Quarterly Investor Presentation May 2, 2024 First Quarter 2024 Filed by WillScot Mobile Mini Holdings Corp. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: McGrath RentCorp Commission File No. 000-13292 Date: May 2, 2024

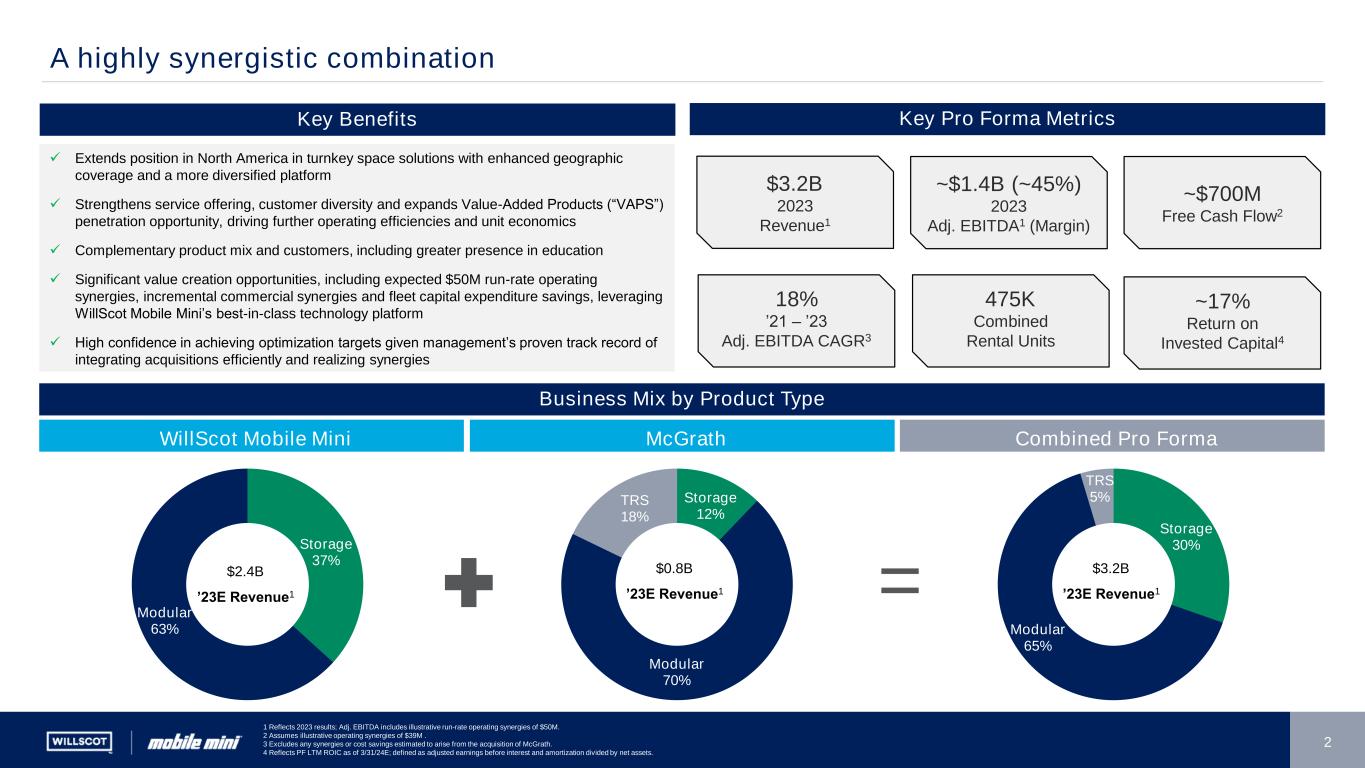

2 A highly synergistic combination Storage 30% Modular 65% TRS 5%Storage 12% Modular 70% TRS 18% Storage 37% Modular 63% $2.4B ’23E Revenue1 ✓ Extends position in North America in turnkey space solutions with enhanced geographic coverage and a more diversified platform ✓ Strengthens service offering, customer diversity and expands Value-Added Products (“VAPS”) penetration opportunity, driving further operating efficiencies and unit economics ✓ Complementary product mix and customers, including greater presence in education ✓ Significant value creation opportunities, including expected $50M run-rate operating synergies, incremental commercial synergies and fleet capital expenditure savings, leveraging WillScot Mobile Mini’s best-in-class technology platform ✓ High confidence in achieving optimization targets given management’s proven track record of integrating acquisitions efficiently and realizing synergies Key Benefits Business Mix by Product Type Combined Pro Forma $3.2B 2023 Revenue1 ~$1.4B (~45%) 2023 Adj. EBITDA1 (Margin) 18% ’21 – ’23 Adj. EBITDA CAGR3 ~17% Return on Invested Capital4 475K Combined Rental Units Key Pro Forma Metrics WillScot Mobile Mini McGrath =$0.8B ’23E Revenue1 $3.2B ’23E Revenue1 ~$700M Free Cash Flow2 1 Reflects 2023 results; Adj. EBITDA includes illustrative run-rate operating synergies of $50M. 2 Assumes illustrative operating synergies of $39M . 3 Excludes any synergies or cost savings estimated to arise from the acquisition of McGrath. 4 Reflects PF LTM ROIC as of 3/31/24E; defined as adjusted earnings before interest and amortization divided by net assets.

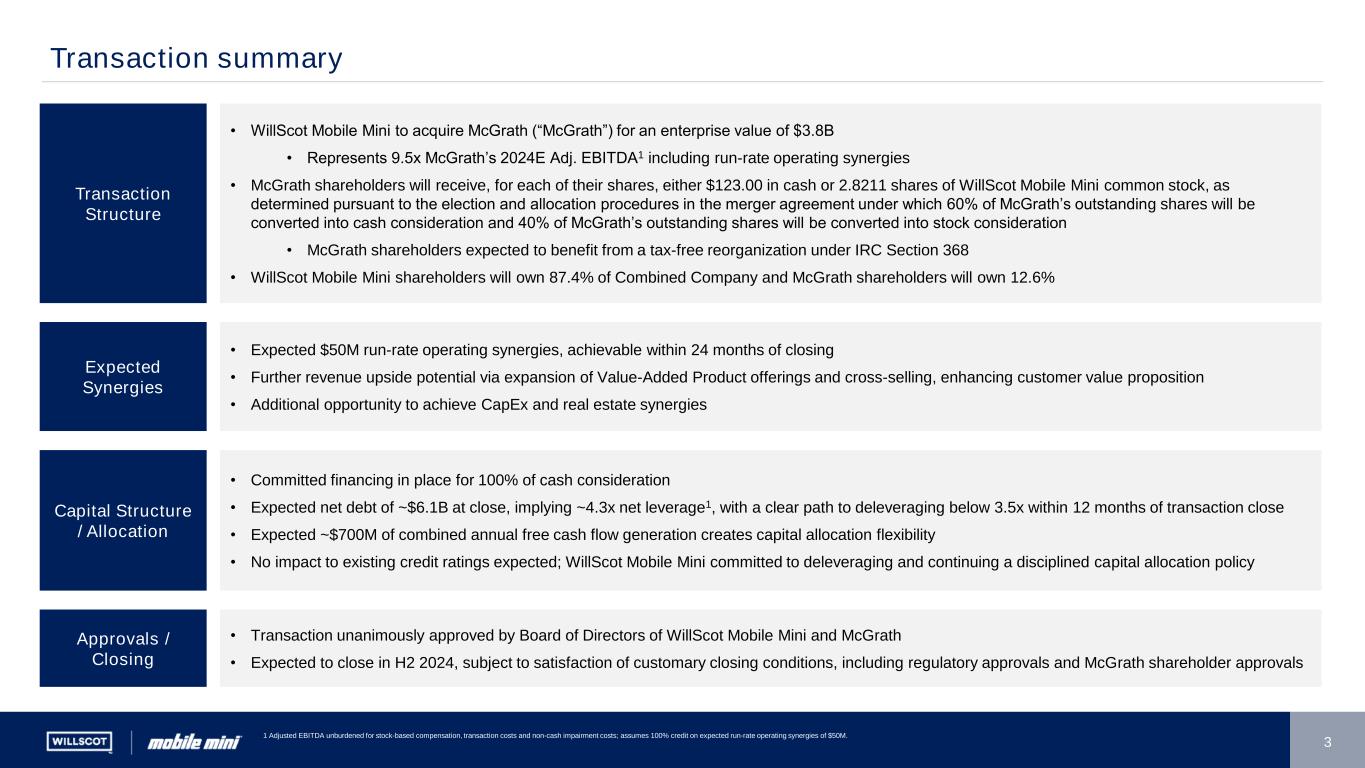

3 Transaction summary • WillScot Mobile Mini to acquire McGrath (“McGrath”) for an enterprise value of $3.8B • Represents 9.5x McGrath’s 2024E Adj. EBITDA1 including run-rate operating synergies • McGrath shareholders will receive, for each of their shares, either $123.00 in cash or 2.8211 shares of WillScot Mobile Mini common stock, as determined pursuant to the election and allocation procedures in the merger agreement under which 60% of McGrath’s outstanding shares will be converted into cash consideration and 40% of McGrath’s outstanding shares will be converted into stock consideration • McGrath shareholders expected to benefit from a tax-free reorganization under IRC Section 368 • WillScot Mobile Mini shareholders will own 87.4% of Combined Company and McGrath shareholders will own 12.6% Transaction Structure Expected Synergies • Expected $50M run-rate operating synergies, achievable within 24 months of closing • Further revenue upside potential via expansion of Value-Added Product offerings and cross-selling, enhancing customer value proposition • Additional opportunity to achieve CapEx and real estate synergies Capital Structure / Allocation • Committed financing in place for 100% of cash consideration • Expected net debt of ~$6.1B at close, implying ~4.3x net leverage1, with a clear path to deleveraging below 3.5x within 12 months of transaction close • Expected ~$700M of combined annual free cash flow generation creates capital allocation flexibility • No impact to existing credit ratings expected; WillScot Mobile Mini committed to deleveraging and continuing a disciplined capital allocation policy Approvals / Closing • Transaction unanimously approved by Board of Directors of WillScot Mobile Mini and McGrath • Expected to close in H2 2024, subject to satisfaction of customary closing conditions, including regulatory approvals and McGrath shareholder approvals 1 Adjusted EBITDA unburdened for stock-based compensation, transaction costs and non-cash impairment costs; assumes 100% credit on expected run-rate operating synergies of $50M.

4 Compelling strategic and financial rationale Strategic ✓ Combination of two highly complementary companies with leadership positions in turnkey space solutions ✓ Enhanced ability to serve a more diverse set of customers ✓ Broad rental fleet with long rental duration and useful life driving attractive unit economics ✓ Significant operating synergies, with high certainty given WillScot Mobile Mini’s track record for integrating acquisitions ✓ Complementary specialty fleets for turnkey space solutions across North America ✓ Demonstrated playbook for efficient integration and operational enhancement of modular and portable storage businesses ✓ Near-term capex savings enabled by branch density and enhanced fleet breadth ✓ Compounding of revenue and Adj. EBITDA growth across the combined platform ✓ Combination accelerates roll-out opportunity for VAPS, enhancing pro forma growth ✓ Combination positions the business to capitalize on significant, long-term industry tailwinds (strategic reshoring and federally-funded infrastructure investments) ✓ Unique opportunity to drive shareholder returns ✓ Combined business positioned to convert financial strength into multiple expansion and valuation re-rating ✓ Shareholders to benefit from the combined advantages across human capital economics, technological processes and operational efficiencies Financial $3.2B Combined 2023 Revenue1 45 - 50% Adj. EBITDA Margin over next 3 - 5 years2 ~$700M Combined Free Cash Flow2 $50M Expected operating synergies to be realized within ~24 months of closing 15 - 20% Return on Invested Capital over next 3 - 5 years2,3 ~$1.4B Combined 2023 Adj. EBITDA1,2 Note: All data Pro Forma for acqusition of McGrath. 1 Reflects 2023 results 2 Assumes illustrative run-rate operating synergies of $50M. 3 ROIC defined as adjusted earnings before interest and amortization divided by net assets.

5 Combination enhances customer value proposition ✓ Increased capabilities to service customers consistently ✓ Increased customer access to innovative products and services, including Value-Added Products, ProRack, Cold Storage, and ClearSpan structures ✓ Greater available fleet of ~475K pro forma rental units can be deployed across larger combined customer base and branch network ✓ Increased branch density reduces growth CapEx requirements, while more efficient utilization of the pro forma fleet helps eliminate redundancies via fleet sharing ✓ Complementary WillScot Mobile Mini and McGrath locations support synergy realization ✓ In-house refurbishments and conversions at scale are highly capital efficient and will allow deferral of new fleet purchases ✓ WillScot Mobile Mini’s best-in-class technology platform enhances overall branch network efficiency FLEX VAPS Data Package Planning Package Lateral File Cabinet 50” Flat Screen Professional Workstation Package Premium Conference Package ProRack

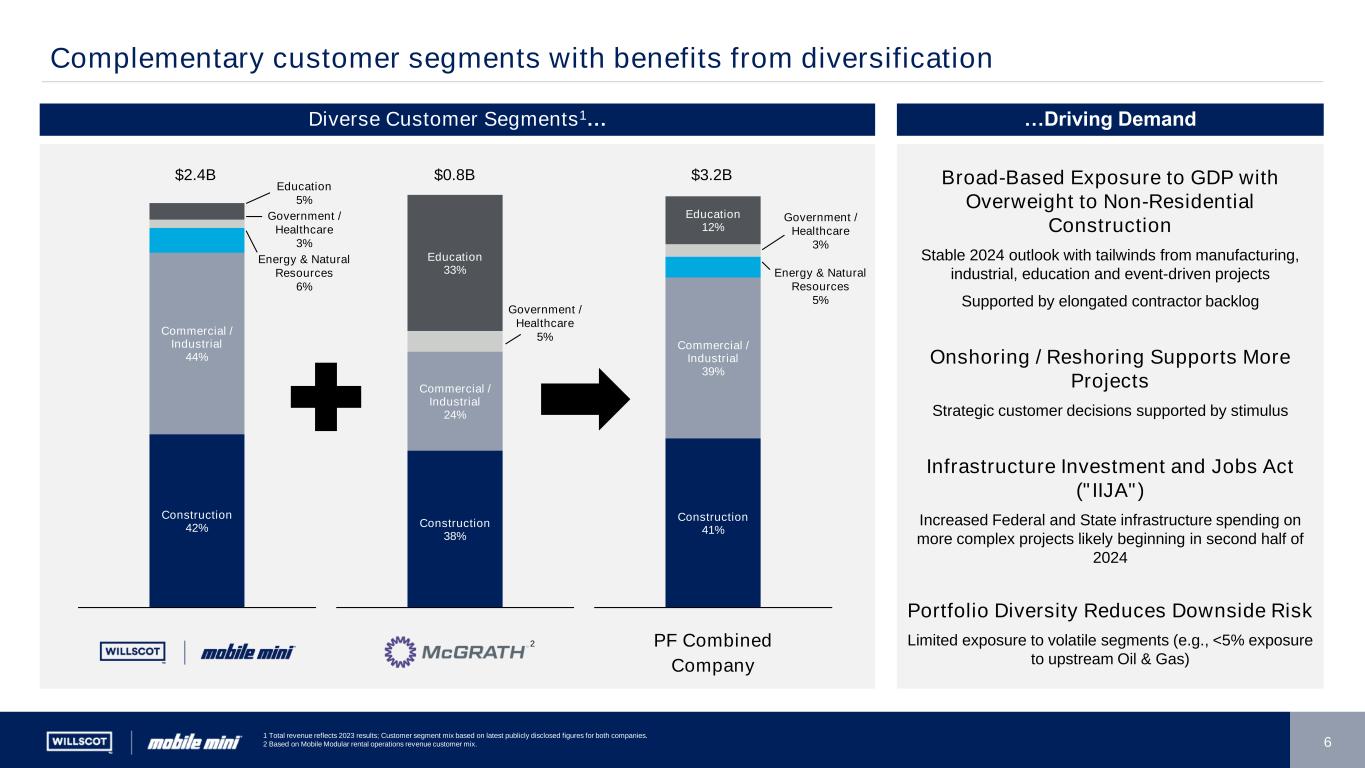

6 Complementary customer segments with benefits from diversification Diverse Customer Segments1… …Driving Demand Broad-Based Exposure to GDP with Overweight to Non-Residential Construction Stable 2024 outlook with tailwinds from manufacturing, industrial, education and event-driven projects Supported by elongated contractor backlog Onshoring / Reshoring Supports More Projects Strategic customer decisions supported by stimulus Infrastructure Investment and Jobs Act ("IIJA") Increased Federal and State infrastructure spending on more complex projects likely beginning in second half of 2024 Portfolio Diversity Reduces Downside Risk Limited exposure to volatile segments (e.g., <5% exposure to upstream Oil & Gas) Construction 42% Commercial / Industrial 44% Share $2.4B Construction 41% Commercial / Industrial 39% Education 12% Share PF Combined Company $3.2B Construction 38% Commercial / Industrial 24% Education 33% Share $0.8B Government / Healthcare 3% Education 5% Energy & Natural Resources 6% Government / Healthcare 3% Energy & Natural Resources 5% Government / Healthcare 5% 2 1 Total revenue reflects 2023 results; Customer segment mix based on latest publicly disclosed figures for both companies. 2 Based on Mobile Modular rental operations revenue customer mix.

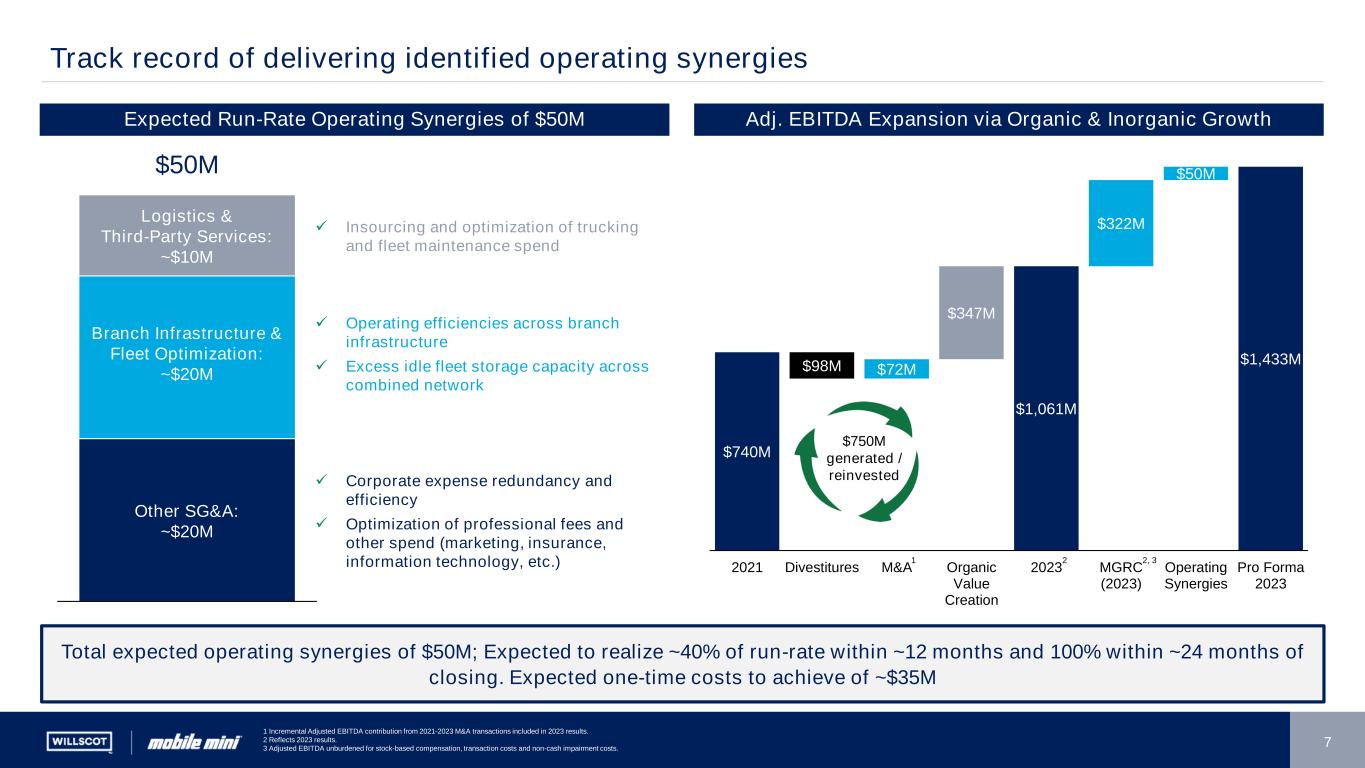

7 $740M $1,061M $1,433M $98M $72M $322M $50M $347M 2021 Divestitures M&A Organic Value Creation 2023 MGRC (2023) Operating Synergies Pro Forma 2023 Expected Run-Rate Operating Synergies of $50M Adj. EBITDA Expansion via Organic & Inorganic Growth Track record of delivering identified operating synergies $750M generated / reinvested Total expected operating synergies of $50M; Expected to realize ~40% of run-rate within ~12 months and 100% within ~24 months of closing. Expected one-time costs to achieve of ~$35M ✓ Corporate expense redundancy and efficiency ✓ Optimization of professional fees and other spend (marketing, insurance, information technology, etc.) ✓ Operating efficiencies across branch infrastructure ✓ Excess idle fleet storage capacity across combined network ✓ Insourcing and optimization of trucking and fleet maintenance spend $50M Category 1 Branch Infrastructure & Fleet Optimization: ~$20M Logistics & Third-Party Services: ~$10M Other SG&A: ~$20M 2 2, 31 1 Incremental Adjusted EBITDA contribution from 2021-2023 M&A transactions included in 2023 results. 2 Reflects 2023 results. 3 Adjusted EBITDA unburdened for stock-based compensation, transaction costs and non-cash impairment costs.

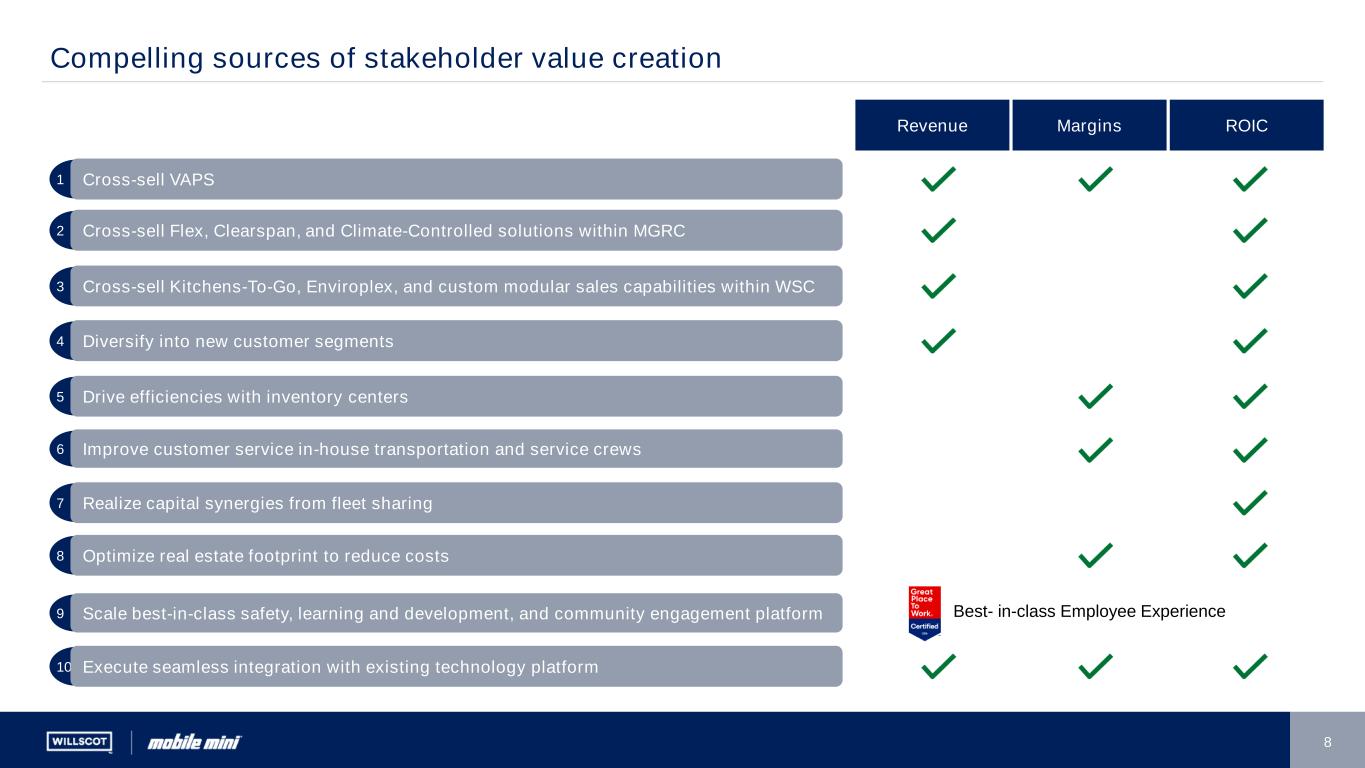

8 Compelling sources of stakeholder value creation 1 Cross-sell VAPS 2 Cross-sell Flex, Clearspan, and Climate-Controlled solutions within MGRC 3 Cross-sell Kitchens-To-Go, Enviroplex, and custom modular sales capabilities within WSC 4 Diversify into new customer segments 5 Drive efficiencies with inventory centers 6 Improve customer service in-house transportation and service crews 7 Realize capital synergies from fleet sharing 8 Optimize real estate footprint to reduce costs 9 Scale best-in-class safety, learning and development, and community engagement platform 10 Execute seamless integration with existing technology platform Revenue Margins ROIC Best- in-class Employee Experience

9 Acquisition benefits all stakeholders Unique opportunity to drive shareholder returns Powerful cash flow characteristics compound growth over time Significant, high certainty synergies achievable based on WillScot Mobile Mini’s track record of substantial value creation through M&A Enhances value proposition of turnkey space solutions across key customer segments ClearSpan VAPS FLEX