UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-4108

Oppenheimer Variable Account Funds

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Arthur S. Gabinet

OFI Global Asset Management, Inc.

Two World Financial Center, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: December 31

Date of reporting period: 12/31/2012

| Item 1. | Reports to Stockholders. |

| December 31, 2012 | ||||

|

Oppenheimer Small- & Mid-Cap Growth Fund/VA A Series of Oppenheimer Variable Account Funds

|

Annual Report | |||

| ANNUAL REPORT

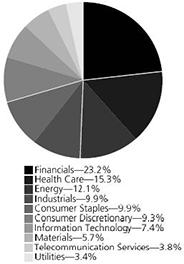

Listing of Top Holdings

Fund Performance Discussion

Financial Statements |

||||

|

OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA | ||

2 OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

FUND PERFORMANCE DISCUSSION | ||

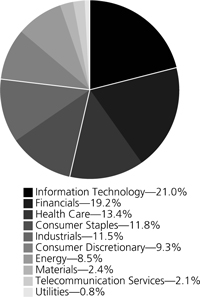

The Fund’s Non-Service shares produced a return of 16.45% during the one-year period ended December 31, 2012. On a relative basis, the Fund outperformed the Russell 2500 Growth Index (the “Index”), which returned 16.13% over the same period.

The Fund also outperformed the Russell 2000 Growth Index and the Russell MidCap Growth Index, which returned 14.59% and 15.81%, respectively, for the one-year period ended December 31, 2012, as well as its peers in the Lipper VA Mid-Cap Growth Funds Index, which returned 13.62% for the same period.

Economic and Market Environment

Domestic equities generally produced positive returns this period. The period began during a time of improved market sentiment in which the United States managed to avoid a return to recession and European policymakers appeared to take steps to address the region’s sovereign debt and banking sector crises. Renewed investor optimism helped produce gains in the U.S. equity market as well as across a number of international equity markets over the first three months of 2012. The rebound across equities gained momentum after the European Central Bank (the “ECB”) took steps to enhance liquidity for troubled banks and reduce rates on newly issued sovereign debt securities.

The second quarter was more volatile for the equity markets. In the U.S., slower than expected first quarter growth contributed to a sell-off in the stock market. Consumer confidence dropped as U.S. unemployment figures ticked slightly upwards after showing signs of improvement from the recession highs. The fear of contagion from the worsening European sovereign debt crisis and a recession across much of Europe drove negative market sentiment, particularly over May and June.

In the second half of the period, the global equity markets resumed an upward trend as certain events appeared to help calm market jitters. Investors had been deeply concerned about the possibility of Greece pulling out of the euro and its ramifications for the future of the Eurozone and its common currency. The results of elections in Greece and continued efforts by European policymakers to stabilize the situation in the region made far less likely the imminent fracturing of the Eurozone and the serious consequences that might have for the euro.

The markets responded positively to central banks’ continued efforts to stimulate economic growth. The ECB committed to potentially unlimited bond purchases to ease financing pressure on countries like Spain and Italy. Under the plan, these and other members of the European Union (excluding Greece) will be able to maintain access to funding at sustainable interest rates, on the condition that they continue with strict reform programs.

In the U.S., the Federal Reserve (the “Fed”) introduced a third round of quantitative easing (“QE3”), under which it announced plans to purchase Treasury and mortgage-backed bonds on a monthly basis until the labor market shows signs of substantial improvement. While these actions and a last minute temporary resolution of the so-called fiscal cliff enacted by the U.S. Congress largely prevented the markets from trading in negative territory in the final quarter, a number of concerns throughout the globe remained and presented the possibility for future market volatility.

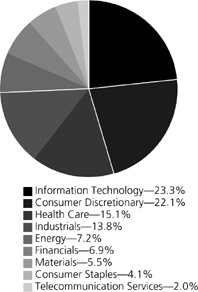

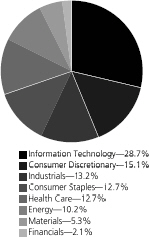

Top Individual Contributors

The Fund outperformed the Index during the period due to positive stock selection in the information technology, consumer staples and health care sectors. An underweight position relative to the Index in the energy sector, particularly in the first half of 2012, also helped Fund performance. These positive results were partly offset by negative stock selection in the industrials and consumer discretionary sectors. The top performing stocks for the Fund this period were Equinix, Inc., Ulta Salon, Cosmetics & Fragrance, Inc., TransDigm Group, Inc., Alexion Pharmaceuticals, Inc. and Catamaran Corp. All of these holdings were among the top ten holdings of the Fund at period end. Equinix is an information technology company that provides a global platform of data centers and internet exchanges. The company benefited from higher demand for its data center services and also announced plans to expand in Brazil with the opening of a new data center. Equinix also announced plans to convert to a real estate investment trust (REIT) around 2015. Ulta Salon, one of our consumer discretionary positions, exceeded financial projections as it successfully implemented its plan to gain market share in the huge retail segment devoted to cosmetics and fragrances.

TransDigm, an industrials sector company, is a global designer, producer and supplier of aircraft components for use on commercial and military-aircraft. The company experienced more than 30% growth in revenue and earnings during the period driven partly by acquisitions. Alexion Pharmaceuticals and Catamaran were leading performers among our health care positions. Alexion is a global biopharmaceutical company that focuses on developing treatments for ultra-rare diseases. The company’s lead drug Soliris treats patients with rare, life-threatening blood disorders. In addition to growing quickly in its original indication, Soliris was approved for patients in a second indication. Catamaran Corp., a pharmacy benefit management (PBM) service provider, completed the acquisition of a large competitor, which we believe enhances its prospects for profitability and growth. Catamaran also reported strong quarterly financial results throughout the period.

Top Individual Detractors

While detractors from performance were limited this period, the most significant were Timken Co., HMS Holdings Corp. and Chipotle Mexican Grill, Inc. Timken Co. is an industrials sector company that manufactures bearings, high-performance steels and related components. The tumultuous economic environment in tandem with weak demand, particularly in Asia and Europe, weighed on the company’s stock. HMS Holdings provides specialized services to health care providers and payers. The company announced disappointing third quarter results and lowered guidance. Chipotle Mexican Grill, a consumer discretionary holding, is an operator of quick service Mexican restaurants that reported a slowdown in sales in the second quarter. We exited our positions in these three stocks during the period.

OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA 3

Strategy & Outlook

Looking forward, we expect a challenging macroeconomic environment characterized by modest GDP growth, very low interest rates and anemic corporate profit growth. In addition, we believe the stock market will be influenced by uncertainty involving fiscal matters, including the debt ceiling in the U.S., difficult economic and sovereign debt challenges in Europe as well as questions about the growth prospects of China.

Despite these challenges, we are encouraged that the Small and Mid-Cap Growth segments of the market offer in our view reasonable valuations, above average growth prospects, relatively low exposure to the problems of Europe and possible mergers and acquisitions interest from large companies seeking new avenues of growth. We will continue to focus our efforts on seeking high-quality, faster growing small and mid-sized companies that we believe have the potential to generate positive returns.

Investors should consider the Fund’s investment objective, risks, charges and expenses carefully before investing. The Fund’s prospectus and summary prospectus contain this and other information about the Fund, and may be obtained by asking your financial advisor or calling us at 1.800.988.8287. Read prospectuses and summary prospectuses carefully before investing.

Total returns include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown.

The Fund’s investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OppenheimerFunds, Inc. or its affiliates.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

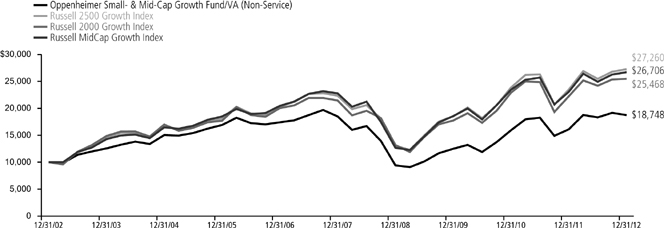

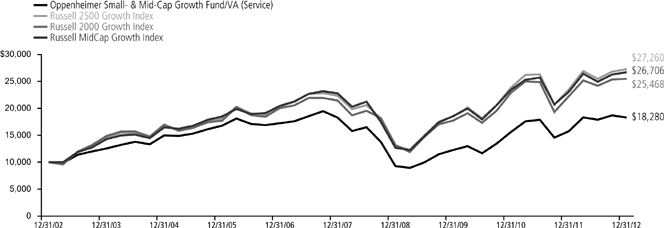

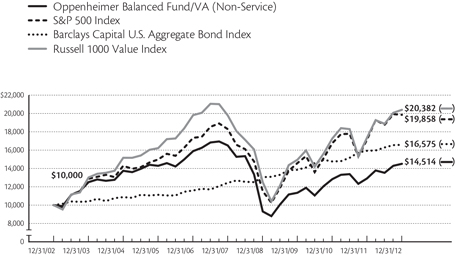

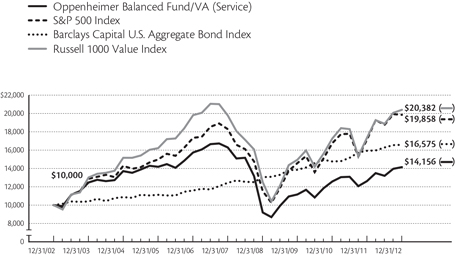

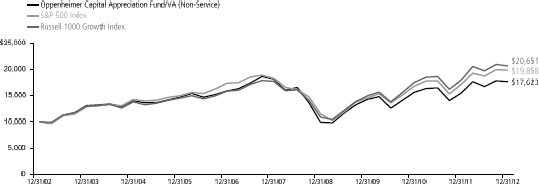

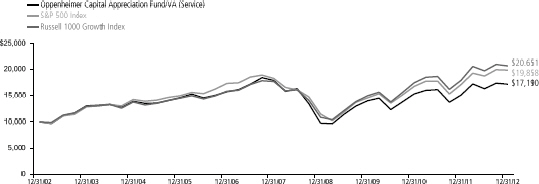

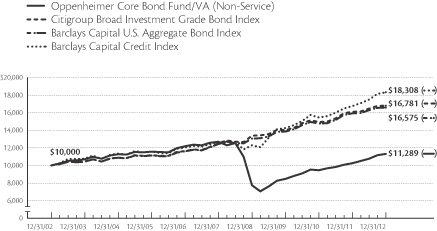

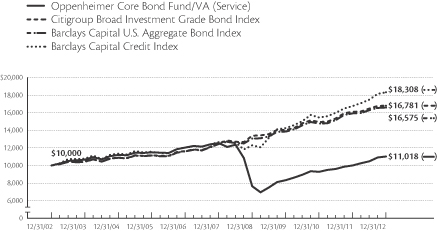

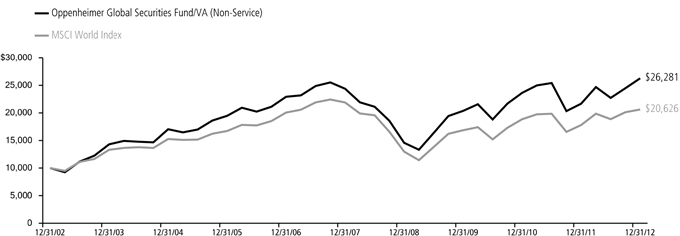

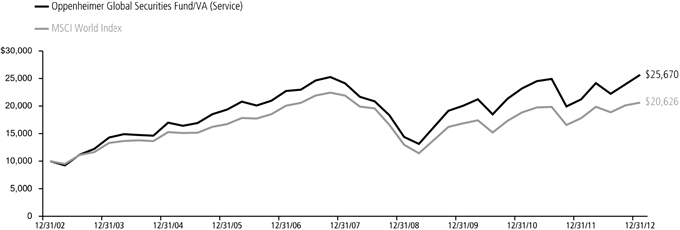

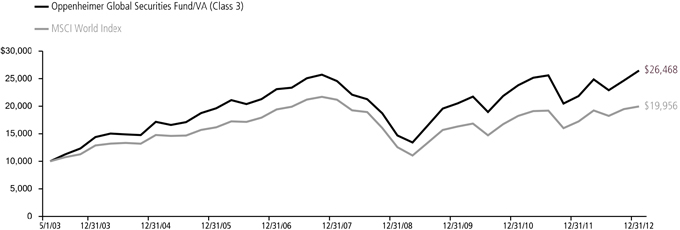

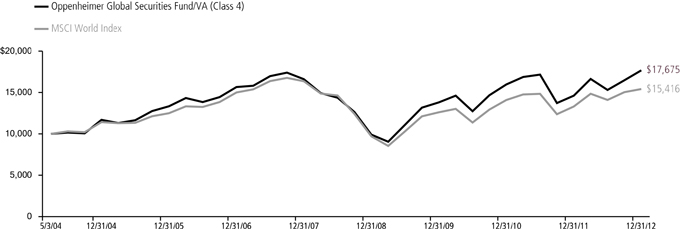

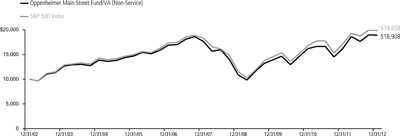

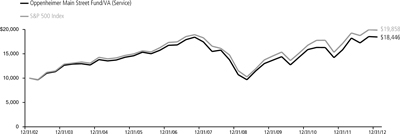

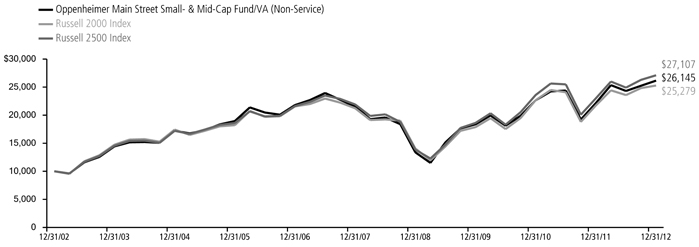

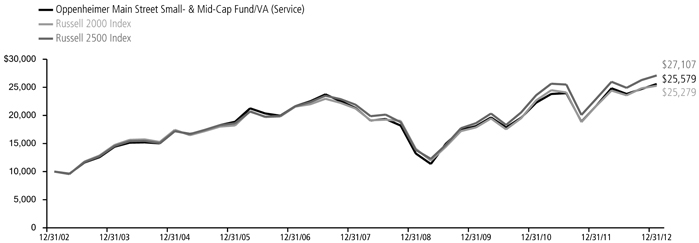

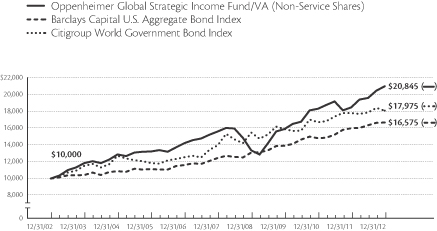

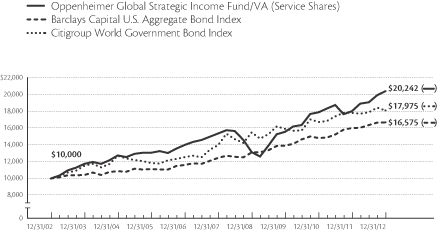

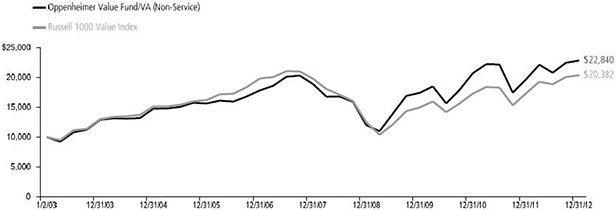

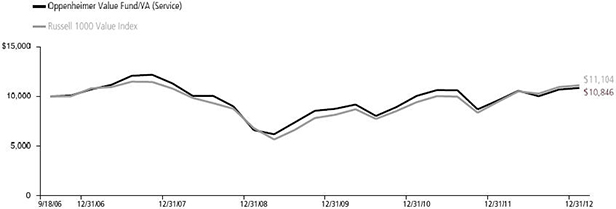

Comparing the Fund’s Performance to the Market. The graphs that follow show the performance of a hypothetical $10,000 investment in each share class of the Fund held until December 31, 2012. Performance is measured over a ten-fiscal-year period for both Classes. Performance information does not reflect charges that apply to separate accounts investing in the Fund. If these charges were taken into account, performance would be lower. The graphs assume that all dividends and capital gains distributions were reinvested in additional shares. Past performance cannot guarantee future results.

The Fund’s performance is compared to the performance of the Russell 2500 Growth Index, the Russell 2000 Growth Index and the Russell MidCap Growth Index. The Russell 2500 Growth Index is an index of U.S. small-cap and mid-cap growth stocks. The Russell 2000 Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell MidCap Growth Index is an index that measures the performance of those Russell mid-cap companies with higher price-to-book ratios and higher forecasted growth values. The indices are unmanaged and cannot be purchased directly by investors. Index performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the indices.

4 OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

Non-Service Shares

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

Average Annual Total Returns of Non-Service Shares of the Fund at 12/31/12

1-Year 16.45% 5-Year 0.27% 10-Year 6.49%

Service Shares

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

Average Annual Total Returns of Service Shares of the Fund at 12/31/12

1-Year 16.17% 5-Year 0.01% 10-Year 6.22%

The performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, call us at 1.800.988.8287. The Fund’s total returns should not be expected to be the same as the returns of other funds, whether or not both funds have the same portfolio managers and/or similar names. The Fund’s total returns include changes in share price and reinvested distributions but do not include the charges associated with the separate account products that offer this Fund. Such performance would have been lower if such charges were taken into account.

OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA 5

|

FUND EXPENSES | ||

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended December 31, 2012.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes.

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any charges associated with the separate accounts that offer this Fund. Therefore, the “hypothetical” lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these separate account charges were included your costs would have been higher.

| Actual | Beginning Account Value |

Ending Account Value |

Expenses Paid During 6 Months Ended December 31, 2012 |

|||||||||||

| Non-Service shares |

$ | 1,000.00 | $ | 1,023.60 | $ | 4.08 | ||||||||

| Service shares |

1,000.00 | 1,022.50 | 5.35 | |||||||||||

| Hypothetical |

||||||||||||||

| (5% return before expenses) |

||||||||||||||

| Non-Service shares |

1,000.00 | 1,021.11 | 4.07 | |||||||||||

| Service shares |

1,000.00 | 1,019.86 | 5.35 | |||||||||||

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended December 31, 2012 are as follows:

| Class | Expense Ratios | |||

| Class Non-Service |

0.80% | |||

| Class Service |

1.05 |

The expense ratios reflect voluntary waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

6 OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

STATEMENT OF INVESTMENTS December 31, 2012 | ||

OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA 7

|

STATEMENT OF INVESTMENTS / (Continued) | ||

Footnotes to Statement of Investments

1. Non-income producing security.

2. Rate shown is the 7-day yield as of December 31, 2012.

3. Is or was an affiliate, as defined in the Investment Company Act of 1940, at or during the period ended December 31, 2012, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the period in which the issuer was an affiliate are as follows:

| Shares December 30, 2011a |

Gross Additions |

Gross Reductions |

Shares December 31, 2012 |

|||||||||||||

| Oppenheimer Institutional Money Market Fund, Cl. E |

14,138,260 | 229,904,918 | 232,730,167 | 11,313,011 | ||||||||||||

| Value | Income | |||||||||||||||

| Oppenheimer Institutional Money Market Fund, Cl. E |

$ | 11,313,011 | $ | 18,398 | ||||||||||||

a. December 30, 2011 represents the last business day of the Fund’s 2011 fiscal year. See Note 1 of the accompanying Notes.

See accompanying Notes to Financial Statements.

8 OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

STATEMENT OF ASSETS AND LIABILITIES December 31, 2012 | ||

| Assets |

||||

| Investments, at value—see accompanying statement of investments: |

||||

| Unaffiliated companies (cost $412,677,963) |

$ | 578,594,629 | ||

| Affiliated companies (cost $11,313,011) |

11,313,011 | |||

| 589,907,640 | ||||

| Cash |

36,828 | |||

| Receivables and other assets: |

||||

| Shares of beneficial interest sold |

4,483,275 | |||

| Investments sold |

749,709 | |||

| Dividends |

32,091 | |||

| Other |

32,163 | |||

| Total assets |

595,241,706 | |||

| Liabilities |

||||

| Payables and other liabilities: |

||||

| Shares of beneficial interest redeemed |

210,144 | |||

| Transfer and shareholder servicing agent fees |

51,519 | |||

| Shareholder communications |

36,821 | |||

| Trustees’ compensation |

29,951 | |||

| Legal, auditing and other professional fees |

28,542 | |||

| Distribution and service plan fees |

7,410 | |||

| Other |

1,651 | |||

| Total liabilities |

366,038 | |||

| Net Assets |

$ | 594,875,668 | ||

| Composition of Net Assets |

||||

| Par value of shares of beneficial interest |

$ | 10,874 | ||

| Additional paid-in capital |

603,404,659 | |||

| Accumulated net investment income |

42,730 | |||

| Accumulated net realized loss on investments |

(174,499,261 | ) | ||

| Net unrealized appreciation on investments |

165,916,666 | |||

| Net Assets |

$ | 594,875,668 | ||

| Net Asset Value Per Share |

||||

| Non-Service Shares: |

||||

| Net asset value, redemption price per share and offering price per share (based on net assets of $558,934,198 and 10,198,959 shares of beneficial interest outstanding) | $54.80 | |||

| Service Shares: |

||||

| Net asset value, redemption price per share and offering price per share (based on net assets of $35,941,470 and 674,992 shares of beneficial interest outstanding) | $53.25 | |||

See accompanying Notes to Financial Statements.

OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA 9

|

STATEMENT OF OPERATIONS For the Year Ended December 31, 2012 | ||

| Investment Income |

||||

| Dividends: |

||||

| Unaffiliated companies (net of foreign withholding taxes of $12,294) |

$ | 5,033,509 | ||

| Affiliated companies |

18,398 | |||

| Interest |

295 | |||

| Total investment income |

5,052,202 | |||

| Expenses |

||||

| Management fees |

4,415,676 | |||

| Distribution and service plan fees-Service shares |

94,918 | |||

| Transfer and shareholder servicing agent fees: |

||||

| Non-Service shares |

576,569 | |||

| Service shares |

37,939 | |||

| Shareholder communications: |

||||

| Non-Service shares |

65,176 | |||

| Service shares |

4,312 | |||

| Trustees’ compensation |

38,063 | |||

| Custodian fees and expenses |

4,077 | |||

| Administration service fees |

1,500 | |||

| Other |

69,215 | |||

| Total expenses |

5,307,445 | |||

| Less waivers and reimbursements of expenses |

(321,027 | ) | ||

| Net expenses |

4,986,418 | |||

| Net Investment Income |

65,784 | |||

| Realized and Unrealized Gain |

||||

| Net realized gain on investments from unaffiliated companies |

50,857,244 | |||

| Net change in unrealized appreciation/depreciation on investments |

42,312,507 | |||

| Net Increase in Net Assets Resulting from Operations |

$ | 93,235,535 | ||

See accompanying Notes to Financial Statements.

10 OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

STATEMENTS OF CHANGES IN NET ASSETS December 31, 2012 | ||

| Year Ended December 31, 2012 |

Year Ended December 30, 20111 |

|||||||||

| Operations |

||||||||||

| Net investment income (loss) |

$ | 65,784 | $ | (3,504,153) | ||||||

| Net realized gain |

50,857,244 | 77,531,562 | ||||||||

| Net change in unrealized appreciation/depreciation |

42,312,507 | (62,965,525) | ||||||||

| Net increase in net assets resulting from operations |

93,235,535 | 11,061,884 | ||||||||

| Beneficial Interest Transactions |

||||||||||

| Net increase (decrease) in net assets resulting from beneficial interest transactions: |

||||||||||

| Non-Service shares |

(71,703,483) | (80,390,137) | ||||||||

| Service shares |

(5,448,961) | 3,579,422 | ||||||||

| (77,152,444) | (76,810,715) | |||||||||

| Net Assets |

||||||||||

| Total increase (decrease) |

16,083,091 | (65,748,831) | ||||||||

| Beginning of period |

578,792,577 | 644,541,408 | ||||||||

| End of period (including accumulated net investment income (loss) of $42,730 and $(23,054), respectively) |

$ | 594,875,668 | $ | 578,792,577 | ||||||

1. December 30, 2011 represents the last business day of the Fund’s 2011 fiscal year. See Note 1 of the accompanying Notes.

See accompanying Notes to Financial Statements.

OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA 11

|

FINANCIAL HIGHLIGHTS | ||

| Non-Service Shares |

|

Year Ended December 31, 2012 |

|

|

Year Ended December 30, 20111 |

|

|

Year Ended December 31, 2010 |

|

|

Year Ended December 31, 2009 |

|

|

Year Ended December 31, 2008 |

| |||||

| Per Share Operating Data |

||||||||||||||||||||

| Net asset value, beginning of period |

$ | 47.06 | $ | 46.55 | $ | 36.52 | $ | 27.54 | $ | 54.07 | ||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||

| Net investment income (loss)2 |

0.01 | (0.26) | (0.11) | (0.05) | (0.13) | |||||||||||||||

| Net realized and unrealized gain (loss) |

7.73 | 0.77 | 10.14 | 9.03 | (26.40) | |||||||||||||||

| Total from investment operations |

7.74 | 0.51 | 10.03 | 8.98 | (26.53) | |||||||||||||||

| Dividends and/or distributions to shareholders: |

||||||||||||||||||||

| Net asset value, end of period |

$ | 54.80 | $ | 47.06 | $ | 46.55 | $ | 36.52 | $ | 27.54 | ||||||||||

| Total Return, at Net Asset Value3 |

16.45% | 1.09% | 27.46% | 32.61% | (49.07)% | |||||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 558,934 | $ | 543,020 | $ | 611,872 | $ | 547,683 | $ | 461,684 | ||||||||||

| Average net assets (in thousands) |

$ | 575,072 | $ | 605,083 | $ | 548,739 | $ | 478,968 | $ | 754,170 | ||||||||||

| Ratios to average net assets:4 |

||||||||||||||||||||

| Net investment income (loss) |

0.03% | (0.53)% | (0.29)% | (0.17)% | (0.30)% | |||||||||||||||

| Total expenses5 |

0.85% | 0.84% | 0.85% | 0.86% | 0.71% | |||||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses |

0.80% | 0.80% | 0.76% | 0.71% | 0.68% | |||||||||||||||

| Portfolio turnover rate |

66% | 91% | 95% | 102% | 78% |

1. December 30, 2011 represents the last business day of the Fund’s 2011 fiscal year. See Note 1 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Total returns are not annualized for periods less than one full year. Total return information does not reflect expenses that apply at the separate account level or to related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| Year Ended December 31, 2012 |

0.85 | % | ||

| Year Ended December 30, 2011 |

0.84 | % | ||

| Year Ended December 31, 2010 |

0.85 | % | ||

| Year Ended December 31, 2009 |

0.86 | % | ||

| Year Ended December 31, 2008 |

0.71 | % |

See accompanying Notes to Financial Statements.

12 OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

| Service Shares |

|

Year Ended December 31, 2012 |

|

|

Year Ended December 30, 20111 |

|

|

Year Ended December 31, 2010 |

|

|

Year Ended December 31, 2009 |

|

|

Year Ended December 31, 2008 |

| |||||

| Per Share Operating Data |

||||||||||||||||||||

| Net asset value, beginning of period |

$ | 45.84 | $ | 45.46 | $ | 35.75 | $ | 27.03 | $ | 53.22 | ||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||

| Net investment loss2 |

(0.12) | (0.37) | (0.20) | (0.13) | (0.24) | |||||||||||||||

| Net realized and unrealized gain (loss) |

7.53 | 0.75 | 9.91 | 8.85 | (25.95) | |||||||||||||||

| Total from investment operations |

7.41 | 0.38 | 9.71 | 8.72 | (26.19) | |||||||||||||||

| Dividends and/or distributions to shareholders: |

||||||||||||||||||||

| Net asset value, end of period |

$ | 53.25 | $ | 45.84 | $ | 45.46 | $ | 35.75 | $ | 27.03 | ||||||||||

| Total Return, at Net Asset Value3 |

16.17% | 0.83% | 27.16% | 32.26% | (49.21)% | |||||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 35,942 | $ | 35,773 | $ | 32,669 | $ | 26,098 | $ | 21,952 | ||||||||||

| Average net assets (in thousands) |

$ | 37,842 | $ | 37,775 | $ | 27,552 | $ | 22,605 | $ | 35,815 | ||||||||||

| Ratios to average net assets:4 |

||||||||||||||||||||

| Net investment loss |

(0.22)% | (0.78)% | (0.53)% | (0.44)% | (0.57)% | |||||||||||||||

| Total expenses5 |

1.10% | 1.09% | 1.10% | 1.12% | 0.98% | |||||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses |

1.05% | 1.05% | 1.01% | 0.97% | 0.95% | |||||||||||||||

| Portfolio turnover rate |

66% | 91% | 95% | 102% | 78% | |||||||||||||||

1. December 30, 2011 represents the last business day of the Fund’s 2011 fiscal year. See Note 1 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Total returns are not annualized for periods less than one full year. Total return information does not reflect expenses that apply at the separate account level or to related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| Year Ended December 31, 2012 |

1.10 | % | ||

| Year Ended December 30, 2011 |

1.09 | % | ||

| Year Ended December 31, 2010 |

1.10 | % | ||

| Year Ended December 31, 2009 |

1.12 | % | ||

| Year Ended December 31, 2008 |

0.98 | % |

See accompanying Notes to Financial Statements.

OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA 13

|

NOTES TO FINANCIAL STATEMENTS | ||

1. Significant Accounting Policies

Oppenheimer Small- & Mid-Cap Growth Fund/VA (the “Fund”) is a separate series of Oppenheimer Variable Account Funds, an open-end management investment company registered under the Investment Company Act of 1940, as amended. The Fund’s investment objective is to seek capital appreciation by investing in “growth type” companies. The Fund’s investment adviser is OppenheimerFunds, Inc. (the “Manager”).

The Fund offers two classes of shares. Both classes are sold at their offering price, which is the net asset value per share, to separate investment accounts of participating insurance companies as an underlying investment for variable life insurance policies, variable annuity contracts or other investment products. The class of shares designated as Service shares is subject to a distribution and service plan. Both classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class.

The following is a summary of significant accounting policies consistently followed by the Fund.

Previous Annual Period. The last day of the Fund’s fiscal year was the last day the New York Stock Exchange was open for trading. The Fund’s financial statements have been presented through that date to maintain consistency with the Fund’s net asset value calculations used for shareholder transactions.

Investment in Oppenheimer Institutional Money Market Fund. The Fund is permitted to invest daily available cash balances in an affiliated money market fund. The Fund may invest the available cash in Class E shares of Oppenheimer Institutional Money Market Fund (“IMMF”) to seek current income while preserving liquidity. IMMF is a registered open-end management investment company, regulated as a money market fund under the Investment Company Act of 1940, as amended. The Manager is also the investment adviser of IMMF. When applicable, the Fund’s investment in IMMF is included in the Statement of Investments. Shares of IMMF are valued at their net asset value per share. As a shareholder, the Fund is subject to its proportional share of IMMF’s Class E expenses, including its management fee. The Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in IMMF.

Allocation of Income, Expenses, Gains and Losses. Income, expenses (other than those attributable to a specific class), gains and losses are allocated on a daily basis to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that class.

Federal Taxes. The Fund intends to comply with provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its investment company taxable income, including any net realized gain on investments not offset by capital loss carryforwards, if any, to shareholders. Therefore, no federal income or excise tax provision is required. The Fund files income tax returns in U.S. federal and applicable state jurisdictions. The statute of limitations on the Fund’s tax return filings generally remain open for the three preceding fiscal reporting period ends.

The tax components of capital shown in the following table represent distribution requirements the Fund must satisfy under the income tax regulations, losses the Fund may be able to offset against income and gains realized in future years and unrealized appreciation or depreciation of securities and other investments for federal income tax purposes.

| Undistributed Net Investment Income |

Undistributed Long-Term Gain |

Accumulated Loss Carryforward1,2,3,4 |

Net Unrealized Appreciation Based on cost of Securities and Other Investments for Federal Income Tax Purposes |

|||||||||

| $72,666 |

$— | $174,096,463 | $165,513,859 | |||||||||

1. As of December 31, 2012, the Fund had $172,735,813 of net capital loss carryforwards available to offset future realized capital gains, if any, and thereby reduce future taxable gain distributions. Details of the capital loss carryforwards are included in the table below. Capital loss carryovers with no expiration, if any, must be utilized prior to those with expiration dates.

| Expiring | ||||||

| 2017 |

$ | 172,735,813 | ||||

2. As of December 31, 2012, the Fund had $1,360,650 of post-October losses available to offset future realized capital gains, if any.

3. During the fiscal year ended December 31, 2012, the Fund utilized $44,334,654 of capital loss carryforward to offset capital gains realized in that fiscal year.

4. During the fiscal year ended December 30, 2011, the Fund utilized $83,964,525 of capital loss carryforward to offset capital gains realized in that fiscal year.

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of dividends and distributions made during the fiscal year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. Also, due to timing of dividends and distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or net realized gain was recorded by the Fund.

14 OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

1. Significant Accounting Policies (Continued)

No distributions were paid during the years ended December 31, 2012 and December 31, 2011.

The aggregate cost of securities and other investments and the composition of unrealized appreciation and depreciation of securities and other investments for federal income tax purposes as of December 31, 2012 are noted in the following table. The primary difference between book and tax appreciation or depreciation of securities and other investments, if applicable, is attributable to the tax deferral of losses or tax realization of financial statement unrealized gain or loss.

| Federal tax cost of securities |

$ | 424,393,781 | ||

|

|

|

|||

| Gross unrealized appreciation |

$ | 168,886,438 | ||

| Gross unrealized depreciation |

(3,372,579) | |||

|

|

|

|||

| Net unrealized appreciation |

$ | 165,513,859 | ||

|

|

|

Trustees’ Compensation. The Board of Trustees has adopted a compensation deferral plan for independent trustees that enables trustees to elect to defer receipt of all or a portion of the annual compensation they are entitled to receive from the Fund. For purposes of determining the amount owed to the Trustee under the plan, deferred amounts are treated as though equal dollar amounts had been invested in shares of the Fund or in other Oppenheimer funds selected by the Trustee. The Fund purchases shares of the funds selected for deferral by the Trustee in amounts equal to his or her deemed investment, resulting in a Fund asset equal to the deferred compensation liability. Such assets are included as a component of “Other” within the asset section of the Statement of Assets and Liabilities. Deferral of trustees’ fees under the plan will not affect the net assets of the Fund, and will not materially affect the Fund’s assets, liabilities or net investment income per share. Amounts will be deferred until distributed in accordance with the compensation deferral plan.

Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations and may differ from U.S. generally accepted accounting principles, are recorded on the ex-dividend date. Income and capital gain distributions, if any, are declared and paid annually or at other times as deemed necessary by the Manager.

Investment Income. Dividend income is recorded on the ex-dividend date or upon ex-dividend notification in the case of certain foreign dividends where the ex-dividend date may have passed. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income is recognized on an accrual basis. Discount and premium, which are included in interest income on the Statement of Operations, are amortized or accreted daily.

Custodian Fees. “Custodian fees and expenses” in the Statement of Operations may include interest expense incurred by the Fund on any cash overdrafts of its custodian account during the period. Such cash overdrafts may result from the effects of failed trades in portfolio securities and from cash outflows resulting from unanticipated shareholder redemption activity. The Fund pays interest to its custodian on such cash overdrafts, to the extent they are not offset by positive cash balances maintained by the Fund, at a rate equal to the Federal Funds Rate plus 0.50%. The “Reduction to custodian expenses” line item, if applicable, represents earnings on cash balances maintained by the Fund during the period. Such interest expense and other custodian fees may be paid with these earnings.

Security Transactions. Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Indemnifications. The Fund’s organizational documents provide current and former trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Other. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

2. Securities Valuation

The Fund calculates the net asset value of its shares as of the close of the New York Stock Exchange (the “Exchange”), normally 4:00 P.M. Eastern time, on each day the Exchange is open for trading.

The Fund’s Board has adopted procedures for the valuation of the Fund’s securities and has delegated the day-to-day responsibility for valuation determinations under those procedures to the Manager. The Manager has established a Valuation Committee which is responsible for determining a “fair valuation” for any security for which market quotations are not “readily available.” The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA 15

|

NOTES TO FINANCIAL STATEMENTS / (Continued) | ||

2. Securities Valuation (Continued)

Valuation Methods and Inputs

Securities are valued using unadjusted quoted market prices, when available, as supplied primarily by third party pricing services or dealers.

The following methodologies are used to determine the market value or the fair value of the types of securities described below:

Securities traded on a registered U.S. securities exchange (including exchange-traded derivatives other than futures and futures options) are valued based on the last sale price of the security reported on the principal exchange on which it is traded, prior to the time when the Fund’s assets are valued. In the absence of a sale, the security is valued at the last sale price on the prior trading day, if it is within the spread of the current day’s closing “bid” and “asked” prices, and if not, at the current day’s closing bid price. A security of a foreign issuer traded on a foreign exchange but not listed on a registered U.S. securities exchange is valued based on the last sale price on the principal exchange on which the security is traded, as identified by the third party pricing service used by the Manager, prior to the time when the Fund’s assets are valued. If the last sale price is unavailable, the security is valued at the most recent official closing price on the principal exchange on which it is traded. If the last sales price or official closing price for a foreign security is not available, the security is valued at the mean between the bid and asked price per the exchange or, if not available from the exchange, obtained from two dealers. If bid and asked prices are not available from either the exchange or two dealers, the security is valued by using one of the following methodologies (listed in order of priority); (1) using a bid from the exchange, (2) the mean between the bid and asked price as provided by a single dealer, or (3) a bid from a single dealer.

Shares of a registered investment company that are not traded on an exchange are valued at that investment company’s net asset value per share.

Corporate and government debt securities (of U.S. or foreign issuers) and municipal debt securities, event-linked bonds, loans, mortgage-backed securities, collateralized mortgage obligations, and asset-backed securities are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers who may use matrix pricing methods to determine the evaluated prices.

Short-term money market type debt securities with a remaining maturity of sixty days or less are valued at cost adjusted by the amortization of discount or premium to maturity (amortized cost), which approximates market value. Short-term debt securities with a remaining maturity in excess of sixty days are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers.

A description of the standard inputs that may generally be considered by the third party pricing vendors in determining their evaluated prices is provided below.

| Security Type | Standard inputs generally considered by third-party pricing vendors | |

| Corporate debt, government debt, municipal, mortgage-backed and asset-backed securities | Reported trade data, broker-dealer price quotations, benchmark yields, issuer spreads on comparable securities, the credit quality, yield, maturity, and other appropriate factors. | |

| Loans | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. | |

| Event-linked bonds | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. |

If a market value or price cannot be determined for a security using the methodologies described above, or if, in the “good faith” opinion of the Manager, the market value or price obtained does not constitute a “readily available market quotation,” or a significant event has occurred that would materially affect the value of the security the security is fair valued either (i) by a standardized fair valuation methodology applicable to the security type or the significant event as previously approved by the Valuation Committee and the Fund’s Board or (ii) as determined in good faith by the Manager’s Valuation Committee. The Valuation Committee considers all relevant facts that are reasonably available, through either public information or information available to the Manager, when determining the fair value of a security. Fair value determinations by the Manager are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined. Those fair valuation standardized methodologies include, but are not limited to, valuing securities at the last sale price or initially at cost and subsequently adjusting the value based on: changes in company specific fundamentals, changes in an appropriate securities index, or changes in the value of similar securities which may be further adjusted for any discounts related to security-specific resale restrictions. When possible, such methodologies use observable market inputs such as unadjusted quoted prices of similar securities, observable interest rates, currency rates and yield curves. The methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities nor can it be assured that the Fund can obtain the fair value assigned to a security if it were to sell the security.

To assess the continuing appropriateness of security valuations, the Manager, or its third party service provider who is subject to oversight by the Manager, regularly compares prior day prices, prices on comparable securities, and sale prices to the current day prices and challenges those prices exceeding certain tolerance levels with the third party pricing service or broker source. For those securities valued by fair valuations, whether through a standardized fair valuation methodology or a fair valuation determination, the Valuation Committee reviews and affirms the reasonableness of the valuations based on such methodologies and fair valuation determinations on a regular basis after considering all relevant information that is reasonably available.

Classifications

Each investment asset or liability of the Fund is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Various data inputs are used in determining the value of each of the Fund’s investments as of the reporting period end. These data inputs are categorized in the following hierarchy under applicable financial accounting standards:

16 OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

2. Securities Valuation (Continued)

1) Level 1-unadjusted quoted prices in active markets for identical assets or liabilities (including securities actively traded on a securities exchange)

2) Level 2-inputs other than unadjusted quoted prices that are observable for the asset or liability (such as unadjusted quoted prices for similar assets and market corroborated inputs such as interest rates, prepayment speeds, credit risks, etc.)

3) Level 3-significant unobservable inputs (including the Manager’s own judgments about assumptions that market participants would use in pricing the asset or liability).

The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The table below categorizes amounts that are included in the Fund’s Statement of Assets and Liabilities as of December 31, 2012 based on valuation input level:

| Level 1— Unadjusted Quoted Prices |

Level 2— Other Significant Observable Inputs |

Level 3— Significant Unobservable Inputs |

Value | |||||||||||||

| Assets Table |

||||||||||||||||

| Investments, at Value: |

||||||||||||||||

| Common Stocks |

||||||||||||||||

| Consumer Discretionary |

$ | 127,709,473 | $ | — | $ | — | $ | 127,709,473 | ||||||||

| Consumer Staples |

24,070,801 | — | — | 24,070,801 | ||||||||||||

| Energy |

41,305,708 | — | — | 41,305,708 | ||||||||||||

| Financials |

39,935,974 | — | — | 39,935,974 | ||||||||||||

| Health Care |

87,599,118 | — | — | 87,599,118 | ||||||||||||

| Industrials |

79,393,990 | — | — | 79,393,990 | ||||||||||||

| Information Technology |

135,259,735 | — | — | 135,259,735 | ||||||||||||

| Materials |

31,828,084 | — | — | 31,828,084 | ||||||||||||

| Telecommunication Services |

11,491,746 | — | — | 11,491,746 | ||||||||||||

| Investment Company |

11,313,011 | — | — | 11,313,011 | ||||||||||||

|

|

|

|||||||||||||||

| Total Assets |

$ | 589,907,640 | $ | — | $ | — | $ | 589,907,640 | ||||||||

|

|

|

|||||||||||||||

Currency contracts and forwards, if any, are reported at their unrealized appreciation/ depreciation at measurement date, which represents the change in the contract’s value from trade date. Futures, if any, are reported at their variation margin at measurement date, which represents the amount due to/from the Fund at that date. All additional assets and liabilities included in the above table are reported at their market value at measurement date.

There have been no significant changes to the fair valuation methodologies of the Fund during the period.

3. Shares of Beneficial Interest

The Fund has authorized an unlimited number of $0.001 par value shares of beneficial interest of each class. Transactions in shares of beneficial interest were as follows:

| Year Ended December 31, 2012 | Year Ended December 30, 2011 | |||||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||||

| Non-Service Shares |

||||||||||||||||||

| Sold |

424,674 | $ | 22,730,798 | 665,252 | $ | 32,309,437 | ||||||||||||

| Redeemed |

(1,765,118 | ) | (94,434,281 | ) | (2,270,275 | ) | (112,699,574 | ) | ||||||||||

|

|

||||||||||||||||||

| Net decrease |

(1,340,444 | ) | $ | (71,703,483 | ) | (1,605,023 | ) | $ | (80,390,137 | ) | ||||||||

|

|

||||||||||||||||||

| Service Shares |

||||||||||||||||||

| Sold |

138,098 | $ | 7,173,273 | 366,560 | $ | 18,018,685 | ||||||||||||

| Redeemed |

(243,546 | ) | (12,622,234 | ) | (304,822 | ) | (14,439,263 | ) | ||||||||||

|

|

||||||||||||||||||

| Net increase (decrease) |

(105,448 | ) | $ | (5,448,961 | ) | 61,738 | $ | 3,579,422 | ||||||||||

|

|

||||||||||||||||||

4. Purchases and Sales of Securities

The aggregate cost of purchases and proceeds from sales of securities, other than short-term obligations and investments in IMMF, for the year ended December 31, 2012, were as follows:

| Purchases | Sales | |||||||||

| Investment securities |

$ | 394,290,066 | $ | 475,434,991 | ||||||

5. Fees and Other Transactions with Affiliates

Management Fees. Under the investment advisory agreement, the Fund pays the Manager a management fee based on the daily net assets of the Fund at an annual rate as shown in the following table:

OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA 17

|

NOTES TO FINANCIAL STATEMENTS / (Continued) | ||

5. Fees and Other Transactions with Affiliates (Continued)

| Fee Schedule | ||||

| Up to $200 million |

0.75% | |||

| Next $200 million |

0.72 | |||

| Next $200 million |

0.69 | |||

| Next $200 million |

0.66 | |||

| Next $700 million |

0.60 | |||

| Over $1.5 billion |

0.58 | |||

Administrative Service Fees. The Fund pays the Manager a fee of $1,500 per year for preparing and filing the Fund’s tax returns.

Transfer Agent Fees. OppenheimerFunds Services (“OFS”), a division of the Manager, acts as the transfer and shareholder servicing agent for the Fund. For the year ended December 31, 2012, the Fund paid $613,219 to OFS for services to the Fund.

Distribution and Service Plan for Service Shares. The Fund has adopted a Distribution and Service Plan (the “Plan”) in accordance with Rule 12b-1 under the Investment Company Act of 1940 for Service shares to pay OppenheimerFunds Distributor, Inc. (the “Distributor”), for distribution related services, personal service and account maintenance for the Fund’s Service shares. Under the Plan, payments are made periodically at an annual rate of 0.25% of the daily net assets of Service shares of the Fund. The Distributor currently uses all of those fees to compensate sponsors of the insurance product that offers Fund shares, for providing personal service and maintenance of accounts of their variable contract owners that hold Service shares. These fees are paid out of the Fund’s assets on an on-going basis and increase operating expenses of the Service shares, which results in lower performance compared to the Fund’s shares that are not subject to a service fee. Fees incurred by the Fund under the Plan are detailed in the Statement of Operations.

Waivers and Reimbursements of Expenses. The Manager has voluntarily agreed to limit the Fund’s expenses after payments, waivers and/or reimbursements and reduction to custodian expenses, excluding expenses incurred directly or indirectly by the Fund as a result of investments in other investment companies, wholly-owned subsidiaries and pooled investment vehicles; so that those expenses, as percentages of daily net assets, will not exceed the annual rate of 0.80% for Non-Service shares and 1.05% for Service shares. During the year ended December 31, 2012, the Manager waived fees and/or reimbursed the Fund $291,926 and $19,619 for Non-Service and Service shares, respectively.

The Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in IMMF. During the year ended December 31, 2012, the Manager waived fees and/or reimbursed the Fund $9,482 for IMMF management fees.

Some of these undertakings may be modified or terminated at any time; some may not be modified or terminated until after one year from the date of the current prospectus, as indicated therein.

6. Subsequent Event

The Board of Trustees of the Fund recently approved a series of modifications to the Fund’s investment advisory and transfer agency arrangements in connection with internal corporate restructuring efforts at OppenheimerFunds, Inc. (“OFI”). As a result of these modifications, on January 1, 2013 (the “Effective Date”), OFI Global Asset Management, Inc. (“OFI Global”), a wholly-owned subsidiary of OFI, became the investment adviser and transfer agent to the Fund under the terms of the Fund’s advisory agreement and transfer agency agreement, respectively. OFI Global, in turn, entered into a new sub-advisory agreement for the Fund, on the Effective Date, whereby OFI Global will have oversight and supervisory responsibilities and OFI will choose the Fund’s investments and provide related advisory services to the Fund. In addition, on the Effective Date, OFI Global entered into a sub-transfer agency agreement with Shareholder Services, Inc. doing business as OppenheimerFunds Services, a wholly-owned subsidiary of OFI, under which it will be responsible for providing transfer agency services to the Fund.

The realignment of advisory service responsibility between OFI Global and OFI did not result in any change in the persons managing the assets of the Fund, the level or nature of the advisory services provided to the Fund, or the fees charged to the Fund.

7. Pending Litigation

Since 2009, a number of class action lawsuits have been pending in federal courts against OppenheimerFunds, Inc., the Fund’s Adviser through December 31, 2012 and Sub-Adviser effective January 1, 2013 (the “Manager”), OppenheimerFunds Distributor, Inc., the Fund’s principal underwriter and distributor (the “Distributor”), and certain funds (but not including the Fund) advised by the Manager and distributed by the Distributor (the “Defendant Funds”). Several of these lawsuits also name as defendants certain officers and current and former trustees of the respective Defendant Funds. The lawsuits raise claims under federal securities law and allege, among other things, that the disclosure documents of the respective Defendant Funds contained misrepresentations and omissions and that the respective Defendant Funds’ investment policies were not followed. The plaintiffs in these actions seek unspecified damages, equitable relief and awards of attorneys’ fees and litigation expenses. The Defendant Funds’ Boards of Trustees have also engaged counsel to represent the Funds and the present and former Independent Trustees named in those suits.

Other class action and individual lawsuits have been filed since 2008 in various state and federal courts against the Manager and certain of its affiliates by investors seeking to recover investments they allegedly lost as a result of the “Ponzi” scheme run by Bernard L. Madoff and his firm, Bernard L. Madoff Investment Securities, LLC (“BLMIS”). Plaintiffs in these suits allege that they suffered losses as a result of their investments in several funds

18 OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

7. Pending Litigation (Continued)

managed by an affiliate of the Manager and assert a variety of claims, including breach of fiduciary duty, fraud, negligent misrepresentation, unjust enrichment, and violation of federal and state securities laws and regulations, among others. They seek unspecified damages, equitable relief and awards of attorneys’ fees and litigation expenses. Neither the Distributor, nor any of the Oppenheimer mutual funds, their independent trustees or directors are named as defendants in these lawsuits. None of the Oppenheimer mutual funds invested in any funds or accounts managed by Madoff or BLMIS. On February 28, 2011, a stipulation of partial settlement of three groups of consolidated putative class action lawsuits relating to these matters was filed in the U.S. District Court for the Southern District of New York. On August 19, 2011, the court entered an order and final judgment approving the settlement as fair, reasonable and adequate. In September 2011, certain parties filed notices of appeal from the court’s order approving the settlement. The settlement does not resolve other outstanding lawsuits against the Manager and its affiliates relating to BLMIS.

On April 16, 2010, a lawsuit was filed in New York state court against the Manager, an affiliate of the Manager and AAArdvark IV Funding Limited (“AAArdvark IV”), an entity advised by the Manager’s affiliate, in connection with investments made by the plaintiffs in AAArdvark IV. Plaintiffs allege breach of contract against the defendants and seek compensatory damages, costs and disbursements, including attorney fees. On July 15, 2011, a lawsuit was filed in New York state court against the Manager, an affiliate of the Manager and AAArdvark Funding Limited (“AAArdvark I”), an entity advised by the Manager’s affiliate, in connection with investments made by the plaintiffs in AAArdvark I. The complaint alleges breach of contract against the defendants and seeks compensatory damages, costs and disbursements, including attorney fees. On November 9, 2011, a lawsuit was filed in New York state court against the Manager, an affiliate of the Manager and AAArdvark XS Funding Limited (“AAArdvark XS”), an entity advised by the Manager’s affiliate, in connection with investments made by the plaintiffs in AAArdvark XS. The complaint alleges breach of contract against the defendants and seeks compensatory damages, costs and disbursements, including attorney fees.

The Manager believes the lawsuits and appeals described above are without legal merit and, with the exception of actions it has settled, is defending against them vigorously. While it is premature to render any opinion as to the outcome in these lawsuits, or whether any costs that the Defendant Funds may bear in defending the suits might not be reimbursed by insurance, the Manager believes that these suits should not impair the ability of the Manager or the Distributor to perform their respective duties to the Fund, and that the outcome of all of the suits together should not have any material effect on the operations of any of the Oppenheimer mutual funds.

OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA 19

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | ||

The Board of Trustees and Shareholders of Oppenheimer Variable Account Funds:

We have audited the accompanying statement of assets and liabilities of Oppenheimer Small- & Mid-Cap Growth Fund/VA (a separate series of Oppenheimer Variable Account Funds), including the statement of investments, as of December 31, 2012, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the four-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The accompanying financial highlights of Oppenheimer Small- & Mid-Cap Growth Fund/VA for the year ended December 31, 2008 were audited by other auditors whose report dated February 11, 2009 expressed an unqualified opinion on those financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2012, by correspondence with the custodian and transfer agent. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Oppenheimer Small- & Mid-Cap Growth Fund/VA as of December 31, 2012, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the four-year period then ended, in conformity with U.S. generally accepted accounting principles.

KPMG LLP

Denver, Colorado

February 19, 2013

20 OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|

FEDERAL INCOME TAX INFORMATION Unaudited | ||

In early 2013, if applicable, shareholders of record received information regarding all dividends and distributions paid to them by the Fund during calendar year 2012.

Dividends, if any, paid by the Fund during the fiscal year ended December 31, 2012 which are not designated as capital gain distributions should be multiplied by the maximum amount allowable but not less than 100% to arrive at the amount eligible for the corporate dividend-received deduction.

The foregoing information is presented to assist shareholders in reporting distributions received from the Fund to the Internal Revenue Service. Because of the complexity of the federal regulations which may affect your individual tax return and the many variations in state and local tax regulations, we recommend that you consult your tax advisor for specific guidance.

OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA 21

|

BOARD APPROVAL OF THE FUND’S INVESTMENT ADVISORY AGREEMENT Unaudited | ||

Each year, the Board of Trustees (the “Board”), including a majority of the independent Trustees, is required to determine whether to renew the Fund’s investment advisory agreement (the “Agreement”). The Investment Company Act of 1940, as amended, requires that the Board request and evaluate, and that the Manager provide, such information as may be reasonably necessary to evaluate the terms of the Agreement. The Board employs an independent consultant to prepare a report that provides information, including comparative information that the Board requests for that purpose. In addition to in-person meetings focused on this evaluation, the Board receives information throughout the year regarding Fund services, fees, expenses and performance.

The Manager and the independent consultant provided information to the Board on the following factors: (i) the nature, quality and extent of the Manager’s services, (ii) the investment performance of the Fund and the Manager, (iii) the fees and expenses of the Fund, including comparative expense information, (iv) the profitability of the Manager and its affiliates, including an analysis of the cost of providing services, (v) whether economies of scale are realized as the Fund grows and whether fee levels reflect these economies of scale for Fund investors and (vi) other benefits to the Manager from its relationship with the Fund. The Board was aware that there are alternatives to retaining the Manager.

Outlined below is a summary of the principal information considered by the Board as well as the Board’s conclusions.

Nature, Quality and Extent of Services. The Board considered information about the nature, quality and extent of the services provided to the Fund and information regarding the Manager’s key personnel who provide such services. The Manager’s duties include providing the Fund with the services of the portfolio manager and the Manager’s investment team, who provide research, analysis and other advisory services in regard to the Fund’s investments; securities trading services; oversight of third-party service providers; monitoring compliance with applicable Fund policies and procedures and adherence to the Fund’s investment restrictions; and risk management. The Manager is responsible for providing certain administrative services to the Fund as well. Those services include providing and supervising all administrative and clerical personnel who are necessary in order to provide effective corporate administration for the Fund; compiling and maintaining records with respect to the Fund’s operations; preparing and filing reports required by the Securities and Exchange Commission; preparing periodic reports regarding the operations of the Fund for its shareholders; preparing proxy materials for shareholder meetings; and preparing the registration statements required by Federal and state securities laws for the sale of the Fund’s shares. The Manager also provides the Fund with office space, facilities and equipment.

The Board also considered the quality of the services provided and the quality of the Manager’s resources that are available to the Fund. The Board took account of the fact that the Manager has had over fifty years of experience as an investment adviser and that its assets under management rank it among the top mutual fund managers in the United States. The Board evaluated the Manager’s advisory, administrative, accounting, legal, compliance services and risk management, and information the Board has received regarding the experience and professional qualifications of the Manager’s key personnel and the size and functions of its staff. In its evaluation of the quality of the portfolio management services provided, the Board considered the experience of Ronald Zibelli, Jr., the portfolio manager for the Fund, and the Manager’s investment team and analysts. The Board members also considered the totality of their experiences with the Manager as directors or trustees of the Fund and other funds advised by the Manager. The Board considered information regarding the quality of services provided by affiliates of the Manager, which its members have become knowledgeable about in connection with the renewal of the Fund’s service agreements. The Board concluded, in light of the Manager’s experience, reputation, personnel, operations and resources that the Fund benefits from the services provided under the Agreement.

Investment Performance of the Manager and the Fund. Throughout the year, the Manager provided information on the investment performance of the Fund, including comparative performance information. The Board also reviewed information, prepared by the Manager and by the independent consultant, comparing the Fund’s historical performance to relevant market indices and to the performance of other mid-cap growth funds underlying variable insurance products. The Board considered that the Fund outperformed its performance universe median for the one-year period, slightly underperformed its performance universe median for the three-year period and underperformed its performance universe median during the five- and ten-year periods. The Board also considered, however, the Manager’s assertion that the portfolio manager’s high quality emphasis, which generally was out of favor in 2009, accounted for the Fund’s underperformance. The Board considered that the Manager changed the Fund’s name and investment policies on May 1, 2010 to reflect that the Fund could invest in small-cap stocks as well as mid-cap stocks. The Board also considered the Manager’s assertion that these changes have helped improve the Fund’s recent performance. The Board also considered the Fund’s recent improved performance, ranking in the top quintile of its performance for the one-year period.

Costs of Services by the Manager. The Board reviewed the fees paid to the Manager and the other expenses borne by the Fund. The Board also considered the comparability of the fees charged and the services provided to the Fund to the fees and services for other clients or accounts advised by the Manager. The independent consultant provided comparative data in regard to the fees and expenses of the Fund and other mid-cap growth funds underlying variable insurance products. In reviewing the fees and expenses charged to the VA funds, the Board considered the Manager’s assertion that, because there is much greater disparity in the fees and services that may be provided by a manager to a VA fund as opposed to a retail fund, when comparing the expenses of the various VA funds to those of retail funds, it is most appropriate to focus on total expenses (rather than on the management fees). Accordingly, while the Board reviewed and considered all expenses, it focused on total expenses. The Board also considered that the Fund’s actual management fees and total expenses were lower than the expense group median and average. The Board noted that the Manager has voluntarily agreed to waive fees and/or reimburse the Fund for certain expenses in order to limit “Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursement” (excluding (i) interest, taxes, dividends tied to short sales, brokerage commissions, and other expenditures which are capitalized in accordance with generally accepted accounting principles; (ii) expenses incurred directly or indirectly by the Fund as a result of investments in other investment companies, wholly-owned subsidiaries and pooled investment vehicles; (iii) certain other expenses attributable to, and incurred as a result of, a Fund’s investments; and (iv) other extraordinary expenses (including litigation expenses) not incurred in the ordinary course of the Fund’s business) to the annual rates of 0.80% for Non-Service Shares and 1.05% for Service Shares as calculated on the daily net assets of the Fund. This waiver and/or reimbursement may not be amended or withdrawn until one year after the date of the Fund’s prospectus.

22 OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

Economies of Scale and Profits Realized by the Manager. The Board considered information regarding the Manager’s costs in serving as the Fund’s investment adviser, including the costs associated with the personnel and systems necessary to manage the Fund, and information regarding the Manager’s profitability from its relationship with the Fund. The Board reviewed whether the Manager may realize economies of scale in managing and supporting the Fund. The Board noted that the Fund currently has management fee breakpoints, which are intended to share with Fund shareholders economies of scale that may exist as the Fund’s assets grow.

Other Benefits to the Manager. In addition to considering the profits realized by the Manager, the Board considered information that was provided regarding the direct and indirect benefits the Manager receives as a result of its relationship with the Fund, including compensation paid to the Manager’s affiliates and research provided to the Manager in connection with permissible brokerage arrangements (soft dollar arrangements). The Board also considered that the Manager must be able to pay and retain experienced professional personnel at competitive rates to provide quality services to the Fund.

Conclusions. These factors were also considered by the independent Trustees meeting separately from the full Board, assisted by experienced counsel to the Fund and to the independent Trustees. Fund counsel and the independent Trustees’ counsel are independent of the Manager within the meaning and intent of the Securities and Exchange Commission Rules.

Based on its review of the information it received and its evaluations described above, the Board, including a majority of the independent Trustees, decided to continue the Agreement. In addition, the Board, including a majority of the Independent Trustees, approved the restructuring of the Fund’s investment advisory arrangement so that effective January 1, 2013, (i) OFI Global Asset Management, Inc. (“OFI Global”), a wholly owned subsidiary of the Manager, will serve as the investment adviser to the Fund in place of the Manager under a Restated Advisory Agreement (“Restated Advisory Agreement”), and (ii) OFI Global will enter into a Sub-Advisory Agreement (“Sub-Advisory Agreement”) with the Manager to provide investment sub-advisory services to the Fund. OFI Global will pay the Manager a percentage of the net investment advisory fee (after all applicable waivers have been deducted) that it receives from the Fund. The Agreement will continue until earlier of August 31, 2013 or the effective date of the Restated Advisory Agreement between the Fund and OFI Global. The Restated Advisory Agreement and Sub-Advisory Agreement will continue until August 31, 2013.

In arriving at its decisions, the Board did not single out any factor or factors as being more important than others, but considered all of the above information, and considered the terms and conditions of the Agreement, Restated Advisory Agreement and Sub-Advisory Agreement, including the management fees, in light of all the surrounding circumstances.

OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA 23

|

PORTFOLIO PROXY VOTING POLICIES AND PROCEDURES; UPDATES TO STATEMENTS OF INVESTMENTS Unaudited | ||

The Fund has adopted Portfolio Proxy Voting Policies and Procedures under which the Fund votes proxies relating to securities (“portfolio proxies”) held by the Fund. A description of the Fund’s Portfolio Proxy Voting Policies and Procedures is available (i) without charge, upon request, by calling the Fund toll-free at 1.800.525.7048, (ii) on the Fund’s website at oppenheimerfunds.com, and (iii) on the SEC’s website at www.sec.gov. In addition, the Fund is required to file Form N-PX, with its complete proxy voting record for the 12 months ended June 30th, no later than August 31st of each year. The Fund’s voting record is available (i) without charge, upon request, by calling the Fund toll-free at 1.800.525.7048, and (ii) in the Form N-PX filing on the SEC’s website at www.sec.gov.

The Fund files its complete schedule of portfolio holdings with the SEC for the first quarter and the third quarter of each fiscal year on Form N-Q. The Fund’s Form N-Q filings are available on the SEC’s website at www.sec.gov. Those forms may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

24 OPPENHEIMER SMALL- & MID-CAP GROWTH FUND/VA

|