| ITEM 1B. |

9 | |||||

| ITEM 2. |

9 | |||||

| ITEM 3. |

10 | |||||

| ITEM 4. |

10 | |||||

| ITEM 5. |

11 | |||||

| ITEM 6. |

13 | |||||

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

14 | ||||

| ITEM 7A. |

38 | |||||

| ITEM 8. |

39 | |||||

| ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

82 | ||||

| ITEM 9A. |

82 | |||||

| ITEM 9B. |

82 | |||||

| ITEM 10. |

83 | |||||

| ITEM 11. |

84 | |||||

| ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

84 | ||||

| ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

84 | ||||

| ITEM 14. |

84 | |||||

| ITEM 15. |

85 | |||||

| 89 | ||||||

2

Table of Contents

| ITEM 1. | BUSINESS. |

| (a) | General Development of Business |

PACCAR Inc (the Company or PACCAR), incorporated under the laws of Delaware in 1971, is the successor to Pacific Car and Foundry Company which was incorporated in Washington in 1924. The Company traces its predecessors to Seattle Car Manufacturing Company formed in 1905.

| (b) | Financial Information About Industry Segments and Geographic Areas |

Information about the Company’s industry segments and geographic areas in response to Items 101(b), (c)(1)(i), and (d) of Regulation S-K appears in Item 8, Note R, of this Form 10-K.

| (c) | Narrative Description of Business |

PACCAR is a multinational company operating in three principal industry segments: (1) the Truck segment includes the design, manufacture and distribution of high-quality, light-, medium- and heavy-duty commercial trucks; (2) the Parts segment includes the distribution of aftermarket parts for trucks and related commercial vehicles; and (3) the Financial Services segment includes finance and leasing products and services provided to customers and dealers. Light and medium-duty trucks have a gross vehicle weight (GVW) ranging from 16,000 to 33,000 lbs (Class 5 to 7) in North America and 6 to 16 metric tonnes in Europe. Heavy duty trucks have a GVW of over 33,000 lbs (Class 8) in North America and over 16 metric tonnes in Europe. PACCAR’s finance and leasing activities are principally related to PACCAR products and associated equipment. PACCAR’s Other business is the manufacturing and marketing of industrial winches.

TRUCKS

PACCAR’s trucks are marketed under the Kenworth, Peterbilt and DAF nameplates. These trucks, which are built in three plants in the United States, three in Europe and one each in Australia, Canada, Mexico and Brasil, are used worldwide for over-the-road and off-highway hauling of freight, petroleum, wood products, construction and other materials. The Company also manufactures engines at its Columbus, Mississippi facility. PACCAR competes in the North American Class 5 - 7 markets primarily with Kenworth and Peterbilt conventional models. These trucks are assembled at facilities in Ste. Therese, Canada and in Mexicali, Mexico, which are operated by PACCAR’s wholly owned subsidiaries located in those countries. PACCAR competes in the European light/medium market with DAF cab-over-engine trucks assembled in the United Kingdom by Leyland, one of PACCAR’s wholly owned subsidiaries. Commercial truck manufacturing comprises the largest segment of PACCAR’s business and accounts for 77% of total 2014 net sales and revenues.

Substantially all trucks are sold to independent dealers. The Kenworth and Peterbilt nameplates are marketed and distributed by separate divisions in the U.S. and a foreign subsidiary in Canada. The Kenworth nameplate is also marketed and distributed by foreign subsidiaries in Mexico and Australia. The DAF nameplate is marketed and distributed worldwide by a foreign subsidiary headquartered in the Netherlands and is also marketed and distributed by foreign subsidiaries in Brasil and Australia. The decision to operate as a subsidiary or as a division is incidental to PACCAR’s Truck segment operations and reflects legal, tax and regulatory requirements in the various countries where PACCAR operates.

The Truck segment utilizes centrally managed purchasing, information technology, technical research and testing, treasury and finance functions. Some manufacturing plants in North America produce trucks for more than one nameplate, while other plants produce trucks for only one nameplate, depending on various factors. As a result of the close similarity of the business models employed by each nameplate, best manufacturing practices within the Company are shared on a routine basis.

The Company’s trucks have a reputation for high quality and are essentially custom products, most of which are ordered by dealers according to customer specification. Some units are ordered by dealers for stocking to meet the needs of certain customers who require immediate delivery or for customers that require chassis to be fitted with specialized bodies. For a significant portion of the Company’s truck operations, major components, such as engines, transmissions and axles, as well as a substantial percentage of other components, are purchased from component manufacturers pursuant to PACCAR and customer specifications. DAF, which is more

3

Table of Contents

vertically integrated, manufactures PACCAR engines and axles and a higher percentage of other components for its heavy truck models. The Company also manufactures engines at its Columbus, Mississippi facility. In 2014, the Company installed PACCAR engines in 36% of the Company’s Kenworth and Peterbilt heavy-duty trucks in the U.S. and Canada. Engines not manufactured by the Company are purchased from Cummins Inc. (Cummins). The Company has a long-term agreement with Cummins to provide for continuity of supply. A loss of supply from Cummins, and the resulting interruption in the production of trucks, would have a material effect on the Company’s results. The cost of purchased materials and parts includes raw materials, partially processed materials, such as castings, and finished components manufactured by independent suppliers. The cost of materials purchased from suppliers of raw materials, partially processed materials and finished components make up approximately 85% of the cost of new trucks. The value of major finished truck components manufactured by independent suppliers ranges from approximately 30% in Europe to approximately 85% in North America. In addition to purchased materials, the Company’s cost of sales includes labor and factory overhead, vehicle delivery and warranty. Accordingly, except for certain factory overhead costs such as depreciation, property taxes and utilities, the Company’s cost of sales are highly correlated to sales.

The Company’s DAF subsidiary purchases fully assembled cabs from a competitor, Renault V.I., for its European light- and medium-duty product lines pursuant to a joint product development and long-term supply contract. Sales of trucks manufactured with these cabs amounted to approximately 2% of consolidated revenues in 2014. A short-term loss of supply, and the resulting interruption in the production of these trucks, would not have a material effect on the Company’s results of operations. However, a loss of supply for an extended period of time would require the Company to either contract for an alternative source of supply or to manufacture cabs itself.

Other than these components, the Company is not limited to any single source for any significant component, although the sudden inability of a supplier to deliver components could have a temporary adverse effect on production of certain products. No significant shortages of materials or components were experienced in 2014. Manufacturing inventory levels are based upon production schedules, and orders are placed with suppliers accordingly.

Key factors affecting Truck segment earnings include the number of new trucks sold in the markets served and the margins realized on the sales. The Company’s sales of new trucks are dependent on the size of the truck markets served and the Company’s share of those markets. Truck segment sales and margins tend to be cyclical related to the level of overall economic activity, the availability of capital and the amount of freight being transported. The Company’s costs for trucks sold consist primarily of material costs which are influenced by commodities prices such as steel, copper, aluminum and petroleum. The Company utilizes long-term supply agreements with its suppliers to reduce the variability of the unit cost of purchased materials and finished components. The Company’s spending on research and development varies based on product development cycles and government requirements such as the periodic need to meet diesel engine emissions and vehicle fuel efficiency standards in the various markets served. The Company maintains rigorous control of selling, general and administrative (SG&A) expenses and seeks to minimize such costs.

There are four principal competitors in the U.S. and Canada commercial truck market. The Company’s share of the U.S. and Canadian Class 8 market was 27.9% of retail sales in 2014, and the Company’s medium-duty market share was 16.7% in 2014. In Europe, there are six principal competitors in the commercial truck market, including parent companies to two competitors of the Company in the U.S. In 2014, DAF had a 13.8% share of the Western and Central European heavy-duty market and a 8.8% share of the light/medium market. These markets are highly competitive in price, quality and service. PACCAR is not dependent on any single customer for its sales. There are no significant seasonal variations in sales.

The Peterbilt, Kenworth and DAF nameplates are recognized internationally and play an important role in the marketing of the Company’s truck products. The Company engages in a continuous program of trademark and trade name protection in all marketing areas of the world.

The Company’s truck products are subject to environmental, noise and emission regulations. Competing manufacturers are subject to the same regulations. The Company believes the cost of complying with noise and emission regulations will not be detrimental to its business.

The Company had a total production backlog of $5.6 billion at the end of 2014. Within this backlog, orders scheduled for delivery within three months (90 days) are considered to be firm. The 90-day backlog approximated $3.1 billion at December 31, 2014, $2.0 billion at December 31, 2013, and $1.4 billion at December 31, 2012. Production of the year end 2014 backlog is expected to be substantially completed during 2015.

4

Table of Contents

PARTS

The Parts segment includes the distribution of aftermarket parts for trucks and related commercial vehicles in the U.S., Canada, Europe, Australia, Mexico and South America. Aftermarket truck parts are sold and delivered to the Company’s independent dealers through the Company’s 17 strategically located parts distribution centers (PDCs). Parts are primarily purchased from various suppliers and also manufactured by the Company. Aftermarket parts inventory levels are determined largely by anticipated customer demand and the need for timely delivery. The Parts segment accounted for 16% of total 2014 net sales and revenues.

PACCAR Parts opened a new PDC in Montreal, Canada in 2014 and began construction of a new 160,000 square-foot PDC in Renton, Washington; the new facility will increase the distribution capacity for the Company’s dealers and customers in the northwestern U.S. and western Canada.

Key factors affecting Parts segment earnings include the aftermarket parts sold in the markets served and the margins realized on the sales. Aftermarket parts sales are influenced by the total number of the Company’s trucks in service and the average age and mileage of those trucks. To reflect the benefit the Parts segment receives from costs incurred by the Truck segment, certain factory overhead, research and development, engineering and SG&A expenses are allocated from the Truck segment to the Parts segment. The Company’s costs for parts sold consist primarily of material costs which are influenced by commodities prices such as steel, copper, aluminum and petroleum. The Company utilizes long-term supply agreements with its suppliers to reduce the variability of the cost of parts sold. The Company maintains rigorous control of SG&A expenses and seeks to minimize such costs.

OTHER BUSINESSES

Other businesses include a division of the Company which manufactures industrial winches in two U.S. plants and markets them under the Braden, Carco and Gearmatic nameplates. The markets for these products are highly competitive, and the Company competes with a number of well established firms. Sales of industrial winches were approximately 1% of net sales and revenues in 2014.

The Braden, Carco and Gearmatic trademarks and trade names are recognized internationally and play an important role in the marketing of those products.

FINANCIAL SERVICES

PACCAR Financial Services (PFS) operates in 22 countries in North America, Europe, Australia and South America through wholly owned finance companies operating under the PACCAR Financial trade name. PFS also conducts full service leasing operations through wholly owned subsidiaries in North America and Germany under the PacLease trade name. Selected dealers in North America are franchised to provide full service leasing. PFS provides its franchisees equipment financing and administrative support. PFS also operates full service lease outlets on its own behalf. PFS’s retail loan and lease customers consist of small, medium and large commercial trucking companies, independent owner/operators and other businesses that purchased their trucks principally from PACCAR’s independent dealers. PFS accounts for 6% of net sales and revenues in 2014.

The Company’s finance receivables are classified as dealer wholesale, dealer retail and customer retail segments. The dealer wholesale segment consists of truck inventory financing to PACCAR dealers. The dealer retail segment consists of loans and leases to participating dealers and franchises that use the proceeds to fund customers’ acquisition of commercial vehicles and related equipment. The customer retail segment consists of loans and leases directly to customers for the acquisition of commercial vehicles and related equipment. Customer retail receivables are further segregated between fleet and owner/operator classes. The fleet class consists of customer retail accounts operating more than five trucks. All other customer retail accounts are considered owner/operator. Each individual class has similar measurement attributes, risk characteristics and common methods to monitor and assess credit risk.

Receivables are secured by the products financed or leased. The terms of loan and lease contracts vary with the type and usage of equipment but generally range from three to five years. Payment is required on dealer inventory financing when the floored truck is sold to a customer or upon maturity of the flooring loan, whichever comes first. Dealer inventory loans generally mature within one to two years.

5

Table of Contents

The Company funds its financial services activities primarily from collections on existing finance receivables and borrowings in the capital markets. The primary sources of borrowings in the capital markets are commercial paper and medium-term notes issued in the public markets and, to a lesser extent, bank loans. An additional source of funds is loans from other PACCAR companies. PFS attempts to match the maturity and interest rate characteristics of its debt with the maturity and interest rate characteristics of loans and leases.

Key factors affecting the earnings of the Financial Services segment include the volume of new loans and leases, the yield earned on the loans and leases, the costs of funding investments in loans and leases and the ability to collect the amounts owed to PFS. New loan and lease volume is dependent on the volume of new trucks sold by Kenworth, Peterbilt and DAF and the share of those truck sales that are financed by the Financial Services segment. Finance market share is influenced by the extent of competition in the financing market. PFS’s competitors primarily include banks and independent finance and leasing companies.

The revenue earned on loans and leases depends on market interest and lease rates and the ability of PFS to differentiate itself from the competition by superior industry knowledge and customer service. Dealer inventory loans have variable rates with rates reset monthly based on an index pertaining to the applicable local market. Retail loan and lease contracts normally have fixed rates over the contract term. PFS obtains funds either through fixed rate borrowings or through variable rate borrowings, a portion of which have been effectively converted to fixed rate through the use of interest rate contracts. This enables PFS to obtain a stable spread between the cost of borrowing and the yield on fixed rate contracts over the contract term. Included in Financial Services cost of revenues is depreciation on equipment on operating leases. The amount of depreciation on operating leases principally depends on the amount of leased equipment, and the average term of the lease which generally range from three to five years and residual values which generally range from 30 to 50%. The margin earned is the difference between the revenues on loan and lease contracts and the direct costs of operation, including interest and depreciation.

PFS incurs credit losses when customers are unable to pay the full amounts due under loan and finance lease contracts. PFS takes a conservative approach to underwriting new retail business in order to minimize credit losses.

The ability of these customers to pay their obligations to PFS depends on the state of the general economy, the extent of freight demand, freight rates and the cost of fuel, among other factors. PFS limits its exposure to any one customer, with no one customer or dealer balance representing over 5% of the aggregate portfolio assets. PFS generally requires a down payment and secures its interest in the underlying truck equipment collateral and may include other collateral or personal guarantees. In the event of default, PFS will repossess the vehicle and sell it in the open market primarily through its dealer network. PFS will take legal means to recover any shortfall between the amounts owed and the amounts recovered from sale of the collateral. The amount of credit losses depends on the rate of default on loans and finance leases and, in the event of repossession, the ability to recover the amount owed from sale of the collateral which is affected by used truck prices. PFS’s experience over the last fifty years financing truck sales has been that periods of economic weakness result in higher past dues and increased rates of repossession. Used truck prices also tend to fall during periods of economic weakness. As a result, credit losses tend to increase during periods of economic weakness. PFS provides an allowance for credit losses based on specifically identified customer risks and an analysis of estimated losses inherent in the portfolio, considering the amount of past due accounts, the trends of used truck prices and the economic environment in each of its markets.

Financial Services SG&A expenses consist primarily of personnel costs associated with originating and servicing the Company’s loan and lease portfolios. These costs vary somewhat depending on overall levels of business activity, but given the ongoing nature of servicing activities, tend to be relatively stable.

PATENTS

The Company owns numerous patents which relate to all product lines. Although these patents are considered important to the overall conduct of the Company’s business, no patent or group of patents is considered essential to a material part of the Company’s business.

REGULATION

As a manufacturer of highway trucks, the Company is subject to the National Traffic and Motor Vehicle Safety Act and Federal Motor Vehicle Safety Standards promulgated by the National Highway Traffic Safety Administration as well as environmental laws and regulations in the United States, and is subject to similar regulations in Canada, Mexico, Australia, Brasil and Europe. In addition, the Company is subject to certain other licensing requirements to do business in the United States and Europe. The Company believes

6

Table of Contents

it is in compliance with laws and regulations applicable to safety standards, the environment and other licensing requirements in all countries where it has operations.

Information regarding the effects that compliance with international, federal, state and local provisions regulating the environment has on the Company’s capital and operating expenditures and the Company’s involvement in environmental cleanup activities is included in Management’s Discussion and Analysis of Financial Condition and Results of Operations and the Company’s Consolidated Financial Statements in Items 7 and 8, respectively.

EMPLOYEES

On December 31, 2014, the Company had approximately 23,300 employees.

OTHER DISCLOSURES

The Company’s filings on Forms 10-K, 10-Q and 8-K and any amendments to those reports can be found on the Company’s website www.paccar.com free of charge as soon as practicable after the report is electronically filed with, or furnished to, the Securities and Exchange Commission (SEC). In addition, our reports filed with the SEC can be found at www.sec.gov. The information on the Company’s website is not incorporated by reference into this report.

| ITEM 1A. | RISK FACTORS. |

The following are significant risks which could have a material negative impact on the Company’s financial condition or results of operations.

Business and Industry Risks

Commercial Truck Market Demand is Variable. The Company’s business is highly sensitive to global and national economic conditions as well as economic conditions in the industries and markets it serves. Negative economic conditions and outlook can materially weaken demand for the Company’s equipment and services. The yearly demand for commercial vehicles may increase or decrease more than overall gross domestic product in markets the Company serves, which are principally North America and Europe. Demand for commercial vehicles may also be affected by the introduction of new vehicles and technologies by the Company or its competitors.

Competition and Prices. The Company operates in a highly competitive environment, which could adversely affect the Company’s sales and pricing. Financial results depend largely on the ability to develop, manufacture and market competitive products that profitably meet customer demand.

Production Costs and Supplier Capacity. The Company’s products are exposed to variability in material and commodity costs. Commodity or component price increases and significant shortages of component products may adversely impact the Company’s financial results or use of its production capacity. Many of the Company’s suppliers also supply automotive manufacturers, and factors that adversely affect the automotive industry can also have adverse effects on these suppliers and the Company. Supplier delivery performance can be adversely affected if increased demand for these suppliers’ products exceeds their production capacity. Unexpected events, including natural disasters, may increase the Company’s cost of doing business or disrupt the Company’s or its suppliers’ operations.

Liquidity Risks, Credit Ratings and Costs of Funds. Disruptions or volatility in global financial markets could limit the Company’s sources of liquidity, or the liquidity of customers, dealers and suppliers. A lowering of the Company’s credit ratings could increase the cost of borrowing and adversely affect access to capital markets. The Company’s Financial Services segment obtains funds for its operations from commercial paper, medium-term notes and bank debt. If the markets for commercial paper, medium-term notes and bank debt do not provide the necessary liquidity in the future, the Financial Services segment may experience increased costs or may have to limit its financing of retail and wholesale assets. This could result in a reduction of the number of vehicles the Company is able to produce and sell to customers.

7

Table of Contents

The Financial Services Industry is Highly Competitive. The Company’s Financial Services segment competes with banks, other commercial finance companies and financial services firms which may have lower costs of borrowing, higher leverage or market share goals that result in a willingness to offer lower interest rates, which may lead to decreased margins, lower market share or both. A decline in the Company’s truck unit sales and a decrease in truck residual values due to lower used truck pricing are also factors which may affect the Company’s Financial Services segment.

The Financial Services Segment is Subject to Credit Risk. The Financial Services segment is exposed to the risk of loss arising from the failure of a customer, dealer or counterparty to meet the terms of the loans, leases and derivative contracts with the Company. Although the financial assets of the Financial Services segment are secured by underlying equipment collateral, in the event a customer cannot meet its obligations to the Company, there is a risk that the value of the underlying collateral will not be sufficient to recover the amounts owed to the Company, resulting in credit losses.

Interest Rate Risks. The Financial Services segment is subject to interest rate risks, because increases in interest rates can reduce demand for its products, increase borrowing costs and potentially reduce interest margins. PFS uses derivative contracts to mitigate the risk of changing interest rates.

Product Liability, Litigation and Regulatory Actions. The Company’s products are subject to recall for environmental, performance and safety-related issues. Product recalls, lawsuits, regulatory actions or increases in the reserves the Company establishes for contingencies may increase the Company’s costs and lower profits. Refer to Item 3 – Legal Proceedings for a discussion of the risk associated with the European Commission investigation. The Company’s reputation and its brand names are valuable assets, and claims or regulatory actions, even if unsuccessful or without merit, could adversely affect the Company’s reputation and brand images because of adverse publicity.

Information Technology. The Company relies on information technology systems, including the internet and other computer systems, which may be subject to disruptions during the process of upgrading or replacing software, databases or components; power outages; hardware failures; computer viruses; or outside parties attempting to disrupt the Company’s business or gain unauthorized access to the Company’s electronic data. The Company maintains protections to guard against such events. If the Company’s computer systems were to be damaged, disrupted or breached, it could result in negative impact on the Company’s operating results and also could cause reputational damage, business disruption or the disclosure of confidential data.

Political, Regulatory and Economic Risks

Multinational Operations. The Company’s global operations are exposed to political, economic and other risks and events beyond its control in the countries in which the Company operates. The Company may be adversely affected by political instabilities, fuel shortages or interruptions in utility or transportation systems, natural calamities, wars, terrorism and labor strikes. Changes in government monetary or fiscal policies and international trade policies may impact demand for the Company’s products, financial results and competitive position. PACCAR’s global operations are subject to extensive trade, competition and anti-corruption laws and regulations that could impose significant compliance costs.

Environmental Regulations. The Company’s operations are subject to and affected by environmental laws and regulations that impose significant compliance costs. The Company could experience higher research and development costs due to changes in government requirements for its products, including changes in engine and vehicle emissions, safety regulations, fuel requirements or greenhouse gas regulations.

8

Table of Contents

Currency Exchange and Translation. The Company’s consolidated financial results are reported in U.S. dollars, while significant operations are denominated in the currencies of other countries. Currency exchange rate fluctuations can affect the Company’s assets, liabilities and results of operations through both translation and transaction risk, as reported in the Company’s financial statements. The Company uses certain derivative financial instruments and localized production of its products to reduce, but not eliminate, the effects of foreign currency exchange rate fluctuations.

Accounting Estimates. In the preparation of the Company’s financial statements in accordance with U.S. generally accepted accounting principles, management uses estimates and makes judgments and assumptions that affect asset and liability values and the amounts reported as income and expense during the periods presented. Certain of these estimates, judgments and assumptions, such as residual values on operating leases, the allowance for credit losses, warranty and pension expenses and the provision for income taxes, are particularly sensitive. If actual results are different from estimates used by management, they may have a material impact on the financial statements. For additional disclosures regarding accounting estimates, see “Critical Accounting Policies” under Item 7 of this Form 10-K.

Taxes. Changes in statutory income tax rates in the countries in which the Company operates impact the Company’s effective tax rate. Changes to other taxes or the adoption of other new tax legislation could affect the Company’s provision for income taxes and related tax assets and liabilities.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS. |

None.

| ITEM 2. | PROPERTIES. |

The Company and its subsidiaries own and operate manufacturing plants in five U.S. states, three countries in Europe, and in Australia, Canada, Mexico and Brasil. The Company also has 17 parts distribution centers, many sales and service offices, and finance and administrative offices which are operated in owned or leased premises in these and other countries. Facilities for product testing and research and development are located in Washington state and the Netherlands. The Company’s corporate headquarters is located in owned premises in Bellevue, Washington. The Company considers all of the properties used by its businesses to be suitable for their intended purposes.

The Company invests in facilities, equipment and processes to provide manufacturing and warehouse capacity to meet its customers’ needs and improve operating performance.

The following summarizes the number of the Company’s manufacturing plants and parts distribution centers by geographical location within indicated industry segments:

| U.S. | Canada | Australia | Mexico | Europe | So. America | |||||||||||||||||||

| Truck |

4 | 1 | 1 | 1 | 3 | 1 | ||||||||||||||||||

| Parts |

6 | 2 | 1 | 1 | 5 | 2 | ||||||||||||||||||

| Other |

2 | – | – | – | – | – | ||||||||||||||||||

9

Table of Contents

| ITEM 3. | LEGAL PROCEEDINGS. |

In January 2011, the European Commission (EC) commenced an investigation of all major European commercial vehicle manufacturers, including subsidiaries of the Company, concerning whether such companies participated in agreements or concerted practices to coordinate their commercial policy in the European Union. On November 20, 2014, the EC issued a Statement of Objections to the manufacturers, including DAF Trucks N.V., its subsidiary DAF Trucks Deutschland GmbH and PACCAR Inc as their parent. The Statement of Objections is a procedural step in which the EC expressed its preliminary view that the manufacturers had participated in anticompetitive practices in the European Union. The EC indicated that it will seek to impose significant fines on the manufacturers. DAF is studying the Statement of Objections and will prepare a response. The EC will review the manufacturers’ responses before issuing a decision. Any decision would be subject to appeal. The Company is unable to estimate the potential fine at this time and accordingly, no accrual for any potential fine has been made as of December 31, 2014.

The Company and its subsidiaries are parties to various lawsuits incidental to the ordinary course of business. Except for the EC matter noted above, management believes that the disposition of such lawsuits will not materially affect the Company’s business or financial condition.

| ITEM 4. | MINE SAFETY DISCLOSURES. |

Not applicable.

10

Table of Contents

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

| (a) | Market Information, Holders, Dividends, Securities Authorized for Issuance Under Equity Compensation Plans and Performance Graph. |

Market Information, Holders and Dividends.

Common stock of the Company is traded on the NASDAQ Global Select Market under the symbol PCAR. The table below reflects the range of trading prices as reported by the NASDAQ Stock Market LLC and cash dividends declared. There were 1,818 record holders of the common stock at December 31, 2014.

| 2014 | 2013 | |||||||||||||||||||||||

| DIVIDENDS DECLARED |

STOCK PRICE | DIVIDENDS DECLARED |

STOCK PRICE | |||||||||||||||||||||

| QUARTER |

HIGH | LOW | HIGH | LOW | ||||||||||||||||||||

| First |

$ | .20 | $ | 68.81 | $ | 53.59 | $ | .20 | $ | 51.38 | $ | 45.42 | ||||||||||||

| Second |

.22 | 68.38 | 60.21 | .20 | 55.05 | 47.12 | ||||||||||||||||||

| Third |

.22 | 67.64 | 56.61 | .20 | 60.00 | 52.59 | ||||||||||||||||||

| Fourth |

.22 | 71.15 | 55.34 | .20 | 59.35 | 53.67 | ||||||||||||||||||

| Year-End Extra |

1.00 | .90 | ||||||||||||||||||||||

The Company expects to continue paying regular cash dividends, although there is no assurance as to future dividends because they are dependent upon future earnings, capital requirements and financial conditions.

Securities Authorized for Issuance Under Equity Compensation Plans.

The following table provides information as of December 31, 2014 regarding compensation plans under which PACCAR equity securities are authorized for issuance.

| Number of Securities Granted and to be Issued on Exercise of Outstanding Options and Other Rights |

Weighted-average Exercise Price of Outstanding Options |

Securities Available for Future Grant |

||||||||||

| Stock compensation plans approved by stockholders |

5,087,666 | $ | 44.25 | 16,072,105 | ||||||||

All stock compensation plans have been approved by the stockholders.

The number of securities to be issued includes those issuable under the PACCAR Inc Long Term Incentive Plan (LTI Plan) and the Restricted Stock and Deferred Compensation Plan for Non-Employee Directors (RSDC Plan). Securities to be issued include 365,251 shares that represent deferred cash awards payable in stock. The weighted-average exercise price does not include the securities that represent deferred cash awards.

Securities available for future grant are authorized under the following two plans: (i) 15,198,432 shares under the LTI Plan, and (ii) 873,673 shares under the RSDC Plan.

11

Table of Contents

Stockholder Return Performance Graph.

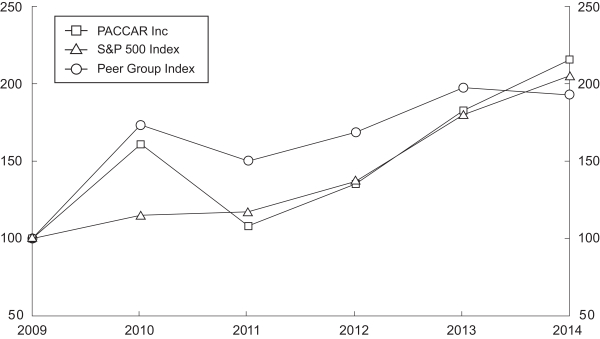

The following line graph compares the yearly percentage change in the cumulative total stockholder return on the Company’s common stock, to the cumulative total return of the Standard & Poor’s Composite 500 Stock Index and the return of an industry peer group of companies (the Peer Group Index) for the last five fiscal years ended December 31, 2014. Standard & Poor’s has calculated a return for each company in the Peer Group Index weighted according to its respective capitalization at the beginning of each period with dividends reinvested on a monthly basis. Management believes that the identified companies and methodology used in the graph for the Peer Group Index provide a better comparison than other indices available. The Peer Group Index consists of AGCO Corporation, Caterpillar Inc., Cummins Inc., Dana Holding Corporation, Deere & Company, Eaton Corporation, Meritor Inc., Navistar International Corporation, Oshkosh Corporation and AB Volvo. Scania AB is no longer included in the Peer Group Index of the performance graph due to its acquisition in 2014. The comparison assumes that $100 was invested on December 31, 2009 in the Company’s common stock and in the stated indices and assumes reinvestment of dividends.

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |||||||||||||||||||

| PACCAR Inc |

100 | 160.38 | 108.27 | 135.46 | 182.73 | 215.96 | ||||||||||||||||||

| S&P 500 Index |

100 | 115.06 | 117.49 | 136.30 | 180.44 | 205.14 | ||||||||||||||||||

| Peer Group Index |

100 | 173.34 | 149.98 | 169.25 | 197.02 | 192.63 | ||||||||||||||||||

12

Table of Contents

| (b) | Use of Proceeds from Registered Securities |

Not applicable

| (c) | Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

On December 6, 2011, the Board of Directors approved a plan to repurchase up to $300 million of the Company’s outstanding common stock. As of December 31, 2014, the Company has repurchased 5.7 million shares for $234.7 million under this plan. The following are details of repurchases made under the plan for the fourth quarter of 2014:

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Maximum Dollar Value that May Yet be Purchased Under this Plan |

|||||||||

| October 1 - 31, 2014 |

150,000 | $ | 56.99 | $ | 65,342,812 | |||||||

| November 1 - 30, 2014 |

$ | 65,342,812 | ||||||||||

| December 1 - 31, 2014 |

$ | 65,342,812 | ||||||||||

|

|

|

|||||||||||

| Total |

150,000 | $ | 56.99 | $ | 65,342,812 | |||||||

|

|

|

|||||||||||

| ITEM 6. | SELECTED FINANCIAL DATA. |

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| (millions except per share data) | ||||||||||||||||||||

| Truck, Parts and Other Net Sales |

$ | 17,792.8 | $ | 15,948.9 | $ | 15,951.7 | $ | 15,325.9 | $ | 9,325.1 | ||||||||||

| Financial Services Revenues |

1,204.2 | 1,174.9 | 1,098.8 | 1,029.3 | 967.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Revenues |

$ | 18,997.0 | $ | 17,123.8 | $ | 17,050.5 | $ | 16,355.2 | $ | 10,292.9 | ||||||||||

| Net Income |

$ | 1,358.8 | $ | 1,171.3 | $ | 1,111.6 | $ | 1,042.3 | $ | 457.6 | ||||||||||

| Net Income Per Share: |

||||||||||||||||||||

| Basic |

3.83 | 3.31 | 3.13 | 2.87 | 1.25 | |||||||||||||||

| Diluted |

3.82 | 3.30 | 3.12 | 2.86 | 1.25 | |||||||||||||||

| Cash Dividends Declared Per Share |

1.86 | 1.70 | 1.58 | 1.30 | .69 | |||||||||||||||

| Total Assets: |

||||||||||||||||||||

| Truck, Parts and Other |

8,701.5 | 9,095.4 | 7,832.3 | 7,771.3 | 6,355.9 | |||||||||||||||

| Financial Services |

11,917.3 | 11,630.1 | 10,795.5 | 9,401.4 | 7,878.2 | |||||||||||||||

| Truck, Parts and Other Long-Term Debt |

150.0 | 150.0 | 150.0 | 150.0 | ||||||||||||||||

| Financial Services Debt |

8,230.6 | 8,274.2 | 7,730.1 | 6,505.4 | 5,102.5 | |||||||||||||||

| Stockholders’ Equity |

6,753.2 | 6,634.3 | 5,846.9 | 5,364.4 | 5,357.8 | |||||||||||||||

| Ratio of Earnings to Fixed Charges |

16.14x | 11.17x | 10.69x | 8.93x | 3.89x | |||||||||||||||

13

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

OVERVIEW:

PACCAR is a global technology company whose Truck segment includes the design and manufacture of high-quality, light-, medium- and heavy-duty commercial trucks. In North America, trucks are sold under the Kenworth and Peterbilt nameplates, in Europe, under the DAF nameplate and in Australia and South America, under the Kenworth and DAF nameplates. The Parts segment includes the distribution of aftermarket parts for trucks and related commercial vehicles. The Company’s Financial Services segment derives its earnings primarily from financing or leasing PACCAR products in North America, Europe and Australia. The Company’s Other business is the manufacturing and marketing of industrial winches.

Consolidated net sales and revenues of $18.99 billion in 2014 were the highest in the Company’s history. The increase of 11% from $17.12 billion in 2013 was mainly due to record truck and aftermarket parts sales and higher financial services revenues. Truck unit sales increased in 2014 to 142,900 units from 137,100 units in 2013, reflecting higher industry retail sales in the U.S. and Canada, partially offset by a lower over 16-tonne market in Europe. Record freight volumes and improving fleet utilization are contributing to excellent parts and service business.

In 2014, PACCAR earned net income for the 76th consecutive year. Net income in 2014 of $1.36 billion was the second highest in the Company’s history, increasing from $1.17 billion in 2013, primarily due to record Truck and Parts segment sales, improved Truck segment operating margin and record Financial Services segment pre-tax income. Earnings per diluted share of $3.82 was the second best in the Company’s history.

DAF introduced a new range of Euro 6 CF and XF four-axle trucks and tractors for heavy-duty applications. These new vehicles expand DAF’s product range in the construction, container and refuse markets and complement DAF’s award-winning Euro 6 on-highway trucks. In addition, DAF introduced the new DAF Euro 6 CF Silent distribution truck for deliveries in urban areas with noise restrictions, and the new DAF Euro 6 CF and XF Low Deck tractors which maximize trailer volume within European height and length regulations. These new vehicles expand DAF’s product range in distribution and over-the-road applications and expand DAF’s Euro 6 range of trucks.

Kenworth and Peterbilt launched their new medium-duty cab-over-engine distribution trucks with extensive exterior and interior enhancements. In addition, new vocational Kenworth T880 and Peterbilt Model 567 trucks were introduced, which expanded PACCAR’s offerings in the construction, utility and refuse markets.

In 2014, the Company’s research and development expenses were $215.6 million compared to $251.4 million in 2013.

PACCAR Parts opened a new distribution center in Montreal, Canada and now has 17 parts distribution centers supporting over 2,000 DAF, Kenworth and Peterbilt dealer locations. PACCAR began construction of a new 160,000 square-foot distribution center in Renton, Washington. The new facility will increase the distribution capacity for the Company’s dealers and customers in the northwestern U.S. and western Canada.

The PACCAR Financial Services (PFS) group of companies has operations covering four continents and 22 countries. The global breadth of PFS and its rigorous credit application process support a portfolio of loans and leases with total assets of $11.92 billion that earned a record pre-tax profit of $370.4 million. PFS issued $1.58 billion in medium-term notes during the year to support portfolio growth.

Truck and Parts Outlook

Truck industry retail sales in the U.S. and Canada in 2015 are expected to be 250,000–280,000 units compared to 249,400 units in 2014 driven by expansion of truck industry fleet capacity and economic growth. In Europe, the 2015 truck industry registrations for over 16-tonne vehicles are expected to be 200,000–240,000 units, compared to the 226,900 truck registrations in 2014.

Heavy-duty truck industry sales for South America were 129,000 units in 2014, and heavy-duty truck industry sales are estimated to be in a range of 110,000 to 130,000 units in 2015. The production of DAF trucks in Brasil and the continued growth of the DAF Brasil dealer network will further enhance PACCAR’s vehicle sales in South America.

14

Table of Contents

In 2015, PACCAR Parts sales are expected to grow 5-8% in North America, reflecting steady economic growth and high fleet utilization. PACCAR Parts deliveries are expected to increase in Europe, reflecting slightly improving freight markets and PACCAR Parts’ innovative customer service programs. Sales in Europe may be affected by recent declines in the values of the euro relative to the U.S. dollar.

Capital investments in 2015 are expected to be $300 to $350 million, focused on enhanced powertrain development and increased operating efficiency for our factories and distribution centers. Research and development (R&D) in 2015 is expected to be $220 to $260 million, focused on new products and services.

Financial Services Outlook

Based on the truck market outlook, average earning assets in 2015 are expected to be slightly higher than current levels. Current levels of freight tonnage, freight rates and fleet utilization are contributing to customers’ profitability and cash flow. If current freight transportation conditions decline due to weaker economic conditions, then past due accounts, truck repossessions and credit losses would likely increase from the current low levels.

See the Forward-Looking Statements section of Management’s Discussion and Analysis for factors that may affect these outlooks.

RESULTS OF OPERATIONS:

| ($ in millions, except per share amounts) | ||||||||||||

| Year Ended December 31, |

2014 | 2013 | 2012 | |||||||||

| Net sales and revenues: |

||||||||||||

| Truck |

$ | 14,594.0 | $ | 13,002.9 | $ | 13,131.5 | ||||||

| Parts |

3,077.5 | 2,822.2 | 2,667.5 | |||||||||

| Other |

121.3 | 123.8 | 152.7 | |||||||||

|

|

|

|

|

|

|

|||||||

| Truck, Parts and Other |

17,792.8 | 15,948.9 | 15,951.7 | |||||||||

| Financial Services |

1,204.2 | 1,174.9 | 1,098.8 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 18,997.0 | $ | 17,123.8 | $ | 17,050.5 | |||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) before income taxes: |

||||||||||||

| Truck |

$ | 1,160.1 | $ | 936.7 | $ | 920.4 | ||||||

| Parts |

496.7 | 416.0 | 374.6 | |||||||||

| Other |

(31.9 | ) | (26.5 | ) | (7.0 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Truck, Parts and Other |

1,624.9 | 1,326.2 | 1,288.0 | |||||||||

| Financial Services |

370.4 | 340.2 | 307.8 | |||||||||

| Investment income |

22.3 | 28.6 | 33.1 | |||||||||

| Income taxes |

(658.8 | ) | (523.7 | ) | (517.3 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net Income |

$ | 1,358.8 | $ | 1,171.3 | $ | 1,111.6 | ||||||

|

|

|

|

|

|

|

|||||||

| Diluted earnings per share |

$ | 3.82 | $ | 3.30 | $ | 3.12 | ||||||

|

|

|

|

|

|

|

|||||||

| Return on revenues |

7.2 | % | 6.8 | % | 6.5 | % | ||||||

The following provides an analysis of the results of operations for the Company’s three reportable segments - Truck, Parts and Financial Services. Where possible, the Company has quantified the impact of factors identified in the following discussion and analysis. In cases where it is not possible to quantify the impact of factors, the Company lists them in estimated order of importance. Factors for which the Company is unable to specifically quantify the impact include market demand, fuel prices, freight tonnage and economic conditions affecting the Company’s results of operations.

15

Table of Contents

2014 Compared to 2013:

Truck

The Company’s Truck segment accounted for 77% and 76% of total revenues for 2014 and 2013, respectively.

| ($ in millions) | ||||||||||||

| Year Ended December 31, |

2014 | 2013 | % CHANGE | |||||||||

| Truck net sales and revenues: |

||||||||||||

| U.S. and Canada |

$ | 8,974.5 | $ | 7,138.1 | 26 | |||||||

| Europe |

3,657.6 | 3,844.4 | (5 | ) | ||||||||

| Mexico, South America, Australia and other |

1,961.9 | 2,020.4 | (3 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| $ | 14,594.0 | $ | 13,002.9 | 12 | ||||||||

|

|

|

|

|

|

|

|||||||

| Truck income before income taxes |

$ | 1,160.1 | $ | 936.7 | 24 | |||||||

|

|

|

|

|

|

|

|||||||

| Pre-tax return on revenues |

7.9 | % | 7.2 | % | ||||||||

| The Company’s worldwide truck net sales and revenues increased to $14.59 billion from $13.0 billion in 2013, primarily due to higher truck deliveries in the U.S. and Canada, higher price realization in Europe related to higher content Euro 6 emission vehicles, partially offset by lower truck deliveries in Europe and Mexico.

Truck segment income before income taxes and pre-tax return on revenues reflect higher truck unit deliveries and improved price realization in the U.S. and Canada and lower R&D spending, partially offset by lower deliveries in Europe and Mexico.

The Company’s new truck deliveries are summarized below:

|

| |||||||||||

| Year Ended December 31, |

2014 | 2013 | % CHANGE | |||||||||

| U.S. |

74,300 | 59,000 | 26 | |||||||||

| Canada |

10,500 | 9,700 | 8 | |||||||||

|

|

|

|

|

|

|

|||||||

| U.S. and Canada |

84,800 | 68,700 | 23 | |||||||||

| Europe |

39,500 | 48,400 | (18 | ) | ||||||||

| Mexico, South America, Australia and other |

18,600 | 20,000 | (7 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Total units |

142,900 | 137,100 | 4 | |||||||||

|

|

|

|

|

|

|

|||||||

In 2014, industry retail sales in the heavy-duty market in the U.S. and Canada increased to 249,400 units from 212,200 units in 2013. The Company’s heavy-duty truck retail market share was 27.9% compared to 28.0% in 2013. The medium-duty market was 73,300 units in 2014 compared to 65,900 units in 2013. The Company’s medium-duty market share was a record 16.7% in 2014 compared to 15.7% in 2013.

The over 16-tonne truck market in Western and Central Europe in 2014 was 226,900 units, a 6% decrease from 240,800 units in 2013. The largest decreases were in the U.K. and France, partially offset by increases in Germany and Spain. The Company’s market share was 13.8% in 2014, a decrease from 16.2% in 2013. The decrease in market share was primarily due to the lower DAF registrations in the U.K. and the Netherlands which were impacted by the Euro 5/Euro 6 transition rules. The 6 to 16-tonne market in 2014 was 46,900 units compared to 57,200 units in 2013. The Company’s market share was 8.8% in 2014, a decrease from 11.8% in 2013. The decline in market share is a result of reduced registrations in the U.K. which were also affected by the Euro 5/Euro 6 transition rules.

16

Table of Contents

The major factors for the changes in net sales and revenues, cost of sales and revenues and gross margin between 2014 and 2013 for the Truck segment are as follows:

| NET | COST | GROSS | ||||||||||

| ($ in millions) |

SALES | OF SALES | MARGIN | |||||||||

| 2013 |

$ | 13,002.9 | $ | 11,691.9 | $ | 1,311.0 | ||||||

| Increase (decrease) |

||||||||||||

| Truck delivery volume |

1,265.8 | 1,086.9 | 178.9 | |||||||||

| Average truck sales prices |

477.4 | 477.4 | ||||||||||

| Average per truck material, labor and other direct costs |

408.6 | (408.6 | ) | |||||||||

| Factory overhead and other indirect costs |

63.6 | (63.6 | ) | |||||||||

| Operating leases |

(7.2 | ) | (12.5 | ) | 5.3 | |||||||

| Currency translation |

(144.9 | ) | (133.0 | ) | (11.9 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total increase |

1,591.1 | 1,413.6 | 177.5 | |||||||||

|

|

|

|

|

|

|

|||||||

| 2014 |

$ | 14,594.0 | $ | 13,105.5 | $ | 1,488.5 | ||||||

|

|

|

|

|

|

|

|||||||

|

• Truck delivery volume reflects higher truck deliveries in the U.S. and Canada which resulted in higher sales ($1,798.6 million) and cost of sales ($1,511.5 million), partially offset by lower truck deliveries in Europe and Mexico which resulted in lower sales ($564.3 million) and costs of sales ($457.8 million).

• Average truck sales prices increased sales by $477.4 million, primarily due to higher content Euro 6 emission vehicles in Europe ($274.9 million), improved price realization in the U.S. and Canada ($146.6 million) and in Mexico ($31.9 million).

• Average cost per truck increased cost of sales by $408.6 million, primarily due to higher content Euro 6 emission vehicles in Europe ($352.6 million).

• Factory overhead and other indirect costs increased $63.6 million, primarily due to higher salaries and related costs ($59.5 million) to support higher sales volume, higher depreciation expense ($13.0 million), partially offset by lower Euro 6 project expenses ($17.4 million).

• Operating lease revenues and cost of sales decreased due to lower average asset balances as lease maturities exceeded new lease volume.

• Truck gross margins in 2014 of 10.2% increased from 10.1% in 2013 due to factors noted above.

Truck SG&A expenses for 2014 decreased to $198.2 million from $214.1 million in 2013. The decrease was primarily due to lower promotion and marketing costs. As a percentage of sales, SG&A decreased to 1.4% in 2014 compared to 1.6% in 2013, reflecting higher sales volume and ongoing cost controls.

Parts

The Company’s Parts segment accounted for 16% of total revenues for both 2014 and 2013.

|

| |||||||||||

| ($ in millions) | ||||||||||||

| Year Ended December 31, |

2014 | 2013 | % CHANGE | |||||||||

| Parts net sales and revenues: |

||||||||||||

| U.S. and Canada |

$ | 1,842.9 | $ | 1,635.5 | 13 | |||||||

| Europe |

867.2 | 828.3 | 5 | |||||||||

| Mexico, South America, Australia and other |

367.4 | 358.4 | 3 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 3,077.5 | $ | 2,822.2 | 9 | ||||||||

|

|

|

|

|

|

|

|||||||

| Parts income before income taxes |

$ | 496.7 | $ | 416.0 | 19 | |||||||

|

|

|

|

|

|

|

|||||||

| Pre-tax return on revenues |

16.1 | % | 14.7 | % | ||||||||

The Company’s worldwide parts net sales and revenues increased due to higher aftermarket demand in all markets. The increase in Parts segment income before taxes and pre-tax return on revenues was primarily due to higher sales and gross margins.

17

Table of Contents

The major factors for the changes in net sales and revenues, cost of sales and revenues and gross margin between 2014 and 2013 for the Parts segment are as follows:

| ($ in millions) |

NET SALES |

COST OF SALES |

GROSS MARGIN |

|||||||||

| 2013 |

$ | 2,822.2 | $ | 2,107.0 | $ | 715.2 | ||||||

| Increase (decrease) |

||||||||||||

| Aftermarket parts volume |

187.8 | 120.0 | 67.8 | |||||||||

| Average aftermarket parts sales prices |

82.5 | 82.5 | ||||||||||

| Average aftermarket parts direct costs |

57.8 | (57.8 | ) | |||||||||

| Warehouse and other indirect costs |

8.0 | (8.0 | ) | |||||||||

| Currency translation |

(15.0 | ) | (11.1 | ) | (3.9 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total increase |

255.3 | 174.7 | 80.6 | |||||||||

|

|

|

|

|

|

|

|||||||

| 2014 |

$ | 3,077.5 | $ | 2,281.7 | $ | 795.8 | ||||||

|

|

|

|

|

|

|

|||||||

| • | Higher market demand in all markets resulted in increased aftermarket parts sales volume of $187.8 million and related cost of sales by $120.0 million. |

| • | Average aftermarket parts sales prices increased sales by $82.5 million reflecting improved price realization in all markets. |

| • | Average aftermarket parts direct costs increased $57.8 million due to higher material costs in all markets. |

| • | Warehouse and other indirect costs increased $8.0 million primarily due to additional costs to support higher sales volume. |

| • | Parts gross margins in 2014 of 25.9% increased from 25.3% in 2013 due to higher price realization and other factors noted above. |

Parts SG&A expense for 2014 increased to $207.5 million from $204.1 million in 2013. The increase was primarily due to higher salaries and related expenses. As a percentage of sales, Parts SG&A decreased to 6.7% in 2014 from 7.2% in 2013, reflecting higher sales volume.

18

Table of Contents

Financial Services

The Company’s Financial Services segment accounted for 6.3% and 6.9% of total revenues for 2014 and 2013, respectively.

| ($ in millions) | ||||||||||||

| Year Ended December 31, |

2014 | 2013 | % CHANGE | |||||||||

| New loan and lease volume: |

||||||||||||

| U.S. and Canada |

$ | 2,798.3 | $ | 2,617.4 | 7 | |||||||

| Europe |

988.1 | 838.3 | 18 | |||||||||

| Mexico and Australia |

668.7 | 862.9 | (23 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| $ | 4,455.1 | $ | 4,318.6 | 3 | ||||||||

| New loan and lease volume by product: |

||||||||||||

| Loans and finance leases |

$ | 3,516.7 | $ | 3,368.1 | 4 | |||||||

| Equipment on operating lease |

938.4 | 950.5 | (1 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| $ | 4,455.1 | $ | 4,318.6 | 3 | ||||||||

| New loan and lease unit volume: |

||||||||||||

| Loans and finance leases |

32,900 | 32,200 | 2 | |||||||||

| Equipment on operating lease |

9,000 | 9,000 | ||||||||||

|

|

|

|

|

|

|

|||||||

| 41,900 | 41,200 | 2 | ||||||||||

| Average earning assets: |

||||||||||||

| U.S. and Canada |

$ | 6,779.0 | $ | 6,331.9 | 7 | |||||||

| Europe |

2,683.8 | 2,495.9 | 8 | |||||||||

| Mexico and Australia |

1,721.4 | 1,770.1 | (3 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| $ | 11,184.2 | $ | 10,597.9 | 6 | ||||||||

| Average earning assets by product: |

||||||||||||

| Loans and finance leases |

$ | 7,269.3 | $ | 6,876.3 | 6 | |||||||

| Dealer wholesale financing |

1,462.0 | 1,490.9 | (2 | ) | ||||||||

| Equipment on lease and other |

2,452.9 | 2,230.7 | 10 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 11,184.2 | $ | 10,597.9 | 6 | ||||||||

| Revenues: |

||||||||||||

| U.S. and Canada |

$ | 641.2 | $ | 626.6 | 2 | |||||||

| Europe |

317.8 | 303.5 | 5 | |||||||||

| Mexico and Australia |

245.2 | 244.8 | ||||||||||

|

|

|

|

|

|

|

|||||||

| $ | 1,204.2 | $ | 1,174.9 | 2 | ||||||||

| Revenue by product: |

||||||||||||

| Loans and finance leases |

$ | 410.3 | $ | 407.7 | 1 | |||||||

| Dealer wholesale financing |

52.3 | 55.1 | (5 | ) | ||||||||

| Equipment on lease and other |

741.6 | 712.1 | 4 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 1,204.2 | $ | 1,174.9 | 2 | ||||||||

|

|

|

|

|

|

|

|||||||

| Income before income taxes |

$ | 370.4 | $ | 340.2 | 9 | |||||||

|

|

|

|

|

|

|

|||||||

In 2014, new loan and lease volume of $4.46 billion increased 3% compared to $4.32 billion in 2013. PFS’s finance market share on new PACCAR truck sales was 27.7% in 2014 compared to 29.2% in 2013 due to increased competition.

PFS revenue of $1.20 billion in 2014 was comparable to $1.17 billion in 2013. PFS income before income taxes increased to a record $370.4 million compared to $340.2 million in 2013, primarily due to higher finance and lease margins related to increased average earning asset balances.

19

Table of Contents

The major factors for the changes in interest and fees, interest and other borrowing expenses and finance margin for the year ended December 31, 2014 are outlined below:

| ($ in millions) |

INTEREST AND FEES |

INTEREST AND OTHER BORROWING EXPENSES |

FINANCE MARGIN |

|||||||||

| 2013 |

$ | 462.8 | $ | 155.9 | $ | 306.9 | ||||||

| Increase (decrease) |

||||||||||||

| Average finance receivables |

23.7 | 23.7 | ||||||||||

| Average debt balances |

5.3 | (5.3 | ) | |||||||||

| Yields |

(19.1 | ) | (19.1 | ) | ||||||||

| Borrowing rates |

(26.0 | ) | 26.0 | |||||||||

| Currency translation |

(4.8 | ) | (1.5 | ) | (3.3 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total (decrease) increase |

(.2 | ) | (22.2 | ) | 22.0 | |||||||

|

|

|

|

|

|

|

|||||||

| 2014 |

$ | 462.6 | $ | 133.7 | $ | 328.9 | ||||||

|

|

|

|

|

|

|

|||||||

|

• Average finance receivables increased $462.3 million (net of foreign exchange effects) in 2014 as a result of retail portfolio new business volume exceeding collections.

• Average debt balances increased $329.4 million in 2014 (net of foreign exchange effects). The higher average debt balances reflect funding for a higher average earning asset portfolio, including loans, finance leases and equipment on operating leases.

• Lower market rates resulted in lower portfolio yields (5.3% in 2014 and 5.6% in 2013) and lower borrowing rates (1.6% in 2014 and 2.0% in 2013).

The following table summarizes operating lease, rental and other revenues and depreciation and other expense:

|

| |||||||||||

| ($ in millions) | ||||||||||

| Year Ended December 31, |

2014 | 2013 | ||||||||

| Operating lease and rental revenues |

$ | 712.2 | $ | 663.0 | ||||||

| Used truck sales and other |

29.4 | 49.1 | ||||||||

|

|

|

|

|

|||||||

| Operating lease, rental and other revenues |

$ | 741.6 | $ | 712.1 | ||||||

|

|

|

|

|

|||||||

| Depreciation of operating lease equipment |

$ | 472.3 | $ | 435.4 | ||||||

| Vehicle operating expenses |

100.6 | 98.1 | ||||||||

| Cost of used truck sales and other |

15.6 | 38.2 | ||||||||

|

|

|

|

|

|||||||

| Depreciation and other expense |

$ | 588.5 | $ | 571.7 | ||||||

|

|

|

|

|

|||||||

20

Table of Contents

The major factors for the changes in operating lease, rental and other revenues, depreciation and other expense and related lease margin for the year ended December 31, 2014 are outlined below:

| ($ in millions) |

OPERATING LEASE, RENTAL AND OTHER REVENUES |

DEPRECIATION AND OTHER EXPENSE |

LEASE MARGIN |

|||||||||

| 2013 |

$ | 712.1 | $ | 571.7 | $ | 140.4 | ||||||

| Increase (decrease) |

||||||||||||

| Used truck sales |

(20.5 | ) | (20.7 | ) | .2 | |||||||

| Results on returned lease assets |

(6.5 | ) | 6.5 | |||||||||

| Average operating lease assets |

39.7 | 30.6 | 9.1 | |||||||||

| Revenue and cost per asset |

10.5 | 15.7 | (5.2 | ) | ||||||||

| Currency translation and other |

(.2 | ) | (2.3 | ) | 2.1 | |||||||

|

|

|

|

|

|

|

|||||||

| Total increase |

29.5 | 16.8 | 12.7 | |||||||||

|

|

|

|

|

|

|

|||||||

| 2014 |

$ | 741.6 | $ | 588.5 | $ | 153.1 | ||||||

|

|

|

|

|

|

|

|||||||

| • | A lower volume of used truck sales decreased operating lease, rental and other revenues by $20.5 million and decreased depreciation and other expense by $20.7 million. |

| • | Average operating lease assets increased $222.3 million in 2014, which increased revenues by $39.7 million and related depreciation and other expense by $30.6 million. |

| • | Revenue per asset increased $10.5 million due to higher rental rates, partially offset by lower fee income. Cost per asset increased $15.7 million due to higher depreciation and maintenance expenses. |

The following table summarizes the provision for losses on receivables and net charge-offs:

| ($ in millions) |

2014 | 2013 | ||||||||||||||

| PROVISION FOR LOSSES ON RECEIVABLES |

NET CHARGE-OFFS |

PROVISION FOR LOSSES ON RECEIVABLES |

NET CHARGE-OFFS |

|||||||||||||

| U.S. and Canada |

$ | 6.1 | $ | 5.1 | $ | 1.9 | $ | .5 | ||||||||

| Europe |

5.4 | 6.5 | 7.4 | 11.0 | ||||||||||||

| Mexico and Australia |

3.9 | 4.4 | 3.6 | 2.1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 15.4 | $ | 16.0 | $ | 12.9 | $ | 13.6 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The provision for losses on receivables was $15.4 million in 2014, an increase of $2.5 million compared to 2013, mainly due to a higher portfolio balance in the U.S., higher past dues resulting from a weaker mining industry in Australia, partially offset by improved portfolio performance across other markets.

The Company modifies loans and finance leases as a normal part of its Financial Services operations. The Company may modify loans and finance leases for commercial reasons or for credit reasons. Modifications for commercial reasons are changes to contract terms for customers that are not considered to be in financial difficulty. Insignificant delays are modifications extending terms up to three months for customers experiencing some short-term financial stress, but not considered to be in financial difficulty. Modifications for credit reasons are changes to contract terms for customers considered to be in financial difficulty. The Company’s modifications typically result in granting more time to pay the contractual amounts owed and charging a fee and interest for the term of the modification. When considering whether to modify customer accounts for credit reasons, the Company evaluates the creditworthiness of the customers and modifies those accounts that the Company considers likely to perform under the modified terms. When the Company modifies loans and finance leases for credit reasons and grants a concession, the modifications are classified as troubled debt restructurings (TDR).

21

Table of Contents

| The post-modification balance of accounts modified during the years ended December 31, 2014 and 2013 are summarized below:

|

| |||||||||||||||

| ($ in millions) |

2014 | 2013 | ||||||||||||||

| RECORDED INVESTMENT |

% OF TOTAL PORTFOLIO* |

RECORDED INVESTMENT |

% OF TOTAL PORTFOLIO* |

|||||||||||||

| Commercial |

$ | 181.6 | 2.5 | % | $ | 233.0 | 3.2 | % | ||||||||

| Insignificant delay |

64.1 | .9 | % | 110.1 | 1.6 | % | ||||||||||

| Credit - no concession |

31.5 | .4 | % | 24.2 | .3 | % | ||||||||||

| Credit - TDR |

27.1 | .4 | % | 13.6 | .2 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 304.3 | 4.2 | % | $ | 380.9 | 5.3 | % | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| * | Recorded investment immediately after modification as a percentage of ending retail portfolio. |

In 2014, total modification activity decreased compared to 2013 primarily due to lower modifications for commercial reasons and insignificant delays, partially offset by an increase in TDR modifications. The decrease in commercial modifications primarily reflects lower levels of additional equipment financed and end-of-contract modifications. The decline in modifications for insignificant delays reflects 2013 extensions granted to two customers in Australia primarily due to business disruptions arising from flooding. TDR modifications increased primarily due to a contract modification for a large customer in the U.S.

The following table summarizes the Company’s 30+ days past due accounts:

| At December 31, |

2014 | 2013 | ||||||

| Percentage of retail loan and lease accounts 30+ days past due: |

||||||||

| U.S. and Canada |

.1 | % | .3 | % | ||||

| Europe |

1.1 | % | .7 | % | ||||

| Mexico and Australia |

2.0 | % | 1.4 | % | ||||

|

|

|

|

|

|||||

| Worldwide |

.5 | % | .5 | % | ||||

|

|

|

|

|

|||||

Accounts 30+ days past due were .5% at December 31, 2014 and 2013. The higher past dues in Europe, Mexico and Australia were offset by lower past dues in the U.S. and Canada. The Company continues to focus on maintaining low past due balances.

When the Company modifies a 30+ days past due account, the customer is then generally considered current under the revised contractual terms. The Company modified $4.0 million of accounts worldwide during the fourth quarter of 2014 and $4.9 million during the fourth quarter of 2013 that were 30+ days past due and became current at the time of modification. Had these accounts not been modified and continued to not make payments, the pro forma percentage of retail loan and lease accounts 30+ days past due would have been as follows:

| At December 31, |

2014 | 2013 | ||||||

| Pro forma percentage of retail loan and lease accounts 30+ days past due: |

||||||||

| U.S. and Canada |

.1 | % | .3 | % | ||||

| Europe |

1.2 | % | .8 | % | ||||

| Mexico and Australia |

2.3 | % | 1.7 | % | ||||

|

|

|

|

|

|||||

| Worldwide |

.6 | % | .6 | % | ||||

|

|

|

|

|

|||||

Modifications of accounts in prior quarters that were more than 30 days past due at the time of modification are included in past dues if they were not performing under the modified terms at December 31, 2014 and 2013. The effect on the allowance for credit losses from such modifications was not significant at December 31, 2014 and 2013.

The Company’s 2014 and 2013 pre-tax return on average earning assets for Financial Services was 3.3% and 3.2%, respectively.

22

Table of Contents

Other

Other includes the winch business as well as sales, income and expenses not attributable to a reportable segment, including a portion of corporate expense. Other sales represent approximately 1% of consolidated net sales and revenues for 2014 and 2013. Other SG&A was $59.5 million in 2014 and $47.1 million in 2013. The increase in SG&A was primarily due to higher salaries and related expenses of $11.4 million. Other income (loss) before tax was a loss of $31.9 million in 2014 compared to a loss of $26.5 million in 2013. The higher loss in 2014 was primarily due to higher salaries and related expenses and lower income before tax from the winch business.

Investment income was $22.3 million in 2014 compared to $28.6 million in 2013. The lower investment income in 2014 primarily reflects lower yields on investments due to lower market interest rates, partially offset by higher average investment balances.

The 2014 effective income tax rate of 32.7% increased from 30.9% in 2013. The increase in the effective tax rate was primarily due to a higher proportion of income generated in higher taxed jurisdictions.

| ($ in millions) | ||||||||||

| Year Ended December 31, |

2014 | 2013 | ||||||||

| Domestic income before taxes |

$ | 1,267.3 | $ | 827.0 | ||||||

| Foreign income before taxes |

750.3 | 868.0 | ||||||||

|

|

|

|

|

|||||||

| Total income before taxes |

$ | 2,017.6 | $ | 1,695.0 | ||||||

|

|

|

|

|

|||||||

| Domestic pre-tax return on revenues |

12.4 | % | 10.2 | % | ||||||

| Foreign pre-tax return on revenues |

8.6 | % | 9.7 | % | ||||||

|

|

|

|

|

|||||||

| Total pre-tax return on revenues |

10.6 | % | 9.9 | % | ||||||

|

|

|

|

|

|||||||

The higher income before income taxes and pre-tax return on revenues for domestic operations were primarily due to higher revenues from trucks and parts operations and higher truck margins. The lower income before income taxes and pre-tax return on revenues for foreign operations were primarily due to lower revenues and truck margins in all foreign markets, except Canada.

2013 Compared to 2012:

Truck

The Company’s Truck segment accounted for 76% and 77% of total revenues for 2013 and 2012, respectively.