First Quarter 2016 Earnings Release April 28, 2016 1 Questar Corporation A Rockies-based integrated natural gas company offering growth and high returns Making lives better by developing and delivering essential energy

This presentation contains forward-looking statements within the meaning of the federal securities laws. Such statements are based on management's current expectations, estimates and projections, which are subject to a wide range of uncertainties and business risks. Factors that could cause actual results to differ from those anticipated are discussed in the company's periodic filings with the Securities and Exchange Commission, including its annual report on Form 10-K for the year ended December 31, 2015. Questar undertakes no obligation to publicly correct or update the forward-looking statements in this presentation to reflect future events or circumstances. All such statements are expressly qualified by this cautionary statement. Notes and caution regarding forward-looking statements 2

KEVIN HADLOCK Executive Vice President & Chief Financial Officer Questar Corporation 3

Q1 2016 Financial Summary 4 ▪ Reported Q1 2016 adjusted earnings of $87.5 million compared to Q1 2015 net income of $84.6 million(1) ▪ Adjusted earnings of $0.50 per diluted share in Q1 2016 compared to $0.48 per diluted share in Q1 2015(1) ▪ Adjusted EBITDA for Q1 2016 totaled $208.1 million, up 2% compared to Q1 2015(2) ▪ Excluding energy efficiency program costs, consolidated O&M and G&A expense for Q1 2016 was down $3.3 million, or 5% compared to Q1 2015(2) ▪ Capital investment for the first three months of 2016 was $68.5 million, a decrease of 12% compared to the first three months of 2015 (3) (1) Excludes costs associated with the merger (2) See appendix (3) Q1 2015 capital spending included $11.4 million acquisition of Eagle Mountain City’ gas distribution assets

Net Income (Loss) 5 $ millions (except earnings per share) Q1 2016 Q1 2015 Change Questar Gas $47.6 $43.8 $3.8 Wexpro 26.2 27.7 (1.5) Questar Pipeline 14.2 13.9 0.3 Corporate and other (0.5) (0.8) 0.3 Adjusted Earnings $87.5 $84.6 $2.9 Dominion merger charges (Corp) (9.0) - (9.0) Net Income $78.5 $84.6 (6.1) Adjusted earnings per diluted share $0.50 $0.48 $0.02 Earnings per diluted share $0.45 $0.48 ($0.03) Weighted-average diluted shares 176.1 176.5 (0.4)

Q1 2016 gross margin was up $9.8 million or 7% versus Q1 2015 Q1 2016 net income of $47.6 million, an increase of 9% compared to Q1 2015 Capital investment for Q1 2016 was $59.1 million, compared to $54.4 million in Q1 2015 (2) Questar Gas Results 6 $ millions Q1 2016 Q1 2015 $ Change % Change Gross margin $151.0 $141.2 $9.8 7% Adjusted EBITDA (1) 99.1 91.2 7.9 9% Net Income 47.6 43.8 3.8 9% Capital investment 59.1 54.4 4.7 9% (1) See appendix (2) Q1 2015 capital spending included $11.4 million acquisition of Eagle Mountain City’ gas distribution assets

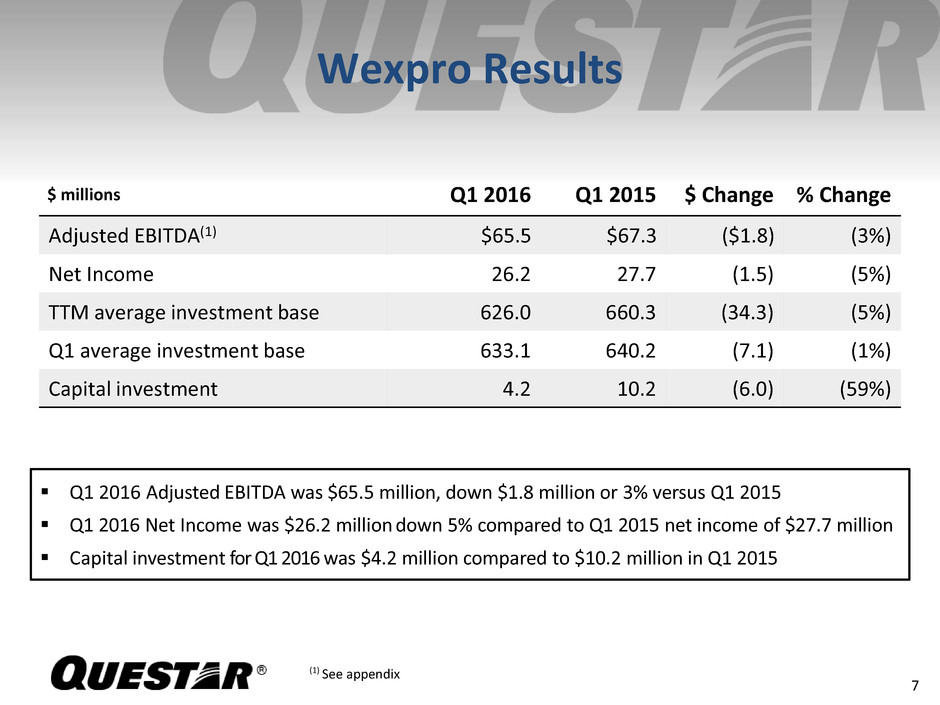

Wexpro Results 7 $ millions Q1 2016 Q1 2015 $ Change % Change Adjusted EBITDA(1) $65.5 $67.3 ($1.8) (3%) Net Income 26.2 27.7 (1.5) (5%) TTM average investment base 626.0 660.3 (34.3) (5%) Q1 average investment base 633.1 640.2 (7.1) (1%) Capital investment 4.2 10.2 (6.0) (59%) Q1 2016 Adjusted EBITDA was $65.5 million, down $1.8 million or 3% versus Q1 2015 Q1 2016 Net Income was $26.2 million down 5% compared to Q1 2015 net income of $27.7 million Capital investment for Q1 2016 was $4.2 million compared to $10.2 million in Q1 2015 (1) See appendix

Questar Pipeline Results 8 $ millions Q1 2016 Q1 2015 $ Change % Change Revenue $62.3 $66.2 ($3.9) (6%) Adjusted EBITDA(1) 42.1 42.5 (0.4) (1%) Net income 14.2 13.9 0.3 2% Capital investment 6.6 8.7 (2.1) (24%) Q1 2016 revenue was down $3.9 million or 6% versus Q1 2015 Q1 2016 net income was $14.2 million, an increase of 2% compared to Q1 2015 Capital investment for Q1 2016 was $6.6 million compared to $8.7 million in Q1 2015 (1) See appendix

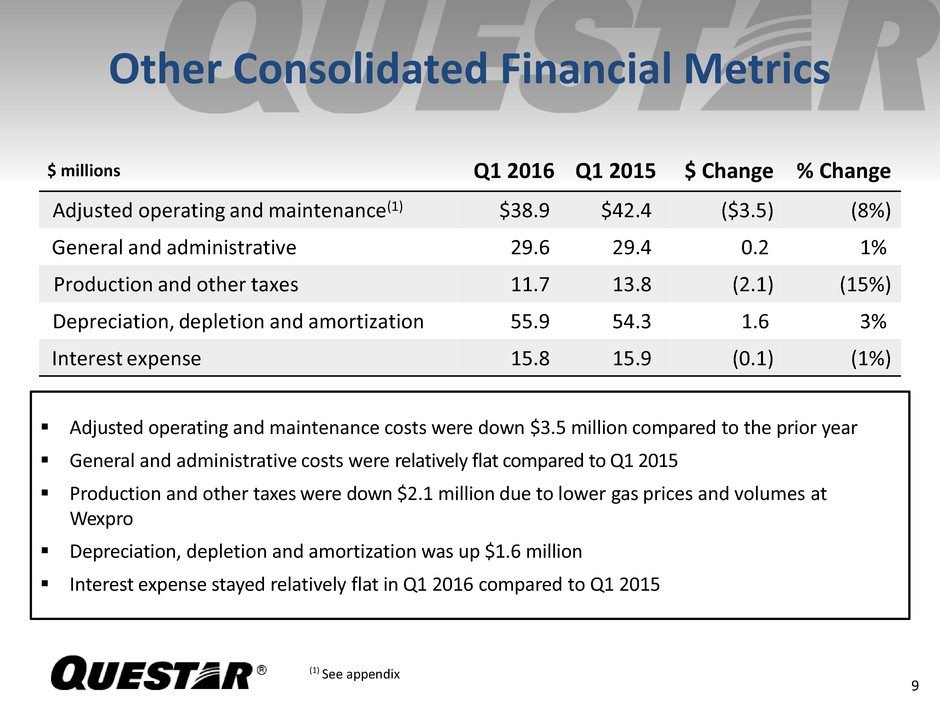

Other Consolidated Financial Metrics 9 $ millions Q1 2016 Q1 2015 $ Change % Change Adjusted operating and maintenance(1) $38.9 $42.4 ($3.5) (8%) General and administrative 29.6 29.4 0.2 1% Production and other taxes 11.7 13.8 (2.1) (15%) Depreciation, depletion and amortization 55.9 54.3 1.6 3% Interest expense 15.8 15.9 (0.1) (1%) Adjusted operating and maintenance costs were down $3.5 million compared to the prior year General and administrative costs were relatively flat compared to Q1 2015 Production and other taxes were down $2.1 million due to lower gas prices and volumes at Wexpro Depreciation, depletion and amortization was up $1.6 million Interest expense stayed relatively flat in Q1 2016 compared to Q1 2015 (1) See appendix

10 ▪ Cash Flow (1) - Cash flow for the three months ended March 31, 2016 totaled $134.9 million, a decrease of 4% compared to the three months ended March 31, 2015 ▪ Liquidity -At the end of the first quarter 2016, Questar had net available liquidity of $541.9 million with $541.5 million of unused commercial paper capacity (1) Cash flow from operations before changes in working capital; See appendix Cash Flow and Liquidity

RON JIBSON Chairman, President & Chief Executive Officer Questar Corporation 11

Dominion Merger Update 12 ▪ On February 23, 2016 the Federal Trade Commission granted early termination of the 30-day waiting period under the Hart- Scott-Rodino Act with regards to the Merger ▪ On March 3, 2016 Questar and the Parent jointly filed merger applications with the Public Service Commission of Utah and Wyoming Public Service Commission and provided notice of the proposed Merger to the Idaho Public Utilities Commission ▪ Utah and Wyoming Public Service Commission hearings are expected to occur during the third quarter of this year ▪ A shareholder vote on the proposed merger is schedule for May 12, 2016

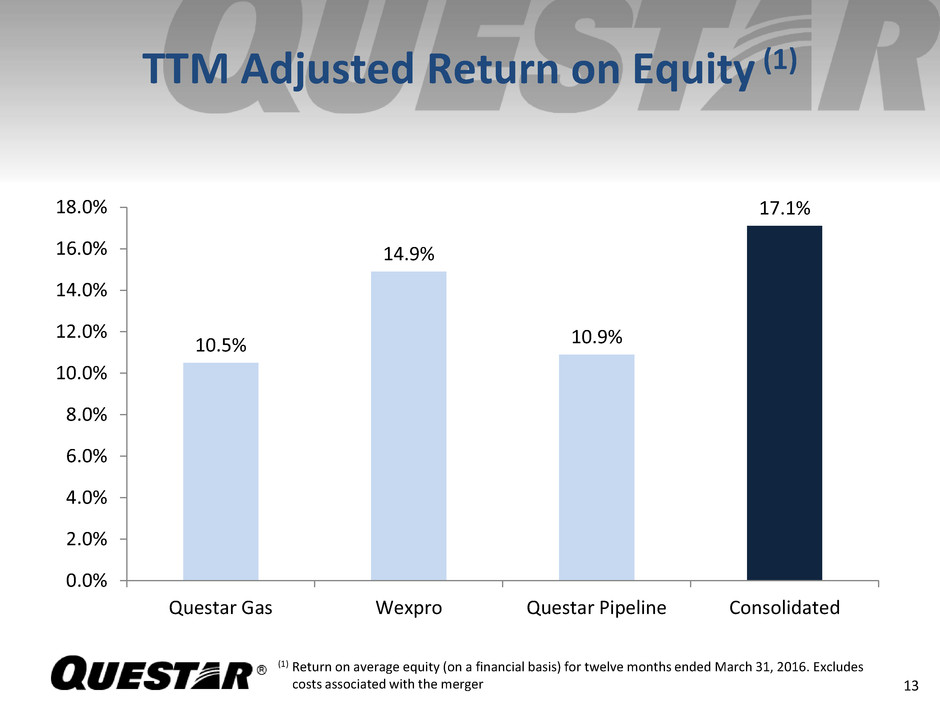

TTM Adjusted Return on Equity (1) 13 10.5% 14.9% 10.9% 17.1% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% Questar Gas Wexpro Questar Pipeline Consolidated (1) Return on average equity (on a financial basis) for twelve months ended March 31, 2016. Excludes costs associated with the merger

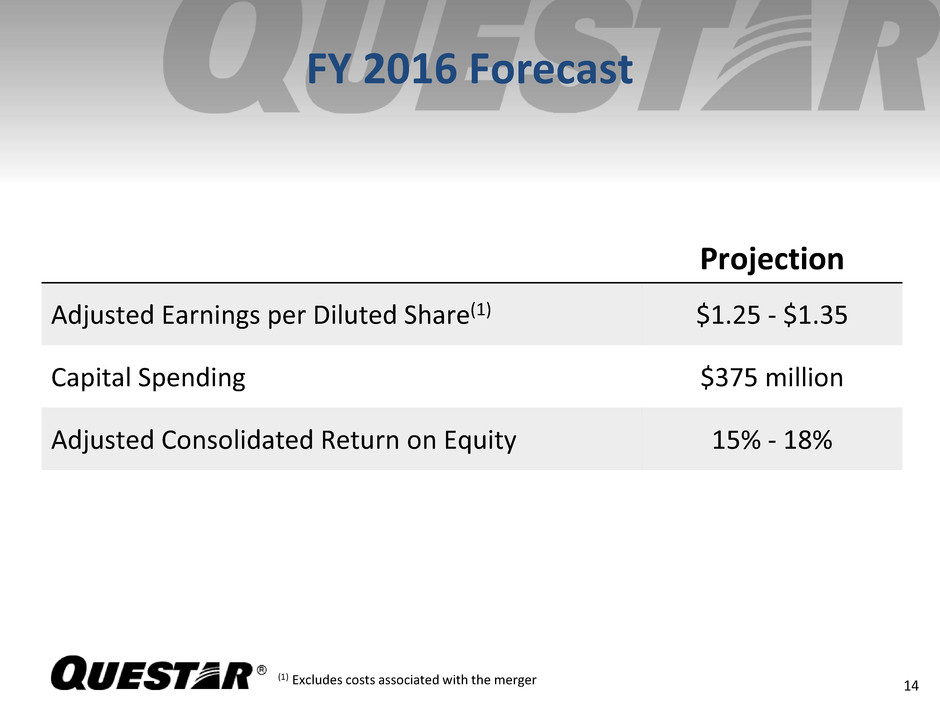

FY 2016 Forecast 14 Projection Adjusted Earnings per Diluted Share(1) $1.25 - $1.35 Capital Spending $375 million Adjusted Consolidated Return on Equity 15% - 18% (1) Excludes costs associated with the merger

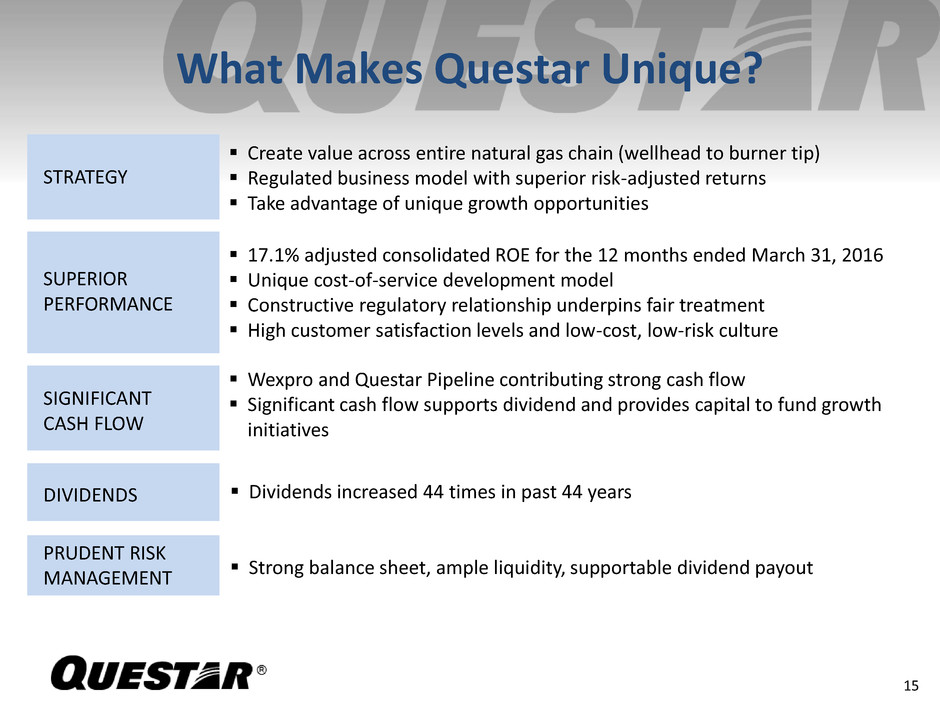

STRATEGY SIGNIFICANT CASH FLOW SUPERIOR PERFORMANCE PRUDENT RISK MANAGEMENT What Makes Questar Unique? 15 DIVIDENDS Create value across entire natural gas chain (wellhead to burner tip) Regulated business model with superior risk-adjusted returns Take advantage of unique growth opportunities 17.1% adjusted consolidated ROE for the 12 months ended March 31, 2016 Unique cost-of-service development model Constructive regulatory relationship underpins fair treatment High customer satisfaction levels and low-cost, low-risk culture Wexpro and Questar Pipeline contributing strong cash flow Significant cash flow supports dividend and provides capital to fund growth initiatives Dividends increased 44 times in past 44 years Strong balance sheet, ample liquidity, supportable dividend payout

APPENDIX 16

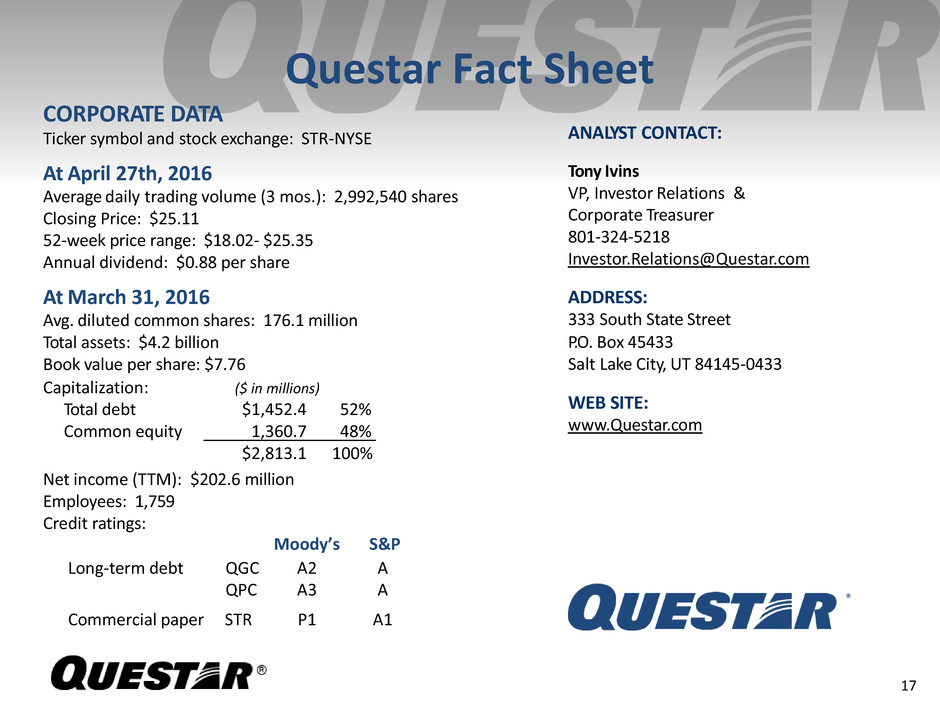

Questar Fact Sheet 17 CORPORATE DATA Ticker symbol and stock exchange: STR-NYSE At April 27th, 2016 Average daily trading volume (3 mos.): 2,992,540 shares Closing Price: $25.11 52-week price range: $18.02- $25.35 Annual dividend: $0.88 per share At March 31, 2016 Avg. diluted common shares: 176.1 million Total assets: $4.2 billion Book value per share: $7.76 Net income (TTM): $202.6 million Employees: 1,759 Credit ratings: ANALYST CONTACT: Tony Ivins VP, Investor Relations & Corporate Treasurer 801-324-5218 Investor.Relations@Questar.com ADDRESS: 333 South State Street P.O. Box 45433 Salt Lake City, UT 84145-0433 WEB SITE: www.Questar.com Moody’s S&P Long-term debt QGC A2 A QPC A3 A Commercial paper STR P1 A1 Capitalization: ($ in millions) Total debt $1,452.4 52% Common equity $1,360.7 48% $2,813.1 100%

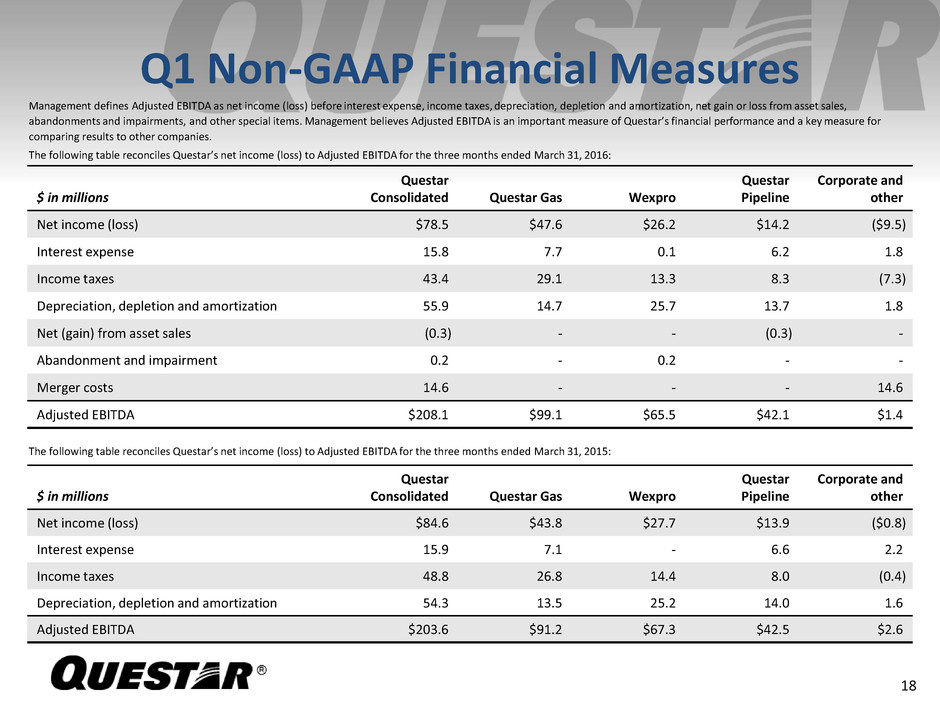

$ in millions Questar Consolidated Questar Gas Wexpro Questar Pipeline Corporate and other Net income (loss) $84.6 $43.8 $27.7 $13.9 ($0.8) Interest expense 15.9 7.1 - 6.6 2.2 Income taxes 48.8 26.8 14.4 8.0 (0.4) Depreciation, depletion and amortization 54.3 13.5 25.2 14.0 1.6 Adjusted EBITDA $203.6 $91.2 $67.3 $42.5 $2.6 Q1 Non-GAAP Financial Measures 18 Management defines Adjusted EBITDA as net income (loss) before interest expense, income taxes, depreciation, depletion and amortization, net gain or loss from asset sales, abandonments and impairments, and other special items. Management believes Adjusted EBITDA is an important measure of Questar’s financial performance and a key measure for comparing results to other companies. The following table reconciles Questar’s net income (loss) to Adjusted EBITDA for the three months ended March 31, 2016: $ in millions Questar Consolidated Questar Gas Wexpro Questar Pipeline Corporate and other Net income (loss) $78.5 $47.6 $26.2 $14.2 ($9.5) Interest expense 15.8 7.7 0.1 6.2 1.8 Income taxes 43.4 29.1 13.3 8.3 (7.3) Depreciation, depletion and amortization 55.9 14.7 25.7 13.7 1.8 Net (gain) from asset sales (0.3) - - (0.3) - Abandonment and impairment 0.2 - 0.2 - - Merger costs 14.6 - - - 14.6 Adjusted EBITDA $208.1 $99.1 $65.5 $42.1 $1.4 The following table reconciles Questar’s net income (loss) to Adjusted EBITDA for the three months ended March 31, 2015:

Q1 Non-GAAP Financial Measures (Cont.) 19 Management believes consolidated operating and maintenance expense excluding energy efficiency program costs is a useful measure to assess Questar’s operational performance because energy efficiency program costs are offset by equivalent changes in the program’s cost-recovery revenues. The following table reconciles Questar’s adjusted operating and maintenance expense to GAAP operating and maintenance expense for the three months ended March 31, 2016 and 2015: $ in millions 3 months ended March 31, 2016 2015 Adjusted operating and maintenance expense $38.9 $42.4 Energy efficiency program costs 11.5 9.9 GAAP operating and maintenance expense $50.4 $52.3 $ in millions 3 months ended March 31, 2016 2015 Adjusted operating and maintenance expense $38.9 $42.4 General and administrative expenses 29.6 29.4 Adjusted combined O&M and G&A expense 68.5 71.8 Energy efficiency program costs 11.5 9.9 GAAP combined O&M and G&A expense $80.0 $81.7 The following table reconcilesQuestar’s adjusted combined O&M and G&A expense to GAAP combined O&M and G&A expense for the three months ended March 31, 2016 and 2015:

Q1 Non-GAAP Financial Measures (Cont.) 20 Management believes cash flow from operations before changes in operating assets and liabilities is an important measure of Questar’s operating cash flows that excludes the volatility associated with changes in operating assets and liabilities. The following table reconcilesQuestar’s cash flow from operations before changes in operating assets and liabilities to GAAP net cash provided by operating activities for the three months ended March 31, 2016 and 2015: 3 months ended March 31, 2016 2015 Cash flow from operations before changes in operating assets and liabilities $134.9 $140.8 Changes in operating assets and liabilities 198.1 82.6 Net cash provided by operating activities $333.0 $223.4