UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-4108

Oppenheimer Variable Account Funds

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette

OFI Global Asset Management, Inc.

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: December 31

Date of reporting period: 6/30/2016

Item 1. Reports to Stockholders.

|

|

||||

| June 30, 2016 |

||||

|

Oppenheimer |

||||

| Discovery Mid Cap Growth Fund/VA |

Semiannual Report | |||

| A Series of Oppenheimer Variable Account Funds

|

||||

|

SEMIANNUAL REPORT |

||||

|

Listing of Top Holdings |

||||

|

Fund Performance Discussion |

||||

|

Financial Statements |

PORTFOLIO MANAGERS: Ronald J. Zibelli, Jr., CFA and Justin Livengood, CFA

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED 6/30/16

| Inception Date |

6-Months | 1-Year | 5-Year | 10-Year | ||||||||||||||||

|

Non-Service Shares |

8/15/86 | 1.63% | -1.33% | 9.86% | 5.41% | |||||||||||||||

|

Service Shares |

10/16/00 | 1.50 | -1.57 | 9.58 | 5.14 | |||||||||||||||

|

Russell MidCap Growth Index |

2.15 | -2.14 | 9.98 | 8.12 | ||||||||||||||||

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, call us at 1.800.988.8287. The Fund’s total returns should not be expected to be the same as the returns of other funds, whether or not both funds have the same portfolio managers and/or similar names. The Fund’s total returns include changes in share price and reinvested distributions but do not include the charges associated with the separate account products that offer this Fund. Such performance would have been lower if such charges were taken into account.

The Fund’s performance is compared to the performance of the Russell MidCap Growth Index. The Russell MidCap Growth Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell MidCap companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the Index. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

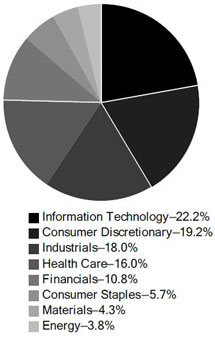

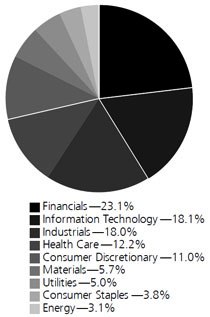

TOP HOLDINGS AND ALLOCATIONS

2 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

Fund Performance Discussion

The Fund’s Non-Service shares produced a return of 1.63% during the reporting period, underperforming the Russell MidCap Growth Index (the “Index”) return of 2.15% and outperforming the Morningstar U.S. Insurance Fund Mid-Cap Growth peer group’s return of 0.18%.

The Fund’s Non-Service shares ranked in the 19th percentile (21 out of 99 funds) in Morningstar’s U.S. Insurance Fund Mid-Cap Growth peer group over the 1-year period ended June 30, 2016. Over the longer-term, Fund’s Non-Service shares ranked in the 8th (9 out of 96 funds), 21st (18 out of 93 funds), and 80th (69 out of 78 funds) percentiles for the 3-, 5- and 10-year periods ended June 30, 2016, respectively. Note that we have managed the Fund under the current investment process for six years.

The Fund generated its strongest results versus the Index in consumer discretionary, health care, materials, and industrials sectors, as a result of stronger relative stock selection. The Fund underperformed the Index in the consumer staples, information technology and financials sectors.

MARKET OVERVIEW

The first half of 2016 was a volatile time for global equity markets. China’s slowing economy, big swings in crude oil prices, and the interest rate hike path indicated by the Fed in its December 2015 communication contributed to a tumultuous environment. March saw a temporary relief rally as communication from the Fed turned more accommodative in light of this weak start to the year. Oil prices and commodities rose, but continued to experience volatility through the close of the reporting period. However, unanswered questions, including how quickly the Fed would raise interest rates and whether Britain would decide to exit the E.U. on its June 23 vote, made for an uncertain period. The U.K. surprised the markets by ultimately deciding to exit the E.U. As a result, markets dropped sharply and remained volatile through the reporting period’s end.

TOP INDIVIDUAL CONTRIBUTORS

Top performing stocks for the Fund this reporting period included Ulta Salon, NVIDIA and Equinix. Ulta Salon, a leading specialty retailer of beauty products, had a strong reporting period. In a treacherous first quarter for many retailers, Ulta delivered significantly better-than-expected results and guidance. Ulta has grown revenue and earnings per share (“EPS”) by more than 20% for the past four calendar years, including 24% revenue growth and 30% EPS growth in the most recent quarter. NVIDIA Corp., a visual computing company that develops graphics chips for use in PCs, mobile devices, servers, automobiles and supercomputers, reported revenue above consensus over the first quarter of its fiscal year and guided second quarter revenue ahead of consensus expectations driven by broad-based growth. We believe the company is positioned to benefit from growth opportunities across all four key platforms, with a particularly strong competitive position in the gaming market. Equinix, a global leader in data center colocation and interconnection services, had a solid quarter with its shares up over 17%. The company once again reported stronger-than-expected quarterly profit and sold eight data centers in the EU to Digital Realty Trust, which reduced debt and gave them new liquidity for future growth.

TOP INDIVIDUAL DETRACTORS

Detractors from performance this reporting period included ServiceNow and Palo Alto Networks. ServiceNow, a provider of software services to automate and manage IT services for enterprises, traded down sharply on disappointing fourth quarter billings results and slightly lower than expected fiscal year 2016 guidance. Palo Alto Networks, a provider of network security solutions, reported fourth quarter guidance that missed consensus estimates, with management pointing to longer sales cycles and a weak economic picture. We exited our positions in both stocks during the reporting period and invested the proceeds in other areas of the information technology sector, such as semiconductor and semiconductor capital equipment companies.

STRATEGY & OUTLOOK

Our long-term investment process seeks dynamic companies with above average and sustainable revenue and earnings growth that we believe are positioned to outperform. This includes leading firms in structurally attractive industries with committed management teams that have proven records of performance.

The macroeconomic environment is characterized by anemic economic expansion, weak corporate profit trends and very low interest rates. Widespread efforts by monetary and fiscal authorities to stimulate improved economic performance are producing limited results thus far. The Brexit vote towards the end of the reporting period does not change the direction of these underlying global dynamics, but does exacerbate and accelerate their impact. We believe that high quality companies generating superior growth profiles will continue to outperform over time.

3 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

The Fund’s investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OppenheimerFunds, Inc. or its affiliates.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested..

The Morningstar U.S. Insurance Fund Mid-Cap Growth Funds Category Average is the average return of the mutual funds within the investment category as defined by Morningstar. Returns include the reinvestment of distributions but do not consider sales charges. Morningstar U.S. Insurance Fund Mid-Cap Growth Funds Category Average performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

Morningstar ranking is for Non-Service shares and ranking may include more than one share class of funds in the category, including other share classes of this Fund. Ranking is based on total return as of 6/30/16, without considering sales charges. Different share classes may have different expenses and performance characteristics. Fund rankings are subject to change monthly. The Fund’s total-return percentile rank is relative to all funds that are in the Morningstar U.S. Insurance Fund Mid-Cap Growth Funds category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. The top-performing fund in a category will always receive a rank of 1.

4 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended June 30, 2016.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During 6 Months Ended June 30, 2016” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes.

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any charges associated with the separate accounts that offer this Fund. Therefore, the “hypothetical” lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these separate account charges were included your costs would have been higher.

| Actual | Beginning Value |

Ending Account Value |

Expenses Paid During 6 Months Ended June 30, 2016 |

|||||||||||||||

| Non-Service shares |

$ | 1,000.00 | $ | 1,016.30 | $ | 4.02 | ||||||||||||

| Service shares |

1,000.00 | 1,015.00 | 5.27 | |||||||||||||||

| Hypothetical (5% return before expenses) |

||||||||||||||||||

| Non-Service shares |

1,000.00 | 1,020.89 | 4.03 | |||||||||||||||

| Service shares |

1,000.00 | 1,019.64 | 5.29 | |||||||||||||||

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended June 30, 2016 are as follows:

| Class | Expense Ratios | |||||

| Non-Service shares |

0.80% | |||||

| Service shares |

1.05 | |||||

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

5 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

STATEMENT OF INVESTMENTS June 30, 2016 Unaudited

6 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

Footnotes to Statement of Investments

1. Non-income producing security.

2. Rate shown is the 7-day yield at period end.

3. Is or was an affiliate, as defined in the Investment Company Act of 1940, as amended, at or during the reporting period, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the reporting period in which the issuer was an affiliate are as follows:

| Shares December 31, 2015 |

Gross Additions |

Gross Reductions |

Shares June 30, 2016 |

|||||||

|

|

||||||||||

| Oppenheimer Institutional Money Market Fund, Cl. E |

20,396,181 | 153,651,971 | 144,206,904 | 29,841,248 | ||||||

| Value | Income | |||||||||

|

|

||||||||||

| Oppenheimer Institutional Money Market Fund, Cl. E |

$ 29,841,248 | $ | 50,915 | |||||||

See accompanying Notes to Financial Statements.

7 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

STATEMENT OF ASSETS AND LIABILITIES June 30, 2016 Unaudited

|

|

||||

| Assets |

||||

| Investments, at value—see accompanying statement of investments: | ||||

| Unaffiliated companies (cost $510,095,620) | $ | 649,902,458 | ||

| Affiliated companies (cost $29,841,248) | 29,841,248 | |||

|

|

|

|||

| 679,743,706 | ||||

|

|

||||

| Cash | 500,000 | |||

|

|

||||

| Receivables and other assets: | ||||

| Investments sold | 5,816,728 | |||

| Shares of beneficial interest sold | 174,602 | |||

| Dividends | 159,413 | |||

| Other | 50,299 | |||

|

|

|

|||

| Total assets

|

|

686,444,748

|

| |

|

|

||||

| Liabilities |

||||

| Payables and other liabilities: | ||||

| Investments purchased | 14,762,867 | |||

| Shares of beneficial interest redeemed | 3,684,743 | |||

| Trustees’ compensation | 41,844 | |||

| Shareholder communications | 16,865 | |||

| Distribution and service plan fees | 7,037 | |||

| Other | 11,866 | |||

|

|

|

|||

| Total liabilities | 18,525,222 | |||

|

|

||||

| Net Assets |

$ | 667,919,526 | ||

|

|

|

|||

|

|

||||

| Composition of Net Assets |

||||

| Par value of shares of beneficial interest | $ | 9,279 | ||

|

|

||||

| Additional paid-in capital | 498,760,344 | |||

|

|

||||

| Accumulated net investment income | 137,067 | |||

|

|

||||

| Accumulated net realized gain on investments | 29,205,998 | |||

|

|

||||

| Net unrealized appreciation on investments | 139,806,838 | |||

|

|

|

|||

| Net Assets |

$ | 667,919,526 | ||

|

|

|

|||

|

|

||||

| Net Asset Value Per Share |

||||

| Non-Service Shares: | ||||

| Net asset value, redemption price per share and offering price per share (based on net assets of $633,486,322 and 8,779,933 shares of beneficial interest outstanding) | $72.15 | |||

|

|

||||

| Service Shares: | ||||

| Net asset value, redemption price per share and offering price per share (based on net assets of $34,433,204 and 498,758 shares of beneficial interest outstanding) | $69.04 | |||

See accompanying Notes to Financial Statements.

8 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

STATEMENT OF OPERATIONS For the Six Months Ended June 30, 2016 Unaudited

|

|

||||

| Investment Income |

||||

| Dividends: | ||||

| Unaffiliated companies (net of foreign withholding taxes of $3,282 ) | $ | 2,469,904 | ||

| Affiliated companies | 50,915 | |||

|

|

|

|||

| Total investment income | 2,520,819 | |||

|

|

||||

| Expenses |

||||

| Management fees | 2,298,364 | |||

|

|

||||

| Distribution and service plan fees - Service shares | 41,926 | |||

|

|

||||

| Transfer and shareholder servicing agent fees: | ||||

| Non-Service shares | 304,351 | |||

| Service shares | 16,787 | |||

|

|

||||

| Shareholder communications: | ||||

| Non-Service shares | 20,478 | |||

| Service shares | 1,128 | |||

|

|

||||

| Trustees’ compensation | 16,170 | |||

|

|

||||

| Borrowing fees | 5,963 | |||

|

|

||||

| Custodian fees and expenses | 2,299 | |||

|

|

||||

| Other | 30,416 | |||

|

|

|

|||

| Total expenses | 2,737,882 | |||

| Less reduction to custodian expenses | (228) | |||

| Less waivers and reimbursements of expenses | (120,603) | |||

|

|

|

|||

| Net expenses

|

|

2,617,051

|

| |

|

|

||||

| Net Investment Loss | (96,232) | |||

|

|

||||

| Realized and Unrealized Gain (Loss) |

||||

| Net realized gain on investments from unaffiliated companies | 30,429,218 | |||

|

|

||||

| Net change in unrealized appreciation/depreciation on investments | (21,612,935) | |||

|

|

||||

| Net Increase in Net Assets Resulting from Operations |

$ | 8,720,051 | ||

|

|

|

|||

See accompanying Notes to Financial Statements.

9 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

STATEMENTS OF CHANGES IN NET ASSETS

| Six Months Ended June 30, 2016 (Unaudited) |

Year Ended December 31, 2015 |

|||||||

|

|

||||||||

| Operations |

||||||||

| Net investment loss | $ | (96,232) | $ | (1,807,584) | ||||

|

|

||||||||

| Net realized gain | 30,429,218 | 54,533,950 | ||||||

|

|

||||||||

| Net change in unrealized appreciation/depreciation | (21,612,935) | (5,614,443) | ||||||

|

|

|

|||||||

| Net increase in net assets resulting from operations

|

|

8,720,051

|

|

|

47,111,923

|

| ||

|

|

||||||||

| Dividends and/or Distributions to Shareholders |

||||||||

| Distributions from net realized gain: | ||||||||

| Non-Service shares | (48,415,668) | (61,563,484) | ||||||

| Service shares | (2,737,189) | (2,875,460) | ||||||

|

|

|

|||||||

|

|

(51,152,857)

|

|

|

(64,438,944)

|

| |||

|

|

||||||||

| Beneficial Interest Transactions |

||||||||

| Net increase (decrease) in net assets resulting from beneficial interest transactions: | ||||||||

| Non-Service shares | 13,073,647 | (5,761,632) | ||||||

| Service shares | (200,342) | 7,088,846 | ||||||

|

|

|

|||||||

|

|

12,873,305

|

|

|

1,327,214

|

| |||

|

|

||||||||

| Net Assets |

||||||||

| Total decrease | (29,559,501) | (15,999,807) | ||||||

|

|

||||||||

| Beginning of period | 697,479,027 | 713,478,834 | ||||||

|

|

|

|||||||

| End of period (including accumulated net investment income of $137,067 and $233,299, respectively) | $ | 667,919,526 | $ | 697,479,027 | ||||

|

|

|

|||||||

See accompanying Notes to Financial Statements.

10 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

FINANCIAL HIGHLIGHTS

| Non-Service Shares | Six Months Ended June 30, 2016 (Unaudited) |

Year Ended December 31, 2015 |

Year Ended December 31, 2014 |

Year Ended December 31, 2013 |

Year Ended December 31, 2012 |

Year Ended December 30, 20111 |

||||||||||||||||||

|

|

||||||||||||||||||||||||

| Per Share Operating Data |

||||||||||||||||||||||||

| Net asset value, beginning of period | $ | 76.85 | $ | 78.82 | $ | 74.51 | $ | 54.80 | $ | 47.06 | $ | 46.55 | ||||||||||||

|

|

||||||||||||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||||||

| Net investment income (loss)2 | (0.01) | (0.19) | (0.29) | (0.16) | 0.01 | (0.26) | ||||||||||||||||||

| Net realized and unrealized gain | 1.23 | 5.67 | 4.60 | 19.88 | 7.73 | 0.77 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total from investment operations | 1.22 | 5.48 | 4.31 | 19.72 | 7.74 | 0.51 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Dividends and/or distributions to shareholders: | ||||||||||||||||||||||||

| Dividends from net investment income | 0.00 | 0.00 | 0.00 | (0.01) | 0.00 | 0.00 | ||||||||||||||||||

| Distributions from net realized gain | (5.92) | (7.45) | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total dividends and/or distributions to shareholders | (5.92) | (7.45) | 0.00 | (0.01) | 0.00 | 0.00 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Net asset value, end of period | $ | 72.15 | $ | 76.85 | $ | 78.82 | $ | 74.51 | $ | 54.80 | $ | 47.06 | ||||||||||||

|

|

|

|||||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Total Return, at Net Asset Value3 |

1.63% | 6.61% | 5.78% | 35.98% | 16.45% | 1.09% | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||

| Net assets, end of period (in thousands) | $ | 633,487 | $ | 660,450 | $ | 682,515 | $ | 725,406 | $ | 558,934 | $ | 543,020 | ||||||||||||

|

|

||||||||||||||||||||||||

| Average net assets (in thousands) | $ | 611,596 | $ | 695,736 | $ | 688,259 | $ | 618,970 | $ | 575,072 | $ | 605,083 | ||||||||||||

|

|

||||||||||||||||||||||||

| Ratios to average net assets:4 | ||||||||||||||||||||||||

| Net investment income (loss) | (0.02)% | (0.24)% | (0.39)% | (0.24)% | 0.03% | (0.53)% | ||||||||||||||||||

| Expenses excluding specific expenses listed below | 0.84% | 0.83% | 0.83% | 0.84% | 0.85% | 0.84% | ||||||||||||||||||

| Interest and fees from borrowings | 0.00%5 | 0.00%5 | 0.00% | 0.00% | 0.00% | 0.00% | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total expenses6 | 0.84% | 0.83% | 0.83% | 0.84% | 0.85% | 0.84% | ||||||||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | 0.80% | 0.80% | 0.80% | 0.80% | 0.80% | 0.80% | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Portfolio turnover rate | 60% | 81% | 113% | 84% | 66% | 91% | ||||||||||||||||||

1. December 30, 2011 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Total returns are not annualized for periods less than one full year. Total return information does not reflect expenses that apply at the separate account level or to related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

11 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

FINANCIAL HIGHLIGHTS Continued

| Service Shares | Six Months Ended June 30, 2016 (Unaudited) |

Year Ended December 31, 2015 |

Year Ended December 31, 2014 |

Year Ended December 31, 2013 |

Year Ended December 31, 2012 |

Year Ended December 30, 20111 |

||||||||||||||||||

|

|

||||||||||||||||||||||||

| Per Share Operating Data |

||||||||||||||||||||||||

| Net asset value, beginning of period | $ | 73.88 | $ | 76.21 | $ | 72.22 | $ | 53.25 | $ | 45.84 | $ | 45.46 | ||||||||||||

|

|

||||||||||||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||||||

| Net investment loss2 | (0.09) | (0.38) | (0.46) | (0.30) | (0.12) | (0.37) | ||||||||||||||||||

| Net realized and unrealized gain | 1.17 | 5.50 | 4.45 | 19.27 | 7.53 | 0.75 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total from investment operations | 1.08 | 5.12 | 3.99 | 18.97 | 7.41 | 0.38 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Dividends and/or distributions to shareholders: | ||||||||||||||||||||||||

| Dividends from net investment income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

| Distributions from net realized gain | (5.92) | (7.45) | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total dividends and/or distributions to shareholders | (5.92) | (7.45) | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Net asset value, end of period | $ | 69.04 | $ | 73.88 | $ | 76.21 | $ | 72.22 | $ | 53.25 | $ | 45.84 | ||||||||||||

|

|

|

|||||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Total Return, at Net Asset Value3 |

1.50% | 6.35% | 5.53% | 35.62% | 16.17% | 0.83% | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||

| Net assets, end of period (in thousands) | $ | 34,433 | $ | 37,029 | $ | 30,964 | $ | 36,549 | $ | 35,942 | $ | 35,773 | ||||||||||||

|

|

||||||||||||||||||||||||

| Average net assets (in thousands) | $ | 33,731 | $ | 32,812 | $ | 32,927 | $ | 35,905 | $ | 37,842 | $ | 37,775 | ||||||||||||

|

|

||||||||||||||||||||||||

| Ratios to average net assets:4 | ||||||||||||||||||||||||

| Net investment loss | (0.27)% | (0.49)% | (0.64)% | (0.49)% | (0.22)% | (0.78)% | ||||||||||||||||||

| Expenses excluding specific expenses listed below | 1.09% | 1.08% | 1.08% | 1.09% | 1.10% | 1.09% | ||||||||||||||||||

| Interest and fees from borrowings | 0.00%5 | 0.00%5 | 0.00% | 0.00% | 0.00% | 0.00% | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total expenses6 | 1.09% | 1.08% | 1.08% | 1.09% | 1.10% | 1.09% | ||||||||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | 1.05% | 1.05% | 1.05% | 1.05% | 1.05% | 1.05% | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Portfolio turnover rate | 60% | 81% | 113% | 84% | 66% | 91% | ||||||||||||||||||

1. December 30, 2011 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Total returns are not annualized for periods less than one full year. Total return information does not reflect expenses that apply at the separate account level or to related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

12 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

NOTES TO FINANCIAL STATEMENTS June 30, 2016 Unaudited

1. Organization

Oppenheimer Discovery Mid Cap Growth Fund/VA (the “Fund”), a separate series of Oppenheimer Variable Account Funds, is a diversified open-end management investment company registered under the Investment Company Act of 1940 (“1940 Act”), as amended. The Fund’s investment objective is to seek capital appreciation. The Fund’s investment adviser is OFI Global Asset Management, Inc. (“OFI Global” or the “Manager”), a wholly-owned subsidiary of OppenheimerFunds, Inc. (“OFI” or the “Sub-Adviser”). The Manager has entered into a sub-advisory agreement with OFI. Shares of the Fund are sold only to separate accounts of life insurance companies.

The Fund offers two classes of shares. Both classes are sold at their offering price, which is the net asset value per share, to separate investment accounts of participating insurance companies as an underlying investment for variable life insurance policies, variable annuity contracts or other investment products. The class of shares designated as Service shares is subject to a distribution and service plan. Both classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class.

The following is a summary of significant accounting policies followed in the Fund’s preparation of financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

2. Significant Accounting Policies

Security Valuation. All investments in securities are recorded at their estimated fair value, as described in Note 3.

Reporting Period End Date. The last day of the Fund’s reporting period is the last day the New York Stock Exchange was open for trading during the period. The Fund’s financial statements have been presented through that date to maintain consistency with the Fund’s net asset value calculations used for shareholder transactions.

Allocation of Income, Expenses, Gains and Losses. Income, expenses (other than those attributable to a specific class), gains and losses are allocated on a daily basis to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that class.

Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations and may differ from U.S. GAAP, are recorded on the ex-dividend date. Income and capital gain distributions, if any, are declared and paid annually or at other times as deemed necessary by the Manager.

The tax character of distributions is determined as of the Fund’s fiscal year end. Therefore, a portion of the Fund’s distributions made to shareholders prior to the Fund’s fiscal year end may ultimately be categorized as a tax return of capital.

Investment Income. Dividend income is recorded on the ex-dividend date or upon ex-dividend notification in the case of certain foreign dividends where the ex-dividend date may have passed. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income is recognized on an accrual basis. Discount and premium, which are included in interest income on the Statement of Operations, are amortized or accreted daily.

Return of Capital Estimates. Distributions received from the Fund’s investments in Real Estate Investments Trusts (REITs), generally are comprised of income and return of capital. The Fund records investment income and return of capital based on estimates. Such estimates are based on historical information available from each REIT and other industry sources. These estimates may subsequently be revised based on information received from REITs after their tax reporting periods are concluded.

Custodian Fees. “Custodian fees and expenses” in the Statement of Operations may include interest expense incurred by the Fund on any cash overdrafts of its custodian account during the period. Such cash overdrafts may result from the effects of failed trades in portfolio securities and from cash outflows resulting from unanticipated shareholder redemption activity. The Fund pays interest to its custodian on such cash overdrafts, to the extent they are not offset by positive cash balances maintained by the Fund, at a rate equal to the Federal Funds Rate plus 0.50%. The “Reduction to custodian expenses” line item, if applicable, represents earnings on cash balances maintained by the Fund during the period. Such interest expense and other custodian fees may be paid with these earnings.

Security Transactions. Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Indemnifications. The Fund’s organizational documents provide current and former Trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Federal Taxes. The Fund intends to comply with provisions of the Internal Revenue Code applicable to regulated investment companies and to

13 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

NOTES TO FINANCIAL STATEMENTS Unaudited / Continued

2. Significant Accounting Policies (Continued)

distribute substantially all of its investment company taxable income to shareholders. Therefore, no federal income or excise tax provision is required. The Fund files income tax returns in U.S. federal and applicable state jurisdictions. The statute of limitations on the Fund’s tax return filings generally remains open for the three preceding fiscal reporting period ends. The Fund has analyzed its tax positions for the fiscal year ended December 31, 2015, including open tax years, and does not believe there are any uncertain tax positions requiring recognition in the Fund’s financial statements.

During the fiscal year ended December 31, 2015, the Fund did not utilize any capital loss carryforward to offset capital gains realized in that fiscal year. Capital loss carryforwards with no expiration, if any, must be utilized prior to those with expiration dates. Capital losses with no expiration will be carried forward to future years if not offset by gains.

At period end, it is estimated that the Fund will not have any capital loss carryforwards. The estimated capital loss carryforward represents the carryforward as of the end of the last fiscal year, increased or decreased by capital losses or gains realized in the first six months of the current fiscal year. During the reporting period, it is estimated that the Fund will not utilize any capital loss carryforward to offset realized capital gains.

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of dividends and distributions made during the fiscal year from net investment income or net realized gains are determined in accordance with federal income tax requirements, which may differ from the character of net investment income or net realized gains presented in those financial statements in accordance with U.S. GAAP. Also, due to timing of dividends and distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or net realized gain was recorded by the Fund.

The aggregate cost of securities and other investments and the composition of unrealized appreciation and depreciation of securities and other investments for federal income tax purposes at period end are noted in the following table. The primary difference between book and tax appreciation or depreciation of securities and other investments, if applicable, is attributable to the tax deferral of losses or tax realization of financial statement unrealized gain or loss.

| Federal tax cost of securities |

$ | 540,571,590 | ||

|

|

|

|||

| Gross unrealized appreciation |

$ | 142,442,360 | ||

| Gross unrealized depreciation |

(3,270,244) | |||

|

|

|

|||

| Net unrealized appreciation |

$ | 139,172,116 | ||

|

|

|

Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

3. Securities Valuation

The Fund calculates the net asset value of its shares as of 4:00 P.M. Eastern time, on each day the New York Stock Exchange (the “Exchange”) is open for trading, except in the case of a scheduled early closing of the Exchange, in which case the Fund will calculate net asset value of the shares as of the scheduled early closing time of the Exchange.

The Fund’s Board has adopted procedures for the valuation of the Fund’s securities and has delegated the day-to-day responsibility for valuation determinations under those procedures to the Manager. The Manager has established a Valuation Committee which is responsible for determining a “fair valuation” for any security for which market quotations are not “readily available.” The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

Valuation Methods and Inputs

Securities are valued using unadjusted quoted market prices, when available, as supplied primarily by third party pricing services or dealers.

The following methodologies are used to determine the market value or the fair value of the types of securities described below:

Securities traded on a registered U.S. securities exchange (including exchange-traded derivatives other than futures and futures options) are valued based on the last sale price of the security reported on the principal exchange on which it is traded, prior to the time when the Fund’s assets are valued. In the absence of a sale, the security is valued at the mean between the bid and asked price on the principal exchange or, if not available from the principal exchange, obtained from two dealers. If bid and asked prices are not available from either the exchange or two dealers, the security is valued by using one of the following methodologies (listed in order of priority): (1) a bid from the principal exchange, (2) the mean between the bid and asked price as provided by a single dealer, or (3) a bid from a single dealer. A security of a foreign issuer traded on a foreign exchange, but not listed on a registered U.S. securities exchange, is valued based on the last sale price on the principal exchange on which the security is traded, as identified by the third party pricing service used by the Manager, prior to the time when the Fund’s assets are valued. If the last sale price is unavailable, the security is valued at the most recent official closing price on the principal exchange on which it is traded. If the last sales price or official closing price for a foreign security is not available, the security is valued at the mean between the bid and asked price per the exchange or, if not available from the exchange, obtained from two dealers. If bid and asked prices are not available from either the exchange or two dealers, the security is valued by using one of the following methodologies (listed in order of priority): (1) a bid from the exchange, (2) the mean between the bid and asked price as provided by a single dealer, or (3) a bid from a single dealer.

Shares of a registered investment company that are not traded on an exchange are valued at that investment company’s net asset value per share.

Corporate and government debt securities (of U.S. or foreign issuers) and municipal debt securities, event-linked bonds, loans, mortgage-backed securities, collateralized mortgage obligations, and asset-backed securities are valued at the mean between the “bid” and “asked” prices utilizing

14 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

3. Securities Valuation (Continued)

evaluated prices obtained from third party pricing services or broker-dealers who may use matrix pricing methods to determine the evaluated prices.

Short-term money market type debt securities with a remaining maturity of sixty days or less are valued at cost adjusted by the amortization of discount or premium to maturity (amortized cost), which approximates market value. Short-term debt securities with a remaining maturity in excess of sixty days are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers.

A description of the standard inputs that may generally be considered by the third party pricing vendors in determining their evaluated prices is provided below.

| Security Type |

Standard inputs generally considered by third-party pricing vendors | |

| Corporate debt, government debt, municipal, mortgage-backed and asset-backed securities |

Reported trade data, broker-dealer price quotations, benchmark yields, issuer spreads on comparable securities, the credit quality, yield, maturity, and other appropriate factors. | |

| Loans |

Information obtained from market participants regarding reported trade data and broker-dealer price quotations. | |

| Event-linked bonds |

Information obtained from market participants regarding reported trade data and broker-dealer price quotations. |

If a market value or price cannot be determined for a security using the methodologies described above, or if, in the “good faith” opinion of the Manager, the market value or price obtained does not constitute a “readily available market quotation,” or a significant event has occurred that would materially affect the value of the security, the security is fair valued either (i) by a standardized fair valuation methodology applicable to the security type or the significant event as previously approved by the Valuation Committee and the Fund’s Board or (ii) as determined in good faith by the Manager’s Valuation Committee. The Valuation Committee considers all relevant facts that are reasonably available, through either public information or information available to the Manager, when determining the fair value of a security. Fair value determinations by the Manager are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined. Those fair valuation standardized methodologies include, but are not limited to, valuing securities at the last sale price or initially at cost and subsequently adjusting the value based on: changes in company specific fundamentals, changes in an appropriate securities index, or changes in the value of similar securities which may be further adjusted for any discounts related to security-specific resale restrictions. When possible, such methodologies use observable market inputs such as unadjusted quoted prices of similar securities, observable interest rates, currency rates and yield curves. The methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities nor can it be assured that the Fund can obtain the fair value assigned to a security if it were to sell the security.

To assess the continuing appropriateness of security valuations, the Manager, or its third party service provider who is subject to oversight by the Manager, regularly compares prior day prices, prices on comparable securities, and sale prices to the current day prices and challenges those prices exceeding certain tolerance levels with the third party pricing service or broker source. For those securities valued by fair valuations, whether through a standardized fair valuation methodology or a fair valuation determination, the Valuation Committee reviews and affirms the reasonableness of the valuations based on such methodologies and fair valuation determinations on a regular basis after considering all relevant information that is reasonably available.

Classifications

Each investment asset or liability of the Fund is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Various data inputs are used in determining the value of each of the Fund’s investments as of the reporting period end. These data inputs are categorized in the following hierarchy under applicable financial accounting standards:

1) Level 1-unadjusted quoted prices in active markets for identical assets or liabilities (including securities actively traded on a securities exchange)

2) Level 2-inputs other than unadjusted quoted prices that are observable for the asset or liability (such as unadjusted quoted prices for similar assets and market corroborated inputs such as interest rates, prepayment speeds, credit risks, etc.)

3) Level 3-significant unobservable inputs (including the Manager’s own judgments about assumptions that market participants would use in pricing the asset or liability).

The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The Fund classifies each of its investments in investment companies which are publicly offered as Level 1. Investment companies that are not publicly offered are measured using net asset value as a practical expedient, and are not classified in the fair value hierarchy.

The table below categorizes amounts that are included in the Fund’s Statement of Assets and Liabilities at period end based on valuation input level:

15 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

NOTES TO FINANCIAL STATEMENTS Unaudited / Continued

3. Securities Valuation (Continued)

| Level 1— Unadjusted Quoted Prices |

Level 2— Other Significant Observable Inputs |

Level 3— Significant Inputs |

Value | |||||||||||||

|

|

||||||||||||||||

| Assets Table |

||||||||||||||||

| Investments, at Value: |

||||||||||||||||

| Common Stocks |

||||||||||||||||

| Consumer Discretionary |

$ | 124,713,413 | $ | — | $ | — | $ | 124,713,413 | ||||||||

| Consumer Staples |

36,930,227 | — | — | 36,930,227 | ||||||||||||

| Energy |

24,515,405 | — | — | 24,515,405 | ||||||||||||

| Financials |

70,358,019 | — | — | 70,358,019 | ||||||||||||

| Health Care |

104,067,524 | — | — | 104,067,524 | ||||||||||||

| Industrials |

116,886,540 | — | — | 116,886,540 | ||||||||||||

| Information Technology |

144,641,503 | — | — | 144,641,503 | ||||||||||||

| Materials |

27,789,828 | — | — | 27,789,828 | ||||||||||||

| Investment Company |

29,841,247 | — | — | 29,841,247 | ||||||||||||

|

|

|

|||||||||||||||

| Total Assets |

$ | 679,743,706 | $ | — | $ | — | $ | 679,743,706 | ||||||||

|

|

|

|||||||||||||||

Forward currency exchange contracts and futures contracts, if any, are reported at their unrealized appreciation/depreciation at measurement date, which represents the change in the contract’s value from trade date. All additional assets and liabilities included in the above table are reported at their market value at measurement date.

4. Investments and Risks

Investments in Affiliated Funds. The Fund is permitted to invest in other mutual funds advised by the Manager (“Affiliated Funds”). Affiliated Funds are open-end management investment companies registered under the 1940 Act, as amended. The Manager is the investment adviser of, and the Sub-Adviser provides investment and related advisory services to, the Affiliated Funds. When applicable, the Fund’s investments in Affiliated Funds are included in the Statement of Investments. Shares of Affiliated Funds are valued at their net asset value per share. As a shareholder, the Fund is subject to its proportional share of the Affiliated Funds’ expenses, including their management fee. The Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in the Affiliated Funds.

Each of the Affiliated Funds in which the Fund invests has its own investment risks, and those risks can affect the value of the Fund’s investments and therefore the value of the Fund’s shares. To the extent that the Fund invests more of its assets in one Affiliated Fund than in another, the Fund will have greater exposure to the risks of that Affiliated Fund.

Investment in Oppenheimer Institutional Money Market Fund. The Fund is permitted to invest daily available cash balances in a money market Affiliated Fund. The Fund may invest the available cash in Class E shares of Oppenheimer Institutional Money Market Fund (“IMMF”) to seek current income while preserving liquidity or for defensive purposes. IMMF is regulated as a money market fund under the Investment Company Act of 1940, as amended.

Equity Security Risk. Stocks and other equity securities fluctuate in price. The value of the Fund’s portfolio may be affected by changes in the equity markets generally. Equity markets may experience significant short-term volatility and may fall sharply at times. Different markets may behave differently from each other and U.S. equity markets may move in the opposite direction from one or more foreign stock markets. Adverse events in any part of the equity or fixed-income markets may have unexpected negative effects on other market segments.

The prices of individual equity securities generally do not all move in the same direction at the same time and a variety of factors can affect the price of a particular company’s securities. These factors may include, but are not limited to, poor earnings reports, a loss of customers, litigation against the company, general unfavorable performance of the company’s sector or industry, or changes in government regulations affecting the company or its industry.

5. Market Risk Factors

The Fund’s investments in securities and/or financial derivatives may expose the Fund to various market risk factors:

Commodity Risk. Commodity risk relates to the change in value of commodities or commodity indexes as they relate to increases or decreases in the commodities market. Commodities are physical assets that have tangible properties. Examples of these types of assets are crude oil, heating oil, metals, livestock, and agricultural products.

Credit Risk. Credit risk relates to the ability of the issuer of debt to meet interest and principal payments, or both, as they come due. In general, lower-grade, higher-yield debt securities are subject to credit risk to a greater extent than lower-yield, higher-quality securities.

Equity Risk. Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the general market.

Foreign Exchange Rate Risk. Foreign exchange rate risk relates to the change in the U.S. dollar value of a security held that is denominated in a foreign currency. The U.S. dollar value of a foreign currency denominated security will decrease as the dollar appreciates against the currency, while the U.S. dollar value will increase as the dollar depreciates against the currency.

Interest Rate Risk. Interest rate risk refers to the fluctuations in value of fixed-income securities resulting from the inverse relationship between price and yield. For example, an increase in general interest rates will tend to reduce the market value of already issued fixed-income investments, and

16 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

5. Market Risk Factors (Continued)

a decline in general interest rates will tend to increase their value. In addition, debt securities with longer maturities, which tend to have higher yields, are subject to potentially greater fluctuations in value from changes in interest rates than obligations with shorter maturities.

Volatility Risk. Volatility risk refers to the magnitude of the movement, but not the direction of the movement, in a financial instrument’s price over a defined time period. Large increases or decreases in a financial instrument’s price over a relative time period typically indicate greater volatility risk, while small increases or decreases in its price typically indicate lower volatility risk.

6. Shares of Beneficial Interest

The Fund has authorized an unlimited number of $0.001 par value shares of beneficial interest of each class. Transactions in shares of beneficial interest were as follows:

| Six Months Ended June 30, 2016 | Year Ended December 31, 2015 | |||||||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||||||

|

|

||||||||||||||||||||

| Non-Service Shares |

||||||||||||||||||||

| Sold |

146,606 | $ | 10,736,692 | 316,843 | $ | 25,835,263 | ||||||||||||||

| Dividends and/or distributions reinvested |

674,971 | 48,415,668 | 772,150 | 61,563,484 | ||||||||||||||||

| Redeemed |

(635,482 | ) | (46,078,713) | (1,154,717 | ) | (93,160,379) | ||||||||||||||

|

|

|

|||||||||||||||||||

| Net increase (decrease) |

186,095 | $ | 13,073,647 | (65,724 | ) | $ | (5,761,632) | |||||||||||||

|

|

|

|||||||||||||||||||

|

|

||||||||||||||||||||

| Service Shares |

||||||||||||||||||||

| Sold |

29,057 | $ | 2,029,005 | 153,951 | $ | 11,748,349 | ||||||||||||||

| Dividends and/or distributions reinvested |

39,877 | 2,737,189 | 37,465 | 2,875,460 | ||||||||||||||||

| Redeemed |

(71,388 | ) | (4,966,536) | (96,510 | ) | (7,534,963) | ||||||||||||||

|

|

|

|||||||||||||||||||

| Net increase (decrease) |

(2,454 | ) | $ | (200,342) | 94,906 | $ | 7,088,846 | |||||||||||||

|

|

|

|||||||||||||||||||

7. Purchases and Sales of Securities

The aggregate cost of purchases and proceeds from sales of securities, other than short-term obligations and investments in IMMF, for the reporting period were as follows:

| Purchases | Sales | |||||||||||

|

|

||||||||||||

| Investment securities |

$ | 380,717,963 | $ | 416,050,916 | ||||||||

8. Fees and Other Transactions with Affiliates

Management Fees. Under the investment advisory agreement, the Fund pays the Manager a management fee based on the daily net assets of the Fund at an annual rate as shown in the following table:

| Fee Schedule | ||||

|

|

||||

| Up to $200 million |

0.75% | |||

| Next $200 million |

0.72 | |||

| Next $200 million |

0.69 | |||

| Next $200 million |

0.66 | |||

| Next $700 million |

0.60 | |||

| Over $1.5 billion |

0.58 | |||

The Fund’s effective management fee for the reporting period was 0.72% of average annual net assets before any applicable waivers.

Sub-Adviser Fees. The Manager has retained the Sub-Adviser to provide the day-to-day portfolio management of the Fund. Under the Sub-Advisory Agreement, the Manager pays the Sub-Adviser an annual fee in monthly installments, equal to a percentage of the investment management fee collected by the Manager from the Fund, which shall be calculated after any investment management fee waivers. The fee paid to the Sub-Adviser is paid by the Manager, not by the Fund.

Transfer Agent Fees. OFI Global (the “Transfer Agent”) serves as the transfer and shareholder servicing agent for the Fund. The Fund pays the Transfer Agent a fee based on annual net assets. Fees incurred and average net assets for each class with respect to these services are detailed in the Statement of Operations and Financial Highlights, respectively.

Sub-Transfer Agent Fees. The Transfer Agent has retained Shareholder Services, Inc., a wholly-owned subsidiary of OFI (the “Sub-Transfer Agent”), to provide the day-to-day transfer agent and shareholder servicing of the Fund. Under the Sub-Transfer Agency Agreement, the Transfer Agent pays the Sub-Transfer Agent an annual fee in monthly installments, equal to a percentage of the transfer agent fee collected by the Transfer Agent from the Fund, which shall be calculated after any applicable fee waivers. The fee paid to the Sub-Transfer Agent is paid by the Transfer Agent, not by the Fund.

Trustees’ Compensation. The Fund’s Board of Trustees (“Board”) has adopted a compensation deferral plan for Independent Trustees that enables Trustees to elect to defer receipt of all or a portion of the annual compensation they are entitled to receive from the Fund. For purposes of determining

17 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

NOTES TO FINANCIAL STATEMENTS Unaudited / Continued

8. Fees and Other Transactions with Affiliates (Continued)

the amount owed to the Trustees under the plan, deferred amounts are treated as though equal dollar amounts had been invested in shares of the Fund or in other Oppenheimer funds selected by the Trustees. The Fund purchases shares of the funds selected for deferral by the Trustees in amounts equal to his or her deemed investment, resulting in a Fund asset equal to the deferred compensation liability. Such assets are included as a component of “Other” within the asset section of the Statement of Assets and Liabilities. Deferral of Trustees’ fees under the plan will not affect the net assets of the Fund and will not materially affect the Fund’s assets, liabilities or net investment income per share. Amounts will be deferred until distributed in accordance with the compensation deferral plan.

Distribution and Service Plan for Service Shares. The Fund has adopted a Distribution and Service Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act for Service shares to pay OppenheimerFunds Distributor, Inc. (the “Distributor”), for distribution related services, personal service and account maintenance for the Fund’s Service shares. Under the Plan, payments are made periodically at an annual rate of 0.25% of the daily net assets of Service shares of the Fund. The Distributor currently uses all of those fees to compensate sponsors of the insurance product that offers Fund shares, for providing personal service and maintenance of accounts of their variable contract owners that hold Service shares. These fees are paid out of the Fund’s assets on an on-going basis and increase operating expenses of the Service shares, which results in lower performance compared to the Fund’s shares that are not subject to a service fee. Fees incurred by the Fund under the Plan are detailed in the Statement of Operations.

Waivers and Reimbursements of Expenses. The Manager has contractually agreed to limit the Fund’s expenses after payments, waivers and/or reimbursements and reduction to custodian expenses, excluding expenses incurred directly or indirectly by the Fund as a result of investments in other investment companies, wholly-owned subsidiaries and pooled investment vehicles; so that those expenses, as percentages of daily net assets, will not exceed the annual rate of 0.80% for Non-Service shares and 1.05% for Service shares. The expense limitations do not include interest and fees from borrowing, and other expenses not incurred in the ordinary course of the Fund’s business. During the reporting period, the Manager waived fees and/or reimbursed the Fund $103,513 and $5,586 for Non-Service and Service shares, respectively.

The Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in IMMF. During the reporting period, the Manager waived fees and/or reimbursed the Fund $11,504 for IMMF management fees.

Waivers and/or reimbursements may be modified or terminated as set forth according to the terms in the prospectus.

9. Borrowings and Other Financing

Joint Credit Facility. A number of mutual funds managed by the Manager participate in a $1.28 billion revolving credit facility (the “Facility”) intended to provide short-term financing, if necessary, subject to certain restrictions in connection with atypical redemption activity. Expenses and fees related to the Facility are paid by the participating funds and are disclosed separately or as other expenses on the Statement of Operations. The Fund did not utilize the Facility during the reporting period.

10. Pending Litigation

In 2009, several putative class action lawsuits were filed and later consolidated before the U.S. District Court for the District of Colorado against OppenheimerFunds, Inc. (“OFI”), OppenheimerFunds Distributor, Inc. (“OFDI”), and Oppenheimer Rochester California Municipal Fund, a fund advised by OFI Global Asset Management, Inc. and distributed by the Distributor (the “California Fund”), in connection with the California Fund’s investment performance. The plaintiffs asserted claims against OFI, OFDI and certain present and former trustees and officers of the California Fund under the federal securities laws, alleging, among other things, that the disclosure documents of the California Fund contained misrepresentations and omissions and the investment policies of the California Fund were not followed. Plaintiffs in the suit filed an amended complaint and defendants filed a motion to dismiss. In 2011, the court issued an order which granted in part and denied in part the defendants’ motion to dismiss. In 2012, plaintiffs filed a motion, which defendants opposed, to certify a class and appoint class representatives and class counsel. In March 2015, the court granted plaintiffs’ motion for class certification. In May 2015, the U.S. Court of Appeals for the Tenth Circuit vacated the class certification order and remanded the matter to the district court for further proceedings. In October 2015, the district court reaffirmed its order and determined that the suit will proceed as a class action. In December 2015, the Tenth Circuit denied defendants’ petition to appeal the district court’s reaffirmed class certification order.

OFI and OFDI believe the suit is without merit; that it is premature to render any opinion as to the likelihood of an outcome unfavorable to them in the suit; and that no estimate can yet be made as to the amount or range of any potential loss. Furthermore, OFI believes that the suit should not impair the ability of OFI or OFDI to perform their respective duties to the Fund and that the outcome of the suit should not have any material effect on the operations of any of the Oppenheimer funds.

18 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

PORTFOLIO PROXY VOTING POLICIES AND GUIDELINES; UPDATES TO STATEMENTS OF INVESTMENTS Unaudited

The Fund has adopted Portfolio Proxy Voting Policies and Guidelines under which the Fund votes proxies relating to securities (“portfolio proxies”) held by the Fund. A description of the Fund’s Portfolio Proxy Voting Policies and Guidelines is available (i) without charge, upon request, by calling the Fund toll-free at 1.800.525.7048, (ii) on the Fund’s website at www.oppenheimerfunds.com, and (iii) on the SEC’s website at www.sec.gov. In addition, the Fund is required to file Form N-PX, with its complete proxy voting record for the 12 months ended June 30th, no later than August 31st of each year. The Fund’s voting record is available (i) without charge, upon request, by calling the Fund toll-free at 1.800.525.7048, and (ii) in the Form N-PX filing on the SEC’s website at www.sec.gov.

The Fund files its complete schedule of portfolio holdings with the SEC for the first quarter and the third quarter of each fiscal year on Form N-Q. The Fund’s Form N-Q filings are available on the SEC’s website at www.sec.gov. Those forms may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

19 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

DISTRIBUTION SOURCES Unaudited

For any distribution that took place over the Fund’s reporting period, the table below details on a per-share basis the percentage of the Fund’s total distribution payment amount that was derived from the following sources: net income, net profit from the sale of securities, and other capital sources. This information is based upon income and capital gains using generally accepted accounting principles as of the date of each distribution. Because the Fund is actively managed, the relative amount of the Fund’s total distributions derived from various sources over the calendar year may change. Please note that this information should not be used for tax reporting purposes as the tax character of distributable income may differ from the amounts used for this notification. You will receive IRS tax forms in the first quarter of each calendar year detailing the actual amount of the taxable and non-taxable portion of distributions paid to you during the tax year.

For the most current information, please go to oppenheimerfunds.com. Select your Fund, then the ’Detailed’ tab; where ‘Dividends’ are shown, the Fund’s latest pay date will be followed by the sources of any distribution, updated daily.

|

Fund Name |

Pay |

Net Income |

Net Profit |

Other Capital |

||||||||||||

|

Oppenheimer Discovery Mid Cap Growth Fund/VA |

|

6/21/16 |

|

|

0.0% |

|

|

100.0% |

|

|

0.0% |

| ||||

20 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

THIS PAGE INTENTIONALLY LEFT BLANK.

21 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

THIS PAGE INTENTIONALLY LEFT BLANK.

22 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

THIS PAGE INTENTIONALLY LEFT BLANK.

23 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

A Series of Oppenheimer Variable Account Funds

| Trustees and Officers | Sam Freedman, Chairman of the Board of Trustees and Trustee | |

| Jon S. Fossel, Trustee | ||

| Richard F. Grabish, Trustee | ||

| Beverly L. Hamilton, Trustee | ||

| Victoria J. Herget, Trustee | ||

| Robert J. Malone, Trustee | ||

| F. William Marshall, Jr., Trustee | ||

| Karen L. Stuckey, Trustee | ||

| James D. Vaughn, Trustee | ||

| Arthur P. Steinmetz, Trustee, President and Principal Executive Officer | ||

| Ronald J. Zibelli, Jr., Vice President | ||

| Justin Livengood, Vice President | ||

| Cynthia Lo Bessette, Secretary and Chief Legal Officer | ||

| Jennifer Sexton, Vice President and Chief Business Officer | ||

| Mary Ann Picciotto, Chief Compliance Officer and Chief Anti-Money Laundering Officer | ||

| Brian S. Petersen, Treasurer and Principal Financial & Accounting Officer | ||

| Manager | OFI Global Asset Management, Inc. | |

| Sub-Adviser | OppenheimerFunds, Inc. | |

| Distributor | OppenheimerFunds Distributor, Inc. | |

| Transfer and | OFI Global Asset Management, Inc. | |

| Shareholder | ||

| Servicing Agent | ||

| Sub-Transfer Agent | Shareholder Services, Inc. | |

| DBA OppenheimerFunds Services | ||

| Independent | KPMG LLP | |

| Registered | ||

| Public | ||

| Accounting | ||

| Firm | ||

| Legal Counsel | Ropes & Gray LLP | |

| Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, or calling us at 1.800.988.8287. Read prospectuses and summary prospectuses carefully before investing. | ||

| The financial statements included herein have been taken from the records of the Fund without examination of those records by the independent registered public accounting firm. | ||

| © 2016 OppenheimerFunds, Inc. All rights reserved. Oppenheimer funds are distributed by OppenheimerFunds Distributor, Inc. | ||

|

|

||||

| June 30, 2016 |

||||

|

Oppenheimer |

||||

| Conservative Balanced Fund/VA |

Semiannual Report | |||

| A Series of Oppenheimer Variable Account Funds

|

||||

| SEMIANNUAL REPORT |

||||

| Listing of Top Holdings |

||||

| Fund Performance Discussion |

||||

| Financial Statements |

||||

PORTFOLIO MANAGERS: Krishna Memani and Magnus Krantz

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED 6/30/16

| Inception Date |

6-Months | 1-Year | 5-Year | 10-Year | ||||||||||||||||

| Non-Service Shares |

2/9/87 | 4.20% | 3.70% | 6.90% | 2.77% | |||||||||||||||

| Service Shares |

5/1/02 | 4.03 | 3.45 | 6.62 | 2.51 | |||||||||||||||

| Russell 3000 Index |

3.62 | 2.14 | 11.60 | 7.40 | ||||||||||||||||

| Barclays U.S. Aggregate Bond Index |

5.31 | 6.00 | 3.76 | 5.13 | ||||||||||||||||

| Reference Index |

4.92 | 5.06 | 6.82 | 6.55 | ||||||||||||||||

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, call us at 1.800.988.8287. The Fund’s total returns should not be expected to be the same as the returns of other funds, whether or not both funds have the same portfolio managers and/or similar names. The Fund’s total returns include changes in share price and reinvested distributions but do not include the charges associated with the separate account products that offer this Fund. Such performance would have been lower if such charges were taken into account.

The Fund’s performance is compared to the performance of the Russell 3000 Index, the Barclays U.S. Aggregate Bond Index and the Fund’s Reference Index. The Russell 3000 Index measures the performance of the largest 3,000 U.S. companies, representing approximately 98% of the investable U.S. equity market. The Barclays U.S. Aggregate Bond Index is an index of U.S dollar-denominated, investment-grade U.S. corporate government and mortgage-backed securities. The Fund’s Reference Index is a customized weighted index currently comprised of 65% of the Barclays U.S. Aggregate Bond Index and 35% of the Russell 3000 Index. The Indices are unmanaged and cannot be purchased directly by investors. Index performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the indices. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

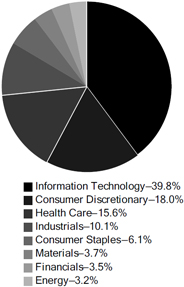

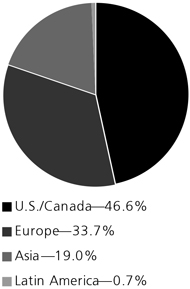

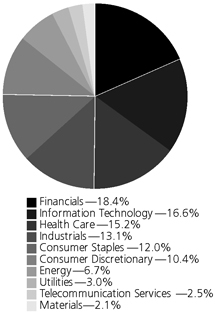

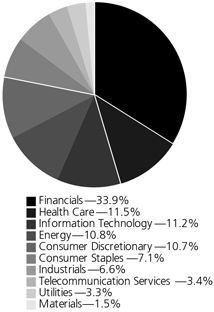

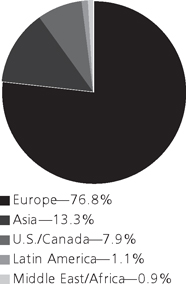

TOP HOLDINGS AND ALLOCATIONS

2 OPPENHEIMER CONSERVATIVE BALANCED FUND/VA

Fund Performance Discussion

The Fund’s Non-Service shares produced a return of 4.20% during the reporting period. On a relative basis, the Fund’s Reference Index returned 4.92%. The Fund’s Reference Index is a customized weighted index currently comprised of the following underlying broad-based security indices: 65% of the Barclays U.S. Aggregate Bond Index and 35% of the Russell 3000 Index. Measured separately, the Barclays U.S. Aggregate Bond Index returned 5.31% and the Russell 3000 Index returned 3.62%.

MARKET OVERVIEW

2016 started off with credit markets widening amid stock market weakness. The Federal Reserve’s (the “Fed”) statement in January suggested they would continue gradually raising rates this year, which further roiled markets as global growth continued to show risk of slowing further. Risk asset weakness and the Bank of Japan cutting rates to negative levels at the end of January helped U.S. Treasury yields fall dramatically.

By mid-February markets began to turn. The European Central Bank (“ECB”) hinted it would likely ease further, the Bank of Japan’s tone remained dovish, China signaled it would provide further stimulus, and better than expected economic data helped turn sentiment. A dovish Fed statement in mid-March and further dovish statements from Chair Yellen (sometimes at odds with other Fed speakers) helped the better trend in risk sentiment persist.

The second quarter of 2016 began with improving data momentum, payrolls and wages remained steady, while survey indicators such as the Institute for Supply Management (“ISM”) and consumer sentiment also improved. Chinese and emerging market growth looked to have stabilized or modestly strengthened. The market continued to price for one with the potential of two hikes by the Federal Reserve in 2016, as core consumer price inflation data remained stable at about 2.2% year-over-year, and headline inflation stabilized at about 1%.

Data trends continued into May, which led to expectations that the Fed would hike at least twice during 2016 – including the potential for a June hike. A weak May payrolls report caused the market to back off the possibility of two hikes, as did a dovish Chair Yellen in her press conference after the mid-June Federal Open Market Committee meeting.

The big surprise news came late in June with voters in the United Kingdom opting to drop out of the European Union. U.S. markets became extremely volatile for two days. However, risk assets sharply rebounded, while bond yields remain depressed on expectations of further central bank easing.

EQUITY STRATEGY REVIEW

The equity strategy produced positive absolute performance during the reporting period, but underperformed the Russell 3000 Index. The equity strategy’s underperformance stemmed primarily from weaker relative stock selection in the information technology and energy sectors. The equity strategy outperformed the Russell 3000 Index in the health care, financials and industrials sectors, due largely to stronger relative stock selection.