|

OPPENHEIMER |

|

Global Fund/VA |

|

A series of Oppenheimer Variable Account Funds |

|

|

Summary Prospectus |

April 30, 2015 |

|

Share Classes: |

|

Non-Service Shares |

|

Service Shares |

Before you invest, you may want to review the Fund's prospectus, which contains more information about the Fund and its risks.

You can find the Fund's prospectus, Statement of Additional Information, Annual Report and other information about the Fund

online at www.oppenheimerfunds.com/fund/GlobalFundVA. You can also get this information at no cost by calling 1.800.225.5677 or by sending an email request to: info@oppenheimerfunds.com.

The Fund's prospectus and Statement of Additional Information ("SAI"), both dated April 30, 2015, and through page 28 of its most recent Annual Report, dated December 31, 2014, are incorporated by reference into this Summary Prospectus. You can access the Fund's prospectus and SAI at www.oppenheimerfunds.com/fund/GlobalFundVA. The Fund's prospectus is also available from financial intermediaries who are authorized to sell Fund shares.

Investment Objective. The Fund seeks capital appreciation.

Fees and Expenses of the Fund. This table describes the fees and expenses that you may pay if you buy and hold or redeem shares of the Fund. The accompanying prospectus of the participating insurance company provides information on initial or contingent deferred sales charges, exchange fees or redemption fees for that variable life insurance policy, variable annuity or other investment product. The fees and expenses of those products are not charged by the Fund and are not reflected in this table. Expenses would be higher if those fees were included.

|

Shareholder Fees (fees paid directly from your investment) |

||

|

|

Non-Service |

Service |

|

Maximum Sales Charge (Load) imposed on purchases (as % of offering price) |

None |

None |

|

Maximum Deferred Sales Charge (Load) (as % of the lower of original offering price or redemption proceeds) |

None |

None |

|

Annual Fund Operating Expenses |

|

|

|

|

|

(expenses that you pay each year as a percentage of the value of your investment) |

Non-Service |

Service |

||

|

Management Fees |

0.63 |

% |

0.63 |

% |

|

Distribution and/or Service (12b-1) Fees |

None |

0.25 |

% |

|

|

Other Expenses |

0.13 |

% |

0.13 |

% |

|

Total Annual Fund Operating Expenses |

0.76 |

% |

1.01 |

% |

Example. The following Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in a class of shares of the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your expenses would be as follows, whether or not you redeemed your shares:

|

|

1 Year |

3 Years |

5 Years |

10 Years |

||||||||

|

Non-Service |

$ |

78 |

$ |

244 |

$ |

424 |

$ |

946 |

||||

|

Service |

$ |

104 |

$ |

323 |

$ |

561 |

$ |

1,242 |

||||

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 13% of the average value of its portfolio.

Principal Investment Strategies. The Fund invests mainly in common stock of U.S. and foreign companies. The Fund can invest without limit in foreign securities and can invest in any country, including countries with developing or emerging markets. However, the Fund currently emphasizes its investments in developed markets such as the United States, Western European countries and Japan. The Fund does not limit its investments to companies in a particular market capitalization range, but primarily invests in mid- and large-cap companies.

Under normal market conditions, the Fund will invest in at least three different countries (one of which may be the United States). Typically, the Fund invests in a number of different countries. The Fund is not required to allocate its investments in any set percentages in any particular countries.

|

|

The portfolio manager primarily looks for quality companies, regardless of domicile, that have sustainable growth. His investment

approach combines a thematic approach to idea generation with bottom-up, fundamental company analysis. The portfolio manager

seeks to identify secular changes in the world and looks for pockets of durable change that he believes will drive global

growth for the next decade. These large scale structural themes are referred to collectively as MANTRA®: Mass Affluence, New

Technology, Restructuring, and Aging. The portfolio manager does not target a fixed allocation with regard to any particular

theme, and may choose to focus on various sub-themes within each theme. Within each sub-theme, the portfolio manager employs

fundamental company analysis to select investments for the Fund's portfolio. The economic characteristics he seeks include

a combination of high return on invested capital, good cash flow characteristics, high barriers to entry, dominant market

share, a strong competitive position, talented management, and balance sheet strength that the portfolio manager believes

will enable the company to fund its own growth. These criteria may vary. The portfolio manager also considers how industry

dynamics, market trends and general economic conditions may affect a company's earnings outlook.

The portfolio manager has a long-term investment horizon of typically three to five years. He also has a contrarian

buy discipline; he buys high quality companies that fit his investment criteria when their valuations underestimate their

long-term earnings potential. For example, a company's stock price may dislocate from its fundamental outlook due to a short-term

earnings glitch or negative, short-term market sentiment, which can give rise to an investment opportunity. The portfolio

manager monitors individual issuers for changes in earnings potential or other effects of changing market conditions that

may trigger a decision to sell a security, but do not require a decision to do so.

Principal Risks. The price of the Fund's shares can go up and down substantially. The value of the Fund's investments may change because of broad changes in the markets in which the Fund invests or because of poor investment selection, which could cause the Fund to underperform other funds with similar investment objectives. There is no assurance that the Fund will achieve its investment objective. When you redeem your shares, they may be worth more or less than what you paid for them. These risks mean that you can lose money by investing in the Fund.

Risks of Investing in Stock. The value of a Fund's portfolio may be affected by changes in the stock markets. Stock markets may experience significant short-term volatility and may fall sharply at times. Adverse events in any part of the equity or fixed-income markets may have unexpected negative effects on other market segments. Different stock markets may behave differently from each other and U.S. stock markets may move in the opposite direction from one or more foreign stock markets.

The prices of individual stocks generally do not all move in the same direction at the same time. For example, "growth" stocks may perform well under circumstances in which "value" stocks in general have fallen. A variety of factors can affect the price of a particular company's stock. These factors may include, but are not limited to: poor earnings reports, a loss of customers, litigation against the company, general unfavorable performance of the company's sector or industry, or changes in government regulations affecting the company or its industry. To the extent that securities of a particular type are emphasized, for example foreign stocks, stocks of small- or mid-cap companies, growth or value stocks, or stocks of companies in a particular industry, fund share values may fluctuate more in response to events affecting the market for those types of securities.

Industry and Sector Focus. At times the Fund may increase the relative emphasis of its investments in a particular industry or sector. The prices of stocks of issuers in a particular industry or sector may go up and down in response to changes in economic conditions, government regulations, availability of basic resources or supplies, or other events that affect that industry or sector more than others. To the extent that the Fund increases the relative emphasis of its investments in a particular industry or sector, its share values may fluctuate in response to events affecting that industry or sector. To some extent that risk may be limited by the Fund's policy of not concentrating its investments in any one industry.

Risks of Growth Investing. If a growth company's earnings or stock price fails to increase as anticipated, or if its business plans do not produce the expected results, its securities may decline sharply. Growth companies may be newer or smaller companies that may experience greater stock price fluctuations and risks of loss than larger, more established companies. Newer growth companies tend to retain a large part of their earnings for research, development or investments in capital assets. Therefore, they may not pay any dividends for some time. Growth investing has gone in and out of favor during past market cycles and is likely to continue to do so. During periods when growth investing is out of favor or when markets are unstable, it may be more difficult to sell growth company securities at an acceptable price. Growth stocks may also be more volatile than other securities because of investor speculation.

Risks of Foreign Investing. Foreign securities are subject to special risks. Securities traded in foreign markets may be less liquid and more volatile than those traded in U.S. markets. Foreign issuers are usually not subject to the same accounting and disclosure requirements that U.S. companies are subject to, which may make it difficult for the Fund to evaluate a foreign company's operations or financial condition. A change in the value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of securities denominated in that foreign currency and in the value of any income or distributions the Fund may receive on those securities. The value of foreign investments may be affected by exchange control regulations, foreign taxes, higher transaction and other costs, delays in the settlement of transactions, changes in economic or monetary policy in the United States or abroad, expropriation or nationalization of a company's assets, or other political and economic factors. In addition, due to the inter-relationship of global economies and financial markets, changes in political and economic factors in one country or region could adversely affect conditions in another country or region. Investments in foreign securities may also expose the Fund to time-zone arbitrage risk. Foreign securities may trade on weekends or other days when the Fund does not price its shares. As a result, the value of the Fund's net assets may change on days when you will not be able to purchase or redeem the Fund's shares. At times, the Fund may emphasize investments in a particular country or region and may be subject to greater risks from adverse events that occur in that country or region. Foreign securities and foreign currencies held in foreign banks and securities depositories may be subject to only limited or no regulatory oversight.

Risks of Developing and Emerging Markets . Investments in developing and emerging markets are subject to all the risks associated with foreign investing, which may be greater for such investments. Developing or emerging market countries may have less well-developed securities markets and exchanges that may be substantially less liquid than those of more developed markets. Settlement procedures in developing or emerging markets may differ from those of more established securities markets, and settlement delays may result in the inability to invest assets or to dispose of portfolio securities in a timely manner. Securities prices in developing or emerging markets may be

|

2 |

significantly more volatile than is the case in more developed nations of the world, and governments of developing or emerging market countries may also be more unstable than the governments of more developed countries. Such countries' economies may be more dependent on relatively few industries or investors that may be highly vulnerable to local and global changes. Developing or emerging market countries also may be subject to social, political or economic instability. The value of developing or emerging market countries' currencies may fluctuate more than the currencies of countries with more mature markets. Investments in developing or emerging market countries may be subject to greater risks of government restrictions, including confiscatory taxation, expropriation or nationalization of a company's assets, restrictions on foreign ownership of local companies, restrictions on withdrawing assets from the country, protectionist measures, and practices such as share blocking. In addition, the ability of foreign entities to participate in privatization programs of certain developing or emerging market countries may be limited by local law. Investments in securities of issuers in developing or emerging market countries may be considered speculative.

Eurozone Investment Risks. Certain of the regions in which the Fund invests, including the European Union (EU), currently experience significant financial difficulties. Following the recent global economic crisis, some of these countries have depended on, and may continue to be dependent on, the assistance from others such as the European Central Bank (ECB) or other governments or institutions, and failure to implement reforms as a condition of assistance could have a significant adverse effect on the value of investments in those and other European countries. In addition, countries that have adopted the euro are subject to fiscal and monetary controls that could limit the ability to implement their own economic policies, and could voluntarily abandon, or be forced out of, the euro. Such events could impact the market values of Eurozone and various other securities and currencies, cause redenomination of certain securities into less valuable local currencies, and create more volatile and illiquid markets.

Risks of Small- and Mid-Cap Companies. The stock prices of small- and mid-cap companies may be more volatile and their securities may be more difficult to sell than those of larger companies. They may not have established markets, may have fewer customers and product lines, may have unseasoned management or less management depth and may have more limited access to financial resources. Smaller companies may not pay dividends or provide capital gains for some time, if at all.

Investing in Special Situations. At times, the Fund may seek to benefit from what it considers to be "special situations," such as mergers, reorganizations, restructurings or other unusual events that are expected to affect a particular issuer. There is a risk that the expected change or event might not occur, which could cause the price of the security to fall, perhaps sharply. In that case, the investment might not produce the expected gains or might cause a loss. This is an aggressive investment technique that may be considered speculative.

Who Is the Fund Designed For? The Fund's shares are available only as an investment option under certain variable annuity contracts, variable life insurance policies and investment plans offered through insurance company separate accounts of participating insurance companies. The Fund is designed primarily for investors seeking capital appreciation over the long term. Those investors should be willing to assume the risks of short-term share price fluctuations that are typical for a fund that focuses on stocks and foreign securities. Because of its focus on long-term growth, the Fund may be more appropriate for investors with longer term investment goals. The Fund is not designed for investors needing current income. The Fund is not a complete investment program. You should carefully consider your own investment goals and risk tolerance before investing in the Fund.

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

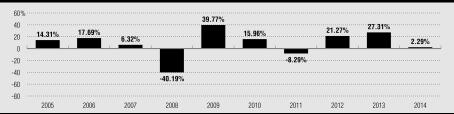

The Fund's Past Performance. The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's

Non-Service Shares performance from calendar year to calendar year and by showing how the Fund's average annual returns for

the periods of time shown in the table compare with those of a broad measure of market performance. Charges imposed by the

insurance accounts that invest in the Fund are not included and the returns would be lower if they were. The Fund's past investment

performance is not necessarily an indication of how the Fund will perform in the future. More recent performance information

is available by calling the toll-free number on the back of this prospectus and on the Fund's website at:

www.oppenheimerfunds.com/fund/GlobalFundVA

|

3 |

During the period shown, the highest return before taxes for a calendar quarter was 22.81% (2nd Qtr 09) and the lowest return before taxes for a calendar quarter was -21.51% (4th Qtr 08).

The following table shows the average annual total returns before taxes for each class of the Fund's shares.

|

Average Annual Total Returns for the periods ended December 31, 2014 |

||||||

|

|

1 Year |

5 Years |

10 Years |

|||

|

Non-Service Shares (inception 11-12-1990) |

2.29 |

% |

10.93 |

% |

7.22 |

% |

|

Service Shares (inception 07-13-2000) |

2.06 |

% |

10.65 |

% |

6.96 |

% |

|

MSCI All Country World Index |

4.16 |

% |

9.17 |

% |

6.09 |

% |

|

(reflects no deductions for fees, expenses or taxes) |

||||||

Investment Adviser. OFI Global Asset Management, Inc. (the "Manager") is the Fund's investment adviser. OppenheimerFunds, Inc. (the "Sub-Adviser") is its sub-adviser.

Portfolio Manager. Rajeev Bhaman, CFA, has been portfolio manager and Vice President of the Fund since August 2004.

Purchase and Sale of Fund Shares. Shares of the Fund may be purchased only by separate investment accounts of participating insurance companies as an underlying investment for variable life insurance policies, variable annuity contracts or other investment products. Individual investors cannot buy shares of the Fund directly. You may only submit instructions for buying or selling shares of the Fund to your insurance company or its servicing agent, not directly to the Fund or its Transfer Agent. The accompanying prospectus of the participating insurance company provides information about how to select the Fund as an investment option.

Taxes. Because shares of the Fund may be purchased only through insurance company separate accounts for variable annuity contracts, variable life insurance policies or other investment products, any dividends and capital gains distributions will be taxable to the participating insurance company, if at all. However, those payments may affect the tax basis of certain types of distributions from those accounts. Special tax rules apply to life insurance companies, variable annuity contracts and variable life insurance contracts. For information on federal income taxation of a life insurance company with respect to its receipt of distributions from the Fund and federal income taxation of owners of variable annuity or variable life insurance contracts, see the accompanying prospectus for the applicable contract.

Payments to Broker-Dealers and Other Financial Intermediaries. The Fund, the Sub-Adviser, or their related companies may make payments to financial intermediaries, including to insurance companies that offer shares of the Fund as an investment option. These payments for the sale of Fund shares and related services may create a conflict of interest by influencing the intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

For More Information About Oppenheimer Global Fund/VA

You can access the Fund's prospectus and SAI at www.oppenheimerfunds.com/fund/GlobalFundVA. You can also request additional information about the Fund or your account:

|

Telephone |

Call OppenheimerFunds Services toll-free: 1.800.988.8287 |

|

|

Mail: |

For requests by mail: |

For requests by courier or express mail: |

|

Internet: |

You may request documents, and read or download certain documents at www.oppenheimerfunds.com |

|

|

|

PR0485.001.0415 |