UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-00696

| T. Rowe Price Small-Cap Stock Fund, Inc. |

|

|

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

|

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area

code: (410) 345-2000

Date of fiscal year end: December

31

Date of reporting period: December 31, 2014

Item 1. Report to Shareholders

|

|

Small-Cap

Stock Fund |

December

31, 2014 |

The views and opinions in this report were current as of December 31, 2014. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

As I write this annual letter for 2014, I cannot help but compare this year’s Russell 2000 Index chart to a carnival ride. The year started with a dip in late January, followed by a recovery into March that favored high-beta stocks. This was followed by another decline in small-caps in the spring before a quick recovery by the middle of the year. The fun proved to be short-lived, however, as the market sold off in July and then suffered a significant swoon in the fall amid fears of Federal Reserve monetary tightening. From mid-October, though, we had a nice recovery.

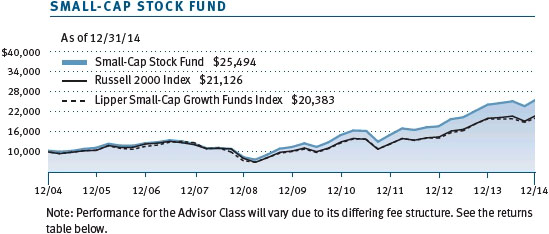

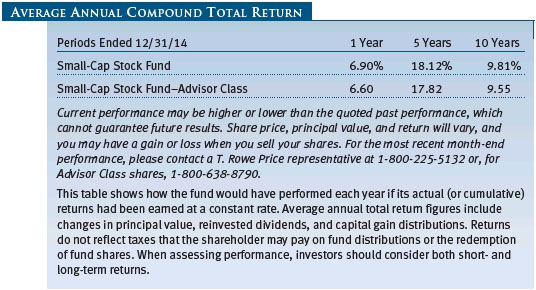

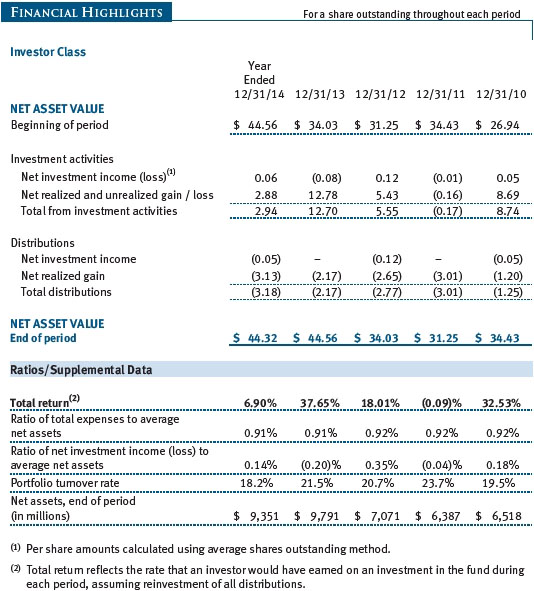

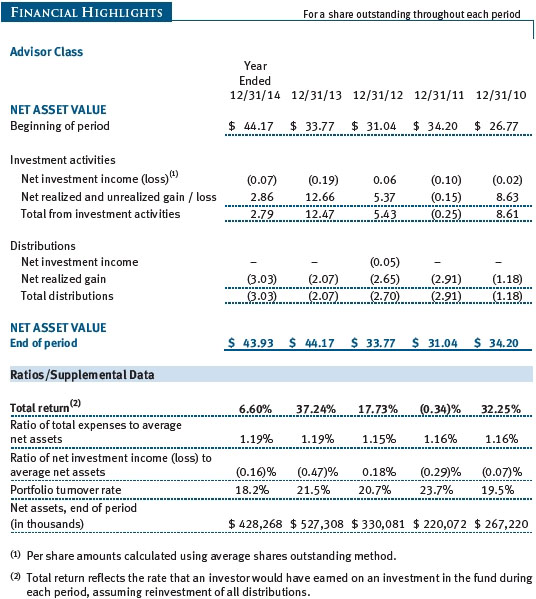

We are pleased to report that our Small-Cap Stock Fund outperformed its benchmark and peer group over the last six months and full year. The Small-Cap Stock Fund gained 6.90% in 2014, compared with 4.89% for the Russell 2000 Index and 1.98% for the Lipper Small-Cap Growth Funds Index. The fund gained 2.53% in the last six months. (Returns for the Advisor Class shares were slightly lower, reflecting their different cost structure.) As we noted in our semiannual letter, Lipper reclassified the Small-Cap Stock Fund from the small-cap core category to the growth category on April 30, 2014. We believe this change was the result of market dynamics and shifting valuations, as we have not altered our investment strategy. Based on cumulative total return, Lipper ranked the fund 67 of 530, 123 of 464, 60 of 408, and 22 of 286 small-cap growth funds for the 1-, 3-, 5-, and 10-year periods ended December 31, 2014, respectively. (Results will vary for other periods. Past performance cannot guarantee future results.)

We enter 2015 with the U.S. economy on strong footing. The stunning plunge in oil prices could, if sustained, provide a $200 billion boost to the U.S. economy over the year. Extra dollars in consumers’ pockets should lead to improved consumer and business confidence. We believe the equity market outlook for at least the first half of 2015 looks solid. However, we remain cautious on the small-cap sector, and our concerns are detailed in the Outlook section of this letter.

PERFORMANCE REVIEW

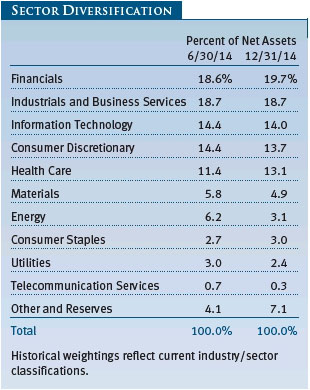

The portfolio was aided by stock selection. We realized particularly strong results in the consumer discretionary and health care sectors in the past six months. Financials, our largest overweight versus our benchmark, was a drag on performance during that period. Materials and information technology stocks also hindered performance.

Over the past several years, we have pointed out to shareholders that it was only a matter of time before merger and acquisition (M&A) activity accelerated. Last year the flurry of activity benefited performance. The announced takeovers of 18 portfolio holdings resulted in an average premium of 37% over the prevailing prior trading price. We wouldn’t be surprised to see more M&A activity in the small-cap space in 2015.

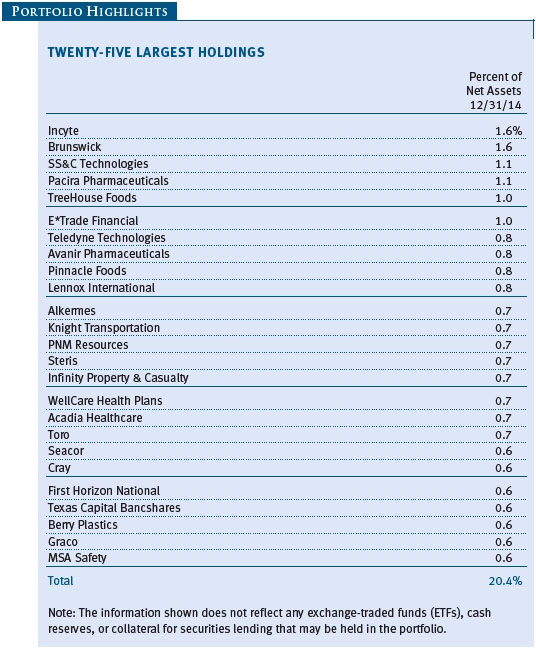

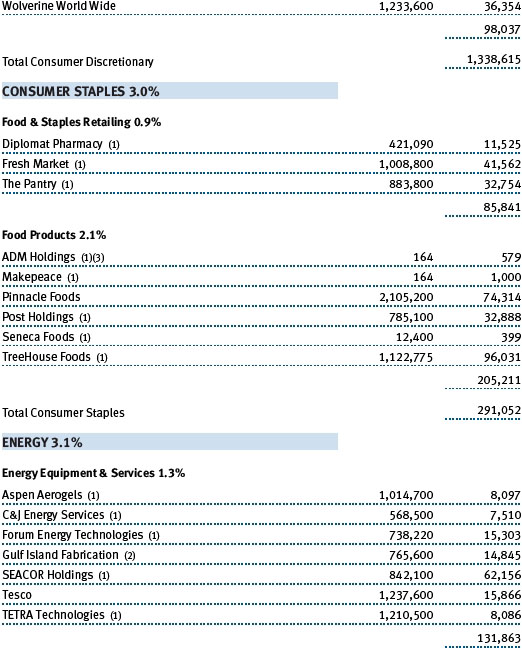

Rising consumer confidence and declining energy prices helped many of our holdings in the consumer discretionary sector. Jack in the Box, BJ’s Restaurants, Denny’s, and Sonic performed well amid expectations that improving labor markets and the plunge in oil prices would feed through to consumers. Jack in the Box exceeded sales and earnings growth projections despite higher food costs. Indeed, this segment of the sector saw investors chasing price momentum. Core-Mark Holding, which distributes products to convenience stores, also benefited from the trend. Boat maker Brunswick, which had been hampered earlier in the year by severe weather, gained on higher earnings than expected and favorable reactions to new product launches. (Please refer to the portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

Biotechnology stocks experienced a significant sell-off early in the year amid concerns about valuations, but shares snapped back and rewarded some of our longer-term holdings. Our fund also benefited from active acquisition in the space. Avanir Pharmaceuticals, one of the fund’s top holdings, agreed to be acquired by Otsuka Pharmaceuticals for a good premium. Similarly, Cubist Pharmaceuticals was acquired by Merck Pharmaceuticals in a cash deal at a premium of about 38% on its share price. Incyte continues to offer innovative solutions to medical disorders. The U.S. Food and Drug Administration approved the drug Jakafi for the treatment of polycythemia vera, a rare blood disorder. The pharmaceutical reported strong earnings, as Jakafi is the first drug approved for the disorder. The company also reported positive Phase III trial data on Baricitinib, which Incyte is developing with Eli Lilly to treat rheumatoid arthritis.

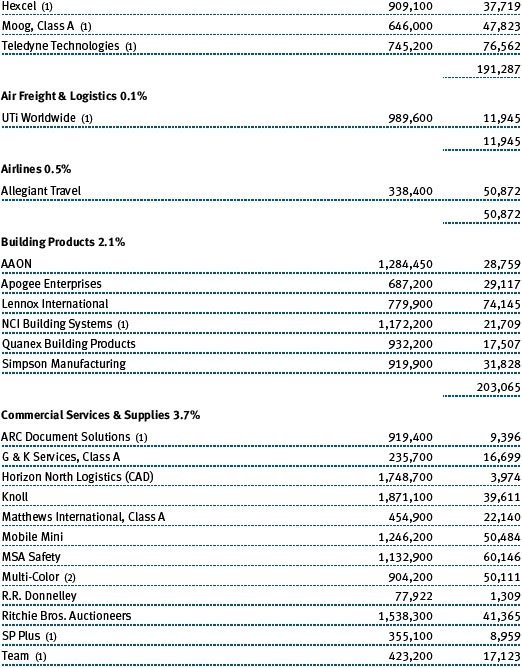

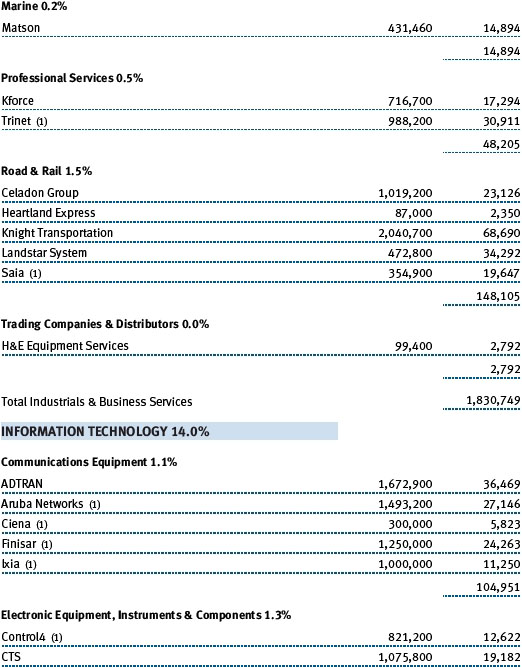

Among industrials and business services, in which we hold a large overweight, Knight Transportation benefited from the improving economic conditions and a tailwind for stronger freight demand. Packaging solutions company Multi-Color exceeded earnings expectations.

Consumer staples holdings were bid up by falling gas prices and rising M&A activity. The Pantry agreed to be acquired by Couche-Tarde in an all-cash deal at an attractive premium to its prior trading price. Specialty pharmacy Diplomat Pharmacy, which provides drugs for chronic diseases, went public late last year at an attractive valuation, and shares were promptly bid up by investors. The company shortly afterward reported strong earnings.

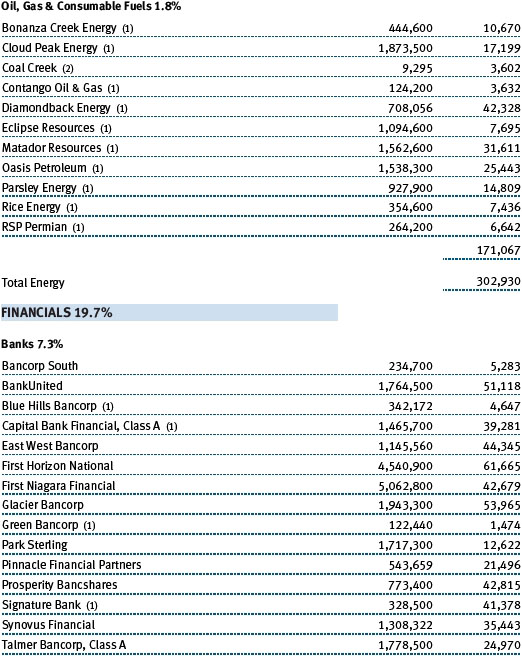

In my 22 years of running this portfolio, I have seldom, if ever, seen such a clear consensus on any sector form as quickly as the current investor perception regarding energy. Within a few weeks, investors watched plunging oil prices and fled the sector in droves. While we remain very interested in the sector from a contrarian perspective, we are not at all tempted to move back into the space. Structurally, the oil markets appear to be significantly oversupplied, in no small part due to the U.S. shale oil revolution. While this trend is positive from an energy independence perspective, it has led to a structural oversupply of 1.8 million barrels of oil per day, with 5 million barrels of spare capacity. In our view, this weakness will persist given market supply and increased exploration and production (E&P) efficiencies. This will inevitably lead to cost deflation in the oil services industry, which will, in turn, help drive oil prices lower. Thus, we have been very cautious in the energy equipment and services industry, eliminating firms that we felt were challenged in this new environment, including Key Energy Services. We also made changes among higher-cost E&P producers, particularly those with weaker balance sheets. We reduced Contango Oil & Gas and eliminated Bill Barrett and Energy XXI Bermuda. Athlon Energy agreed to be acquired by Encana in an all-cash deal at a strong premium to its trading price. The deal appears particularly good for our shareholders given the sudden drop in energy prices.

Our financial holdings suffered setbacks. BankUnited turned in solid earnings but reported that new loan growth had stalled, prompting analysts to reduce earnings estimates in 2015. Waddell & Reed Financial suffered negative flows following the departure of several high-profile managers and the relatively poor performance of its Ivy Asset Strategy Fund. Financial Engines declined as the higher-multiple segment of the market came under pressure. Investors appeared to remain concerned about a challenging pricing environment, slowing new assets, and the retirement of CEO Jeff Maggioncalda. Real estate management company St. Joe reported disappointing earnings. Land sales fell short of expectations, and investors appeared concerned that management does not have a viable plan to deploy the firm’s substantial excess capital.

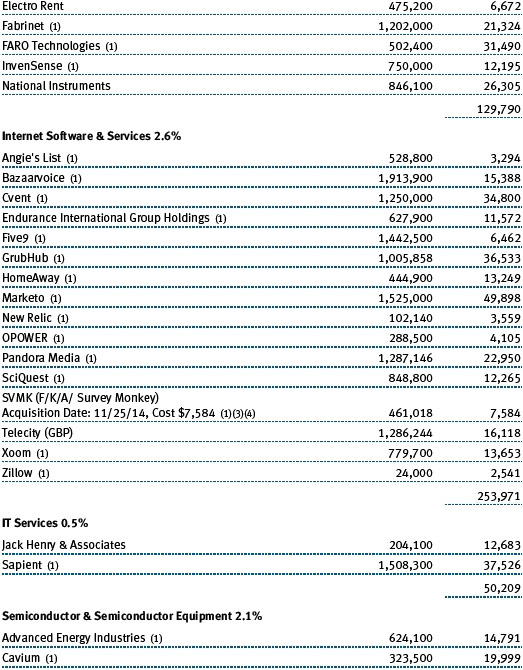

Among our information technology holdings, Internet radio company Pandora Media exceeded revenues and earnings expectations and further increased guidance for the fourth quarter. Investors, however, are focused on management comments noting an “increasingly competitive environment” and are fixated on the upcoming negotiations around content cost in its recent Copyright Royalty Board rate proceedings. Controversy surrounds the wide difference between Pandora’s proposal and that of the group representing the major music labels. The decision is expected by next December. Interactive Intelligence reported poor earnings as revenues were well below expectations. The previous year’s comparison had included a huge order for cloud-based services that wasn’t repeated in 2014. The company also reported a slippage in the number of big deals that had been expected to close in the first half. Cloud revenues continue to grow, and the firm is working on a robust pipeline. While the company reported solid third-quarter earnings, it guided fourth-quarter revenues a bit below market expectations.

In the materials sector, aluminum producer Constellium recently increased its debt to acquire Wise, a producer of aluminum components currently in favor among automobile makers as they prepare to meet upcoming fuel efficiency requirements. Investors have recently balked at the company’s incremental leverage and are concerned that automotive companies will not be ready anytime soon to use aluminum auto bodies in their fleets. We remain comfortable with this holding. Flotek Industries, which markets specialty chemicals used in oil field drilling, declined amid the volatile crude markets. The firm manufactures an innovative and environmentally friendly surfactant, which aids in oil recovery. Flotek announced in early December that a review of its first two months of the fourth quarter suggested the strongest 60-day period in the firm’s history. Despite these positive comments, the shares remain well below their midyear price range.

PORTFOLIO STRATEGY

On the Buy Side

We selectively added to a few cyclical

names in the second half of 2014. In the machinery segment, we added

Chart Industries, Hillenbrand, and Alamo. Chart Industries, which has significantly underperformed

over the last year, makes highly engineered equipment used in production and

storage of hydrocarbon and industrial gases. Chart is a major beneficiary of

growth in liquefied natural gas demand. The stock gained last year on strong

growth in China but faltered as demand slackened. We are excited about the

long-term opportunity for natural gas as a fuel

for high-horsepower applications in marine and railway transportation, and we

believe Chart is positioned to benefit from this trend. We have used the

uncertainty around the China slowdown and lower oil prices to add to our

position.

During the third quarter, we initiated a position in Hillenbrand. With its strong cash flow, Hillenbrand has diversified its business into material-handling equipment through acquisitions. We are optimistic about management’s ability to add value by bringing their manufacturing expertise to these acquired businesses. End markets for process equipment are robust due to investment in petrochemical infrastructure in North America. Alamo manufactures products for industrial and agricultural uses, including tractor-mounted mowing equipment, vacuum trucks, snow-removal equipment, and a variety of mowers. The firm also has a healthy mix of profitable aftermarket sales. Alamo has a history of buying assets economically and improving operations, and we believe the stock is attractively priced.

In the materials sector, we added to Worthington Industries. Legacy steel service center Worthington is transforming into a diversified manufacturer through acquisitions. We were attracted to the company’s free cash flow generation, improving profitability, and growth prospects. We also participated in the attractively priced initial public offering (IPO) of Ryerson Holding during the second half of 2014. The company is the second-largest steel distributor in North America, and we see a significant internal margin improvement opportunity. Ongoing deleveraging should achieve a more sustainable capital position, and strengthening end market demand is likely to drive steel volume growth.

In the processing industries, we had the opportunity to revisit Minerals Technologies and initiate a position in Wausau Paper. Minerals Technologies was a previous fund holding and has thrived under a new management team. Its recent purchase of Amcol International brings several exciting catalysts to this global specialty minerals company. Amcol was an undermanaged company, and we believe Minerals’ management can use their strong skills to improve returns by improving efficiency, decreasing costs, and enhancing operating margins and free cash flow. We believe Minerals’ paper and steel businesses appear poised to show organic growth in 2015, which should further drive investor interest. Wausau Paper has recently attracted the attention of an activist investor. New management from Georgia-Pacific should be able to improve returns as the firm maximizes its recently completed investment in a large new tissue machine.

In the energy sector, we are proceeding cautiously given the uncertain environment. We added Eclipse Resources, a natural gas producer with a good position in the Utica shale in the Northeast. We will look to add selectively to the company, which debuted as an IPO in 2014, as we believe the long-term prospects outweigh the potential risks. We also added to our position in drilling services company Tesco due to its attractive market position and ability to gain share by buying out smaller competitors. The company features a strong balance sheet and has used some of its cash to buy back stock.

In information technology, we added to software company Cvent, the leading provider of corporate event-management tools. Cvent also offers a proprietary hotel database, which we think has significant long-term potential, especially since events compose nearly one-third of global hotel revenue. We bought Veeco, a previous holding, as we believe the manufacturer of market equipment for light-emitting diodes (LEDs) is well positioned to benefit from the growth in lighting and ultra-high-definition TVs. Both applications require twice the LED content of standard high-definition TVs.

In health care, we bought Halyard Health, which was spun out of Kimberly-Clark last year. The company is recognized for its “blue surgical gown” fabric. As is typical of such deals, Halyard had been run by Kimberly as a “cash cow,” which hurt growth compared with its peers. However, we believe the new CEO, Robert Abernathy, a former executive with Kimberly-Clark, has the business acumen to step up research and development and execute on cost rationalization opportunities to drive improved growth.

We also added Associated Estates Realty, a $1 billion real estate investment trust focused on multifamily housing in the Southeast, mid-Atlantic, and upper Midwest regions and in Texas. The firm had a 4.3% dividend yield at the time of our purchase and trades at a discount to its net asset value. It has recently drawn the attention of activist shareholders Land & Buildings. Management believes the firm’s development program will help close its net asset value gap.

On the Sell Side

As at midyear, a number of our holdings

were involved in M&A activity, including Rockwood, Cubist Pharmaceuticals,

Avanir, TW Telecom, Athlon Energy, Volcano, and Annie’s, among others.

Rockwood was a long-term successful holding. Late in 2014, we had a flurry of M&A activity in health care. Cubist Pharmaceuticals received a $102 per-share all-cash bid from Merck; Volcano received a takeout offer from Philips NV; and, as noted earlier, Avanir received a premium cash bid from Otsuka Holdings in Japan. We eliminated Volcano, significantly cut our position size in Cubist, and trimmed our holdings in Avanir. Other eliminations included Athlon, which was taken over by Encana; TW Telecom, bought out by Level 3; and Annie’s, acquired by General Mills.

We also trimmed a number of early-cycle names in consumer discretionary. As gas prices have fallen, some firms have begun to approach a fuller valuation, and this led us to cut positions. We significantly reduced our position size in Jack in the Box, as the firm has been an outstanding performer.

As we wrote in July, we have to periodically trim our small-caps that have graduated into the mid-cap space. Stocks we reduced for capitalization and valuation reasons included Jack Henry & Associates, Signature Bank, and Acuity Brands.

We also reduce holdings in securities where we have lost confidence in our investment thesis. One such holding is Stage Stores, a small-market department store that had been relatively insulated from competition but is coming under pressure from e-commerce and brick-and-mortar retailers. With the stock trading at a premium to other department stores, the risk/reward profile was no longer compelling given the incremental risk.

We also significantly cut our holdings in H&E Equipment Services as the firm had been executing very well, and its cyclical end markets on the Gulf Coast were in favor until recently. The crack in crude oil prices has certainly made this a fortuitous sale. As noted above, we eliminated Key Energy Services, Bill Barrett, and Energy XXI.

Following very strong gains, we significantly reduced our position size in Dynegy. The firm recently announced a transformational set of acquisitions by buying a large number of power plants from Duke and Energy Capital Partners. The firm borrowed capital to do so and, therefore, increased its risk profile. We felt the stock had reached a level that did not offer a commensurate return potential.

OUTLOOK

Much has been written about the relatively poor performance of small-cap stocks in 2014. Following the stunning 39% return of the Russell 2000 in 2013, we wrote the following:

“Our greatest concern remains extended valuations in small-caps. The asset class is richly priced, value is hard to find, and a decade or more of limited IPO activity has more dollars chasing fewer names. With that backdrop, we would caution investors not to expect future returns to match the extraordinary gains of 2013.”

Indeed, small-caps have struggled mightily over the last year. In fact, December’s strong performance of nearly 3% propelled the Russell 2000 to a positive mid-single-digit gain in 2014. For the year, small-caps trailed the S&P 500 by nearly nine percentage points, turning in their worst year relative to the large-cap index since 1998.

Despite this period of underperformance, we are in a similar position as we were a year ago. Small-cap valuations remain expensive and are near their historical highs, with the Russell 2000 selling at approximately 19x earnings versus its historical average of 15x. Merrill Lynch notes in a recent study that small-cap earnings estimates appear somewhat optimistic, as analysts are projecting more than 20% earnings growth for the Russell 2000—certainly no mean feat. In yet another sign of peaking valuations, investment bankers have been busily financing new public companies, with 2014 looking to be the best IPO year since 2000. Further, the Fed has given every indication that it will begin raising rates in 2015. This historically tends to usher in increased volatility and typically a period of small-cap underperformance. In addition, the high yield market has retreated as credit spreads over Treasury securities have widened significantly. This is also typically a “shot across the bow” for small-cap investors.

We recommend that investors reduce their small-cap allocation to modest levels as we believe that the asset class will continue to suffer from eroding price/earnings valuations versus large-cap shares. In our view, large-cap stocks will likely outperform small-caps in 2015.

Thank you for your continued support.

Sincerely,

Greg McCrickard

President of the fund and chairman of its Investment Advisory

Committee

January 13, 2015

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF STOCK INVESTING

As with all stock and bond mutual funds, the fund’s share price can fall because of weakness in the stock or bond markets, a particular industry, or specific holdings. The financial markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets. Investing in small companies involves greater risk than is customarily associated with larger companies. Stocks of small companies are subject to more abrupt or erratic price movements than larger-company stocks. Small companies often have limited product lines, markets, or financial resources, and their managements may lack depth and experience. Such companies seldom pay significant dividends that could cushion returns in a falling market.

GLOSSARY

Lipper indexes: Fund benchmarks that consist of a small number of the largest mutual funds in a particular category as tracked by Lipper Inc.

Market capitalization: The total value of a company’s publicly traded shares.

Price/book ratio: A valuation measure that compares a stock’s market price with its book value; i.e., the company’s net worth divided by the number of outstanding shares.

Price/earnings (P/E) ratio: A valuation measure calculated by dividing the price of a stock by its reported earnings per share. The ratio is a measure of how much investors are willing to pay for the company’s earnings.

Price/sales ratio: A valuation measure calculated by dividing the price of a stock by its current or projected (forward) sales (or revenues) per share.

Real estate investment trusts (REITs): Publicly traded companies that own, develop, and operate apartment complexes, hotels, office buildings, and other commercial properties.

Return on equity (ROE): Calculated by dividing a company’s net income by shareholders’ equity, ROE measures how much a company earns on each dollar that common stock investors have put into that company. ROE indicates how effectively and efficiently a company and its management are using stockholder investments.

Russell 2000 Growth Index: A market-weighted total return index that measures the performance of companies within the Russell 2000 Index having higher price/book value ratios and higher forecast growth rates.

Russell 2000 Index: An unmanaged index that tracks the stocks of 2,000 small U.S. companies.

Russell 2000 Value Index: An index that tracks the performance of small-cap stocks with higher price/book ratios and higher forecast growth values.

S&P 500 Index: An unmanaged index that tracks the stocks of 500 primarily large-cap U.S. companies.

Note: Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell indexes. Russell® is a trademark of Russell Investment Group.

Performance and Expenses

| Growth of $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

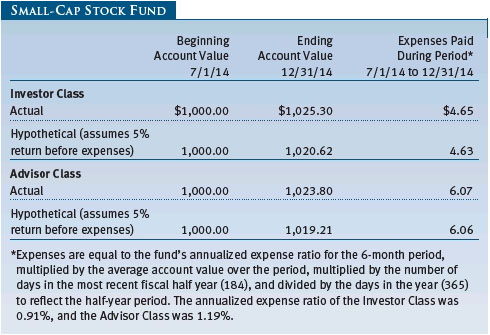

| Fund Expense Example |

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Please note that the fund has two share classes: The original share class (Investor Class) charges no distribution and service (12b-1) fee, and the Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (Actual) provides

information about actual account values and expenses based on the fund’s actual

returns. You may use the information on this line, together with your account

balance, to estimate the expenses that you paid over the period. Simply divide

your account value by $1,000 (for example, an $8,600 account value divided by

$1,000 = 8.6), then multiply the result by the number on the first line under

the heading “Expenses Paid During Period” to estimate the expenses you paid on

your account during this period.

Hypothetical Example for Comparison

Purposes

The information on the second

line of the table (Hypothetical) is based on hypothetical account values and

expenses derived from the fund’s actual expense ratio and an assumed 5% per year

rate of return before expenses (not the fund’s actual return). You may compare

the ongoing costs of investing in the fund with other funds by contrasting this

5% hypothetical example and the 5% hypothetical examples that appear in the

shareholder reports of the other funds. The hypothetical account values and

expenses may not be used to estimate the actual ending account balance or

expenses you paid for the period.

Note: T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000. The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; or accounts of an investor who is a T. Rowe Price Preferred Services, Personal Services, or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $100,000). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| Notes to Financial Statements |

T. Rowe Price Small-Cap Stock Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks to provide long-term capital growth by investing primarily in stocks of small companies. The fund has two classes of shares: the Small-Cap Stock Fund original share class, referred to in this report as the Investor Class, offered since June 1, 1956, and the Small-Cap Stock Fund–Advisor Class (Advisor Class), offered since March 31, 2000. Advisor Class shares are sold only through unaffiliated brokers and other unaffiliated financial intermediaries that are compensated by the class for distribution, shareholder servicing, and/or certain administrative services under a Board-approved Rule 12b-1 plan. Each class has exclusive voting rights on matters related solely to that class; separate voting rights on matters that relate to both classes; and, in all other respects, the same rights and obligations as the other class.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including but not limited to ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Distributions from REITs are initially recorded as dividend income and, to the extent such represent a return of capital or capital gain for tax purposes, are reclassified when such information becomes available. Income distributions are declared and paid by each class annually. Capital gain distributions, if any, are generally declared and paid by the fund annually.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Class Accounting The Advisor Class pays distribution, shareholder servicing, and/or certain administrative expenses in the form of Rule 12b-1 fees, in an amount not exceeding 0.25% of the class’s average daily net assets. Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to both classes, investment income, and realized and unrealized gains and losses are allocated to the classes based upon the relative daily net assets of each class.

Rebates Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements and totaled $195,000 for the year ended December 31, 2014.

In-Kind Redemptions In accordance with guidelines described in the fund’s prospectus, the fund may distribute portfolio securities rather than cash as payment for a redemption of fund shares (in-kind redemption). For financial reporting purposes, the fund recognizes a gain on in-kind redemptions to the extent the value of the distributed securities on the date of redemption exceeds the cost of those securities; the fund recognizes a loss if cost exceeds value. Gains and losses realized on in-kind redemptions are not recognized for tax purposes and are reclassified from undistributed realized gain (loss) to paid-in capital. During the year ended December 31, 2014, the fund realized $187,907,000 of net gain on $407,608,000 of in-kind redemptions.

New Accounting Guidance In June 2014, FASB issued Accounting Standards Update (ASU) No. 2014-11, Transfers and Servicing (Topic 860), Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures. The ASU changes the accounting for certain repurchase agreements and expands disclosure requirements related to repurchase agreements, securities lending, repurchase-to-maturity and similar transactions. The ASU is effective for interim and annual reporting periods beginning after December 15, 2014. Adoption will have no effect on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s financial instruments are valued and each class’s net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business.

Fair Value The fund’s financial instruments are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The T. Rowe Price Valuation Committee (the Valuation Committee) has been established by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures and approves all fair value determinations. Specifically, the Valuation Committee establishes procedures to value securities; determines pricing techniques, sources, and persons eligible to effect fair value pricing actions; oversees the selection, services, and performance of pricing vendors; oversees valuation-related business continuity practices; and provides guidance on internal controls and valuation-related matters. The Valuation Committee reports to the Board; is chaired by the fund’s treasurer; and has representation from legal, portfolio management and trading, operations, and risk management.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made. OTC Bulletin Board securities are valued at the mean of the closing bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the closing bid and asked prices for domestic securities and the last quoted sale or closing price for international securities.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted to reflect the fair value of such securities at the close of the NYSE. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, the fund will adjust the previous quoted prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust quoted prices to reflect fair value, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. The fund uses outside pricing services to provide it with quoted prices and information to evaluate or adjust those prices. The fund cannot predict how often it will use quoted prices and how often it will determine it necessary to adjust those prices to reflect fair value. As a means of evaluating its security valuation process, the fund routinely compares quoted prices, the next day’s opening prices in the same markets, and adjusted prices.

Actively traded domestic equity securities generally are categorized in Level 1 of the fair value hierarchy. Non-U.S. equity securities generally are categorized in Level 2 of the fair value hierarchy despite the availability of quoted prices because, as described above, the fund evaluates and determines whether those quoted prices reflect fair value at the close of the NYSE or require adjustment. OTC Bulletin Board securities, certain preferred securities, and equity securities traded in inactive markets generally are categorized in Level 2 of the fair value hierarchy.

Debt securities generally are traded in the OTC market. Securities with remaining maturities of one year or more at the time of acquisition are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Debt securities with remaining maturities of less than one year at the time of acquisition generally use amortized cost in local currency to approximate fair value. However, if amortized cost is deemed not to reflect fair value or the fund holds a significant amount of such securities with remaining maturities of more than 60 days, the securities are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service. Generally, debt securities are categorized in Level 2 of the fair value hierarchy; however, to the extent the valuations include significant unobservable inputs, the securities would be categorized in Level 3.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation and are categorized in Level 1 of the fair value hierarchy. Financial futures contracts are valued at closing settlement prices and are categorized in Level 1 of the fair value hierarchy. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

Thinly traded financial instruments and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded.

Subject to oversight by the Board, the Valuation Committee regularly makes good faith judgments to establish and adjust the fair valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of an equity investment with limited market activity, such as a private placement or a thinly traded public company stock, the Valuation Committee considers a variety of factors, which may include, but are not limited to, the issuer’s business prospects, its financial standing and performance, recent investment transactions in the issuer, new rounds of financing, negotiated transactions of significant size between other investors in the company, relevant market valuations of peer companies, strategic events affecting the company, market liquidity for the issuer, and general economic conditions and events. In consultation with the investment and pricing teams, the Valuation Committee will determine an appropriate valuation technique based on available information, which may include both observable and unobservable inputs. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants; transaction information can be reliably obtained; and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as market-based valuation multiples; a discount or premium from market value of a similar, freely traded security of the same issuer; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the issue. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants. Depending on the relative significance of unobservable inputs, including the valuation technique(s) used, fair valued securities may be categorized in Level 2 or 3 of the fair value hierarchy.

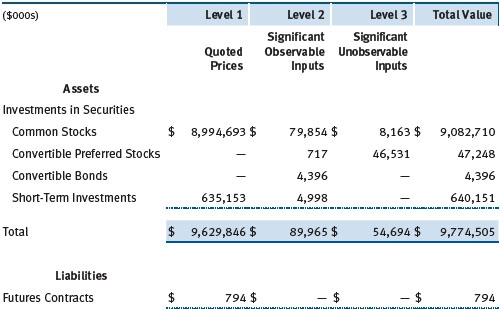

Valuation Inputs The following table summarizes the fund’s financial instruments, based on the inputs used to determine their fair values on December 31, 2014:

There were no material transfers between Levels 1 and 2 during the year ended December 31, 2014.

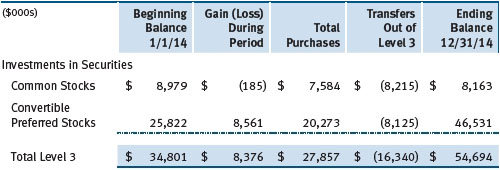

Following is a reconciliation of the fund’s Level 3 holdings for the year ended December 31, 2014. Gain (loss) reflects both realized and change in unrealized gain/loss on Level 3 holdings during the period, if any, and is included on the accompanying Statement of Operations. The change in unrealized gain/loss on Level 3 instruments held at December 31, 2014, totaled $8,376,000 for the year ended December 31, 2014. Transfers into and out of Level 3 are reflected at the value of the financial instrument at the beginning of the period. During the year, transfers out of Level 3 were because observable market data became available for the security.

NOTE 3 - DERIVATIVE INSTRUMENTS

During the year ended December 31, 2014, the fund invested in derivative instruments. As defined by GAAP, a derivative is a financial instrument whose value is derived from an underlying security price, foreign exchange rate, interest rate, index of prices or rates, or other variable; it requires little or no initial investment and permits or requires net settlement. The fund invests in derivatives only if the expected risks and rewards are consistent with its investment objectives, policies, and overall risk profile, as described in its prospectus and Statement of Additional Information. The fund may use derivatives for a variety of purposes, such as seeking to hedge against declines in principal value, increase yield, invest in an asset with greater efficiency and at a lower cost than is possible through direct investment, or to adjust credit exposure. The risks associated with the use of derivatives are different from, and potentially much greater than, the risks associated with investing directly in the instruments on which the derivatives are based. The fund at all times maintains sufficient cash reserves, liquid assets, or other SEC-permitted asset types to cover its settlement obligations under open derivative contracts.

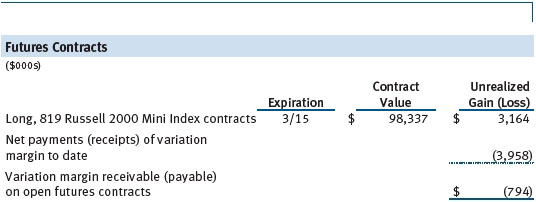

The fund values its derivatives at fair value, as described in Note 2, and recognizes changes in fair value currently in its results of operations. Accordingly, the fund does not follow hedge accounting, even for derivatives employed as economic hedges. Generally, the fund accounts for its derivatives on a gross basis. It does not offset the fair value of derivative liabilities against the fair value of derivative assets on its financial statements, nor does it offset the fair value of derivative instruments against the right to reclaim or obligation to return collateral. As of December 31, 2014, the fund held equity futures with cumulative unrealized gain of $3,164,000; the value reflected on the accompanying Statement of Assets and Liabilities is the related unsettled variation margin.

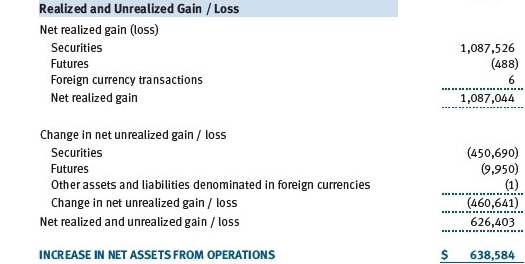

Additionally, during the year ended December 31, 2014, the fund recognized $488,000 of realized loss on Futures and a $(9,950,000) change in unrealized gain/loss on Futures related to its investments in equity derivatives; such amounts are included on the accompanying Statement of Operations.

Counterparty Risk and Collateral The fund invests in exchange-traded or centrally cleared derivative contracts, such as futures, exchange-traded options, and centrally cleared swaps. Counterparty risk on such derivatives is minimal because the clearinghouse provides protection against counterparty defaults. For futures and centrally cleared swaps, the fund is required to deposit collateral in an amount equal to a certain percentage of the contract value (margin requirement), and the margin requirement must be maintained over the life of the contract. Each clearing broker, in its sole discretion, may adjust the margin requirements applicable to the fund.

Collateral may be in the form of cash or debt securities issued by the U.S. government or related agencies. Cash and currencies posted by the fund are reflected as cash deposits in the accompanying financial statements and generally are restricted from withdrawal by the fund; securities posted by the fund are so noted in the accompanying Portfolio of Investments; both remain in the fund’s assets. As of December 31, 2014, securities valued at $4,429,000 had been posted by the fund for exchange-traded and/or centrally cleared derivatives.

Futures Contracts The fund is subject to equity price risk in the normal course of pursuing its investment objectives and uses futures contracts to help manage such risk. The fund may enter into futures contracts to manage exposure to interest rates, security prices, foreign currencies, and credit quality; as an efficient means of adjusting exposure to all or part of a target market; to enhance income; as a cash management tool; or to adjust credit exposure. A futures contract provides for the future sale by one party and purchase by another of a specified amount of a specific underlying financial instrument at an agreed-upon price, date, time, and place. The fund currently invests only in exchange-traded futures, which generally are standardized as to maturity date, underlying financial instrument, and other contract terms. Payments are made or received by the fund each day to settle daily fluctuations in the value of the contract (variation margin), which reflect changes in the value of the underlying financial instrument. Variation margin is recorded as unrealized gain or loss until the contract is closed. The value of a futures contract included in net assets is the amount of unsettled variation margin; net variation margin receivable is reflected as an asset and net variation margin payable is reflected as a liability on the accompanying Statement of Assets and Liabilities. Risks related to the use of futures contracts include possible illiquidity of the futures markets, contract prices that can be highly volatile and imperfectly correlated to movements in hedged security values, and potential losses in excess of the fund’s initial investment. During the year ended December 31, 2014, the volume of the fund’s activity in futures, based on underlying notional amounts, was generally between 0% and 4% of net assets.

NOTE 4 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

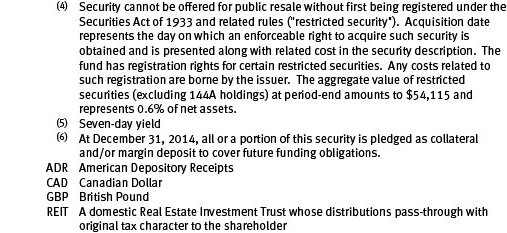

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $1,727,669,000 and $2,803,242,000, respectively, for the year ended December 31, 2014.

NOTE 5 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Reclassifications to paid-in capital relate primarily to redemptions in kind and a tax practice that treats a portion of the proceeds from each redemption of capital shares as a distribution of taxable net investment income or realized capital gain. For the year ended December 31, 2014, the following reclassifications were recorded to reflect tax character (there was no impact on results of operations or net assets):

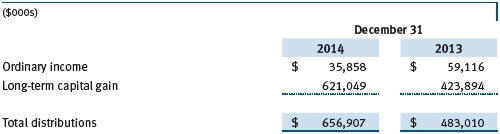

Distributions during the years ended December 31, 2014 and December 31, 2013, were characterized for tax purposes as follows:

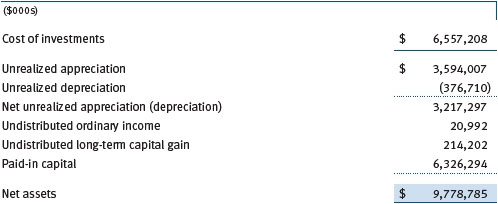

At December 31, 2014, the tax-basis cost of investments and components of net assets were as follows:

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to the deferral of losses from wash sales, the realization of gains/losses on passive foreign investment companies and/or certain open derivative contracts for tax purposes.

NOTE 6 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management agreement between the fund and Price Associates provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.45% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.275% for assets in excess of $400 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At December 31, 2014, the effective annual group fee rate was 0.29%.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share prices and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend-disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the Investor Class. For the year ended December 31, 2014, expenses incurred pursuant to these service agreements were $120,000 for Price Associates; $1,726,000 for T. Rowe Price Services, Inc.; and $2,424,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

Additionally, the fund is one of several mutual funds in which certain college savings plans managed by Price Associates may invest. As approved by the fund’s Board of Directors, shareholder servicing costs associated with each college savings plan are borne by the fund in proportion to the average daily value of its shares owned by the college savings plan. For the year ended December 31, 2014, the fund was charged $324,000 for shareholder servicing costs related to the college savings plans, of which $249,000 was for services provided by Price. The amount payable at period-end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At December 31, 2014, approximately 2% of the outstanding shares of the Investor Class were held by college savings plans.

The fund is also one of several mutual funds sponsored by Price Associates (underlying Price funds) in which the T. Rowe Price Retirement Funds and T. Rowe Price Target Retirement Funds (Retirement Funds) may invest. The Retirement Funds do not invest in the underlying Price funds for the purpose of exercising management or control. Pursuant to a special servicing agreement, expenses associated with the operation of the Retirement Funds are borne by each underlying Price fund to the extent of estimated savings to it and in proportion to the average daily value of its shares owned by the Retirement Funds. Expenses allocated under this agreement are reflected as shareholder servicing expense in the accompanying financial statements. For the year ended December 31, 2014, the fund was allocated $2,555,000 of Retirement Funds’ expenses, of which $1,130,000 related to services provided by Price. At period-end, the amount payable to Price pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At December 31, 2014, approximately 17% of the outstanding shares of the Investor Class were held by the Retirement Funds.

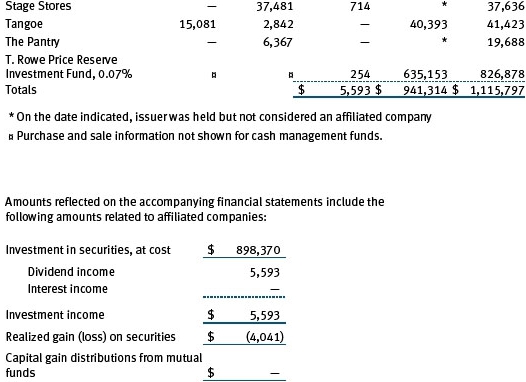

The fund may invest in the T. Rowe Price Reserve Investment Fund, the T. Rowe Price Government Reserve Investment Fund, or the T. Rowe Price Short-Term Reserve Fund (collectively, the Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The Price Reserve Investment Funds are offered as short-term investment options to mutual funds, trusts, and other accounts managed by Price Associates or its affiliates and are not available for direct purchase by members of the public. The Price Reserve Investment Funds pay no investment management fees.

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors and

Shareholders of

T. Rowe Price Small-Cap Stock Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price Small-Cap Stock Fund, Inc. (the “Fund”) at December 31, 2014, the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated therein, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2014 by correspondence with the custodian and brokers, and confirmation of the underlying fund by correspondence with the transfer agent, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore,

Maryland

February 13, 2015

| Tax Information (Unaudited) for the Tax Year Ended 12/31/14 |

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

The fund’s distributions to shareholders included:

| ● |

$30,987,000 from short-term capital gains |

| ● |

$720,296,000 from long-term capital gains, of which $719,995,000 was subject to a long-term capital gains tax rate of not greater than 20%, and $301,000 to a long-term capital gains tax rate of not greater than 25%. |

For taxable non-corporate shareholders, $50,042,000 of the fund’s income represents qualified dividend income subject to the a long-term capital gains tax rate of not greater than 20%.

For corporate shareholders, $50,042,000 of the fund’s income qualifies for the dividends-received deduction.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our website, troweprice.com. To access it, click on the words “Social Responsibility” at the top of our corporate homepage. Next, click on the words “Conducting Business Responsibly” on the left side of the page that appears. Finally, click on the words “Proxy Voting Policies” on the left side of the page that appears.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through our website, follow the above directions to reach the “Conducting Business Responsibly” page. Click on the words “Proxy Voting Records” on the left side of that page, and then click on the “View Proxy Voting Records” link at the bottom of the page that appears.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 100 F St. N.E., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| About the Fund’s Directors and Officers |

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting or potentially affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and business and regulatory affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of the Board’s members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates; “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

| Independent Directors | ||

| Name | ||

| (Year of Birth) | ||

| Year Elected* | ||

| [Number of T. Rowe Price | Principal Occupation(s) and Directorships of Public Companies and | |

| Portfolios Overseen] | Other Investment Companies During the Past Five Years | |

| William R. Brody, M.D., Ph.D. | President and Trustee, Salk Institute for Biological Studies (2009 to | |

| (1944) | present); Director, BioMed Realty Trust (2013 to present); Director, | |

| 2009 | Novartis, Inc. (2009 to present); Director, IBM (2007 to present) | |

| [165] | ||

| Anthony W. Deering | Chairman, Exeter Capital, LLC, a private investment firm (2004 to | |

| (1945) | present); Director, Brixmor Real Estate Investment Trust (2012 to | |

| 2001 | present); Director and Member of the Advisory Board, Deutsche | |

| [165] | Bank North America (2004 to present); Director, Under Armour | |

| (2008 to present); Director, Vornado Real Estate Investment Trust | ||

| (2004 to 2012) | ||

| Donald W. Dick, Jr. | Principal, EuroCapital Partners, LLC, an acquisition and management | |

| (1943) | advisory firm (1995 to present) | |

| 1992 | ||

| [165] | ||

| Bruce W. Duncan | President, Chief Executive Officer, and Director, First Industrial Realty | |

| (1951) | Trust, owner and operator of industrial properties (2009 to present); | |

| 2013 | Chairman of the Board (2005 to present), Interim Chief Executive | |

| [165] | Officer (2007), and Director, Starwood Hotels & Resorts, a hotel and | |

| leisure company (1999 to present) | ||

| Robert J. Gerrard, Jr. | Advisory Board Member, Pipeline Crisis/Winning Strategies, a | |

| (1952) | collaborative working to improve opportunities for young African | |

| 2012 | Americans (1997 to present); Chairman of Compensation Committee | |

| [165] | and Director, Syniverse Holdings, Inc., a provider of wireless voice | |

| and data services for telecommunications companies (2008 to 2011) | ||

| Karen N. Horn | Limited Partner and Senior Managing Director, Brock Capital Group, | |

| (1943) | an advisory and investment banking firm (2004 to present); Director, | |

| 2003 | Eli Lilly and Company (1987 to present); Director, Simon Property | |

| [165] | Group (2004 to present); Director, Norfolk Southern (2008 to present) | |

| Paul F. McBride | Former Company Officer and Senior Vice President, Human | |

| (1956) | Resources and Corporate Initiatives, Black & Decker Corporation | |

| 2013 | (2004 to 2010) | |

| [165] | ||

| Cecilia E. Rouse, Ph.D. | Dean, Woodrow Wilson School (2012 to present); Professor and | |

| (1963) | Researcher, Princeton University (1992 to present); Director, | |

| 2012 | MDRC, a nonprofit education and social policy research organization | |

| [165] | (2011 to present); Member, National Academy of Education | |

| (2010 to present); Research Associate, National Bureau of Economic | ||

| Research’s Labor Studies Program (2011 to present); Member, | ||

| President’s Council of Economic Advisors (2009 to 2011); Chair | ||

| of Committee on the Status of Minority Groups in the Economic | ||

| Profession, American Economic Association (2012 to present) | ||

| John G. Schreiber | Owner/President, Centaur Capital Partners, Inc., a real estate | |

| (1946) | investment company (1991 to present); Cofounder and Partner, | |

| 2001 | Blackstone Real Estate Advisors, L.P. (1992 to present); Director, | |

| [165] | General Growth Properties, Inc. (2010 to 2013); Director, BXMT | |

| (formerly Capital Trust, Inc.), a real estate investment company | ||

| (2012 to present); Director and Chairman of the Board, Brixmor | ||

| Property Group, Inc. (2013 to present); Director, Hilton Worldwide | ||

| (2013 to present) | ||

| Mark R. Tercek | President and Chief Executive Officer, The Nature Conservancy | |

| (1957) | (2008 to present); Managing Director, The Goldman Sachs Group, | |

| 2009 | Inc. (1984 to 2008) | |

| [165] | ||

| *Each independent director serves until retirement, resignation, or election of a successor. | ||

| Inside Directors | ||

| Name | ||

| (Year of Birth) | ||

| Year Elected* | ||

| [Number of T. Rowe Price | Principal Occupation(s) and Directorships of Public Companies and | |

| Portfolios Overseen] | Other Investment Companies During the Past Five Years | |

| Edward C. Bernard | Director and Vice President, T. Rowe Price; Vice Chairman of the | |

| (1956) | Board, Director, and Vice President, T. Rowe Price Group, Inc.; | |

| 2006 | Chairman of the Board, Director, and President, T. Rowe Price | |

| [165] | Investment Services, Inc.; Chairman of the Board and Director, | |

| T. Rowe Price Retirement Plan Services, Inc., and T. Rowe Price | ||

| Services, Inc.; Chairman of the Board, Chief Executive Officer, | ||

| and Director, T. Rowe Price International; Chairman of the Board, | ||

| Chief Executive Officer, Director, and President, T. Rowe Price Trust | ||

| Company; Chairman of the Board, all funds | ||

| Brian C. Rogers, CFA, CIC | Chief Investment Officer, Director, and Vice President, T. Rowe Price; | |

| (1955) | Chairman of the Board, Chief Investment Officer, Director, and Vice | |

| 2013 | President, T. Rowe Price Group, Inc.; Vice President, T. Rowe Price | |

| [111] | Trust Company | |

| *Each inside director serves until retirement, resignation, or election of a successor. | ||

| Officers | ||

| Name (Year of Birth) | ||

| Position Held With Small-Cap Stock Fund | Principal Occupation(s) | |

| Francisco Alonso (1978) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Preston G. Athey, CFA, CIC (1949) | Vice President, T. Rowe Price, T. Rowe Price | |

| Vice President | Group, Inc., and T. Rowe Price Trust Company | |

| Darrell N. Braman (1963) | Vice President, Price Hong Kong, Price | |

| Vice President | Singapore, T. Rowe Price, T. Rowe Price Group, | |

| Inc., T. Rowe Price International, T. Rowe Price | ||

| Investment Services, Inc., and T. Rowe Price | ||

| Services, Inc. | ||

| Ira W. Carnahan, CFA (1963) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Andrew S. Davis (1978) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Roger L. Fiery III, CPA (1959) | Vice President, Price Hong Kong, Price | |

| Vice President | Singapore, T. Rowe Price, T. Rowe Price Group, | |

| Inc., T. Rowe Price International, and T. Rowe | ||

| Price Trust Company | ||

| Christopher T. Fortune (1973) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| John R. Gilner (1961) | Chief Compliance Officer and Vice President, | |

| Chief Compliance Officer | T. Rowe Price; Vice President, T. Rowe Price | |

| Group, Inc., and T. Rowe Price Investment | ||

| Services, Inc. | ||

| Gregory S. Golczewski (1966) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Trust Company | |

| Gregory K. Hinkle, CPA (1958) | Vice President, T. Rowe Price, T. Rowe Price | |

| Treasurer | Group, Inc., and T. Rowe Price Trust Company | |

| Patricia B. Lippert (1953) | Assistant Vice President, T. Rowe Price and | |

| Secretary | T. Rowe Price Investment Services, Inc. | |

| Robert J. Marcotte (1962) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Gregory A. McCrickard, CFA (1958) | Vice President, T. Rowe Price, T. Rowe Price | |

| President | Group, Inc., and T. Rowe Price Trust Company | |

| David Oestreicher (1967) | Director, Vice President, and Secretary, T. Rowe | |

| Vice President | Price Investment Services, Inc., T. Rowe Price | |

| Retirement Plan Services, Inc., T. Rowe | ||

| Price Services, Inc., and T. Rowe Price Trust | ||

| Company; Chief Legal Officer, Vice President, | ||

| and Secretary, T. Rowe Price Group, Inc.; Vice | ||

| President and Secretary, T. Rowe Price and | ||

| T. Rowe Price International; Vice President, | ||

| Price Hong Kong and Price Singapore | ||

| Curt J. Organt, CFA (1968) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Timothy E. Parker, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Charles G. Pepin (1966) | Director, T. Rowe Price Trust Company; Vice | |

| Vice President | President, T. Rowe Price and T. Rowe Price | |

| Group, Inc. | ||

| Deborah D. Seidel (1962) | Vice President, T. Rowe Price, T. Rowe Price | |

| Vice President | Group, Inc., T. Rowe Price Investment Services, | |

| Inc., and T. Rowe Price Services, Inc. | ||

| Michael F. Sola, CFA (1969) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| J. David Wagner, CFA (1974) | Vice President, T. Rowe Price, T. Rowe Price | |

| Vice President | Group, Inc., and T. Rowe Price Trust Company | |

| Julie L. Waples (1970) | Vice President, T. Rowe Price | |

| Vice President | ||

|

Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for at least 5 years. | ||

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Anthony W. Deering qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Deering is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

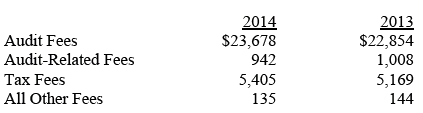

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $2,283,000 and $1,691,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.