| (Oppenheimer OVAF Main Street Fund/VA) | ||||||||||||||||||||

|

Investment Objective. The Fund seeks capital appreciation. |

||||||||||||||||||||

|

Fees and Expenses of the Fund. This table describes the fees and expenses that you may pay if you buy and hold or redeem shares of the Fund. The accompanying prospectus of the participating insurance company provides information on initial or contingent deferred sales charges, exchange fees or redemption fees for that variable life insurance policy, variable annuity or other investment product. The fees and expenses of those products are not charged by the Fund and are not reflected in this table. Expenses would be higher if those fees were included. |

||||||||||||||||||||

|

Shareholder Fees (fees paid directly from your investment) |

||||||||||||||||||||

|

||||||||||||||||||||

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

||||||||||||||||||||

|

||||||||||||||||||||

|

Example. The following Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in a class of shares of the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your expenses would be as follows, whether or not you redeemed your shares: |

||||||||||||||||||||

|

||||||||||||||||||||

|

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 37% of the average value of its portfolio. |

||||||||||||||||||||

|

Principal Investment Strategies. The Fund mainly invests in common stocks of U.S. companies of different capitalization ranges. The Fund currently focuses on "larger capitalization" issuers, which are considered to be companies with market capitalizations equal to the companies in the Russell 1000 Index. The portfolio managers use fundamental research and quantitative models to select securities for the Fund's portfolio, which is comprised of both growth and value stocks. While the process may change over time or vary in particular cases, in general the selection process currently uses:

The portfolio is constructed and regularly monitored based upon several analytical tools, including quantitative investment models. The Fund aims to maintain a broadly diversified portfolio across major economic sectors by applying investment parameters for both sector and position size. The portfolio managers use the following sell criteria: the stock price is approaching its target, deterioration in the company's competitive position, poor execution by the company's management, or identification of more attractive alternative investment ideas. |

||||||||||||||||||||

|

Principal Risks. The price of the Fund's shares can go up and down substantially. The value of the Fund's investments may change because of broad changes in the markets in which the Fund invests or because of poor investment selection, which could cause the Fund to underperform other funds with similar investment objectives. There is no assurance that the Fund will achieve its investment objective. When you redeem your shares, they may be worth more or less than what you paid for them. These risks mean that you can lose money by investing in the Fund. Main Risks of Investing in Stock. The value of the Fund's portfolio may be affected by changes in the stock markets. Stock markets may experience significant short-term volatility and may fall sharply at times. Different stock markets may behave differently from each other and U.S. stock markets may move in the opposite direction from one or more foreign stock markets. The prices of individual stocks generally do not all move in the same direction at the same time and a variety of factors can affect the price of a particular company's stock. These factors may include, but are not limited to: poor earnings reports, a loss of customers, litigation against the company, general unfavorable performance of the company's sector or industry, or changes in government regulations affecting the company or its industry. At times, the Fund may emphasize investments in a particular industry or economic or market sector. To the extent that the Fund increases its emphasis on investments in a particular industry or sector, the value of its investments may fluctuate more in response to events affecting that industry or sector, such as changes in economic conditions, government regulations, availability of basic resources or supplies, or other events that affect that industry or sector more than others. Main Risks of Small- and Mid-Sized Companies. The stock prices of small- and mid-sized companies may be more volatile and their securities may be more difficult to sell than those of larger companies. They may not have established markets, may have fewer customers and product lines, may have unseasoned management or less management depth and may have more limited access to financial resources. Smaller companies may not pay dividends or provide capital gains for some time, if at all. Who Is the Fund Designed For? The Fund's shares are available only as an investment option under certain variable annuity contracts, variable life insurance policies and investment plans offered through insurance company separate accounts of participating insurance companies. The Fund is designed primarily for investors seeking capital appreciation. Those investors should be willing to assume the risks of short-term share price fluctuations that are typical for a fund that focuses on stocks. The Fund is not designed for investors needing current income. The Fund is not a complete investment program. You should carefully consider your own investment goals and risk tolerance before investing in the Fund. An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. |

||||||||||||||||||||

|

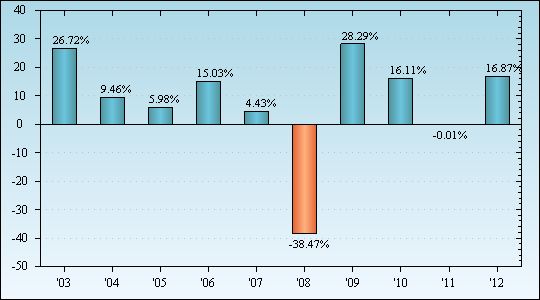

The Fund's Past Performance. The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's Non-Service Shares performance from year to year and by showing how the Fund's average annual returns for 1, 5, and 10 years compare with those of a broad measure of market performance. Charges imposed by the insurance accounts that invest in the Fund are not included and the returns would be lower if they were. The Fund's past investment performance is not necessarily an indication of how the Fund will perform in the future. More recent performance information is available by calling the toll-free number on the back of this prospectus and on the Fund's website at: https://www.oppenheimerfunds.com/fund/MainStreetFundVA |

||||||||||||||||||||

|

||||||||||||||||||||

|

During the period shown, the highest return before taxes for a calendar quarter was 18.50% (2nd Qtr 09) and the lowest return before taxes for a calendar quarter was -22.18% (4th Qtr 08). |

||||||||||||||||||||

|

Average Annual Total Returns for the periods ended December 31, 2012 |

||||||||||||||||||||

|

The following table shows the average annual total returns before taxes for each class of the Fund's shares. |

||||||||||||||||||||

|