UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4108

Oppenheimer Variable Account Funds

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Arthur S. Gabinet

OFI Global Asset Management, Inc.

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: December 31

Date of reporting period: 6/30/2015

Item 1. Reports to Stockholders.

|

|

||||

| June 30, 2015 |

||||

|

Oppenheimer |

Semiannual Report | |||

|

Discovery Mid Cap Growth Fund/VA |

||||

|

A Series of Oppenheimer Variable Account Funds

|

||||

|

SEMIANNUAL REPORT |

||||

|

Listing of Top Holdings |

||||

|

Fund Performance Discussion |

||||

|

Financial Statements |

PORTFOLIO MANAGERS: Ronald J. Zibelli, Jr., CFA and Justin Livengood, CFA

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED 6/30/15

| Inception Date |

6-Months | 1-Year | 5-Year | 10-Year | ||||||||||||||||

| Non-Service Shares |

8/15/86 | 9.80% | 15.32 % | 20.02 % | 6.75 % | |||||||||||||||

| Service Shares |

10/16/00 | 9.68 | 15.07 | 19.72 | 6.48 | |||||||||||||||

| Russell Midcap Growth Index |

4.18 | 9.45 | 18.69 | 9.69 | ||||||||||||||||

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, call us at 1.800.988.8287. The Fund’s total returns should not be expected to be the same as the returns of other funds, whether or not both funds have the same portfolio managers and/or similar names. The Fund’s total returns include changes in share price and reinvested distributions but do not include the charges associated with the separate account products that offer this Fund. Such performance would have been lower if such charges were taken into account.

The Fund’s performance is compared to the performance of the Russell Midcap Growth Index. The Russell Midcap Growth Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the Index. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

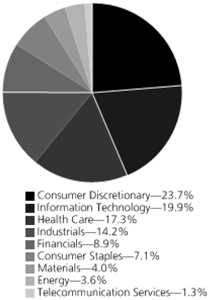

TOP HOLDINGS AND ALLOCATIONS

2 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

Fund Performance Discussion

The Fund’s Non-Service shares produced a return of 9.80% during the reporting period, outperforming the Russell Midcap Growth Index’s (the “Index”) return of 4.18% and the Morningstar Mid-Cap Growth peer group’s return of 5.88% over the same period. The Fund outperformed the Index in all sectors, led by stock selection in the consumer discretionary, industrials and information technology sectors.

In addition, the Fund’s Non-Service shares ranked in the 7th percentile (16 out of 104 funds) in Morningstar’s Mid-Cap Growth peer group over the 6-month period ended June 30, 2015. Over the longer-term, Fund’s Non-Service shares ranked in the 6th (6 out of 104 funds), 5th (5 out of 99 funds), and 89th (68 out of 80 funds) percentiles for the 1-, 5- and 10-year periods ended June 30, 2015, respectively.

GLOBAL MARKET AND ECONOMIC ENVIRONMENT

Markets were volatile during the six-month reporting period, but generally produced positive results with growth stocks outperforming value stocks. After U.S. equities outperformed other developed and emerging market equities in 2014, the market environment shifted over the first half of 2015. The dollar continued to strengthen, which acted as a drag on growth. Businesses, especially U.S. firms with revenues dependent on exporting goods and services, cited this as a headwind. European Central Bank (“ECB”) President Mario Draghi announced the purchase of €60 billion a month in sovereign bonds from Eurozone countries for at least 19 months, a form of quantitative easing (“QE”) that is projected to increase the ECB’s balance sheet by over €1 trillion. The announcement and implementation of these extraordinary monetary policies had a significant impact on financial markets. European markets rallied and the euro fell against the currencies of most major trading partners. This resulted in European and emerging market equities outperforming U.S. equities over the first half of the period.

Over the second half of the reporting period, fallout from the collapse of oil prices, weak overseas economies and a strong U.S. dollar weighed on U.S. Gross Domestic Product (“GDP”) and corporate profit forecasts. In a repeat of last year, first quarter GDP growth was negative (-0.2%). Meanwhile, the Federal Reserve continued to forewarn a shift in monetary policy to higher interest rates later this year. Outside of the U.S., concerns around Greece’s debt situation emerged yet again late this reporting period. The markets had hoped for an 11th hour resolution to the stand-off between Greece and its creditors, but instead got an escalation of the crisis after the Greek Prime Minister called for a referendum. In the minds of many, this increased the odds of a Greek exit from the Eurozone (“Grexit”) and impacted the markets through the end of the reporting period. Shortly after the period ended, Eurozone leaders agreed to offer Greece a third bailout, averting a Grexit for the time being.

TOP INDIVIDUAL CONTRIBUTORS

During the reporting period, top contributors to performance included Centene Corp., Palo Alto Networks, Inc. and Avago Technologies Ltd. Centene, a managed care company that serves more than four million Medicaid members across 25 states, reported strong first quarter financial results in April and raised guidance at its investor day in June. The stock also benefitted from merger and acquisition activity in the managed care sector during the reporting period. Palo Alto Networks, which provides network security software and solutions, has been benefiting from a strong security backdrop and competitive displacement of incumbent vendors. The company also reported strong financial results. Avago is a semiconductor supplier that reported strong results, due partly to accretive acquisitions, including LSI Corporation and PLX Technology. The company also announced plans to acquire Broadcom.

TOP INDIVIDUAL DETRACTORS

The most significant detractors from the Fund’s performance included Tiffany & Co., NetSuite, Inc. and Rackspace Hosting, Inc., each of which we exited by period end. Tiffany & Co., a leading retailer of high quality branded jewelry, reported disappointing holiday comps and lowered 2015 guidance, with currency headwinds pressuring the business significantly. NetSuite, a leading vendor of SaaS (Software as a Service) Enterprise Applications, guided fiscal year 2015 earnings per share (EPS) that was below the street estimates due to higher investments. Rackspace Hosting, a provider of managed hosting to small- and medium-sized businesses globally, released first quarter results and second quarter guidance that missed expections.

STRATEGY & OUTLOOK

Our long-term investment process remains the same. We seek dynamic companies with above average and sustainable revenue and earnings growth that we believe are positioned to outperform. This includes leading firms in structurally attractive industries with committed management teams that have proven records of performance.

3 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

We typically have several themes across the portfolios with current examples including Affordable Care Act beneficiaries, Building Materials, Consumer Revival and Cybersecurity. Looking forward, we are constructive on the prospects for mid-cap growth stocks in the second half 2015. At period end, we are anticipating economic growth similar to the 2% trend of the last few years, modest increases in interest rates and a soft profit growth outlook. Our segment of the market offers reasonable valuations, low exposure to a strong dollar and rising merger and acquisition activity. In addition, we feel that mid-caps offer an ongoing superior opportunity to generate outperformance through effective stock selection. We remain confident that our proven investment process can further leverage benchmark returns through effective stock selection.

The Fund’s investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OppenheimerFunds, Inc. or its affiliates.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

4 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended June 30, 2015.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the 6 Months Ended June 30, 2015” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes.

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any charges associated with the separate accounts that offer this Fund. Therefore, the “hypothetical” lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these separate account charges were included your costs would have been higher.

| Actual | Beginning Account Value January 1, 2015 |

Ending Account Value June 30, 2015 |

Expenses Paid During 6 Months Ended June 30, 2015 |

|||||||||

| Non-Service shares |

$ | 1,000.00 | $ | 1,098.00 | $ | 4.17 | ||||||

| Service shares |

1,000.00 | 1,096.80 | 5.47 | |||||||||

| Hypothetical (5% return before expenses) |

||||||||||||

| Non-Service shares |

1,000.00 | 1,020.83 | 4.02 | |||||||||

| Service shares |

1,000.00 | 1,019.59 | 5.27 | |||||||||

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended June 30, 2015 are as follows:

| Class | Expense Ratios | |

| Non-Service shares |

0.80% | |

| Service shares |

1.05 |

The expense ratios reflect voluntary waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

5 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

STATEMENT OF INVESTMENTS June 30, 2015 Unaudited

6 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

Footnotes to Statement of Investments

1. Non-income producing security.

2. Security is a Master Limited Partnership.

3. Is or was an affiliate, as defined in the Investment Company Act of 1940, as amended, at or during the period ended June 30, 2015, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the period in which the issuer was an affiliate are as follows:

| Shares December 31, 2014 |

Gross Additions |

Gross Reductions |

Shares June 30, 2015 |

|||||||||||||

|

|

||||||||||||||||

| Oppenheimer Institutional Money Market Fund, Cl. E |

11,090,218 | 142,157,739 | 144,587,930 | 8,660,027 | ||||||||||||

| Value | Income | |||||||||||||||

|

|

||||||||||||||||

| Oppenheimer Institutional Money Market Fund, Cl. E |

$ | 8,660,027 | $ | 10,511 | ||||||||||||

4. Rate shown is the 7-day yield as of June 30, 2015.

See accompanying Notes to Financial Statements.

7 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

STATEMENT OF ASSETS AND LIABILITIES June 30, 2015 Unaudited

|

|

||||

| Assets |

||||

| Investments, at value—see accompanying statement of investments: | ||||

| Unaffiliated companies (cost $533,342,413) | $ | 734,804,936 | ||

| Affiliated companies (cost $8,660,027) | 8,660,027 | |||

|

|

|

|||

| 743,464,963 | ||||

|

|

||||

| Cash | 1,906,523 | |||

|

|

||||

| Receivables and other assets: | ||||

| Investments sold | 1,241,893 | |||

| Shares of beneficial interest sold | 206,576 | |||

| Dividends | 72,028 | |||

| Other | 56,214 | |||

|

|

|

|||

| Total assets |

|

746,948,197

|

| |

|

|

||||

| Liabilities |

||||

| Payables and other liabilities: | ||||

| Shares of beneficial interest redeemed | 1,792,532 | |||

| Investments purchased | 1,676,498 | |||

| Trustees’ compensation | 44,921 | |||

| Shareholder communications | 19,513 | |||

| Distribution and service plan fees | 6,691 | |||

| Other | 15,545 | |||

|

|

|

|||

| Total liabilities |

|

3,555,700

|

| |

|

|

||||

| Net Assets | $ | 743,392,497 | ||

|

|

|

|||

|

|

||||

| Composition of Net Assets |

||||

| Par value of shares of beneficial interest | $ | 9,408 | ||

|

|

||||

| Additional paid-in capital | 509,021,297 | |||

|

|

||||

| Accumulated net investment loss | (864,916) | |||

|

|

||||

| Accumulated net realized gain on investments | 33,764,185 | |||

|

|

||||

| Net unrealized appreciation on investments | 201,462,523 | |||

|

|

|

|||

| Net Assets | $ | 743,392,497 | ||

|

|

|

|||

|

|

||||

| Net Asset Value Per Share |

||||

| Non-Service Shares: | ||||

| Net asset value, redemption price per share and offering price per share (based on net assets of $711,061,328 and 8,983,633 shares of beneficial interest outstanding) | $79.15 | |||

|

|

||||

| Service Shares: | ||||

| Net asset value, redemption price per share and offering price per share (based on net assets of $32,331,169 and 424,377 shares of beneficial interest outstanding) | $76.19 | |||

See accompanying Notes to Financial Statements.

8 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

STATEMENT OF OPERATIONS For the Six Months Ended June 30, 2015 Unaudited

|

|

||||

| Investment Income |

||||

| Dividends: | ||||

| Unaffiliated companies | $ | 2,090,818 | ||

| Affiliated companies | 10,511 | |||

|

|

|

|||

| Total investment income

|

|

2,101,329

|

| |

|

|

||||

| Expenses |

||||

| Management fees | 2,598,071 | |||

|

|

||||

| Distribution and service plan fees: | ||||

| Service shares | 39,858 | |||

|

|

||||

| Transfer and shareholder servicing agent fees: | ||||

| Non-Service shares | 350,654 | |||

| Service shares | 15,944 | |||

|

|

||||

| Shareholder communications: | ||||

| Non-Service shares | 19,076 | |||

| Service shares | 869 | |||

|

|

||||

| Trustees’ compensation | 14,009 | |||

|

|

||||

| Custodian fees and expenses | 2,356 | |||

|

|

||||

| Other | 26,184 | |||

|

|

|

|||

| Total expenses | 3,067,021 | |||

| Less reduction to custodian expenses | (73) | |||

| Less waivers and reimbursements of expenses | (94,302) | |||

|

|

|

|||

| Net expenses

|

|

2,972,646

|

| |

|

|

||||

| Net Investment Loss |

|

(871,317)

|

| |

|

|

||||

| Realized and Unrealized Gain |

||||

| Net realized gain on investments from unaffiliated companies | 35,054,551 | |||

|

|

||||

| Net change in unrealized appreciation/depreciation on investments | 34,428,307 | |||

|

|

||||

| Net Increase in Net Assets Resulting from Operations | $ | 68,611,541 | ||

|

|

|

|||

See accompanying Notes to Financial Statements.

9 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

STATEMENTS OF CHANGES IN NET ASSETS

| Six Months Ended June 30, 2015 (Unaudited) |

Year Ended December 31, 2014 |

|||||||

|

|

||||||||

| Operations |

||||||||

| Net investment loss | $ | (871,317) | $ | (2,911,214) | ||||

|

|

||||||||

| Net realized gain | 35,054,551 | 120,740,276 | ||||||

|

|

||||||||

| Net change in unrealized appreciation/depreciation | 34,428,307 | (78,732,569) | ||||||

|

|

|

|

|

|||||

| Net increase in net assets resulting from operations

|

|

68,611,541

|

|

|

39,096,493

|

| ||

|

|

||||||||

| Dividends and/or Distributions to Shareholders |

||||||||

|

|

||||||||

| Distributions from net realized gain: | ||||||||

| Non-Service shares | (61,563,484) | — | ||||||

| Service shares | (2,875,460) | — | ||||||

|

|

|

|

|

|||||

| (64,438,944) | — | |||||||

|

|

||||||||

| Beneficial Interest Transactions |

||||||||

| Net increase (decrease) in net assets resulting from beneficial interest transactions: | ||||||||

| Non-Service shares | 24,448,376 | (80,362,833) | ||||||

| Service shares | 1,292,690 | (7,209,426) | ||||||

|

|

|

|

|

|||||

|

|

25,741,066

|

|

|

(87,572,259)

|

| |||

|

|

||||||||

| Net Assets |

||||||||

| Total increase (decrease) | 29,913,663 | (48,475,766) | ||||||

|

|

||||||||

| Beginning of period | 713,478,834 | 761,954,600 | ||||||

|

|

|

|

|

|||||

|

End of period (including accumulated net investment income (loss) of ($864,916) and $6,401, respectively) |

$ | 743,392,497 | $ | 713,478,834 | ||||

|

|

|

|||||||

See accompanying Notes to Financial Statements.

10 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

FINANCIAL HIGHLIGHTS

| Non-Service Shares | Six Months Ended June 30, 2015 (Unaudited) |

Year Ended December 31, 2014 |

Year Ended December 31, 2013 |

Year Ended December 31, 2012 |

Year Ended December 30, 20111 |

Year Ended December 31, 2010 |

||||||||||||||||||||

|

|

||||||||||||||||||||||||||

| Per Share Operating Data |

||||||||||||||||||||||||||

| Net asset value, beginning of period | $ | 78.82 | $ | 74.51 | $ | 54.80 | $ | 47.06 | $ | 46.55 | $ | 36.52 | ||||||||||||||

|

|

||||||||||||||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||||||||

| Net investment income (loss)2 | (0.09) | (0.29) | (0.16) | 0.01 | (0.26) | (0.11) | ||||||||||||||||||||

| Net realized and unrealized gain | 7.87 | 4.60 | 19.88 | 7.73 | 0.77 | 10.14 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Total from investment operations | 7.78 | 4.31 | 19.72 | 7.74 | 0.51 | 10.03 | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||

| Dividends and/or distributions to shareholders: | ||||||||||||||||||||||||||

| Dividends from net investment income | 0.00 | 0.00 | (0.01) | 0.00 | 0.00 | 0.00 | ||||||||||||||||||||

| Distributions from net realized gain | (7.45) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Total dividends and/or distributions to shareholders | (7.45) | 0.00 | (0.01) | 0.00 | 0.00 | 0.00 | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||

| Net asset value, end of period | $ | 79.15 | $ | 78.82 | $ | 74.51 | $ | 54.80 | $ | 47.06 | $ | 46.55 | ||||||||||||||

|

|

|

|||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||

| Total Return, at Net Asset Value3 |

9.80% | 5.78% | 35.98% | 16.45% | 1.09% | 27.46% | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||||

| Net assets, end of period (in thousands) | $ | 711,061 | $ | 682,515 | $ | 725,406 | $ | 558,934 | $ | 543,020 | $ | 611,872 | ||||||||||||||

|

|

||||||||||||||||||||||||||

| Average net assets (in thousands) | $ | 707,240 | $ | 688,259 | $ | 618,970 | $ | 575,072 | $ | 605,083 | $ | 548,739 | ||||||||||||||

|

|

||||||||||||||||||||||||||

| Ratios to average net assets:4 | ||||||||||||||||||||||||||

| Net investment income (loss) | (0.23)% | (0.39)% | (0.24)% | 0.03% | (0.53)% | (0.29)% | ||||||||||||||||||||

| Total expenses5 | 0.83% | 0.83% | 0.84% | 0.85% | 0.84% | 0.85% | ||||||||||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | 0.80% | 0.80% | 0.80% | 0.80% | 0.80% | 0.76% | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||

| Portfolio turnover rate | 40 % | 113 % | 84 % | 66 % | 91 % | 95 % | ||||||||||||||||||||

1. December 30, 2011 represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Total returns are not annualized for periods less than one full year. Total return information does not reflect expenses that apply at the separate account level or to related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| Six Months Ended June 30, 2015 |

0.83 | % | ||||

| Year Ended December 31, 2014 |

0.83 | % | ||||

| Year Ended December 31, 2013 |

0.84 | % | ||||

| Year Ended December 31, 2012 |

0.85 | % | ||||

| Year Ended December 30, 2011 |

0.84 | % | ||||

| Year Ended December 31, 2010 |

0.85 | % |

See accompanying Notes to Financial Statements.

11 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

FINANCIAL HIGHLIGHTS Continued

| Service Shares | Six Months Ended June 30, 2015 (Unaudited) |

Year Ended December 31, 2014 |

Year Ended December 31, 2013 |

Year Ended December 31, 2012 |

Year Ended December 30, 20111 |

Year Ended December 31, 2010 |

||||||||||||||||||||

|

|

||||||||||||||||||||||||||

| Per Share Operating Data |

||||||||||||||||||||||||||

| Net asset value, beginning of period | $ | 76.21 | $ | 72.22 | $ | 53.25 | $ | 45.84 | $ | 45.46 | $ | 35.75 | ||||||||||||||

|

|

||||||||||||||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||||||||

| Net investment loss2 | (0.19) | (0.46) | (0.30) | (0.12) | (0.37) | (0.20) | ||||||||||||||||||||

| Net realized and unrealized gain | 7.62 | 4.45 | 19.27 | 7.53 | 0.75 | 9.91 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Total from investment operations | 7.43 | 3.99 | 18.97 | 7.41 | 0.38 | 9.71 | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||

| Dividends and/or distributions to shareholders: | ||||||||||||||||||||||||||

| Dividends from net investment income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||||

| Distributions from net realized gain | (7.45) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

| Total dividends and/or distributions to shareholders | (7.45) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||

| Net asset value, end of period | $ | 76.19 | $ | 76.21 | $ | 72.22 | $ | 53.25 | $ | 45.84 | $ | 45.46 | ||||||||||||||

|

|

|

|||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||

| Total Return, at Net Asset Value3 |

9.68% | 5.53% | 35.62% | 16.17% | 0.83% | 27.16% | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||||

| Net assets, end of period (in thousands) | $ | 32,331 | $ | 30,964 | $ | 36,549 | $ | 35,942 | $ | 35,773 | $ | 32,669 | ||||||||||||||

|

|

||||||||||||||||||||||||||

| Average net assets (in thousands) | $ | 32,157 | $ | 32,927 | $ | 35,905 | $ | 37,842 | $ | 37,775 | $ | 27,552 | ||||||||||||||

|

|

||||||||||||||||||||||||||

| Ratios to average net assets:4 | ||||||||||||||||||||||||||

| Net investment loss | (0.48)% | (0.64)% | (0.49)% | (0.22)% | (0.78)% | (0.53)% | ||||||||||||||||||||

| Total expenses5 | 1.08% | 1.08% | 1.09% | 1.10% | 1.09% | 1.10% | ||||||||||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | 1.05% | 1.05% | 1.05% | 1.05% | 1.05% | 1.01% | ||||||||||||||||||||

|

|

||||||||||||||||||||||||||

| Portfolio turnover rate | 40 % | 113 % | 84 % | 66 % | 91 % | 95 % | ||||||||||||||||||||

1. December 30, 2011 represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Total returns are not annualized for periods less than one full year. Total return information does not reflect expenses that apply at the separate account level or to related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| Six Months Ended June 30, 2015 |

1.08 | % | ||||

| Year Ended December 31, 2014 |

1.08 | % | ||||

| Year Ended December 31, 2013 |

1.09 | % | ||||

| Year Ended December 31, 2012 |

1.10 | % | ||||

| Year Ended December 30, 2011 |

1.09 | % | ||||

| Year Ended December 31, 2010 |

1.10 | % |

See accompanying Notes to Financial Statements.

12 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

NOTES TO FINANCIAL STATEMENTS June 30, 2015 Unaudited

1. Organization

Oppenheimer Discovery Mid Cap Growth Fund/VA (the “Fund”) is a separate series of Oppenheimer Variable Account Funds, as a diversified open-end management investment company registered under the Investment Company Act of 1940 (“1940 Act”), as amended. The Fund’s investment objective is to seek capital appreciation. The Fund’s investment adviser is OFI Global Asset Management, Inc. (“OFI Global” or the “Manager”), a wholly-owned subsidiary of OppenheimerFunds Inc. (“OFI” or the “Sub-Adviser”). The Manager has entered into a sub-advisory agreement with OFI. Shares of the Fund are sold only to separate accounts of life insurance companies.

The Fund offers two classes of shares. Both classes are sold at their offering price, which is the net asset value per share, to separate investment accounts of participating insurance companies as an underlying investment for variable life insurance policies, variable annuity contracts or other investment products. The class of shares designated as Service shares is subject to a distribution and service plan. Both classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class.

The following is a summary of significant accounting policies followed in the Fund’s preparation of financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

2. Significant Accounting Policies

Security Valuation. All investments in securities are recorded at their estimated fair value, as described in Note 3.

Reporting Period End Date. The last day of the Fund’s reporting period is the last day the New York Stock Exchange was open for trading during the period. The Fund’s financial statements have been presented through that date to maintain consistency with the Fund’s net asset value calculations used for shareholder transactions.

Allocation of Income, Expenses, Gains and Losses. Income, expenses (other than those attributable to a specific class), gains and losses are allocated on a daily basis to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that class.

Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations and may differ from U.S. generally accepted accounting principles, are recorded on the ex-dividend date. Income and capital gain distributions, if any, are declared and paid annually or at other times as deemed necessary by the Manager.

The tax character of distributions is determined as of the Fund’s fiscal year end. Therefore, a portion of the Fund’s distributions made to shareholders prior to the Fund’s fiscal year end may ultimately be categorized as a tax return of capital.

Investment Income. Dividend income is recorded on the ex-dividend date or upon ex-dividend notification in the case of certain foreign dividends where the ex-dividend date may have passed. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income is recognized on an accrual basis. Discount and premium, which are included in interest income on the Statement of Operations, are amortized or accreted daily.

Return of Capital Estimates. Distributions received from the Fund’s investments in MLPs generally are comprised of income and return of capital. The Fund records investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded.

Custodian Fees. “Custodian fees and expenses” in the Statement of Operations may include interest expense incurred by the Fund on any cash overdrafts of its custodian account during the period. Such cash overdrafts may result from the effects of failed trades in portfolio securities and from cash outflows resulting from unanticipated shareholder redemption activity. The Fund pays interest to its custodian on such cash overdrafts, to the extent they are not offset by positive cash balances maintained by the Fund, at a rate equal to the Federal Funds Rate plus 0.50%. The “Reduction to custodian expenses” line item, if applicable, represents earnings on cash balances maintained by the Fund during the period. Such interest expense and other custodian fees may be paid with these earnings.

Security Transactions. Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Indemnifications. The Fund’s organizational documents provide current and former Trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Federal Taxes. The Fund intends to comply with provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its investment company taxable income to shareholders. Therefore, no federal income or excise tax provision is required. The

13 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

NOTES TO FINANCIAL STATEMENTS Unaudited / Continued

2. Significant Accounting Policies (Continued)

Fund files income tax returns in U.S. federal and applicable state jurisdictions. The statute of limitations on the Fund’s tax return filings generally remains open for the three preceding fiscal reporting period ends.

During the fiscal year ended December 31, 2014, the Fund utilized $50,885,832 of capital loss carryforward to offset capital gains realized in that fiscal year. Capital loss carryforwards with no expiration, if any, must be utilized prior to those with expiration dates. Capital losses with no expiration will be carried forward to future years if not offset by gains.

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of dividends and distributions made during the fiscal year from net investment income or net realized gains are determined in accordance with federal income tax requirements, which may differ from the character of net investment income or net realized gains presented in those financial statements in accordance with GAAP. Also, due to timing of dividends and distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or net realized gain was recorded by the Fund.

The aggregate cost of securities and other investments and the composition of unrealized appreciation and depreciation of securities and other investments for federal income tax purposes as of June 30, 2015 are noted in the following table. The primary difference between book and tax appreciation or depreciation of securities and other investments, if applicable, is attributable to the tax deferral of losses or tax realization of financial statement unrealized gain or loss.

| Federal tax cost of securities |

$ | 542,873,134 | ||

|

|

|

|||

| Gross unrealized appreciation |

$ | 204,302,327 | ||

| Gross unrealized depreciation |

(3,710,498) | |||

|

|

|

|||

| Net unrealized appreciation |

$ | 200,591,829 | ||

|

|

|

Use of Estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

3. Securities Valuation

The Fund calculates the net asset value of its shares as of the close of the New York Stock Exchange (the “Exchange”), normally 4:00 P.M. Eastern time, on each day the Exchange is open for trading.

The Fund’s Board has adopted procedures for the valuation of the Fund’s securities and has delegated the day-to-day responsibility for valuation determinations under those procedures to the Manager. The Manager has established a Valuation Committee which is responsible for determining a “fair valuation” for any security for which market quotations are not “readily available.” The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

Valuation Methods and Inputs

Securities are valued using unadjusted quoted market prices, when available, as supplied primarily by third party pricing services or dealers.

The following methodologies are used to determine the market value or the fair value of the types of securities described below:

Securities traded on a registered U.S. securities exchange (including exchange-traded derivatives other than futures and futures options) are valued based on the last sale price of the security reported on the principal exchange on which it is traded, prior to the time when the Fund’s assets are valued. In the absence of a sale, the security is valued at the last sale price on the prior trading day, if it is within the spread of the current day’s closing “bid” and “asked” prices, and if not, at the current day’s closing bid price. A security of a foreign issuer traded on a foreign exchange, but not listed on a registered U.S. securities exchange, is valued based on the last sale price on the principal exchange on which the security is traded, as identified by the third party pricing service used by the Manager, prior to the time when the Fund’s assets are valued. If the last sale price is unavailable, the security is valued at the most recent official closing price on the principal exchange on which it is traded. If the last sales price or official closing price for a foreign security is not available, the security is valued at the mean between the bid and asked price per the exchange or, if not available from the exchange, obtained from two dealers. If bid and asked prices are not available from either the exchange or two dealers, the security is valued by using one of the following methodologies (listed in order of priority): (1) using a bid from the exchange, (2) the mean between the bid and asked price as provided by a single dealer, or (3) a bid from a single dealer.

Shares of a registered investment company that are not traded on an exchange are valued at that investment company’s net asset value per share.

Corporate and government debt securities (of U.S. or foreign issuers) and municipal debt securities, event-linked bonds, loans, mortgage-backed securities, collateralized mortgage obligations, and asset-backed securities are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers who may use matrix pricing methods to determine the evaluated prices.

Short-term money market type debt securities with a remaining maturity of sixty days or less are valued at cost adjusted by the amortization of discount or premium to maturity (amortized cost), which approximates market value. Short-term debt securities with a remaining maturity in excess of sixty days are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers.

A description of the standard inputs that may generally be considered by the third party pricing vendors in determining their evaluated prices is provided below.

14 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

3. Securities Valuation (Continued)

| Security Type | Standard inputs generally considered by third-party pricing vendors | |

|

| ||

| Corporate debt, government debt, municipal, mortgage-backed and asset-backed securities | Reported trade data, broker-dealer price quotations, benchmark yields, issuer spreads on comparable securities, the credit quality, yield, maturity, and other appropriate factors. | |

|

| ||

| Loans | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. | |

|

| ||

| Event-linked bonds | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. | |

If a market value or price cannot be determined for a security using the methodologies described above, or if, in the “good faith” opinion of the Manager, the market value or price obtained does not constitute a “readily available market quotation,” or a significant event has occurred that would materially affect the value of the security, the security is fair valued either (i) by a standardized fair valuation methodology applicable to the security type or the significant event as previously approved by the Valuation Committee and the Fund’s Board or (ii) as determined in good faith by the Manager’s Valuation Committee. The Valuation Committee considers all relevant facts that are reasonably available, through either public information or information available to the Manager, when determining the fair value of a security. Fair value determinations by the Manager are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined. Those fair valuation standardized methodologies include, but are not limited to, valuing securities at the last sale price or initially at cost and subsequently adjusting the value based on: changes in company specific fundamentals, changes in an appropriate securities index, or changes in the value of similar securities which may be further adjusted for any discounts related to security-specific resale restrictions. When possible, such methodologies use observable market inputs such as unadjusted quoted prices of similar securities, observable interest rates, currency rates and yield curves. The methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities nor can it be assured that the Fund can obtain the fair value assigned to a security if it were to sell the security.

To assess the continuing appropriateness of security valuations, the Manager, or its third party service provider who is subject to oversight by the Manager, regularly compares prior day prices, prices on comparable securities, and sale prices to the current day prices and challenges those prices exceeding certain tolerance levels with the third party pricing service or broker source. For those securities valued by fair valuations, whether through a standardized fair valuation methodology or a fair valuation determination, the Valuation Committee reviews and affirms the reasonableness of the valuations based on such methodologies and fair valuation determinations on a regular basis after considering all relevant information that is reasonably available.

Classifications

Each investment asset or liability of the Fund is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Various data inputs are used in determining the value of each of the Fund’s investments as of the reporting period end. These data inputs are categorized in the following hierarchy under applicable financial accounting standards:

1) Level 1-unadjusted quoted prices in active markets for identical assets or liabilities (including securities actively traded on a securities exchange)

2) Level 2-inputs other than unadjusted quoted prices that are observable for the asset or liability (such as unadjusted quoted prices for similar assets and market corroborated inputs such as interest rates, prepayment speeds, credit risks, etc.)

3) Level 3-significant unobservable inputs (including the Manager’s own judgments about assumptions that market participants would use in pricing the asset or liability).

The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The table below categorizes amounts that are included in the Fund’s Statement of Assets and Liabilities as of June 30, 2015 based on valuation input level:

| Level 1— Unadjusted Quoted Prices |

Level 2— Other Significant Observable Inputs |

Level 3— Significant Unobservable Inputs |

Value | |||||||||||||

|

|

||||||||||||||||

| Assets Table | ||||||||||||||||

| Investments, at Value: | ||||||||||||||||

| Common Stocks |

||||||||||||||||

| Consumer Discretionary |

$ | 174,391,323 | $ | — | $ | — | $ | 174,391,323 | ||||||||

| Consumer Staples |

52,031,558 | — | — | 52,031,558 | ||||||||||||

| Energy |

26,057,128 | — | — | 26,057,128 | ||||||||||||

| Financials |

65,095,207 | — | — | 65,095,207 | ||||||||||||

| Health Care |

127,456,334 | — | — | 127,456,334 | ||||||||||||

| Industrials |

104,431,061 | — | — | 104,431,061 | ||||||||||||

| Information Technology |

146,395,152 | — | — | 146,395,152 | ||||||||||||

| Materials |

29,105,741 | — | — | 29,105,741 | ||||||||||||

| Telecommunication Services |

9,841,432 | — | — | 9,841,432 | ||||||||||||

| Investment Company | 8,660,027 | — | — | 8,660,027 | ||||||||||||

|

|

|

|||||||||||||||

| Total Assets | $ | 743,464,963 | $ | — | $ | — | $ | 743,464,963 | ||||||||

|

|

|

|||||||||||||||

15 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS Unaudited / Continued

3. Securities Valuation (Continued)

Forward currency exchange contracts and futures contracts, if any, are reported at their unrealized appreciation/depreciation at measurement date, which represents the change in the contract’s value from trade date. All additional assets and liabilities included in the above table are reported at their market value at measurement date.

4. Investments and Risks

Investment in Oppenheimer Institutional Money Market Fund. The Fund is permitted to invest daily available cash balances in an affiliated money market fund. The Fund may invest the available cash in Class E shares of Oppenheimer Institutional Money Market Fund (“IMMF”) to seek current income while preserving liquidity or for defensive purposes. IMMF is a registered open-end management investment company, regulated as a money market fund under the 1940 Act. The Manager is the investment adviser of IMMF, and the Sub-Adviser provides investment and related advisory services to IMMF. When applicable, the Fund’s investment in IMMF is included in the Statement of Investments. Shares of IMMF are valued at their net asset value per share. As a shareholder, the Fund is subject to its proportional share of IMMF’s Class E expenses, including its management fee. The Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in IMMF.

Master Limited Partnerships (“MLPs”). MLPs issue common units that represent an equity ownership interest in a partnership and provide limited voting rights. MLP common units are registered with the Securities and Exchange Commission (“SEC”), and are freely tradable on securities exchanges such as the NYSE and the NASDAQ Stock Market (“NASDAQ”), or in the over-the-counter (“OTC”) market. An MLP consists of one or more general partners, who conduct the business, and one or more limited partners, who contribute capital. MLP common unit holders have a limited role in the partnership’s operations and management. The Fund, as a limited partner, normally would not be liable for the debts of the MLP beyond the amounts the Fund has contributed, but would not be shielded to the same extent that a shareholder of a corporation would be. In certain circumstances creditors of an MLP would have the right to seek return of capital distributed to a limited partner. This right of an MLP’s creditors would continue after the Fund sold its investment in the MLP.

Equity Security Risk. Stocks and other equity securities fluctuate in price. The value of the Fund’s portfolio may be affected by changes in the equity markets generally. Equity markets may experience significant short-term volatility and may fall sharply at times. Different markets may behave differently from each other and U.S. equity markets may move in the opposite direction from one or more foreign stock markets. Adverse events in any part of the equity or fixed-income markets may have unexpected negative effects on other market segments.

The prices of individual equity securities generally do not all move in the same direction at the same time and a variety of factors can affect the price of a particular company’s securities. These factors may include, but are not limited to, poor earnings reports, a loss of customers, litigation against the company, general unfavorable performance of the company’s sector or industry, or changes in government regulations affecting the company or its industry.

5. Shares of Beneficial Interest

The Fund has authorized an unlimited number of $0.001 par value shares of beneficial interest of each class. Transactions in shares of beneficial interest were as follows:

| Six Months Ended June 30, 2015 | Year Ended December 31, 2014 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

|

|

||||||||||||||||

| Non-Service Shares | ||||||||||||||||

| Sold | 196,585 | $ | 16,451,527 | 416,592 | $ | 31,353,214 | ||||||||||

| Dividends and/or distributions reinvested | 772,149 | 61,563,484 | — | — | ||||||||||||

| Redeemed | (644,663) | (53,566,635) | (1,493,014) | (111,716,047) | ||||||||||||

|

|

|

|||||||||||||||

| Net increase (decrease) | 324,071 | $ | 24,448,376 | (1,076,422) | $ | (80,362,833) | ||||||||||

|

|

|

|||||||||||||||

|

|

||||||||||||||||

| Service Shares | ||||||||||||||||

| Sold | 33,458 | $ | 2,706,902 | 42,402 | $ | 3,058,524 | ||||||||||

| Dividends and/or distributions reinvested | 37,465 | 2,875,460 | — | — | ||||||||||||

| Redeemed | (52,852) | (4,289,672) | (142,155) | (10,267,950) | ||||||||||||

|

|

|

|||||||||||||||

| Net increase (decrease) | 18,071 | $ | 1,292,690 | (99,753) | $ | (7,209,426) | ||||||||||

|

|

|

|||||||||||||||

6. Purchases and Sales of Securities

The aggregate cost of purchases and proceeds from sales of securities, other than short-term obligations and investments in IMMF, for the six months ended June 30, 2015 were as follows:

| Purchases | Sales | |||||

|

| ||||||

| Investment securities |

$ | 288,325,167 | $325,472,996 | |||

7. Fees and Other Transactions with Affiliates

Management Fees. Under the investment advisory agreement, the Fund pays the Manager a management fee based on the daily net assets of the Fund at an annual rate as shown in the following table:

16 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

7. Fees and Other Transactions with Affiliates (Continued)

| Fee Schedule | ||||

|

|

||||

| Up to $200 million |

0.75% | |||

| Next $200 million |

0.72 | |||

| Next $200 million |

0.69 | |||

| Next $200 million |

0.66 | |||

| Next $700 million |

0.60 | |||

| Over $1.5 billion |

0.58 | |||

The Fund’s effective management fee for the six months ended June 30, 2015 was 0.71% of average annual net assets before any applicable waivers.

Sub-Adviser Fees. The Manager has retained the Sub-Adviser to provide the day-to-day portfolio management of the Fund. Under the Sub-Advisory Agreement, the Manager pays the Sub-Adviser an annual fee in monthly installments, equal to a percentage of the investment management fee collected by the Manager from the Fund, which shall be calculated after any investment management fee waivers. The fee paid to the Sub-Adviser is paid by the Manager, not by the Fund.

Transfer Agent Fees. OFI Global (the “Transfer Agent”) serves as the transfer and shareholder servicing agent for the Fund. The Fund pays the Transfer Agent a fee based on annual net assets. Fees incurred and average net assets for each class with respect to these services are detailed in the Statement of Operations and Financial Highlights, respectively.

Sub-Transfer Agent Fees. The Transfer Agent has retained Shareholder Services, Inc., a wholly-owned subsidiary of OFI (the “Sub-Transfer Agent”), to provide the day-to-day transfer agent and shareholder servicing of the Fund. Under the Sub-Transfer Agency Agreement, the Transfer Agent pays the Sub-Transfer Agent an annual fee in monthly installments, equal to a percentage of the transfer agent fee collected by the Transfer Agent from the Fund, which shall be calculated after any applicable fee waivers. The fee paid to the Sub-Transfer Agent is paid by the Transfer Agent, not by the Fund.

Trustees’ Compensation. The Fund’s Board of Trustees (“Board”) has adopted a compensation deferral plan for Independent Trustees that enables Trustees to elect to defer receipt of all or a portion of the annual compensation they are entitled to receive from the Fund. For purposes of determining the amount owed to the Trustee under the plan, deferred amounts are treated as though equal dollar amounts had been invested in shares of the Fund or in other Oppenheimer funds selected by the Trustee. The Fund purchases shares of the funds selected for deferral by the Trustee in amounts equal to his or her deemed investment, resulting in a Fund asset equal to the deferred compensation liability. Such assets are included as a component of “Other” within the asset section of the Statement of Assets and Liabilities. Deferral of Trustees’ fees under the plan will not affect the net assets of the Fund and will not materially affect the Fund’s assets, liabilities or net investment income per share. Amounts will be deferred until distributed in accordance with the compensation deferral plan.

Distribution and Service Plan for Service Shares. The Fund has adopted a Distribution and Service Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act for Service shares to pay OppenheimerFunds Distributor, Inc. (the “Distributor”), for distribution related services, personal service and account maintenance for the Fund’s Service shares. Under the Plan, payments are made periodically at an annual rate of 0.25% of the daily net assets of Service shares of the Fund. The Distributor currently uses all of those fees to compensate sponsors of the insurance product that offers Fund shares, for providing personal service and maintenance of accounts of their variable contract owners that hold Service shares. These fees are paid out of the Fund’s assets on an on-going basis and increase operating expenses of the Service shares, which results in lower performance compared to the Fund’s shares that are not subject to a service fee. Fees incurred by the Fund under the Plan are detailed in the Statement of Operations.

Waivers and Reimbursements of Expenses. The Manager has contractually agreed to limit the Fund’s expenses after payments, waivers and/or reimbursements and reduction to custodian expenses, excluding expenses incurred directly or indirectly by the Fund as a result of investments in other investment companies, wholly-owned subsidiaries and pooled investment vehicles; so that those expenses, as percentages of daily net assets, will not exceed the annual rate of 0.80% for Non-Service shares and 1.05% for Service shares. During the six months ended June 30, 2015, the Manager waived fees and/or reimbursed the Fund $82,168 and $3,750 for Non-Service and Service shares, respectively.

The Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in IMMF. During the six months ended June 30, 2015, the Manager waived fees and/or reimbursed the Fund $8,384 for IMMF management fees.

Waivers and/or reimbursements may be modified or terminated as set forth according to the terms in the prospectus.

8. Pending Litigation

In 2009, several lawsuits were filed as putative class actions and later consolidated before the U.S. District Court for the District of Colorado in connection with the investment performance of Oppenheimer Rochester California Municipal Fund (the “California Fund Suit”), a fund advised by OppenheimerFunds, Inc. (“OFI”), and distributed by its subsidiary OppenheimerFunds Distributor, Inc. ( “OFDI”). The plaintiffs asserted claims against OFI, OFDI and certain present and former trustees and officers of the Fund under the federal securities laws, alleging, among other things, that the disclosure documents of the Fund contained misrepresentations and omissions and the investment policies of the Fund were not followed. Plaintiffs in the California Fund Suit filed an amended complaint and defendants filed a motion to dismiss. In 2011, the court issued an order which granted in part

17 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS Unaudited / Continued

8. Pending Litigation (Continued)

and denied in part the defendants’ motion to dismiss. In 2012, plaintiffs filed a motion, which defendants opposed, to certify a class and appoint class representatives and class counsel. In March 2015, the court granted plaintiffs’ motion for class certification. In May 2015, the U.S. Court of Appeals for the Tenth Circuit vacated the class certification order and remanded the matter to the district court for further proceedings. In July 2015, the district court held an evidentiary hearing on plaintiffs’ motion for class certification. OFI and OFDI believe the California Fund Suit is without merit; that it is premature to render any opinion as to the likelihood of an outcome unfavorable to them in the California Fund Suit; and that no estimate can yet be made as to the amount or range of any potential loss.

18 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

PORTFOLIO PROXY VOTING POLICIES AND PROCEDURES; UPDATES TO STATEMENTS OF INVESTMENTS Unaudited

The Fund has adopted Portfolio Proxy Voting Policies and Procedures under which the Fund votes proxies relating to securities (“portfolio proxies”) held by the Fund. A description of the Fund’s Portfolio Proxy Voting Policies and Procedures is available (i) without charge, upon request, by calling the Fund toll-free at 1.800.525.7048, (ii) on the Fund’s website at www.oppenheimerfunds.com, and (iii) on the SEC’s website at www.sec.gov. In addition, the Fund is required to file Form N-PX, with its complete proxy voting record for the 12 months ended June 30th, no later than August 31st of each year. The Fund’s voting record is available (i) without charge, upon request, by calling the Fund toll-free at 1.800.525.7048, and (ii) in the Form N-PX filing on the SEC’s website at www.sec.gov.

The Fund files its complete schedule of portfolio holdings with the SEC for the first quarter and the third quarter of each fiscal year on Form N-Q. The Fund’s Form N-Q filings are available on the SEC’s website at www.sec.gov. Those forms may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

19 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND

DISTRIBUTION SOURCES Unaudited

For any distribution that took place over the Fund’s reporting period, the table below details on a per-share basis the percentage of the Fund’s total distribution payment amount that was derived from the following sources: net income, net profit from the sale of securities, and other capital sources. This information is based upon income and capital gains using generally accepted accounting principles as of the date of each distribution. Because the Fund is actively managed, the relative amount of the Fund’s total distributions derived from various sources over the calendar year may change. Please note that this information should not be used for tax reporting purposes as the tax character of distributable income may differ from the amounts used for this notification. You will receive IRS tax forms in the first quarter of each calendar year detailing the actual amount of the taxable and non-taxable portion of distributions paid to you during the tax year.

For the most current information, please go to oppenheimerfunds.com. Select your Fund, then the ‘Detailed’ tab; where ‘Dividends’ are shown, the Fund’s latest pay date will be followed by the sources of any distribution, updated daily.

| Fund Name | Pay Date | Net Income | Net Profit from Sale |

Other Capital Sources |

||||||||||||

|

|

||||||||||||||||

|

Oppenheimer Discovery Mid Cap Growth Fund/VA |

6/16/15 | 0.0% | 100.0% | 0.0% | ||||||||||||

20 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

THIS PAGE INTENTIONALLY LEFT BLANK.

21 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND

THIS PAGE INTENTIONALLY LEFT BLANK.

22 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

THIS PAGE INTENTIONALLY LEFT BLANK.

23 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND

OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA

A Series of Oppenheimer Variable Account Funds

| Trustees and Officers | Sam Freedman, Chairman of the Board of Trustees and Trustee | |

| Jon S. Fossel, Trustee | ||

| Richard F. Grabish, Trustee | ||

| Beverly L. Hamilton, Trustee | ||

| Victoria J. Herget, Trustee | ||

| Robert J. Malone, Trustee | ||

| F. William Marshall, Jr., Trustee | ||

| Karen L. Stuckey, Trustee | ||

| James D. Vaughn, Trustee | ||

| Arthur P. Steinmetz, Trustee, President and Principal Executive Officer | ||

| Ronald J. Zibelli, Jr., Vice President | ||

| Justin Livengood, Vice President | ||

| Arthur S. Gabinet, Secretary and Chief Legal Officer | ||

| Jennifer Sexton, Vice President and Chief Business Officer | ||

| Mary Ann Picciotto, Chief Compliance Officer and Chief Anti-Money Laundering Officer | ||

| Brian W. Wixted, Treasurer and Principal Financial & Accounting Officer | ||

| Manager | OFI Global Asset Management, Inc. | |

| Sub-Adviser | OppenheimerFunds, Inc. | |

| Distributor | OppenheimerFunds Distributor, Inc. | |

| Transfer and Shareholder Servicing Agent |

OFI Global Asset Management, Inc. | |

| Sub-Transfer Agent | Shareholder Services, Inc. | |

| DBA OppenheimerFunds Services | ||

| Independent Registered Public Accounting Firm |

KPMG LLP | |

| Legal Counsel | Ropes & Gray LLP | |

| Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com or calling us at 1.800.988.8287. Read prospectuses and summary prospectuses carefully before investing. | ||

| The financial statements included herein have been taken from the records of the Fund without examination of those records by the independent registered public accounting firm. | ||

| © 2015 OppenheimerFunds, Inc. All rights reserved. Oppenheimer funds are distributed by OppenheimerFunds Distributor, Inc. | ||

PORTFOLIO MANAGERS: Krishna Memani and Magnus Krantz

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED 6/30/015

| Inception Date |

6-Months | 1-Year | 5-Year | 10-Year | ||||||||||||||||

| Non-Service Shares |

2/9/87 | 1.32% | 3.94 | % | 10.26 | % | 2.57 | % | ||||||||||||

| Service Shares |

5/1/02 | 1.13 | 3.63 | 9.99 | 2.32 | |||||||||||||||

| Russell 3000 Index |

1.94 | 7.29 | 17.54 | 8.15 | ||||||||||||||||

| Barclays U.S. Aggregate Bond Index | -0.15 | 1.81 | 3.34 | 4.43 | ||||||||||||||||

| Reference Index |

0.68 | 3.91 | 8.47 | 6.32 | ||||||||||||||||

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, call us at 1.800.988.8287. The Fund’s total returns should not be expected to be the same as the returns of other funds, whether or not both funds have the same portfolio managers and/or similar names. The Fund’s total returns include changes in share price and reinvested distributions but do not include the charges associated with the separate account products that offer this Fund. Such performance would have been lower if such charges were taken into account.

The Fund’s performance is compared to the performance of the Russell 3000 Index, the Barclays U.S. Aggregate Bond Index and the Fund’s Reference Index. The Russell 3000 Index measures the performance of the largest 3,000 U.S. companies, representing approximately 98% of the investable U.S. equity market. The Barclays U.S. Aggregate Bond Index is an index of U.S dollar-denominated, investment-grade U.S. corporate government and mortgage-backed securities. The Fund’s Reference Index is a customized weighted index currently comprised of 65% of the Barclays U.S. Aggregate Bond Index and 35% of the Russell 3000 Index. The Indices are unmanaged and cannot be purchased directly by investors. Index performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the indices. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

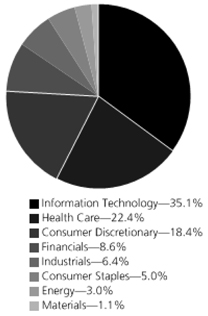

TOP HOLDINGS AND ALLOCATIONS

2 OPPENHEIMER CONSERVATIVE BALANCED FUND/VA

Fund Performance Discussion

The Fund’s Non-Service shares produced a return of 1.32% during the reporting period. On a relative basis, the Fund outperformed its Reference Index, which returned 0.68%. The Fund’s Reference Index is a customized weighted index currently comprised of the following underlying broad-based security indices: 65% of the Barclays U.S. Aggregate Bond Index and 35% of the Russell 3000 Index. Measured separately, the Barclays U.S. Aggregate Bond Index returned - 0.15% and the Russell 3000 Index returned 1.94%.

MARKET OVERVIEW

The opening months of 2015 were marked by cooling U.S. growth after the strong fourth quarter of 2014. The dollar continued to strengthen significantly during this time against most of the U.S.’s major trading partners, which acted as a drag on growth. Businesses, especially U.S. firms with revenues dependent on exporting goods and services, cited this as a headwind. European Central Bank (“ECB”) President Mario Draghi announced the purchase of €60 billion a month in sovereign bonds from Eurozone countries for at least 19 months, a form of quantitative easing (“QE”) that is projected to increase the ECB’s balance sheet by over €1 trillion. The announcement and implementation of these extraordinary monetary policies had a significant impact on financial markets, with European markets rallying and the euro falling against most major trading partners.

Over the second half of the reporting period, market volatility returned despite a continuation of slow and stable growth in the U.S. Deflationary pressures also appeared to have subsided during the period. Oil prices rebounded from around $48 dollars per barrel to nearly $60 dollars per barrel. It is important to note that while these levels still represent a significant discount to previous years, we believe the lower prices should continue to have a stimulative effect on developed and emerging world oil importers. Meanwhile, emerging issues in Greece highlighted downside risks to the global economy and capital markets. Greece’s ongoing negotiations with creditors and ultimate default on a $1.7 billion International Monetary Fund (“IMF”) payment on June 30, 2015, led to a more challenging environment for the Eurozone. Shortly after the period ended, Eurozone leaders agreed to offer Greece a third bailout, averting a Greek exit.

Longer-term U.S. Treasury rates continued to swing fairly wildly during the reporting period. Over the first half of the reporting period, the 10-year treasury rate fell, starting the reporting period at 2.17% and declining to 1.92% at the end of March. However, over the second half of the reporting period, longer-term U.S. Treasury rates marched higher as the 10-year treasury rate increased to 2.49% before ending the period at 2.35% due to the uncertainty around Greece. This net upward movement in rates ultimately contributed to U.S. Treasuries generating negative total returns during this time and for the overall reporting period.

EQUITY STRATEGY REVIEW

The equity strategy produced positive absolute performance during the reporting period, and outperformed the Russell 3000 Index. The equity strategy’s outperformance stemmed largely from stronger relative stock selection in the health care, information technology, financials and consumer staples sectors. The equity strategy underperformed the Russell 3000 Index in the consumer discretionary, industrials and materials sectors.

The equity strategy’s top contributors to performance included Mondelez International, Inc., JPMorgan Chase & Co. and Imperva, Inc. Mondelez manufactures and sells consumer products, primarily in the snack food and confection categories. Management reported significant margin expansion during the first quarter, surprising investors and leading to the stock’s strong performance. JPMorgan Chase performed well during the reporting period due primarily to rising interest rates. Higher rates should lead to expanding net interest margins for the company. Additionally, the Federal Reserve Board’s Comprehensive Capital Analysis and Review (CCAR) results were released late in the first quarter, which allowed the company to increase its dividends and continue to buy back stock. Imperva develops protection software and services for databases and business applications. The company reported strong results, demonstrating that the new management team’s sales and marketing overhaul is bearing fruit.

Detractors from performance included Xerox Corp., Applied Materials, Inc. and Simon Property Group, Inc. Xerox provides business process and information technology outsourcing, and document management services. Weak quarterly guidance triggered a major selloff in the stock as poor execution led to further downward revisions of earnings estimates. Applied Materials provides equipment used in the manufacture of LCD displays and solar panels, and the processing of silicon wafers to make computer chips. The company dropped its merger with Tokyo Electron as the U.S. Department of Justice would not allow the transaction to proceed on acceptable terms. The market reacted negatively. Simon Property is a real estate investment trust (REIT) that owns, develops, and manages retail real estate — primarily malls and outlets — mostly within the U.S. and Puerto Rico. Simon properties sold off along with the general REIT universe during the second quarter, driven primarily by rising long term interest rates.

3 OPPENHEIMER CONSERVATIVE BALANCED FUND/VA

FIXED-INCOME STRATEGY REVIEW

During the reporting period, the fixed-income strategy produced a modest return and outperformed the Barclays U.S. Aggregate Bond Index. The fixed-income strategy received its strongest results from its investments in mortgage-backed securities (“MBS”) and asset-backed securities (“ABS”). Among MBS, the strategy had its largest exposure to government agency MBS, with a smaller allocation to non-agency MBS. Security selection within the agency MBS sector and an allocation to non-agency MBS served the strategy well during this reporting period as agency inverse interest-only security prices were supported by a more dovish Federal Reserve (“Fed”) outlook while non-agency MBS prices benefited from solid fundamentals and a lack of supply. The strategy’s exposure to ABS is primarily concentrated in securities backed by auto loans. These investments performed well for the fixed-income strategy this reporting period.

In addition to these investments, the fixed-income strategy had its largest exposure to corporate bonds at period end. The strategy had its largest weighting in investment grade corporate bonds, which we believe still offer solid value, and also maintained an allocation to non-investment grade (BB-rated and below) corporate bonds, which have historically offered attractive yields for only incremental credit risk relative to their investment grade (BBB-rated and above) counterparts. Both investment grade and non-investment grade corporate bonds benefited the fixed-income strategy’s performance versus the Barclays U.S. Aggregate Bond Index this reporting period, although investment grade corporates produced a slight negative return.

The primary detractor from the fixed-income strategy’s performance was its minimal exposure to U.S. Treasuries. As mentioned earlier, U.S. Treasury rates rose for the overall six-month reporting period, which impacted the total returns of these securities.