Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

| |

x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the year ended December 31, 2016

|

| |

¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number 1-9810

OWENS & MINOR, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Virginia | | 54-1701843 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

9120 Lockwood Boulevard, Mechanicsville, Virginia | | 23116 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (804) 723-7000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, $2 par value | | New York Stock Exchange |

3.875% Senior Notes due 2021 | | Not Listed |

4.375% Senior Notes due 2024 | | Not Listed |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer | | x | | Accelerated filer | | ¨ |

| | | |

Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of Common Stock held by non-affiliates (based upon the closing sales price) was approximately $2,336,644,396 as of June 30, 2016.

The number of shares of the Company’s common stock outstanding as of February 13, 2017 was 61,038,220 shares.

Documents Incorporated by Reference

The proxy statement for the annual meeting of shareholders to be held on May 5, 2017, is incorporated by reference for Item 5 of Part II and Part III.

Form 10-K Table of Contents

|

| | | | |

| | | |

Item No. | | | Page |

| | | |

| | | |

1 |

| | | |

1A. |

| | | |

1B. |

| | | |

2 |

| | | |

3 |

| | | |

| | | |

| | | |

4 |

| | Mine Safety Disclosures | |

5 |

| | | |

6 |

| | | |

7 |

| | | |

7A. |

| | | |

8 |

| | | |

9 |

| | | |

9A. |

| | | |

9B. |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

10 |

| | | |

11 |

| | | |

12 |

| | | |

13 |

| | | |

14 |

| | | |

| | | |

| | | |

| | | |

15 |

| | | |

Corporate Officers can be found at the end of this Form 10-K.

Part I

Item 1. Business

General

Owens & Minor, Inc. and subsidiaries (we, us or our), a Fortune 500 company headquartered in Richmond, Virginia, is a leading global healthcare services company that connects the world of medical products to the point of care. We provide vital supply chain assistance to the providers of healthcare services and the manufacturers of healthcare products, supplies and devices. With fully developed networks in the United States and Europe, we are equipped to serve a customer base ranging from hospitals, integrated healthcare systems, group purchasing organizations, and the U.S. federal government, to manufacturers of life-science and medical devices and supplies, including pharmaceuticals in Europe. The description of our business should be read in conjunction with the consolidated financial statements and supplementary data included in this Form 10-K.

Founded in 1882, Owens & Minor was incorporated in 1926 in Richmond, Virginia. We focus our operations on healthcare logistics services and provide our customers with a service portfolio that covers procurement, inventory management, delivery and sourcing of products for the healthcare market. Through organic growth and acquisitions over many years, we significantly expanded and strengthened our company, achieving national scale in the United States healthcare market. In 2012, through the acquisition of the Movianto Group (Movianto), we entered into third-party logistics services for the pharmaceutical, biotechnology and medical device industries in the European market, leveraging an existing platform that also expands our ability to serve our United States-based manufacturer customers on an international level.

In the fourth quarter of 2014, we completed the acquisitions of Medical Action Industries Inc. (Medical Action), a leading producer of surgical kits and procedure trays for the healthcare market, and ArcRoyal, a privately held surgical kitting company based in Ireland. These acquisitions further expanded our capabilities to offer our provider and manufacturer customers a range of kitting services, including the ability to combine instruments and supplies into sterilized custom procedure trays used in a variety of clinical procedures, such as cardiac and orthopedic procedures, and sterilized minor procedure kits and trays which are used in a wide variety of minor surgical and medical procedures, such as I.V. start kits and suture removal. This approach enables healthcare providers to track and manage the supply chain for products, supplies and instruments used in clinical settings.

In 2016, we have made certain changes to the leadership team, organizational structure, budgeting and financial reporting processes which drive changes to segment reporting. These changes align our operations into three distinct business units: Domestic, International and Clinical & Procedural Solutions (CPS). Domestic is our U.S. distribution, logistics and value-added services business, while International is our European distribution, logistics and value-added services business. CPS provides product-related solutions, including surgical and procedural kitting and sourcing. Furthermore, the basis for segment reporting shifts from the geography of the end customer to the business unit selling the product or providing the service. This includes intercompany transactions as well. Beginning with the first quarter of 2016, we report our financial results using this three segment structure and have recast prior year segment results on the same basis. Financial information by segment and geographic area appears in Note 20, “Segment Information,” of the Notes to Consolidated Financial Statements included in this annual report.

The Domestic Segment

Healthcare product volumes in the United States are dependent on the rates of utilization of medical/surgical procedures by consumers, which are subject to fluctuation according to the condition of the domestic economy and other factors such as changes in regulation affecting reimbursement. Aside from consumer-driven activity, the healthcare industry is also experiencing growing demand for advanced logistics and inventory management services from healthcare providers and manufacturers that are focused on achieving more efficient and cost-effective supply-chain operations.

In the United States, healthcare supply distributors contract with group purchasing organizations (GPOs) that negotiate distribution contracts on behalf of their healthcare provider members and also contract directly with healthcare providers and manufacturers for their services. Healthcare providers are increasingly consolidating into larger, more sophisticated networks that are actively seeking reductions in the total cost of delivering healthcare products. These healthcare providers face complex financial challenges, including managing the cost of purchasing, receiving, storing and tracking supplies.

Economic trends have also driven significant consolidation within the healthcare products distribution and logistics industry due to the competitive advantages enjoyed by larger organizations. Among these advantages are the ability to serve customers in widespread geographic locations, purchase inventory in large volume, develop more sophisticated technology platforms and decision-support systems and provide expertise to healthcare providers and manufacturers to help reduce supply chain costs.

We offer a comprehensive portfolio of products and services to healthcare providers and manufacturers in the United States. Our portfolio of medical and surgical supplies includes branded products purchased in large volume from manufacturers and our own proprietary private-label products, which are internally sourced through our sourcing capabilities abroad or through a select group of manufacturers. We store our products at our distribution centers and provide delivery of these products, along with related services, to healthcare providers around the nation.

Most supplies are delivered using a leased fleet and almost all of our delivery personnel are our teammates, ensuring a consistent level of performance and customer service. In situations where they are more cost-effective and timely, we use contract carriers and parcel delivery services. We customize product deliveries, whether the orders are “just-in-time,” “low-unit-of-measure,” pallets, or truckloads. We also customize delivery schedules according to customers’ needs to increase their efficiency in receiving and storing products. We have deployed low-unit-of-measure automated picking modules in our larger distribution centers to maximize efficiency, and our distribution center teammates use voice-pick technology to enhance speed and accuracy in performing certain warehousing processes.

We also offer additional services to healthcare providers including supplier management, analytics, inventory management, outsourced resource management, clinical supply management and business process consulting. These value-add services help providers improve their process for contracting with vendors, purchasing supplies and streamlining inventory. These services include our operating room-focused inventory management program that helps healthcare providers manage suture and endo-mechanical inventory, as well as our customizable surgical supply service that includes the kitting and delivery of surgical supplies in procedure-based totes to coincide with the healthcare providers' surgical schedule.

The majority of our distribution arrangements compensate us on a cost-plus percentage basis, under which a negotiated percentage mark-up is added to the contract cost of the product agreed to by the customer and the supplier. We price our services for certain other arrangements under activity-based pricing models. In these cases, pricing depends upon the type, level and/or complexity of services that we provide to customers, and in some cases we do not take title to the product (although we maintain certain custodial risks). As a result, this fee-for-service pricing model aligns the fees we charge with the cost of the services provided, which is a component of distribution, selling and administrative expenses, rather than with the cost of the product, which is a component of cost of goods sold.

We offer a variety of programs and services dedicated to providing logistics and marketing solutions to our manufacturer customers as well. These programs and services are designed to help manufacturers increase market share, drive sales growth, and achieve operational efficiencies. Manufacturer programs are generally negotiated on an annual basis and provide for enhanced levels of support that are aligned with the manufacturer’s annual objectives and growth goals. We have contractual arrangements with manufacturers participating in these programs that provide performance-based incentives to us, as well as cash discounts for prompt payment. Program incentives can be earned on a monthly, quarterly or annual basis.

All of our distribution and logistics services utilize a common infrastructure of distribution centers, equipment, technology, and delivery methods (internal fleet, common carrier or parcel services). We operate a network of 41 distribution centers located throughout the continental United States, which are strategically located to efficiently serve our provider and manufacturer customers. A significant investment in information technology supports our business including warehouse management systems, customer service and ordering functions, demand forecasting programs, electronic commerce, data warehousing, decision support and supply-chain management.

The International Segment

Our International segment includes our European distribution and logistics business. We provide contract logistics services to the pharmaceutical, biotechnology and medical device industries, offering a broad range of supply chain logistics services to manufacturers. Our warehousing and transportation offerings include storage, controlled-substance handling, cold-chain, emergency and export delivery, inventory management and pick & pack services. Our other services include order-to-cash, re-labeling, customer service and returns management.

Client logistics contracts in our International segment are generally for three-year terms with rolling automatic one- year extension periods. The tendering or competitive bidding process typically takes 12 to 18 months from the initial client request for proposal until becoming operational. We offer significant flexibility to tailor contracts to specific client requirements, and benefit from the expansion of clients into additional European countries. Pricing may be activity-based, with fees determined by clients’ particular requirements for warehousing, handling and delivery services, or it may be based on buy-sell wholesaler arrangements for product distribution.

Our International segment has a network of 20 logistics centers in 11 European countries, including Belgium, Czech Republic, Denmark, France, Germany, Netherlands, Poland, Slovakia, Spain, Switzerland and the United Kingdom. To serve our clients, we use a fleet of leased and owned trucks, including cold-chain delivery trucks. The majority of our drivers are our International teammates, although contract carriers and parcel services are used in situations where they are more cost-effective and timely.

Clinical & Procedural Solutions (CPS)

Our CPS segment provides product-related solutions, helping manufacturers and healthcare providers source, assemble and deliver procedure kits efficiently and effectively to the point-of-care. Our facilities in the U.S. and Ireland offer the combining of instruments and supplies into kits and trays which are assembled and delivered based on the specifications of U.S. based provider customers, as well as manufacturers and providers across Europe. These custom procedure trays (CPT) serve a wide number of surgical specialties, including robotics, orthopedics, cardiology, cath labs, gastric, laproscopic and labor and delivery. We also offer minor procedure kits, which give complete cost-saving solutions for the delivery of procedure-specific components, with more than 1,200 possible configurations assembled to meet the industry's most stringent standards. We operate two kitting facilities in the U.S and one in Ireland. For sterilized kits and trays, we utilize one or more third-party sterilization contractors.

Through our global sourcing services, based in Ireland with teams in Asia and the U.S., we work with a wide range of manufacturers around the world to offer an expanding portfolio of proprietary products and sourcing services for manufacturers and provider customers. Our full range of sourcing services include: manufacturing capacity management, container load optimization, customs compliance assurance and more. We offer our own proprietary brands of products across a wide spectrum of categories, including patient care, O.R. protection, and labor and delivery. By offering a single brand for thousands of regularly purchased items, we can increase efficiency and support product standardization initiatives.

Our CPS products are typically purchased pursuant to purchase orders or supply agreements in which the purchaser specifies whether such products are to be supplied through a distributor or directly. This segment may sell on an intercompany basis to our other segments when we are the designated distributor, to other third-party distributors or directly to healthcare providers and manufacturers.

Our Customers

We currently provide distribution, kitting, outsourced resource management and/or consulting services to thousands of healthcare provider customers. These customers include multi-facility networks of healthcare providers offering a broad spectrum of healthcare services to a particular market or markets (IDNs) as well as smaller, independent hospitals in the United States. In addition to contracting with healthcare providers at the IDN level and through GPOs, we also contract with other types of healthcare providers including surgery centers, physicians’ practices and smaller networks of hospitals that have joined together to negotiate terms. We have contracts to provide distribution services to the members of a number of national GPOs, including Vizient (formerly Novation, LLC and MedAssets Inc.), Premier, Inc. (Premier) and HealthTrust Purchasing Group (HPG). In 2016, we renewed the distribution agreements with two of these GPOs to continue our status as an authorized distributor for their member healthcare providers and allow us to compete with other authorized distributors for the business of individual members. Below is a summary of these agreements:

|

| | | | | | |

GPO | | Year of Renewal | | Term | | Sales to Members as a % of Consolidated Net Revenue in 2016 |

Vizient | | 2016 | | 3 years | | 48% |

Premier | | 2016 | | 5 years | | 20% |

HPG | | 2013 | | 5 years | | 14% |

We have our own independent relationships with most of our hospital customers through separate contractual commitments that may or may not be based upon the terms of our agreement with the GPO. As a result, the termination or expiration of an agreement with a particular GPO would not necessarily mean that we would lose the members of such GPO as our customers.

Our supplier and manufacturer customers represent the largest and most influential healthcare manufacturers in the industry. We have long-term relationships with these important companies in the healthcare supply chain and have long provided traditional distribution services to them. We currently have relationships with approximately 1,100 supplier and manufacturer customers. In the Domestic segment, sales of products supplied by Medtronic accounted for approximately 13% of our consolidated net revenue for 2016. Sales of products supplied by Becton Dickinson were approximately 9% of our consolidated net revenue for 2016. Sales of products supplied by Johnson & Johnson were approximately 9% of our consolidated net revenue for 2016.

In Europe, we serve a diverse customer base of approximately 500 manufacturer clients, including pharmaceutical, biotechnology and medical device manufacturers.

Asset Management

In the healthcare supply distribution industry, a significant investment in inventory and accounts receivable is required to meet the rapid delivery requirements of customers and provide high-quality service. As a result, efficient asset management is essential to our profitability. We continually work to refine our processes to optimize inventory and collect accounts receivable.

Inventory

We are focused in our efforts to optimize inventory and continually consolidate products and collaborate with supply-chain partners on inventory productivity initiatives. When we convert large-scale, multi-state IHN customers to our distribution network, an additional investment in inventory in advance of expected sales is generally required. We actively monitor inventory for obsolescence and use inventory turnover and other operational metrics to measure our performance in managing inventory.

Accounts Receivable

In the normal course of business, we provide credit to our U.S. and European customers and use credit management techniques to evaluate customers’ creditworthiness and facilitate collection. These techniques may include performing initial and ongoing credit evaluations of customers based primarily on financial information provided by them and from sources available to the general public. We also use third-party information from sources such as credit reporting agencies, banks and other credit references. We actively manage our accounts receivable to minimize credit risk, days sales outstanding (DSO) and accounts receivable carrying costs. Our ability to accurately invoice and ship product to customers enhances our collection results and drives our positive DSO performance. We also have arrangements with certain customers under which they make deposits on account, either because they do not meet our standards for creditworthiness or in order to obtain more favorable pricing.

Competition

The industries in which we operate are highly competitive in the United States and Europe. The U.S. sector includes Owens & Minor, Inc., as well as two major nationwide manufacturers who also provide distribution services, Cardinal Health, Inc. and privately-held Medline, Inc. In addition, we compete with a number of regional and local distributors and customer self-distribution models. Major logistics competitors serving healthcare manufacturers in the United States and in Europe include United Parcel Service, FedEx Corporation, Deutsche Post DHL and Alloga, as well as local competitors in specific countries.

Regulation

The medical/surgical supply distribution, healthcare logistics and healthcare services industries in the United States are subject to regulation by federal, state and local government agencies. Each of our distribution centers is licensed to distribute medical and surgical supplies, as well as certain pharmaceutical and related products, and each of our CPS kitting facilities is licensed to perform kit assembly operations. We must comply with laws and regulations, including those governing operations, storage, transportation, manufacturing, sales, safety and security standards for each of our distribution centers and kitting facilities, of the Food and Drug Administration, the Centers for Medicare and Medicaid Services, the Drug Enforcement Agency, the Department of Transportation, the Environmental Protection Agency, the Department of Homeland Security, the Occupational Safety and Health Administration, and state boards of pharmacy, or similar state licensing boards and regulatory agencies. We are also subject to various federal and state laws intended to protect the privacy of health or other personal information and to prevent healthcare fraud and abuse. We believe we are in material compliance with all statutes and regulations applicable to our operations.

Our operations outside the U.S. are subject to local, country and European-wide regulations, including those promulgated by the European Medicines Agency (EMA) and the Medical Devices Directive. In addition, quality requirements are imposed by healthcare industry manufacturers and pharmaceutical companies which audit our operations on a regular basis. Each of our logistics centers in Europe is licensed to distribute medicinal, medical and surgical supplies, as well as certain pharmaceutical and related products, according to the country-specific requirements. Our logistics centers in Europe are able to store ambient, cold-chain or deep frozen products, are licensed to distribute narcotic and other pharmaceutical products included in clinical trials and are licensed for secondary packaging activities for medicinal products. Movianto is also ISO 9001:2008 certified across the entire enterprise. Our Ireland-based CPS kitting facility is licensed to assemble kits and sell them in the markets we serve and operates in compliance with the requirements of ISO 9001:2008 and ISO/EU 13485:2012 standards. We believe we are in material compliance with all applicable statutes and regulations, as well as prevailing industry best practices, in the conduct of our European business operations.

Employees

At the end of 2016, we employed approximately 5,600 full- and part-time teammates in the U.S. and 2,300 outside of the U.S. Most of our teammates outside the U.S. are covered by collective bargaining agreements. We continue to have positive relationships with teammates and European works councils.

Available Information

We make our Forms 10-K, Forms 10-Q and Forms 8-K (and all amendments to these reports) available free of charge through the SEC Filings link in the Investor Relations content section on our website located at www.owens-minor.com as soon as reasonably practicable after they are filed with or furnished to the SEC. Information included on our website is not incorporated by reference into this Annual Report on Form 10-K.

You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding the company (http://www.sec.gov).

Additionally, we have adopted a written Code of Honor that applies to all of our directors, officers and teammates, including our principal executive officer and senior financial officers. This Code of Honor (including any amendments to or waivers of a provision thereof) and our Corporate Governance Guidelines are available on our website at www.owens-minor.com.

Item 1A. Risk Factors

Set forth below are certain risk factors that we currently believe could materially and adversely affect our business, financial condition and results of operations. These risk factors are in addition to those mentioned in other parts of this report and are not all of the risks that we face. We could also be affected by risks that we currently are not aware of or that we currently do not consider material to our business.

We face competition and accelerating pricing pressure.

The medical/surgical supply distribution industry in the United States is highly competitive and characterized by pricing pressure which accelerated in 2016 and put further margin pressure on our business. We expect this margin pressure to continue through 2017. We compete with other national distributors and a number of regional and local distributors, as well as customer self-distribution models and, to a lesser extent, certain third-party logistics companies. Competitive factors within the medical/surgical supply distribution industry include market pricing, total delivered product cost, product availability, the ability to fill and invoice orders accurately, delivery time, range of services provided, efficient product sourcing, inventory management, information technology, electronic commerce capabilities, and the ability to meet customer-specific requirements. Our success is dependent on the ability to compete on the above factors, while managing internal costs and expenses. These competitive pressures could have a material adverse effect on our results of operations.

In addition, in recent years, the healthcare industry in the United States has experienced and continues to experience significant consolidation in response to cost containment legislation and general market pressures to reduce costs. This consolidation of our customers and suppliers generally gives them greater bargaining power to reduce the pricing available to them, which may adversely impact our results of operations and financial condition.

The healthcare third-party logistics business in both the United States and Europe also is characterized by intense competition from a number of international, regional and local companies, including large conventional logistics companies and internet based non-traditional competitors that are moving into the healthcare and pharmaceutical distribution business. This competitive market places continuous pricing pressure on us from customers and manufacturers that could adversely affect our results of operations and financial condition if we are unable to continue to increase our revenues and to offset margin reductions caused by pricing pressures through cost control measures.

We have significant concentration in and dependence on Group Purchasing Organizations and certain healthcare provider customers.

In 2016, our top ten customers in the United States represented approximately 27% of our consolidated net revenue. In addition, in 2016, approximately 81% of our consolidated net revenue was from sales to member hospitals under contract with our largest group purchasing organizations (GPO): Vizient, Premier and HPG. We could lose a significant healthcare provider customer or GPO relationship if an existing contract expires without being replaced or is terminated by the customer or GPO prior to its expiration. For example, in April 2016, we announced the loss of our largest IDN customer which had accounted for approximately $525 million of revenue in 2015. Although the termination of our relationship with a given GPO would not necessarily result in the loss of all of the member hospitals as customers, any such termination of a GPO relationship, or a significant individual healthcare provider customer relationship, could have a material adverse effect on our results of operations and financial condition.

Our operating earnings are partially dependent on certain significant domestic suppliers.

In the United States, we distribute products from nearly 1,100 suppliers and are dependent on these suppliers for the continuing supply of products. In 2016, sales of products of our ten largest domestic suppliers accounted for approximately 56% of consolidated net revenue. In the Domestic segment, sales of products supplied by Medtronic, Becton Dickinson and Johnson & Johnson accounted for approximately 13%, 9% and 9% of our consolidated net revenue for 2016, respectively. We

rely on suppliers to provide agreeable purchasing and delivery terms and performance incentives. Our ability to sustain adequate operating earnings has been, and will continue to be, partially dependent upon our ability to obtain favorable terms and incentives from suppliers, as well as suppliers continuing use of third-party distributors to sell and deliver their products. A change in terms by a significant supplier, or the decision of such a supplier to distribute its products directly to healthcare providers rather than through third-party distributors, could have a material adverse effect on our results of operations and financial condition.

Our inability to adequately integrate acquisitions could have a material adverse effect on our operations.

In connection with our growth strategy, we from time to time acquire other businesses that we believe will expand or complement our existing businesses and operations. The integration of acquisitions involves a number of significant risks, which may include but are not limited to, the following:

| |

• | Expenses and difficulties in the transition and integration of operations and systems; |

| |

• | Retention of current customers and the ability to obtain new customers; |

| |

• | The assimilation and retention of personnel, including management personnel, in the acquired businesses; |

| |

• | Accounting, tax, regulatory and compliance issues that could arise; |

| |

• | Difficulties in implementing uniform controls, procedures and policies in our acquired companies, or in remediating control deficiencies in acquired companies not formerly subject to the Sarbanes-Oxley Act of 2002; |

| |

• | Unanticipated expenses incurred or charges to earnings based on unknown circumstances or liabilities; |

| |

• | Failure to realize the synergies and other benefits we expect from the acquisition at the pace we anticipate; |

| |

• | General economic conditions in the markets in which the acquired businesses operate; and |

| |

• | Difficulties encountered in conducting business in markets where we have limited experience and expertise. |

If we are unable to successfully complete and integrate our strategic acquisitions in a timely manner, our business, growth strategies and results of operations could be adversely affected.

Our global operations increase the extent of our exposure to the economic, political, currency and other risks of international operations.

Our global operations involve issues and risks, including but not limited to the following, any of which could have an adverse effect on our business and results of operations:

| |

• | Lack of familiarity with and expertise in conducting business in foreign markets; |

| |

• | Foreign currency fluctuations and exchange risk; |

| |

• | Unexpected changes in foreign regulations or conditions relating to labor, economic or political environment, and social norms or requirements; |

| |

• | Adverse tax consequences and difficulties in repatriating cash generated or held abroad; |

| |

• | Local economic environments, such as in the European markets served by Movianto and ArcRoyal, including recession, inflation, indebtedness, currency volatility and competition; and |

| |

• | Changes in trade protection laws and other laws affecting trade and investment, including import/export regulations in both the United States and foreign countries. |

Our operations are also subject to risks of violation of laws that prohibit improper payments to and bribery of government officials and other individuals and organizations. These laws include the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act and other similar laws and regulations in foreign jurisdictions, any violation of which could result in substantial liability and a loss of reputation in the marketplace. Failure to comply with these laws also could subject us to civil and criminal penalties that could adversely affect our business and results of operations.

Changing conditions in the United States healthcare industry may impact our results of operations.

We, along with our customers and suppliers, are subject to extensive federal and state regulations relating to healthcare as well as the policies and practices of the private healthcare insurance industry. In recent years, there have been a number of government and private initiatives to reduce healthcare costs and government spending. These changes have included an increased reliance on managed care; reductions in Medicare and Medicaid reimbursement levels; consolidation of competitors, suppliers and customers; a shift in healthcare provider venues from acute care settings to clinics, physician offices and home care; and the development of larger, more sophisticated purchasing groups. All of these changes place additional financial pressure on healthcare provider customers, who in turn seek to reduce the costs and pricing of products and services provided by us. We expect the healthcare industry to continue to change significantly and these potential changes, which may include a reduction in government support of healthcare services, adverse changes in legislation or regulations, and further reductions in

healthcare reimbursement practices, could have a material adverse effect on our business, results of operations and financial condition.

We are subject to stringent regulatory and licensing requirements.

We must comply with numerous laws and regulations in the United States, Europe, Asia and other countries where we operate. We also are required to hold permits and licenses and to comply with the operational and security standards of various governmental bodies and agencies. Any failure to comply with these laws and regulations or any failure to maintain the necessary permits, licenses or approvals, or to comply with the required standards, could disrupt our operations and/or adversely affect our results of operations and financial condition. In addition, we are subject to various federal and state laws intended to prevent healthcare fraud and abuse. The requirements of these fraud and abuse laws are complicated and subject to interpretation and may be applied by a regulator, prosecutor or judge in a manner that could have a material adverse effect on our business, results of operations and financial condition.

Additionally, our business relies on the secure transmission and storage of sensitive information relating to our customers, company and workforce, and, in certain instances, patient-identifiable health information. We are subject to state, federal and foreign laws that regulate the confidentiality of such information, how that information may be used, and the circumstances under which such information may be released. Regulations currently in place, including regulations governing electronic health data transmissions, continue to evolve and are often unclear and difficult to apply. Our failure to maintain the confidentiality of information in accordance with applicable regulatory requirements could expose us to claims, damages, fines and penalties and/or costs for remediation and, as a result, have a material adverse effect on our business and financial condition.

Products we source, assemble and sell may be subject to recalls and product liability claims.

Certain of the products that we sell and distribute are sourced and sold under one or more private labels or are assembled by us into custom trays and minor procedure kits. If these products do not function as designed, are inappropriately designed or are not properly produced, we may have to withdraw such products from the market and/or be subject to product liability claims. Although we maintain insurance against product liability and defense costs in amounts believed to be reasonable, there is no assurance that we can successfully defend any such claims or that the insurance we carry will be sufficient. A successful claim against us in excess of insurance coverage could have a material adverse impact on our business, financial condition and results of operations.

General economic conditions may adversely affect demand for our products and services.

Poor or deteriorating economic conditions in the United States and the other countries in which we conduct business could adversely affect the demand for healthcare services and consequently, the demand for our products and services. Poor economic conditions also could lead our suppliers to offer less favorable terms of purchase to distributors, which would negatively affect our profitability. These and other possible consequences of financial and economic decline could have a material adverse effect on our business, results of operations and financial condition.

Our results of operations may suffer upon the bankruptcy, insolvency, or other credit failure of a customer that has a substantial amount owed to us.

We provide credit in the normal course of business to customers. We perform initial and ongoing credit evaluations of customers and maintain reserves for credit losses. The bankruptcy, insolvency or other credit failure of one or more customers with substantial balances due to us could have a material adverse effect on our results of operations and financial condition.

Our operations depend on the proper functioning of information systems, and our business could be adversely affected if we experience a cyber-attack or other systems breach.

We rely on information systems to receive, process, analyze and manage data in distributing thousands of inventory items to customers from numerous distribution and logistics centers. These systems are also relied upon for billings to and collections from customers, as well as the purchase of and payment for inventory and related transactions from our suppliers. In addition, the success of our long-term growth strategy is dependent upon the ability to continually monitor and upgrade our information systems to provide better service to customers. Our business and results of operations may be materially adversely affected if systems are interrupted or damaged by unforeseen events (including cyber-attacks) or fail to operate for an extended period of time, or if we fail to appropriately enhance our systems to support growth and strategic initiatives.

Our distribution and logistics services include acting as the primary billing, order-to-cash and collections function for many of our customers. These services rely on the performance and uptime of our information systems. If our information

systems are interrupted, damaged or fail to operate, our customers could be negatively impacted which could have a material adverse effect on our results of operations.

We could be subject to adverse changes in the tax laws or challenges to our tax positions.

We operate throughout the United States and Europe as well as in China. As a result, we are subject to the tax laws and regulations of the United States federal, state and local governments and of various foreign jurisdictions. From time to time, legislative and regulatory initiatives are proposed, including but not limited to proposals to repeal LIFO (last-in, first-out) treatment of domestic inventory or changes in tax accounting methods for inventory, import tarriffs and taxes, or other tax items, that could adversely affect our tax positions, tax rate or cash payments for taxes.

Our business and operations depend on the proper functioning of critical facilities and distribution networks.

Damage or disruption to our distribution capabilities due to weather, natural disaster, fire, terrorism, pandemic, strikes, the financial and/or operational instability of key suppliers, geo-political events or other reasons could impair our ability to distribute our products and conduct our business. To the extent that we are unable, or it is not financially feasible, to mitigate the likelihood or potential impact of such events, or to manage effectively such events if they occur, there could be a material adverse effect on our business, financial condition or results of operations.

We operate within the European Union, including in the United Kingdom and therefore may be affected by United Kingdom's withdrawal from the European Union.

We operate within the European Union (the “E.U.”), including the United Kingdom (the “U.K.”). On June 23, 2016, the U.K. held a referendum in which voters approved an exit from the E.U., commonly referred to as “Brexit”. As a result of the referendum, it is expected that the British government will begin negotiating the terms of the U.K.’s withdrawal from the E.U. A withdrawal could, among other outcomes, disrupt the free movement of goods, services and people between the U.K. and the E.U., and disrupt trade between the U.K. and the E.U. Given the lack of comparable precedent and recent occurrence of these events, we are monitoring the situation but it is unclear what financial, trade and legal implications the withdrawal of the U.K. from the E.U. would have and how such withdrawal may affect our operations or financial performance.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Our Domestic segment operated 41 distribution centers as well as office and warehouse space across the United States as of December 31, 2016. We leased all of the centers from unaffiliated third parties with the exception of one location which we own. We also leased small offices for sales and consulting personnel across the United States. In addition, we leased space on a temporary basis from time to time to meet our inventory storage needs.

At December 31, 2016, our International segment properties spanned 11 European countries and included 20 logistics centers (18 leased and two owned) and seven transport depots, of which we leased six and owned one. We also leased office space in the United Kingdom and Ireland.

At December 31, 2016, our CPS segment operated two kitting facilities in the United States (one leased and one owned) and one in Europe. We also leased offices in China, Malaysia and Ireland.

We own our corporate headquarters building, and adjacent acreage, in Mechanicsville, Virginia, a suburb of Richmond, Virginia.

We regularly assess our business needs and make changes to the capacity and location of distribution and logistics centers. We believe that our facilities are adequate to carry on our business as currently conducted. A number of leases are scheduled to terminate within the next several years. We believe that, if necessary, we could find facilities to replace these leased premises without suffering a material adverse effect on our business.

Item 3. Legal Proceedings

We are subject to various legal actions that are ordinary and incidental to our business, including contract disputes, employment, workers’ compensation, product liability, regulatory and other matters. We establish reserves from time to time based upon periodic assessment of the potential outcomes of pending matters. In addition, we believe that any potential liability arising from employment, product liability, workers’ compensation and other personal injury litigation matters would be adequately covered by our insurance coverage, subject to policy limits, applicable deductibles and insurer solvency. While the outcome of legal actions cannot be predicted with certainty, we believe, based on current knowledge and the advice of counsel, that the outcome of these currently pending matters, individually or in the aggregate, will not have a material adverse effect on our financial condition or results of operations.

Part II

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Owens & Minor, Inc.’s common stock trades on the New York Stock Exchange under the symbol OMI. As of February 13, 2017, there were approximately 3,180 common shareholders of record. We believe there are an estimated additional 41,075 beneficial holders of our common stock. See Selected Quarterly Financial Information in Item 15 of this report for high and low closing sales prices of our common stock and quarterly cash dividends per common share and Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, for a discussion of our dividend payments.

5-Year Total Shareholder Return

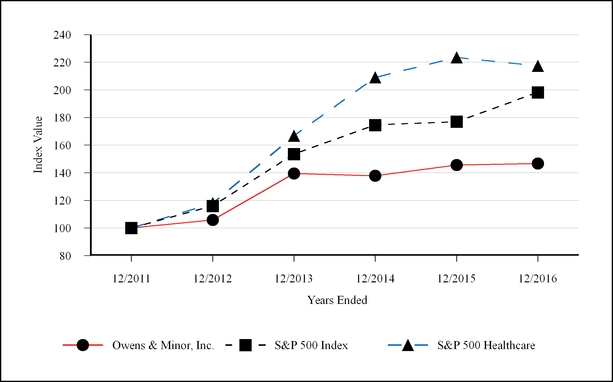

The following performance graph compares the performance of our common stock to the Standard & Poor's Composite- 500 Index (S&P 500 Index) and the Standard & Poor's Composite-500 Healthcare Index (S&P 500 Healthcare Index), an independently prepared index that includes more than 50 companies in the healthcare industry. This graph assumes that the value of the investment in the common stock and each index was $100 on December 31, 2011, and that all dividends were reinvested.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Base Period | | Years Ended |

Company Name / Index | 12/2011 | | 12/2012 | | 12/2013 | | 12/2014 | | 12/2015 | | 12/2016 |

Owens & Minor, Inc. | $ | 100.00 |

| | $ | 105.8 |

| | $ | 139.5 |

| | $ | 137.9 |

| | $ | 145.5 |

| | $ | 146.8 |

|

S&P 500 Index | 100.00 |

| | 116.0 |

| | 153.6 |

| | 174.6 |

| | 177.0 |

| | 198.2 |

|

S&P 500 Healthcare | 100.00 |

| | 117.9 |

| | 166.8 |

| | 209.0 |

| | 223.4 |

| | 217.4 |

|

Share Repurchase Program. In February 2014, our Board of Directors authorized a share repurchase program of up to $100 million of our outstanding common stock to be executed at the discretion of management over a three-year period, expiring in February 2017. The program was intended to offset shares issued in conjunction with our stock incentive plan and return capital to shareholders. The authorized repurchases under this program were completed in December 2016.

In October 2016, our Board of Directors authorized a new share repurchase program of up to $100 million of the company’s outstanding common stock to be executed at the discretion of management over a three-year period. The new authorization took effect in December 2016 upon the completion of the previous authorization. The timing of repurchases and the exact number of shares of common stock to be purchased will depend upon market conditions and other factors and may be suspended or discontinued at any time. Purchases under the share repurchase program are made either pursuant to 10b5-1 plans entered into by the company from time to time and/or during the company’s scheduled quarterly trading windows for officers and directors.

During the year ended December 31, 2016, we repurchased in open-market transactions and retired approximately 2.0 million shares at an average price per share of $34.72.

The following table summarizes share repurchase activity by month during the fourth quarter of 2016.

|

| | | | | | | | | | | | | |

Period | Total number

of shares purchased | | Average price paid per share | | Total number of

shares purchased

as part of a

publicly announced programs | | Maximum dollar

value of shares

that may yet

be purchased under the programs |

October | 189,720 |

| | $ | 33.68 |

| | 189,720 |

| | $ | 14,956,747 |

|

November | 351,156 |

| | $ | 33.08 |

| | 351,156 |

| | $ | 3,340,746 |

|

December | 126,389 |

| | $ | 34.57 |

| | 126,389 |

| | $ | 98,971,148 |

|

Total | 667,265 |

| | | | 667,265 |

| | |

Item 6. Selected Consolidated Financial Data

(in thousands, except ratios and per share data) |

| | | | | | | | | | | | | | | | | | | | |

| At or for the years ended December 31, |

| 2016 (1) | | 2015 (2) | | 2014 (3) | | 2013 (4) | | 2012 (5) | |

Summary of Operations: | | | | | | | | | | |

Net revenue | $ | 9,723,431 |

| | $ | 9,772,946 |

| | $ | 9,440,182 |

| | $ | 9,071,532 |

| | $ | 8,868,324 |

| |

Net income | $ | 108,787 |

| | $ | 103,409 |

| | $ | 66,503 |

| | $ | 110,882 |

| | $ | 109,003 |

| |

| | | | | | | | | | |

Per Common Share: | | | | | | | | | | |

Net income per share—basic | $ | 1.76 |

| | $ | 1.65 |

| | $ | 1.06 |

| | $ | 1.76 |

| | $ | 1.72 |

| |

Net income per share—diluted | $ | 1.76 |

| | $ | 1.65 |

| | $ | 1.06 |

| | $ | 1.76 |

| | $ | 1.72 |

| |

Cash dividends | $ | 1.02 |

| | $ | 1.01 |

| | $ | 1.00 |

| | $ | 0.96 |

| | $ | 0.88 |

| |

Stock price at year end | $ | 35.29 |

| | $ | 35.98 |

| | $ | 35.11 |

| | $ | 36.56 |

| | $ | 28.51 |

| |

| | | | | | | | | | |

Summary of Financial Position: | | | | | | | | | | |

Total assets | $ | 2,717,752 |

| | $ | 2,773,776 |

| | $ | 2,729,963 |

| | $ | 2,322,134 |

| | $ | 2,213,764 |

| |

Cash and cash equivalents | $ | 185,488 |

| | $ | 161,020 |

| | $ | 56,772 |

| | $ | 101,905 |

| | $ | 97,888 |

| |

Total debt | $ | 569,387 |

| | $ | 573,522 |

| | $ | 609,173 |

| | $ | 215,831 |

| | $ | 216,995 |

| |

Total Owens & Minor, Inc. shareholders’ equity | $ | 960,038 |

| | $ | 992,590 |

| | $ | 990,838 |

| | $ | 1,023,913 |

| | $ | 972,526 |

| |

| | | | | | | | | | |

Selected Ratios: | | | | | | | | | | |

Gross margin as a percent of revenue | 12.21 | % | | 12.43 | % | | 12.39 | % | | 12.31 | % | | 10.43 | % | |

Distribution, selling and administrative expenses as a percent of revenue | 9.98 | % | | 10.17 | % | | 10.42 | % | | 10.08 | % | | 8.14 | % | |

Operating earnings as a percent of revenue | 2.05 | % | | 2.05 | % | | 1.69 | % | | 2.18 | % | | 2.22 | % | |

Days sales outstanding (DSO) (6) | 23.1 |

| | 21.0 |

| | 22.1 |

| | 22.1 |

| | 20.8 |

| |

Average annual inventory turnover (7) | 9.2 |

| | 9.4 |

| | 10.1 |

| | 10.4 |

| | 10.1 |

| |

____________________________

(1) We incurred charges of $24.7 million ($17.8 million after tax, or $0.29 per diluted common share) associated with acquisition-related and exit and realignment activities in 2016. See Notes 3 and 9 of Notes to Consolidated Financial Statements.

(2) We incurred charges of $28.4 million ($23.4 million after tax, or $0.37 per diluted common share) associated with acquisition-related and exit and realignment activities in 2015. We also recognized a gain of $1.5 million ($1.5 million after tax, or $0.02 per diluted common share) associated with the partial recovery of a 2014 contract claim settlement. See Notes 3 and 9 of Notes to Consolidated Financial Statements.

(3) We incurred charges of $42.8 million ($35.3 million after tax, or $0.56 per common share) associated with acquisition-related and exit and realignment activities in 2014, a loss on estimated contract claim settlement of $3.9 million ($3.9 million after tax, or $0.06 per common share), a net gain of $3.7 million ($4.7 million after tax, or $0.07 per common share) associated with fair value adjustments related to purchase accounting, and a loss on early retirement of debt of $14.9 million ($9.1 million after tax or $0.14 per common share). See Notes 3 and 9 of Notes to Consolidated Financial Statements.

(4) We incurred charges of $12.4 million ($8.9 million after tax, or $0.14 per common share) associated with acquisition-related and exit and realignment activities in 2013. See Notes 3 and 9 of Notes to Consolidated Financial Statements.

(5) We incurred charges of $10.2 million ($8.2 million after tax, or $0.13 per common share) associated with acquisition-related and exit and realignment activities in 2012. See Notes 3 and 9 of Notes to Consolidated Financial Statements.

(6) Based on year end accounts receivable and net revenue for the fourth quarter of the year.

(7) Based on average annual inventory and cost of goods sold for the respective year.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s discussion and analysis of financial condition and results of operations is intended to assist the reader in the understanding and assessment of significant changes and trends related to the results of operations of the Company together with its subsidiaries. The discussion and analysis presented below refers to, and should be read in conjunction with, the consolidated financial statements and accompanying notes included in Item 8 of Part II of this Annual Report on Form 10-K.

Overview

Owens & Minor, Inc., along with its subsidiaries, (we, us, or our) is a leading global healthcare services company. In 2016, we have made certain changes to the leadership team, organizational structure, budgeting and financial reporting processes which drive changes to segment reporting. These changes align our operations into three distinct business units: Domestic, International and Clinical & Procedural Solutions (CPS). Domestic is our U.S. distribution, logistics and value-added services business, while International is our European distribution, logistics and value-added services business. CPS provides product-related solutions, including surgical and procedural kitting and sourcing. Furthermore, the basis for segment reporting shifts from the geography of the end customer to the business unit selling the product or providing the service. This includes intercompany transactions as well. Beginning with the first quarter of 2016, we report our financial results using this three segment structure and have recast prior year segment results on the same basis. Segment financial information is provided in Note 20 of Notes to Consolidated Financial Statements included in this annual report.

Financial Highlights.

The following table provides a reconciliation of reported operating earnings, net income and diluted net income per common share to non-GAAP measures used by management:

|

| | | | | | | | | | | |

| For the years ended December 31, |

(Dollars in thousands, except per share data) | 2016 | | 2015 | | 2014 |

Operating earnings, as reported (GAAP) | $ | 199,599 |

| | $ | 200,359 |

| | $ | 159,536 |

|

Acquisition-related and exit and realignment charges (1) | 24,675 |

| | 28,404 |

| | 42,801 |

|

Fair value adjustments related to purchase accounting (2) | — |

| | — |

| | (3,706 | ) |

Other (3) | — |

| | (1,500 | ) | | 3,907 |

|

Operating earnings, adjusted (non-GAAP) (Adjusted Operated Earnings) | $ | 224,274 |

| | $ | 227,263 |

| | $ | 202,538 |

|

Operating Earnings as a percent of revenue (GAAP) | 2.05 | % | | 2.05 | % | | 1.69 | % |

Adjusted Operating Earnings as a percent of revenue (non-GAAP) | 2.31 | % | | 2.33 | % | | 2.15 | % |

| | | | | |

Net income as reported (GAAP) | $ | 108,787 |

| | $ | 103,409 |

| | $ | 66,503 |

|

Acquisition-related and exit and realignment charges, (1) | 24,675 |

| | 28,404 |

| | 42,801 |

|

Income tax expense (benefit) (5) | (6,835 | ) | | (5,003 | ) | | (7,499 | ) |

Fair value adjustments related to purchase accounting (2) | — |

| | — |

| | (3,706 | ) |

Income tax expense (benefit) (5) | — |

| | — |

| | (997 | ) |

Other (3) | — |

| | (1,500 | ) | | 3,907 |

|

Income tax expense (benefit) (5) | — |

| | — |

| | — |

|

Loss on early retirement of debt (4) | — |

| | — |

| | 14,890 |

|

Income tax expense (benefit) (5) | — |

| | — |

| | (5,798 | ) |

Net income, adjusted (non-GAAP) (Adjusted Net Income) | $ | 126,627 |

| | $ | 125,310 |

| | $ | 110,101 |

|

| | | | | |

Net income per diluted common share, as reported (GAAP) | $ | 1.76 |

| | $ | 1.65 |

| | $ | 1.06 |

|

Acquisition-related and exit and realignment charges (1) | 0.29 |

| | 0.37 |

| | 0.56 |

|

Fair value adjustments related to purchase accounting (2) | — |

| | — |

| | (0.07 | ) |

Other (3) | — |

| | (0.02 | ) | | 0.06 |

|

Loss on early retirement of debt (4) | — |

| | — |

| | 0.14 |

|

Net income per diluted common share, adjusted (non-GAAP) (Adjusted EPS) | $ | 2.05 |

| | $ | 2.00 |

| | $ | 1.76 |

|

Net income per diluted share was $1.76 for the year ended December 31, 2016, an improvement of $0.11 compared to 2015. Adjusted EPS (non-GAAP) was $2.05 for the year ended December 31, 2016, an improvement of $0.05 over the prior year. Domestic segment operating earnings were $165.5 million for 2016, compared to $162.9 million for 2015. Results for the year reflected a continued focus on expense control initiatives, offset by the previously announced exit of a large customer and lower income from manufacturer product price changes compared to prior year. We expect revenue and gross margin to continue to be negatively affected by this customer exit as well as other competitive dynamics. The International segment operating earnings were $5.6 million, an improvement of $2.4 million compared to prior year. The increase was a result of improved operational efficiency. CPS operating earnings of $53.8 million in 2016 declined compared to prior year by $8.1 million as a result of lower revenues compared to prior year and production challenges in capacity and workforce availability which may continue into 2017.

Use of Non-GAAP Measures

Adjusted operating earnings, adjusted net income and adjusted EPS are an alternative view of performance used by management, and we believe that investors' understanding of our performance is enhanced by disclosing these performance measures. In general, the measures exclude items and charges that (i) management does not believe reflect our core business and relate more to strategic, multi-year corporate activities; or (ii) relate to activities or actions that may have occurred over multiple or in prior periods without predictable trends. Management uses these non-GAAP financial measures internally to evaluate our performance, evaluate the balance sheet, engage in financial and operational planning and determine incentive compensation.

Management provides these non-GAAP financial measures to investors as supplemental metrics to assist readers in assessing the effects of items and events on our financial and operating results and in comparing our performance to that of our competitors. However, the non-GAAP financial measures used by us may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies.

The non-GAAP financial measures disclosed by us should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations to those financial statements set forth above should be carefully evaluated.

The following items have been excluded in our non-GAAP financial measures:

(1) Acquisition-related charges, pre-tax, were $1.2 million in 2016, $9.8 million in 2015 and $16.1 million in 2014. The current year amount related primarily to costs incurred to settle certain obligations and address other on-going matters associated with the acquisitions of ArcRoyal and Medical Action which were partially offset on a year-to-date basis by the first quarter gain on the sale of property acquired with Medical Action. Charges in 2015 consisted primarily of costs to continue the integration of Medical Action and ArcRoyal which were acquired in the fourth quarter of 2014 including certain severance and contractual payments to the former owner and costs to transition information technology and other administrative functions. Charges in 2014 consisted primarily of transaction costs incurred to perform due diligence and analysis related to these acquisitions, as well as costs to resolve certain contingencies with the former Movianto owner.

Exit and realignment charges (income), pre-tax, were $23.5 million in 2016, $18.6 million in 2015 and $26.7 million in 2014. Charges in 2016 were associated with severance activities (including our voluntary employee separation program in the first quarter of 2016), and other costs associated with our strategic organizational realignment which include information technology asset write-offs, certain professional fees and costs to streamline administrative functions and processes in the United States and Europe. Similar charges in 2015 and 2014 also included the consolidation of distribution and logistics centers and closure of offsite warehouses in the United States and Europe. Further information regarding these items is included in Note 9 of Notes to Consolidated Financial Statements. We expect to incur additional charges in 2017 as we continue to reposition the company.

(2) The fourth quarter of 2014 included a gain of $6.7 million (pretax) recorded in other operating income, net from a fair value adjustment to contingent consideration related to the 2012 Movianto acquisition purchase price, offset by the incremental charge to cost of goods sold of $3.0 million (pretax) from purchase accounting impacts related to the sale of acquired inventory that was written up to fair value in connection with the 2014 acquisitions.

(3) The fourth quarter of 2015 included an insurance recovery of $1.5 million related to a contract settlement in the United Kingdom for which $3.9 million was expensed in 2014. Both the 2015 recovery and the 2014 settlement expense were recorded in other operating income, net.

(4) In 2014, we repaid our 2016 Notes and recorded a net loss on the early retirement of $14.9 million (pretax), which includes the redemption premium offset by the recognition of a gain on previously settled interest rate swaps.

(5) These charges have been tax effected in the preceding table by determining the income tax rate depending on the amount of charges incurred in different tax jurisdictions and the deductibility of those charges for income tax purposes.

More information about these charges is provided in Notes 3, 9 and 10 of Notes to Consolidated Financial Statements included in this annual report.

Results of Operations

2016 compared to 2015

|

| | | | | | | | | | | | | | |

Net revenue. | For the years ended December 31, | | Change |

(Dollars in thousands) | 2016 | | 2015 | | $ | | % |

Domestic | $ | 9,191,574 |

| | $ | 9,176,855 |

| | $ | 14,719 |

| | 0.2 | % |

International | 343,674 |

| | 372,638 |

| | (28,964 | ) | | (7.8 | )% |

CPS | 539,580 |

| | 561,812 |

| | (22,232 | ) | | (4.0 | )% |

Inter-segment | (351,397 | ) | | (338,359 | ) | | (13,038 | ) | | 3.9 | % |

Net revenue | $ | 9,723,431 |

| | $ | 9,772,946 |

| | $ | (49,515 | ) | | (0.5 | )% |

Consolidated net revenue declined in 2016 primarily as a result of the previously announced exit of a large domestic customer and unfavorable foreign exchange impacts. We expect revenue for 2017 to be negatively impacted by this customer exit as well. In the Domestic segment, growth with our other large healthcare provider customers contributed to the year over year change. In the International segment, excluding the impact of a U.K.-based customer exit in 2015 and the negative impact of foreign exchange, revenues increased 0.8% compared to last year. The decline in CPS revenue is largely attributed to a short-term customer contract in late 2015 which did not recur in the current year and production challenges in capacity and workforce availability which may continue into 2017.

|

| | | | | | | | | | | | | | |

Cost of goods sold. | For the years ended December 31, | | Change |

(Dollars in thousands) | 2016 | | 2015 | | $ | | % |

Cost of goods sold | $ | 8,536,121 |

| | $ | 8,558,373 |

| | $ | (22,252 | ) | | (0.3 | )% |

Cost of goods sold includes the cost of the product (net of supplier incentives and cash discounts) and all costs incurred for shipments of products from manufacturers to our distribution centers for all customer arrangements where we are the primary obligor, bear risk of general and physical inventory loss and carry all credit risk associated with sales. These are sometimes referred to as distribution or buy/sell contracts. Cost of goods sold also includes direct and certain indirect labor, material and overhead costs associated with our CPS business. There is no cost of goods sold associated with our fee-for-service arrangements. As a result of the factors discussed above which affected sales activity, cost of goods sold decreased from prior year by $22.3 million.

|

| | | | | | | | | | | | | | |

Gross margin. | For the years ended December 31, | | Change |

(Dollars in thousands) | 2016 | | 2015 | | $ | | % |

Gross margin | $ | 1,187,310 |

| | $ | 1,214,573 |

| | $ | (27,263 | ) | | (2.2 | )% |

As a % of net revenue | 12.21 | % | | 12.43 | % | | | | |

The decrease in gross margin compared to the prior year was largely attributable to lower income from manufacturer product price changes, the previously announced exit of a large domestic customer in September 2016 and the unfavorable impact of foreign currency translation of $11.9 million. The exit of a U.K.-based customer in July 2015 also negatively affected the year-to-date comparison. With increasing customer cost pressures and competitive dynamics in healthcare, we believe the current trend of increased gross margin pressure will continue.

We value Domestic segment inventory under the LIFO method. Had inventory been valued under the first-in, first-out (FIFO) method, gross margin as a percentage of net revenue would have been 1 basis point lower in 2016 and the same in 2015.

|

| | | | | | | | | | | | | | |

Operating expenses. | For the years ended December 31, | | Change |

(Dollars in thousands) | 2016 | | 2015 | | $ | | % |

Distribution, selling & administrative expenses | $ | 970,424 |

| | $ | 993,783 |

| | $ | (23,359 | ) | | (2.4 | )% |

As a % of net revenue | 9.98 | % | | 10.17 | % | | | | |

Other operating income, net | $ | (7,388 | ) | | $ | (7,973 | ) | | $ | 585 |

| | (7.3 | )% |

Distribution, selling and administrative (DS&A) expenses include labor and warehousing costs associated with our distribution and logistics services and all costs associated with our fee-for-service arrangements. Shipping and handling costs are included in DS&A expenses and include costs to store, move, and prepare products for shipment, as well as costs to deliver products to customers. The costs to convert new customers to our information systems are included in DS&A and are generally incurred prior to the recognition of revenues from the new customers. Depreciation and amortization, previously reported as a separate financial statement line item in the consolidated statements of income is now included in distribution, selling and administrative expenses for all periods presented.

The decrease in DS&A expenses compared to prior year reflected the decreased sales activity in the year, benefits of cost control initiatives, lower fuel costs and improved operational efficiency as well as favorable foreign currency translation impacts of $12.3 million.

The decrease in other operating income, net was attributed primarily to foreign currency transactional losses in 2016.

A discussion of the acquisition-related and exit and realignment charges is included above in the Overview section.

|

| | | | | | | | | | | | | | |

Interest expense, net. | For the years ended December 31, | | Change |

(Dollars in thousands) | 2016 | | 2015 | | $ | | % |

Interest expense, net | $ | 27,057 |

| | $ | 27,149 |

| | $ | (92 | ) | | (0.3 | )% |

Effective interest rate | 4.93 | % | | 4.78 | % | | | | |

Interest expense was consistent with prior year.

|

| | | | | | | | | | | | | | |

Income taxes. | For the years ended December 31, | | Change |

(Dollars in thousands) | 2016 | | 2015 | | $ | | % |

Income tax provision | $ | 63,755 |

| | $ | 69,801 |

| | $ | (6,046 | ) | | (8.7 | )% |

Effective tax rate | 37.0 | % | | 40.3 | % | | | | |

The change in the effective tax rate compared to 2015 resulted from a higher percentage of the company's pretax income earned in lower tax rate jurisdictions compared to prior year and the non-deductibility of certain prior year acquisition-related charges for income tax purposes.

2015 compared to 2014

|

| | | | | | | | | | | | | | |

Net revenue. | For the years ended December 31, | | Change |

(Dollars in thousands) | 2015 | | 2014 | | $ | | % |

Domestic | $ | 9,176,855 |

| | $ | 8,910,733 |

| | $ | 266,122 |

| | 3.0 | % |

International | 372,638 |

| | 481,402 |

| | (108,764 | ) | | (22.6 | )% |

CPS | 561,812 |

| | 294,358 |

| | 267,454 |

| | 90.9 | % |

Inter-segment | (338,359 | ) | | (246,311 | ) | | (92,048 | ) | | 37.4 | % |

Net revenue | $ | 9,772,946 |

| | $ | 9,440,182 |

| | $ | 332,764 |

| | 3.5 | % |

Consolidated net revenue improved in the year ended December 31, 2015 largely as a result of growth in our Domestic segment. The continued trend of growth in our existing large healthcare provider customer accounts and new business exceeded declines from smaller customers and lost business when compared to prior year. Domestic segment growth rates are impacted by ongoing market trends including healthcare utilization rates. CPS revenues in 2015 benefitted from a full year of activity from the fourth quarter 2014 acquisitions of Medical Action and ArcRoyal. The decrease in the International segment was largely driven by unfavorable foreign currency translation impacts of $52.5 million in 2015. On a constant currency basis, excluding the late 2014 transition of a customer from a buy/sell to a fee-for-service arrangement, International segment revenues declined approximately 3.5% for the year ended December 31, 2015, compared to prior year. This decline was largely a result of the previously announced exit from a U.K. customer contract, as well as other lost business.

|

| | | | | | | | | | | | | | |

Cost of goods sold. | For the years ended December 31, | | Change |

(Dollars in thousands) | 2015 | | 2014 | | $ | | % |

Cost of goods sold | $ | 8,558,373 |

| | $ | 8,270,216 |

| | $ | 288,157 |

| | 3.5 | % |

Cost of goods sold includes the cost of the product (net of supplier incentives and cash discounts) and all costs incurred for shipments of products from manufacturers to our distribution centers for all customer arrangements where we are the primary obligor, bear risk of general and physical inventory loss and carry all credit risk associated with sales. These are sometimes referred to as distribution or buy/sell contracts. Beginning in the fourth quarter of 2014, cost of goods sold also includes direct and certain indirect labor, material and overhead costs associated with our CPS operations. There is no cost of goods sold associated with our fee-for-service business. As a result of the increase in sales activity, cost of goods sold increased from the prior year by $288.2 million.

|

| | | | | | | | | | | | | | |

Gross margin. | For the years ended December 31, | | Change |

(Dollars in thousands) | 2015 | | 2014 | | $ | | % |

Gross margin | $ | 1,214,573 |

| | $ | 1,169,966 |

| | $ | 44,607 |

| | 3.8 | % |

As a % of net revenue | 12.43 | % | | 12.39 | % | | | | |

The improvement in gross margin for the year ended December 31, 2015, compared to the prior year was largely attributable to revenue growth in the Domestic segment, higher benefits from certain manufacturer product price changes compared to prior year and the full year activity from the late 2014 acquisitions. These benefits were unfavorably affected by $40.6 million from foreign currency translation.

We value Domestic segment inventory under the LIFO method. Had inventory been valued under the first-in, first-out (FIFO) method, gross margin as a percentage of net revenue would have been the same in 2015 and higher by 8 basis points in 2014.

|

| | | | | | | | | | | | | | |

Operating expenses. | For the years ended December 31, | | Change |

(Dollars in thousands) | 2015 | | 2014 | | $ | | % |

Distribution, selling & administrative expenses | $ | 993,783 |

| | $ | 984,102 |

| | $ | 9,681 |

| | 1.0 | % |

As a % of net revenue | 10.17 | % | | 10.42 | % | | | | |

Other operating income, net | $ | (7,973 | ) | | $ | (16,473 | ) | | $ | 8,500 |

| | (51.6 | )% |

Distribution, selling and administrative (DS&A) expenses include labor and warehousing costs associated with our distribution and logistics services and all costs associated with our fee-for-service arrangements. Shipping and handling costs are included in DS&A expenses and include costs to store, move, and prepare products for shipment, as well as costs to deliver products to customers. The costs to convert new customers to our information systems are included in DS&A and are generally incurred prior to the recognition of revenues from the new customers. Depreciation and amortization, previously reported as a separate financial statement line item in the consolidated statements of income is now included in distribution, selling and administrative expenses for all periods presented.