| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4 rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. Not Rated includes fixed income securities and fixed income derivatives that have not been rated by any rating agency. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. The Average Duration calculation reflects the impact of the equivalent exposure of derivative positions, if any. |

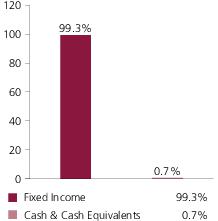

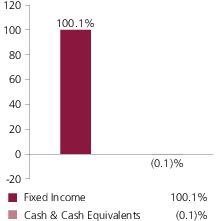

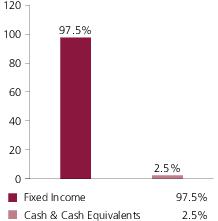

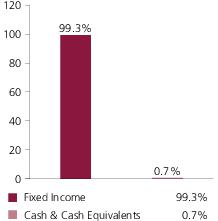

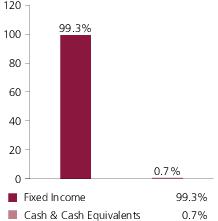

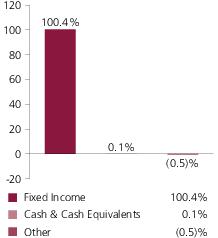

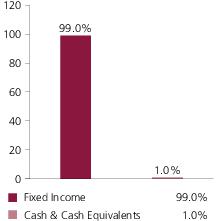

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (m) | In determining each instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening feature (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

| (o) | Less than 0.1%. |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4 rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. Not Rated includes fixed income securities and fixed income derivatives that have not been rated by any rating agency. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. The Average Duration calculation reflects the impact of the equivalent exposure of derivative positions, if any. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (m) | In determining each instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening feature (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

| (o) | Less than 0.1%. |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4 rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. Not Rated includes fixed income securities and fixed income derivatives that have not been rated by any rating agency. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. The Average Duration calculation reflects the impact of the equivalent exposure of derivative positions, if any. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (m) | In determining each instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening feature (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

| (o) | Less than 0.1%. |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4 rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. Not Rated includes fixed income securities and fixed income derivatives that have not been rated by any rating agency. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. The Average Duration calculation reflects the impact of the equivalent exposure of derivative positions, if any. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (m) | In determining each instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening feature (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

| (o) | Less than 0.1%. |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4 rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. Not Rated includes fixed income securities and fixed income derivatives that have not been rated by any rating agency. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. The Average Duration calculation reflects the impact of the equivalent exposure of derivative positions, if any. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (m) | In determining each instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening feature (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

| (o) | Less than 0.1%. |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4 rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. Not Rated includes fixed income securities and fixed income derivatives that have not been rated by any rating agency. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. The Average Duration calculation reflects the impact of the equivalent exposure of derivative positions, if any. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (m) | In determining each instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening feature (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

| (o) | Less than 0.1%. |

| Share Class | Annualized Expense Ratio | Beginning Account Value 4/01/23 | Ending Account Value 9/30/23 | Expenses Paid During Period (p) 4/01/23-9/30/23 | |

| A | Actual | 0.90% | $1,000.00 | $952.25 | $4.39 |

| Hypothetical (h) | 0.90% | $1,000.00 | $1,020.50 | $4.55 | |

| B | Actual | 1.65% | $1,000.00 | $948.70 | $8.04 |

| Hypothetical (h) | 1.65% | $1,000.00 | $1,016.75 | $8.32 | |

| I | Actual | 0.65% | $1,000.00 | $952.65 | $3.17 |

| Hypothetical (h) | 0.65% | $1,000.00 | $1,021.75 | $3.29 | |

| R6 | Actual | 0.58% | $1,000.00 | $952.97 | $2.83 |

| Hypothetical (h) | 0.58% | $1,000.00 | $1,022.10 | $2.93 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

| Share Class | Annualized Expense Ratio | Beginning Account Value 4/01/23 | Ending Account Value 9/30/23 | Expenses Paid During Period (p) 4/01/23-9/30/23 | |

| A | Actual | 0.70% | $1,000.00 | $947.29 | $3.41 |

| Hypothetical (h) | 0.70% | $1,000.00 | $1,021.50 | $3.54 | |

| B | Actual | 1.45% | $1,000.00 | $943.83 | $7.05 |

| Hypothetical (h) | 1.45% | $1,000.00 | $1,017.75 | $7.31 | |

| I | Actual | 0.60% | $1,000.00 | $948.34 | $2.92 |

| Hypothetical (h) | 0.60% | $1,000.00 | $1,022.00 | $3.03 | |

| R6 | Actual | 0.53% | $1,000.00 | $948.68 | $2.58 |

| Hypothetical (h) | 0.53% | $1,000.00 | $1,022.35 | $2.68 |

| Share Class | Annualized Expense Ratio | Beginning Account Value 4/01/23 | Ending Account Value 9/30/23 | Expenses Paid During Period (p) 4/01/23-9/30/23 | |

| A | Actual | 0.69% | $1,000.00 | $962.33 | $3.39 |

| Hypothetical (h) | 0.69% | $1,000.00 | $1,021.55 | $3.49 | |

| B | Actual | 1.44% | $1,000.00 | $958.73 | $7.05 |

| Hypothetical (h) | 1.44% | $1,000.00 | $1,017.80 | $7.26 | |

| C | Actual | 1.59% | $1,000.00 | $956.37 | $7.78 |

| Hypothetical (h) | 1.59% | $1,000.00 | $1,017.05 | $8.02 | |

| I | Actual | 0.59% | $1,000.00 | $962.60 | $2.89 |

| Hypothetical (h) | 0.59% | $1,000.00 | $1,022.05 | $2.98 | |

| R6 | Actual | 0.52% | $1,000.00 | $961.80 | $2.55 |

| Hypothetical (h) | 0.52% | $1,000.00 | $1,022.40 | $2.63 |

| Share Class | Annualized Expense Ratio | Beginning Account Value 4/01/23 | Ending Account Value 9/30/23 | Expenses Paid During Period (p) 4/01/23-9/30/23 | |

| A | Actual | 0.90% | $1,000.00 | $954.38 | $4.40 |

| Hypothetical (h) | 0.90% | $1,000.00 | $1,020.50 | $4.55 | |

| B | Actual | 1.65% | $1,000.00 | $951.06 | $8.05 |

| Hypothetical (h) | 1.65% | $1,000.00 | $1,016.75 | $8.32 | |

| I | Actual | 0.65% | $1,000.00 | $956.09 | $3.18 |

| Hypothetical (h) | 0.65% | $1,000.00 | $1,021.75 | $3.29 | |

| R6 | Actual | 0.60% | $1,000.00 | $956.35 | $2.93 |

| Hypothetical (h) | 0.60% | $1,000.00 | $1,022.00 | $3.03 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

| Share Class | Annualized Expense Ratio | Beginning Account Value 4/01/23 | Ending Account Value 9/30/23 | Expenses Paid During Period (p) 4/01/23-9/30/23 | |

| A | Actual | 0.83% | $1,000.00 | $958.66 | $4.06 |

| Hypothetical (h) | 0.83% | $1,000.00 | $1,020.85 | $4.19 | |

| B | Actual | 1.58% | $1,000.00 | $955.08 | $7.72 |

| Hypothetical (h) | 1.58% | $1,000.00 | $1,017.10 | $7.97 | |

| I | Actual | 0.58% | $1,000.00 | $959.35 | $2.84 |

| Hypothetical (h) | 0.58% | $1,000.00 | $1,022.10 | $2.93 | |

| R6 | Actual | 0.51% | $1,000.00 | $959.68 | $2.50 |

| Hypothetical (h) | 0.51% | $1,000.00 | $1,022.45 | $2.58 |

| Share Class | Annualized Expense Ratio | Beginning Account Value 4/01/23 | Ending Account Value 9/30/23 | Expenses Paid During Period (p) 4/01/23-9/30/23 | |

| A | Actual | 0.82% | $1,000.00 | $957.94 | $4.01 |

| Hypothetical (h) | 0.82% | $1,000.00 | $1,020.90 | $4.14 | |

| B | Actual | 1.57% | $1,000.00 | $955.42 | $7.68 |

| Hypothetical (h) | 1.57% | $1,000.00 | $1,017.15 | $7.92 | |

| I | Actual | 0.57% | $1,000.00 | $960.14 | $2.79 |

| Hypothetical (h) | 0.57% | $1,000.00 | $1,022.15 | $2.88 | |

| R6 | Actual | 0.50% | $1,000.00 | $960.50 | $2.45 |

| Hypothetical (h) | 0.50% | $1,000.00 | $1,022.50 | $2.53 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

| Issuer | Shares/Par | Value ($) | ||

| Municipal Bonds – 97.2% | ||||

| Airport Revenue – 0.1% | ||||

| Denver, CO, City & County Airport System Rev., “A”, 4.125%, 11/15/2047 | $ | 55,000 | $47,938 | |

| Denver, CO, City & County Airport System Rev., “A”, 4.125%, 11/15/2053 | 50,000 | 42,424 | ||

| $90,362 | ||||

| General Obligations - General Purpose – 15.0% | ||||

| Arab, AL, General Obligation Warrants, “A”, AGM, 3%, 12/01/2046 | $ | 1,120,000 | $771,508 | |

| Birmingham, AL, General Obligation Warrants, “B”, 5%, 12/01/2043 | 245,000 | 248,847 | ||

| Birmingham-Jefferson, AL, Civic Center Authority Rev., “A”, 5.25%, 5/31/2053 | 750,000 | 763,801 | ||

| Bridgeview, IL, Stadium and Redevelopment Projects, Taxable, AAC, 5.14%, 12/01/2036 | 160,000 | 138,124 | ||

| Chicago, IL, General Obligation, “A”, 5.5%, 1/01/2035 | 40,000 | 41,634 | ||

| Chicago, IL, General Obligation, “A”, 5.5%, 1/01/2040 | 270,000 | 276,281 | ||

| Chicago, IL, General Obligation, “F”, 5.5%, 1/01/2042 | 110,000 | 109,061 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Capital Appreciation, Series 2022A, 0%, 7/01/2024 | 5,121 | 4,947 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Capital Appreciation, Series 2022A, 0%, 7/01/2033 | 40,508 | 23,874 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 5.625%, 7/01/2027 | 34,739 | 35,648 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 5.625%, 7/01/2029 | 34,176 | 35,314 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 5.75%, 7/01/2031 | 115,194 | 120,299 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 4%, 7/01/2033 | 31,477 | 28,214 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 4%, 7/01/2035 | 57,199 | 49,709 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 4%, 7/01/2037 | 24,283 | 20,384 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 4%, 7/01/2041 | 33,016 | 26,545 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 4%, 7/01/2046 | 121,336 | 93,548 | ||

| Fort Payne, AL, General Obligation Warrants, “A”, AGM, 5%, 5/01/2047 | 750,000 | 756,634 | ||

| Jasper, AL, General Obligation Warrants, 5%, 3/01/2032 (Prerefunded 3/01/2024) | 500,000 | 501,924 | ||

| Mobile County, AL, General Obligation Warrants, 5%, 8/01/2036 | 500,000 | 518,341 | ||

| Montevallo, AL, American Village Public Educational Building Authority Refunding Rev. (Alabama Veterans Living Legacy Project), 4%, 12/01/2034 | 655,000 | 599,823 | ||

| Montevallo, AL, American Village Public Educational Building Authority Refunding Rev. (Alabama Veterans Living Legacy Project), 4%, 12/01/2035 | 250,000 | 228,823 | ||

| Oxford, AL, General Obligation Warrants, “A”, 5%, 7/01/2052 | 1,000,000 | 1,011,444 | ||

| Pike Road, AL, General Obligation, 5%, 2/29/2048 | 500,000 | 514,240 | ||

| Pike Road, AL, General Obligation, 5%, 2/29/2052 | 500,000 | 512,165 | ||

| State of Illinois, General Obligation, 5.5%, 5/01/2039 | 120,000 | 125,194 | ||

| State of Illinois, General Obligation, “B”, 5.5%, 5/01/2047 | 55,000 | 57,057 | ||

| State of Illinois, General Obligation, “C”, 4%, 10/01/2040 | 170,000 | 148,757 | ||

| State of Illinois, General Obligation, “C”, 4%, 10/01/2041 | 100,000 | 86,591 | ||

| Texas Cedar Port Navigation & Improvement District, Unlimited Tax, 4.5%, 8/31/2048 | 70,000 | 63,186 | ||

| Texas Cedar Port Navigation & Improvement District, Unlimited Tax, 4.5%, 8/31/2052 | 30,000 | 26,728 | ||

| Trussville, AL, General Obligation Warrants, “A”, 4%, 8/01/2041 | 750,000 | 677,560 | ||

| Vestavia Hills, AL, General Obligation Warrants, 4%, 8/01/2038 | 1,000,000 | 933,074 | ||

| $9,549,279 | ||||

| General Obligations - Schools – 5.4% | ||||

| Chicago, IL, Board of Education, Unlimited Tax General Obligation Dedicated Rev., “A”, 4%, 12/01/2047 | $ | 255,000 | $198,088 | |

| Huntsville, AL, School Warrants, “C”, 5%, 11/01/2030 (Prerefunded 11/01/2023) | 1,000,000 | 1,000,786 | ||

| Little Rock, AR, School District & Construction, “A”, BAM, 3%, 2/01/2048 | 625,000 | 425,396 | ||

| Mobile County, AL, Board of School Commissioners, Special Tax School Warrants, 4%, 3/01/2039 | 1,000,000 | 914,554 | ||

| Mobile County, AL, Board of School Commissioners, Special Tax School Warrants, “B”, BAM, 4.125%, 3/01/2047 | 1,000,000 | 888,356 | ||

| $3,427,180 | ||||

| Healthcare Revenue - Hospitals – 10.5% | ||||

| Alabama DCH Health Care Authority, “A”, 4%, 6/01/2046 | $ | 1,000,000 | $812,762 | |

| Alabama DCH Health Care Authority, Health Care Facilities Rev., 5%, 6/01/2033 | 500,000 | 501,973 | ||

| Issuer | Shares/Par | Value ($) | ||

| Municipal Bonds – continued | ||||

| Healthcare Revenue - Hospitals – continued | ||||

| Alabama Health Care Authority (Baptist Health), “A”, 5%, 11/15/2037 | $ | 875,000 | $886,067 | |

| Alabama Special Care Facilities Financing Authority Rev. (Daughters of Charity), ETM, AAC, 5%, 11/01/2025 | 270,000 | 281,617 | ||

| Birmingham, AL, Special Care Facilities Financing Authority Health Care Rev. (Children's Hospital), 5%, 6/01/2031 | 750,000 | 755,233 | ||

| Colorado Health Facilities Authority Rev. (CommonSpirit Health), “A-2”, 4%, 8/01/2049 | 15,000 | 12,082 | ||

| East Alabama Health Care Authority, Health Care Facilities Rev., “A”, 4%, 9/01/2048 | 500,000 | 404,956 | ||

| Harris County, TX, Cultural Education Facilities Finance Corp., Hospital Rev. (Memorial Hermann Health System), “A”, 4.125%, 7/01/2052 | 430,000 | 365,714 | ||

| Mobile, AL, Infirmary Health System Special Care Facilities Financing Authority Rev. (Infirmary Health System, Inc.), “A”, 4%, 2/01/2040 | 1,000,000 | 854,108 | ||

| North Carolina Medical Care Commission, Health Care Facilities Rev. (Rex Healthcare), “A”, 4%, 7/01/2049 | 520,000 | 431,010 | ||

| Spartanburg County, SC, Regional Health Services District Hospital Rev., “A”, 4%, 4/15/2043 | 425,000 | 360,198 | ||

| UAB Medicine Finance Authority Rev., “B”, 5%, 9/01/2035 | 1,000,000 | 1,017,239 | ||

| $6,682,959 | ||||

| Healthcare Revenue - Long Term Care – 1.7% | ||||

| Birmingham, AL, Special Care Facilities Financing Authority Rev. (Methodist Home for the Aging), 5.75%, 6/01/2045 | $ | 250,000 | $201,886 | |

| Pell City, AL, Special Care Facilities Financing Authority Rev. (Noland Health Services, Inc.), “A”, 4%, 12/01/2038 | 1,000,000 | 872,996 | ||

| $1,074,882 | ||||

| Industrial Revenue - Environmental Services – 0.3% | ||||

| Muscle Shoals, Sheffield, and Tuscumbia, AL, Solid Waste Disposal Authority Rev. (Cherokee Industrial Landfill Project), “A”, 6%, 5/01/2040 (z) | $ | 300,000 | $225,000 | |

| Industrial Revenue - Other – 0.8% | ||||

| Mobile County, AL, Limited Obligation Warrants (Gomesa Project), 4%, 11/01/2045 (n) | $ | 500,000 | $409,770 | |

| Port Beaumont, TX, Navigation District, Dock & Wharf Facility Rev. (Jefferson Gulf Coast Energy Project), “A”, 3.625%, 1/01/2035 (n) | 100,000 | 77,307 | ||

| $487,077 | ||||

| Miscellaneous Revenue - Other – 1.7% | ||||

| Alabama Stadium Trace Village Improvement District Development Incentive Anticipation, 3.625%, 3/01/2036 | $ | 230,000 | $176,889 | |

| California Infrastructure & Economic Development Bank Rev. (Brightline West Passenger Rail), “A”, 3.65%, 1/01/2050 (Put Date 1/31/2024) (n) | 375,000 | 372,709 | ||

| Matching Fund Special Purpose Securitization Corp., “A”, 5%, 10/01/2026 | 35,000 | 35,133 | ||

| New York Liberty Development Corp., Liberty Rev. (3 World Trade Center Project), “1”, 5%, 11/15/2044 (n) | 260,000 | 240,200 | ||

| Pennsylvania Economic Development Financing Authority, Private Activity Rev. (PennDOT Major Bridges Package One Project), AGM, 5%, 12/31/2057 | 275,000 | 264,885 | ||

| $1,089,816 | ||||

| Multi-Family Housing Revenue – 2.8% | ||||

| Alabama Housing Finance Authority, Multi-Family Housing Rev. (Maryvale Place Project), “F”, HUD Section 8, 4%, 10/01/2025 (Put Date 4/01/2025) | $ | 1,000,000 | $985,231 | |

| New Hampshire National Finance Authority Municipal Certificates, “1-A”, 4.375%, 9/20/2036 | 220,418 | 204,104 | ||

| New Mexico Mortgage Finance Authority, Multifamily Housing Rev. (Mountain View II & III Apartments Project), HUD Section 8, 5%, 2/01/2042 (Put Date 9/01/2025) | 75,000 | 75,548 | ||

| New Mexico Mortgage Finance Authority, Multifamily Housing Rev. (Santa Fe Apartment & Sangre de Cristo Project), HUD Section 8, 5%, 2/01/2042 (Put Date 6/01/2025) | 120,000 | 120,568 | ||

| New York, NY, Housing Development Corp., Multi-Family Housing Rev. (Sustainable Development Bonds), “G”, FHA, 2.45%, 11/01/2045 | 585,000 | 369,732 | ||

| $1,755,183 | ||||

| Port Revenue – 1.6% | ||||

| Alabama Port Authority Docks Facilities Refunding Rev., “A”, AGM, 5%, 10/01/2035 | $ | 1,000,000 | $1,008,285 | |

| Sales & Excise Tax Revenue – 8.9% | ||||

| Cherokee County, AL, Board of Education Special Tax School Warrants (Sales Tax), 5%, 12/01/2048 | $ | 1,000,000 | $1,009,765 | |

| Chicago, IL, Metropolitan Pier & Exposition Authority Refunding Bonds (McCormick Place Expansion Project), Capital Appreciation, “B-1”, AGM, 0%, 6/15/2044 | 820,000 | 279,724 | ||

| Guam Government Business Privilege Tax Refunding, “F”, 5%, 1/01/2030 | 5,000 | 4,985 | ||

| Guam Government Business Privilege Tax Refunding, “F”, 5%, 1/01/2031 | 5,000 | 4,967 | ||

| Guam Government Business Privilege Tax Refunding, “F”, 4%, 1/01/2042 | 60,000 | 48,557 | ||

| Jefferson County, AL, Cooper Green Mercy Health Services Authority Rev., “A”, 5.25%, 9/01/2052 | 810,000 | 806,855 | ||

| Issuer | Shares/Par | Value ($) | ||

| Municipal Bonds – continued | ||||

| Sales & Excise Tax Revenue – continued | ||||

| Jefferson County, AL, Limited Obligation Refunding Warrants, 4%, 9/15/2042 | $ | 1,000,000 | $870,206 | |

| Lawrence County, AL, Board of Education Special Tax School Warrants, AGM, 4%, 1/31/2042 | 1,000,000 | 899,784 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., “2019A-1”, 4.55%, 7/01/2040 | 16,000 | 14,721 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., “2019A-1”, 4.75%, 7/01/2053 | 57,000 | 50,392 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., “2019A-1”, 5%, 7/01/2058 | 650,000 | 587,979 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., “2019A-2”, 4.329%, 7/01/2040 | 142,000 | 127,184 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., “2019A-2”, 4.329%, 7/01/2040 | 58,000 | 51,948 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., “2019A-2”, 4.784%, 7/01/2058 | 401,000 | 350,010 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., Capital Appreciation, “2019A-1”, 0%, 7/01/2027 | 26,000 | 22,139 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., Capital Appreciation, “2019A-1”, 0%, 7/01/2029 | 4,000 | 3,110 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., Capital Appreciation, “2019A-1”, 0%, 7/01/2031 | 247,000 | 174,982 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., Capital Appreciation, “2019A-1”, 0%, 7/01/2033 | 237,000 | 151,858 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., Capital Appreciation, “2019A-1”, 0%, 7/01/2046 | 465,000 | 119,872 | ||

| Wisconsin Public Finance Authority Limited Obligation Grant Rev. (American Dream at Meadowlands Project), “A”, 6.25%, 8/01/2027 (a)(d)(n) | 100,000 | 76,375 | ||

| $5,655,413 | ||||

| Single Family Housing - State – 0.9% | ||||

| Connecticut Housing Finance Authority Rev. (Housing Mortgage Finance Program), “C-1”, 4%, 11/15/2047 | $ | 130,000 | $128,048 | |

| Maryland Community Development Administration, Department of Housing & Community Development Residential Rev., “A”, GNMA, 4.45%, 9/01/2043 | 385,000 | 359,945 | ||

| Maryland Community Development Administration, Department of Housing & Community Development Residential Rev., “A”, GNMA, 4.5%, 9/01/2046 | 130,000 | 120,083 | ||

| $608,076 | ||||

| State & Local Agencies – 1.3% | ||||

| Alabama Public Health Care Authority Lease Rev. (Department of Public Health Facilities), 5%, 9/01/2030 | $ | 280,000 | $283,270 | |

| Bessemer, AL, Public Educational Building Authority Rev. (DHR Building Project), “A”, AGM, 5%, 7/01/2030 | 210,000 | 210,119 | ||

| Pennsylvania Public School Building Authority, School Lease Rev. (School District of Philadelphia Project), “A”, AGM, 5%, 6/01/2033 | 350,000 | 358,918 | ||

| $852,307 | ||||

| Student Loan Revenue – 0.8% | ||||

| Iowa Student Loan Liquidity Corp. Rev., “B”, 3%, 12/01/2039 | $ | 5,000 | $4,616 | |

| Iowa Student Loan Liquidity Corp. Rev., “B”, 3.5%, 12/01/2044 | 90,000 | 65,445 | ||

| Minnesota Office of Higher Education Supplemental Student Loan Program Rev., 2.65%, 11/01/2038 | 40,000 | 34,853 | ||

| New Jersey Higher Education Student Assistance Authority, Senior Student Loan Rev., “B”, 4%, 12/01/2041 | 415,000 | 392,564 | ||

| $497,478 | ||||

| Tax - Other – 6.4% | ||||

| Birmingham-Jefferson, AL, Civic Center Authority, “A”, 4%, 7/01/2043 | $ | 750,000 | $647,219 | |

| Birmingham-Jefferson, AL, Civic Center Authority, “B”, 5%, 7/01/2043 | 500,000 | 498,704 | ||

| Chicago, IL, Board of Education, Dedicated Capital Improvement Tax Bond, 5%, 4/01/2045 | 45,000 | 44,419 | ||

| Chicago, IL, Board of Education, Dedicated Capital Improvement Tax Bond, 5.75%, 4/01/2048 | 125,000 | 130,862 | ||

| Guam Government Limited Obligation Rev., “A”, 5%, 12/01/2036 | 30,000 | 29,285 | ||

| Guam Government Limited Obligation Rev., “A”, 5%, 12/01/2046 | 85,000 | 74,538 | ||

| Jefferson County, AL, Board of Education, 4%, 2/01/2042 | 805,000 | 719,703 | ||

| St. Clair County, AL, Board of Education, Special Tax School Warrants (15 Mill Moody Tax), “A”, BAM, 4.125%, 2/01/2048 | 500,000 | 441,798 | ||

| St. Clair County, AL, Board of Education, Special Tax School Warrants (15 Mill Moody Tax), “A”, BAM, 4.25%, 2/01/2052 | 500,000 | 443,931 | ||

| Tuscaloosa, AL, Board of Education, School Tax Warrants, 5%, 8/01/2036 (Prerefunded 8/01/2026) | 1,000,000 | 1,034,225 | ||

| $4,064,684 | ||||

| Tobacco – 0.6% | ||||

| Buckeye, OH, Tobacco Settlement Financing Authority Senior Asset-Backed Refunding, 2020B-2, “2”, 5%, 6/01/2055 | $ | 185,000 | $159,361 | |

| Golden State, CA, Tobacco Securitization Corp., Tobacco Settlement Rev., Taxable, “B-1”, 3.85%, 6/01/2050 | 255,000 | 231,299 | ||

| $390,660 | ||||

| Toll Roads – 0.3% | ||||

| Virginia Small Business Financing Authority Senior Lien Rev. (Elizabeth River Crossings Opco LLC Project), 3%, 1/01/2041 | $ | 250,000 | $179,979 | |

| Issuer | Shares/Par | Value ($) | ||

| Municipal Bonds – continued | ||||

| Transportation - Special Tax – 3.4% | ||||

| Jefferson County, AL, Transportation Infrastructure Bank, Limited Obligation Rev., “B”, AGM, 5%, 8/15/2035 | $ | 1,000,000 | $1,048,881 | |

| Jefferson County, AL, Transportation Infrastructure Bank, Limited Obligation Rev., “B”, AGM, 5%, 8/15/2036 | 1,000,000 | 1,039,299 | ||

| New Jersey Transportation Trust Fund Authority, “A”, 5%, 12/15/2039 | 45,000 | 46,163 | ||

| New Jersey Transportation Trust Fund Authority, “CC”, 5.5%, 6/15/2050 | 40,000 | 42,145 | ||

| $2,176,488 | ||||

| Universities - Colleges – 14.3% | ||||

| Alabama Community College System Board of Trustees Rev. (Bishop State Community College), BAM, 4%, 1/01/2044 | $ | 300,000 | $265,160 | |

| Alabama Community College System Board of Trustees Rev. (Bishop State Community College), BAM, 4%, 1/01/2049 | 1,000,000 | 848,931 | ||

| Auburn University, AL, General Fee Rev., “A”, 5%, 6/01/2048 | 1,500,000 | 1,520,685 | ||

| Homewood, AL, Educational Building Authority Facilities Rev. (Samford University), “A”, 5%, 12/01/2034 | 500,000 | 511,492 | ||

| Jacksonville, AL, Public Educational Building Authority Higher Education Facilities Rev. (Jacksonville State University Foundation), “A”, 5%, 7/01/2036 | 580,000 | 584,044 | ||

| Jacksonville, AL, Public Educational Building Authority Higher Education Facilities Rev. (Jacksonville State University Foundation), “A”, AGM, 5.25%, 8/01/2048 | 750,000 | 764,942 | ||

| Massachusetts Development Finance Agency Rev. (Suffolk University), 4%, 7/01/2051 | 345,000 | 261,163 | ||

| Puerto Rico Industrial, Tourist, Educational, Medical & Environmental Control Facilities Financing Authority, Educational Facilities Rev. (University Plaza Project), NPFG, 5%, 7/01/2033 | 60,000 | 58,177 | ||

| University of Alabama in Huntsville, General Fee Rev., “B2”, 5%, 9/01/2035 | 755,000 | 793,091 | ||

| University of Alabama in Huntsville, General Fee Rev., “B2”, 5%, 9/01/2036 | 475,000 | 496,034 | ||

| University of North Alabama, General Fee Rev., “B”, BAM, 5%, 11/01/2039 | 1,000,000 | 1,029,119 | ||

| University of South Alabama, Facilities Rev., BAM, 5%, 10/01/2036 | 500,000 | 509,054 | ||

| University of South Alabama, Facilities Rev., “A”, BAM, 5%, 4/01/2049 | 750,000 | 744,590 | ||

| University of West Alabama, General Fee Rev., AGM, 4%, 1/01/2040 | 770,000 | 685,445 | ||

| $9,071,927 | ||||

| Utilities - Investor Owned – 0.8% | ||||

| Mobile, AL, Industrial Development Board Pollution Control Rev. (Alabama Power Co. Barry Plant Project), “C”, 3.78%, 6/01/2034 (Put Date 6/16/2026) | $ | 500,000 | $490,968 | |

| Utilities - Municipal Owned – 0.6% | ||||

| Puerto Rico Electric Power Authority Refunding Rev., “DDD”, 5%, 7/01/2020 (a)(d) | $ | 5,000 | $1,250 | |

| Puerto Rico Electric Power Authority Refunding Rev., “DDD”, 5%, 7/01/2021 (a)(d) | 70,000 | 17,500 | ||

| Puerto Rico Electric Power Authority Refunding Rev., “DDD”, 5%, 7/01/2022 (a)(d) | 115,000 | 28,750 | ||

| Puerto Rico Electric Power Authority Refunding Rev., “VV”, NPFG, 5.25%, 7/01/2034 | 15,000 | 14,793 | ||

| Puerto Rico Electric Power Authority Rev., “A”, 5%, 7/01/2029 (a)(d) | 180,000 | 45,000 | ||

| Puerto Rico Electric Power Authority Rev., “A”, 5%, 7/01/2042 (a)(d) | 30,000 | 7,500 | ||

| Puerto Rico Electric Power Authority Rev., “AAA”, 5.25%, 7/01/2021 (a)(d) | 15,000 | 3,750 | ||

| Puerto Rico Electric Power Authority Rev., “AAA”, 5.25%, 7/01/2030 (a)(d) | 5,000 | 1,250 | ||

| Puerto Rico Electric Power Authority Rev., “CCC”, 5.25%, 7/01/2027 (a)(d) | 65,000 | 16,250 | ||

| Puerto Rico Electric Power Authority Rev., “DDD”, AGM, 3.65%, 7/01/2024 | 50,000 | 49,482 | ||

| Puerto Rico Electric Power Authority Rev., “SS”, AGM, 4.375%, 7/01/2030 | 15,000 | 14,370 | ||

| Puerto Rico Electric Power Authority Rev., “TT”, 5%, 7/01/2021 (a)(d) | 40,000 | 10,000 | ||

| Puerto Rico Electric Power Authority Rev., “TT”, 5%, 7/01/2023 (a)(d) | 30,000 | 7,500 | ||

| Puerto Rico Electric Power Authority Rev., “TT”, 5%, 7/01/2027 (a)(d) | 5,000 | 1,250 | ||

| Puerto Rico Electric Power Authority Rev., “TT”, 5%, 7/01/2037 (a)(d) | 95,000 | 23,750 | ||

| Puerto Rico Electric Power Authority Rev., “UU”, AGM, 4.25%, 7/01/2027 | 70,000 | 67,947 | ||

| Puerto Rico Electric Power Authority Rev., “WW”, 5.375%, 7/01/2022 (a)(d) | 5,000 | 1,250 | ||

| Puerto Rico Electric Power Authority Rev., “WW”, 5.25%, 7/01/2025 (a)(d) | 15,000 | 3,750 | ||

| Puerto Rico Electric Power Authority Rev., “ZZ”, 5%, 7/01/2018 (a)(d) | 40,000 | 10,000 | ||

| Puerto Rico Electric Power Authority Rev., “ZZ”, 5.25%, 7/01/2023 (a)(d) | 50,000 | 12,500 | ||

| Puerto Rico Electric Power Authority Rev., “ZZ”, 5.25%, 7/01/2024 (a)(d) | 15,000 | 3,750 | ||

| Puerto Rico Electric Power Authority Rev., “ZZ”, 5.25%, 7/01/2026 (a)(d) | 55,000 | 13,750 | ||

| Puerto Rico Electric Power Authority Rev., Taxable, “EEE”, 6.05%, 7/01/2032 (a)(d) | 40,000 | 10,000 | ||

| $365,342 | ||||

| Utilities - Other – 5.3% | ||||

| Alabama Southeast Energy Authority Commodity Supply Rev. (Project No.6), 5%, 1/01/2054 (Put Date 6/01/2030) | $ | 500,000 | $505,044 | |

| Black Belt Energy Gas District, AL, Gas Project Rev. (Project No. 8), “A”, 4%, 12/01/2052 (Put Date 12/01/2029) | 180,000 | 168,123 | ||

| Issuer | Shares/Par | Value ($) | ||

| Municipal Bonds – continued | ||||

| Utilities - Other – continued | ||||

| Black Belt Energy Gas District, AL, Gas Project Rev., “A”, 4%, 6/01/2051 (Put Date 12/01/2031) | $ | 210,000 | $198,004 | |

| Black Belt Energy Gas District, AL, Gas Project Rev., “C-1”, 5.25%, 2/01/2053 (Put Date 6/01/2029) | 425,000 | 431,272 | ||

| California Community Choice Financing Authority, Clean Energy Project Rev., “C”, 5.25%, 1/01/2054 (Put Date 10/01/2031) | 410,000 | 409,033 | ||

| Southeast Alabama Energy Authority Commodity Supply Rev. (Project No. 2), “A”, 4%, 12/01/2051 (Put Date 12/01/2031) | 1,000,000 | 930,086 | ||

| Southeast Alabama Energy Authority Commodity Supply Rev. (Project No. 5), “A”, 5.25%, 1/01/2054 (Put Date 7/01/2029) | 360,000 | 362,336 | ||

| Tennessee Energy Acquisition Corp., Gas Project Rev., “A-1”, 5%, 5/01/2053 (Put Date 5/01/2028) | 360,000 | 359,163 | ||

| $3,363,061 | ||||

| Water & Sewer Utility Revenue – 13.7% | ||||

| Auburn, AL, Waterworks Board Water Rev., 5%, 9/01/2036 (Prerefunded 9/01/2025) | $ | 1,000,000 | $1,020,793 | |

| Birmingham, AL, Waterworks Board Water Rev., 5%, 1/01/2036 (Prerefunded 1/01/2028) | 750,000 | 793,782 | ||

| Cullman, AL, Utilities Board Water Rev., “A”, AGM, 5%, 9/01/2035 | 1,000,000 | 1,006,582 | ||

| Gadsden, AL, Waterworks and Sewer Rev., AGM, 4%, 6/01/2033 | 1,000,000 | 979,329 | ||

| Guam Waterworks Authority Rev. (Water and Wastewater System), 5%, 7/01/2036 | 45,000 | 45,003 | ||

| Guam Waterworks Authority Rev. (Water and Wastewater System), 5%, 1/01/2046 | 120,000 | 113,097 | ||

| Guam Waterworks Authority Rev. (Water and Wastewater System), “A”, 5%, 7/01/2029 | 45,000 | 45,078 | ||

| Guam Waterworks Authority Rev. (Water and Wastewater System), “A”, 5%, 7/01/2035 | 45,000 | 45,027 | ||

| Guam Waterworks Authority Rev. (Water and Wastewater System), “A”, 5%, 1/01/2050 | 95,000 | 88,041 | ||

| Jefferson County, AL, Senior Lien Sewer Rev., Current Interest Warrants, “A”, AGM, 5%, 10/01/2044 | 750,000 | 736,256 | ||

| Limestone County, AL, Water & Sewer Authority Rev., 5%, 12/01/2045 | 1,000,000 | 1,018,483 | ||

| Madison, AL, Water & Wastewater Board Rev., 3%, 12/01/2050 | 1,000,000 | 666,149 | ||

| Michigan Finance Authority Local Government Loan Program Rev. (Detroit Water and Sewerage Department Sewage Disposal System Rev. Refunding Second Lien Local Project), “C-7”, NPFG, 5%, 7/01/2032 | 15,000 | 15,085 | ||

| Michigan Finance Authority Local Government Loan Program Rev. (Detroit Water and Sewerage Department Water Supply System Rev. Refunding Second Lien Local Project), “D-6”, NPFG, 5%, 7/01/2036 | 20,000 | 20,044 | ||

| Michigan Finance Authority Local Government Loan Program Rev. (Detroit Water and Sewerage Department Water Supply System Rev. Refunding Senior Lien Local Project), “D-1”, AGM, 5%, 7/01/2035 | 10,000 | 10,047 | ||

| Michigan Finance Authority Local Government Loan Program Rev. (Detroit Water and Sewerage Department Water Supply System Rev. Refunding Senior Lien Local Project), “D-1”, AGM, 5%, 7/01/2037 | 20,000 | 20,054 | ||

| Montgomery, AL, Water Works and Sanitary Sewer Board, Water and Sewer Rev., 5%, 9/01/2048 | 500,000 | 514,240 | ||

| Orange Beach, AL, Water Sewer & Fire Protection Authority Water Rev., 4%, 5/15/2047 | 1,000,000 | 854,925 | ||

| Prichard, AL, Water Works & Sewer Board Rev., 4%, 11/01/2044 | 700,000 | 489,432 | ||

| Texas Water Development Board State Water Implementation Rev., “A”, 5%, 10/15/2058 (w) | 200,000 | 205,607 | ||

| $8,687,054 | ||||

| Total Municipal Bonds (Identified Cost, $68,363,973) | $61,793,460 | |||

| Bonds – 0.3% | ||||

| Consumer Services – 0.3% | ||||

| Toll Road Investors Partnership II LP, Capital Appreciation, NPFG, 0%, 2/15/2025 (n) | $ | 136,000 | $122,460 | |

| Toll Road Investors Partnership II LP, Capital Appreciation, NPFG, 0%, 2/15/2043 (n) | 189,099 | 62,164 | ||

| Total Bonds (Identified Cost, $200,659) | $184,624 | |||

| Contingent Value Instruments – 0.1% | ||||

| General Obligations - General Purpose – 0.1% | ||||

| Commonwealth of Puerto Rico, General Obligation Contingent Value Instrument, 11/01/2043 (Identified Cost, $88,426) | $ | 149,038 | $77,313 | |

| Investment Companies (h) – 1.9% | ||||

| Money Market Funds – 1.9% | ||||

| MFS Institutional Money Market Portfolio, 5.4% (v) (Identified Cost, $1,199,599) | 1,199,500 | $1,199,740 | ||

| Other Assets, Less Liabilities – 0.5% | 348,065 | |||

| Net Assets – 100.0% | $63,603,202 | |||

| Issuer | Shares/Par | Value ($) | ||

| Municipal Bonds – 98.2% | ||||

| Airport Revenue – 0.3% | ||||

| Wayne County, MI, Airport Authority Rev. (Detroit Metropolitan Wayne County Airport), “B”, 5%, 12/01/2044 | $ | 95,000 | $93,727 | |

| Wayne County, MI, Airport Authority Rev. (Detroit Metropolitan Wayne County Airport), “B”, BAM, 5%, 12/01/2039 | 105,000 | 104,994 | ||

| Wayne County, MI, Airport Authority Rev. (Detroit Metropolitan Wayne County Airport), “C”, 5%, 12/01/2039 | 80,000 | 79,827 | ||

| Wayne County, MI, Airport Authority Rev. (Detroit Metropolitan Wayne County Airport), “C”, 5%, 12/01/2044 | 125,000 | 123,166 | ||

| $401,714 | ||||

| General Obligations - General Purpose – 4.4% | ||||

| Arkansas Higher Education, General Obligation, 4%, 6/01/2029 | $ | 2,000,000 | $1,948,184 | |

| Bridgeview, IL, Stadium and Redevelopment Projects, Taxable, AAC, 5.14%, 12/01/2036 | 375,000 | 323,728 | ||

| Chicago, IL, General Obligation, “A”, 5.5%, 1/01/2035 | 80,000 | 83,268 | ||

| Chicago, IL, General Obligation, “A”, 5.5%, 1/01/2040 | 550,000 | 562,794 | ||

| Chicago, IL, General Obligation, “F”, 5.5%, 1/01/2042 | 225,000 | 223,080 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Capital Appreciation, Series 2022A, 0%, 7/01/2024 | 9,759 | 9,427 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Capital Appreciation, Series 2022A, 0%, 7/01/2033 | 77,204 | 45,501 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 5.625%, 7/01/2027 | 66,209 | 67,941 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 5.625%, 7/01/2029 | 65,135 | 67,305 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 5.75%, 7/01/2031 | 63,265 | 66,069 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 4%, 7/01/2033 | 59,992 | 53,773 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 4%, 7/01/2035 | 111,025 | 96,486 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 4%, 7/01/2037 | 46,282 | 38,851 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 4%, 7/01/2041 | 62,925 | 50,593 | ||

| Commonwealth of Puerto Rico, General Obligation Restructured Bonds, Series 2022A, 4%, 7/01/2046 | 216,442 | 166,873 | ||

| Little Rock, AR, Library Construction Refunding, 4%, 3/01/2036 | 1,500,000 | 1,486,603 | ||

| State of Illinois, General Obligation, 5.5%, 5/01/2039 | 120,000 | 125,194 | ||

| State of Illinois, General Obligation, 5.75%, 5/01/2045 | 115,000 | 119,890 | ||

| State of Illinois, General Obligation, “B”, 5.5%, 5/01/2047 | 115,000 | 119,302 | ||

| State of Illinois, General Obligation, “C”, 4%, 10/01/2040 | 345,000 | 301,888 | ||

| State of Illinois, General Obligation, “C”, 4%, 10/01/2041 | 210,000 | 181,840 | ||

| $6,138,590 | ||||

| General Obligations - Schools – 8.9% | ||||

| Benton County, AR, Bentonville School District No. 6 Construction Refunding, “B”, 4%, 6/01/2037 | $ | 1,500,000 | $1,398,525 | |

| Benton County, AR, Bentonville School District No. 6 Construction Refunding, “B”, 4%, 6/01/2047 | 1,000,000 | 858,577 | ||

| Benton County, AR, Bentonville School District No. 6 Construction, “G”, 2.25%, 6/01/2046 | 1,000,000 | 587,354 | ||

| Crittenden County, AR, Community College District, 4.6%, 2/01/2035 | 285,000 | 280,369 | ||

| Crittenden County, AR, Community College District, 4.7%, 2/01/2040 | 625,000 | 607,437 | ||

| Crittenden County, AR, Earle Special School District Refunding and Construction, 4%, 2/01/2048 | 2,060,000 | 1,763,004 | ||

| Fort Smith, AR, School District No. 100 Construction, “B”, 2.75%, 2/01/2045 | 1,370,000 | 925,490 | ||

| Greene County, AR, Tech School District No. T-1, Construction Refunding, 3.75%, 4/01/2041 | 1,100,000 | 934,216 | ||

| Greene County, AR, Tech School District No. T-1, Construction Refunding, 3.75%, 4/01/2042 | 1,000,000 | 828,798 | ||

| Johnson County, AR, Clarksville School District No. 17 Refunding, 0.5%, 12/01/2024 | 350,000 | 329,510 | ||

| Little Rock, AR, School District & Construction of Pulaski County, 3%, 2/01/2030 | 1,030,000 | 930,223 | ||

| Little Rock, AR, School District & Construction, “A”, BAM, 3%, 2/01/2048 | 755,000 | 513,879 | ||

| North Little Rock, AR, School District No. 1, 2%, 2/01/2027 | 2,000,000 | 1,821,153 | ||

| North Little Rock, AR, School District No. 1, 2%, 2/01/2038 | 865,000 | 579,436 | ||

| $12,357,971 | ||||

| Healthcare Revenue - Hospitals – 12.6% | ||||

| Arkansas Development Finance Authority, Health Care Rev. (Baptist Health), 5%, 12/01/2047 | $ | 2,000,000 | $1,949,144 | |

| Arkansas Development Finance Authority, Health Care Rev. (Baptist Health), “A”, 5%, 12/01/2029 | 1,000,000 | 1,014,250 | ||

| Arkansas Development Finance Authority, Health Care Rev. (Baptist Memorial Health Care Corp.), “B-1”, 5%, 9/01/2034 | 740,000 | 749,779 | ||

| Arkansas Development Finance Authority, Health Care Rev. (Baptist Memorial Health Care Corp.), “B-1”, 5%, 9/01/2044 | 2,000,000 | 1,887,521 | ||

| Arkansas Development Finance Authority, Healthcare Facilities Rev. (Carti Surgery Center Project), “B”, 4.25%, 7/01/2041 | 750,000 | 609,765 | ||

| Arkansas Development Finance Authority, Healthcare Facilities Rev. (Carti Surgery Center Project), “B”, 4%, 7/01/2052 | 1,250,000 | 863,149 | ||

| Arkansas Development Finance Authority, Hospital Rev. (Washington Regional Medical Center), 5%, 2/01/2038 | 1,900,000 | 1,801,227 | ||

| Arkansas Development Finance Authority, Hospital Rev. (Washington Regional Medical Center), 4%, 2/01/2042 | 990,000 | 802,012 | ||

| Arkansas Development Finance Authority, Hospital Rev. (Washington Regional Medical Center), “A”, 5%, 2/01/2033 | 1,645,000 | 1,646,105 | ||

| Batesville, AK, Public Facilities Board, Hospital Rev. (White River Health System, Inc.), 5%, 6/01/2027 | 500,000 | 506,279 | ||

| Issuer | Shares/Par | Value ($) | ||

| Municipal Bonds – continued | ||||

| Healthcare Revenue - Hospitals – continued | ||||

| Colorado Health Facilities Authority Rev. (CommonSpirit Health), “A-2”, 4%, 8/01/2049 | $ | 30,000 | $24,164 | |

| Conway, AR, Hospital Rev. (Conway Regional Medical Center), “A”, 4%, 8/01/2038 | 1,000,000 | 837,713 | ||

| Doylestown, PA, Hospital Authority Rev., “A”, 4%, 6/30/2045 | 20,000 | 14,257 | ||

| Harris County, TX, Cultural Education Facilities Finance Corp., Hospital Rev. (Memorial Hermann Health System), “A”, 4.125%, 7/01/2052 | 810,000 | 688,903 | ||

| Montgomery County, MD, Rev. (Trinity Health Credit Group), 5%, 12/01/2045 | 300,000 | 300,557 | ||

| Pulaski, AR, Hospital Rev. (Arkansas Children's Hospital), 4.25%, 3/01/2048 | 1,000,000 | 880,773 | ||

| Springdale, AR, Public Facilities Board Hospital Rev. (Children's Northwest Project), 5%, 3/01/2040 | 2,820,000 | 2,823,968 | ||

| $17,399,566 | ||||

| Industrial Revenue - Other – 1.7% | ||||

| Lowell, AR, Industrial Development Rev. (Arkansas Democrat-Gazette), VRDN, 3.2%, 9/30/2036 | $ | 2,000,000 | $2,000,000 | |

| Port Beaumont, TX, Navigation District, Dock & Wharf Facility Rev. (Jefferson Gulf Coast Energy Project), “A”, 2.875%, 1/01/2041 (n) | 170,000 | 105,612 | ||

| Port Beaumont, TX, Navigation District, Dock & Wharf Facility Rev. (Jefferson Gulf Coast Energy Project), “A”, 4%, 1/01/2050 (n) | 390,000 | 261,752 | ||

| $2,367,364 | ||||

| Industrial Revenue - Paper – 0.1% | ||||

| Valparaiso, IN, Exempt Facilities Rev. (Pratt Paper LLC Project), 7%, 1/01/2044 | $ | 100,000 | $100,652 | |

| Miscellaneous Revenue - Other – 2.8% | ||||

| Bryant, AR, Capital Improvement Rev., 4.2%, 2/01/2050 | $ | 1,000,000 | $857,137 | |

| Fayetteville, AR, Hotel, Motel and Restaurant Rev., BAM, 5%, 11/01/2034 | 2,000,000 | 2,020,283 | ||

| Matching Fund Special Purpose Securitization Corp., “A”, 5%, 10/01/2026 | 60,000 | 60,229 | ||

| New York Liberty Development Corp., Liberty Rev. (3 World Trade Center Project), “1”, 5%, 11/15/2044 (n) | 375,000 | 346,442 | ||

| Pennsylvania Economic Development Financing Authority, Private Activity Rev. (PennDOT Major Bridges Package One Project), AGM, 5%, 12/31/2057 | 560,000 | 539,402 | ||

| $3,823,493 | ||||

| Multi-Family Housing Revenue – 0.3% | ||||

| New Hampshire National Finance Authority Municipal Certificates, “1-A”, 4.375%, 9/20/2036 | $ | 433,939 | $401,821 | |

| Sales & Excise Tax Revenue – 17.8% | ||||

| Bentonville, AR, Sales & Use Tax Refunding Improvement, “B”, 3%, 11/01/2034 | $ | 1,000,000 | $859,152 | |

| Bentonville, AR, Sales & Use Tax Refunding Improvement, “B”, 3%, 11/01/2035 | 1,000,000 | 841,785 | ||

| Bentonville, AR, Sales & Use Tax Refunding Improvement, “B”, 3%, 11/01/2036 | 785,000 | 642,145 | ||

| Cabot, AR, Sales & Use Tax Refunding and Improvements, “B”, 4%, 12/01/2029 | 250,000 | 252,024 | ||

| Chicago, IL, Metropolitan Pier & Exposition Authority Refunding Bonds (McCormick Place Expansion Project), Capital Appreciation, “B-1”, AGM, 0%, 6/15/2044 | 1,585,000 | 540,686 | ||

| Conway, AR, Sales & Use Tax Rev., Capital Improvement, 4.5%, 5/01/2030 | 850,000 | 850,162 | ||

| Conway, AR, Sales & Use Tax Rev., Capital Improvement, 4.5%, 5/01/2035 | 1,150,000 | 1,150,084 | ||

| Forrest City, AR, Sales & Use Tax , 3%, 11/01/2032 | 350,000 | 307,267 | ||

| Forrest City, AR, Sales & Use Tax , 3%, 11/01/2033 | 370,000 | 321,570 | ||

| Forrest City, AR, Sales & Use Tax , 3%, 11/01/2034 | 380,000 | 326,062 | ||

| Forrest City, AR, Sales & Use Tax , 3%, 11/01/2036 | 400,000 | 328,438 | ||

| Guam Government Business Privilege Tax Refunding, “F”, 5%, 1/01/2030 | 10,000 | 9,970 | ||

| Guam Government Business Privilege Tax Refunding, “F”, 5%, 1/01/2031 | 10,000 | 9,935 | ||

| Guam Government Business Privilege Tax Refunding, “F”, 4%, 1/01/2042 | 110,000 | 89,022 | ||

| Guam Government Business Privilege Tax Rev., “D”, 5%, 11/15/2031 | 415,000 | 409,014 | ||

| Madison County, AR, Sales & Use Tax, 4.375%, 11/30/2043 (w) | 1,000,000 | 931,403 | ||

| Madison County, AR, Sales & Use Tax, 4.625%, 11/30/2048 (w) | 500,000 | 470,644 | ||

| Massachusetts Bay Transportation Authority, Sales Tax Rev., “A-1”, 5.25%, 7/01/2029 | 1,000,000 | 1,096,757 | ||

| Mississippi County, AR, 4%, 6/01/2036 | 650,000 | 609,554 | ||

| Mountain View, AK, Sales and Use Tax Rev., BAM, 3%, 11/01/2031 | 335,000 | 296,311 | ||

| Mountain View, AK, Sales and Use Tax Rev., BAM, 3%, 11/01/2034 | 415,000 | 354,056 | ||

| Mountain View, AK, Sales and Use Tax Rev., BAM, 3%, 11/01/2035 | 425,000 | 354,250 | ||

| Phillips County, AR, Sales & Use Tax, BAM, 3.75%, 9/01/2038 | 1,170,000 | 1,062,565 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., “2019A-1”, 4.55%, 7/01/2040 | 36,000 | 33,123 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., “2019A-1”, 4.75%, 7/01/2053 | 122,000 | 107,856 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., “2019A-1”, 5%, 7/01/2058 | 2,108,000 | 1,906,862 | ||

| Issuer | Shares/Par | Value ($) | ||

| Municipal Bonds – continued | ||||

| Sales & Excise Tax Revenue – continued | ||||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., “2019A-2”, 4.329%, 7/01/2040 | $ | 235,000 | $210,481 | |

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., “2019A-2”, 4.329%, 7/01/2040 | 120,000 | 107,480 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., “2019A-2”, 4.536%, 7/01/2053 | 2,000 | 1,706 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., “2019A-2”, 4.784%, 7/01/2058 | 62,000 | 54,116 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., Capital Appreciation, “2019A-1”, 0%, 7/01/2024 | 3,000 | 2,904 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., Capital Appreciation, “2019A-1”, 0%, 7/01/2027 | 66,000 | 56,198 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., Capital Appreciation, “2019A-1”, 0%, 7/01/2029 | 12,000 | 9,330 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., Capital Appreciation, “2019A-1”, 0%, 7/01/2031 | 593,000 | 420,098 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., Capital Appreciation, “2019A-1”, 0%, 7/01/2033 | 568,000 | 363,946 | ||

| Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Rev., Capital Appreciation, “2019A-1”, 0%, 7/01/2046 | 2,189,000 | 564,298 | ||

| Rogers, AR, Sales & Use Tax Rev., 4%, 11/01/2032 | 1,060,000 | 1,047,833 | ||

| Rogers, AR, Sales & Use Tax Rev., 4%, 11/01/2033 | 2,495,000 | 2,456,821 | ||

| Rogers, AR, Sales & Use Tax Rev., “B”, 5%, 11/01/2036 | 2,000,000 | 2,031,994 | ||

| Springdale, AR, Sales & Use Tax Refunding & Improvement, Taxable, “B”, BAM, 4.125%, 8/01/2050 | 2,000,000 | 1,751,835 | ||

| Springdale, AR, Sales & Use Tax Rev., BAM, 5%, 4/01/2037 | 1,000,000 | 1,004,777 | ||

| Wisconsin Public Finance Authority Limited Obligation Grant Rev. (American Dream at Meadowlands Project), “A”, 6.25%, 8/01/2027 (a)(d)(n) | 280,000 | 213,850 | ||

| Wisconsin Public Finance Authority Limited Obligation Grant Rev., Taxable (American Dream at Meadowlands Project), ”A“, 5.625%, 8/01/2024 (a)(d)(n) | 200,000 | 152,750 | ||

| $24,611,114 | ||||

| Secondary Schools – 0.6% | ||||

| Arkansas Development Finance Authority, Charter School Capital Improvement Rev. (LISA Academy Project), 4.5%, 7/01/2039 | $ | 750,000 | $660,781 | |

| District of Columbia Rev. (Rocketship D.C.), “A”, 5%, 6/01/2039 (n) | 250,000 | 224,118 | ||

| $884,899 | ||||

| Single Family Housing - State – 0.7% | ||||

| Maryland Community Development Administration, Department of Housing & Community Development Residential Rev., “A”, GNMA, 4.45%, 9/01/2043 | $ | 825,000 | $771,310 | |

| Maryland Community Development Administration, Department of Housing & Community Development Residential Rev., “A”, GNMA, 4.5%, 9/01/2046 | 275,000 | 254,023 | ||

| $1,025,333 | ||||

| State & Local Agencies – 2.5% | ||||

| Arkansas Development Finance Authority Rev. (Donaghey Plaza Project), 5%, 6/01/2034 | $ | 2,605,000 | $2,606,814 | |

| North Carolina Turnpike Authority, Triangle Expressway System Appropriation Rev., Capital Appreciation, 0%, 1/01/2044 | 2,360,000 | 834,158 | ||

| $3,440,972 | ||||

| Student Loan Revenue – 0.1% | ||||

| Iowa Student Loan Liquidity Corp. Rev., “B”, 3%, 12/01/2039 | $ | 10,000 | $9,232 | |

| Iowa Student Loan Liquidity Corp. Rev., “B”, 3.5%, 12/01/2044 | 185,000 | 134,525 | ||

| $143,757 | ||||

| Tax - Other – 4.3% | ||||

| Chicago, IL, Board of Education, Dedicated Capital Improvement Tax Bond, 5%, 4/01/2045 | $ | 90,000 | $88,839 | |

| Chicago, IL, Board of Education, Dedicated Capital Improvement Tax Bond, 5.75%, 4/01/2048 | 260,000 | 272,193 | ||

| Fayetteville, AR, Liberty Improvement Bonds, 4%, 1/01/2037 | 2,000,000 | 1,839,074 | ||

| Little Rock, AR, Hotel & Restaurant Gross Receipts Tax Rev., 5%, 7/01/2034 | 3,000,000 | 3,022,809 | ||

| Triborough Bridge & Tunnel Authority Rev., NY, Payroll Mobility Tax (MTA Bridges and Tunnels), ”C-3“, 3%, 5/15/2051 | 890,000 | 598,995 | ||

| Wisconsin Public Finance Authority Limited Obligation PILOT Rev. (American Dream at Meadowlands Project), 7%, 12/01/2050 | 100,000 | 88,977 | ||

| $5,910,887 | ||||

| Tax Assessment – 0.0% | ||||

| Brunswick, MD, Special Obligation Refunding (Brunswick Crossing Special Taxing District), 4%, 7/01/2029 | $ | 15,000 | $14,316 | |

| Brunswick, MD, Special Obligation Refunding (Brunswick Crossing Special Taxing District), 5%, 7/01/2036 | 13,000 | 12,700 | ||

| $27,016 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Municipal Bonds – continued | ||||

| Tobacco – 2.7% | ||||

| Arkansas Development Finance Authority, Tobacco Settlement Rev. (Cancer Research Center Project), Capital Appreciation, AAC, 0%, 7/01/2027 | $ | 2,470,000 | $2,103,864 | |

| Arkansas Development Finance Authority, Tobacco Settlement Rev. (Cancer Research Center Project), Capital Appreciation, AAC, 0%, 7/01/2028 | 500,000 | 407,887 | ||

| Buckeye, OH, Tobacco Settlement Financing Authority Senior Asset-Backed Refunding, 2020A-2, “1”, 4%, 6/01/2048 | 185,000 | 156,266 | ||

| Buckeye, OH, Tobacco Settlement Financing Authority Senior Asset-Backed Refunding, 2020B-2, “2”, 5%, 6/01/2055 | 750,000 | 646,057 | ||

| Golden State, CA, Tobacco Securitization Corp., Tobacco Settlement Rev., Taxable, “B-1”, 3.85%, 6/01/2050 | 495,000 | 448,992 | ||

| $3,763,066 | ||||

| Toll Roads – 1.2% | ||||

| Metropolitan Washington, D.C., Airport Authority, Dulles Toll Road Rev. (Dulles Metrorail and Capital Improvement Projects), “A”, AGM, 4%, 10/01/2052 | $ | 1,000,000 | $860,931 | |

| Texas Private Activity Surface Transportation Corp., Senior Lien Rev. (NTE Mobility Partners Segments 3 LLC Segments 3A & 3B Facility), 7%, 12/31/2038 | 230,000 | 230,437 | ||

| Texas Private Activity Surface Transportation Corp., Senior Lien Rev. (NTE Mobility Partners Segments 3 LLC Segments 3A & 3B Facility), 6.75%, 6/30/2043 | 180,000 | 180,288 | ||

| Virginia Small Business Financing Authority Senior Lien Rev. (Elizabeth River Crossings Opco LLC Project), 3%, 1/01/2041 | 500,000 | 359,958 | ||

| $1,631,614 | ||||

| Transportation - Special Tax – 1.9% | ||||

| New Jersey Economic Development Authority Rev. (NJ Transit Transportation Project), 4%, 11/01/2044 | $ | 1,015,000 | $903,830 | |

| New Jersey Transportation Trust Fund Authority, “A”, 5%, 12/15/2039 | 125,000 | 128,231 | ||

| New Jersey Transportation Trust Fund Authority, Transportation Program, “BB”, 4%, 6/15/2044 | 1,775,000 | 1,563,660 | ||

| $2,595,721 | ||||

| Universities - Colleges – 15.0% | ||||

| Arkansas State University, Housing System Rev. (Jonesboro Campus), 4.5%, 3/01/2031 | $ | 2,500,000 | $2,500,853 | |

| Arkansas State University, Student Fee Rev. (Jonesboro Campus), “C”, AGM, 4.5%, 3/01/2027 | 545,000 | 545,159 | ||

| Arkansas Technology University Student Fee Rev., “A”, BAM, 5%, 12/01/2042 | 500,000 | 500,320 | ||

| Arkansas Technology University Student Fee Rev., “A”, BAM, 4.5%, 12/01/2047 | 500,000 | 457,736 | ||

| Arkansas Technology University Student Fee Rev., “A”, BAM, 4.5%, 12/01/2052 | 1,000,000 | 903,973 | ||

| Board of Trustees of the University of Arkansas, Various Facilities Rev. (Fayetteville Campus), “A”, 5%, 11/01/2047 | 2,000,000 | 2,041,846 | ||

| Board of Trustees of the University of Arkansas, Various Facilities Rev. (UAMS Campus), “A”, 5%, 12/01/2045 | 1,705,000 | 1,740,561 | ||

| Board of Trustees of the University of Arkansas, Various Facilities Rev. (UAMS Northwest Arkansas), “A”, 5%, 4/01/2040 | 500,000 | 519,593 | ||

| Board of Trustees of the University of Arkansas, Various Facilities Rev. (UAMS Northwest Arkansas), “A”, 5%, 4/01/2047 | 2,000,000 | 2,034,569 | ||

| Board of Trustees of the University of Arkansas, Various Facilities Rev. (UAMS Northwest Arkansas), “A”, 5%, 4/01/2052 | 500,000 | 506,518 | ||

| Board of Trustees of the University of Arkansas, Various Facilities Rev. (UAPB Campus), 5%, 12/01/2047 | 1,000,000 | 1,018,567 | ||

| Board of Trustees of the University of Arkansas, Various Facilities Rev. (UAPB Campus), 4%, 12/01/2052 | 1,000,000 | 838,946 | ||

| Connecticut Health & Educational Facilities Authority Rev. (Connecticut College Issue), “M”, 3%, 7/01/2047 | 1,120,000 | 740,348 | ||

| Massachusetts Development Finance Agency Rev. (Suffolk University), 4%, 7/01/2051 | 620,000 | 469,337 | ||

| Puerto Rico Industrial, Tourist, Educational, Medical & Environmental Control Facilities Financing Authority, Higher Education Rev. (University of Sacred Heart), 4.375%, 10/01/2031 | 60,000 | 60,045 | ||

| Puerto Rico Industrial, Tourist, Educational, Medical & Environmental Control Facilities Financing Authority, Higher Education Rev. (University of Sacred Heart), 5%, 10/01/2042 | 65,000 | 65,126 | ||

| Pulaski, AR, Student Tuition & Fee Rev. (Technical College), BAM, 5%, 9/01/2030 | 1,000,000 | 1,012,580 | ||

| Red River, TX, Education Finance Corp., Higher Education Rev. (Houston Baptist University Project), 5.5%, 10/01/2046 | 340,000 | 334,394 | ||

| University of Arkansas Facilities Rev. (Fayetteville Campus), “A”, 5%, 11/01/2043 | 1,500,000 | 1,527,242 | ||

| University of Arkansas Facilities Rev. (UAMS Campus), 5%, 11/01/2025 | 2,000,000 | 2,001,255 | ||

| University of Central Arkansas Student Fee Rev., “A”, AGM, 5%, 11/01/2038 | 500,000 | 509,568 | ||

| University of Central Arkansas Student Fee Rev., “A”, AGM, 4%, 11/01/2048 | 550,000 | 456,434 | ||

| $20,784,970 | ||||

| Utilities - Electric Power – 0.3% | ||||

| Texas Municipal Power Agency, Transmission System Rev., AGM, 2%, 9/01/2033 | $ | 625,000 | $461,133 | |

| Utilities - Municipal Owned – 3.0% | ||||

| Benton, AR, Public Utility Rev., AGM, 5%, 9/01/2030 | $ | 1,000,000 | $1,021,050 | |

| Benton, AR, Public Utility Rev., AGM, 5%, 9/01/2035 | 1,000,000 | 1,016,435 | ||

| Conway, AR, Electric Improvement Rev., “A”, 4%, 12/01/2043 | 1,915,000 | 1,691,347 | ||

| Issuer | Shares/Par | Value ($) | ||

| Municipal Bonds – continued | ||||

| Utilities - Municipal Owned – continued | ||||

| Puerto Rico Electric Power Authority Refunding Rev., “DDD”, 5%, 7/01/2020 (a)(d) | $ | 15,000 | $3,750 | |

| Puerto Rico Electric Power Authority Refunding Rev., “DDD”, 5%, 7/01/2021 (a)(d) | 155,000 | 38,750 | ||

| Puerto Rico Electric Power Authority Refunding Rev., “DDD”, 5%, 7/01/2022 (a)(d) | 260,000 | 65,000 | ||

| Puerto Rico Electric Power Authority Refunding Rev., “VV”, NPFG, 5.25%, 7/01/2034 | 15,000 | 14,793 | ||

| Puerto Rico Electric Power Authority Rev., “A”, 5%, 7/01/2029 (a)(d) | 410,000 | 102,500 | ||

| Puerto Rico Electric Power Authority Rev., “A”, 5%, 7/01/2042 (a)(d) | 65,000 | 16,250 | ||

| Puerto Rico Electric Power Authority Rev., “AAA”, 5.25%, 7/01/2021 (a)(d) | 30,000 | 7,500 | ||

| Puerto Rico Electric Power Authority Rev., “AAA”, 5.25%, 7/01/2030 (a)(d) | 15,000 | 3,750 | ||

| Puerto Rico Electric Power Authority Rev., “CCC”, 5.25%, 7/01/2027 (a)(d) | 145,000 | 36,250 | ||

| Puerto Rico Electric Power Authority Rev., “TT”, 5%, 7/01/2021 (a)(d) | 60,000 | 15,000 | ||

| Puerto Rico Electric Power Authority Rev., “TT”, 5%, 7/01/2023 (a)(d) | 70,000 | 17,500 | ||

| Puerto Rico Electric Power Authority Rev., “TT”, 5%, 7/01/2027 (a)(d) | 10,000 | 2,500 | ||

| Puerto Rico Electric Power Authority Rev., “TT”, 5%, 7/01/2037 (a)(d) | 210,000 | 52,500 | ||

| Puerto Rico Electric Power Authority Rev., “WW”, 5.375%, 7/01/2022 (a)(d) | 10,000 | 2,500 | ||

| Puerto Rico Electric Power Authority Rev., “WW”, 5.25%, 7/01/2025 (a)(d) | 25,000 | 6,250 | ||

| Puerto Rico Electric Power Authority Rev., “ZZ”, 5%, 7/01/2018 (a)(d) | 95,000 | 23,750 | ||

| Puerto Rico Electric Power Authority Rev., “ZZ”, 5.25%, 7/01/2023 (a)(d) | 110,000 | 27,500 | ||

| Puerto Rico Electric Power Authority Rev., “ZZ”, 5.25%, 7/01/2024 (a)(d) | 35,000 | 8,750 | ||

| Puerto Rico Electric Power Authority Rev., “ZZ”, 5.25%, 7/01/2026 (a)(d) | 95,000 | 23,750 | ||

| Puerto Rico Electric Power Authority Rev., Taxable, “EEE”, 6.05%, 7/01/2032 (a)(d) | 80,000 | 20,000 | ||

| $4,217,375 | ||||

| Utilities - Other – 3.3% | ||||

| Alabama Southeast Energy, Cooperative District Energy Supply Rev., “A-1”, 5.5%, 11/01/2053 (Put Date 1/01/2031) | $ | 1,005,000 | $1,032,898 | |

| California Community Choice Financing Authority, Clean Energy Project Rev., “C”, 5.25%, 1/01/2054 (Put Date 10/01/2031) | 815,000 | 813,078 | ||

| Osceola, AR, Utility & Improvement Refunding Rev., “A”, BAM, 4.25%, 7/31/2053 | 1,500,000 | 1,310,970 | ||

| Southeast Alabama Energy Authority Commodity Supply Rev. (Project No. 5), “A”, 5.25%, 1/01/2054 (Put Date 7/01/2029) | 755,000 | 759,900 | ||

| Tennessee Energy Acquisition Corp., Gas Project Rev., “A-1”, 5%, 5/01/2053 (Put Date 5/01/2028) | 725,000 | 723,315 | ||

| $4,640,161 | ||||

| Water & Sewer Utility Revenue – 13.7% | ||||

| Benton County, AR, Washington Regional Public Water Authority Rev., BAM, 4%, 10/01/2052 | $ | 500,000 | $428,210 | |

| Conway, AR, Wastewater Improvement Rev., “A”, 4%, 10/01/2039 | 525,000 | 459,422 | ||

| Fort Smith, AR, Water and Sewer and Construction Rev., 5%, 10/01/2035 | 3,850,000 | 3,987,515 | ||

| Fort Smith, AR, Water and Sewer Refunding Rev., BAM, 5%, 10/01/2028 | 1,370,000 | 1,410,486 | ||

| Fort Smith, AR, Water and Sewer Rev., BAM, 5%, 10/01/2029 | 1,000,000 | 1,028,698 | ||

| Guam Waterworks Authority Rev. (Water and Wastewater System), 5%, 7/01/2036 | 85,000 | 85,005 | ||

| Guam Waterworks Authority Rev. (Water and Wastewater System), 5%, 1/01/2046 | 500,000 | 471,237 | ||

| Guam Waterworks Authority Rev. (Water and Wastewater System), “A”, 5%, 7/01/2029 | 245,000 | 245,422 | ||

| Guam Waterworks Authority Rev. (Water and Wastewater System), “A”, 5%, 7/01/2035 | 245,000 | 245,148 | ||

| Guam Waterworks Authority Rev. (Water and Wastewater System), “A”, 5%, 1/01/2050 | 200,000 | 185,349 | ||

| Hot Springs, AR, Construction Wastewater Rev., “B”, BAM, 2.75%, 12/01/2047 | 1,000,000 | 653,593 | ||

| Hot Springs, AR, Construction Wastewater Rev., “B”, BAM, 2.75%, 12/01/2050 | 1,000,000 | 632,999 | ||

| Hot Springs, AR, Wastewater Rev., “C”, BAM, 4.5%, 12/01/2052 | 2,000,000 | 1,876,838 | ||

| Hot Springs, AR, Waterworks & Construction Refunding Rev., BAM, 4.25%, 10/01/2047 | 1,500,000 | 1,359,174 | ||

| Hot Springs, AR, Waterworks Rev., BAM, 4%, 10/01/2035 | 1,125,000 | 1,107,122 | ||

| Hot Springs, AR, Waterworks Rev., BAM, 4%, 10/01/2039 | 1,000,000 | 922,963 | ||

| Hot Springs, AR, Waterworks Rev., BAM, 4%, 10/01/2041 | 500,000 | 452,147 | ||

| Hot Springs, AR, Waterworks Rev., BAM, 3.75%, 10/01/2043 | 1,750,000 | 1,487,261 | ||

| Malvern, AR, Water and Sewer Refunding and Construction Rev., BAM, 3.7%, 8/01/2043 | 750,000 | 614,230 | ||

| Michigan Finance Authority Local Government Loan Program Rev. (Detroit Water and Sewerage Department Sewage Disposal System Rev. Refunding Second Lien Local Project), “C-7”, NPFG, 5%, 7/01/2032 | 50,000 | 50,285 | ||

| Michigan Finance Authority Local Government Loan Program Rev. (Detroit Water and Sewerage Department Water Supply System Rev. Refunding Second Lien Local Project), “D-6”, NPFG, 5%, 7/01/2036 | 65,000 | 65,143 | ||

| Michigan Finance Authority Local Government Loan Program Rev. (Detroit Water and Sewerage Department Water Supply System Rev. Refunding Senior Lien Local Project), “D-1”, AGM, 5%, 7/01/2035 | 30,000 | 30,143 | ||

| Michigan Finance Authority Local Government Loan Program Rev. (Detroit Water and Sewerage Department Water Supply System Rev. Refunding Senior Lien Local Project), “D-1”, AGM, 5%, 7/01/2037 | 75,000 | 75,203 | ||

| Texarkana, AR, Public Facilities Board, Waterworks & Sewer Facilities Rev., AGM, 4%, 8/31/2040 | 550,000 | 505,788 | ||

| Issuer | Shares/Par | Value ($) | ||

| Municipal Bonds – continued | ||||

| Water & Sewer Utility Revenue – continued | ||||

| Texarkana, AR, Public Facilities Board, Waterworks & Sewer Facilities Rev., AGM, 4%, 8/31/2043 | $ | 685,000 | $624,392 | |

| $19,003,773 | ||||

| Total Municipal Bonds (Identified Cost, $150,890,857) | $136,132,962 | |||

| Bonds – 0.3% | ||||

| Consumer Services – 0.3% | ||||

| Toll Road Investors Partnership II LP, Capital Appreciation, NPFG, 0%, 2/15/2025 (n) | $ | 245,000 | $220,608 | |

| Toll Road Investors Partnership II LP, Capital Appreciation, NPFG, 0%, 2/15/2043 (n) | 472,747 | 155,409 | ||

| Total Bonds (Identified Cost, $410,593) | $376,017 | |||

| Contingent Value Instruments – 0.1% | ||||

| General Obligations - General Purpose – 0.1% | ||||

| Commonwealth of Puerto Rico, General Obligation Contingent Value Instrument, 11/01/2043 (Identified Cost, $168,530) | $ | 284,049 | $147,350 | |

| Investment Companies (h) – 0.6% | ||||

| Money Market Funds – 0.6% | ||||

| MFS Institutional Money Market Portfolio, 5.4% (v) (Identified Cost, $905,852) | 905,826 | $906,007 | ||

| Other Assets, Less Liabilities – 0.8% | 1,102,339 | |||

| Net Assets – 100.0% | $138,664,675 | |||

| Issuer | Shares/Par | Value ($) | ||

| Municipal Bonds – 97.1% | ||||

| Airport Revenue – 8.2% | ||||

| California Municipal Finance Authority Rev. (LINXS APM Project), “A”, 5%, 12/31/2047 | $ | 2,190,000 | $2,132,322 | |

| Fresno, CA, Airport Revenue, “A”, BAM, 4.25%, 7/01/2044 | 1,000,000 | 909,107 | ||

| Fresno, CA, Airport Revenue, “A”, BAM, 5%, 7/01/2053 | 1,000,000 | 989,760 | ||

| Long Beach, CA, Senior Airport Rev., “C”, AGM, 5%, 6/01/2042 | 1,000,000 | 998,306 | ||

| Long Beach, CA, Senior Airport Rev., “C”, AGM, 5.25%, 6/01/2047 | 1,500,000 | 1,526,879 | ||

| Los Angeles, CA, Department of Airports Refunding Rev. (Los Angeles International), “A”, 5.25%, 5/15/2042 | 2,000,000 | 2,061,799 | ||

| Los Angeles, CA, Department of Airports Refunding Rev. (Los Angeles International), “A”, 4.125%, 5/15/2043 | 500,000 | 447,512 | ||

| Los Angeles, CA, Department of Airports Rev. (Los Angeles International), “H”, 4%, 5/15/2047 | 3,000,000 | 2,601,165 | ||

| Los Angeles, CA, Department of Airports Rev. (Los Angeles International), “A”, 4%, 5/15/2049 | 5,000,000 | 4,251,048 | ||

| Los Angeles, CA, Department of Airports Rev. (Los Angeles International), “C”, 5%, 5/15/2038 | 1,935,000 | 1,949,742 | ||

| Los Angeles, CA, Department of Airports Rev. (Los Angeles International), “D”, 5%, 5/15/2037 | 1,305,000 | 1,328,235 | ||

| Los Angeles, CA, Department of Airports Rev. (Los Angeles International), “D”, 5%, 5/15/2038 | 1,305,000 | 1,320,053 | ||

| Sacramento County, CA, Airport System Rev., “B”, 5%, 7/01/2038 | 2,000,000 | 2,014,751 | ||

| Sacramento County, CA, Airport System Rev., “C”, 5%, 7/01/2039 | 1,000,000 | 1,004,149 | ||

| Sacramento County, CA, Special Facilities Airport Rev. (Cessna Aircraft Co. Project), VRDN, 3.95%, 10/31/2028 | 5,275,000 | 5,275,000 | ||