Oppenheimer

Discovery Mid Cap Growth Fund/VA

A series of Oppenheimer Variable

Account Funds

Summary Prospectus April 28, 2017

| Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, Statement of Additional Information, Annual Report and other information about the Fund online at https://www.oppenheimerfunds.com/fund/DiscoveryMidCapGrowthFundVA. You can also get this information at no cost by calling 1.800.225.5677 or by sending an email request to: info@oppenheimerfunds.com. |

The

Fund’s prospectus and Statement of Additional Information (“SAI”), both dated April 28, 2017, and through page 27 of its most recent Annual Report, dated December 31, 2016, are

incorporated by reference into this Summary Prospectus. You can access the Fund’s prospectus and SAI at https://www.oppenheimerfunds.com/fund/DiscoveryMidCapGrowthFundVA. The Fund’s prospectus is also available from financial intermediaries who are authorized to

sell Fund shares.

Investment Objective. The Fund seeks capital appreciation.

Fees and Expenses of the

Fund. This table describes the fees and expenses that you may pay if you buy and hold or redeem shares of the Fund. The accompanying prospectus of the

participating insurance company provides information on initial or contingent deferred sales charges, exchange fees or redemption fees for that variable life insurance policy, variable annuity or other investment

product. The fees and expenses of those products are not charged by the Fund and are not reflected in this table. Expenses would be higher if those fees were included.

Shareholder Fees

(fees paid directly from your

investment)

| Non-Service | Service | ||

| Maximum Sales Charge (Load) imposed on purchases (as % of offering price) | None | None | |

| Maximum Deferred Sales Charge (Load) (as % of the lower of original offering price or redemption proceeds) | None | None | |

Annual Fund Operating Expenses

(expenses that you pay each year as a

percentage of the value of your investment)

| Non-Service Shares | Service Shares | ||

| Management Fees | 0.72% | 0.72% | |

| Distribution and/or Service (12b-1) Fees | None | 0.25% | |

| Other Expenses | 0.12% | 0.12% | |

| Total Annual Fund Operating Expenses | 0.84% | 1.09% | |

| Fee Waiver and/or Expense Reimbursement* | (0.04)% | (0.04)% | |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 0.80% | 1.05% | |

| * | After discussions with the Fund’s Board, the Manager has contractually agreed to waive fees and/or reimburse the Fund for certain expenses in order to limit “Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement” (excluding any applicable dividend expense, taxes, interest and fees from borrowing, any subsidiary expenses, Acquired Fund Fees and Expenses, brokerage commissions, unusual and infrequent expenses and certain other Fund expenses) to annual rates of 0.80% for Non-Service Shares and 1.05% for Service Shares as calculated on the daily net assets of the Fund. This fee waiver and/or expense reimbursement may not be amended or withdrawn for one year from the date of this prospectus, unless approved by the Board. |

Example.The following Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. Sales charges

and fees for the variable life insurance policy, variable annuity or other investment product offered by participating insurance companies are not charged by the Fund and are not reflected in the Example. The Example

assumes that you invest $10,000 in a class of shares of the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses

remain the same. Any applicable fee waivers and/or expense reimbursements are reflected in the below examples for the period

during which such fee waivers and/or expense

reimbursements are in effect. Although your actual costs may be higher or lower, based on these assumptions your expenses would be as follows, whether or not you redeemed your shares:

| 1 Year | 3 Years | 5 Years | 10 Years | ||

| Non-Service Shares | $82 | $265 | $464 | $1,038 | |

| Service Shares | $108 | $344 | $600 | $1,332 | |

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio

turnover rate may indicate higher transaction costs. These costs, which are not reflected in the annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal

year, the Fund’s portfolio turnover rate was 141% of the average value of its portfolio.

Principal Investment

Strategies. The Fund mainly invests in common stocks of U.S. companies that the portfolio manager expects to have above-average growth rates. The Fund seeks to

invest in newer companies or in more established companies that are in the early growth phase of their business cycle, which is typically marked by above-average growth rates. Under normal circumstances, the Fund will

invest at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of “mid-cap” issuers. The Fund defines mid-cap issuers as those issuers that are within the range of

market capitalizations of the Russell Midcap® Growth Index. This range is subject to change at any time due to market activity or changes in the composition of that

index. The range of the Russell Midcap Growth Index is reconstituted annually to preserve its capitalization characteristics. The Fund may invest up to 20% of its net assets in companies in other market capitalization

ranges. The Fund measures a company’s capitalization at the time the Fund buys a security, and is not required to sell a security if the issuer’s capitalization moves outside of the Fund’s definition

of mid-cap issuers.

The Fund invests primarily in

U.S. companies but may also purchase securities of issuers in any country, including developed countries and emerging markets. The Fund has no limits on the amount of its assets that can be invested in foreign

securities.

In selecting investments for the

Fund, the portfolio managers look for companies with high growth potential using a “bottom-up” stock selection process. The “bottom-up” approach focuses on fundamental analysis of individual

issuers before considering the impact of overall economic, market or industry trends. This approach includes analysis of a company’s financial statements and management structure and consideration of the

company’s operations, product development, and its industry position.

The portfolio managers currently

focus on high-growth companies that are characterized by industry leadership, market share growth, high caliber management teams, sustainable competitive advantages, and strong growth themes or new innovative products

or services. The portfolio managers monitor individual issuers for changes in the factors above, which may trigger a decision to sell a security, but does not require a decision to do so. The factors considered by the

portfolio managers may vary in particular cases and may change over time.

Principal Risks. The price of the Fund’s shares can go up and down substantially. The value of the Fund’s investments may change because of broad changes in

the markets in which the Fund invests or because of poor investment selection, which could cause the Fund to underperform other funds with similar investment objectives. There is no assurance that the Fund will

achieve its investment objective. When you redeem your shares, they may be worth less than what you paid for them. These risks mean that you can lose money by investing in the Fund.

Risks of Investing in

Stocks. The value of the Fund’s portfolio may be affected by changes in the stock markets. Stock markets may experience significant short-term volatility and may fall sharply at times.

Adverse events in any part of the equity or fixed-income markets may have unexpected negative effects on other market segments. Different stock markets may behave differently from each other and U.S. stock markets may

move in the opposite direction from one or more foreign stock markets.

The prices of individual stocks

generally do not all move in the same direction at the same time. For example, “growth” stocks may perform well under circumstances in which “value” stocks in general have fallen. A variety of

factors can affect the price of a particular company’s stock. These factors may include, but are not limited to: poor earnings reports, a loss of customers, litigation against the company, general unfavorable

performance of the company’s sector or industry, or changes in government regulations affecting the company or its industry. To the extent that securities of a particular type are emphasized (for example foreign

stocks, stocks of small- or mid-cap companies, growth or value stocks, or stocks of companies in a particular industry), fund share values may fluctuate more in response to events affecting the market for those types

of securities.

Industry and Sector Focus. At times the Fund may increase the relative emphasis of its investments in a particular industry or sector. The prices of stocks of issuers in a particular industry or sector may go up and

down in response to changes in economic conditions, government regulations, availability of basic resources or supplies, or other events that affect that industry or sector more than others. To the extent that the

Fund increases the relative emphasis of its investments in a particular industry or sector, its share values may fluctuate in response to events affecting that industry or sector. To some extent that risk may be

limited by the Fund’s policy of not concentrating its investments in any one industry.

Risks of Mid-Cap Companies. Mid-cap companies generally involve greater risk of loss than larger companies. The prices of securities issued by mid-sized companies may be more volatile and their securities may be less

liquid and more

2

difficult to sell than those of larger

companies. They may have less established markets, fewer customers and product lines, less management depth and more limited access to financial resources. Mid-cap companies may not pay dividends for some time, if at

all.

Risks of Growth Investing. If a growth company’s earnings or stock price fails to increase as anticipated, or if its business plans do not produce the expected results, its securities may decline sharply.

Growth companies may be newer or smaller companies that may experience greater stock price fluctuations and risks of loss than larger, more established companies. Newer growth companies tend to retain a large part of

their earnings for research, development or investments in capital assets. Therefore, they may not pay any dividends for some time. Growth investing has gone in and out of favor during past market cycles and is likely

to continue to do so. During periods when growth investing is out of favor or when markets are unstable, it may be more difficult to sell growth company securities at an acceptable price. Growth stocks may also be

more volatile than other securities because of investor speculation.

Risks of Foreign Investing. Foreign securities are subject to special risks. Securities traded in foreign markets may be less liquid and more volatile than those traded in U.S. markets. Foreign issuers are usually

not subject to the same accounting and disclosure requirements that U.S. companies are subject to, which may make it difficult for the Fund to evaluate a foreign company’s operations or financial condition. A

change in the value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of investments denominated in that foreign currency and in the value of any income or distributions

the Fund may receive on those investments. The value of foreign investments may be affected by exchange control regulations, foreign taxes, higher transaction and other costs, delays in the settlement of transactions,

changes in economic or monetary policy in the United States or abroad, expropriation or nationalization of a company’s assets, or other political and economic factors. In addition, due to the inter-relationship

of global economies and financial markets, changes in political and economic factors in one country or region could adversely affect conditions in another country or region. Investments in foreign securities may also

expose the Fund to time-zone arbitrage risk. Foreign securities may trade on weekends or other days when the Fund does not price its shares. As a result, the value of the Fund’s net assets may change on days

when you will not be able to purchase or redeem the Fund’s shares. At times, the Fund may emphasize investments in a particular country or region and may be subject to greater risks from adverse events that

occur in that country or region. Foreign securities and foreign currencies held in foreign banks and securities depositories may be subject to only limited or no regulatory oversight.

Cyclical Opportunities. At times, the Fund might seek to take advantage of short-term market movements or changes in the business cycle by investing in companies or industries that are sensitive to those changes.

For example, when the economy is expanding, companies in consumer durables and the technology sector might benefit. There is a risk that, if a cyclical event does not have the anticipated effect or when the issuer or

industry is out of phase in the business cycle, the value of the Fund’s investment could fall.

Who Is The Fund Designed

For? The Fund’s shares are available only as an investment option under certain variable annuity contracts, variable life insurance policies and

investment plans offered through insurance company separate accounts of participating insurance companies. The Fund is designed primarily for investors seeking capital appreciation over the long term. Those investors

should be willing to assume the risks of short-term share price fluctuations and losses that are typical for an aggressive growth fund emphasizing mid-cap stock investments. The Fund does not seek current income and

is not designed for investors needing current income. The Fund is not a complete investment program and may not be appropriate for all investors. You should carefully consider your own investment goals and risk

tolerance before investing in the Fund.

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

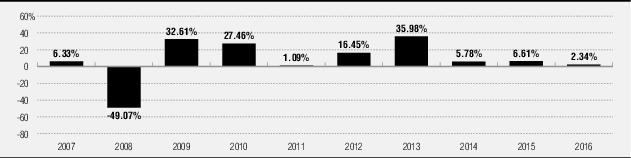

The Fund’s Past

Performance. The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s Non-Service Shares

performance from calendar year to calendar year and by showing how the Fund’s average annual returns for the periods of time shown in the table compare with those of a broad measure of market performance.

Charges imposed by the insurance accounts that invest in the Fund are not included and the returns would be lower if they were. The Fund’s past investment performance is not necessarily an indication of how the

Fund will perform in the future. More recent performance information is available by calling the toll-free number on the back of this prospectus and on the Fund’s website at:

https://www.oppenheimerfunds.com/fund/DiscoveryMidCapGrowthFundVA

3

During the period

shown, the highest return before taxes for a calendar quarter was 16.47% (1st Qtr 12) and the lowest return before taxes for a calendar quarter was -32.43% (4th Qtr 08).

The following table shows the

average annual total returns before taxes for each class of the Fund’s shares.

Average Annual Total Returns for the periods ended December 31, 2016

| 1 Year | 5 Years | 10 Years | ||

| Non-Service Shares (inception 8/15/1986) | 2.34% | 12.82% | 5.40% | |

| Service Shares (inception 10/16/2000) | 2.08% | 12.53% | 5.12% | |

| Russell Mid Cap Growth Index | 7.33% | 13.51% | 7.83% | |

| (reflects no deduction for fees, expenses, or taxes) | ||||

Investment Adviser. OFI Global Asset Management, Inc. (the “Manager”) is the Fund’s investment adviser. OppenheimerFunds, Inc. (the

“Sub-Adviser”) is its sub-adviser.

Portfolio Managers. Ronald J. Zibelli, Jr., CFA, has been Vice President and the lead portfolio manager of the Fund since November 2008. Justin Livengood, CFA, has been Vice

President and a co-portfolio manager of the Fund since April 2014.

Purchase and Sale of Fund

Shares. Shares of the Fund may be purchased only by separate investment accounts of participating insurance companies as an underlying investment for variable

life insurance policies, variable annuity contracts or other investment products. Individual investors cannot buy shares of the Fund directly. You may only submit instructions for buying or selling shares of the Fund

to your insurance company or its servicing agent, not directly to the Fund or its Transfer Agent. The accompanying prospectus of the participating insurance company provides information about how to select the Fund as

an investment option.

Taxes. Because shares of the Fund may be purchased only through insurance company separate accounts for variable annuity contracts, variable life insurance

policies or other investment products, provided certain requirements are met, any dividends and capital gains distributions will be taxable to the participating insurance company, if at all. Special tax rules apply to

life insurance companies, variable annuity contracts and variable life insurance contracts. For information on federal income taxation of a life insurance company with respect to its receipt of distributions from the

Fund and federal income taxation of owners of variable annuity or variable life insurance contracts, see the accompanying prospectus for the applicable contract.

Payments to Broker-Dealers and

Other Financial Intermediaries. The Fund, the Sub-Adviser, or their related companies may make payments to financial intermediaries, including to insurance companies that offer shares

of the Fund as an investment option. These payments for the sale of Fund shares and related services may create a conflict of interest by influencing the intermediary and your salesperson to recommend the Fund over

another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

4

THIS PAGE INTENTIONALLY LEFT

BLANK

For More Information About Oppenheimer

Discovery Mid Cap Growth Fund/VA

You can access the Fund’s

prospectus and SAI at https://www.oppenheimerfunds.com/fund/DiscoveryMidCapGrowthFundVA. You can also request additional information about the Fund or your account:

| Telephone: | Call OppenheimerFunds Services toll-free: 1.800.988.8287 | |

| Mail: | For requests by mail: OppenheimerFunds Services P.O. Box 5270 Denver, Colorado 80217-5270 | For requests by courier or express mail: OppenheimerFunds Services 12100 East Iliff Avenue Suite 300 Aurora, Colorado 80014 |

| Internet: | You may request documents, and read or download certain documents at www.oppenheimerfunds.com | |